Hong Kong: Mainland Enterprises’ Preferred Platform for “Going Out” (2024 YRD Survey Results)

Hong Kong is mainland China’s bridgehead for foreign economic co‑operation. (shutterstock.com)

The Third Plenary Session of the CPC Central Committee highlighted efforts to optimise the co‑ordination for opening up on regional basis and improve the mechanisms for high‑quality co‑operation under the Belt and Road Initiative (BRI). The government will also continue to encourage domestic enterprises to “go global”. In Hong Kong, the Chief Executive’s 2024 Policy Address called for further efforts to attract mainland enterprises to set up international or regional headquarters in the city and assist them in “going out” through Hong Kong’s platforms. In fact, Hong Kong has always been mainland China’s bridgehead for foreign economic co‑operation as well as mainland enterprises’ preferred platform for “going global”.

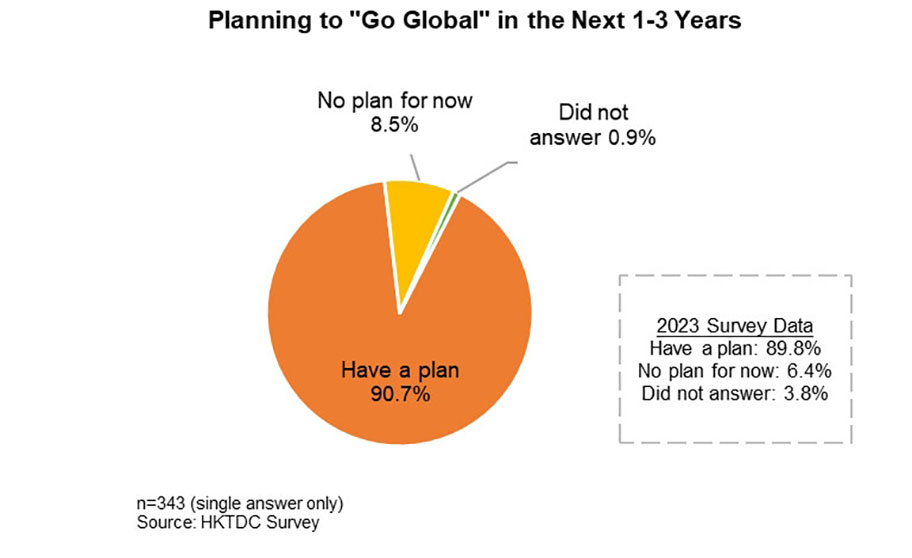

Following a similar study in 2023, HKTDC Research conducted a new questionnaire survey in the Yangtze River Delta (YRD) in August 2024 to understand the operational challenges facing mainland enterprises in the current fast‑changing economic environment, their direction for “going out” and the services support they need. The survey shows that 90.7% of respondents planned to “go global” to expand international business in the next one‑to‑three years, reflecting the direction most enterprises are still actively taking to explore international business opportunities despite numerous challenges. Moreover:

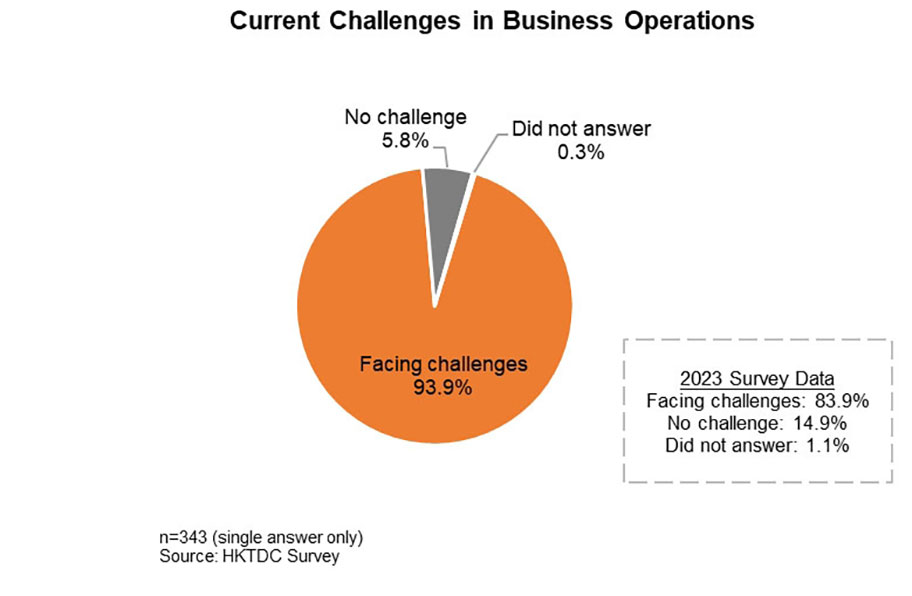

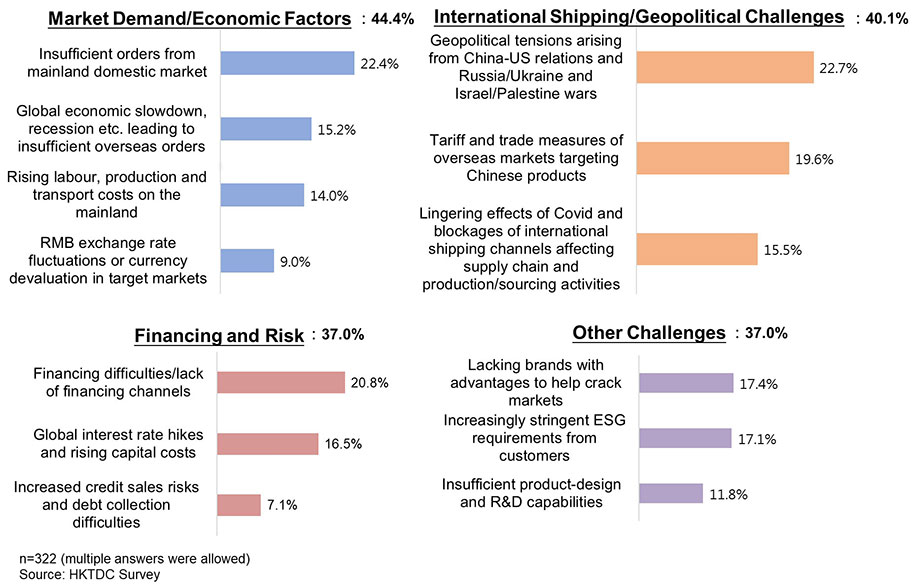

- 93.9% of respondents said they are facing challenges in market demand, shipping/geopolitics and financing. Compared with the survey findings of 83.9% in 2023, mainland enterprises are obviously encountering more difficulties now.

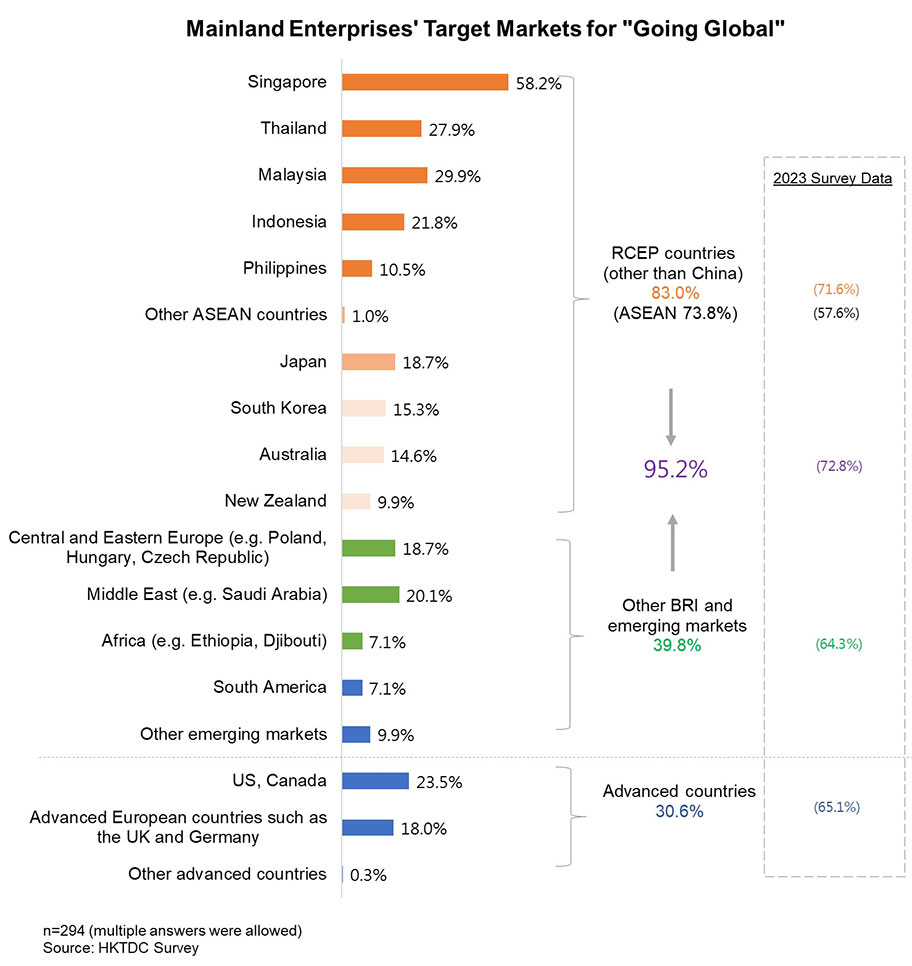

- As many as 95.2% of “go global” mainland enterprises focus on the BRI, the Regional Comprehensive Economic Partnership (RCEP) and other emerging markets, substantially more than the 2023 survey finding of 72.8%. Among them, 83.0% intended to explore business opportunities in RCEP countries.

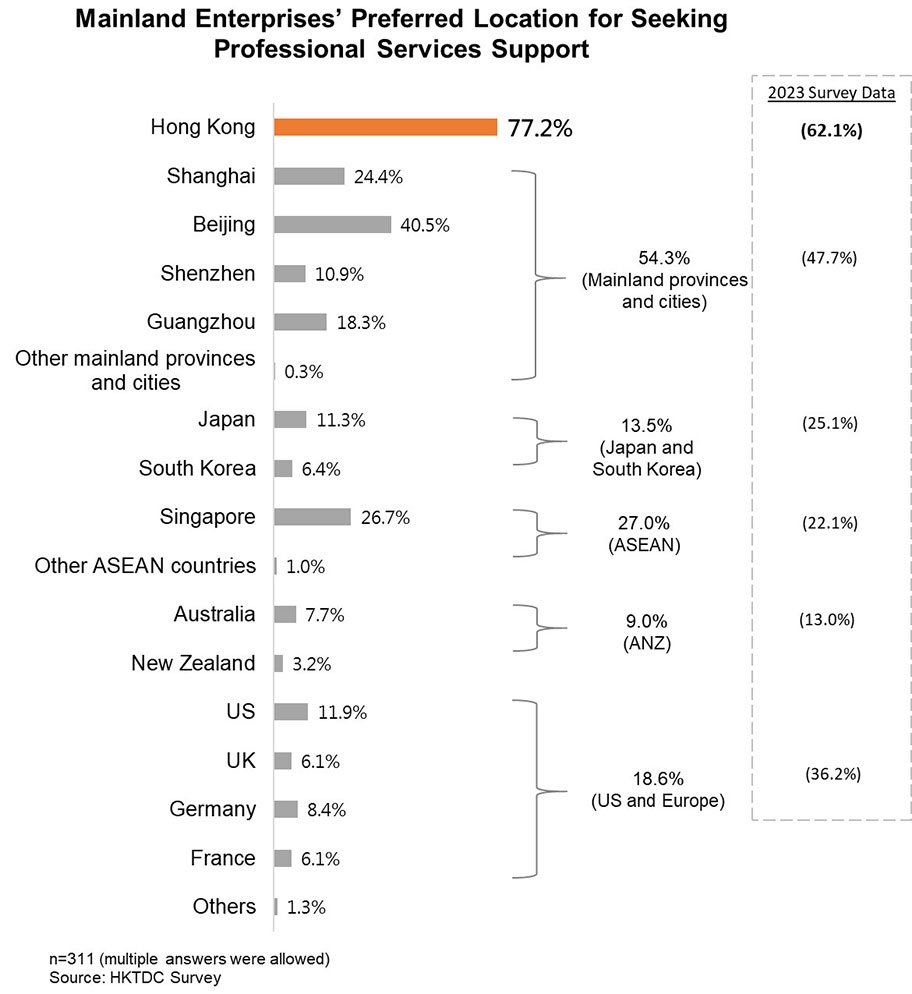

- 77.2% said they would go to Hong Kong to find the services support they need for international business, including marketing/product design/e-commerce, financing and risk management, and professional services, suggesting that the city is mainland enterprises’ preferred platform for “going out”.

Actively “Going Out” for Investment and Development

The Third Plenary Session of the 20th Central Committee of the Communist Party of China (Third Plenum) held from 15‑18 July 2024 called for efforts to steadily expand institutional opening‑up, deepen foreign trade structural reform and regulatory regime reform for foreign investment and outward investment, and optimise the co‑ordination for opening up on regional basis, including improving the mechanisms for high‑quality co‑operation under the Belt and Road Initiative. [1] On the one hand, the new edition of the negative list for foreign investment access recently issued by the central government [2], which completely removes all restrictions on such investment access in the manufacturing sector, is further attracting foreign investment into China. On the other hand, the central government also continues to support mainland enterprises in “going global” to co‑operate with overseas partners in arranging international business and expanding overseas markets.

The 14th Five-Year Plan [3] specifically supports efforts of Hong Kong and Macao to better integrate into the overall development of the country and supports their participation in, and contribution to, the country’s comprehensive opening‑up and development of a modern economic system as well as fostering the two cities as functional platforms for the BRI. As an effective services platform for international trade and business, Hong Kong is a “super connector” and “super value‑adder” between mainland enterprises and the rest of the world and is assisting these enterprises in “going out” to explore new markets and opportunities, including the BRI and other emerging markets. In the Policy Address delivered on 16 October 2024, the Chief Executive of the HKSAR also proposed to step up efforts to attract mainland enterprises to set up international or regional headquarters in Hong Kong, providing one‑stop, diversified professional advisory services for mainland enterprises in the city looking to “go global”.

In fact, companies around the world are taking a fresh look at their international expansion strategies and many hope to resume their pace of foreign investment to further boost their businesses. According to the 2024 annual report released by the United Nations Conference on Trade and Development (UNCTAD) [4], although global foreign direct investment (FDI) decreased by 2% to US$1.3 trillion in 2023, the decline was substantially smaller than the 12% in 2022, suggesting global businesses are actively exploring strategies to resume foreign investment.

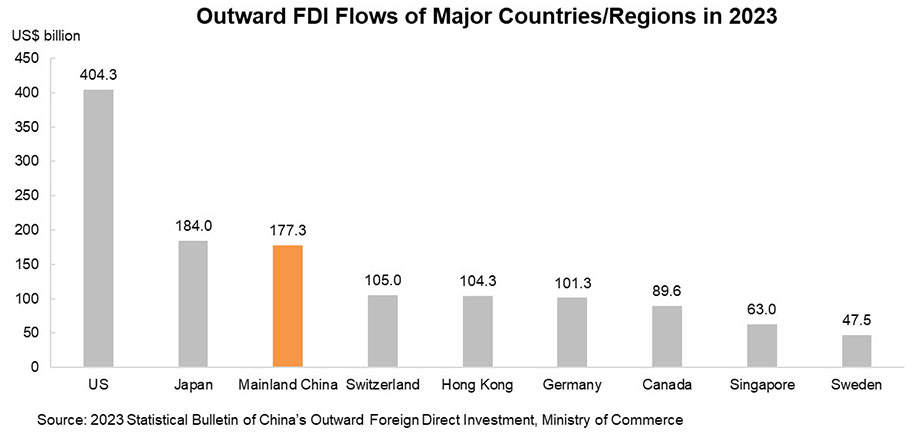

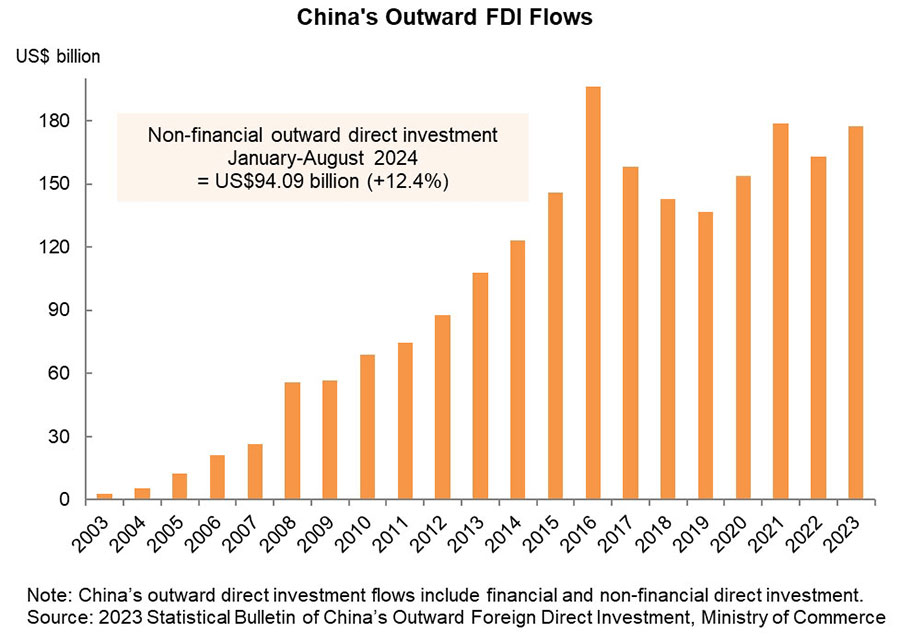

Meanwhile, the statistical bulletin released by the Ministry of Commerce in September 2024 [5] showed that mainland China’s outward direct investment flow reached US$177.29 billion in 2023, an increase of 8.7% on the previous year, ranking third in the world after the US (US$404.32 billion) and Japan (US$184.02 billion) and maintaining a top three position for 12 consecutive years. These figures suggest that mainland enterprises are “going out” to reconstruct their international business development pattern after the pandemic.

According to the Ministry of Commerce [6], from January to August 2024, China’s non‑financial outward direct investment reached US$94.09 billion, up 12.4% year on year. Of this, the non‑financial direct investment in BRI countries totalled US$20.51 billion, up 2.2% year on year.

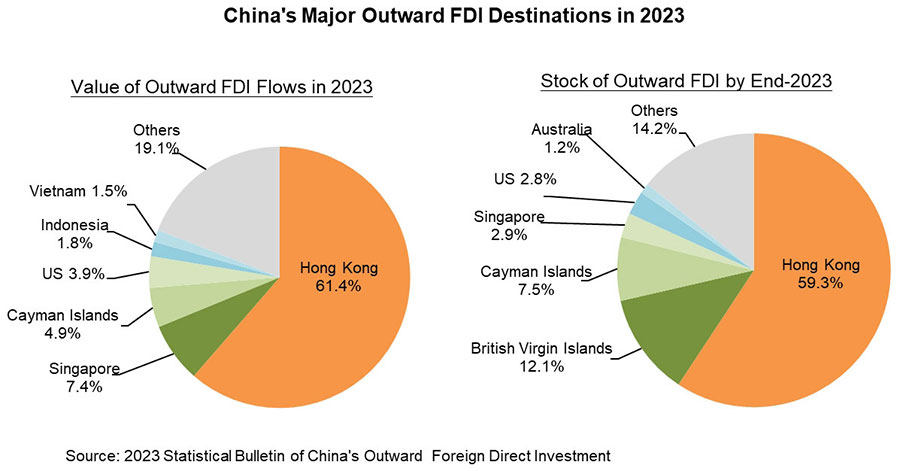

It is worth noting that Hong Kong is the primary destination of mainland enterprises’ outward direct investment. In 2023, mainland China’s FDI outflow to Hong Kong reached US$108.77 billion, up 11.5%, accounting for 61.4% of mainland China’s total FDI outflow. Based on the cumulative FDI outflow at the end of 2023, China’s FDI stock in Hong Kong amounted to US$1,752.5 billion, up 10.3% year on year, accounting for 59.3% of China’s total outward FDI stock.

In 2023, mainland enterprises’ FDI in BRI countries reached US$40.71 billion (up 31.5% year on year), accounting for 23.0% of China’s FDI outflows. Their investment in the 10 ASEAN countries reached US$25.12 billion (up 34.7% year on year), accounting for 14.2% of China’s FDI outflows. These figures suggested that mainland enterprises are attaching greater importance to BRI countries, including ASEAN partners, when looking to “go global”, not just developed countries.

Although Hong Kong is mainland China’s largest destination of outward direct investment, the majority of companies concerned are mainly using Hong Kong’s platform and services, including legal, advisory, accounting and other diversified professional services to aid their overseas expansion. In addition to a strategic location and matured market environment, the free flow of capital in Hong Kong also facilitates foreign exchange and cross‑border fund movements. This further attracts mainland companies to establish a presence in Hong Kong to handle their business within the city and in overseas markets. As a functional platform, Hong Kong can assist mainland companies in formulating a more comprehensive strategy for their global business development to tap into the vast opportunities in BRI countries and other overseas markets.

YRD Companies Going Out: 2024 Survey Results

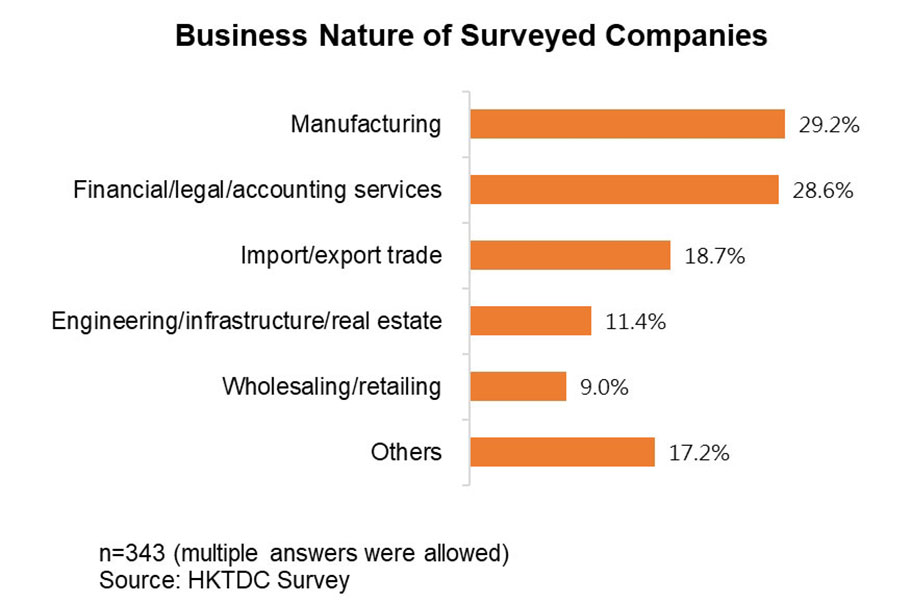

HKTDC Research conducted a questionnaire survey in Nanjing in August 2024 to gauge the “go global” intentions of companies in the YRD [7]. The survey received 457 responses. Deducting those from government departments, chambers of commerce and non‑mainland companies, 343 were valid responses completed by mainland companies mainly operating in the YRD. This was a new survey since the questionnaire conducted by HKTDC Research on the mainland, primarily in the Greater Bay Area, in mid‑2023 [8]. The 2024 survey results are as follows:

- Facing more business challenges

- 93.9% of the surveyed companies said they are facing all kinds of challenges, mainly problems arising from market demand/economic factors (44.4%), international shipping/geopolitical challenges (40.1%) and financing and risks (37.0%). Compared with the survey findings of 83.9% in 2023, mainland enterprises are obviously facing more challenges now.

- Continuing to “go out” to explore opportunities

- Similar to the survey last year, 90.7% of respondents said they planned to “go global” to expand international business in the next 1-3 years, reflecting that as new opportunities for foreign economic co-operation and new markets arise, many mainland companies are re-examining their development strategies, actively planning their international business development and continuing to “go global” for overseas market investments.

- Attaching greater importance to the development of overseas markets

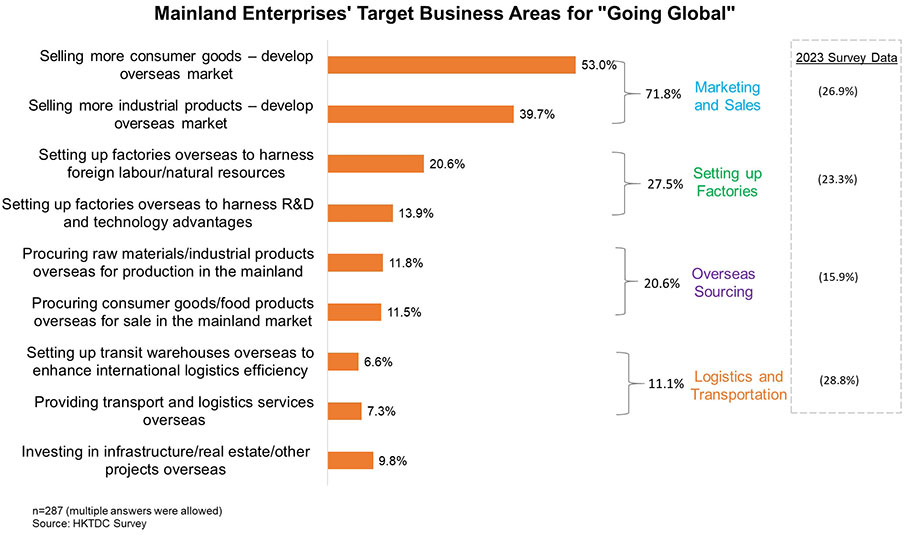

- Among those mainland companies that planned to expand overseas business, 71.8% chose to focus on marketing and sales, almost three times higher than that of other strategies (just 26.9% chose marketing and sales in 2023), suggesting they are attaching greater importance to the development of overseas markets. Other areas of focus include setting up factories (27.5%), overseas sourcing (20.6%) and logistics and transportation (11.1%).

- Actively exploring BRI-related opportunities

- When asked about their target markets for “going global”, as many as 95.2% of respondents said they will focus on tapping business opportunities in BRI, RCEP and other emerging markets (just 72.8% in 2023). In particular, 83.0% said they intend to go to RCEP countries, while close to 40% hope to develop overseas business in other BRI and emerging markets, and just 30.6% aim to go to advanced countries (as many as 65.1% in 2023). This shows that mainland companies are now focusing more on BRI- and RCEP-related opportunities.

- Hong Kong: Mainland enterprises’ preferred platform for “going out”

- Surveyed mainland enterprises with plans to “go global” said Hong Kong is mainland enterprises’ preferred services platform for expanding overseas. Some 77.2% of them see the city as their preferred services platform for developing various types of businesses overseas as opposed to 62.1% in 2023. Although this survey mainly focused on YRD enterprises, which are geographically quite a distance from Hong Kong, the survey findings show that they also hope to choose Hong Kong’s services to help them tap business opportunities worldwide.

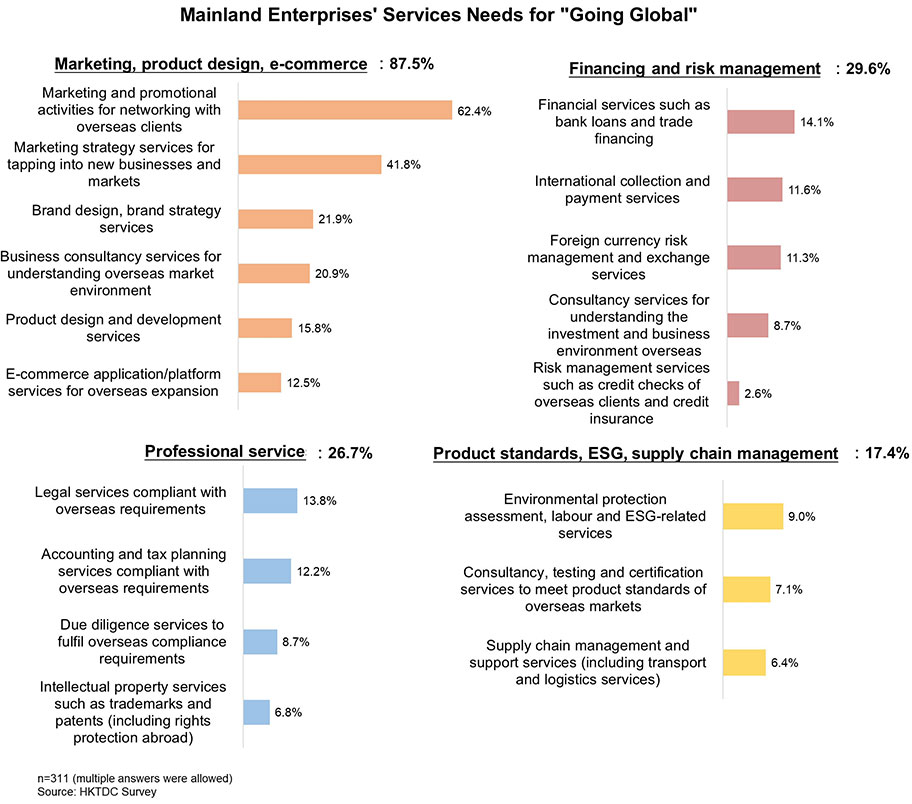

- Needing diversified services support

- Mainland enterprises need a wide range of professional services to develop international business. As many as 87.5% of surveyed enterprises said they are seeking services on marketing, product design and e-commerce. The reason is that most “go global” enterprises mainly focus on marketing and sales (see previous paragraphs for details). Other services needs include financing and risk management (29.6%), professional services (26.7%) and product standards, ESG and supply chain management (17.4%).

[For more details on the results of the 2023 survey, please refer to Hong Kong: The Premier Platform for Mainland Companies to Expand into the BRI and RCEP Markets]

Appendix:

[1] Source: “Communique of the Third Plenary Session of the 20th CPC Central Committee”

[2] For more details, please refer to: 2024 Negative List for Foreign Investment Access to Take Effect in November

[3] Source: “Outline of the 14th Five‑Year Plan for National Economic and Social Development and Long‑Range Objectives Through the Year 2035”

[4] Source: “2024 World Investment Report” of the United Nations Conference on Trade and Development (UNCTAD)

[5] Source: “Statistical Bulletin of China’s Outward Foreign Direct Investment 2023” of the Ministry of Commerce

[6] Source: Ministry of Commerce

[7] The HKTDC Research questionnaire survey was conducted on the sidelines of the SmartHK Suzhou‑Hong Kong High‑Quality Development Co‑operation Conference held by the HKTDC in Nanjing in August 2024.

[8] HKTDC Research conducted a questionnaire survey in the Greater Bay Area and the Yangtze River Delta region in 2023 to learn about mainland enterprises’ “go global” strategies. For more details, please refer to: Hong Kong: The Premier Platform for Mainland Companies to Expand into the BRI and RCEP Markets

Original article published in https://research.hktdc.com