Chinese Mainland

HKTDC Research | 30 Sep 2015

The ASEAN Link in China’s Belt and Road Initiative

Crucial Position of ASEAN in both the Land and Sea Routes

Chinese President Xi Jinping’s announcement of the creation of the 21st Century Maritime Silk Road during a speech to the Indonesian parliament in October 2013 is seen as an indication of the important role that ASEAN plays in China’s Belt and Road Initiative. In March 2015, when China issued The Vision and Actions on Jointly Building the Silk Road Economic Belt and the 21st Century Maritime Silk Road policy initiative, it came as no surprise that strong emphasis was placed on orienting the trade routes towards ASEAN countries with a proposed China-Indochina Peninsula Economic Corridor.

ASEAN countries have long been the key trading partners of China. Since the launch of the China-ASEAN Free Trade Area (CAFTA) in 2010, improved institutional co-ordination and increasingly sophisticated intra-regional supply chains have driven China-ASEAN bilateral trade to new heights. Bilateral trade has grown significantly at an average annual rate of 18% between 2009 and 2014. To deepen multilateral co-operation, China and ASEAN began negotiating an upgrade of the existing CAFTA pact in 2014, with a focus on strengthening investment, trade in goods and services, and economic and technology co-operation. The discussion, likely to be concluded by the end of 2015, is expected to further enhance ASEAN’s crucial role in the Belt and Road Initiative and to facilitate further regional integration.

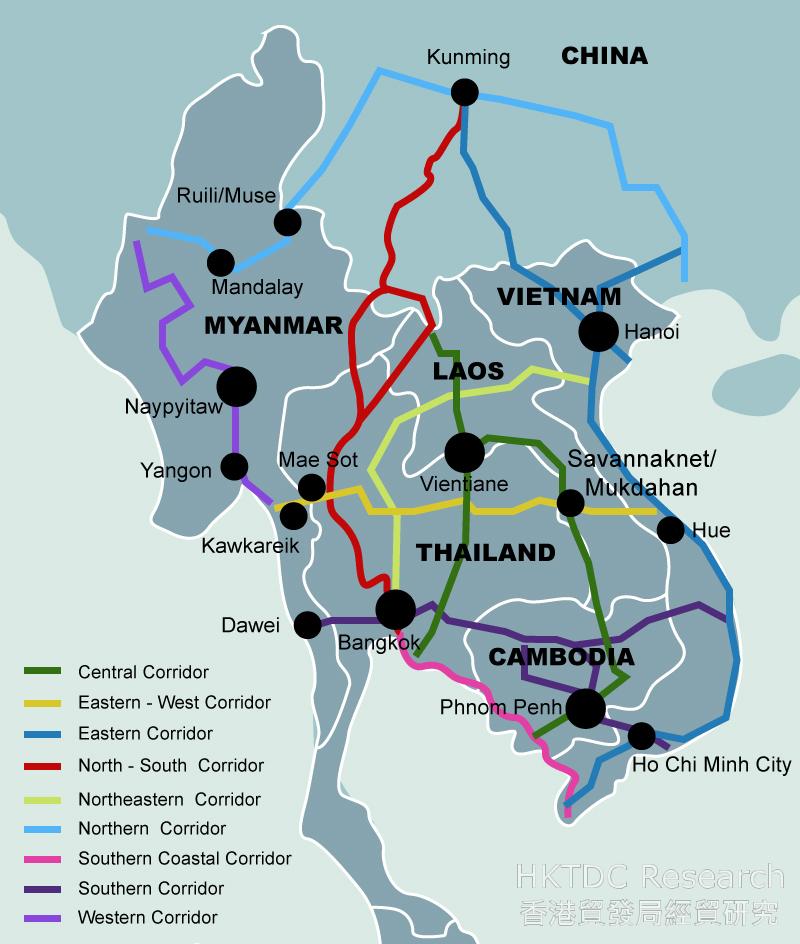

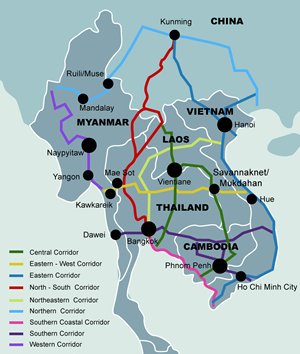

Mainland Southeast Asia, or the Indochina peninsula, is connected to China by land. The transnational transport network of the Greater Mekong Sub-region (GMS), of which Guangxi and Yunnan provinces are members, in combination with the proposed maritime silk road that will link major sea ports along the coasts of Vietnam, Cambodia, Thailand and Myanmar, will intensify China-ASEAN trade and industrial co-operation. It will also extend the economic benefits further afield to South Asia and Western Asia when the new multimodal transportation networks are in place.

Transportation Network in the China-Indochina Peninsula Economic Corridor

In building the China-Indochina Peninsula Economic Corridor, China will piggyback on the economic co-operation mechanisms of the GMS. During the Fifth Leaders Meeting on Greater Mekong Sub-regional Economic Co-operation, held in Bangkok in December 2014, Chinese Premier Li Keqiang put forward three suggestions with regard to deepening the relations between China and the five countries in the Indochina Peninsula. These were: (1) to jointly plan and build an extensive transportation network, as well as a number of industrial co-operation projects; (2) to create a new mode of co-operation for fundraising; and (3) to promote sustainable and co-ordinated socio-economic development. Currently, the countries along the Greater Mekong River are engaged in building nine cross-national highways, connecting east and west, and linking north to south.

Land Transportation

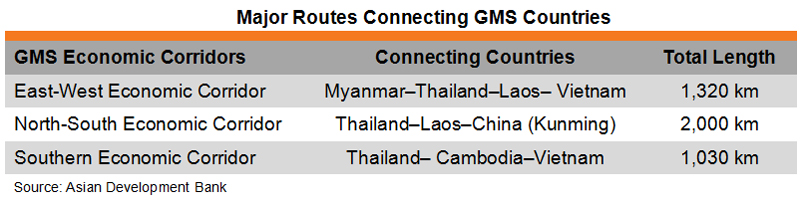

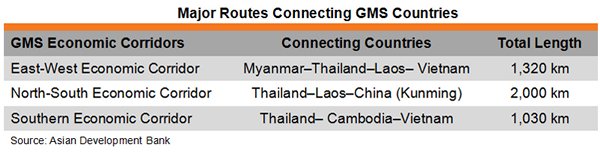

The nine highways linking the GMS intersect with the ‘East-West Economic Corridor’, ‘North-South Economic Corridor’ and ‘Southern Economic Corridor’, and form the backbone of the GMS transportation infrastructure. These three major economic corridors will integrate infrastructure development with trade, investment and other economic opportunities of the GMS countries.

The North-South Economic Corridor has been taking shape with the opening of the whole Kunming-Bangkok Highway in 2013, while China has also completed construction of an expressway in Guangxi leading to the Friendship Gate and Dongxing Port at the China-Vietnam border. The highway from Kunming to its borders with Myanmar and Vietnam has also been upgraded.

Building upon existing infrastructure, China and Thailand are working to improve cross-border rail networks. Construction is scheduled to begin in October 2015 on a new dual-track railway that will connect Laem Chabang (Thailand’s largest port) with Nong Khai, an industrial border area near to the Laotian capital of Vientiane, and to run further to Kunming. A high-speed rail link between Kunming and Kolkata in India, crossing Myanmar and Bangladesh, is also under study.

The China-led Asia Infrastructure Investment Bank (AIIB), with its focus primarily on infrastructure projects in Asia, is expected to play a constructive role in bridging the huge investment gap in funding ASEAN’s major cross-border infrastructure projects, such as the ASEAN Highway Network and Singapore-Kunming Rail Link.

Sea Transportation

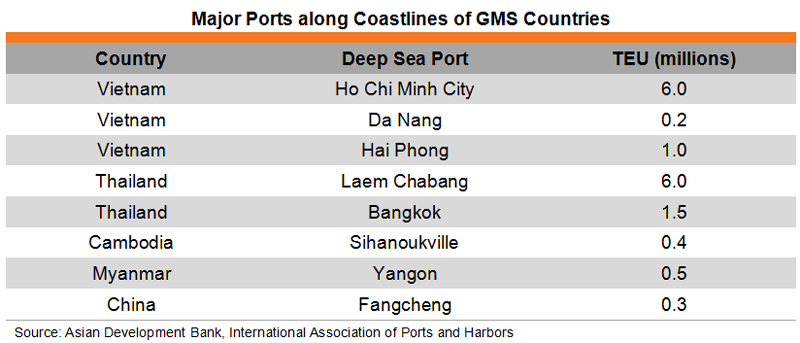

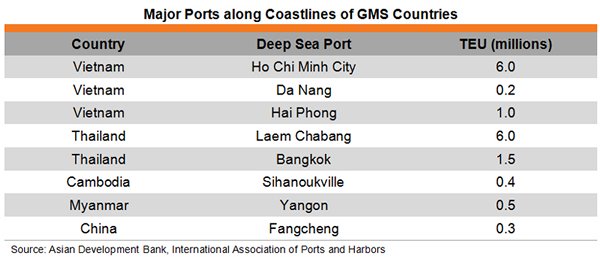

Maritime co-operation is essential to building the 21st Century Maritime Silk Road. Currently, Vietnam and Thailand have the most developed seaport facilities among the GMS countries.

China and the maritime ASEAN countries are actively investing in their maritime infrastructure. The Philippines is promoting its Strong Republic Nautical Highway to enhance inter-island connectivity, while Indonesia announced its Maritime Axis policy doctrine in 2014. Besides, China has carried out a variety of ocean-related co-operations with Indonesia, Thailand, Malaysia, India and Sri Lanka, including a China-Malaysia joint port project in Malacca.

Air Transportation

Air connectivity is also key to completing a comprehensive sea, land and air integrated network. The ASEAN Open Skies policy, effective from 2015, is set to enhance regional trade by allowing airlines from ASEAN countries to fly freely throughout the region under a single, unified market. ASEAN has also recently concluded an exchange of fifth freedom air traffic rights between ASEAN countries and China, allowing Chinese carriers to use ASEAN gateway city airports to fly beyond.

Within China, Kunming is seen to be the main airline transit point to ASEAN and South Asia, with more than half of its international flights destined for Southeast Asian countries. In total, Kunming has air routes to more than 20 cities in ASEAN and South Asian countries, including newly added direct flights to Koh Samui and Krabi Island in Thailand, and Siem Reap in Cambodia.

Custom Reforms Fuel Cross-border Trade and Investment

Aside from infrastructure upgrade, GMS countries are keen to enhance regional connectivity through introducing one-stop customs and harmonised administrative measures across their borders. Thailand, for example, has introduced e-logistics at its borders with other GMS countries and a One Stop Export Service Centre to improve logistics efficiency. Laos and Vietnam have recently launched single-window inspection at their border checkpoints, while China and Thailand are also working to streamline their respective import regulations.

In March 2015, China’s General Administration of Customs (GAC) announced it would introduce customs clearance integration reforms in provinces along the Silk Road Economic Belt. Under reforms that took effect in May 2015, companies in Chinese cities within the Economic Belt have the option to go through customs formalities (including declaration, tax payment and goods inspection) either through their local in-charge customs houses, or via port customs through which goods are either imported or exported.

Accelerating Cross-border E-commerce

E-commerce has played an increasingly important role in stimulating international trade in recent years. With the ASEAN Economic Community (AEC) set for formal establishment by the end of 2015, and the promotion of e-commerce as a means to expand trade under China’s Belt and Road Initiative, cross-border e-commerce is likely to further accelerate.

China has been exploring ways to tap into the ASEAN e-commerce market. Yunnan and Guangxi have taken the lead in this, given their strategic locations and geographical proximity to mainland Southeast Asia. In 2013, the Chinese government designated Yunnan and Guangxi as the border financial comprehensive reform pilot areas, with the aim to facilitate trade and investment activities in the two provinces and to promote the use of the Renminbi in the China-Indochina Peninsula Economic Corridor and the Bangladesh-China-India-Myanmar Economic Corridor. These reform measures help to reduce costs and facilitate regional trade. China has also raised the cash limit that individuals are allowed to carry when crossing the border from RMB20,000 to RMB200,000.

At the seventh GMS Economic Corridors Forum held in June 2015, ministers from the six GMS countries endorsed the GMS cross-border e-commerce co-operation platform framework that China proposed, with a view to promoting cross-border trade and facilitate goods and commodity flows. Key areas of co-operation will cover co-operation of e-commerce enterprises, facilitation of cross-border e-commerce customs procedures, investment in cross-border e-commerce infrastructure, improvement of the e-commerce supporting services systems and building the capacity of e-commerce.

At the China-ASEAN e-commerce summit held in Nanning in September 2015, it was announced that Nanning had become a state-level cross-border e-commerce pilot city, with the establishment of the China-ASEAN e-commerce park and the participation of leading Chinese e-commerce companies such as Jingdong, Tencent, Alibaba and Meiliwan. To provide better services and facilitate trade flows, Guangxi will strengthen co-operation with ASEAN countries in customs, import / export inspection and quarantine, as well as other information exchanges. According to the Regional Department of Commerce Office, Guangxi’s e-commerce trade value rose 65.9% to RMB210 billion in 2014 and increased further by 84.7% to RMB 194 billion in the first half of 2015.

Mainland e-commerce companies are also moving quickly to explore the new models of cross-border e-commerce with ASEAN. Tmall Global, China’s leading e-commerce platform, announced in 2015 that it would launch a partnership duty-free shop project with King Power, Thailand’s largest duty-free group. Under the agreement, Chinese tourists will be allowed to buy stored-value cards online prior to travelling abroad, and be able to collect the purchased items from five of King Power’s duty-free shops upon arrival in Thailand.

| Content provided by |  |

Editor's picks

Trending articles

Hong Kong Export Credit Insurance Corporation | 30 Sep 2015

Laos: Benefiting from the Commencement of AEC

Strengths

- Abundant natural resources

- Stable political environment

Challenges

- Weak public finances

- Lack of skilled labor

- Insufficient basic infrastructure

|

Key Data

|

|

| Capital | Vientiane |

| Population | 6.7 million |

| Currency | Kip |

| Official language | Lao |

| Form of state | One-party rule |

Political Trend

Laos has been under the one-party rule of the Lao People's Revolutionary Party (LPRP) since 1975. Elections for the National Assembly are held every five years. The most recent election was held in April 2011, with only four independents being elected and they were vetted in advance by the party-controlled Lao Front for National Construction (LFNC). Thus, although all citizens over the age of 18 are eligible and required to vote, power still remains firmly in the hands of the LPRP. It is expected that the political climate in Laos will remain stable over the coming years, with the LPRP maintaining tight grip on power.

Laos joined the Association of Southeast Asian Nations (ASEAN) in 1997 and the World Trade Organisation (WTO) in 2013. The Laos government will look for greater regional and international integration through the establishment of the ASEAN Economic Community (AEC) by the end of 2015. Meanwhile, Laos also maintains close political and economic ties with China, which is the largest source of foreign investment and the largest export market for Laos. The two countries have agreed to build a US$7 billion high-speed railway project. However, some international agencies warned that China’s growing influence in Laos could lead to an unhealthy financial dependence on China, and that Laos should look to balance China’s influence by drawing support from other Asian countries as well as the West.

Economic Trend

Source: Economist Intelligence Unit (www.eiu.com), World Bank

Lao’s economy continued its robust expansion with growth of around 7.3% in 2014, the ninth consecutive year of above 7% growth, fuelled by the development of the mining industry, the hydroelectric sector and construction. While the Laos economy remains the smallest in Southeast Asia, it has been drawing the attention of foreign investors for a number of reasons, including its abundant natural resources, low-cost labor force, and proximity to China and the fast-growing markets of ASEAN. Rapid growth is also forecast for 2015. Lao’s current account deficit remained large in proportion to GDP over recent years.

Laos mainly imported oil, machinery and equipment, and vehicles from nearby countries. For the first six months of the fiscal year 2014-15, its trade deficit was widened from 3.1% to 6.2% of GDP, with import demand for fuel and vehicles remaining large. Meanwhile, Laos’s foreign exchange reserves coverage was low. These indicators imply significant vulnerability to shocks. The recent trends in fiscal consolidation and credit growth slowdown as well as signs of depreciation will help in curbing domestic demand for imports and therefore lessen the pressure on reserves.

The commencement of the AEC by 2015 is expected to present new opportunities for Laos. The country’s export performance continues to skew towards hydropower and mining exports, as non-resource sectors still operate in a relatively high-cost business environment with low labor productivity. Laos may expect to see new opportunities for foreign investment and some benefits through lower costs of imports and future inflows of some professional services that Laos currently lacks.

Hong Kong – Laos Trade

Total exports from Hong Kong to Laos increased by 26.4% from HK$ 240 million in 2013 to HK$ 304 million in 2014. The top three export categories to Laos in 2014 were: (1) Telecommunications, audio & video equipment (-57.4%), (2) Textiles (-26.1%), and (3) Electrical machinery, apparatus & appliances, & parts (+59.3%), which represented 30.9% of total exports to Laos.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering buyers in Laos, except for extending the waiting period for transfer delay claims from four months to six months. In the past 12 months (from July 2014 to June 2015), there was no insured business on Laos.

| Content provided by |  |

Editor's picks

Trending articles

Hong Kong Export Credit Insurance Corporation | 30 Sep 2015

Myanmar: Much Economic Reform to be Done

Strengths

- Rich endowment of natural resources

- Geographic location between Mainland China and India

- Young and low-cost labor force

Challenges

- Political and economic reforms

- Ethnic and sectarian tensions

- Limited economic diversification

- Deficient basic infrastructure

|

Key Information

|

|

| Capital | Naypyidaw |

| Population | 51.4 million |

| Currency | Myanmar Kyat (1 MMK = 0.0009 USD as of 9 June 2015) |

| Official language | Burmese |

| Form of state | Multi-party democracy |

| Major Merchandise Exports (% of total, 2013) | Major Merchandise Imports (% of total, 2013) |

| Fuels and mining products (40.4%) | Manufactured goods (59.4%) |

| Agricultural products (26.6%) | Fuels and mining products (20.4%) |

| Manufactured goods (26.4%) | Agricultural products (7.6%) |

| Top three export countries (% of total, 2013) | Top three import countries (% of total, 2013) |

| Thailand (41.7%) | China (27.1%) |

| Hong Kong (21.1%) | Singapore (27.0%) |

| India (12.6%) | Thailand (11.4%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

Following decades of military rule and isolation from the rest of the world, Myanmar has taken steps in the transition to a more open country and initiated a series of political and economic reforms.

However, Myanmar’s reform process has been slowing over the past three years. The military still dominates key decision-making and the current constitution will continue to entrench the primacy of the military. The authorities announced in late 2014 that a general election would be held in the last week of October 2015 or early November. Even if the opposition wins the election, the military will remain politically powerful.

Apart from the political issues stemming from the liberalisation process, the government also faces other major challenges. Internally, ethnic and sectarian divisions continued. Externally, the relations with the West could still be volatile due to the government’s handling of ethnic, religious and social unrest. Thanks to the political liberalisation, Myanmar has re-engaged with the West. The United States and the European Union have lifted some of their sanctions against Myanmar. A fair election this year would ensure a stronger Western engagement.

Economic Trend

Myanmar's economy is predominantly agricultural, accounts for about 37% of GDP. The country has rich endowments of natural gas, oil, and precious stones. Its Buddhist temples have boosted the increasingly important tourism industry. Since the transition to a civilian government in 2011, the country has begun an economic overhaul aimed at attracting foreign investment and reintegrating into the global economy. Economic reforms included establishing a managed float of the Kyat, granting the Central Bank operational independence, liberalizing the telecommunications sector, and enacting a new Anti-corruption Law. Young labor force and ASEAN's membership have attracted foreign investment in the energy sector, garment industry, information technology, and food and beverages.

The growth prospect of the Myanmar economy remains favorable, should the reforms are sustained. The expectation of interest rate hike by the Federal Reserve and the wide current account deficit will continue to put downward pressure on the Kyat this year. The weaker Kyat suggested imported inflation would worsen. Combined with growing domestic demand, inflation rate would rise to 8.4% in this financial year, before easing somewhat to 7.6% in FY 2016.

Myanmar remains one of the poorest countries in Asia, with GDP per capita of just over US$ 1,200 in FY 2014. From a strategic development point of view, improvements in agricultural productivity is of central importance, as the sector represents the core means of livelihood for the majority of the population.

Hong Kong – Myanmar Trade

Total exports from Hong Kong to Myanmar increased by 43.5% from HK$ 869 million in 2013 to HK$ 1,246 million in 2014. The top three export categories to Myanmar were: (1) telecommunications, audio & video equipment (+59.6%), (2) textiles (+72.7%), and (3) photographic apparatus, equipment and supplies and optical goods, nes; watches and clocks (-20.5%), which represented 61.4% of total exports to Myanmar.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering buyers in Myanmar with the exception of those under US and EU sanctions[1]. From June 2014 to May 2015, there was no insured business on Myanmar.

[1] EU sanctions: http://eeas.europa.eu/cfsp/sanctions/index_en.htm;

US sanctions: http://www.treasury.gov/resource-center/sanctions/Programs/pages/burma.aspx

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 5 Oct 2015

Outbound Investment of Chinese Enterprises: Hong Kong the First Port of Call for Professional Services (Executive Summary)

China’s outward foreign direct investment (FDI) grew 14% to US$123.1 billion in 2014, making the country the world’s third-largest source of outward FDI for three consecutive years. In fact, in recent years, the Chinese government has substantially relaxed administrative measures dealing with overseas investments and has built platforms to facilitate the “going out” of enterprises to invest overseas. At the same time, many enterprises are actively “going out” in search of brands, technologies or other resources to raise their competitiveness and to help their transformation and upgrading. Subsequently, China’s overseas investments have gradually diversified into different areas. In addition, with the active promotion of its “Belt and Road” development strategy, China is seeking to strengthen economic cooperation with regions along the Belt and Road and foster related construction by leveraging the mainland’s comparative advantages, including those of the Pearl River Delta (PRD), the Yangtze River Delta (YRD) and the Bohai Rim. It is expected that China’s outward investment activities will expand further.

Hong Kong, in particular, is a key destination for the mainland’s outward FDI. In 2013, 58.3% of the mainland’s outward FDI was carried out via Hong Kong. At the end of 2013, Hong Kong was the destination for 57.1% of the mainland’s cumulative outward FDI. These mainland funds are mostly using Hong Kong’s trading platform as a springboard to invest in other regions overseas.

Hong Kong possesses definite advantages in helping mainland enterprises make overseas investments, including the free flow of capital, abundant international communication resources and world-class professional services. To better understand the intent of mainland enterprises as they transform, upgrade and seek new business partners, the HKTDC conducted three questionnaire surveys from 2013 to 2015 in key outward FDI areas of the mainland, and in-depth visits were paid to local enterprises in areas such as the PRD and the YRD. The latest survey was carried out in mid-2015 in the Bohai Rim area.

The surveys found that a vast majority of enterprises, whether in the PRD, the YRD or the Bohai Rim, have already committed to increasing their investment – or would consider doing so – in order to enhance their competitiveness and to adjust their business and operating strategies for the ultimate goals of transformation and upgrading. The main intention of enterprises in the YRD and the Bohai Rim is to enhance their product design and research-and-development (R&D) capability, followed by the development and marketing of their own brands. PRD enterprises, however, are primarily concerned with the development and marketing of their own brands while product design and technological capabilities are only of secondary concern.

On the other hand, enterprises in both the YRD and the Bohai Rim are more concerned with bringing in overseas advantages in order to develop the domestic markets. This is not quite the same as the strategy of PRD enterprises, which gives equal emphasis to local and overseas markets. Nevertheless, most enterprises in all three areas express the need to look outside for service support, including such professional services as product development and design, branding and promotion strategies, marketing, finance, business consultancy, law and accounting. They are also “going out” to look for business partners overseas. For instance, they will bring in overseas brands to the China market, develop overseas sales networks jointly with foreign enterprises, or engage in technological collaboration with foreign enterprises in an effort to help develop new businesses and new markets.

Moreover, more than half of the enterprises surveyed express keen interest in going to Hong Kong to look for services they need or to identify suitable overseas partners. Indeed, 65% of the surveyed enterprises in the PRD, 56% in the YRD and 60% in the Bohai Rim rate Hong Kong as the most preferred service platform for “going out”. Secondary choices include the United States, Germany and Taiwan.

Hong Kong’s services suppliers are clearly able to render effective support to mainland enterprises in investing overseas. This is particularly true of Bohai Rim enterprises. Although they are geographically farther away from Hong Kong than their counterparts in the PRD and the YRD, many are still willing to go through Hong Kong or even set up office there in order to utilise its cost-effective professional services and to help them solve problems with their outward investments. Their views include:

-

As an international financial centre in the region, Hong Kong can help mainland enterprises raise funds and provide trade-related financial services such as credit negotiation and discounting. It can also help them raise funds for offshore investment projects in Hong Kong or international capital markets.

-

Other than finding low-cost financing channels for investment projects, Hong Kong’s services suppliers also provide effective due diligence for investors and make appropriate assessments for investment projects to ensure the sustainable development of their investment businesses and to control risks within reasonable confines.

-

With its professional accounting and auditing services, Hong Kong can provide appropriate international tax planning for overseas investment projects from the mainland and spare them unnecessary tax burdens.

-

Other advantages such as the free flow of international information and the abundance of communication resources also afford mainland enterprises a timely grasp of the latest investment environment, trade barriers and other market situations overseas. This will prove very effective in helping enterprises formulate global investment strategies.

-

Hong Kong is also a trading centre for technology in the region. As such, it is an ideal platform for mainland technology enterprises to open up overseas markets, look for collaboration opportunities with foreign technological partners and raise funds for offshore technology projects.

Over the years, services practitioners in Hong Kong have helped countless mainland enterprises handle their trading and investment businesses in Hong Kong and overseas markets. Other than the services mentioned by Bohai Rim enterprises, Hong Kong also provides professional services in law, branding strategies, risk assessment of sustainable operations, licensing arrangement, international certification and testing, among others. As the mainland quickens its pace of “going out” and “bringing in” and advances its “Belt and Road” initiative, more business opportunities will become available to services practitioners in Hong Kong.

Please click here to purchase the full research report.

| Content provided by |  |

Editor's picks

Trending articles

15 Oct 2015

The China Effect on Global Innovation

By McKinsey Global Institute

How innovative is China? How innovative does it need to be? These are the fundamental questions underlying this research. The answers are somewhat surprising. In many ways, we find, Chinese industry is more innovative than is generally acknowledged. Chinese companies have established strong positions in two types of innovation—developing new products and services that address consumer needs, and process innovations that make manufacturing more efficient. We also find that China has a growing need to innovate more broadly, across more industries, and raise innovation performance in engineering and science. China needs to evolve from an innovation “sponge” to an innovation leader to sustain GDP growth in the coming decade as other drivers of growth—an expanding labor force and capital investment—decline.

We conclude that China has the potential to meet its “innovation imperative” and to emerge as a driving force in innovation globally. The “China effect” in global innovation would be felt in several ways. As the nation with the largest population and the second-largest economy in GDP terms, China will be a growing source of innovation to serve the needs of an enormous and increasingly demanding consumer market. It is also a logical location for R&D and rapid commercialization of new ideas by global companies—for China, for other emerging markets, and for the rest of the world. Finally, the Chinese model of rapid, low-cost innovation can be applied around the world, potentially disrupting a range of industries…

Please click to view the full report.

Editor's picks

Trending articles

22 Oct 2015

One Belt One Road - A role for UK companies in developing China’s new initiative

In September 2015, the China-Britain Business Council released a comprehensive new report on China's ambitious and complex "One Belt One Road" initiative in partnership with the Foreign & Commonwealth Office. Designed as a practical guide to where the opportunities lie for UK companies, the report contains succinct chapters on the seven key sectors and 13 major regions to help you understand what the implications are in your industry and where your next steps should be.

"UK business is poised to play an integral part ...

New markets will open and new supply chains will change the way goods move across the globe."

HM Ambassador Barbara Woodward

For more details, please see www.cbbc.org/sectors/one-belt,-one-road.

Editor's picks

Trending articles

HKTDC Research | 11 Nov 2015

Belt and Road Initiative Spurs China's Outward Investment Programme

China is now the world’s third largest source of foreign direct investment (FDI). In recent years, the Chinese government has substantially relaxed the relevant administrative measures for dealing with overseas investments and introduced the Belt and Road development strategy in order to strengthen economic co-operation with the regions concerned. In light of this, China's level of outward investment will further expand, while its investment in countries along the Belt and Road is expected to show sustained growth.

Hong Kong is the preferred services platform for China’s outward investment activities and has provided a full range of professional services for mainland enterprises looking to invest abroad. In particular, it has specialised in providing assistance in the areas of finance, law, tax, the risk assessment of sustainable operations, and international testing and certification, among others. As the mainland accelerates the pace of its “going out” activities and advances the Belt and Road initiative, more business opportunities will inevitably become available to services practitioners in Hong Kong.

Outward Investment on a Steady Rise

China’s overseas investment activities have continued to grow in recent years, making the country one of the leading sources of global FDI. According to the latest figures from the United Nations Conference on Trade and Development (UNCTAD), China’s total outward FDI rose from about US$101 billion (US$107.8 billion, according to China) in 2013 to an estimated US$116 billion [1] in 2014 (US$123.1 billion, according to China), placing it behind only the US and Hong Kong [2]. This has made China the world’s third-largest source of FDI for three consecutive years, starting from 2012.

In recent years, China has substantially relaxed its outbound investment management procedures and actively built platforms to help more businesses in order to “go out” and co-operate with foreign partners to transform and upgrade themselves. In particular, the resolution adopted by the Third Plenary Session of the 18th CPC Central Committee at the end of 2013 proposed that, in order to meet the needs of economic globalisation, China should continue opening up both internally and externally and combine the strategies of “going out” to invest overseas with “bringing in” the advantages of foreign partners to achieve the most effective allocation of international and domestic resources.

The National Development and Reform Commission (NDRC) subsequently issued the Administrative Measures for the Approval and Record Filing of Outbound Investment Projects. This greatly narrows the scope of investment requiring the approval of the departments concerned. As of May 2014, general outbound investment projects with an investment level of less than US$1 billion only require filing in terms of a record being kept. At the end of 2014, the NDRC announced the scrapping of approval for general outbound investment projects with an investment of more than US$1 billion (except for projects involving sensitive countries, regions and sectors) [4]. Since then, record filing has replaced approval for all general outbound investment projects, unless those involve sensitive countries, regions or sectors.

Belt and Road: A Long-term strategy and a Boost to Investments

China is now promoting the Belt and Road initiative, an external development strategy centring on the Silk Road Economic Belt and the 21st Century Maritime Silk Road. In March 2015, China issued Vision and Actions on Jointly Building the Silk Road Economic Belt and the 21st Century Maritime Silk Road (Vision and Actions). This proposed the acceleration of the Belt and Road Initiative in order to encourage countries along the routes to achieve economic policy coordination, promote the orderly and free flow of economic factors and undertake a more efficient allocation of resources and a deeper integration of the relevant markets. The ultimate aim is to create an open, inclusive and balanced regional economic co-operation architecture that is of benefit to all parties concerned.

The Vision and Actions document stresses that investment and trade co-operation are the key requirements for building the Belt and Road. In line with this, China hopes to work with the countries along the Belt and Road to improve bilateral investment and trade facilitation, and to remove any investment and trade barriers. The purpose is to create a sound business environment within the region and in all of the relevant countries. Hence, considerable emphasis will be placed on pushing forward negotiations with regard to bilateral investment protection and double taxation avoidance agreements in order to protect the lawful rights and interests of investors, while expanding mutual investment areas.

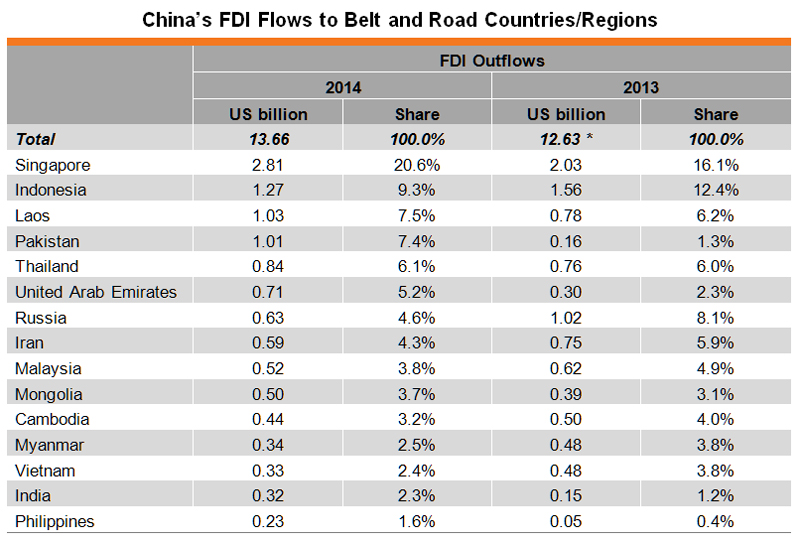

Notably, China’s FDI outflow to countries along the Belt and Road has increased rapidly in recent years. Such outflows rise from about US$400 million in 2004 to US$13.66 billion in 2014, growing at an average annual rate of approximately 43% in the period. This pace of growth is far higher than the average annual growth rate of 36% enjoyed by China’s overall outward FDI flows during the same period. The share received by the Belt and Road countries as part of China's total outward FDI flows also increased from about 7% in 2004 to 11.1% in 2014.

According to the figures published by the Ministry of Commerce (MOFCOM), Chinese enterprises made direct investments totalling US$12.03 billion in 48 countries along the Belt and Road between January and September 2015, up 66.2% from the same period last year. The key destinations for China’s FDI outflows were Singapore, Kazakhstan, Laos, Indonesia and Russia.

China’s implementation of the Belt and Road strategy is expected to further boost outbound investment by many mainland enterprises in the countries along the Belt and Road. China has also indicated that it will adopt a more proactive opening up strategy, giving full scope to the comparative advantages of different regions, including the Pearl River Delta (PRD), the Yangtze River Delta (YRD) and the Bohai Rim area. All such regions will be granted a greater degree of economic openness as well as enhanced economic strength in order to promote the building of the Belt and Road and comprehensively raise the level of China’s open economy. China's outbound investment, including that destined for countries along the Belt and Road, is expected to further expand in the future in line with this scenario. In line with the Vision and Actions agenda, the major investment projects in the countries along the Belt and Road are likely to focus on the following areas:

-

Infrastructure construction, including facilities relating to roads, shipping, aviation, energy and communications.

-

Agriculture, forestry, animal husbandry and fisheries, including the production and processing of related products.

-

Oil, gas, energy and metal ores, including co-operation in exploring and developing traditional and new energy resources.

-

Emerging industries, such as new-generation information technology, biotechnology and new materials.

-

Co-operation in science and technology, including establishing joint laboratories and carrying out technology transfers and maritime co-operation.

Opportunities for Hong Kong Companies

Over the years, service practitioners in Hong Kong have helped countless mainland enterprises handle their trading and investment businesses both in Hong Kong and in many overseas markets. With its inherent advantages when it comes to supporting mainland enterprises in their overseas investments, such as its free flow of capital, abundant international information resources and world-class professional services, Hong Kong is the preferred services platform for many mainland enterprises when they look to undertaking overseas ventures. Its professional services cover all aspects of such endeavours, including finance, law, tax, the risk assessment of sustainable operations, and international testing and certification.

Hong Kong is the main channel for China’s FDI outflows. In 2014, the amount of China's outward FDI carried through Hong Kong amounted to US$70.9 billion - or 57.6% of the mainland's total outward FDI flow. In terms of cumulative investment up until the end of 2014, the total amount of outward FDI from the mainland carried via Hong Kong was US$509.9 billion, accounting for 57.8% of the total cumulative investment as at end-2014.

According to surveys undertaken by HKTDC Research in the PRD, the YRD and the Bohai Rim between 2013 and 2015, most local enterprises intend to adopt the "going out" development strategy, as well as "bringing in" the advantages of foreign partners in order to develop both their domestic and overseas markets. In order to facilitate this, mainland enterprises need the support of wide-ranging professional services.

It is worth noting that more than half of the enterprises surveyed express a keen interest in using Hong Kong to find the services they need or to help identify suitable overseas partners. Indeed, some 65% of the surveyed enterprises in the PRD, 56% in the YRD and 60% in the Bohai Rim rate Hong Kong as the preferred service platform for “going out”. As the mainland accelerates its pace of “going out” and “bringing in” and advances its Belt and Road initiative, more business opportunities will inevitably become available to service practitioners in Hong Kong.

[Remarks: For more information on China’s outward FDI and the details of the HKTDC research findings, please see the HKTDC research report: Outbound Investment of Chinese Enterprises: Hong Kong the First Port of Call for Professional Services]

[1] Source: World Investment Report 2015, UNCTAD

[2] Hong Kong is the leading destination for the mainland’s FDI outflow, as well as the largest source of FDI for the mainland.

[3] The 18th CPC Central Committee adopted at its Third Plenary Session on 12 November 2013 the "Decision of the CPC Central Committee on Major Issues Concerning Comprehensively Deepening Reforms".

[4] NDRC Decree No. 20: "Decision of NDRC on Amending the Relevant Clauses of the Administrative Measures for the Approval and Record-Filing of Outbound Investment Projects and Administrative Measures for the Approval and Record-Filing of Foreign Investment Projects". (27 December 2014)

| Content provided by |  |

Editor's picks

Trending articles

13 Nov 2015

The Age of the Renminbi is Just Beginning

By Lawrence J. Lau

The age of the Renminbi is just beginning. In order to understand the rise of the Renminbi, it is important to realise that the centre of gravity of the World economy, in terms of both GDP and international trade, has been gradually shifting from North America and Western Europe to East Asia, and within East Asia from Japan to China, over the past couple of decades. China has become the second largest economy by GDP as well as the second largest trading nation in the World. The Chinese economy has also been growing and continues to grow at much higher rates than North American and European economies and Japan. China, with a national saving rate in excess of 40%, is a potential large foreign direct and portfolio investor to the rest of the World.

Please click here for the full report.

Editor's picks

Trending articles

13 Nov 2015

Possible Enhancement of the World Trade and Investment Systems

By Lawrence J. Lau

Economic analysis tells us that voluntary free trade benefits both the exporting and the importing countries. It also tells us that direct investment, which is necessarily long-term in nature, and long-term portfolio investment benefit both the investor and the investee countries. So on this basis, both international trade and long-term cross-border investment should be encouraged and promoted. What new initiatives can be undertaken to enhance the growth of international trade and long-term cross-border investment, and in so doing enhance the growth of the world economy as a whole?

The United States, as the largest trading nation in the world, in terms of goods and services, and China, as the second largest trading nation in the world (the largest in terms of goods alone), can jointly provide leadership in global trade promotion initiatives. Similarly, the U.S. and China, as the two largest countries of origin as well as destination of foreign direct investment can also jointly provide leadership in facilitating cross-border direct investment.

Even though for the economy as a whole every trading country is supposed to have a net gain from international trade, trade does create both “winners” and “losers” inside every country. One vexing problem of long standing for governments worldwide is how to redistribute the gains from international trade among their citizens so that everyone, or almost everyone, receives a net benefit. Unless the “losers” can feel that they have also benefited from international trade, they will oppose the expansion of trade and further opening of the economy. This is a problem that we shall attempt to address in Sections 2 and 3.

The harmonisation of product standards is also a long-standing issue in international trade—if standards can become more harmonised, it will facilitate trade, reduce transaction costs and lower the prices of many imported goods. Another major issue is the redefinition of the rules of origin to take into account the fact that the same product is today processed at or includes components and parts from many different economies so that it cannot be properly considered to have originated solely from the location of the final assembly and packaging. There is a crying need for the revision and simplification of these rules and to base them on the relative value added of different economies to a finished product. The treatment of cyber trade is also becoming a hot issue as it has been increasing by leaps and bounds, both within as well as across economies.

The growing proliferation of free trade areas (FTAs) around the world also raises the concern that the world trade system may once again become fragmented. A mechanism for open accession by countries or regions which are not original signatories to specific free trade agreements will help to avoid the increasing fragmentation of the world trade system. There is also a need to facilitate long-term cross-border investment flows, especially considering the vast differences in saving rates and demographic conditions across different economies. Bilateral or multilateral investment treaties based on the principle of national treatment can be very useful in this regard.

Finally, it may be helpful to the reduction of global carbon emissions by imposing a global tax on imports that depend on the carbon content. The tax rate does not need to be high, but such a tax will send a signal that the entire world will be working together to prevent climate change. All of these issues will be discussed.

This is the time for developing innovative ideas! This is the time to consider the next generation of enhancement of the world trade and investment systems!

Please click here for the full report.

Editor's picks

Trending articles

18 Nov 2015

OTG China – Investing USD 1tn along ‘One Belt One Road’

By Standard Chartered Bank

Summary

The China-led OBOR initiative aims to boost trade and investment growth through better infrastructure connectivity across Asia, extending to the Middle East, Africa and Europe. Simply put, ‘One Belt’ is a modern-day Silk Road, and ‘One Road’ is the maritime equivalent. The OBOR initiative has the potential to channel China’s savings and construction expertise to other countries to resolve their infrastructure bottlenecks, while making more efficient use of China’s excess capacity.

We estimate that official financing for OBOR could potentially top USD 1tn in the next decade. Infrastructure investment entails long-term investment commitments with uncertain returns, and official involvement is indispensable. We expect the recently established Asian Infrastructure Investment Bank (AIIB), New Development Bank (NDB) and Silk Road Fund (SRF), together with China’s policy banks, to play a leading role in supporting infrastructure development at the early stage. The AIIB, in particular, could potentially spur investment by other development banks and ‘crowd in’ private investment.

Commercial banks with substantial footprints along the OBOR are likely to play an important role in amplifying the effects of official funding. China’s strategy needs to be aligned with those of the other OBOR countries. The initiative has raised concerns in both OBOR and non-OBOR countries about China’s political and economic agenda. China-led investment in strategic industries such as telecommunications and energy may raise fears about the country’s expanding influence. To be successful, China needs to improve strategy alignment with other countries, gain the support of local communities, and embrace market principles and transparency. Domestically, China needs to better coordinate the investment plans of local governments to prevent a new round of over-investment.

If implemented effectively, the initiative can boost growth, Renminbi use and commodity demand. The expected infrastructure investment boom will not only lift demand immediately, but also raise potential growth rates by building physical capital. China will also benefit through more effective use of its excess capacity. In particular, we estimate that official financial support for the OBOR initiative may increase demand for crude steel by 200 million tonnes (mt) in 10 years, or 20% of China’s annual production capacity. Commodity-intensive infrastructure investment will also support commodity demand and prices. The initiative may accelerate China’s shift from being the world’s biggest goods exporter to a major capital exporter, and expand the use of Renminbi in international trade, investment and financial transactions.

Please click here for the full report.