來源:新華財金社

僅僅三年多時間,"一帶一路"從倡議變成實實在在的行動,從理念和總體框架設計進入務實合作階段。從籌建亞洲基礎設施投資銀行到成立絲路基金,再到國家開發銀行的近千個項目,"一帶一路"建設取得明顯進展。"一帶一路"倡議得到了世界上100多個國家的響應,中國對沿線國家投資累計超過500億美元。不僅為各方在投資、貿易、金融、文化和旅遊等領域深化合作奠定了堅實基礎,也給沿線各國民眾帶來了實實在在的好處。未來,"一帶一路"將進一步釋放沿線國家和地區的內在發展動力,逐漸發展成為和平之路、繁榮之路、開放之路、創新之路、文明之路,共同譜寫人類合作共贏的新篇章。

"一帶一路"將加速亞洲和亞太經濟一體化進程

形成推動世界持續發展的新重心

"一帶一路"將成為亞洲經濟一體化的"兩翼",有效連接中亞、西亞、東南亞、南亞、東北亞等地區,顯著改善區域內的整體基礎設施互聯互通狀況和營商環境。作為世界經濟增長的重要引擎,亞洲已日漸成為經濟全球化的中堅力量,但也面臨不少問題。如亞洲一體化水平與歐洲、北美洲相比仍有不小的差距。考慮到亞洲國家擁有巨大的生產能力,如果能夠擴張亞洲內部市場規模,更多的中間投入品和最終品將由發達國家市場轉入本地區,亞洲可能獲得新的增長動力。同時,亞洲各區域間發展不平衡,聯繫不緊密,交通基礎設施不聯不通、聯而不通、通而不暢等問題相對比較突出,對深化區域合作構成不少障礙。"一帶一路"是中國將自身的產能優勢、技術與資金優勢、經驗與模式優勢轉化為市場與合作優勢的重要途徑。"一帶一路"涵蓋亞洲20多個國家和地區,擁有40多億人口和20多萬億美元的經濟規模,通過"一帶一路"建設能夠促進亞洲國家分享中國改革發展紅利,推動相關國家間實現合作與對話,建立更加平等均衡的經貿關係,夯實亞洲經濟一體化的基礎,邁向命運共同體,開創亞洲新未來。

"一帶一路"將化解亞太一體化進程面臨的諸多難題。目前,亞太經濟一體化的首要挑戰是成員經濟發展水平存在巨大差異,不同人均GDP水平暗示著各成員對地區經濟一體化存在不同的利益訴求。一個統一的一體化方案難以滿足不同成員的發展要求,因而在亞太經合組織(APEC)的發展歷程中,諸多的貿易投資自由化方案最後不得不以流產而告終。另外,APEC成員在社會制度、政局穩定等非經濟領域也存在較大的差異,為推行經濟一體化帶來重重障礙。在"一帶一路"建設的推動下,未來亞太地區將逐步形成立足周邊、輻射"一帶一路"、面向全球的高標準自貿區網絡。中日韓自貿區、區域全面經濟夥伴關係協定、中國—東盟自貿區升級版、亞太自貿區有望取得進展,進而推動區域經濟一體化進程。同時,共建"一帶一路"還有助於促進亞太國家互通互聯,形成互補共贏的合作局面,加速亞太經濟一體化進程。

"一帶一路"將打破亞歐大陸長期封閉的狀態

形成推動世界均衡發展的新路徑

亞歐大陸是世界上最大的陸地,是世界上跨度最長的經濟走廊,也是最具發展潛力的經濟帶。陸路交通不暢一直是制約亞歐大陸發展的主要因素之一,因而亞歐大陸處於長期封閉的狀態。"一帶一路"將打破封閉,打造互聯互通的亞歐大陸。"一帶一路"貫穿亞歐大陸,一邊是活躍的東亞經濟圈,另一邊是發達的歐洲經濟圈,中間廣大腹地國家經濟發展潛力巨大。根據"一帶一路"走向,陸上依託國際大通道,以沿線中心城市為支撐,以重點經貿產業園區為合作平台,通過渝新歐(重慶、新疆和歐洲)、中吉烏(中國與吉爾吉斯斯坦、烏茲別克斯坦)、中巴伊(中國與巴基斯坦、伊朗)等鐵路項目的建設,將從北、中、南三個方向全面打通亞歐大陸橋,最終形成新亞歐大陸橋、中蒙俄、中國—中亞—西亞三大國際經濟合作走廊,暢通中國經中亞、俄羅斯至波羅的海,中國經中亞、西亞至波斯灣、地中海的通道;海上則從中國沿海港口過南海經印度洋連接至歐洲。積極推進中俄高鐵合作和中老、中泰、中巴、中哈等鐵路合作項目,將進一步促進亞歐大陸基礎設施的互聯互通,推動亞歐大陸各國進行更廣泛、更深層、更多樣的區域合作,為亞歐經濟發展注入新動力。打破亞歐大陸長期封閉的狀態,有助於促進歐亞大陸腹地不發達地區的經濟增長,改變區域經濟政治的空間佈局、活動方式及其流向,為區域協同發展作出新的貢獻。

"一帶一路"將打造利益共享的全球價值鏈

形成推動世界共同發展的新模式

當前,世界經濟仍處於深度調整期,低增長、低通脹、低需求同高失業、高債務、高泡沫等風險交織,氣候變化、能源安全、糧食安全等全球性挑戰不斷增多,不僅發展中國家需要實現可持續性的經濟轉型,發達國家也需要促進經濟轉型。因此,需要世界各國攜手打造利益共享的全球價值鏈,促進共同發展。

"一帶一路"沿線國家的經濟發展主要是依靠沿海國家的快速發展,主要經濟中心城市多數聚集在沿海地區,廣大內陸國家尤其是發展中國家並未被真正納入全球價值鏈。目前,"一帶一路"沿線多數為低收入國家,多數內陸國家的基礎設施相對落後、產業發展滯後、對外開放程度不高、社會發展水平較低,對於加快經濟社會發展、實現國家現代化的願望十分迫切。"一帶一路"沿海國家多數精於製造業,而內陸國家資源豐富、能源供給充足,如果能夠將沿海國家的製造能力與內陸國家的豐富資源整合起來,共同打造利益共享的全球價值鏈,將有效促進區域經濟增長,並將加速"一帶一路"沿線國家的經濟融合,實現共同發展。

共同建設利益共享的全球價值鏈,有利於區域內各國的發展同其他國家形成聯動增長效應,相互帶來正面外溢效應,充分發揮各國的比較優勢,共同優化全球經濟資源配置,完善全球產業佈局,培育普惠各方的全球大市場,實現共同發展。"一帶一路"是將沿海國家製造能力與內陸國家豐富資源有機結合的新物流模式、貿易模式和發展平台。隨著"一帶一路"的發展,沿線將形成發達的經濟中心、文化中心,沉睡的資源也將得到全面、合理的開發,沿線國家將以全方位的國際合作解決自身的問題,更有效地融入全球經濟,在共同打造全球價值鏈的過程中獲得巨大收益。

"一帶一路"將推動人類命運共同體建設

形成推動世界和平發展的新境界

"一帶一路"是人類命運共同體建設的路徑、橋樑和紐帶。"一帶一路"繼承了古絲綢之路開放兼容的歷史傳統,同時也吸納了亞洲國家"開放的區域主義"精神,體現了世界各國謀求發展的現實需求。無論從歷史還是現實來看,"一帶一路"都為人類命運共同體建設提供了重要的路徑和戰略支撐。"一帶一路"倡導合作共贏的理念,強調世界之大容得下大家共同發展,呼籲各方摒棄你輸我贏、贏者通吃的舊思維,致力於實現“以和為貴,和而不同,以達天下大同”。有助於凝聚共識,圍繞共同的主題推動區域內多邊合作平台整合、對接,促進相關國家加強溝通,促進人類命運共同體建設,形成推動人類合作共贏發展的新格局,讓更多國家和地區受益。

"一帶一路"將從多邊和雙邊各個層面推進命運共同體建設。將充分依靠中國與有關國家既有的雙邊多邊機制,與沿線國家建立廣泛的溝通和協作機制,借助當前行之有效的區域合作平台,形成推動人類合作共贏發展的新格局。同時,能夠在增信釋疑的基礎上,推進沿線不同國家主導的多個次區域合作組織形成寬領域、深層次、高水平、全方位的合作格局,使各經濟體在合作中實現共贏,使廣大民眾獲得實實在在的好處。"一帶一路"堅持共商共建、共創共享原則,不搞封閉機制,有意願的國家和經濟體都可參與,成為"一帶一路"的支持者、建設者和受益者,將加速人類命運共同體建設,共同建造和平、增長、改革、文明的發展環境,構建各方融合發展的新格局,為各方帶來更大發展機遇。

"一帶一路"將促進沿線國家和地區加強戰略對接

形成推動世界包容發展的新方式

"一帶一路"作為全方位的合作開放戰略,將以經濟走廊理論、經濟帶理論等創新經濟發展理論、區域合作理論、全球化理論,形成促進區域發展的"共商、共建、共享"原則,給21世紀的國際合作帶來新的理念。"一帶一路"將促進沿線國家和地區加強戰略對接,實現包容性發展。如"一帶一路"倡議可與歐盟提出的"容克計劃"、俄羅斯提出的"大歐亞夥伴關係計劃"、韓國倡導的"歐亞計劃"、波蘭提出的"琥珀之路"進行對接,建造中歐"和平、增長、改革、文明"四座橋樑,暢通亞太經濟圈和歐洲經濟圈,釋放亞歐大陸市場的巨大潛力,為亞歐經濟發展注入新動力,為地區和世界發展作出貢獻。

"一帶一路"將通過促進沿線國家和地區的戰略對接,實現政策溝通,共同打造開放、包容、均衡、普惠的區域經濟合作架構,促進經濟要素有序自由流動、資源高效配置和市場深度融合,推動沿線區域實現經濟政策協調,開展更大範圍、更高水平、更深層次的區域合作。

一是促進東南亞地區形成更緊密的經濟夥伴關係。"一帶一路"將深化中國與東盟的戰略互信、拓展睦鄰友好、聚焦經濟發展、擴大共同利益匯合點,打造中國東盟自貿區升級版,建立和健全地區供應鏈、產業鏈與價值鏈,提升東盟與中國產業在全球的競爭能力。二是促進南亞地區形成共同發展的區域經濟體新格局。"一帶一路"將以連接中印兩大市場橋樑的中巴經濟走廊和孟中印緬經濟走廊建設為重要切入點,以沿線中心城市為依託,以鐵路、公路為載體和紐帶,培育沿線優勢產業群和邊境經濟合作區,形成優勢互補、共同發展的區域經濟新格局。三是促進中亞西亞形成優勢互補的產業合作。中亞、西亞地區是"一帶一路"建設的重點方向,將從北、中、南三個方向全面打通亞歐大陸橋,最終形成中國—中亞—西亞國際經濟合作走廊,實現基礎設施的互聯互通,推動中亞、西亞地區合作由能源領域合作轉向產業鏈合作。四是促進中蒙俄建立嶄新的投資貿易關係。"一帶一路"有利於完善中蒙俄合作機制,進一步深化中蒙俄在教育、科技、文化等領域的全方位合作,挖掘和釋放中蒙俄經濟合作的巨大潛力,打造中蒙俄經濟走廊,推動經貿合作上升到新的水平。五是促進東北亞地區成為亞太地區重要的增長極。"一帶一路"建設的加速推進,將促進東北亞地區在國際通道建設上實現更大的突破,向北向西可通過俄羅斯西伯利亞大鐵路進入歐洲的鐵海聯運體系,向東向南進入太平洋陸海聯運體系,加速東北亞地區的互聯互通,促進人員和生產要素在區域內合理流動,建立更緊密的區域合作關係。(作者單位:中國國際經濟交流中心)

原文鏈接

編輯推薦

熱門文章

粵港澳大灣區建設被納入「國家十三五規劃」及「一帶一路願景與行動」的國家戰略,可為香港發展帶來不可錯失的新機遇,應盡早部署籌謀,善用香港在金融、專業服務和國際聯繫的優勢,加強與廣東合作,為香港經濟未來持續繁榮發展開拓新領域、新動力。

香港在金融、專業服務和國際聯繫的優勢亦可協助推動大灣區產業升級轉型發展,把粵港澳大灣區建設成為具有國際競爭優勢的世界級城市群,並作為中國重要經濟引擎,帶動中南、西南等泛珠地區發展,以及在「一帶一路」建設過程中發揮重要推動作用。在參考海外一些經濟成熟灣區,並分析香港及珠三角的發展優勢,本文就粵港澳大灣區未來在產業、貿易方面的發展及香港可發揮的功能,提出一些初步建議希望作為進一步討論的參考。

粵港澳大灣區的發展優勢

1. 對外交通物流

粵港澳大灣區作為一個經濟整體,集中了大珠三角地區主要的機場群和港口群,空運及海運的貨物處理量不但領先全國,更在全球排名第一;珠三角還擁有以灣區為中心的放射狀鐵路和高速公路幹網,擁有內外多式交通聯動的物流優勢。相對中國內地及海外其他地區,粤港澳大灣區作為「一帶一路」沿線國家海陸空綜合運輸大通道的區位及物流基建優勢明顯。

2. 上下游產業供應鏈

廣東在全國省市工業增加值和出口均排名第一,而珠三角佔廣東全省工業增加值和出口比重分別是80%和95%。雖然近年珠三角生產成本上升,但珠三角有物流和產業結構及配套全面的優勢,大部分企業仍選擇將生產線留在珠三角,並向自動化生產及高產值方面提升。香港貿發局的問卷調查顯示,70%受訪製造商及貿易商仍以珠三角為最主要的生產或採購基地,81%的受訪企業在珠三角採購生產所需原材料及半製成品。有計劃擴建或遷移廠房的企業當中,59%表示仍會選址珠三角,其餘的也大多會選擇靠近珠三角的內地其他地區或東南亞地區。事實上,有已遷往越南北部的企業表示,當地的投資優勢之一是能方便對接珠三角的供應鏈,提高生產效益及降低物流成本。

3. ICT及科研產業集群

在創新驅動發展戰略的推動下,珠三角高新產業帶已逐漸形成。珠三角高新產業帶是由科技部批准的三個國家級高新技術產業帶之一,產業帶內有廣州、深圳、佛山、中山、珠海、惠州6個國家級高新技術產業開發區,東莞、肇慶、江門3個省級的高新技術產業開發區,廣州、珠海2個國家軟體產業基地,3個國家級高新技術產品出口基地,12個國家「863」成果轉化基地和1個國家級的大學科技園。2015年珠三角先進製造業、高技術製造業增加值佔總增加值比重分別達53.9%和31.8%,研發經費支出比重達2.7%,百萬人口發明專利申請量達1,728件,萬人發明專利擁有量達23.33件,技術自給率超過71%。

4. 國際金融及專業服務

相對內地其他城市群,珠三角灣區的獨有優勢是在「一小時經濟圈」內擁有香港這個國際金融中心,集合大量專業服務和國際人才,同時香港的經濟和司法體系有別於內地,是跨國企業進入亞洲及中國市場的理想平台。據香港特區政府的調查顯示,截至2016年6月,香港共有3,731家地區總部和地區辦事處,代表其位於香港以外地區的母公司負責在中國內地、東北亞及東南亞的業務。香港亦因此連續多年成為全球吸納直接外來投資及輸出向外直接投資的領先地區。此外,截至2016年底,香港佔中國內地累計實際利用外資總額的52%,以及佔中國2015年底累計對外直接投資總額近60%。

粵港澳大灣區經濟融合發展前瞻

雖然粵港澳三地的政治體制和法律制度存在很大差別,但通過現有政府合作架構和CEPA、自貿區等合作平台,粵港、粵澳已基本實現貿易自由化,港澳已計劃開展自由貿易協議談判,完成後粵港澳三地將連繫成為一個自由貿易區。同時,香港作為內地引進來、走出去的服務平台,粵港兩地產業集群的參與者,包括生產企業、服務供應商、資金提供者、大學、科研中心等,互相滲透參與的情況已非常普遍,實質已形成一個經濟整體。這可以從粵港兩地的人員流動、物流運輸、資金融通、商業存在及企業投資可見一斑。

隨著港珠澳大橋和深中通道的開建通車,環珠江口的交通連繫和通關貿易往來將進一步加強。粵港澳大灣區規劃目標之一,是要進一步推動灣區深度合作,協調港澳和珠三角城市的港口、機場、鐵路和公路等基建項目的對接規劃和建設,擴大金融和服務業開放合作,促進生產要素、產品、技術和服務在整個大灣區內更自由流動,提供一個有利於現有產業集群轉型升級和培養新的產業集群茁壯成長的生態環境,吸引更多海內外投資者和商貿活動在大灣區內集聚,為區內各城市帶來更多更大的發展空間和機遇。

美國三藩市灣區由9個縣區組成,雖然各個縣區各有特色和優勢,但整個灣區的經濟產業發展同城化程度非常高,且互動性很強。灣區內各次區域的產業集群非常類近,主要是利用當地人才優勢發展的行業,包括專業、科研和技術服務等,以及與旅遊相關的行業。大部分在灣區發展表現突出的行業都會在幾乎所有次區域存在。雖然灣區的3個最重要、發展規模最大的產業集群主要落戶在三藩市和聖荷西兩個次區域,但四成三的次區域都會擁有最少兩個灣區發展較好的產業集群。加上灣區內居民日常往來不同次區域工作及生活的聯繫非常頻繁,在在顯示三藩市灣區的經濟運作是以一個整體共同推進。而各次區域間互動性之高,意味如一些發展策略只孤立地從一個縣或次區域角度考慮,便會錯過從灣區整體考慮所帶來的利益[1]。

珠三角企業順應市場及本身發展需要,已開始在多於一個城市設點。例如TCL通訊科技控股有限公司的生產基地在惠州,其中國總部便設立在深圳,而香港辦事處便負責海外業務。又例如樺嶺進出口貿易有限公司最早期發展只在惠州,但業務不斷擴充後不同體育用品的生產線便分散在珠三角不同城市,更在廣州設立中國總部和產品研發中心。未來樺嶺為了更好地統籌逐漸擴大的海外業務,亦會考慮在香港開設辦事處。可以預見珠三角企業將越來越多會就大灣區不同城市的競爭優勢和經營環境來布局其業務。因此粵港澳大灣區的經濟產業發展同城化程度亦將提高,與此同時,灣區內各城市間的互動性亦會增強。

香港在大灣區未來發展可發揮的功能

1. 環球供應鏈管理及物流中心

近年中國生產成本增加,不少企業將生產線遷移或擴充至越南、孟加拉等新發展國家,逐步形成連接中國、東亞、東南亞和南亞的亞洲區域供應鏈, 與美洲和歐洲並列成為全球三大區域供應鏈之一。面對工資上漲及招工難的壓力,不少在珠三角的勞動密集型企業如服裝及鞋等已將生產線搬遷往東南亞及南亞等熱門地區,以致中國佔美國和歐盟的服裝進口比重由2012年的39%及42%分別下降至2016年的36%及34%。同期,中國佔美國和歐盟的鞋進口比重由2012年的72%及51%下降至58%及45%。雖然如此,中國佔美國及歐盟的整體進口比重同期不跌反升,而中國佔全球工業製成品出口比重亦由2012年16.8%上升至2015年18.6%,顯示中國的製造業及出口已逐步向高增值和上游產品發展。

世界貿易組織的數據顯示,中國出口半製成品佔世界比重由2010年的9.6%上升至2014年的12%,當中很大部分是輸往東南亞和南亞,反映這些地區國家與中國越趨緊密的供應鏈關係。珠三角目前是各類消費品和中間產品的世界工廠。隨著中國企業及其他跨國企業擴大在東南亞及南亞的加工生產活動,他們必須進口在其他國家生產,包括他們在珠三角的廠房及上游供應商製造的各種零配件、組件和工業物料。

此外,由於東南亞及南亞新興產地的工業基礎仍處於發展初期,本地及外資企業在這些國家擴大生產的過程中,若要引入更先進的工序,便須尋求國外的專家和服務支援,包括廣泛的工程、工具製造及環境服務等。香港是亞洲的國際商業物流中心,本地服務供應商擁有豐富的專業知識,商業網絡遍及多個國家地區,在連接中國與其他地區的供應鏈管理上可提供一站式服務,包括上述的生產、物流及環保服務等。

除發展加工生產活動相關的供應鏈外,隨著中國及其他亞洲新興國家經濟崛起,居民收入上升而產生大量消費進口需求,與之相關的物流供應鏈服務發展亦非常快。特別是近年電子商貿蓬勃發展,大大改變了經營業務的方式,產品更新流動速度進一步上升,對高效的國際供應鏈服務需求將進一步提升。從目前香港轉口貿易的結構及增長看來,香港物流業在亞洲區域供應鏈中擔當著重要角色。

憑藉香港、深圳和廣州的機場和港口的服務網絡和效率優勢,加上粵港兩地海關和港口的緊密合作,包括香港機場與南沙保稅港區物流園區的一站式空陸聯運超級幹線的新型物流服務,粵港澳大灣區在未來連接環球主要區域供應鏈和服務中國連接亞洲的區域供應鏈發展中,將可維持物流樞紐的地位和競爭力。

不過大灣區內有香港、澳門、廣州、深圳和珠海五個機場,香港、廣州和深圳亦各自擁有其國際港口群,彼此間如何協調,形成合理錯位發展和互補合作,從而加強大灣區整體的競爭力,有賴各參與成員溝通合作。有分析指東京灣區內有六個港口,包括東京港、橫濱港、橫須賀港、川崎港、千葉港和木更津港。為了避免惡性競爭,這些港口都經過協調規劃,促進分工與合作,各港口依據自身基礎和特色承擔不同功能,協同發展港口群。

粵港澳大灣區內的港口和機場等基礎設施的規劃和發展,也可以參照類似的模式,以協調促進彼此分工,優勢互補。例如香港作為國際航空樞紐,有較強的國際航線(客運和貨運)聯繫,可以通過與跟深圳的機場和港口的水陸交通連繫和海關合作,提供連繫中國內地城市和海外市場的多式聯運服務。珠海機場在港珠澳大橋通車後,也可與香港機場有更緊密合作,進一步加強大灣區作為國際物流樞紐的競爭力。在促進大灣區的物流資源整合和優勢互補方面,粵港兩地可進一步加強合作,提升國際貿易線上物流、通關、支付、溯源、追蹤等先進高效服務。

2. 先進生產及創新研發中心

科技與創新是未來發展的主要方向,要建設粵港澳大灣區成為具世界影響力和競爭力的城市群,科技與創新更是重要的推動元素。科技發展不單是要提升區內發展科技研發能力,還要把科技廣泛應用到不同層面,例如智慧生產、智慧城市、物聯網、環保節能等,以提升整體經濟效率和可持續發展水平。珠三角區內工業發展本身亦可拉動更多的研發投入,形成良性循環。

廣東的規劃資料顯示,珠三角就其已有產業優勢,將建設五大高新技術產業集群:以廣深、佛山等為重點,帶動珠海、肇慶等市資訊產業發展,加快建設珠三角國家級資訊產業基地;打造一批新能源產業集群,以廣深珠、東莞、惠州為重點,建設新能源汽車生產基地,以深莞和佛山、中山為重點,建設國家太陽能光伏高技術產業基地,支援深圳、江門、肇慶發展低碳經濟,加快廣州、深圳、佛山、東莞打造世界級新能源和環保節能產業基地;以廣州、佛山國家火炬計劃新材料特色產業基地、新材料國家高技術產業基地為依託,打造國家級新材料產業重要基地;以廣深兩個國家生物產業基地和中山等基地為支撐,打造國家生物醫藥和現代重要重大創新產業基地;以廣深為核心,深莞惠、廣佛和中江國際級LED 新光源產業一體化發展,形成珠三角LED 新光源上下游一體化產業帶。

相對美國加州大灣區工業結構主要集中在專業/科學及技術服務業以及資訊業等範疇,珠三角有廣泛領域的工業結構,除了高新科技行業外,仍有很多不同的傳統製造業。科技的應用可在不同層面推進,除了智慧城市、物聯網、環保節能等大方向外,如何促進大灣區內的科研及先進技術和現代專業服務與傳統工業相結合,從而加速工業升級轉型是不可忽略的發展方向。例如,珠三角內的製造業生產線正需要向自動化發展,區內各市的行業協會可加強交流合作,結合不同的產業提升資源及科學技術資源,發展適合自身行業的自動化設備。

目前內地企業具有不俗的科研能力,已開發不少在資訊科技(ICT)應用和解決方案、移動終端應用(Apps)等領域受市場歡迎的技術和產品;但較少企業能把有關技術從地區推擴至全國應用及利用符合國際標準的技術開發國際市場。另一方面,內地在部分先進技術領域正處於起步階段,但又往往因為不同的技術規格和用者經驗(user experience),難以直接引進外國技術於內地應用。

相對內地,香港的科研投入和整體研發能力可能較弱,但香港企業熟悉國際科技潮流趨勢及技術標準,同時擁有廣泛國際市場網絡的優勢,可與深圳以至大灣區內城市合作,加強相關技術領域的人才流通、技術應用、規格標準等方面合作,除可幫助內地科技成果進行商業化開拓海外市場,亦可有效為內地業者引進合適的外國技術,同時進行本地化應用,促進大灣區整體發展。

在部分高科技產業,例如物聯網應用、下一代互聯網發展等,內地一些企業目前仍缺乏部分專門知識,使有關研發及技術應用多少受到制約。香港科技業者熟悉外國先進科技,而且善於使用根據國際標準/框架開發的技術,或引進外國技術,協助内地有關項目進行商業化,切合市場需求。

事實上香港作為區內蓬勃的知識產權貿易中心,對知識產權提供良好保護,並擁有優良的專業服務,一直吸引海外科技、創意、研發及眾多自設研發部門的設計生產公司以香港為平台與中國內地及亞洲其他市場進行知識產權交易。因應大灣區未來科技與創新的發展需要,香港正可發揮知識產權貿易的優勢,一方面引進所需海外技術等知識產權,同時協助大灣區的科研成果推出市場並發展國際市場業務。

金融科技是另一個香港可參與大灣區科技創新發展的領域。廣東省十三五規劃提出要推動深圳與香港共建全球金融中心,香港本身就是一個國際金融中心,加上與內地在金融方面的聯繫日趨緊密,為金融科技發展提供很好的合作基礎和機遇。例如若有科技金融公司有意開發股票投資的金融科技,香港股票市場與上海和深圳的股票市場均有聯繫,當中可以有發展空間。要從事金融科技,必須同時具備金融服務知識和技術背景,香港擁有大批具備專業金融經驗與知識的人才,同時有透明的法規及建全的監管,並注重資訊安全,大可以結合大灣區內的技術人才開發相關的金融科技。粵港若能做好協調大灣區內金融科技的發展和應用,包括系統的標準和連接等,將可促進大灣區內的金融科技應用和研究,達至領先的水平。

預料粵港澳大灣區未來將有更多的創客及投資者受到各種鼓勵,投身於各類科創企業。除財政資源外,這些科創企業亦對技術、市場網絡及企業發展等方面的支援服務大有需求。深圳以至大灣區內的科創企業,可以結合香港的優勢,例如資訊及資金自由流通、國際市場網絡及企業管理等,提升發展能力。要推動深圳與香港共建創新中心,可以加強深圳與香港有關科研單位及科技企業的交流聯繫,創造技術合作平台,還要把對接平台擴大到其他相關的金融及專業服務,希望能做到結合彼此的優勢。

吸引人才匯聚是帶動科技及創新的重要因素。香港配合深圳,在吸納人材方面,特別是海外人才,也可以發揮其特點。香港作為一個國際化的都市,相對內地城市的生活,部分外國的人才可能較容易適應在這裡生活。因此,為了吸納外國的專業人才與內地及香港人員組成研究團隊,可以發展香港和深圳比鄰的兩個相連的團隊。外國的專業人才既可在香港一個較為國際化的環境生活,也可與珠三角地區,特別是深圳在研究工作上保持緊密聯繫。香港的對外聯繫與國際化背景也正好定位為大灣區對外科技交流合作基地。香港和深圳在落馬洲河套地區計劃合作發展的「深港創新及科技園」如果能夠在這方面起到帶領及示範作用,吸引國內外頂尖企業、大學或科研機構進駐,將有助推動大灣區未來發展。

3. 一帶一路建設

「一帶一路」倡議以「五通」,即政策溝通、設施聯通、貿易暢通、資金融通、民心相通為主要內容。當中設施聯通將是的倡議首個階段的重點推進方向,帶動基建項目發展。亞洲開發銀行最新的資料顯示,由2016-2030年,單在亞洲發展中國家,每年所須的基礎建設投資便超過17,000億美元。國有企業是目前參與「一帶一路」沿線基建項目的主力軍。不過「一帶一路」建設涉及的基建投資規模龐大、類別眾多,所需的資金、風險承擔、管理技術等遠超政府或國有企業的能力負擔。通過公私營部門合作(PPP) ,補足上述投資要素,並引入不同創新意念,對「一帶一路」成功建設至關重要 。

PPP項目組織可以非常複雜,涉及來自不同國家的投資者,多元的投資主體亦代表不同利益目標。香港企業除擁有豐富的PPP項目經驗外,香港作為國際樞紐,可以發揮「超級聯繫人」的優勢,有效地為項目配對各方參與者及提供融資方案。廣東省向來是中國內地對外承包工程的主要投資來源,廣東企業以致中國內地企業在項目總承包的優勢比較突出,但香港相關專業及商業服務在個別專門細分項目有其過人之處。例如不少香港的建築、測量及工程服務公司達到世界一流水準,服務範圍廣泛,可以為廣東企業參與「一帶一路」國家基建項目工程,提供顧問、設計、規劃及監理等服務。加上國際經驗豐富、掌握和分析海外資訊的能力較強,可以有效地為項目進行風險評估及為項目投資提供適當風險管理。

投資貿易合作是「一帶一路」建設的另一重點內容。一方面,中國希望與沿線國家著力研究解決投資貿易便利化問題,消除投資和貿易壁壘,以便拓展相互投資領域;同時要優化產業鏈分工布局,推動上下游產業鏈和關聯產業協同發展,用以提升區域產業配套能力和綜合競爭力,包括鼓勵合作建設各類產業園區,希望與「一帶一路」國家攜手促進產業集群發展。

香港和中國內地特別是珠三角是中國最早對外開放的地區,至今珠三角企業在國際化發展方面,不管是引進來或走出去都是領先中國水平。2015年末,廣東是中國擁有最多外商投資企業數目及對外直接投資存量最大的省份。

廣東企業在技術、資本、管理等方面已經具備一定的競爭力,參與國際競爭的能力不斷增強,具備了「走出去」的條件,特別是當前中國內地經濟正處於轉型升級的關鍵時期,國內資源環境約束加劇,勞動力成本上升,企業利潤率水平降低,若能積極主動地抓住「一帶一路」戰略機遇,發揮廣東製造業的優勢,將可加快「走出去」拓展企業國際化經營的戰略布局。

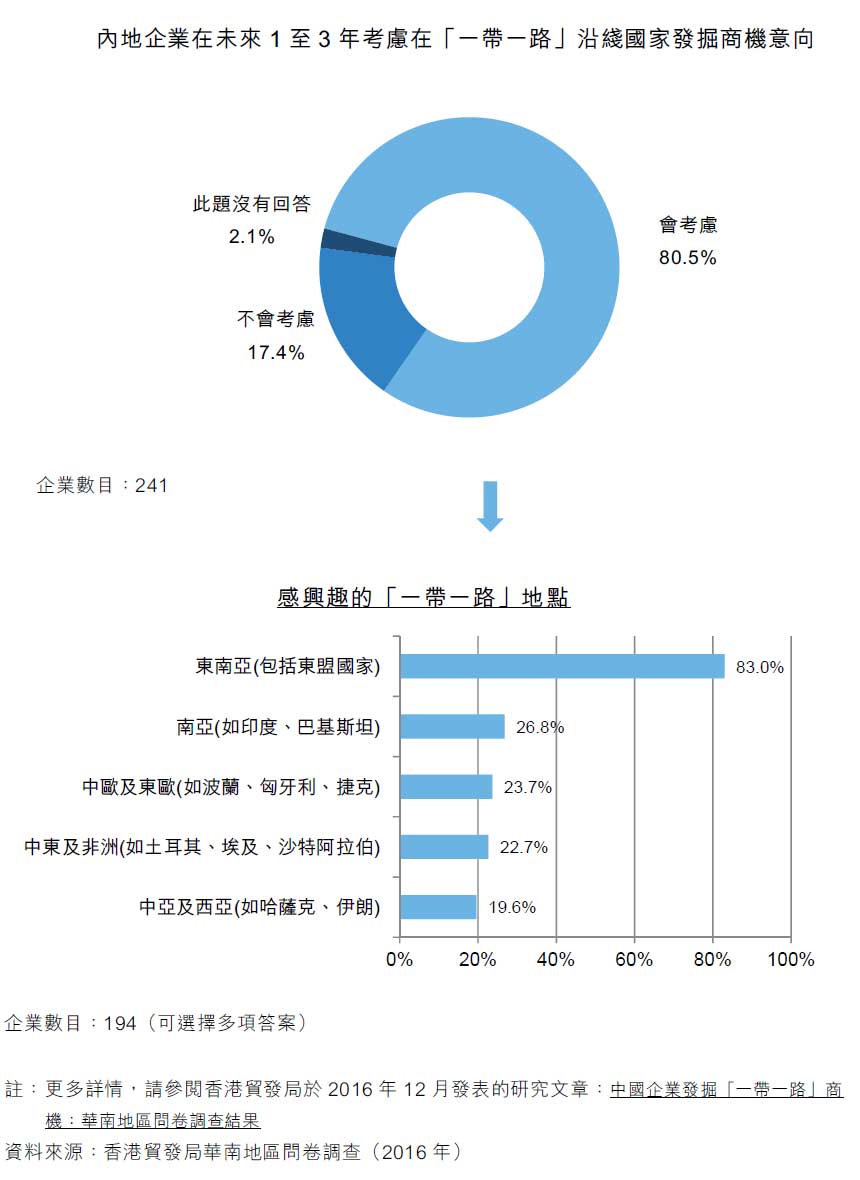

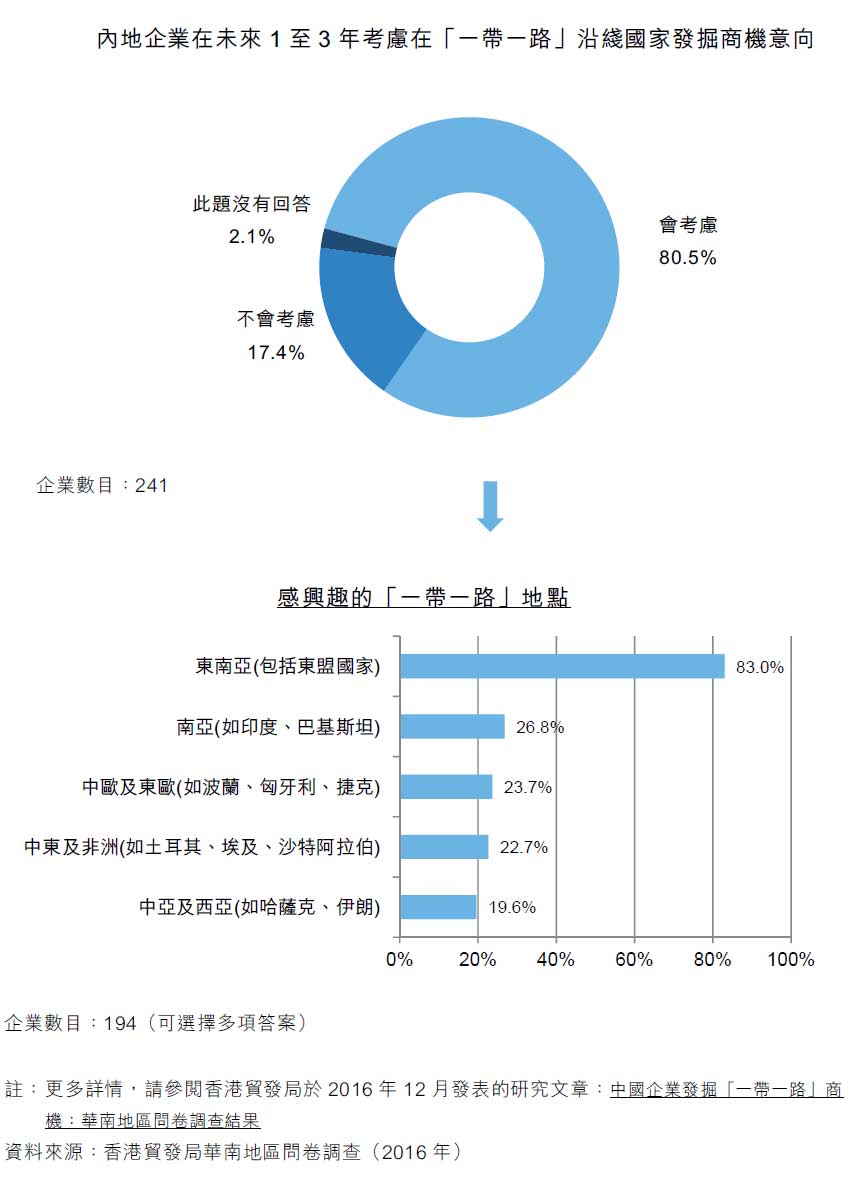

香港貿發局研究部在2016年第2及第3季向超過200家廣東省有關企業進行問卷調查。80%受訪企業表示會在未來1-3年考慮在「一帶一路」沿線國家發掘商機。表示會考慮發掘「一帶一路」商機的企業當中,最多企業表示希望增加銷售產品往「一帶一路」市場,部分企業選擇前往「一帶一路」投資設廠生產、在當地採購各類消費品/食品/原材料等供應內地市場、亦有部分表示希望在「一帶一路」國家設立中轉倉庫以加強國際物流效率。

受訪企業感興趣發掘上述「一帶一路」商機的地點,則絕大部分選擇包括東盟國家的東南亞地區,佔會考慮發掘「一帶一路」商機企業83%。粵港澳大灣區是海上絲綢之路的重要交通物流樞紐,並已與東南亞國家建立有效的供應鏈關係。香港服務業者多年來協助廣東及其他內地企業,處理在香港和海外市場的貿易及投資業務。隨著內地推進「一帶一路」的發展戰略,進一步鼓勵企業「走出去」投資海外,香港服務業將進一步就金融、法律、物流、稅務、市場推廣、風險評估等不同方面,加強與廣東合作,發掘「一帶一路」商機。

內地企業前往外國建立銷售網絡、進行直接投資、採購和各類型收購活動時,往往需要美元或其他外幣資金為有關業務融資。目前企業通過內地的銀行體系或其他融資渠道為海外投資項目籌集資金仍有不少限制。若內地企業能更便利地使用香港的商貿平台,利用香港資金流通和一應俱全的專業服務優勢為海外業務融資,將可有效地解決他們「走出去」的投、融資問題。銀行融資以外,香港其他的金融服務和投資者,例如創投及私募資金等不僅可提供股本資金,更可為內地企業注入國際元素,通過香港成立國際公司架構,為「走出去」的個別投資項目,進行具成本效益的股本和債務融資,以支持有關項目的發展和營運。

此外,港澳與大灣區內及與其他珠三角地區的港口和機場進一步加強緊密連繫後,可進一步推廣至與其他海外港口的合作,特別是與沿「21世紀海上絲綢之路」的東南亞地區港口達成某種形式的聯盟,目標是促進港口間貨物進出口的便利化,例如通關安排,港區聯動等。這些發展將有助提升大灣區發展生產、銷售、供應鏈管理、國際物流庫存及分撥等領域的競爭力。

以跨境網上銷售為例,大灣區內的交通物流網絡發展成熟,十分便利消費者的網購活動,以及各類小商品生產商發展電子商貿業務。現時內地網購及電商活動,絕大部分只著眼中國內地市場,國際業務仍有待發展。香港是最受歡迎的跨境網購目的地之一,擁有完善的電子商貿平台,在網絡安全和個人資料私隱保障方面,特別為重視網絡安全的外國用戶所信賴,而且不同的國際支付工具和第三方支付平台能為消費者的跨境網購提供便利;加上本港擁有高效的國際物流網絡,有關服務供應商能有效為消費者提供集運、代購、國際轉運、清關等服務,是外國消費者網購大灣區以及其他內地商品,和大灣區網民尋找外國潮流產品的理想平台,若粵港雙方能協力加強相關商品流通,進一步提供例如商品進出境的海關、商檢等便利措施,可促進大灣區內有關業務發展。

總結

三藩市灣區、紐約灣區、東京灣區等發展突出的區域經濟體,其共通處是整個地區由多個互動性強的集群組成,而集群內的企業既能互惠發展,同時又共同享有集群賦予的競爭優勢。由於這些集群的企業會分布在區域內不同城市,使整個區域的同城化程度增加,整個區域的經濟運作因此有必要以一個整體共同推進,包括一些發展策略有必要從整個區域角度考慮,才能保障灣區經濟帶來的利益。因此國家發改委計劃將粵港澳大灣區作為一個整體來規劃是有其必要性。

不過粵港澳大灣區包含粵港澳三個不同的政治、行政和經濟體系,與三藩市、紐約、東京等海外灣區,或內地環渤海,長三角等內地灣區不同,在進行整體規劃時存在不少障礙。因此在制定規劃時不可以過分依賴單一方專家論證分析,而必須要有各相關持分者代表的參與,進行諮詢和討論。

有分析認為,世界其他主要灣區經濟都有「單核」的特徵,例如紐約灣區以紐約市為中心,東京灣區則以東京都為中心,至於舊金山灣區則主要以三藩市,其次以聖荷西市為中心。至於珠三角大灣區內則有廣州、深圳及香港三個主要城市,各自在人口、經濟總量方面差距並不太遠。如何整合各市在大灣區內協同發展及共同到海外推廣將是重要課題。

國務院關於《深化泛珠三角區域合作的指導意見》(「意見」)中提出構建以粵港澳大灣區為龍頭,帶動泛珠以致東南亞及南亞地區發展。在對中南、西南內陸地區的聯繫與及面向國際,輻射東南亞、南亞這個經濟紐帶功能上,香港與內地珠三角地區可以有分工協作。總體而言,香港作為國際商貿平台、金融中心應該繼續發揮對外聯繫的功能,結合大灣區內聯腹地的優勢,提升整個灣區對更廣泛地區的拉動作用。但在具體分工上,過去經驗顯示,不單是香港、廣州、深圳等一線城市均希望成為區域或國際級的金融、貿易及航運中心,各市都希望吸引國際企業及商業活動落戶;各二三線城市事實上亦希望參與相關競爭,發展高增值回報的產業。

參考三藩市灣區等經濟產業發展同城化發展的方向,粵港澳大灣區作為一個整體規劃的目標,應在訂定未來發展的宏觀大方向後,然後朝著目標,通過如「意見」中提到泛珠地區要清理阻礙要素合理流動的各種規定和做法,推動各類生產要素跨區域有序自由流動和優化配置。同時,為了提供一個有利於現有產業集群轉型升級和培養新的產業集群茁壯成長的生態環境,吸引更多海內外投資者和商貿活動在大灣區內集聚,粵港應從擴大市場吸引力、優化營商環境和加強培養和吸引人才等方面加強合作,應對全球化大環境下國內及海外其他區域的競爭。

粵港澳大灣區從人口、面積、經濟總量等指標比較,與大部分成熟海外灣區不遑多讓,若果整個區域在市場准入、流通等方面真正做到市場融合,對吸引投資,推進高新科技和創新行業發展,以致提升大灣區作為世界級城市群都非常有利。

香港整體上可以在融資、國際運營和風險管理三方面提升功能,加強與珠三角企業合作,提升國際商貿平台作用,同時推動粵港澳大灣區產業升級轉型發展,並在「一帶一路」建設過程中發揮「超級聯繫人」角色的核心價值。

[1] The Bay Area: A Regional Economic Assessment, Bay Area Council Economic Institute, October 2012

編輯推薦

熱門文章

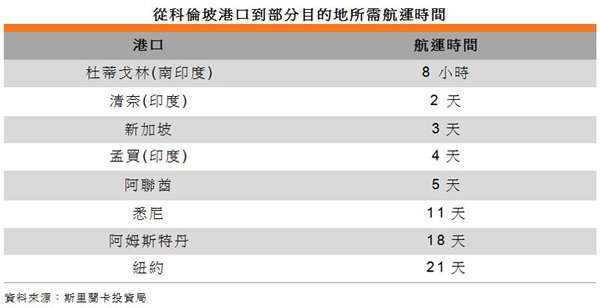

根據中國發布的《推動共建絲綢之路經濟帶和21世紀海上絲綢之路的願景與行動》,海上絲綢之路包含兩條路線,其中之一是從中國沿海港口過南海到印度洋,延伸至歐洲。印度洋是亞歐運輸的主要通道,佔中國海外貿易,能源和原料運輸的很大比重。斯里蘭卡擁有眾多優越條件,是這條海上絲綢之路的重要節點。因此,廣東省在參與建設「一帶一路」,打造粵港澳大灣區成為絲綢之路經濟帶的國際物流樞紐規劃中,將與斯里蘭卡聯結,建設水鐵聯運大通道。

斯里蘭卡物流優勢

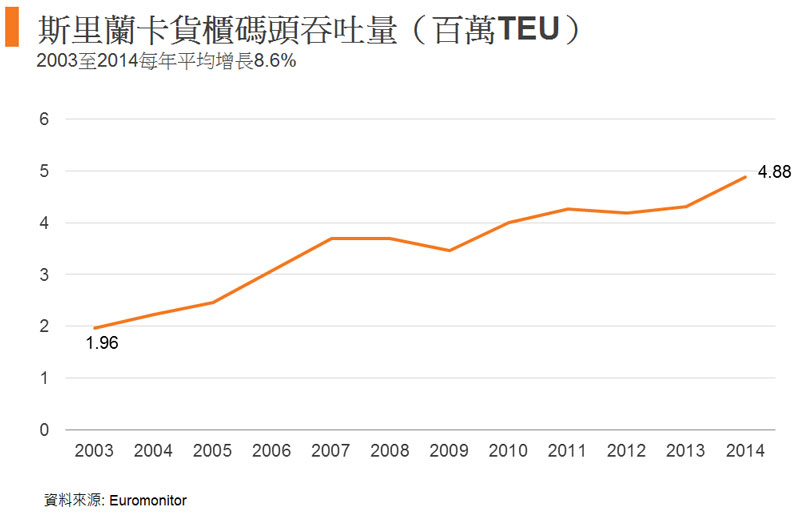

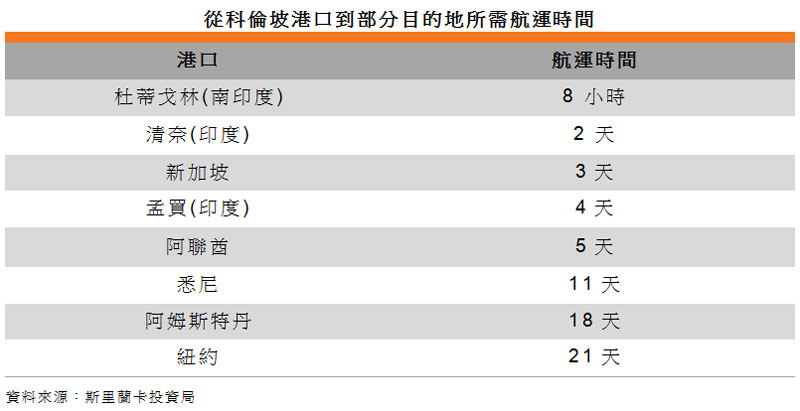

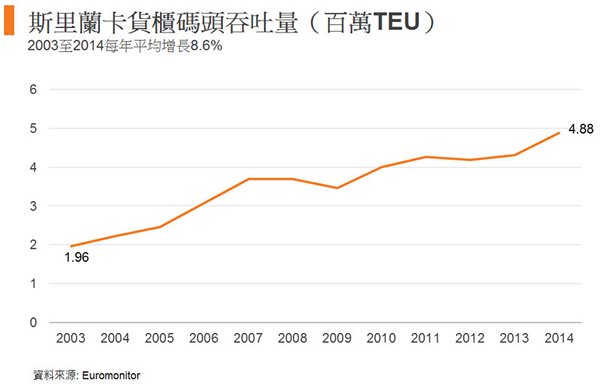

斯里蘭卡位於印度洋多條世界上繁忙的航道之間,並與印度非常接近,是通往印度次大陸的門戶,擁有發展成為南亞主要航運中心和物流樞紐所需的優勢(請參閱《斯里蘭卡:南亞新興物流樞紐》)。斯里蘭卡經濟規模雖小,2014年總貿易額為310億美元(僅及印度7,780億美元的4%),卻是區內一個重要的轉運中心,不少航運公司在這裡為貨物進行集拼及拆箱,再運往其他目的地。2014年,科倫坡港的貨櫃吞吐量增長12.3%至488萬個標準貨櫃(TEU),當中主要是轉運貨物,佔總貨櫃吞吐量的75%。

世界航運公會(World Shipping Council)的統計數字顯示,斯里蘭卡西岸的主要貨櫃港口科倫坡港(Port of Colombo)是南亞最繁忙的港口,2013年貨物處理量為431萬TEU,領先於印度最大的貨櫃港口尼赫魯港(Jawaharlal Nehru)(2013年處理量為412萬TEU)。

科倫坡港

鑒於市場對國際物流服務的需求不斷增長,斯里蘭卡政府已展開科倫坡港口擴建計劃。在此之前,科倫坡港有3個貨櫃碼頭,分別為Jaya Container Terminal、Unity Container Terminal 及 South Asia Gateway Terminal,合共有7個主貨櫃泊位和4個駁船泊位。

擴建計劃完成後,科倫坡港將增添3個碼頭。第一個新碼頭南貨櫃碼頭(South Container Terminal)現已開始營運,是南亞地區首個可容納特大貨櫃船的碼頭,發展商是招商局國際有限公司與斯里蘭卡港務局合資經營的科倫坡國際貨櫃碼頭有限公司(Colombo International Container Terminals Limited)。此外,由斯里蘭卡港務局全資擁有的東貨櫃碼頭(East Container Terminal),將於2015年底投入服務,而西貨櫃碼頭(West Container Terminal)則仍在籌劃階段。加入3個新碼頭後,科倫坡港的貨櫃處理量將由目前每年400多萬TEU,大幅增加至1,200萬TEU,成為世界最大貨櫃碼頭之一。

漢班托塔港

為了進一步擴展物流業,斯里蘭卡政府在南部沿海城市漢班托塔(Hambantota)發展一個新港口和經濟特區。值得注意的是,一家由中國港灣工程有限公司與中國水電建設集團國際工程有限公司合資經營的公司,獲選為整個發展項目的承建商。

第一期工程業已完成,新建港口已於2014年開始投入營運,可供4艘貨輪同時停泊,並設有船舶加油碼頭。第二期工程正在進行中,將增建一個有7個泊位的貨櫃碼頭,預料工程於2015年底竣工。此外,第三期工程將建造一個船塢。雖然該發展項目的大部分工程仍未完工,但漢班托塔港的業務已有良好進展,在2014年共處理了388艘貨船,較2013年增加一倍有多。

斯里蘭卡雖然沒有生產汽車,但漢班托塔現已成為汽車轉運中心。由於地理位置理想,加上漢班托塔屬深水港,越來越多日本、韓國和印度的汽車製造商利用這個港口,把在印度、泰國、日本和中國生產的汽車,轉運到非洲、中東、歐洲和美洲市場。根據斯里蘭卡港務局的資料,漢班托塔港於2014年共處理254艘運載汽車的貨輪,較前一年增加85%。同年處理的汽車貨量接近190,000 輛,遠較2013年的65,000輛為多。除汽車外,漢班托塔港勢必成為其他多類貨物的轉運樞紐,與科倫坡港看齊;該港口尤其希望為其他亞洲生產基地的代工生產(OEM)廠商提供貨物轉運服務。

外商參與

基建設施一向是物流樞紐必須具備的「有形條件」,斯里蘭卡在這方面已有大量的公共及私人投資;然而,在「無形條件」方面,該國正面臨不少挑戰,包括需要吸納足夠的合資格專業人才和國際參與者。目前,斯里蘭卡的物流和運輸業仍落後於區內多個主要樞紐,包括香港、新加坡和迪拜。

根據世界銀行發表的《2014年物流表現指數》,斯里蘭卡在160個國家中排行第89位。斯里蘭卡在「物流服務能力和質素」取得2.91分,較印度(3.03)、阿聯酋(3.5)、香港(3.81)和新加坡(3.97)為低,顯示該國需要改善物流服務的質素,而在「硬件」方面,例如港口、道路和鐵路等,也須作出更多投資。

外國物流服務供應商的參與能為斯里蘭卡引入符合國際標準的服務水平,對其物流業的未來發展非常重要。現時斯里蘭卡的法例規定,一家船務代理的外資持股量最高只能達40%,若要高於此比例,必須向投資局申請,並由該局逐一審批。

對外資物流公司來說,斯里蘭卡除地理位置優越外,還有其他具吸引力的優點。該國與其他發展中國家不同,甚少出現港口擠擁情況,也極少發生大規模勞資糾紛。此外,與區內其他國家相比,在斯里蘭卡進行國際貿易所需承擔的相關成本較低。根據世界銀行的《2015年營商環境報告》,斯里蘭卡出口及進口貨櫃的成本,分別為每個560美元及690美元,遠遠低於南亞區平均的1,923美元及2,118美元,以及孟買的1,120美元及1,250美元。

香港貿發局研究部於2015年初前赴斯里蘭卡考察,訪問了一家在當地經營的香港航運及物流服務供應商。據該公司指出,越來越多輪船和平底駁船公司到斯里蘭卡經營業務,有助該國物流業達到規模經濟,從而獲取佳績。舉例來說,全球最大的物流公司之一美集物流(APL Logistics)已宣布將於今年在斯里蘭卡設立南亞區拼裝中心。該公司發表聲明,表示將在斯里蘭卡經營貨櫃貨運站、倉庫和其他與物流相關的業務。香港物流服務供應商如有意進一步在外地擴展業務,可與斯里蘭卡同業合作,在南亞區拓展商機。

聯絡資料

| 斯里蘭卡港務局 (Sri Lanka Ports Authority) |

電話:(+94 11) 2421201 傳真:(+94 11) 2440651 電郵:webmaster@slpa.lk 網址:www.slpa.lk |

| 特許物流及運輸學會 (The Chartered Institute of Logistics and Transport) |

電話: (+94 11) 5657357 傳真: (+94 11) 2698494 電郵: admin@ciltsl.com 網址: www.ciltsl.com |

| 斯里蘭卡物流及貨運代理協會 (Sri Lanka Logistics & Freight Forwarders’ Association) |

電話: (+94 11) 4943031 傳真:(+94 11) 2507577 電郵: secretary.general@slffa.com 網址: www.slffa.com |

| 錫蘭船舶代理協會 (Ceylon Association of Ships’ Agents) |

電話: (+94 11) 2696227 傳真: (+94 11) 2698648 電郵: info@casa.lk 網址: www.casa.lk |

| 科倫坡付貨人學院 (Shippers’ Academy Colombo) |

電話: (+94 11) 3560844 傳真:(+94 11) 2874065 電郵: enquiries@shippersacademy.lk 網址: www.shippersacademy.lk |

| 斯里蘭卡付貨人委員會 (Sri Lanka Shippers’ Council) |

電話: (+94 11) 2392840 傳真: (+94 11) 2449352 電郵: slsc@chamber.lk 網址: www.shipperscouncil.lk |

編輯推薦

熱門文章

亞的斯亞貝巴-吉布提鐵路(亞吉鐵路)是中國在非洲一項最新的投資項目。隨著「一帶一路」建設的推進,這類投資項目的數量必定會不斷增加,但中國與非洲的發展規劃是否協調一致?

吉布提是非洲最小的國家之一,而埃塞俄比亞素來被視為東非之角的經濟龍頭,現在,兩國均是「一帶一路」倡議的受益者。「一帶一路」是中國主導的大規模國際基建及貿易發展計劃。

吉布提國土雖小,但其港口位處紅海入口的戰略位置,舉足輕重。吉布提有大量外國軍隊駐扎,當中包括美國在非洲的最大軍事基地。相比之下,埃塞俄比亞作為非洲第二人口大國,是區内的經濟發展亮點。

儘管兩個國家的情況截然不同,但現已被亞吉鐵路聯繫起來。亞吉鐵路主要由中國建設和投資,並由中國中鐵和中國土木工程集團負責興建,2016年10月正式通車,成為非洲首條跨境電氣化鐵路。整項工程造價達40億美元,其中大部分融資來自中國進出口銀行。

埃塞俄比亞地處内陸,而亞吉鐵路全長750公里,大大改善了該國的進出口運輸交通。最重要的是,亞的斯亞貝巴與吉布提港之間的公路運輸路程,原本需時7天,現在則大幅縮減至10個小時。該鐵路是中國與非洲戰略合作的成果,被視為「一帶一路」不可或缺的一部分。

此外,蒙巴薩-內羅畢鐵路(蒙內鐵路)是另一項由中國出資/主導的項目,今年6月亦投入運作。蒙內鐵路全長485公里,實為一個價值140億美元的標準軌距鐵路網絡的第一期工程。該鐵路網絡規模遠超蒙內鐵路,最終將由肯尼亞延伸至烏干達,再抵達盧旺達。

上述鐵路網絡落成後,中國製造的商品可望透過蒙巴薩港打開東非多個内陸市場。中國對礦產的依賴程度正日益加深,而該項目料將改善非洲礦產出口的供應鏈。

中國在非洲已展開眾多工程項目,上述鐵路是其中兩個最新項目。早於1970年代,中國在非洲已興建坦贊鐵路,把內陸的贊比亞及其產銅帶與坦桑尼亞的三蘭港連接起來。當時坦贊鐵路是中國在非洲最大型的援助項目。

最近,中國承諾向非洲各國多個大型基建項目作出投資,成為「一帶一路」建設的關鍵元素。顯然,中國希望在非洲的經濟發展中擔當重要角色,而這一方針勢必提高中國在非洲大陸的商業版圖。

在2015中非合作論壇上,中國國家主席習近平慷慨地承諾將向非洲提供600億美元的發展援助。其中大部分資金將投入若干大型基建項目,包括新的埃塞-吉布提鐵路和東非海岸一系列港口升級工程。

對於中國的策略,約翰内斯堡大學孔子學院政治分析員David Monyae評論道:「中國無條件進行投資及商業活動,成功提升在非洲大陸的影響力,營造了北京政府樂意支持非洲發展的印象。」

不過,其他分析員則以懷疑的眼光看待此事,斷言「一帶一路」乃中國打造一個全球貿易集團並建立「勢力範圍」的手段。南非安全研究所顧問Peter Fabricius便是其中之一。他認為:「習近平可能正利用一個偶然的機遇,務求擴大中國作為世界龍頭大國的經濟及政治影響力。衆所周知,美國由奉行孤立主義的特朗普出任總統,在全球事務中逐步退卻,因此中方正善加利用當前的時機。」

Fabricius與其他分析員均認為,有明顯跡象顯示國際市場正形成全新的經濟秩序。理由之一是,除美國和法國等多個國家之外,中國最近亦在吉布提建立軍事基地。

然而,其餘人士則不同意非洲各地進行的「一帶一路」項目乃是中國為暗地裡聚集勢力而作出的舉措。相反,他們堅信非洲人口達10億,中國在東非的投資純粹是為了建立更廣闊的貿易網絡,旨在進一步打開非洲的消費市場。因此,有關人士認為,推進「一帶一路」之目的應是透過改善貿易通路促進共同發展。

至於地緣政治野心和全球貿易網絡擴大二者能否真正分開而論,仍有討論空間。無論實況如何,南非著名商業記者Peter Bruce認為:「中國在非洲的影響力巨大,引人注目,而其影響力的擴張速度極快。」

不少人認為,關鍵問題是適用於中國的方案是否亦適用於非洲。代表整個非洲大陸55個國家的非洲聯盟對此表示樂觀。非盟早已表明,歡迎中國合作參與非洲的基礎設施和技術項目。

南非經濟學家Greg Mills的見解或多或少解釋了非盟熱忱背後的原因,他指出:「中國的承包商和企業願意接受西方業界大多不會考慮的工作地點和條件。」

中國非洲製造

然而,非洲吸引中國投資者之處不止於基建。世界銀行表示,由於中國工資預期上升,導致成本壓力上漲,因此估計中國將對外輸出8,600萬個低技能製造業工作崗位。預料非洲最終將成為這一輪勞動力需求轉移的主要受益者。

對於這一轉變,Mills說:「低技術、勞力密集型製造活動實際上不能在中國進行。隨著中國經濟逐漸向上爬升,非洲確實有望把握有關的勞動力需求機遇。」

紡織業是正經歷這一進程的產業。中國已將部分紡織業生產設施遷往非洲,其中在東非的埃塞俄比亞,中國重金投資了若干大型製造業項目,而該國勢將成為非洲的製衣中心。

埃塞俄比亞原本已是非洲增長最快的經濟體之一。該國一直實行低勞動成本政策,以維持競爭優勢。目前,該國首都亞的斯亞貝巴附近一個工業園區憑藉低/零關稅措施及廉價的勞動力,已吸引約80家中國紡織企業進駐。事實上,中國相對的薪酬水平比埃塞俄比亞高15倍。中國浙江省鞋履製造商華堅集團同樣投入了大量資金在園區內興建大型廠房,目前員工總數超過3,000人。

總體來說,主要由中國出資的運輸基建改善項目令整個非洲地區的製造業效率均得到提升。例如,亞吉鐵路開通後,過去被陸地環繞的埃塞俄比亞現有直通港口的交通路線。

因此,據說其他幾個非洲國家,尤其是摩洛哥、南非、喀麥隆和多哥,都在爭取北京的關注。鑒於中國企業已經在非洲創造了約60萬個就業機會,自然所有非洲國家都希望把握「一帶一路」可能帶來的機遇。

中國明顯認為,輸出部分製造業崗位將有助一些非洲國家進一步實現自給自足。不過,反對者堅稱,中國乃在利用當地的廉價勞動力,對非洲許多合作夥伴國的高壓統治和管治不善等問題視若無睹。

儘管存在上述種種憂慮,惟綜觀全球經濟環境,商品價格收入下滑將成為長遠趨勢,無可否認,非洲各國如要實現經濟可持續增長,必須擴大製造業。中國方面,顯然有意利用非洲的這一需求。

最後,與所有其他投資者一樣,中國希望確保其投資取得良好回報,對非洲基建項目的投資更明顯地反映了這個目標。對此Bruce特別指出:「中國在非洲的投資無一不為其帶來某種形式的利益,或是政治利益,或是經濟利益。」

與數年前中國的情況無異,非洲熱切希望更全面地參與經濟全球化的發展。許多人相信,「一帶一路」如果可以促進非洲的發展及帶動當地經濟,那麼只會對非洲大陸有利。

特約記者 Mark Ronan 開普敦報道

編輯推薦

熱門文章

在「一帶一路」倡議下,由於沿線涵蓋超過60個國家,料將衍生不少跨境投資、買賣以至法律爭議等專業法律服務的需求,為香港法律界帶來龐大的發展機會。

香港律師會於5月中與來自22個沿線國家及司法地區的38個法律團體簽署《香港宣言》,目標之一是推動可一致依循的「商業貿易模範法」(Model Law on Business and Trade),並爭取確立香港作為區内法律專業服務中心的地位。

香港律師會會長蘇紹聰律師提到,該會早於2015年已成立「一帶一路」委員會,參與的60名成員就配合國家倡議的「一帶一路」政策,探討如何發揮香港的法律專業服務於「一帶一路」藍圖中的角色。

促推行模範法

他續指,「一帶一路」沿線涵蓋超過60個國家及司法地區,其法律體制各有不同,但由於將涉及不少跨境投資及經濟活動,該會認為有需要推行「模範法」,讓相關的企業、投資者於一致的法律語言或遊戲規則進行貿易磋商。同時,該會計劃設立「一帶一路」法律資訊平台,提供涵蓋60多個國家的基本投資及法規的資訊,以及當地法律諮詢服務的資料。

蘇紹聰表示,《香港宣言》其中一個目標,是集合成員的力量推動法律方面的交流及策略性合作,透過舉辦「一帶一路」年會或雙年會,探討「一帶一路」的挑戰及機遇,以及投資者感興趣的法律相關課題。他並提到,該會會與中華全國律師協會計劃成立「一帶一路律師聯盟」,希望與「一帶一路」沿線國家及司法地區的律師建立緊密關係,並透過香港的平台連繫各司法區的法律專業人士,一同把握發展的機遇。

他指出,「一帶一路」涉及不少大型跨境基建項目、商業合約的制訂等,對解決跨境法律爭議的相關法律服務有一定需求。他強調本港不少律師早於1980、1990年代,已負責處理内地及東南亞貿易投資相關法律事務,可謂經驗豐富。「所不同是,以往是協助外國投資者到内地或東南亞處理法律事務,而『一帶一路』的服務對象大部分是内地的企業及投資者。」

「一帶一路」涉及大型跨境基建項目、商業合約的制訂等,對跨境法律爭議的相關法律服務有一定需求。

舉辦培訓課程

蘇紹聰續指,當年海外投資者到内地投資,相關的法律事務都交由香港的國際事務所處理,由於部分到內地開創事業的法律界元老級已自立門戶,近年不少内地「走出去」的企業,也會選擇他們的事務所協助處理事務,而這也是未來的大趨勢。

他坦言,「一帶一路」沿線國家或地區並非港人所熟悉,要走訪當地處理法律事務,客觀條件當然不及留港處理樓宇買賣合約或新股上市等法律事務,「譬如我90年代初到内地工作,酒店晚上9時便關燈和冷氣,文化的差異頗具挑戰性,但經驗確實難得。」

一為經驗傳授,二為確保業界的專業水平,香港律師會亦計劃向政府申請資助,舉辦培訓課程,鼓勵新一代的律師,尤其任職於中小型事務所的,裝備自己、接受挑戰,迎接「一帶一路」帶來機遇。

香港律師會會長蘇紹聰表示,該會正爭取確立香港作為「一帶一路」倡議下,區内法律專業服務中心的地位。

完善法律體制佔優

「一帶一路」的投資項目規模龐大,往往涉及多個司法區,屬國際級的投資,需要具國際水準的專業服務之配合,包括國際法律及解決爭議服務。蘇紹聰認為,香港專業法律人才的質素無庸置疑,加上擁有完善法律制度、自由的市場,可以擔當起「一帶一路」沿線國家及司法區中商業爭議裁決中心的角色。

「香港沿用普通法,司法機構獨立、監管機制可靠又具透明度,崇尚法治精神,不偏不倚的態度,充分得到國際的認可。」他説。

蘇紹聰又指,推廣香港於「一帶一路」倡議中的優勢,需要政府及各專業機構的共同努力。該會跟香港貿發局建立良好的夥伴關係,並透過參與貿發局不同活動,包括一帶一路高峰論壇、在内地不同城市舉行的「創新升級.香港論壇」(SmartHK),以及在東南亞國家舉行的「時尚潮流.魅力香港」(In Style • Hong Kong)等,推介香港的法律專業服務的特色,從而開拓更廣濶的市場。

香港律師會透過參與貿發局不同活動,推介香港的法律專業服務的特色,從而開拓更廣濶的市場。圖為一帶一路高峰論壇。

編輯推薦

熱門文章

在歐盟較新的成員國當中,捷克的機場規模最大,鐵路網絡亦非常密集,在歐洲名列前茅,因此許多跨國企業均選擇在捷克設立區域物流中心。捷克的航空交通相當便利,有不少航班飛往中國內地,在中東歐國家之中可謂數一數二。再者,客機機腹載貨容量增加,加上香港至捷克首都布拉格的全貨運新航班投入服務,更進一步加強了捷克的競爭優勢,令這個國家備受亞洲貿易商和投資者注目。

近數十年來,捷克的製造業及資訊科技業欣欣向榮,許多本土企業羽翼已豐,可以謀求進一步的發展。有些企業東主考慮與可靠的海外夥伴合作擴展業務,或是出售整間公司。與此同時,自從捷克總統米洛什澤曼於2013年執政後,捷克與中國的關係顯著改善;到2016年3月中國國家主席習近平歷史性國事訪問捷克3天,兩國關係更上一層樓。

中捷兩國關係持續改善,創造了更有利營商的氣氛。事實上,有些涉及捷克公司的投資交易是通過香港進行。一些捷克企業致力拓展亞洲市場,因而在香港設有辦事處,以便管理亞洲業務。

捷克是重要的物流接口

捷克一直致力發展空運,以克服內陸國這個不利因素,因此與亞洲有較佳的空運聯繫,有不少航班往返中國內地和香港,在中東歐國家中可算首屈一指。舉例來說,布拉格瓦茨拉夫哈維爾國際機場(Václav Havel Airport Prague)現有定期航班,直飛北京、上海和成都這3個中國城市。

這些客運航班的機腹已有一定的載貨容量,加上香港與布拉格之間的全貨運航班自2017年5月起投入服務(由總部設於斯洛伐克的 Air Cargo Global營運,須在土庫曼的土庫曼巴希機場技術停站),令捷克更有能力去處理中國及亞洲公司的貨運需求。歐洲的跨境電子商貿一片興旺,這些公司都希望汲取箇中商機。

捷克跟其他V4國家(維謝格拉德四國) 不同,與獨聯體(CIS)地區並沒有共同邊界,因此不能成為貨櫃轉運的主要鐵路換車站,無法直接得益。鐵路換車站的作用是把前蘇聯國家如俄羅斯、哈薩克及白俄羅斯等使用的寬軌鐵路(1,520毫米)列車所載貨櫃,轉裝到中國及歐盟使用的標準軌距鐵路(1,435毫米)的列車。

不過,捷克擁有一個聯繫世界各地的機場,以及密集的鐵路網。捷克的鐵路網是歐洲最密集的鐵路網之一,僅在盧森堡和比利時之後。這表示捷克仍然極具競爭力,能夠吸引富士康(Foxconn)及亞馬遜(Amazon)等跨國公司前來成立區域物流中心,以便把高增值電子產品配送到歐洲各地,以及處理網上訂單的配貨事務。

鐵路對捷克非常重要,這並不僅是為了建立物流樞紐。捷克的鐵路工業有200年歷史,加上歐洲近幾十年出現鐵路私有化浪潮,這些因素有助捷克成為鐵路應用領域的全球領導者,也為該國提供了另一途徑,為歐亞之間的鐵路擴展貢獻所長。

世界各地的鐵路系統正在迅速擴展,許多捷克公司都參與其中,輪組製造商GHH-Bonatrans便是其中一家。GHH-Bonatrans是歐洲最大規模的鐵路輪組製造商,也是一家優質的全球軌道運輸方案供應商。該公司於2015年爭取到香港鐵路有限公司的合同,為後者供應客運列車車輪;去年在香港設立了Bonatrans Asia Limited,作為首個亞洲據點。

資料來源:Bonatrans Asia Limited

資料來源:Bonatrans Asia Limited

Bonatrans Asia Limited在亞洲積極尋找商機,除了擁有香港和中國內地客戶外,亦與其他亞洲國家有業務往來,包括印度及東盟諸國。該公司在香港設有辦事處,主要負責銷售及為亞洲客戶提供服務,製造和輔助設施則設於印度,這樣可方便該公司向亞洲客戶推廣新產品和提供售後解決方案。中國中車股份有限公司是一個主要的亞洲客戶,估計佔在2015至16年度Bonatrans交貨量約12%。

亞洲的鐵路網高速發展,商機湧現,捷克的鐵路應用方案供應商在價格方面極具競爭力,也希望把握當中的機遇。舉例來說,2016年中國高速鐵路的總里程達22,000公里。隨著本土生產 [1] 的高速火車輪組及車軸湧現,中國對這類進口產品的依賴程度正逐漸下降。不過,由於捷克供應商提供的火車零部件,能滿足每小時450公里行車速度的最嚴格要求,因此他們依然是深受中國鐵路營運者歡迎的合作夥伴。此外,捷克還擁有先進技術,可以降低噪音,加強鐵路與車輪的接觸保護,這是該國另一項重要優勢。

香港的鐵路在安全、可靠、顧客服務及成本效益方面,均屬於世界領先水平,再加上香港匯聚各類專業服務,亦具備廣泛的全球網絡和聯繫,令香港能吸引捷克企業前來,與亞洲投資者合作,特別是在中國的「一帶一路」這類區域及/或區際發展倡議框架下尋找商機。香港早已是中國內地對外直接投資的管道,不單在促進資本流動方面擔當關鍵的聯繫人角色,亦為新打進市場的捷克企業提供必需的當地知識和可靠的支援。

中國在捷克掀起併購熱潮

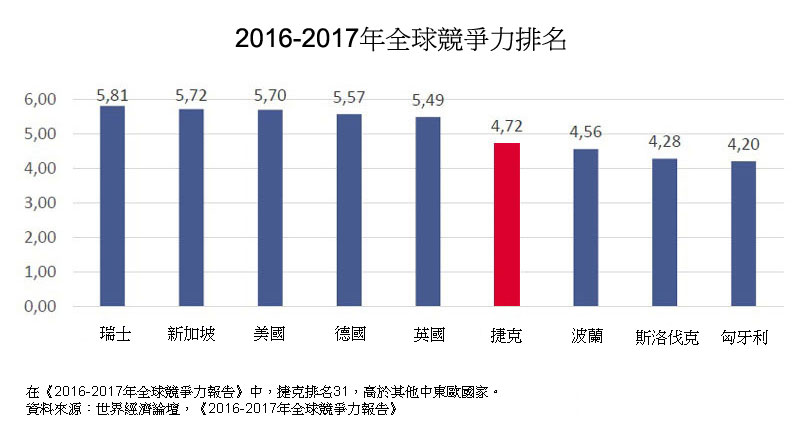

捷克經濟的另一張王牌,就是實力雄厚和富有競爭力的工業基礎。捷克是最工業化的歐盟國家,工業佔整體經濟活動逾47%。從下圖可見,捷克的競爭力排名高於波蘭和斯洛伐克等中東歐國家。因此,在吸引外商投資方面,捷克有其顯著優勢。

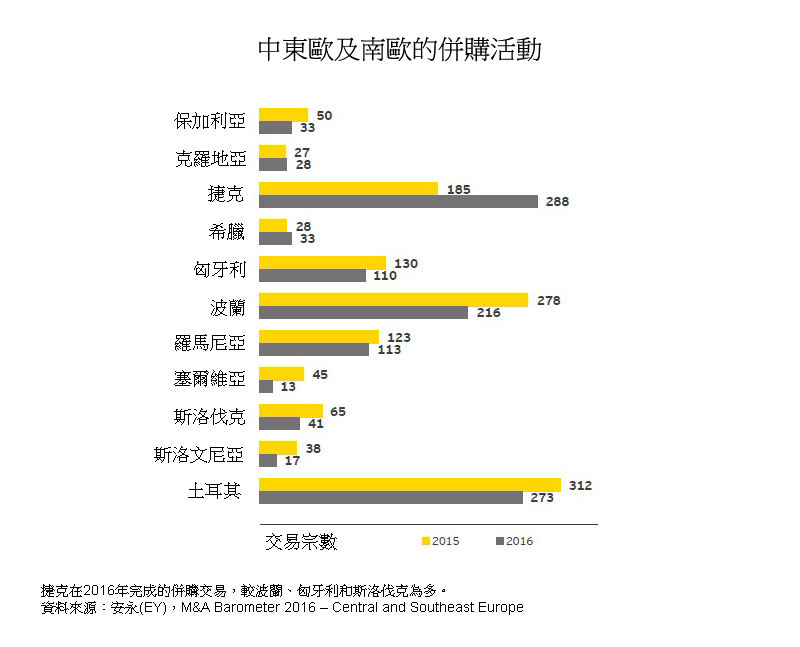

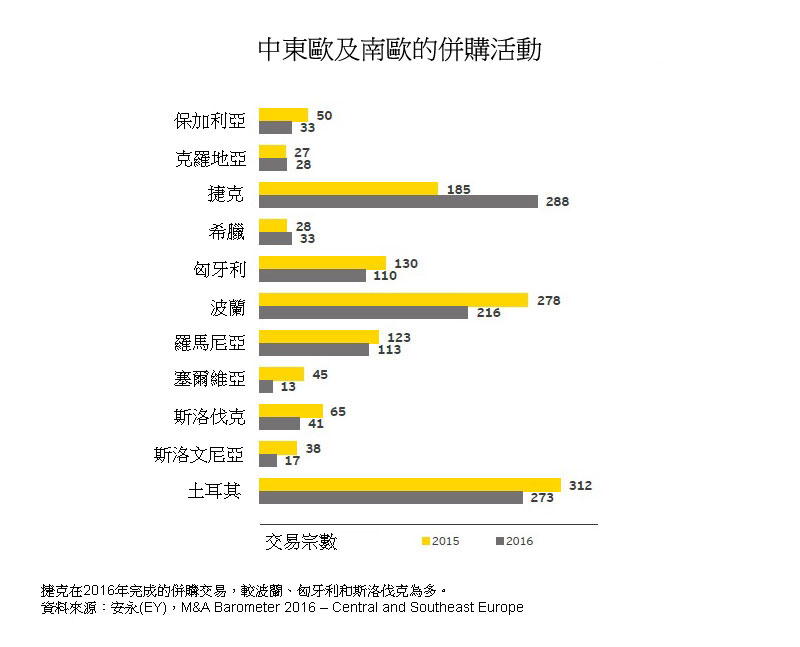

捷克的製造業及資訊科技業經過近幾十年的興旺後,許多本土企業(大部分是家族事業)已經成熟,可以謀求更大發展。有些企業東主考慮與可靠的海外夥伴合作擴展業務,亦有一些有意出售整家公司;這些企業便成為外商的收購目標。2016年,捷克是併購交易最活躍的中東歐國家,完成了288宗買賣交易,估計涉及總額99億美元。

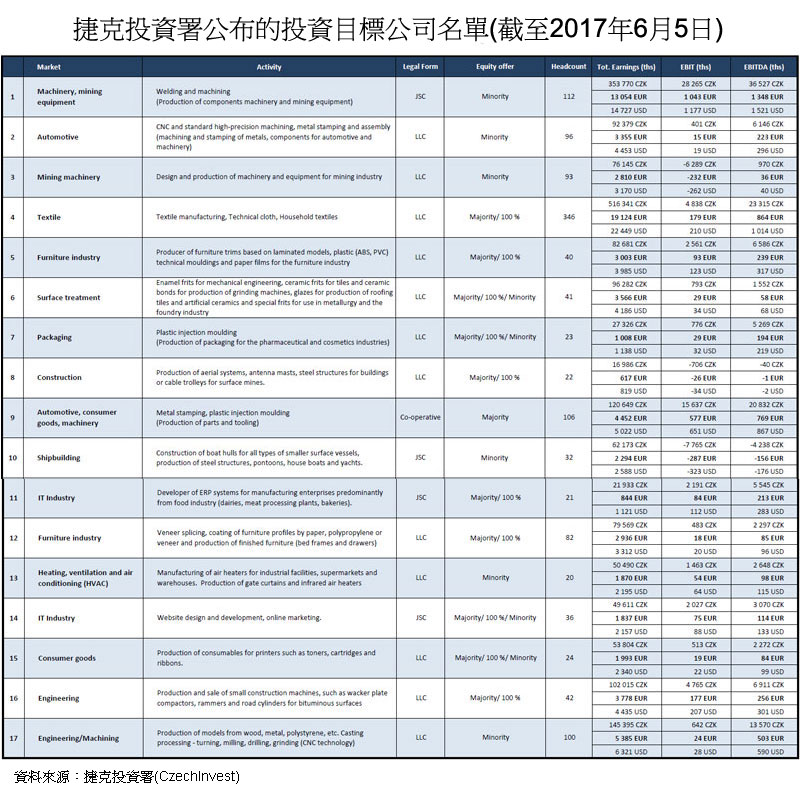

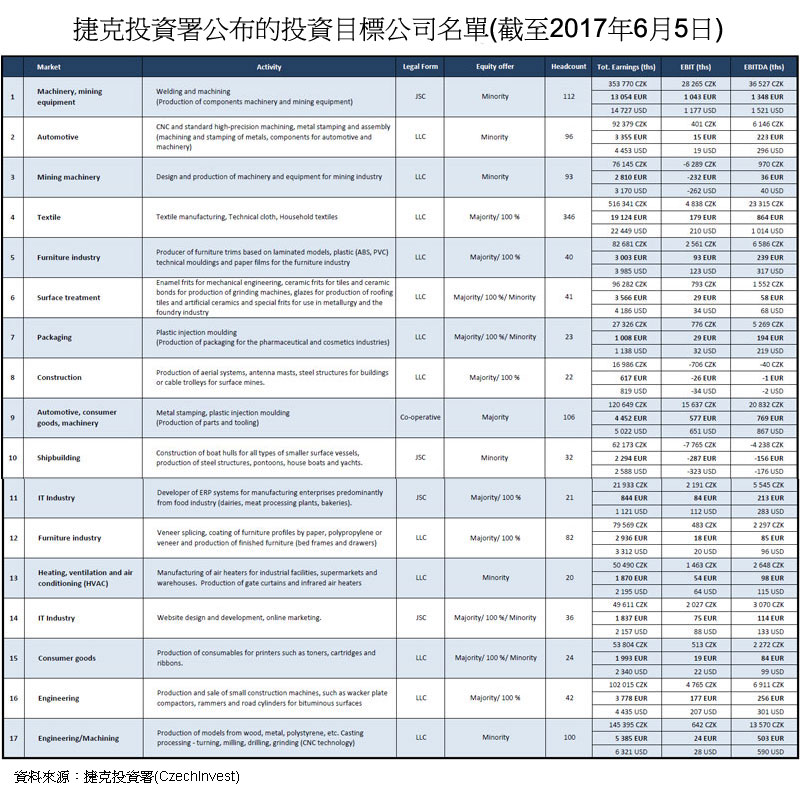

為協助捷克公司洽商交易,捷克的商業及投資拓展機構CzechInvest(捷克投資署)推出了CzechLink計劃,協助他們尋找合資格的投資者,以及進行事前評估。該署的網站不時刊登被稱為「目標」(Targets)的捷克公司名單,即是正積極為合資項目或收購項目尋找夥伴/投資者的公司。該署亦為已簽署保密協議的準投資者,包括私募股權基金及投資顧問,提供更詳盡的公司資料。

中捷兩國的商貿關係顯著改善,亦令併購浪潮升溫。自從捷克總統米洛什澤曼於2013年上台後,兩國關係明顯好轉;到2016年3月中國國家主席習近平歷史性國事訪問捷克3天,兩國的良好關係更上一層樓。截至2017年3月為止,中國投資者擁有的捷克公司合計達2,101家,總資本額約達55億捷克克朗,折合約2.4億美元。

到目前為止,捷克迎來的中國投資者當中,規模最大的應該是總部設於上海的中國華信能源。該公司已在布拉格成立了第二總部,被視為許多中國牽頭的投資交易背後的主要推手。自2015年9月以來,華信能源促成了多項惹人注目的大型併購交易,其中涉及捷克最大的航空公司Travel Service,捷克最大的網上旅行社Invia.cz,捷克第五大啤酒釀造商Pivovary Lobkowicz Group,五星酒店如布拉格文華東方及Le Palais Art Hotel Prague,布拉格最大的辦公大樓Florentinum,媒體機構如Médea Group、Empresa Media 及 Barrandov Television Group,高端冶金工程公司ŽĎAS,以及捷克歷史最悠久的足球會SK Slavia Praha等。

華信能源除了推動本身的投資外,亦不斷建立平台,以促進中國企業在捷克的投資。華信能源於2016年3月收購了J&T Finance Group,成為第一家擁有歐洲銀行的中國民營企業。之後,華信能源與中國工商銀行合作,設立了「中國—中東歐投資合作基金」,為中國與中東歐之間的投資穿針引線,特別是與「一帶一路」有關的項目。

香港發揮商業管道的作用

香港是中國內地對外投資的管道,處理內地近60%的對外直接投資;香港本身也是捷克一個主要的亞洲投資來源地 [2]。中國在捷克掀起併購熱潮,在捷克亦有大量投資,在這些商業活動裡,往往有港商參與其中。事實上,有些中國內地牽頭的投資交易是通過香港進行的。其中一項備受注目的交易,是在2016年12月,由中資背景的香港公司Eurasia Development Group收購了捷克公司Mountfield,後者是捷克一家大型的自行組裝(DIY)產品和園藝工具銷售商。

資料來源: www.mountfield.cz

一些有遠見的捷克公司也傾向在香港設立據點,通過這個穩妥可靠的門戶去打進亞洲市場。例子包括一些知名的捷克玻璃和照明產品公司,例如Lasvit 及Preciosa,他們在香港成立了區域代表辦事處或控股公司,一來可以靠近中國內地的生產基地,二來也方便踏足亞洲興旺的住宅和商業地產市場。這些捷克公司除了為高級酒店、辦公大樓和豪宅提供特別訂製的照明裝置及玻璃藝術品外,亦借助香港作為試驗場,以評估在亞洲建立更大據點的可行性。

香港與捷克簽署的全面性避免雙重課稅協定(CDTA)已於2012年1月24日生效。這樣,捷克公司在規劃一些涉及香港的投資和擴展活動時,可以更有把握作出明確的預算。稅務上的彈性安排,促使Lasvit與本港的高級百貨公司連卡佛(Lane Crawford)合作,把家居零售系列引入香港發售。Lasvit在香港設有控股公司,監督亞洲的銷售事務和項目。

香港是一個免稅港,物流效率卓越,法規公開透明。香港也是一個蜚聲國際的貿易中心,鄰近中國內地的高增值生產基地,這些因素使香港成為不少捷克公司開拓亞洲市場時的首選據點,GHH-Bonatrans、Lasvit 及Preciosa便是其中一些例子。這些公司希望借助香港這個平台去展示技術、尋找投資者、實踐商業意念。中國在捷克的投資方興未艾,加上中國與中東歐國家通過「一帶一路」和「16+1模式」的合作與日俱增,在這背景下,香港勢必擔當日益吃重的角色。

[1] 舉例,太原鋼鐵集團於2014年生產了第一批中國本土製造的輪組及車軸,並於2016年完成必需的測試。

[2] 在捷克的亞洲投資者排行榜中,香港名列第七,前6名依序為韓國、日本、中國內地、新加坡、印度及泰國。截至2015年底,香港在捷克的累計直接投資額為2,370萬美元。

編輯推薦

熱門文章

來源: 新華財金社

6月末,烏魯木齊-青島港-孟加拉首列鐵海聯運班列開行。這是繼上月烏魯木齊國際陸港開通首列至連雲港的鐵海聯運班列後,烏魯木齊國際陸港又與東南沿海第二個國際大港青島港實現了鐵海聯運。

當日,56節滿載PVC材料的車廂駛出烏魯木齊中歐班列集結中心,經鐵路運往青島港後,再轉海路運往孟加拉吉達港。因在烏魯木齊就完成了報 關、報檢等業務,整個運輸過程中節約了時間和物流成本。從烏魯木齊至青島預計需要 110 小時(不到五天時間),再到孟加拉,比原來節約了近半個月。

青島港駐疆辦事處主任焦建民說,這可以說是青島港的“西移”,把4000多公里外的“碼頭”搬到了新疆。據瞭解,鐵海聯運的貨物只要在烏魯木齊報關、報檢後,就視為已經到達青島港的港口前沿,貨物到青島後可一次性放行,直接上船,實現真正意義上的鐵海聯運。

可以說,中歐(青島)國際班列的開通,實現了青島港碼頭到4000多公里外的新疆的前移,可以更好地服務于新疆企業,節省了企業運輸的時間和經濟成本,實現了陸港、路局、港口三方聯動。

此前,6 月 19 日,烏魯木齊國際陸港區與青島港簽訂了戰略合作協定,雙方將借助國家“一帶一路”倡議及青島港海洋經濟發展機遇,依託烏魯木齊區位優勢,發揮雙方在基礎設施、港口服務和鐵路運輸方面的資源和政策優勢,暢通冷鏈物流通道,發展雙向海鐵聯運,打造連通烏魯木齊、青島兩地,面向“一帶一路”沿線國家的陸橋運輸服務品牌。戰略合作協定還將固化區港合作模式,優化陸港、路局、港口及與關檢、遠洋運輸等單位的多方聯動,有利於提高發運和通關效率,形成多方長效合作機制。

負責中歐班列烏魯木齊集結中心業務的亞歐大陸橋國際物流公司總經理劉昌林告訴分析師,中歐班列烏魯木齊集結中心是公司的發貨場所,中歐班列今年的開行目標是500列,目前已經開行超過260列。未來集結中心還將與天津港、上海港、寧波港等合作,開通更多的海鐵聯運線路,打通“海上絲綢之路”和“陸上絲綢之路”。

青島港國際貨運物流有限公司業務部經理曹鵬也表示,戰略合作協定是要搭建一條從新疆到青島更便捷的運輸通道,把青島港的航線、服務、價格等優勢帶到新疆。他還透露,公司計畫開通從烏魯木齊到青島港的班列,可能從每週1班增加到以後的每週10班,滿足新疆企業對於港口運輸的需求。

鐵海聯運,即由烏魯木齊國際陸港“一票制”發運鐵海聯運班列,經青島、連雲港等港口通關轉為海運,直達日韓與東南亞地區。鐵海聯運的開通,發揮了烏魯木齊多式聯運海關監管中心的功能和作用。對進出口企業來說,當月就可在新疆完成退稅業務,無需像以往那樣派人專門到青島港退稅,為企業流動資金提供了保障。

烏魯木齊國際陸港區規劃建設始於2015年11月,主要包括多式聯運海關監管中心、中歐班列新疆集結中心、綜合保稅區等。烏魯木齊國際陸港區則連接國內、國外兩個市場,拉動現代物流業、國際商貿業、高端服務業、先進製造業集聚發展。

烏魯木齊市與青島市歷史上就有著緊密的經濟、貿易和文化往來。烏魯木齊國際陸港經由青島港“一票制”到達東南亞的鐵海聯運線路,將打造成一條帶動雙方產業互動發展的“政策通道”“物流通道”和“經濟發展通道”。

烏魯木齊國際陸港所在地——烏魯木齊經開區(頭屯河區)區委常委劉海江說,實現鐵海聯運,是烏魯木齊與青島兩地落實國家“一帶一路”倡議的具體舉措。由烏魯木齊國際陸港“一票制”發運鐵海聯運班列,經青島通關轉為海運,直達日韓與東南亞地區,實現兩地優勢互補、強強聯合。烏魯木齊國際陸港區也將立足新疆優勢產業和優勢資源,實現東向物流發展戰略。

據他透露,烏魯木齊國際陸港區近日還與天津港(集團)有限公司簽訂合作協定,並在天津港成立了烏魯木齊行銷中心,預計7月上旬將從烏魯木齊國際陸港區開行到天津港的首趟鐵海聯運班列,目的地是太平洋沿岸國家。未來,烏魯木齊國際陸港區還將與寧波港、上海港等合作,實現更多的鐵海聯運線路,打通海上絲綢之路和陸上絲綢之路。

編輯推薦

熱門文章

Fung Business Intelligence

2017年5月15日,在北京舉辦的首屆“一帶一路”國際合作高峰論壇圓滿閉幕。與會的外國元首、政府首腦簽署了圓桌峰會聯合公報,各國之間形成了270多項具體成果清單,成績喜人。為期兩天的論壇以“加強國際合作,共建‘一帶一路’,實現共贏發展”為主題,吸引了來自130多個國家和70多個國際組織約1,500名代表參加,包括29位外國元首和政府首腦。

“一帶一路”國際合作高峰論壇是今年中國最高規格的外交盛會,也是自習近平主席2013年提出“一帶一路”重大合作倡議以來,中國為此召開的首次國際會議。經過三年多的發展,目前已有100多個國家和國際組織共同參與“一帶一路”建設。在論壇的閉幕式上,習近平主席宣佈中國將在2019年舉辦第二屆“一帶一路”國際合作高峰論壇。

受古代絲綢之路的啟發,中國政府提出“一帶一路”倡議,旨在促進亞洲、歐洲、非洲以及其他地區的貿易和經濟一體化。它包括“絲綢之路經濟帶”和“21世紀海上絲綢之路”,為參與的國家和國際組織提供開放型合作平臺,以促進政策溝通、設施聯通、貿易暢通、資金融通和民心相通。

請按此閱覽英文原文。

編輯推薦

熱門文章

背景

中國現正推動「一帶一路」發展,即「絲綢之路經濟帶」和「21世紀海上絲綢之路」的對外發展戰略。2015年3月,中國發佈《推動共建絲綢之路經濟帶和21世紀海上絲綢之路的願景與行動》文件(「願景與行動」),倡議加快「一帶一路」建設,以便推動沿綫各國實現經濟政策協調,促進經濟要素有序自由流動、資源高效配置和市場深度融合,共同打造開放、包容、均衡、普惠的區域經濟合作架構。

「願景與行動」特別表明,投資貿易合作是「一帶一路」建設的重點內容之一,希望與亞洲、歐洲、非洲等沿綫國家着力研究解决投資貿易便利化問題,以消除投資和貿易壁壘,構建區域內和各國良好的營商環境,包括加强雙邊投資保護協定、磋商避免雙重徵稅協定,以便保護投資者的合法權益,拓展相互投資領域;同時要優化產業鏈分工布局,推動上下游產業鏈和關聯產業協同發展,用以提升區域產業配套能力和綜合競爭力,包括鼓勵合作建設境外經貿合作區、跨境經濟合作區等各類產業園區,希望與「一帶一路」國家携手促進產業集群發展。

境外經濟貿易合作區發展概况

中國的境外經貿合作區建設始於2006年,主要是由中國商務部牽頭,與政治穩定且與中國關係較好的國家政府達成共識,然後以國內審批通過的企業為建設經營主體,由該企業與國外政府協議和簽約,在有關國家投資建設、或與所在國企業共同投資建設基礎設施完善、主導產業明確、公共服務功能健全的產業園區,再由該企業開展對外招商,吸引國內、所在國和其他外國相關企業入區投資發展,形成產業集群,並建立相對完善的產業鏈,這種發展模式相當於中國企業以集群、抱團方式,集體對外進行直接投資和經貿合作。

為進一步創新和推動境外經濟貿易合作區發展,完善建設境外經濟貿易合作區的服務工作,2013年商務部、財政部聯合制訂了《境外經濟貿易合作區確認考核和年度考核管理辦法》。有關《管理辦法》的合作區是指在中華人民共和國境內(不含香港、澳門和台灣地區)註冊、具有獨立法人資格的中資控股企業(以下稱實施企業),通過在境外設立的中資控股的獨立法人機構(以下稱建區企業),投資建設的基礎設施完備、主導產業明確、具有集聚和輻射效應的產業園區。

申請確認考核的合作區應有利於中國優勢產業「走出去」,優化國內產業結構;有利於利用資源,提高資源配置能力;有利於建立商貿物流網絡,拓展貿易發展空間;有利於開展技術合作,提升技術創新水平;有利於促進所在國的經濟社會發展,與外國夥伴實現互利共贏等。

根據《管理辦法》通過確認考核或年度考核的合作區,可申請中央財政專項資金資助,包括相關金融機構對符合國家政策規定和貸款條件的建區和入區企業,積極提供必要的授信支持和配套金融服務。

據2013年《商務部、國家開發銀行關於支持境外經濟貿易合作區建設發展有關問題的通知》,商務部和國家開發銀行共同建立合作區項目協調和信息共享等聯合工作機制,為符合條件的合作區實施企業、入區企業提供投融資等方面的政策支持,具體措施包括國家開發銀行根據國家對外發展戰略的需要,支持國內產業集群「走出去」,為合作區建設提供投融資等服務,同時積極探討依托境外金融機構信用、項目自身及其他資產抵質押、土地出讓應收賬款質押等模式,為合作區實施企業提供融資支持,和通過與東道國有實力的金融機構合作,以轉貸款、銀團貸款等方式,為入園企業提供融資服務。

境外經貿合作區目前已成為中國企業「走出去」的重要形式之一,是中國企業對外投資合作的重要載體和平台。中國商務部數字顯示,截至2016年底,中國企業已在36個國家建設合作區77個,累計投資241.9億美元,入區企業1,522家,總產值702.8億美元。

中國境外經貿合作區建設在「一帶一路」國家的成效尤其顯著。「一帶一路」沿綫國家大多處於工業化發展初期,具良好市場發展潛力,和强烈吸引外商投資意願。中國現時在20個「一帶一路」國家正在建設56個合作區,佔所有在建的境外合作區總數72.7%,累計投資185.5億美元,入區企業1,082家,總產值506.9億美元,為當地創造就業職位約18萬個,促進合作區所在國的工業化和相關產業發展,特別是輕紡、家電、鋼鐵、建材、化工、汽車、機械、礦產品等重點產業發展和升級。[1]

亞洲經濟貿易合作區個案

中國在「一帶一路」的合作區遍及歐洲、亞洲和非洲等地,不同地點合作區在資源、市場、交通運輸、基建等方面各具優勢。當中亞洲地區更是中國開展「一帶一路」經貿合作重點地區之一。順應大部分亞洲國家,特別是東南亞國家,近年積極以工業園等經濟特區模式吸引投資,推動經濟發展和創造就業,中國更可把經濟貿易合作建設作為重要推動力,加强與東南亞地區合作,構建中國-中南半島經濟走廊。

對中國內地和香港的中小型企業而言,他們似乎也較樂意聚焦東南亞地區的發展機會。無論是前往東南亞直接投資設廠從事加工貿易、與當地夥伴開展產能合作,或發掘當地的工業物料和消費市場等,均受到中小企業青睞。事實上,東南亞國家近年工業生產迅速擴張,基礎設施建設投資增加,已逐漸與中國建立緊密的供應鏈關係。

根據香港貿發局研究部2016年中在華南地區進行的問卷調查結果顯示,大部分受訪的內地企業(83%)表示希望前往包括東盟國家在內的東南亞地區,發掘「一帶一路」商機,其次是前往南亞(27%)、中歐及東歐(24%)等地。他們希望增加銷售各類產品往「一帶一路」市場(88%),部分企業則希望前往當地投資設廠生產(36%),或在當地採購各類消費品/食品或原材料等(35%)。

中國目前在東盟投資並通過考核的合作區包括:(1)中國印度尼西亞聚龍農業產業合作區;(2)老撾萬象賽色塔綜合開發區;(3)柬埔寨經濟特區;(4)泰中羅勇工業園;和(5)越南龍江工業園。另外,由中國和馬來西亞兩國政府共同開創的「兩國雙園」國際產能合作新模式,分別在馬來西亞關丹和中國廣西欽州建立兩個產業園區,有望成為中國政府推進「一帶一路」發展戰略的先行探索和實踐的經濟合作項目。

請按此購買這份研究報告。

[1]資料來源:中國商務部

編輯推薦

熱門文章

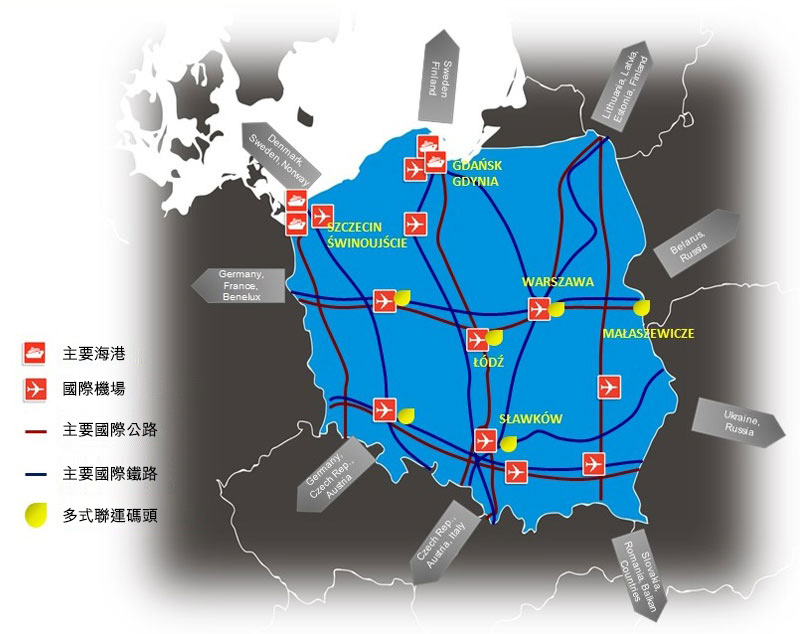

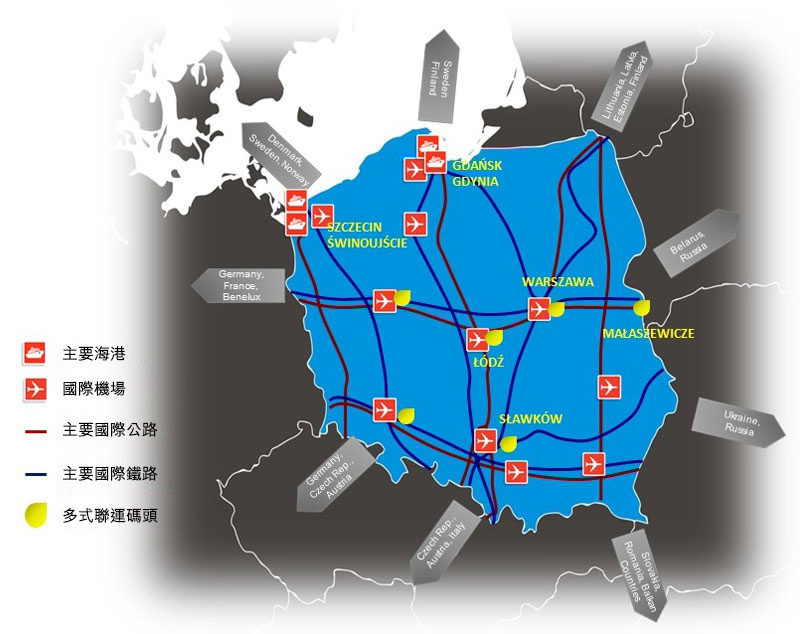

2013年4月,連接波蘭第三大城市羅茲(Łódź)與中國西南部四川省省會成都的直通鐵路貨運服務開通。自此之後,波蘭已成為一個日受歡迎的物流樞紐,可以替代現有的歐亞海運及空運航線,為貿易商提供具競爭力的服務。此外,俄羅斯與烏克蘭的衝突持續,殃及途經烏克蘭到匈牙利及斯洛伐克等地的鐵路貨運,更令波蘭大受歡迎。

亞歐鐵路貨運不斷增長,初見其利,對波蘭來說,是新的國家經濟發展計劃賴以成功的關鍵因素。這項發展計劃名為Morawiecki,由該國副總理兼經濟發展與財政部部長莫拉維茨基(Mateusz Morawiecki)提出,與「一帶一路」倡議有許多共通之處,不僅計劃擴大投資,還要改善人均收入,提高國際貿易的重要性。

從折衷之道到市場開放方案

自2012年12月首班直達貨櫃列車從成都到達羅茲以來,連接中國與波蘭的定期鐵路貨運服務大幅增加。這些新路線包括蘇州至華沙的鐵路班列,於2013年9月開通,而2015年8月起開辦的廈門至羅茲線,更是首條由一個自由貿易區(即廈門海滄保稅港區)開出的鐵路貨運線。

鐵路運輸通常被視為海運與空運之間的折衷方案。對某些貿易商來說,海運時間太長,而空運則收費不菲,而快速增長的中波鐵路運輸,就是一個更具吸引力的物流方案。這個發展勢頭還增強了波蘭作為中東歐區域轉運中心的作用,方便高增值產品往來中國與歐洲。俄羅斯與烏克蘭衝突不斷,目前大多數亞歐鐵路服務均避免通過俄烏邊界,而波蘭則能提供現成的運輸服務取而代之,在爭取區域物流業務方面大見成效。

若將40英尺長的高櫃從香港運往波蘭,貨主通常會選擇一條海運航線,需時33天才能到達波蘭北部的格但斯克(Gdańsk),港口至港口的收費約1,800美元。若貨物不僅是以波蘭市場為目的地,貿易商亦可以考慮運往歐洲其他港口,如德國漢堡(1,800美元,32天)、斯洛文尼亞的庫珀港(Koper)(1,700美元,25天),以及較常用的希臘比雷埃夫斯港(Piraeus)(1,600美元,22天)。中遠集團最近收購了比雷埃夫斯港的多數股權,並令前往歐洲各主要樞紐的陸路連繫(公路及鐵路)更方便。

資料來源:中東歐—中國物流合作秘書處

舉例來說,貨物扺達比雷埃夫斯港後,可以通過全歐交通網絡(Trans-European Transport Network,簡稱TEN-T)運往波蘭或歐洲其他地區的倉庫及配送中心。TEN-T有兩大走廊:波羅的海—亞得里亞海走廊是連接中東歐國家與波羅的海及亞得里亞海各港口的南北軸線,而北海—波羅的海走廊則是連接波羅的海國家及波蘭與德國、比利時、荷蘭和盧森堡的東西軸線。波蘭正好位於兩大走廊的交匯處,貨車在兩三天內可到達歐洲大部分國家的首都。然而,貨物從比雷埃夫斯港以陸路運往波蘭首都華沙、匈牙利首都布達佩斯、斯洛伐克首都布拉迪斯拉發(Bratislava)、捷克的帕爾杜比采(Pardubice)和塞爾維亞首都貝爾格萊德等中東歐主要城市,運費通常在1,100歐元以上。

另一方面,由於路線、作業表現和海關協議均有重大改進,直通貨櫃列車不用兩星期就可扺達華沙。例如,俄羅斯、哈薩克和白俄羅斯等前蘇聯國家的列車使用寬軌(1,520毫米),而中國及歐盟的列車則使用準軌(1,435毫米),現時在霍爾果斯(Khorgas)將貨櫃轉換列車,50分鐘內就可完成。霍爾果斯在中國—哈薩克邊界附近,是絲綢之路經濟帶最繁忙的交匯點之一。

鐵路運輸的費用隨時是海運的兩倍以上,例如,從深圳以鐵路運送一個40英尺長高櫃到華沙的站到站費用約為4,000美元。儘管如此,速度是越來越多貿易商選擇鐵路的主要原因之一,因為他們須迅速交貨(通常是同一天),以滿足電子商貿業務不斷增長的需要。

貿易商如打算將來自香港的產品運往歐洲,這個折衷方案乍看並非十分吸引,因為用保稅貨車將產品運往內地火車站還需額外的成本及時間。不過,在內地設廠生產並直接出口到歐洲的香港製造商,則日趨頻密使用這條路線。

每艘貨櫃船可運載超過11,000個貨櫃,而列車只能運送約60至65個貨櫃,與海運相比,鐵路價格較高,運力有限,不適合所有產品。據經營首班中波直通鐵路貨運列車的羅茲物流公司Hatrans Logistics表示,前往歐洲的列車主要運載電子產品、汽車配件、電器和醫療設備,而運往中國的大多是先進機械設備、汽車及建築材料。值得注意的是,食品飲料已成為歐亞列車上的慣常貨物。

為善用返回中國列車的閑置運力,波蘭出口商開始與物流業者合作拓展新商機,而一些有遠見的中國企業甚至自設採購團隊,物色有吸引力的歐洲產品來填補回程貨櫃的空位。

資料來源﹕www.chopin-deli.com

例如,Hatrans Logistics已在中國跨境電子商貿平台京東全球購推出一家網店,名為蕭邦美食(Chopin-Deli),以推銷咖啡、茶、果汁、烈酒、果醬及糖果等食品飲料,而且還在成都設立陳列室展示其他特色產品,包括在內地市場具有相當大潛力的產品,如受損土壤的清潔材料、建築材料(木地板)、時尚產品(健康/飲食補充劑和運動飲料),以及個人護理用品(化妝品和護髮品)等。

據波蘭屠戶與肉品製造商協會(Association of Polish Butchers and Meat Producers)稱,波蘭各城市幾乎都有中國及亞洲餐館,其中95%的食材實際上在當地種植。這種情況不僅反映波蘭食品業大有能力滿足中國及亞洲廚師的需求,而且顯示波蘭新鮮農產品和加工食品飲料在中國和亞洲市場的潛力甚大。為進一步加強客戶的信心,波蘭成為唯一實施3個全國食品質量制度的歐盟國家, 即QMP(優質肉類計劃)、PQS(豬肉質量制度)和為多種產品而設的QAFP(食品質量保證制度),以保證肉類產品的安全及質量。

波蘭Ostrowski及Moniecki等地區早前爆發H5N8禽流感,導致香港禁止進口波蘭禽肉及相關產品(包括禽蛋)。不過,2016年,香港從波蘭進口約2.05萬公噸冷藏禽肉及480萬隻禽蛋,顯示波蘭食品備受香港消費者歡迎。這種情況又為波蘭與香港的合作敞開一個新窗口,即波蘭的食品飲料可以與亞洲的烹飪技巧配合,為亞洲美食愛好者創製佳餚。

在歐盟,波蘭是莓果、漿果、蘑菇、青瓜、洋蔥及大蒜等產品的主要出口國,除肉類産品外,該國也積極向亞洲市場促銷水果及蔬菜。去年6月中國 國家主席習近平訪問波蘭,兩國政府簽署多項合作協議,之後波蘭蘋果在9月獲准進入中國市場。隨著亞洲製造商日漸瞭解波蘭農產品的質量和物有所值等優點,來自波蘭的蘋果、蘋果汁、穀物和冷凍蔬菜已成為全球食品供應鏈的一部分,市場供應日益增多。

波蘭是歐洲最大的藍莓生產國,繼蘋果取得成功後,草莓、紅桑子、加侖子和藍莓等水果亦可望在中國市場有不俗的表現。特別是波蘭的收穫季節與拉丁美洲和新西蘭等水果產地不同,可互作補充。波蘭莓果已經在香港有售,該國水果種植者廣泛認為,香港是進軍其他亞洲市場,特別是中國內地的良好測試平台。

許多波蘭食品飲料公司將香港視為亞洲食品消費潮流指標。LEI Food & Drinks就是一個好例子,這家波蘭優質食品飲料製造商兼出口商已直接在香港設點,以進入亞洲市場。該公司在香港的倉庫為多家高級酒店提供優質的蘋果和新鮮果汁,而他們的果汁採用傳統的冷榨方法生產,不含防腐劑或添加糖份。同時,該公司還通過香港的展覽會等不同渠道,向亞洲市場推銷有機蘋果片、香腸、運動飲料和酒精飲料等。

波蘭全國蔬果生產者組織協會(National Association of Fruit and Vegetables Producer Groups)表示,該國使用人造肥料的歷史很短,土壤比較綠色及清潔,僅兩三年就可轉為有機種植,而歐盟其他國家則需時6至7年。自2004年加入歐盟以來,波蘭得到歐盟的財政支持,在農業、作物儲存和食品加工等領域已有長足發展,基礎設施先進。

波蘭是歐盟第二大禽類生產國,僅次於法國,已與歐洲其他地區的農民分享在母雞雞舍自動化及管理方面的先進經驗。除天然食品、營養食品和安全食品外,農業經驗及技術商業化是香港與波蘭另一大有可為的合作領域。在這方面,香港擁有眾多優勢,包括成熟的科技交易平台,以及在測試平台建立、概念驗證試驗和解決方案訂製等領域進行國際合作的卓越往績。

貿易蓬勃帶動投資需求

由於中國消費者對歐洲更佳、更安全、更吸引的產品需求甚殷,而製造商也需要歐洲源源不斷供應原材料和零部件,因此中國與歐盟的貿易總額預料會由2016年約5,700億美元增加到2020年超過1萬億美元。鐵路運輸勢將在歐亞供應鏈中發揮更重要的作用,因而需要改善基礎設施,而來自波蘭國內及海外私人投資者和機構(包括歐盟)的投資也有更大需求。

亞歐鐵路貨運不斷增長,已初見其利,波蘭政府認為這是Morawiecki計劃取得成功的關鍵因素。該計劃與「一帶一路」倡議有許多共通之處,預期在2020年前將投資超過2萬億茲羅提(約4,900億美元),不僅在波蘭國內外擴大投資,還要提高人均收入,加強國際貿易的重要性。

根據Morawiecki計劃設定的目標,預計波蘭的人均GDP將由目前達歐盟平均水平的69%,上升至2020年的79%。這個目標如果實現,那麼該國對品質更高,品種更多的進口產品會新增不少需求。該計劃還會推動投資,從目前佔GDP的20%,提高到2020年的25%,而對外直接投資預計會增長70%,為全球服務供應商帶來越來越多的商機,既能促進外商在波蘭的投資,也能推動波蘭機構及企業的對外投資。

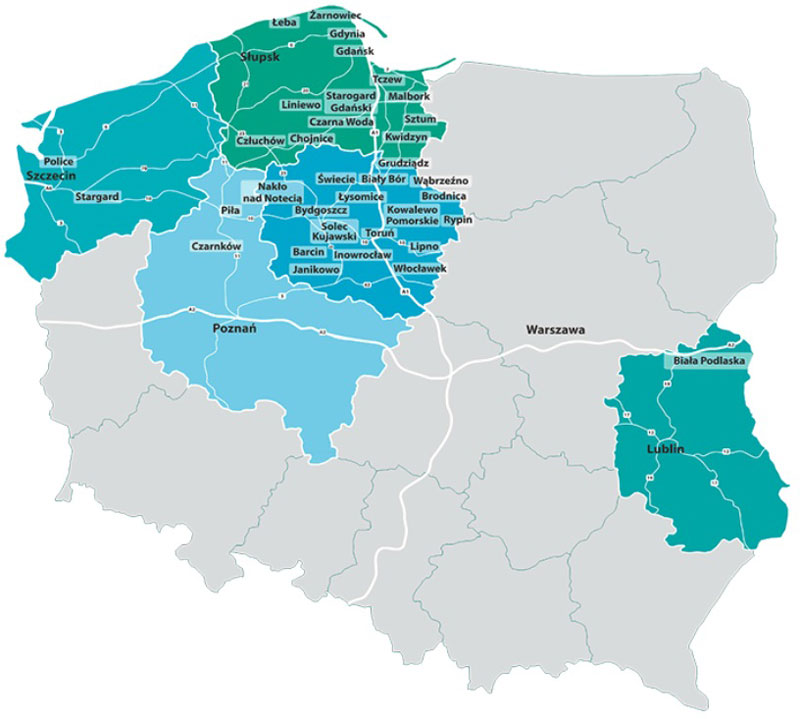

在地區層面,該國地方政府積極開展新項目和制訂具競爭力的優惠措施,吸引國內外投資者建設基礎設施,及/或升級改造現有設施,以善用歐亞鐵路發展日趨蓬勃的機遇,開拓市場對裝卸服務及製造/加工設施不斷增長的需求。舉例來說,波麥拉寧經濟特區(Pomeranian Special Economic Zone,簡稱PSEZ)最近擴展至盧布林(Lublin)地區的比亞瓦—波德拉斯卡(Biała Podlaska)縣,靠近波蘭與白俄羅斯邊界。

資料來源:波蘭投資貿易局(PAIH)

PSEZ是波蘭14個經濟特區之一,一向積極實施一系列配套項目及擴展活動,包括支持初創企業、資訊通訊科技及新技術發展的格但斯克科技園區(Gdańsk Science and Technology Park),以及位於格丁尼亞(Gdynia)重點建設現代化環境以支持造船及相關行業的波羅的海新技術港( Baltic Port of New Technologies)。

據2016年12月30日發布的部長會議規例,PSEZ因業績良好,覆蓋範圍進一步擴大到波蘭東部。PSEZ計劃在盧布林地區的比亞瓦—波德拉斯卡縣,利用已停用軍事機場的基礎設施,以及現有的內陸轉運設施,建設一個物流中心或轉運樞紐,目的是與連接中國與西歐的新絲綢之路結合起來。

PSEZ的管理公司波麥拉寧經濟特區有限公司表示,隨著鐵路聯繫改善,製造商可以將生產活動(或至少是運往歐洲市場產品的部分生產工序)遷移到波蘭或其他中東歐地區。新的比亞瓦—波德拉斯卡分區接近波蘭與白俄羅斯的邊界,可作為物流樞紐,讓轉運貨物從寬軌列車轉到準軌(1,435 毫米)列車,或者將貨物拆箱,以便分揀並直接發送至歐洲的客戶或倉庫。此外,該分區也有助生產活動遷往波蘭各地甚至整個中東歐地區。

將新分區交由PSEZ管理,可保證與全國的多式聯運系統發揮最佳的協同效應。位於比亞瓦—波德拉斯卡的內陸貨運港,可與波麥拉寧地區的格但斯克/格丁尼亞以及西波麥拉寧地區的Szczecin/Świnoujście等不凍港有更佳的聯繫,最大限度提高整體貨物周轉量。除物流優勢外,在新分區投資的公司還可享受較高的稅項減免,根據投資成本或兩年內新聘員工的開支,減稅率分別為50%(員工250人以上的大企業)、60%(中型企業)及70%(微型及小型企業)。

波蘭中部的羅茲亦積極吸引中國投資。中國投資者已在當地經營一家塑料廠,生產電視機、電腦屏幕及其他娛樂設備的零部件,而另一家玻璃廠亦即將投產。這些中資工廠憑藉當地的地理優勢,不僅可在中波之間快速交貨,甚至遍及整個歐洲大陸。

為吸引中國投資者,地方政府和羅茲經濟特區制訂了長遠計劃,在主要貨運站附近發展新的基礎設施和工業區,以促進中資企業與當地商界的合作,特別是在電機工程、食品加工、酒精飲料、化妝品和藥品等行業。

投資初見成效後繼者陸續湧現

截至2015年底,香港在波蘭的累計直接投資額為4.187億美元,在波蘭的外來投資來源地中排第24位,在亞洲僅次於韓國和日本。香港最知名的企業包括和記港口(原名和記港口控股)、東方海外、嘉里物流和國泰航空更是香港在波蘭投資的成功範例。

自2005年以來,長江和記實業的附屬公司和記港口在格丁尼亞港開展多個投資項目,將格丁尼亞貨櫃碼頭改造為現代化貨櫃裝卸設施,並加強該港作為集貨港的作用,把波蘭與德國不來梅和漢堡,以及荷蘭鹿特丹等歐洲其他樞紐連接起來。 2015年,格丁尼亞貨櫃碼頭完成深水港發展計劃,包括增加一個深水泊位,可停泊載重多達19,000個貨櫃的船舶,並擴建其鐵路終點站。

香港貨櫃輪船公司東方海外是前G6聯盟成員,最近在其亞歐環回線增加直接靠泊格但斯克的服務。鑒於亞歐商路前景樂觀,直接靠泊格但斯克,可方便中國及亞洲公司直接將零部件運往波麥拉寧物流中心等港口附近設施以進行加工,藉此享受低營運成本以及歐盟製造的免關稅地位。

隨著客戶在中東歐發展,香港嘉里物流為確保他們的貨物可以順利進出當地,遂擴大在歐洲的業務範圍,於2016年11月在波蘭西部波茲南開設共享服務中心,並於2017年3月在華沙設立新辦事處。新的共享服務中心旨在提高在區內的總體成本效益和服務競爭力,而新的華沙辦事處則為客戶提供海陸空等國際貨運代理及海關經紀服務。

香港的旗艦航空公司國泰航空尚未開辦直飛波蘭的航班,仍是波蘭乘客不熟悉的名字。然而,該公司卻於2016年4月選擇在波蘭第二大城市克拉科夫(Kraków)開設第4個環球客戶聯絡中心。克拉科夫是波蘭南部莫洛波爾斯卡(Małopolska)地區的首府,過去3年當地的外判服務在歐洲排名第一[1]。國泰是首批直接在克拉科夫設立商業據點的亞洲公司,新設的聯絡中心擁有一支懂得多國語言的年輕專業團隊,人數超過120人,負責處理非洲、歐洲及中東的來電,涉及訂位、行李、網上辦理登機、網站技術問題等。

在中國「一帶一路」倡議和波蘭經濟計劃的框架下,不少波蘭企業、中介公司及項目業主有意與中國投資者一起發展。香港憑藉多元化的投資足跡,加上現有的專業及財務顧問服務集群,以及廣泛的全球網絡和聯繫,大有條件成為波蘭企業的合作夥伴。

上述發展策略及框架不斷取得進展,而且日趨明確具體,預料不斷會有雄心勃勃的建議提出,涉及技術要求更高和更複雜的項目。凡此種種,無不需要更先進的項目融資服務和更全面的專業服務。香港作為國際合作的超級聯繫人,一向擅長提供這些服務。

例如,香港金融管理局的基建融資促進辦公室有約60家合作夥伴,包括金融機構、銀行、投資者、律師和保險公司,是香港持續發展為基建融資中心的重要推動力。特別值得注意的是,該辦公室的宗旨是幫助有意投資基建項目的公司妥善處理不斷變化的基建投資及融資問題。

隨著貿易和投資進一步擴張,各類法律服務的需求將與日俱增,包括合同安排、項目管理和爭議解決等。由於香港的普通法制度廣受信賴,司法獨立,若有香港服務供應商參與,可令有意從「一帶一路」中獲益的本地、亞洲和波蘭貿易商和投資者倍感安心。

[1] 根據Tholons Outsourcing Destinations List的資料。