GDP (US$ Billion)

172.94 (2018)

World Ranking 56/193

GDP Per Capita (US$)

9,401 (2018)

World Ranking 74/192

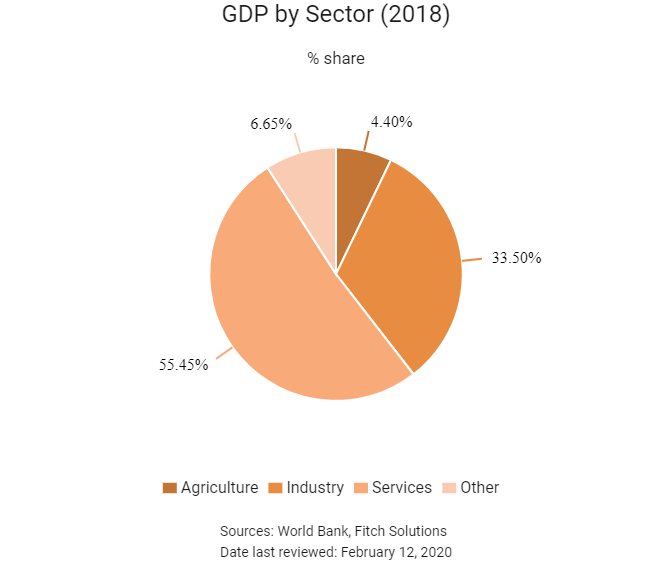

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

64.4 (2019)

Currency (Period Average)

Kazakhstani Tenge

382.75per US$ (2019)

Political System

Unitary republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

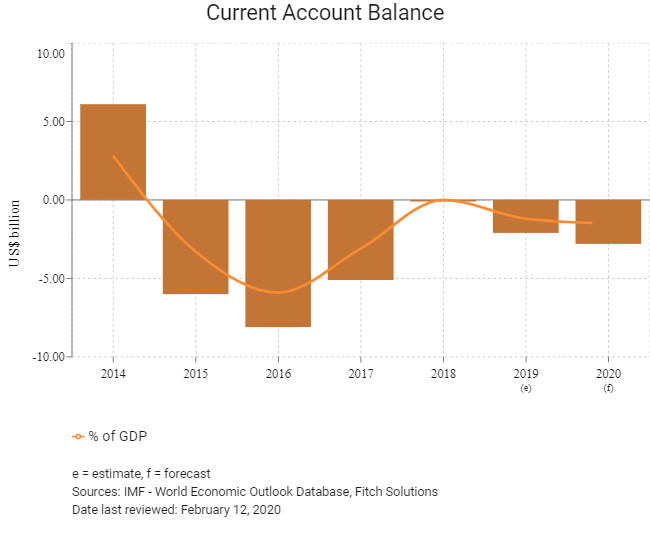

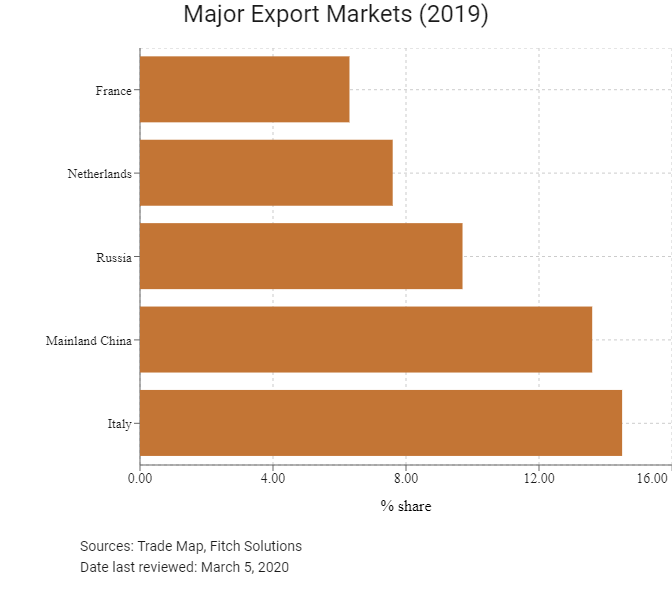

Kazakhstan has transitioned from lower-middle income to upper-middle income status in less than two decades. The country moved to the upper-middle income group in 2006. Strategically, it links the large and fast-growing markets of China and South Asia with those of Russia and Western Europe by road, rail and a port on the Caspian Sea. However, progress on poverty reduction was largely stagnant in 2014 and 2015, reflecting slow growth and weak labour market outcomes. The economy’s vulnerability to external shocks remains the main challenge to achieving stable and sustainable development. External demand from China and Russia, Kazakhstan’s main trading partners, and global oil demand and prices will continue to be the key external factors affecting Kazakhstan’s economic performance. Domestic factors include the pace of implementation of structural and institutional reforms as well as the potential impact of the political transition.

Ongoing structural and institutional reforms (including the government's ambitious privatisation programme, those under the 100 Concrete Steps programme, the country's integration into China's Belt and Road trade route and the Strategic Plan for Development of Kazakhstan to 2025) aim to increase private sector participation in the economy, bolster foreign direct investment and facilitate the development of a vibrant, modern and innovative non-oil sector. In addition, recently approved plans for the construction of the Meridian Highway will have tangible impact on infrastructure development in Western Eurasia and pose an attractive alternative to existing cross-continental trading routes.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2015

President Nursultan Nazarbayev was re-elected with 97.7% of votes cast.

March 2017

Parliament approved constitutional reforms that would reduce the president's powers in favour of lawmakers and the cabinet.

May 2018

Parliament appointed Nazarbayev chairman for life of the newly strengthened Security Council, preparing the stage for his post-presidential role.

November 2018

The Kazakh government awarded 857.93MW of power supply deals through tenders in 2018. The government initially planned to award 1GW of power, comprising 290MW of solar, 620MW of wind, 75MW of hydropower and 15MW of bio-power. A total of 3.24GW was received in offers from a total of 30 local and foreign firms.

January-May 2019

Over January to May, repairs at Kazakhstan’s thee largest oilfields – Kashagan, Karachaganak and Tengiz – led to a 19.1% y-o-y contraction in mining and quarrying output, compared to a 3.1% drop over the first five months of the previous year.

March 2019

Nazarbayev announced his resignation.

April 2019

President Kassym-Jomart Tokayev, the former Senate chairman, announced snap presidential elections for June 9, 2019.

June 2019

Kassym Jomart-Tokayev won Kazakhstan's presidential election in the first round.

August 2019

French rail transport company Alstom and Kazakhstan Railways (KTZ) signed a memorandum of understanding (MoU) for the development of digital technologies for the railway signalling in the Republic of Kazakhstan. The MoU included interlocking technology, which would be implemented during the upgrade of interlockings at Kazakhstan's largest stations. KTZ intended to launch new technologies, particularly the deployment of modern signalling systems in shorter terms and at a qualitatively high level, in partnership with Alstom.

October 2019

President Kassym-Jomart Tokayev signed a presidential decree that granted former president Nazarbayev the right to veto most of the president's ministerial appointments, heads of various security forces and regional governors. While Tokayev retained the right to unilaterally appoint the ministers of defence, internal affairs and foreign affairs, most other posts would be subjected to Nazarbayev's approval, including the head of Tokayev's own security detail.

Sources: BBC country profile – Timeline, Fitch Solutions

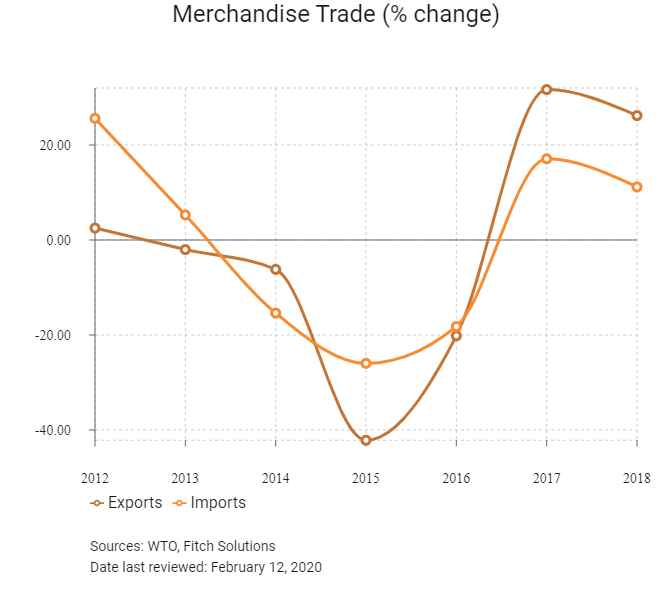

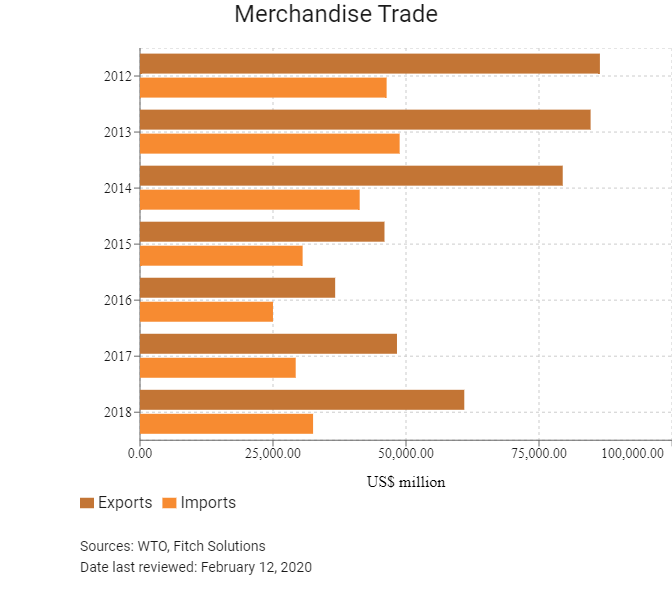

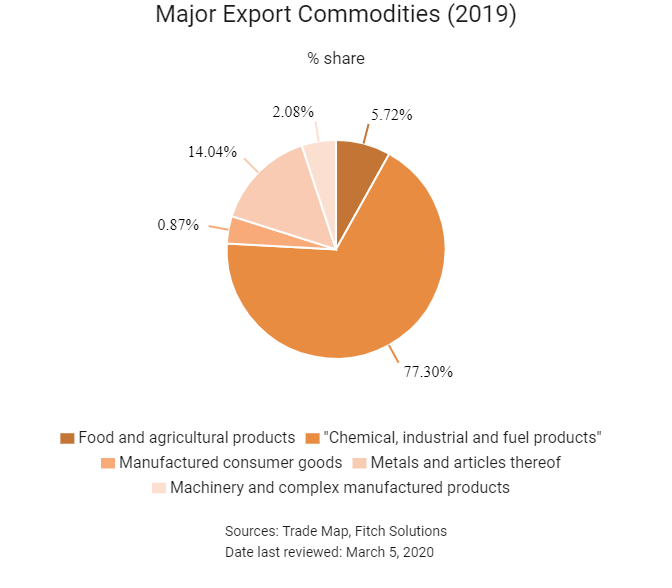

Merchandise Trade

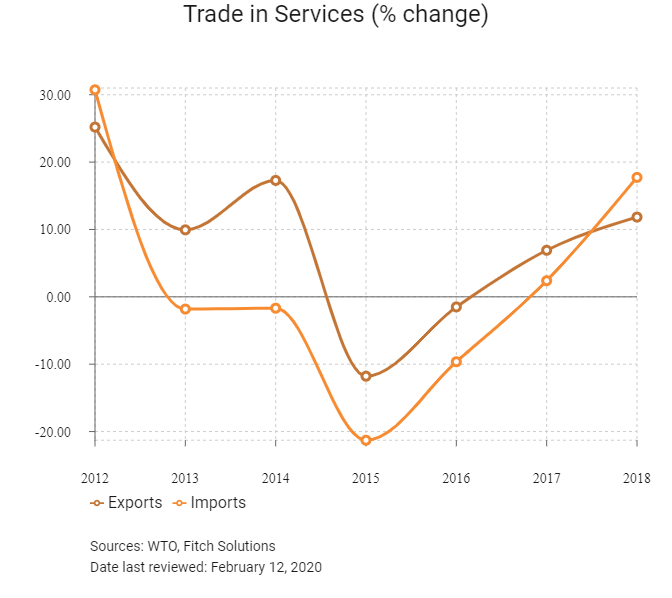

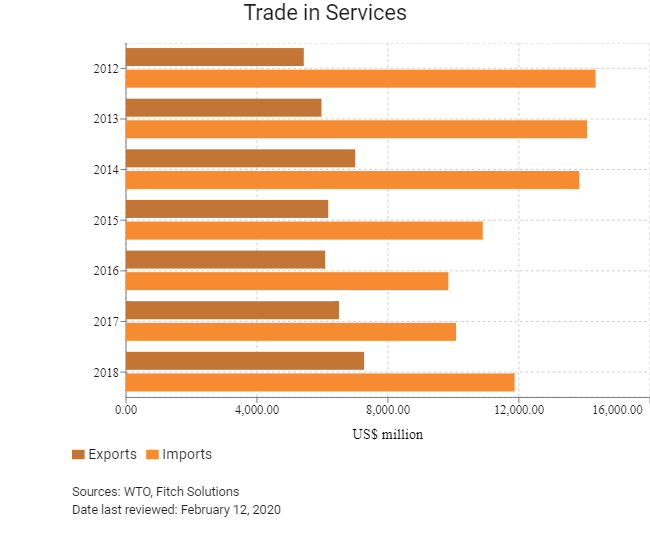

Trade in Services

- Kazakhstan was officially accepted as the 162nd member of the WTO on November 30, 2015.

- Since January 11, 2016, taxpayers have been liable for this issuance of electronic invoices (e-invoicing) on certain goods listed by the government, which was the measure specifically taken by the government following Kazakhstan's accession to the WTO, as well as the lowering of customs duties on approximately 1,500 products. E-invoicing has been obligatory for large taxpayers from January 2018 and will be obligatory for all categories of taxpayers from 2019.

- The Customs Union, which became the Eurasian Economic Union (EAEU) as of January 1, 2015, came into existence in 2010 and consisting of Kazakhstan, Russia and Belarus. Customs borders between the three countries were removed on July 1, 2011. Since then, a free trade zone has come into operation and the three countries have adopted unified import and export duties against trade with other countries, although exceptions remain for certain sectors, such as pharmaceuticals, plastics and transport equipment. Armenia joined the union on January 2, 2015, and Kyrgyzstan officially became the fifth member on August 12, 2015.

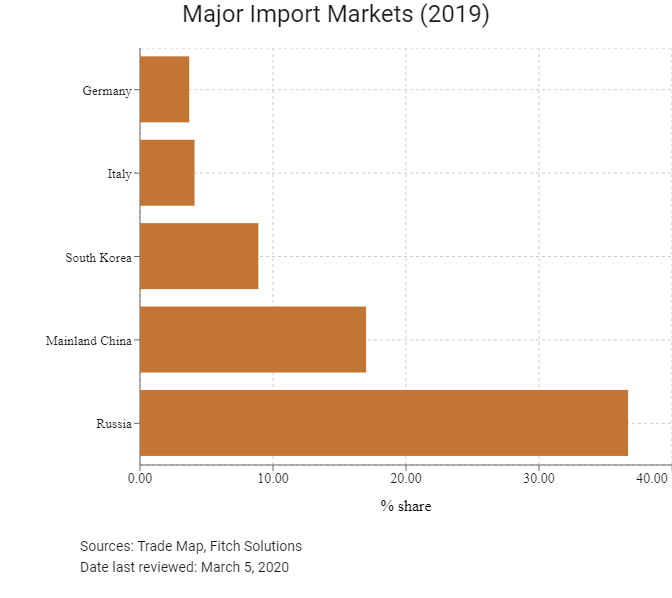

- Kazakhstan does not import much from other EAEU member states, except Russia, with which Kazakhstan already had tariff-free trade prior to the EAEU as it had been in a customs union with Russia and Belarus since 2010. In 2016, Kazakhstan's major importing partners were Russia (39.1% of total product imports), China (15.99% of total product imports), Germany (5.06% of total product imports), the United States (4.27% of total product imports) and Italy (3.2% of total products imports).

- The new Kazakhstan Customs Code and the Customs Code of the EAEU implemented a number of progressive provisions intended for the simplification of customs procedures, the integration of IT initiatives and the reduction of 'red tape' issues in customs control procedures from January 2018.

- In April 2018, full-scale electronic declaration was launched for all customs procedures through Information System 'Astana-1'. The Customs Code of the EAEU conceptually changed the definition of a 'customs declarant', which may significantly impact the business models of supply chains and logistics. The new provisions allow an entity that is qualified as an 'authorised economic operator' to apply simplified customs procedures.

- All labelling must be in both Russian and Kazakh. Goods from the customs union countries are generally exempt from Kazakhstan customs duties. Customs duties apply to goods imported to the customs union countries from third countries. Customs duty rates are established either based on a percentage (generally ranging between 0% and 30%; higher rates exist for certain goods) of the customs value of goods or in absolute terms in euros or USD.

- In addition to membership in the customs union, Kazakhstan has concluded a number of bilateral and multilateral Free Trade Agreements (FTAs) with the Commonwealth of Independent States (CIS), which provide for the exemption of goods circulated between the CIS member states from customs duties, provided certain conditions are met.

- The ATA Carnet temporary import system has been launched in Kazakhstan. This system allows the duty-free temporary import and export of goods for specific purposes.

- There are various anti-dumping measures imposed on products from Ukraine, autos parts and steel products from China and other countries, and light passenger vehicles from Italy and Germany.

- A customs processing fee is assessed at KZT25,000 for the main page of a customs declaration and KZT11,000 for each supplemental page.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- EAEU: The Customs Union (which became the EAEU as of January 1, 2015) consisting of Kazakhstan, Russia and Belarus came into existence in 2010, and customs borders among the three countries were removed on July 1, 2011. Via EAEU membership, the country has been able to increase its levels of trade openness by entering into FTAs with partners it would not ordinarily have. For example, Vietnam's FTA with the EAEU came into effect from October 2016, and in April 2017 it was announced that the EAEU and India had signed an FTA in order to stimulate trade between the Single Market bloc and India.

- Uzbekistan, Kyrgyzstan, Russia and Georgia FTAs: Kazakhstan officially entered into a customs union with Russia and Belarus on July 1, 2010. Since then, Kazakhstan's trade policy has been heavily influenced by regulations promulgated by the customs union and its governing body the Eurasian Economic Commission, a supra-national body located in Moscow.

- CIS: Kazakhstan is part of the CIS, a political and economic confederation of nine member states and two associate members. All of these are former Soviet Republics located in Eurasia (primarily in Central to North Asia), formed following the dissolution of the Soviet Union. Georgia withdrew its membership in 2008 and the Baltic States (Estonia, Latvia and Lithuania) chose not to participate.

- Common Economic Zone (CEZ): The CEZ for goods came into force on May 20, 2004 and incorporates Belarus, Kazakhstan, Russia and Ukraine.

- Ukraine-Kazakhstan FTA: An FTA between Ukraine and Kazakhstan came into force on October 19, 1998.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

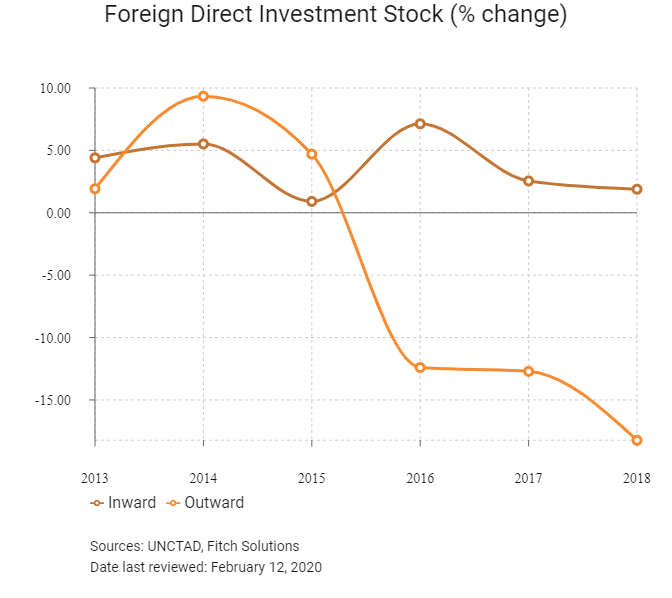

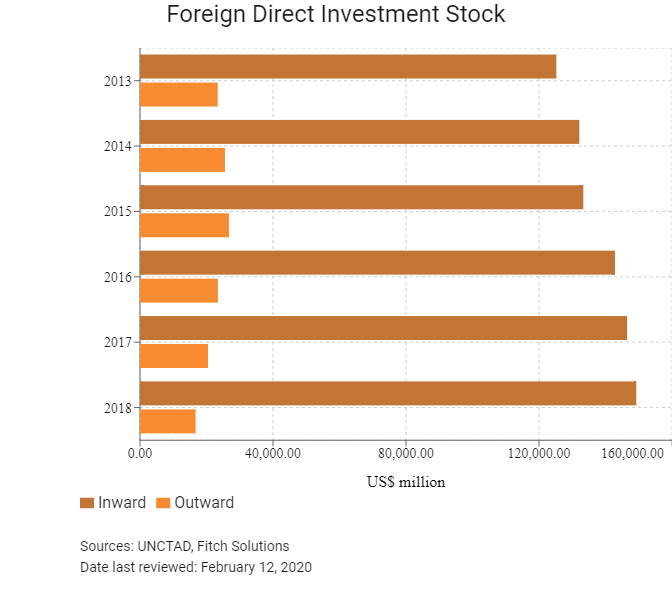

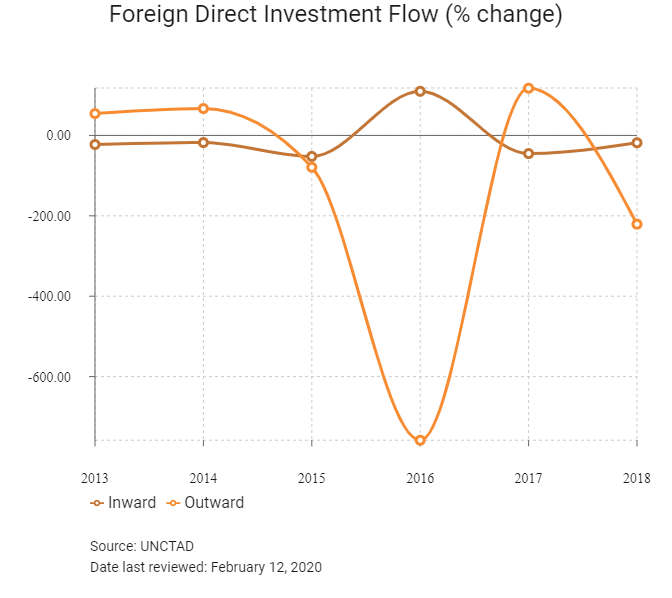

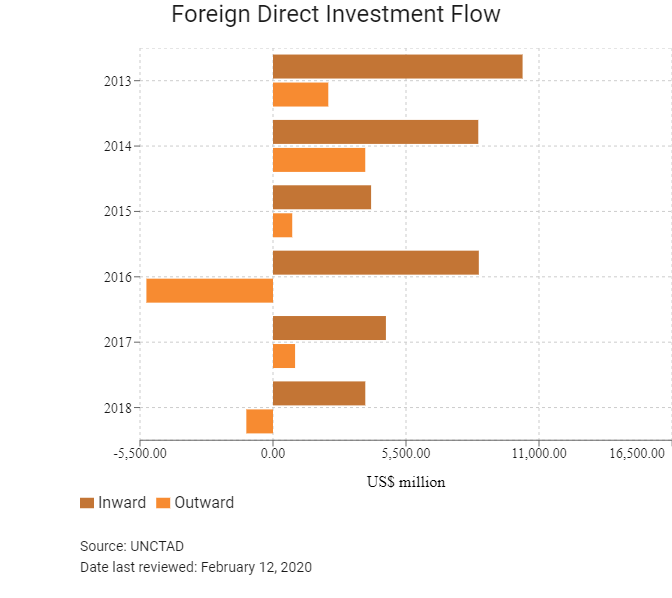

Foreign Direct Investment

Foreign Direct Investment Policy

- The government recognises FDI is essential to promote economic diversification and the modernisation is key industries, such as oil and gas, and there is, therefore, a well-developed investment promotion strategy and an associated incentive programme in place to encourage FDI. The government organisation 'KAZNEX Invest', operating under the Ministry of Investment and Development, offers support, advice and information to foreign investors through its online portal, Invest in Kazakhstan. The website also details the country's investment incentive programme. Investors in any industry may receive exemption from customs duties on raw materials and production equipment, as well as grants of up to 30% of the value of fixed assets.

- To improve business environment and attract FDI, the government launched an annual USD3 billion stimulus package for 2015-2017, as part of the Bright Path five-year economic plan, with investment priorities including transport and logistics, utility networks and energy infrastructure. Meanwhile, the government is devoted to greatly reduce the time required to register a business (to one hour), and the paperwork needed for customs procedures and other business operations (by 60%), and extended and expanded its visa-free entry scheme to citizens of a number of countries in order to boost tourism and foreign investment.

- The government has identified a number of priority sectors to which it is attempting to divert foreign investment, including metallurgy; machinery for extractive, agricultural and transport activities; oil refining; petrochemicals; food processing; chemical production; automotives; electrical equipment; and the production of construction materials. In addition, investors in these industries may benefit from incentives including corporate income and land tax exemption for 10 years, property tax exemption for eight years, subsidies up to the value of 30% of construction and new equipment costs, stability of legislation and state support through the one-stop shop.

- The new Tax Code introduced value-added tax (VAT) control accounts (an analogue of the Azerbaijan VAT deposit account) as an alternative option of VAT refund from the state (which is still applicable, subject to certain criteria). This measure is aimed at tracing VAT payments between suppliers and customers and the remittance of VAT to the state. Taxpayers may opt for using VAT control accounts on a voluntary basis.

- There are significant restrictions on where foreigners can own land in Kazakhstan, including restrictions on private ownership if the property is being used for a specific purpose. Foreigners are allowed to own land for the construction of residential or commercial real estate, but can only rent agricultural land.

- There are caps on foreign capital in certain sectors, including media outlets (limited at 20%), air transport (49%) and non-mobile telecommunications (49%). There are many regulations surrounding foreign involvement in the oil and gas industry, which is subject to changeable and arbitrarily enforced legislation that often disadvantages foreign investors. The tax regime for foreign oil and gas companies is more onerous than for other sectors, with profits taxed outside the standard corporate income tax system at different rates, according to the contract. Tax stability is only guaranteed for one project: The Tengiz field. Furthermore, the exports of oil and gas products are subject to customs duty at USD40 per tonne as of 2016, undermining profit margins for companies involved in the hydrocarbons sector.

- Kazakhstan has specific ratios for the employment of foreign and local workers in all sectors. Furthermore, there are certain requirements for the use of local businesses in the supply of raw materials and services. Specific codes exist for the oil and gas and autos sectors. While some of these have been relaxed since the country ascended to the WTO in 2016, they still remain a pertinent barrier for foreign investment.

- Kazakhstan is pushing ahead with its much-delayed privatisation programme, and the first companies will likely come to market in the near term. IPOs of national carrier Air Astana and uranium producer KazAtomProm were promised for 2018. The sales of minority stakes in energy producer KazMunayGas, national electricity utility Samruk Energy, postal service KazPost and the Kazakh national railway operator are due to follow in 2019 or 2020. Dual listings are planned for most of the assets, with London the preferred international venue. Kazakh authorities are hoping that the latest privatisation drive will prove more successful than its predecessor, the 'People's IPO' programme.

- There is a special economic zone (SEZ) programme in place offering generous incentives for domestic and foreign businesses based in 10 specific locations throughout Kazakhstan. Businesses based in these SEZs benefit from incentives such as: Exemption from income tax, land tax, property tax, VAT and customs duties on imports, and simplified procedures for employing foreign workers. Businesses in the Alatau Innovation Technology Park are also eligible for exemption from social security payments for employees for five years.

- The Astana International Financial Centre (AIFC) aims to create favourable conditions for investment and finance and to develop the securities market, ensuring its integration with international capital markets. The AIFC also intends to develop insurance, banking, and Islamic finance markets in Kazakhstan. It seeks to become a financial hub for the Central Asian region, member states of the EAEU, the Caucasus, Western China, the Middle East, Mongolia, and Europe. The AIFC provides a special legal regime based on the principles of English law, independent financial regulation in accordance with international standards, tax preferences for a period of 50 years, simplified visa and labour conditions, and has English as an official language. Judges in the AIFC Court have exclusive jurisdiction over disputes between the AIFC's participants.

Sources: WTO – Trade Policy Review, Government websites

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

10 SEZs located throughout the country namely: |

– Corporate Income Tax (CIT): 100% reduction (subject to certain conditions) |

Sources: Fitch Solutions, Government websites

- Value Added Tax: 12%

- Corporate Income Tax: 20%

Sources: Kazakhstan's Ministry of Finance, Fitch Solutions

Important Updates to Taxation Information

- A new tax code has been introduced from January 2018. Tax payers in Kazakhstan have also been afforded more protection in terms of legal mechanisms should they be involved in a dispute with the Kazakh tax revenue authority. The principle of 'good faith' is now enshrined in the tax code, which effectively means that the burden of proving tax violations is imposed on the tax authorities, as opposed to the tax payers themselves.

- The new tax regime imposes a considerable burden on businesses engaged in extractive industries, ensuring that, other than state-owned enterprises, only large multinational companies can achieve the economies of scale to take part. Businesses engaged in the exploration and extraction of mineral resources – including additional excess profits, taxed at rates of between 0-60%, rent tax on the export of crude oil at varying rates (depending on production levels and oil prices) and mineral extraction tax which ranges from 5-18% on the value of extracted crude oil and gas condensate (between 0-22% for minerals and coal and at 10% on the value of natural gas).

- The tax regime has become more conducive to business operations owing to the introduction of online filing for all major taxes, which has greatly reduced the time-consuming process of tax administration. Therefore, only around seven different types of annual tax payments need to be made in Kazakhstan which, consequently, takes around 182 hours to pay. This is the shortest time frame out of all eight Caucasus and Central Asian state and falls well below global norms for annual tax compliance time burdens.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

20% on profits |

|

Capital Gains Tax |

20% on profits |

|

Branch Income Tax |

19% on profits |

|

Property Tax |

1.5% on immovable property |

|

VAT |

12% on sale of goods, services and imports |

|

Social Tax |

-9.5% flat rate paid by employers (based on employees' salaries) |

|

Mineral Extraction Tax (MET) |

-5-18% on the value of extracted crude oil and gas condensate |

|

Withholding Tax (dividends, interest, royalties, capital gains, insurance premiums under risk insurance agreements) |

15% |

|

Withholding Tax (any income of a 'black-listed' entity and other income) |

20% |

Sources: Kazakhstan's Ministry of Finance, Fitch Solutions

Date last reviewed: February 12, 2020

Localisation Requirements

Each year the Kazakh government sets different quotas for the hiring of foreign workers or how many local workers must be hired within different sectors. Sectors like mining and oil and gas have their own local workforce hiring requirements as provided for in the codes governing these industries. Automotives and agriculture have also been targeted.

Obtaining Foreign Worker Permits for Skilled Workers

As of January 1, 2017, the Kazakh government has adopted rules that make it more difficult for foreign workers to obtain a permit to work in the country. Overall, the process is time consuming and expensive. On average, a work permit takes around two and a half months to be issued. There are several critical changes to the previous regime. Under these new rules, heads of foreign branches and representative offices in Kazakhstan and heads of companies engaged in government contracts are now required to apply for work permits (they used to be exempt). Heavy fines now apply if work permits are not obtained. However, employers will no longer have to show proof that they have conducted market research on whether there is a local Kazakh citizen who can be employed for the role before applying for a foreign worker permit. Ratio requirements for local citizen hires or caps on foreign worker hires do not apply to branches of international businesses that employ 30 people or fewer. Fourth, a state fee will now have to be paid for every general work visa issued, whereas before it was free.

Visa/Travel Restrictions

Residents of several countries can travel to Kazakhstan visa-free. From January 2017, this has extended to include residents of the European Union (EU), the United States, and Japan.

Regional Workers

Significant migration from the country has taken place, which has the potential to increase further since Kazakhstan became a fully-fledged member of the EAEU in 2015. The country is a member, along with Russia, Belarus, Kazakhstan and Armenia. The EAEU single market provides for the free movement of goods, people, capital and services between member states, with a common external tariff regime. This has significantly increased the ease with which Kazakh citizens can be employed in other EAEU member states. EAEU ascension has also significantly widened the pool of potential labour for positions in Kazakhstan. The freedom of labour tenet in the EAEU regional agreement provides the country with access to the common labour market. All workers have equal rights in other EAEU member states, with no quota requirements needing to be met. The qualifications of Kazakh workers in various professional fields are automatically recognised. Workers involved in legal, educational, medical and pharmaceutical activities will still have to undergo a recognition procedure of their various qualifications in other EAEU member states. We note that the process of employing foreign citizens from non-EAEU or CIS countries remains complicated in Kazakhstan as the government implements fairly strict quota systems for foreign hires and strict local hiring content requirements in key industries, such as mining, and oil and gas.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (stable) |

08/22/2019 |

|

Standard & Poor's |

B+ (stable) |

10/20/2017 |

|

Fitch Ratings |

BB (stable) |

06/13/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

36/190 |

28/190 |

25/191 |

|

Ease of Paying Taxes Index |

50/190 |

56/190 |

64/191 |

|

Logistics Performance Index |

71/160 |

N/A |

N/A |

|

Corruption Perception Index |

124/180 |

113/180 |

N/A |

|

IMD World Competitiveness |

38/63 |

34/63 |

N/A |

Sources: World Bank, IMD, Transparency International

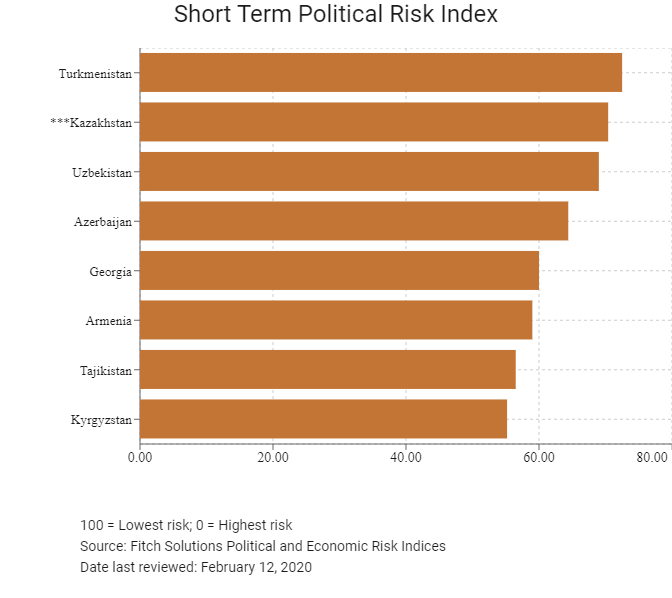

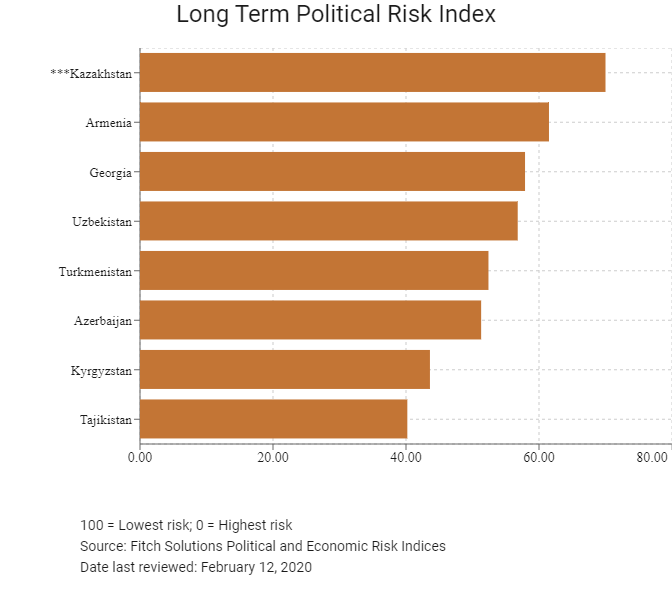

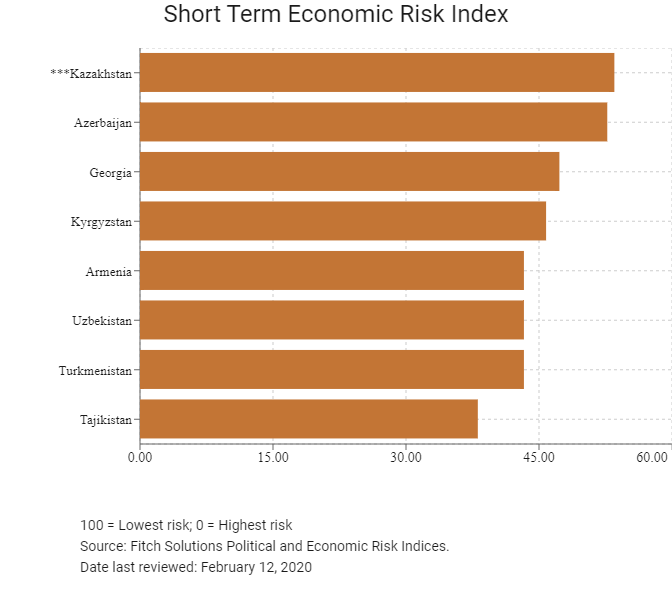

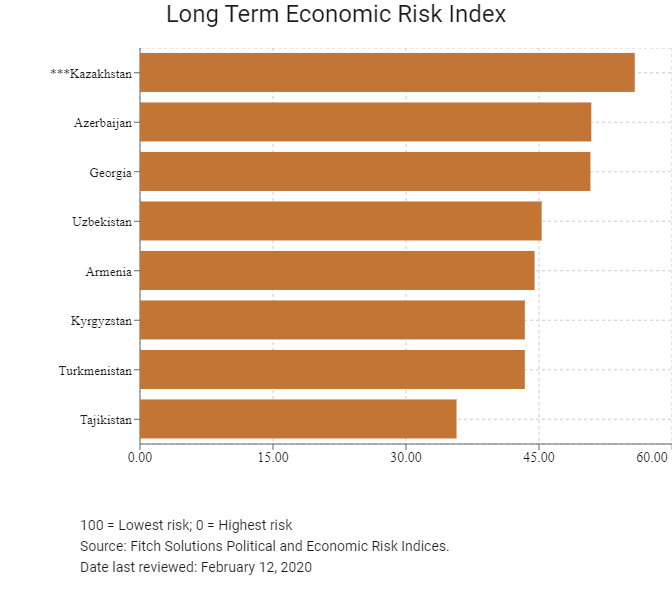

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

78/202 |

78/201 |

76/201 |

|

Short-Term Economic Risk Score |

54.4 |

55.6 |

53.5 |

|

Long-Term Economic Risk Score |

56 |

57.0 |

55.8 |

|

Political Risk Index Rank |

85/202 |

72/201 |

71/201 |

|

Short-Term Political Risk Score |

66.7 |

70.4 |

70.4 |

|

Long-Term Political Risk Score |

66 |

70.0 |

70.0 |

|

Operational Risk Index Rank |

N/A |

58/201 |

58/201 |

|

Operational Risk Score |

57.7 |

59.3 |

60.2 |

Source: Fitch Solutions

Date last reviewed: February 12, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

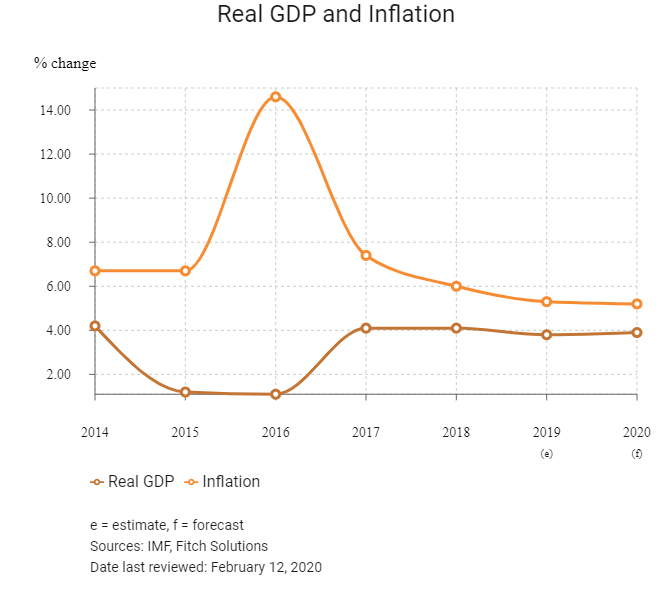

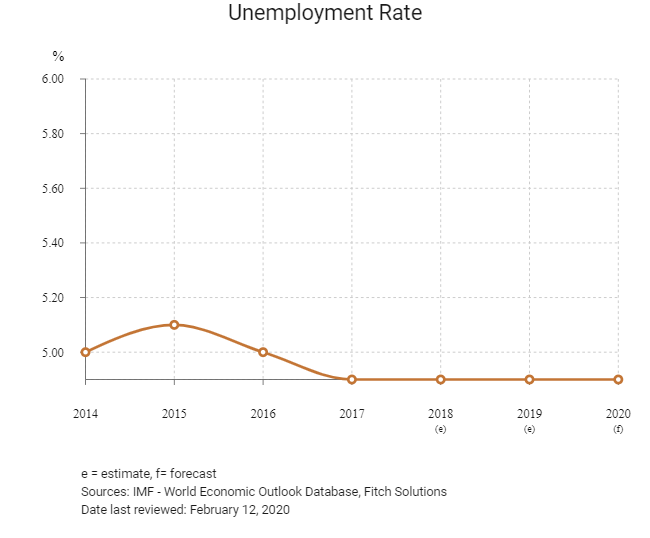

Economic activity is projected to decelerate in 2019 as diminished oil output, due to maintenance at the three main oil fields, and a challenging external backdrop weigh on merchandise exports. That said, domestic demand should buffer the slowdown as a planned fiscal stimulus supports consumption and cheaper credit conditions boost capital investment. The government's ambitious privatisation programme and the country's integration into regional infrastructure development projects, such as China's Belt and Road trade route, will also bolster foreign direct investment (FDI) and support a diversification of the economy. Recovering growth and rising FDIs will support the tenge, mitigating inflationary pressures and allowing for monetary policy easing over the next two years. However, the high level of dollarisation in the banking sector poses risks and will remain a drag on the effectiveness of monetary policy."

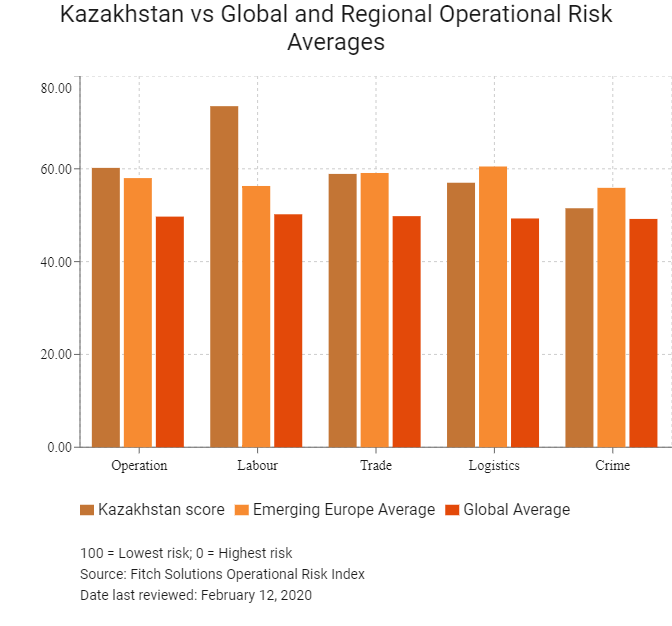

OPERATIONAL RISK

Key factors contributing to the attractiveness of the country's business environment are the high levels of educational attainment of the Kazakh labour force by global standards, the country's high trade turnover and inward FDI stock volumes, and the attractive business environment. Kazakhstan's relative areas of weakness pertain to its logistics profile and its crime and security environment, where the poor quality and extent of the country's transport network and limited access to international seaports are the most prominent risks. However, high levels of FDI, ambitious government expansion plans and a well-educated labour force will entice potential investors in the long run. Kazakhstan's growing prominence in Central Asia will also facilitate investment in the wider region. The development of the country's physical and financial infrastructure will attract more foreign investors wanting to increase their exposure to frontier markets such as Tajikistan and Kyrgyzstan without having to base their operations in these countries.

Source: Fitch Solutions

Date last reviewed: February 12, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Kazakhstan Score |

60.2 |

73.5 |

58.9 |

57.0 |

51.5 |

|

Caucasus and Central Asia Average |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

3 |

1 |

3 |

2 |

4 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

15 |

1 |

17 |

20 |

20 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

58 |

5 |

67 |

66 |

93 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.4 |

56.1 |

58.3 |

|

Azerbaijan |

61.2 |

62.5 |

62.5 |

66.4 |

53.2 |

|

Kazakhstan |

60.2 |

73.5 |

58.9 |

57.0 |

51.5 |

|

Armenia |

56.8 |

60.5 |

58.6 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Uzbekistan |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Tajikistan |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Turkmenistan |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Regional Averages |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 12, 2020

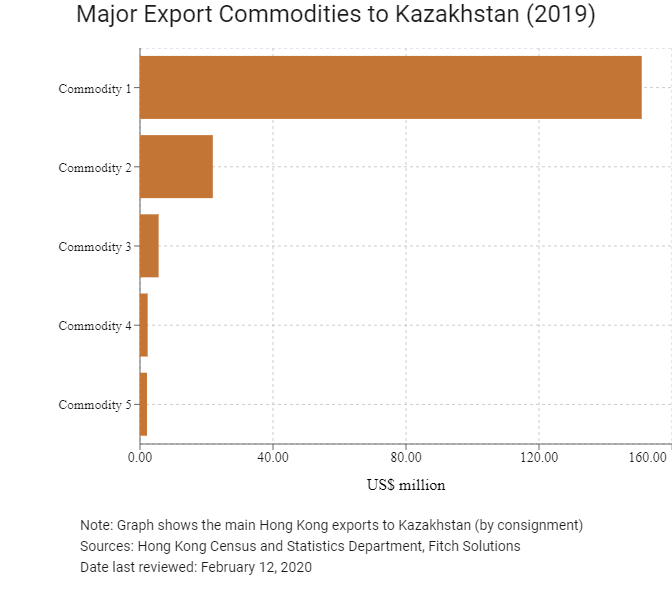

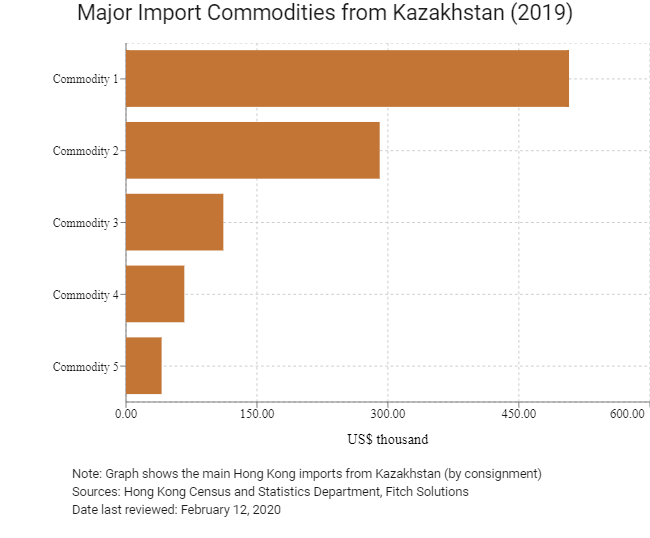

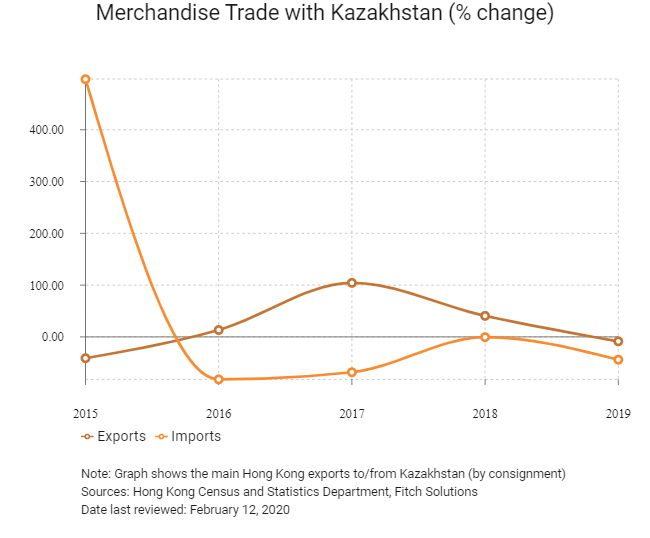

Hong Kong’s Trade with Kazakhstan

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 150.9 |

| Commodity 2 | Office machines and automatic data processing machines | 21.9 |

| Commodity 3 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 5.6 |

| Commodity 4 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 2.3 |

| Commodity 5 | Professional, scientific and controlling instruments and apparatus | 2.1 |

| Import Commodity | Commodity Detail | Value (US$ thousand) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 507.5 |

| Commodity 2 | Office machines and automatic data processing machines | 290.6 |

| Commodity 3 | Power generating machinery and equipment | 111.5 |

| Commodity 4 | Crude animal and vegetable materials | 66.8 |

| Commodity 5 | Machinery specialised for particular industries | 40.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Kazakh residents visiting Hong Kong |

10,687 |

-10.4 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board,Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of Emerging Europeans residing in Hong Kong |

114 |

29.5 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years

Source: United Nations Department of Economic and Social Affairs - Population Division

Date last reviewed: February 13, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Kazakh companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate General of the Republic of Kazakhstan in Hong Kong SAR, PRC

Address: 25/F, Wyndham Place, 40-44 Wyndham Street, Central, Hong Kong

Email: hongkong@mfa.kz

Tel: (852) 2548 3841

Fax: (852) 2548 8361

Source: Consulate General of the Republic of Kazakhstan in Hong Kong SAR, PRC

Visa Requirements for Hong Kong Residents

As of 2012, it was mutually agreed that Hong Kong residents may visit the Republic of Kazakhstan visa-free for a stay of up to 14 days. Likewise, nationals of the Republic of Kazakhstan will also enjoy 14 days' visa-free access to Hong Kong.

Source: Consulate General of the Republic of Kazakhstan in Hong Kong SAR, PRC

Date last reviewed: February 12, 2020

Kazakhstan

Kazakhstan