Chinese Mainland E-Commerce Retail Market: Market Positioning of Hong Kong Fashion Products

(Consumer Survey Results)

Key findings:

- The Chinese mainland has a huge e-commerce retail market, and the government has adopted numerous measures to facilitate cross-border e-commerce imports, allowing many fashion products to benefit from preferential import tax and customs clearance advantages. This provides e-commerce businesses with numerous market development opportunities.

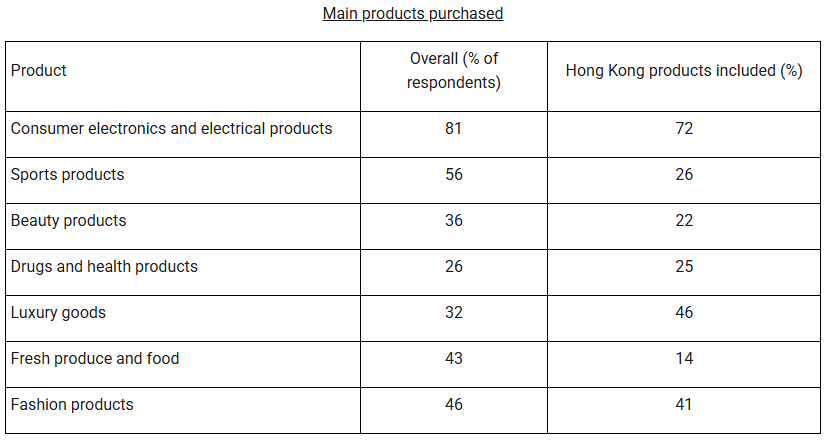

- Fashion products are the third most popular product category shopped online, with 46% of respondents saying that they have bought them. Additionally, 41% bought Hong Kong fashion products online. Consumers aged 30-49 are the most frequent online shoppers of these products. There are more females than males buying them.

- Consumers said that brand image and word of mouth (49%) is the most important consideration when purchasing fashion products online. Those who have bought Hong Kong fashion products value brand image and word of mouth even higher (61%). Younger consumers have considerations fairly similar to the overall age trend. Both males and females give top consideration to brand image and word of mouth. Considerations in different regions are by no means identical.

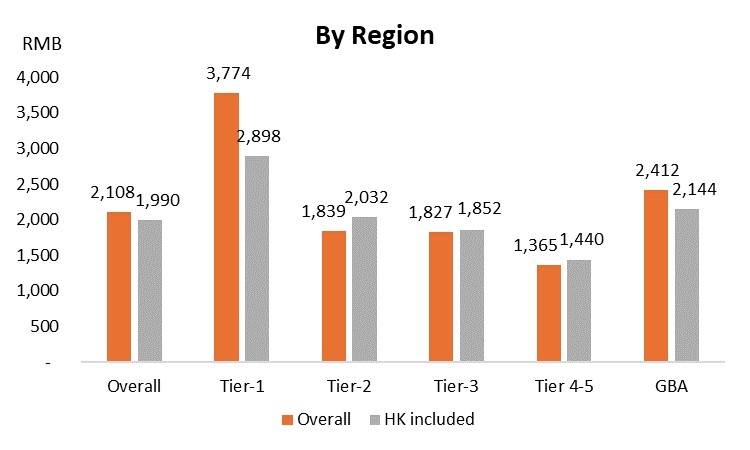

- The average order value (AOV) for the online purchase of fashion products is highest for tier-one city consumers (RMB3,774), followed by consumers in mainland GBA cities (RMB2,412). In buying Hong Kong fashion products, the AOV in tier-two cities, tier-three cities and tiers four and five cities is even higher, reaching respectively RMB2,032, RMB1,852 and RMB1,440.

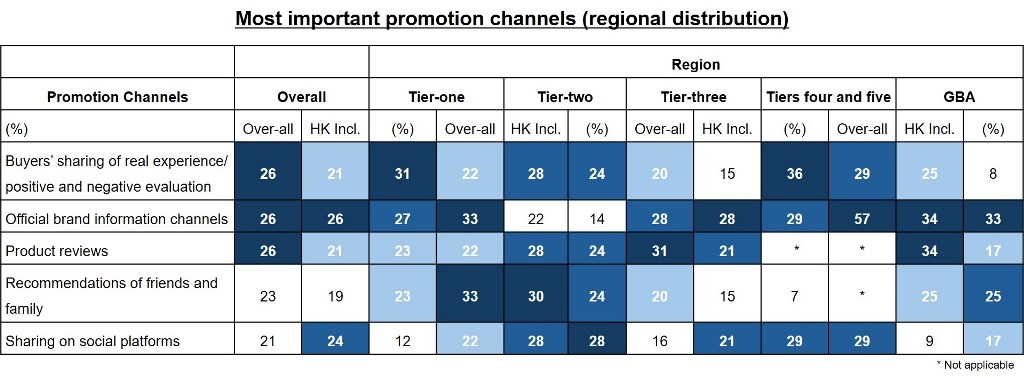

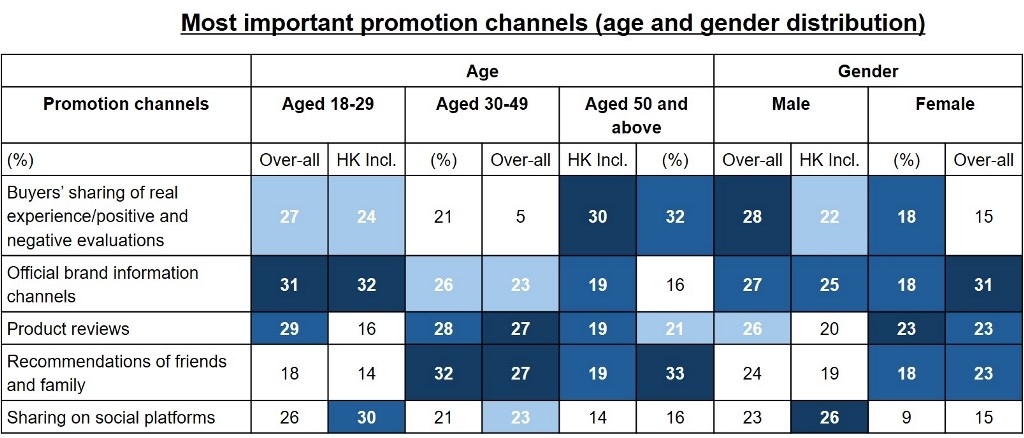

- Consumers mainly obtain product information from buyers’ sharing of real experience, official brand channels and product reviews. Consumers across regions have differences in the channels they value most. Younger consumers value official brand channels most. Female consumers put product reviews first while male consumers consider buyers’ sharing of real experience as most important.

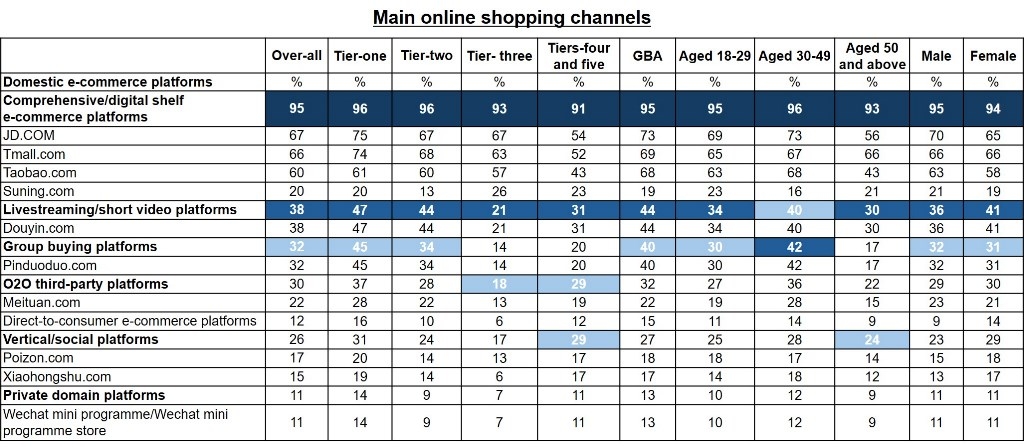

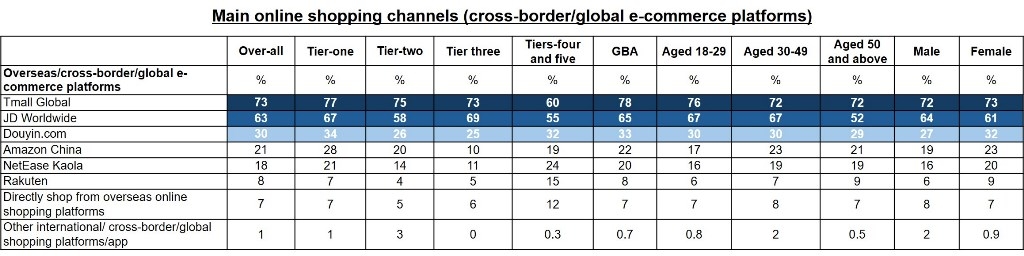

- Mainland consumers mainly use comprehensive/shelf-based e-commerce platforms as their shopping channel, with over 90% of the respondents (accounting for 95% of the total) using these platforms for online shopping. When shopping for cross-border or imported products online, consumers generally prefer using Tmall Globaland JD Worldwide, with 73% and 63% of respondents using these two platforms to buy overseas/cross-border/globally sourced products online.

In 2024, HKTDC Research commissioned a market survey agency to conduct a questionnaire survey of 2,200 middle-income class or above consumers from different mainland cities. The aim was to understand their online consumption habits and their preferences regarding Hong Kong products. For details, please refer toHong Kong Businesses Navigating Chinese Mainland E-commerce Retail Market – Consumer Survey Results. |

Mainland leads global e-commerce retail

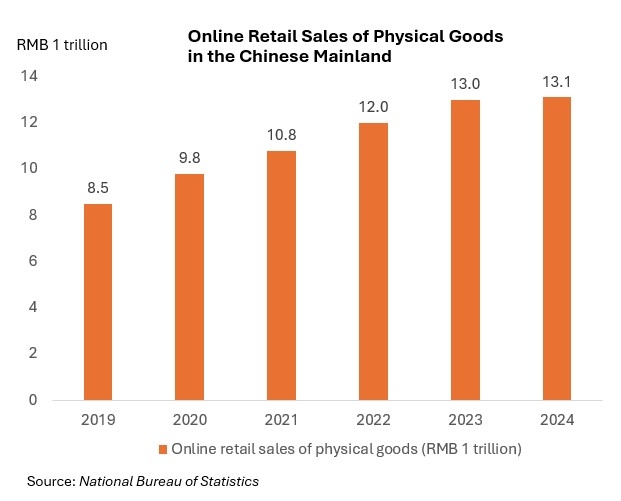

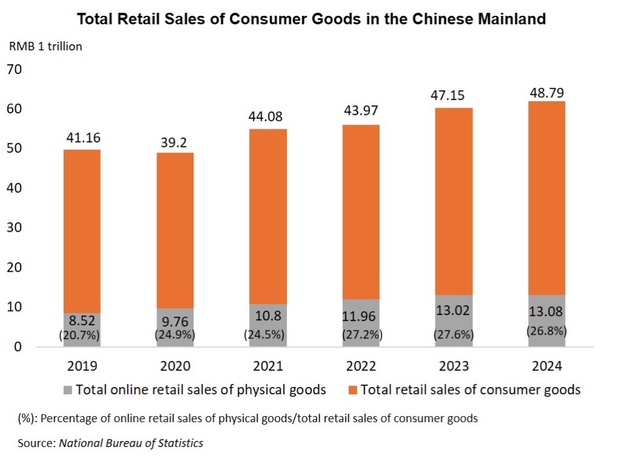

The Chinese mainland e‑commerce retail market is leading globally and is huge in size. National Bureau of Statistics figures show that the mainland’s online retail sales of physical goods surged by approximately 54.1% from RMB8.5 trillion in 2019 to RMB13.1 trillion in 2024. This accounted for 26.8% of total retail sales of all consumer goods and is an important factor for the current sustained growth of the mainland consumer market. Furthermore, according to a report jointly published late last year by the HKTDC and the Hong Kong Export Credit Insurance Corporation [1], Hong Kong companies interviewed generally believe that the Chinese mainland e‑commerce market will hold the greatest growth potential in the coming two years.

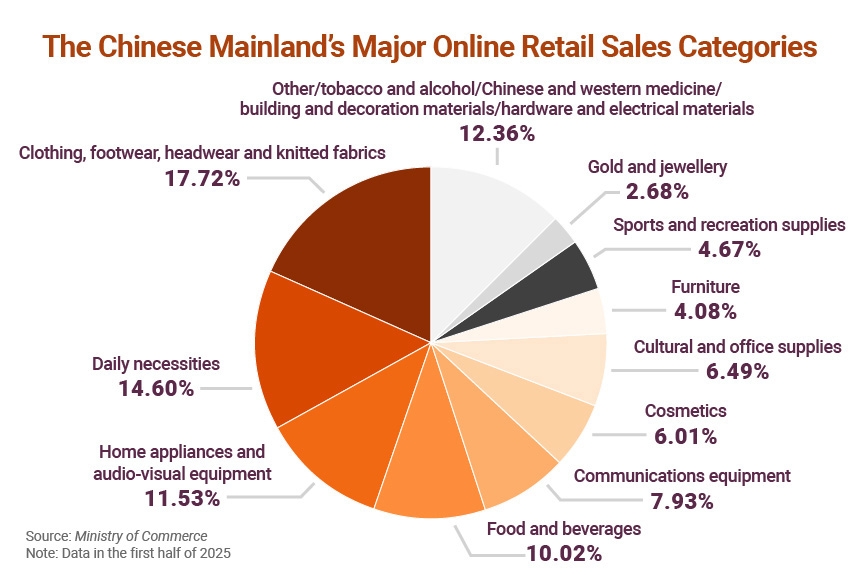

The booming of the mainland online retail market is reflected not only in the growth in total sales but also in the diversification of product categories. Data from the Ministry of Commerce reveals that, by the first half of 2025, consumers were already very accustomed to buying various consumer goods through online channels. In the online retail sales of physical goods, clothing, footwear, headwear and knitted fabrics (17.72%) constituted the largest product category.

Legal and regulatory requirements

The mainland government has introduced a number of laws and regulations targeting the e‑commerce industry to ensure its healthy development. In particular, since 1 January 2019, the E-commerce Law of the People’s Republic of China has been in force on the mainland to regulate e‑commerce activities and maintain market order. In addition, fashion product companies must pay attention to and comply with various legal and regulatory requirements related to the e‑commerce industry, including:

- Refunds and returns: According to the Law of the People’s Republic of China on the Protection of Consumer Rights and Interests, consumers making online purchases have the right to return goods within seven days without giving a reason.

- Personal information handling: The Measures for the Supervision and Administration of Online Trading [2] stipulate that online trading businesses that collect and use the personal information of consumers must adhere to the principles of legality, rationality and necessity; state explicitly the purposes, methods and scope of collection or use of information; and obtain the consent of consumers.

- Dos and don’ts in marketing:The Code of Conduct for Online Presenters [3] mandates that online presenters should guide users to interact civilly, express themselves rationally, spend reasonably, and must not hype “hot” social topics and sensitive issues, or intentionally create “hot issues” in public opinion.

- Anti-unfair competition practices: The newly revised Anti-unfair Competition Law of the People’s Republic of China[4] stipulates that platform operators are forbidden to use pricing rules to force or quasi-force vendors into selling commodities below costs, thereby disrupting market competition.

(For details, please refer to An Analysis of the Chinese Mainland’s E-commerce Retail Market [Research Report])

Cross-border e-commerce regulations

If Hong Kong companies choose to expand into the mainland market through cross‑border e‑commerce, they must comply with a series of regulatory requirements related to product imports. The mainland also implements preferential measures for cross‑border e‑commerce imports, including:

- Taxation: Cross-border e-commerce imports are eligible for preferential taxation treatment, including zero tariff within quota for goods on the retail import list and the levying of import value-added tax (VAT) and consumption tax at 70% of the statutory tax payable.

- Product specifications: Cross-border e-commerce imports enjoy more simplified customs clearance procedures than general trade. This means that cross-border e-commerce retail imports need not go through first-time import licensing, registration or record-filing requirements and will only be subject to regulations for the importation of personal-use articles. Nevertheless, goods imported through cross-border e-commerce retail channels can only be sold directly to consumers and cannot be resold.

- Product scope: The mainland maintains a List of Imported Goods in Cross-border E-commerce Retail. Only coded commodity items on this list are eligible for import into the mainland through cross-border e-commerce. Commodities outside this list will have to be imported through ordinary trading means. Hong Kong companies must ensure that their products comply with the latest commodity category revisions.

- Purchase limit: Mainland consumers purchasing imported commodities through cross-border e-commerce retail are subject to a single transaction limit of RMB5,000 and an annual transaction limit of RMB26,000.

(For details, please refer to An Analysis of the Chinese Mainland’s E-commerce Retail Market [Research Report])

Consumers shop online frequently

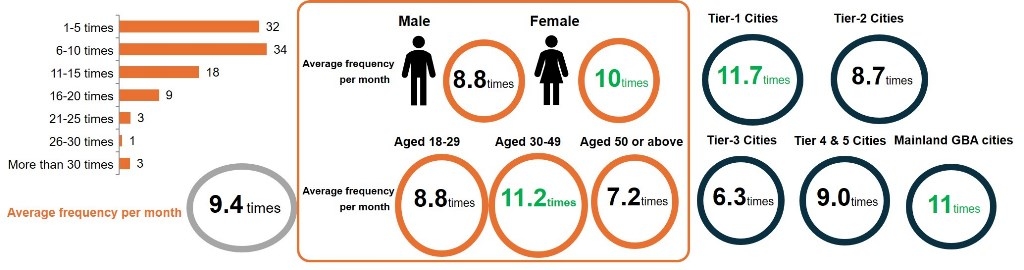

HKTDC Research’s survey reveals that mainland consumers shop online frequently. Overall, the respondents shop online 9.4 times a month on average.

Regionally, in tier‑one cities and mainland GBA cities where economic development is higher and logistics infrastructure better, consumers shop online more frequently than those in other regions, averaging 11.7 times and 11 times per month respectively.

Efficient logistics

Mainland consumers can usually take delivery of their products soon after placing orders on online platforms. The survey shows that, on average, consumers receive their products 3.2 days after ordering. Consumers in tier‑two and tier‑three cities take delivery soonest, getting their online products in an average of 3.1 days. Males get their products sooner than females: in 3.0 days on average. Consumers in the 18‑29 and 30‑49 age groups take delivery 3.1 days after ordering, which is earlier than for consumers aged 50 and above.

Fashion products popular

Mainland consumers purchase all kinds of products from online shopping platforms, with fashion products ranking third in popularity among product categories. Their popularity also ranks third for online shopping consumers of Hong Kong products. Over the past year, 46% of respondents reported buying these products online, and 41% said they had bought Hong Kong products online.

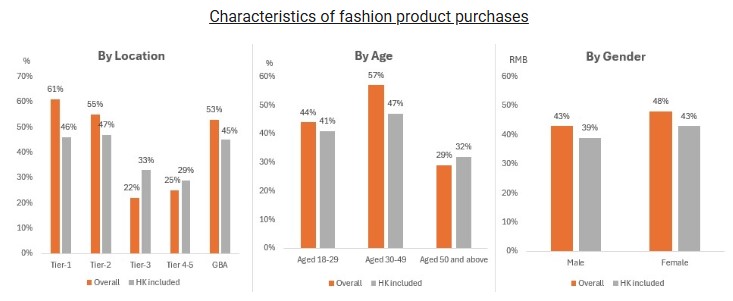

Characteristics of fashion product purchases

- Highest proportion of fashion product online purchases in tier-one cities

Regionally, consumers in tier‑one cities have the highest proportion of online fashion product purchases (61%), followed by tier‑two cities (55%). The proportion in tier‑three cities is only 22%.

The pattern for Hong Kong fashion products is similar across regions. In tier‑two cities, 47% buy fashion products, closely followed by tier‑one cities (46%) and mainland GBA cities (45%). The proportion in tiers four and five cities is only 29%.

- Consumers aged 30-49 shop online for fashion products most frequently

Age‑wise, consumers aged 30‑49 shop online for fashion products most frequently (57%), followed by those in the 18‑29 age group (44%). The proportion is only 29% for those aged 50 and above.

Hong Kong fashion products are most popular with consumers aged 30‑49 (47%), followed by those aged 18‑29 (41%). The proportion for those aged over 50 is only 32%, which is much lower than the overall trend (46%).

- Females buyfashion products online more frequently than males

Gender‑wise, females (48%) buy fashion products online more frequently than males (43%). When it comes to buying Hong Kong fashion products, women (43%) also tend to buy these products online more frequently than men (39%).

Considerations in fashion product shopping

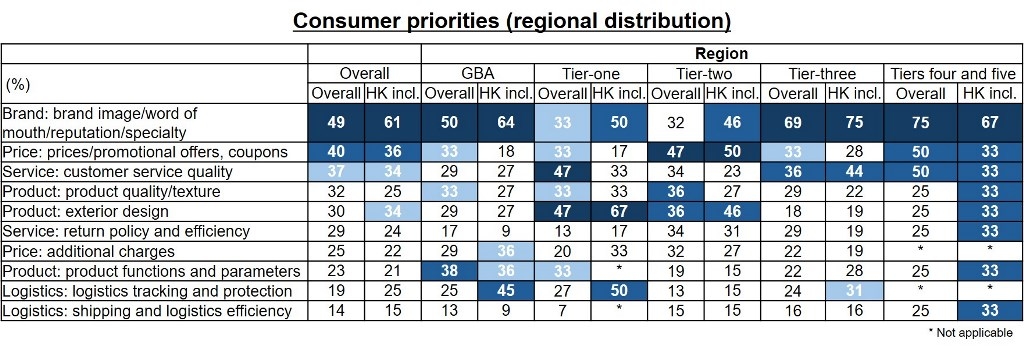

- Top considerations: brand image, price/promotional offers and customer service quality

When shopping for fashion products online, mainland consumers pay most attention to brand image and word of mouth (49%), price/promotional offers (40%), and customer service quality (37%).

When buying Hong Kong fashion products online, they also put brand image and word of mouth first (61%), followed by price/promotional offers (36%), and then customer service quality (34%) and product exterior design (34%).

- Considerations vary across regions

From a regional perspective, GBA consumers pay most attention to brand image and word of mouth (50%), and put product functions and parameters (38%), price/promotional offers (33%) and product quality (33%) before customer service quality (29%). Tier‑three city consumers also put brand image and word of mouth (69%) first, followed by customer service quality (36%) and then price/promotional offers (33%). Considerations of tiers four and five city consumers are similar to the overall trend. They consider brand image and word of mouth (75%) as most important, followed by price/promotional offers (50%) and customer service quality (50%).

Consumers in tier‑one cities consider customer service quality (47%) and product exterior design (47%) as most important, followed by brand image/word of mouth (33%), price/promotional offers (33%), product quality (33%) and product functions and parameters (33%). Tier‑two city consumers put price/promotional offers (47%) first, followed by product quality and texture (36%) and product exterior design (36%). Brand image and word of mouth (32%), and customer service quality (34%) are not among their top three considerations.

When buying Hong Kong fashion products online, GBA consumers’ top considerations vary appreciably from the overall trend. They pay most attention to brand image and word of mouth (64%), logistics tracking and protection (45%), additional charges (36%) and product functions and parameters (36%). Consumers in tier‑three cities also pay most attention to brand image and word of mouth (75%), followed by customer service quality (44%), but they put logistics tracking and protection (31%) before price/promotional offers (28%). Consumers in tiers four and five cities have many considerations. They pay most attention to brand image (67%), followed by price/promotional offers (33%), customer service quality (33%), product quality (33%), product exterior design (33%), return policy and efficiency (33%), product functions/parameters (33%) and shipping and logistics efficiency (33%).

When buying Hong Kong fashion products online, consumers in tier‑one cities pay most attention to product exterior design (67%), followed by brand image/word of mouth (50%) and logistics tracking and protection (50%). Consumers in tier‑two cities put price/promotional offers first (50%), followed by brand image/word of mouth (46%) and product exterior design (46%).

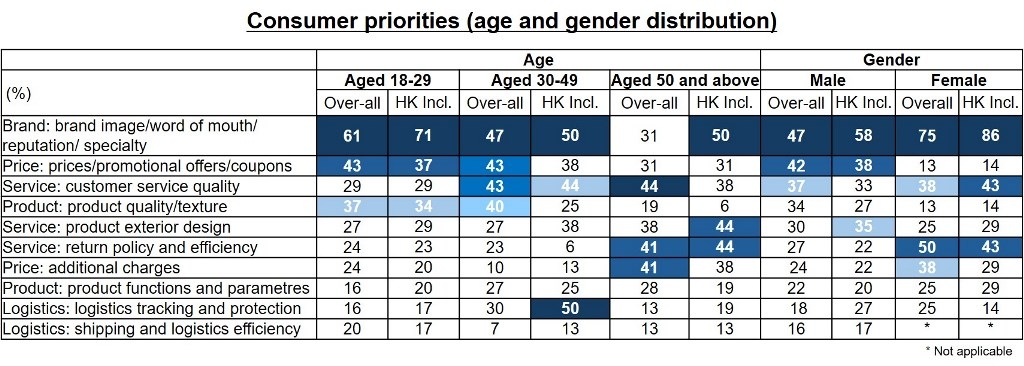

- Considerations of younger consumers are quite similar

In terms of age, when buying fashion products online, whether these are from Hong Kong, the Chinese mainland or other regions, the most important consideration for consumers aged 18‑29 is brand image/word of mouth (61%), followed by price/promotional offers (43%) and product quality/texture (37%).

When consumers aged 30‑49 buy these products online, they also pay most attention to brand image/word of mouth (47%), followed by price/promotional offers (43%) and customer service quality (43%), and then product quality (40%). When buying Hong Kong fashion products online, they also pay most attention to price/promotional offers (50%) and logistics tracking and protection (50%), followed by customer service quality (44%).

The considerations of consumers aged 50 and above are significantly different from other age groups. They do not pay much attention to brands when buying fashion products online. They care most about customer service quality (44%), followed by return policy and efficiency (41%), and additional charges (41%). When buying Hong Kong fashion products online, they pay most attention to brand image/word of mouth (50%), followed by product exterior design (44%) and return policy and efficiency (44%).

- Both male and female consumers put brand image/word of mouth first

By gender, both male and female consumers will first consider brand image and word of mouth when buying fashion products online. For male consumers, the most important consideration is brand image (47%), followed by price/promotional offers (42%) and then customer service quality (37%). Their considerations are roughly the same when buying Hong Kong fashion products online, putting brand image first (58%), followed by price/promotional offers (38%), but they consider product exterior design (35%) more important than customer service quality (33%).

Female consumers also consider brand image and word of mouth (75%) most important, followed by return policy and efficiency (50%) and then customer service quality (38%) and additional charges (38%). When buying Hong Kong fashion products online, they also put brand image and word of mouth first (86%), followed by customer service quality (43%) and return policy and efficiency (43%).

Value of Hong Kong orders

- Average order exceeds RMB2,000

Respondents spend as much as RMB2,108 per order on average when buying fashion products online. When Hong Kong products are included, the average order is about RMB1,990.

- Spending highest in tier-one cities

By region, average spending is highest among respondents in tier‑one cities (RMB3,774), followed by consumers in mainland GBA cities (RMB2,412) and then tier‑two cities (RMB1,839).

- Average spending is higher among respondents in many regions in online shopping of Hong Kong fashion products

When Hong Kong products are included in online shopping for fashion products, the average spending of respondents in tier‑two cities (RMB2,032), tier‑three cities (RMB1,852) and tiers four and five cities (RMB 1,440) is generally higher than overall spending in the corresponding regions.

Promotionchannels

- Buyers’ sharing of real experience, official brand information channels and product reviews are online shoppers’ most important channels for obtaining information

Overall, consumers mainly obtain information from buyers’ sharing of real experience (26%), official brand information channels (26%) and product reviews (26%) when buying fashion products online.

When Hong Kong products are included, the channels differ slightly from the overall trend. Respondents mainly obtain information from official brand information channels (26%), followed by sharing on social platforms (24%). Consumers also care about buyers’ sharing of real experience (21%) and product reviews (21%).

- Channels vary by region

Classified by region, consumers in tier‑one cities consider buyers’ sharing of real experience as most important (31%), followed by official brand information channels (27%) and then product reviews (23%) and recommendations of friends and family (23%). When Hong Kong products are included, consumers in tier‑one cities consider official brand information channels (33%) and recommendations of friends and family (33%) as most important, followed by buyers’ sharing of real experience (22%), product reviews (22%) and sharing on social platforms (22%).

Consumers in tiers four and five cities also consider buyers’ sharing of real experience (36%) as most important, followed by official brand information channels (29%) and sharing on social platforms (29%). When Hong Kong products are included, the priorities of consumers in tiers four and five cities are basically consistent with the overall trend, but they consider official brand information channels (57%) as most important, followed by buyers’ sharing of real experience (29%) and sharing on social platform (29%).

Consumers in mainland GBA cities consider as most important official brand information channels (34%) and product reviews (34%), followed by buyers’ sharing of real experience (25%) and recommendations of friends and family (25%). When Hong Kong products are included, they also put official brand information channels first (33%), followed by recommendations of friends and family (25%), but they pay more attention to product reviews (17%) and sharing on social platforms (17%) than buyers’ sharing of real experience (8%).

Consumers in tier‑three cities consider product reviews as most important (31%), followed by official brand information channels (28%) and then buyers’ sharing of real experience (20%) and recommendations of friends and family (20%). When Hong Kong products are included, tier‑three consumers put official brand information channels (28%) first, followed by product reviews (21%) and sharing on social platforms (21%).

Consumers in tier‑two cities consider as most important recommendations of friends and family (30%), followed by buyers’ sharing of real experience (28%), product reviews (28%) and sharing on social platforms (28%). When Hong Kong products are included, consumers in tier‑two cities consider as most important sharing on social platforms (28%), followed by buyers’ sharing of real experience (24%), product reviews (24%) and recommendations of friends and family (24%).

- Channels valued by different age groups vary

Classified by age, consumers aged 18‑29 consider as most important official brand information channels (31%), followed by product reviews (29%) and then buyers’ sharing of real experience (27%). When Hong Kong products are included, the channels for this age group are similar to the overall trend, with official brand information channels as most important (32%). They pay more attention to sharing on social platforms (30%) and buyers’ sharing of real experience (24%) than product reviews (16%).

Consumers aged 30‑49 consider as most important recommendations of friends and family (32%), followed by product reviews (28%) and then brand official information channels (26%). When Hong Kong products are included, consumers aged 3049 mainly obtain information from product reviews (27%) and recommendations of friends and family (27%), followed by brand official information channels (23%) and sharing on social platforms (23%).

Consumers aged 50 and above consider buyers’ sharing of real experience (30%) as most important, followed by official brand information channels (19%), product reviews (19%) and recommendations of friends and family (19%). When Hong Kong products are included, the considerations of consumers aged 50 and above differ. They consider recommendations of friends and family (33%) as most important, followed by buyers’ sharing of real experience (32%) and then product reviews (21%).

- Female and male consumers differ

In terms of gender, male consumers consider buyers’ sharing of real experience (28%) as most important, followed by official brand information channels (27%) and then product reviews (26%). When Hong Kong products are included, the considerations of male consumers differ. They consider sharing on social platforms (26%) as most important, followed by official brand information (25%) and then buyers’ sharing of real experience (22%).

Female consumers, on the other hand, consider product reviews (23%) as most important, followed by buyers’ sharing of real experience (18%), official brand information channels (18%) and recommendations of friends and family (18%). When Hong Kong products are included, female consumers consider official brand information channels (31%) as most important, followed by product reviews (23%) and recommendations of friends and family (23%).

Consumers’ main shopping channels

Mainland consumers mainly conduct online shopping on traditional comprehensive platforms. Some 95% of respondents have used comprehensive/shelf‑based e‑commerce platforms for online shopping, a percentage far higher than other platforms, such as livestreaming/short video platforms (38%) and group buying platforms (32%).

This is largely the case when classified by regions, gender and age.

On the other hand, when shopping for foreign/cross‑border/global products online, consumers generally prefer using Tmall Global (73%) or JD Worldwide (63%). Classified by region, preferences for different platforms are quite consistent, with consumers in all regions mainly choosing Tmall Global. In terms of age and gender, consumers’ preferences coincide. They mainly choose Tmall Global.

For sample details, please refer to Hong Kong Businesses Navigating Chinese Mainland E-commerce Retail Market - Consumer Survey Results

Related articles:

Chinese Mainland E-Commerce Retail Market: Market Positioning of Hong Kong Luxury Items

Chinese Mainland E-Commerce Retail Market: Market Positioning of Hong Kong Fresh Produce and Food

[1] For more details, please see Unleashing the Lucrative Potential of Cross-Border E-Commerce for Hong Kong Traders (Company Survey and Expert Opinion).

[2] For more details, please see Measures for Supervision of Online Transactions Take Effect in May.

[3] For more details, please see China Announces Code of Conduct for Online Presenters.

[4] For more details, please see Revised Anti-Unfair Competition Law to Take Effect on 15 October.

Original article published in https://hkmb.hktdc.com