Hong Kong

In a bid to pursue long-term business development, many technology-intensive and capital-intensive enterprises on the Chinese mainland have, in recent years, been devoting great efforts to formulating their international business plans as well as further exploring market opportunities arising from the Belt and Road. According to Keda Clean Energy Co Ltd of Guangdong, outbound investment in carrying out production offshore should not just take into account labour and direct production costs but also the overall costs, including transportation, logistics and tariffs. Also, investment strategy should be mapped out according to market demand in order to seek maximum benefit for the company’s business.

Keep an Eye on Belt and Road Market Potential

Keda Clean Energy, listed on the Shanghai Stock Exchange, is mainly engaged in building material machineries (building ceramic machineries, wall material machineries, stone material machineries, etc), clean energy for environmental protection (clean coal gas technology and equipment, gas purification technology and equipment), and clean energy materials (dynamic lithium-ion battery negative electrode materials). The company also provides project contracting arrangement, financing and leasing services. It has 27 subsidiaries in Guangdong, Anhui, Jiangsu, Henan and Liaoning, as well as a number of well-known brands in the trade such as Keda, Henglitai, Kehang, Xinmingfeng, Kdneu, Ai’er and Zhuodahao. Today, the company’s products are sold to more than 40 countries and regions.

Where building material machineries are concerned, Keda Clean Energy actively makes use of Chinese-made equipment to expand its overseas markets and has already established itself as a leader in the Asian market.

The company’s director Jason Zhong told HKTDC Research: “The building material machineries produced by Keda Clean Energy are technology- and capital-intensive, with both their quality and technology reaching international levels. This, coupled with the full support of the mainland in supplying metals in the form of raw materials, electronic/electrical parts and components, as well as abundant top-notch design and engineering personnel, is conducive to the production of building material machineries with advanced technology and high price-performance ratio.

“Although labour and production costs in the mainland have been climbing in recent years, Keda Clean Energy still manages to improve its mainland production business, excel in technology and quality, and further develop the market at home and abroad.”

Zhong added that after 30 years of growth, the mainland building materials market is coming of age and the demand of downstream manufacturers for building material production equipment is becoming stable. To seek long-term business development, Keda Clean Energy is gradually expanding its overseas market. It also attaches importance to the development potential of countries along the Belt and Road. Many countries along the route are eagerly trying to import the necessary equipment for the production of building materials locally to support the burgeoning infrastructure construction and building activities in their countries.

Deploying Overseas Investment Based on Cost and Profit

In addition to exporting building material machineries from the Chinese mainland, Keda Clean Energy has also started to invest in production activities offshore. Such investment projects mainly concentrate in downstream business related to building material equipment, including investing in the production of ceramic building material products in African countries. The ceramic tiles production line the company set up in Kenya began operation at the end of 2016, while its factory in Ghana is scheduled for operation in mid-2017. Infrastructure construction work for its building materials project in Tanzania is also in progress.

Although the building materials made in China have the advantage of low cost, manufacturers in the trade often find it difficult to explore distant markets overseas due to the relatively high import tariffs imposed by some countries and the high transportation cost involved. As construction activities in certain developing countries, such as those in Africa, continue to surge, their demand for building materials is strong. Yet there are hardly any large-scale local investors who are willing to set up building material production lines there supplying the local market.

Zhong said: “Against this background, Keda Clean Energy co-operates with some African distributors whereby China-made equipment is exported to the countries concerned to set up building material production lines there, taking advantage of the raw materials available locally to produce ceramic tile products to supply to the African market.

“Actually, taking into account the labour efficiency and other production costs in Africa, the cost of producing ceramic tiles there is not lower than that in the mainland. But the great savings on import tariffs and transportation cost allow Keda Clean Energy to effectively explore the end market for building materials in Africa. Moreover, the keen demand of the African building materials market means that it can accept higher prices, which in turn brings about greater profit. At the same time, it can also drive the company’s equipment sales to Africa.”

Where building material machineries are concerned, Keda Clean Energy has realised localisation of building ceramic machineries and is moving towards its objective of becoming the world’s building material equipment industry leader. The company has two “state-accredited enterprise technology centres”, one “national engineering technology centre”, two “post-doctoral scientific research workstations”, and three “academician workstations” in the mainland. These innovative R&D platforms complement its mainland production bases in providing advanced equipment and relevant technical support services to its building materials clients. At present, the company is one of the leading enterprises in building material machineries in China and has been awarded honours such as China’s top 500 machinery enterprises, national-level high-tech enterprise, national intellectual property demonstration enterprise, and Guangdong’s top 20 innovative enterprises.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

Editor's picks

Trending articles

In the face of fierce market competition and rising wages and raw materials costs, some enterprises on the Chinese mainland are considering relocating their production to regions offering lower costs. At the same time, a large number of enterprises are choosing to adopt the strategy of transformation and upgrading in a bid to increase competitiveness and meet challenges. PEAK Corporation in Nanhai district, Foshan city, Guangdong province, is actively upgrading its automated production equipment while formulating a strategic production layout plan in an effort to expand its market share.

Introducing Robots to Ease Technical Staff Shortage

Engaged in the R&D and manufacturing of car lifts/hydraulic equipment, PEAK mainly relies on technology and quality to win in the market. Following changes in the external environment, some mainland enterprises seek to lower cost by relocating their production activities. But in contrast, PEAK spares no effort in enhancing its R&D capability and introducing welding robots and other automated production equipment, such as modified computer numerical control (CNC) sawing machines, stamping presses and automated feeder equipment. By so doing, the company can alleviate the problem of technical staff shortage while strengthening its ability to manufacture high-tech and high quality products.

A spokesperson for PEAK told HKTDC Research: “Manufacturing car lifts is a capital-intensive and technology-intensive production activity. While only a small number of non-technical workers are needed, skilled technical staff of the “master” grade are required to carry out the welding and installation processes.

“As such, shifting production to low-cost regions overseas often cannot solve the problem of a shortage in technical staff. Also, the business operations in question have to rely on the support of upstream suppliers in providing raw materials including quality aluminium, iron and steel. The company not only uses the right machinery and production equipment but also has in place a sound quality control system to ensure that its products meet the stringent technical and quality requirements of the mainland and foreign markets.

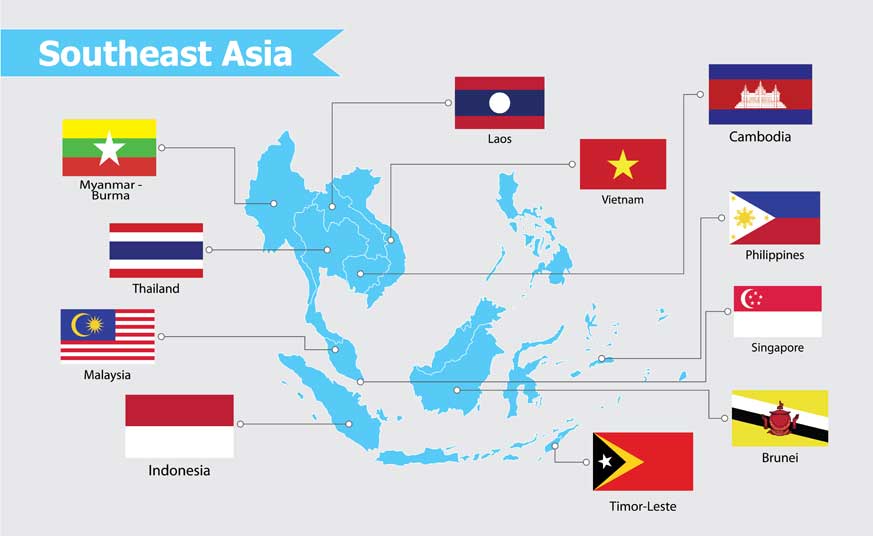

“Some low-cost regions in Southeast Asia are in short supply of technical workers and their raw materials supply chain has yet to be developed. If the metal materials produced in China are used to support production in these regions, the cost of transportation involved is huge. So relocation just for the sake of taking advantage of the lower cost of non-technical labour in these regions is often not worth the while.

The spokesman added: “In view of the fact that Guangdong province has a well-developed supply chain system and good logistics supporting services, in order to ease the problem of shortage in technical staff, PEAK has started to introduce automated welding robots in recent years. It is also co-operating with colleges and technical institutes in training more technical staff capable of operating robots and automated production lines.”

Actually, PEAK has already invested in setting up production lines in the US, utilising automated equipment to produce and assemble car lifts and hydraulic products. The production lines are slated to begin operating in the second half of 2017. The products will be mainly sold to the markets in North America, South America and Europe. Apparently, this move has not been made to lower production cost but to save on tariffs levied on products (or raw materials) imported into the country. It also serves to provide better sales and after-sales services to local clients. In addition, the company can capitalise on the sound local logistics network to cut logistics costs and transportation time in supporting its sales activities in markets neighbouring the US.

PEAK was established in 1999. Today, the company boasts not only advanced production equipment and high technology, but also a strong team of management personnel. Its products include single-post, twin-post, four-post and scissors car lifts, which are designed and manufactured in accordance with the technical standards of the America National Standard Institute (ANSI) and/or European Union’s CE. These products reach the relevant quality control standards and are mainly exported to overseas markets. In 2016, the company’s sales amounted to around US$17 million.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

Editor's picks

Trending articles

Globalisation has precipitated the integration of regional supply chains. Many companies engaged in manufacturing on the mainland have been actively accelerating the “going out” policy by shifting some of their manufacturing business to Southeast Asia and other regions to optimise their overall production layout and meet the challenge of rising production cost on the mainland. Sunny Tan, Executive Vice President of Luen Thai Holdings Limited, says companies need to consider a host of factors other than production cost, such as the trade measures imposed by foreign countries, the supply chain in the relocation destinations, and the demands of end users, before they can effectively upgrade their overall production and operational efficiency.

Preferential Trade Arrangements Affect Production Layout

Tan told HKTDC Research: “Labour and land supply will of course directly impact production cost, but preferential trade arrangements granted by foreign countries to some places of production may also be crucial for lowering the cost of export to overseas markets. For example, products such as apparel and handbags may incur double-digit import tariffs (actual tariff depends on product) when shipped to Europe and North America. However, if they are entitled to tariff reduction and exemption, the benefits may exceed the extent of cost cut.”

He cited the following example: “Thanks to the easing of the US generalised system of preferences (GSP), bags manufactured in beneficiary countries like Myanmar and Cambodia can now enjoy zero import tariff in the US market. In addition, these two countries are also entitled to export bags to the EU, Japan and China with zero duty under different GSP arrangements and free trade agreements. In order to seize the opportunities and enjoy the relevant preferential tax policies, Luen Thai is expanding its bag manufacturing business in the Philippines and Cambodia through developing new capacity and converting some apparel manufacturing facilities for bag production in recent years.”

Provision of Strategic Production Services

Hong Kong-listed Luen Thai is a leading consumer goods supply chain group. It specialises in casual and fashion apparel, sweaters and accessories such as fashion bags and backpacks and makes use of its competitive price, good quality, prompt response and other advantages to provide OEM and ODM services for famous international brands. Its business strategy is to establish regional production networks in China and countries like the Philippines, Cambodia, Vietnam and Indonesia to benefit from the production advantages of different places in the provision of strategic production services to clients.

Luen Thai started its apparel production business in Hong Kong in the 1980s and established a network of production facilities in cities like Dongguan, Panyu and Meizhou in Guangdong province. In the wake of rising production costs and labour shortages on the mainland, it has gradually relocated its production to Southeast Asia in the past decade to lower costs and to benefit from the tariff advantages of these countries.

Tan said: “Not all low-cost countries are suitable for the relocation of production facilities from the Chinese mainland. It all depends on individual companies and the actual circumstances. For example, some ‘Belt and Road’ countries are not popular destinations for foreign investment. Companies may not know the laws and regulations and the culture of these places and may not be familiar with the local labour situation and production support services.

“These will directly affect the feasibility of plans to make investment and set up factories in these places. Moreover, low cost may be due to the lack of supply chain/material support, poor transport infrastructure and logistics services. Some countries have a good supply of unskilled labour but lack skilled workers and technical expertise, which makes it difficult for them to take on high quality and high value-added production activities.”

Catering to the Business Development of International Clients

Tan continued: “In addition to production factors, clients’ needs are also of crucial importance. Internationally renowned brands are quick to respond to market changes. As global economic growth slows down, different brands have been making every effort to upgrade their product design, materials and quality to fight for consumers’ limited spending power. They are willing to keep the production of these products in China and other places of production where the supply chain is more mature in order to be able to respond more swiftly to fierce market competition.

“For products that are more standardised or have a longer life cycle, such as T shirts, underwear and sports sacs, clients may be more willing to trade higher production risks and a longer production cycle for lower cost by shifting production to more backward places of production where cost is lower, such as Bangladesh and Ethiopia.”

Luen Thai owes its success not just to its policy of effectively using the best that the Chinese mainland and other overseas production bases have to offer to satisfy the demands of different clients, but also to its efforts to actively work with the overall brand development strategy of clients. In particular, the less well-known brands are very concerned about their brand and corporate image and want their manufacturers to strictly fulfill their corporate social responsibilities. Luen Thai strictly abides by the laws and regulations of the places of production and ensures compliance with the corresponding labour and moral codes. It also adopts effective environmental protection measures in compliance with the requirements of its clients in order to achieve the objective of sustainable business development.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

Editor's picks

Trending articles

Asia is a fast-growing region. Companies in this region and multi-nationals are adjusting their business strategies rapidly in response to the changing investment environment. Hong Kong-based Artesyn Technologies Asia-Pacific Limited is a company mainly engaged in the manufacturing of information technology products and power supplies. In recent years, it has stepped up the integration of its mainland manufacturing activities, including upgrading its production plants in Guangdong, reinforcing the R&D capability of its Shenzhen Design Centre, and shifting some of its spare parts manufacturing activities to the Philippines where production costs are lower. In future, Artesyn hopes to capitalise further on the cheap labour of Southeast Asian countries in the production of power supply components and parts for its production plants in Guangdong, and make better use of the advantages of different regions for precision planning of production in order to improve its service to its clients in the Asian, European and North American markets.

Upgrading Production in China

Johnny Cheung, Artesyn’s Managing Director (China Operations), points out that, despite their cost advantages, many Southeast Asian countries are hindered by simple production conditions and supply chain systems. In comparison, the Chinese mainland boasts mature electronic manufacturing clusters that supply all the necessary spare parts and production backup services, as well as having an ample supply of tech talent. These are capable of effectively providing comprehensive services to domestic clients as well as to downstream manufacturers in the region, in the areas of material supply, mould and die design and manufacturing, technical support and provision of solutions. China remains a major region for the company’s development in the near future.

Cheung told HKTDC Research: “Faced with rising production costs and labour shortage on the mainland, Artesyn relocated its production facilities in Shenzhen to Zhongshan to lower cost while actively using the nation’s technological resources to reinforce the R&D capability of its Shenzhen Design Centre. Artesyn has in fact further upgraded its facilities in Zhongshan. The introduction of automated equipment has greatly eased labour shortage and made it possible for us to engage in production involving a higher level of technology. We have also built a production line in Luoding in a remote part of western Guangdong to make use of the city’s ample labour supply and lower labour cost to expand our production capacity.”

In order to diversify the risk of over-concentrated production, Artesyn acquired production facilities in the Philippines through its parent company, Artesyn Embedded Technologies Inc. This undoubtedly provides the company with a solution to rising production costs on the mainland. According to Cheung, employees in the Philippines speak good English and can effectively communicate with management personnel from Hong Kong and various parts of the world. This plant has a relatively low employee turnover rate, and stable employment is favourable for the management of production and staff training. Convenient transportation between the Philippines and China and reasonable logistics costs have also made it possible for Artesyn Embedded Technologies to continuously expand its production capacity in that country in recent years. It can take advantage of the relatively low cost of production in this country to produce electronic parts and components for Artesyn’s production activities in Guangdong.

Precision Planning for Production

Cheung said: “The Philippines is still in a developing stage in terms of supply chain, production network and support services, even in the supply of tech talent. Thus, we mainly make use of its labour resources to produce labour-intensive power supply parts and components as well as power supply units for which demand is relatively steady.

“The company’s production lines in Zhongshan and Luoding mainly produce a wide range of high-tech end products with the backing of the mature supply chain in the Pearl River Delta region. Artesyn also strengthens its engineering design so that its products can use more standard parts and components for automated production. While cutting down on the employment of unskilled workers on the mainland, it makes greater use of the cheap labour of the Philippines to produce power supply parts and components and strives to better leverage the advantages of different regions for precision planning of production in order to provide downstream clients with more cost-effective products.”

Artesyn is a subsidiary of the Artesyn Embedded Technologies Inc. and is mainly responsible for the company’s manufacturing business in China. Artesyn Embedded Technologies is a global leader in the design and manufacture of highly-reliable power conversion and embedded computing solutions for a wide range of industries, including communications, computing, healthcare, military, aerospace and industrial automation. As one of the world’s largest companies for embedded power supply business, it supplies clients with standard AC-DC products and a wide range of DC-DC power conversion products. It has over 20,000 employees worldwide across 10 engineering centres of excellence, four world-class manufacturing facilities, and global sales and support offices.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

Editor's picks

Trending articles

A combination of Hong Kong’s multi-modal transportation model and IT solutions advantage allows On Time Express to cut freight transit times by up to 50 per cent. The Hong Kong-based logistics firm’s Spencer Lam says China’s Belt and Road Initiative also creates many new opportunities for traditional freight forwarding across the more than 60 countries under the Initiative.

Speaker:

Spencer Lam, Managing Director, On Time Express Limited

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

The industrial landscape in Asia is undergoing a fresh round of changes. Following the earlier large-scale relocation of production activities from many of the developed countries to lower cost regions in the late 1990s, industrial production activities soared across Asia, particularly in China, which emerged as a manufacturing power house. In recent years, however, the investment environment in China has begun to change. Rising labour and production costs across the mainland have prompted a number of foreign-invested and domestic enterprises to adjust their business strategies, frequently resulting in the relocation of part of their production activities to other locations within Asia, while their mainland business operations have been upgraded in a bid to enhance their competitiveness.

The Changing Business Strategies of Guangdong and Hong Kong Enterprises

Many of the local and Hong Kong enterprises engaged in production and trade in Guangdong actually began to adjust their strategies several years ago in order to cope with the changing investment environment of the Pearl River Delta (PRD) region. Among the steps taken was the relocation of a number of production and sourcing activities to lower-cost regions on the mainland.

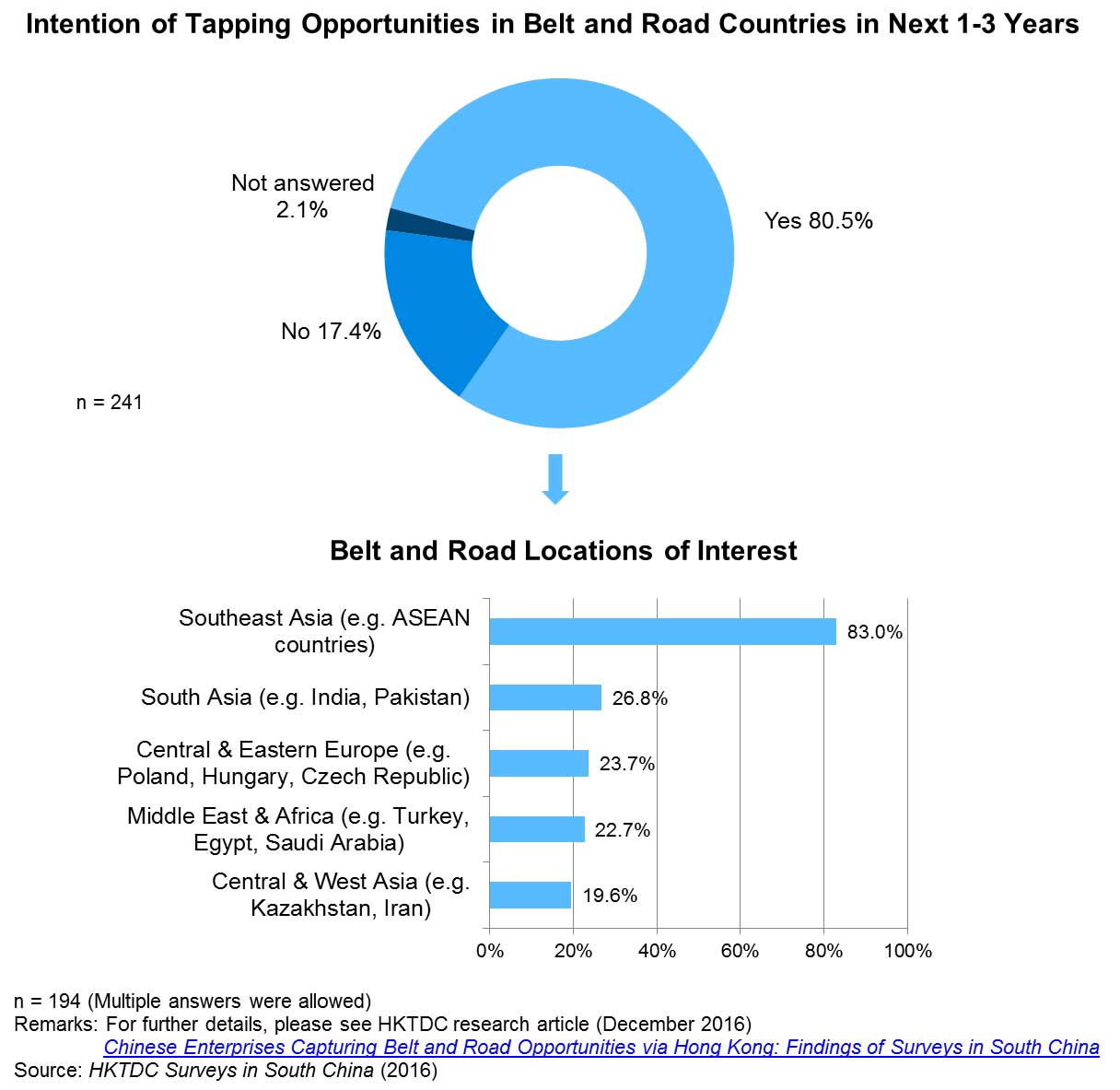

Quite a number of these businesses also opted to set up production facilities in one of the Southeast Asian and other countries set along the Belt and Road routes or to source various products and raw materials from such locations in the hope of reducing costs through the utilisation of external resources. As the growth of both the global and mainland markets has slackened over recent years, amid intensified competition from other low-cost regions, as well as controlling costs, many Guangdong and Hong Kong enterprises have had to take further action with regard to their transformation and upgrading. This has seen many of them aim to switch from labour-intensive production to high value-added business in order to secure sustainable development in the medium to long term.

Many such enterprises have invested heavily in automation in order to alleviate the problem of labour shortages. By using automated production lines, they also hope to produce items of a higher quality with a greater degree of precision in order to meet the increasingly stringent requirements of the international market and to compete more effectively. While some enterprises have increased investment in technological research and development in an effort to develop into a more high-tech business, others have chosen to build their own brands to raise the perceived value of their products. As the pace of globalisation has quickened, the division of labour between different industrial sectors has become increasingly well-defined, a development that has, in turn, made the management of the global supply chain ever more complicated. In this regard, many enterprises in Guangdong and Hong Kong have had to adjust their strategies in light of the changing external environment in order to achieve a more comprehensive transformation and upgrade.

The Developing China/Asia Supply Chain

The advanced supply chain system and range of production support services enjoyed by the PRD is, arguably, unmatched anywhere else in world. In view of this, when mapping out future business plans, the majority of Guangdong and Hong Kong enterprises have opted to retain and even expand their production activities in the PRD, Guangdong its neighbouring regions, often prioritising higher value-added and higher technology content. At the same time, as industrial activities in other low-cost regions across Asia have continued to thrive, the supply chain relationship between China and Asia (including the ASEAN countries) has become increasingly close, a development that, in turn, offers an expanded market and wider sourcing options for Guangdong and Hong Kong enterprises.

At present, many enterprises ship large quantities of industrial materials from the PRD and other mainland regions to Asia and to other countries along the routes of the Belt and Road in order to support local industrial production activities. A number of such enterprises have also relocated to one of these low-cost regions in a bid to enhance their sourcing activities. Typically, the end-products produced/sourced in these regions are then sold on to the more developed countries, while the industrial materials, parts and components sourced there are shipped back to the PRD and other mainland regions in order to support higher-end production activities. Across Asia, the division of labour has become more and more well-defined, while the trading relationships between upstream/downstream suppliers and manufacturers in China and in a number of different Asian regions has become closer and closer. This has, in turn, fuelled the rapid expansion of intra-Asia trade.

Optimising Regional Business Plans

Generally speaking, in many of Asia’s lower cost regions, production conditions are somewhat basic, while the logistics and support services still have much room for improvement and technical personnel remain in short supply. As such, the enterprises that have relocated their production lines to these regions tend to be mainly confined to low-end, labour-intensive processes, producing light industrial goods as well as parts and components with a longer life cycle. Apart from labour costs, enterprises shifting their production offshore must also take into account their overall costs, including transportation, logistics, materials supply and management.

Coupled with the longer turnaround time required for such cross-regional arrangements, this requires the establishment of a highly efficient supply chain management system if industry players are to capitalise on the opportunities arising from changes to the international market. In light of this, when any such enterprise seeks to map out its offshore production plans, it is advised to take into consideration a number of factors, most notably whether the proposed production activity is compatible with the resources of the local market. As additional considerations, the trade barriers and preferential tariff policies implemented by the EU, US and other export markets may also impact on the regional production and sourcing plans of many enterprises.

Overall, as competition in the international market intensifies and the global supply chain continues to evolve, Guangdong and Hong Kong enterprises can no longer solely rely on their facility to lower direct production costs as a way of remaining competitive. Instead, they will have to proactively adopt a number of alternative strategies, including transformation, upgrading and enhancing business value. They will also need to take into consideration such concerns as overall market demand and cost benefits, while looking to optimise their regional business plans in order to increase their competitive edge.

Against this backdrop, Guangdong and Hong Kong should strengthen co-operation when it comes to formulating the necessary policies for promoting the further development of commercial entities in both locations. In particular, every effort will need to be made with regard to the application of smart manufacturing technology as a means of pursuing industrial upgrading, while action should also be taken to promote technological co-operation between enterprises in both locales and to accelerate the pace at which technological achievements are commercialised. Furthermore, both Guangdong and Hong Kong should look to improve the transport and logistics networks that connect them in order to ensure their respective enterprises can effectively plan for business development across the region. Steps should also be taken to encourage all such enterprises to work together when “going out” to capitalise on any emerging Belt and Road opportunities. They should also look to make best use of Hong Kong’s professional services sector in order to formulate long-term developmental strategies and to effectively manage risk. All the while, they need to strengthen their connections with Asia’s growing regional supply chain and make better use of the various regional resources available in order to expand both the mainland market and the wider export opportunities.

Please click here to purchase the full research report.

Editor's picks

Trending articles

The Hong Kong Mass Transit Railway Corporation’s MTR Academy offers the railway’s best experiences and practices for supporting Belt and Road rail developments, says Academy President Morris Cheung. The MTR has a literal and figurative “track record” says Valentin Reyes of Manila’s Light Rail, while Hungary’s MAV learns from MTR’s financial sustainability and service.

Speakers:

Valentin Reyes, HSEQ Director, Light Rail Manila Corp

Morris Cheung, President, MTR Academy

Ilona David, President and CEO, MAV Zrt

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

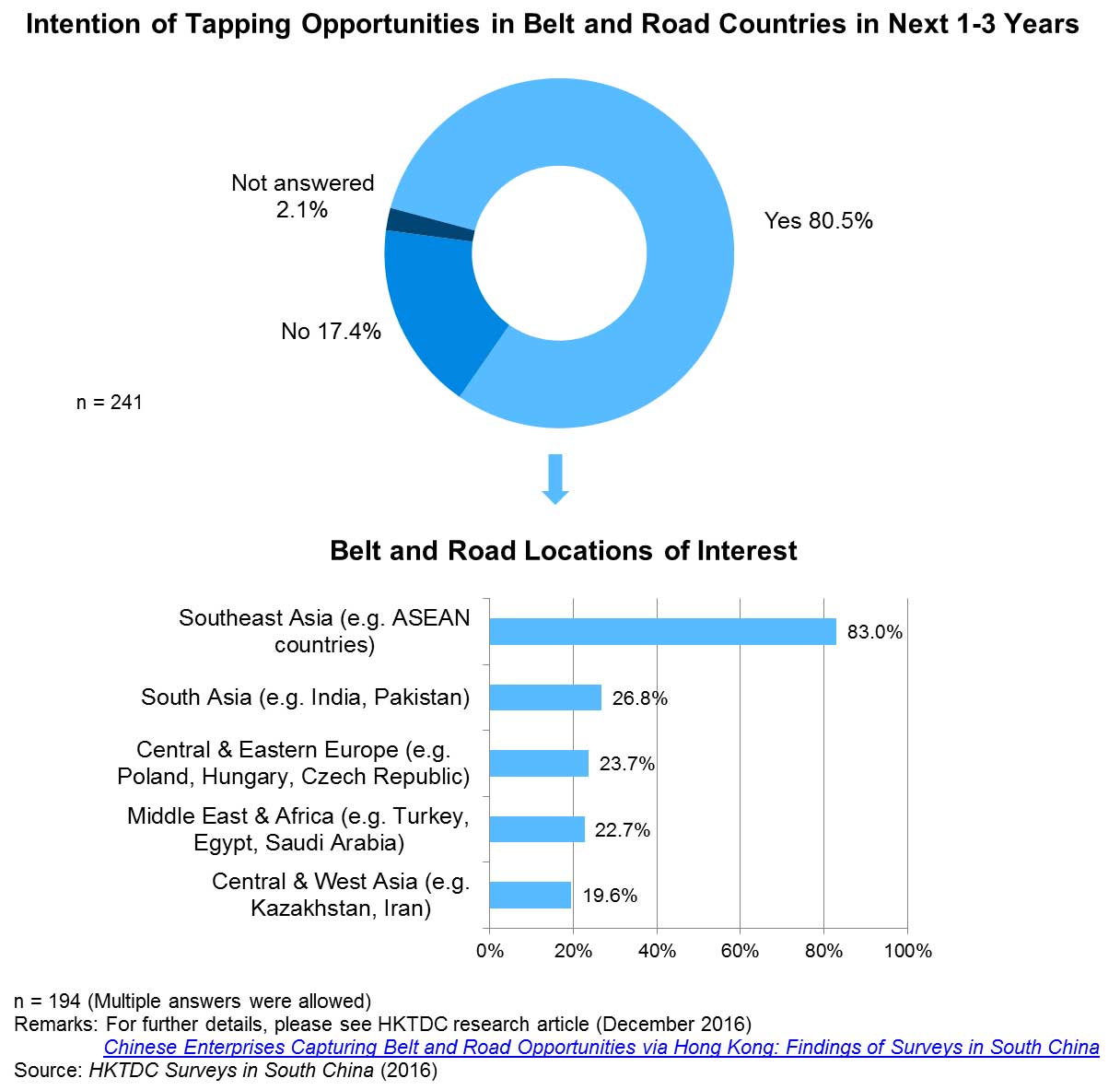

Promoting the Development of Overseas Co-operation Zones: Hong Kong’s Role and Opportunities

From the above cases of economic and trade co-operation zones in Asia, it is apparent that they are beneficial to the “going out” of mainland enterprises to develop overseas business and expand sales opportunities in Belt and Road markets. They are also beneficial to enterprises in fine-tuning their overall production layout by making use of local labour forces and other advantages in concert with existing production activities on the mainland. Meanwhile, with increases in investment and production in Southeast Asia, a regional supply chain network that connects to China has gradually taken shape and is getting increasingly tight-knit and complex, promoting commercial logistics and trade development in the process.

In the course of their development, these co-operation zones can also provide Hong Kong with outbound investment opportunities. An overview of the cases mentioned above indicates that manufacturers and traders in Hong Kong, particularly SMEs, can consider using these co-operation zones as platforms to forge into respective local markets or to set up a base to capitalise on local production advantages to expand into the international market. Those in Hong Kong engaging in housing and infrastructure construction, transportation (including container terminal planning and operating), warehouse management and logistics can also consider collaborating with the co-operation zones through investment or providing related services to facilitate the sustained development and competitive advantages of the zones concerned.

Challenges Facing the Zones and Hong Kong Services

According to a study report published by the World Bank[1], many of the numerous special economic zones and industry parks (inclusive of industrial parks and science parks) around the world fail to develop sustainably. The success or failure of the development of an industry park is dependent not solely on the investment policy and preferential terms offered by the respective host country or region. It also depends very much on factors such as the site location, planning and design, as well as the level of management of the park in question.

This is particularly so because, as competition is intensive among different countries or various regions of the same country, the corporate-tax incentives offered by parks are basically similar. Therefore, an over-reliance on preferential tax treatment but a lack of effective communication and co-ordination between the government and the stakeholders of a park may lead to a poor connection between the park and the surrounding traffic networks as well as an undesirable labour supply and other supportive and promotional services. This would, therefore, be the main obstacle to an industry park’s sustained development and corporate investment.

In the early stages of developing special economic zones and industry parks, some South-east Asian countries have been concerned mostly with promotional activities to attract enterprises and investment, neglecting to establish a set of clear and sound legal and regulatory systems. Such systems would include a co-operative framework for joint public-private development of the zone or park, the specific rights and responsibilities of a zone/park developer and operator, a zone/park design aligned with the planning and infrastructure construction in peripheral cities, and environmental protection and emissions standards.

In the early years in some countries such as Vietnam, in their eagerness to attract private developers to participate in the development of industrial parks, local governments were reliant on signing investment contracts with individual developers without a standardised overall negotiation framework. This led to a large disparity in preferential or concession treatments, resulting in vicious competition among parks and affecting the processes of approving individual local investment projects by the state-level departments concerned. In some cases, even after an investment had been committed, when a project was found to be inconsistent with local conditions or affecting other sectors or economic aspects, the government would only then impose additional restrictions or demand the reopening of negotiations, increasing the investor’s costs and directly affecting the sustainable development of the whole project.

To ensure that special economic zones and industry parks would better serve their purposes – such as attracting investment, creating jobs and driving industrial upgrading – and that the targets of the 2025 development blueprint of the ASEAN Economic Community could be achieved, the ASEAN countries reached consensus at the ASEAN Ministers’ Meeting in August 2016. They agreed to adopt the ASEAN Guidelines for Special Economic Zones Development and Collaboration to serve as a basis for the effective planning and regulation of future zones and industry parks.

Referring to the above case analyses of industry parks in Vietnam, Cambodia and Malaysia, we now attempt to explore possible roles for Hong Kong in promoting the development of China’s overseas co-operation zones regarding location selection, planning/design and management.

Investment Analysis and Due Diligence

The 10 ASEAN countries are not only very different in their economic and population structures, but also in their labour markets, wage levels, stages of economic development, investment policies and in the incentives they offer. Though most ASEAN countries are using industry parks as the main vehicle to drive economic development and attract investment, there are substantial differences in the actual production environment and conditions among individual parks. These include, for example, the park’s location, conditions of the local supply chain, the standards of logistics facilities and services in peripheral areas, the efficiency of inland and international transportation, environmental requirements, the adequacy of skilled and unskilled labour supply, local training of skills and management personnel, etc. All these issues will eventually affect the sustained development capability and competitiveness of a zone.

Therefore, when carrying out investment planning and selecting a location, an investor must properly evaluate the country, the region and the policies concerned to ensure that the development of the zone will align with the local medium- to long-term development plan. This will minimise the hidden risk that an investment project may not have the blessing of the government, and will avoid the difficult scenario of having to co-ordinate and negotiate with the local government to obtain policy incentives and other support. Nevertheless, most enterprises say they do not have sufficient knowledge about the politics, culture and legal regimes of the relatively backward investment locations along the Belt and Road routes, including some of the ASEAN countries. Their problem is compounded by the fact that information is less than transparent in these countries, so it is difficult to ensure that an investment project is in compliance with the legal requirements of the country concerned, or to assess the medium- to long-term benefits and potential risks of the investment in question. Therefore, there is a need to seek professional services support.

Hong Kong’s service providers in this field are not only familiar with the legal and investment regimes of advanced countries, but can also utilise their extensive international networks in carrying out effective risk assessment for mainland enterprises intending to invest in emerging or Belt and Road countries. They can also offer strategic recommendations regarding the feasibility of an investment project, and can conduct special surveys on key or sensitive issues such as the environmental policy and tax incentives of an investment location. This can help investors control risks and ensure the sustainable development of a project after an investment has been made.

Zone/Park Planning and Management

The United Nations Industrial Development Organization (UNIDO) estimates there are more than 1,000 special economic zones in the ASEAN region, of which 893 are industrial parks. In Vietnam alone, there are more than 320 manufacturing-oriented industrial parks. As approximately half of the foreign direct investments entering Vietnam have ended up in industrial parks, competition among them is very keen.

Some industrial parks in Asia are designed so poorly that overcrowding and traffic congestion are common, while a number of old-style park premises lack green spaces and lifestyle recreation facilities, all indirectly leading to a host of labour, pollution and social problems. At the other extreme, some industrial parks are developed so ahead of time that their size and facilities far exceed actual demand. Consequently, enterprises setting up operations in these parks must bear very high management fees, unless they obtain subsidies from the government or the developer.

Furthermore, the designated new economic zones or industrial parks in some emerging countries are located in relatively remote areas in order to play a leading role in regional development and growth. Investors and developers in such cases not only have to concern themselves with the development of these zones, but they must also handle and provide transportation and other infrastructure to connect them to peripheral areas and the main ports.

Take Vietnam’s Longjiang Industrial Park as an example. In response to the expected opening of the Ho Chi Minh City-Trung Luong Expressway in 2010, the management company of the park had been upgrading its internal road system in earnest, as well as speeding up negotiations with the local government to facilitate road construction connecting the park to the expressway and to raise its overall transportation and logistics efficiency.

Hong Kong is a hub for infrastructure and real property services boasting more than 2,100 world-class companies engaging in architectural design, surveying and engineering services. These companies have a lot of experience in developing Hong Kong and overseas businesses and are capable of supporting the mainland in developing various types of industry parks overseas by offering a comprehensive range of project consultancy and management services. These include strategic recommendations in architectural design, project supervision, government-developer collaboration, infrastructure development, sewage and waste treatment, etc. Even for projects as large as the East Coast Economic Region in Malaysia, Hong Kong’s services sector can help add value and inject sustainable development planning concepts through their experience in participating in the development of large-scale integrated communities and the integrative utilisation of infrastructure and land.

|

Hong Kong Experts Participate in Delhi-Mumbai Industrial Corridor Project AECOM provided full programme management services for the Dholera Special Investment Region (DSIR) as part of the Delhi-Mumbai Industrial Corridor (DMIC) Development Corporation’s new cities infrastructure programme. The programme aims to transform India’s manufacturing and service base by developing a number of smart, sustainable and industrial cities along the 921-mile corridor between Delhi and Mumbai, the first to be developed being the 347-square-mile township of DSIR. AECOM’s project scope consists of implementing all base infrastructure including water supply, sewerage, roads, highways, power and rail; performing extensive flood-control and drainage measures to protect the future city; and overseeing the development and execution of all public-private partnership delivered projects, such as the railway connecting Ahmedabad to Dholera, industrial waste-water treatment and a potable water-treatment plant. In the process of developing new towns in Hong Kong, AECOM’s experts had to overcome the land constraints and technical challenges while being able to appreciate the needs of these developments at various stages, from engaging stakeholders, conceptual designs to construction, enhancement to completion, and finally making the entire project more resilient within a short timeframe. The unique experience, advanced technology and knowledge used can be readily put into practice in the Delhi-Mumbai Industrial Corridor. [The Hong Kong specialists of AECOM have also participated in a number of ASEAN infrastructure projects. For details, please visit AECOM’s website at www.aecom.com/hk/about-aecom/]. Remark: The above case is published on HKTDC’s Belt and Road web page: www.beltandroad.hktdc.com/ |

As far as the management of zones and parks is concerned, it should be noted that ASEAN’s guidelines for developing and co-operating in special economic zones permit that the developer and operator of an industry park can be different entities. Professional operation services providers offer management and real properties letting services, public utility services such as water and power supply, as well as waste and sewage treatment. They can also offer a host of value-added services such as the setting up of training centres and the provision of services in healthcare, childcare, transportation and employee recruitment.

In Hong Kong, other than local professional real property management service companies, there are also a large number of major international management services companies and consultancies. In addition to providing outstanding management and operation services, these companies are also in a position to recruit clients and match partners for zones and parks through their transnational client networks.

It is highly advantageous for the development of an industry cluster if a park can identify a suitable anchor investor that matches its positioning. The SSEZ has now attracted an industry cluster of about 100 enterprises from the mainland, Europe, the US and Japan that are engaging in textiles, light-industry products and accessories.

Environmental Protection Services

Belt and Road countries are mostly low- to medium-developing economies, but as they gradually industrialise, more and more of their residents are concerned about the resultant pollution. This has forced government planners and developers to pay more attention to environmental protection in industry related projects, and environmental assessment has become one of the investment requirements in many co-operation zones.

As these zones are mostly established in undeveloped or rural areas, industrial development will inevitably impact on the environment. Residents close to some co-operation zones have staged protests against the pollution brought about by mainland enterprises, impacting the zones’ long-term development. Moreover, planning and building environmental protection infrastructure takes time and requires adequate funding. Should the building of such infrastructure lag behind the zones’ development projects, irreparable environmental and pollution problems may result.

Hong Kong’s environmental-protection firms are adept at providing international-standard services in sewage treatment, pollution control and resource economisation. They are also experienced in advanced environmental management and enjoy a good international reputation. Hence they can provide the co-operation zones concerned with various types of environmental services as well as environmental assessment, environmental protection architectural/system design and related advisory services that are in compliance with the standards in advanced countries.

Production and Logistics Services

Belt and Road countries are mostly lacking in key production materials as well as other industrial materials and parts/components. Nor do they have enough skilled workers, technicians and engineers. While on the one hand they have to rely on the importation of certain materials to support production and operations, on the other hand they need different types of skilled personnel to provide production technology support. By virtue of its extensive international logistics network, Hong Kong is capable of effectively linking up goods transportation networks in mainland China, in Belt and Road countries and other important production bases, providing access to the huge production material support from the mainland and from within the region. Moreover, because of its ready supply of personnel in technology application and production technology, and also because of its convenient transportation network, Hong Kong can at any time provide extensive key parts and components, industrial materials and technological support to the production facilities set up by mainland enterprises in the Belt and Road co-operation zones.

|

Demand for Integrated Logistics Services Kerry Logistics (HK) Ltd points out that as ASEAN’s economy is becoming increasingly buoyant and mainland enterprises often choose to invest in factories in the ASEAN market as part of their “going out” strategy, the demands of ASEAN and mainland enterprises operating there for logistics and transportation services is bound to rise rapidly. In a move to effectively serve ASEAN and mainland clients, Kerry Logistics, as a pioneer service provider in cross-border transportation in ASEAN, has launched Kerry Asia Road Transport (KART), an overland cross-border transport network linking ASEAN countries and China, to supply high-efficiency long-haul overland transport and door-to-door delivery services. (Note 1) As the pioneer in creating an ASEAN-wide cross-border road transportation network, Kerry Logistics has successfully linked Singapore, Malaysia, Thailand, Vietnam, Cambodia, Laos and Myanmar directly with mainland China. It provides customers with long-haul trucking as well as sea-land and air-land services in these geographically challenging areas. (Note 2) In its recently announced 2016 annual results, Kerry Logistics says its business in other parts of ex-Greater China reported healthy performance. Kerry Logistics’ express business, which covers Thailand, Vietnam, Malaysia and Cambodia, continues to capture growth opportunities arising from increased intra-ASEAN e-commerce volume and cross-border logistics activities. (Note 3) Note 1: For further details, please see HKTDC research article (September 2015): Hong Kong Services for Mainland’s Outbound Investment (5): High-end Logistics Services Help Bolster International Business Expansion Note 2: Source Note 3: Source |

Furthermore, as supply chains become increasingly globalised, responsive and efficient, enterprises have to meet their stringent logistics and distribution requirements. Therefore, industrial parks that want to attract enterprises to invest in developing industry clusters have to plan and develop relevant transportation and logistics services.

MCKIP in Malaysia is an example in point. Since it is in collaboration with Kuantan Port to set up a bonded area to attract investment in export-oriented heavy industry and high-tech industries, the future development focus of Kuantan Port is to upgrade its container handling capability and improve its port logistics services. Hong Kong’s logistics services providers have extensive experience in the design of operational processes and the management of operational systems and IT for container terminals. In fact, they have practical experience and track records (including participation in the development of Shenzhen Special Economic Zone) in utilising related infrastructure support, equipment layouts and advanced operational processes in enhancing the overall operational efficiency of ports. Therefore, they are well qualified to offer help to Kuantan Port in developing the business of transporting goods and containers internationally.

Financing and Insurance Services

Enterprises are the main investors in the industrial zones developed overseas by China. Although zones that have passed required assessments are qualified to receive special subsidies and financing services, most funding would still have to be raised in the market. Hong Kong is one the world’s three major international financial centres, and funds are available from various sources and a wide range of financing products. As such, Hong Kong is in a position to match and accommodate funds and meet the insurance needs of different maturation, exchange rates and asset risks.

Adding to this are Hong Kong’s advantages in being an important business platform in the Asia Pacific with a sound legal system, free-flow of capital and information, and a full complement of professional services in law, accounting, etc. In investing in Belt and Road countries, mainland enterprises can make use of Hong Kong’s professional project evaluation and sustainability assessment services to bring in external funds to finance their overseas investment projects and other business ventures. They can also set up a regional office in Hong Kong and capitalise on Hong Kong’s highly efficient business environment to co-ordinate investment projects in mainland China, Asia and Belt and Road countries to enhance overall operational efficiency.

Furthermore, Hong Kong’s services platform can offer different investment options to mainland enterprises, including the use of private-equity investment funds. As a way to diversify risks, mainland investors can also make use of Hong Kong’s international network to identify offshore partners to carry out equity joint investment and other joint-stock co-operations. Mainland enterprises can also make use of their investment partners’ advantages to overcome their own limitations. By generating synergy between their partner’s advantages and their own knowledge and expertise, they can expand the business scopes of their Belt and Road investments.

Conclusion

Over the years, Hong Kong’s service providers have helped many mainland enterprises handle trade and investment business in Hong Kong and overseas markets. In supporting the overseas investment of mainland enterprises, Hong Kong has definite advantages. These include the availability of a full range of international standard professional services in finance, law, taxation as well as risk assessment in sustainable operation and international certification and testing.

As such, Hong Kong is an important springboard from which mainland enterprises can make overseas investments. As the mainland implements the Belt and Road Initiative and encourages the “going out” of enterprises to invest overseas, outbound investment activities, including investment in setting up Sino-foreign co-operative industrial parks, will become increasingly common.

Although mainland enterprises have definite advantages in the general contracting of projects, Hong Kong’s related professional and business services excel when it comes to specialised project segments. Hong Kong also has extensive international experience and is particularly strong when it comes to grasping and analysing overseas information. Therefore, strengthening co-operation between Hong Kong’s services sector and mainland enterprises would be beneficial to promoting China’s overseas economic and trade co-operation zones.

Please click here to purchase the full research report.

[1] Special Economic Zones: Performance, Lessons Learned and Implications for Zone Development, Akinci G and Crittle J, 2008, World Bank

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (1)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (2)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (3)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (4)

Editor's picks

Trending articles

Malaysia-China Kuantan Industrial Park in Malaysia

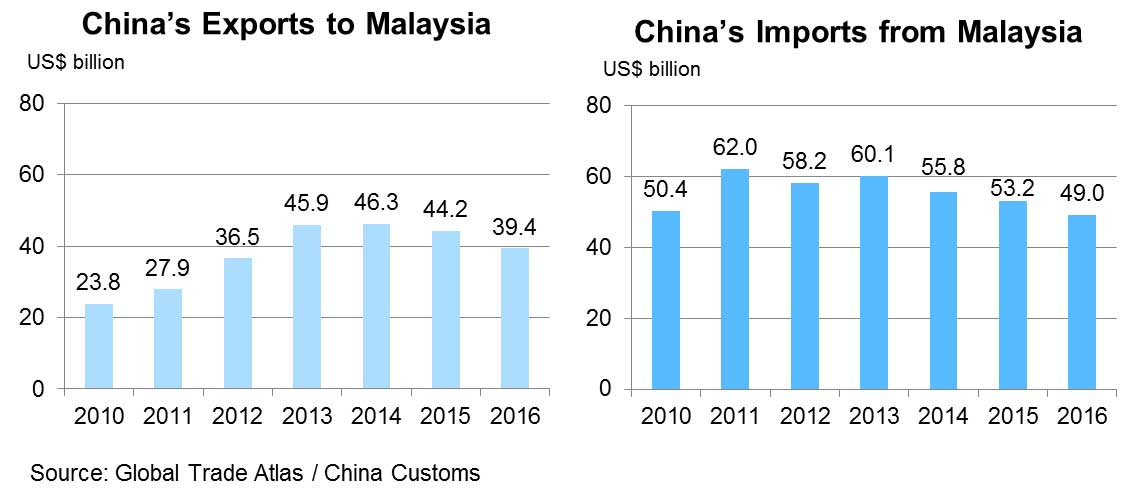

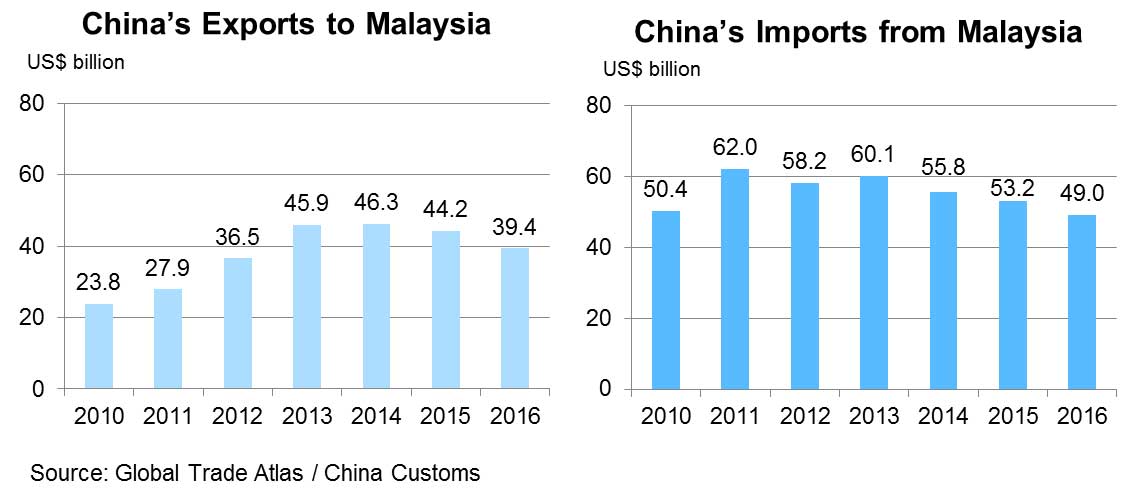

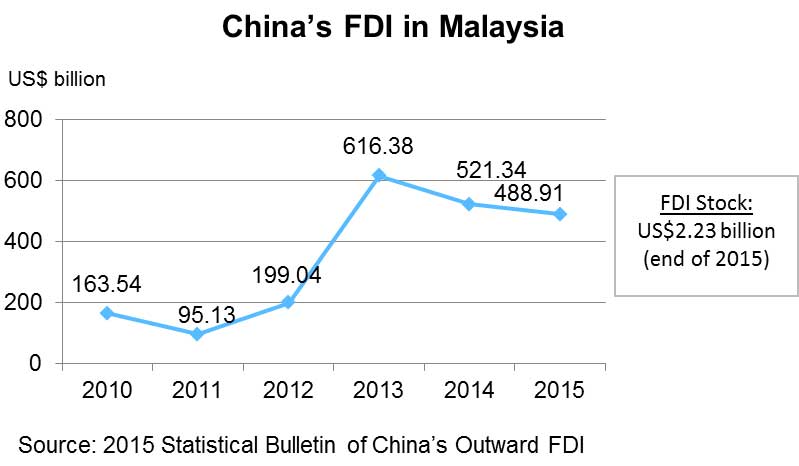

Malaysia, as a major ASEAN economy and an important gateway along the 21st Century Maritime Silk Road, is strengthening its industrial co-operation with China. Industrial parks have been established in Qinzhou in China’s Guangxi Autonomous Region (the China-Malaysia Qinzhou Industrial Park), and Kuantan in Malaysia (Malaysia-China Kuantan Industrial Park, MCKIP). Through this “two countries, twin parks” model of co-operation, China and Malaysia hope to strengthen regional supply chain management, push forward the development of industrial clusters, and promote trade and investment between the two countries. The “Port Alliance” will also be established to improve customs efficiency and expedite trading between the two countries through experiments on joint customs clearance, information sharing and other mechanisms. Malaysia is among China’s largest trading partners and major investment destinations in ASEAN, with the volume of bilateral trade reaching US$88.4 billion in 2016.

MCKIP is a bilateral Malaysia-China government-to-government collaboration. MCKIP Sdn Bhd (MCKIPSB) is a 51:49 joint venture between a Malaysian consortium and a Chinese consortium. IJM Land holds a 40% equity interest in the Malaysian consortium; together, Kuantan Pahang Holding Sdn Bhd and Sime Darby Property hold 30% and the Pahang State Government holds the remaining 30%. The 49% stake of the Chinese consortium is held between the state-owned conglomerate Guangxi Beibu Gulf International Port Group (with a 95% equity interest) and Qinzhou Investment Company (the remaining 5% interest).

MCKIP is located in the East Coast Economic Region (ECER) in Malaysia. In 2008, the Malaysian government established the East Coast Economic Region Development Council (ECERDC) in order to spearhead the economic development of the East Coast. The five key economic sectors of the ECER are: (1) manufacturing, (2) oil, gas and petrochemicals, (3) tourism, (4) agriculture and (5) human capital development. The launch of MCKIP in 2013 has been one of the key milestones in the economic development of the East Coast.

MCKIP targets heavy industry and high-technology industry. These include energy saving and environment friendly technologies, alternative and renewable energy, high-end equipment manufacturing and the manufacture of advanced materials.

There are three distinct phases within the industrial park. MCKIP 1 consists of 1,200 acres of land. The first investor to be established there is Alliance Steel (M) Sdn Bhd, which was granted approval to invest RM5.6 billion in its facility in 2016. Its production site, which will cover 710 acres, is currently under construction, and the steel mill is expected to be operational by the end of 2017. Once in full service, Alliance Steel expects to generate more than 3,500 jobs.

While MCKIP 2 (1,000 acres) is designated for high-end and high-technology industry development, MCKIP 3 (800 acres) is designated for multi-purpose development (including light industry, commercial property, residential areas and tourism parks). Since MCKIP is intended for an assortment of different business opportunities, it is believed that it will attract foreign investment from a wide variety of countries for various purposes.

Many China-based companies are planning to expand their production bases to MCKIP. For example, Guangxi Zhongli Enterprise Group Co Ltd will invest RM2 billion for the development of manufacturing of clay porcelain and ceramic in MCKIP 1. Meanwhile, ZKenergy (Yiyang) New Resources Science and Technology Co Ltd will invest RM200 million for the development of an engineering and production-based centre that will produce renewable energy for MCKIP’s own consumption. China’s Guangxi Investment Group Co Ltd will invest RM580 million on an aluminium component manufacturing facility. Another is Malaysia’s LJ Hightech Material Sdn Bhd, which will invest RM1 billion in a high-technology production-based plant to produce concrete panels and activated rubber powder for the construction industry. The construction works for these projects in MCKIP are expected to begin in the first quarter of 2017. Once completed, they will create more jobs in Malaysia.

Tax and Investment Incentives

In addition to Malaysia’s current incentives package, the Ministry of International Trade and Industry (MITI), together with the ECERDC, has offered special incentive packages for investors in MCKIP (subject to terms and conditions). Below are some highlights of these fiscal incentives:

- Fifteen years of 100% corporate tax exemption from the year of statutory incomes derived, or 100% Investment Tax Allowance on qualifying capital expenditure incurred for five years. (Corporate income tax rate currently stands at 24% in Malaysia.)

- 15% of income-tax rate for qualified knowledge workers in MCKIP until 31 December 2020. (People in the highest income bracket are currently taxed at 28% in Malaysia.)

- Import duty and sales tax exemption for raw materials, parts and components, and plant machinery and equipment.

- Stamp duty exemption on transfer or lease of land or building used for development.

- Investors can apply for Unit Kerjasama Awam Swasta (UKAS) facilitation fund up to 10% of project cost or RM200 million (whichever is lower) to finance the development of basic infrastructure. UKAS was set up by the Public Private Partnership Unit of the Prime Minister's Department.

Port and Logistics Services

Kuantan Port, located 10km from MCKIP, is the gateway for outbound transportation and logistics services in Malaysia’s East Coast Economic Region. Kuantan Port currently handles mainly break-bulk cargoes and liquid-bulk cargoes, such as steel pipes, sawn timber and plywood, iron ore, fertilisers, palm oil, vegetable oil, mineral oil and petrochemical products. Container business mainly handles automotive components for Pekan Automotive Industrial Park.

Kuantan Port is actively developing new terminals as part of its plan to increase its capability in handling break-bulk cargoes and containers. It is also co-operating with MCKIP in developing a bonded area in order to enhance the business content of the port and the industrial park. It is hoped that the bonded facilities will attract investors to set up export-oriented processing plants in heavy industry and high-technology industry, and that this will in turn boost Kuantan Port’s container-transport business and make it an important container transshipment port in eastern Malaysia.

Phase 1 of the Kuantan Port extension project, which is due for completion in 2018, will continue to handle incoming and outgoing break-bulk cargo. Phase 2 will focus on the construction of a deep-water port for the handling of ocean-going container transport. It is estimated that Kuantan Port will be able to berth and handle 200,000 dwt vessels, including 18,000 TEU ocean-going container ships, and provide port users with incoming and outgoing container transport service to ASEAN and international markets.

Kuantan Port is operated by Kuantan Port Consortium Sdn Bhd (KPC) with a strong network of global shipping connections. At present, major shipping lines that operate at Kuantan Port include Evergreen Marine Corporation Ltd, Jardine Shipping Services, Malaysia International Shipping Corporation Bhd and Pacific International Lines. They mainly serve MCKIP and the Kuantan Port Industrial Area, the Gebeng Industrial Estate and the Pekan Automotive Industrial Park.

KPC told HKTDC Research that since the Kuantan Port was lacking in container business and had little or no experience in operating bonded facilities or international customs mutual assistance, it was keen to seek the co-operation of investors with relevant experience in Hong Kong and elsewhere to develop its container-port business. Since Hong Kong operators have rich experience in business process design, operational systems and information-technology management of container terminals, including using relevant infrastructure facilities, equipment layout and advanced business processes to improve the overall operating efficiency of ports, they should be able to assist Kuantan Port in further developing its international cargo and container shipping business.

Port Business Experience Hutchison Whampoa Limited (HWL) is one of the largest listed companies on the main board of the Hong Kong Exchanges. Its core business includes port and related services. Its flagship company – Hong Kong International Terminals Ltd – is located at the city’s Kwai Chung and Tsing Yi Container Terminals. HWL and its group companies operate a network that covers major ports around the world. In ASEAN, for example, Hutchison Port Holdings Ltd operates container terminals and related businesses in Myanmar (Thilawa in Yangon), Thailand (Laem Chabang Port), Malaysia (Port Klang), Indonesia (Port of Tanjung Priok to the north of Jakarta) and Vietnam (Ba Ria – Vung Tau). Source: Web page of Hutchison Whampoa Limited and Hutchison Port Holdings Ltd |

Future Plans

In June 2016, Kuantan Port received approval from Malaysia’s Ministry of Finance to establish a free-zone port. A bonded area will be set up in some port areas, including sections of MCKIP. Economic activities in the bonded areas will be exempt from tariffs, consumption tax, sales tax and service tax. Companies in the industrial park will be offered a variety of value-added services, including transshipment, trading, unpacking and distribution, inspection and testing, repackaging and labelling. Against this backdrop, Kuantan Port will promote the gradual development of MCKIP into an ideal platform for assisting investors in tapping the market in Malaysia, and even ASEAN.

With regard to the development of ocean-going container transport services and bonded ports, steps will be taken to assist MCKIP in attracting investment from China-based enterprises by helping them leverage the strengths of China and Malaysia in terms of land, energy and production materials to improve their overall production allocation in the Asia-Pacific region and further expand their export markets. Apart from helping these enterprises to cut their overall production costs, this will also help them steer clear of trade barriers, such as anti-dumping measures and countervailing duties imposed by the EU, the US and other countries against some of China’s metal and steel products.

In order to meet these goals, it is necessary not only to comply with the trade measures imposed by the importing countries in Europe and North America on raw materials, place of production and place of origin of the restricted products, but also to satisfy the relevant agreements of international customs organisations and the requirements of the importing countries for bonded arrangements, container terminal operation, international customs clearance procedures and customs declaration system. The “Port Alliance” currently being built by China and Malaysia for co-operation between the 10 Chinese ports of Dalian, Shanghai, Ningbo, Qinzhou, Guangzhou, Fuzhou, Xiamen, Shenzhen, Hainan and Taicang and the six Malaysian ports of Port Klang, Malacca, Penang, Johor, Kuantan and Bintulu is expected to cut total time and costs in the cross-border transportation of goods between the two countries. Connections with the ports and customs in other regions have yet to be developed.

These plans should also leave room for future development and build advance supporting facilities in order to meet future demands for transport and logistics services in the export of high technology and high value-added products as the industrial park develops in the long run. The export mix of MCKIP is expected to shift from heavy industry to other sectors following the completion of future investment projects, such as those in the fields of microelectronics, biomedicine and chemical industry, which would generate a far greater demand for cargo transport and logistics services.

Therefore, it is imperative not just to make early plans for relevant facilities and working rules in areas such as customs, bonded services, and cargo inspection and testing to boost the industrial development of MCKIP, but also to make arrangements for necessary logistics facilities such as cold storage, dangerous-goods warehouses and comprehensive distribution facilities, and make use of new-generation information management systems geared to international standards.

It is necessary not just to improve the efficiency of transport and logistics but also to cater to the globalisation trend of the supply chain and satisfy the exacting requirements of clients in the Asia-Pacific region and other countries for logistics and distribution in an efficient mode of operation and production. Experienced investors in port management and planning are needed both in the planning stage and in the actual operation, while support of professional logistics service providers is also necessary. Therefore, the development of MCKIP and Kuantan Port will generate opportunities for Hong Kong companies.

The majority of heavy-industry and technology industry investors in MCKIP come from China and Malaysia, but the industry park also welcomes foreign companies from ASEAN and other countries. For example, the Kuantan Port extension and related infrastructure construction projects, as well as the multi-purpose area in MCKIP 3, all need investment in logistics facilities, commercial real estate, residential property management and hospitality services. MCKIP will generate opportunities for direct investment for Hong Kong and regional investors. As an international financial centre, Hong Kong could also provide project financing, risk management and other services to mainland and other investors, and make use of its rich international market resources to collect market information to help investors reduce their investment risks.

China is one of the world’s major sources of outbound investment and was the second-biggest cross-border investor, after the US, in 2015. More and more China-based enterprises have gone overseas to make direct investment on their own or through acquisitions or mergers in order to open new markets or secure manpower and other resources and promote their long-term development. As a major service platform for Chinese enterprises “going out”, Hong Kong can provide one-stop financial and other professional services to Chinese enterprises investing in MCKIP. For example, Chinese enterprises investing in Malaysia could use Hong Kong to arry out overseas financing for their investment projects and secure more funding for their long-term development. They could also make use of Hong Kong’s deep and broad financial market and choose suitable financing channels to optimise their sources of funds, lower their overall financing costs and open the ASEAN and world markets through MCKIP.

Co-ordinating the Interests of Different Partners Ironsides Holdings Limited is a Hong Kong-based private-equity investment firm that sources funds from Hong Kong, the US and other territories. The firm invests directly into private companies and projects in a number of areas, including healthcare, agriculture, logistics and technology. Its current investments cover, among others, the Southeast and Central Asian regions. Alex Downs, the Director of the company, said: “Chinese enterprises seem to prefer taking a controlling stake when conducting investment in overseas projects or companies. There is, however, always the choice for them to have a much bigger presence in the overseas markets and explore new business opportunities via co-operation with their foreign counterparts, something that could result in decent profits with reduced risks.” Assessing the pro and cons of equity co-investment, Downs said: “Ultimately, Chinese enterprises may not have the controlling stakes in such co-investment models, with success resting on the participants’ contributions and the effective co-operation among the partners. On the upside, the Chinese enterprises would be given the opportunity to participate in a bigger project and have access to markets beyond that of their original business, thus generating sustainable incomes from their overseas investment. This would be a viable option for those ‘going-out’ enterprises without enough experience, exposure and/or resources.” Remarks: For further details, please see HKTDC research article (August 2016) |

Alliance Steel plans to tap the growing demand for steel in the ASEAN and international markets by setting up production facilities in MCKIP. This modern steel complex will make use of advanced Chinese technologies and manufacturing processes and introduce automated production equipment to make top quality high-carbon steel rods, wire and H-shaped bars, while green measures will minimise the environmental impact. The company will also provide training to improve workers’ grasp of metallurgical technology.

Hong Kong’s financial services may directly offer financing to these projects, but can also provide other investment options and help them co-operate with overseas counterparts in the heavy-industry and technology sectors, allowing them to use their investment in MCKIP to expand their overseas market and beef up their strength.

For example, Hong Kong private-equity investment companies could use their extensive global business links to find overseas partners for mainland investors. Through equity co-investment and other forms of joint-stock co-operation, they could provide more investment options to mainland investors who want to expand their overseas presence while containing investment risks. Through equity co-investment, mainland enterprises will not only be able to find partners to share their investment risks but will also be able to draw synergy from the strong points of their partners to venture into new areas and further advance their businesses.

Please click here to purchase the full research report.

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (1)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (2)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (3)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (5)

Editor's picks

Trending articles

Background

China is currently promoting the development of the Belt and Road, namely the outward development strategy of the Silk Road Economic Belt and the 21st Century Maritime Silk Road. In March 2015, China published a document entitled Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road (Vision and Actions), which put forward the initiative to speed up the development of the Belt and Road with the intention of promoting economic co-operation among countries along its routes. The initiative has been designed to enhance the orderly free-flow of economic factors and the efficient allocation of resources, while furthering market integration and creating a regional economic co-operation framework of benefit to all.

Vision and Actions specifically states that investment and trade co-operation are the major components of the Belt and Road Initiative. In co-operation with the Asian, European and African countries along the routes, the initiative strives to improve investment and trade facilitation, and remove investment and trade barriers for the creation of a sound business environment within the region and in all related countries. This can be done by pushing forward the negotiations on bilateral investment protection agreements and double taxation avoidance agreements with a view to protecting the lawful rights and interests of investors and expanding the scope of mutual investment.

Actions should also be taken to improve the division of labour and distribution of industrial chains by encouraging the entire chain and related industries to develop in concert so as to enhance the industrial supporting capacity and general competitiveness of the region. Co-operation is encouraged in order to build all forms of industrial parks, such as overseas economic and trade co-operation zones and cross-border economic co-operation zones. It is hoped that all countries along the Belt and Road routes can work together to promote the cluster development of various industries.

Development of Overseas Economic and Trade Co-operation Zones

China has embarked on the development of overseas economic and trade co-operation zones since 2006, mainly spearheaded by the Ministry of Commerce. Prior consensuses are reached with the governments of countries that are politically stable and on good terms with China, for approved Chinese enterprises to serve as the principal executors in entering into agreements with these governments for investing in and undertaking development projects in their countries.

Alternatively, these Chinese enterprises may co-operate with enterprises of the host countries in jointly investing in, and undertaking the development of, local industrial parks with comprehensive infrastructural facilities, distinct leading industries and sound public service functions. They will then invite other related enterprises from China, the host countries and other countries to invest and develop in the parks in order to form industrial clusters and build up relatively comprehensive industrial chains. Such a development model is equivalent to direct investment with economic and trade co-operation in the form of group projects.