GDP (US$ Billion)

88.90 (2018)

World Ranking 66/193

GDP Per Capita (US$)

4,099 (2018)

World Ranking 115/192

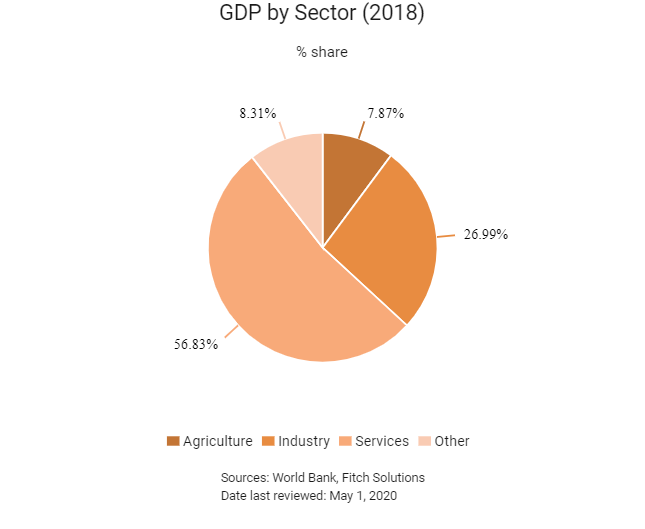

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

52.4 (2019)

Currency (Period Average)

Sri Lankan Rupee

178.74per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Sri Lanka is transitioning from a predominantly rural-based economy towards a more urbanised economy oriented around manufacturing and services. Economic growth has translated into shared prosperity with the national poverty headcount ratio declining from 15.3% in 2006/07 to 4.1% in 2016. However overall debt levels are high and the country has seen muted growth in expenditure on infrastructure development in recent quarters. With the support of the World Bank, the government is carrying out fiscal reforms, improving public financial management, increasing public and private investments, addressing infrastructure constraints, and improving competitiveness. The launch of the country's Vision 2025 plan on September 4, 2017 was designed to strengthen democracy and reconciliation, inclusive and equitable growth as well as to ensure good governance.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2018

Ranil Wickremesinghe was reinstated as prime minister.

June 2019

The Export-Import Bank of China extended a loan of around USD1 billion to support the construction of the first section of the Kadawatha-Mirigama E04 Central Expressway project in Sri Lanka,covering 37.09 km. The expressway would connect Colombo to Kandy. The loan covered 85% of the total contract price. The remaining 15% cost would be financed by a loan from two state banks on a Treasury guarantee.

July 2019

The government cut airline charges on July 8, 2019 in a bid to boost tourism. This move was accompanied by the reinstatement of the free visa programme for 39 countries.

August 2019

Nepal-based CG Cement unveiled plans to build a new integrated cement facility in Mannar, Sri Lanka. The project, which would entail an investment of USD150 million, has already secured approval from the government of Sri Lanka.

October 2019

Sri Lanka's President , Maithripala Sirisena, decided not to run in the presidential elections to be held in November 2019.

November 2019

Gotabaya Rajapaksa, the younger brother of former president Mahinda Rajapaksa, won the presidential election.

March 2020

The 2020 Q1 payment deadlines for income tax, value-added tax (VAT) and certain other taxes were extended until end-April, as part of the policy responses to the Covid-19 pandemic. Other measures announced include tax exemptions for imported masks and disinfectant, price ceilings on essential food items, as well as concessional loans and food allowances for low-income consumers.

March 2020

The Central Bank of Sri Lanka (CBSL) reduced monetary policy rates by 50 basis points (bps) since March. The required reserve ratio on domestic currency deposits of commercial banks had been lowered by one percentage point, and the rate at which CBSL granted advances to commercial banks for temporary liquidity needs had been lowered by 500bps. The president had announced a wide-ranging debt repayment moratorium, which included a six-month moratorium on bank loans for the tourism, garment, plantation and IT sectors, related logistics providers, and small and medium industries, with reduced rate working capital loans and investment-purpose loans for these sectors. Financial institutions were also requested to reschedule non-performing loans. Lower capital conservation buffer requirements and a relaxation of loan classification rules had been announced. In addition, state-owned financial institutions would invest in treasury bonds and bills to stabilise the money market interest rate at 7%.

March 2020

The Sri Lankan authorities introduced measures for a period of three months, aimed at restricting capital outflows, through the suspension of outward investment payments and a prohibition on commercial banks purchasing Sri Lankan sovereign bonds. There were also some current account restrictions, suspending imports of non-essential goods except raw materials, pharmaceutical products and fuel, as well as prohibiting commercial banks facilitating the import of vehicles and non-essential goods, and the suspension of outward remittances. Inward remittances would be exempted from certain regulations and taxes.

April 2020

The parliamentary election scheduled to be held on April 25 had been postponed to June 20, 2020, amid concerns over the Covid-19 outbreak.

Sources: BBC Country Profile – Timeline, Fitch Solutions, IMF, national sources

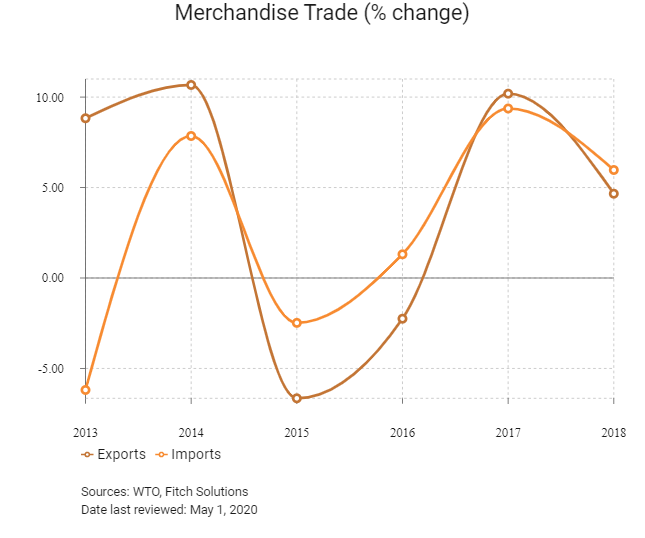

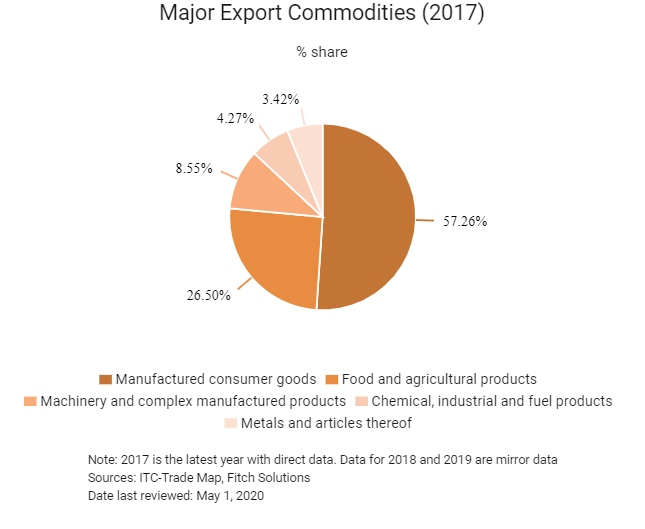

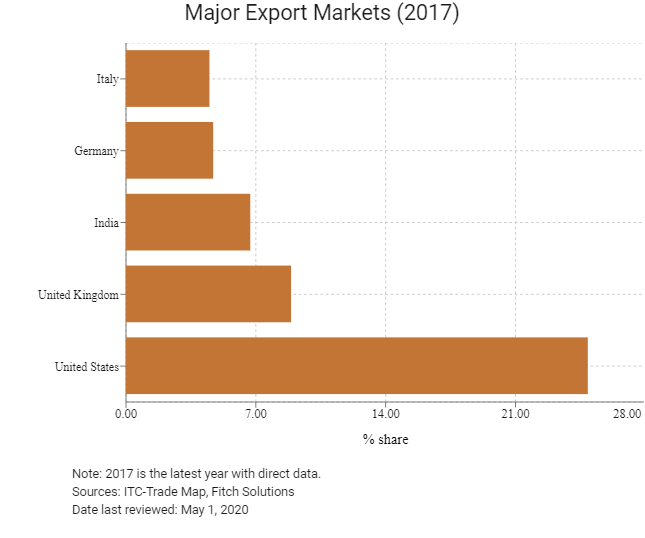

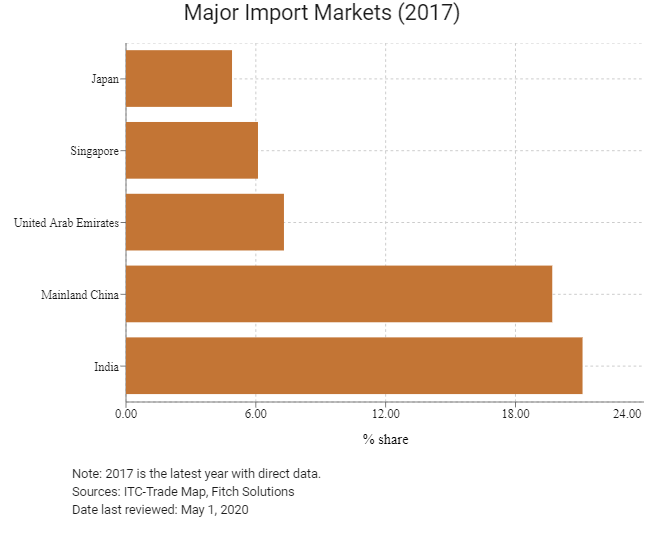

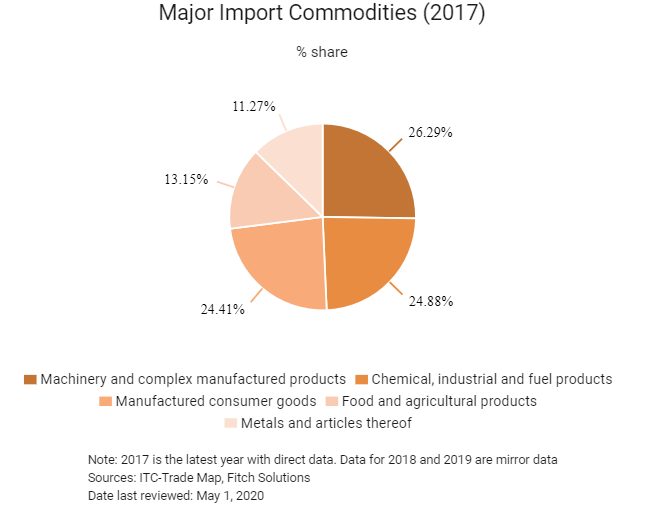

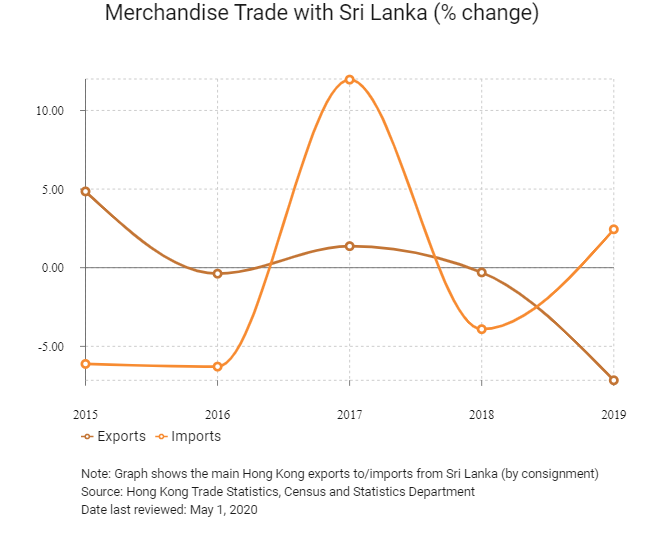

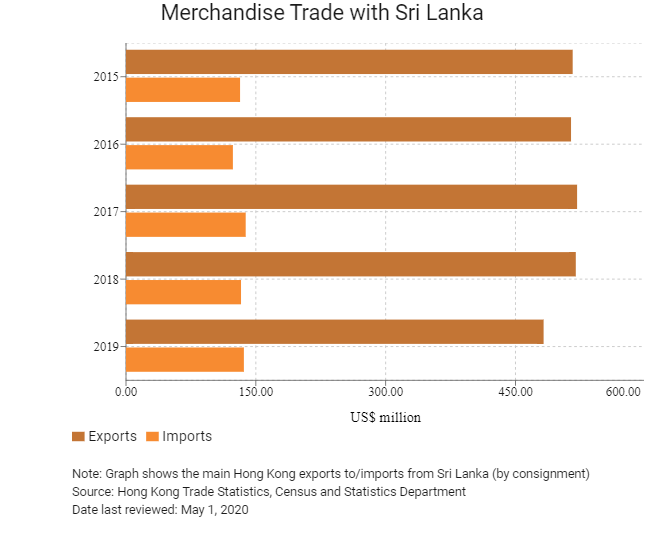

Merchandise Trade

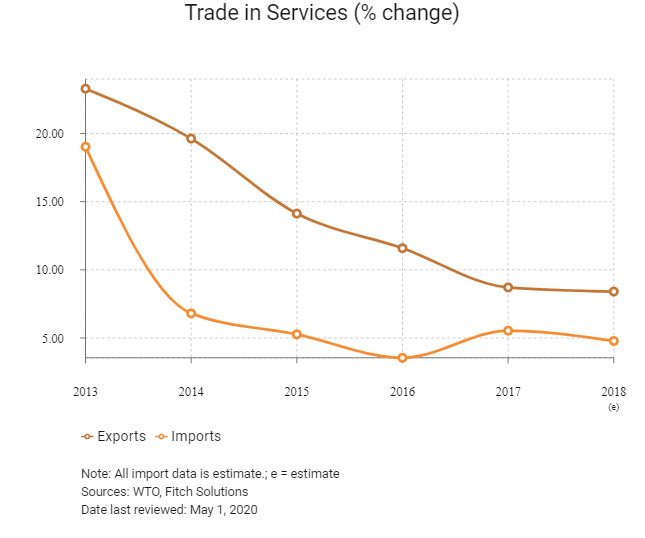

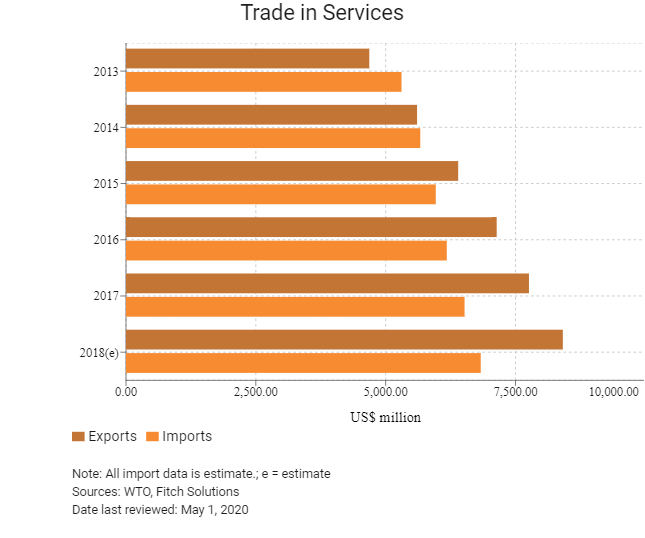

Trade in Services

- Sri Lanka has been a World Trade Organization (WTO) member since January 1995, adopting a liberal trade regime. The strict controls over imported agricultural items that may be detrimental to certain local plants and live animals, have been changed and companies are allowed to trade freely without special restrictions.

- Sri Lanka's tariffs range from 0-30% under a four-band tariff structure with rates being 0%, 15% and 30%. More than 50% of non-agricultural imports are deemed duty free. Essential raw materials and inputs, such as cotton and textiles, are generally non-dutiable, or subject to duties at lower rates.

- Apart from tariffs, duties and taxes that any importer is liable to pay upon import include excise duty, the Nation Building Tax, the Special Commodity Levy and VAT. The VAT rate stands at 15%, with exemptions granted to some ICT equipment, construction equipment, pharmaceuticals, real estate, water, electricity, health and education.

- Sri Lanka also has Generalised System of Preferences (GSP) agreements with Japan, United States, Canada, the European Union (EU), Norway, Turkey and New Zealand, as well as free trade agreements (FTAs) with India and Pakistan. GSP-plus was implemented again in May 2017 and the current regulations will be valid until 2023.

- Exporters and importers may be subject to a range of additional tariffs and taxes intended to promote domestic industries and to reduce the country's import bill. These may include a port and development levy on the value of cargo, in addition to other import and excise duties.

- Sri Lanka is a member of the South Asian Association for Regional Cooperation (SAARC), which formed a South Asian Free Trade Area (SAFTA) in January 2006 with an aim to reduce duties for imports from member countries to between 0% and 5% within 10 years, although progress has not been satisfactory.

- There are various export restrictions applied to goods such as bulk tea and natural sand. There are also export licensing requirements for metal products (raw and semi-processed materials) such as copper, zinc and other steel alloys.

- There are various import bans in place that affect the autos sector, in addition to high import duties (for new vehicles). Vehicles older than two years are not permitted, and commercial vehicles older than four years are also not permitted under 2013 rules.

- Sri Lanka also implements the Special Commodity Levies on imported vegetable oil, onions (and various other vegetables), sugar, garlic, dhal, watana, wheat, rice and fish.

Sources: WTO - Trade Policy Review, Fitch Solutions

Trade Updates

Sri Lanka and Mainland China entered into FTA negotiations and these remain ongoing at the time of writing. Sri Lanka's Minister of Development Strategies and International Trade and Mainland China's Vice Minister of Commerce met on July 6, 2019 and held discussions around recommencing negotiations on the FTA and improving bilateral trade.

Multinational Trade Agreements

Active

- The SAFTA: An agreement between states was reached on January 6, 2004. SAFTA creates a free trade area of nearly two billion people in Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan and Sri Lanka. The seven foreign ministers of the region signed a framework agreement on SAFTA to reduce customs duties on all traded goods to zero by 2016. The SAFTA came into force on January 1, 2006. The SAFTA requires the developing countries (India, Pakistan and Sri Lanka) and the least developing countries (Nepal, Bhutan, Bangladesh, Afghanistan and the Maldives) in South Asia to bring their duties down to 0% at staggered periods. The purpose of SAFTA is to encourage and elevate common contracts among the countries, such as medium- and long-term contracts. SAFTA also involves an agreement on tariff concession, like national duties concession and non-tariff concession.

- The Asia Pacific Trade Agreement (APTA): Formerly the Bangkok Agreement signed in 1975, the APTA is one of Asia's oldest regional preferential trading agreements with six participating states – Bangladesh, Mainland China, India, Laos, South Korea and Sri Lanka. APTA is a dynamic regional agreement that has been instrumental in producing a favourable outcome for Sri Lanka. It is particularly important for Sri Lanka as it is the only trade agreement that Sri Lanka partakes in with Mainland China and South Korea. At the third session of the Ministerial Council held on December 15, 2009 in Seoul, two framework agreements were signed, one on trade facilitation and promotion and the other on the protection and liberalisation of investment; both framework agreements incorporate separate chapters in services and investments. The APTA aims to promote economic development and cooperation through the adoption of mutually beneficial trade liberalisation measures. Further concessions are envisaged at future rounds of trade negotiations, which will target widening product coverage, deepening tariff cuts and adopting modalities for the extension of negotiations into other area, such as non-tariff measures, trade facilitation, framework agreements on services and investment.

- Indo-Sri Lanka FTA (ISFTA): The ISFTA entered into force on March 1, 2000. Under this agreement, most products manufactured in Sri Lanka with at least 35% domestic value addition (if raw materials are imported from India, the domestic value addition requirement is only 25%) qualify for duty-free entry to the Indian market. Sri Lanka exports manufactured products to India, duty-free. Sri Lanka is eager to expand the current FTA with India to a broader Economic and Technology Cooperation Agreement (ETCA). While both the countries already have the benefits of an FTA in goods, recent bilateral talks have been aimed at widening the scope of this pact by including services and investments to make it comprehensive. To further strengthen economic cooperation between Sri Lanka and India, a Comprehensive Economic Partnership Agreement (CEPA) is also under negotiation.

- Sri Lanka-Pakistan FTA: The FTA between Sri Lanka and Pakistan provides duty-free entry into Pakistan for almost all of Sri Lanka's exports except for 541 items on Pakistan's negative list. The FTA was implemented on June 12, 2005.

- Sri Lanka–Singapore FTA: The FTA between Sri Lanka and Singapore is aimed at promoting the bilateral trade of goods and services and to aid the continued expansion of Sri Lanka's manufacturing and services sectors. This partnership is likely to pave the way for higher-quality sector expansion as this would facilitate the transfer of technology and best practices from Singapore, one of Sri Lanka's top 10 foreign investors, accounting for almost 10% of total foreign direct investment inflows. The FTA took effect on May 1, 2018, and aims to eliminate tariffs on 80% of Singapore's exports over 15 years. However, in February 2020 the attorney general informed the Supreme Court that the government is re-examining the FTA signed by the previous administration. The government says that the FTA was contrary to the constitution as approval from Parliament was not obtained before signing.

Under Negotiation

Mainland China-Sri Lanka FTA: Mainland China is investing heavily in strategic ports and port-related industries in Sri Lanka. The FTA between Mainland China and Sri Lanka, currently under negotiation, is set to boost the country's future development and promote trade with Mainland China in sectors such as industry, energy, technology, infrastructure and tourism. Mainland China is an important trade partner for Sri Lanka, supplying almost 20% of Sri Lanka's total imports in 2017 and purchasing approximately 4% of Sri Lanka's exports.

Sources: WTO Regional Trade Agreements database, Government websites, Fitch Solutions

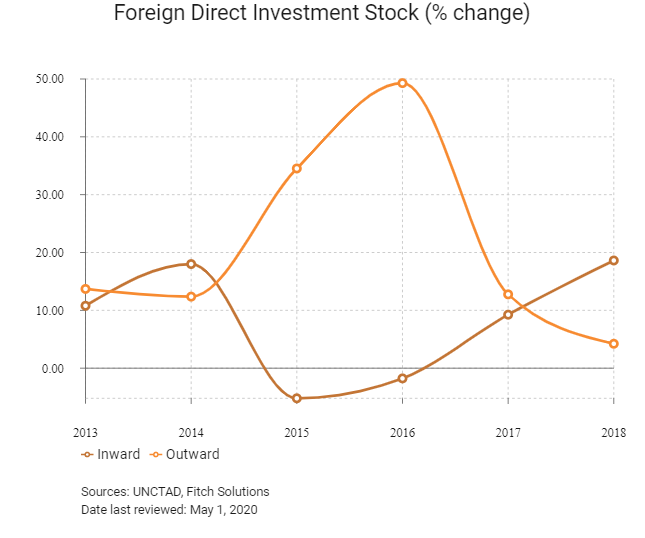

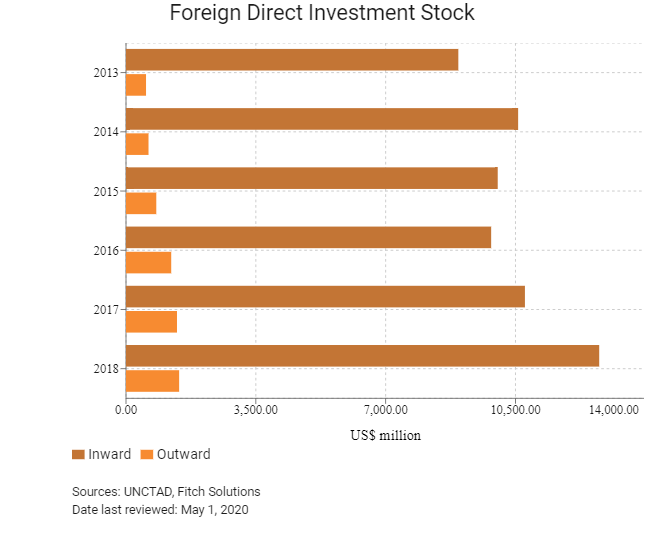

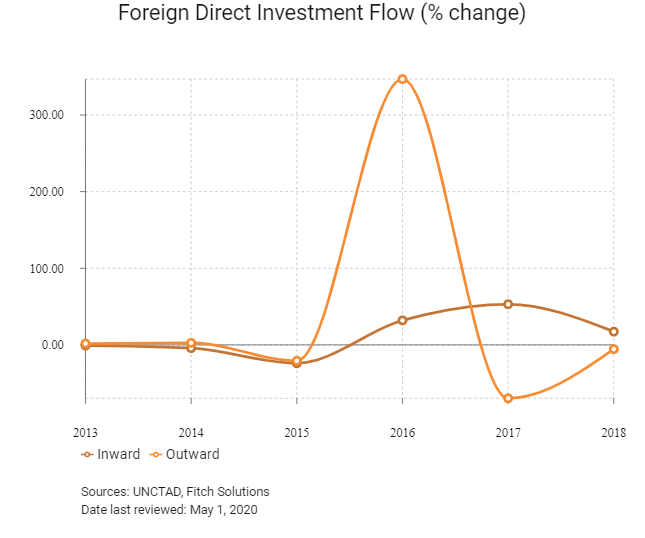

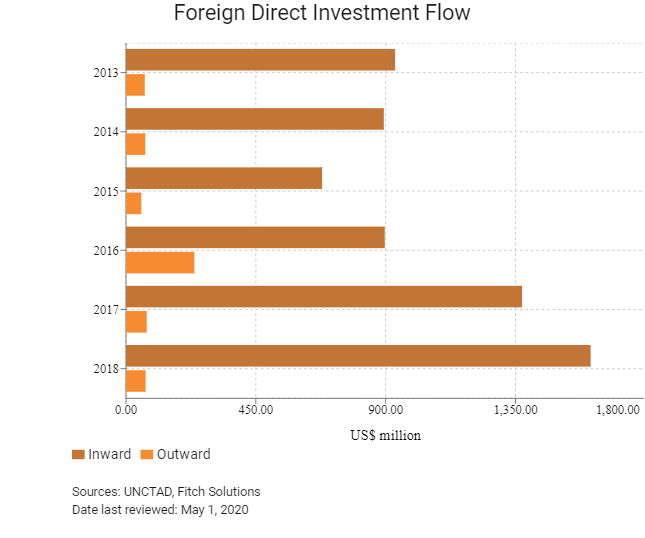

Foreign Direct Investment

Foreign Direct Investment Policy

- In order to promote FDI, the Sri Lankan government has set up the Board of Investment (BOI), which currently manages 14 industrial parks and export processing zones (EPZs) in the country. Tax incentives and duty-free facilitation are given to qualified foreign investors. There are nine key investment sectors identified by the government, with special incentives given to foreign-invested enterprises (FIEs) in these sectors, specifically tourism and leisure, infrastructure, knowledge service, utilities, apparel, export manufacturing, export services, agriculture, and education.

- The BOI plays a key role in the implementation of Sri Lanka's export-oriented industrialisation strategy. Textile and garments have become important industrial products after the development of the EPZs. The BOI plans to introduce new methods, including public-private partnerships for spurring investment. In the 2017 Budget, new incentive packages for landmark projects with investment between USD100-500 million and those worth more than USD500 million were included. Exchange control reform is also proposed to ease foreign exchange remittance to facilitate foreign investment.

- Sri Lanka's 2018 budget envisions a 'Blue-Green Development Strategy' that entails plans to integrate the full economic potential of ocean-related activities into formulating the overall growth strategy, and to build the economy on an environmentally sustainable development strategy. The Enterprise Sri Lanka initiative is expected to promote entrepreneurial skills and facilitate not only established private sectors, but also small business enterprises.

- Since the civil war ended in 2009, Sri Lanka has worked to rebuild and improve infrastructure, drawing in FDI to finance and undertake related infrastructure projects. Mainland China has been keen to participate in such projects, including the Sri Lankan port in Hambantota and the Colombo International Container Terminals. In July 2017, the Sri Lanka Ports Authority (SLPA) and China Merchants Port Holdings (CMP) signed a joint-venture agreement under which up to USD1.12 billion will be invested to handle the commercial operations of the Chinese-built Hambantota Port on a 99-year lease, with the port expected to play a strategic role in the Belt and Road Initiative.

- The government has identified a wide range of targeted industrial sub-sectors to be promoted under the BOI to drive the economic development process of the country. In line with the new policy guidelines of the government, the manufacturing sector is to be promoted in three key segments: non-traditional products (which include all products other than black tea in bulk, crepe rubber, sheet rubber, scrap rubber, coconut oil, desiccated coconut, copra, fresh coconuts, and coconut fibre), local manufacturers of substituted goods (which include boats, pharmaceuticals, tyres and tubes, motor spare parts, furniture, ceramics, glassware, cosmetic products, edible products manufactured out of cultivated agricultural products, and construction materials), and large-scale projects of national interest.

- Foreign ownership is permitted with the exception of some sectors designated as strategic in defence-related industries, forestry and farmland. The government allows 100% foreign investment in any commercial, trading, or industrial activity other than a few specified sectors, including air transport; coastal shipping; large-scale mechanised mining of gems; lotteries; the manufacture of military hardware, military vehicles, and aircraft; dangerous drugs; alcohol; toxic, hazardous, or carcinogenic materials; currency; and security documents. These sectors are regulated and subject to approval by various government agencies. Environmental concerns continue to dent prospects for investors in the primary sector.

- A number of investment incentives are open to investors in Sri Lanka. These are laid out in the Strategic Development Project Act 2008, which provides tax incentives for large projects that the Cabinet identifies as Strategic Development Projects (SDP). These are defined as investments that are believed to be in the national interest, and likely to bring economic and social benefits through the provision of goods and services, substantial inflow of foreign currency, generation of employment and income, and transfer of technology. Projects classified as SDPs are exempted from taxes for up to 25 years in areas such as corporate income tax, VAT, economic service charge, debit tax, customs imports and export taxes, port and airport tax, and the NBT.

- Foreign investments are restricted to 40% ownership in the following areas : production for the export of goods subject to international quotas; growing and primary processing of tea, rubber, coconut; timber-based industries using local timber; deep-sea fishing; mass communications; education; freight forwarding; travel services; and businesses providing shipping services. Foreign ownership in excess of 40% must be pre-approved on a case-by-case basis by the BOI. Foreign investment is not permitted in the following businesses: non-bank money lending and pawn-brokering. Foreign ownership is allowed in most sectors, although the land ownership law prohibits foreigners from owning land, with some exceptions.

- Sri Lanka also has 12 major free-trade zones, also called EPZs, administered by the BOI. In addition, a large private apparel company opened Sri Lanka's first privately-run fabric park in 2007, and thereafter invited local and foreign companies to set up fabric and apparel factories in the park. A number of companies have chosen to locate their factories in and around Colombo to reduce transport time and costs. However, excessive concentration of industries in Colombo has caused heavy traffic, higher real estate prices, and a scarcity of labour. As a result, the BOI now encourages export-oriented factories to be set up in industrial zones outside of the capital, such as Koggala, Seethawaka, Biyagama, Mirigama, Polgahawela, Mawathagama, Kandy, Malwatta, Wathupitiwala, Sooriyawewa.

- Foreign ownership is allowed in most sectors, although the land ownership law prohibits foreigners from owning land with some exceptions. Foreigners are prohibited from purchasing land and real estate except for apartments above the 3rd floor. Currently, the cabinet can approve a land purchase for an investment in the national interest, provided there is a substantial foreign remittance for the purchase of the land. The new budget promised to relax restrictions on apartment ownership. Other policies of concern include the November 2011 Underutilised Assets Act, which resulted in the seizure of 37 companies.

Sources: WTO - Trade Policy Review, ITA, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

| There are 12 free trade zones, called export processing zones, in Sri Lanka, administered by the BOI |

Various corporate income tax (CIT) and customs duty incentives, and exchange control regulation exemptions are available. Sri Lanka and Mainland China have jointly established the Sri Lanka-Mainland China Logistics and Industrial Zone (SLCIZ) in Hambantota in the Southern Province, which would be open for Chinese investors to establish factories. The government plans to allocate 1,000 acres of land for the zone. SLCIZ is expected to include the Hambantota Port, which may be sold to a Chinese state-owned companya. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 8%

- Corporate Income Tax: 28%

Source: Department of Inland Revenue

Important Updates to Taxation Information

- Corporate income tax rates were revised from January 1, 2020. Small and medium enterprises, exports, tourism, education, healthcare, construction and agro processing dividends received from a resident company will be taxed at 14%; manufacturing at 8%; liquor, tobacco, betting and gaming at 28%; and trading, banking and finance, insurance, etc. at 24%.

- Dividends paid by a resident company to any non-resident person will be exempt from income tax with effect from January, 1 2020.

- VAT was reduced to 8% (from 15% previously), while Nation Building Tax was abolished with effect from December 1, 2019.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT (standard rate) |

28% |

|

CIT for small- and medium-sized enterprises that conduct business in Sri Lanka, that do not have an associate that is an entity and with an annual turnover less than LKR500.0 million |

14% |

|

CIT for businesses predominantly conducting business of exporting goods and services |

14% |

|

CIT for businesses predominantly conducting business of an agricultural nature |

14% |

|

CIT for companies predominantly providing educational services |

14% |

|

CIT for companies predominantly in information and communications technology |

14% |

|

CIT for companies predominantly engaged in the promotion of tourism |

14% |

|

CIT for construction services |

14% |

|

CIT for business consisting of betting and gaming, liquor and tobacco |

28% |

|

Branch tax rate |

28% on profits |

|

Dividend tax |

14% |

|

Gains from realization of investment assets |

10% on taxable earnings |

|

Remittance tax |

14% on taxable earnings |

|

Value-added tax |

8% |

|

Tourism development levy payable by tourist hotels and related institutions |

1% on turnover |

|

Customs duties |

Rates vary: 15%, 30% and 0% |

Source: Department of Inland Revenue

Date last reviewed: May 1, 2020

Localisation Requirements

Local workers are given priority in employment and these permits are usually considered for work that locals are unable to do. The employment of foreign personnel is permitted when there is a demonstrated shortage of qualified local labour. Technical and managerial personnel are in short supply, and this shortage is likely to continue in the medium term.

Obtaining Foreign Worker Permits for Skilled Workers

All foreign nationals must obtain visas (on-arrival visas, or visas obtained prior to arrival) to enter Sri Lanka. Foreign nationals intending to work in Sri Lanka should obtain residence visas and work permits. Foreign employees in the commercial sector do not experience significant problems in obtaining work or residence permits. Obtaining a visa in advance is now a requirement and can be completed online via the Electronic Travel Authority, or at a Sri Lankan embassy. Applications should take two working days, but can take longer in some cases. Foreign investors who remit at least USD250,000 can qualify for a one-year resident visa, which can be renewed.

Multiple-Entry Visas

Investors and business persons may obtain multiple-entry visas, which are valid for three or 12 months. To receive a multiple-entry visa, a foreign national must provide proof of his or her activities in Sri Lanka. These visas may be obtained from the Controller of Immigration and Emigration, or from a Sri Lanka diplomatic mission abroad. For a three-month multiple-entry visa, the fee is three times the fee for the single entry, three-month visit visa. For a 12-month multiple-entry visa, the fee is the same as that of a three-month multiple-entry visa plus a tax of LKR10,000.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 (RUR) |

20/11/2018 |

|

Standard & Poor's |

B- (Stable) |

20/05/2020 |

|

Fitch Ratings |

B- (Negative) |

24/04/2020 |

Note: RUR = rating under review

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

111/190 |

100/190 |

99/190 |

|

Ease of Paying Taxes Index |

158/190 |

141/190 |

142/190 |

|

Logistics Performance Index |

94/160 |

N/A |

N/A |

|

Corruption Perception Index |

89/180 |

93/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

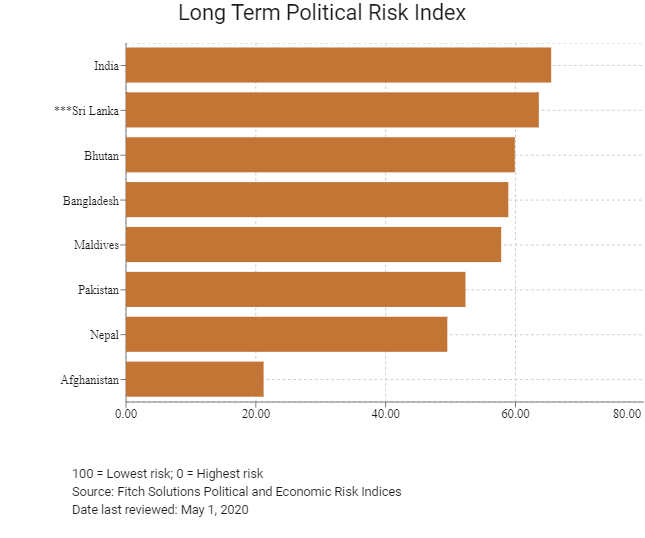

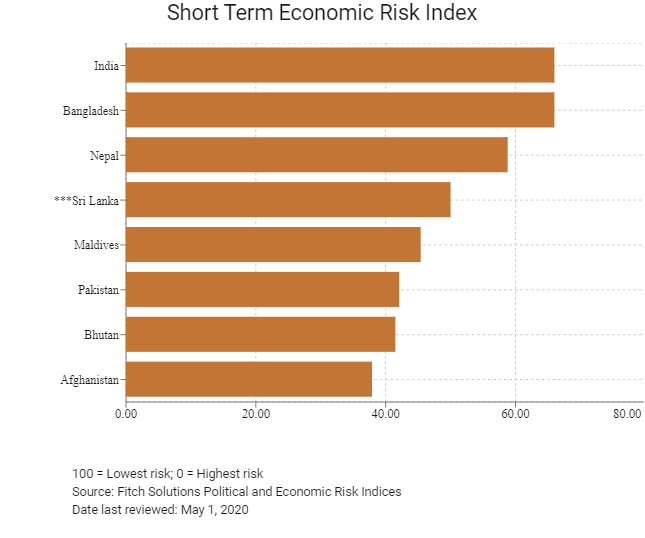

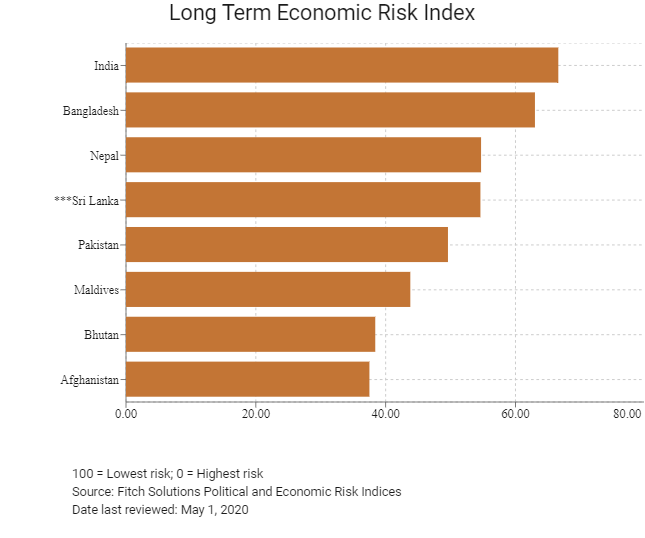

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

81/202 |

104/201 |

81/201 |

|

Short-Term Economic Risk Score |

54.6 |

49.4 |

50.0 |

|

Long-Term Economic Risk Score |

55.6 |

51.8 |

54.6 |

|

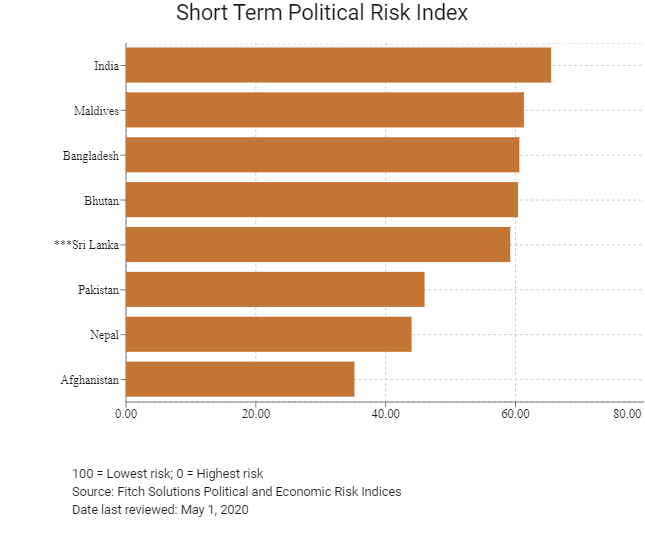

Political Risk Index |

93/202 |

90/202 |

91/202 |

|

Short-Term Political Risk Score |

66.0 |

61.7 |

59.2 |

|

Long-Term Political Risk Score |

63.6 |

63.6 |

63.6 |

|

Operational Risk Index |

98/201 |

94/201 |

92/201 |

|

Operational Risk Score |

49.5 |

50.4 |

50.4 |

Source: Fitch Solutions

Date last reviewed: May 1, 2020

Fitch Solutions Risk Summary

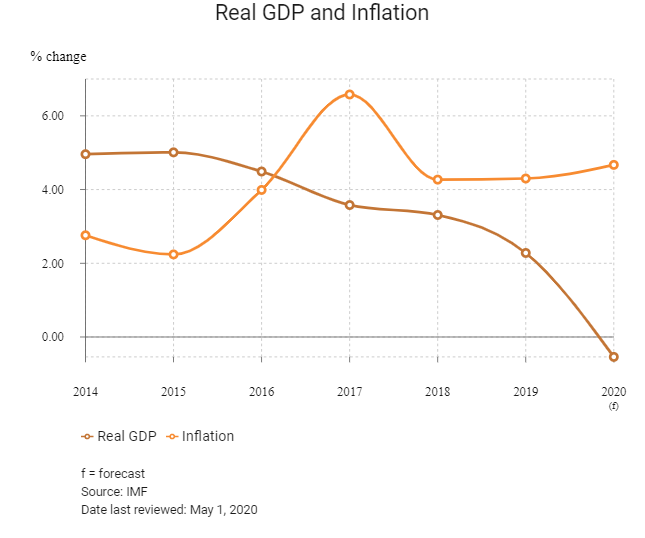

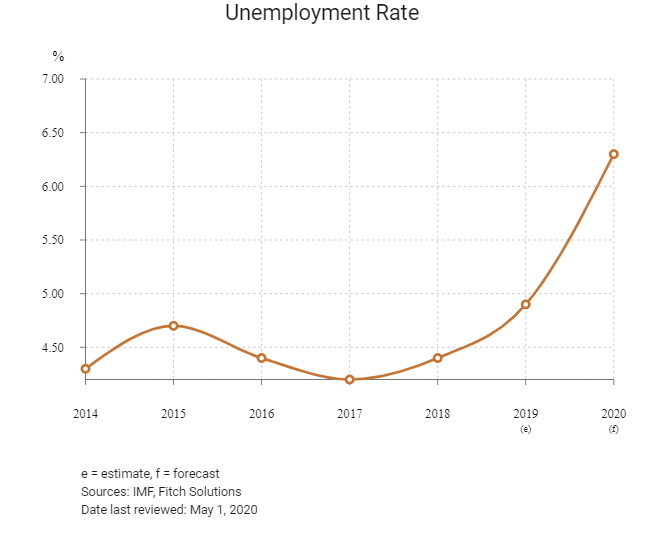

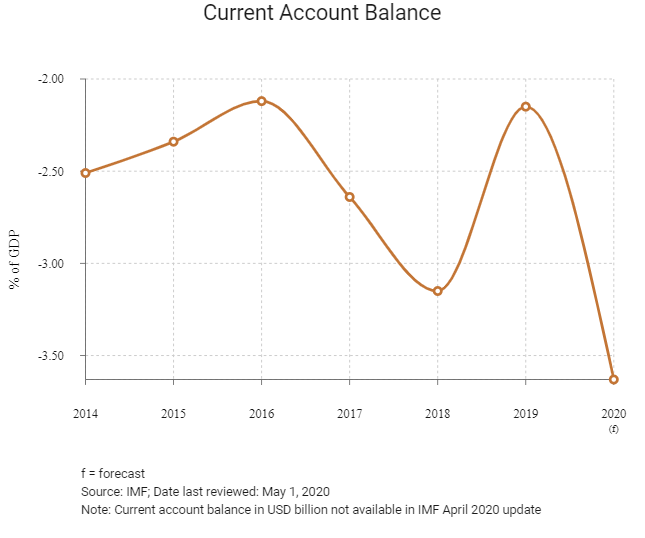

ECONOMIC RISK

The main challenges that the island's economy faces centre on the structural weaknesses of its fiscal and current accounts. Sri Lanka is vulnerable to uncertain global financial conditions as the repayment profile requires the country to access financial markets frequently. A high deficit and rising debt levels could deteriorate debt dynamics and negatively impact market sentiments. In the event of external weaknesses, the country runs the risk of foreign direct investment drying up. The Covid-19 outbreak has also weakened the economy's outlook as it exacerbated an already-challenging macroeconomic situation of low growth rates and significant fiscal pressures.

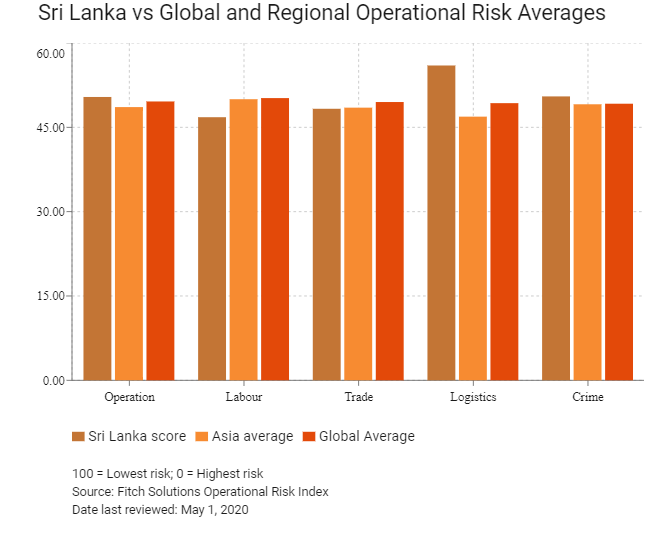

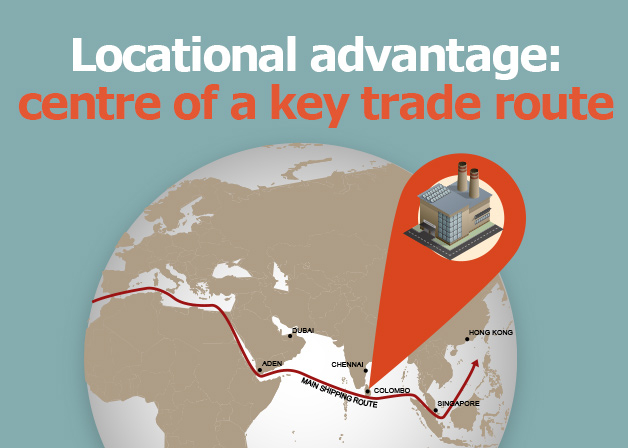

OPERATIONAL RISK

Barriers to trade and investment include sectoral restrictions to foreign investors, the dominance of state-owned enterprises, an uncertain legal environment and a highly ruralised population. That said, there are benefits to investing in Sri Lanka for businesses willing to overcome these risks. Chief among these are good-quality transport infrastructure and strong connections to international trade routes. In addition, a cheap workforce with widespread basic skills lifts Sri Lanka above regional peers that are competing to attract investment in secondary and tertiary industries.

Source: Fitch Solutions

Data last reviewed: May 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Sri Lanka Score |

50.4 |

46.8 |

48.3 |

56.0 |

50.5 |

|

South Asia Average |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

South Asia Position (out of 8) |

3 |

3 |

3 |

2 |

2 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

15 |

20 |

17 |

12 |

15 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

92 |

121 |

108 |

71 |

96 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Secruity Risk Index |

|

India |

53.8 |

46.4 |

55.0 |

66.6 |

47.0 |

|

Bhutan |

50.7 |

44.0 |

50.5 |

51.2 |

57.3 |

|

Sri Lanka |

50.4 |

46.8 |

48.3 |

56.0 |

50.5 |

|

Maldives |

44.0 |

48.0 |

42.9 |

37.5 |

47.8 |

|

Pakistan |

40.5 |

42.6 |

42.6 |

42.4 |

34.4 |

|

Bangladesh |

38.1 |

50.3 |

28.5 |

40.1 |

33.5 |

|

Nepal |

37.0 |

37.7 |

34.1 |

36.6 |

39.7 |

|

Afghanistan |

23.1 |

40.4 |

23.3 |

19.1 |

9.7 |

|

Regional Averages |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 1, 2020

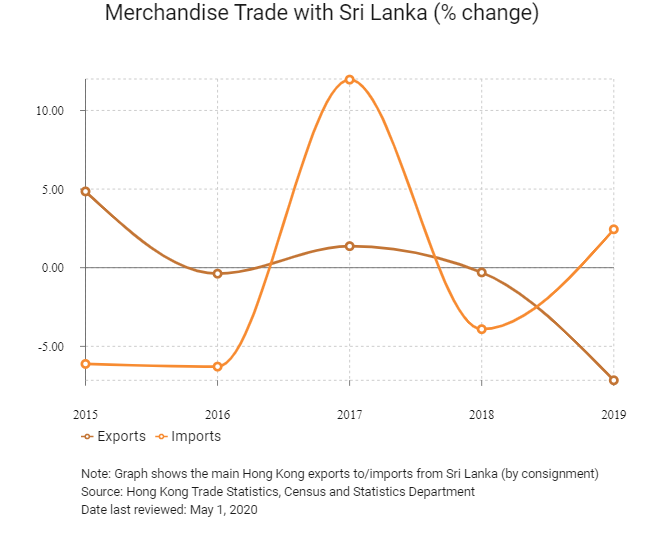

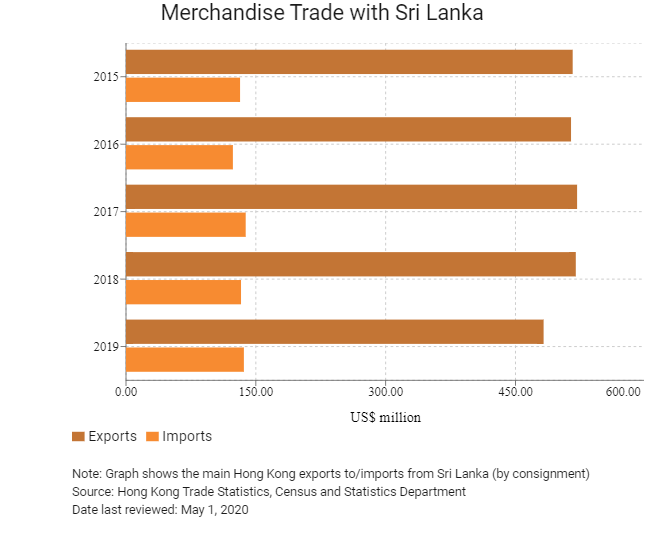

11. Hong Kong Connection

Hong Kong’s Trade with Sri Lanka

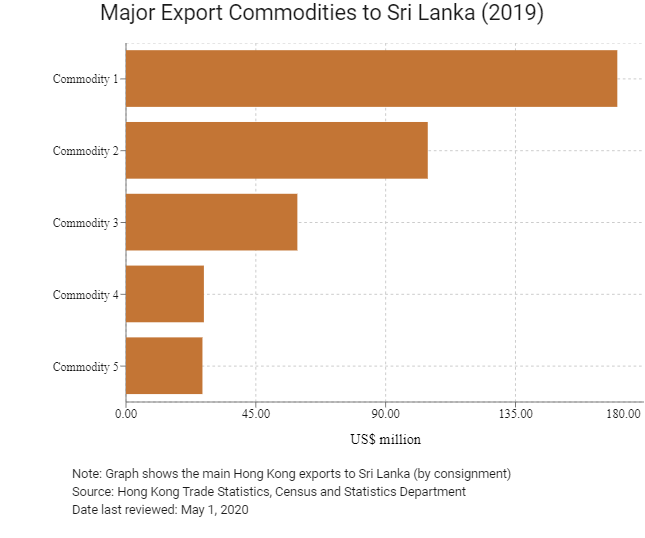

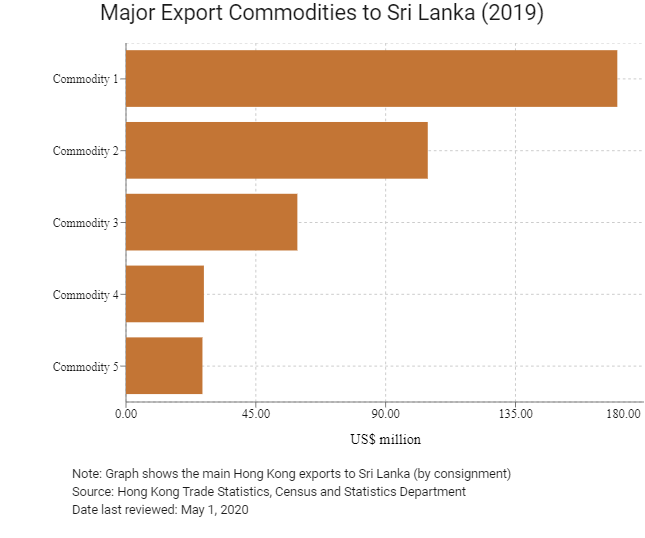

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Textile yarn, fabrics, made-up articles, and related products | 170.3 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 104.6 |

| Commodity 3 | Miscellaneous manufactured articles | 59.4 |

| Commodity 4 | Power generating machinery and equipment | 27.0 |

| Commodity 5 | Articles of apparel and clothing accessories | 26.5 |

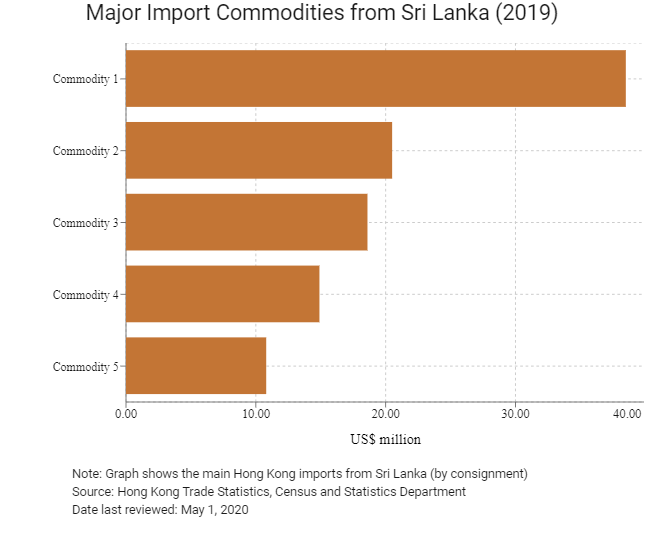

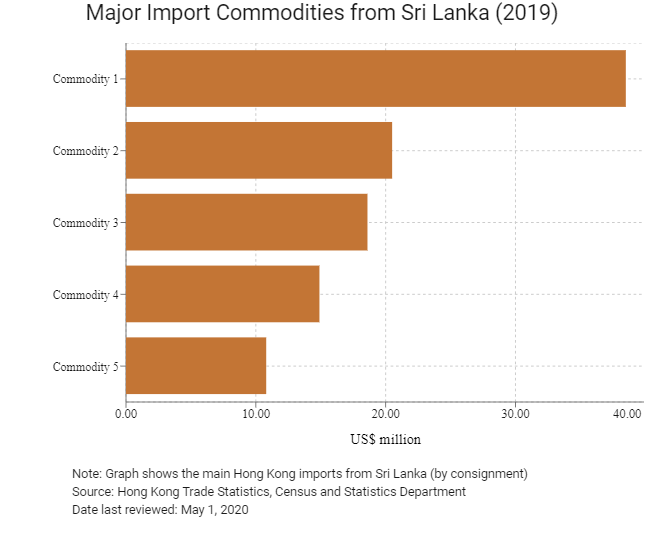

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Articles of apparel and clothing accessories | 38.5 |

| Commodity 2 | Coffee, tea, cocoa, spices, and manufactures thereof | 20.5 |

| Commodity 3 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 18.6 |

| Commodity 4 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 14.9 |

| Commodity 5 | Power generating machinery and equipment | 10.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Sri Lankan residents visiting Hong Kong |

4,620 |

-20.7 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

|

|

2019 |

Growth rate (%) |

|

Number of Sri Lankan residents residing in Hong Kong |

1,013 |

29.5 |

|

Number of South Asians residing in Hong Kong |

46,794 |

29.6 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate year

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: May 1, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Sri Lanka companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and Sri Lanka

Hong Kong has concluded an Avoidance of Double Taxation on income from shipping and aircraft transport agreement with Sri Lanka. This agreement entered into force on March 30, 2005.

Source: Hong Kong Department of Justice

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of the Democratic Socialist Republic of Sri Lanka

Address: Unit 905, 9/F, Sing Shun Factory Building, 495 Castle Peak Road, Cheung Sha Wan, Hong Kong

Email: peter.cheng@wisedragon.hk

Tel: (852) 2581 4111

Fax: (852) 2587 7770

Source: Hong Kong Protocol Division of Government Secretariat

Visa Requirements for Hong Kong Residents

Hong Kong residents need a visa to visit Sri Lanka for a maximum stay of 30 days. All holiday or business travellers visiting Sri Lanka must obtain Electronic Travel Authorisation (ETA) prior to arrival.

Source: Visa on Demand

Date last reviewed: May 1, 2020

Hong Kong’s Trade with Sri Lanka

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Textile yarn, fabrics, made-up articles, and related products | 170.3 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 104.6 |

| Commodity 3 | Miscellaneous manufactured articles | 59.4 |

| Commodity 4 | Power generating machinery and equipment | 27.0 |

| Commodity 5 | Articles of apparel and clothing accessories | 26.5 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Articles of apparel and clothing accessories | 38.5 |

| Commodity 2 | Coffee, tea, cocoa, spices, and manufactures thereof | 20.5 |

| Commodity 3 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 18.6 |

| Commodity 4 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 14.9 |

| Commodity 5 | Power generating machinery and equipment | 10.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Sri Lankan residents visiting Hong Kong |

4,620 |

-20.7 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

|

|

2019 |

Growth rate (%) |

|

Number of Sri Lankan residents residing in Hong Kong |

1,013 |

29.5 |

|

Number of South Asians residing in Hong Kong |

46,794 |

29.6 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate year

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: May 1, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Sri Lanka companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and Sri Lanka

Hong Kong has concluded an Avoidance of Double Taxation on income from shipping and aircraft transport agreement with Sri Lanka. This agreement entered into force on March 30, 2005.

Source: Hong Kong Department of Justice

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of the Democratic Socialist Republic of Sri Lanka

Address: Unit 905, 9/F, Sing Shun Factory Building, 495 Castle Peak Road, Cheung Sha Wan, Hong Kong

Email: peter.cheng@wisedragon.hk

Tel: (852) 2581 4111

Fax: (852) 2587 7770

Source: Hong Kong Protocol Division of Government Secretariat

Visa Requirements for Hong Kong Residents

Hong Kong residents need a visa to visit Sri Lanka for a maximum stay of 30 days. All holiday or business travellers visiting Sri Lanka must obtain Electronic Travel Authorisation (ETA) prior to arrival.

Source: Visa on Demand

Date last reviewed: May 1, 2020

Sri Lanka

Sri Lanka