GDP (US$ Billion)

329.54 (2019)

World Ranking 40/194

GDP Per Capita (US$)

3,416 (2019)

World Ranking 129/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

210.4 (2019)

Currency (Period Average)

Vietnamese Dong

23050.24per US$ (2019)

Political System

Socialist republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

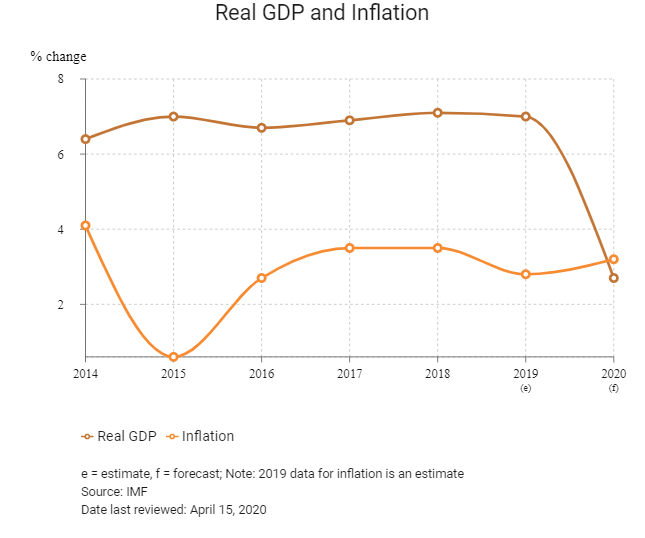

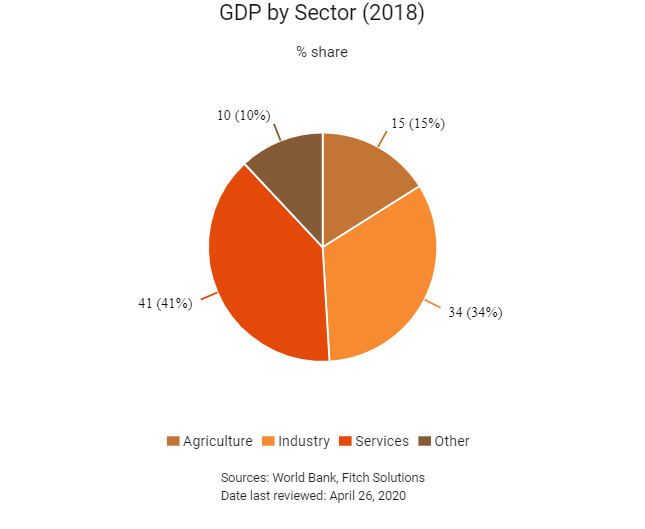

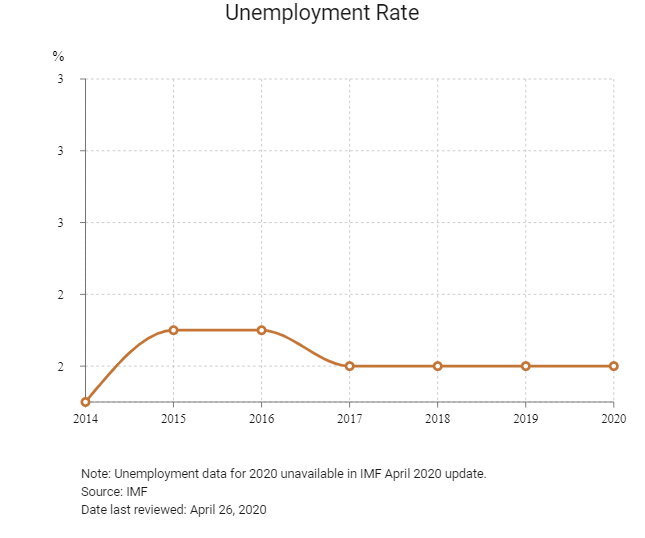

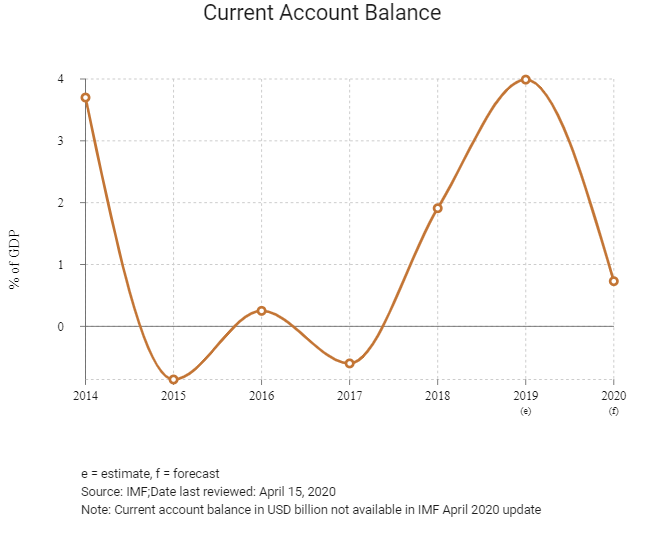

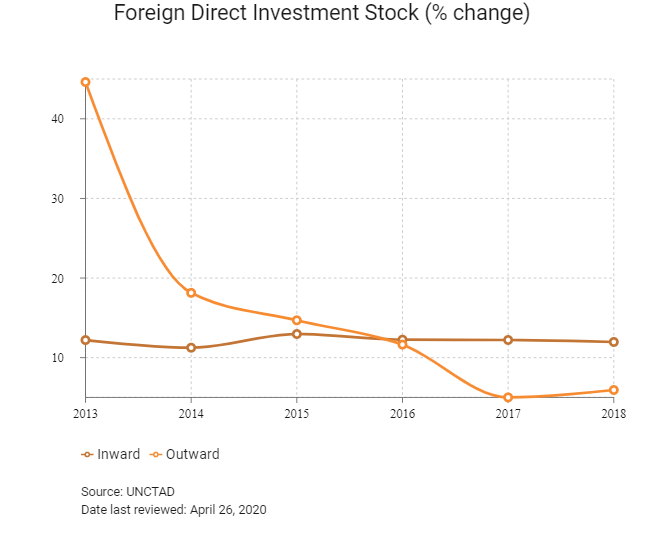

Vietnam's shift from a centrally planned economy to a market economy has transformed it into a lower-middle income country. Vietnam's economy continues to show fundamental strength, supported by robust domestic demand and export-oriented manufacturing. Vietnam is now one of the most dynamic and fastest-growing emerging markets globally. In 2018 continued stellar expansion in manufacturing output, propelled by buoyant export demand for electronics and supported by robust foreign direct investment (FDI) inflows, primarily fuelled solid growth. The robust growth from 2018 is expected to spill over in the near term, owing to healthy private consumption supported by strong private credit growth and rising incomes. The industrial sector also continues to expand at a stellar pace, supported by strong FDI inflows. Vietnam's 2011-2020 Socio-Economic Development Strategy, a 10-year strategy, highlights the need for structural reforms, environmental sustainability, social equity and macroeconomic stability. The Socio-Economic Development Plan for 2016-2020, approved in April 2016, looks to accelerate reforms.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2016

India announced USD500 million worth of credit for Vietnam towards defence spending.

July 2018

Doosan Heavy Industries & Construction started the construction of a 1.33GW thermal power project in Vietnam. The project, known as Nghi Son 2, involved the construction of two 665MW thermal power generation plants in Thanh Hóa. Construction was scheduled to be completed by July 2022.

August 2018

Thailand-based firm Siam Cement Group Public Company signed loan agreements worth more than USD3.2 billion with six financial institutions for the Long Son Petrochemicals' complex in Vietnam. The project, which would require an investment of around USD5.4 billion, would be located in Bà Ria-Vung Tàu Province. Commercial operations were expected to begin in 2023.

October 2018

The Communist Party of Vietnam, Vietnam's ruling Communist Party, agreed to nominate General Secretary Nguyen Phu Trong as president. This took place almost two weeks after the death of former-president Tran Dai Quang on September 21, 2018.

January 2019

In 2018 the Vietnamese government passed several new and amended laws which came into effect in 2019. The laws primarily focused on wages, environmental projects, the food industry, rural development, cybersecurity and administrative procedures.

October 2019

Sumitomo Corporation and BRG Group formed a 50-50 joint venture to build a USD4.2 billion smart city in Hanoi. The five-phase project would come up on a 2.72sq km area in the northern district of Dong Anh. Overall, the project would have 7,000 residential units, hospitals, schools, disaster prevention facilities, security systems and commercial facilities. Construction would start in 2020 with the project due for completion in 2028.

November 2019

The Government of Vietnam sanctioned the Dung Quat 1 and 3 combined-cycle gas turbine plants in the Quang Ngai province. The power facilities would have a capacity of 750MW each. The Dung Quat 1 plant was planned to begin construction in January 2021, with first light to be produced in December 2023. Construction of Dung Quat 3 was due to start in January 2022, with operations slated to commence in December 2024. The two facilities would use gas from the Blue Whale gas field in the South China Sea.

December 2019

Vietnam's National Assembly approved a new Labour Code which will take effect in January 2021. The amended code offers greater protection for employees and is viewed as better aligned with international best practices. It should help smooth the implementation of several key trade agreements.

February 2020

Vietnam planned to increase its power-generating capacity to between 125GW and 130GW, from nearly 54GW currently, by 2030. Renewable-based power capacity would be increased to 15-20%. The government would seek foreign and domestic private investment to help develop new power plants as well as the privatisation of the state-owned power companies. To boost funding in clean energy, the Vietnam Business Forum launched the second edition of the Made in Vietnam Energy Plan later in February.

March 2020

The authorities announced a credit package totalling VND285 trillion (about 3.8% of GDP) from the banking sector for firms and households affected by Covid-19. This was time-bound from March 23 to June 2020.

Samsung Electronics started construction of a new research and development centre in Vietnam. The 16-storey building, which costed USD220 million, was being built in Hanoi. The facility, due for completion by the end of 2022, would be able to accommodate 2,200-3,000 employees.

April 2020

At the beginning of April, 69.5% of the full site had been cleared for 11 sub-projects under the eastern North-South Expressway in Vietnam. The sub-projects would have a total length of 654km, with land cleared for 454.15km. Of the 11 projects, three would be financed through the state budget, and the remainder would be executed under the public-private partnership (PPP) model. The PPP projects had sought approval from the National Assembly to be converted into state-backed projects. The overall 2,109 North-South Expressway woudl link the provinces of Lang Son and Ca Mau.

Sources: BBC Country Profile – Timeline, Fitch Solutions, VN Express

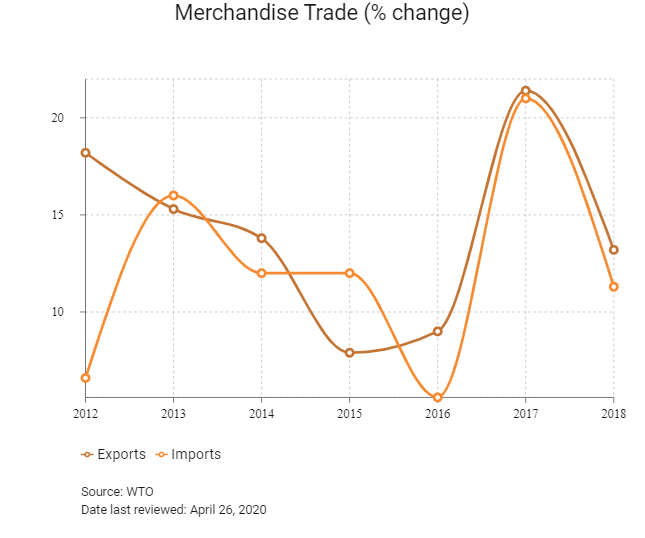

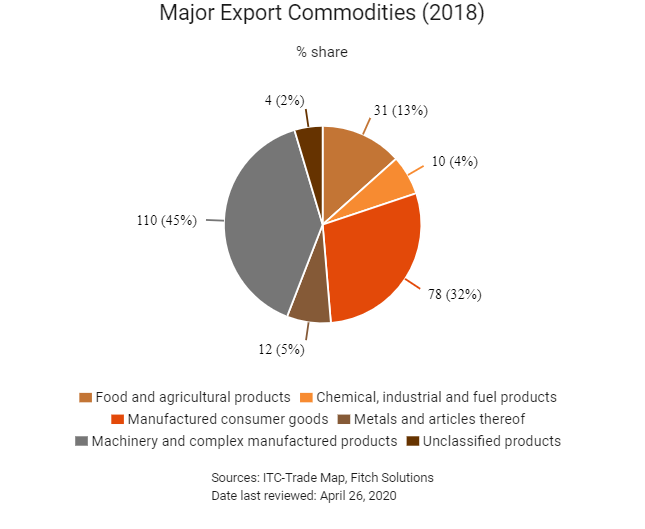

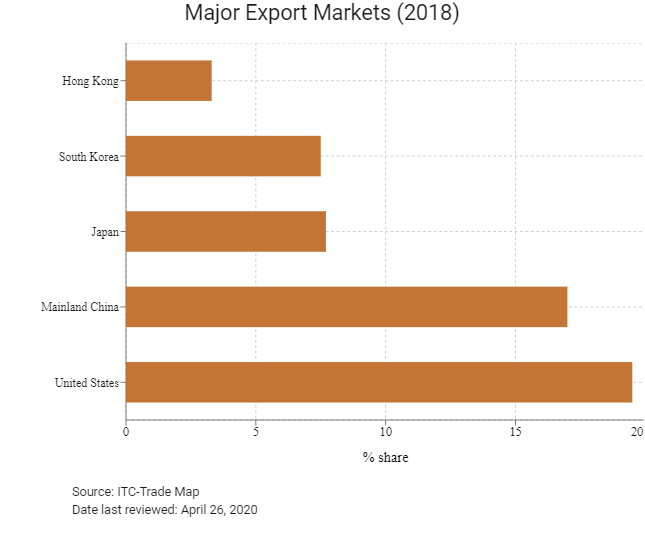

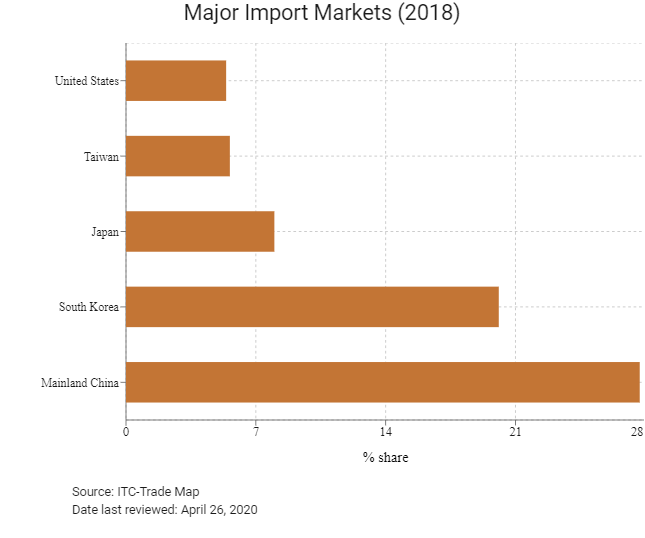

Merchandise Trade

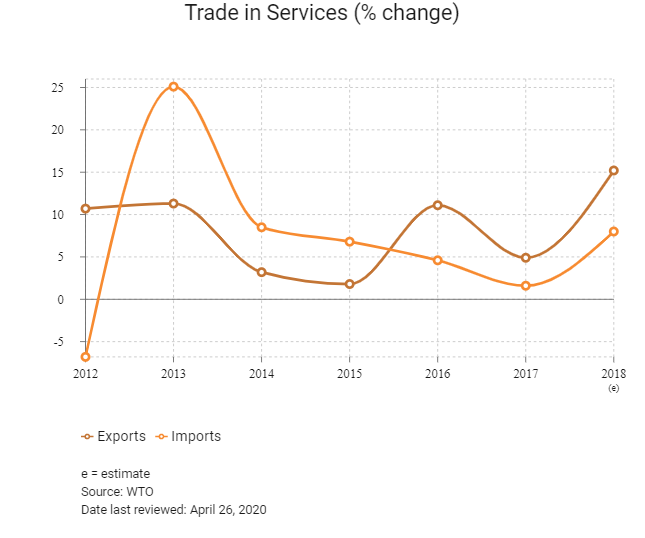

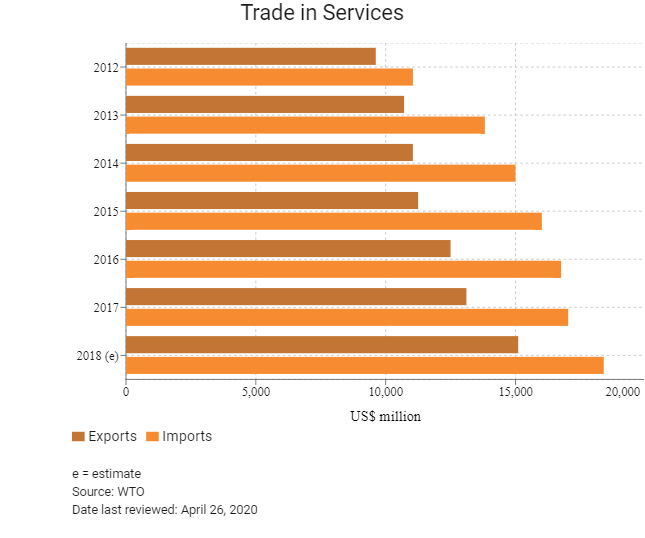

Trade in Services

- Vietnam joined the World Trade Organization (WTO) on January 11, 2007, following more than a decade-long negotiation process. WTO membership has provided Vietnam an anchor to the global market and reinforced the domestic economic reform process.

- Vietnam is a member of the ASEAN and a signatory to the ASEAN Free Trade Agreement (FTA), which aims to reduce tariff and non-tariff barriers to trade between member states. ASEAN has also negotiated FTAs with Australia, New Zealand, Mainland China, India, South Korea and Japan.

- Vietnam shares the top spot with Singapore in South East Asia for having the most bilateral and multilateral FTAs; Vietnam is a signatory to 16 of them. As Vietnam continues to live up to its commitments to further reduce import tariffs, this will lead to deeper economic integration with the world, boosting foreign investment and enhancing productivity.

- Some reductions in import tariffs have come into effect since January 2018 (such as a 0% import tariff for car, motorbike and vehicle components under the ASEAN FTA) and there are further commitments to progressively reduce tariffs to 0% by 2022 for a range of other commodities. For instance, under the Vietnam-South Korea FTA, a range of commodities with import tax rates ranging from 10-20% will see a gradual reduction to 0% by 2022.

- Import duty rates are classified into three categories: ordinary rates, preferential rates and special preferential rates. Preferential rates are applicable to imported goods from countries that have most-favoured-nation (MFN) status with Vietnam. The MFN rates are in accordance with Vietnam's WTO commitments and are applicable to goods imported from other member countries of the WTO. Special preferential rates are applicable to imported goods from countries that have a special preferential trade agreement with Vietnam.

- Vietnam has concluded three important agreements in recent quarters: the ASEAN-Hong Kong FTA, the European Union (EU) FTA and the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). Vietnam is negotiating other agreements, including the Regional Comprehensive Economic Partnership, and FTAs with the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland) and Israel.

- Export duties are charged on only a few items, mainly certain natural resources and these rates range from 0% to 40%.

- Vietnam has reserved the right of importation to state trading entities in the following product categories: cigars and cigarettes, crude oil, newspapers, journals and periodicals and recorded media for sound or pictures (with certain exclusions).

- Vietnam also prohibits importation of equipment and technologies which are more than 10 years old. However, there are exceptions in some special cases.

- Vietnam currently prohibits the import of certain products, including weaponry, ammunition, explosive materials, military technical equipment, firecrackers, second-hand consumer goods, types of publications and cultural products in the category prohibited from dissemination and circulation in Vietnam, right-hand-drive cars, materials and transport facilities, chemicals, plan protection agents prohibited from use in Vietnam, scrap and waste, refrigerating equipment using CFC products and raw material containing asbestos of the group of amphibole chemicals on the list of prohibited chemicals.

- Foreign investors are exempt from import duties on goods imported for their own use which cannot be procured locally, including: machinery, vehicles, components and spare parts for machinery and equipment, raw materials, inputs for manufacturing and construction materials that cannot be produced domestically.

- VAT of 10% applies to goods and services that are not specifically included in the list of goods and services subject to the 0% or 5% rates or the list of goods exempt from VAT. The 5% rate applies to the supply of essential goods and services (water supply, agricultural goods, medical goods and teaching aids).

- VAT refunds are now allowed for imported goods that are later exported (this was previously disallowed). In addition, the scope of items not subject to VAT was amended to include exported products being primarily processed from natural resources and mined minerals. Both these changes were effective from February 1, 2018.

- Vietnam's National Assembly approved a new Labour Code which will take effect in January 2021. The amended code offers greater protection for employees and is viewed as better aligned with international best practices. The amended labour code will help Vietnam match international standards as it becomes a part of several FTAs including the EU Vietnam FTA and the CPTPP.

Sources: WTO – Trade Policy Review, Fitch Solutions, national sources

Multinational Trade Agreements

Active

- Vietnam has been a member of WTO (effective date: January 11, 2007).

- ASEAN FTA (effective from: January 1993): The FTA reduces tariff and non-tariff barriers between member states. The 10 members of the ASEAN FTA are Brunei, Indonesia, Malaysia, Philippines, Singapore, Vietnam, Laos, Myanmar, Indonesia and Cambodia. Vietnam benefits from increased regional integration and tariff liberalisation that includes the elimination of import duties in various sectors and classes of goods. These factors will help reduce input costs for businesses and will increase the country's exporting capacity and industrial base in the long term. Being a member of the ASEAN also opens the economy to other significant trade agreements with key regional markets.

- ASEAN-Mainland China (effective from: January 2005 for goods and July 2007 for services): This is a comprehensive economic cooperation between the ASEAN member states and Mainland China. The goal of the agreement is not just eliminating tariffs as it also seeks to address behind-the-border barriers that impede the flow of goods and services. Trade relations between Vietnam and Mainland China benefit from trade preference in terms of tariff exemption or reduction. Mainland China is an important market for Vietnam, as it is a key trade partner and an important source of investment.

- ASEAN-South Korea FTA (AKFTA): ASEAN and South Korea consolidated their partnership by signing a Framework Agreement on Comprehensive Economic Cooperation at the ninth ASEAN-South Korea Summit on December 13, 2005, which provides for the establishment of the AKFTA. Under this framework three major agreements on trade in goods, trade in services and investment were signed on August 24, 2006, November 20, 2007 and June 2, 2009 respectively. The agreement provides for progressive reduction and elimination of tariffs by each country on almost all products. Vietnam benefits from trade preference in terms of tariff exemption or reduction under this agreement. South Korea is a key trade partner and the removal of tariffs benefits both exporters and importers.

- ASEAN-India FTA (AIFTA): The ASEAN-India Trade in Goods Agreement was signed at the seventh ASEAN Economic Ministers-India Consultations on August 13, 2009. The agreement entered into force on January 1, 2010 for India and some ASEAN member states. The ASEAN-India Trade in Services and Investment Agreements were signed in November 2014. Vietnam benefits from trade preference in terms of tariff exemption or reduction under AIFTA. This will help Vietnam in terms of trade growth and diversification, given the size and performance of the Indian economy and other ASEAN member states.

- The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): The agreement – comprising Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – is in effect. The agreement was ratified in Q418, with the deal representing 13.4% of global GDP, making it the third largest trade agreement after the United States-Mexico-Canada Agreement and the EU. The agreement aims to cut tariffs, improve access to markets and set common ground on labour and environmental standards and intellectual property protections.

- ASEAN-Japan FTA (AJFTA): A Framework for Comprehensive Economic Partnership between the ASEAN and Japan was signed by leaders at the ASEAN-Japan Summit on October 8, 2003 and was aimed at establishing a Comprehensive Economic Partnership agreement between the ASEAN and Japan. The agreement on Comprehensive Economic Partnership among member states of the Association of Southeast Asian Nations and Japan (AJCEP) was concluded in November 2007 and signing was completed by April 14, 2008. AJCEP is comprehensive in scope, with chapters on trade in goods; sanitary and phytosanitary measures; standards, technical regulations and conformity assessment procedures; investment; services; and economic cooperation. The agreement aims at liberalising and facilitating trade in goods between the ASEAN and Japan and promoting cooperation in fields such as information and communications technology, intellectual property and small- and medium enterprises development. The parties will also continue to discuss and negotiate improvements to the chapters on trade in services and investment. Trade relations between Vietnam and Japan benefit from trade preference in terms of tariff exemption or reduction under the AJFTA. Japan provides a large market for exports, with tariff-free trade therefore benefiting the manufacturing sector in particular. The agreement is partly superseded by the CPTPP.

- ASEAN-Australia-New Zealand FTA (AANZFTA): The AANZFTA was signed on February 27, 2009, AANZFTA is the ASEAN's first FTA with two developed countries simultaneously, and the first ASEAN FTA done in a single undertaking. AANZFTA represents ASEAN's most ambitious FTA to date, covering 18 chapters, including new areas that ASEAN had previously never negotiated on, such as competition policy and intellectual property. The AANZFTA also includes an AANZFTA Economic Cooperation Support Programme, which will provide technical assistance and capacity building to the parties of the AANZFTA, with the aim of supporting the implementation of the agreement and the overall regional economic integration process. The agreement entered into force in 2012 for all parties and work is currently underway to resolve and implement the built-in agenda as stipulated under the agreement. The agreement aims to eliminate tariffs on 99% of exports to key ASEAN markets by 2020. The agreement is partly superseded by the CPTPP.

- Chile-Vietnam FTA (effective from: March 2012): As part of the FTA, 73% of Chilean exports will be granted tariff-free access to Vietnam, and the remaining products will benefit from the FTA in terms ranging from three to 15 years. Only 4% of products will be on exception lists. Of Vietnamese exports, 75% will be granted tariff-free access to Chile and the rest of the products will benefit from tax relief in a period ranging from 6 to 11 years. The agreement is superseded by the CPTPP.

- Japan-Vietnam Economic Partnership Agreement (effective from: October 2009): The agreement boosts cooperation between the two countries in many areas such as: goods, services, investment, business climate improvement, human resource transfer, technical transfer and technical transfer. Under this agreement, 92% of goods exchanged between the two countries will enjoy tax exemption and reduction within 10 years from the date of validity of the agreement. Vietnam's agricultural, garment and aquatic products will gain tax exemptions when entering the Japanese market, and Japanese industrial products, including car components and electronic products, will gain tax exemptions or see a decrease to the corresponding import taxes. Superseded by the CPTPP.

- Vietnam-Eurasian Economic Union (EAEU) FTA (effective from: October 2016): The EAEU commits Vietnam to open the market for about 90% of total tariff lines within a 10-year tariff reduction schedule. Tariffs will be eliminated from the entry into force (EIF) of the FTA for products in the priority list of the EAEU (which consists of Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan), including agricultural commodities such as beef, dairy products and wheat flour. Tariffs will be eliminated within three-to-five years after EIF on processed meat and fish, electrical machinery and machinery used in agriculture. Five years after EIF, tariffs will be eliminated on pork and chicken and10 years after EIF, tariffs will be eliminated on alcoholic beverages and cars. Tariff elimination will not be earlier than 2027 for petroleum, and not longer than 10 years for iron and steel. The EAEU will eliminate the tariff rate for approximately 90% of all tariff lines. Groups of products for which the import tariff will be eliminated are agricultural, forestry and fishery products of Vietnam (majority of fishery items, certain kinds of fresh and processed vegetable and fruits, processed meat and fish, and cereals and rice – with a tariff quota of 10,000 tonnes). Also included will be some industrial goods that Vietnam has an advantage in exporting, such as textile (in quota) and raw textile materials, footwear (especially athletic shoes), machinery, electronic components, some pharmaceutical products, iron and steel, rubber products, and wood and furniture.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and the ASEAN commenced negotiations of an FTA and an investment agreement in July 2014. After 10 rounds of negotiations, Hong Kong and the ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investment, economic and technical cooperation, dispute settlement mechanism, and other related areas. The agreements will bring legal certainty, better market access, and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and the ASEAN. The agreements will also extend Hong Kong's FTA and investment agreement network to cover all major economies in South East Asia. Hong Kong is a key export market and the reduction of tariffs will ease the trading process; Hong Kong's potential as a key export market increases the importance of AHKFTA.

Signed

EU-Vietnam FTA: The EU and Vietnam have finished negotiating a trade agreement and an investment protection agreement, and the agreement now awaits ratification. The EU Council today adopted a decision on the conclusion of an FTA between the EU and Vietnam on March 30, 2020. The agreement is expected to enter into force in 2020. Once in force, the agreement will provide opportunities to increase trade and support jobs and growth on both sides through eliminating 99% of all tariffs, reducing regulatory barriers and overlapping red tape, ensuring protection of geographical indications, opening up services and public procurement markets, and making sure that the agreed rules are enforceable.

Waiting To Be Signed

Regional Comprehensive Economic Partnership (RCEP): There are ongoing negotiations regarding the RCEP, which is a regional economic agreement being negotiated between the ASEAN governments and their six FTA partners: Australia, Mainland China, India, Japan, New Zealand and South Korea. This includes a population of more than 3 billion people that contributes around a third of the world's GDP. The RCEP is envisioned to be a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement that aims to advance economic cooperation and broaden and deepen integration in the region, building on existing economic links. The RCEP would lower tariffs and other barriers to the trade of goods among the 16 countries that are in ASEAN or have existing trade deals with ASEAN. Although India pulled out of the agreement on November 4 2019, India was invited to return to the negotiating table at the 29th meeting of the RCEP trade negotiating committee in April 2020. The agreement is expected to be signed in November 2020.

Under Negotiation

- Vietnam-Israel: Vietnam and Israel are negotiating an FTA. Israel is one of Vietnam's important partners in the Middle East, with two-way trade reaching USD2.3 billion in 2015. Prospects for co-operation have been seen in fields such as investment, finance, services, science, technology and labour.

- Vietnam-EFTA: Vietnam and the EFTA (consisting of Iceland, Liechtenstein, Norway and Switzerland) are negotiating an FTA. The EFTA's leading exports to Vietnam included fish, pharmaceutical products, and machinery and mechanical appliances, while electrical machinery, footwear and precious stones and metals were leading imports.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

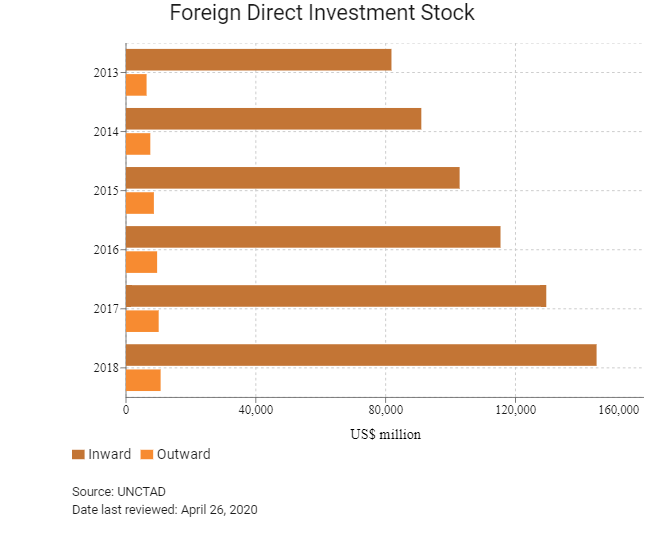

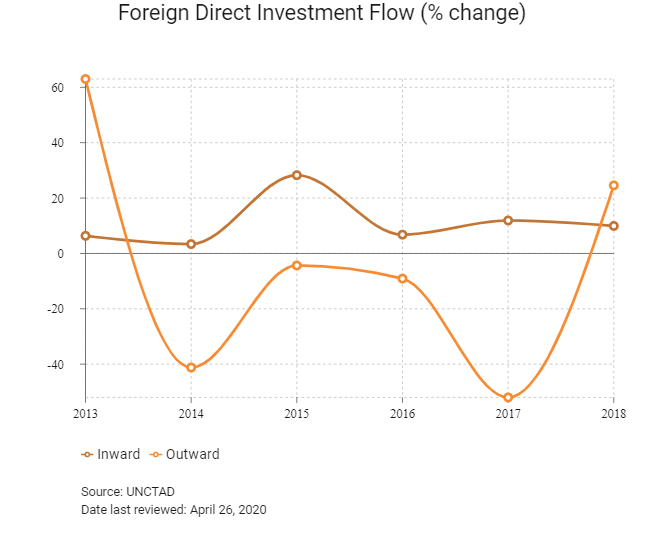

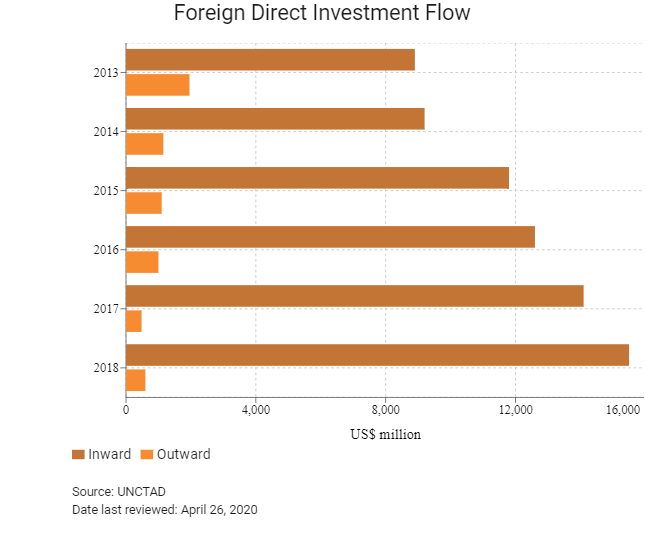

Foreign Direct Investment

Foreign Direct Investment Policy

- The Ministry of Planning and Investment (MPI) oversees the Investment Promotion Department to facilitate all foreign investments, and most provinces and cities have investment promotion agencies. The agencies provide information, explain regulations and offer support to investors when requested.

- Foreign and domestic private entities can establish and own a business except in prohibited business lines, such as illicit drugs, wildlife trafficking and 243 conditional sectors. Foreign investors must negotiate on a case-by-case basis with the government on market access to sectors that are not explicitly open through a trade or investment agreement. The government occasionally issues investment licences with time limits to specifically targeted investors.

- Foreign-owned enterprises (FOEs) and representative offices are obligated to have their annual statements audited. The Accounting Law governs the principles for accounting, audits and organisational structure for businesses to stay compliant in Vietnam. Investors should be aware that FOEs and representative offices have a different audit and compliance requirements. The government aims to replace the Vietnamese Accounting Standards and adopt the International Financial Reporting Standards by 2025.

- Vietnam has made steady progress in improving its business environment. This can be seen by its higher scores in the World Economic Forum's Global Competitiveness Index 4.0, where it is ranked 77th (out of 140) in the 2019 edition, and in the 2020 World Bank's Ease of Doing Business Index, where it ranks 70th among 190 economies. The Vietnamese government has also invested heavily in power and transport infrastructure to meet rapidly rising demand from the burgeoning manufacturing sector, resulting in a positive feedback loop.

- Foreign owners are permitted to acquire full ownership of local companies except when stated otherwise in Vietnam's international and bilateral commitments.

- There is a 25% cap on foreign investment in local banks from one foreign entity and a 30% cap on overall foreign investment in local banks. The government can waive these caps on a case-by-case basis.

- In June 2018, the government passed a new Competition Law, replacing the 2004 version of the law. The new law, which focuses on competition restraining agreements, market dominance, economic concentration and unfair practices, has been effect from July 1, 2019. The law has expanded its scope and now includes both Vietnamese and foreign companies and individuals in case their actions have or potentially have a competition restriction impact on the domestic market. Competition restriction impact is the impact which will exclude, reduce or hinder competition in the market. The Vietnamese government also has authority over offshore activities if there is an impact on the domestic market. The law will apply to foreign entities' part in competition-restricting agreements, economic concentration or other unfair activities, even if they do not have a subsidiary in Vietnam.

- Vietnam permits foreign participation in the telecommunications sector, with varying equity limitations depending on the sub-sector (there are five basic and eight value-added sub-sectors). Foreign ownership in private networks is permitted up to 70%, and foreign ownership in facility-based basic services (eg, public voice service where the supplier owns its transmission facilities) is generally capped at 49%.

- There are no local, state or provincial income taxes in Vietnam.

- Vietnam planned to remove restrictions on foreign ownership of state-owned and listed companies by the end of 2019 as Hanoi looks to open its economy further in order to sustain rapid growth. The move would broadly remove the existing foreign ownership cap of 49% but would exclude companies operating in 'sensitive and important' sectors. The draft law is expected to be submitted to lawmakers for approval in 2019 and to take effect in January 2020. However, the limit for banks will remain at 30%, and insurance will be kept at 49%. The new law would pave the way for Vietnamese companies to be included in the MSCI Emerging Markets Index. The move is also expected to breathe new life into the privatisation of state-owned companies. Vietnam has around 1,500 public companies, including about 740 listed on the two main stock exchanges in Hanoi and Ho Chi Minh City. More than 780 public companies are listed on a second-tier market or remained unlisted. As of April 2020, the law was not yet in effect.

- Tax incentives are granted based on regulated encouraged sectors, encouraged locations and size of the projects. The sectors that are encouraged by the Vietnamese government include education, healthcare, sport, culture, high technology, environmental protection, scientific research and technology development, infrastructural development, processing of agricultural and aquatic products, software production, and renewable energy.

- The encouraged locations include qualifying economic and high-tech zones, certain industrial zones and difficult socioeconomic areas. Large manufacturing projects with investment capital of more than VND6 trillion disbursed within three years of being licensed can also qualify for CIT incentives if:

- The minimum revenue is VND10 trillion per annum by the fourth year of operations at the latest.

- The minimum headcount is 3,000 by the fourth year of operations at the latest.

- The preferential incentive rate applied for large manufacturing projects can be extended for a maximum additional 15 years if the project manufactures goods having international competitiveness and the revenue of which exceeds VND20 trillion per annum within five years from the first year of revenue generation or if the average head count exceeds 6,000.

- New investment projects engaging in manufacturing industrial products prioritised for development will be entitled to income tax incentives if the products support the following:

- The high technology sector.

- The garment, textile and footwear, information technology, automobiles assembly or mechanics sectors and were not produced domestically as of January 1, 2015, or, if produced domestically, they meet the quality standards of the European Union or equivalent.

- Business expansion projects are now entitled to corporate income tax incentives if any of the following criteria are met:

- Additional fixed assets costing at least VND20 billion (or VND10 billion if the projects are in certain specified regions with difficult socioeconomic conditions) are invested.

- There is at least a 20% increase in the value of fixed assets compared with the period before expansion.

- There is at least a 20% increase in the designed capacity compared with the period before expansion.

- Additional tax reductions may be available for engaging in manufacturing, construction and transport activities that employ several female staff or ethnic minorities.

- Business entities in Vietnam are allowed to set up a tax-deductible research and development fund. Enterprises can appropriate up to 10% of annual profits before tax to the fund. Various conditions apply.

- Foreign investors generally pay rental fees for land use rights. The range of rates is wide depending on the location, infrastructure and the industrial sector in which the business is operating. In addition, owners of houses and apartments have to pay land tax under the law on non-agricultural land use. The tax is charged on the specific land area used, based on the prescribed price per square metre at progressive tax rates ranging from 0.03% to 0.15%.

- A natural resources tax (NRT) is payable by industries exploiting Vietnam's natural resources, including petroleum, minerals, natural gas, forest products, natural seafood, natural bird's nests and natural water. Natural water used for agriculture, forestry, fisheries, salt industries and sea water for cooling purposes may be exempt from NRT provided that certain conditions are satisfied. The tax rates vary depending on the natural resource being exploited, ranging from 1% to 40%, and are applied to the production output at a specified taxable value per unit. Various methods are available for the calculation of the taxable value of the resources, including cases where the commercial value of the resources cannot be determined. Crude oil, natural gas and coal gas are taxed at progressive tax rates depending on the daily average production output.

- Environment protection tax is an indirect tax that is applicable to the production and import of certain goods deemed detrimental to the environment, the most significant of which are petroleum and coal. The tax is calculated as an absolute amount on the quantity of the goods.

- At the end of September 2018, the government announced the imposition of higher taxes on petroleum products, aimed at boosting revenue collection and environmental protection. The policy came into effect on January 1, 2019.

- Vietnam's National Assembly approved a new Labour Code which will take effect in January 2021. The amended code offers greater protection for employees and is viewed as better aligned with international best practices, particularly as Vietnam integrates into the world economy. Businesses should review their labour practices and prepare themselves to be compliant when the labour code takes effect.

- Representative offices are one of the simplest and fastest ways to establish a legal entity in Vietnam. Their reporting requirements are also more simplified compared with FOEs. Representative offices are forbidden from directly conducting profit-generating activities and are limited to market research, developing trade contacts, and gathering information on regulations and laws.

Sources: WTO – Trade Policy Review, The International Trade Administration, US Department of Commerce, national sources, Fitch Solutions

Free Trade Zones And Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

270 industrial zones and export processing zones across the country. Vietnam is divided into three key categories of economic zones (KEZs), each of which has its own economic development plan. |

- Foreign investors are exempt from import duties on goods imported for their own use and which cannot be procured locally, including: machinery, vehicles, components and spare parts for machinery and equipment, raw materials, inputs for manufacturing, and construction materials. |

|

Tax holidays/Tax reductions |

- Investors may be considered for tax holidays and reductions. The holidays take the form of a complete exemption from CIT for a certain period beginning immediately after the enterprise first makes profits, followed by a further period where tax is charged at 50% of the applicable rate. However, where the enterprise has not derived profits within three years of the commencement of operations, the tax holidays will start from the fourth year of operation. - Criteria for eligibility to these holidays and reductions are set out in the CIT regulations as follows:

- Four years of tax exemption and 50% tax reduction for five subsequent years shall be given to income earned by enterprises carrying out new investment projects in the socialised sectors and in regions not included in the list of difficult socioeconomic areas.

- From January 1, 2018, certain incentives, including a lower CIT rates, will be granted to small-and-medium-sized enterprises (SMEs). |

Sources: US Department of Commerce, Fitch Solutions, national sources

- Value Added Tax: 10%

- Corporate Income Tax: 20%

Source: Vietnam General Department of Taxation – Ministry of Finance

Important Updates to Taxation Information

- The environmental tax on petrol was increased from VND3,000 to VND4,000 per litre as of 2019.

- In June 2019, Vietnam’s National Assembly approved a new Law on Tax Administration. Under the new law, tax authorities have been granted additional enforcement powers and the law simplifies the process of filing taxes. The new law will take effect from July 2020. The authorities will provide circulars and decrees with details and guidance for the new law ahead of its implementation. Key changes include the speeding up of the issuance of tax registration certificates from 10 days down to three; extensions on filing personal income tax to 120 days instead of 90 and the inclusion of provisions for electronic transactions (discussed below).

- In a move to improve the management and taxation of e-commerce transactions, the Ministry of Finance circulated a draft decree, which includes in its scope organisations operating e-commerce platforms and websites, transporters of the goods, customs brokers, as well as the exporters and importers. An e-commerce activity management system will be developed by the General Department of Customs. Export and import declarations will be processed on a 24 hour basis via this system and the system will share information with the National Single Window and other existing management systems of the General Department of Customs. Consequently, e-invoices will be compulsory effective from November 1, 2020, further provisions relating to e-invoices and electronic documents as per the Law on Tax Administration, will be effectvie from July 1, 2022.

- In 2018, the Vietnamese Ministry of Finance released a draft tax law amending the current laws on value added tax (VAT), special sales tax, CIT, personal income tax, natural resources tax and customs duty. In the draft tax law, there are proposals to increase VAT rates to 11% from January 1, 2020 and 12% from January 1, 2022, while the 5% VAT rate shall be increased to 6% from January 1, 2022.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

20% is the standard rate (preferential rates of 10%, 15%, and 17% are available where certain criteria are met) |

|

The rate of CIT applicable to firms operating in the oil and gas industry |

Ranges from 32% to 50%, depending on the location and specific project conditions. |

|

CIT for firms engaging in prospecting, exploration and exploitation of mineral resources (e.g. gold and precious stones) |

40% or 50%, depending on the project's location |

|

Capital Gains Tax |

0.2% |

|

Branch Tax |

Same as CIT rate |

|

VAT |

- Standard rate: 10% on goods and services |

|

Special Sales Tax (SST) |

Applies to the production or import of certain goods, including cigarettes, cigars, spirits, beer, autos, assorted types of petrol, air conditioners and the provision of certain services including casinos, golf clubs and lotteries. SST rates range from 10% to 150%. Exported goods are not subject to SST. |

|

NRT |

Rates vary depending on the natural resource being exploited, from 1% to 40%, and are applied to the production output at a specified taxable value per unit. |

|

Payroll Tax: Social insurance (SI) |

Capped at VND27.8 million |

|

Payroll Tax: Health insurance (HI) |

Capped at VND27.8 million |

|

Payroll Tax: Unemployment insurance (UI) |

Capped at VND79.6 million |

|

Foreign Contractor Tax (Withholding Tax) |

0.1% to 10%, depending on type of business activity |

Source: Vietnam General Department of Taxation – Ministry of Finance

Date last reviewed: April 26, 2020

Localisation Requirements

Generally, preference for all roles is given to Vietnamese nationals. In order to qualify for work permits, foreign workers must have a degree of specialised knowledge or experience in management and technical roles that the domestic labour force cannot fill or carry out efficiently – as deemed apt by the Department of Labour.

Work permits for skilled workers

All foreign nationals seeking paid employment in Vietnam must be in possession of a valid work permit. The tenure of a work permit for a foreign worker is generally two years. In the first half of 2016 the Vietnamese government issued Decree No. 11, which guides a number of articles of the Labour Code on foreigners working in Vietnam. The decree proposes developments including changes to the conditions, paperwork and timeline for work permit applications and exemptions, allowing the import of skilled and unskilled labour with less bureaucracy Decree No. 11 also extends the time frame for lodging the re-issuance of work permits from 45 days prior to the expiry date, instead of the 15 days as per previous regulations.

Employee Contributions Structure

Social insurance (SI) and unemployment insurance (UI) contributions are applicable to Vietnamese individuals only. Health insurance (HI) contributions are required for Vietnamese and foreign individuals that are employed under Vietnam labour contracts. Effective from January 1, 2018, SI contributions are also applicable to foreign individuals working in Vietnam under a work permit or practising certificate or licence. Accordingly, from 1 January 2019 the salary subject to SI/HI/UI contribution comprises the monthly compensation, certain allowances and other regular payments according to the Labour Law, but this is capped at 20 times the basic salary for SI/HI contributions and 20 times the minimum regional salaries for UI contribution. Effective from July 1 2020, the basic salary will increase from VND1.39 million to VND1.49 million per month. In addition, from January 1 2020 the minimum regional salaries vary from VND3.07 million to VND4.42 million per month. These minimum salaries are subject to change each year.

Sources: Vietnam General Department of Taxation, national sources, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba3 (Negative) |

10/08/2018 |

|

Standard & Poor's |

BB (Stable) |

05/04/2019 |

|

Fitch Ratings |

BB (Stable) |

08/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings, Reuters

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

68/190 |

69/190 |

70/190 |

|

Ease of Paying Taxes Index |

86/190 |

131/190 |

109/190 |

|

Logistics Performance Index |

39/160 |

N/A |

N/A |

|

Corruption Perception Index |

117/180 |

96/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

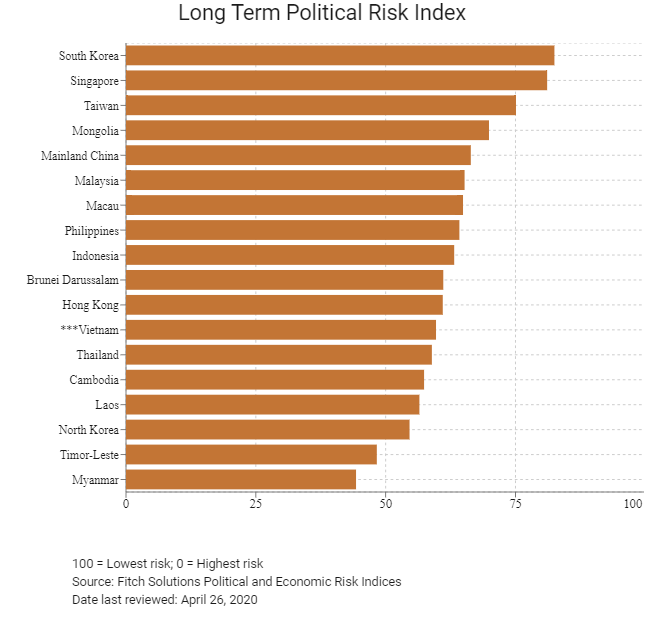

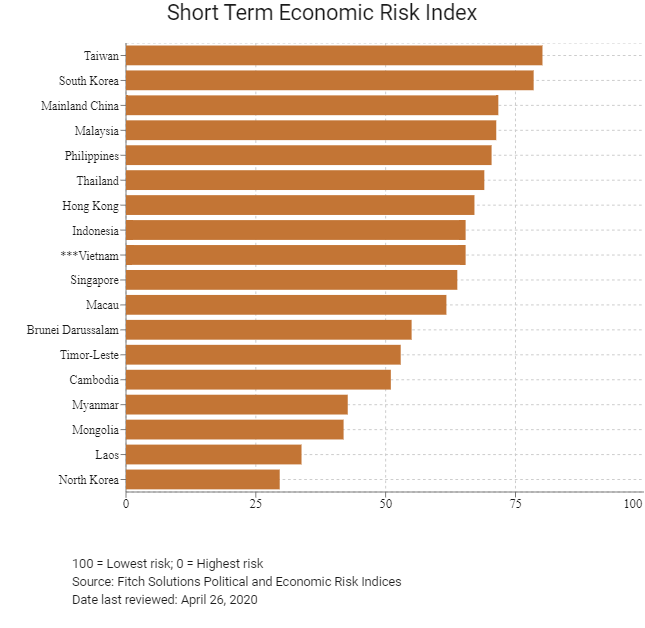

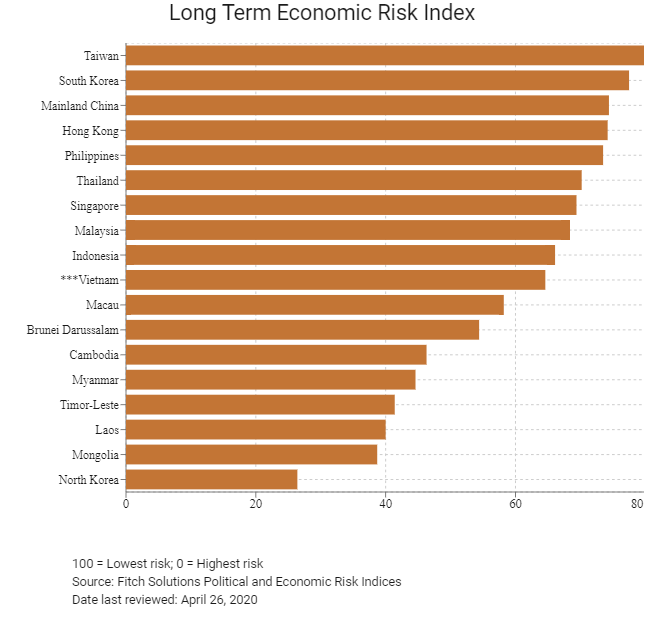

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

43/202 |

51/201 |

51/201 |

|

Short-Term Economic Risk Score |

68.3 |

66.7 |

65.6 |

|

Long-Term Economic Risk Score |

66.7 |

65 |

65.2 |

|

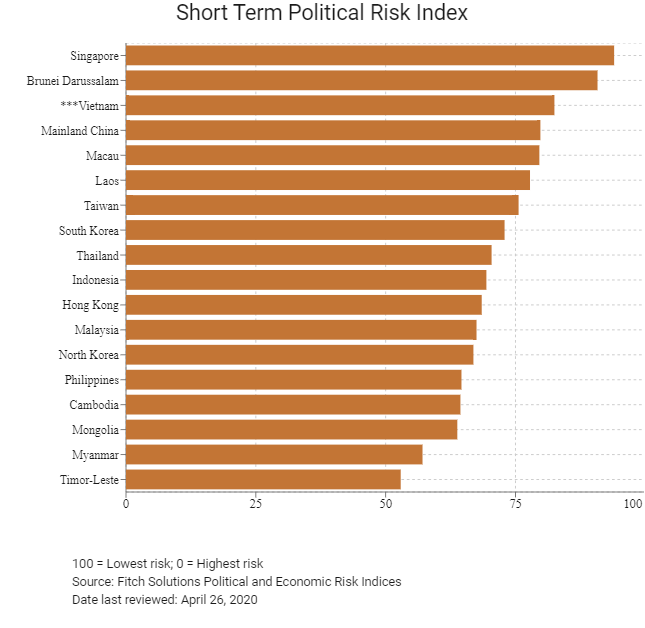

Political Risk Index |

114/202 |

111/201 |

111/201 |

|

Short-Term Political Risk Score |

82.5 |

82.5 |

82.5 |

|

Long-Term Political Risk Score |

59.7 |

59.7 |

59.7 |

|

Operational Risk Index |

77/201 |

85/201 |

85/201 |

|

Operational Risk Score |

53.7 |

52.8 |

53.2 |

Source: Fitch Solutions

Date last reviewed: April 26, 2020

Fitch Solutions Summary

ECONOMIC RISK

Vietnam has recorded important achievements in socioeconomic fields and has become one of the fastest-growing economies in the world. The country is emerging as a key manufacturing hub in the region, supported by economic liberalisation efforts and integration into the global supply chain through trade agreements and membership to regional and international blocs. However, in the short term, we anticipate the economy to come under heavy pressure, with many sub-sectors possibly contracting across most of 2020 on the back of the Covid-19 shock which has slowed manufacturing growth significantly and crippled the tourism industry, amongst others. Nonetheless structural factors underpinning Vietnam's potential for long-term growth (including favourable demographics, proximity to Mainland China and the low cost of labour relative to the region) remain largely unchanged. In addition, there are ongoing efforts to further address macroeconomic imbalances and fiscal deficits.

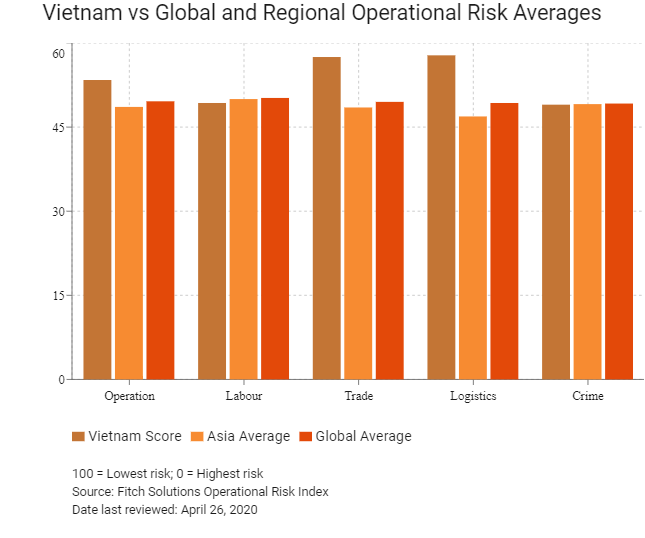

OPERATIONAL RISK

Vietnam is a promising destination for manufacturers in South East Asia on account of the country gradually leaning towards a market-oriented economic model as well as its regional integration efforts. The country also offers a number of strategic advantages, including a relatively stable political environment as well as large-scale transport and utilities infrastructure development projects under way, which will boost Vietnam's regional and global connectivity. A large population and rising incomes create attractive opportunities for consumer-oriented businesses. Nevertheless, Vietnam's competitiveness regarding labour costs is diminishing as wage pressures mount in line with the rising cost of living. In addition, businesses seeking to fill positions in advanced sectors of the economy will be required to import foreign labour or invest in training at additional costs owing to the shortage of advanced skills in the Vietnamese labour market.

Source: Fitch Solutions

Date last reviewed: April 30, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Vietnam Score |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

East and South East Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and South East Asia Position (out of 18) |

11 |

14 |

10 |

9 |

11 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

12 |

17 |

10 |

10 |

18 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

79 |

106 |

71 |

62 |

105 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest Risk; 0 = Highest Risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 26, 2020

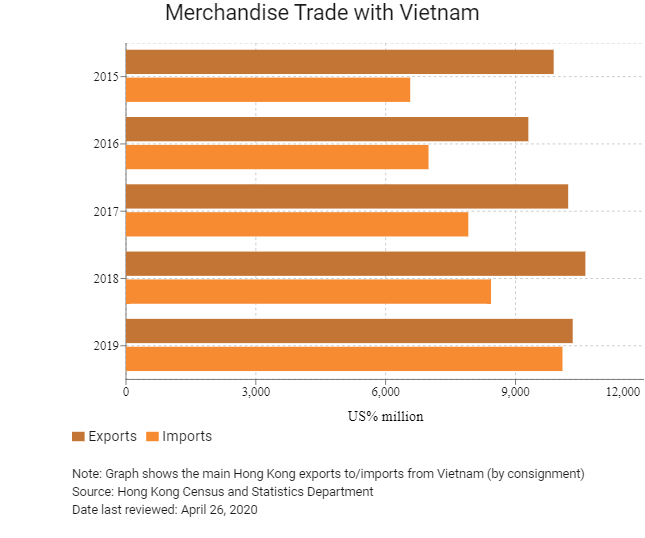

Hong Kong’s Trade with Vietnam

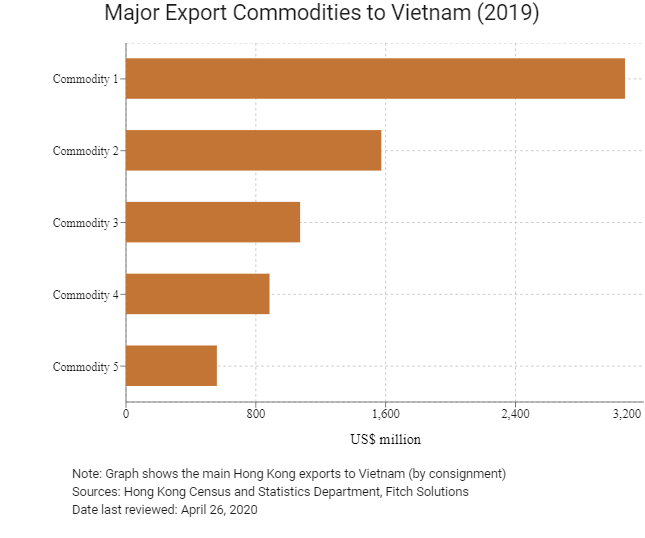

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 3,074.8 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,573.3 |

| Commodity 3 | Textile yarn, fabrics, made-up articles and related products | 1,073.0 |

| Commodity 4 | Office machines and automatic data processing machines | 884.4 |

| Commodity 5 | Miscellaneous manufactured articles | 560.0 |

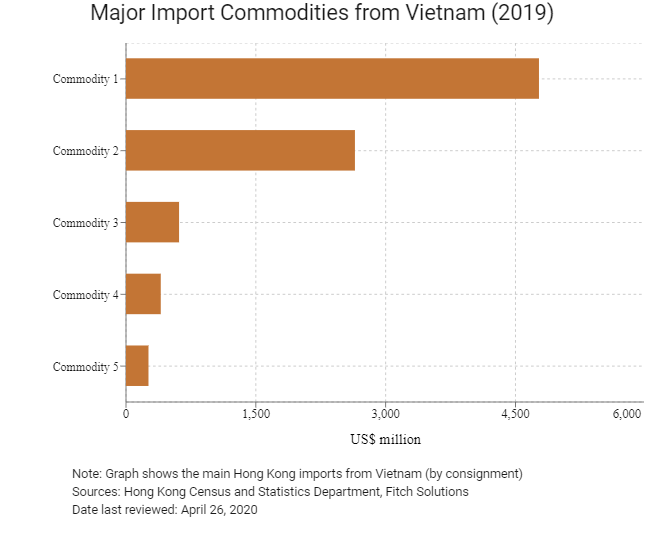

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 4,771.5 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 2,645.1 |

| Commodity 3 | Office machines and automatic data processing machines | 613.1 |

| Commodity 4 | Footwear | 401.7 |

| Commodity 5 | Articles of apparel and clothing accessories | 259.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth Rate (%) |

|

|

Number of Vietnamese residents visiting Hong Kong |

44,406 |

-21.8 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

2019 |

Growth Rate (%) |

|

|

Number of Vietnamese residing in Hong Kong |

14,161 |

29.6 |

|

Number of East and South Asians residing in Hong Kong |

2,834,873 |

3.4 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: April 26, 2020

Commercial Presence in Hong Kong

|

2018 |

Growth rate (%) |

|

|

Number of Vietnamese companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong and Vietnam

Hong Kong has concluded Comprehensive Double Taxation Agreements with Vietnam. This agreement was signed on December 16, 2008 and entered into force on August 12, 2009.

Source: Inland Revenue Department

Chamber of Commerce or Related Organisations

Hong Kong-Vietnam Chamber of Commerce

Address: Unit 1608, 16/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong

Email: info@hkvcc.com

Tel: (852) 3188 6306

Fax: (852) 3188 1808

Source: Hong Kong-Vietnam Chamber of Commerce

Hong Kong Business Association Vietnam

Email: hcmc@hkbav.org / hanoi@hkbav.org / tracy.ly@hkbav.org

Tel: (84) 28 3925 2186 (HCMC) / (84) 24 3845 2270 (Hanoi)

Website: www.hkbav.org

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Vietnam Consulate in Hong Kong

Address: 15/F, Great Smart Tower, 230 Wan Chai Road, Wan Chai, Hong Kong

Email: vnconsul.hongkong@mofa.gov.vn

Tel: (852) 2591 4517 / 2591 4510

Fax: (852) 2591 4524

Source: Hong Kong Protocol Division of Government Secretariat

Visa Requirements for Hong Kong Residents

Vietnam is currently launching a pilot e-Visa system. An e-Visa is processed within 3 working days after the Vietnam Immigration Department has received the application and full e-Visa fee. Vietnam e-Visa is for single entry and valid for a maximum of 30 days.

Source: Visa on Demand

Date last reviewed: April 26, 2020

Vietnam

Vietnam