GDP (US$ Billion)

448.12 (2019)

World Ranking 27/194

GDP Per Capita (US$)

2,230 (2019)

World Ranking 143/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

33 (2018)

Currency (Period Average)

Nigerian Naira

306.92per US$ (2019)

Political System

Federal republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

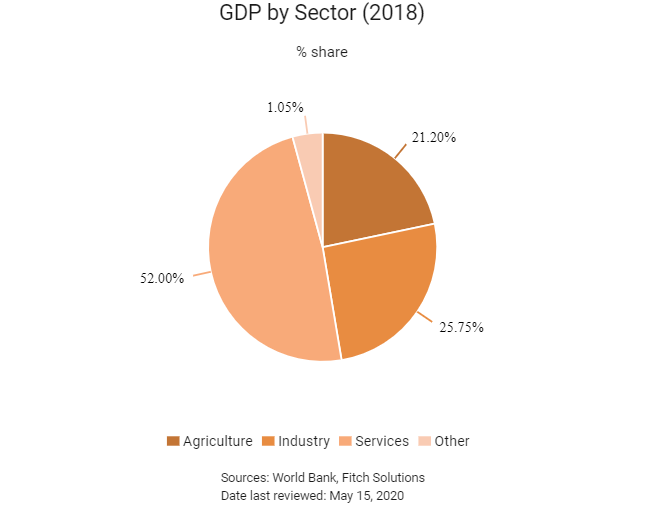

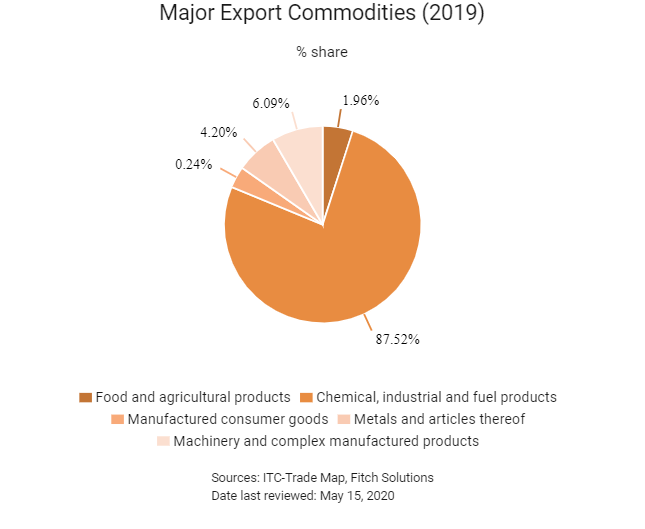

Nigeria is a key African market, accounting for almost half of West Africa's population, and the country boasts one of the largest youth populations in the world. The country also has an abundance of natural resources, with vast oil and gas reserves, and significant agricultural potential. As a member of the Organization of the Petroleum Exporting Countries since 1971, Nigeria ranks as the largest oil producer in Africa and the 11th largest in the world. Nevertheless, oil prices continue to dictate the country's growth pattern due to a high reliance on the hydrocarbons sector for exports and fiscal revenues. As the government begins to implement structural reforms as outlined in its Economic Recovery and Growth Plan 2017-2020, growth can be expected to strengthen gradually if reform momentum is ramped up. Nigeria has made significant progress in socioeconomic terms over the last 15 years; however, the country continues to face massive developmental challenges, which include diversifying the economy, addressing insufficient infrastructure, and building strong and effective institutions, governance structures and public financial management systems.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

July 2018

The Dangote Group mobilised more than USD4.5 billion in debt financing to build an oil refinery project, with a capacity of 650,000 barrels per day.

October 2018

The Nigerian government announced plans to add 4.2GW of electricity to the national grid from 2018-2020. A total of eight underutilised power projects had been selected to deliver incremental power to industrial centres and rural communities in the country. The projects included the Aba Integrated Power Project, the Alaoji combined-cycle gas power plant, the Afam IV gas plant rehabilitation, Afam V gas project rehabilitation and a Seplat gas facility.

December 2018

Nigeria replaced Togo as the revolving head of the 15-nation Economic Community of West African States grouping at the United Nations.

February 2019

General elections were due to be held on February 16, 2019, but were postponed to February 23, 2019, as a result of logistical problems. President Buhari was declared the winner after the sixth quadrennial elections since the end of military rule in 1999.

October 2019

Nigeria announced the closure of all its land borders and the movement of all goods. This may be reviewed in January 2020.

November 2019

The Nigerian Senate approved an increase in the value-added tax rate to 7.5% from 5.0% in a move that aimed to help the government shore up fiscal balances.

November 2019

President Buhari announced that he signed into law a bill that amended legislation on agreements related to offshore oil production. The new Act amended the previous law – with regard to the assignment of royalties found in Section 5 of the Deep Offshore Decree of 1999 – and set a time frame for the review of production sharing contracts with specific penalties for non-compliance with the law. The new amendments made no further changes to fiscal terms and appeared to provide no incentives for new developments.

November 2019

The African Development Bank sanctioned USD210 million to support the Nigeria Transmission Expansion Project, to be executed by Transmission Company of Nigeria (TCN). The project aims to rehabilitate and modernise the power lines to improve distribution and supply across Kano, Kaduna, Delta, Edo, Anambra, Imo and Abia states. The financing would be directed towards the modernisation of existing 263km of 330kV lines and the construction of 204km of new lines to increase TCN's wheeling capacity, stabilise the grid and reduce transmission losses. The project is part of the country's USD1.6 billion Transmission Rehabilitation and Expansion Programme.

May 2020

The government reviewed its 2020 budget assumptions, following the impact of the Covid-19 pandemic, and the associated expected large fall in oil revenues, announced plans to cut/delay non-essential capital spending in 2020. A fiscal stimulus package in the form of a Covid-19 intervention fund of NGN500 billion (USD1.4 billion) was approved by the president to support healthcare facilities, provide relief for taxpayers and incentivise employers to retain and recruit staff during the downturn. Import duty waivers for pharmaceutical firms would be introduced. Regulated fuel prices had been reduced and an automatic fuel price formula introduced to ensure fuel subsidies are eliminated. The president also ordered an increase of the social register by 1 million households to 3.6 million to help cushion the effect of the lockdown.

2020-2021

The Dangote refinery is scheduled to come online by 2021, adding 650,000 barrels per day of extra capacity and making Nigeria a net fuels exporter. Petrolex Oil & Gas is also undertaking a front end engineering design study for a USD3.6 billion (250,000 barrels per day) refining complex in Ogun state, and is aiming to complete construction by 2021.

Sources: BBC Country Profile – Timeline, government sources, Fitch Solutions

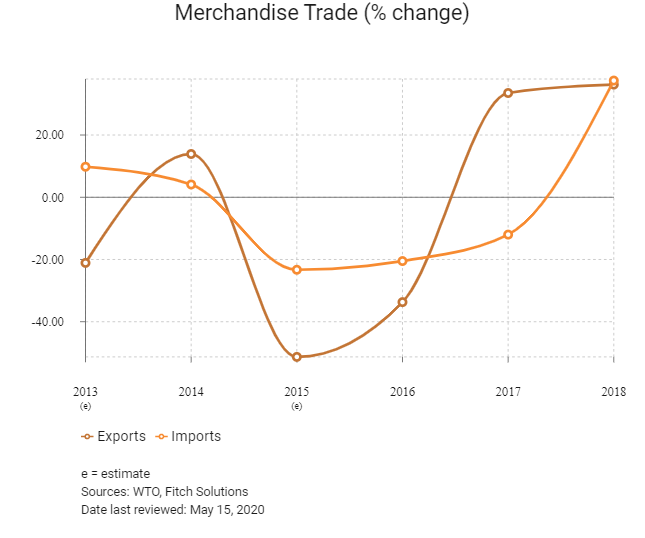

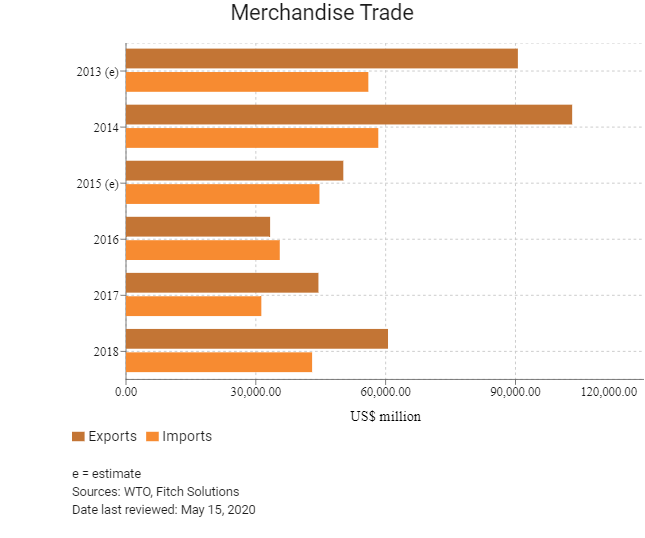

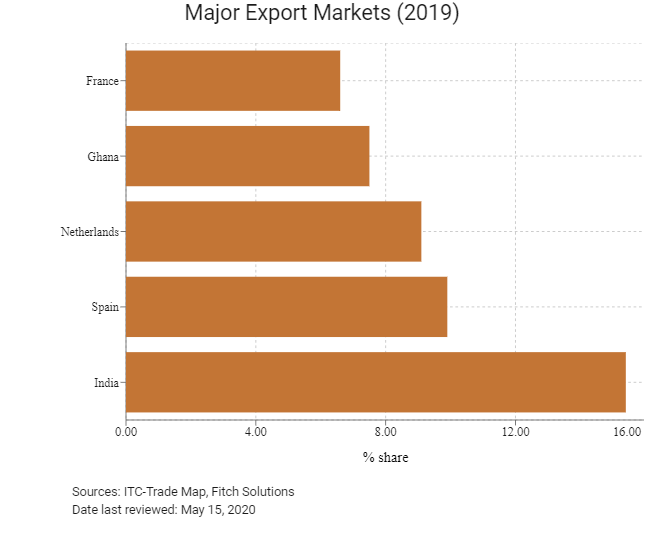

Merchandise Trade

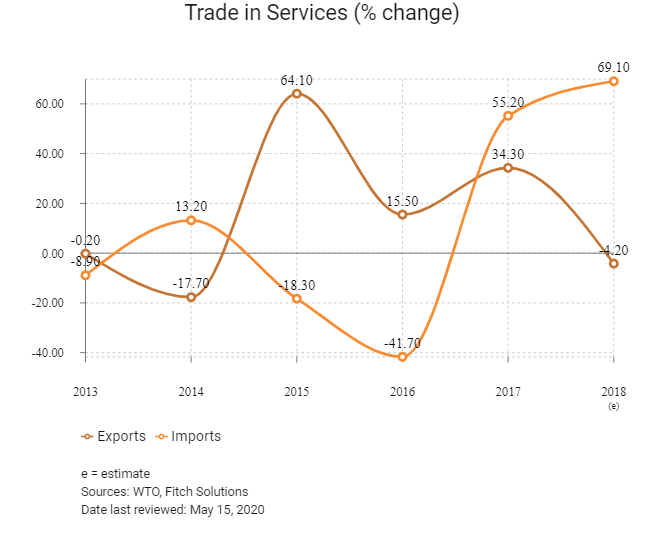

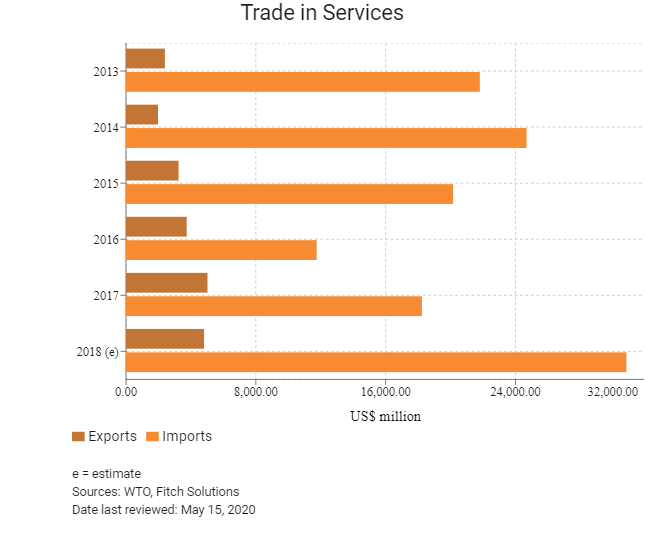

Trade in Services

- Nigeria has been a World Trade Organization (WTO) member since January 1, 1995, and a member of the General Agreement on Tariffs and Trade since November 18, 1960. Nigeria ratified the WTO Trade Facilitation Agreement in 2016, which entered into force in February 2017. Nigeria employs the Harmonised System of Customs Tariffs and all duties are levied on an ad valorem basis, with rates for most product lines ranging from 0% to 35%.

- Measures aimed at supporting local industry (including caps and special duties) have been levied on several import categories, including required inputs of the agricultural and manufacturing sectors. The Nigeria Customs Services increased duties in line with the Central Bank of Nigeria (CBN)'s foreign exchange rate policy. This has had the adverse effect of exacerbating smuggling activities and supply shortages as local output fails to fill the gap, thereby spurring inflation – which remained in double-digit territory over 2018.

- The revised Guidelines on Export Expansion Grant (EEG) Scheme were released and took effect on January 1, 2017. Under this arrangement, the Export Credit Certificate can be used to settle all federal government taxes, such as value added tax, withholding tax and corporate income tax. It can also be used to purchase government bonds and to repay government credit facilities and debts due to the Assets Management Company of Nigeria. To encourage the export of value added and processed/manufactured products, exporters are divided into four categories with maximum applicable EEG rates as indicated below:

- Fully manufactured products: 15%

- Semi-manufactured products: 10%

- Processed/intermediate products: 7.5%

- Merchants/primary agricultural commodities: 5%

- The Nigeria Customs Service imposes import duty rates on imported new and used vehicles, as well as new imported tyres. A fully built car is subject to combined duties and levies of 70% of the value (previously 22%). This is being implemented in line with the country's new policy to strengthen the local autos industry. The tariff rate for fully built commercial vehicles has increased from 10% to 35%. Imports of tyres will be subject to a 20% import duty. Conversely, local automotive plants can import completely knocked-down vehicles for assembly, free of duties, as well as semi-knocked-down vehicles at 5%. The prevailing United States dollar shortage will constrain manufacturers' ability to pay for and clear shipments of imported kits and components required in the manufacturing process.

- In 2015, Nigeria restricted importers of 41 broad categories of traded goods from accessing the Nigerian foreign exchange market. The country's import substitution policies ban the import of some 700 individual items and severely hamper firms' ability to source inputs and raw materials. Nigeria has bans in place on the imports of packaged sugar. This is part of the Nigerian Sugar Master Plan, which aims to achieve self-sufficiency in sugar consumption by 2020. Currently, about 98% of all sugar consumed in Nigeria is imported. Imports of raw sugar, by contrast, are subject to presidential approval on a recommendation from the trade and investment minister. In order to encourage the local production of cement, the Nigerian government has approved a series of measures, including the reinstatement of a ban on the importation of bagged cement and restrictions on the issuance of cement import licences. A levy of NGN500 per tonne applies for all cement imports, while various incentives are available to assist in the development of local capacity through the establishment of a cement training institute in Nigeria. In October 2013, the government of Nigeria announced a gradual ban on fish imports over the years ahead, accompanied by a sharp increase in import duties in the interim period. As of Q119, many of the import restrictions remain in place.

- Capital controls continue to hinder companies to access critical inputs that are not manufactured or sourced domestically. According to the CBN, the measure is intended to stabilise national foreign exchange reserves, as well as to support local manufacturing and job creation.

- In the first half of 2020, the official exchange rate was adjusted by 15%, with an ongoing unification of the various exchange rates under the investors and exporters (I&E) window, Bureau de Change, and retail and wholesale windows. The authorities committed to let the I&E rate move in line with market forces, and it has so far depreciated by about 4%. A few pharmaceutical companies have been identified to ensure they can receive foreign currency (FX) and naira funding. While the I&E window turnover has been low since April, the central bank has resumed FX supply in some of the other windows.

- In the first half of 2020, the official exchange rate was adjusted by 15%, with an ongoing unification of the various exchange rates under the investors and exporters (I&E) window, Bureau de Change, and retail and wholesale windows. The authorities committed to let the I&E rate move in line with market forces, and it has so far depreciated by about 4%. A few pharmaceutical companies have been identified to ensure they can receive foreign currency (FX) and naira funding. While the I&E window turnover has been low since April, the central bank has resumed FX supply in some of the other windows.

- Due to the import substitution drive, certain sectors – Nigerian cocoa processors in particular – face a lack of competitiveness due to the government's unwillingness to sign up to a free trade agreement with the European Union (EU). Ghana, Côte d'Ivoire and Cameroon, Nigeria's West African cocoa export rivals, have each agreed to economic partnership agreements and are not subject to the levies that Nigerian shipments face on arrival at European ports. The resulting higher costs of Nigerian cocoa products have left firms running at a quarter of capacity since 2011. The government opposes the trade deal because it believes that opening the local market to manufactured goods from the EU will destroy its fledgling domestic manufacturing sector which, as of 2016, has seen a steady increase in its manufacturing base (albeit still low). The latest round of talks failed to produce an agreement.Nigeria is a member of the ECOWAS, a customs union of 15 member states including Benin, Burkina Faso, Cape Verde, Côte d'Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Senegal, Sierra Leone and Togo. ECOWAS adopts a five-band tariff regime, with the first four bands ranging from 0% to 20%, and the fifth subjecting some sensitive items to a 35% tariff.

- Nigeria is a member of the Economic Community of West African States (ECOWAS), a customs union consisting 15 member states, including Benin, Burkina Faso, Cape Verde, Côte d'Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Senegal, Sierra Leone and Togo. ECOWAS adopts a five-band tariff regime, with the first four bands ranging from 0% to 20% and the fifth subjecting some sensitive items to a 35% tariff.

- Nigeria has also entered into effective bilateral trade agreements with mainland China, Finland, France, Germany, Italy, South Korea, Netherlands, Romania, Serbia, South Africa, Spain, Sweden, Switzerland, Taiwan and the United Kingdom. In spite of Nigeria's active pursuit of bilateral trade agreements, it adopts a rather protectionist trade policy.

- The Nigerian Export Promotion Council administered an EEG scheme to improve non-oil export performance until 2014, when the government ended the programme due to concerns about corruption on the part of companies who collected the grants, but did not actually export. The federal government's Economic Recovery and Growth Plan 2017-2020, released in February 2017, proposed reviving the EEG in the form of tax credits for companies. The Nigerian Export-Import Bank (NEXIM) provides commercial bank guarantees and direct lending to facilitate export sector growth, although these services are underused. NEXIM's Foreign Input Facility provides normal commercial terms of three to five years (or longer) for the importation of machinery and raw materials used for generating exports.

Sources: WTO – Trade Policy Review, ECOWAS

Trade Updates

- In May 2018, Nigeria and Mainland China announced that they will conduct a currency swap amounting to nearly USD2.4 billion, making trade between the two countries smoother and less reliant on the United States dollar in the future. The currency swap is valid for three years and can be renewed following the approval of both countries.

- In Q418, the Nigerian government moved closer to signing the African Continental Free Trade Area, following extensive consultations with multiple stakeholders. The agreement aims to bring together the African Union's 55 member states into a common market. Nigeria is one of six African nations not to sign the agreement, which has been ratified by 19 of the 22 required states as of Q119.

Multinational Trade Agreements

Active

As a member of the ECOWAS, Nigeria is a signatory to the ECOWAS Trade Liberalisation Scheme (ETLS). Having evolved considerably over the years, this scheme ultimately aims to liberalise trade in the region by abolishing customs duties levied on imports and exports, removing non-tariff barriers between member states and strengthening trade competitiveness with key global partners. The 15-country regional grouping comprises Benin, Burkina Faso, Cape Verde, Côte d'Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Senegal, Sierra Leone and Togo.

Under Negotiation

EU-ECOWAS Economic Partnership Agreement (EPA): The EPA between the EU and ECOWAS will create free trade zones (FTZs) between member states of the two blocs, allowing the entry of some imports from Europe into West Africa and vice versa, free of tariffs. The signing of the interim EPA with the EU by Ghana and Côte d'Ivoire may have put a strain on the ETLS as Nigeria's President Muhammadu Buhari refused to sign the West Africa-EU free trade deal. Tariffs on non-oil exports from Nigeria to the EU are to remain in place until the country signs the EPA, which it has been reluctant to enter into due to fears that it will open up the market to EU imports, and thereby slow domestic manufacturing growth.

Sources: WTO – Trade Policy Review, ECOWAS

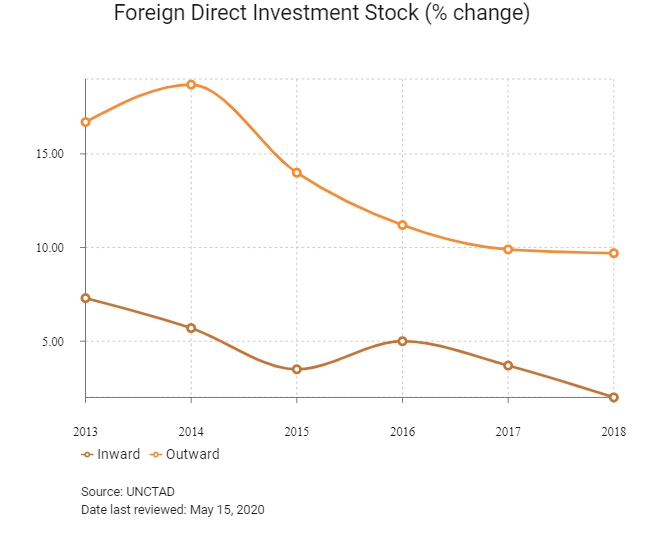

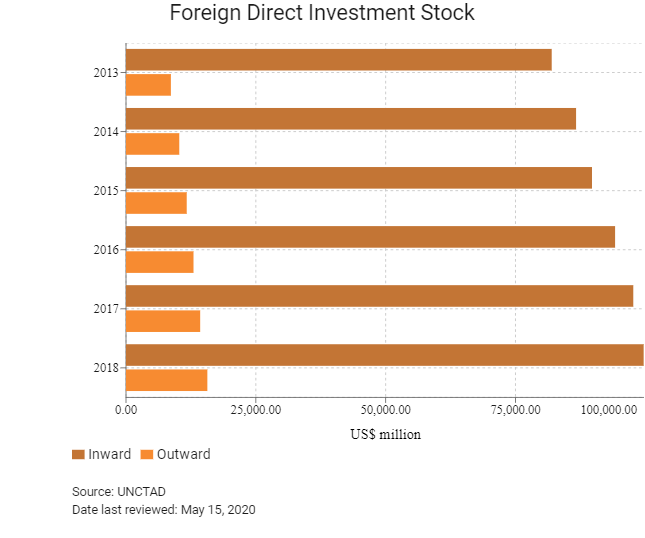

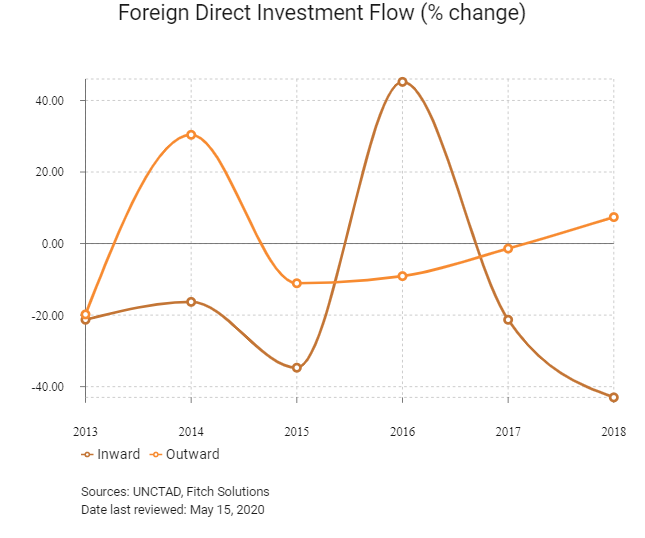

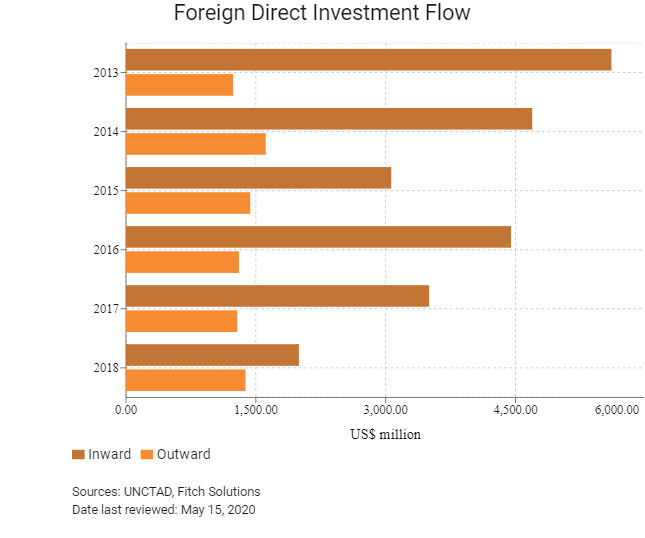

Foreign Direct Investment

Foreign Direct Investment Policy

- Nigeria has historically been a major destination for foreign direct investment (FDI) due to its oil and gas resources, and there are a number of incentives in place for foreign investors. However, Nigerian nationals are given preference in government procurement and there are tightening localisation requirements in certain investment areas, such as the agricultural sector and oil and gas businesses, which limit foreign ownership.

- Foreign ownership is permitted, with the exception of some sectors designated as strategic, defence-related industries and some farmland. The Nigerian Oil & Gas Industry Content Development Act 2010 seeks to increase indigenous participation in the oil and gas industry by prescribing minimum thresholds for the use of local services and materials, and to promote the employment of Nigerian staff in the industry. The Act imposes a levy of 1% on every contract awarded in the upstream oil and gas sector of the economy. Any violation of the Act is liable to a fine of 5% of the contract value and may result in the outright cancellation of the contract.

- The Local Content Act derives from the Nigerian Content Policy, which seeks to promote the active participation of Nigerians in the petroleum sector without compromising standards. Nigerian independent operators are given priority in the award of oil blocks, oil fields and oil lifting licences, as well as in all projects for which contracts are to be awarded in the Nigerian petroleum industry, subject to the fulfilment of conditions specified by the Minister of Petroleum Resources.

- The Nigerian Investment Promotion Commission (NIPC) was created in 1995 to promote and assist FDI. Tapping into resources other than oil is part of the government's economic recovery and growth plan after the worst economic slump in 25 years as oil output and prices fell. Nigeria's potential advantages for future growth include a large consumer market, a strategic geographic location as a hub for Africa and a young and entrepreneurial population. The first step in harnessing this opportunity requires deliberate efforts to improve value-adding activity in the non-oil economy, particularly in the agricultural and services sectors.

- To further encourage investors, incentives – including tax holidays of as much as five years for new companies entering the market, duty-free imports on mining equipment and mining licences for 25 years – have been put in place. According to the country's investment body, up to 120% of expenses on research and development (R&D) are tax deductible, provided that such R&D activities are carried out in Nigeria and are connected with the business from which income or profits are derived. For the purpose of R&D on local raw materials, 140% of expenses are allowed. For cases in which the research is long term, it will be regarded as a capital expenditure and will be written off against profit.

- The NIPC Decree of 1995 permits 100% foreign ownership of companies outside the oil and gas industry. Within oil and gas, foreign firms were previously obliged to participate in joint ventures (JVs) or production sharing agreements. However, provisions made in the 2018 national budget set out proposals that allow for the sale of state equity in JV oil assets, a move that officials say will raise NGN710 billion. The reform is aimed at increasing private sector equity participation to improve efficiencies in the sector, and providing revenue to the government, which will be deployed solely and exclusively for creating new assets in Nigeria. The proposals signal a significant change in the way that the state participates in production and ownership structures in its upstream oil sector.

- Foreign firms will benefits from the government's efforts to improve transparency and predictability for foreign investors. For example, in may 2014, Nigeria signed a Foreign Investment Promotion and Protection Agreement with Canada, which is expected to enhance protection for investors by creating a framework of legally binding rights and obligations. Moreover, Nigeria has signed bilateral investment agreements with more than a dozen countries, notably Mainland China, Italy, Algeria and Egypt, as well as bilateral investment treaties (BITs) with the United Kingdom, France, the Netherlands, Taiwan, South Korea, Serbia, Switzerland, Romania, South Africa, Italy, Spain, Sweden, Finland, Germany and mainland China. These BITs enable investors from the latter countries to enjoy similar benefits to those enjoyed by Nigerian investors. As a result, in theory, Nigerian investors are not provided preferential treatment in their investments over expatriates from BIT countries, and any infringement on the Nigerian side could then be referred to international arbitration.

- The federal government of Nigeria has lifted the suspension of the pioneer status incentive after embarking on a review of the incentive to address identified lapses, abuses and loopholes. On August 2, 2017, the Federal Executive Council approved a new Pioneer Status Incentive Policy based on the comprehensive review of the scheme. Pioneer Status Incentive is a tax holiday that grants qualifying industries and products relief from the payment of CIT for an initial period of three years, extendable for one or two additional years. As part of the new regime, 27 new industries have been added to the list of eligible industries, while new application guidelines have been issued.

- Other similar government initiatives include the establishment of raw materials-based small- and medium-scale industry clusters to promote sustainable development and the growth of local companies. Nine sites across the country have been selected as pilot clusters for deploying fish, plantain, palm oil, okra, cassava and grain processing technologies. This process could lessen the country's dependence on oil exports and could stimulate the growth of new industries offering diverse investment opportunities. Nigeria has seen some success in facilitating cluster development, and there are 15 operational (34 planned) FTZs in Nigeria with different areas of specialisation, including manufacturing, logistics services, warehousing, steel fabrication, food processing and manufacturing, oil and gas services, and trade, tourism and resort services.

- Foreign investors must register with the NIPC, incorporate as a limited liability company (private or public) with the Corporate Affairs Commission, procure appropriate business permits, and register with the Securities and Exchange Commission (when applicable) to conduct business in Nigeria. Manufacturing companies sometimes must meet local content requirements. Expatriate personnel do not require work permits, but they remain subject to quotas, requiring them to obtain residence permits that allow salary remittances abroad.

- Investments in industries related to national security are restricted to domestic investors, including ammunition, firearms and military and paramilitary apparel.

- The Guidelines for Nigerian Content Development in the information and communication technology (ICT) sector issued by the National Information Technology Development Agency on December 3, 2013, require ICT companies to host all consumer and subscriber data locally and for government ministries, departments and agencies to source and procure software from only local software development companies. Enforcement of the guidelines is variable as the state lacks capacity and resources to monitor digital data flows. Federal government data is hosted locally in data centres. The main objective of the National Office of Technology Acquisition and Promotion (NOTAP) is to regulate the international acquisition of technology while creating an environment conducive to local technology. To this end, NOTAP recommends local technical partners to Nigerian users in a bid to reduce the level of imported technology, which currently accounts for more than 90% of technology in use in Nigeria. One of NOTAP's major activities is the review of Technology Transfer Agreements (TTAs), a requirement for importing technology into Nigeria and for companies operating in Nigeria to access foreign currency. NOTAP reviews the legal, economic and technical aspects prior to the approval of TTAs and the subsequent issuance of a certificate. One of the main risks concerning the TTA is the length of the approval process, which can take up to three months. NOTAP states that it plans to have an automated system in place to streamline the TTA process, thereby reducing the approval process to one month or less.

- Though foreign companies may bid on government projects and generally receive national treatment in government procurement, they may also be subject to a local content vehicle (such as requiring to partner with a local firm, or the inclusion of one in a consortium) or other prerequisites, which are likely to vary from tender to tender. Procurements worth more than NGN100 million reportedly undergo full 'due process'. Nigerian companies receive a preferential margin in the bidding process. Nigeria is not a signatory to the World Trade Organization Agreement on Government Procurement. Corruption and lack of transparency in tender processes are key concerns for investors.

- Nigeria retains its multiple FX rate regime, despite calls by investors to adopt a single exchange rate, driven by market forces, such as the Nigerian Autonomous Foreign Exchange Rate Fixing mechanism. The web of different rates for different purposes continues to distort the market, keeping the naira artificially strong for groups such as: pilgrims seeking hard currency to travel to Mecca, small- and medium-sized enterprises, fuel importers, or Nigerians who need to pay overseas school fees. The central bank's limited ability to provide foreign exchange and the imposition of blanket import and FX restrictions prevent many companies from repatriating naira-denominated earnings in a timely manner. Foreign exchange demand remains high because of the dependence on foreign inputs for manufacturing and refined petroleum products. Companies are advised to acquire foreign currency denominated bank accounts.

- Companies engaged in the marketing and distribution of gas for domestic and industrial use (downstream operations) are subject to the Companies Income Tax Act. Beginning on the date in which they begin production, companies engaged in downstream operations and companies using gas in industrial projects benefit from an initial three-year tax holiday. This tax holiday is renewable for an additional two years after the tax holiday expires if the company is performing satisfactorily. The companies also benefit from accelerated capital allowances after the tax-holiday period.

- A gas-flaring penalty is imposed on oil companies for wasteful disposals of gases through burning in oil fields and refineries. Companies engaged in petroleum operations are deemed to be in the upstream sector of the oil and gas sector and are subject to tax under the Petroleum Profit Tax Act.

Sources: WTO – Trade Policy Review, government sources, Fitch Solutions

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

There are 15 FTZs operating in Nigeria, including five in Lagos, the country's business capital and most populous city. Industries permitted in FTZs include chemicals, petroleum, textiles, garments, rubber, plastics, electrical and electronics, telecom equipment, metal, wood, leather, educational materials and cosmetics.

| - Complete tax holiday for all federal, state and local government taxes, rates, custom duties and levies. - One-stop approval for all permits, operating licences and incorporation papers. - Duty-free, tax-free import of raw materials for goods destined for re-export. - Duty-free introduction of capital goods, consumer goods, components, machinery, equipment and furniture. - Permission to sell 100% of manufactured, assembled or imported goods in the domestic Nigerian market. - When selling in the domestic market, the amount of import duties on goods manufactured in the free zones are calculated on the basis of the value of the raw materials or components used in assembly, and not the finished product. - 100% foreign ownership of investments. - 100% repatriation of capital, profits and dividends. - Waiver of all import and export licences. - Waiver on all expatriate quotas for companies operating in the zones. - Prohibition of strikes and lockouts. - Rent-free land during the first six months of construction. - Incentives are available for manufacturing, logistics services, warehousing, steel production, food processing and manufacturing, oil and gas services and tourism. - The Nigerian Export Processing Zone Authority allows duty-free import of all equipment and raw materials into its export processing zones. - The state also encourages private sector participation and partnership with state and local governments under the FTZ programme, resulting in the establishment of the Lekki FTZ (owned by Lagos state) and the Olokola FTZ (which straddles Ogun and Ondo states and is owned by those two states, the federal government and private oil companies). - Workers in FTZs may unionise, but may not strike for an initial 10-year period. |

| Other incentives | - The Nigerian government maintains different and overlapping investment incentive programmes. - The Industrial Development/Income Tax Relief Act provides incentives to pioneer industries deemed beneficial to Nigeria's economic development and to labour-intensive industries, such as apparel. There are currently 71 industries defined as pioneer industries. - Companies that receive pioneer status may benefit from a non-renewable, 100% tax holiday of five years (or seven years, if the company is located in an economically disadvantaged area). - Industries that use 60-80% local raw materials in production may benefit from a 30% tax concession for five years, and investments employing labour-intensive modes of production may enjoy a 15% tax concession for five years. - Additional tax incentives are available for investments in domestic R&D, for companies that invest in local government areas deemed disadvantaged, for local value-added processing, for investments in solid minerals and oil and gas, and for a number of other investment scenarios. - Approved enterprises operating in export FTZs are exempt from all federal, state and local government taxes, levies and rates. |

| Work Experience Acquisition Programme related incentives | - If a company has a minimum net employment of five new employees and if it retains such employees for a minimum of two years from the year of assessment in which the employees are first employed, it is granted Work Experience Acquisition Programme Relief. - This relief is an exemption from income tax equal to 5% of the company's assessable profits in the assessment period in which the company qualifies, subject to other specified conditions. - In addition, if a company has a minimum net employment of 10 employees and if 60% of the employees do not have any form of previous work experience and are within three years of graduating from school or a vocation, the company is granted employment tax relief. - This relief is an exemption from income tax equal to 5% of its assessable profits in the assessment period in which the profits are generated. |

Sources: government sources, Fitch Solutions

- Value Added Tax: 7.5%

- Corporate Income Tax: 30%

Source: Nigeria Federal Inland Revenue Service

Important Updates to Taxation Information

- In 2018, Nigeria and Singapore signed a treaty for the avoidance of double taxation on income and capital gains tax between the two countries. When ratified by the National Assembly, the treaty will provide enhanced reliefs to investors and businesses between both countries to eliminate or reduce the incidence of double taxation in addition to exchange of information and mutual assistance on tax matters.

- On January 26, 2018, the Nigerian government announced the ratification of the Nigeria-Spain double taxation treaty (DTT). The DTT was initially negotiated in June 2009 and presented to the National Assembly for ratification in 2016, alongside DTTs with Sweden and South Korea.

- On October 14, 2019 the Nigerian President Muhammadu Buhari presented the Finance Bill 2019 to the National Assembly. The 2019 Finance Bill, which is currently undergoing legislative process, is set to make sweeping changes to various tax laws in the country once it is approved. VAT may rise to 7.5% in 2020 subject to various government approvals.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate Income Tax (CIT) | 30% on profits |

| ClT – Companies involved in manufacturing or export-oriented activities with turnover not exceeding NGN1 million | Reduced from the normal rate of 30% to 20% over the first five years of operation |

| Petroleum Profit Tax applies to any industry involved in upstream oil activities and replaces the normal CIT applied to companies | Rates on upstream oil producers vary according to the type of venture: - a 50% corporate ncome tax rate applies to production sharing contracts (PSC) with the Nigerian National Petroleum Corporation - 65.75% for non-PSC operations as well as JVs; however, this only applies for the operations' first five years - 85% for non-PSC and JV operations after the first five years |

| Capital Gains Tax | 10% but gains on the disposal of shares are exempt |

| Information technology levy | 1% on businesses (before CIT) which adhere to the following two criteria: - belongs to financial services, internet and telecommunications operations - has an annual turnover of NGN100 million or more |

| Excise duties | 20% |

| Tertiary Education Tax | 2% of the assessable profit |

| Value Added Tax | 7.5% on goods and services |

Source: Nigeria Federal Inland Revenue Service

Date last reviewed: May 15, 2020

Visa Policies

Nigeria has expanded the availability of visas on arrival and broadened the list of activities permitted for both visas on arrival and consular business visas. Effective in 2017, foreign nationals from countries that do not have a Nigerian embassy will be eligible to obtain visas on arrival at a port of entry. Activities that will be permitted on a visa on arrival or consular business visa include meetings, negotiating contracts, conducting sales, job interviews, training or research, purchasing and distributing Nigerian goods, attending trade fairs, and participating in emergency or relief work. The changes to the visa rules for foreign business travellers and investors are part of the Nigeria Immigration Service's 60-day action plan to make it easier to do business in Nigeria.

Work Permits

Existing labour regulations continue to restrict the employment of foreign nationals, particularly in low-skilled positions. Work permits are required for all foreign nationals intending to work in Nigeria. The Executive Order signed in February 2018 prohibits the Ministry of Interior from providing foreign workers with work visas if their skills and expertise are already available locally in Nigeria. Furthermore, the Executive Order elaborates that foreign professionals will be considered for contracting purposes only in cases when it is certified by relevant Nigerian authorities that their expertise is not available in Nigeria. Finally, the Executive Order explicitly directs national ministries, departments and agencies to engage local professionals in the planning, design and execution of national security projects. Employers hiring foreign workers must obtain an expatriate quota and a business permit from the Ministry of Internal Affairs. Only workers coming from other Economic Community of West African States member countries do not need a work permit.

Other Procedures

The costs of employing foreign workers are generally high in Nigeria, owing to high relocation expenses and processing fees for work and residence permits. There are other fees relating to the renewal of quota positions, restoration of lapsed quotas and other services relating to the employment of foreign workers. The main way to legally work in Nigeria is by acquiring a Combined Expatriate Residence Permit and Aliens Card (CERPAC). This document is a combined residency and work permit, but involves a lot of paperwork. An employment contract is a prerequisite for obtaining a CERPAC. In addition, there is limited flexibility for workers to change jobs on the same permit and this would require a re-application process.

Visa/Travel Restrictions

There are four different types of entry permits for Nigeria: tourist visa, business visa, temporary work permit (TWP) visa and subject to regularisation (STR) visa. The STR is required for taking up paid employment as an expatriate in Nigeria.

The business visa is for business-related purposes only, except employment. The TWP allows holders to perform specific short-term work only – for example, equipment repairs, research, auditing and installation work. The TWP is a short-term work and residence permit granted to foreign nationals invited by corporate bodies to provide specialised, skilled services. It is valid for three months and can be renewed at the discretion of the Nigerian authorities.

The CERPAC enables a foreign employee to work and live in Nigeria. To obtain a CERPAC, the Nigerian company must have obtained an expatriate quota approval and the foreigner must have obtained an STR visa. The official cost of a CERPAC is more than USD1,400 and the process usually takes three to six days. The CERPAC is valid for one year and may be renewed on expiry.

Sources: government sources, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | B2 (Negative) | 15/04/2020 |

| Standard & Poor's | B- (Stable) | 26/03/2020 |

| Fitch Ratings | B (Negative) | 06/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 145/190 | 146/190 | 131/190 |

| Ease of Paying Taxes Index | 171/190 | 157/190 | 159/190 |

| Logistics Performance Index | 110/160 | N/A | N/A |

| Corruption Perception Index | 144/180 | 146/180 | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

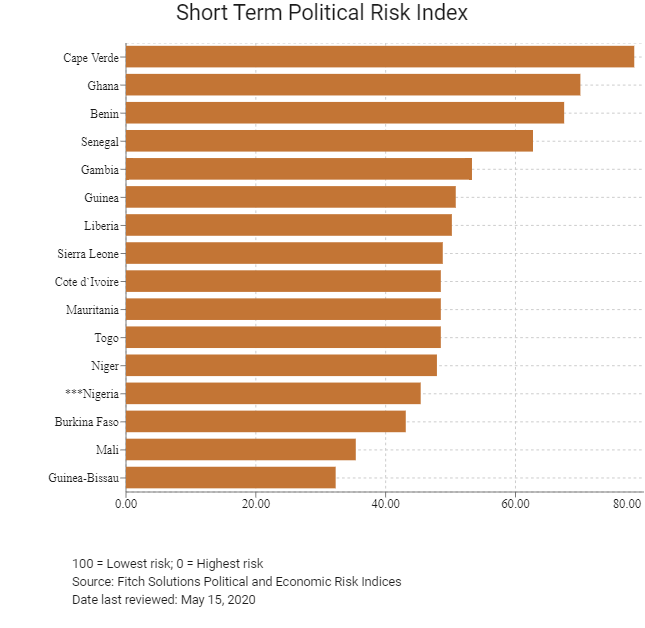

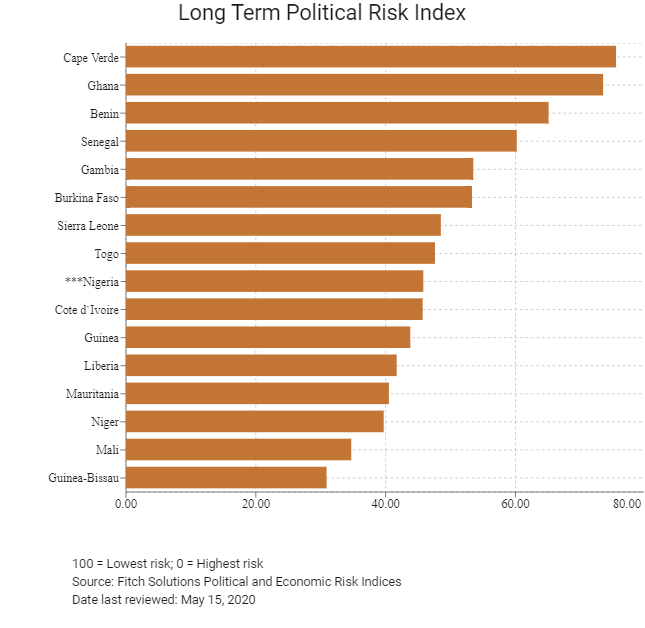

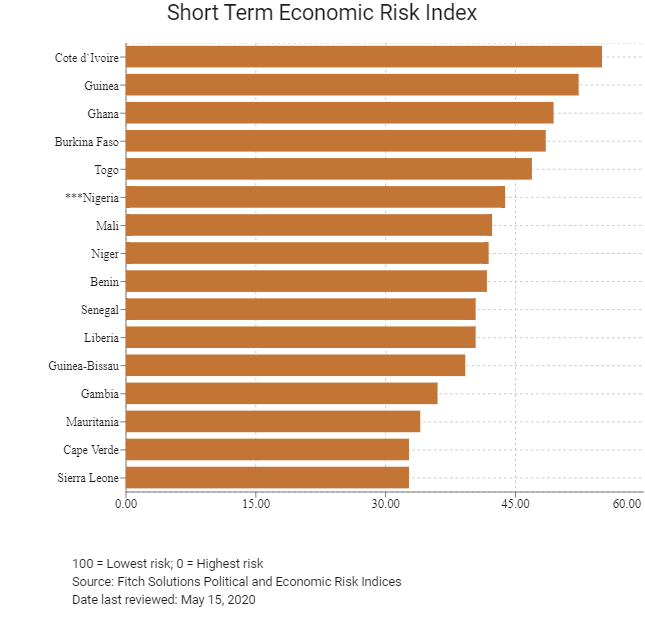

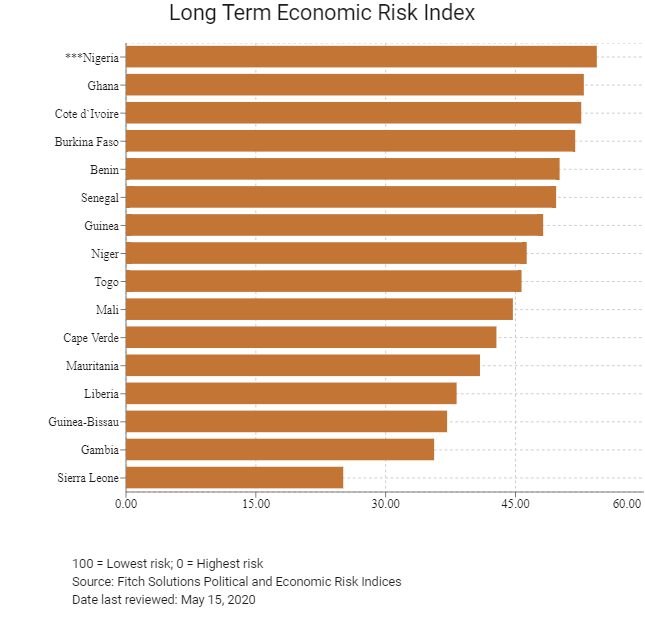

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

Economic Risk Index Rank | 80/202 | 74/201 | 83/201 |

Short-Term Economic Risk Score | 57.1 | 50.6 | 43.8 |

Long-Term Economic Risk Score | 55.7 | 57.6 | 54.4 |

Political Risk Index Rank | 167/202 | 166/201 | 167/201 |

Short-Term Political Risk Score | 49.8 | 46.7 | 45.4 |

Long-Term Political Risk Score | 45.8 | 45.8 | 45.8 |

Operational Risk Index Rank | 156/201 | 148/201 | 146/201 |

Operational Risk Score | 36.3 | 38.1 | 38.3 |

Source: Fitch Solutions

Date last reviewed: May 15, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

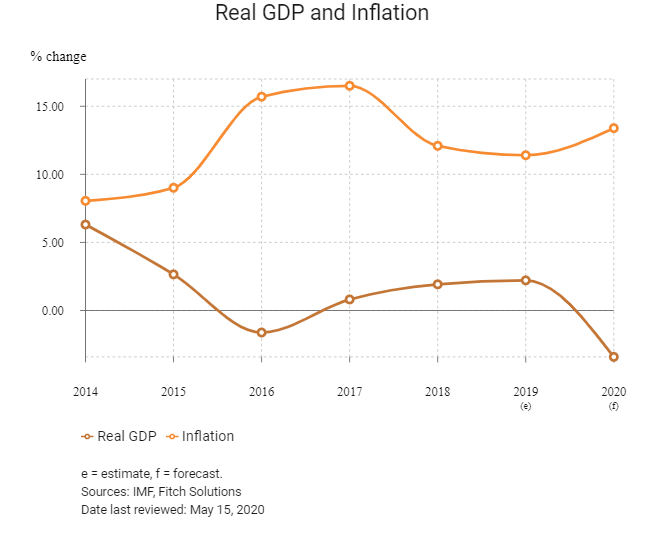

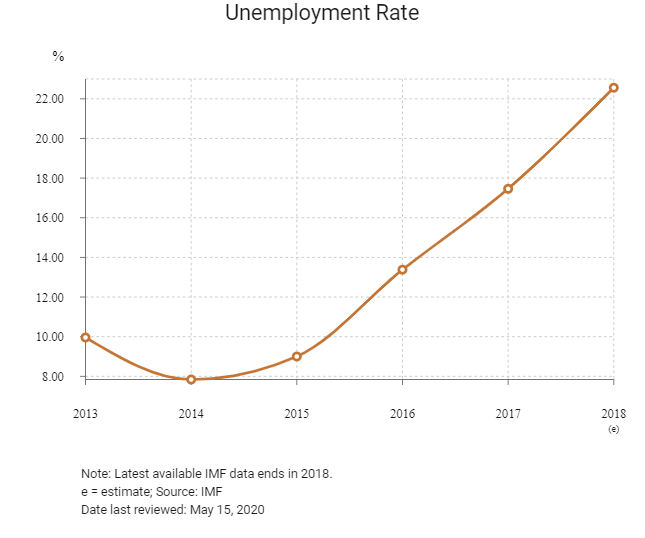

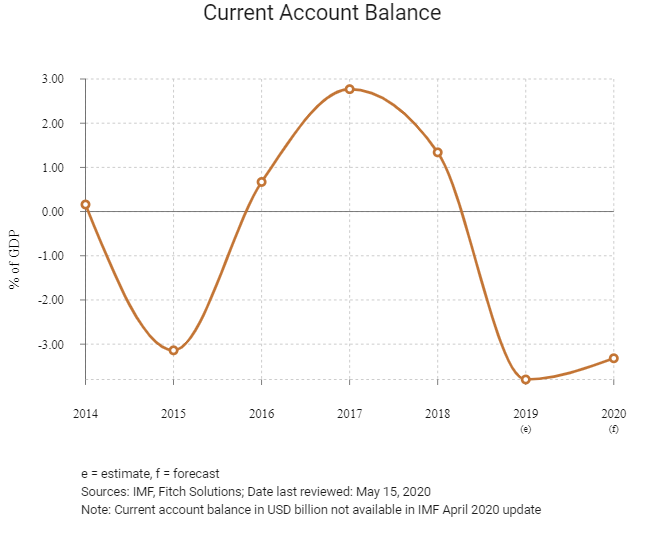

Oil is a major pillar of the Nigerian economy, and when prices were high and production robust, it helped the country garner large foreign reserves, a relatively healthy current account position and low foreign debt (the country had paid off much of its debt in 2006). However, since the price slump in 2014, the structural weakness of an overreliance on oil exports has been highlighted. After only gradually recovering from the 2016 recession, the economy faces a contraction again in 2020. The collapse in crude prices may hinder domestic production, battering FX and fiscal revenues and adding pressure to the country's international reserves and the currency in turn. The Covid-19-induced disruption to activity further dampens the outlook. That said, its power sector's reforms and transport infrastructure capacity building are crucial for long-term productivity gains and industrial diversification. Overall, the long-term outlook remains challenging, weighed by elevated unemployment, insecurity challenges, power shortages, still-low crude prices and a more subdued global economic backdrop.

OPERATIONAL RISK

Nigeria's vast natural resources, as well as strong economic and population growth over the past decade, have given rise to a growing consumer class and expanding labour pool, and attracted considerable investor interest. However, the country remains a difficult operating environment. Businesses operating in Nigeria face heightened security costs, an uncertain regulatory environment, limited labour and capital mobility and uncompetitive import conditions. Nigeria's economy remains strongly tied to the performance of the oil sector, and overall economic activity is unlikely to reach levels seen over the past decade, on the back of weak oil-driven growth, limited reform momentum and sluggish non-oil sector activity. Nigeria's non-oil sector growth potential remains constrained by the acute shortcomings in the country's utilities and transport sectors, high levels of social instability in the restive regions of the country and high structural reliance on sustained oil output for government revenues and economy-wide foreign currency liquidity. Criminal activity and recurrent militant attacks on critical infrastructure threaten the safety of foreign workers and business operations. This also disrupts the country's predominantly gas-reliant power supply and limits freight transit routes.

Source: Fitch Solutions

Date last reviewed: May 12, 2020

Fitch Solutions Political and Economic Risk Indices

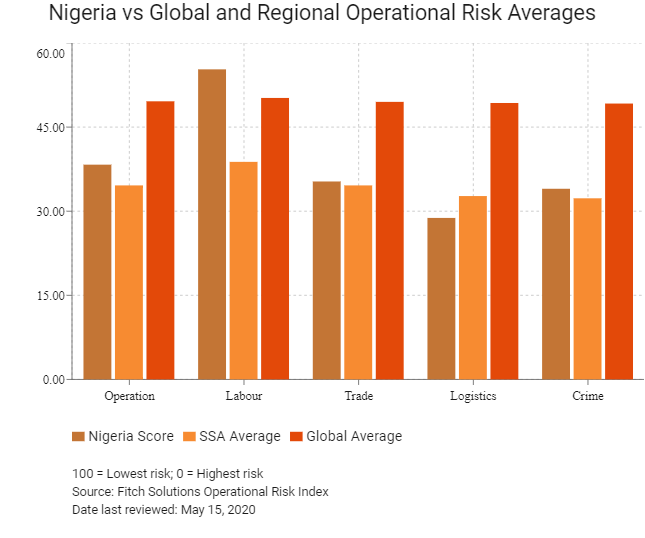

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Nigeria Score | 38.3 | 55.3 | 35.3 | 28.8 | 34.0 |

| West Africa Average | 33.8 | 36.7 | 35.8 | 30.2 | 32.6 |

| West Africa Position (out of 16) | 3 | 1 | 7 | 10 | 8 |

| SSA Average | 34.6 | 38.8 | 34.6 | 32.7 | 32.3 |

| SSA Position (out of 48) | 12 | 1 | 19 | 28 | 20 |

| Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 146 | 63 | 151 | 167 | 152 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

Ghana | 44.8 | 48.2 | 47.1 | 33.6 | 50.2 |

Cape Verde | 42.6 | 40.5 | 50.4 | 36.3 | 43.1 |

Nigeria | 38.3 | 55.3 | 35.3 | 28.8 | 34.0 |

Gambia | 38.3 | 39.9 | 32.2 | 36.2 | 45.0 |

Senegal | 36.8 | 32.8 | 38.5 | 31.5 | 44.5 |

Cote d`Ivoire | 36.7 | 39.7 | 43.0 | 40.1 | 24.0 |

Benin | 36.3 | 40.6 | 34.0 | 31.3 | 39.5 |

Togo | 34.7 | 34.0 | 38.5 | 37.4 | 28.7 |

Mauritania | 32.5 | 36.5 | 39.2 | 21.9 | 32.4 |

Burkina Faso | 31.8 | 36.4 | 31.7 | 27.5 | 31.5 |

Guinea | 31.4 | 31.5 | 35.2 | 31.8 | 26.9 |

Liberia | 30.5 | 35.3 | 31.4 | 20.7 | 34.8 |

Sierra Leone | 29.3 | 23.9 | 34.1 | 23.8 | 35.3 |

Mali | 27.9 | 33.7 | 28.9 | 29.5 | 19.4 |

Guinea-Bissau | 24.8 | 30.4 | 20.8 | 28.1 | 19.8 |

Niger | 24.7 | 29.2 | 32.6 | 24.8 | 12.2 |

Regional Averages | 33.8 | 36.7 | 35.8 | 30.2 | 32.6 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 15, 2020

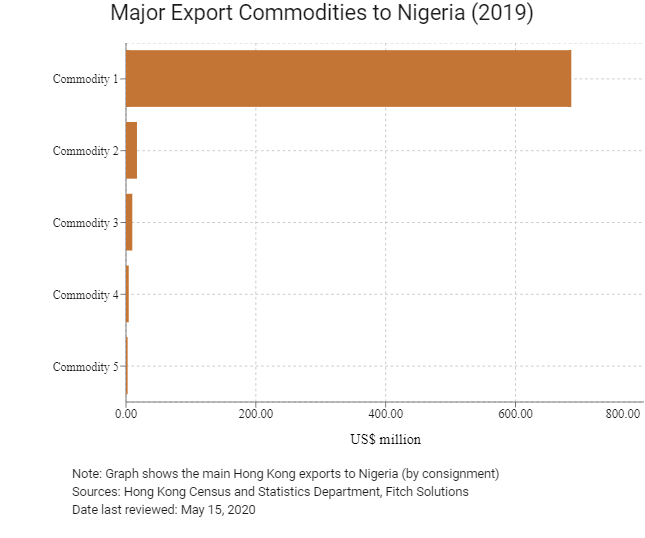

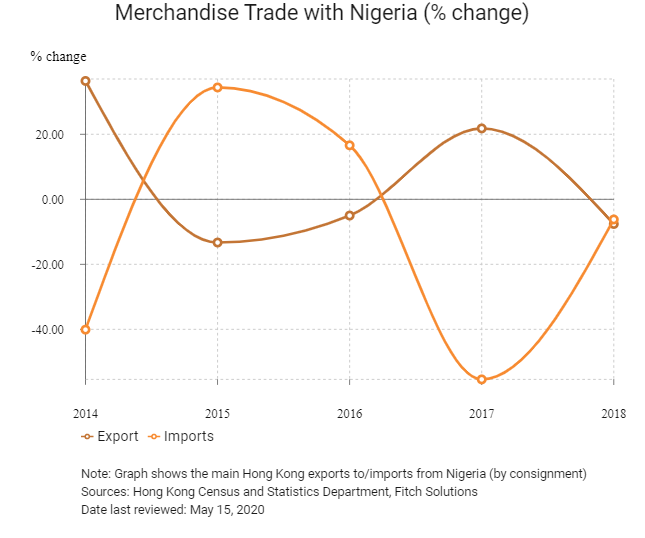

Hong Kong’s Trade with Nigeria

Export Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 686.0 |

Commodity 2 | Office machines and automatic data processing machines | 16.9 |

Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 9.7 |

Commodity 4 | Articles of apparel and clothing accessories | 4.2 |

Commodity 5 | Professional, scientific and controlling instruments and apparatus | 2.5 |

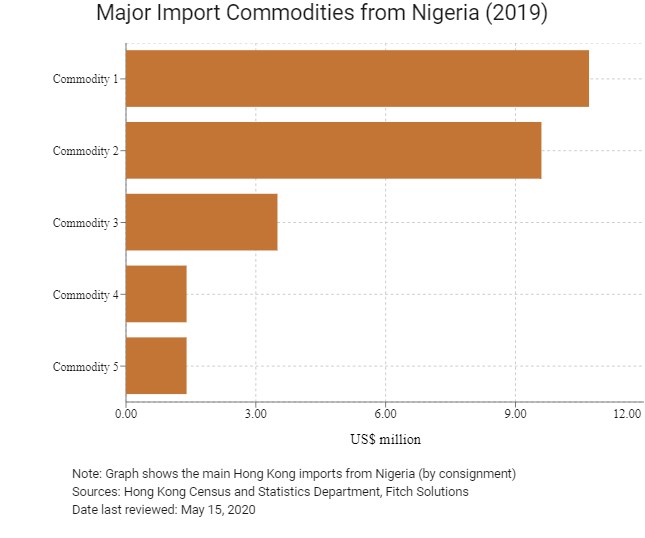

Import Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Metalliferous ores and metal scrap | 10.7 |

Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 9.6 |

Commodity 3 | Leather, leather manufactures, and dressed furskins | 3.5 |

Commodity 4 | Crude animal and vegetable materials | 1.4 |

Commodity 5 | Vegetables and fruit | 1.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Nigerian residents visiting Hong Kong | 1,863 | -411.2 |

| Number of Africans visiting Hong Kong | 123,656 | -10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: May 15, 2020

Commercial Presence in Hong Kong

2016 | Growth rate (%) | |

| Number of Nigerian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong and Nigeria

Tax treaty negotiations are in progress between Nigeria and Hong Kong. The first round of talks was carried out in February 2017.

Sources: Hong Kong Inland Revenue Department, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

Nigerian Consulate General in Hong Kong

Address: Suite 502, 5/F, Fortis Tower, 77-79 Gloucester Road, Wan Chai, Hong Kong

Email: nigeriaconhk@yahoo.com

Tel: (852) 2827 8813 / 2827 8824 / 2827 8834

Fax: (852) 2827 8892 / 2802 9915

Source: Nigerian Consulate General in Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders need a visa to visit Nigeria.

Sources: Nigerian Consulate General in Hong Kong

Date last reviewed: May 15, 2020

Nigeria

Nigeria