Chinese Mainland

By Andrew Scobell, Bonny Lin, Howard J. Shatz, Michael Johnson, Larry Hanauer, Michael S. Chase, Astrid Stuth Cevallos, Ivan W. Rasmussen, Arthur Chan, Aaron Strong, Eric Warner and Logan Ma, RAND Corporation

Since its establishment in 1949, the People's Republic of China (PRC) has viewed itself as an underdeveloped country — economically backward, physically weak, and vulnerable to exploitation by more powerful states. Even as the PRC has grown stronger economically and militarily, especially since launching the reform and opening policies of Deng Xiaoping in 1978, PRC officials continue to insist China is a developing country.

In the initial stages of reform and opening, China's relations with the developed world were shaped by its desire to expand trade and attract investment. In the 1990s, China increased its attention to the Developing World, negotiating economic agreements and creating new China-centric institutions. This accelerated in the 2000s and especially after the 2008 financial crisis, when there were worldwide doubts about the developed-world, and especially the U.S., economic model. China's attention to the Developing World has culminated in numerous institutions and in the new Belt and Road Initiative.

The authors analyze China's political and diplomatic, economic, and military engagement with the Developing World, region by region, focusing on the 21st century through the beginning of the Belt and Road Initiative, an ambitious vision that builds on China's previous activities. The authors discuss specific countries in each region — so-called pivotal states — that are most important to China. The authors show that China has oriented its security concerns and its overall engagement in concentric circles of importance. Near neighbors merit the most attention. The authors conclude with policy implications for the United States.

Key Findings

China's involvement with the Developing World encompasses political and diplomatic, economic, and military dimensions

-

The Developing World offers China economic growth and global influence.

-

Beijing has a growing challenge of protecting overseas citizens and investments.

-

Southeast Asia is China's top priority economically and politically.

China's geostrategic relationships with pivotal states focus on anticipated bilateral and regional benefits

-

China sees benefits in Malaysia (economic), Indonesia (political), Thailand (trustworthiness), and Vietnam (geostrategic risk).

-

Russia concentrates on military activities and shares China's interests in countering terrorism and Western ideas of democracy and human rights.

-

Pakistan assists China in internal security.

-

Iran offers China a friend not beholden to the United States.

-

The Republic of South Africa has a strong financial sector and rule of law.

-

Venezuela's oil deposits have been attractive.

Consequences of the Chinese strategy toward the Developing World for the United States

-

Washington and Beijing are contentious over Chinese activities in the South China Sea and China's insistence that U.S. military vessels and aircraft get permission prior to traversing disputed waters.

-

Outside Southeast Asia, the United States and China appear to be partners in parallel: two states working separately with no collaboration but in pursuit of similar ends. Their relationship varies significantly by region.

-

China is not an adversary but can harm U.S. global interests. A challenge remains as to whether and how to encourage China to act as a cooperative partner.

Recommendations

-

Despite the fact that the United States and China are competitors around the globe and in specific regions, cooperation between the two nations is possible. Washington should look to cooperate with Beijing where interests coincide but must recognize that any cooperation will almost certainly be limited.

-

Washington should appreciate that the degree of possible U.S.-China cooperation is likely to vary by region, with regions closest to China, such as Southeast Asia, more difficult. In contrast, cooperation with Beijing in regions further removed from China, such as the Middle East, is likely to be less difficult.

Please click to read full report.

Editor's picks

Trending articles

China-Egypt Suez Economic and Trade Cooperation Zone proves high water mark for bilateral development.

Chinese President Xi Jinping confirmed China's ongoing commitment to the continued construction of the China-Egypt Suez Economic and Trade Cooperation Zone (the Zone) at a meeting late last month with Abdel-Fattah al-Sisi, the Egyptian President. In the official Joint Communiqué of the Leaders' Roundtable of the 2nd Belt and Road Forum for International Cooperation, released following the Beijing event, the Zone was cited as an explicit example of the kind of "economic corridor" development the Belt and Road Initiative (BRI) was devised to nurture.

Indeed, the Zone, located in the Ain Sokhna district of Suez province east of Cairo, has become something of a landmark project and one seen as demonstrating the success of the Belt and Road Initiative, which ultimately co-opted the project. Construction work on the Zone officially started more than a decade ago – some four years before the BRI was officially launched – with the development headed by the China-Africa TEDA Investment, a subsidiary of the Tianjin Economic-Technological Development Area (TEDA), a highly successful mainland economic zone operator.

To date, the Zone has attracted nearly 80 enterprises, with investments totalling more than US$1 billion, while directly creating employment for more than 3,500 people and indirectly generating a further 30,000 jobs from businesses based in the Zone, the vast majority of which have gone to local workers. The Egyptian branch office of the China Hengshi Foundation Co, which specialises in manufacturing fibreglass fabrics, is one of the businesses now located in the Zone. Testifying to its success in generating local employment, the company's Vice President, Wang Shaijian, said: "We only have 25 Chinese workers, with the remaining 350 staff all Egyptian."

As of the end of 2018, the total output value of the Zone was about $1.2 billion, with some $56 million going to the Egyptian treasury in taxes, according to Liu Aimin, Chairman of China-Africa TEDA Investment Company.

The Zone is located about 120km from Cairo, close to the Suez Canal. It is serviced by the Ain Sokhna Port, which is currently being upgraded by the China Harbour Engineering Company. The construction of a new terminal is currently underway and scheduled to come into operation in the final quarter of 2019. From 2017 to 2018, container business at the port grew by 10% and its bulk business expanded from 30% to 40%.

In January 2016, work started on the second phase of the Zone, covering an additional six square kilometres. Infrastructure construction for two sq km of the second phase was finished in 2018, and according to Liu, eight industry-leading enterprises have already signed up, representing investment totalling $200 million. Chinese motorcycle giant Dayun Group is one of the investors and will officially start operations this year.

One of the early cornerstone investors operating in the Zone was China Jushi, a large producer of fibreglass, with investments totalling about $600 million. As the only fibreglass production base in Africa, the company earned $180 million through exports for Egypt in 2017, and has created trade volumes of more than $5.8 million for both local upstream and downstream industries.

Last year, Jushi's new production base, which has a capacity to manufacture 200,000 tons of fibreglass annually, went into service making Egypt the world's third-largest fibreglass producer. The company has also created more than 2,000 jobs for Egyptians and paid about $16.8 million in taxes to the country's treasury and more than double that figure in customs duties over the past four years.

Another successful project is the TEDA Fun Valley amusement park. Built at an estimated cost of $5.6 million, it opened in April 2015 with the primary purpose of entertaining the families of those working in the Suez Economic and Trade Cooperation Zone. Since then, however, it has proven to be a big hit with local and international tourists and now attracts thousands of visitors a year. With tourism comes demand for transportation, accommodation and food and beverage services, providing further opportunities for local businesses.

Marilyn Balcita, Special Correspondent, Cairo

Editor's picks

Trending articles

By Michael Baltensperger and Uri Dadush, Bruegel

Executive summary

China’s Belt and Road Initiative (BRI) is an international trade and development strategy. Launched in 2013, it is one of the ways China asserts its role in world affairs and captures the opportunities of globalisation. The BRI has the potential to enhance development prospects across the world and in China, but that potential might not be realised because the BRI’s objectives are too broad and ill-defined, and its execution is too often non-transparent, lacking in due diligence and uncoordinated.

This Policy Contribution recounts the background of the BRI and its context, what is known about the extent of the initiative and the intentions behind it. The initiative could address very large infrastructure investments gaps, which is welcome and needed. China’s goal of forging stronger links with its trading partners around the world is legitimate assuming, of course, the underlying intent remains peaceful.

Though many observers welcome the BRI, many others oppose it for good reasons, while others misunderstand it and oppose it for bad reasons. We identify and discuss concerns about the initiative that relate to its geopolitical objectives, its priorities, its geographic scope, the role of state-owned enterprises, the allocation of resources and issues of transparency and of due diligence. In particular, we show that this initiative deals with a vast number of countries that are at very different states of development, and that an apparent lack of well-defined priorities holds the initiative back. We also highlight the issue of debt overload which is distressing several BRI countries and discourages further projects.

There are improvements that China and other stakeholders in the BRI could make to get the most from their investments. The BRI, to be effective, needs to meet the basic conditions of a trade and development strategy, which are clear objectives, adequate resources, selectivity, a workable implementation plan, due diligence and clear communication. Involvement of multilateral lenders could help with this. Finally, China must improve the evaluation of the risks and costs of BRI projects and step up its approach to due diligence to demonstrate that it respects the long-term interests of those countries that are at the receiving end of its BRI projects.

Please click to read full report.

Editor's picks

Trending articles

On February 18th, 2019, the Central Government and the State Council promulgated the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, specifying strategic positioning in five areas, including a vibrant world-class city cluster, a globally influential international innovation and technology hub, an important support pillar for the Belt and Road Initiative, a showcase for in-depth cooperation between the Mainland and Hong Kong and Macao, and a quality living circle for living, working and travelling. Based on this strategic positioning, the Greater Bay Area will assume a leading role in national economic growth and opening up, boosting the development of “one country, two systems”. In the new paradigm of Greater Bay Area development and a new era of comprehensive opening up of the country, Hong Kong will assume an indispensable and active role and attain new room for economic growth.

One. The Greater Bay Area’s city cluster will become a new engine of China’s modern economic development in the new era

The first strategic positioning specified in the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area is a vibrant world-class city cluster. The goal is to “integrate into the global market system, build a global base of emerging industries, advanced manufacturing and modern service industries”, setting an example in developing institutions and mechanisms for high-quality economic development.

In 2018, the Chinese economy grew 6.6%, and nominal GDP exceeded 90 trillion yuan, reinforcing the shift from high-speed growth to high-quality growth in the new era.

Both the size and growth of the Greater Bay Area’s GDP outperform other major domestic city clusters. In 2017, the GDP of the Greater Bay Area amounted to 10.17 trillion yuan. In 2018, the GDP of the nine Greater Bay Areas cities in Guangdong amounted to 8.1 trillion yuan. Considering the yet-to-be released GDP figures for Hong Kong and Macao, the Greater Bay Area’s GDP in 2018 could reach 10.83 trillion yuan, or about 12% of the national total. According to simple projections based on the nominal GDP growth records of the Greater Bay Area cities in the 10 years between 2008 and 2017, the GDP of the Greater Bay Area could reach 15.47 trillion yuan in 2022, achieving the goal of considerably strengthening overall competitiveness. In 2035, the GDP of the Greater Bay Area could reach 52.12 trillion yuan, a big leap in its economic prowess. Assuming a nominal growth rate of 7% for the country as a whole, in 2022, the Greater Bay Area’s GDP would account for 13.1% of the national total. In 2035, the Greater Bay Area’s GDP would account for 18.3% of the national total, genuinely becoming an important engine of China’s economic growth.

The Greater Bay Area city cluster will establish and maintain reasonable collaboration and division of roles, realizing interconnectedness in factor markets. Easy movement of various factors will efficiently improve resource allocation and the synergy of regional development, boosting the transition of the Greater Bay Area from simple addition to organic economic consolidation, improving the quality and efficiency of economic growth, and further elevating the Greater Bay Area’s importance in China’s modern economic development.

In building the Greater Bay Area, Hong Kong has the advantages of “one country, two systems” and a fully international market economy, enabling the Greater Bay Area to better capitalize on its strengths accumulated from early and pilot implementation during Mainland China’s reform and opening up, in adequate industrial systems, congregation of innovative factors, a market economy, and high degree of internationalization, providing important support for national development towards a modern and open economy in line with international standards.

Please click to read the full report.

Editor's picks

Trending articles

China steps up development funding for Iraqi oil and gas projects, while also hiking up level of anticipated fuel imports.

In recent years, Iraq's oil and gas sector has been boosted by significant investment from China within the framework of the wider Belt and Road Initiative (BRI). In a sign this trend is unlikely to abate any time soon, the China Petroleum Engineering and Construction Corporation (CPECC) signed a US$280 million contract in February with Iraq's Basra Gas Company (BGC) to construct a natural gas liquids plant in the country's southern Basra province.

CPECC is a subsidiary of the China National Petroleum Corporation (CNPC), while BGC is a $17 billion joint venture vehicle established 25 years ago to develop Iraq's gas reserves. Iraq's South Gas Company has a 51% shareholding in BGC, with the balance controlled by Royal Dutch Shell (44%) and the Mitsubishi Corp (5%).

The contract awarded to CPECC follows an earlier decision by the joint-venture partners to increase BGC's capacity by 40%. The new project will focus on the capture of flared gas from three major oilfields – Rumaila, West Qurna 1 and Zubair – and its conversion to dry gas for power generation and liquids for the domestic market and export. It is anticipated that work on the plant will be completed by the end of next year.

Central to the project is the development of the Basra Natural Gas Liquids facility at Ar Ratawi. Once fully commissioned, this gas-processing plant will be served by two trains, each with a processing capacity of 200 mmscf/d (million standard cubic feet per day), enabling BGC to increase its total capacity to 1.4 bcf/d (billion cubic feet per day) by the end of 2021. BGC will also be able to produce an increased level of higher-margin refrigerated liquefied petroleum gas for export from the refurbished and expanded storage and marine terminal within Basra's Um Qasr port.

Commenting on the significance of these recent developments, Marcus Antonini, Shell Iraq's Vice-president, said: "With BGC having recently achieved a new production high of more than 1 bcf/d, we are delighted to mark this growth milestone with the commission of an industry-leading competitive project that will reduce gas-flaring from the three Basra oil fields, thus increasing our dry gas supply and NGL export capabilities.

"This will bring significant and widespread societal benefits to the Basra region in terms of jobs, the environment and the security of energy supply."

Gas-flaring, which involves excess gas from oil wells being burnt off, is seen as constituting a significant waste of Iraq's natural resources. The country's government plans to end all flaring by 2021. It is believed that the practice costs the country nearly $2.5 billion in lost revenue each year and, according to the World Bank, if the gas were trapped and utilised it would meet most of Iraq's domestic needs for gas-based power generation.

Flaring is also considered to have a hugely negative impact on the local environment, creating excessive atmospheric pollution and contributing substantially to increasing greenhouse-gas emissions. The new CPECC facility will help address such problems by preventing the transmission of the flared gases into the wider environment.

Chinese investment in Iraq's oil and gas sector has escalated over the past few years, as the Middle East country's trade options have narrowed following the re-imposition of US sanctions. To date, CNPC has secured stakes in the Ahdab, Halfaya and Rumaila oilfields – with the latter the largest in Iraq and the sixth-largest in the world, with estimated oil reserves of 17 billion barrels. Via its PetroChina subsidiary, CNPC also has an interest in the West Qurna I field.

The China National Offshore Oil Corporation (CNOOC), meanwhile, has a stake in the Maysan Oil Fields, while Sinopec, through its Addax Petroleum subsidiary, has interests in the Taq Taq oilfield in Iraqi Kurdistan. In addition, last year, state-owned China Zhenhua Oil, along with two private Chinese companies – the Geo-Jade Petroleum Corporation and the United Energy Group – secured field development deals with the Iraqi government.

Perhaps unsurprisingly, Iraqi oil exports to China are expected to ramp up considerably in the near future. According to Alaa Al-Yasiri, Director General of SOMO, Iraq's state-owned marketing company, the country aims to supply China with about 60% more crude this year than in 2018. This continues an already upward trajectory, with Iraqi crude-oil imports to China rising to 863,000 barrels per day for the first nine months of 2018, a 15% year-on-year increase.

Kicking off the expansion will be a Tianjin-based oil trading venture with Zhenhua Oil. Assessing the likely scale of this particular venture, Al-Yasiri said Iraq was anticipating annual sales of about 160,000 barrels a day, which would be via a number of smaller, independent refiners as well as through several larger petrochemical plants.

Geoff de Freitas, Special Correspondent, Baghdad

Editor's picks

Trending articles

By Hui Lu, Charlene Rohr, Marco Hafner and Anna Knack, RAND Corporation (Europe)

In 2013, Chinese President Xi Jinping announced plans to build a Silk Road Economic Belt and a 21st Century Maritime Silk Road, which have come to be known as the Belt and Road Initiative (BRI). The BRI is geared towards encouraging greater policy coordination, infrastructure connectivity, investment and trade cooperation, financial integration, cultural exchange and regional cooperation between Asia, Europe and Africa, by creating jointly-built trade routes emulating the ancient Silk Road. Using both qualitative and quantitative analysis, this study was to measure the impact of improving transportation multimodal connectivity on multilateral trade and economic growth across countries and regions along China Belt and Road Initiative. This is a proof-of-concept study which is targeted at stimulating discussion and providing empirical evidence on the impact of transport infrastructure improvements in the BRI region. The study's findings aim to be of use to policymakers and stakeholders who are interested in this infrastructure plan.

Key Findings

-

The literature review finds that multimodal transport infrastructure and connectivity can facilitate trade expansion, attract foreign direct investment, speed up the industrialisation process and enable more efficient production networks, facilitate regional integration, and accelerate the process of economic growth.

-

The literature review finds that multimodal transport infrastructure and connectivity can facilitate trade expansion, attract foreign direct investment, speed up the industrialisation process and enable more efficient production networks, facilitate regional integration, and accelerate the process of economic growth.

-

There is a positive and statistically significant relationship between transport infrastructure and connectivity and bilateral trade. Assuming that this relationship is causal, with the proposed level of investment in transport infrastructure in the BRI region, total trade volumes increase not only in the BRI region, but also in the countries outside the initiative (such as those in the EU). Therefore it appears to be a win-win scenario.

Recommendations

-

The BRI region suffers from less developed infrastructure than other regions and this can hamper trade development. Therefore, investing in infrastructure related to trade and transport, such as ports, airports, road, and rail links and connections, should remain a priority and sufficient funding should be made available for this purpose.

-

There could be substantial further benefits if countries and regions along the BRI region coordinate their development plans to achieve compatibility and complementarity between their policies and the infrastructure implementation. Countries should work together to ensure that the initiative delivers sustained economic, social and environmental benefits across generations.

Please click to read full report.

Editor's picks

Trending articles

來源:新華財金社

推進“一帶一路”建設工作領導小組辦公室4月22日發表《共建“一帶一路”倡議:進展、貢獻與展望》報告。全文如下:

共建“一帶一路”倡議:進展、貢獻與展望

推進“一帶一路”建設工作領導小組辦公室

2019年

目錄

前言

一、進展

(一)政策溝通

(二)設施聯通

(三)貿易暢通

(四)資金融通

(五)民心相通

(六)產業合作

二、貢獻

(一)共商:從中國倡議到全球共識

(二)共建:共同打造和諧家園

(三)共用:讓所有參與方獲得實實在在的好處

(四)願景:構建人類命運共同體

(一)和平之路

(二)繁榮之路

(三)開放之路

(四)綠色之路

(五)創新之路

(六)文明之路

(七)廉潔之路

前言

2013年9月和10月,中國國家主席習近平在出訪哈薩克斯坦和印尼時先後提出共建“絲綢之路經濟帶”和“21世紀海上絲綢之路”的重大倡議。中國政府成立了推進“一帶一路”建設工作領導小組,並在中國國家發展改革委設立領導小組辦公室。2015年3月,中國發佈《推動共建絲綢之路經濟帶和21世紀海上絲綢之路的願景與行動》;2017年5月,首屆“一帶一路”國際合作高峰論壇在北京成功召開。中國還先後舉辦了博鼇亞洲論壇年會、上海合作組織青島峰會、中非合作論壇北京峰會、中國國際進口博覽會等。5年多來,共建“一帶一路”倡議得到了越來越多國家和國際組織的積極回應,受到國際社會廣泛關注,影響力日益擴大。

共建“一帶一路”倡議源自中國,更屬於世界;根植於歷史,更面向未來;重點面向亞歐非大陸,更向所有夥伴開放。共建“一帶一路”跨越不同國家地域、不同發展階段、不同歷史傳統、不同文化宗教、不同風俗習慣,是和平發展、經濟合作倡議,不是搞地緣政治聯盟或軍事同盟;是開放包容、共同發展進程,不是要關起門來搞小圈子或者“中國俱樂部”;不以意識形態劃界,不搞零和遊戲,只要各國有意願,都歡迎參與。共建“一帶一路”倡議以共商共建共用為原則,以和平合作、開放包容、互學互鑒、互利共贏的絲綢之路精神為指引,以政策溝通、設施聯通、貿易暢通、資金融通、民心相通為重點,已經從理念轉化為行動,從願景轉化為現實,從倡議轉化為全球廣受歡迎的公共產品。

2018年8月,習近平主席在北京主持召開推進“一帶一路”建設工作5周年座談會,提出“一帶一路”建設要從謀篇佈局的“大寫意”轉入精耕細作的“工筆劃”,向高品質發展轉變,造福沿線國家人民,推動構建人類命運共同體。

一、進展

2013年以來,共建“一帶一路”倡議以政策溝通、設施聯通、貿易暢通、資金融通和民心相通為主要內容扎實推進,取得明顯成效,一批具有標誌性的早期成果開始顯現,參與各國得到了實實在在的好處,對共建“一帶一路”的認同感和參與度不斷增強。

(一)政策溝通

政策溝通是共建“一帶一路”的重要保障,是形成攜手共建行動的重要先導。5年多來,中國與有關國家和國際組織充分溝通協調,形成了共建“一帶一路”的廣泛國際合作共識。

1. 共建“一帶一路”倡議載入國際組織重要檔。共建“一帶一路”倡議及其核心理念已寫入聯合國、二十國集團、亞太經合組織以及其他區域組織等有關檔中。2015年7月,上海合作組織發表了《上海合作組織成員國元首烏法宣言》,支援關於建設“絲綢之路經濟帶”的倡議。2016年9月,《二十國集團領導人杭州峰會公報》通過關於建立“全球基礎設施互聯互通聯盟”倡議。2016年11月,聯合國193個會員國協商一致通過決議,歡迎共建“一帶一路”等經濟合作倡議,呼籲國際社會為“一帶一路”建設提供安全保障環境。2017年3月,聯合國安理會一致通過了第2344號決議,呼籲國際社會通過“一帶一路”建設加強區域經濟合作,並首次載入“人類命運共同體”理念。2018年,中拉論壇第二屆部長級會議、中國-阿拉伯國家合作論壇第八屆部長級會議、中非合作論壇峰會先後召開,分別形成了中拉《關於“一帶一路”倡議的特別聲明》、《中國和阿拉伯國家合作共建“一帶一路”行動宣言》和《關於構建更加緊密的中非命運共同體的北京宣言》等重要成果文件。

2. 簽署共建“一帶一路”政府間合作檔的國家和國際組織數量逐年增加。在共建“一帶一路”框架下,各參與國和國際組織本著求同存異原則,就經濟發展規劃和政策進行充分交流,協商制定經濟合作規劃和措施。截至2019年3月底,中國政府已與125個國家和29個國際組織簽署173份合作檔。共建“一帶一路”國家已由亞歐延伸至非洲、拉美、南太等區域。

3. 共建“一帶一路”專業領域對接合作有序推進。數位絲綢之路建設已成為共建“一帶一路”的重要組成部分,中國與埃及、老撾、沙烏地阿拉伯、塞爾維亞、泰國、土耳其、阿聯酋等國家共同發起《“一帶一路”數字經濟國際合作倡議》,與16個國家簽署加強數字絲綢之路建設合作檔。中國發佈《標準聯通共建“一帶一路”行動計畫(2018-2020年)》,與49個國家和地區簽署85份標準化合作協定。“一帶一路”稅收合作長效機制日趨成熟,中國組織召開“一帶一路”稅收合作會議,發佈《阿斯坦納“一帶一路”稅收合作倡議》,稅收協定合作網路延伸至111個國家和地區。中國與49個沿線國家聯合發佈《關於進一步推進“一帶一路”國家智慧財產權務實合作的聯合聲明》。中國組織召開“一帶一路”法治合作國際論壇,發佈《“一帶一路”法治合作國際論壇共同主席聲明》。中國組織召開“一帶一路”能源部長會議,18個國家聯合宣佈建立“一帶一路”能源合作夥伴關係。中國發佈《共同推進“一帶一路”建設農業合作的願景與行動》、《“一帶一路”建設海上合作設想》等。中國推動建立了國際商事法庭和“一站式”國際商事糾紛多元化解決機制。

(二)設施聯通

設施聯通是共建“一帶一路”的優先方向。在尊重相關國家主權和安全關切的基礎上,由各國共同努力,以鐵路、公路、航運、航空、管道、空間綜合資訊網路等為核心的全方位、多層次、複合型基礎設施網路正在加快形成,區域間商品、資金、資訊、技術等交易成本大大降低,有效促進了跨區域資源要素的有序流動和優化配置,實現了互利合作、共贏發展。

1. 國際經濟合作走廊和通道建設取得明顯進展。新亞歐大陸橋、中蒙俄、中國-中亞-西亞、中國-中南半島、中巴和孟中印緬等六大國際經濟合作走廊將亞洲經濟圈與歐洲經濟圈聯繫在一起,為建立和加強各國互聯互通夥伴關係,構建高效暢通的亞歐大市場發揮了重要作用。

——新亞歐大陸橋經濟走廊。5年多來,新亞歐大陸橋經濟走廊區域合作日益深入,將開放包容、互利共贏的夥伴關係提升到新的水準,有力推動了亞歐兩大洲經濟貿易交流。《中國-中東歐國家合作布達佩斯綱要》和《中國-中東歐國家合作索菲亞綱要》對外發佈,中歐互聯互通平台和歐洲投資計畫框架下的務實合作有序推進。匈塞鐵路塞爾維亞境內貝舊段開工。中國西部-西歐國際公路(中國西部-哈薩克斯坦-俄羅斯-西歐)基本建成。

——中蒙俄經濟走廊。中蒙俄三國積極推動形成以鐵路、公路和邊境口岸為主體的跨境基礎設施聯通網路。2018年,三國簽署《關於建立中蒙俄經濟走廊聯合推進機制的諒解備忘錄》,進一步完善了三方合作工作機制。中俄同江-下列寧斯闊耶界河鐵路橋中方側工程已於2018年10月完工。黑河-布拉戈維申斯克界河公路橋建設進展順利。中俄企業聯合體基本完成莫喀高鐵項目初步設計。三國簽署並核准的《關於沿亞洲公路網國際道路運輸政府間協定》正式生效。中蒙俄(二連浩特)跨境陸纜系統已建成。

——中國-中亞-西亞經濟走廊。5年多來,該走廊在能源合作、設施互聯互通、經貿與產能合作等領域合作不斷加深。中國與哈薩克斯坦、烏茲別克斯坦、土耳其等國的雙邊國際道路運輸協定,以及中巴哈吉、中哈俄、中吉烏等多邊國際道路運輸協議或協定相繼簽署,中亞、西亞地區基礎設施建設不斷完善。中國-沙特投資合作論壇圍繞共建“一帶一路”倡議與沙特“2030願景”進行產業對接,簽署合作協定總價值超過280億美元。中國與伊朗發揮在各領域的獨特優勢,加強涵蓋道路、基礎設施、能源等領域的對接合作。

——中國-中南半島經濟走廊。5年多來,該走廊在基礎設施互聯互通、跨境經濟合作區建設等方面取得積極進展。昆(明)曼(穀)公路全線貫通,中老鐵路、中泰鐵路等項目穩步推進。中老經濟走廊合作建設開始啟動,泰國“東部經濟走廊”與“一帶一路”倡議加快對接,中國與柬老緬越泰(CLMVT)經濟合作穩步推進。中國-東盟(10+1)合作機制、瀾湄合作機制、大湄公河次區域經濟合作(GMS)發揮的積極作用越來越明顯。

——中巴經濟走廊。以能源、交通基礎設施、產業園區合作、瓜達爾港為重點的合作佈局確定實施。中國與巴基斯坦組建了中巴經濟走廊聯合合作委員會,建立了定期會晤機制。一批專案順利推進,瓜達爾港疏港公路、白沙瓦至卡拉奇高速公路(蘇庫爾至木爾坦段)、喀喇昆侖公路升級改造二期(哈威連-塔科特段)、拉合爾軌道交通橙線、凱西姆港1320兆瓦電站等重點專案開工建設,部分專案已發揮效益。中巴經濟走廊正在開啟協力廠商合作,更多國家已經或有意願參與其中。

——孟中印緬經濟走廊。5年多來,孟中印緬四方在聯合工作組框架下共同推進走廊建設,在機制和制度建設、基礎設施互聯互通、貿易和產業園區合作、國際金融開放合作、人文交流與民生合作等方面研擬並規劃了一批重點專案。中緬兩國共同成立了中緬經濟走廊聯合委員會,簽署了關於共建中緬經濟走廊的諒解備忘錄、木姐-曼德勒鐵路項目可行性研究檔和皎漂經濟特區深水港專案建設框架協議。

2.基礎設施互聯互通水準大幅提升。“道路通,百業興”。基礎設施投入不足是發展中國家經濟發展的瓶頸,加快設施聯通建設是共建“一帶一路”的關鍵領域和核心內容。

——鐵路合作方面。以中老鐵路、中泰鐵路、匈塞鐵路、雅萬高鐵等合作專案為重點的區際、洲際鐵路網路建設取得重大進展。泛亞鐵路東線、巴基斯坦1號鐵路幹線升級改造、中吉烏鐵路等項目正積極推進前期研究,中國-尼泊爾跨境鐵路已完成預可行性研究。中歐班列初步探索形成了多國協作的國際班列運行機制。中國、白俄羅斯、德國、哈薩克斯坦、蒙古、波蘭和俄羅斯等7國鐵路公司簽署了《關於深化中歐班列合作協定》。截至2018年底,中歐班列已經聯通亞歐大陸16個國家的108個城市,累計開行1.3萬列,運送貨物超過110萬標箱,中國開出的班列重箱率達94%,抵達中國的班列重箱率達71%。與沿線國家開展口岸通關協調合作、提升通關便利,平均查驗率和通關時間下降了50%。

——公路合作方面。中蒙俄、中吉烏、中俄(大連-新西伯利亞)、中越國際道路直達運輸試運行活動先後成功舉辦。2018年2月,中吉烏國際道路運輸實現常態化運行。中越北侖河公路二橋建成通車。中國正式加入《國際公路運輸公約》(TIR公約)。中國與15個沿線國家簽署了包括《上海合作組織成員國政府間國際道路運輸便利化協定》在內的18個雙多邊國際運輸便利化協定。《大湄公河次區域便利貨物及人員跨境運輸協定》實施取得積極進展。

——港口合作方面。巴基斯坦瓜達爾港開通集裝箱定期班輪航線,起步區配套設施已完工,吸引30多家企業入園。斯里蘭卡漢班托塔港經濟特區已完成園區產業定位、概念規劃等前期工作。希臘比雷埃夫斯港建成重要中轉樞紐,三期港口建設即將完工。阿聯酋哈利法港二期集裝箱碼頭已於2018年12月正式開港。中國與47個沿線國家簽署了38個雙邊和區域海運協定。中國寧波航交所不斷完善“海上絲綢之路航運指數”,發佈了16+1貿易指數和寧波港口指數。

——航空運輸方面。中國與126個國家和地區簽署了雙邊政府間航空運輸協定。與盧森堡、俄羅斯、亞美尼亞、印尼、柬埔寨、孟加拉、以色列、蒙古、馬來西亞、埃及等國家擴大了航權安排。5年多來,中國與沿線國家新增國際航線1239條,佔新開通國際航線總量的69.1%。

——能源設施建設方面。中國與沿線國家簽署了一系列合作框架協定和諒解備忘錄,在電力、油氣、核電、新能源、煤炭等領域開展了廣泛合作,與相關國家共同維護油氣管網安全運營,促進國家和地區之間的能源資源優化配置。中俄原油管道、中國-中亞天然氣管道保持穩定運營,中俄天然氣管道東線將於2019年12月部分實現通氣,2024年全線通氣。中緬油氣管道全線貫通。

——通訊設施建設方面。中緬、中巴、中吉、中俄跨境光纜資訊通道建設取得明顯進展。中國與國際電信聯盟簽署《關於加強“一帶一路”框架下電信和資訊網路領域合作的意向書》。與吉爾吉斯斯坦、塔吉克斯坦、阿富汗簽署絲路光纜合作協定,實質性啟動了絲路光纜專案。

(三)貿易暢通

貿易暢通是共建“一帶一路”的重要內容。共建“一帶一路”促進了沿線國家和地區貿易投資自由化便利化,降低了交易成本和營商成本,釋放了發展潛力,進一步提升了各國參與經濟全球化的廣度和深度。

1.中國發起《推進“一帶一路”貿易暢通合作倡議》,83個國家和國際組織積極參與。海關檢驗檢疫合作不斷深化,2017年5月首屆“一帶一路”國際合作高峰論壇以來,中國與沿線國家簽署100多項合作檔,實現了50多種農產品食品檢疫准入。中國和哈薩克斯坦、吉爾吉斯斯坦、塔吉克斯坦農產品快速通關“綠色通道”建設積極推進,農產品通關時間縮短了90%。中國進一步放寬外資准入領域,營造高標準的國際營商環境,設立了面向全球開放的12個自由貿易試驗區,並探索建設自由貿易港,吸引沿線國家來華投資。中國平均關稅水準從加入世界貿易組織時的15.3%降至目前的7.5%。中國與東盟、新加坡、巴基斯坦、格魯吉亞等多個國家和地區簽署或升級了自由貿易協定,與歐亞經濟聯盟簽署經貿合作協定,與沿線國家的自由貿易區網路體系逐步形成。

2.2013-2018年,中國與沿線國家貨物貿易進出口總額超過6萬億美元,年均增長率高於同期中國對外貿易增速,佔中國貨物貿易總額的比重達到27.4%。其中,2018年,中國與沿線國家貨物貿易進出口總額達到1.3萬億美元,同比增長16.4%。中國與沿線國家服務貿易由小到大、穩步發展。2017年,中國與沿線國家服務貿易進出口額達977.6億美元,同比增長18.4%,佔中國服務貿易總額的14.1%,比2016年提高1.6個百分點。世界銀行研究組分析了共建“一帶一路”倡議對71個潛在參與國的貿易影響,發現共建“一帶一路”倡議將使參與國之間的貿易往來增加4.1%。(注1)

3.跨境電子商務等新業態、新模式正成為推動貿易暢通的重要新生力量。2018年,通過中國海關跨境電子商務管理平台零售進出口商品總額達203億美元,同比增長50%,其中出口84.8億美元,同比增長67.0%,進口118.7億美元,同比增長39.8%。“絲路電商”合作蓬勃興起,中國與17個國家建立雙邊電子商務合作機制,在金磚國家等多邊機制下形成電子商務合作檔,加快了企業對接和品牌培育的實質性步伐。

(四)資金融通

資金融通是共建“一帶一路”的重要支撐。國際多邊金融機構以及各類商業銀行不斷探索創新投融資模式,積極拓寬多樣化融資管道,為共建“一帶一路”提供穩定、透明、高品質的資金支持。

1.探索新型國際投融資模式。“一帶一路”沿線基礎設施建設和產能合作潛力巨大,融資缺口亟待彌補。各國主權基金和投資基金發揮越來越重要的作用。近年來,阿聯酋阿布達比投資局、中國投資有限責任公司等主權財富基金對沿線國家主要新興經濟體投資規模顯著增加。絲路基金與歐洲投資基金共同投資的中歐共同投資基金於2018年7月開始實質性運作,投資規模5億歐元,有力促進了共建“一帶一路”倡議與歐洲投資計畫相對接。

2.多邊金融合作支撐作用顯現。中國財政部與阿根廷、俄羅斯、印尼、英國、新加坡等27國財政部核准了《“一帶一路”融資指導原則》。根據這一指導原則,各國支援金融資源服務於相關國家和地區的實體經濟發展,重點加大對基礎設施互聯互通、貿易投資、產能合作等領域的融資支持。中國人民銀行與世界銀行集團下屬的國際金融公司、泛美開發銀行、非洲開發銀行和歐洲復興開發銀行等多邊開發機構開展聯合融資,截至2018年底已累計投資100多個項目,覆蓋70多個國家和地區。2017年11月,中國-中東歐銀聯體成立,成員包括中國、匈牙利、捷克、斯洛伐克、克羅地亞等14個國家的金融機構。2018年7月、9月,中國-阿拉伯國家銀行聯合體、中非金融合作銀行聯合體成立,建立了中國與阿拉伯國家之間、非洲國家之間的首個多邊金融合作機制。

3.金融機構合作水準不斷提升。在共建“一帶一路”中,政策性出口信用保險覆蓋面廣,在支持基礎設施、基礎產業的建設上發揮了獨特作用;商業銀行在多元化吸收存款、公司融資、金融產品、貿易代理、信託等方面具有優勢。截至2018年底,中國出口信用保險公司累計支持對沿線國家的出口和投資超過6000億美元。中國銀行、中國工商銀行、中國農業銀行、中國建設銀行等中資銀行與沿線國家建立了廣泛的代理行關係。德國商業銀行與中國工商銀行簽署合作諒解備忘錄,成為首家加入“一帶一路”銀行合作常態化機制的德國銀行。

4.金融市場體系建設日趨完善。沿線國家不斷深化長期穩定、互利共贏的金融合作關係,各類創新金融產品不斷推出,大大拓寬了共建“一帶一路”的融資管道。中國不斷提高銀行間債券市場對外開放程度,截至2018年底,熊貓債發行規模已達2000億人民幣左右。中國進出口銀行面向全球投資者發行20億人民幣“債券通”綠色金融債券,金磚國家新開發銀行發行首單30億人民幣綠色金融債,支援綠色絲綢之路建設。證券期貨交易所之間的股權、業務和技術合作穩步推進。2015年,上海證券交易所、德意志交易所集團、中國金融期貨交易所共同出資成立中歐國際交易所。上海證券交易所與哈薩克斯坦阿斯坦納國際金融中心管理局簽署合作協定,將共同投資建設阿斯坦納國際交易所。

5.金融互聯互通不斷深化。已有11家中資銀行在28個沿線國家設立76家一級機構,來自22個沿線國家的50家銀行在中國設立7家法人銀行、19家外國銀行分行和34家代表處。2家中資證券公司在新加坡、老撾設立合資公司。中國先後與20多個沿線國家建立了雙邊本幣互換安排,與7個沿線國家建立了人民幣清算安排,與35個沿線國家的金融監管當局簽署了合作檔。人民幣國際支付、投資、交易、儲備功能穩步提高,人民幣跨境支付系統(CIPS)業務範圍已覆蓋近40個沿線國家和地區。中國-國際貨幣基金組織聯合能力建設中心、“一帶一路”財經發展研究中心掛牌成立。

(五)民心相通

民心相通是共建“一帶一路”的人文基礎。享受和平、安寧、富足,過上更加美好生活,是各國人民的共同夢想。5年多來,各國開展了形式多樣、領域廣泛的公共外交和文化交流,增進了相互理解和認同,為共建“一帶一路”奠定了堅實的民意基礎。

1.文化交流形式多樣。中國與沿線國家互辦藝術節、電影節、音樂節、文物展、圖書展等活動,合作開展圖書廣播影視精品創作和互譯互播。絲綢之路國際劇院、博物館、藝術節、圖書館、美術館聯盟相繼成立。中國與中東歐、東盟、俄羅斯、尼泊爾、希臘、埃及、南非等國家和地區共同舉辦文化年活動,形成了“絲路之旅”、“中非文化聚焦”等10余個文化交流品牌,打造了絲綢之路(敦煌)國際文化博覽會、絲綢之路國際藝術節、海上絲綢之路國際藝術節等一批大型文化節會,在沿線國家設立了17個中國文化中心。中國與印尼、緬甸、塞爾維亞、新加坡、沙烏地阿拉伯等國簽訂了文化遺產合作檔。中國、哈薩克斯坦、吉爾吉斯斯坦“絲綢之路:長安-天山廊道的路網”聯合申遺成功。“一帶一路”新聞合作聯盟建設積極推進。絲綢之路沿線民間組織合作網路成員已達310家,成為推動民間友好合作的重要平台。

2.教育培訓成果豐富。中國設立“絲綢之路”中國政府獎學金項目,與24個沿線國家簽署高等教育學歷學位互認協定。2017年沿線國家3.87萬人接受中國政府獎學金來華留學,佔獎學金生總數的66.0%。香港、澳門特別行政區分別設立共建“一帶一路”相關獎學金。在54個沿線國家設有孔子學院153個、孔子課堂149個。中國科學院在沿線國家設立碩士、博士生獎學金和科技培訓班,已培訓5000人次。

3.旅遊合作逐步擴大。中國與多個國家共同舉辦旅遊年,創辦絲綢之路旅遊市場推廣聯盟、海上絲綢之路旅遊推廣聯盟、“萬里茶道”國際旅遊聯盟等旅遊合作機制。與57個沿線國家締結了涵蓋不同護照種類的互免簽證協定,與15個國家達成19份簡化簽證手續的協定或安排。2018年中國出境旅遊人數達1.5億人次,到中國旅遊的外國遊客人數達3054萬人次,俄羅斯、緬甸、越南、蒙古、馬來西亞、菲律賓、新加坡等國成為中國主要客源市場。

4.衛生健康合作不斷深化。自首屆“一帶一路”國際合作高峰論壇召開以來,中國與蒙古、阿富汗等國,世界衛生組織等國際組織,比爾及梅琳達·蓋茨基金會等非政府組織相繼簽署了56個推動衛生健康合作的協議。2017年8月,“一帶一路”暨健康絲綢之路高級別研討會在北京召開,發佈了《北京公報》。中國與瀾滄江-湄公河國家開展愛滋病、瘧疾、登革熱、流感、結核病等防控合作,與中亞國家開展包蟲病、鼠疫等人畜共患病防控合作,與西亞國家開展脊髓灰質炎等防控合作。中國先後派出多支眼科醫療隊赴柬埔寨、緬甸、老撾、斯里蘭卡等國開展“光明行”活動,派遣短期醫療隊赴斐濟、湯加、密克羅尼西亞、瓦努阿圖等太平洋島國開展“送醫上島”活動。在35個沿線國家建立了中醫藥海外中心,建設了43個中醫藥國際合作基地。

5.救災、援助與扶貧持續推進。首屆“一帶一路”國際合作高峰論壇以來,中國向沿線發展中國家提供20億人民幣緊急糧食援助,向南南合作援助基金增資10億美元,在沿線國家實施了100個“幸福家園”、100個“愛心助困”、100個“康復助醫”等項目。開展援外文物合作保護和涉外聯合考古,與6國開展了8個援外文物合作項目,與12國開展了15個聯合考古專案。中國向老撾等國提供地震監測儀器設備,提高防震減災能力。中國在柬埔寨、尼泊爾開展社會組織合作專案24個,助力改善當地民眾生活。

(六)產業合作

共建“一帶一路”支持開展多元化投資,鼓勵進行協力廠商市場合作,推動形成普惠發展、共用發展的產業鏈、供應鏈、服務鏈、價值鏈,為沿線國家加快發展提供新的動能。

1.中國對沿線國家的直接投資平穩增長。2013-2018年,中國企業對沿線國家直接投資超過900億美元,在沿線國家完成對外承包工程營業額超過4000億美元。2018年,中國企業對沿線國家實現非金融類直接投資156億美元,同比增長8.9%,佔同期總額的13.0%;沿線國家對外承包工程完成營業額893億美元,佔同期總額的53.0%。世界銀行研究表明,預計沿線國家的外商直接投資總額將增加4.97%,其中,來自沿線國家內部的外商直接投資增加4.36%,來自經濟合作與發展組織國家的外商直接投資增加4.63%,來自非沿線國家的外商直接投資增加5.75%。(注2)

2.國際產能合作和協力廠商市場合作穩步推進。沿線國家加快發展產生了國際產能合作的巨大市場需求,中國積極回應並與相關國家推進市場化、全方位的產能合作,促進沿線國家實現產業結構升級、產業發展層次提升。目前中國已同哈薩克斯坦、埃及、埃塞俄比亞、巴西等40多個國家簽署了產能合作檔,同東盟、非盟、拉美和加勒比國家共同體等區域組織進行合作對接,開展機制化產能合作。中國與法國、義大利、西班牙、日本、葡萄牙等國簽署了協力廠商市場合作檔。

3.合作園區蓬勃發展。中國各類企業遵循市場化法治化原則自主赴沿線國家共建合作園區,推動這些國家借鑒中國改革開放以來通過各類開發區、工業園區實現經濟增長的經驗和做法,促進當地經濟發展,為沿線國家創造了新的稅收源和就業管道。同時,中國還分別與哈薩克斯坦、老撾建立了中哈霍爾果斯國際邊境合作中心、中老磨憨-磨丁經濟合作區等跨境經濟合作區,與其他國家合作共建跨境經濟合作區的工作也在穩步推進。

二、貢獻

共建“一帶一路”倡議著眼於構建人類命運共同體,堅持共商共建共用原則,為推動全球治理體系變革和經濟全球化作出了中國貢獻。

(一)共商:從中國倡議到全球共識

共商就是“大家的事大家商量著辦”,強調平等參與、充分協商,以平等自願為基礎,通過充分對話溝通找到認識的相通點、參與合作的交匯點、共同發展的著力點。

——打造共商國際化平台與載體。2017年5月,首屆“一帶一路”國際合作高峰論壇在北京成功召開,29個國家的元首和政府首腦出席論壇,140多個國家和80多個國際組織的1600多名代表參會,論壇形成了5大類、76大項、279項具體成果,這些成果已全部得到落實。2019年4月,第二屆“一帶一路”國際合作高峰論壇繼續在北京舉辦。“一帶一路”國際合作高峰論壇已經成為各參與國家和國際組織深化交往、增進互信、密切往來的重要平台。2018年11月,首屆中國國際進口博覽會成功舉辦,172個國家、地區和國際組織參加,3600餘家境外企業參展,4500多名政商學研各界嘉賓在虹橋國際經濟論壇上對話交流,發出了“虹橋聲音”。中國還舉辦了絲綢之路博覽會暨中國東西部合作與投資貿易洽談會、中國-東盟博覽會、中國-亞歐博覽會、中國-阿拉伯國家博覽會、中國-南亞博覽會、中國-東北亞博覽會、中國西部國際博覽會等大型展會,都成為中國與沿線各國共商合作的重要平台。

——強化多邊機制在共商中的作用。共建“一帶一路”順應和平與發展的時代潮流,堅持平等協商、開放包容,促進沿線國家在既有國際機制基礎上開展互利合作。中國充分利用二十國集團、亞太經合組織、上海合作組織、亞歐會議、亞洲合作對話、亞信會議、中國-東盟(10+1)、瀾湄合作機制、大湄公河次區域經濟合作、大圖們倡議、中亞區域經濟合作、中非合作論壇、中阿合作論壇、中拉論壇、中國-中東歐16+1合作機制、中國-太平洋島國經濟發展合作論壇、世界經濟論壇、博鼇亞洲論壇等現有多邊合作機制,在相互尊重、相互信任的基礎上,積極同各國開展共建“一帶一路”實質性對接與合作。

——建立“二軌”對話機制。中國與沿線國家通過政黨、議會、智庫、地方、民間、工商界、媒體、高校等“二軌”交往管道,圍繞共建“一帶一路”開展形式多樣的溝通、對話、交流、合作。中國組織召開了中國共產黨與世界政黨高層對話會,就共建“一帶一路”相關議題深入交換意見。中國與相關國家先後組建了“一帶一路”智庫合作聯盟、絲路國際智庫網路、高校智庫聯盟等。英國、日本、韓國、新加坡、哈薩克斯坦等國都建立了“一帶一路”研究機構,舉辦了形式多樣的論壇和研討會。中外高校合作設立了“一帶一路”研究中心、合作發展學院、聯合培訓中心等,為共建“一帶一路”培養國際化人才。中外媒體加強交流合作,通過舉辦媒體論壇、合作拍片、聯合採訪等形式,提高了共建“一帶一路”的國際傳播能力,讓國際社會及時瞭解共建“一帶一路”相關資訊。

(二)共建:共同打造和諧家園

共建就是各方都是平等的參與者、建設者和貢獻者,也是責任和風險的共同擔當者。

——打造共建合作的融資平台。由中國發起的亞洲基礎設施投資銀行2016年開業以來,在國際多邊開發體系中發揮越來越重要的作用,得到國際社會廣泛信任和認可。截至2018年底,亞洲基礎設施投資銀行已從最初57個創始成員,發展到遍佈各大洲的93個成員;累計批准貸款75億美元,撬動其他投資近400億美元,已批准的35個項目覆蓋印尼、巴基斯坦、塔吉克斯坦、阿塞拜疆、阿曼、土耳其、埃及等13個國家。亞洲基礎設施投資銀行在履行自身宗旨使命的同時,也與其他多邊開發銀行一起,成為助力共建“一帶一路”的重要多邊平台之一。2014年11月,中國政府宣佈出資400億美元成立絲路基金,2017年5月,中國政府宣佈向絲路基金增資1000億人民幣。截至2018年底,絲路基金協定投資金額約110億美元,實際出資金額約77億美元,並出資20億美元設立中哈產能合作基金。2017年,中國建立“一帶一路”PPP工作機制,與聯合國歐洲經濟委員會簽署合作諒解備忘錄,共同推動PPP模式更好運用於“一帶一路”建設合作專案。

——積極開展協力廠商市場合作。共建“一帶一路”致力於推動開放包容、務實有效的協力廠商市場合作,促進中國企業和各國企業優勢互補,實現“1+1+1>3”的共贏。2018年,第一屆中日協力廠商市場合作論壇和中法協力廠商市場合作指導委員會第二次會議成功舉辦。英國欣克利角核電等一批合作項目順利落地,中國中車與德國西門子已經在一些重點項目上達成了三方合作共識。

(三)共用:讓所有參與方獲得實實在在的好處

共用就是兼顧合作方利益和關切,尋求利益契合點和合作最大公約數,使合作成果福及雙方、惠澤各方。共建“一帶一路”不是“你輸我贏”或“你贏我輸”的零和博弈,而是雙贏、多贏、共贏。

——將發展成果惠及沿線國家。中國經濟對世界經濟增長的貢獻率多年保持在30%左右。近年來,中國進口需求迅速擴大,在對國際貿易繁榮作出越來越大貢獻的同時,拉動了對華出口的沿線國家經濟增長。中國貨物和服務貿易年進口值均佔全球一成左右,2018年,中國貨物貿易進口14.1萬億人民幣,同比增長12.9%。2018年,中國對外直接投資1298.3億美元,同比增長4.2%,對沿線國家的直接投資佔比逐年增長。在共建“一帶一路”合作框架下,中國支援亞洲、非洲、拉丁美洲等地區廣大發展中國家加大基礎設施建設力度,世界經濟發展的紅利不斷輸送到這些發展中國家。世界銀行研究組的量化貿易模型結果顯示,共建“一帶一路”將使“發展中的東亞及太平洋國家”的國內生產總值平均增加2.6%至3.9%。(注3)

——改善沿線國家民生。中國把向沿線國家提供減貧脫困、農業、教育、衛生、環保等領域的民生援助納入共建“一帶一路”範疇。中國開展了中非減貧惠民合作計畫、東亞減貧合作示範等活動。積極實施湄公河應急補水,幫助沿河國家應對乾旱災害,向泰國、緬甸等國提供防洪技術援助。中國與世界衛生組織簽署關於“一帶一路”衛生領域合作的諒解備忘錄,實施中非公共衛生合作計畫、中國-東盟公共衛生人才培養百人計畫等專案。中國累計與沿線國家合作培養數千名公共衛生管理和疾病防控人員,累計為相關國家5200余名白內障患者實施免費複明手術。中國每年為周邊國家近3萬名患者提供優質醫療服務。中國中醫藥團隊先後在柬埔寨、科摩羅、多哥、聖多美及普林西比島、巴布亞新磯內亞等國家實施快速清除瘧疾方案。

——促進科技創新成果向沿線國家轉移。中國與沿線國家簽署了46個科技合作協定,先後啟動了中國-東盟、中國-南亞等科技夥伴計畫,與東盟、南亞、阿拉伯國家、中亞、中東歐共建了5個區域技術轉移平台,發起成立了“一帶一路”國際科學組織聯盟。通過沿線國家青年科學家來華從事短期科研工作以及培訓沿線國家科技和管理人員等方式,形成了多層次、多元化的科技人文交流機制。2018年,中國接收500名沿線國家青年科學家來華科研,培訓科技管理人員逾1200人次。中國積極開展航太國際合作,推動中國北斗導航系統、衛星通訊系統和衛星氣象遙感技術服務沿線國家建設。

——推動綠色發展。中國堅持《巴黎協定》,積極宣導並推動將綠色生態理念貫穿於共建“一帶一路”倡議。中國與聯合國環境規劃署簽署了關於建設綠色“一帶一路”的諒解備忘錄,與30多個沿線國家簽署了生態環境保護的合作協定。建設綠色絲綢之路已成為落實聯合國2030年可持續發展議程的重要路徑,100多個來自相關國家和地區的合作夥伴共同成立“一帶一路”綠色發展國際聯盟。中國在2016年擔任二十國集團主席國期間,首次把綠色金融議題引入二十國集團議程,成立綠色金融研究小組,發佈《二十國集團綠色金融綜合報告》。中國積極實施“綠色絲路使者計畫”,已培訓沿線國家2000人次。中國發佈《關於推進綠色“一帶一路”建設的指導意見》、《“一帶一路”生態環境保護合作規劃》等檔,推動落實共建“一帶一路”的綠色責任和綠色標準。

(四)願景:構建人類命運共同體

共建“一帶一路”順應了人類追求美好未來的共同願望。國際社會越來越認同共建“一帶一路”倡議所主張的構建人類命運共同體的理念,構建人類命運共同體符合當代世界經濟發展需要和人類文明進步的大方向。共建“一帶一路”倡議正成為構建人類命運共同體的重要實踐平台。

——源自中國更屬於世界。共建“一帶一路”跨越不同地域、不同發展階段、不同文明,是一個開放包容的平台,是各方共同打造的全球公共產品。共建“一帶一路”目標指向人類共同的未來,堅持最大程度的非競爭性與非排他性,順應了國際社會對全球治理體系公正性、平等性、開放性、包容性的追求,是中國為當今世界提供的重要公共產品。聯合國秘書長古特雷斯指出,共建“一帶一路”倡議與聯合國新千年計畫宏觀目標相同,都是向世界提供的公共產品。共建“一帶一路”不僅促進貿易往來和人員交流,而且增進各國之間的瞭解,減少文化障礙,最終實現和平、和諧與繁榮。

——為全球治理體系變革提供了中國方案。當今世界面臨增長動能不足、治理體系滯後和發展失衡等挑戰。共建“一帶一路”體現開放包容、共同發展的鮮明導向,超越社會制度和文化差異,尊重文明多樣性,堅持多元文化共存,強調不同經濟發展水準國家的優勢互補和互利共贏,著力改善發展條件、創造發展機會、增強發展動力、共用發展成果,推動實現全球治理、全球安全、全球發展聯動,致力於解決長期以來單一治理成效不彰的困擾。

——把沿線國家的前途和命運緊緊聯繫在一起。人類只有一個地球,各國共處一個世界。為了應對人類共同面臨的各種挑戰,追求世界和平繁榮發展的美好未來,世界各國應風雨同舟,榮辱與共,構建持久和平、普遍安全、共同繁榮、開放包容、清潔美麗的世界。人類命運共同體理念融入了利益共生、情感共鳴、價值共識、責任共擔、發展共贏等內涵。共建“一帶一路”主張守望相助、講平等、重感情,堅持求同存異、包容互諒、溝通對話、平等交往,把別人發展看成自己機遇,推進中國同沿線各國乃至世界發展機遇相結合,實現發展成果惠及合作雙方、各方。中國在40年改革開放中積累了很多可資借鑒的經驗,中國無意輸出意識形態和發展模式,但中國願意通過共建“一帶一路”與其他國家分享自己的發展經驗,與沿線國家共建美好未來。

三、展望

當今世界正處於大發展大變革大調整時期,和平、發展、合作仍是時代潮流。展望未來,共建“一帶一路”既面臨諸多問題和挑戰,更充滿前所未有的機遇和發展前景。這是一項事關多方的倡議,需要同心協力;這是一項事關未來的倡議,需要不懈努力;這是一項福澤人類的倡議,需要精心呵護。我們相信,隨著時間的推移和各方共同努力,共建“一帶一路”一定會走深走實,行穩致遠,成為和平之路、繁榮之路、開放之路、綠色之路、創新之路、文明之路、廉潔之路,推動經濟全球化朝著更加開放、包容、普惠、平衡、共贏的方向發展。

(一)和平之路

古絲綢之路,和時興,戰時衰。共建“一帶一路”離不開和平安寧的環境。共建“一帶一路”倡議主張建設相互尊重、公平正義、合作共贏的新型國際關係,打造對話不對抗、結伴不結盟的夥伴關係。各國應尊重彼此主權、尊嚴、領土完整,尊重彼此發展道路和社會制度,尊重彼此核心利益和重大關切。

和平安全是推進共建“一帶一路”的基本前提和保證。各國需樹立共同、綜合、合作、可持續的安全觀,營造共建共用的安全格局。要著力化解衝突,堅持政治解決;要著力斡旋調解,堅持公道正義;要著力推進反恐,標本兼治,消除貧困落後和社會不公。各國需摒棄冷戰思維、零和遊戲和強權政治,堅決反對恐怖主義、分裂主義、極端主義。在涉及國家主權、領土完整、安全穩定等重大核心利益問題上給予相互支持。堅持以對話解決爭端、以協商化解分歧,增進合作互信,減少相互猜疑。各國需深化在網路安全、打擊跨國犯罪、打擊販毒、打擊“三股勢力”、聯合執法、安全保衛等方面的合作,為區域經濟發展和人民安居樂業營造良好環境。

中國始終是維護地區和世界和平、促進共同發展的堅定力量。中國堅持走和平發展道路,堅定奉行獨立自主的和平外交政策,尊重各國人民自主選擇的發展道路和奉行的內外政策,決不干涉各國內政,不把自己的意志強加給對方,不把本國利益淩駕於他國利益之上。為保證共建“一帶一路”順利推進,中國願同沿線各國共同構建爭端解決機制,共建安全風險預警防控機制,共同制定應急處置工作機制。一旦發生糾紛,當事方能夠坐下來就相互利益關切溝通交流,對話而不是對抗,不但為共建“一帶一路”營造良好發展環境,而且共同推動建設各國彼此尊重核心利益、和平解決分歧的和諧世界。

(二)繁榮之路

發展是解決一切問題的總鑰匙,共建“一帶一路”聚焦發展這個根本性問題,釋放各國發展潛力,實現經濟融合、發展聯動、成果共用。共建“一帶一路”順應世界多極化、經濟全球化、文化多樣化、社會資訊化的潮流,致力於維護全球自由貿易體系和開放型世界經濟。

沿線國家市場規模和資源稟賦各有優勢,互補性強,潛力巨大,合作前景廣闊。各國需在充分照顧各方利益和關切基礎上,凝聚共識,將共識轉化為行動,按照戰略對接、規劃對接、平台對接、專案對接的工作思路,形成更多可視性成果,實現優勢互補,促進共同繁榮發展。

共建“一帶一路”將繼續把互聯互通作為重點,聚焦關鍵通道、關鍵節點、關鍵專案,著力推進公路、鐵路、港口、航空、航太、油氣管道、電力、網路通信等領域合作,與各國共同推動陸、海、天、網四位一體的互聯互通。中國願意與各國共建“一帶一路”空間資訊走廊。深化與沿線國家在經貿領域的互利共贏,擴大雙多邊投資貿易規模。深入開展產業合作,共同辦好經貿、產業合作園區。抓住新工業革命的發展新機遇,培育新動能、新業態,保持經濟增長活力。第二屆“一帶一路”國際合作高峰論壇期間,中國將與有關國家簽署一批產能與投資合作重點專案清單。建立穩定、可持續、風險可控的金融服務體系,創新投資和融資模式,推廣政府和社會資本合作,建設多元化融資體系和多層次資本市場,發展普惠金融,完善金融服務網路。

(三)開放之路

開放帶來進步,封閉導致落後。對一個國家而言,開放如同破繭成蝶,雖會經歷一時陣痛,但將換來新生。共建“一帶一路”以開放為導向,努力解決經濟增長和平衡發展問題。

共建“一帶一路”堅持普惠共贏,打造開放型合作平台,推動形成開放型世界經濟。共建“一帶一路”是和平發展、經濟合作倡議,不是搞地緣政治聯盟或軍事同盟;是開放包容、共同發展進程,不是要關起門來搞小圈子或者“中國俱樂部”;不以意識形態劃界,不搞零和遊戲。不管處於何種政治體制、地域環境、發展階段、文化背景,都可以加入“一帶一路”朋友圈,共商共建共用,實現合作共贏。

中國支援、維護和加強基於規則的、開放、透明、包容、非歧視的多邊貿易體制,促進貿易投資自由化便利化,與沿線國家共建高標準自由貿易區,推動經濟全球化健康發展。同時,共建“一帶一路”也著力解決發展失衡、治理困境、數字鴻溝、分配差距等問題,讓世界各國的發展機會更加均等,讓發展成果由各國人民共用。

在共建“一帶一路”過程中,中國開放的大門只會越開越大,中國願為世界各國帶來共同發展新機遇,與各國積極發展符合自身國情的開放型經濟,共同攜手向著構建人類命運共同體的目標不斷邁進。

(四)綠色之路

共建“一帶一路”倡議踐行綠色發展理念,宣導綠色、低碳、迴圈、可持續的生產生活方式,致力於加強生態環保合作,防範生態環境風險,增進沿線各國政府、企業和公眾的綠色共識及相互理解與支援,共同實現2030年可持續發展目標。

沿線各國需堅持環境友好,努力將生態文明和綠色發展理念全面融入經貿合作,形成生態環保與經貿合作相輔相成的良好綠色發展格局。各國需不斷開拓生產發展、生活富裕、生態良好的文明發展道路。開展節能減排合作,共同應對氣候變化。制定落實生態環保合作支援政策,加強生態系統保護和修復。探索發展綠色金融,將環境保護、生態治理有機融入現代金融體系。

中國願與沿線各國開展生態環境保護合作,將努力與更多國家簽署建設綠色絲綢之路的合作檔,擴大“一帶一路”綠色發展國際聯盟,建設“一帶一路”可持續城市聯盟。建設一批綠色產業合作示範基地、綠色技術交流與轉移基地、技術示範推廣基地、科技園區等國際綠色產業合作平台,打造“一帶一路”綠色供應鏈平台,開展國家公園建設合作交流,與沿線各國一道保護好我們共同擁有的家園。

(五)創新之路

創新是推動發展的重要力量。共建“一帶一路”需向創新要動力。5年多來,中國與沿線國家優化創新環境,集聚創新資源,加強科技創新合作,將繼續促進科技同產業、科技同金融深度融合。

21世紀以來,全球科技創新進入空前密集活躍時期,新一輪科技革命和產業變革正在重構全球創新版圖、重塑全球經濟結構。共建“一帶一路”為大部分處於工業化初中級階段的國家平等合理融入全球產業鏈和價值鏈提供了新契機。隨著各類要素資源在沿線國家之間的共用、流動和重新組合,各國可以利用各自比較優勢,著眼於技術前沿應用研究、高技術產品研發和轉化,不斷將創新驅動發展推向前進。共建“一帶一路”將成為沿線國家創新發展的新平台,成為沿線國家實現跨越式發展的驅動力,成為世界經濟發展的新動能。中國與沿線國家之間的聯動發展、合作應對挑戰,已經並還將使不同國家、不同階層、不同人群在開放型世界經濟發展中共用經濟全球化的成果。

數字經濟是繼農業經濟、工業經濟之後的主要經濟形態。當今世界正在經歷一場更大範圍、更深層次的科技革命和產業變革,現代資訊技術不斷取得突破,數位經濟蓬勃發展,各國利益更加緊密相連。共建“一帶一路”堅持創新驅動發展,與各方加強在人工智慧、納米技術、量子電腦等前沿領域合作,推動大資料、雲計算、智慧城市建設,連接成21世紀的數字絲綢之路。通過沿線國家青年科學家來華從事短期科研工作以及培訓沿線國家科技和管理人員等方式,形成多層次、多元化的科技人文交流機制。通過共建國家級聯合科研平台,深化長期穩定的科技創新合作機制,提升沿線國家的科技創新能力。構建“一帶一路”技術轉移協作網路,促進區域創新一體化發展。智慧財產權是創新驅動發展的基本保障,沿線國家應尊重智慧財產權,推動更加有效地保護和使用智慧財產權,構建高水準智慧財產權保護體系。

(六)文明之路

共建“一帶一路”推動文明交流超越文明隔閡、文明互鑒超越文明衝突、文明共存超越文明優越,使各國相互理解、相互尊重、相互信任。

古絲綢之路打開了各國各民族交往的視窗,書寫了人類文明進步的歷史篇章。共建“一帶一路”深厚的文明底蘊、包容的文化理念,為沿線國家相向而行、互學互鑒提供了平台,促進了不同國家、不同文化、不同歷史背景人群的深入交流,使人類超越民族、文化、制度、宗教,在新的高度上感應、融合、相通,共同推進構建人類命運共同體。共建“一帶一路”推動沿線國家在教育、科技、文化、衛生、體育、媒體、旅遊等領域開展廣泛合作,促進政黨、青年、社會組織、智庫、婦女、地方交流協同並進,初步形成了和而不同、多元一體的文明共榮發展態勢。

中國願與沿線國家和有關國際組織共同推動建立多層次人文合作機制,搭建更多合作平台,開闢更多合作管道。推動教育合作,擴大互派留學生規模,提升合作辦學水準。建設好“一帶一路”國際智庫合作委員會和“一帶一路”新聞合作聯盟。繼續開展歷史文化遺產保護、文物援外合作、聯合考古合作,推進博物館交流合作,聯合打造具有絲綢之路特色的旅遊產品。加強政黨、民間組織往來,密切婦女、青年等群體交流,促進包容發展。第二屆“一帶一路”國際合作高峰論壇期間,中國有關部門將與聯合國兒童基金會共同發起“關愛兒童、共用發展,促進可持續發展目標實現”合作倡議。中國社會組織將啟動“絲路一家親”行動,推動沿線各國社會組織共同開展民生領域合作。中國也將繼續向沿線發展中國家提供力所能及的支持和幫助。

(七)廉潔之路

廉潔是共建“一帶一路”的道德“底線”和法律“紅線”。沿線國家需協力打造廉潔高效的現代營商環境,加強對“一帶一路”建設專案的監督管理和風險防控,建立規範透明的公共資源交易流程。在專案招投標、施工建設、運營管理等過程中嚴格遵守相關法律法規,消除權力尋租空間,構建良性市場秩序。各國應加強反腐敗國際交流合作,以《聯合國反腐敗公約》等國際公約和相關雙邊條約為基礎開展司法執法合作,推進雙邊引渡條約、司法協助協定的簽訂與履行,構築更加緊密便捷的司法執法合作網路。各國需推動企業加強自律意識,構建合規管理體系,培育廉潔文化,防控廉潔風險,堅決抵制商業賄賂行為。政府、企業、國際社會三方需共同努力,採取有效措施,建立拒絕腐敗分子入境、腐敗資產返還等合作機制,通力協作斬斷腐敗鏈條、構築反腐敗防線。

中國願與各國一道完善反腐敗法治體系和機制建設,不斷改善營商環境,持續打擊商業賄賂行為。深化與沿線國家反腐敗法律法規對接,深化反腐敗務實合作。加強對“走出去”企業廉潔教育培訓,強化企業合規經營管理。中國願與沿線國家共同努力,把“一帶一路”建設成為廉潔之路。

世界潮流浩浩蕩蕩。共建“一帶一路”倡議順應歷史大潮,所體現的價值觀和發展觀符合全球構建人類命運共同體的內在要求,也符合沿線國家人民渴望共用發展機遇、創造美好生活的強烈願望和熱切期待。毋庸置疑,隨著時間的推移,共建“一帶一路”將進一步彰顯出強大的生命力和創造力。通過佈局開篇的“大寫意”和精耕細作的“工筆劃”,共建“一帶一路”將久久為功,向高品質高標準高水準發展,為建設一個持久和平的世界,建設一個普遍安全的世界,建設一個共同繁榮的世界,建設一個開放包容的世界,建設一個清潔美麗的世界,最終實現構建人類命運共同體的美好願景作出更大貢獻。

(注1)Suprabha Baniya, Nadia Rocha, Michele Ruta. Trade Effects of the New Silk Road: A Gravity Analysis. WORLD BANK Policy Research Working Paper 8694,January 2019.

(注2)Maggie Xiaoyang Chen, Chuanhao Lin. Foreign Investment across the Belt and Road Patterns, Determinants and Effects. WORLD BANK Policy Research Working Paper 8607, October 2018.

(注3)Fran ois de Soyres. The Growth and Welfare Effects of the Belt and Road Initiative on East Asia Pacific Countries. WORLD BANK GROUP, October 2018 Number 4.

Editor's picks

Trending articles

State visit by Chinese President proves catalyst for raft of mainland-funded Philippines' oil and gas initiatives.

Following Chinese President Xi Jinping's visit to the Philippines in late November last year, there are clear signs new vigour has been breathed into the country's oil and gas sector. In particular, this official visit seems to have acted as a catalyst for a number of Philippines-based projects backed by China within the wider framework of the Belt and Road Initiative (BRI), both within and beyond the energy sector.

Among the many investment memoranda signed during the visit was a Memorandum of Understanding (MoU) with regard to joint maritime oil and gas exploration by China and the Philippines. This key agreement is seen as providing a roadmap for both countries to ultimately work together with regard to the exploration and development of the South China Sea's oil and gas reserves via their respective representative companies – in China's case, the China National Offshore Oil Corporation (CNOOC). To date, its Philippine counterpart has yet to be appointed.

Prior to Xi's visit, the signing of the MoU seemed far from certain, primarily due to concerns over its impact on the dispute surrounding the South China Sea islands, over which both countries claim sovereignty. Despite such concerns, the Philippines government ultimately agreed the MoU, largely because it paves the way to a solution to the country's long-term liquefied natural gas (LNG) supply problem.

Just one gas field currently supplies the country – the Malampaya gas field in Palawan. This is expected to be approaching exhaustion within three years, leaving the country's gas-powered energy sector, set to the south of Luzon island, with a major supply shortfall.

One new gas-fired plant – in the Pagbilao, Quezon province – is, however, expected to come online within the next 12 months. Work on the project by the Australia-listed Energy World Corp has only recently resumed, following a six month-delay triggered by several funding concerns, which are now said to have been resolved. Once in operation, its ongoing demand for LNG will be met via an adjacent processing hub, which is also being constructed by Energy World.

In a further move, the Philippines government is also looking to construct an additional LNG hub near Batangas City in Southern Luzon, which will act as the key conduit for the offshore gas required to run the region's power-generation facilities. This project, too, now seems to be suddenly back on track.

The first sign that that project was to go ahead came at the beginning of December when First Gen Corp – a major local player in the Philippine power-generation sector – signed a joint development agreement with Japan's Tokyo Gas Company with regard to the construction of the Batangas LNG terminal. Under the terms of the agreement, Tokyo Gas will take a 20% participating interest in the LNG project and will continue to provide support throughout the various stages of its development.

A few weeks later, again in the wake of Xi's visit, the Philippines Department of Energy gave the go-ahead for a second LNG terminal to be built at Batangas. This time, the appointed lead developer is the Tanglawan Group, a joint venture between Davao-based tycoon Dennis Uy's Phoenix Petroleum Corp and CNOOC. Uy is rapidly becoming the go-to guy for BRI projects in the country. Just last month, the Mislatel Consortium, a joint venture between his Udenna Corp and China Telecommunications Corp, won the contract to become the Philippines' third national telecom company.

Marilyn Balcita, Special Correspondent, Manila

Editor's picks

Trending articles

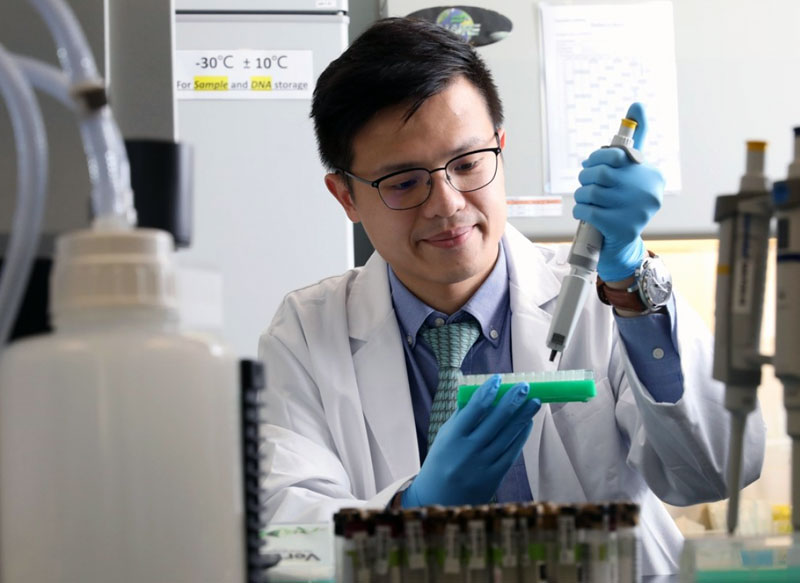

Hong Kong is set to become a significant hub for cooperation in R&D and advanced biomedical services in the Greater Bay Area and beyond. The Outline Development Plan for Guangdong-Hong Kong-Macao Greater Bay Area, promulgated in February 2019, looks to improve the environment for innovation in the region. It says that a plan will be drawn up to foster the research and development of clinical medicine, and facilitate the cross-boundary use of medical data and bio-samples (such as blood needed for R&D cooperation projects in higher education institutions, R&D institutes and laboratories in the Greater Bay Area).

Hong Kong will be in an excellent position to fill the gap between mainland China and overseas in the field of genetic and biomedical information. It can build major databases which will benefit biomedical firms and research institutes in Hong Kong, particularly in genetics-related research and medicine development. Coupled with the city’s strong protection of intellectual property rights and proprietary information, as well as the logistics support for the delivery of bio-samples, Hong Kong can become a bridgehead for biomedical companies looking to extend their research and services from the Greater Bay Area to the Belt and Road and other overseas markets.

The Bay Area is to Liberalise Controls

Currently mainland China maintains strict controls on the export and trading of human genetic data and bio-samples such as blood because of health and safety concerns. Under CEPA, Hong Kong investors enjoy national treatment when investing in the mainland’s human health services sector. However, they are expressly excluded from launching services on genetic information, blood collection, pathological data and other services that may endanger public health and safety.

These are major hurdles for Hong Kong businesses, as well as foreign investors based in the city, looking to conduct cross-boundary cooperation with their mainland counterparts in front-end biomedical research in areas like genetics-based therapy and medicine. The Greater Bay Area development plan is set to deal with obstacles like these, so players affected by them should watch developments closely to see how the governments of the Bay Area implement the liberalisation measures envisaged in the plan.

Liberalising controls will come as welcome news to biomedical firms and laboratories like Hong Kong-based Sanomics Limited, which has been advocating cross-boundary data sharing in order to strengthen technological cooperation in the Bay Area. In an interview with HKTDC Research, Sanomics’ CEO and Director Stanley Sy stressed the difference between the way traditional therapies work and new medical approaches. He pointed to the way treatments such as chemotherapy are applied in a one-size-fits-all method, based on the needs of the average cancer patient; and contrasted that to precision medicine, currently emerging as a new approach for treating cancer, which considers individual variations in the genes, environment, and lifestyle of each patient.

New Technology Facilitates Precision Medicine

This new approach is made possible by advances in genetic and genomic technologies with which medical practitioners can precisely detect different gene mutations that cause cancer. Through precision medicine, the analysis of different gene mutations can lead to targeted therapies for individual patients.

Sy used an example to explain how this worked, saying: “In the case of lung cancer, studies found that targeted therapy treatment for patients with mutation in the epidermal growth factor receptor (EGFR) gene was more effective than chemotherapy for the condition. Therefore, the relevant EGFR test is the key for assessing which targeted therapy, such as tyrosine kinase inhibitor (TKI), would be effective for certain lung cancer patients.”

Sanomics carries out genomic diagnostics for patients in Hong Kong, Asia and other regions all over the world. The company is looking to develop its in-house expertise and deploy the latest genetic and genomic technologies to serve its clinical and pharmaceutical clients worldwide. As well as tissue-based profiling tests for assessing patients diagnosed with various types of cancer, Sanomics has successfully developed proprietary liquid biopsy tests to trace the cancer’s cell-free DNA in the blood. This allows tests to be carried out with a simple blood sample rather than via expensive and invasive surgical biopsies. These liquid biopsies can assess the gene mutation with a high degree of accuracy, and in turn help medical practitioners rapidly formulate targeted treatment and prescribe precision medicine for their patients.

Potentials along Belt and Road Routes

Since its inception as a technological start-up in the Hong Kong Science Park in 2015, Sanomics has expanded its biomedical team from a few founding experts to more than 30 personnel. It opened another office and laboratory in Bangkok in January 2019 under Board of Investment (BOI) company registration, both to help serve the Thailand market and also to reach out more effectively to clients from other Belt and Road regions.

Explaining the reasoning behind his company’s attraction to the Belt and Road markets, Sy said: “Certain cancers like lung cancer and nasopharyngeal cancer are more common in Asia, which has a similar demand for genomic tests to Hong Kong and south China. Enhanced marketing along the Belt and Road routes would certainly help Sanomics expand its services to Asian clients and beyond with scale of economy advantages. To date, Sanomics has handled more than 7,000 patient cases across 20 countries and regions, and has worked with over 830 health care professionals and more than 260 clinics and hospitals worldwide.”

Hong Kong Provides Quality Professional Service Supports

Hong Kong’s capacity to expand as a biomedical services hub rests not just on the strength of its companies, but also on its worldwide appeal as a platform for technological cooperation. The city’s sound legal system and protection of intellectual property rights and other proprietary information enjoy an excellent reputation internationally, which encourages the sharing of biomedical data and other proprietary information by biomedical players from Hong Kong, mainland China and elsewhere. With the Greater Bay Area set to relax regulatory biomedical requirements, Hong Kong is likely to see an even greater level of cross-boundary technological cooperation among biomedical players.

Pointing to the quality of Hong Kong’s professional talent as a factor in the growth of the city’s biomedical sector, Sy said: “In addition to outstanding R&D capabilities and leading expertise, biomedical players here also greatly benefit from the city’s wide array of professional services.” He also highlighted its comprehensive logistics network, which he reckoned gave the city an edge in the field of biomedical research. Quality cold-chain services for delivering bio-samples from clients to laboratories, and effective customs clearance arrangements in accordance with the health and export control requirements of countries and customs territories, are a must for biomedical companies looking to serve clients around the world. As Hong Kong is an international transportation hub with quality cold-chain logistics services, this is another factor which should help the city capitalise on the Greater Bay Area advantages and link it to the Belt and Road’s biomedical services market.

[Remark: For more information, please refer to HKTDC research article: Hong Kong Leading the Way in Greater Bay Area Biomedical Services Cooperation]

Editor's picks

Trending articles

By CGCC Vision

The “Belt and Road Initiative” (B&R), China’s diplomatic strategy that stresses on economic benefits, has generally received support from countries in the area, but in the international arena, the Indo-Pacific Strategy (IPS) linking Japan, the US, Australia and India is regarded as a regional cooperation alliance that rivals the B&R. The subtle relationship between the B&R and IPS is characterised by both competition and coexistence, which will add more uncertainties to the global political and economic situations.

Simon Shen: Balancing diplomacy seeks cooperation amid competition

The IPS stemmed from a joint statement issued by India and Japan in 2016, when the leaders of the two countries proposed to improve the “connectivity between Asia and Africa” through a “free and open IndoPacific”. Simon Shen, co-director of the International affairs Research Institute at the chinese University of Hong Kong, said that the IPS, which was discussed in more detail in Japan’s Diplomatic Bluebook 2017, points to a prosperous society consisting of two continents (Asia and Africa) and the two oceans (Pacific Ocean and Indian Ocean). Japan will expand infrastructure, trade and investment for Asian countries; it will support national construction for African countries, and commit to promoting good governance with the aim of achieving “confluence of the two seas” and connectivity between Asia and Africa through humanity support, peacekeeping, etc.

According to Shen, Australia began to position regional strategic interests in the Indo-Pacific region in its 2013 National Defence White Paper, where it mentioned the need to strengthen economic and security relations with India; and India, with its foreign policy influenced by pragmatism, advocates stepping up new military cooperation with its allies and actively participates in global governance. Since 2011, India has been strengthening relations with the US and Australia through the Indo-Pacific region. The most frequently used new phrase by US President Trump in his foreign policy is precisely “Indo-Pacific”. He has repeatedly stressed the freedom of navigation in the Pacific Ocean, which is in line with the right to freedom of navigation in the Indian and Pacific Oceans espoused by the IPS. The US’s emphasis on the IPS is self-evident.

IPS does not impede cooperation among countries

Shen admitted that the US, Japan, Australia and India indeed have common strategic goals and economic complementarities: “Japan’s advanced production technology and India’s population market can be structurally integrated, while the US and Australia can mutually benefit each other through trade. Moreover, none of the four countries want China to be the only dominant force in the region, so they have a common strategic goal.” Shen added that the current IPS roadmap is relatively clear, i.e. to use the ASEAN countries as a centre and buffer zone in the Indo-Pacific region to offset or at least balance out China’s influence on ASEAN.

However, Shen believes while it is relatively easy for these countries to strengthen economic cooperation through the IPS, it is quite difficult for them to use it to form a substantive military alliance. He pointed out that although China regards the IPS as a new containment effort of the US, it is not possible for all the countries involved in the strategy to become a single entity: “After the IPS is put in place, China can still cooperate with individual countries on different issues. India, Japan and Australia are not willing to undermine relations with China on the economic front, and China also wants to rope in these three countries in response to the trade war with the US.” Shen pointed out that India’s decision not to participate in Indo-Pacific military cooperation also shows that China’s efforts to win over India is beginning to bear fruit.

Balancing diplomacy seeks cooperation amid competition

Shen expected that the IPS and B&R will not turn the global situation into a binary opposition similar to that during the old Cold War era, because countries, especially

India, want to pursue a balancingdiplomacy strategy. (Note: “Balancing diplomacy” means that the country refuses to join any camp, but it is not passively being “non-aligned” or “neutral”. Instead, it adopts a series of policies that contradict and influence each other in objectives and that offset each other, always keeping “a way out” for itself in terms of policy and stance in order to maintain its own vague position.) “The Middle East and East Africa within the Indo-Pacific region will welcome options other than the B&R; Russia with its own geostrategic Eurasian Union should be pleased to see an Indo-Pacific that is more south-focused than Asia Pacific; and the EU is mulling over a ‘connectivity strategy' to link up with Asia, which can be seen as echoing the IPS.”

Who will be the biggest beneficiary in the rivalry between the IPS and B&R? Shen expected the ASEAN countries, which are set to be the centre of India-Pacific and outpost of the “Belt and Road”, will be offered more projects. In addition, they have always been adopting hedge diplomacy between the major powers; thus, they are expected to be the biggest beneficiary.

Looking ahead at the future development of the global situation, Shen believes there is no absolute exclusivity in such grand strategies as the IPS and B&R. “Just like the relationship between the B&R and Russia’s Eurasian Union where cooperation and competition co-exist, the B&R and IPS can also compete and cooperate with each other concurrently, which all the countries in the region will be happy to see.”

George leung: B&R is a chorus involving and benefiting countries across the world

After taking office, US President Trump actively canvassed support from India, Japan and Australia for the Indo-Pacific Strategy (IPS). Recently, US Secretary of State Pompeo unveiled a USD113 million “Indo-Pacific Economic Vision” investment plan, which seems intended to compete with China’s B&R. However, the IPS still lacks a blueprint to take it forward, so inevitably, it sounds more like a slogan.

In contrast, the B&R, an initiative that covers the Asia, Europe and Africa continents, has entered its fifth year. Although there have been some controversial issues during its launch, the initiative has always received wide support from countries along the “Belt and Road”, enabling it to gradually move from vision to fruition. HSBc asia Pacific adviser george leung believes the China-initiated B&R is fundamentally an international economic cooperation platform for multilateral participation, and Southeast Asian countries stand to benefit the most from it.

Funding from china is essential in the early stages

Leung said that infrastructure is the core and priority area of the B&R. A number of infrastructure development demonstration projects were launched over the past five years. The Mombasa–Nairobi Standard Gauge Railway was completed and opened to traffic; the Addis Ababa–Djibouti Railway commenced operation; the second phase of the Hambantota Port development project was completed; Pakistan’s Gwadar Port resumed operations; and the SinoThai railway, the Hungary-Serbia railway and the China-Russia highway bridge in Heihe began construction. The huge capital needed for these cross-border infrastructure projects triggers concern that B&R projects may lead to greater debt burden on many debt-ridden Southeast Asian countries and may even cause a crisis there.

Indeed, the B&R involves mostly developing countries. Leung pointed out that as these countries have weak infrastructure and their financial systems are also not well developed, investment risks are high and there are rarely any financial institutions that can provide sufficient funding support alone. However, the Asia Development Bank projects that the Asian region needs as much as USD26 trillion for infrastructure projects in 2016-2030. Hence, in the early stages of the B&R, the Chinese government has been the main funder for project implementation. In addition, the Chinaled Asian Infrastructure Investment Bank has approved more than USD5.3 billion in project investments and earmarked USD41 billion for the New Development Bank. China will also contribute an additional RMB100 billion to the Silk Road Fund. China's investments are evident.

Attract international capital to grow bigger

As the BRI enters the intensive stage, Leung stressed that it is important to have more international cooperation and private capital participation. In particular, commercial banks can serve as major fund providers to offer loans at an early stage; investment banks can broaden direct financing channels to provide diversified financial intermediation services; pension funds and insurance companies can provide long-term funding through capital markets and asset management; and private capital can participate via publicprivate partnerships. At the same time, some funds can attract international capital participation through the issuance of green bonds, infrastructure securitisation and RMB-denominated products in Hong Kong.

Meanwhile, Southeast Asian countries have gradually become global manufacturing bases. Leung believes by improving their infrastructure and bringing their products closer to the Asian consumer markets, especially China’s large consumer base of 1.4 billion people, they are creating a truly win-win situation. He is convinced that given the current anti-economic globalisation sentiment and rising trade protectionism, the B&R’s importance is more prominent as it not only focuses on construction and interconnection of infrastructure, but also guides investment to the real economy. The B&R is not China’s solo show, but rather a chorus involving and benefiting countries around the world.

This article was first published in the magazine CGCC Vision. Please click to read the full article (P. 7-12).