GDP (US$ Billion)

456.17 (2018)

World Ranking 27/193

GDP Per Capita (US$)

51,344 (2018)

World Ranking 14/192

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

107.8 (2018)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Federal republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Austria has a well-developed market economy that welcomes foreign direct investment (FDI), particularly in technology and research and development (R&D). The country benefits from a skilled labour force and a high standard of living, with the capital, Vienna, consistently placing at the top of global quality-of-life rankings. Austria does fairly well in terms of business environment as it ranks 27th out of 190 countries in the World Bank's 2020 Ease of Doing Business Index. Austria's strengths are its stable economy, its location at the centre of Europe, and its skilled and highly productive workforce. Export incentives, political stability and low telecommunication costs also make the Austrian business climate favourable. Generally, the Austrian government favours FDI targeting the high-tech sector. Another attractive factor is Austria's accommodating commercial taxation system, which is one of the most favourable in Europe, as it does not have a wealth tax or a professional tax. The Austrian economy is well equipped to grow at a steady pace over the next 10 years with real GDP growth set to outperform relative to the eurozone. With more than 50% of its GDP attributed to exports, Austria's economy is closely tied to other European Union (EU) economies, especially that of Germany.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2019

The European Investment Bank (EIB) sanctioned EUR2.4 billion in new financing to improve public services, upgrade infrastructure and strengthen private sector investment in various European countries. Of the total, the bank would provide EUR905 million for five transport projects in Austria, France, Germany, Latvia and the Netherlands. The EIB would also finance the expansion of the 8km cross border Karawanken tunnel between Austria and Slovenia.

May 2019

Chancellor Sebastian Kurz was removed from his post following a no-confidence vote.

Setpember 2019

Legislative elections were held in Austria on September 29 to elect the 27th National Council, the lower house of Austria's bicameral parliament. The snap elections were called in the wake of the collapse of the ruling Austrian People's Party (ÖVP)-Freedom Party of Austria coalition and the announcement of then vice chancellor Heinz-Christian Strache's resignation in May 2019. ÖVP won the legislative election with 37.5% of the vote, winning 71 seats, while the second place SPÖ had 21.2% and 40 seats.

November 2019

The EIB provided a EUR90 million (USD99.8 million) loan to support Energie Steiermark's power grid expansion measures to integrate renewable and other energy-efficiency projects in Austria, according to a press release from EIB. The financing would be directed towards sustainable investments in the 30,000km electricity grid in Styria.

March 2020

Austrian Federal Railways announced plans to invest around EUR1.1 billion (USD1.2 billion) in railway infrastructure projects across the states of Styria, Tirol and Vorarlberg. Key focus areas would be the modernisation of railway lines, new stops and additional parking spaces; the construction of park and ride facilities at the train stations; and double-track route expansions.

On March 12, the European Central Bank (ECB) decided to provide monetary policy support through additional asset purchases of EUR120 billion until the end of 2020 under the existing asset purchase program (APP) as well as additional temporary auctions of the full-allotment fixed-rate temporary liquidity facility at the deposit facility rate and more favourable terms on existing targeted long-term refinancing operations between June 2020 and June 2021.

To mitigate the economic impact on Covid-19, on March 15 the Austrian government announced a total fiscal package amounting to EUR38 billion (about 9% of GDP). Financing includes EUR9 billion in guarantees to companies, including exporters and the tourism industry; and EUR10 billion for the deferral of personal and corporate income taxes (for 2020), social security contributions (three months) and VAT payments (until the end of September 2020).

On March 18, the ECB implemented further monetary policy measures which included an additional EUR750 billion APP of private and public sector securities (Pandemic Emergency Purchase Program) until the end of 2020, an expanded range of eligible assets under the corporate sector purchase program, and the relaxation of collateral standards for Eurosystem refinancing operations.

Sources: BBC Country Profile – Timeline, Fitch Solutions

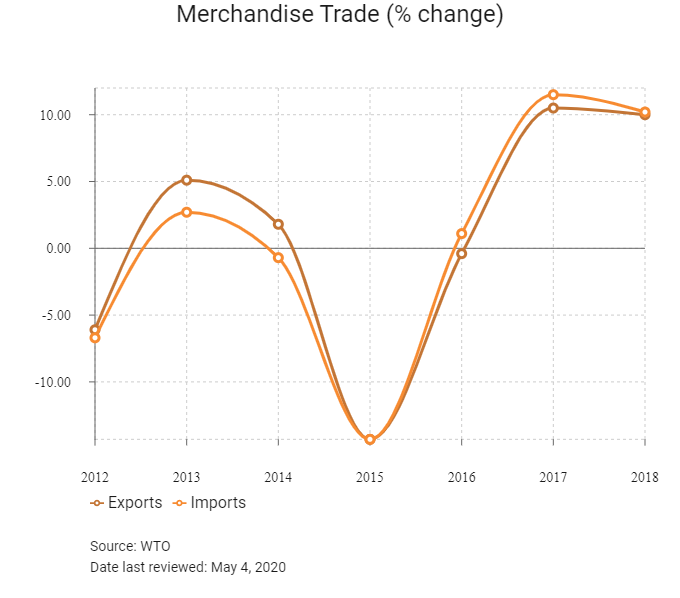

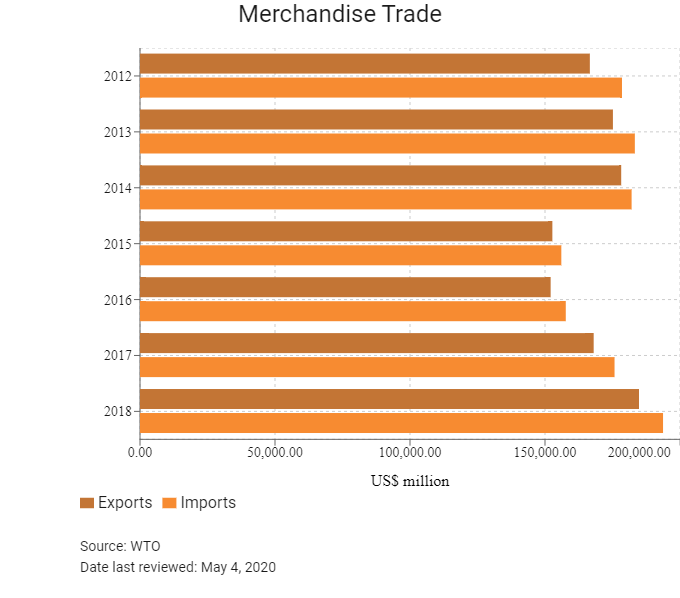

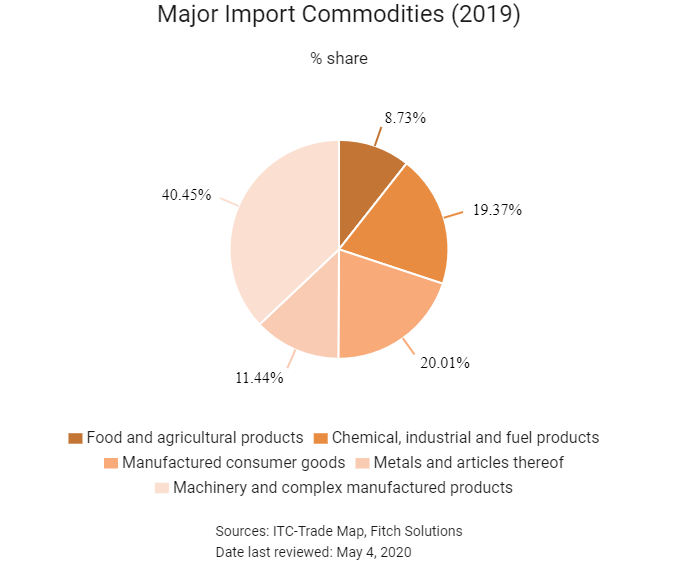

Merchandise Trade

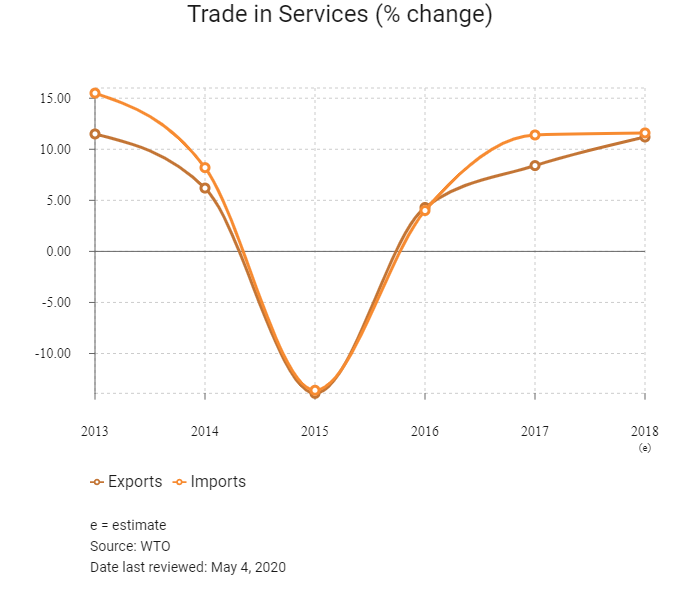

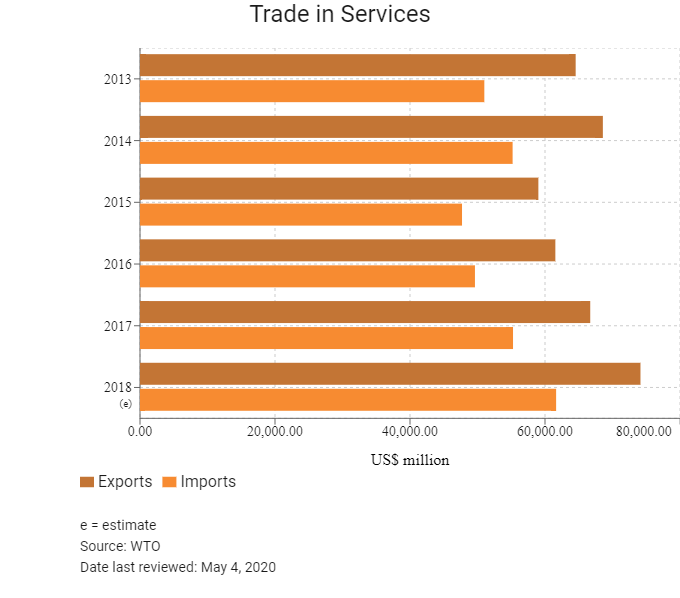

Trade in Services

- Austria joined the World Trade Organization (WTO) in January 1995 and has been a member of the General Agreement on Tariffs and Trade since 1951. The country is also a member state of the EU. All EU member states are WTO members, as is the EU in its own right.

- Austria applies the EU's Common External Tariff, which means goods manufactured and imported from within the EU are not subject to customs charges. The average tariff rate for EU states is 1.5%, which is among the lowest globally. The duties for non-European countries are also relatively low, especially for manufactured goods (4.2% on average). However, the textile, clothing item (high duties and quota system) and food-processing sectors (average duties of 17.3% and numerous tariff quotas) still see protective measures. Most of the country's major trade partners are within the EU, hence risks are less pronounced.

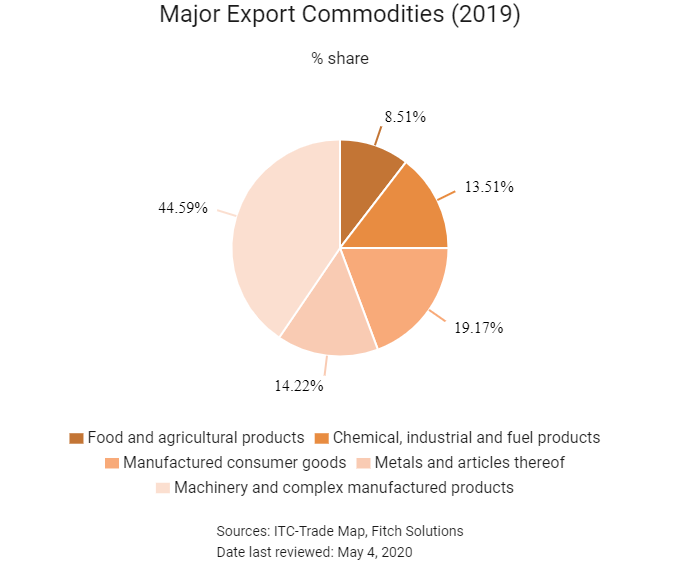

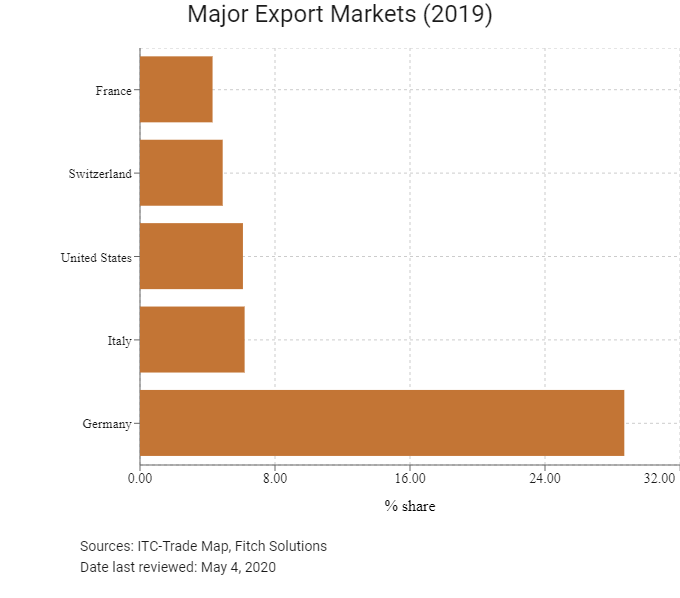

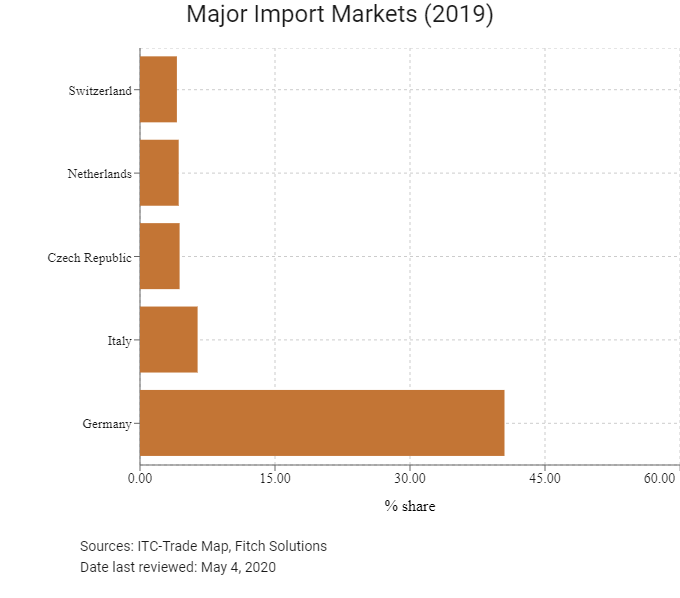

- Austria is well embedded in Germany's export supply chain, where more than one-third of its export produce is headed. Economic growth in Germany is of particular importance to Austria's external sector.

- Austria's export industry is mainly focused on Europe, consuming almost 80% of domestic exports on average. In 2018 the United States accounted for 6.4% of Austria's exports. In an effort to boost and diversify trade, improving trade routes, especially to the fast-expanding emerging economies in Asia, is becoming a priority. To this end, the Austrian Federal Railways, along with national rail counterparts in Russia, Slovakia and Ukraine, has formed a joint venture company to link Europe with East Asia along broad-gauge freight lines, with Vienna to become a major rail freight hub. The new cargo line promises to be quicker and more environmentally friendly than road and sea routes, saving up to 20 days on goods moving to and from Japan, Mainland China and South Korea. A key project phase is the EUR6.7 billion 400km line to connect Slovakia and Vienna, which is in the planning phase. Once environmental impact and other assessments in the two countries have been completed, the project is expected to take eight years to construct.

- The EU has imposed various anti-dumping measures on a wide range of products, predominantly in the areas of textiles, parts, steel, iron and machinery on goods coming from China and a few other Asian nations to protect domestic industries.

- In 2016 the European Commission (EC) introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- In March 2016, the EC imposed a definitive countervailing duty (8.7% or 9.0%) on imports consisting largely of textile products originating in India.

- On January 1, 2017, the EU imposed additional import duties on certain fruit and vegetables if the quantity of the goods exceeds the trigger volume level within the specified application period.

- On November 15, 2017, the EC allocated a total value of EUR62 million (USD74.4 million) for funding promotional campaigns of EU agricultural products implemented in the internal market for 2018. The budget consists of various promotional topics of EU goods in the internal market with an additional focus on the promotion of fruit, vegetables and sheep and goat meat.

- In total, the EU imposes 39 unique anti-dumping measures, affecting 19 states. China has the largest number of anti-dumping provisions against it. There are relatively fewer tariff lines, with only 23 tariffs applicable to imports.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

- European Economic Area (EEA)-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the European Commission, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the European Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products, and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland): An agreement between the EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of the SADC included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking EPA with the EU as part of other trading blocs – such as the East African Community and the Economic Community of Central African States.

- EU-Singapore Free Trade Agreement (EUSFTA): On February 13, 2019, the European Parliament passed the agreement which would see the creation of the EUSFTA: The FTA between the EU and Singapore aims to eliminate duties for industrial and agricultural goods in a progressive step-by-step approach. The FTA entered into force on November 21, 2019. The agreement creates opportunities for market access in services and investments, and includes provisions in areas such as competition policy, government procurement, intellectual property rights, transparency in regulation and sustainable development. The EU is Singapore's third largest trading partner in goods and its largest services trading partner. Under the agreement, 84% of Singapore's exports will enter the EU duty free, while tariffs for the remaining goods will be removed within the first five years.

Provisionally Active

Comprehensive Economic and Trade Agreement (CETA): CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and European Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

Ratification Pending

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties had ratified the agreement as of October 2018). The agreement has been provisionally applied since 2013.

- EU-Vietnam FTA: The EU and Vietnam have finished negotiating a trade agreement and an investment protection agreement, and the agreement now awaits ratification. The EU Council adopted a decision on the conclusion of an FTA between the EU and Vietnam on March 30, 2020. The agreement is expected to enter into force in 2020. The agreement will provide opportunities to increase trade and support jobs and growth on both sides through eliminating 99% of all tariffs, reducing regulatory barriers and overlapping red tape, ensuring the protection of geographical indications, opening up services and public procurement markets, and making sure that the agreed rules are enforceable.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017, and bilateral trade in services added EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The EU Council authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018. As of April 2020, negotiations were still under way.

- Transatlantic Trade and Investment Partnership: This agreement between the EU and the United States was expected to increase trade and services, but it is unlikely to pass under the administration of United States President Donald Trump against a backdrop of rising global trade tensions.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Austrian government welcomes FDI, particularly when such investments have the potential to create new jobs, support advanced technology fields, promote capital-intensive industries and enhance links to R&D.

- Austria's national investment promotion company, the Austrian Business Agency (ABA), is the first point of contact for foreign companies aiming to establish their own business in Austria. It provides comprehensive information about Austria as a business location, identifies suitable sites for greenfield investments and consults in setting up a company. The ABA provides its services free of charge.

- The Austrian government may impose performance requirements when foreign investors seek financial or other assistance from the government, although there are no performance requirements to apply for tax incentives. There is no requirement that Austrian nationals must hold shares in foreign investments or for technology transfer, and no requirement for foreign investors to use domestic content in the production of goods or technology.

- In order to register a new company or open a subsidiary in Austria, a company must first be listed on the Austrian Companies' Register at a local court. The next step is to seek confirmation of registration from the Austrian Federal Economic Chamber (WKO) to establish that the company is really a new business. The investor must then notarise the 'declaration of establishment', deposit a minimum capital requirement in an Austrian bank, register with the tax office, register with the district trade authority, register employees for social security and register with the municipality where the business will be located. Membership of the WKO is mandatory for all businesses in Austria.

- Austrian agencies do not press investors to keep investments in the country, but the WKO carries out annual polls among its members to measure their satisfaction with the business climate, thus providing early warning to the government of problems investors have identified.

- In Austria, tax incentives are currently restricted to a few causes (predominantly fire brigades, donations to social causes, science, R&D, conservation and the arts).

- Continued momentum for reform, following the changes made in 2016, will be a key part of Austria's growth story over the next decade. The government's January 2016 reforms lowered the lowest income tax rate from 36.5% to 25.0%, and the highest rate of 50.0% was adjusted to apply to incomes of more than EUR90,000, from EUR60,000 previously. Part of the reform package also entitles non-financial corporations to cash credits (12.0%) on R&D expenses.

- In April 2019, Austria’s government announced that it will soon finalise plans to raise more than EUR200.0 million in taxes from internet businesses. The three-pronged tax package, first flagged in January, 2019, includes a 5% tax on advertising sales that targets companies such as Alphabet’s Google or Facebook. There is now a requirement for online platforms such as Airbnb to report the transactions they arrange to Austrian tax authorities and to be liable if landlords do not tax their rental income. Two thirds of the foreseeable revenue is expected to come from online retailers from non-EU countries, such as Alibaba Group Holding. These companies will have to pay VAT for low-value goods as an exemption for orders below EUR22 is phased out.

- The government's initiative to cut Austria's banking tax in 2016 to revive credit growth will provide further positive impulses for the economy. In exchange for a one-off payment (the amount has yet to be disclosed), Austrian banks will be able to deduct their contributions to the EU bank resolution and deposit guarantee fund. Before the banking tax reform, Austrian banks were faced with one of the highest tax rates in the EU, impeding banking profitability.

- Austria offers financial and tax incentives (within EU competition policy limits) to firms undertaking projects in economically underdeveloped areas. In most of these areas, eligibility for co-financing subsidies under EU regional and cross-border programmes has gradually declined under the EU's financial frameworks, but subsidies could account for up to EUR200 million per year (mainly for rural areas) within the EU Common Strategic Framework from 2014 to 2020.

- Austria's Wirtschaftsservice is a government institution that provides financial incentives for businesses.

- Financial incentives provided by Austrian federal, state and local governments to promote investment are equally available to domestic and foreign investors and include tax incentives, preferential loans, loan guarantees and grants. Most incentives are targeted to investment that meets specified criteria, including job creation and the use of cutting-edge technology. Tax allowances for advanced employee training, and R&D expenditure are also available, as are financing options for start-ups and cash grants.

- The Austrian Labour Market Service offers grants for job creation and personnel development training.

- There are no sectoral or geographic restrictions on foreign investment. American investors have not complained of discriminatory laws against foreign investors. Corporate taxes are relatively low (25% flat tax) and a tax reform implemented in 2016 aims to further stimulate the economy. Citizens and investors have reported that it is difficult to establish and maintain banking services since the Foreign Account Tax Compliance Act Agreement came into force in 2014, as some Austrian banks have been reluctant to take on this reporting burden.

- Potential investors should factor in Austria's strict environmental regulations and environmental impact assessments into their investment decision-making. The requirement that over 50% of energy providers must be in public hands creates a potential additional burden for investments in the energy sector. Strict liability and co-existence regulations in the agricultural sector restrict research and virtually outlaw the cultivation, marketing, or distribution of biotechnology crops. This situation is unlikely to improve for biotech producers under the new coalition government.

- There is no principal limitation on establishing and owning a business in Austria. A local managing director must be appointed to any newly-started enterprise. For non-EU citizens to establish and own a business, the Austrian Foreigner's Law mandates a residence permit that includes the right to run a business. Many Austrian trades are regulated, and the right to run a business in many trades sectors is only granted when certain preconditions are met, such as certificates of competence, and the recognition of foreign education.

- There are no limitations on the ownership of private businesses. Austria maintains an investment screening process for takeovers of 25% or more in the sectors of national security and public services, such as energy and water supply, telecommunication, and education services, where the Austrian government retains the right of approval. The screening process has rarely been used since its introduction in 2012.

- Austria has bilateral investment treaties (BITs) in force with the following countries: Albania, Algeria, Argentina, Armenia, Azerbaijan, Bangladesh, Belarus, Belize, Bosnia-Herzegovina, Bulgaria, Chile, Mainland China, Croatia, Cuba, Czech Republic, Egypt, Estonia, Ethiopia, Georgia, Guatemala, Hong Kong, Hungary, India, Iran, Jordan, Kazakhstan, South Korea, Kuwait, Latvia, Lebanon, Libya, Lithuania, North Macedonia, Malaysia, Malta, Mexico, Moldova, Mongolia, Montenegro, Morocco, Namibia, Oman, Paraguay, Philippines, Poland, Romania, Russia, Saudi Arabia, Serbia, Slovakia, Slovenia, Tajikistan, Tunisia, Turkey, Ukraine, United Arab Emirates, Uzbekistan, Vietnam and Yemen. BITs with Cambodia, Kyrgyzstan, Nigeria and Zimbabwe have been signed but have not yet entered into force.

Sources: US State Department, ABA, Fitch Solutions

Free Trade Zones And Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

R&D incentives |

- R&D costs are fully deductible at the time they accrue. |

Sources: National sources, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 25%

Source: Austria Ministry of Finance

Important Updates to Taxation Information

- On 1 September 2019, the EU Tax Dispute Resolution Act EU-BStbG) came into force.

- On 22 October 2019, the Tax Amendment Act 2020 (AbgÄG) was published in the Austrian Federal Law Gazette. Large multinational companies with a worldwide revenue of at least EUR750 million and a yearly domestic revenue at least EUR25 million from providing online advertising services are subject to a 5% digital services tax.

- On 29 October 2019, the Tax Reform Act 2020 (‘Steuerreformgesetz 2020’) was published in the Austrian Federal Law Gazette. According to the Tax Reform Act 2020, several changes to the Austrian VAT law entered into force from January 1 2020 (eg, a reduced VAT rate of 10% for the supply of e-books and e-papers, the simplification of the rule for call-off stocks, and new rules for chain transactions).

- The Annual Tax Act of 2018 introduced new controlled foreign corporation rules for permanent establishments (applicable to business years starting from January 1, 2019), overriding the rules of treaties and permanent establishments. This is designed to limit artificial deferral of tax by using offshore lower-tax avenues. In May 2019, the Austrian Ministry of Finance published a draft bill for the Tax Reform Act I 2019/20.

- According to the draft bill of the Tax Reform Act I 2019/20, the reduced VAT rate of 10% shall apply for e-books and e-papers as of January 1, 2020.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

25% |

|

Capital Gains Tax |

Same rate as ordinary income |

|

VAT |

Standard rate: 20%, a certain limited range of goods and services is taxed at the reduced rate of 10% (for items such as books, food, restaurants, passenger transportation, medicines) or 13% (eg, animals, seeds and plants, cultural services, museums, zoos, film screenings, wood, domestic air travel, athletic events); certain other transactions are exempted from Austrian VAT (eg, export transactions) |

|

Stability fee for banks |

A stability fee for financial institutions is charged at 0.024% based on balance sheet totals of over EUR300.0 million to EUR20.0 billion and 0.029% on balance sheet totals over EUR20.0 billion. In addition, a special payment based on the balance sheet totals of the financial year ending in 2015 has to be made in installments from 2017 to 2020. The special payment amounts to 0.211% of the balance sheet totals of over EUR300.0 million to EUR20.0 billion and 0.258% on balance sheet totals over EUR20.0 billion. |

|

Real Estate Tax |

Tax rate on agricultural area and forestry: |

|

Withholding Tax: dividends, interest and royalties |

25% for businesses and 27.5% for other recipients for all profit distributions |

|

Transfer Tax |

Acquisition tax of 3.5% of the consideration (plus 1.1% registration fee with the land register) |

|

Payroll Tax: social security |

- Employer's contribution amounts to 21.48% of an employee's salary |

Sources: Austria Ministry of Finance, Fitch Solutions

Date last reviewed: May 4, 2020

General Localisation Requirements

If investors want to employ foreign workers in Austria, they will need to apply for a work permit with the AMS. The AMS only grants that permission if there is no comparable person in the pool of registered unemployed persons. This does not apply to senior management positions.

Austria offers several non-immigrant business visa classifications, including intra-company transfers/rotational workers and employees on temporary duty. The recruitment of long-term overseas specialists or those with managerial duties is governed by a points-based immigration scheme to attract skilled workers and specialists in individual sectors (points are available for qualification, education, age and language skills). This Red-White-Red card (RWR) model has been designed to allow firms to react flexibly to rising demand for talent in different occupations. It is available to highly qualified individuals, qualified specialists/craftsmen in certain understaffed professions (qualified labour and registered nurse jobs) and key personnel or professionals. Applicants must have an offer of employment to apply for the RWR. Highly qualified individuals may apply locally in Austria or opt to find a potential employer from abroad and have the company apply in Austria on their behalf. Austrian immigration law requires those applying for residency permits to take German language courses and exams. In 2017 the Austrian government introduced a law that introduces a specific visa category under the RWR model for founders of start-up enterprises to support Austria's push to expand its innovation economy.

Social Security

Social insurance is compulsory in Austria and comprises health insurance, old-age pension insurance, unemployment insurance and accident insurance. Employers and employees contribute a percentage of total monthly earnings to a compulsory social insurance fund. Austrian laws closely regulate terms of employment, including working hours, minimum vacation time, holidays, maternity leave, statutory separation notice, severance pay, dismissal and an option for part-time work for parents with children under the age of seven. Problematic areas include increased deficits in the pension and health insurance systems, the shortage of personnel to care for the increasing number of elderly people, and escalating costs for retirement and long-term care. Owing to employer contributions to social insurance for employees, paid leave, paid sick leave, fringe benefits and the like, additional wage costs in Austria add up to about 70% of gross pay.

General European Union Work Permit

EU member citizens do not require a work permit, but their employer must inform the job office about their employment. Citizens of the EEA (with EU member states, Iceland, Norway and Lichtenstein) and Switzerland do not require a visa to enter, reside or work in the country.

No work permit is needed by foreigners from outside the EU if they have a permanent residence or family reunion permit, have been granted asylum, study in the country, or have Blue or Green Cards. Since the beginning of 2014, citizens of Romania and Bulgaria also enjoy free labour market access. For Croatian nationals, certain restrictions regarding work permits are still in place.

EU Blue Card

This type of residence and work permit allows highly qualified non-EU citizens to live and work in Austria for up to two years. It is tied to a confirmed job offer and will only be granted if the AMS is satisfied that no Austrian or EU citizen is available to do the work specified. A foreigner holding a Blue Card may reside in the country and work in the job for which the Blue Card was issued or change that job under the conditions defined.

Only applicants who have completed a university degree course of at least three years are eligible for a Blue Card. Their qualifications must match the job profile, and the salary specified in the work contract must be 1.5 times higher than the average yearly income of full-time employees in Austria. The figures are published regularly by Statistik Austria.

RWR Card

Non-EU citizens who qualify as 'key workers' can apply for a RWR Card, which allows them to work for a specified employer and live in Austria for a period of 12 months. In order to qualify as a key worker, one must be highly qualified, a skilled worker in a shortage occupation, a self-employed key worker or a graduate of an Austrian university. The RWR Card works on a points-based system.

After 10 months of working and living in Austria, RWR Card holders may apply for an RWR Card plus, which entitles them to free access to the Austrian labour market. Family members of RWR or of Blue Card holders are also eligible to apply for a RWR Card plus.

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aa1 (stable) |

25/05/2018 |

|

Standard & Poor's |

AA+ (stable) |

29/01/2013 |

|

Fitch Ratings |

AA+ (stable) |

15/05/2020 |

Sources: Moody's, Standard & Poor's, Fitch Rating

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

22/190 |

26/190 |

27/190 |

|

Ease of Paying Taxes Index |

39/190 |

40/190 |

44/190 |

|

Logistics Performance Index |

4/160 |

N/A |

N/A |

|

Corruption Perception Index |

14/180 |

N/A |

N/A |

|

IMD World Competitiveness |

18/63 |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

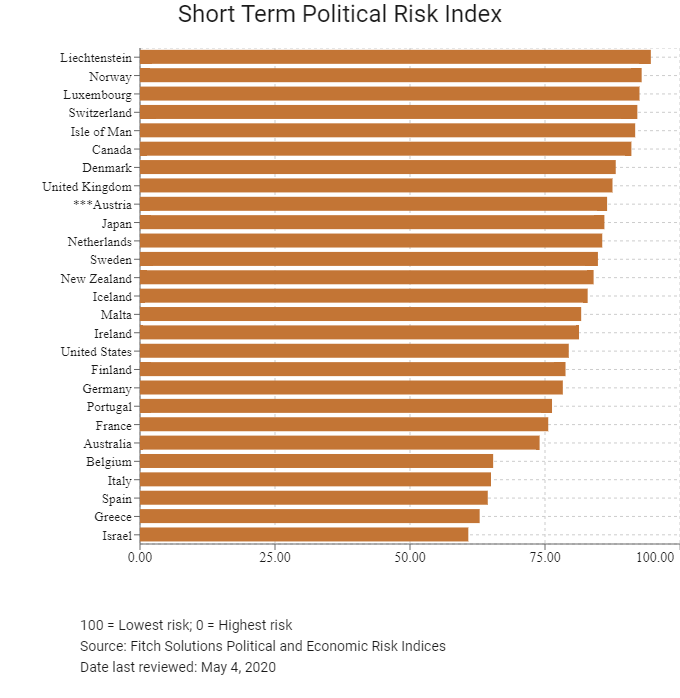

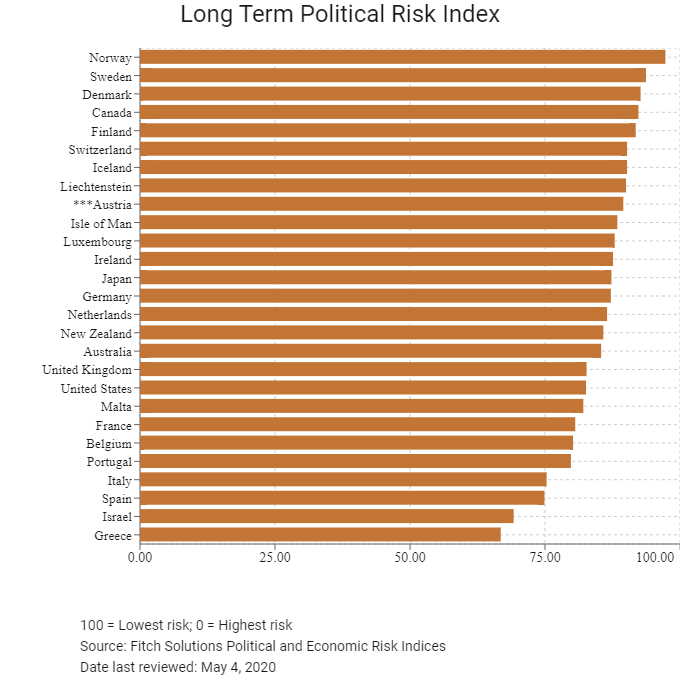

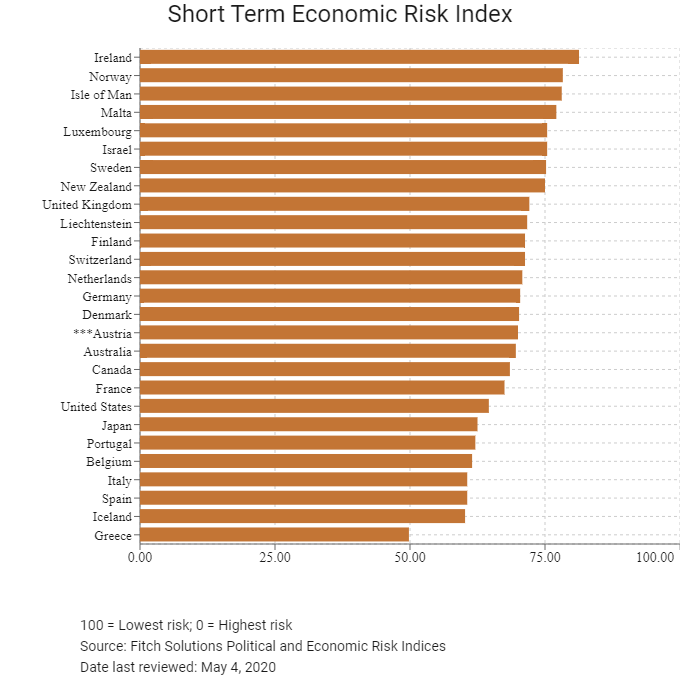

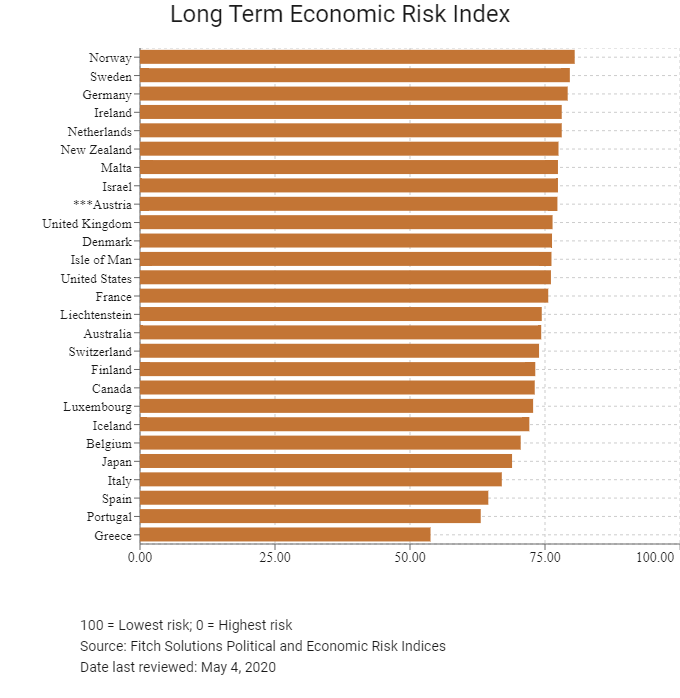

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

9/202 |

6/201 |

12/201 |

|

Short-Term Economic Risk Score |

75.0 |

72.9 |

70.0 |

|

Long-Term Economic Risk Score |

77.3 |

78.8 |

77.3 |

|

Political Risk Index |

9/202 |

9/201 |

9/201 |

|

Short-Term Political Risk Score |

85.6 |

86.5 |

86.5 |

|

Long-Term Political Risk Score |

89.5 |

89.5 |

89.5 |

|

Operational Risk Index |

13/201 |

13/201 |

12/201 |

|

Operational Risk Score |

74.7 |

74.4 |

74.8 |

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Risk Summary

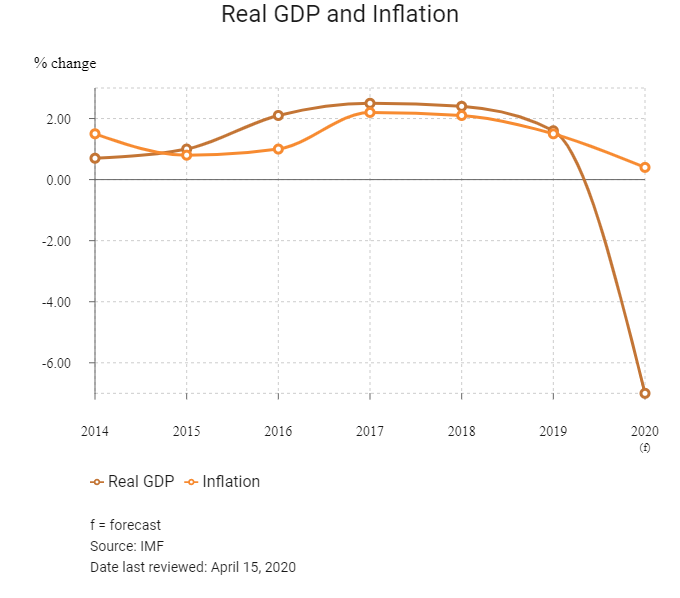

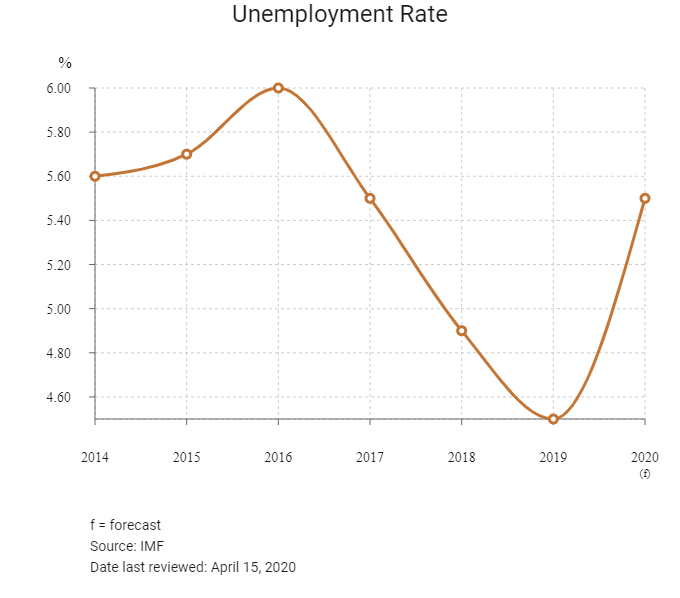

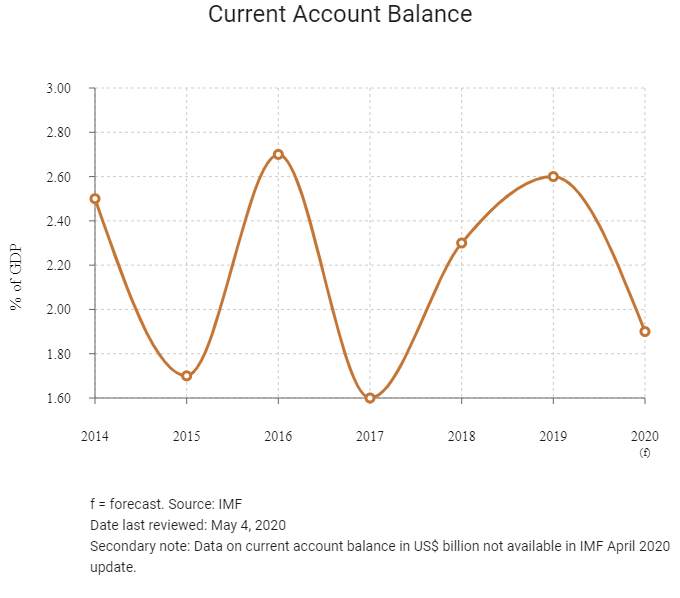

ECONOMIC RISK

The economy will cool in 2020 amid weakening global demand due to the Covid-19 pandemic and lingering external headwinds. Growth is expected to be broad based, with a tighter labour market in particular implying scope for a steady contribution of private consumption to headline growth figures in the coming years. As Austria remains highly integrated and reliant on external demand from the wider eurozone, a significant slowdown in eurozone economic activity has the potential to negatively impact Austrian growth. In terms of demographics, the influx of thousands of migrants in 2015-2016 and Austria's ageing population may present fiscal problems in the long term, with the possibility of shortfalls in the welfare and pension systems.

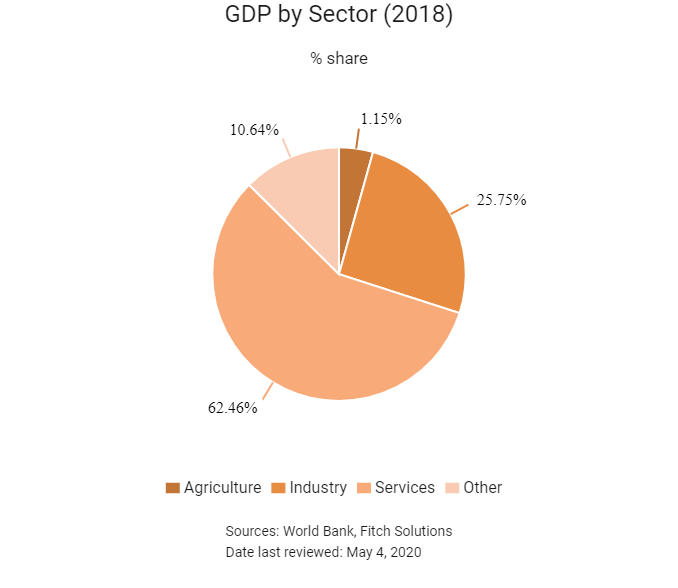

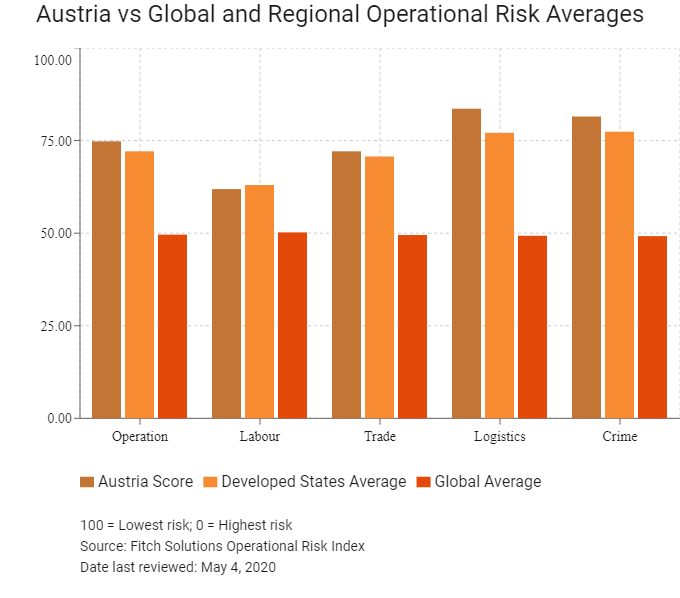

OPERATIONAL RISK

Austria's economy features a large service sector, a sound industrial sector and a small but highly developed agricultural sector. The Austrian economy has greatly benefitted from its strong commercial relations with the Central and Eastern Europe (CEE) region, specifically in the banking and insurance sectors. Austria has traditionally attracted a significant amount of foreign direct investment owing to its geographical location as an intersection of Eastern and Western Europe. The country's business environment ranks among the top 10th percentile globally owing to its strong logistics profile, solid legal and security environments, and investor-friendly trade and investment policies. Austria's large and competitive manufacturing sector as well as highly developed service industry equips the economy to grow at a robust pace over the coming decade. The main headwinds the country will face over the medium term arise from stalling reform momentum, a rigid labour market and rising competition from neighbouring CEE, while a weakened global outlook will drag on investment in the near term.

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Austria Score |

74.8 |

61.9 |

72.1 |

83.6 |

81.5 |

|

Developed States Average |

72.1 |

63.0 |

70.7 |

77.1 |

77.4 |

|

Developed States Position (out of 27) |

10 |

15 |

14 |

6 |

10 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

12 |

33 |

21 |

6 |

12 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk |

Crime and Security Risk Index |

|

Denmark |

79.5 |

70.5 |

76.6 |

88.5 |

82.3 |

|

Switzerland |

78.4 |

74.4 |

76.9 |

79.3 |

83.2 |

|

Netherlands |

78.3 |

65.4 |

78.2 |

88.8 |

80.7 |

|

United States |

77.7 |

79.7 |

75.8 |

85.9 |

69.3 |

|

Sweden |

77.3 |

66.8 |

76.9 |

86.7 |

78.6 |

|

New Zealand |

76.9 |

72.0 |

74.5 |

73.0 |

88.3 |

|

Canada |

76.2 |

73.6 |

74.4 |

75.1 |

81.6 |

|

United Kingdom |

76.1 |

70.2 |

77.9 |

78.3 |

78.2 |

|

Norway |

76.0 |

63.8 |

71.1 |

81.2 |

87.9 |

|

Austria |

74.8 |

61.9 |

72.1 |

83.6 |

81.5 |

|

Finland |

73.9 |

54.9 |

72.2 |

84.7 |

83.7 |

|

Ireland |

73.5 |

66.6 |

78.1 |

70.4 |

79.0 |

|

Luxembourg |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Australia |

72.4 |

68.7 |

72.5 |

68.4 |

79.9 |

|

Germany |

72.1 |

66.2 |

67.9 |

80.8 |

73.6 |

|

Spain |

71.9 |

61.0 |

70.0 |

80.6 |

76.0 |

|

France |

71.5 |

60.7 |

70.1 |

82.6 |

72.8 |

|

Belgium |

71.4 |

57.0 |

75.1 |

82.3 |

71.1 |

|

Iceland |

71.4 |

59.8 |

67.6 |

70.0 |

88.1 |

|

Japan |

71.2 |

69.9 |

65.9 |

77.5 |

71.5 |

|

Portugal |

70.0 |

52.5 |

67.4 |

81.7 |

78.4 |

|

Israel |

67.9 |

71.3 |

67.3 |

70.2 |

62.7 |

|

Malta |

64.9 |

54.3 |

68.6 |

63.0 |

73.7 |

|

Isle of Man |

64.4 |

49.9 |

68.6 |

56.6 |

82.4 |

|

Italy |

63.8 |

55.1 |

59.8 |

76.2 |

64.3 |

|

Liechtenstein |

63.1 |

47.0 |

57.1 |

65.1 |

83.2 |

|

Greece |

57.9 |

53.2 |

48.9 |

69.9 |

59.6 |

|

Regional Averages |

72.1 |

63.0 |

70.7 |

77.1 |

77.4 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 4, 2020

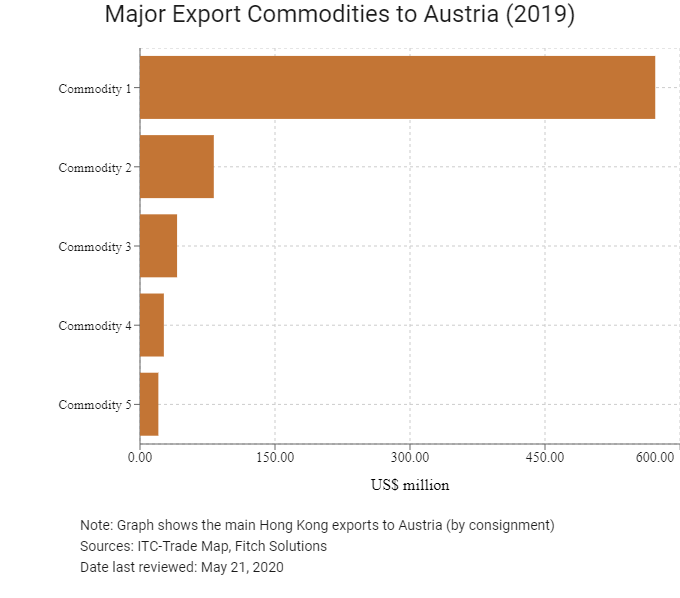

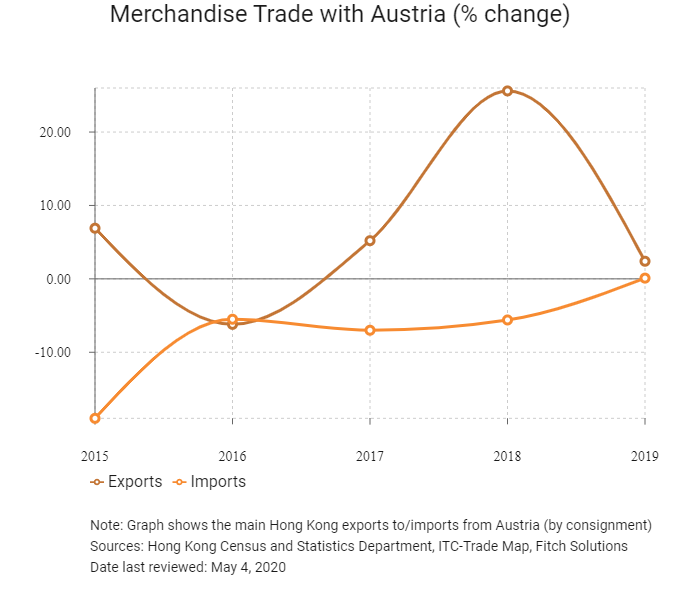

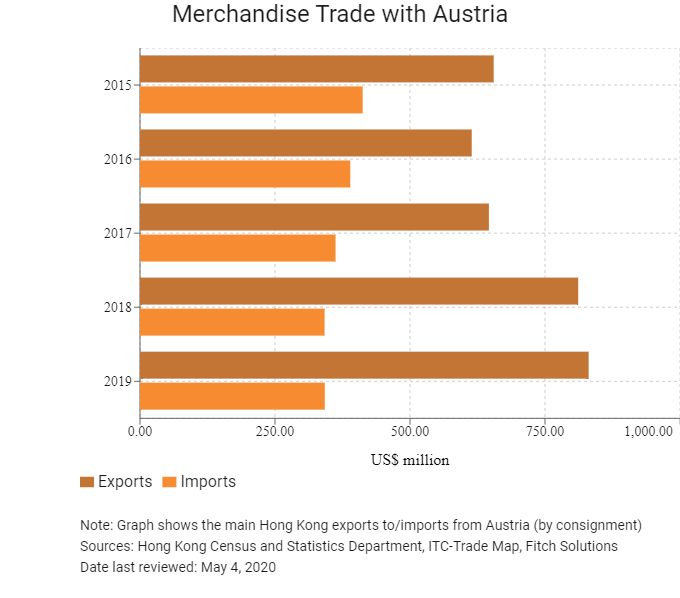

Hong Kong’s Trade with Austria

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery and equipment and parts thereof |

572.5 |

|

Commodity 2 |

Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof |

82.0 |

|

Commodity 3 |

Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

41.2 |

|

Commodity 4 |

Clocks and watches and parts thereof |

26.5 |

|

Commodity 5 |

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof |

20.4 |

|

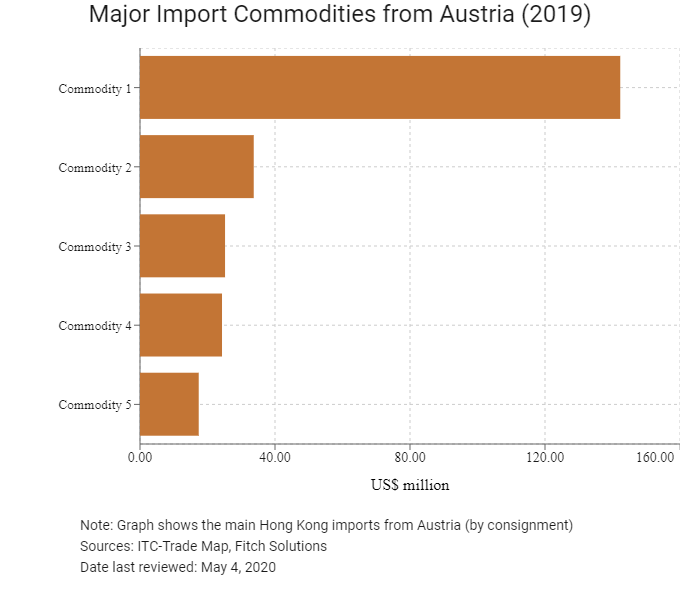

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery and equipment and parts thereof |

142.3 |

|

Commodity 2 |

Glass and glassware |

33.7 |

|

Commodity 3 |

Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

25.2 |

|

Commodity 4 |

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof |

24.3 |

|

Commodity 5 |

Works of art, collectors' pieces and antiques |

17.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Austrian residents visiting Hong Kong |

22,136 |

-27.0 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of developed states citizens residing in Hong Kong |

83,786 |

29.6 |

Source: United Nations Department Of Economic And Social Affairs – Population Division

Note: Growth rate is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: May 4, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

452 |

12.2 |

|

- Regional offices |

709 |

5.2 |

|

- Local offices |

948 |

12.1 |

Treaties and agreements between Hong Kong and Austria

Austria and Hong Kong signed a comprehensive double tax agreement in May 2010, with the agreement effective from July 2013.

Chamber of Commerce or Related Organisations

The Austrian Chamber of Commerce Hong Kong

Address: GPO Box 8031, Central, Hong Kong

Email: austrocham@austrocham.com

Tel: (852) 3105 0152

Fax: (852) 3105 995

Source: The Austrian Chamber of Commerce Hong Kong

Austrian Hong Kong Society

Email: kontakt@ahks.at

Tel: (43) 664 283 5423

Website: www.ahks.at

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate General of Austria in Hong Kong

Address: Room 2201, Chinachem Tower, 34-37 Connaught Road, Central, Hong Kong

Email: hongkong-gk@bmeia.gv.at

Tel: (852) 2522 8086

Fax: (852) 2587 7331

Visa Requirements for Hong Kong Residents

HKSAR passport holders can travel to the Schengen Zone without a visa. They can travel for tourism and business purposes and remain in the region for a period of up to 90 days.

Source: Visa on Demand

Date last reviewed: May 4, 2020

Austria

Austria