Hong Kong

China’s Belt and Road Initiative provides countries with lagging technology the opportunities to install state-of-the-art systems, says Michael Gazeley of Hong Kong-based Network Box. With dangers to cyber security lurking across the Internet, Hong Kong has the environment to nurture talent locally and from around the world to keep systems safe. See Part 1 for comment on Hong Kong’s “dream” connection for technology.

Speaker:

Michael Gazeley, Managing Director, Network Box Corporation Limited

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com/

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

China has become a major trading country and important source of foreign investment around the world as its economic activities with other countries continue to grow. Under the Belt and Road development strategy, Chinese enterprises have stepped up their efforts in “going out” to engage in trade and investment activities in countries along the Belt and Road routes. This has spurred demand for professional services to support these enterprises' growing international business.

China’s coastal areas, including the Pearl River Delta adjoining Hong Kong and the Yangtze River Delta (YRD), have always been major areas for economic co-operation with foreign countries. More and more enterprises in Shanghai and the adjacent areas have been heading for the Belt and Road regions in search of opportunities to boost the development of their businesses.

HKTDC conducted a questionnaire survey in Shanghai, Jiangsu and other places in the YRD in the first quarter of 2017 to gauge the situation. The survey results indicate that the great majority of domestic respondents (84%) would consider tapping business opportunities in Belt and Road countries in the next one to three years. Among these, many enterprises (46%) said that Hong Kong was their preferred destination for seeking professional services outside the mainland for capturing business opportunities. This matches with the findings of a similar HKTDC survey in South China last year. [1]

The Belt and Road destinations that respondents showed the greatest interest in were Southeast Asia (62%), South Asia (32%), and Central/Eastern Europe (28%). Most enterprises (58%) expressed the hope of selling more industrial products, relevant services and technologies to Belt and Road markets, while one in three (32%) would consider investing and setting up factories in Belt and Road countries.

There is no doubt that Hong Kong is the preferred platform for mainland enterprises “going out” to invest overseas. Hong Kong service providers have been helping mainland enterprises handle their trade and investment businesses in Hong Kong and overseas markets for many years. Further efforts by mainland enterprises, including those in the YRD, to tap Belt and Road opportunities are bound to generate more business for Hong Kong. (For more details on China’s foreign investment and Hong Kong as the preferred platform for mainland enterprises “going out” to invest overseas, see: China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform)

Belt and Road: Hotspot for China’s Foreign Trade and Investment

China has become a major world economy and the economic activities of Chinese enterprises abroad have gradually extended from trade to other fields of investment. China’s foreign trade volume stood at US$3.69 trillion in 2016, second only to the US with US$3.71 trillion. [2] During the same period, China’s foreign direct investment (FDI) flows (excluding financial sector investment) reached US$170 billion [3], which was among the highest in the world and exceeded foreign capital inflow. It is now a country with net capital outflow.

China’s trade and investment in Belt and Road countries will see sustained growth particularly under the Belt and Road initiative and development strategy. Figures released by the Ministry of Commerce showed China’s total trade with Belt and Road countries rose by 0.6% to RMB6.3 trillion (equivalent to US$1 trillion) in 2016, accounting for just over a quarter (26%) of China’s total foreign trade during the period. Direct investment made by Chinese enterprises in non-financial sectors in 53 Belt and Road countries totalled US$14.53 billion, accounting for 8.5% of China’s total non-financial FDI during this period. Most of the investment went to Singapore, Indonesia, India, Thailand and Malaysia.

As China gears up for the Belt and Road development strategy and encourages businesses to develop trade and investment with the countries and regions concerned, the Belt and Road initiative has become an important factor in driving the “going out” of Chinese enterprises for all kinds of economic activities. As Hong Kong has consistently been the preferred service platform for these enterprises [4], the development of the Belt and Road initiative is expected to spur demand for various Hong Kong support services from mainland enterprises.

HKTDC joined hands with the Shanghai Municipal Commission of Commerce in conducting a questionnaire survey among related enterprises in Shanghai and Jiangsu of the YRD in the first quarter of 2017 to find out about the challenges facing mainland enterprises in the region, their transformation, upgrading and investment strategies, their intention of “going out” to capture Belt and Road opportunities, and their demand for related professional services.

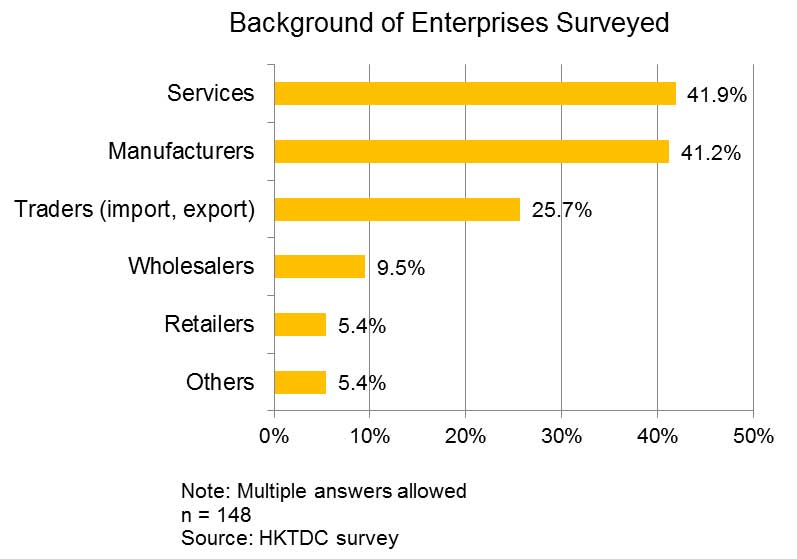

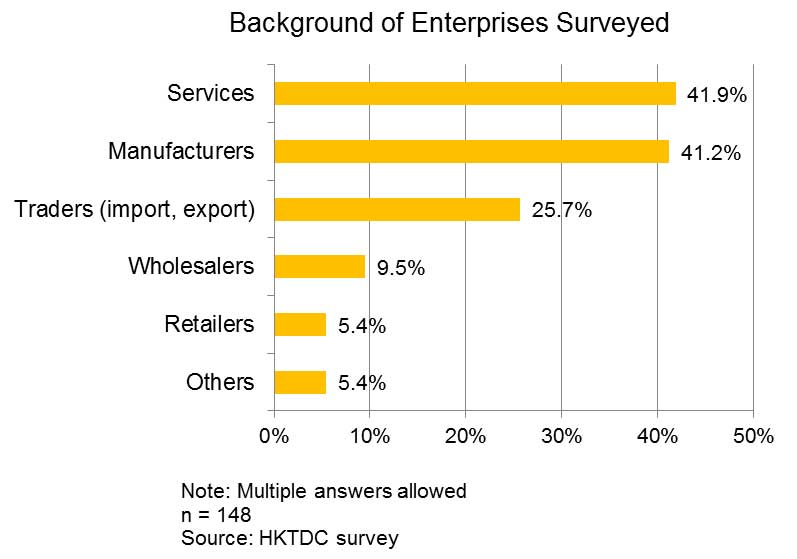

This survey was similar to the one conducted by HKTDC in South China in 2016. [5] A total of 163 completed questionnaires were collected. Of these, 148 were completed by mainland enterprises, including service suppliers, manufacturers and traders. What follows is a summary of the views expressed by these 148 mainland enterprises on “going out” to capture Belt and Road opportunities.

Challenges in Business Operation

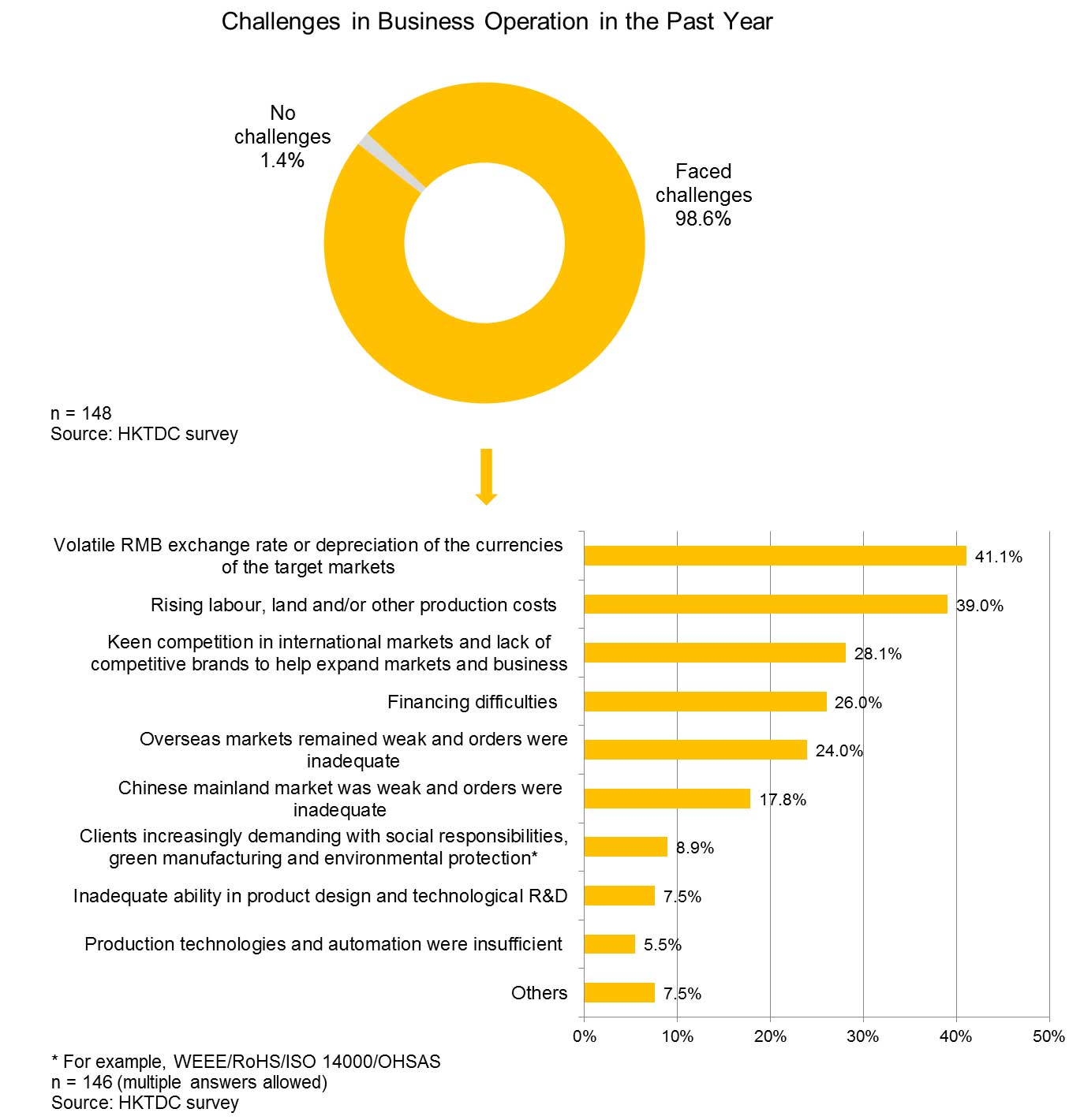

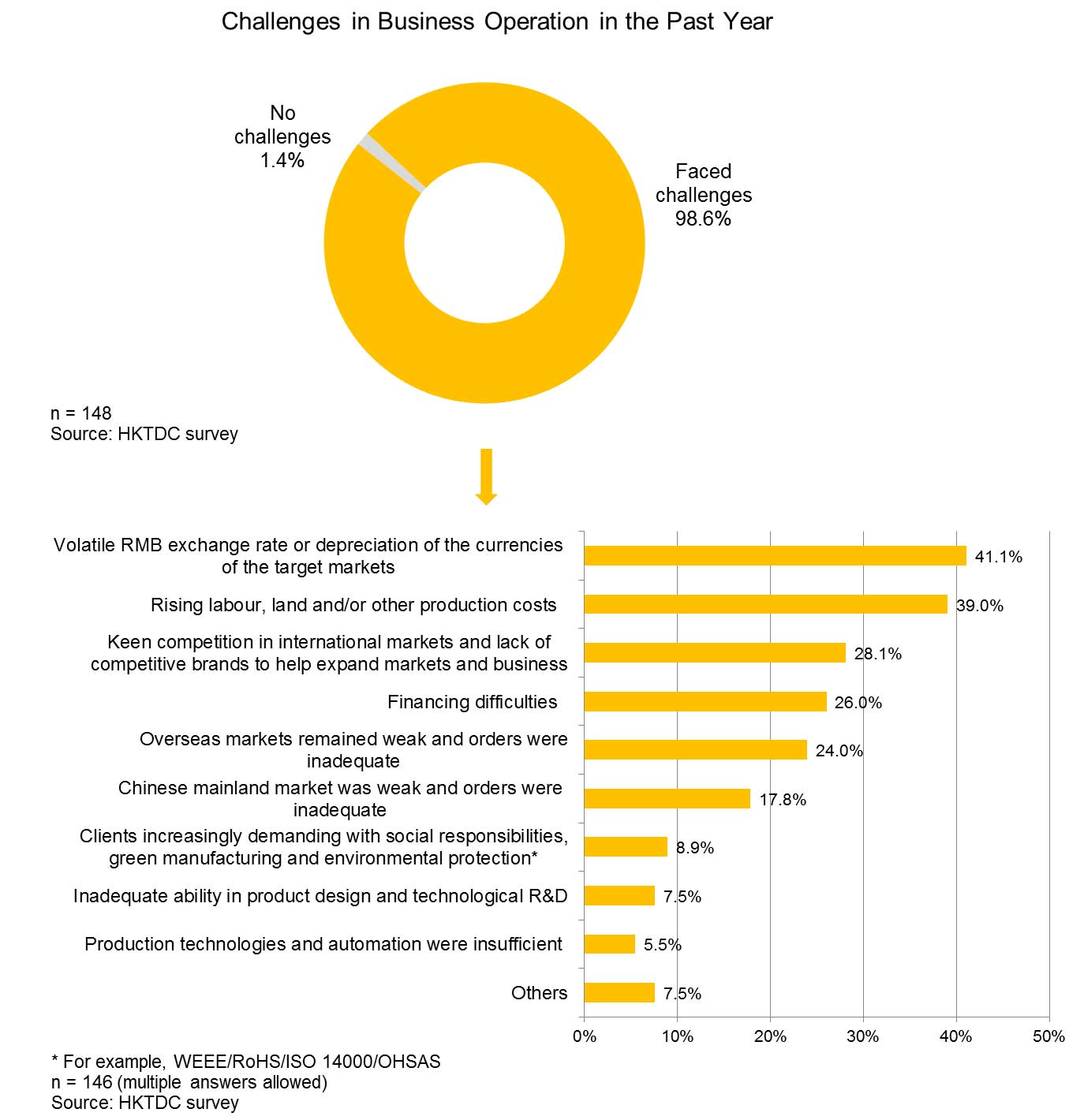

Virtually all respondents (99%) said that their business operations faced a variety of challenges over the past year. Their foremost concerns were the volatile RMB exchange rate (41%) and rising labour, land and/or other production costs (39%). Other challenges included keen competition in international markets (28%), financing difficulties (26%) and weak overseas markets and inadequate orders (24%).

Most Important Countermeasure: Develop Overseas Markets

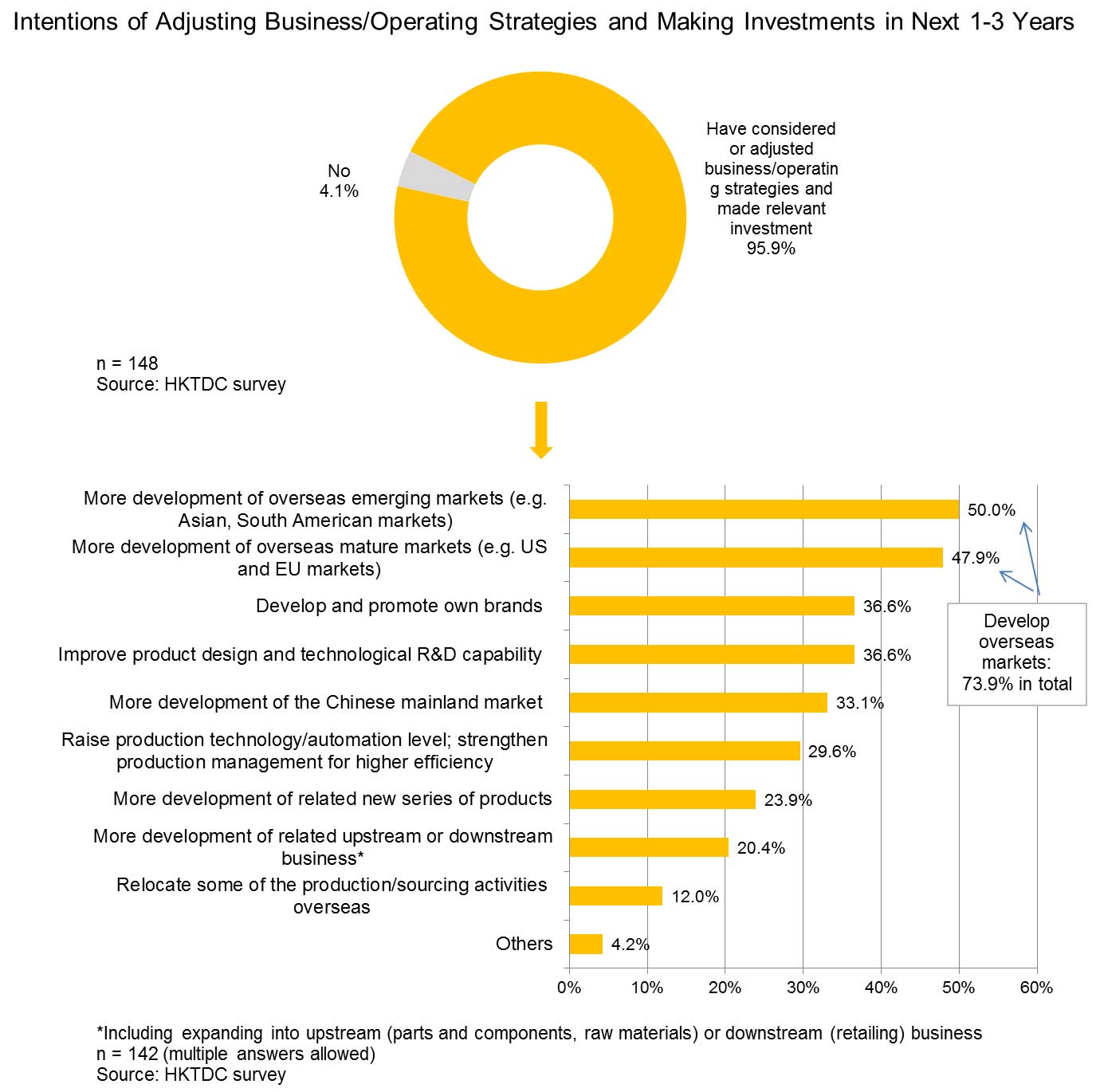

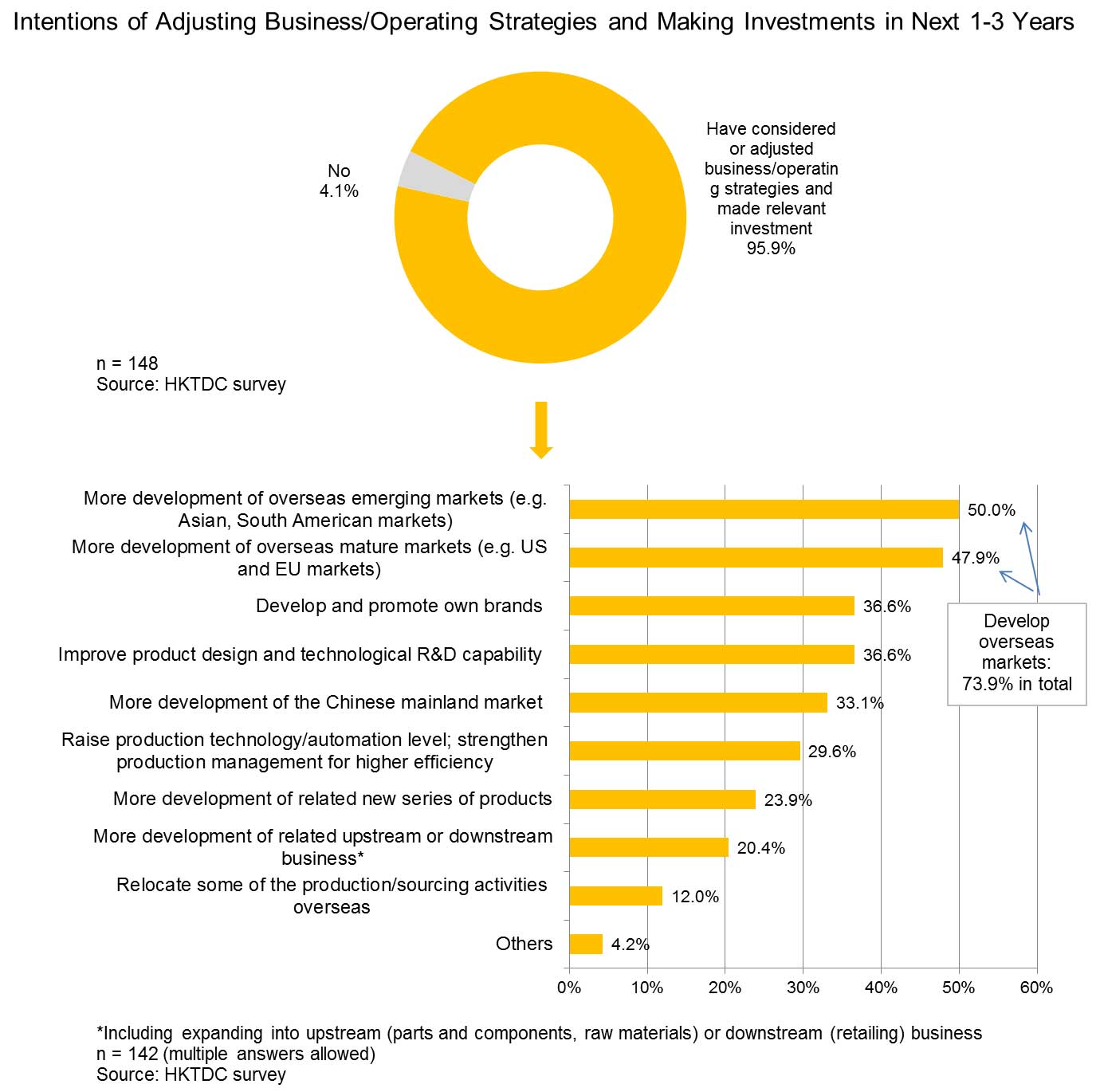

In order to tackle these challenges, over 95% of the respondents said either they would consider adjusting their business/operating strategies and making relevant investment in the next one to three years or they had already done so. Almost three out of every four (74%) of the respondents said they would first exert themselves to develop overseas markets. Of these, half (50%) said they would develop further overseas emerging markets and 48% said they would focus on overseas mature markets. More than one in three (37%) said they would develop/promote their own brands, while the same number said they would work on the improvement of product design and technological R&D capability.

Belt and Road Opportunities: Focusing on Southeast Asian Markets

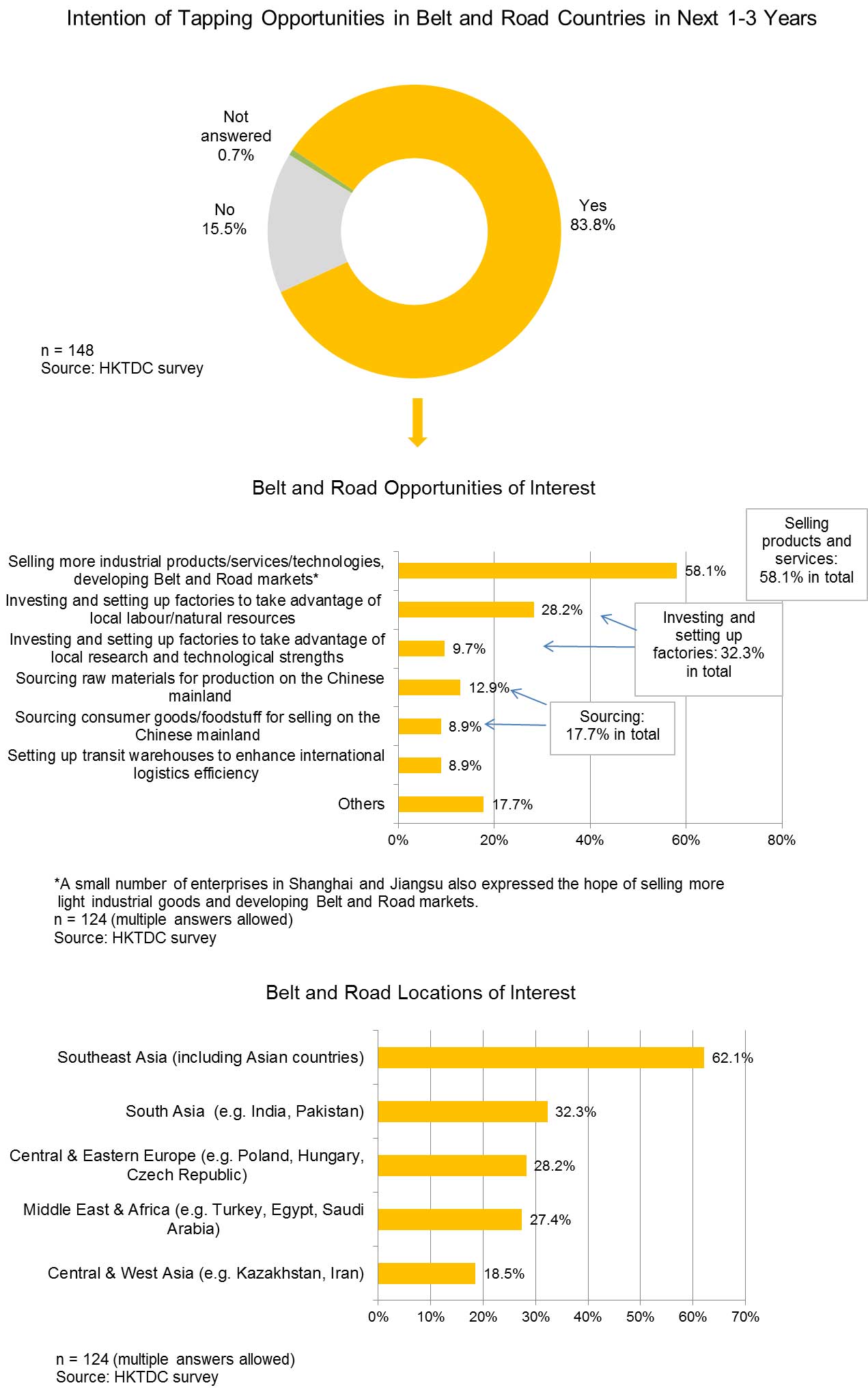

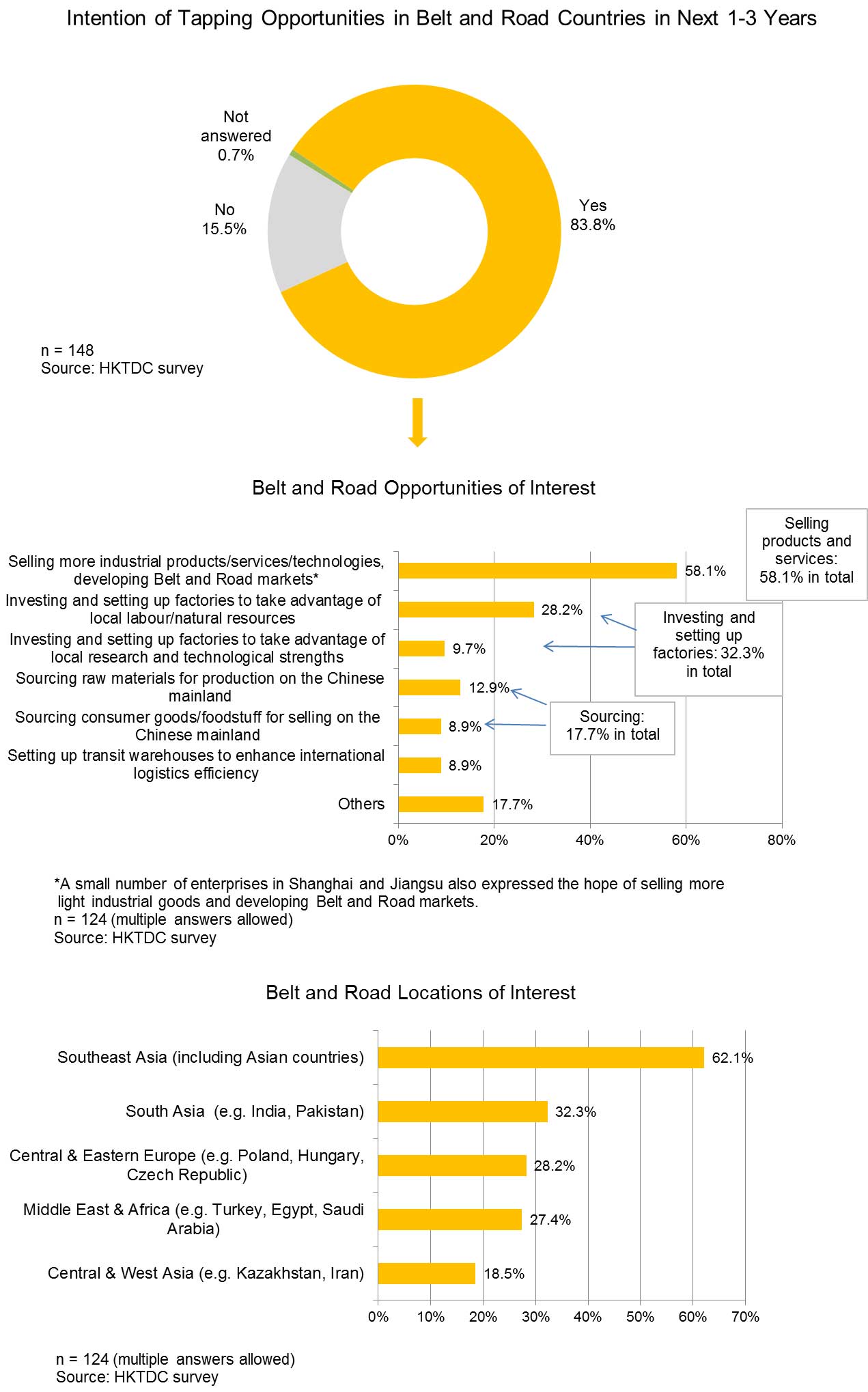

As China continues to promote the Belt and Road development strategy, 84% of the respondents said they would consider tapping business opportunities in Belt and Road countries in the next one to three years.

Among those enterprises that would consider tapping Belt and Road opportunities, most said they wanted to sell more industrial products and related services and technologies to the Belt and Road markets. Just under a third (32%) said they wanted to go to Belt and Road countries to invest and set up factories for production, while 18% said they would like to go to source consumer goods/foodstuff for selling on the Chinese mainland and source raw materials for production on the Chinese mainland. Another 9% said they hoped to set up transit warehouses in Belt and Road countries to improve their international logistics efficiency.

Among those enterprises interested in tapping opportunities in Belt and Road markets, almost two thirds (62%) said they would focus on Southeast Asia, including ASEAN countries. Fewer respondents chose other regions, with a third (32%) picking South Asia (32%), just over one in four going for Central and Eastern Europe (28%) and the Middle East and Africa (27%), and one in five choosing Central and West Asia (19%).

Although there is a slight difference between the preferences of the respondents in this survey and the one conducted in South China last year, the preferences for Belt and Road opportunities and locations of interest are similar, suggesting that most mainland enterprises have the same intentions of tapping Belt and Road opportunities, regardless of where they are based.

Comparison of Survey Findings in South China and YRD

| Opportunities of Interest | Survey in South China | Survey in YRD |

| Selling products | 88% | 58% |

| Investing and setting up factories | 36% | 32% |

| Sourcing | 35% | 18% |

| Setting up transit warehouses | 22% | 9% |

| Locations of Interest | Survey in South China | Survey in YRD |

| Southeast Asia | 83% | 62% |

| South Asia | 27% | 32% |

| Central & Eastern Europe | 24% | 28% |

| Middle East & Africa | 23% | 27% |

| Central & West Asia | 20% | 19% |

Source: HKTDC survey

Need to Seek Services Support

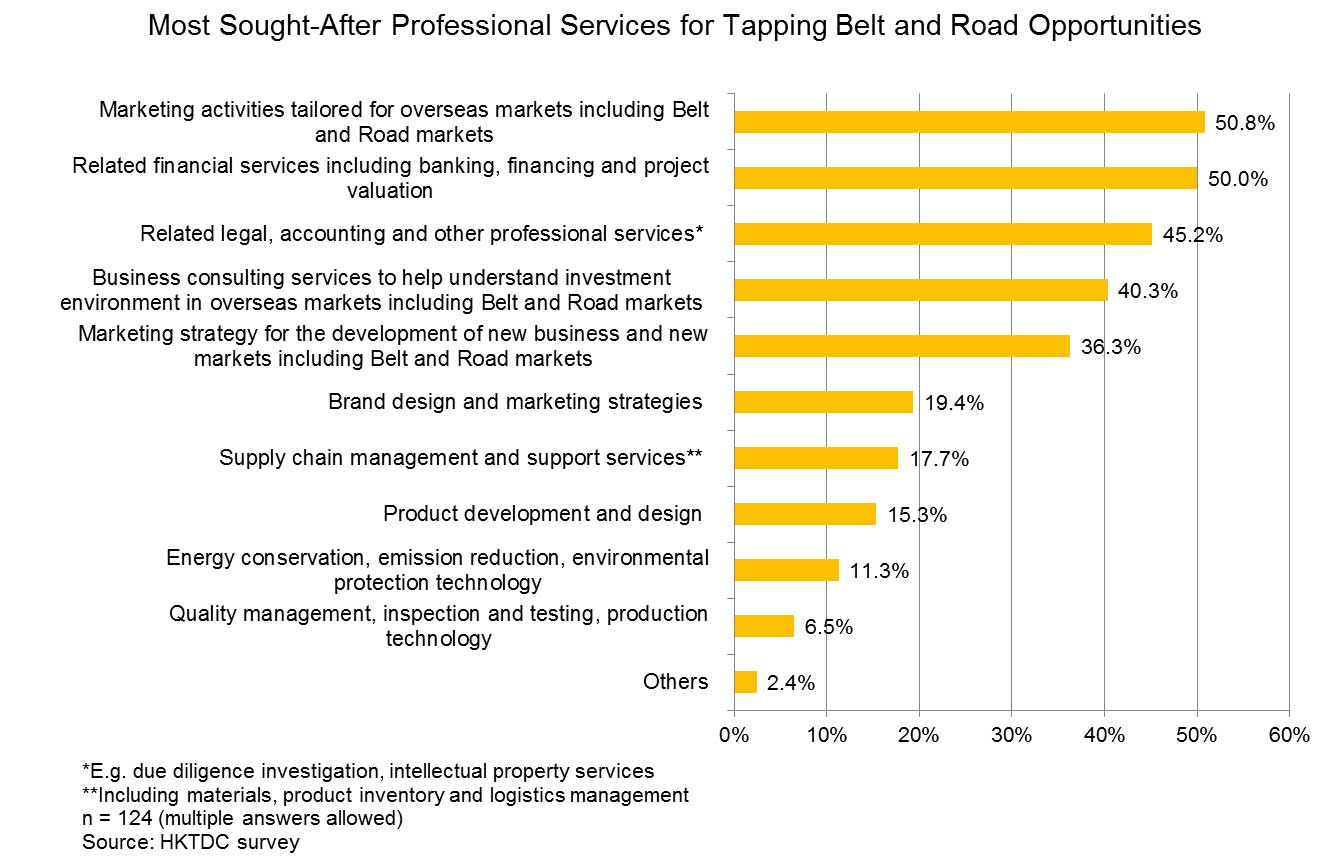

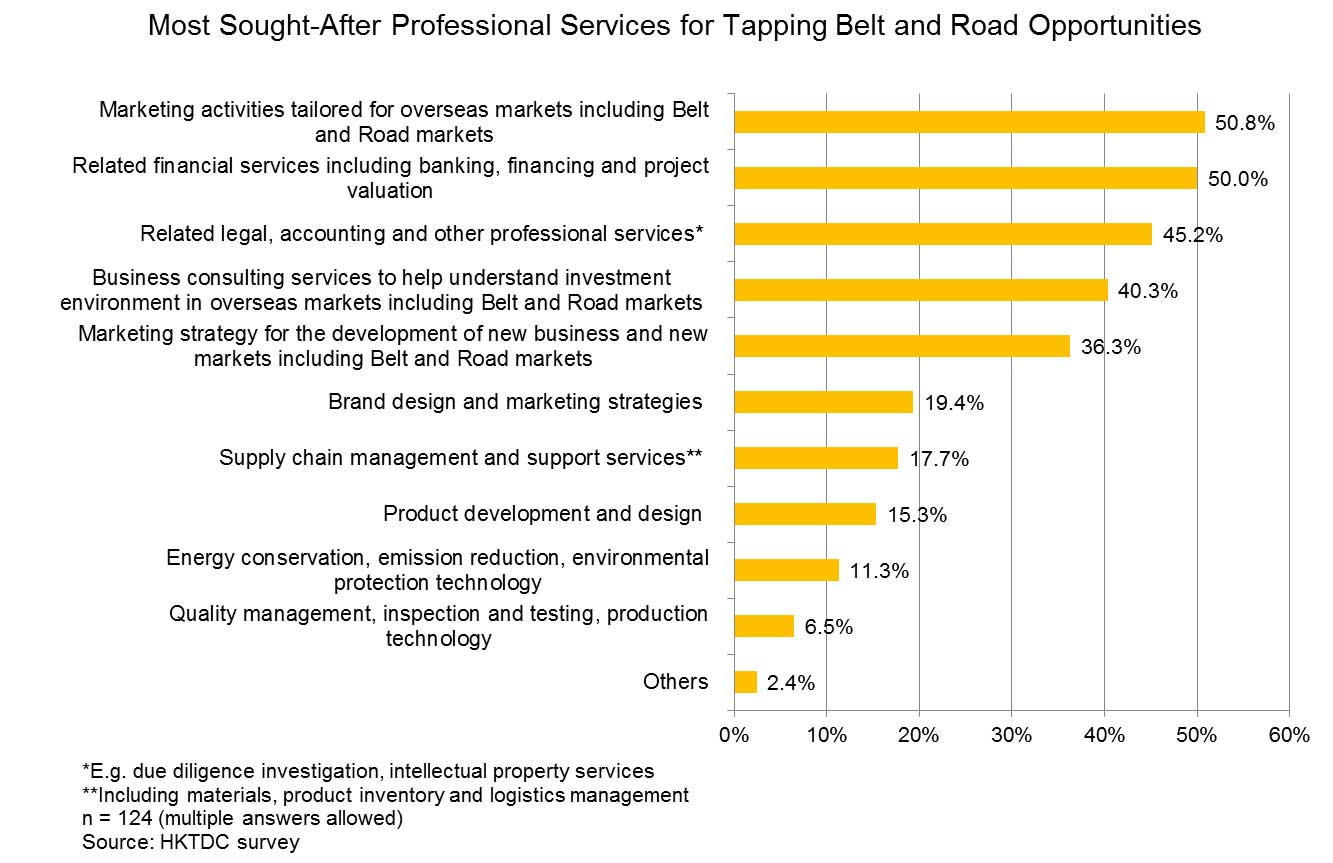

Of those enterprises looking to tap into Belt and Road opportunities, half (51%) said they would like to become involved in marketing activities tailored for Belt and Road and other overseas markets. Half (50%) said they would require related financial services, including banking, financing and project valuation. Just under half (45%) said they would like to seek related legal, accounting and other professional services. 40% said they would require business consulting services to help understand the investment environment in overseas markets, including Belt and Road markets.

Seeking Services Support in the Chinese Mainland and Hong Kong

In order to locate these aforementioned professional services, more than half (55%) of the respondents looking to tap Belt and Road opportunities said they would first source these support services locally. However, a significant number said they would also seek various professional services outside the mainland. Hong Kong was the most preferred destination for most enterprises, accounting for almost half (46%) of all respondents who would like to tap into Belt and Road markets. This again matched the findings of the survey conducted by HKTDC in South China last year. Other destinations highlighted as of interest included the US (34%), Germany (27%) and Singapore (23%).

HKTDC Research would like to acknowledge the help extended by the Shanghai Municipal Commission of Commerce in conducting the survey.

[1] For details about the survey in South China, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

[2] Source: Customs Administration of China; World Trade Organisation

[3] Source: Ministry of Commerce of China

[4] On Hong Kong as the preferred service platform for mainland enterprises “going out”, please see: Guangdong: Hong Kong Service Opportunities Amid China’s “Going Out” Strategy, Jiangsu/YRD: Hong Kong Service Opportunities Amid China's "Going Out" Initiative, China’s “Going Out” Initiatives: Professional Services Demand in Bohai and China's “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities.

[5] Please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

Editor's picks

Trending articles

The lower labour costs, improved infrastructure and preferential tax treatment have all led to Vietnam attracting a significant inflow of foreign direct investment (FDI). Increasingly, the country is now targetting investment from higher value-added industries, with potential investors advised to look beyond labour cost advantages. There are, however, genuine concerns as to the lack of engineering expertise and ancillary industries within the country, a particular challenge for any business undertaking more sophisticated production with higher degree of automation.

In order to tackle this shortfall, certain investors – including a number from Hong Kong, are making use of the technical and other services, as well as material supplies from the Chinese mainland as a means of supporting their Vietnamese operations. Even for the infrastructural development, such as those in Northern Vietnam bordering China, one of Vietnam’s development directions is to strengthen the country’s access to the Chinese supply chain. In the circumstances, effective management and efficient logistics services are crucial when it comes to ensuring foreign investors and other related companies can properly orchestrate their cross-border arrangements and achieve the maximum operational efficiency.

Enhancing the Infrastructure of Northern Vietnam

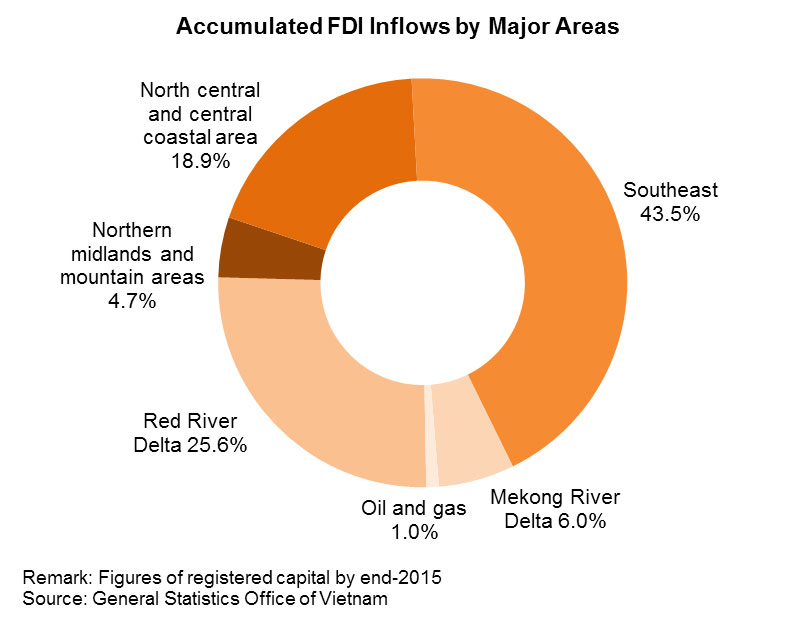

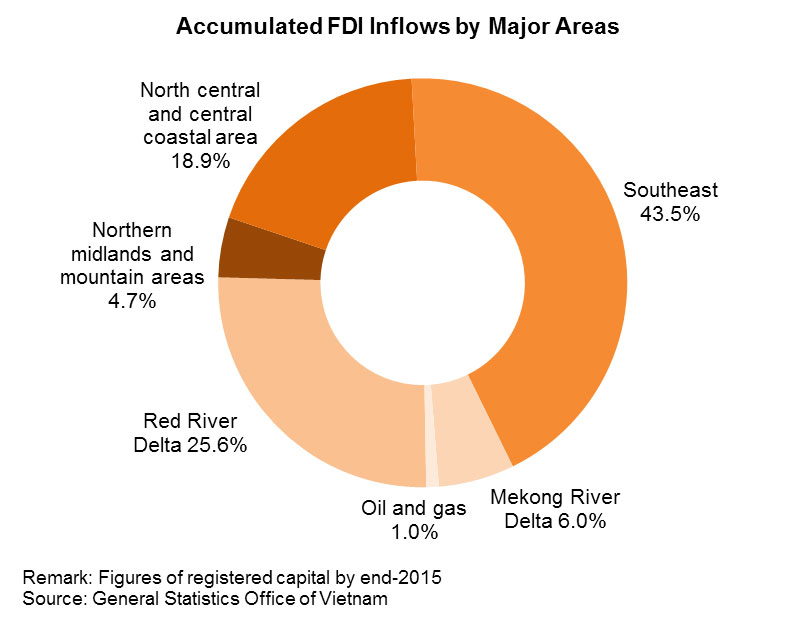

Northern Vietnam is being increasingly targetted by foreign investors, many of whom had previously favoured business opportunities in the south of the county. Highlighting this traditional preference, at the end of 2015, the southeast part of the country – extending across Ho Chi Minh City, Dong Nai and Ba Ria-Vung Tau – accounted for 43.5% of the total accumulated FDI inflow. By comparison, the Red River Delta – including Hanoi, Bac Ninh and Hai Phong – accounted for just 25.6% of the cumulative total. More recently, nonetheless, the northern cities and provinces have started to attract a greater proportion of overall FDI. This is down to both a greater effort on the part of the government to promote the economy of the north and a marked improvement to the infrastructure across the region.

A sign of this change in emphasis is the city of Hai Phong, which attracted the second highest level of FDI in Vietnam in 2016, solely trailing Ho Chi Minh City. Hai Phong is set within the Hanoi-Hai Phong-Ha Long economic triangle. It is also the site of Northern Vietnam’s largest seaport. Of late, sea freight connections between Hai Phong and the ASEAN, US and European markets have been bolstered by the increased availability of container liner services, the consequence of a shift in focus by the international shipping companies.

Cat Bi International Airport, Hai Phong’s principal air transportation hub, has direct links to several other Vietnamese regions, including Ho Chi Minh and Da Nang, as well as offering flights to other Asian countries. The completion of a new highway connecting the city to Hanoi, the country’s capital, has also provided a boost to business and industrial activities in the Hai Phong region. The highway also extends to Ha Long, capital city of the resource-rich Quảng Ninh province. Additionally, Hai Phong’s access to the markets and supply chains of southwest China have been further improved by the completion of highway connections to Mong Cai and Lang Son, the two Vietnamese cities that respectively border the Chinese townships of Tongxing and Pingxiang of Guangxi region.

Hai Phong: The Cost Benefits

Overall, the improvements to its infrastructure have made Hai Phong far more attractive to a range of business and industrial investors, with the success of the VSIP Hai Phong Industrial Park being an example of this. Jointly established in 2008 by a Singapore consortium and a Vietnamese state-owned enterprise, it has a total area of 1,600 hectares, of which 500 hectares are reserved for industrial development. The remaining space has been given over to a range of commercial and residential projects.

As well as benefitting from improvements to the local transportation network, VSIP Hai Phong also owes much to its success to its access to all the required utilities, including reliable electricity, water supplies and optical fibre telecommunication services. This has seen it attract projects largely related to higher value-added industries. To date, these include companies specialising in:

- Electrical and electronics

- Precision engineering

- Pharmaceuticals and healthcare

- Supporting industries

- Consumer goods

- Building and specialty materials

- Logistics and warehousing

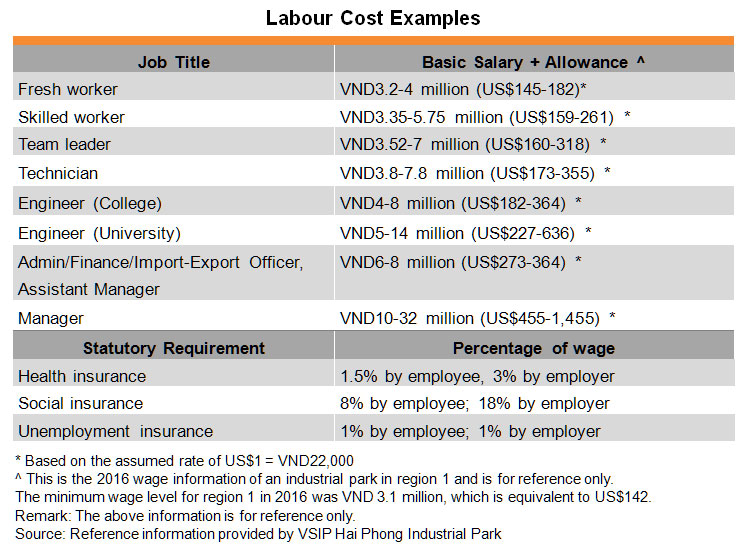

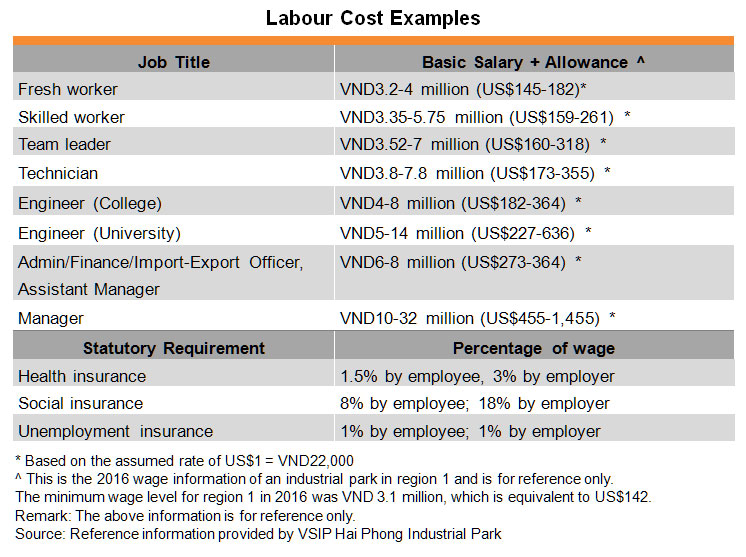

In line with the latest government regulations, industrial investors in VSIP Hai Phong are entitled to claim a range of tax benefits, including preferential corporate income tax rates and exemption from certain import taxes (those related to export processing enterprises[1]). Employees working in the park also pay a lower level of personal import tax[2]. In addition to this, labour costs are relatively low in Hai Phong and its neighbouring regions, with the total monthly cost per worker – factoring in statutory contributions, such as insurance – starting at around US$200-250. This is a relatively low cost when compared to the current wage levels in China.

(Remark: For more information regarding labour costs, please see: Vietnam’s Youthful Labour Force in Need of Production Services.)

Seeking Production Supports from China

According to VSIP Hai Phong, the park is currently home to some 35 industrial projects, with investments sourced from ASEAN, Japan, Korea, Taiwan and Hong Kong. An estimated 70% of its industrial areas have already been occupied by such projects. For the future, the park plans to attract more high-end investments, specifically those related to production of technology products and the supporting industries. Any such investments, of course, will be obliged to comply with all the statutory environmental regulations, although any potentially polluting industry that demonstrates it can meet the required emission standards may not be refused.

Many of the industrial projects based in the park are related to processing production, particularly with regard to textiles and clothing items, electronic products and packaging materials. Among the other investors are several companies engaged in the manufacture of intermediate goods, the majority of which are utilised as production inputs by downstream clients in Hai Phong and Northern Vietnam. Production of this kind, however, relies heavily on imported industrial goods and raw materials. One foreign-invested company, which undertakes the assembly production of electronic products and office machinery, for instance, has indicated that it is sourcing competitively-priced, high quality parts and components from elsewhere in Asia in order to support its Hai Phong production activities.

Several Hong Kong-invested companies are also operating in VSIP Hai Phong. One of them, which has a focus on plastic injection moulding, metal stamping and die-casting, told HKTDC Research that it had established a manufacturing operation in Vietnam in order to follow in the footsteps of one its downstream clients. Typically, the plastic and metal outputs of its Hai Phong factory are mainly used for the processing production of IT and other electronic products by its clients in Vietnam. As such, maintaining the Hai Phong factory saves the company money when it comes to logistics costs, while shortening the delivery lead time to its downstream clients. As another plus point, it also enjoys the accrued tax benefits of being based in Vietnam.

While acknowledging a number of clear advantages of being based in Vietnam, maintaining an operation in Hai Phong has not been without its challenges for the company. One of its particular problems is related to the relatively low skill levels of many local workers, with their productivity, consequently, a bit lower than that of their counterparts in southern China. While Vietnamese labour costs are lower, in productivity terms, the labour cost differential between Vietnam and China is far from substantial. In order to enhance its production efficiency, the company is now planning to further automate its operations, a development that will see it requiring lower staff levels. Labour costs, therefore, will ultimately become relatively insignificant when it comes to considering further investments at the site.

The fact that Vietnam lacks a number of the key supporting industries, such as precision tool-making and engineering support, has huge significance for the future industrial development of the country. This lack of technicians and engineers, for instance, has already deterred the aforementioned Hong Kong company from establishing an in-house manufacturing moulds and tooling facility in Hai Phong.

In order to tackle these problems, the company has to buy in various services and supplies from the Chinese mainland. For one thing, the company needs to orchestrate their in-house engineering talents and facilities like computer numeric control machines to make the moulds and tooling in south China, which would then be shipped to Hai Phong for use in processing production. As the plastics and metal raw materials are mainly sourced from China, as well as certain other Asian countries, the company is obliged to utilise efficient logistic services for the delivery of such materials to Hai Phong. The company, then, is making the best use of a variety of supports from China in order to facilitate its bid follow its client’s downstream investments in Vietnam.

[1] For details of the preferential treatment, please see: Vietnam Utilises Preferential Zones as a Means of Offsetting Investment Costs.

[2] According to VSIP Hai Phong, all local and expatriate labours working in Dinh Vu-Cat Hai Economic Zone (including VSIP Hai Phong) enjoy 50% reduction of personal income tax.

Editor's picks

Trending articles

Hong Kong has an online environment that other countries can “only dream about”, says Michael Gazeley of locally-based but global cyber security firm, Network Box. He says China’s Belt and Road Initiative consists of online (as well as land and sea) trading links and Hong Kong can rely on its fast, stable Internet and world class infrastructure to safely connect up the cyber Belt and Road. Catch Part 2 on Hong Kong’s expertise in cyber security.

Speaker:

Michael Gazeley, Managing Director, Network Box Corporation Limited

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com/

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Hutchison Ports regards its Hong Kong headquarters as the right place to run its global network – including connecting people, cultures and systems across the Belt and Road, according to Group Managing Director Eric Ip. Particularly relevant is Hutchison Ports’ award-winning nGen high technology operations system, which was developed in Hong Kong.

Speaker:

Eric Ip, Group Managing Director, Hutchison Ports

Related Links:

Hong Kong Trade Development Council

https://www.hktdc.com/

HKTDC Belt and Road Portal

https://beltandroad.hktdc.com/en/

822 Views

822 Views