Think Business, Think Hong Kong symposium organised by the HKTDC was held on 8 January at Shangri-La Jakarta, Indonesia, attracting some 2,000 participants.

- 1,500+ participants attended the full-day symposium to explore the latest business opportunities across sectors and Hong Kong’s latest developments

- Symposium facilitated 200+ business matching meetings

- 400+ Indonesian and Hong Kong business leaders joined gala dinner

9 January 2025 (Jakarta, Indonesia) – The Think Business, Think Hong Kong (TBTHK) mega promotion organised by the Hong Kong Trade Development Council (HKTDC) was successfully held on 8 January in Jakarta, Indonesia.

To promote bilateral trade and investment between Hong Kong and Indonesia, TBTHK attracted some 2,000 participants. Over 1,500 participants attended the full-day symposium to explore the latest business opportunities across sectors and Hong Kong’s latest developments. At the same time, over 400 leaders of the Indonesian and Hong Kong business communities joined the gala dinner for further networking and dialogue.

Dr Peter K N Lam, HKTDC Chairman, Mr Paul Chan, Financial Secretary of the Hong Kong SAR Government and Dr Edi Prio Pambudi, Deputy Minister for Coordination of International Economic Cooperation, attended the opening ceremony.

Dr Lam stated, “TBTHK is our annual flagship promotion that aims to strengthen business ties between Hong Kong and our major international partners. Indonesia has long been an important partner for Hong Kong. As we meet local government and business leaders on this visit, we look to strengthen our bilateral ties.”

He added, “We have long been known for our strengths in traditional sectors, such as finance, trade, logistics and professional services. With the tremendous advances we have been making in newer sectors, such as innovation and sustainability, many opportunities await Indonesian businesses in our dynamic world city.”

Mr Chan, in his speech, stated that Hong Kong enjoys the unique advantage of one country, two systems, enabling it to serve as a superconnector and super value-adder between China and the rest of the world.

He said, "Under ‘one country’, we enjoy the full support of our motherland to develop as international financial, shipping and trade centres as well as an international hub for high-calibre talent. We also benefit from the national development strategy of the Guangdong-Hong Kong-Macao Greater Bay Area, or GBA.”

He added, “The GBA is not just a huge consumer market. It pools together the financial and professional service capabilities of Hong Kong as well as the tech and advanced manufacturing capabilities of Shenzhen and other cities, like Dongguan and Huizhou.”

And under “two systems”, he pointed out, “Foreign companies with a presence in Hong Kong, including Indonesian companies, can leverage the Closer Economic Partnership Arrangement (CEPA) between the mainland and Hong Kong to gain easy and unparalleled access to the immense mainland market.”

Dr Edi Prio Pambudi said, “We aim to achieve ambitious growth targets, as we work towards our vision of becoming an advanced economy by 2045, including a GDP growth rate of 8%, as outlined by President Prabowo. Achieving this target requires robust collaboration between Indonesia and key partners, like Hong Kong. It is imperative that we continue to seek support and engagement of Hong Kong corporations to further drive Indonesia’s economic development."

He added, “Hong Kong’s contributions as investors and innovators are essential to achieving our goals to create a diversified and resilient economy that will generate high-quality jobs, foster sustainable development and ensure long-term prosperity for both Indonesia and Hong Kong, while also driving Indonesia towards economic milestones that benefit not only our nation, but also the global community."

Notable speakers discussing opportunities in finance, smart city and sustainability

At the symposium, leaders of the Indonesian business communities highlighted how Hong Kong plays an essential role as a superconnector and super value-adder, linking Mainland China and the rest of the world, especially the dynamic ASEAN region, for businesses across diverse sectors, including finance, smart city, sustainability, transportation, innovation and technology (I&T) and more. By showcasing these strengths, the event reinforced Hong Kong’s status as the preferred destination in Asia for international businesses, talent and investment.

The symposium’s plenary session featured renowned speakers, including The Honourable Bernard Charnwut Chan, Chairman and President of Asia Financial Holdings Ltd, Mr Guy Bradley, Chairman of Swire Pacific Limited, Mr Kenneth Hui, Executive Director (External) of Hong Kong Monetary Authority, Mrs Shinta Widjaja Kamdani, CEO of Sintesa Group and Chairwoman of Indonesian Employer's Association, and Mr Rex Sham Co-Founder & Chief Science Officer of Insight Robotics Limited. They discussed the global outlook, while examining opportunities for Hong Kong and Indonesian businesses to propel regional development, paving the way for sustainable growth.

Subsequently, four thematic sessions were held. A session co-organised with the Hong Kong Monetary Authority (HKMA), “RMB Opportunities in International Trade and Hong Kong’s Strategic Role”, highlighted how Hong Kong played a pivotal role in the wider use of RMB in the region over the past 10-15 years. It also discussed how Mainland China and Indonesian businesses can leverage Hong Kong’s financial strengths and the multifaceted benefits of RMB use to become part of a growing economic partnership.

A thematic session supported by Cyberport, “Building for the Future”, explored Hong Kong’s vibrant PropTech sector that integrates artificial intelligence (AI) and IoT, driving efficiency and growth across mobility, living, decarbonisation and governance.

Another session co-organised with Invest Hong Kong (InvestHK), “Hong Kong – An Ideal Business Hub for Supply Chain Companies and Beyond”, highlighted Hong Kong’s strengths in multinational supply chains and providing one-stop support for international businesses. It also discussed how the global supply chain is being reshaped and how Hong Kong is well equipped to support the industry in navigating this changing landscape.

The fourth session on “Innovations in Green Technology for a Sustainable Tomorrow” highlighted Hong Kong’s leadership in innovative green-tech solutions and discussed the groundbreaking opportunities for a more resilient and sustainable future for Indonesia and markets along the Belt and Road.

Networking sessions for further collaboration

The symposium brought together 22 exhibitors from diverse sectors from Hong Kong. An InnoVenture Salon exhibition with Hong Kong start-ups, including Hong Kong Cyberport Management Company Limited, Hong Kong Science & Technology Parks Corporation, Ambit Geospatial Solution Limited, Binery Limited (Pintar Investments), Leapstack International Limited and One Energy (HK) Limited, showcased their innovative solutions. Meanwhile, business advisory bodies, including Conpak CPA Limited and InvestHK, were on-site at the Business Support Zone to offer consultations to businesses looking to set up operations in Hong Kong. The symposium also facilitated over 200 on-site business matching meetings between Indonesian and Hong Kong companies.

The Hong Kong Tourism Board also set up a Hong Kong Café at the symposium for guests to immerse themselves in the vibrant neighbourhood of “Old Town Central”, while enjoying authentic Hong Kong snacks, such as milk tea and egg waffles, which embody the city’s unique East-meets-West spirit.

Following the symposium, the Hong Kong Dinner was held at The Ritz-Carlton Jakarta, Pacific Place hosting Mr Chan, Ms Dyah Roro Esti Widya Putri, Vice Minister of Trade, Ministry of Trade of the Republic of Indonesia, and H.E. Wang Lutong Ambassador Extraordinary and Plenipotentiary of the People's Republic of China in Indonesia. It was attended by over 400 prominent guests from political and business circles.

Mr Paul Chan, Financial Secretary of the Hong Kong SAR Government, talked about deepening economic ties between Hong Kong and Indonesia

Dr Peter K N Lam, Chairman of the HKTDC, shared insights into Hong Kong’s current business climate and advantages, highlighting opportunities for greater collaboration between Indonesian and Hong Kong businesses

Dr Edi Prio Pambudi, Deputy Minister for Coordination of International Economic Cooperation, addressed participants at the TBTHK symposium

The symposium featured an InnoVenture Salon exhibition with Hong Kong start-ups showcasing their innovations

The Hong Kong dinner’s LED Dance with Martial Arts performance highlighted Hong Kong’s rich cultural heritage and identity

Video: http://bit.ly/3DXmYUZ

Original article published in https://mediaroom.hktdc.com/

Editor's picks

Trending articles

AI platform developed by Hong Kong start-up monitors disasters and carbon emissions

Residents can expect less damage from landslides and floods thanks to a new monitoring system developed by a start-up that uses data collected by Hong Kong’s own satellites.

Established in 2023 with the support of the Hong Kong University of Science and Technology (HKUST), Stellerus Technology uses artificial intelligence to analyse satellite data and make predictions about the environment and potential disasters.

Prior to the company’s founding, such services used data derived from ground-based sensing systems such as Internet of Things (IoT) sensors, which have a very limited range. However, the launch of HKUST’s own satellite from the Jiuquan Satellite Launchpad in Gansu province in August 2023 has made critical environmental and geographic data readily available.

With the acquisition of this new data source, Stellerus’s proprietary system can report on a wide variety of incidents including landslides and floods, as well as analysing climate risks.

The company has worked with clients, such as the State Grid Corporation of China to analyse climate hazard risks. In addition, the company is developing a simulation platform – also known as “digital twin” - that can be used to predict and assess risks.

Outside of Hong Kong, Stellerus sees strong demand for environmental monitoring services across the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) and is exploring setting up R&D centres in GBA cities. Indonesia is also a focus for its intelligent climate monitoring services with several projects under discussion.

While the start-up’s technology is held in high regard across the sector, it lacks public profile and market awareness among business and government players, according to Co-Founder and Chief Technology Officer Jeffrey Xu.

This led Stellerus to enter the 2024 HKTDC Start-Up Express programme in which it was named one of the 10 winners for its ClimaTech solutions.

“Start-Up Express gave us an opportunity to introduce our technology to other start-ups and the judging panel. Through the competition, we came to know more about the start-up ecosystem in Hong Kong,” he said.

Under HKTDC’s guidance, Stellerus also took part in events, such as the Hong Kong-Jiangsu High-Quality Development Forum and the Belt and Road Summit, to understand R&D and market access policies for satellite technology, and explore business opportunities with potential clients.

In 2025, Indonesia and Central Asia will form the focus of the start-up's outreach by participating in HKTDC’s Think Business Think Hong Kong campaign in Jakarta and making use of HKTDC’s branch network.

Looking ahead, Stellerus is working on improving its AI technology for processing and analysing satellite data. It is working with HKUST to develop a greenhouse gas observation payload to install on board the China Space Station, which will provide data that could help reduce the worst effects of climate change.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

The next campaign will take place in Jakarta in January

The next Think Business, Think Hong Kong (TBTHK) – a mega promotion campaign highlighting Hong Kong’s benefits as a business and investment hub – will take place in Jakarta on 8 January, bringing together business leaders from Hong Kong and Indonesia.

TBTHK, which has been organised by the Hong Kong Trade Development Council (HKTDC), aims to showcase Hong Kong as an ideal springboard for Indonesian businesses to access new opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), as well as the wider China and Asia markets.

More than 20 government representatives and business leaders will speak at a full-day symposium at the Shangri-La Jakarta about the latest developments and opportunities in Asia and across diverse sectors, including finance, smart city, sustainability, transportation, innovation and technology (I&T) and more.

More than 1,000 participants, including Indonesian government officials and business leaders from large corporations and SMEs, are expected to attend.

“Hong Kong's strategic location as an international financial, fundraising and investment hub, and as the gateway between Mainland China and the rest of the world, presents immense opportunities for Indonesian businesses,” said Ronald Ho, HKTDC’s Regional Director of Southeast Asia and South Asia, speaking at a press conference in Jakarta.

The TBTHK promotion will also build on the success of an HKTDC-organised delegation, led by Hong Kong SAR Chief Executive John Lee, which visited Indonesia among other ASEAN markets last year, Mr Ho added.

In addition to the symposium, some 20 Hong Kong service providers and start-ups will feature their flagship products and solutions in the exhibition’s Business Support Zone.

An InnoVenture Salon will also create opportunities for collaboration with Indonesian participants.

A high-level gala dinner, during which Hong Kong and Indonesia business leaders can further engage in dialogue and network, will conclude the day’s events.

A delegation of some 100 senior executives, innovators, start-ups and professional service providers from various sectors – including I&T, infrastructure and transportation – will also explore business opportunities in Indonesia through company visits, networking events and business matching meetings.

As the largest country in Southeast Asia, Indonesia is an important partner for Hong Kong. Economically, Hong Kong and Indonesia have seen their trade and investment ties deepen over the past decades.

At the end of 2023, Hong Kong was Indonesia’s sixth largest investor, after Singapore, Japan, the US, the Netherlands and Mainland China. In the same year, Hong Kong was Indonesia’s second-largest source of FDI, after Singapore.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

Successful IP, innovation events strengthen Hong Kong’s trading hub status

The Business of IP Asia (BIP Asia) Forum and Entrepreneur Day (E-Day) attracted more than 400 exhibitors as well as experts and business leaders from around the world, reinforcing Hong Kong’s position as a leading regional centre for IP trading and an international hub for innovation and technology.

The two events ran concurrently in the first week of December, featuring a diverse mix of exhibitions, competitions, workshops and business matching meetings.

The theme for this year’s BIP Asia Forum – which was jointly organised by the Hong Kong SAR Government and the Hong Kong Trade Development Council (HKTDC) – was Reimagining IP for Impact and Growth.

Eric Chan, the Government’s Chief Secretary for Administration, outlined measures to enhance Hong Kong’s IP infrastructure and build an IP-savvy workforce in his opening remarks on the first morning.

These plans include updating Hong Kong’s Copyright Ordinance and the registered design regime as well as introducing legislative amendments to streamline IP litigation.

The Government’s Intellectual Property Department will also work the Qualifications Secretariat to develop IP training materials for 23 industries, Mr Chan added.

One key topic that emerged during the BIP Asia Forum was the importance of IP financing.

Wang Binying, Deputy Director General of the World Intellectual Property Organization (WIPO), pointed out that global IP filings had mixed results last year.

This highlighted continued willingness to invest in IP while raising questions over how to accelerate development and turn downsides into positives, Ms Wang added.

“An important way to improve this trend is to promote IP financing, in particular financing high-potential start-ups and emerging technologies,” she said.

HKTDC Chairman Dr Peter K N Lam, who also spoke on the Forum’s first day, noted that the WIPO’s Global Innovation Index ranked the Shenzhen-Hong Kong-Guangzhou science and technology cluster second worldwide for the fifth year in a row.

“Hong Kong is an international trading and investment centre, so we need to provide a free and fair environment in which to do business,” he said.

In addition to the annual BIP Asia Forum, the HKTDC leverages physical platforms such as the Hong Kong International Licensing Show and the Hong Kong International Film & TV Market to promote the development and trading of cultural and creative products.

Meanwhile, this year’s E-Day, which was hosted by HKTDC, showcased more than 340 start-ups, invention projects and support services.

This included 10 start-ups from Thailand who were part of E-Day’s first Thai pavilion, organised by the Kingdom’s Department of International Trade Promotion.

Pannakarn Jiamsuchon, Thai Trade Commissioner & Consul (Commercial), said: “Our participation at E-Day not only promoted the Thai start-up sector but also drew global investors into the market, creating a win-win situation.”

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

Winners recognised for innovation in green tech, smart catering, digital marketing

The InnoClub Awards, now in its second year, has saluted three more ground-breaking start-ups from the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

Green biotech firm Zence Object Technology took home the InnoClub GBA Innovator Award. Smart catering solutions provider Wada Foodtech received the InnoClub Industry Impact Award. Digital marketing specialist GoGo Chart won the InnoClub Rising Star Award.

The awards ceremony was held during last week’s Entrepreneur Day, the annual start-up showcase organised by the Hong Kong Trade Development Council (HKTDC).

The HKTDC runs InnoClub – a community-based platform supporting start-ups and SMEs in the GBA – in collaboration with Hang Seng Bank.

The two organisations set up the InnoClub Awards last year to recognise exceptional achievements by InnoClub members.

Zence Object Technology, which was founded in 2020, converts organic waste into commercially viable biodegradable materials such as paper, boards and plastics. These can be used for consumer product packaging and in construction.

The start-up, which initially focused on tea leaves, is expanding the range of waste it can work with and has almost finished building its own R&D and production facility.

The company moved into mass production last year.

Founder and CEO Calvin Sio said: “We hope that with InnoClub’s continued support, we can broaden our reach within the GBA and expand to other regions, meeting global sustainability needs.”

Wada FoodTech helps optimise food management across the catering supply chain, from central processing and warehousing to end-point retail.

The start-up’s digitised approach, leveraging patented Artificial Intelligence Of Things technology, promises to strengthen food safety controls while boosting efficiency.

The company is currently focusing on Australia, Hong Kong and Japan.

Founder and CEO Jason Chen said: “We have launched a subscription-based catering service platform that only charges platform fees, empowering businesses to expand. Thanks to InnoClub’s support we plan to pursue other markets overseas.”

GoGo Chart, which was founded in 2016, has provided mobile and digital marketing solutions to over 2,000 mobile apps and brands across more than 60 countries and regions.

The company has developed its own campaign management platform and software as a service offerings, providing comprehensive solutions that allow clients to self-select services and reduce promotional costs.

The start-up’s clients mainly come from four sectors: finance, consumer brands, e-commerce and gaming.

Founder and CEO Daniel Lo said: “In addition to actively assisting Hong Kong SMEs with their digital transformation, we intend to leverage the advantages of the GBA to expand globally, connecting with more potential clients through the extensive member and client networks of InnoClub and Hang Seng Bank.”

InnoClub now has some 1,400 corporate members after being established in 2021.

Aside from business matching, InnoClub also organises gatherings, seminars and GBA delegations to facilitate the exchange of ideas and collaboration among its members.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

New Spain-Hong Kong Business Association joins the Forum for the first time

This year’s Hong Kong Forum, the annual gathering for Hong Kong business associations from around the world, brought together more than 320 business leaders from 30 countries and regions to the city.

The two-day event, which was held in the first week of December, covered a range of topics, including Hong Kong’s business outlook and Hong Kong’s Northern Metropolis development, which aims to strengthen the city’s position as an international business and innovation hub.

Delegates included representatives from the Spain-Hong Kong Business Association, the latest addition to the Federation of Hong Kong Business Associations Worldwide (FHKBAW) after joining this year.

“With our strengths in traditional industries and the strides we are making in newer sectors, Hong Kong is brimming with opportunities,” said Margaret Fong, Executive Director of the Hong Kong Trade Development Council (HKTDC), during her opening remarks.

“Amid today’s digital and sustainability agendas, the city is accelerating its transition towards a more innovation-driven, digitally competitive and greener future,” Ms Fong added.

Hans Poulis, FHKBAW Chairman, said: “We had some remarkable sessions lined up this year, including a discussion on the foundation of global competitiveness that emphasised the critical role of the rule of law and international cooperation in maintaining Hong Kong's status as a leading financial hub.”

John Lee, Chief Executive of the Hong Kong SAR Government, was guest of honour at the keynote luncheon on the Forum’s second day.

“Hong Kong is the world's super connector,” Mr Lee said. “Hong Kong has long attracted businesses and investors, thanks to our clear and compelling advantages.”

Mr Lee highlighted select government initiatives that have been implemented to promote economic opportunities, including the Northern Metropolis, which he described as “the new engine of Hong Kong’s economic future”.

He also mentioned the ongoing progression of Hong Kong’s eight centres of excellence, eight priority areas for development set out in China’s latest Five-Year Plan, as well as two promotional platforms to attract key people and companies: Hong Kong Talent Engage and the Office for Attracting Strategic Enterprises.

This year marked the 25th Hong Kong Forum, which was co-organised by the HKTDC and FHKBAW.

The Forum is the FHKBAW’s annual flagship event.

The federation, founded in 2000, represents 49 business associations from around the world, with some 11,000 business executives and professionals as their members.

The newly elected FHKBAW office holders for 2024-2027 were also announced during this year’s Hong Kong Forum.

Margaret Wong from the Hong Kong Business Association of Northern California was elected as the new Chairman, while Dennis Chiu of the Hong Kong Singapore Business Association was elected Vice-Chairman. Keith Jackson of the Hong Kong-UK Business Forum and Cindy Ho of The Hong Kong-Canada Business Association will serve as Honorary Treasurer and Honorary Secretary, respectively.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

Start-up financing and next-gen innovation on the agenda at Asian Financial Forum 2025

One of the world’s major gatherings of finance sector leaders will return to Hong Kong in January, cementing Hong Kong’s status as Asia’s top financial centre according to the Global Financial Centres Index.

Co-organised by the Hong Kong SAR Government and the Hong Kong Trade Development Council (HKTDC), the Asian Financial Forum will be held on 13-14 January 2025 and will launch the International Finance Week series of events for the financial and business communities, which will run to 17 January.

Under the theme Powering the Next Growth Engine, the two-day event will feature a wide range of speeches, seminars and workshops exploring the finance industry’s role in supporting and developing the enterprises that will drive global growth in the coming decades.

Participants can expect to hear insights from policymakers and understand the latest research and economic forecasts made by industry experts.

Topical issues in the Insurance and Risk Management, Asset and Wealth Management and China Investments sub-sectors will be covered in dedicated sessions.

As an ideal arena for investors to learn about new opportunities, networking and deal-making will continue to be a highlight of the event. In January 2024, the forum featured over 560 projects seeking funding and over 700 deal-making meetings were held. In 2025, deal-making will focus on priority sectors, such as environment and energy, food and agriculture, healthcare, infrastructure and fintech.

Start-ups seeking investors will be featured in the InnoVenture Salon programme comprising pitching sessions, matchmaking and mentoring by leading venture capital firms and angel funders.

The forum’s exhibition zone will bring together over 100 international financial institutions, technology companies, start-ups, investment promotion agencies and sponsors to showcase a wide range of financial innovations, solutions, and ideas aimed at promoting collaboration and empowering entrepreneurs and innovators.

Now in its 18th year, Asian Financial Forum has become a must-attend event on Hong Kong’s conference and events calendar.

In 2024, the event featured more than 140 speakers from around the world and attracted over 3,600 visitors from more than 50 countries and regions, including over 70 overseas and Mainland China delegations, keen to discuss industry issues, discover exciting investment opportunities, and expand professional networks.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

Platform costs and exchange rates form main concerns

A survey of Hong Kong trade and manufacturing companies has shown that most expect online cross-border sales to increase in the next two years, however more than half are concerned about third-party platform commissions and long payment periods.

Titled Unleashing the Lucrative Potential of Cross-border E-commerce for Hong Kong Traders, the survey of 352 businesses was conducted by the Hong Kong Export Credit Insurance Corporation (HKECIC) and Hong Kong Trade Development Council (HKTDC).

In addition to the challenges posed by commission rates and invoicing, businesses also cited exchange rates (46.6%) and costly refund policies (28.4%) as problems faced in their e-commerce operations.

Noting that many e-commerce businesses have limited assets and insufficient collateral to secure financing from traditional financial institutions, HKECIC Commissioner Terence Chiu revealed that the HKECIC has collaborations with reinsurance companies and banks to develop bespoke trade credit insurance solutions, aiming to provide coverage for trade loans to Hong Kong e-commerce businesses.

“These initiatives encourage and support local enterprises in securing trade financing and expanding into cross-border e-commerce,” he said.

Other issues cited by businesses included intense competition (84.9%), regulatory compliance (54.0%) and complex customs procedures (38.4%)

Despite financing challenges, businesses are enthusiastic about the role of e-commerce in their market expansion with respondents saying that e-commerce broadens their sales channels (69%), allows them to access new opportunities (50.3%) or enhances their brand awareness (48.9%).

75% of surveyed companies are exporting into Mainland China through online platforms, followed by ASEAN (53%), USA (42.2%), Japan (30.9%) and the EU (30%).

Looking ahead, respondents generally agreed that, for the next two years, Mainland China (61.6%) and ASEAN (44.3%) offer the greatest growth potential.

Original article published in https://hkmb.hktdc.com

Editor's picks

Trending articles

Hong Kong is mainland China’s bridgehead for foreign economic co‑operation. (shutterstock.com)

The Third Plenary Session of the CPC Central Committee highlighted efforts to optimise the co‑ordination for opening up on regional basis and improve the mechanisms for high‑quality co‑operation under the Belt and Road Initiative (BRI). The government will also continue to encourage domestic enterprises to “go global”. In Hong Kong, the Chief Executive’s 2024 Policy Address called for further efforts to attract mainland enterprises to set up international or regional headquarters in the city and assist them in “going out” through Hong Kong’s platforms. In fact, Hong Kong has always been mainland China’s bridgehead for foreign economic co‑operation as well as mainland enterprises’ preferred platform for “going global”.

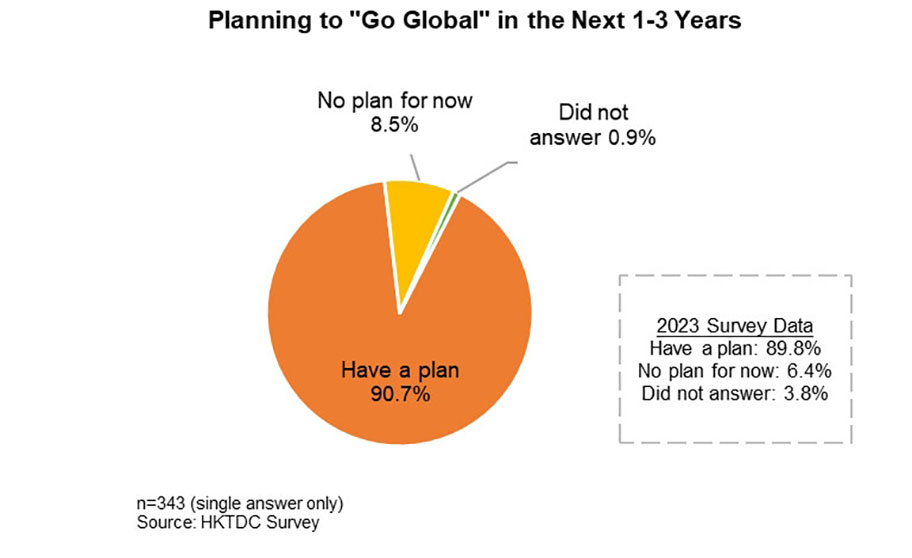

Following a similar study in 2023, HKTDC Research conducted a new questionnaire survey in the Yangtze River Delta (YRD) in August 2024 to understand the operational challenges facing mainland enterprises in the current fast‑changing economic environment, their direction for “going out” and the services support they need. The survey shows that 90.7% of respondents planned to “go global” to expand international business in the next one‑to‑three years, reflecting the direction most enterprises are still actively taking to explore international business opportunities despite numerous challenges. Moreover:

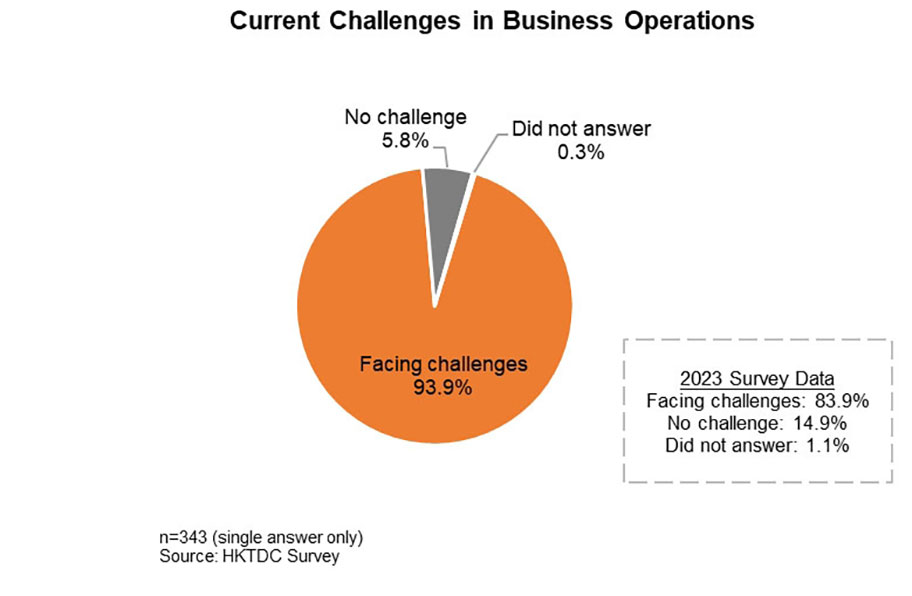

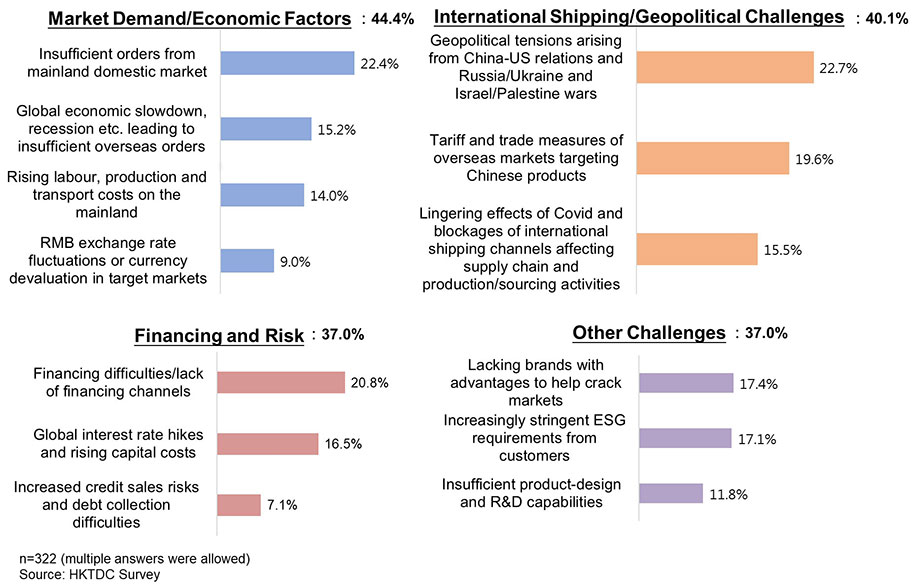

- 93.9% of respondents said they are facing challenges in market demand, shipping/geopolitics and financing. Compared with the survey findings of 83.9% in 2023, mainland enterprises are obviously encountering more difficulties now.

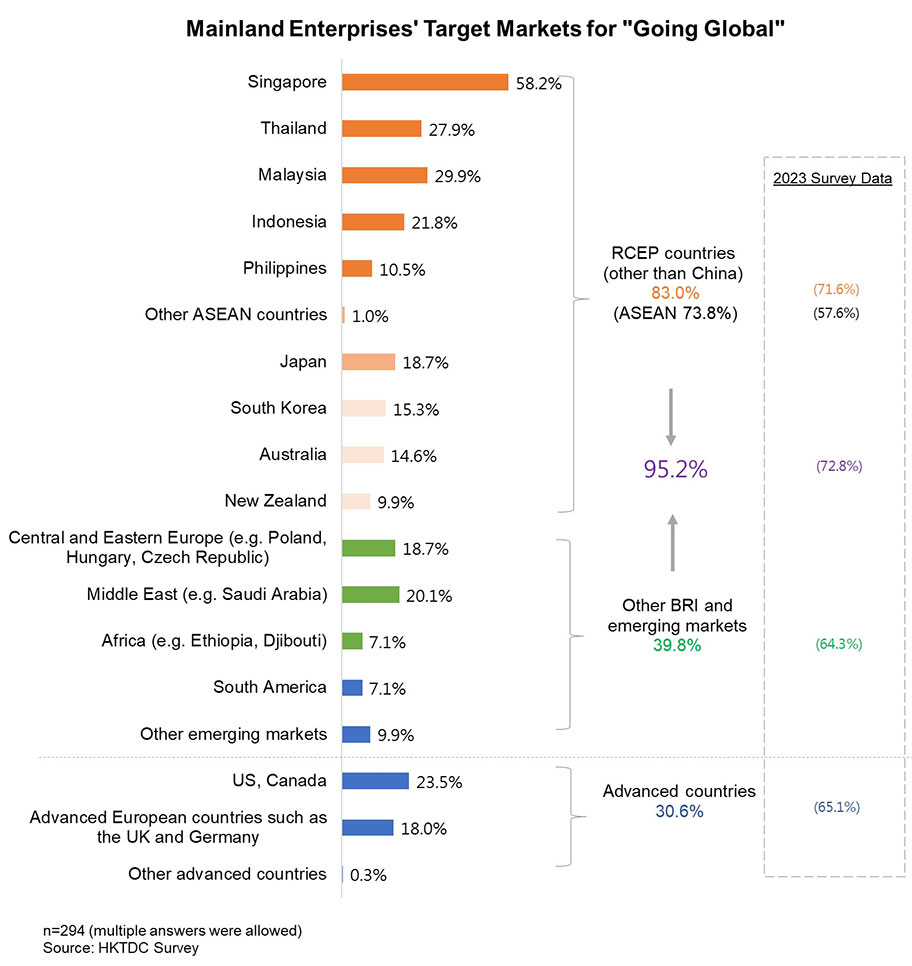

- As many as 95.2% of “go global” mainland enterprises focus on the BRI, the Regional Comprehensive Economic Partnership (RCEP) and other emerging markets, substantially more than the 2023 survey finding of 72.8%. Among them, 83.0% intended to explore business opportunities in RCEP countries.

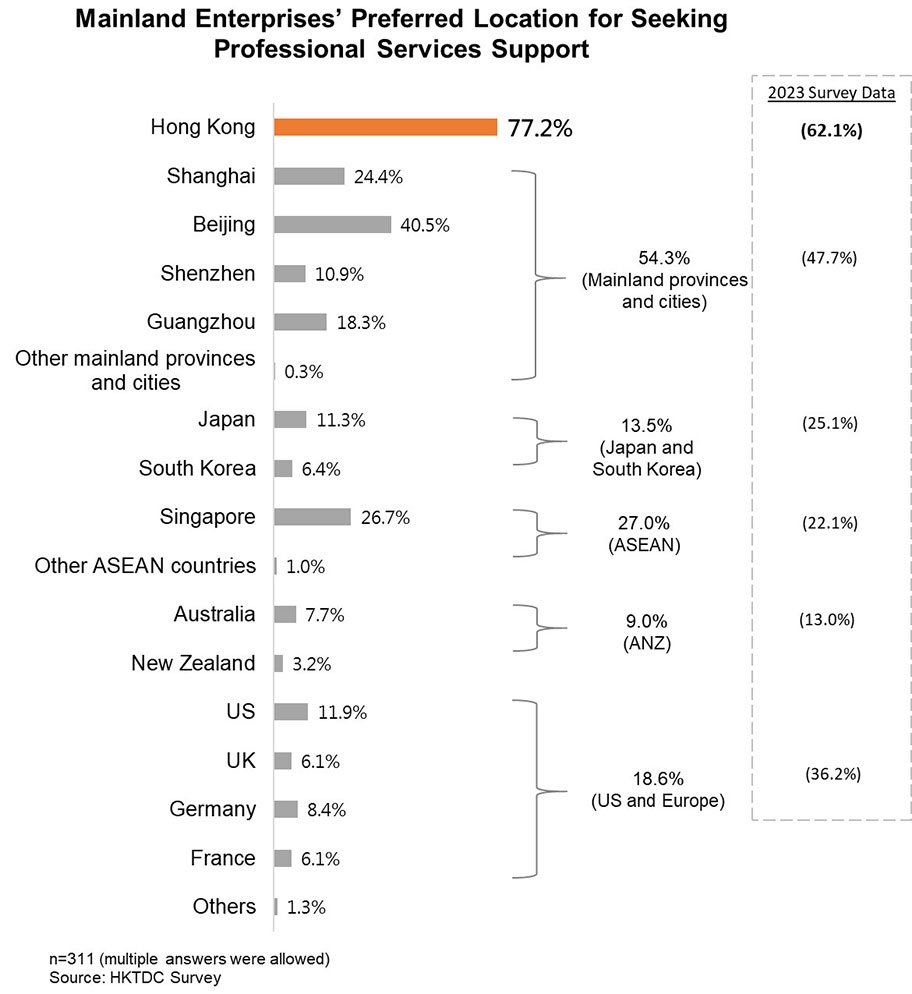

- 77.2% said they would go to Hong Kong to find the services support they need for international business, including marketing/product design/e-commerce, financing and risk management, and professional services, suggesting that the city is mainland enterprises’ preferred platform for “going out”.

Actively “Going Out” for Investment and Development

The Third Plenary Session of the 20th Central Committee of the Communist Party of China (Third Plenum) held from 15‑18 July 2024 called for efforts to steadily expand institutional opening‑up, deepen foreign trade structural reform and regulatory regime reform for foreign investment and outward investment, and optimise the co‑ordination for opening up on regional basis, including improving the mechanisms for high‑quality co‑operation under the Belt and Road Initiative. [1] On the one hand, the new edition of the negative list for foreign investment access recently issued by the central government [2], which completely removes all restrictions on such investment access in the manufacturing sector, is further attracting foreign investment into China. On the other hand, the central government also continues to support mainland enterprises in “going global” to co‑operate with overseas partners in arranging international business and expanding overseas markets.

The 14th Five-Year Plan [3] specifically supports efforts of Hong Kong and Macao to better integrate into the overall development of the country and supports their participation in, and contribution to, the country’s comprehensive opening‑up and development of a modern economic system as well as fostering the two cities as functional platforms for the BRI. As an effective services platform for international trade and business, Hong Kong is a “super connector” and “super value‑adder” between mainland enterprises and the rest of the world and is assisting these enterprises in “going out” to explore new markets and opportunities, including the BRI and other emerging markets. In the Policy Address delivered on 16 October 2024, the Chief Executive of the HKSAR also proposed to step up efforts to attract mainland enterprises to set up international or regional headquarters in Hong Kong, providing one‑stop, diversified professional advisory services for mainland enterprises in the city looking to “go global”.

In fact, companies around the world are taking a fresh look at their international expansion strategies and many hope to resume their pace of foreign investment to further boost their businesses. According to the 2024 annual report released by the United Nations Conference on Trade and Development (UNCTAD) [4], although global foreign direct investment (FDI) decreased by 2% to US$1.3 trillion in 2023, the decline was substantially smaller than the 12% in 2022, suggesting global businesses are actively exploring strategies to resume foreign investment.

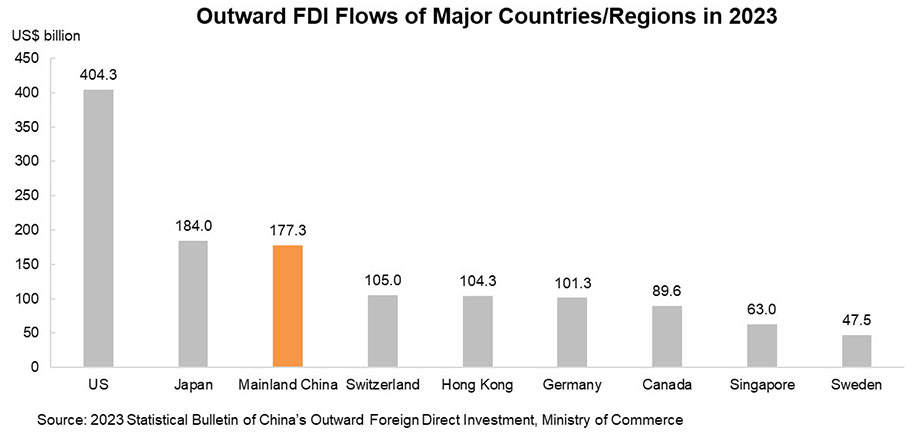

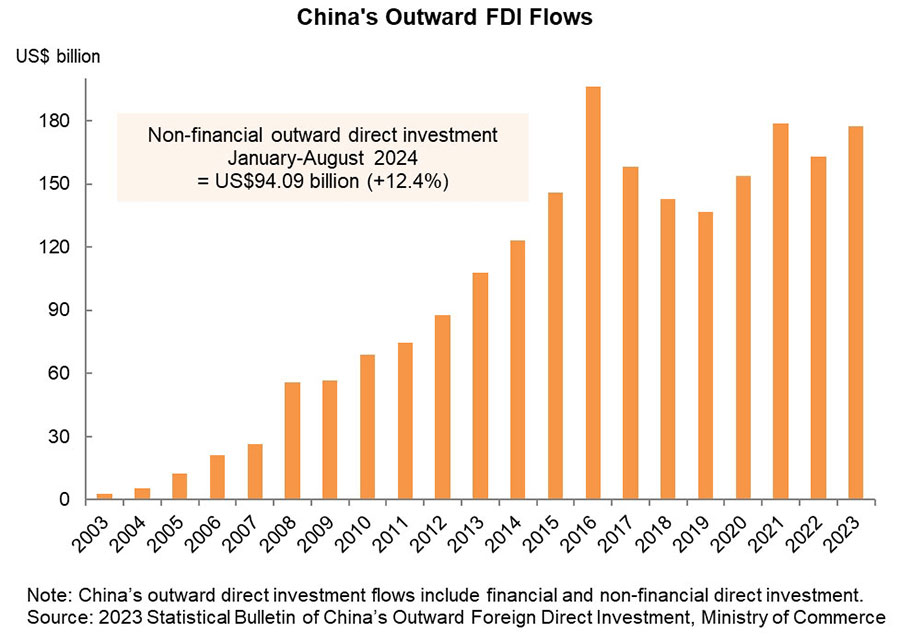

Meanwhile, the statistical bulletin released by the Ministry of Commerce in September 2024 [5] showed that mainland China’s outward direct investment flow reached US$177.29 billion in 2023, an increase of 8.7% on the previous year, ranking third in the world after the US (US$404.32 billion) and Japan (US$184.02 billion) and maintaining a top three position for 12 consecutive years. These figures suggest that mainland enterprises are “going out” to reconstruct their international business development pattern after the pandemic.

According to the Ministry of Commerce [6], from January to August 2024, China’s non‑financial outward direct investment reached US$94.09 billion, up 12.4% year on year. Of this, the non‑financial direct investment in BRI countries totalled US$20.51 billion, up 2.2% year on year.

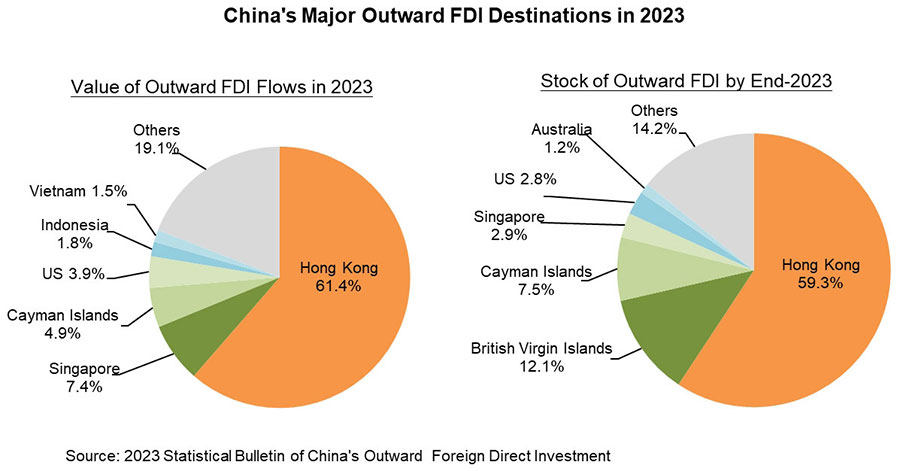

It is worth noting that Hong Kong is the primary destination of mainland enterprises’ outward direct investment. In 2023, mainland China’s FDI outflow to Hong Kong reached US$108.77 billion, up 11.5%, accounting for 61.4% of mainland China’s total FDI outflow. Based on the cumulative FDI outflow at the end of 2023, China’s FDI stock in Hong Kong amounted to US$1,752.5 billion, up 10.3% year on year, accounting for 59.3% of China’s total outward FDI stock.

In 2023, mainland enterprises’ FDI in BRI countries reached US$40.71 billion (up 31.5% year on year), accounting for 23.0% of China’s FDI outflows. Their investment in the 10 ASEAN countries reached US$25.12 billion (up 34.7% year on year), accounting for 14.2% of China’s FDI outflows. These figures suggested that mainland enterprises are attaching greater importance to BRI countries, including ASEAN partners, when looking to “go global”, not just developed countries.

Although Hong Kong is mainland China’s largest destination of outward direct investment, the majority of companies concerned are mainly using Hong Kong’s platform and services, including legal, advisory, accounting and other diversified professional services to aid their overseas expansion. In addition to a strategic location and matured market environment, the free flow of capital in Hong Kong also facilitates foreign exchange and cross‑border fund movements. This further attracts mainland companies to establish a presence in Hong Kong to handle their business within the city and in overseas markets. As a functional platform, Hong Kong can assist mainland companies in formulating a more comprehensive strategy for their global business development to tap into the vast opportunities in BRI countries and other overseas markets.

YRD Companies Going Out: 2024 Survey Results

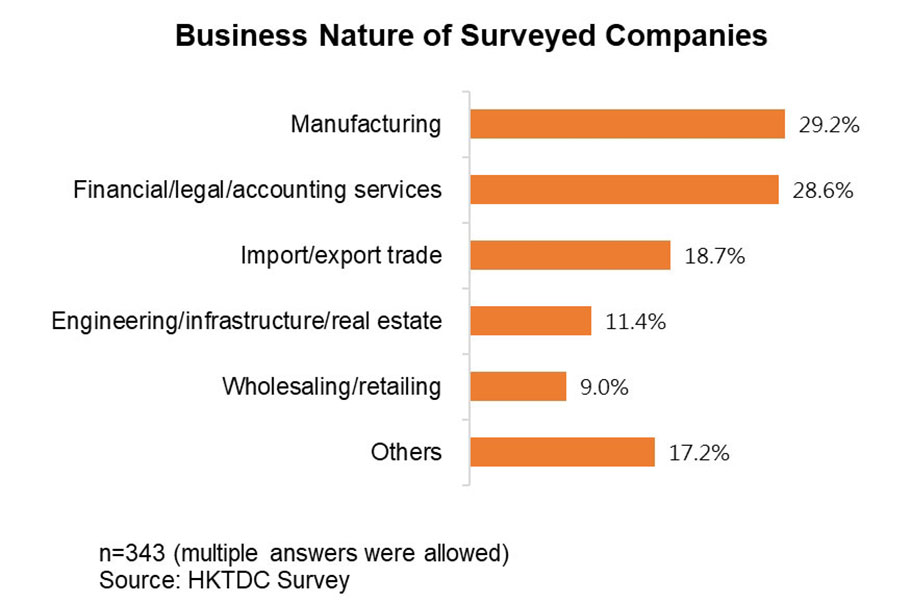

HKTDC Research conducted a questionnaire survey in Nanjing in August 2024 to gauge the “go global” intentions of companies in the YRD [7]. The survey received 457 responses. Deducting those from government departments, chambers of commerce and non‑mainland companies, 343 were valid responses completed by mainland companies mainly operating in the YRD. This was a new survey since the questionnaire conducted by HKTDC Research on the mainland, primarily in the Greater Bay Area, in mid‑2023 [8]. The 2024 survey results are as follows:

- Facing more business challenges

- 93.9% of the surveyed companies said they are facing all kinds of challenges, mainly problems arising from market demand/economic factors (44.4%), international shipping/geopolitical challenges (40.1%) and financing and risks (37.0%). Compared with the survey findings of 83.9% in 2023, mainland enterprises are obviously facing more challenges now.

- Continuing to “go out” to explore opportunities

- Similar to the survey last year, 90.7% of respondents said they planned to “go global” to expand international business in the next 1-3 years, reflecting that as new opportunities for foreign economic co-operation and new markets arise, many mainland companies are re-examining their development strategies, actively planning their international business development and continuing to “go global” for overseas market investments.

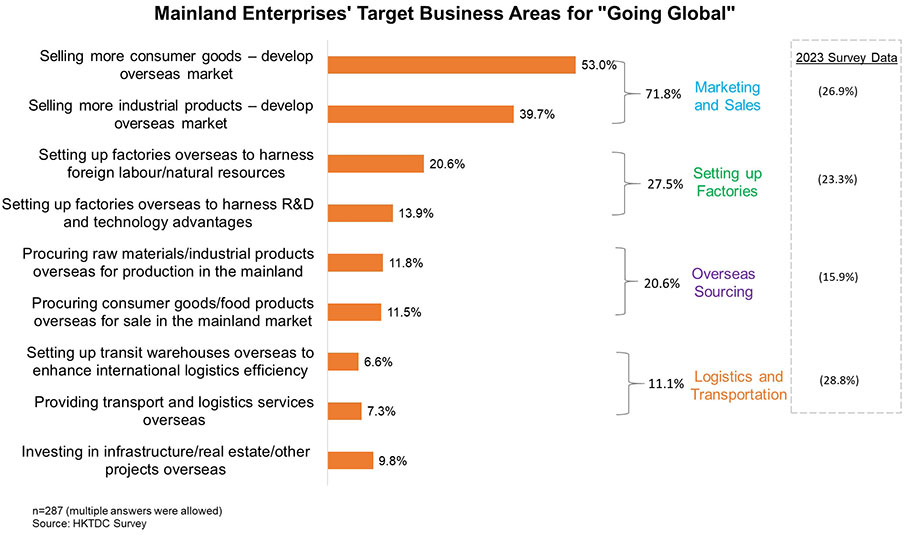

- Attaching greater importance to the development of overseas markets

- Among those mainland companies that planned to expand overseas business, 71.8% chose to focus on marketing and sales, almost three times higher than that of other strategies (just 26.9% chose marketing and sales in 2023), suggesting they are attaching greater importance to the development of overseas markets. Other areas of focus include setting up factories (27.5%), overseas sourcing (20.6%) and logistics and transportation (11.1%).

- Actively exploring BRI-related opportunities

- When asked about their target markets for “going global”, as many as 95.2% of respondents said they will focus on tapping business opportunities in BRI, RCEP and other emerging markets (just 72.8% in 2023). In particular, 83.0% said they intend to go to RCEP countries, while close to 40% hope to develop overseas business in other BRI and emerging markets, and just 30.6% aim to go to advanced countries (as many as 65.1% in 2023). This shows that mainland companies are now focusing more on BRI- and RCEP-related opportunities.

- Hong Kong: Mainland enterprises’ preferred platform for “going out”

- Surveyed mainland enterprises with plans to “go global” said Hong Kong is mainland enterprises’ preferred services platform for expanding overseas. Some 77.2% of them see the city as their preferred services platform for developing various types of businesses overseas as opposed to 62.1% in 2023. Although this survey mainly focused on YRD enterprises, which are geographically quite a distance from Hong Kong, the survey findings show that they also hope to choose Hong Kong’s services to help them tap business opportunities worldwide.

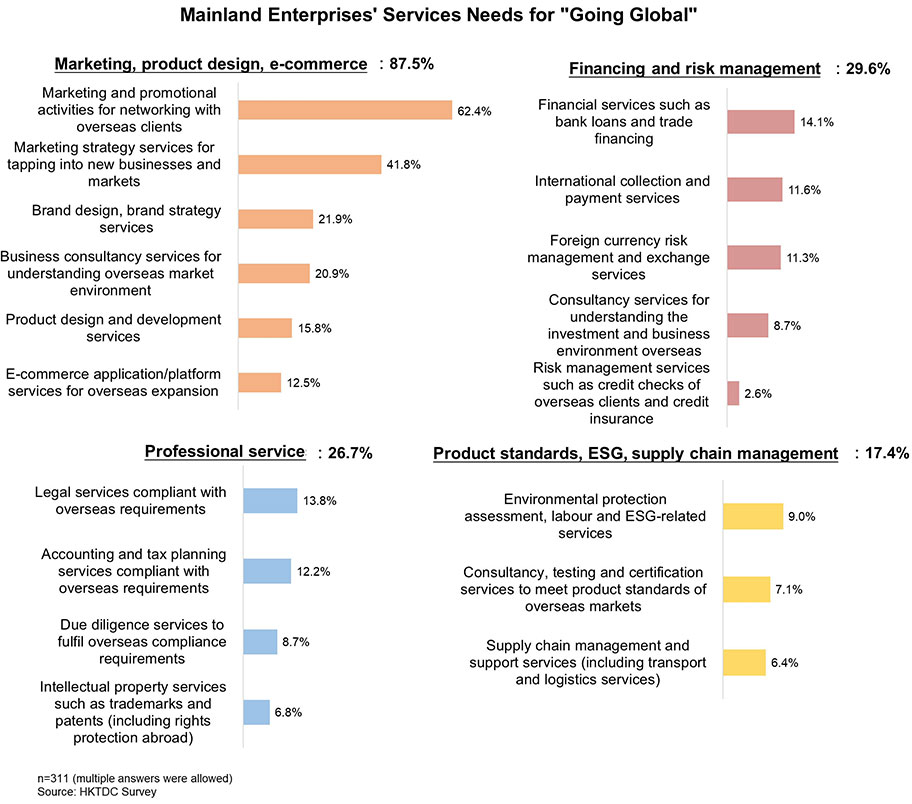

- Needing diversified services support

- Mainland enterprises need a wide range of professional services to develop international business. As many as 87.5% of surveyed enterprises said they are seeking services on marketing, product design and e-commerce. The reason is that most “go global” enterprises mainly focus on marketing and sales (see previous paragraphs for details). Other services needs include financing and risk management (29.6%), professional services (26.7%) and product standards, ESG and supply chain management (17.4%).

[For more details on the results of the 2023 survey, please refer to Hong Kong: The Premier Platform for Mainland Companies to Expand into the BRI and RCEP Markets]

Appendix:

[1] Source: “Communique of the Third Plenary Session of the 20th CPC Central Committee”

[2] For more details, please refer to: 2024 Negative List for Foreign Investment Access to Take Effect in November

[3] Source: “Outline of the 14th Five‑Year Plan for National Economic and Social Development and Long‑Range Objectives Through the Year 2035”

[4] Source: “2024 World Investment Report” of the United Nations Conference on Trade and Development (UNCTAD)

[5] Source: “Statistical Bulletin of China’s Outward Foreign Direct Investment 2023” of the Ministry of Commerce

[6] Source: Ministry of Commerce

[7] The HKTDC Research questionnaire survey was conducted on the sidelines of the SmartHK Suzhou‑Hong Kong High‑Quality Development Co‑operation Conference held by the HKTDC in Nanjing in August 2024.

[8] HKTDC Research conducted a questionnaire survey in the Greater Bay Area and the Yangtze River Delta region in 2023 to learn about mainland enterprises’ “go global” strategies. For more details, please refer to: Hong Kong: The Premier Platform for Mainland Companies to Expand into the BRI and RCEP Markets

Original article published in https://research.hktdc.com

Editor's picks

Trending articles

Experts look to new trade routes and digitalisation to support supply chain transformation

Supply chain disruptions and technology integration were the hot topics at the recently concluded Asian Logistics, Maritime and Aviation Conference in Hong Kong with attendees concluding that businesses must be agile and resilient in their response to climate change, geopolitical tensions and other major issues facing the industry.

Conference attendees noted that supply chain disruption has exposed the vulnerabilities associated with concentrated distribution hubs, and that to build more resilient networks, businesses are exploring alternative trade routes.

"I think the government has to develop new trade links such as how the Hong Kong SAR government is working very closely with the Belt and Road countries and regions,” said Hong Kong Air Cargo Terminals Chief Executive Wilson Kwong.

Despite the time and effort required to set up new routes, nevertheless, the logistician is confident that Hong Kong’s status as an international aviation hub will ensure that it is best placed to take advantage of improved connectivity to global markets.

“With the commencement of the three-runway system, the cargo capacity of the Hong Kong International Airport will be raised to 10 million tonnes per annum in the next decade,” he disclosed.

“Working with a government that facilitates business, a business-friendly Airport Authority, and a very engaging and cooperative community, leads me to be very positive about the future."

Across more than 20 conference sessions, over 2,200 participants from over 30 countries and regions discussed the latest insights on major issues facing the industry.

Industry players noted that in today's rapidly changing global landscape, the dynamics of supply chains are undergoing a substantial transformation.

While speakers identified innovation and digitalisation as the key competencies for logistics business to successfully deal with external change, attendees also acknowledged the pace of technological change is unprecedented.

“Compared to the other industrial revolutions of our past, in this digital revolution the difference is that it's an extremely fast-moving technology and the windows of opportunity are open for a very short period. If you don’t capture it, then you lose something,” observed Shamika N. Sirimanne, Director, Division on Technology and Logistics, UN Trade & Development.

“It's a concern with this new technology. It's a different technology than what you have experienced.”

The annual conference brought together leading logistics industry experts, new energy and digital innovators, and sustainability and strategy leads from major corporations to examine how global trade trends are impacting key issues affecting supply chain management. These include supply chain diversification, sustainability and green energy, and the benefits and challenges offered by AI and new tech.

Apart from talks, this year’s event also featured an exhibition of close to 90 industry service providers from around the world, including freight forwarding, logtech, maritime, port and supply chain management services and more.

Over 300 business-matching sessions were held during the conference to help connect shippers with service providers and to facilitate industry-wide collaboration.

Original article published in https://hkmb.hktdc.com