Central and Eastern Europe

Thursday 25 April 2019 (Beijing) – It was announced today that 27 global institutions have signed up to a set of voluntary principles – the Green Investment Principles (GIP) for the Belt and Road -- to promote green investment in the Belt &Road region.

The announcement was made at the GIP signing ceremony as part of the Financial Connectivity Forum organized by the People’s Bank of China (the Central Bank) and the Ministry of Finance in Beijing during the second Belt and Road High-level Forum. Deputy Governor Chen Yulu from the People’s Bank of China attended the GIP signing ceremony.

Chen Yulu, Deputy Governor of the People’s Bank of China

As a mandate from the China-UK Economic and Financial Dialogue in 2017, the Green Finance Committee of China Society for Finance and Banking and the City of London Corporation’s Green Finance Initiative led the initiative to develop the GIP, which was first published in London in November 2018. The World Economic Forum, UNPRI, Belt & Road Bankers Roundtable, the Green Belt and Road Investor Alliance and the Paulson Institute are also part of the drafting group. A full list of the principles is provided at the bottom of this release.

Building on existing responsible and ESG investment initiatives, the GIP aims to incorporate low-carbon and sustainable development practices into investment projects in Belt and Road countries, which will host the majority of the world’s infrastructure investments in coming decades.

Since its launch five months ago, the GIP has received strong backing from the global financial industry, including commercial banks, development banks, institutional investors, stock exchanges and other stakeholders that invest or help mobilize investment in the Belt and Road. As of April 25, 2019, twenty-seven institutions have signed up to the GIP. These institutions include (in alphabetical order):

Agricultural Bank of China, Agricultural Development Bank of China, Al Hilal Bank, Astana International Exchange, Bank of China, Bank of East Asia, China Construction Bank, China Development Bank, China International Contractors Association, China International Capital Corporation, Crédit Agricole-CIB, DBS Bank, Deutsche Bank, Export-Import Bank of China, First Abu Dhabi Bank, Habib Bank of Pakistan, Hong Kong Exchanges and Clearing, Industrial and Commercial Bank of China, Industrial Bank, Khan Bank, Luxembourg Stock Exchange, Mizuho Bank, Natixis Bank, Silk Road Fund, Standard Chartered Bank, Trade and Development Bank of Mongolia and UBS Group.

These signatories include all major banks from China that invest in the Belt & Road region and some of the largest financial institutions from (in alphabetical order) France, Germany, Hong Kong, Japan, Kazakhstan, Luxembourg, Mongolia, Pakistan, Singapore, Switzerland, United Arab Emirates and the United Kingdom. Several service providers, including Deloitte, Ernst & Young, KPMG and PWC, have also expressed their support for the GIP.

Ma Jun, Chairman of China’s Green Finance Committee, announced at the GIP signing ceremony that a Secretariat would be established to support future work of the GIP. The GIP Secretariat will work on expanding the membership, the development of implementation tools and case studies, a green project database for the Belt & Road, as well as compiling the progress report.

Chen Yulu, Deputy Governor of the People’s Bank of China, said at the signing ceremony: “The financial institutions represented here today are the leading institutions of green investment for the Belt and Road. I hope that all signatories can seize the great opportunity of the BRI, and actively promote the GIP and enhance their capacity for green investment.”

Dr. Ma Jun said: “The majority of global infrastructure investment in the coming decades will be in the Belt and Road region and they will have a significant impact on the implementation of the Paris Agreement and UN Sustainable Development Goals. The aim of the GIP is to ensure that environmental friendliness, climate resilience, and social inclusiveness are built into new investment projects in the Belt and Road.”

Ma Jun, Chairman of China Green Finance Committee

Catherine McGuinness, Chair of Policy at City of London Corporation commented: “While there is some way to go to ensuring the Belt and Road is truly green, today’s announcement is another step in the right direction, and a powerful statement of intent from financial firms in China, the UK and across the world.”

Catherine McGuinness, Chair of Policy at City of London Corporation

Family photo of major GIP Signatories

David Aikman, Chief Representative Officer of China and Member of the Executive Committee, World Economic Forum, addressed the importance of making GIP an opportunity for green transformation in the region and said: “It will be a shared opportunity for inter-connectivity, environmental friendliness and economic development through green investment in many countries around the world.”

Signatories also expressed their commitment to greening their investment practices with the implementation of GIP. “Business and economic ties between China, Europe, and BRI countries continue to strengthen”, said Werner Steinmueller, Deutsche Bank Management Board Member and Chief Executive Officer for Asia Pacific. “We are one of the most active foreign banks participating in BRI with full corporate and investment banking offerings along the route. By committing to the GIP, we are pledging that we will not only help steer BRI’s open collaboration across countries from China to Europe, but also strive to ensure these projects are as sustainable as possible.”

Gu Shu, President of Industrial and Commercial Bank of China, commented: “Green investments play a critical role in addressing environmental and climate challenges along the Belt and Road. ICBC has participated actively in the drafting of the GIP. We have also invited BRBR members to sign up to the GIP and integrate environmental factors into the BRI-related financing decisions, operations, product development and risk management.”

Gu Shu, President of Industrial and Commercial Bank of China

Bill Winters, Group Chief Executive of Standard Chartered PLC, stated: “We have been supporting our clients in managing their environmental and social risks for decades and are committed to working with all parties to implement the Green Investment Principles and contribute to commerce and prosperity across the Belt and Road markets.”

Benjamin Hung Pi Cheng, Regional CEO of Greater China & North Asia, Standard Chartered

Philippe Brassac, CEO of Crédit Agricole S.A and the Chairman of Crédit Agricole CIB, said: “Today, we reaffirm our ambition to be your long-term banking partner for your energy transition projects. A partner that is both realistic and demanding concerning the climate.”

“As China’s development finance institution and its major bank for the Belt and Road, the China Development Bank will stay committed to green finance, implement green investment principles, increase the provision of green finance, and grow the capacity for green development, to contribute to sustainable economic and social development along the Belt and Road”, said Hu Zhirong, Director of International Finance Bureau of China Development Bank.

Huang Liangbo, Vice President of Export-Import Bank of China, said: “To cater to the needs of the BRI participating parties to conserve resources, protect the environment and cope with climate change, the Export-Import Bank of China has been diversifying its financial products and services related to green projects, and played a major role in investing and financing green infrastructures.”

Lin Jingzhen, Vice President of Bank of China, said: “By signing up to the GIPs, it marks a milestone for Bank of China to integrate green development strategy into our efforts of supporting the construction of the Belt and Road ‘financial artery’. We look forward to working with international counterparts to foster the green and sustainable development along the Belt and Road.”

Qian Wenhui, President of Agricultural Development Bank of China, said: “Agricultural Development Bank of China will gather forces from all sides and assist domestic agriculture-related enterprise and projects to participate in the Belt and Road green investments.”

Tao Yiping, President of Industrial Bank, commented: “By proactively supporting the low-carbon, green and sustainable development of countries along the Belt and Road, GIP will support global financial institutions to establish more extensive and intensive corporations within multilateral frameworks and to increase environmental and social risk management ability.”

Xie Duo, Chairman of the Silk Road Fund, commented: “The Silk Road Fund, being a medium to long-term development and investment fund to support the BRI, is committed to implementing and promoting green investment philosophy, and dedicated to building a green Silk Road.”

Muhammad Aurangzeb, President and CEO of Habib Bank of Pakistan, said: “It is a great initiative taken by China Green Finance Committee and City of London for this GIP signing. As Pakistan’s largest Bank, and the largest executor of CPEC related financing in Pakistan, HBL is positioned to play an integral role towards a greener CPEC, with the ultimate goal of a greener BRI.”

Tim Bennett, CEO of Astana International Exchange, said: “The sign up to the GIP emphasizes the regional perspective of AIX to support infrastructure and economic development in Kazakhstan and in the region in accordance with environmentally and socially friendly international practices.”

Abdulhamid Saeed, Group Chief Executive Officer of First Abu Dhabi Bank, stated: “By becoming one of the first signatories to the GIP, we intend to take a more active role in the Belt and Road Initiative and in supporting global efforts to promote green investments within the UAE and beyond.”

For more information, please contact:

CHENG Lin

China Coordinator of the GIP, China Green Finance Committee

Tel: +86 (10) 8302 1702

Email: lin.cheng@greenfinance.org.cn

Simon Horner

Head of Policy and Innovation, City of London

Tel: +44 (0) 7721 977119

Email: simon.horner@cityoflondon.gov.uk

ANNEX: GREEN INVESTMENT PRINCIPLES FOR THE BELT AND ROAD

Principle 1: Embedding sustainability into corporate governance

We will embed sustainability into our corporate strategy and organisational culture. Our boards and senior management will exercise oversight of sustainability-related risks and opportunities, set up robust systems, designate competent personnel, and maintain acute awareness of potential impacts of our investments and operations on climate, environment and society in the B&R region.

Principle 2: Understanding Environmental, Social and Governance Risks

We will strive to better understand the environmental laws, regulations, and standards of the business sectors in which we operate as well as the cultural and social norms of our host countries. We will incorporate environmental, social and governance (ESG) risk factors into our decision-making processes, conduct in-depth environmental and social due diligence, and develop risk mitigation and management plans, with the help of independent third-party service providers, when appropriate.

Principle 3: Disclosing environmental information

We will conduct analysis of the environmental impact of our investments and operations, which should cover energy consumption, greenhouse gas (GHG) emissions, pollutants discharge, water use and deforestation, and explore ways to conduct environmental stress test of investment decisions. We will continually improve our environmental/ climate information disclosure and do our best to practice the recommendations of the Task Force on climate-related Financial Disclosure.

Principle 4: Enhancing communication with stakeholders

We will institute stakeholder information sharing mechanism to improve communication with stakeholders, such as government departments, environmental protection organizations, the media, affected communities and civil society organizations, and set up conflict resolution mechanism to resolve disputes with communities, suppliers and clients in a timely and appropriate manner.

Principle 5: Utilizing green financial instruments

We will more actively utilize green financial instruments, such as green bonds, green asset backed securities (ABS), Yield Co, emission rights based financing, and green investment funds, in financing green projects. We will also actively explore the utilisation of green insurance, such as environmental liability insurance and catastrophe insurance, to mitigate environmental risks in our operations.

Principle 6: Adopting green supply chain management

We will integrate ESG factors into supply chain management and utilize international best practices such as life cycle accounting on GHG emissions and water use, supplier whitelists, performance indices, information disclosure and data sharing, in our investment, procurement and operations.

Principle 7: Building capacity through collective action

We will allocate funds and designate personnel to proactively work with multilateral organizations, research institutions, and think tanks to develop our organizational capacity in policy implementation, system design, instruments development and other areas covered in these principles.

Editor's picks

Trending articles

China Aircraft Leasing Group Holdings Ltd (CALC), an aircraft operating lessor founded in Hong Kong, specialises in providing aircraft full-life solutions, such as aircraft leasing, purchase and leaseback, structured financing to airlines around the world. It also provides value-added services including fleet planning, fleet upgrade and aircraft recycling. In a dynamic market that has been gaining traction year after year, CALC is one of the market players that stand to benefit from the boom. Today, the company has grown to become China’s largest independent aircraft operating lessor, Asia’s first large-scale aircraft recycling facility operator, and one of the top 10 global aircraft lessors in terms of the combined asset value of its fleet and orders placed. Its global presence is continuing to expand.

CALC’s business is mainly divided into two areas: CALC itself is responsible for the leasing of new aircraft; its member company, Aircraft Recycling International (ARI), focuses on the disassembling and recycling of used aircraft and spare parts supply. This unique business model means the company’s services cover an aircraft’s full life cycle – from its days as a new plane to the time it comes to the end of its lifespan. As the first full value-chain aircraft solutions provider in Asia, CALC currently owns and manages 130 aircraft in its fleet and is on track to expand its fleet to more than 300 by year 2023.

Over the past three decades, the aviation leasing industry has been growing at a remarkable speed as more and more airlines prefer to lease, rather than own, their aircraft for operation flexibility and efficiency. The outlook for the industry has become even more positive in recent years, with low interest rates and surging demand for air travel providing strong tailwinds. Amid the boom, CALC launched in 2014 a “globalisation strategy” aimed to carve out a global presence for the company. In less than two years, CALC’s clientele expanded to include airlines in Asia Pacific, Southeast Asia, Europe, Middle East and the United States, many of which are flag carriers or top-tier airlines in their markets.

The aircraft lessor first set its sights on Harbin, the pivot hub of the Longjiang Silk Road Economic Belt under the Belt and Road framework, which connects Eurasia with the Pacific and Baltic countries through a comprehensive land and sea transportation network. In 2014, CALC signed an agreement with the Harbin Municipal Government on the establishment of China’s first and largest aircraft disassembly project, the China Aircraft Disassembly Centre. The centre features an ageing aircraft material recycling system, which provides services to countries including those along the Belt and Road routes.

Also in 2014, CALC entered into leasing agreements with Air India – its first non-Chinese customer – for five new Airbus A320 aircraft. The first of the five planes was delivered during Indian Foreign Minister Sushma Swaraj's trip to China in February 2015.

As the “Aviation Silk Road” continued to gather momentum, CALC expanded its reach into more and more Belt and Road countries. In 2016, it delivered two new Airbus A320 aircraft to Pegasus Airlines, Turkey’s leading low-cost carrier, and four Airbus A320 aircraft to Jetstar Pacific, Vietnam’s first low-cost carrier. In 2017, CALC continued to deliver aircraft to airlines in various parts of the world, including in Russia, one of the largest markets on the Belt and Road.

Currently, aviation is one of the key areas of focus of the Belt and Road Initiative. As of the end of December 2016, China had signed bilateral air transportation agreements with 120 countries and regions. Mike Poon, Chief Executive Officer of CALC, said CALC sees great growth opportunities arising from the Belt and Road Initiative.

“In China, demand for domestic and international air transport services, including different aviation financial services, is growing rapidly. Meanwhile, many Belt and Road countries are emerging economies with an underdeveloped aviation sector. We believe our growth potential is high since we are the first-mover in the industry and one of the few operators that provide full value-chain aircraft solutions and value-added services to our clients around the world,” Poon said.

That is not to say there is no challenge. As with many other cross-border industries, the aircraft lessor sector is exposed to different operational risks, including political instability, credit risk and interconnectivity risk. To counter the risks, which are not unusual in Belt and Road countries, CALC relies on its own professional team with substantial experience in global financing and a comprehensive risk management system. This enables the company, which is listed on the Hong Kong Stock Exchange, to keep risks under control when expanding internationally.

According to Poon, in its continued effort to expand its international presence, CALC, being a Hong Kong company, also enjoys a diversity of advantages that the city offers. They include an open economy, the city’s sophisticated banking and financial sector, the common law system, and Hong Kong’s role as a facilitator of Belt and Road opportunities. In addition, the Hong Kong government’s move last year to grant aircraft leasing tax concessions to qualifying lessors has taken the city a step towards establishing itself as an international aircraft leasing hub. All these local advantages stand CALC in good stead, enabling it to grow fast and in the right direction while playing an effective role in building the “Aviation Silk Road”.

Belarus, a landlocked nation in Eastern Europe bordering Russia, Latvia, Lithuania, Poland and Ukraine, has caught rising interest among Hong Kong’s business community in recent years under the Belt and Road Initiative (BRI). Going hand in hand with its role as a transport gateway linking China with the EU and CIS countries, it is seen as an increasingly open investment destination for manufacturing and high-tech developments.

An Important Transport Node on the Silk Road Economic Belt

Strategically located on the new Eurasia land bridge, eight rail container routes on the China-Western Europe trade pass through Belarus, enabling cargo to move much faster between China and Germany via Kazakhstan, Russia, Belarus and Poland, taking about 17 days. In comparison, sea freight takes around three weeks longer, although the freight cost of travelling by rail is about 60-70% higher. As shippers have become more receptive to the expanding rail container routes, more than 3,000 Sino-European trains used Belarus’s rail network in 2017.

Source: Great Stone Industrial Park

Two pan-European Corridors – II (Berlin-Moscow) and IX (Helsinki-Greece) – pass through Belarus, strengthening its position as a main trade and transport thoroughfare in the region. Standing at the border between Belarus and Poland is the Kozlovichi-Kukuryki checkpoint – one of the busiest cargo truck checkpoints between the Commonwealth of Independent States (CIS) and the European Union (EU).

In light of the recent enlargement of Poland’s Pomeranian Special Economic Zone (PSEZ) with an aim of integrating with the New Silk Road Route connecting China and West Europe near the Polish-Belarusian border and the ongoing talks with Germany’s Duisburg Inland Port about the Duisburg-Brest-Minsk rail link, cross-border traffic between Poland and Belarus is expected to soar in coming years.

To cope with the expected traffic growth, the country is continuing to upgrade or convert cities such as Brest and Grodno into large trans-shipment centres and logistics hubs. While the details of the project have not yet been disclosed, it has been reported that the China Gansu International Corporation for Economic and Technical Co-operation (CGICOP) is about to start construction of its own transport and logistics complex in the Grodno region, close to the cargo-and-passenger border crossing point between Belarus and Poland.

Currently, more than 100mn tons of goods transit through Belarus every year, supporting a large transport sector that accounts for 6% of GDP. The present volume of trade, as well as the country’s ongoing investment in infrastructure for transportation and manufacturing industry, continues to make Belarus prosper as an important node on the Silk Road Economic Belt.

Having reaped the early profits from the increasing level of Asia-Europe rail traffic, the country’s state-owned railway company, Belarusian Railways, is anticipating an uptrend in Eurasian cargo flows. For 2018, it expects container shipping on the China-EU-China route to grow by a further 30% to top 300,000 containers, after a 74% year-on-year growth to 245,400 containers last year.

As new logistics and trans-shipment facilities are being built to handle the switches between broad-gauge (1,520mm) and standard-gauge (1,435mm) rail for trains carrying Chinese/Asian cargo to the EU market, or consolidate shipments before sorting and sending to final customers or warehouses in Europe, industry agglomeration featuring manufacturing relocation is also in the offing.

A Manufacturing Relocation Destination

Under Belarus’s membership of the Eurasian Economic Union (EAEU or EEU), products made in Belarus can be treated, subject to the country of origin rules, as Belarusian-made and able to be exported to the other EAEU markets of Russia, Kazakhstan, Armenia and Kyrgyzstan, free of tariffs.[1] This, coupled to the country’s geographical proximity to most of the markets in Europe, as well as well-connected road and rail transportation networks, helps to make Belarus an attractive destination for foreign manufacturing companies.

Source: National Agency of Investment and Privatization, Republic of Belarus

To oil the wheels further, the Belarusian government has continued to liberalise its economy and provide generous investment incentives. As a result, it has welcomed increasing numbers of foreign investors in a number of priority sectors that feature export-oriented, import-substituting and high-tech industries, such as information and communication technologies (ICT), creation and development of logistics systems, home appliances and electronics and the production of electrical equipment.

As an added incentive for new-to-the-market companies, the Belarusian government has established six free economic zones (FEZs) across the country’s six major regions – Brest, Gomel, Grodno, Minsk, Mogilev and Vitebsk. All of these offer would-be investors a range of incentives, including preferential arrangements on corporate income, real estate and land taxes.

Chinese investment, which grew more than 11-fold between 2011 (US$19mn) and 2017 (US$232mn), is one of the factors spearheading the manufacturing investment in Belarus. Most notable examples of Chinese investment in Belarus include Midea Group’s joint venture with Belarus’ Horizont Holding Company, which has been producing microwave ovens and water heaters in the Free Economic Zone Minsk (FEZ Minsk) on the outskirts of Minsk since 2007, and the China-Belarus Industrial Park, otherwise known as Great Stone Industrial Park, which was co-founded by Hong Kong-based state enterprise China Merchants Group (CMG) in 2012 and is expected to operate until 2062.

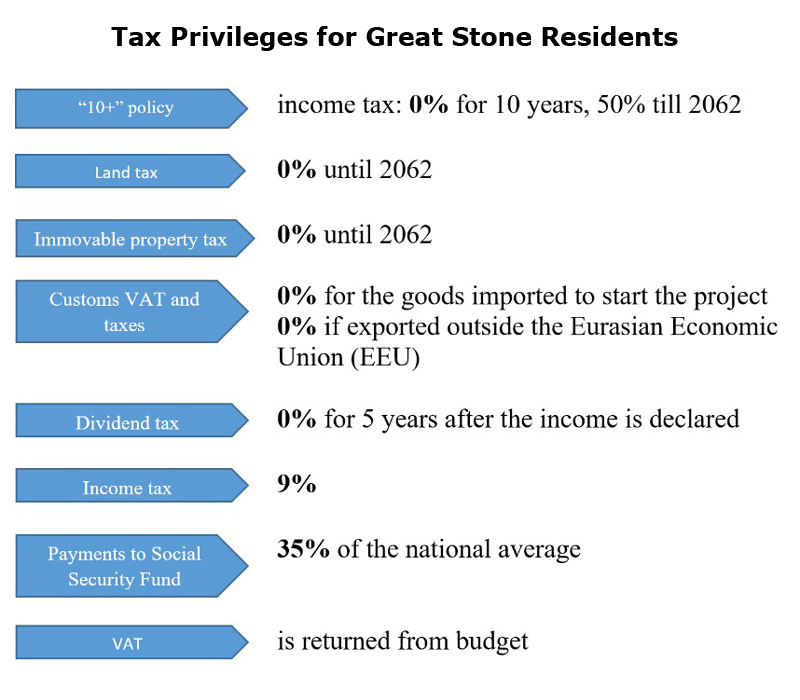

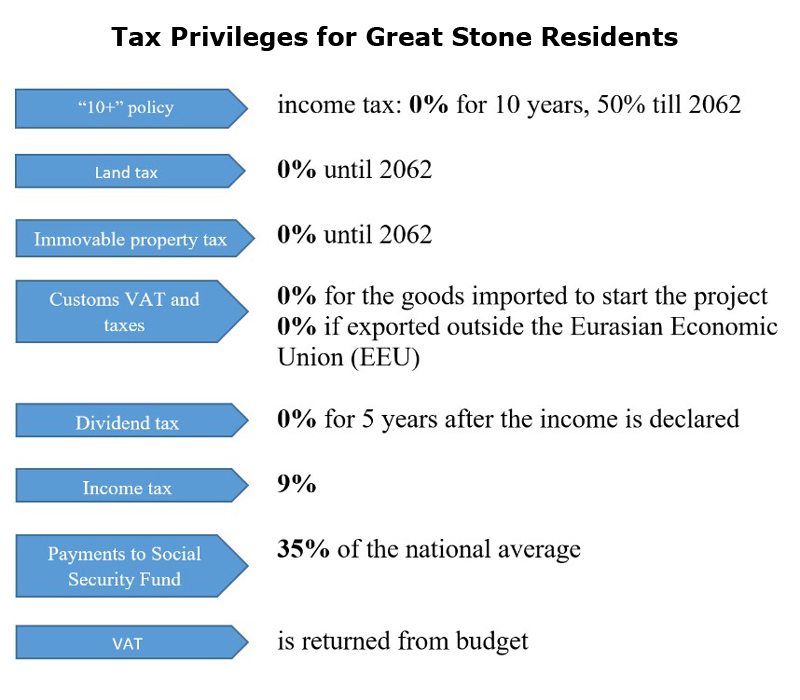

Thanks to its unrivalled perks, such as exemptions on corporate income tax, value-added tax (VAT), VAT on imports, real estate tax, land tax and tax on dividends, Great Stone has had great success in attracting Chinese companies. Current residents include ZTE, Huawei, Zoomlion, YTO Group Corporation, Xinzhu Corporation, Lotusland Renewable Energy and CGICOP. Other deals in the pipeline include companies working in the fields of composite materials, film coating technologies for cars, and joint design.

Source: Great Stone Industrial Park

With Phase I of the park’s development now completed, the Great Stone Industrial Park expects to see the number of resident companies grow from the current 27 to at least 35 by the end of 2018, when Phase II is due to finish, and to 60-70 by 2020 under Phase III of the development.

To facilitate Sino-European cargo flows, Great Stone has been holding talks with Germany’s Duisburg Inland Port about linking up to the Duisburg-Brest-Minsk rail service, and there are plans for a direct connection between the park and Minsk International Airport, 5km away. This should help the park further develop multimodal logistics involving air-rail and/or air-road freight.

An Evolving High-Tech Economy

Also in sync with the country’s development vision is the advancement of the high-tech industries. Few people know that Belarus has had a strong industrial base since the Soviet era, with a world class reputation for the quality of its machinery manufacturing, chemical engineering, petrochemicals, light industry (e.g. textiles, knitting, sewing, footwear, and household electrical appliances) and food processing.

Belarusian companies that have achieved international success include Polimaster, which makes radiation detection equipment and is said to have 20% of the US market in radiation measurement devices; Belshina, producer of some of the largest tyres in the world; and BelAZ, manufacturer of the world’s most powerful dump trucks with a capacity of 496 tons. The country is also a leading manufacturer of potash fertiliser, with an estimated one-sixth of the global potassium market.

Source: National Agency of Investment and Privatization, Republic of Belarus

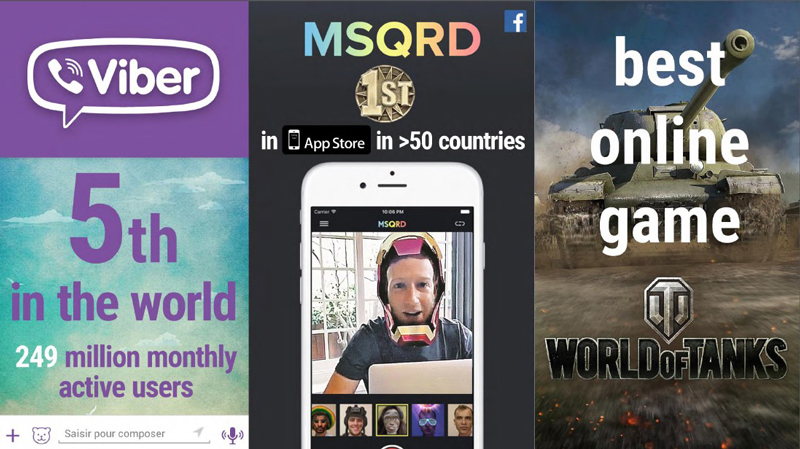

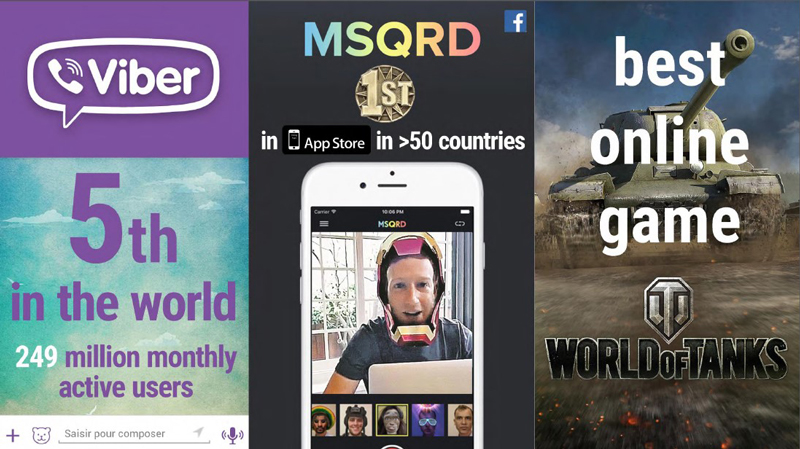

To counter its lack of natural resources, the country has built on this robust industrial foundation by establishing a reputation for technological innovation and nurturing the rapid growth of its IT sector. Between 2006 and 2016, Belarus’s export of IT services grew at a compound annual growth rate (CAGR) of 35% from US$48mn to US$957mn. The sector’s share of Belarusian exports grew from 2% to 14% over that period.

Successful Belarusian IT products include Viber (one of the world’s most popular cross-platform instant messaging and VoIP applications, with much of the development outsourced to Belarus), Viber, face-swapping application, MSQRD and multiplayer online game, World of Tanks.

Source: National Agency of Investment and Privatization, Republic of Belarus

Many of Belarus’s more pioneering tech companies are keen to tap into the opportunities offered by China and other countries across Asia, and see Hong Kong businesses as their natural partners in any such move. Furthermore, as an acknowledged IP hub, Hong Kong is uniquely positioned to help Belarusian tech companies fulfil their technology transfer aspirations and successfully commercialise their IP properties in the wider Asian market.

To oil the wheels of economic upgrade and diversification, Belarus has been understandably keen to attract overseas investment in recent years, while also being open to privatising a number of its state-owned industries. It has launched a series of economic reforms, including the Presidential Decree No. 8 “On the Development of Digital Economy” which allows cryptocurrency-related companies to operate and create crypto platform operators and cryptocurrency exchange operators in the country’s dedicated High-Tech Park (HTP).

Initiatives like these are designed to upgrade and diversify the Belarusian economy from its Soviet-era reliance on heavy machine-based industry and agriculture. The idea is to encourage the engagement with the high-tech sector, in particular with blockchain technology, cryptocurrencies and self-driving vehicles. It’s hoped this will make the country much more competitive in the modern digital economy and create the conditions to attract global IT companies to Belarus.

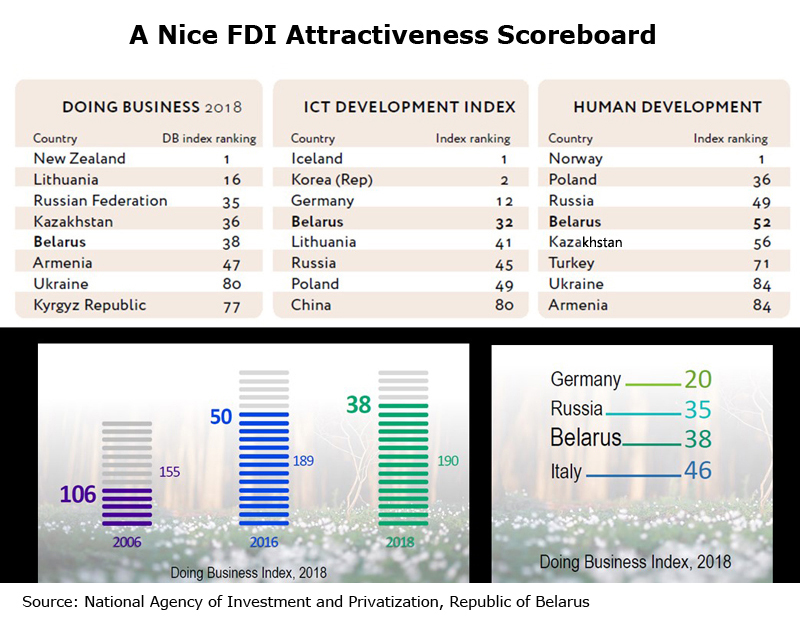

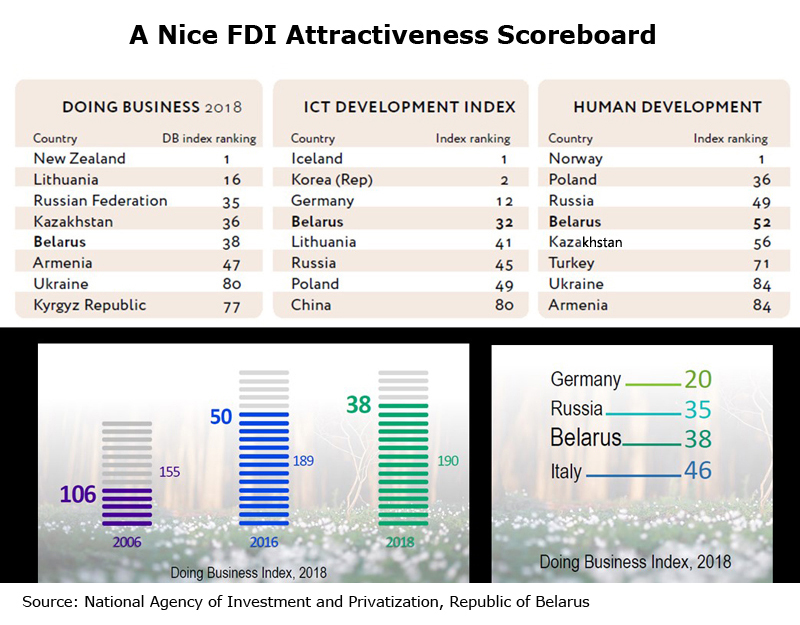

Belarus, which has one of the lowest rates of corruption among the ex-Soviet states, has also been increasing its efforts to liberalise the economy and improve its business and investment environment. One recent measure along these lines was a presidential decree issued by Alexander Lukashenko to minimise the state’s interference in commercial operations.

This continued liberalisation, coupled with a stable government, is clearly contributing to Belarus’s encouraging recent improvement on the various scoreboards measuring levels of competitiveness and the ease of doing business. This is likely to continue, with the plan to kick-start a new wave of privatisation, which will see four state-owned/controlled companies – OJSC Kryon (which makes air separation products), OJSC Lakokraska (paint and varnish materials), OJSC 8 Marta (linen, knitwear and hosiery) and OJSC Lenta (home textiles, technical/industrial/medical materials) – being sold off.

In a further bid to promote investment opportunities within the country, in February 2017, the Belarusian government granted five-day visa-free travel to citizens of some 80 countries and territories. It is currently considering granting 30-day visa-free entry to Chinese citizens.

As a key element in facilitating greater synergy between Hong Kong and Belarus, HKSAR passport holders have been entitled to visit Belarus visa-free for up to 14 days since 13 February 2018[2], following the formal adoption of a Comprehensive Agreement for the Avoidance of Double Taxation (CDTA) between the two parties on 30 November 2017.

A New Level of Sino-Belarusian Co-operation and Hong Kong Opportunities

Belarus, an active BRI participant, is offering a slew of lucrative business possibilities for Hong Kong and mainland entrepreneurs. Merchandise trade and manufacturing production aside, evolving promises on infrastructure investment are poised to bring Sino-Belarusian co-operation to a new level and give Hong Kong’s professional services providers a new world of opportunities.

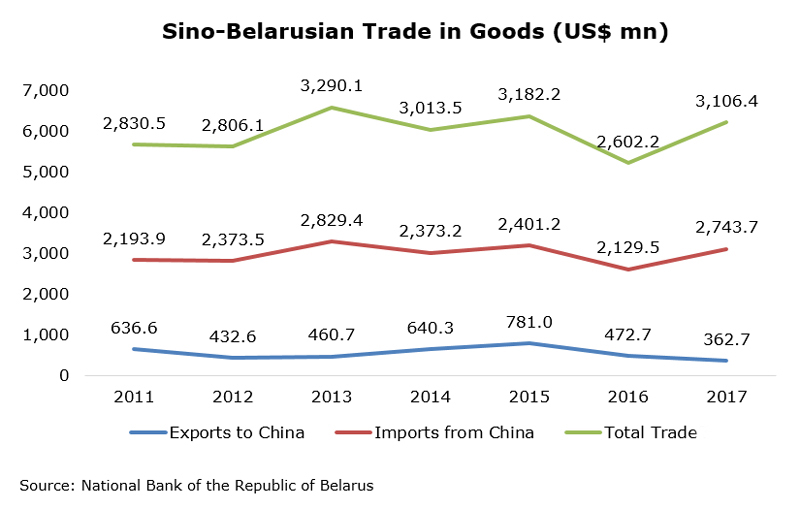

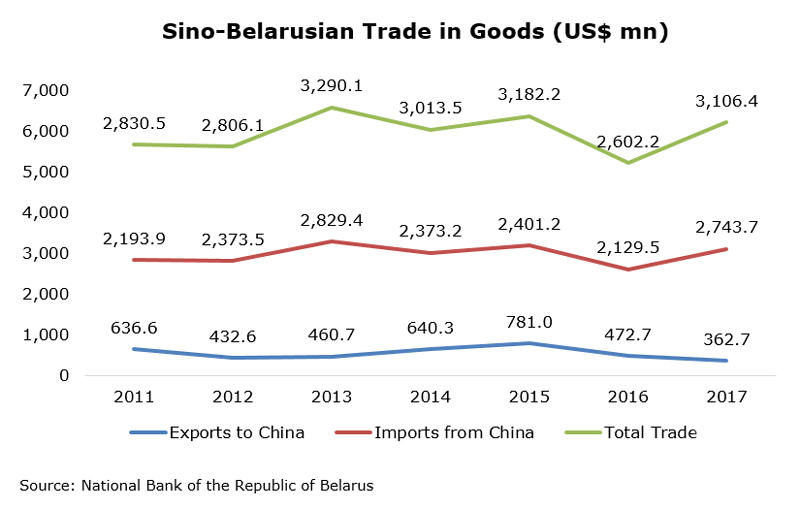

On the trade front, China is Belarus’ third largest trading partner (after Russia and the EU) though it only bought 1.2% of Belarusian exports and supplied 8% of Belarusian imports in 2017. Last year, China was Belarus’s sixth most important export destination (after Russia, the EU, Ukraine, Kazakhstan and Brazil) and third most important import source (after Russia and the EU).

With a strong agriculture and livestock sectors, expansion of agricultural trade such as sugar beet, vegetables, potatoes, grains and legumes, rapeseed, and flax fibre, along with meat and dairy industry exports, has always been one of the focal points of the country’s external trade development. To this end, Belarus and China signed a deal in July 2017 and became the first CIS country to export beef and poultry to China.

Source: The Press Service of the President of the Republic of Belarus

Following the deal signed between the two countries, the first shipment of frozen beef from Belarus arrived in the Chinese market in February 2018. A separate investment agreement concluded at the same time will soon see a Chinese food group building a livestock farm for 50,000 head of cattle in the Vitebsk Oblast, with a total investment of around US$400m.

While Belarus has a flourishing food and food processing industry, not every Belarusian product has received the go ahead to be sold in the Chinese market. Hong Kong, as a free port, can act as a test bed to promote and distribute Belarusian agricultural and dairy products in other key Asian markets. Some of the first movers include the seven Belarusian companies[3], which debuted some of the country’s traditional delicacies and drinks such as confectionary, pastry, natural juices and 68% vodka at the Hong Kong Food Expo 2017.

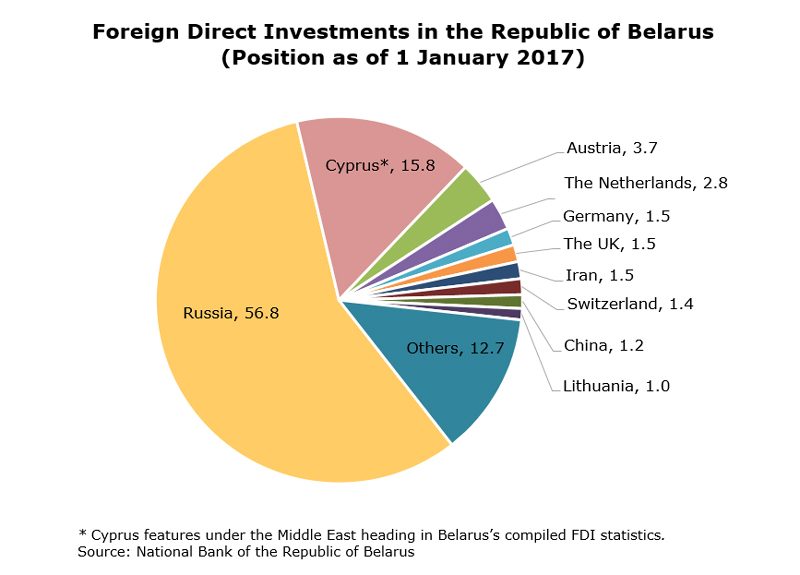

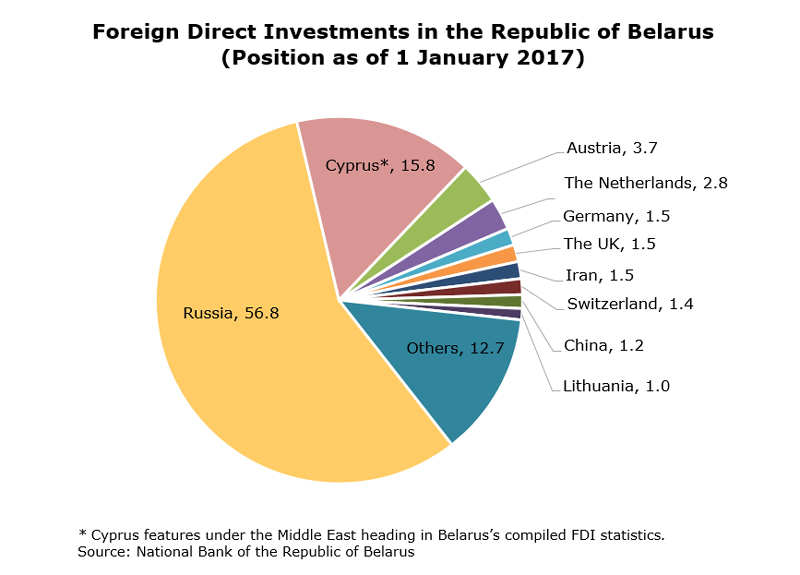

European countries, such as Russia, and several EU member states like Austria, the Netherlands, Germany and the UK, dominated Belarus’s FDI scene as they did on the trade front, contributing nearly 75% of the country’s FDI as of 1 January 2017. But China, despite its small share of only 1.2% (i.e. US$231.8mn) of the total, was already the largest Asian investor in Belarus, while Hong Kong came fourth behind South Korea and Singapore, with a FDI position of US$3.8mn.

While China is currently far from being able to challenge the position of Russia and the EU in terms of trade with and investment in Belarus, there is clearly room for expansion. This fits in with China’s BRI vision and the Belarusian government’s desire for public-private partnerships (PPPs) as a means of implementing several forthcoming infrastructure projects.

Prospective projects include the M-10 Highway Reconstruction, the country’s pilot PPP project, which involves a two-year construction period and an 18-year operational period. It is being built in collaboration with European Bank for Reconstruction and Development (EBRD). Also of interest to Chinese and Asian investors are the development plans for Belarus’s secondary towns and rural areas, including 100 settlements with fewer than 60,000 inhabitants. In that regard, China has already had a hand in two state housing projects.

Examples of PPP Projects in Republic of Belarus

| Name of project | The initiator of the project | Preliminary cost of capital expenditures | The current stage of preparation |

| Reconstruction of the M-10 highway: the border of the Russian Federation (Selishche) – Gomel – Kobrin; 109.9 km - 195.15 km | The Ministry of Transport and Communications | US$200mn | The feasibility study for the project is under preparation as part of the agreement between the Republic of Belarus represented by the Ministry of Transport and Communications and the EBRD. |

| Reconstruction of the complex of buildings of City Clinical Hospital No.3 in Grodno into Grodno Regional Clinical Oncology Centre | Grodno Regional Executive Committee | US$100mn | Negotiations are underway to attract the International Finance Corporation to finance the preparation of the project. |

| Construction of three children's preschool institutions in Minsk region | Minsk Regional Executive Committee | US$13.2mn | With the financial support of the EU, a selected consortium of consultants is developing a feasibility study for the project. |

| Designing and construction of the ambulance station in Baranovichi | Baranovichi District Executive Committee | US$4.3mn | Sources for preparation and subsequent implementation of the project are being searched. |

Source: National Agency of Investment and Privatization, Republic of Belarus

In terms of securing investment for large-scale infrastructure projects, Hong Kong’s status as an international financial centre makes it ideally equipped to broker Belarusian PPP projects and act as a useful partner when it comes to matchmaking Asian investors with substantial Belarusian infrastructure initiatives, especially after the great success of the Great Stone Industrial Park led by the Hong Kong-based CMG.

[1] Details of the EAEU’s Unified Customs Tariffs (UCT or CU) applicable on the goods imported from third countries can be found on the website of Eurasian Economic Commission.

[2] Belarus is the 160th country or territory having granted visa-free access or visa-on-arrival to HKSAR passport holders.

[3] The seven Belarusian companies are Krasny Pischevik, Spartak, Slodych and Kommunarka confectioneries, Minsk Kristall distillery, Brest Belaclo distillery and Krinitsa Brewery.

Editor's picks

Trending articles

AliExpress logistics centre set to be built close to country's border with Germany as overall e-commerce levels soar.

Poland is set to be the site of major new AliExpress logistics centre, serving its host country as well as online shoppers in neighbouring Germany and the Czech Republic. The new centre is to be a joint venture between the Alibaba-owned online marketplace, the Shanghai-headquartered Worldwide Logistics Group (WWL) and ATC Cargo, a multi-modal Polish freight delivery company.

The move is seen as recognition of AliExpress' success in building its customer base in eastern and central Europe. Although Allegro – Poland's take on eBay – remains the most popular e-commece site in the new centre's host country, the Chinese online platform has made huge strides in terms of building market share and consumer awareness. As a sign of this, in an October 2017 survey conducted by PayU, the Dutch fintech company, AliExpress was namechecked by 62% of Poland's online shoppers when they were asked to identify e-commerce market leaders.

Another factor in the choice of Poland as the site of the new centre is its strategic geographical advantage with regard to the aims of the Belt and Road Initiative (BRI), China's ambitious international infrastructure development and trade facilitation programme. This would see Poland function as the primary land conduit between China and the mega-markets of Europe, particularly Germany's 81-million strong consumer base. As a wider acknowledgement of the country's geographical advantages, Amazon has already begun work on its own US$876 million logistics facility in Szczecin, a city in northwest Poland set close to the German border.

One of the advantages of the new AliExpress facility is that, for the first time, it will allow businesses in the region to buy goods in small batches rather than by the container-load, as has been the previous practice. It will also help to manage the increased traffic between China and Poland, with some 500,000 parcels handled in 2017, a 200% increase on the previous year.

One negative aspect of this increased throughput, however, is that the huge surge in the volume of trade has spurred moves by the Polish government to clamp down on VAT avoidance on the part of the country's e-shoppers. Poland, unlike most other European countries (with the exception of France), does not waive the duty on imported e-commerce items valued at up to $55. To date, though, the Polish treasury has taken no action to enforce payment on such items.

In light of the increasingly large sums involved, however, actions are now being taken to ensure that such payments are processed. The most likely solution will see buyers permitted to specify the value of each delivery online, with the government's own system verifying this with the relevant e-commerce platform.

● In other moves, the Polish Financial Supervision Authority (KNF) has now signed a fintech cooperation agreement with the Hong Kong Monetary Authority (HKMA). This will see the two bodies working together on a range of fintech-related research projects, while also facilitating a wider exchange of information, mutual consultation and a greater overall level of knowledge and expertise interchange.

Anna Dowgiallo, Warsaw Consultant

Editor's picks

Trending articles

By European Think-tank Network on China (ETNC)

Sizing Up Chinese Investments in Europe

Chinese investments in Europe have surged in recent years, and have become a critical feature of Europe-China relations. Foreign direct investment (FDI) in the European Union traced back to mainland China hit a record EUR 35 billion in 2016, compared with only EUR 1.6 billion in 2010, according to data gathered by the Rhodium Group. In a historic shift, the flow of Chinese direct investment into Europe has surpassed the declining flows of annual European direct investments into China. As China continues to grow, develop, and integrate into the global economy, its overseas investments expand in quantity and quality, reflecting both the growing sophistication of the Chinese economy and broader Chinese commercial and policy goals. Going beyond FDI, Chinese investment is creating new realities for Europe-China relations.

This report by the European Think-tank Network on China (ETNC) brings together original analysis from 19 European countries to better understand these trends and their consequences for policy making and Europe-China relations, including at the bilateral, subregional and EU levels. As in all ETNC reports, it seeks to do so using a country-level approach. Through these case studies, including an introductory explanation and analysis of EU-wide data, the report aims to identify and contextualize the motives for Chinese investment in Europe and the vehicles used. However, the originality of the report also lies in the analysis of national-level debates on China, Chinese investment, and openness to foreign investment more generally. This is not just a story about FDI strictly defined, but about the (geo)political implications that emanate from deeper economic interaction with China. Ultimately, Europe is far from speaking with a single voice on these matters, and identifying where the divergences and convergences lie, will be crucial in formulating solid and complementary policy positions at the EU and national level moving forward.

China’s growing investment interests in Europe

Until recently, it was not uncommon to depict China as a minor source of investment in Europe and elsewhere in relative terms. Indeed, of total FDI stock held in the European Union by the end of 2015, China only accounted for 2 percent according to Eurostat figures, and its investment stock in many European countries remains low when compared with older investors. However, the facts on the ground are evolving rapidly, and China still has plenty of room to grow: The total stock of Chinese outbound direct investment worldwide still only represents 10 percent of its national GDP. Compare this to France or the UK (50+ percent), Germany (39 percent), the United States (34 percent) and Japan (28 percent). If China continues on its path towards more advanced levels of economic development, we must expect a massive further increase in its outbound FDI. Europe has already become a favored destination for Chinese investment, and policymakers need to adapt to a new force shaping the economic and political landscape in Europe.

As the country analyses of this report show, European economies have a wide range of assets and features that Chinese investors seek. There should be no doubt that China needs Europe (maybe even more than vice-versa). Patterns of Chinese investment highlight sources of European attractiveness that need to be better appreciated and leveraged. Among the things that Chinese investors seek in Europe are:

- Technology, to include established high-tech assets, emerging technologies and know-how;

- Access to the European market, for Chinese goods and services;

- Access to third markets via European corporate networks, especially in Latin America and Africa;

- Brand names to improve the marketability of Chinese products both abroad and for the Chinese market;

- Integrated regional and global value chains in production, knowledge and transport;

- A stable legal, regulatory and political environment, particularly in a context of global disruption and political uncertainty;

- Political/diplomatic influence in a region that in aggregate terms remains the second largest economy after the US.

Behind the growth in China’s outbound investments is the story of China’s economic transformation towards more consumption-based growth and higher value-added industries, including technology and services. The success of China’s economic transformation depends on an increased commercial presence abroad and deepening international linkages. This is not only true for all economic enterprises in China, including SOEs and private companies, but it also serves as a critical source of Party legitimacy and political stability.

In this context, many chapters in this report confirm the importance of Beijing’s policy initiatives in shaping investments overseas, and in Europe in particular. Beijing’s “going out” policy starting in 2001, and intensifying after the Global Financial crisis, has facilitated and encouraged the internationalization of Chinese firms for much of the last two decades as a means to develop the national economy. More recently, both China’s 12th and 13th five-year plans (2011-2015; 2016-2020) have encouraged overseas investments as a means to access supply chains, quality brand names and advanced technology – all reasons for investing in Europe. As China’s industrial strategy grows in sophistication, plans such as “Made in China 2025” will increasingly channel overseas investments as a means to achieve clear policy goals in the so-called “new strategic industries” defined in Beijing. In 2016, the largest share of Chinese global mergers and acquisitions targeted the high-tech sector (24 percent of total deal values), compared to 20 percent that targeted energy and material assets (Rhodium Group, 2017). The controls on outbound Chinese capital that the Chinese government deployed in 2016 and 2017 also highlight the crucial impact of Beijing’s interests and policies, i.e., the political nature of outbound capital flows. Finally, as China continues to press forward with its Belt and Road Initiative (BRI), an initiative now elevated to constitutional rank within the Chinese Communist Party in fall 2017, Europe can also expect to see an increasing number of related Chinese investments.

Please click to read the full report.

Editor's picks

Trending articles

Budapest airport signs deal with leading mainland logistics business, with e-commerce tipped to be primary beneficiary.

As the Belt and Road Initiative (BRI) continues to roll out across Central and Eastern Europe (CEE), Budapest is looking to become one of the programme's key air-cargo distribution points. In order to deliver on this, late last year, Liszt Ferenc International Airport – the Hungarian capital's primary air-passenger and freight terminal – struck a new deal with STO Express, one of the mainland's largest logistics companies, which is expected to see the volume of China-origin freight channelled via Budapest soar.

The deal was finalised during last November's China-CEE Summit in Budapest and has seen the Hungarian airport designated as STO's official air-cargo hub for the wider region. As a consequence, the level of air-cargo throughput at the Liszt Ferenc facility is expected to grow substantially over the coming months, with a rise in the level of cross-border e-commerce items expected to be one of the major contributory factors. In order to fully facilitate this dramatic and rapid upturn in volume, EKOL, an Istanbul-headquartered logistics-services provider, is also party to the co-operation agreement with STO.

Commenting on the significance of the deal, Rene Droese, Liszt Ferenc's Director of Property and Cargo Services, said: "Export-import between China and Hungary, as well as the wider CEE region, plays a hugely important role in our rapidly developing market. With this agreement now in place, I believe that Budapest and its airport will provide the best solution for STO's distribution requirements in the immediate region and across Europe."

Immediately prior to the formal agreement, STO began running its first service via the Hungarian airport, with a cargo-load of e-commerce deliveries touching down in Budapest on 3 November. With the arrangement between the airport operator – Budapest Airport Ltd – and STO now formalised, the logistics company will run regular scheduled cargo flights between Hungary and a number of mainland cities. The service is expected to be widely used by many of STO's existing partner businesses, most notably Alibaba, the Hangzhou-headquartered e-commerce giant.

The deal with STO caps an already successful year for Liszt Ferenc, which saw its cargo throughput for January-October 2017 increase by 14.5% compared with the same period in 2016, taking its total cargo volume for the first 10 months of last year to 103,700 tonnes. Overall, the airport is said to have enjoyed 36% growth in cargo traffic since December 2015, a considerable achievement given the high levels of competition and the parlous state of its neighbouring economies.

At present, the airport is midway through its own extensive upgrade and expansion plan. Last year it completed a major refurbishment of its primary terminal, while also opening phase one of its dedicated business zone.

Meanwhile, work is still on-going on the construction of Cargo City, the airport's new and expanded cargo-handling facility. Scheduled for completion in 2019, it will have an annual handling capacity of 150,000 tonnes and provide a range of centralised cargo services, including facilities for handling companies and forwarders, customs processing points and certified storage for special cargoes, as well as a temperature-controlled zone.

In terms of the BRI, China's ambitious infrastructure development and trade facilitation programme, the CEE region is seen as of particular significance. As well as prioritising trade with a number of the rapidly emerging CEE economies – most notably Poland, the Czech Republic, Slovakia and Hungary – the region is also seen as a vital conduit between China and the mega-markets of Western Europe.

Beata Balazs, Budapest Consultant

Editor's picks

Trending articles

By Chris Devonshire-Ellis, the Founding Partner and Chairman of Dezan Shira & Associates

With both China and Russia gearing up for overseas rail and Arctic shipping potential to Europe, positive moves to accept and accommodate improved rail links are being taken in the Baltics. Russia has recently signaled its desire to extend and redevelop passenger rail services from St. Petersburg to Berlin in a route that sees cross-border travel through Latvia, Lithuania, the Western Russian enclave of Kaliningrad, and through Poland.

Estonia, to the north-east, has also been discussing improvements with Russia concerning both road and rail connectivity, with the Deputy Minister of Transport of the Russian Federation Sergey Aristov stating in April that Estonia and Russia have reached an agreement regarding the re-establishing of their cooperation in transportation. Aristov was reported as saying the discussions were “very positive.” Estonia was represented by Ahti Kuningas, deputy secretary general for transport at the Ministry of Economic Affairs and Communications, Priit Rohumaa, chairman of the supervisory board of Estonian Railways, and the Estonian Ambassador to Russia Arti Hilpus. According to Ambassador Hilpas, discussions revolved around the potential for high speed links and Russian/Estonian highway collaborations.

These developments are partially geared to accentuate the increasing amount of Chinese freight trains arriving in Europe via Kazakhstan and Russia, and to allow both Chinese and Russia trade access too and obtain supplies from the Baltics. At present, much of the rail traffic enters the EU into Poland via Belarus, further south, leaving the Baltics and Nordic nations out of the loop. Chinese-European freight is seeing a 100 percent increase this year, compared to 2016, with 1,000 freight trains expected to make the journey during 2017. Such growth rates are only expected to continue. Coming Europe’s way are Chinese electronics, going the other – are valuable and perishable European consumables.

Getting the Baltics configured into this trade, both from the mutual access perspective as well as services provision, is also inspiring some serious infrastructure developments. Both Estonia and Finland are discussing the possibility of connecting to each other via a 90 km, Helsinki-Tallinn undersea tunnel. A one-way journey would take just 30 minutes, as opposed to an effective 3 hour (including airport time) trip to take the 60 minute Turboprop, and the 2 hours by ferry.

Helsinki and Tallinn jointly represent an economic area populated by 1.5 million people, and there is active inter-city movement of people for work and leisure as well as freight traffic. Last year, Tallinn processed 10 million port visitors, with Helsinki reporting 11.5 million marine passengers passing through. Traffic between the two port cities in particular saw major growth last year and tens of thousands embark on work-related trips between the two cities weekly. The EU-funded studies, which are being undertaken by a consortium of interested businesses, are expected to produce initial feasibility results later in the year. These are to include cost-benefit analyses and impact assessments for both the rail and marine options, how the undersea tunnel can be technically implemented, and price tag determinants for construction, maintenance, and rail traffic. It will also sketch out the project’s main features, including location of routes, stations, and rolling stock depots.

These are part of Rail Baltica, a greenfield rail transport infrastructure project intended to integrate the Baltic States in the European rail network. The project includes five European Union countries – Poland, Lithuania, Latvia, Estonia, and Finland. It will connect Helsinki, Tallinn, Pärnu, Riga, Panevežys, Kaunas, Vilnius, and Warsaw, and is expected to be completed by 2026.

Russia is not part of this grouping, as it is not an EU nation. Nonetheless, bilateral discussions between Russian Railways and the same group of nations have been and continue to take place. An example is the Kouvola Rail Forum taking place in Finland this September. The program specifically deals with the Eurasian Land Bridge, China rail, and Finnish-Russian rail connectivity, which has been upgraded in recent years to almost wholly electrified routes.

The Taiwanese electronics business MIPRO recently won a €22.3m contract awarded by the Finnish Transport Agency (Liikennevirasto) for the renewal of signalling systems at Niirala, Kotolahti-Mussalo, and Vainkkala marshalling yards in eastern Finland, which connect directly with Russia and the Russian Railway and highway network, although these require some development on both sides. However, both Finland and Russia recognize this, and are taking steps to integrate technological systems such as the introduction of RFID remote identifier systems. These in particular, offer potential benefits along the entire supply chain – from customers and operators to handlers and border authorities, benefiting China, Russia, and EU customers and smoothing over the entire supply chain.

Finland has also been discussing the potential for a US$3.4 billion “Arctic Corridor” that would connect Northern Europe with Russia, China, and Arctic Ocean deep-water ports. The idea is being pitched by a group of Finnish academics and business leaders, and would connect the city of Rovaniemi in northern Finland with the Norwegian port of Kirkenes on the Barents Sea. Ships could move goods from China as well as oil and gas from Arctic fields in Russia westward along the Northern Sea Route to Kirkenes. Cargo would be offloaded to the railway and sent southward through rail connections to Scandinavia, Helsinki, the Baltic states, and the rest of Europe. The Chinese routes for this are explained in the article “China’s Maritime Arctic Silk Road On Ice”.

“The Arctic Corridor project sees OBOR as very important as it provides an alternative to connect Asia with the Arctic and Europe.” said Timo Lohi, a spokesman for the Arctic Corridor project. Lohi also notes that Kirkenes in Norway is the closest Western port to Asia. Kirkenes Port is also ice-free, allowing the use of larger vessels and saving on ice-breaking costs.

These developments, tucked away into North-Eastern Europe, seem a long way from China when viewed on traditional flat maps. However, this is the top of the world, and distances are actually shorter than they appear. A direct flight from Helsinki to Beijing for example takes just 6 hours.

It should be remembered that Finland is a major gateway into Russia and also offers mutual access to China for electronics, as well as high quality Finnish goods to China. The same applies to the Baltic nations of Estonia, Latvia, and Lithuania, with Estonia especially having tied itself to developing China trade services as well as being a viable rail and sea port. While much of this depends upon the acceptance of Russia, and Russian Rail operators in the Baltics, a politically tricky subject at present, should military and security concerns be put to rest, the Baltics region can become a major player in future Chinese and Russian regional trade. Regional manufacturers should be looking at adjusting quality consumer products to Chinese tastes, and especially the sustainable, yet exotic (such as Nordic meats and fish) in addition to high quality clothing and other consumables. The services industries and development funds in particular, in everything related to transportation, warehousing, logistics, and related IT within the region should be keeping an eye on these possibilities. The EU’s next major capital city as concerns OBOR and influence may well be Helsinki.

This article was first published on Silk Road Briefing. Please click to read the full report.

Editor's picks

Trending articles

Tax incentives and financing expertise for Belt and Road Initiative projects offer huge opportunities for Hong Kong as a treasury centre, says Paul She of global accounting and consultancy firm, Mazars. The firm is focusing on technology clients related to the Belt and Road – some for IPO launch on the Hong Kong Stock Exchange – companies “often missed by the market”.

Speaker:

Paul She, Practising Director, Mazars CPA Limited

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Express Luck Industrial, a manufacturer of high-technology TVs founded and headquartered in Shenzhen, ships its products to various parts of the globe. The firm has offices in different places, from Hong Kong to Hungary to Mexico. Among these branches, the one in Hong Kong plays a pivotal role in central management and raising capital for the company.

One of the major markets for Express Luck’s products is Central and Eastern Europe (CEE). A few years ago, the firm started to manufacture TV sets in Romania and shipped the finished goods directly to different parts of the region, helping Express Luck enhance operational efficiency.

Then in the first half of 2016, Express Luck chanced upon an opportunity for growth in CEE: a global electronic company was looking for a buyer to take over its production plant in an industrial area on the outskirt of Budapest, Hungary. It was an attractive offer because the plant is well-located and well-equipped, and only slight moderation of the existing facilities was needed to ensure compatibility with Express Luck’s production activity. Express Luck bought it without much hesitation.

In the process of setting up the plant, the Hong Kong office of Express Luck played a leading role in management matters, including financial planning and devising business strategies for the plant.

Terry Tam, Chief Financial Officer of the Hong Kong office of Express Luck, says the plant, launched into operation in October 2016, now produces LED TVs for the company’s own brands and some other licensed brands. In 2016, Express Luck exported a total of five million TV sets. It expects the plant in Hungary to produce 600,000 sets for the year 2017 – about one-tenth of the aggregate output of the whole company – and more in the years to come, given the great growth potential of the CEE market.

Express Luck is not alone in its optimistic projections of CEE. Over the past decade, Chinese investment in CEE has been growing by 32 per cent annually. In 2016, China set up a 10 billion-euro investment fund to finance projects in the region. In pushing its Belt and Road Initiative, China has also enlisted CEE as a strategic partner.

As Chinese interest in the region continues to grow, CEE countries are also making an effort to promote closer economic ties with China. Hungary, China’s biggest investment destination in CEE, is in particular responsive to the Belt and Road Initiative. In June 2015, it became the first EU member to sign a memorandum of understanding with China on integrating its “Eastern Opening” policy with the Belt and Road Initiative. In May 2017, the two countries announced the establishment of a comprehensive strategic partnership.

According to Tam, the advantages of investing in Hungary are plenty, including the “availability of skilled workers, established infrastructure and supportive government policies”. He believes the Belt and Road Initiative will raise the living standard of people in the CEE and therefore drive up demand for consumer products such as TVs.

“Demand for TVs in Eastern Europe is already on the rise. Many people still have an old model TV at home and they want to switch to inexpensive LED TVs. The Belt and Road Initiative should help push the demand further as it will bring more growth opportunities to the region. When that happens, we may expand our operation there,” Tam says.

Meanwhile, Express Luck is gradually expanding its Hong Kong operation to cope with the company’s growth at home and abroad. The branch moved to a bigger office in April 2017 and is positioned as a second headquarters. According to Tam, as Express Luck’s business is expanding in CEE, the Hong Kong operation is expected to play a bigger role in helping to raise capital, given that the city is a “world-class financing platform” offering different means for companies to raise funds.

With its geographical advantage and a sophisticated financial system, Hong Kong demonstrates through Express Luck’s story what added value it can offer to Chinese companies seeking to build up a presence in countries along the Belt and Road.

By Philippe Le Corre, Visiting Fellow in the Center on the United States and Europe at Brookings

China’s Belt and Road summit is over but the Chinese narrative is only just getting started. In a video released by the state-owned media outlet China Daily, a Western father tells his daughter a BRI bedtime story: 'China’s idea does not only belong to China. It belongs to the world'. Yet the world - and Europe in particular - still has plenty of reservations about the concept.

In China’s mind, most roads – and belts - lead to the 500 million-strong European Union consumer market, the world’s largest and richest (though the impact of Brexit and the departure of the UK's 65 million consumers remains to be seen). During last week's BRI summit, China insisted it wanted to share 'growth, development and connectivity' and 'collaborate more closely on concrete projects' with the EU, but the European Commission’s vice president Jyrki Katainen made some different points. In his speech at Beijing, he said that any scheme connecting Europe and Asia should adhere to a number of principles including market rules and international standards, and should complement existing networks and policies. The EU's reservations about China came to a head last year when EU lawmakers voted against China's application for 'market economy status' under WTO law, which, if granted, would reduce possible penalties in anti-dumping cases. The sore point is steel: China's huge production capacity has flooded world markets and threatened the robust industrial base the European Commission considers essential for jobs, growth and competitiveness.

But while the battle over market economy status continues, China has been steadily increasing its presence in Eastern and Central Europe. In 2012 it created the '16+1' mechanism, a platform where the Chinese prime minister meets – usually once a year- with the leaders of 16 countries including EU members such as Poland, Hungary, Bulgaria, Slovenia and the Baltic states, as well as non-EU members including Serbia, Albania and Montenegro. This framework has become a launch pad for the Belt and Road Initiative (at least half of the countries have signed BRI memorandums of understanding with China since 2015), and has helped China to build (or in some cases rebuild) close relations with Eastern European countries. After some complaints from Brussels, the European Commission was eventually admitted as an observer the 16 + 1 group.

Major BRI infrastructure projects are now starting to take shape in Europe - not without controversy. One of China’s top state-owned enterprises is building a high-speed railway line between Belgrade, the capital of Serbia and Budapest, the capital of Hungary. A member of the EU, Hungary is currently under investigation for possible violations of EU transparency requirements in public tenders in relation to the project.

Athens’s Piraeus Harbour is another major piece of infrastructure that has become representative of China’s offensive in Europe. Since 2016, the Greek harbour has been controlled by China Ocean Shipping Company (Cosco) which acquired 51% of the Port Authority and will be able to acquire a further 16% by 2021, following substantial investments. The idea is quite simple: through the 'Maritime Silk Road' and the extension of the Suez Canal, China will be able to reach the Mediterranean Sea and will use Piraeus as a platform for Chinese companies and goods. Cosco intends to turn Piraeus into one of the largest container transit ports in Europe.

In 2016, Chinese foreign direct investments in the EU reached €35 billion, a 77% increase over the previous year. While some Eastern and Southern European States - non EU members - often have little alternative to Chinese capital, Western Europe has a different, more nuanced perception of China, hence the determination to protect sensitive technologies that could affect Europe’s long-term strategic independence and/or security.

Brussels is also concerned about the issues of reciprocity and access to the Chinese market for European companies. Despite several years of negotiations, there is still no bilateral investment treaty, and European companies have found it increasingly difficult to do business in China. Year after year, the EU Chamber of Commerce in China has expressed its dissatisfaction about the difficulties foreign firms encounter, concerns shared by the American Chamber of Commerce.

Yet there has been no unified EU policy toward BRI. Several EU countries and cities have been particularly receptive to Chinese investors. Others have been more cautious, seeking guarantees from China that it will follow international standards and not pursue exclusively its geostrategic interests. Although the EU was represented by a European Commission VP last week in Beijing, neither the President of the European Council Donald Tusk nor the Commission’s Head Jean-Claude Juncker made the trip. Among member states, the prime ministers of Italy, Spain, Hungary, Greece and the Polish president were in attendance. Other countries – including Germany, the Netherlands and the UK - were represented by their finance or economy minister. France, which has just changed governments after the election of President Emmanuel Macron, sent a former prime minister.

It is fair to say that the BRI represents opportunities for Europe, but it is primarily a Chinese project that will help China to expand its influence in the vast Eurasia region in future decades. It is not clear what level of control China's 'partners' will have. For the past few years, China has demonstrated its ability to divide Europeans by creating new entities such as the 16+1 mechanism, and by encouraging EU members to join the Beijing-run Asian Infrastructure Investment Bank (AIIB). In 2015, the UK broke ranks with other EU members (and the United States) by announcing it was joining the AIIB, forcing others to follow without delay.

Although connectivity is both a Chinese and EU concept, it is easy to understand why certain European leaders are reluctant to give China carte blanche to invest in the continent’s infrastructure. At the end of the day, Europe and China have similar aims: preserving jobs; fuelling economic growth; and maintaining social stability. They may not achieve these goals in the same ways.

Please click to read the full report.

987 Views

987 Views