Russia

Standard Chartered is a leading international banking group, with more than 86,000 employees and an over 150-year history in some of the world’s most dynamic markets. We bank the people and companies driving investment, trade and the creation of wealth across Asia, Africa and the Middle East. Today we have a unique on-the-group presence across the Greater China region.

Corporate and Institutional Clients

Our cross-border network helps clients facilitate trade and finance across the fastest growing markets in today’s global economy. We serve clients via the Greater China Platform with our experience in the RMB business and our broad network across China, Hong Kong and Taiwan. We offer a full suite of products in areas such as Financial Markets, Transaction Banking, Research Islamic Banking and Corporate Finance.

Retail Clients

Spanning more than 30 countries our retail banking business serves over 9 million clients through almost 1,200 branches and 5,000 ATMs as well as award-winning digital channels such as Breeze. We offer internet banking in 32 markets, mobile banking in 19 markets and Breeze in 13 markets.

Commercial & Private Bank

Our footprint in the Greater China markets and key geographies across Asia, Africa and the Middle East ensures that we are well placed to support mid-sized firms as they continue to grow and internationalise. As the private bank for business owners our geographic footprint coincides with some of the fastest growing wealth pools in the world.

Citi, a leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Established in Hong Kong more than 20 years ago, On Time Express Ltd (OTEL) is a leading provider of freight forwarding and logistics services with a global presence. In 2014, OTEL set up a specialised eTotal team to handle small-sized parcels and develop e-commerce logistics solutions. Leveraging OTEL’s extensive logistics network, eTotal provides e-tailers with a comprehensive logistics solution that includes booking for air and sea freight shipping services, overseas warehousing, delivery by local post and localised pre- and after-sales services. The services are aimed at streamlining the order management process and reducing transportation time.

eTotal has established close partnerships with leading e-commerce operators including Alibaba’s Cainiao Network. With the help of eTotal, in just one year, the shipping time of small-sized parcels travelling from China to Russia has been reduced from 30-45 days to 15-20 days, with some even arriving in 5-7 days.

eTotal owns warehouses in Shanghai, Beijing, Shenzhen and Hong Kong, and processes close to 100,000 parcels (or 10 tonnes of goods) daily. The company offers air charter services during peak seasons. Apart from strengthening existing partnerships and optimising routes and services, eTotal also supports the Belt and Road Initiative by connecting more e-commerce platforms and sellers, and expanding into the Central Asian and European markets, in order to offer a more comprehensive logistics services package for cross-border e-tailers. The exponential growth of cross-border e-commerce business in recent years is dependent on modern cross-border logistics. The Belt and Road Initiative facilitates international trading and provides unlimited opportunities for the development of cross-border logistics and e-commerce.

Russia’s government uses strategic investment vehicles such as Advanced Special Economic Zones (ASEZs) and the Free Ports of Vladivostok (FPVs) to boost economic development in the Russian Far East District (FEFD). It has also implemented two special schemes – the Special Administrative Region (SAR) and the Integrated Entertainment Zone (IEZ) – to unleash the region’s full potential in the financial and tourism sectors. This gives Hong Kong, a renowned special administrative region, an international financial centre and a world-class tourist destination, opportunities to forge closer partnerships with the region in fields covering a wide spectrum of professional services.

Special Administrative Regions (SARs)

On 26 July 2018, the Russian government passed a law to create two foreign offshore zones on two Russian islands – Oktyabrsky in Kaliningrad Region in the west, and Russky in Primorsky Region in the east. It also drew up the rules under which businesses in these zones could receive multinational company (MNC) status and enjoy a number of preferences, including fast registration, tax benefits, and benefits related to currency control. Companies located in the SARs would be considered Russian for tax purposes, but not for currency control purposes.

Even before they were given SAR status, both islands were budding international business centres. Oktyabrsky has for some time been a popular location for European-bound Russian companies and Russian-bound European companies; while Russky Island hosts the annual Eastern Economic Forum (EEF), the biggest international platform for developing political, economic and cultural ties between Russia and Asia Pacific, and is the home of the Far East Federal University (FEFU).

In order to enjoy the perks being offered under the new SAR legislation, many foreign-domiciled Russian companies are reportedly considering relocation. One of the first to announce a move to the SAR on Russky Island was Finwig Holdings, an important shareholder in one of the FEFD’s key financial institutions, Vostochny Bank. Meanwhile, the EN+ Group is in the process of relocating its subsidiaries to the Russian SARs, including aluminium producer RUSAL (currently registered in the British crown dependency of Jersey) and the group’s energy division En+ Holding Limited (domiciled at present in Cyprus).

At the moment, only foreign-domiciled Russian companies can apply to be re-domiciled in the SARs, but in the future other multinational companies will be allowed to make an application. The goal is to develop Russky Island into a regional financial centre, with a complementary stock market which will work together with upgraded multimodal logistics and the expanding FPV and ASEZ networks in the FEFD.

Hong Kong, being a special administrative region as well as Asia’s leading financial and logistics hub, is in an excellent position to provide unique advice and support on policy and development to its FEFD counterparts.

Growing Tourism Industry

Russky Island, a military base for more than a century, is not only an aspiring SAR, but also an increasingly popular tourist destination. It enjoys unpolluted sea, clean air and a pristine natural environment suitable for eco-tourism, while the campus of the FEFU is fast becoming one of the most attractive of the group of MICE venues used for international conferences and business events.

The island is not the only natural tourism magnet in the FEFD, which attracted nearly 6 million visitors in 2017 (a huge 270% rise from 2012). The region boasts four UNESCO World Heritage Sites – the Lena Pillars Nature Park, the volcanoes of Kamchatka, the Sikhote-Alin mountain range (home to several rare species of animal, including the Amur tiger, Himalayan bear and Siberian musk deer) and Wrangel Island (which hosts the world’s largest population of Pacific walruses and is a breeding ground for Asian Snow geese).

It also offers culinary tourists an exquisite, though largely underrated, cuisine. Famous for its sea cucumbers, as well as other cold-water seafood such as snow crabs, king crabs, squids and shellfish, the FEFD supplies catches not only to Russian markets, but also to overseas ones in Japan, South Korea, mainland China, Hong Kong and other Asian countries.

Another important strand of FEFD’s tourism industry is entertainment and gambling. The Russia Federal Government has set up the Primorye Integrated Entertainment Zone (IEZ) in the FEFD’s Primorsky Region as a designated gambling zone with hotels and casinos offering entertainment, shopping, water sports and skiing. It is designed to be capable of receiving 8 million visitors a year.

The Primorye IEZ occupies more than 600 hectares of land in Muravyinaya Bay, which is about 45 minutes’ drive from Vladivostok (the administrative capital of the FEFD) and 20 minutes from Vladivostok International Airport (VVO). Since its inception in 2009, the IEZ has attracted more than RUB78 billion (US$1 billion) of private investment from Russia, China, Cambodia and South Korea.

The first project to get up and running in the zone, the hotel/casino Tigre de Cristal, opened in November 2015. Its casino area houses more than 250 gaming machines and 50 gaming tables, while its 5-star hotel complex contains 121 hotel rooms and suites. In 2017, it entertained 348,000 visitors, of which 80% were Russians. Most of the remainder came from mainland China, South Korea and Japan.

It is worth noting the Hong Kong investment behind the Tigre de Cristal project. In 2011, Lawrence Ho Yau Lung, the chairperson of the Hong Kong-listed Melco International Development Limited, became the largest shareholder and chairman of Summit Ascent Holdings Limited. In 2013, this business acquired a majority stake in the G1 Entertainment LLC in a bid to accelerate the construction and upgrade the management of the Tigre de Cristal project.

To support the development of the Primorye IEZ, the regional government has levied a tax of just 3% on gross gaming revenue for casinos operating in it – a far lower rate than, say, the 35% paid by casinos in Macau. The sustained level of government support and the success of the Tigre de Cristal operation are thought to be the reasons behind growing interest in the IEZ among Russian and overseas gaming industry players.

Three more entertainment complexes are expected to open in the Primorye IEZ in the near future – Naga Vladivostok, a 4-star hotel with a casino and a concert hall which has investment from Cambodia’s Naga Corp Ltd; Shambala, funded by Russia’s CJSC Shambala; and Selena, backed by Russian consortium Diamond Fortune Holdings Prim.

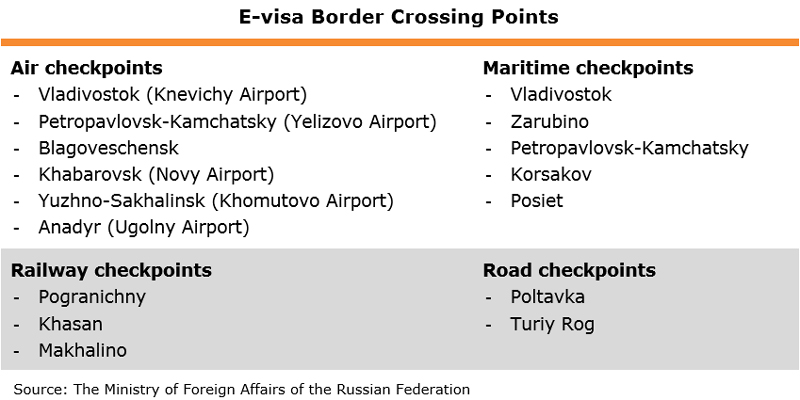

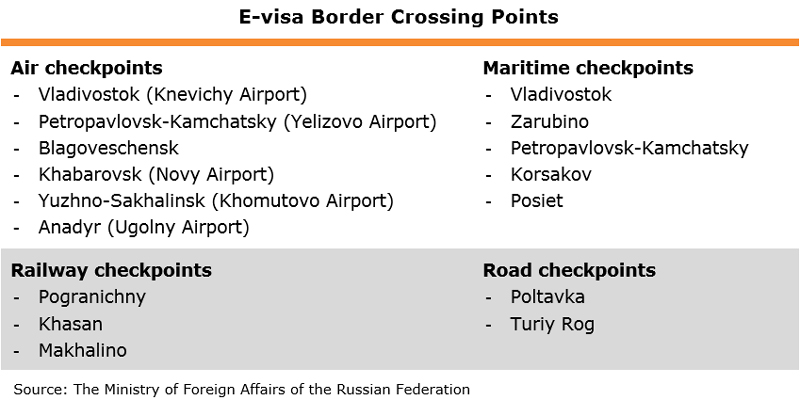

In order to attract more Asian tourists, the operators in the Primorye IEZ are working with the federal and regional governments to offer a unique duty-free shopping experience with a wide variety of global brands. The introduction in 2018 of free, simplified electronic visas for foreigners from 18 countries – Algeria, Bahrain, Brunei, India, Iran, Japan, Kuwait, Qatar, mainland China, Morocco, Mexico, North Korea, Oman, Saudi Arabia, Singapore, Tunisia, Turkey and United Arab Emirates (UAE) – is another factor encouraging tourists to come to the FEFD. Visitors from these countries can apply for up to 8 days’ stay in Russia within 30 calendar days of the visa being issued, arriving via designated border crossing points in the Free Port of Vladivostok. [1] Since its launch, 59,000 e-visas have been issued, 45,000 of them to mainland Chinese tourists.

Opportunities for Hong Kong companies to participate in the development of the tourism industry in the Russian Far East are plentiful. They can not only provide investment and project management, but also act as a marketing platform for the FEFD to promote its tourism to potential Asian visitors. This is especially true given the growing connections between Hong Kong and the region – evidenced by the availability of direct flights between Vladivostok and Hong Kong, and the sizeable numbers of Russians from the FEFD living in the city.

[1] Hong Kong citizens can enjoy up to 14 days of visa-free entry into Russia.

Editor's picks

Trending articles

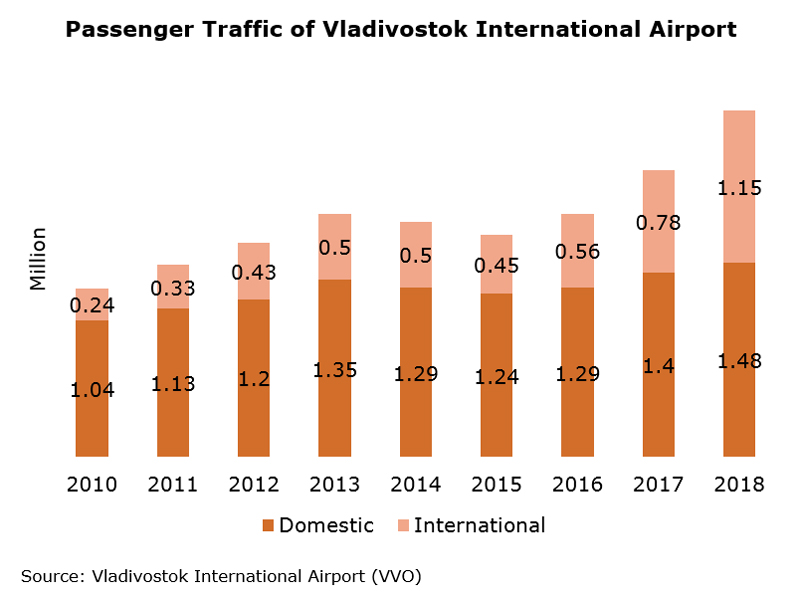

Vladivostok is home to Russia’s largest ports on the Pacific Coast and the eastern terminal of one of the world’s longest train rides, the Trans-Siberian Railway. To strengthen the city’s role as the eastern gateway to Russia, the Vladivostok International Airport (VVO), has been continuously upgraded with new facilities and an expanding reach to Asia.

Railways and pipelines, used extensively for transporting energy minerals and metals over long distances, have long been the backbone of Russia’s logistics system. In order to make it more efficient, the Russian rail monopoly RZD has over recent years put in place various transit time savings, such as the introduction of door-to-door and just-in-time schemes and the greater use of a single window for customs, alongside improvements which enable the provision of higher-speed rail services for container cargo.

As a result, cargo container trains can now complete the journey between the Russian Far East and European Part of Russia via the Trans-Siberian Railway in about six to seven days, instead of the 10 to 11 days it took prior to 2017. The average train speed on the trip now averages 75km per hour, up from the previous 30-40km per hour. This has helped strengthen Russia’s role as an integrator in the Eurasian transport market, and saw transit container traffic grow by 25% in 2018 (and by 150% since 2004).

The tariffs involved in shipping a forty-foot container (FEU) by sea plus rail to continental Europe from major Chinese or South-east Asian ports via the Trans-Siberian Railway can usually start from US$4,000. For traders who can ship their cargo to Northern European ports for just US$2,200 per FEU, albeit at a much slower pace of 40 days, this means the Russian route is only cost-effective for high-value and time-sensitive products.

However, the Russian government and the Russian Railways (RZD) hope that further railway improvements, including a RUB150-billion (US$2.3-billion) digitalisation plan and a modernisation project designed to shorten the minimum Moscow-Vladivostok transit time still further, will help encourage shippers to consider the shorter yet higher-priced Russian alternative.

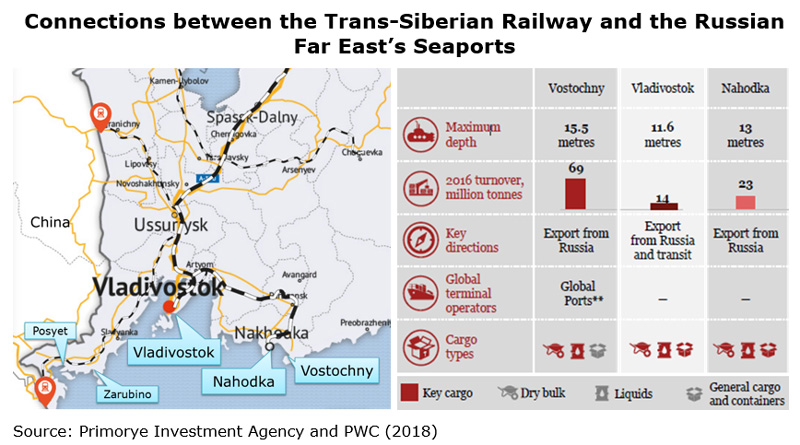

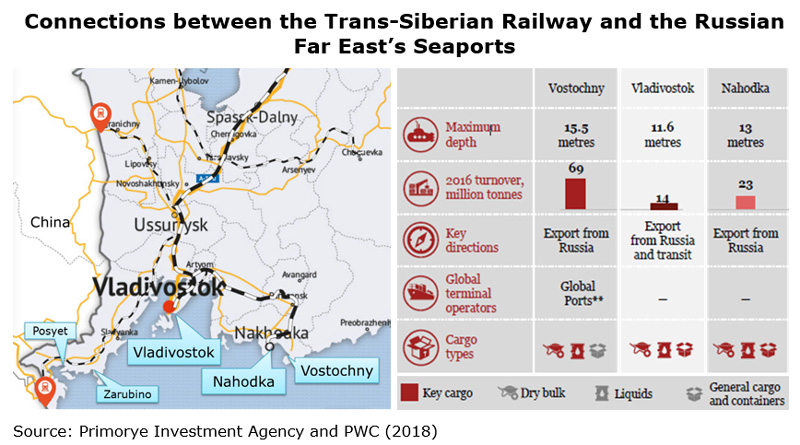

The Trans-Siberian Railway is linked to three major deep-water ports in the Russian Far East – the Port of Vladivostok on the north-west of the ice-free Golden Horn Bay, and the Ports of Nakhodka and Vostochny on either side of the Nakhodka harbour. The Port of Vladivostok, which has an annual capacity of 620,000 TEUs, is the most important and the closest to Vladivostok railway station, providing year-round traffic to and from Asia-Pacific trade partners such as China, Japan, South Korea, Taiwan, Thailand and Vietnam. The Port of Nakhodka is an alternative option for general cargo and container vessels, while the Port of Vostochny is one of Russia’s leading coal handling ports.

These three Far Eastern ports are mostly used by traders moving products, both bulk and general, between Russia and North-east Asia countries such as China (Dalian, Qingdao, Shanghai and Tianjin), Japan, Mongolia, North Korea and South Korea. That said, FESCO, a leading public transport and logistics company in Russia with operations in ports, rail, integrated logistics and the shipping business, provides Hong Kong traders with an alternative way to penetrate the Russian market via the Russian Far East. Its multimodal transportation service, including a block-train service between Vladivostok and Moscow, reaches more than 50 inland locations in Russia.

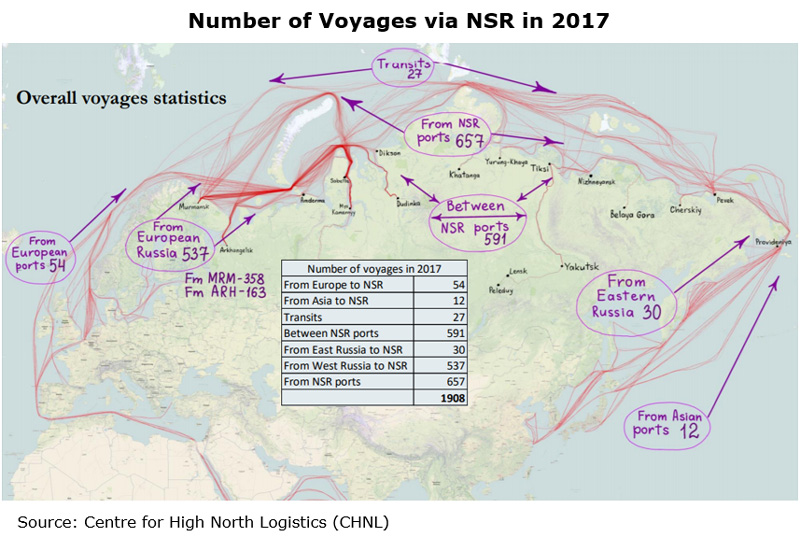

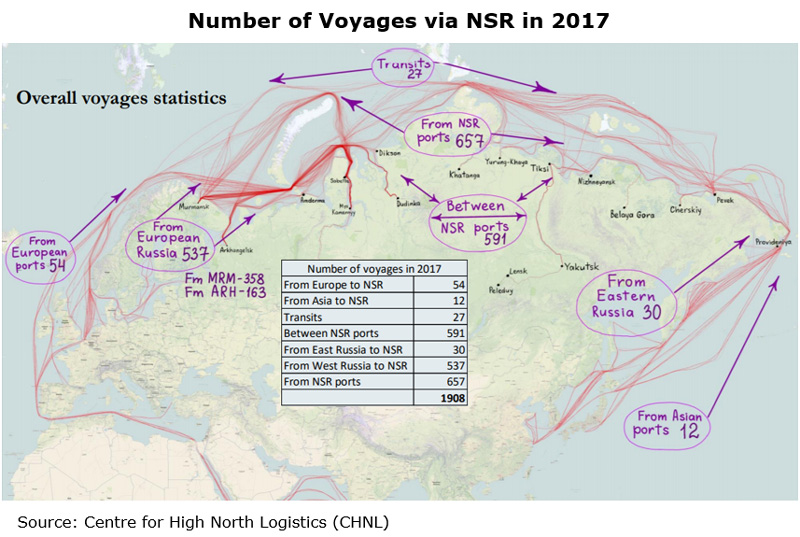

Another viable transit path is the Northern Sea Route (NSR) – a shipping route between the Atlantic Ocean and the Pacific Ocean along the Russian coast of Siberia, via mostly Russian Arctic waters. This is a shorter journey than the conventional Suez Canal route. While the NSR is still a long way from challenging the Suez Canal as a major international trade lane, the Russian and Chinese governments believe that the melting of the Arctic ice sheet will open up new, lucrative Asia-Europe transport routes. They have already earmarked tens of billions of dollars for the development of ships and shipbuilding, navigational aids and ports along the NSR.

The multimodal Russian Far East transit network also includes the fast-growing Vladivostok International Airport (VVO), which is gaining popularity among international travellers as well as traders of high-value, time-sensitive and perishable goods. Moscow’s airports are still by far the main gates for Russian-bound air cargo from Asia. Even for goods destined for the Russian Far East market, the more frequent and convenient flight connections to Moscow used until recently to ensure that using Vladivostok was out of the question.

However, the situation has somewhat changed since the airport was rebuilt for the APEC Russia 2012 Summit. Since then, VVO has significantly improved its infrastructure, handling capacity and flight frequency. This has allowed it to expand its network to 50 routes and 26 international destinations, including Hong Kong. Last year it added a number of new airlines from South Korea (T’way Air, Eastar Jet, Air Busan and Air Philip) and China (China Express), and new destinations including Daegu and Muan in South Korea, Qiqihar in China’s Heilongjiang Province, Sapporo in Japan and Phu Quoc in Vietnam, offering a wider choice to both passenger and shippers.

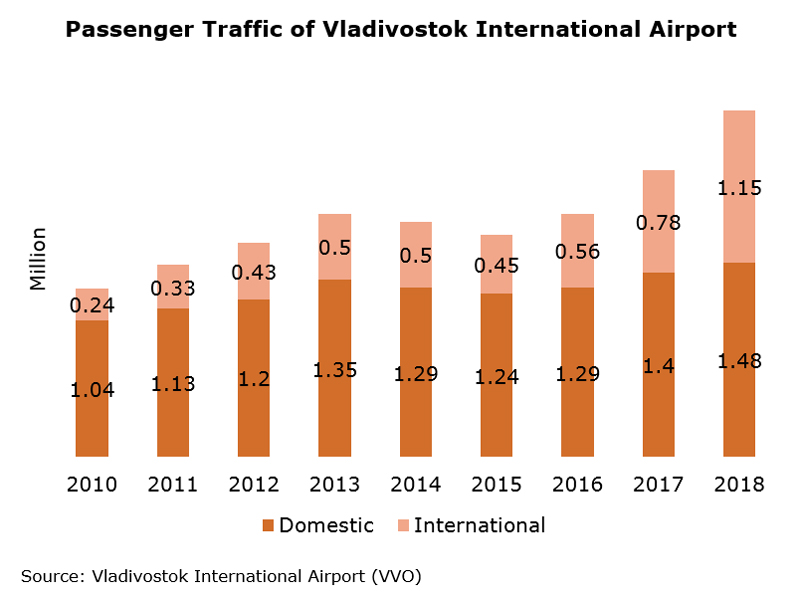

Thanks also to the launch of simplified electronic visas in August 2017 for passport holders from 18 countries including Japan, mainland China and North Korea, for up to 8 days’ stay in Russia via designated border crossing points in the Free Port of Vladivostok, VVO’s international passenger flows surged by 47% year-on-year in 2018, to 1.15 million. This handsome growth in passenger traffic has also enabled airlines to make more profits from the increased amount of belly capacity available for air cargo.

Advanced Special Economic Zones

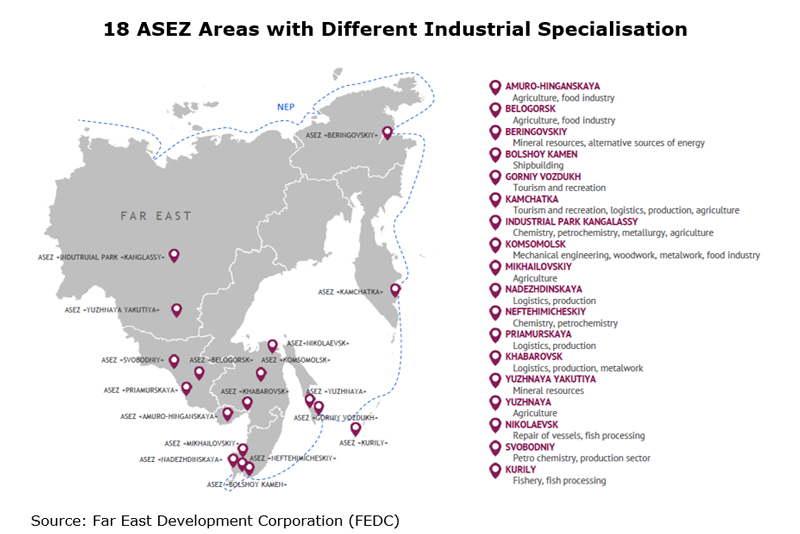

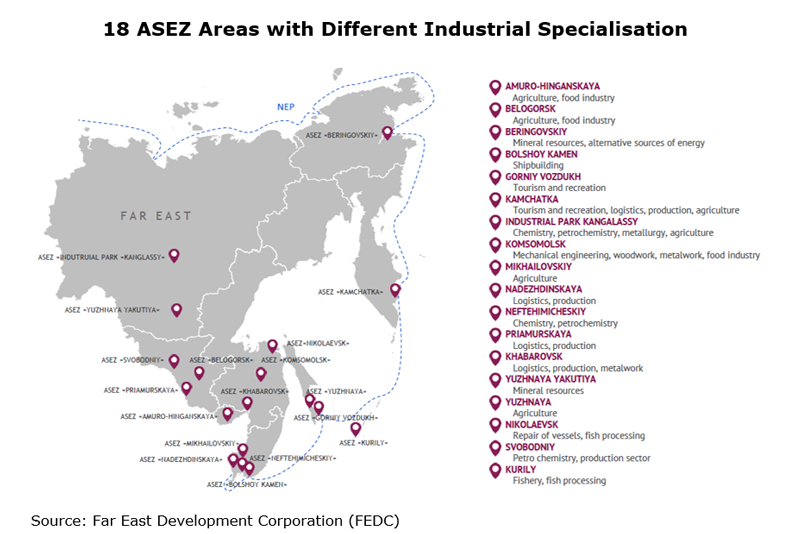

There are four dedicated Advanced Special Economic Zones (ASEZs) in the region – Kamchatka, Khabarovsk, Nadezhdinskaya and Priamurskaya – designed to bolster manufacturing, promote the development of the region’s logistics industry and encourage overseas players to set up a presence there. The aim is to attract export-oriented or import-substituting manufacturing industries into the region, and at the same time to develop into multimodal transport and logistics hubs.

These dedicated logistics zones are popular with local and overseas logistics players because of both their excellent multimodality and the government investment in roads and highways. The ASEZ Nadezhdinskaya, for example, is reported to have already attracted nearly 40 resident companies with a total investment of more than US$370 million. The public sector is planning to invest a further US$16 billion over the next decade to upgrade the zone’s business and social infrastructure, with the aim of attracting up to 300 companies and an additional US$200 billion in private investment.

Third-Party Logistics Opportunities

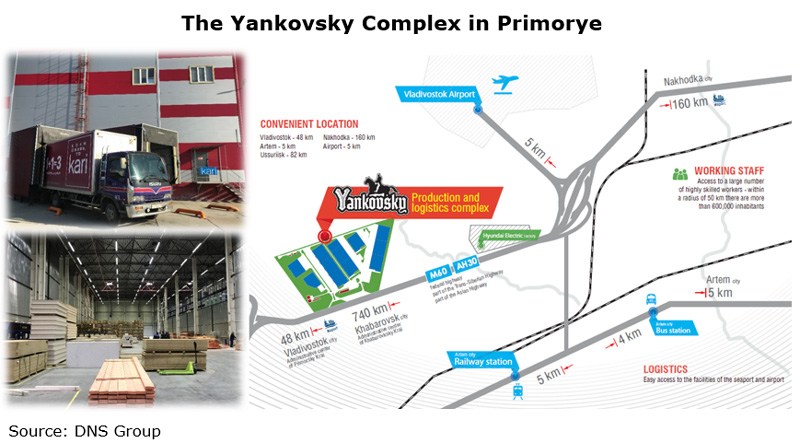

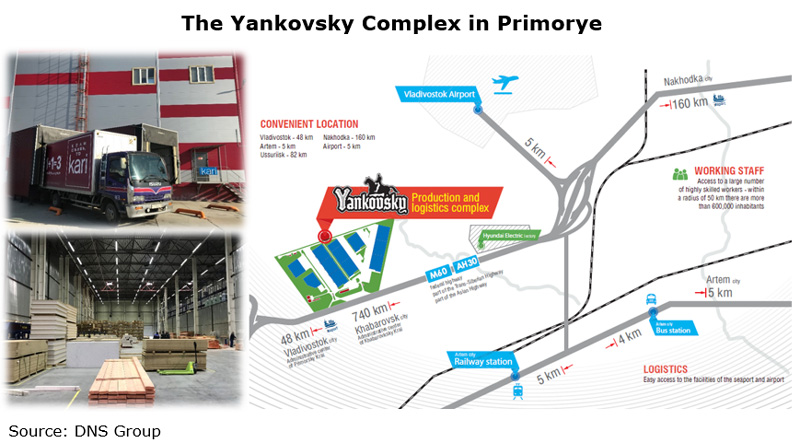

One business looking to cash in on the region’s logistics revolution is DNS Group (DNS), the second-largest consumer electronics retailer in Russia and a Free Port of Vladivostok (FPV) resident. It is one of the first to develop third-party logistics and warehousing capacities in the Russian Far East. In its Yankovsky complex in Primorye, DNS has developed a number of modern warehouses with production areas both for its own use and also for leasing, especially to businesses that are new to Russia. The complex has easy access to the loading stations for trucks heading to and from to the airport, seaport and railway station. Currently, most of the companies using it produce or warehouse for local markets.

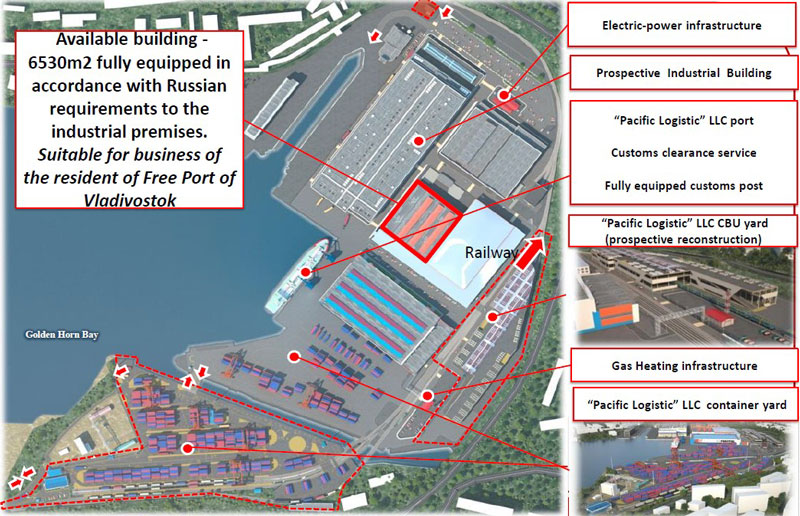

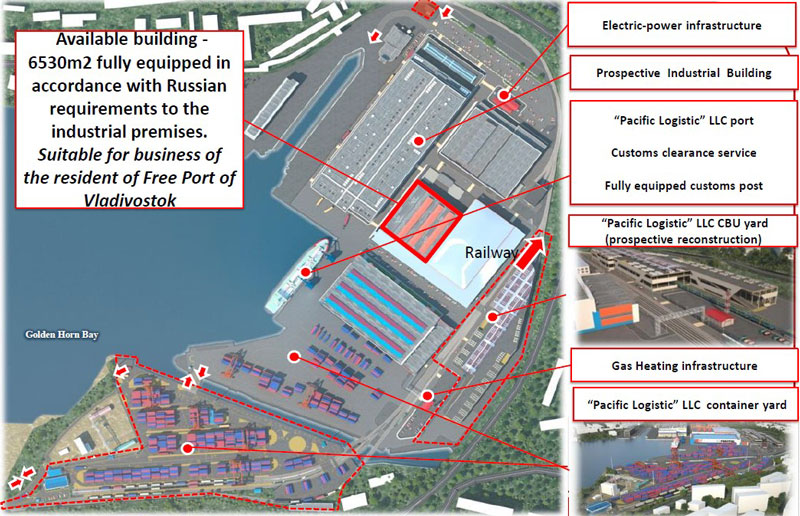

Another example is the industrial plant in the centre of Vladivostok where the Russian-Japanese joint venture MAZDA SOLLERS Manufacturing RUS makes cars and car engines. The facility, which is located right next to the Golden Horn Bay and connected to the Trans-Siberian Railway via extended tracks, is offering manufacturing space to companies whose products require seamless intermodal support for quality assurance and supply chain optimisation.

Source: MAZDA SOLLERS Manufacturing RUS

Editor's picks

Trending articles

The rise of the Russian Far East District (FEFD) as an attractive destination for investment in manufacturing is down to several factors - rich natural resources, abundant land, an upgraded infrastructure, unfettered access to the markets of the Eurasian European Union (EAEU[1]), and the availability of generous tax incentives. It is proving especially attractive to resource-intensive manufacturing industries, both upstream ones such as agriculture, aquaculture, forestry, petrochemicals and chemicals, and downstream like food processing, paper and pulp, rubber and plastics, electrical equipment, medicine and jewellery.

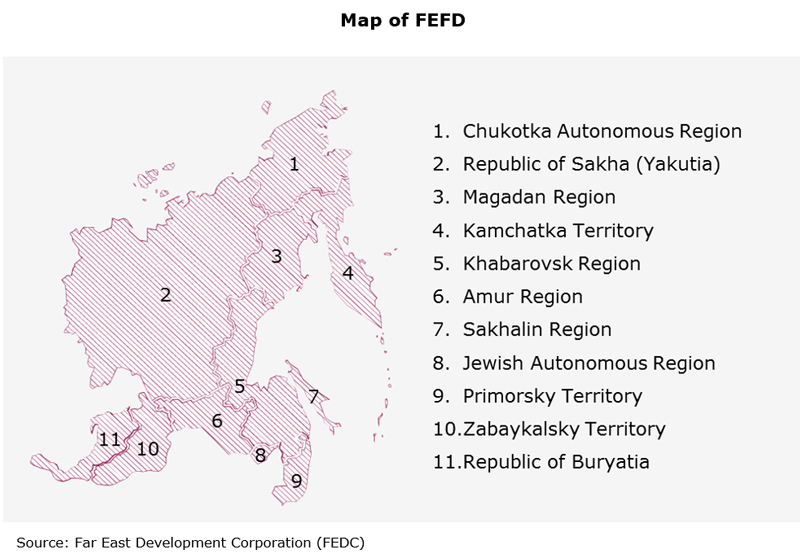

Expanding with Strategic Investment Vehicles

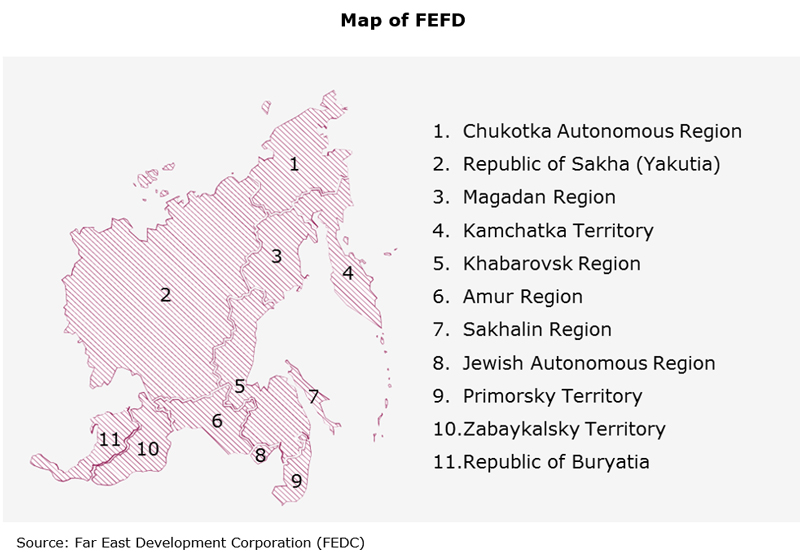

The FEFD is a Russian federal district which shares borders with Mongolia, China and North Korea. Since a recent restructuring, which saw its administrative capital move from Khabarovsk to Vladivostok, it has expanded to cover 11 so-called “subjects” (a collective name for areas variously labelled regions, territories and republics).[2]

Although it is home to less than seven million people, just 5% of Russia’s total population, it comprises one-third of the country’s land mass and contains major deposits of diamonds, oil and gas, gold, coal and polymetals. Its population enjoys a relatively high average monthly salary – in November 2018, it stood at RUB54,000 (US$810), 27% higher than the national average. This is largely down to the blossoming of the mining industry in Sakha and Sakhalin, and the flourishing of the logistics industry in Primorsky and Khabarovsk.

However, its development has suffered somewhat because of the rapid economic growth of western (or European) Russia, and in particular that of cities like Moscow and St Petersburg. That has led to a sustained migration of labour away from the FEFD, and an increasing dearth of infrastructure investment across the vast territory. These, in turn, have meant that the costs of labour and living in FEFD are higher than they might otherwise have been.

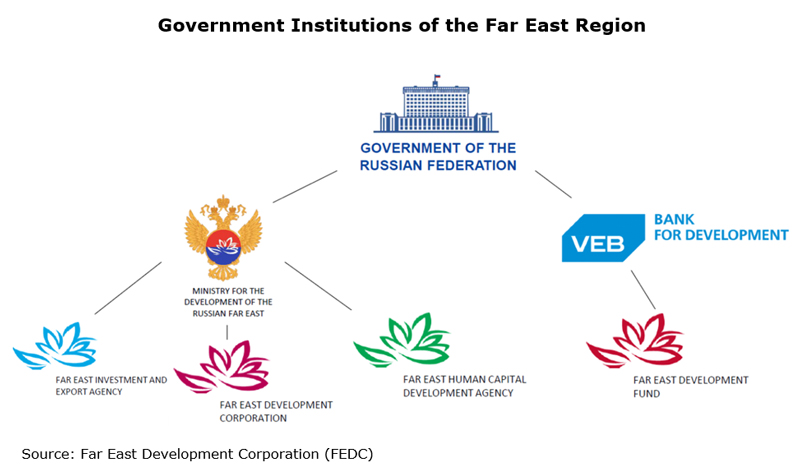

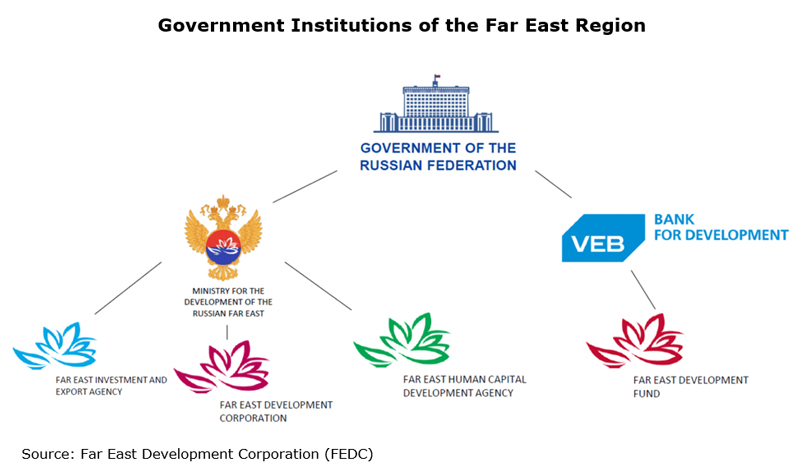

The Russian government has taken action to try to arrest this and make FEFD more attractive to both local and overseas investors. In the past five years, it has introduced more than 180 pieces of legislation and set up a ministry – the Ministry for the Development of Russian Far East – and four government agencies to accelerate infrastructure improvements and increase industrial capability in the FEFD. One of the most important initiatives was the establishment of the Far East Development Corporation (FEDC) which oversees the district’s Advanced Special Economic Zones (ASEZs) and Free Ports of Vladivostok (FPVs).

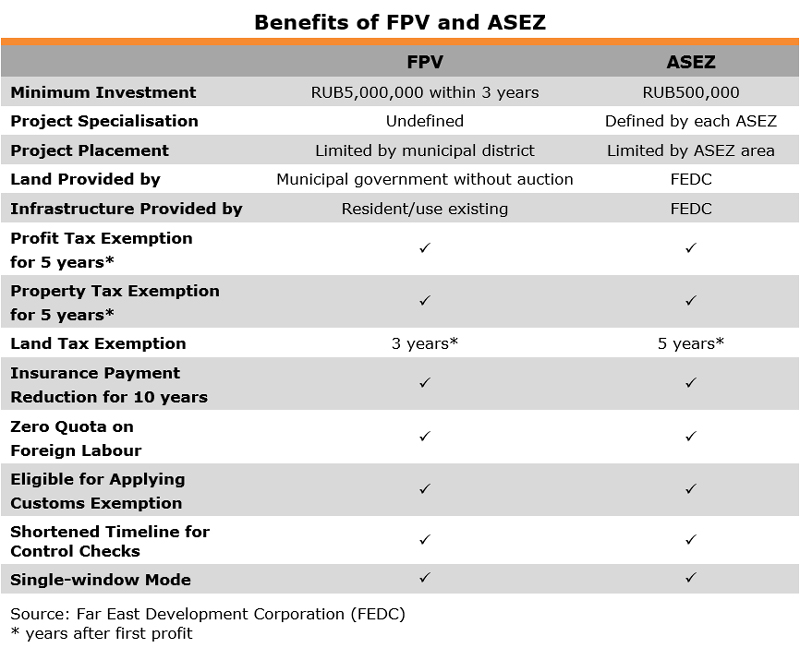

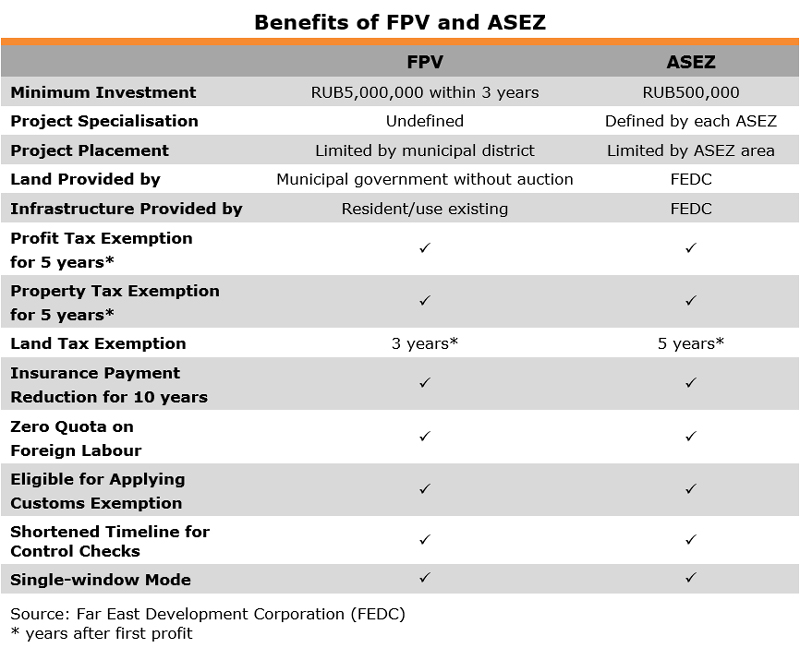

The ASEZs and FPVs offer generous tax perks and other preferential treatments, ranging from land use rights to administrative procedures, to try to encourage manufacturing investment.

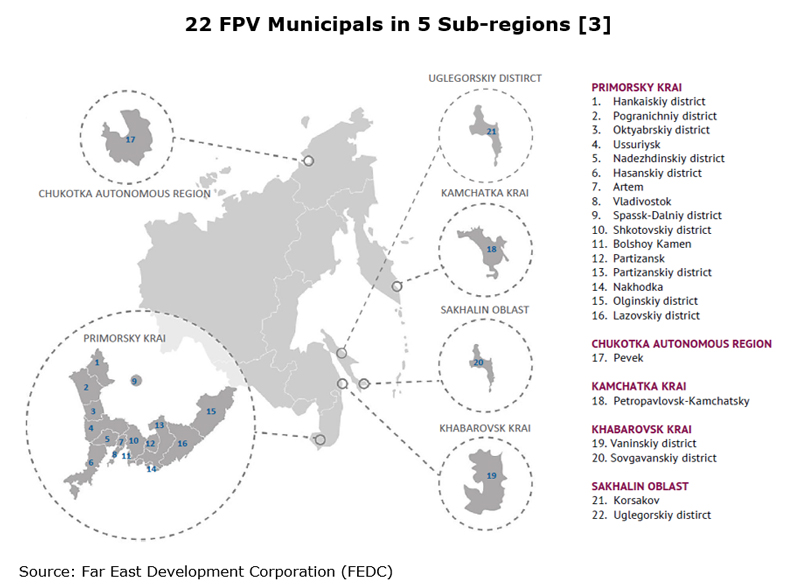

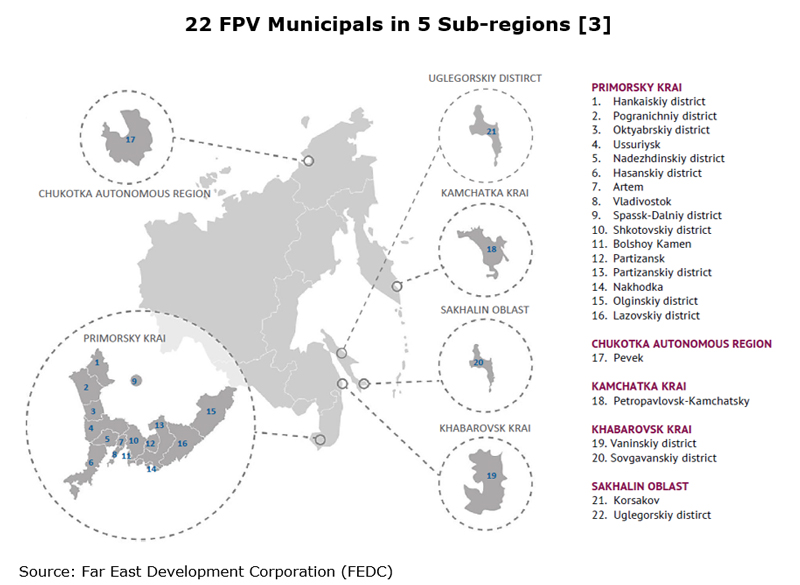

Currently, there are 22 FPV municipals operating in five sub-regions across FEFD and 18 ASEZ areas in nine of its 11 subjects. FPVs involve preferential status being given to companies within a municipal boundary, while an ASEZ is a designated plot (or plots) of land given over to a specific industrial specialisation, ranging from the processing of mineral, agriculture and aquaculture resources to services such as logistics and tourism.

These FPVs and ASEZs have so far concluded more than 1,200 agreements involving committed investment worth US$118 billion. About 10% of the businesses which have signed agreements are backed by foreign shareholders, more than half of which are Chinese. Japanese companies account for 13% of foreign shareholders, while South Korean businesses make up 12%. Real estate is the most popular sector for FPV businesses with a foreign shareholder, accounting for 23% of the total, followed by services (14%) and construction (11%). ASEZ investors, on the other hand, favour food, agriculture and construction.

More recently, amid the lingering Sino-US trade tension, the FPVs and ASEZs in FEFD have come to be considered not only as emerging manufacturing investment spots offering unfettered access to EAEU markets, but also as alternative sources of agricultural products affected by US tariffs. Some Chinese and Russian investors have, for example, already started soybean processing in the FEFD’s Amur Region and Jewish Autonomous Region, in order to supply the Chinese mainland market. They are also targeting the booming ASEAN demand for agricultural products, which is estimated to have been on a par with China’s since 2016.

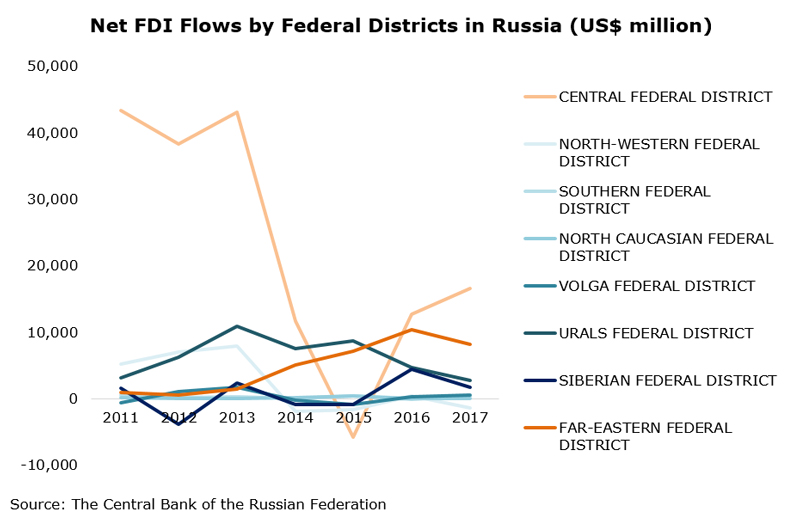

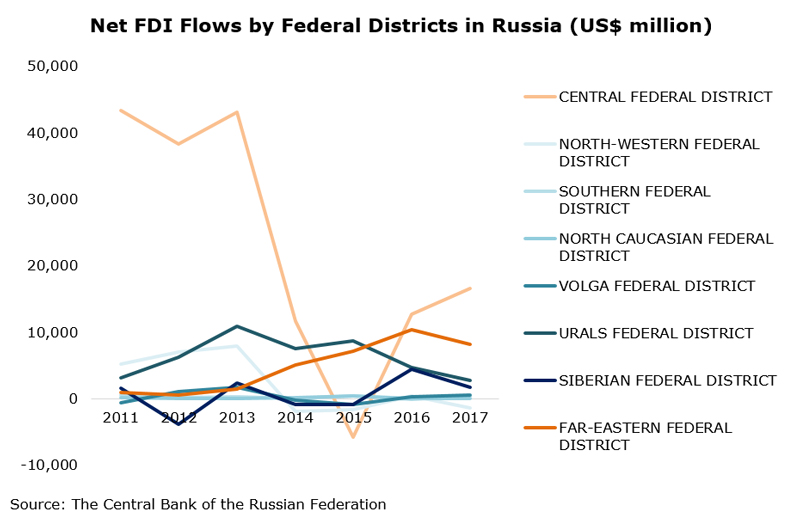

In an early sign of the success of the FPVs and ASEZs, the FEFD is estimated to have accounted for 25% of the nation’s FDI flows between 2012 and 2017. In 2017 alone, the region received the second highest amount of net FDI inflows, behind only the Central Federal District where Moscow acts as a powerful magnet for foreign investment and businesses.

Nurturing Homegrown R&D Talent

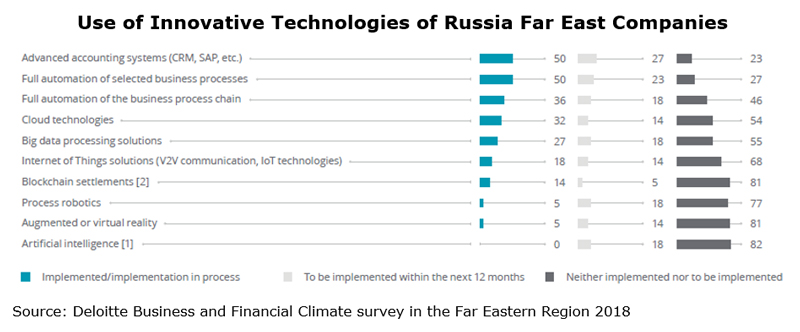

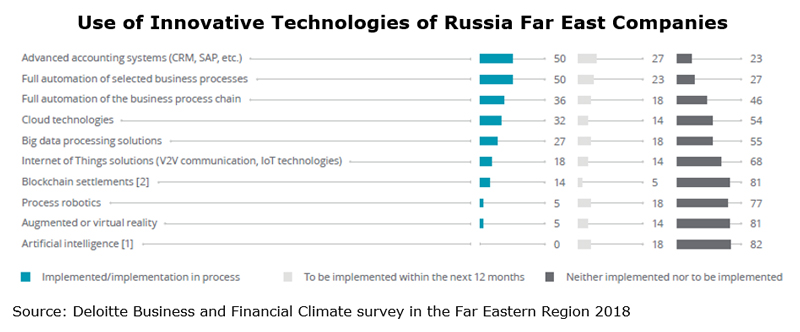

Because the FEFD has a small labour force, it is a suitable location for developing industries that rely on technology rather than cheap labour. Examples include manufacturers which can use technological advances in cloud computing, big data analytics, AI, the Internet of things (IoT) and robotics to develop smart factories or automated manufacturing.

It’s not just companies that are looking to adopt technology to take advantage of their presence in the FEFD. Local universities have been working hand-in-hand with the public and private sectors to develop talent. Leading examples include Rosatom State Atomic Energy Corporation (nuclear energy), Gazprom (oil and gas), Progress Arsenyev Aviation Company (military helicopters) and MAZDA SOLLERS (a Russian-Japanese car-making joint venture) which are already partnering with the Far East Federal University (FEFU).

To facilitate technology R&D and cultivate a start-up ecosystem, the Russian government has recently set up a Russky Technopark in the FEFU campus, which provides start-ups with subsidised office space and business-matching sessions with prospective investors.

In addition to developing local talent, Russia is looking for support from overseas to provide funding for R&D. With little sign of an immediate easing of Western sanctions, Russian technology owners may well have to increase their growing reliance on the Asian capital pool and financial market.

An example of this is the leading Russian petrochemical company, Gazprom Neftekhim Salavat, which showcased its manufacturing projects at the Asian Financial Forum 2019 (AFF). It sees Hong Kong as an ideal platform for bringing Asian investors and Russian project owners together to turn visions of collaboration into action.

As the Belt and Road Initiative (BRI) develops, more Russian companies and/or regional development agencies may turn to Asia for investment roadshows, while Hong Kong’s success as a free port and special administration region (SAR) could allow it to contribute to Russia’s own programme of SAR development. With Hong Kong on course to becoming a major innovation and technology hub under the Guangdong-Hong Kong-Macao Greater Bay Area (GHKM Bay Area) project, the territory is also ready for further partnerships with tech start-ups looking to grow their Asian market and/or reach out to Asian sources of funding.

[1] EAEU currently comprises five member states – Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia.

[2] The terms territory, region, area and republic are inherited from the Soviet Union and are now generally called “subjects” under the Ministry for the Development of the Russian Far East.

[3] The Russian terms “krai” and “oblast” can be loosely translated as “territory” and “region”.

Editor's picks

Trending articles

Historically icebound for 10 months of the year, global warming may have inadvertently opened trans-Arctic shipping lane.

With a growing number of container ships trialling the Northern Sea Route (NSR) this year, there is ever-increasing expectation that this previously largely inaccessible marine channel may emerge as a serious alternative to the Suez Canal, at present the primary conduit for Asia-Europe freight. It is, however, essential that the NSR is navigable by container ships, as such vessels account for about 98% of all consumer goods shipments across the world.

Of course, the NSR is not some newly discovered route. Although first successfully navigated in 1872, its freezing temperatures – due to the fact it runs wholly along the Russian Arctic coast – saw it deemed as largely impassable, with weather conditions previously putting it off-limits to shipping for 10 months of the year. Now, though, a combination of the increased demand on existing shipping lanes and the far milder weather conditions triggered by global warming have led to the viability of the route being reassessed.

Despite the changes in the local climate and improvements in marine technology, the NSR is still seen as off-limits to the massive Panamax vessels – which can carry up to 20,000 TEUs and make up much of the traffic that passes through the Suez Canal. For one thing, all container craft passing through the NSR need to have the way ahead cleared by an accompanying icebreaker vessel, with such ships not capable of driving through a wide enough route to accommodate the very largest freight-carrying ships. On top of that, the remote location and inhospitable environment make effecting rescues for stricken vessels along the NSR extremely difficult, while any large-scale oil leakages could be potentially environmentally catastrophic in this relatively pristine region.

The challenging nature of the route, however, has not deterred shipping lines from seriously considering its potential. In a pioneering move back in August, the Copenhagen-headquartered Maersk Line despatched one of its ships – the 3,600 TEU Venta Maersk – along the route, making it the first container ship scheduled to pass along the NSR.

On 23 August, the ship set sail from Vladivostok with a cargo of frozen fish destined for Busan, South Korea's largest port. On 28 September, it docked at St Petersburg laden with Korean consumer electronics, after having successfully negotiated the challenges of the NSR. Tellingly, despite being accompanied by an icebreaker, the container vessel never had to call upon its services and passed through the icy waterway entirely unaided.

On the upside, the entire voyage was completed in 10 days less than the typical time taken to reach the same ports via the Suez Canal. On the downside, the increased technical requirements and other related costs meant that the per TEU rate for shipments passing through the NSR is considerably higher than those made via the more traditional route.

While, at present, it may seem there is little likelihood of many scheduled container-ship services adopting the route, the costs and the associated challenges have proven to be no bar to the increasing number of crude oil and LNG tankers that now work the route, largely on account of their more robust construction, wider profit margins and more specific geographic necessity. Indeed, in the first eight months of this year, the volume of such cargo shipped along the route grew by 80% to 10 million tonnes, with crude oil accounting for 45% of the total.

Taking the lead on the tanker front is Saint Petersburg-based SovComFlot, with its fleet having competed more than 100 NSR runs already this year. Back in June, the shipping company announced it had entered into a strategic partnership with Novatek, one of Russia's largest independent gas producers, which will see SovComFlot charged with transporting LNG from a number of drilling sites around the Arctic region, including Sabatta, a gas-field that lies almost exactly at the mid-point of the NSR.

Overall, Russia sees the greater exploitation of the NSR as something of a priority, especially as it has been designated as one of the key development pillars of the Far Eastern Federal District. It is also seen as a catalyst for boosting trade between Europe and the Asia-Pacific region. Indeed, with climate change expected to have continuing impact along the NSR route as a whole, it is anticipated that, ultimately, the route will remain sufficiently free of ice all year round for regular commercial shipping services to be scheduled in.

With both SovComFlot and Maersk having led the way to a certain degree, it is now expected that the Shanghai-headquartered COSCO shipping group will step up its own services along the NSR, a move that has been directly mandated by China's central government in line with its growing interests in the Arctic region. In order to facilitate the inevitable rise in traffic this will trigger, it is now seen as essential to develop the existing seaports along the Eastern Siberian coastline.

Given the mutual interests involved, such developments are likely to herald a major new phase of Sino-Russian co-operation. Indeed, a number of commentators have been quick to point out that such joint initiatives would tie in neatly with both the aims of China's Belt and Road Initiative and the domestic priorities laid down by the Russian Federal Government.

Leonid Orlov, Moscow Consultant

Editor's picks

Trending articles

To reduce its dependence on oil and gas and Western technology, Russia is rapidly developing its technology and innovation sector and positioning it as a key component in the process of economic diversification. The Russian government has introduced a wide array of incentives and a state-of-the-art infrastructure to support the sector, but it also needs foreign participation in terms of investment and know-how transfer in order to build the inclusive and sustainable growth which it considers the key to success. Coinciding as this does with the current Belt and Road Initiative (BRI) and Guangdong-Hong Kong-Macau Bay Area development, Russia’s technology drive gives Hong Kong the opportunity to develop a closer and broader technology co-operation partnership with the country. This in turn could help pave Hong Kong’s path towards becoming a global technology and innovation hub.

Russia’s New Growth Engine

Russia sees technology and innovation as a new engine of economic growth and a key component in its attempt to cut the country’s reliance on the energy sector which accounted for more than half of the country’s exports and nearly 40% of the federal budget revenues in 2017. The Western-led sanctions on Russia, which followed the country’s annexation of Crimea in 2014, included bans on selling technologies, especially in the military and energy sectors. In response, the Kremlin has encouraged Russian companies to develop home-grown technological solutions.

More than 15 billion rubles (US$250 million) were made available from the state budget to develop alternatives to Western technologies. The Ministry of Economic Development created the Federal Targeted Programme for Research and Development in Priority Areas of Development of the Russian Scientific and Technological Complex for 2014-2020 (The 2014-2020 Programme), which was designed to incentivise research institutes and private companies to develop homemade equivalents to imported tech. The aim was to make Russia a world-class R&D leader with a competitive R&D ecosystem.

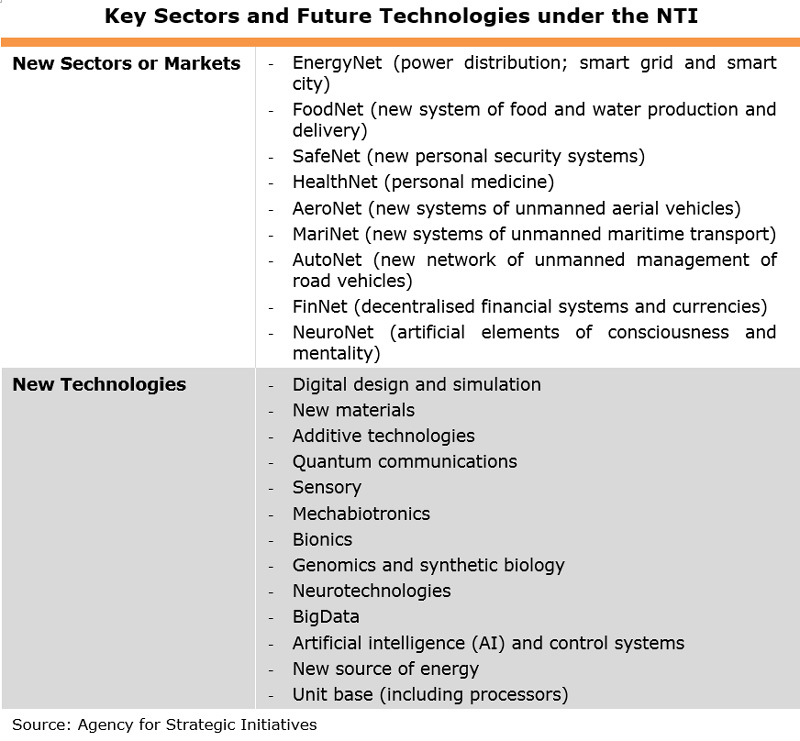

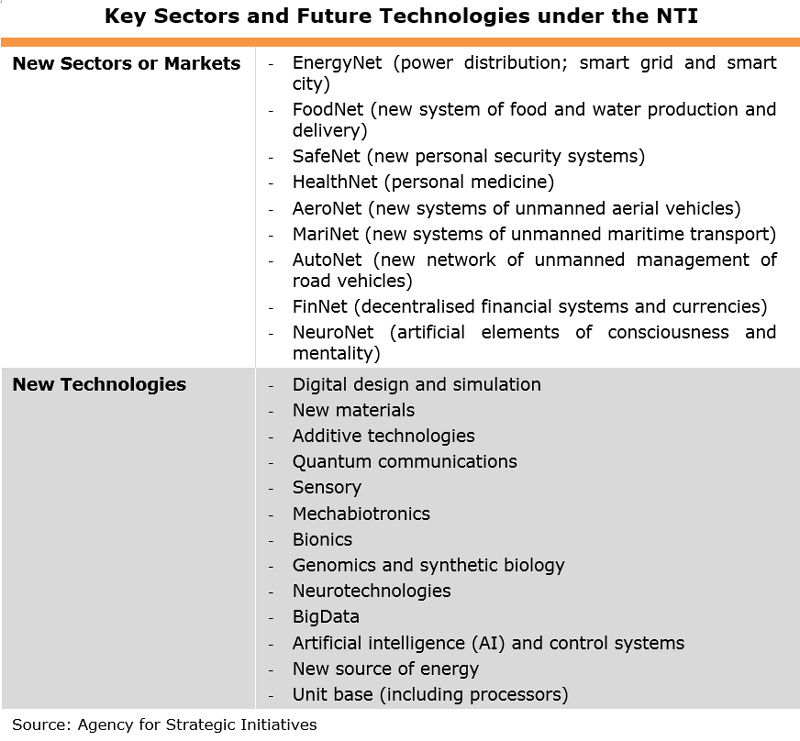

In December 2014, the country’s president Vladimir Putin launched the National Technology Initiative (NTI) setting out the need for innovation solutions to protect Russia’s national security and quality of life. He heralded the advent of a new technological order in the next 10 to 15 years and called for the creation of an environment which would make Russia a global technological leader by 2035.

The NTI indicates new sectors and markets for Russian tech companies to target, and looks at the main demand factors, key market niches and possible types of products and services to fill these niches. It also identifies a number of key technologies which will lead to the creation of new products and services, and set out measures, including institutional, financial and research tools, which will stimulate and support the development of domestic and global champions in these new sectors.

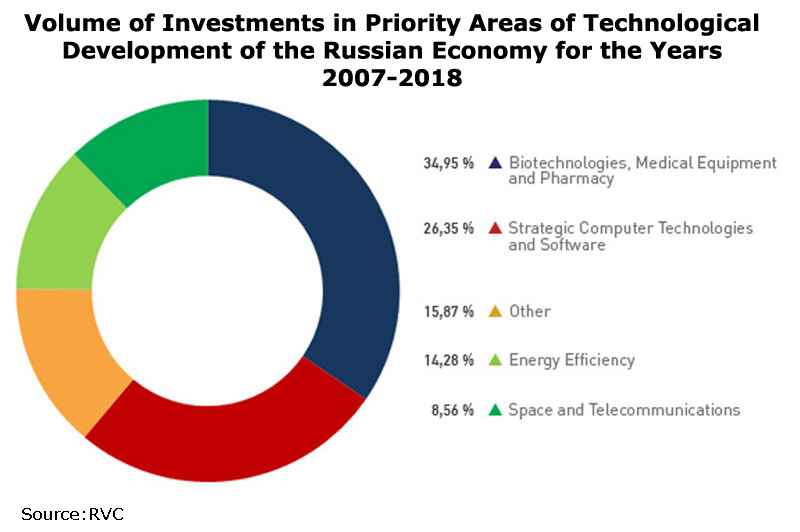

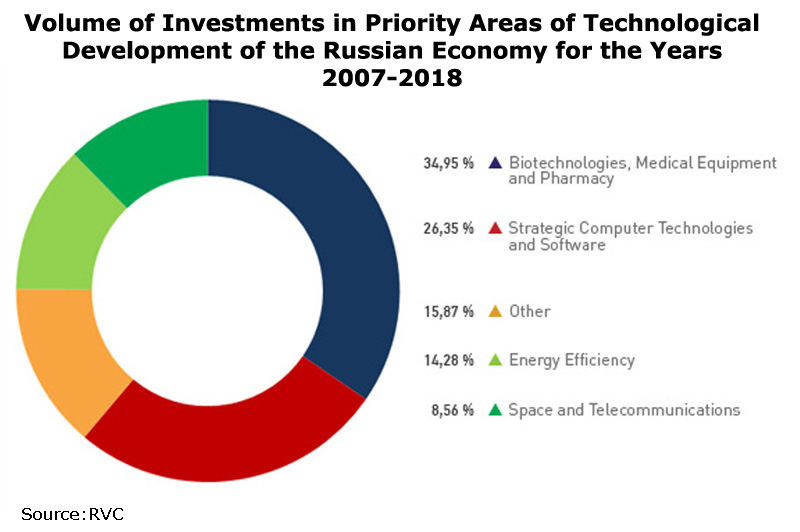

One of the aims of the NTI is to create the conditions in which private investment in such forms as joint investment, mutual funds, crowd-funding and crowd-investing can begin to take over the funding of Russia’s innovation and technology sector from pubic finance. A key tool in the attempt to achieve this is the Russian Venture Company (RVC) – a publicly-owned fund of funds [1] set up in 2006 to develop Russia’s venture capital industry and provide support to the country’s high-tech sector. As of 2018, there are 26 RVC-backed funds with a total valuation of 36 billion rubles (US$0.6 billion) in operation, supporting 225 approved investment projects across a variety of priority sectors, including: (i) biotechnology, medical equipment and pharmaceuticals; (ii) IT such as computer technologies and software development; (iii) energy efficiency; and (iv) space and telecommunications.

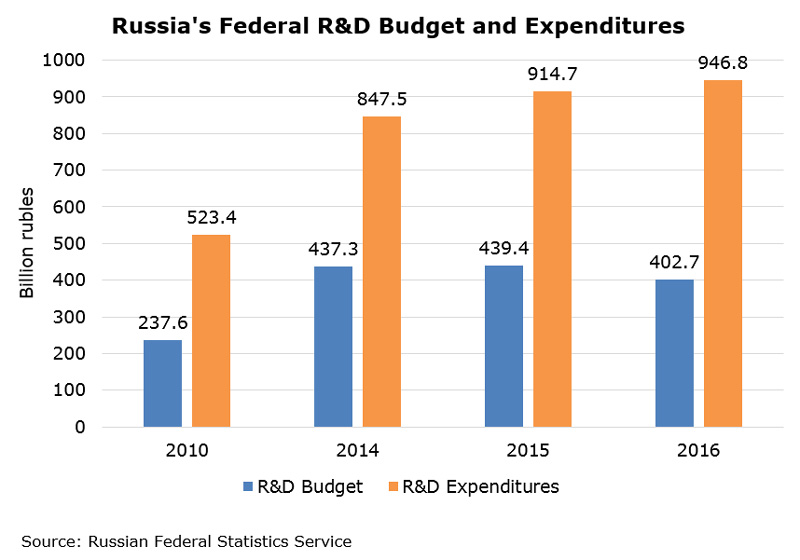

The Russian government further set out its blueprint for sustained technology-driven economic growth in its Strategy for the Scientific and Technological Development of the Russian Federation, published in 2016. This policy document pointed to the need for Russia to import strategic technologies to strengthen the nation’s technological capacity and to increase the share of GDP on R&D.

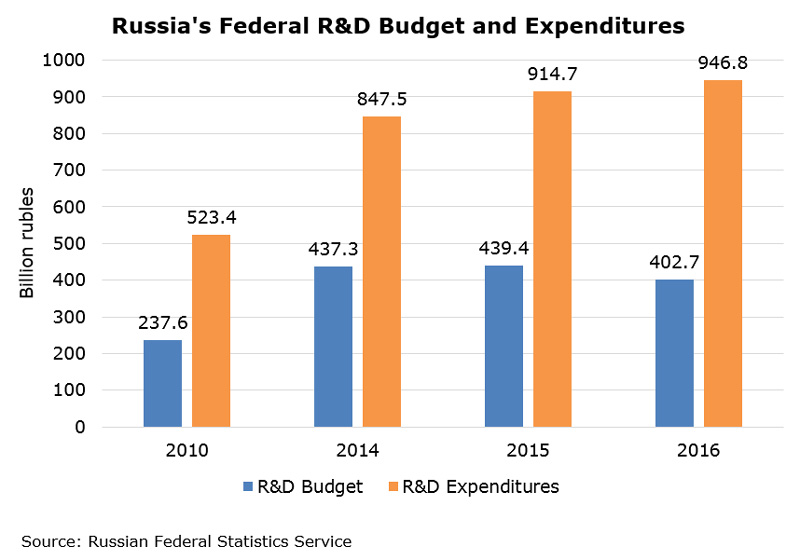

In recent years, increases in federal spending on R&D have become even more vital for technological innovation in Russia as the country’s venture capital industry has been crippled by the effect of international economic sanctions. Between 2010 and 2016, federal expenditure on R&D rose by nearly 70%. At the same time, FDI inflows into Russia have begun to grow as private investors regain confidence in the Russia economy. Last year, foreign investors poured US$11.5 billion into professional, scientific and technical activities, making it Russia’s fifth-largest FDI category with 7.7% of the total FDI inflows. That was up from just US$205 million in 2012.

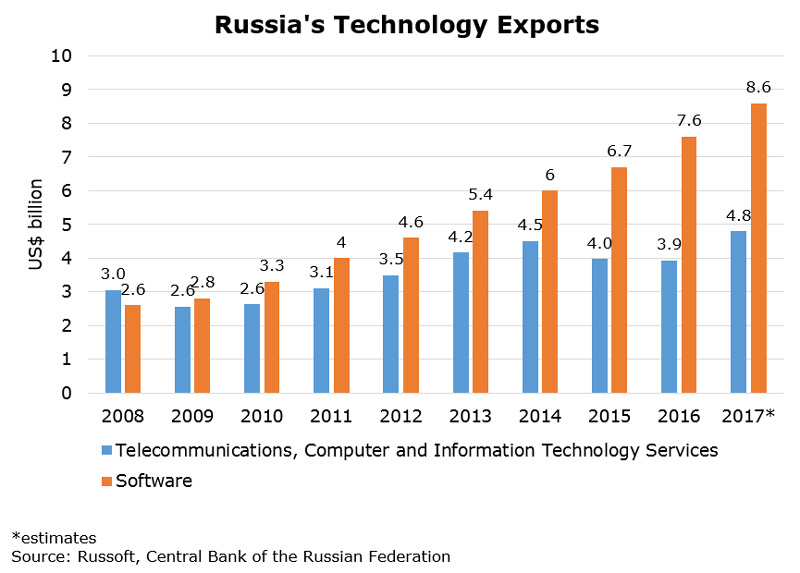

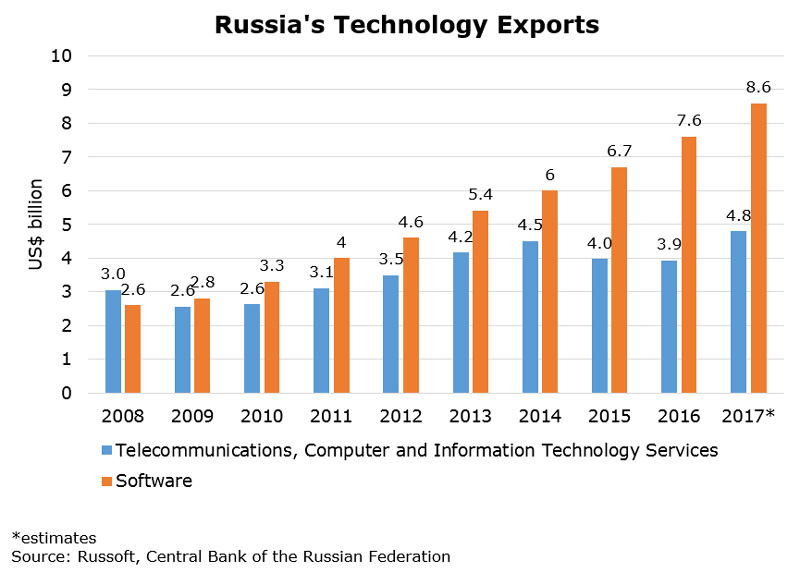

With technology and innovation increasingly becoming a new engine of economic growth, the Russian Ministry of Economic Development expects the country’s high-tech exports to grow to about 3.5 times their current level by 2020, reaching 240-330 billion rubles (US$4-6 billion), and then to rise further to 400-670 billion rubles (or US$7-11 billion) by 2025. Only time will tell if these goals could be realised. However, the recent growth of Russia’s technology exports (especially software, which reached a record high in 2017, and telecommunication, computer and IT services, which surpassed their pre-crisis levels last year) is widely regarded as the first fruit of the boost the country has given to its technology sector.

A Vibrant Start-up Scene

There has been a dearth in venture funding available to Russian start-ups in recent years, due in part to international economic sanctions. In 2017, there were no listed US investors at all in Russian start-ups – a stark change from 2012, when US$400 million was put in by US investors. Despite that, Russia has maintained a vibrant start-up scene, laying a solid foundation for its technology and innovation ecosystem to thrive. As the 2018 Inc. 5000 Europe [2] list, which tracks the three-year revenue growth of private companies, shows, Russia is one of the best European destinations for fast-growing companies. Moscow was named the second-best European city overall with St. Petersburg in ninth place, the two cities accounting respectively for 171 and 70 of the companies on the list.

Examples of fast-growing private companies in Russia include Moscow-based manufacturer Varmega and food and beverage firm Kompaniya Optima, which both saw their revenues increase by about 2,000% between 2013 and 2016.

Some local Russian tech companies have already begun to take on their foreign rivals in terms of market share. The homegrown internet behemoth Yandex reported a 24% growth in sales to 94 billion rubles (US$1.6 billion) in 2017 and is estimated to have been responsible for more than half of the country’s online searches, overtaking all foreign search engines.

To help create a technology and innovation ecosystem filled with vibrant start-ups, the Russian government has been strengthening the country’s tech-related infrastructure. This has included the establishment of more than 50 operating science and technology parks throughout the country, aimed at encouraging local and foreign high-tech companies to localise the R&D, production and application of their cutting-edge technologies.

Among the most active are Technopolis Moscow – the flagship project of innovation infrastructures in the Russian capital and home to some 80 high-tech companies including the Dutch micro-electro-mechanical systems (MEMs) producer Mapper Lithography and the European energy management giant Schneider Electric – and the Science Park of St. Petersburg, which has become one of the city’s key tools for the development of its innovation policy, implementing projects along the whole chain of innovation development from start-ups to industry and business incubation to cluster development.

Source: Technopolis Moscow

As well as providing physical infrastructures and favourable tax incentives for high-tech companies, some of these science and technology parks have also implemented their own incubators. One example of this is the Ingria Business Incubator of the Science Park of St. Petersburg, first launched in 2008 as a pilot project and now one of the country’s most famous and successful business incubators.

Ingria has attracted investment worth some 1.5 billion rubles (US$24 million). Riding on the back of its success, the Science Park of St. Petersburg has also created a Cluster Development Centre, an Engineering Centre (API) and a Prototype Development Centre to support and service its residents along the whole chain of development. Some of its successful exits, such as the cloud-based business management solutions provider FreshOffice, have successfully entered the international market by opening offices, for example, in ASEAN countries.

The Russian government has also spent a great deal of time and money upgrading and expanding the Moscow-based Skolkovo Innovation Centre. One of the largest technoparks in Eastern Europe and home to more than 1,800 start-ups, Skolkovo is a state-of-the-art high-tech hub which is increasingly becoming a hotspot for venture capitalists focusing on fields like bio-medicine, energy efficiency and strategic computer, nuclear and space technologies.

In line with the NTI and other tech-related initiatives, Skolkovo not only helps start-ups to accelerate and scale up in the local Russian market, but encourage them to make inroads into the international marketplace. In collaboration with an extensive partner network of more than 60 organisations in 17 countries and well-known international accelerators such as Y Combinator, Plug and Play Tech Center, 500 Startups and SOSV, more than 200 Skolkovo residents have so far gained market access in more than 70 countries worldwide, reporting international sales of over 4.2 billion rubles (US$66 million).

Skolkovo orgainises Startup Village, the largest start-up conference for technology entrepreneurs in Russia and the Commonwealth of Independent States (CIS), and the annual Open Innovations forum to bolster the development and commercialisation of advanced technologies, promotion of global technology brands and creation of new tools for international co-operation in the field of innovation. It has also been active in forging partnerships with foreign counterparts to help its earlier-stage start-ups with investment, incubators and accelerators, and market access.

One recent successful example of this is the joint venture between Skolkovo and China’s Cybernaut Investment Group to create a joint Sino-Russian business incubator in Skolkovo, a robotics center in mainland China, a US$200 million venture fund and a joint acceleration program to invest in Skolkovo resident companies that specialise in IT, robotics, space and telecommunication technologies to enter the Chinese mainland market.

A number of Skolkovo residents have already successfully launched products and projects on the Chinese mainland with their counterparts there. One example of this is Optogard Nanotech which is, in co-operation with Shandong Trustpipe Industry, developing a laser-plasma technology for metals and alloys in pipe production in the Shandong province. Another is the content delivery service provider CDNvideo, which has had great success helping its Chinese clients to deliver their internet and video content across the globe and recently sold a controlling stake to the Shenzhen-listed Wangsu Science & Technology.

President Putin has described China’s BRI as "innovative” and is keen to step up efforts to align the BRI with the development programs of the Russia-led Eurasian Economic Union (EAEU). Given this policy approach, it is unsurprising that the two economies are not only making progress in promoting co-operation in traditional areas such as energy, logistics, manufacturing production and agriculture, but also in new areas such as the digital economy and technology and innovation.

A Growing Role for Hong Kong

Skolkovo is already making good use of Hong Kong as a premier convention and exhibition centre in Asia. It is reaching out to prospective counterparts in Asia and beyond, by attending and showcasing its offerings in the city’s flagship events such the Asian Financial Forum (AFF) and the HKTDC International ICT Expo. Some companies such as the Estonia-based digital security solution provider DigiFlak, have reportedly started production in the region, while others have found franchising partners or opened offices in Hong Kong.

Taking note of Hong Kong’s pivotal role as a technology marketplace in Asia and its vision to become a global technology and innovation hub, the Moscow School of Management Skolkovo, a new graduate business school and research institution of Skolkovo, has teamed up with the Hong Kong University of Science and Technology (HKUST) to roll out the world’s first Executive MBA (EMBA) Programme devoted to the development of Belt and Road in Eurasia with a focus on innovation. With Hong Kong keen to move from being a renowned technology marketplace to a global technology and innovation hub, it is rolling out the red carpet for Russian technology and innovation companies. The city has ample opportunities for tech-related firms including start-ups, technology owners, patent holders and venture capitalists to exploit, under the umbrellas of the BRI and the Guangdong-Hong Kong-Macau Bay Area initiatives.

The Hong Kong/Shenzhen Innovation and Technology Park, set within the 87-hectare Lok Ma Chau Loop is a good example of the opportunities available. Occupying a strategic location in Hong Kong bordering Shenzhen, the Park offers four times as much land area as Hong Kong Science Park. This not only gives Hong Kong’s innovation and technology ecosystem much more space to welcome Russian technology and innovation companies, but also allows the city to offer Russian R&D companies the opportunity to leverage the competitive advantages of both Hong Kong and Shenzhen in innovation and technology and accelerate their access to the mainland market.

Russian technology companies can use the Park to tap the supply chain, manufacturing capabilities and talent pool across the border in Shenzhen, while at the same time enjoying the advantages of being in Hong Kong – a professionally managed superstructure, proximity to world-class universities and research institutions, and a top-notch business support service ecosystem and financial infrastructure.

The city’s robust IP protection regime, arbitration capabilities and professional licensing, franchising and IP registration services also make it an ideal launchpad for Russian start-ups looking to exploit the ever-growing markets for cutting-edge technologies in Asia.

As a renowned international financial centre in which about half of the top 100 global financial technology (FinTech) companies currently operate, Hong Kong is a useful partner for Russia companies specialising in this fast-growing field. Hong Kong can act as a landing pad for Russian FinTechs eyeing regional opportunities, a market for Russian FinTechs providing business-to-business (B2B) services and a platform for Russian FinTechs seeking Asian expansion.

Source: ibox

A good case in point is the Russian FinTech start-up ibox which has been pushing its mobile point of sales (mPoS) solutions hard to become a force in Southeast Asia with a holding company situated in Hong Kong.

Hong Kong’s ability to act as a capital-raising and business platform for Russian companies was strengthened in 2016 when the Hong Kong Stock Exchange (HKEx) approved Russia as an acceptable jurisdiction of incorporation for listing applicants and the Hong Kong-Russian Comprehensive Double Taxation Agreement (CDTA) came into force.

In the near future, it is expected that the far-reaching Guangdong-Hong Kong-Macau Bay Area development will see Hong Kong grow into a global innovation hub, attracting more tech-savvy companies from Guangdong and abroad to capitalise on the city’s advantages such as free flow of information and capital, extensive international market networks, and sound corporate management.

As the largest and most advanced economy in the 11-city innovation-driven economic cluster in Southern China, Hong Kong is an ideal bridgehead for Russia companies looking to gain access to this new center of innovation and technology in Asia.

[1] The RVC capital fund portfolio includes funds for the early stages, and seed funds, special-purpose, capital funds and supporting funds for the infrastructure and service projects of the technological entrepreneurship market.

[2] The Inc. 5000 Europe list of the fastest-growing companies recognises the innovative achievements of European companies in generating sustainable growth and jobs.

470 Views

470 Views