GDP (US$ Billion)

16.21 (2018)

World Ranking 121/193

GDP Per Capita (US$)

4,346 (2018)

World Ranking 110/192

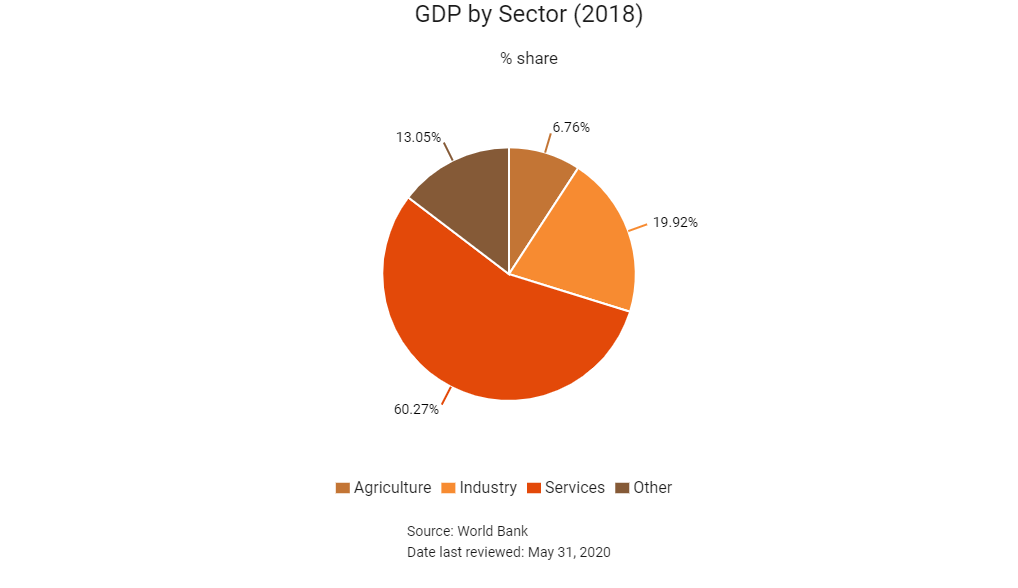

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

116.9 (2019)

Currency (Period Average)

Georgian Lari

2.82per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

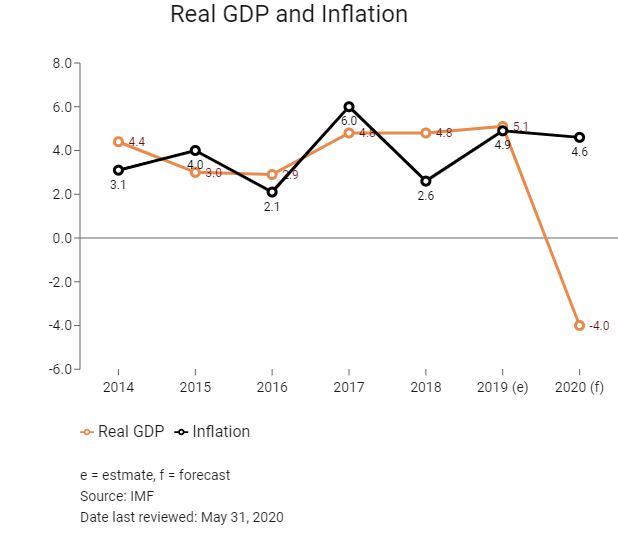

Over the past decade, Georgia's economy has grown at an average annual rate of 4.5%. This was in spite of numerous shocks, including the global financial crisis of 2007-2008, and the regional geopolitical and economic headwinds in recent years. Economic growth in the coming decade will be higher than the last, owing to an already-favourable business environment that is set to improve. Georgia has overhauled its economic management and governance, and is the outperformer in the Caucasus and Central Asian region in terms of its overall openness to international trade and foreign investment. This has significantly bolstered the private sector, and the country's international performance on governance and the investment climate have soared. Georgia's strategic position on the Black Sea coast and Mainland China's revived Silk Road trade route have been highly beneficial for the country's tourism, transport services and construction sectors. Georgia's lack of tariff and non-tariff barriers to trade, numerous free trade agreements (FTAs) and liberal international investment regime serve to reduce trade and investment-related risks for businesses that operate in this market.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2018

The Japan International Cooperation Agency signed an official development assistance loan agreement for up to JPY38.7 billion (USD348.9 million) with the government of Georgia for the East-West Highway Improvement Project (phase two). The project involved the construction of an international logistics network connecting the Black and Caspian seas. The project was expected to be completed in September 2021.

December 2018

Salome Zurabishvili won the presidential election on the back of campaign promises to join the EU and the North Atlantic Treaty Organization.

July 2019

Aigroup had unveiled plans to build an electric car manufacturing factory in Georgia. The project would be carried out in partnership with Changan Corporation. The facility would be located within Aigroup's proposed industrial complex which is to be built on 1 square kilometre of area in Kutaisi. It would have a capacity to produce 40,000 electric cars annually.

August 2019

The ADB had approved a USD415 million loan for the USD558.6 million Kvesheti-Kobi road project in Georgia. It was first in a series of works that would be undertaken as part of upgrades planned for the North-South Corridor. The corridor was a key transit route for Georgia, Armenia and regional trading partners, and intersected with the East-West Highway to the north of Tbilisi.

January 2020

Enlighten Renewable Energy signed an agreement to acquire the rights to an under-development 100MW wind project in Georgia. A joint venture between a Georgian firm and a company operating in central and Eastern Europe was developing the project, which required an investment of USD135-155 million. Work on the project was expected to start in one-and-a-half to two years, after establishment, operation and financing agreements for the project development and licensing activities were completed.

April 2020

On April 3, the Georgian government introduced an export ban on medical and pharmaceutical items in connection with the Covid-19 outbreak. On April 1, the Georgian authorities also announced a waiver from VAT duties for imports of certain medical items necessary in the fight against the Covid-19.

April 2020

In response to Covid-19, the 'Anti-Crisis Economic Action Plan' was unveiled on April 24, which lists government's initiatives to support the population and businesses along with the measures already implemented by the government, such as the payment for gas, electricity and utilities for users consuming up to 200kW of electricity and/or up to 200cu m of natural gas monthly. The government introduced the State Program for Maintaining Prices of Primary Consumption Food Products. The programme envisages subsidies for certain imported products to keep their local price stable (rice, pasta, buckwheat, sunflower oil, sugar, milk powder, beans, wheat, and wheat powder) for the period from March 15 to May 15 2020; bank loan service holidays for individuals; income and property tax holidays for hotels (until November 1, 2020). Within the framework of the new programme 'Co-financing Mechanism for Supporting Family-owned, Small and Medium-size Hotel Industries', Enterprise Georgia (the agency of the Ministry of Economic and Sustainable Development of Georgia) will co-finance up to 80% of the annual interest rate on loans issued to family-owned, small- and medium-sized hotels; the custom clearance term for vehicles imported before April 1, 2020, was extended to September 1, 2020, for car importers; the credit guarantee scheme would be enhanced; and VAT refunds would become automatic and would accelerate. The prime minister also stated that the government plans to support agriculture and construction sectors.

April 2020

In response to Covid-19, the government announced that employers will receive a state subsidy over the next six months for each job maintained. In addition, starting from January 2021, the rule of indexation of pensions will be introduced. According to this rule, the pensions would increase by at least the rate of inflation; for pensioners aged 70 and above the pensions will increase in addition by 80% of the real economic growth rate. Regardless of the actual rates of inflation and economic growth, the pension increase would be at least GEL20 for the pensioners below 70 and above GEL25 for pensioners above age 70.

April 2020

In response to Covid-19, it was announced that commercial banks would gain access to a long-term financial resource of GEL600 million. GEL500.0 million will be provided to support businesses, including through the credit guarantee scheme. Financing for working capital will increase. Additional funds of about GEL350 million will be directed to health spending including lab testing and quarantine expenditures as well as increased costs associated with hospitalisation, medical treatment and medical supplies.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

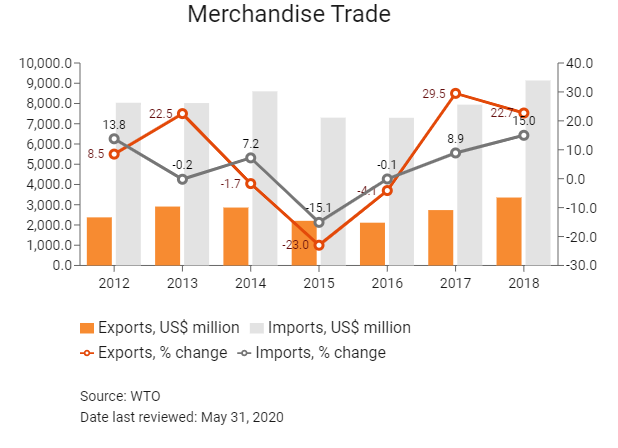

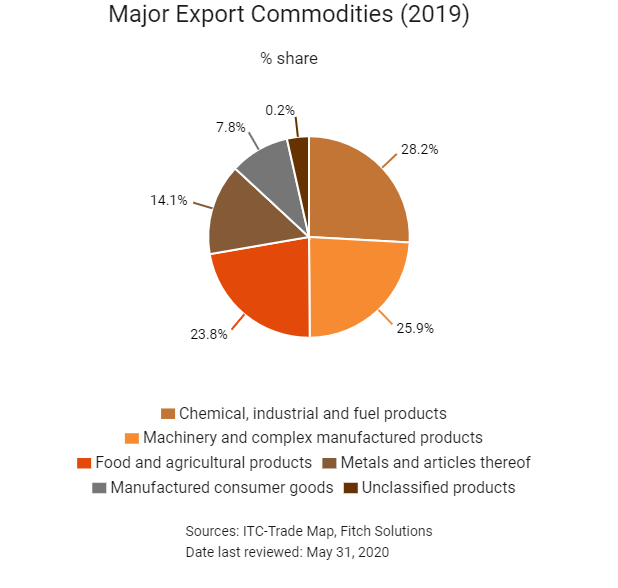

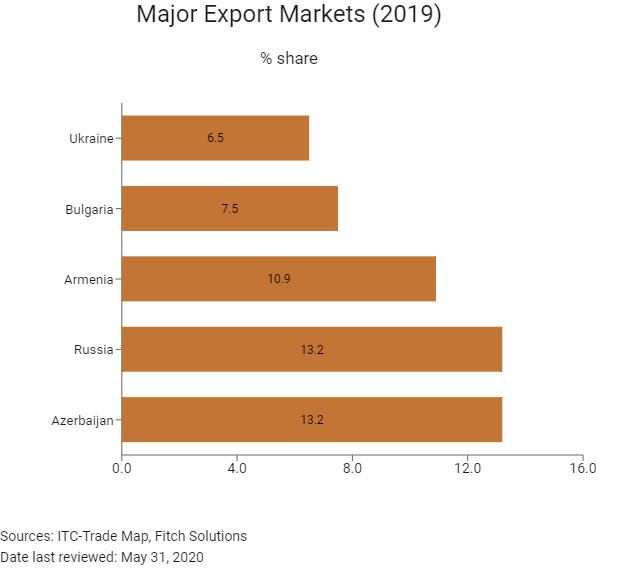

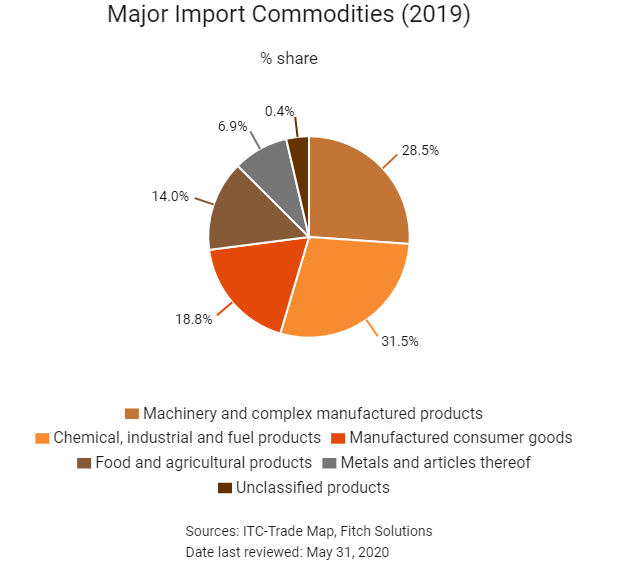

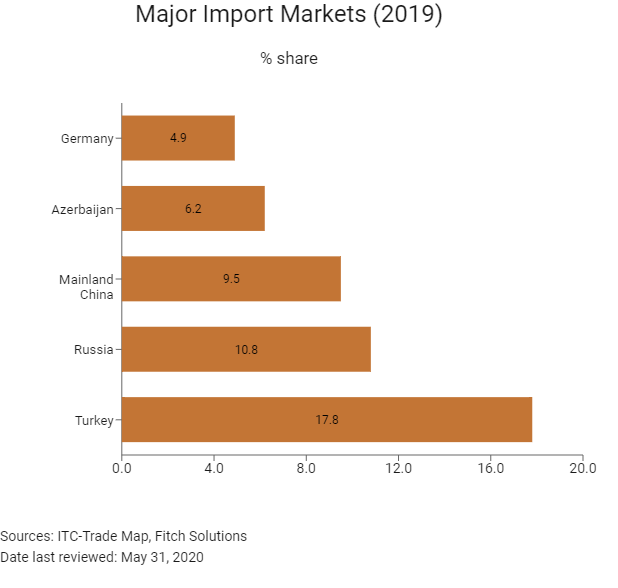

Merchandise Trade

Trade in Services

- Georgia has been a member of the World Trade Organization (WTO) since June 14, 2000.

- Since achieving independence, Georgia has enacted a range of economic reforms that has seen the country conclude a wide range of FTAs with globally important players such as the EU, Turkey and (most recently) Mainland China. Thanks to its liberal trade regime, Georgia has signed FTAs with many of its neighbours, such as Ukraine, Belarus, Azerbaijan, Armenia, Russia, Moldova, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan and Turkmenistan. In addition, it concluded a Deep and Comprehensive FTA with the EU.

- Georgia enjoys lower tariffs on 3,400 goods exported to the United States, Norway, Switzerland, Canada and Japan under the Generalised Schemes of Preferences (GSP).

- The country has also introduced customs clearance zones which have significantly streamlined border clearance times to the bare minimum, and imposed very minimal tariff and non-tariff barriers to international trade. Such reforms are helping the country's tourism and transport services sectors take off, especially as its strategic geographic location means that Georgia is set to become a key transit point for East-West trade under Mainland China's new Silk Road overland route.

- Georgia is not a member of any customs unions or single or common market areas (which usually provide for the free movement of the various factors of production). As a former Soviet state, the country was a member of the Commonwealth of Independent States (CIS). However, Georgia has not joined the CIS FTA or the Russian-led Eurasian Economic Union (EAEU). Although Georgia withdrew its membership in 2008, the CIS bloc has traditionally been the primary trading region for Georgia, largely part because of geographic proximity. Therefore, Georgia has separate FTAs with countries in the CIS.

- The United States and Georgia established a high-level bilateral dialogue on Trade and Investment in 2012, aimed at identifying measures to increase bilateral trade and investment. The United States and Georgia have shared a bilateral investment treaty since 1997, and Georgia can export many of its products duty-free to the United States under the GSP.

- There are a series of import tariffs applied on some agricultural products, which affect all trade-partner countries, unless specifically excluded in an FTA.

- In comparison with the EAEU single market bloc, penetrating the Georgian market as an outsider is easier, since tariff and non-tariff barriers to trade with Georgia are minimal. Nearly 90% of all goods imported to Georgia are duty free, and the country has the second-lowest average applied import tariff rate (0.7%) out of all eight Caucasus and Central Asian states.

- Georgia has the lowest time and cost burdens for both export and import procedures (for border and documentary compliance) out of all eight Caucasus and Central Asian states. There are no tariffs imposed on exports from the country as well as for no tariffs on goods imported for transit or re-export purposes. The introduction of customs clearance zones has significantly streamlined border clearance times to the bare minimum and the implementation of an integrated border management system has reduced the number of intervening agencies to only one point of contact between transporters and customs officials.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Georgia-EU Deep and Comprehensive Free Trade Area (DCFTA): The EU and Georgia signed an association agreement on June 27, 2014 which entered into force on July 1, 2016. The agreement introduces a preferential trade regime. This regime increases market access between the EU and Georgia based on having better-matched regulations. The FTA with the EU provides a significant and wealthy export market for Georgia's manufacturing industries. The EU is Georgia's main trade partner, accounting for approximately 29% of total trade. The DCFTA allows for closer economic integration of Georgia with the EU based on reforms in trade-related areas. Based on the principles of the WTO, the DCFTA removes all import duties on goods and provides for broad mutual access to trade in services. It will allow EU and Georgian companies to set up a subsidiary or a branch office on a non-discriminatory basis, allowing the foreign company to benefit from the same treatment as domestic companies in the partner's market. The DCFTA allows Georgian trade-related laws to generally match selected pieces of the EU legal framework. Georgia's adoption of EU approaches to policymaking will improve governance, strengthen the rule of law and provide more economic opportunities by expanding the EU market to Georgian goods and services. It will also attract foreign investment to Georgia.

- Georgia-Turkey FTA: The agreement came into effect in January 2008. Turkey is one of Georgia's largest exporting and importing partners. In February 2018 it was announced that Georgia and Turkey were taking action to widen the existing FTA between them and enable Georgian producers to increase export volume to Turkey by as much as 20%.

- Georgia-Mainland China FTA: As of January 1, 2018, the FTA concluded between Georgia and Mainland China came into operation. It allows more than 90% of Georgian products duty-free access to the market of Mainland China and will boost Georgia's profile as a new Silk Road transit hub for East-West trade. Mainland China is one of Georgia's top five exporting and importing partners and its market dominance is likely to increase over the medium term now that the FTA is officially in operation.

- Georgia-Hong Kong FTA: An FTA between Georgia and Hong Kong was signed on June 28, 2018. Georgia will eliminate import tariffs on 96.6% of its tariff lines for Hong Kong products. The FTA was negotiated in 2016 and has several standard components, namely the elimination or reduction of tariffs, the liberalisation of non-tariff barriers, flexibility regarding rules of origin to facilitate bilateral trade, customs facilitation procedures, the liberalisation, promotion and protection of investment, the liberalisation of trade in services and a dispute settlement mechanism for the FTA. The agreement was drafted based on the FTA between Georgia and Mainland China.

- Georgia-European Free Trade Association: Signed in February 2016, the agreement grants Georgia free trade access to Switzerland, Norway, Iceland and Liechtenstein.

Sources: WTO Regional Trade Agreements database, Government websites, Fitch Solutions

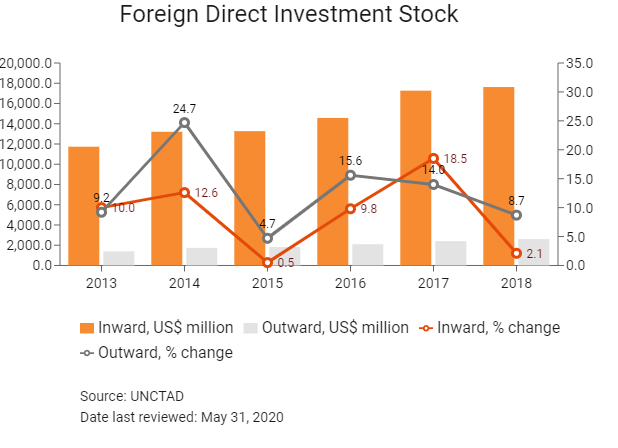

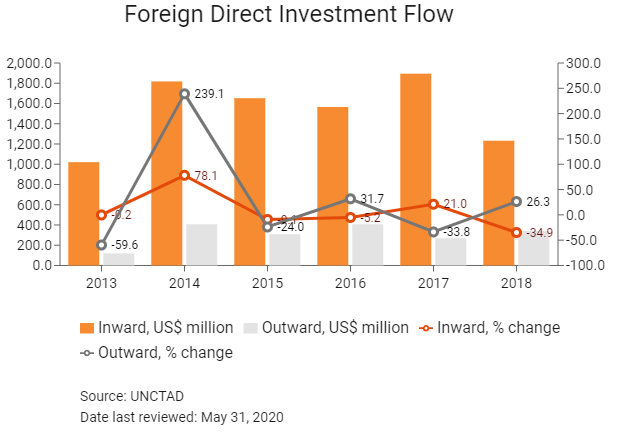

Foreign Direct Investment

↵

Foreign Direct Investment Policy

- 'Invest in Georgia', the Georgian national investment agency, sits under the direct supervision of the Prime Minister and is the only official state agency responsible for promoting and facilitating foreign direct investment (FDI) in Georgia. Invest in Georgia acts as a moderator between foreign investors and the government.

- To encourage foreign investment in tourism, industry and agriculture, the Georgian government has two free tourism zones (Anaklia and Kobuleti), two FIZs in Poti (sea port) and Kutaisi (the second largest city) and two new projects managed by the Agriculture Projects Management Agency to support agriculture development in Georgia. Under these schemes, the Government of Georgia offers interested investors unprecedented terms with respect to taxation and land use.

- Georgia has bilateral agreements on investment promotion and mutual protection with 32 countries, including: the United States, Armenia, Austria, Azerbaijan, Belgium, Bulgaria, Mainland China, the Czech Republic, Estonia, Egypt, Finland, France, Germany, Greece, Iran, Israel, Italy, Kazakhstan, Kyrgyzstan, Kuwait, Latvia, Lithuania, Luxemburg, Moldova, the Netherlands, Romania, Sweden, Turkey, Turkmenistan, Uzbekistan, the United Kingdom and Ukraine. Negotiations are underway with the governments of 24 countries, including Bangladesh, Belarus, Bosnia and Herzegovina, Croatia, Cyprus, Denmark, Iceland, India, Indonesia, Jordan, South Korea, Lebanon, Malta, Norway, the Philippines, Portugal, Saudi Arabia, Slovakia, Slovenia, Spain, Switzerland, Syria, Tajikistan and Qatar. Additionally, Georgia signed a Trade and Investment Framework Agreement (TIFA) with the United States in 2007.

- The Georgian government has opened most economic activities to foreign involvement. Successive governments have maintained a welcoming stance to foreign investors and a business-friendly policy programme, which is not likely to change given the country's commitment to an open and inclusive economy, as outlined in the national development plan, Georgia 2020. There is a clear promotion strategy in place for FDI and investors may benefit from incentives offered for businesses located in FIZs.

- Georgia has developed a wide body of legislation guaranteeing equal rights and protections for both domestic and foreign investors, ensuring that expropriations are infrequent and must be adequately compensated. The Law on Promotion and Guarantee of Investment Activity also stipulates that foreign investors are protected from legislative changes that would adversely affect their investment for a period of 10 years. There are few regulatory restrictions placed on foreign involvement, and 100% foreign ownership is permitted in almost all sectors. Government policy is investor-friendly and economic reforms have included changes to the regulatory environment and tax system that have cut through red tape and reduced the fiscal burden on businesses, thereby boosting the country's appeal to foreign investors.

- Investment may be screened in the pharmaceuticals, weapons production, exploitation of natural resources, financial activities and telecommunications sectors, but licences for new businesses in these industries must be issued within a month. No screening or licensing requirements are in place for foreign investment in all other areas of economic activity.

- As a logistics and transhipment corridor to the Caucasus and Central Asia, the Georgian economy is highly transit oriented; around 60% of all types of overland international freight throughput are in transit. Aside from infrastructure upgrades at major seaports, such as Batumi and Poti, and the construction of a deep-sea port at Anaklia to accommodate larger vessels, several planned projects are poised to strengthen the country's logistical importance.

- The main industries of interest to foreign investors in Georgia include agriculture, manufacturing, tourism, logistics and other services. The government has prioritised these sectors as targets for FDI through a clear and informative investment promotion strategy via the Georgia National Investment Agency. The Invest in Georgia website provides prospective investors with information about the targeted sectors and aims to encourage and support new projects.

- A limited incentive programme is in place for investment in agriculture and food processing projects in underdeveloped regions, whereby interest payments on loans funding such facilities are subsidised by the agriculture ministry, which may also provide a grant of up to 40% for investments under USD1 million.

- As part of wider economic reforms, the Georgian government initiated a privatisation programme that has allowed the state to divest the majority of its economic assets. The only sectors in which the state is required to maintain a controlling interest are air, shipping and rail traffic control, defence and nuclear energy. Most of the large state-owned entities have now been privatised, and although the government retains a presence in oil and gas, electricity and railways, only its role in the latter (through Georgian Railways) remains significant.

- There are currently several restrictions regarding foreign ownership of agricultural land in Georgia, but foreigners can own non-agricultural land in Georgia without restriction. In June 2017, the Georgian parliament announced a temporary ban on agricultural land sales to foreigners. A ban on the foreign ownership of land was later enshrined in the Georgian constitution in September 2017. The new laws stipulate that foreign nationals and legal entities owned by foreign nationals (such as banks), cannot own agricultural land in Georgia unless certain special circumstances permit it. These include if a foreign national inherits agricultural land from a Georgian citizen, co-owns the land with a Georgian spouse or member of a Georgian household or becomes a permanent Georgian resident. While this ban does not apply to sales that were entered into before the amended laws, foreigners who own agricultural land are supposed to sell it within six months of this law becoming operational or it may be confiscated by the Georgian government.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce, Government websites, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Georgia currently has four free industrial zones (FIZs) which are operated by private businesses. These are the Poti FIZ (operated by Rakia Georgia FIZ), the Kutaisi FIZ #1 (operated by Georgia International Holding, Fresh Georgia), the Kutaisi FIZ #2 (operated by Hualing Group) and the Tbilisi FIZ (operated by Tbilisi Free Zone JSC, a subsidiary of BitFury Group). |

- Businesses registered in FIZs benefit from certain tax exemptions. |

|

Port of Anaklia FIZ (currently under development) |

- Port of Anaklia FIZ is being developed concurrently with the Anaklia Deep Sea Port Project (Georgia's first deep seaport). |

|

Corporate Income Tax (CIT) exemptions |

- Income derived from budgetary, international, and charitable organisations, but not including income or profit derived from normal operations and commercial activity. |

Source: Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 15%

Source: Revenue Service of the Ministry of Finance, Georgia

Important Updates to Taxation Information

- In 2016, the Georgian government announced that it would adopt measures which aim to align the tax regime with the Estonian model of taxation. This model allows for all businesses (except profit sharing ventures) to be exempt from taxation and will, therefore, decrease the taxation burden for companies in Georgia. This came into effect from January 1, 2017, and effectively means that all businesses (except commercial banks, credit unions, insurance companies, microfinance organisations and pawn shops) will be effected by this new corporate tax regime from January 1, 2019.

- Companies are only taxed on their distributed profits (for example, in the form of dividends to shareholders) and not on their retained earnings. This is not necessarily meant to reduce the tax burden for corporate entities, but rather to defer payment and make the calculation of corporate tax easier. Businesses pay a 15% flat corporate tax rate on transactions such as profit distribution, costs incurred not related to economic activity, free of charge distributions and over-limit representative expenses. International financial companies, where 10% or less of total global income is derived from Georgian sources, are exempt from paying CIT on any income derived from financial services.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Tax |

- 15% flat corporate tax rate on distributed profits while undistributed profits are exempt from CIT |

|

Property Tax |

1% on the annual average residual value of fixed assets (except for land) |

|

Land Tax |

- Agricultural land tax varies according to the quality of land and administration unit |

|

VAT |

18% on sale of all goods and services (standard) |

|

Withholding Tax |

Dividends: 5% |

Source: Revenue Service of the Ministry of Finance, Georgia

Date last reviewed: May 31, 2020

Localisation Requirements

The Georgian government does not enforce any localisation policies on businesses in terms of using domestic goods, labour or technology.

Foreign Worker Permits

Despite Georgia adopting a more stringent visa regime in 2014, it remains a fairly quick and low-cost process to obtain a foreign work visa in Georgia. Prior to 2014, people wanting to work in Georgia could enter and do so on a tourist visa. This has now been changed and anybody who wants to work in Georgia must apply for a long-term visa and eventually a resident's permit. The long-term visa is valid for 180 days. Resident permits take around 30 days to be issued.

Visa/Travel Restrictions

Various countries and groups enjoy visa-free access to Georgia and are usually permitted to stay (but not work) in the country for up to 360 days. Citizens of countries within the EU, the Commonwealth of Independent States, North Atlantic Trade Organisation, the Schengen area, the Gulf Co-operation Council, the United States and a wide range of others can enter Georgia visa-free.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba2 (Stable) |

19/09/2019 |

|

Standard & Poor's |

BB (Stable) |

11/10/2019 |

|

Fitch Ratings |

BB (Negative) |

24/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

9/190 |

6/190 |

7/190 |

|

Ease of Paying Taxes Index |

22/190 |

16/190 |

14/190 |

|

Logistics Performance Index |

119/160 |

N/A |

N/A |

|

Corruption Perception Index |

41/180 |

44/180 |

NA |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International, Fitch Solutions

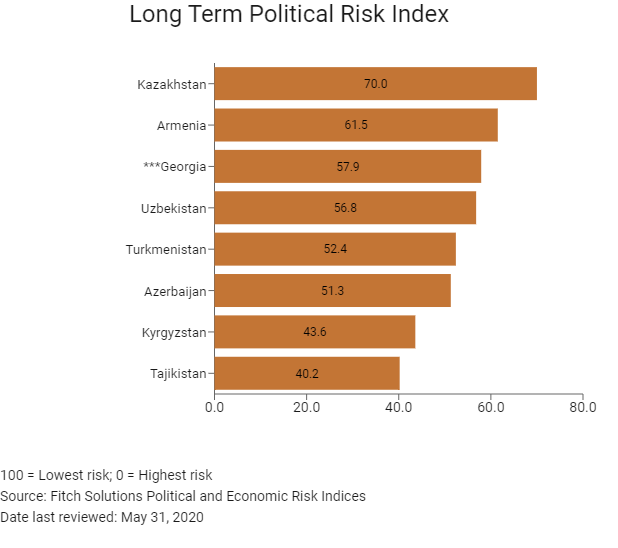

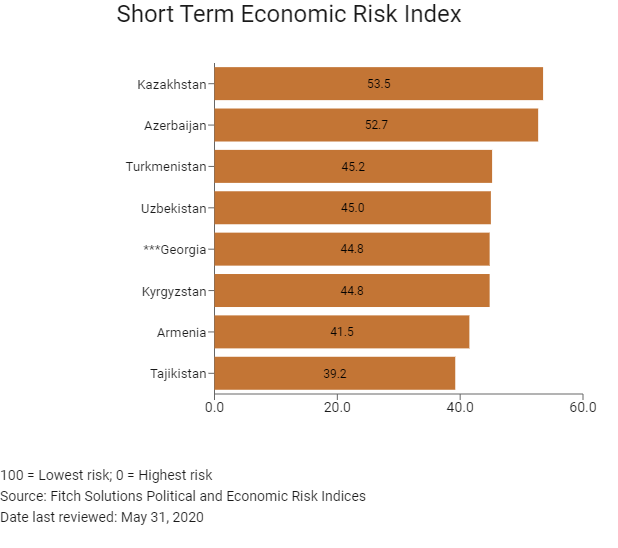

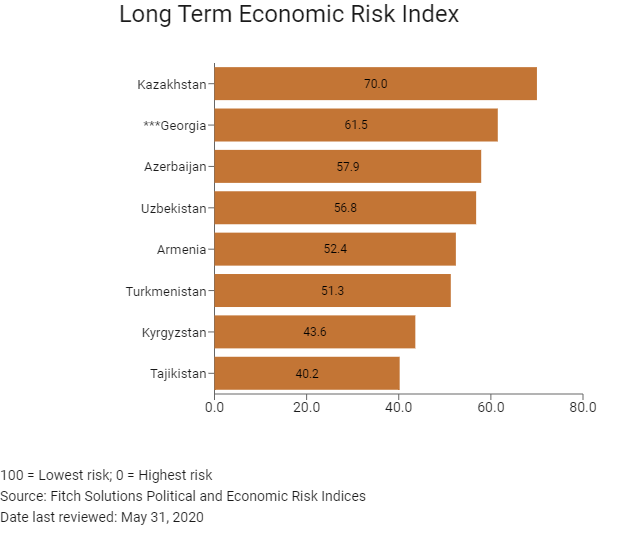

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

114/202 |

110/201 |

111/201 |

|

Short-Term Economic Risk Score |

47.1 |

45.8 |

44.8 |

|

Long-Term Economic Risk Score |

49.5 |

50.8 |

50.1 |

|

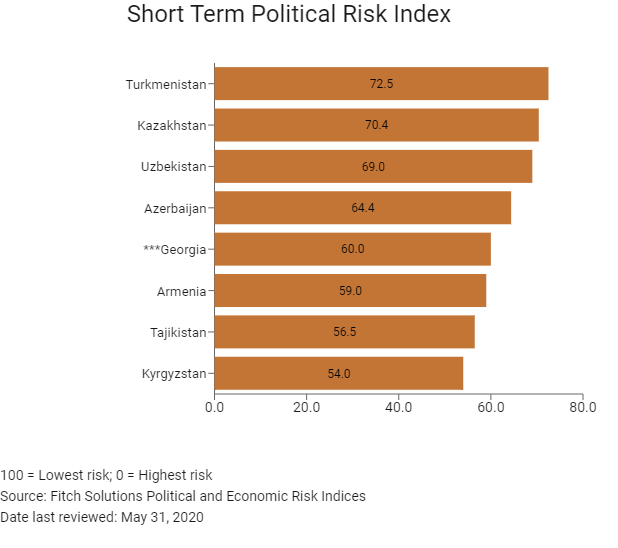

Political Risk Index Rank |

134/202 |

117/201 |

117/201 |

|

Short-Term Political Risk Score |

56.5 |

60.0 |

60.0 |

|

Long-Term Political Risk Score |

54.9 |

57.9 |

57.9 |

|

Operational Risk Index Rank |

51/201 |

49/201 |

51/201 |

|

Operational Risk Score |

61.6 |

62.4 |

62.3 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

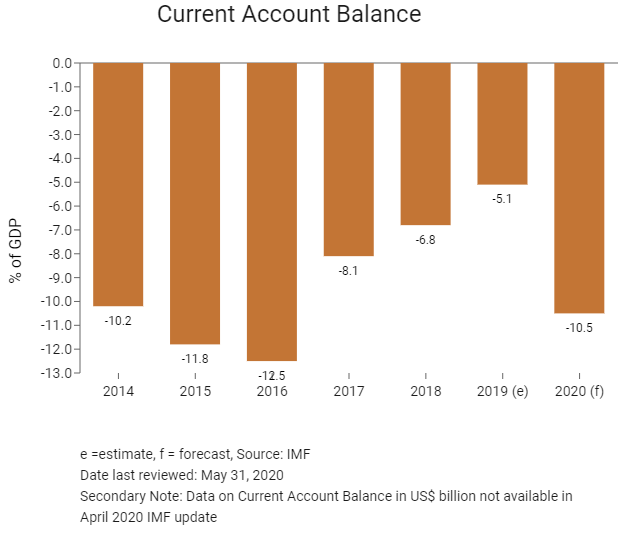

ECONOMIC RISK

Georgia's current account deficit is among the widest in Europe and will remain a risk for the stability of the economy. In the wake of the Covid-19 pandemic it is likely to widen even further as inbound tourism freezes and copper exports plummet. Georgia's economy will therefore face increased risks in 2020. When business returns to normal post the Covid-19 crisis, growth will be mainly driven by strong investment and improving private consumption, amid an increasingly favourable business and monetary policy backdrop. Gross fixed capital formation will be a key driver of economic growth over the coming quarters, coming from large-scale investment projects that are financed either by the state or multilateral organisations. That said, although Georgia has managed to reorient its exports towards European markets in recent years, the Commonwealth of Independent States remains a significant export market.

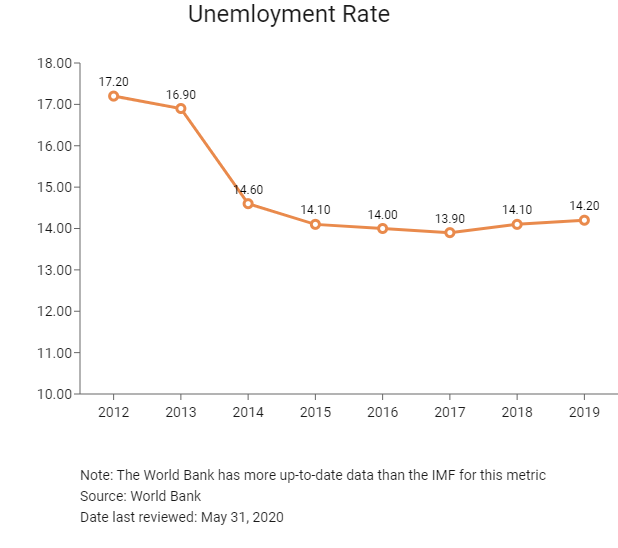

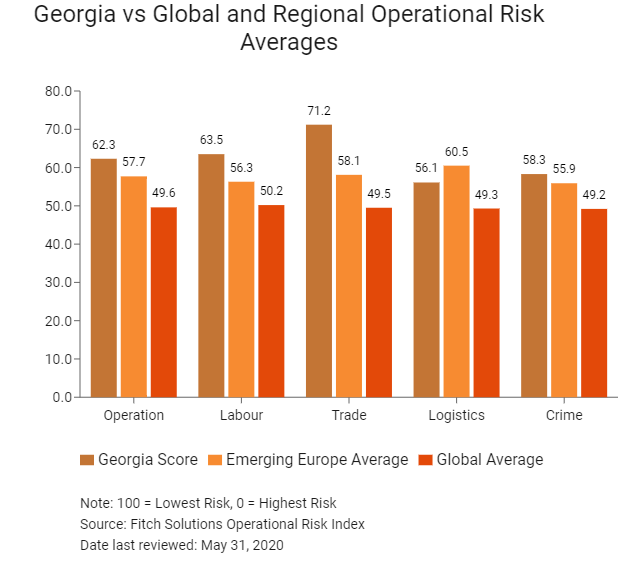

OPERATIONAL RISK

Georgia is a top performing state in the Caucasus and Central Asia region for Operational Risk, with its main strengths being the liberal trade and investment regimes, its increasingly efficient bureaucratic systems and regionally low corruption levels. The country's labour market is also attractive for businesses requiring basic skills of numeracy and literacy owing to regionally high educational attainment levels and competitive labour costs. Downside risks come from the state's logistics profile, given Georgia's reliance on natural gas and refined fuel imports and the current poor quality of its transport network by OECD standards. That said, transport risks are expected to abate over time due to the significant international funding the state is receiving for transport infrastructure on account of its strategic position on Mainland China's planned overland new Silk Road route.

Source: Fitch Solutions

Date last reviewed: June 1, 2020

Fitch Solutions Political and Economic Risk Indicies

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Georgia Score |

62.3 |

63.5 |

71.2 |

56.1 |

58.3 |

|

Caucasus and Central Asia Average |

51.4 |

58.3 |

52.0 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

1 |

2 |

1 |

3 |

1 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

12 |

4 |

2 |

21 |

13 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

51 |

26 |

23 |

70 |

65 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.2 |

56.1 |

58.3 |

|

Azerbaijan |

60.5 |

62.5 |

60.0 |

66.4 |

53.2 |

|

Kazakhstan |

60.1 |

73.5 |

58.6 |

57.0 |

51.5 |

|

Armenia |

56.9 |

60.4 |

59.1 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.5 |

54.7 |

38.5 |

41.4 |

43.2 |

|

Uzbekistan |

44.1 |

54.1 |

41.7 |

43.1 |

37.7 |

|

Tajikistan |

44.0 |

54.8 |

50.1 |

39.2 |

31.7 |

|

Turkmenistan |

39.1 |

42.8 |

37.1 |

47.3 |

29.4 |

|

Regional Averages |

51.4 |

58.3 |

52.0 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

Hong Kong’s Trade with Georgia

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Georgian residents visiting Hong Kong |

296 |

-32.4 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of emerging Europeans residing in Hong Kong |

114 |

29.5 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Georgian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Georgia

- The Mainland China-Georgia FTA came into force in January 2018.

- The Mainland China-Georgia bilateral investment treaty entered into force in March 1995.

- Georgia has a double taxation agreement with Mainland China which came into force on November 10, 2005.

Sources: UNCTAD, Fitch Solutions

Visa Requirements for Hong Kong Residents

HKSAR passport holders need a visa to travel to Georgia. They can apply for an e-visa. An e-visa is an easy way to get a permit to enter into and travel within Georgia for the purpose of a short stay. An e-visa is applied for online and emailed to the recipient.

Source: Georgia e-Visa Portal

Date last reviewed: May 31, 2020

Georgia

Georgia