Chinese Mainland

Fung Business Intelligence | 2 Jun 2015

Asia Sourcing Update May 2015

WORLD BANK PREDICTS CAMBODIA’S ECONOMIC GROWTH TO S LOW SLIGHTLY

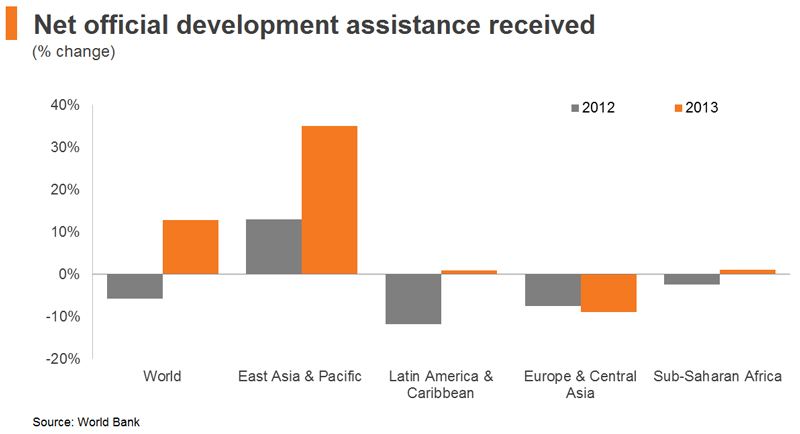

In its East Asia and Pacific Economic Update released in April, the World Bank predicts that the real GDP growth in Cambodia will moderate slightly from 7.0% yoy last year to 6.9% yoy in 2015 and 2016, and 6.8% yoy in 2017. The slowdown is attributable in part to the concerns over reduced competitiveness in the garment industry and the modest growth in the agricultural sector amid weak agricultural commodity prices.

The garment industry, which accounted for 77% of the country’s total exports last year, is facing increasing challenges. The 28% wage increase at the beginning of this year makes Cambodia’s garment exports less competitive among its neighbouring sourcing countries. At the same time, the appreciation of the US dollar, to which the Cambodian riel is pegged, also makes garment exports to the EU – the largest export market for Cambodia’s garments – less competitive in euro terms.

According to Ken Loo, secretary general of the Garment Manufacturers Association of Cambodia (GMAC), only 13 new export-oriented garment factories opened in 1Q15, compared to 40 exportoriented factories opened in the same period last year. While the World Bank’s prediction is among the least optimistic, the Asian Development Bank and Cambodia’s Prime Minister both forecast that Cambodia’s real GDP growth will accelerate to 7.3% yoy in 2015.

GARMENT EXPORTS GROW 11% YOY IN 1Q15

Cambodia exported US$1.73 billion worth of garments in 1Q15, up by 11% over the same period last year, according to data from the Ministry of Commerce. The figure points to a possible recovery of the garment industry, which grew a mere 4% yoy in terms of export value in 2014 due to falling orders.

By export destination, Cambodia’s garment exports to the EU increased by 16% yoy to US$680 million in the first quarter, while those to the US fell 1% yoy to US$537 million. Garment exports to other markets rose 21% yoy to US$521 million, indicating that the country’s efforts in diversifying its export markets have started to pay off.

The EU has accounted for an increasingly large share in Cambodia’s garment exports, overtaking the US as the largest export market for Cambodia’s garments. This is due mainly to the duty-free privileges granted by the EU to Cambodia under the “Everything but Arms” arrangement.

As labour strikes over minimum wage have gradually subsided, the growth of garment exports is likely to accelerate in the rest of the year.

VARIOUS PROJECTS UNDERWAY TO BOOST ELECTRICITY SUPPLY

Cambodia’s state energy provider Electricité du Cambodge (EDC) announced in March its plan to develop a high-voltage distribution network that can enhance the transmission capacity in a number of provinces along the Tonlé Sap Lake.

The project, funded by a concessional loan from China, will include the construction of a distribution network connecting Battambang, a province in north-western Cambodia, to the Siem Reap, Kampong Thom and Kampong Cham provinces. Another network will also be constructed to connect the Kampong Speu province to Takhmao, a city in the Kandal province, via a circular-grid network crossing the Tonlé Sap Lake, upper and lower Mekong River and Bassac River. To be completed over the next three years, together the new grids will extend the existing networks by about 450 kilometres in length.

To meet the growing domestic demand for power and reduce the reliance on imported electricity, Cambodia has been actively developing electricity generation capacity by coal and hydropower.

The Russei Chrum Krom River hydroelectric dam has begun operating in January. With power generation capacity of 338 megawatts, the dam is so far the largest hydropower station in Cambodia. It is the fifth dam built by Chinese investors in the country. The sixth one, with power generation capacity of 246 megawatts, will also become operational later this year.

To view the full article, please go to page top to download the PDF version.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 3 Jun 2015

Guangdong Pilot Free Trade Zone: Opportunities for Hong Kong

Summary

The objective of the China (Guangdong) Pilot Free Trade Zone (GDFTZ), officially launched on 21 April 2015[1], is to further open up the mainland to the world through in-depth co-operation between Guangdong, Hong Kong and Macau, and to streamline foreign investment management by way of implementing the negative list and record filing system. Currently, Hong Kong, capitalising on CEPA[2] concessions, can enter the increasingly buoyant mainland market ahead of foreign investors in areas such as services incidental to manufacturing, telecommunication services, financial services, legal services, and technical testing and analysis services. It can be expected that the GDFTZ policies and the CEPA framework will deepen liberalisation of trade in services between Guangdong, Hong Kong and Macau, and will provide more scope for Hong Kong companies to enter both the Guangdong and the entire mainland markets.

As to trade in goods on the mainland, Hong Kong companies may choose between either the GDFTZ’s facilitation measures and bonded arrangements that are available to cross-boundary e-commerce operators, or the zero tariff preferential treatment granted to Hong Kong products under CEPA, and pick the appropriate sales channel for their circumstances. Moreover, the various GDFTZ measures introduced to encourage Guangdong, Hong Kong and Macau to jointly develop the international market and strengthen trade ties among the economies along the Maritime Silk Road will also serve to consolidate Hong Kong’s position as a trade and shipping hub in the Asia-Pacific region.

The GDFTZ is making great efforts to deepen financial co-operation between Guangdong, Hong Kong and Macau. These include promoting cross-boundary renminbi business, a development that is bound to strengthen Hong Kong’s position as an offshore renminbi centre. A plan to launch pilot reforms of foreign exchange control will also help expedite the pace of internationalisation of the renminbi. Meanwhile, the Hong Kong business platform is the top choice for mainland enterprises, especially Guangdong enterprises, in their “going out” strategy of making outward direct investment. Coupled with the fact that the GDFTZ is proactively leading the Pearl River Delta (PRD) region to “go out” and undergo transformation and upgrade, this development will create more opportunities for Hong Kong service suppliers.

Positioning: In-depth Co-operation Between Guangdong, Hong Kong and Macau

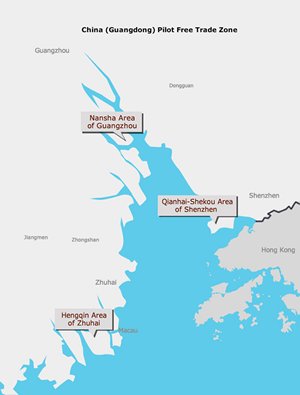

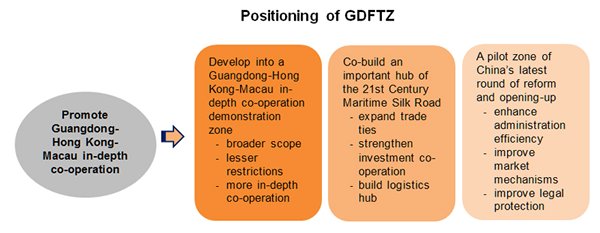

The GDFTZ covers (i) Nansha Area of Guangzhou; (ii) Qianhai-Shekou Area of Shenzhen; and (iii) Hengqin Area of Zhuhai. According to the Overall Plan for the China (Guangdong) Pilot Free Trade Zone issued by the State Council in April 2015, the GDFTZ, which includes Hong Kong and Macau, aims to serve the mainland and open it up to the world. Efforts will be made to build the GDFTZ into a Guangdong-Hong Kong-Macau in-depth co-operation demonstration zone. It will be an important hub for the 21st Century Maritime Silk Road and a pilot zone of China’s latest round of reform and opening up. The development objectives of the GDFTZ are: to establish a new and open economic system based on pilot reforms implemented over a period of three to five years; to deepen Guangdong-Hong Kong-Macau co-operation; create new advantages in international economic co-operation; and set up a free trade park with a regulated environment meeting high international standards, and offering investment and trade facilitation, leader functions, and safe and highly efficient supervision.

Reducing Market Access Restrictions on Foreign Investment

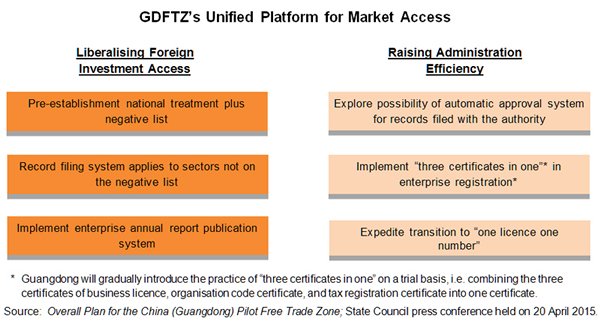

One of the major tasks of the GDFTZ is to create an international, market-oriented and regulated business environment. Apart from optimising the regulated environment and building a new administration and management system to raise administration efficiency, emphasis will be placed on establishing a market access and supervision system featuring “low entry threshold, high control standard”. This new system will implement a foreign investment negative list that reduces or removes access restrictions on foreign investments, expands the liberalisation of the service sector and manufacturing industry, and increases the degree of opening up and transparency.

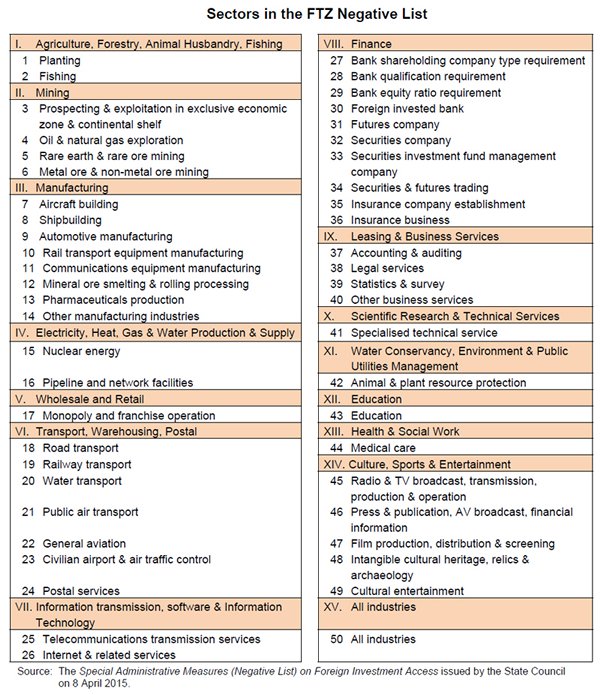

The Special Administrative Measures (Negative List) on Foreign Investment Access, issued by the State Council on 8 April 2015, sets out the special management measures for businesses and industries in which foreign investment does not qualify for national treatment. These special measures apply to the four free trade zones (FTZs) of Guangdong, Shanghai, Tianjin and Fujian. For sectors falling outside the scope of the negative list, the prior approval requirement for foreign-invested projects, as well as the examination and approval of contracts and articles of association of foreign-invested enterprises, will be replaced by record filing requirements based on the principle of same treatment for foreign and domestic investors.

Special administrative measures relating to national security, public order, public culture, financial prudence, government procurement, subsidies, special procedures and tax-related matters not on the negative list are subject to existing provisions. Foreign investment concerning national security is subject to review in accordance with the Tentative Measures for the National Security Review of Foreign Investment in Free Trade Zones.

Hong Kong Companies Entitled to Both FTZ and CEPA Concessions

Based on China’s Industrial Classification for the National Economy[3], the negative list issued by the State Council contains 50 project types under 15 categories, with 122 items subject to special administrative measures. It is specifically stated that Hong Kong investors investing in the FTZs must comply with the negative list. However, if the measures offered under CEPA and its supplements are applicable to the FTZs – and prove to be more open and preferential for qualified investors – then the CEPA provisions shall prevail[4]. In light of this, Hong Kong investors should check the provisions set out in CEPA and the FTZ negative list and choose whichever is more beneficial to them in developing their market access to the mainland and Guangdong.

Meanwhile, the Agreement between the Mainland and Hong Kong on Achieving Basic Liberalisation of Trade in Services in Guangdong (the Guangdong Agreement), signed under the CEPA framework and which came into effect in March 2015, contains both negative and positive listings for Hong Kong companies entering the Guangdong market. Under the Guangdong agreement, Guangdong opens up 153 service sub-sectors to Hong Kong, accounting for 95.6% of the 160 sub-sectors[5]. Some of its measures are even more liberal than the FTZ negative list. Thus Hong Kong companies entering the Guangdong market can simultaneously enjoy the liberal market access requirement of the GDFTZ as well as the preferential measures offered in CEPA and the Guangdong Agreement. In light of this, Hong Kong companies have an advantage over foreign investors, by being able to expand into the Guangdong and even the entire mainland markets in greater breadth and depth. For instance:

-

Mining, Prospecting and Exploration

Under the CEPA Guangdong Agreement where access to “services incidental to mining” in Guangdong has been added, Hong Kong companies are granted national treatment. However, according to the negative list applicable to GDFTZ, foreign investors are still subject to various restrictive measures in areas such as certain types of prospecting and exploration, oil and natural gas exploration, and rare earth and metal ore mining and processing.[6]

-

Manufacturing

With the exception of those industries classified under the prohibited category in the Catalogue for the Guidance of Foreign Investment in Industries, Hong Kong companies are allowed under CEPA to provide “services incidental to manufacturing” on the mainland. These take the form of equity joint ventures, contractual joint ventures or wholly owned enterprises, with no restrictions on taking controlling stakes. However, foreign investors wishing to invest in manufacturing projects in the GDFTZ – which are not even listed under the prohibited category[7] in the Catalogue for the Guidance of Foreign Investment in Industries, such as aircraft building, shipbuilding, automotive/rail transport equipment manufacturing, and communications equipment manufacturing – are still subject to various restrictions like taking controlling stakes.[8]

-

Gas, Heat and Water Supply

CEPA stipulates that when Hong Kong companies engage in the construction or operation of gas, heating, water supply and drainage networks in Guangdong cities larger than one million people, the mainland party must take a controlling stake in the project. But in the GDFTZ, if foreign investors wish to engage in such business in Chinese cities with a population of more than 500,000, the mainland party must take a controlling stake.

-

Telecommunications Services

Under the positive list of the CEPA Guangdong Agreement, Hong Kong service suppliers are allowed to establish joint-venture or wholly owned enterprises in Guangdong to provide telecommunication services on the mainland including multi-party communications, store and forward, call centre services, and Internet access services for online users (with business scope limited to Guangdong Province).

By contrast, foreign investors in the GDFTZ are only allowed to invest in those telecommunications services liberalised under the commitments made when China joined the World Trade Organization (WTO). Also, the negative list states that foreign equity ratio in value-added telecommunications services (except for e-commerce) may not exceed 50%. The mainland stake in basic telecommunications services may not be less than 51%.

-

Banking

CEPA has listed in detail the lower market access requirements on Hong Kong banks entering the mainland. For instance, Hong Kong banks wishing to set up wholly owned banks or branches on the mainland must have assets totalling US$6 billion at the end of the year preceding their application. This is much lower than the US$20 billion threshold imposed on foreign banks. Besides, the Guangdong Agreement further removes the minimum operation period and profit requirements on Hong Kong banks wishing to establish business arms in Guangdong to conduct renminbi business. The minimum amount requirement on operating funds that incorporated banks established on the mainland must transfer to their Guangdong branches has also been lifted.

In the banking sector, the FTZ negative list sets out the shareholding company type requirements as well as the qualifications and equity ratio of the banking institutions. For example, foreign-invested financial institutions must satisfy a total assets requirement of a certain amount. Some restrictive conditions are also imposed on foreign banks, such as the head office of foreign bank branches must transfer operating funds to them at no cost, and the funds must exist in a specific form meeting corresponding administration requirements. The relevant departments have yet to promulgate the relevant detailed regulations and measures.

-

Legal Services

Under CEPA, Hong Kong law firms that have set up representative offices on the mainland are allowed to operate in association with between one and three mainland law firms. The positive list in the Guangdong Agreement stipulates specifically that in Guangdong, mainland law firms can assign mainland-practising lawyers to the representative offices of Hong Kong law firms to act as mainland legal consultants. Meanwhile, Hong Kong law firms can assign Hong Kong lawyers to mainland law firms to act as Hong Kong-related or cross-boundary legal consultants. Also, Hong Kong law firms can operate in partnership with their mainland counterparts in Qianhai, Nansha and Hengqin in Guangdong on a pilot basis.

However, foreign law firms can only set up representative offices in the GDFTZ and are not allowed to handle Chinese legal matters, nor employ Chinese lawyers.

-

Technical Testing and Analysis

Under CEPA, Hong Kong testing organisations accredited by the Hong Kong Accreditation Service (HKAS) are allowed to co-operate with designated mainland organisations to undertake testing of all products processed in Hong Kong that require China Compulsory Certification (CCC). These organisations can also undertake testing on food items and other products subject to voluntary certification in Guangdong on a pilot basis. Moreover, the positive list in the Guangdong Agreement accords them the right to co-operate with designated mainland organisations to undertake testing under CCC of audio and visual products that are designed and prototyped in Hong Kong and processed or manufactured in Guangdong. But no such measures are offered to foreign industry players.

-

Individually-owned Businesses

According to CEPA, Hong Kong permanent residents with Chinese citizenship may set up individually-owned businesses in various mainland cities and provinces to engage in designated business without being subject to the approval procedures applicable to foreign investments or any restrictions on the number of employees and the business area (excluding franchise operations). The Guangdong Agreement further expands the designated business scope for Hong Kong individually-owned businesses.

However, the FTZ negative list states that foreign investors may not engage in business activities as investors in individually-owned businesses or individually wholly-owned enterprises in the FTZ.

(Note: For details and measures on the above, please refer to relevant documents such as the FTZ negative list and CEPA.)

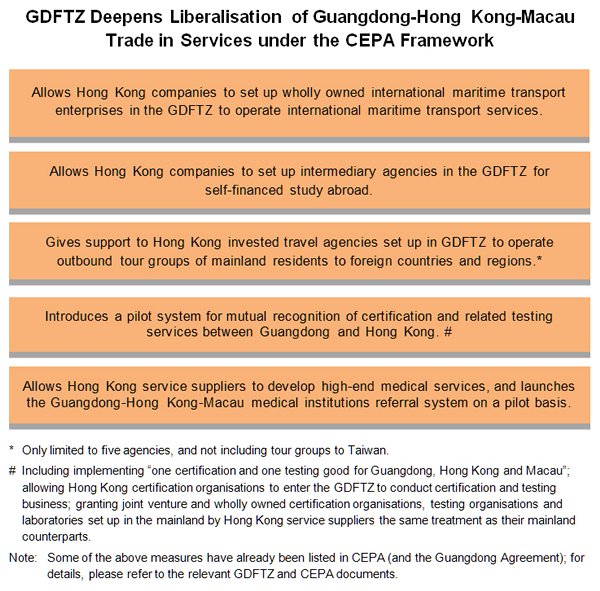

Advance Liberalisation of Trade in Services between Guangdong, Hong Kong and Macau

In addition to market access, the overall GDFTZ plan also states clearly that, under the CEPA framework (and the Guangdong Agreement), efforts will be made to deepen liberalisation of trade in services between Guangdong, Hong Kong and Macau and to further expand the scope of opening up the service sector to Hong Kong and Macau. Action to be taken includes exploring the possibility of removing or liberalising the access restrictions on qualification criteria, equity ratio, and business scope imposed on Hong Kong and Macau investors, with an emphasis on services serving the financial, transportation and shipping, commercial, professional and technical sectors. Meanwhile, steps will also be taken to look into the feasibility of offering a special arrangement between Guangdong, Hong Kong and Macau that mutually recognises the professional qualifications of employees in the service sector. In view of this, Hong Kong companies entering the service market in Guangdong, while capitalising on CEPA’s facilitation measures, should also pay close attention to the detailed facilitation measures introduced by the GDFTZ.

Strengthen International Trade Functions

Meanwhile, the GDFTZ will encourage Guangdong, Hong Kong and Macau to jointly strengthen trade ties with countries and regions along the 21st Century Maritime Silk Road in a move to expand the international market. Enterprises will be encouraged to set up headquarters in the GDFTZ and establish operations centres integrating the functions of logistics, trade and settlement. Action will be taken to jointly develop offshore trade with Hong Kong and Macau. Efforts will also be made to strengthen co-operation between Guangdong, Hong Kong and Macau in the convention and exhibition industry. This will allow industry players to set up bonded goods displays and trading platforms in special customs supervision zones under the premise of strictly implementing the policy of levying taxes on import and export goods. Other measures include:

- Support parallel import of automotives on a pilot basis;

- Encourage the development of innovative financing and leasing business;

- Support development of futures bonded delivery and warehouse receipt financing in special customs supervision zones;

- Develop an innovative interactive development mode for e-commerce between Guangdong, Hong Kong and Macau; actively develop cross-boundary e-commerce;

- Set up an intellectual property operation centre for the south China region;

- Actively undertake service outsourcing, and advance the development of such services as software development, industrial design and information management;

- Strengthen Guangdong-Hong Kong-Macau co-operation in product inspection and testing technology as well as standards formulation.

As for building a logistics hub on the 21st Century Maritime Silk Road, the GDFTZ will set up an interactive mechanism for seaports and airports in Guangdong, Hong Kong and Macau. It will explore the feasibility of aligning regulations and standards with Hong Kong and Macau in freight forwarding and freight transportation. The GDFTZ will also proactively develop such industries as international maritime transport, international ships management, international crew services, and international shipbroking. Support will be given to Hong Kong and Macau enterprises to invest in international ocean-going and air transport services. Industry players will be allowed to operate, on a trial basis, the business of consolidation and transit of air courier items from foreign countries, Taiwan, Hong Kong and Macau. Meanwhile, action will be taken to liberalise the equity ratio restriction on Chinese-foreign contractual joint ventures engaged in international shipping.

Hong Kong is a trade and shipping hub in the Asia-Pacific region, and an important gateway to the international market for Guangdong and other provinces in China. The city hosts large numbers of ship owners, consignors and traders, and has developed a full spectrum of shipping services: shipping financing, insurance, broking, ships management and related legal services. Many Hong Kong companies conduct international trade in Guangdong and, by capitalising on the development of Hong Kong’s trading and shipping services support industry, have broadened the horizons of Hong Kong’s trading and shipping sectors.

For instance, even before it was officially launched in the GDFTZ, the Nansha Area of Guangzhou had made it a priority to develop producer services. This included relying on Hong Kong’s position as an international financial, trade and shipping centre to promote Guangdong-Hong Kong-Macau co-operation in related industries. As at the end of April 2015, about 800 Hong Kong-invested enterprises had established a presence in Nansha. Among them is Kingboard Chemical Holdings Ltd, whose petrochemical production and distribution project in Nansha carries out the production and distribution of chemical products such as epoxy and Tetrabromob ispheno1-A. The Nansha Cargo Park Co Ltd in Panyu, Guangzhou, invested and set up by the Henry Fok Ying Tung Group, engages in integrated logistics in Nansha, including wharf operation, bonded supervision, logistics and delivery, freight forwarding and insurance, and logistics solution consultation. Meanwhile, Enpro Supply Chain Management Ltd of Hong Kong operates a plastics packaging supply chain centre in the Nansha Bonded Logistics Park. The firm takes advantage of the bonded logistics facilities in Nansha and the international shipping network of Hong Kong to provide a one-stop plastics packaging supply chain, as well as regional delivery services for the Chinese mainland and Southeast and Northeast Asia.

As the GDFTZ strengthens trade ties with economies along the Maritime Silk Road jointly with Hong Kong and Macau in the hope of becoming a logistics hub on the Maritime Silk Road, this is bound to provide Hong Kong industry players with extra room for development, as well as enhancing Hong Kong’s position as a trade and shipping centre in the Asia Pacific.

|

Trade in Goods: Cross-border E-commerce Operators and CEPA Concessions One of the focusses where trade in goods is concerned is cross-border e-commerce import. Currently, Guangzhou and Shenzhen are among the designated pilot cities authorised to conduct e-commerce imports[9]. Some cross-border e-commerce operators have already started business in the Qianhai and Nansha sub-zones in the GDFTZ. These industry players enjoy facilitation in customs clearance, inspection and quarantine for their imports, and also take advantage of the FTZ’s bonded import and warehousing arrangements to lower costs and to apply for personal postal articles tax for their goods. Goods imported into China under “general trade” are subject to import tariffs and 17% VAT. But cross-border e-commerce operators in pilot bonded areas may adopt the “bonded reserve goods mode”, whereby merchandise sourced from foreign countries in bulk can be delivered to designated cross-border warehouses in the bonded area first. After the consumer has placed an order online, the e-commerce operator will then complete customs clearance procedures and make a customs declaration for the goods concerned to be imported as “personal articles” and pay personal postal articles tax. After verification by Customs, the merchandise is delivered to the consumer by courier companies. Currently, four tax rates apply to personal postal articles:

However, cross-border e-commerce operators conducting imports in the form of “personal articles” must meet the above criteria of placing orders online and delivery by courier company, as well as observe the principle of “for personal use and in reasonable quantity”. The value of personal postal articles carried by an international traveller is limited to Rmb1000[10] per trip, otherwise, these articles would be treated as imported goods under “general trade” and are subject to customs clearance and payment of import tariff and VAT[11]. The import of “personal articles” is tax free if the tax amount is below Rmb50. The lower 10% personal postal articles tax rate applies to certain goods, but for other items it remains as high as 20% or more. However, if the goods meet the Hong Kong origin requirement, Hong Kong companies may consider taking advantage of the zero tariff rate concession offered under CEPA and paying the 17% VAT[12]. As to which import arrangement is more advantageous, it all depends on the type of product imported, the applicable tax rate, the country of origin, and the sales strategy of the company concerned. |

Deepen Financial Co-operation between Guangdong, Hong Kong and Macau

The GDFTZ devotes great efforts to deepening financial co-operation between Guangdong, Hong Kong and Macau. It implements financial reform and innovation in order to strengthen and give full play to Guangdong, Hong Kong and Macau’s joint role in advancing the mainland’s financial reform and innovation. It also promotes liberalisation of trade in services between the three places and propels economic transformation and upgrade. Detailed development directions include:

-

Promoting development of cross-boundary renminbi business between Guangdong, Hong Kong and Macau:

-

To turn the renminbi into the major denomination and settlement currency for cross-border large-amount transactions and investments between the GDFTZ and Hong Kong, Macau and foreign countries.

-

To advance two-way renminbi financing between the GDFTZ and Hong Kong and Macau.

-

To allow banking financial institutions in the GDFTZ to conduct cross-boundary renminbi lending business with their Hong Kong and Macau counterparts.

-

To allow non-banking financial institutions such as securities companies, fund management companies, futures companies and insurance companies in the GDFTZ to conduct cross-boundary renminbi business with their Hong Kong and Macau counterparts.

-

-

Further opening up to Hong Kong and Macau:

-

To look into the possibility of introducing cross-boundary renminbi credit assets transfer business under the CEPA framework.

-

To improve the negative-list management approach for the financial sector in a bid to promote further liberalisation of the financial services sector in the GDFTZ to Hong Kong and Macau.

-

-

Strengthening financial services for enterprises “going out”:

-

This includes giving support to financial institutions in Guangdong, Hong Kong and Macau to jointly set up renminbi overseas investment funds in the GDFTZ.

-

In addition to promoting Guangdong-Hong Kong-Macau financial co-operation, the GDFTZ will also enhance investment and financing facilitation and make use of innovative measures to meet the financial needs of enterprises in the FTZ. These include:

- To launch a new management model for local and foreign currency accounts, and introduce innovations in such areas as account opening, account business scope, funds transfer, and dynamic monitoring mechanism.

- To look into the possibility of rolling out innovative cross-boundary financing business by way of free trade account and other risk control methods.

- To introduce, under the premise of risk control, foreign exchange control pilot reforms with emphasis on renminbi convertibility under the capital account.

- To allow organisations in the FTZ to bring in, under the macro-prudential framework, local and foreign currency funds from abroad and to issue local and foreign currency bonds offshore.

- To introduce on a pilot basis renminbi convertibility under the capital account within a set limit, allowing qualified organisations to carry out transactions such as direct investment, mergers and acquisitions, bond instruments and financial investment within the set limit.

|

Enhancing Hong Kong’s Position as an Offshore RMB Centre In recent years, many financial institutions in Hong Kong have been making use of the mainland’s increasingly open financial policies and CEPA’s market liberalisations to gradually participate in the mainland financial market and develop business. By doing so, they accumulate practical operation experience in the hope of acting as first-movers when the mainland further liberalises its relevant policies, as well as identifying business opportunities brought about by liberalisation. For instance, Qianhai, in Shenzhen, had already identified trial financial reforms and innovation as the focusses of its liberalisation policies even before the GDFTZ was officially launched. The aim is to create a modern services systems and mechanisms innovation zone, as well as a pioneer zone for close co-operation between Hong Kong and the mainland. It also explored the possibility of broadening the channels for diverting renminbi funds from overseas to support the development of offshore renminbi business in Hong Kong, and to build an innovative pilot zone for cross-boundary renminbi business. As of 30 April 2015, some 1,335 Hong Kong-invested enterprises had established a presence in Qianhai, with the total registered capital reaching Rmb215.4 billion[13]. Among the different industries, the financial sector is one of the major areas of Qianhai-Shenzhen-Hong Kong co-operation. For instance, commercial banks including the HSBC, Hang Seng Bank, Bank of East Asia, Standard Chartered Bank and China Merchants Bank have set up branches in Qianhai. Many of these banks make use of Qianhai’s advantages to develop cross-boundary renminbi business and participate in lending projects related to Qianhai. Since Qianhai launched its cross-boundary renminbi lending projects on 22 January 2013, the total cross-boundary loans obtained by Qianhai enterprises from Hong Kong reached Rmb82.6 billion by the end of 2014[14]. These loans have supported the development of the real economy in Qianhai, and have contributed to financial innovations of the existing currency supply mechanism and renminbi exchange rate system. The renminbi’s role in cross-boundary transactions, as well as the renminbi lending business of Hong Kong’s financial institutions, have been strengthened, effectively further enhancing Hong Kong’s position as an offshore renminbi trading centre. As the GDFTZ further implements reforms and opening up to deepen financial co-operation between Guangdong, Hong Kong and Macau, this move helps to promote cross-boundary renminbi business. The possibility of further opening up the FTZ to Hong Kong and Macau under the CEPA framework is also bound to bring about greater market opportunities for Hong Kong industry players. |

Engine for Regional Development

The GDFTZ will also develop into an important platform leading the development of the Pearl River Delta and other regions, including:

-

Leading the transformation and upgrade of the PRD:

-

To build public service platforms for technology R&D, industrial design and intellectual property serving the transformation and upgrade of processing trade.

-

-

Creating a Pan-PRD integrated service zone:

-

Relying on closer co-operation with Hong Kong and Macau, efforts will be made to encourage enterprises in the GDFTZ to conduct co-ordinated international and domestic trade, support and foster integrated foreign trade services enterprises, and provide such services as customs clearance, financing, tax refunds and international settlement for small and medium-sized enterprises.

-

-

Building an important window for mainland enterprises “going out”:

-

Relying on the advantages of Hong Kong and Macau in financial services, information, international trade networks, and risk management, action will be taken to build the GDFTZ into a window and integrated service platform for mainland enterprises and individuals embracing the “going out” strategy, while support will be given to mainland enterprises and individuals to participate in the building of the 21st Century Maritime Silk Road.

-

|

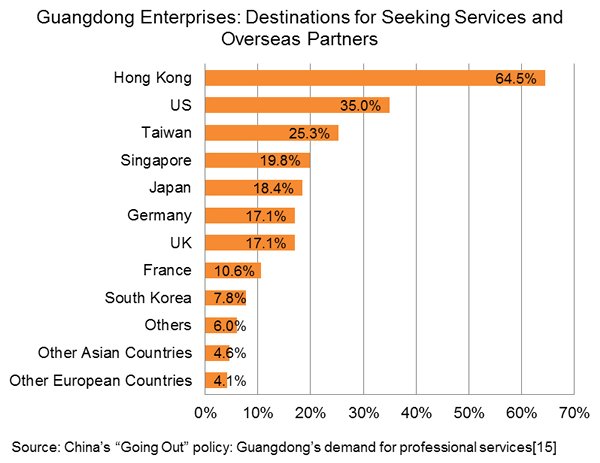

Helping Guangdong Undergo Transformation and Upgrade in “Going Out” Guangdong has long been one of the important provinces in China’s foreign economic and trade co-operation. The province plays an active role in promoting the development of the south China region and pan-PRD. It is also a major source of China’s outward investment, especially non-financial investment. It is worth noting that currently a majority of Guangdong enterprises are eager to undergo transformation and upgrade. They want to make use of the “going out” strategy, and “bring in” the advantages of their business partners, in order to develop the mainland and overseas markets simultaneously – and the Hong Kong service platform is the top choice of those enterprises. According to an HKTDC survey conducted in 2013 in Guangdong province on the “going out” strategy and “transformation and upgrade”, more than 90% of the surveyed enterprises indicated that they would consider, or had already, increased investment as a way of boosting competitiveness. Their most sought-after service support included financial and professional services such as brand design, product development, marketing, business consultancy, and legal/accounting and banking/financing. Meanwhile, 91% of the enterprises indicated that they would “go out” to seek co-operation partners. The majority of enterprises expressed interest in sourcing services and business partners from Hong Kong, accounting for 65% of the surveyed enterprises[15]. Hong Kong service suppliers have handled matters relating to trade and investment in Hong Kong and foreign markets on behalf of mainland enterprises for many years. The GDFTZ is leading the PRD region in transforming and upgrading, and is becoming an important window for the mainland’s “going out” policy. It can be expected that more detailed measures will be introduced to help enterprises in the FTZ make use of the Hong Kong platform to acquire services and co-operation partners. This is bound to create more opportunities for Hong Kong service suppliers. |

Opportunities for Hong Kong

Under the premise of in-depth co-operation between Guangdong, Hong Kong and Macau, the GDFTZ has liberalised market access for foreign investment. The record filing system has been introduced on top of the negative list in order to streamline foreign investment administration. This, coupled with the liberalisation and concessionary measures offered to Hong Kong under CEPA, has greatly expanded the scope for Hong Kong companies to enter and develop the Guangdong and the entire mainland markets.

Under CEPA and the Guangdong Agreement, Hong Kong already enjoys market access and preferential measures in many sectors, and is a step ahead of foreign investors in expanding the increasingly buoyant mainland market. Preferential policies applicable to Hong Kong are wide ranging. They cover services incidental to mining and manufacturing, as well as services in the areas of telecommunications, finance, legal, and technical testing and analysis services.

The GDFTZ’s liberalisation measures provide Hong Kong companies with even more options to develop the mainland market. For instance, where trade in goods is concerned, Hong Kong companies can choose either the GDFTZ’s facilitation measures and bonded arrangements offered to cross-border e-commerce operators, or the zero tariff preferential treatment granted to Hong Kong products under CEPA. Companies can select the right channel for selling to the mainland market based on their situation.

Meanwhile, the GDFTZ deepens the liberalisation of trade in services between Guangdong, Hong Kong and Macau in the hope of achieving breakthroughs in such sectors as finance, transportation and shipping, trade and commerce, professional services and technical services. Guangdong, Hong Kong and Macau are encouraged to jointly develop the international market, and to forge themselves into an important hub for trade along the Maritime Silk Road. The GDFTZ has introduced detailed development measures including: supporting parallel import of automobiles on a pilot basis; setting up an intellectual property operation centre in the south China region; advancing the development of industrial design; and supporting Hong Kong and Macau enterprises in investing in shipping and air transport services. Against this backdrop, it can be expected that enterprises in Guangdong, Hong Kong and Macau will have increased business co-operation opportunities in these sectors. They can utilise their individual resource advantages in market, talent, management and financing to complement one another, and make more use of the services offered by Hong Kong. This can help Hong Kong consolidate its roles as a trade/shipping hub in the Asia Pacific and as an important regional trade centre for technical services and intellectual property rights.

With regard to the financial sector, the GDFTZ devotes great efforts to deepening financial co-operation between Guangdong, Hong Kong and Macau, and further opening up to Hong Kong and Macau financial services suppliers. This can help Hong Kong’s financial sector to enter the mainland market and enhance the city’s position as an international financial centre. In particular, the GDFTZ’s efforts in promoting the development of cross-boundary renminbi business between Guangdong, Hong Kong and Macau are bound to strengthen Hong Kong’s role as an offshore renminbi trading centre. Also, the GDFTZ’s action in introducing foreign exchange control pilot reforms with an emphasis on renminbi convertibility under the capital account serves to accelerate the pace of internationalisation of the currency. Under the premise of deepening Guangdong-Hong Kong-Macau co-operation, it can be expected that Hong Kong will play an important part. In view of this, Hong Kong industry players should pay close attention to the detailed measures announced by the mainland so as to effectively capture the right business opportunities.

The Hong Kong business platform is also the prime choice of mainland enterprises undergoing transformation and upgrade in their pursuit for “going out”. Possessing such advantages as free capital flow, rich international communication resources, and international-level professional services, Hong Kong can offer mainland enterprises, especially Guangdong enterprises, a full range of services. As the GDFTZ leads the PRD region in undergoing transformation and upgrade, coupled with the fact that the “going out” policy encourages outward direct investment, this development trend is set to provide Hong Kong service suppliers with more opportunities.

Appendix: Functional Positioning of Sub-zones

Nansha Area of Guangzhou

The Nansha New Area, or GDFTZ (Nansha), is blessed with the policy advantages of being a state-level new area, a state-level economic and technological development zone, a bonded port area, and a new and high-tech development zone. With a sound industrial foundation, Nansha New Area is one of China’s three shipbuilding bases, a national auto and spare parts manufacturing and export base, as well as a nuclear power equipment manufacturing base in the PRD region. Where scientific research is concerned, the research base of the Guangzhou Institute of Industry Technology under the Chinese Academy of Sciences is located in Nansha. It has built a technology innovation platform for numerical-control equipment technology research and development, and modern logistics industry planning services. It has also been rated as a state-level technology transfer demonstration base. Moreover, the Hong Kong University of Science and Technology and the Fok Ying Tung Foundation have jointly established a facility for promoting the internationalisation of traditional Chinese medicine in the Nansha New Area.

GDFTZ (Nansha) will devote great efforts to creating a regulated international business environment in line with new international practice. It aims to take the lead in implementing free trade in services with Hong Kong and Macau. Building an international shipping and logistics centre with comprehensive international trade functions and strong financial innovation ability is another goal. It will also develop into a demonstration base for technology innovation co-operation between countries and regions along the 21st Century Maritime Silk Road.

GDFTZ (Nansha) comprises seven functional sub-zones: (1) an international shipping development and co-operation zone; (2) a financial and commercial development experimental zone; (3) a Guangdong-Hong Kong-Macau integrated development experimental zone; (4) an international education and medical co-operation experimental zone; (5) a Guangdong-Hong Kong-Macau scientific and technological innovation and co-operation zone; (6) a comprehensive outbound investment service zone; and (7) a processing trade transformation and upgrade service zone.

Qianhai-Shekou Area of Shenzhen

Qianhai and Shekou are just across the sea from Hong Kong. Leveraging on the close co-operation in modern services between Shenzhen and Hong Kong, and taking advantage of Hong Kong’s rule of law and level of internationalisation, as well as its advanced port development, GDFTZ (Qianhai-Shekou) will give emphasis to developing new strategic services such as finance, modern logistics, information, and technology services. It aims to transform into a pilot demonstration base for China’s financial sector to open up to the world, an important base for trade in services worldwide and an international hub port of China.

Hengqin Area of Zhuhai

The Hengqin New Area, or GDFTZ (Hengqin) is linked to Macau via the Lianhua Bridge. It implements an innovative supervision mode of round-the-island real-time monitoring. Capitalising on the co-operation with higher education institutes such as the University of Macau and the development of the Chimelong Ocean Kingdom in Zhuhai, GDFTZ (Hengqin) will give emphasis to developing a number of industries. These include: tourism, leisure and health; commercial and financial services; culture, science and education; and new and high technology. Action will be taken to set up a pilot zone to open-up cultural and education services and an international commercial services and leisure tourism base, as well as create a new carrier for the diversified development of Macau’s economy.

[1] At the State Council Executive Meeting held on 12 December 2014, it was adopted that the Guangdong Free Trade Zone was to be established. Occupying an area of 116.2 sq km, the GDFTZ covers three sub-zones: (i) Nansha Area of Guangzhou (60 sq km, including the 7.06-sq km Guangzhou Nansha Bonded Port Area); (ii) Qianhai-Shekou Area of Shenzhen (28.2 sq km, including the 3.71-sq km Shenzhen Qianhai Bay Bonded Port Area); and (iii) Hengqin Area of Zhuhai (28 sq km).

[2] Here CEPA refers to the Mainland and Hong Kong Closer Economic Partnership Arrangement and its supplements.

[3] China’s Industrial Classification GB/T4754-2011

[4] Investments from Macau and Taiwan are subject to the provisions in their respective arrangement/agreement signed with the mainland.

[5] For details, please visit the website of Hong Kong government Trade and Industry Department at http://www.tid.gov.hk/english/cepa/legaltext/files/Info_Note_2014.pdf

[6] The sector of “services incidental to mining” under CEPA is defined in accordance with the WTO classification of service industries, while the mining industry mentioned in the FTZ Negative List is classified in accordance with China’s Industrial Classification. The areas covered by the two classifications are not identical.

[7] Catalogue for the Guidance of Foreign Investment in Industries 2015.

[8] The sector of “services incidental to manufacturing” under CEPA is defined in accordance with the WTO classification of service industries, while the manufacturing industry mentioned in the FTZ Negative List is classified in accordance with China’s Industrial Classification. The areas covered by the two classifications are not identical.

[9] Currently, pilot cities in the mainland where cross-border e-commerce imports can be conducted include: Shanghai, Chongqing, Hangzhou, Ningbo, Zhengzhou, Guangzhou and Shenzhen.

[10] The maximum value of personal postal articles carried by individuals travelling to and from Hong Kong, Macau and Taiwan is Rmb800. In case the value of an article exceeds the set limit, after Customs has examined and verified that the article is really for personal use, it can still go through customs clearance procedures as a personal article provided that it is the only item carried by the traveller at the time.

[11] For details, please see the Circular of the General Administration of Customs on Pilot Online Shopping Bonded Import Mode in Cross-border E-Commerce (Shu Ke Han [2013] No.59), and the Notice on Supervision over Cross-border E-Commerce Import and Export Goods and Articles (GAC Announcement (2014) No.56).

[12] For details on zero tariff rate concession and Hong Kong origin requirement under CEPA, please visit the website of the Hong Kong Government Trade and Industry Department: http://www.tid.gov.hk/english/cepa/index.html

[13] Source: Authority of Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone

[14] Source: Authority of Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone

[15] For more details, please refer to HKTDC Research’s article Guangdong: Hong Kong service opportunities amid China’s “going out” strategy and report China’s “Going Out” policy: Guangdong’s demand for professional services

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 16 Jun 2015

Guangdong-Hong Kong Cooperation to Scale New Heights

Professor Feng Xiaoyun from Guangzhou’s Jinan University envisages that Guangdong-Hong Kong cooperation is set to reach new heights during the 13th Five-Year Plan period (2016-2020). In particular, under the country’s “One Belt, One Road” initiative, the building of the Guangdong-Hong Kong-Macau Big Bay Area will bring about significant advances in Guangdong-Hong Kong cooperation. Hong Kong, as the only global city in the Greater Pearl River Delta (PRD) region, will perform the functions of leading the PRD to “go out” and raising the level of internationalisation of the regional economy, making the city cluster in the region the most vibrant and internationally competitive in the Asia Pacific.

Professor Feng Xiaoyun of the College of Economics, Jinan University, pointed out at an international forum held in May this year that Guangdong-Hong Kong cooperation is set to reach new heights during the 13th Five-Year Plan period. In order to better understand this view point, Pansy Yau, HKTDC’s deputy director of research, interviewed Professor Feng at the Guangzhou CUHK Kaifeng Hotel.

Guangdong-Hong Kong cooperation is set to make significant advances during the 13th Five-Year Plan period because according to the framework agreements on Guangdong-Hong Kong cooperation and Guangdong-Macau cooperation signed by Guangdong with Hong Kong and Macau respectively in 2010, the three places will join hands in building a world-class city cluster in the region by 2020. In view of this, in the next five years, i.e. during the 13th Five-Year Plan period, major breakthroughs can be expected in the mode and mechanism of cooperation between Guangdong and Hong Kong in the course of promoting integration of regional economy and in basically forming a world-class city cluster.

General speaking, city cluster has two definitions. One is spatial integration of a number of cities in a specific region. The other is functional integration of the cities in that region. Functional integration means that each city in the region would have its specific function(s) and the functions of all the cities will add together to create a complementary relationship. As such, a city cluster usually has clear division of functions with each city performing different economic functions, which will work together to form a competitive city cluster.

In the Outline of the Plan for the Reform and Development of the Pearl River Delta (2008-2020), clear division of functions has been set out for different cities in the PRD. This includes positioning Guangzhou as a modern services centre in the south China region; Shenzhen as a technological research and innovation centre; Foshan and Dongguan as international high-end manufacturing bases; Zhuhai, Zhongshan and Jiangmen as advanced manufacturing bases in the mainland; and Huizhou as a petrochemical base.

As for Hong Kong, its positioning is to serve as the engine propelling PRD cities to go international and develop into global cities. Within the Guangdong-Hong Kong-Macau city cluster, Hong Kong’s biggest comparative advantage is its global network. As a matter of fact, in every city cluster, there is a city whose function is to lead the whole cluster to integrate into the global network. And the city undertaking this function is positioned as a global city. Currently, among the 11 cities in the Guangdong-Hong Kong-Macau city cluster (comprising nine PRD cities, Hong Kong and Macau), Hong Kong is the only global city. In other words, the leader function performed by Hong Kong fully demonstrates her comparative advantage.

Hong Kong takes the lead among PRD cities in international transportation as well as commercial services such as financial and legal services, accounting, and marketing on a global level. Innovative systems being implemented in the Guangdong Pilot Free Trade Zone (GDFTZ) and efforts to further promote liberalisation of trade in services between Guangdong and Hong Kong are bound to strengthen Hong Kong’s role in leading the whole city cluster to integrate with the global network, as well as building the Guangdong-Hong Kong-Macau Big Bay Area into an important hub along the Maritime Silk Road.

In the document Vision and Action on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road issued earlier by three State Council ministries and commissions, it was specifically mentioned that efforts will be made to give full play to the functions of the GDFTZ in strengthening cooperation with Hong Kong and Macau and creating the Guangdong-Hong Kong-Macau Big Bay Area along the Maritime Silk Road, and that the big bay area will play a very significant role in the building of the Maritime Silk Road.

Note: The Guangdong provincial government announced the Implementation Plan of Guangdong Province for Participating in the Construction of “One Belt, One Road” on 3 June, putting forward that efforts will be made to build the Guangdong-Hong Kong-Macau Big Bay Area into a first-class international financial and trade centre, technological and innovation centre, transportation and shipping centre, and cultural exchange centre on the Maritime Silk Road, and that action will be taken to build a logistics hub in the big bay area for trade between China and countries along the Maritime Silk Road.

| Content provided by |  |

Editor's picks

Trending articles

Hong Kong Export Credit Insurance Corporation | 30 Jun 2015

Israel: Open Economy with Low Tax Policy

Strengths

- Well-developed science and technology sector

- Large offshore reserves of natural gas

Challenges

- Unstable coalition governments

- Geopolitical tensions

|

Key Data

|

|

| Capital | Jerusalem |

| Population | 8.2 million |

| Currency | New shekel |

| Official language | Hebrew, Arabic |

| Form of state | Parliamentary democracy |

| Major Merchandise Exports (% of total, 2013) | Major Merchandise Imports (% of total, 2013) |

| Chemicals & chemical products (excl. refining) (29.3%) | Fuel (20.5%) |

| Polished diamonds (16.2%) | Diamonds (11.6%) |

| Electronic communication, medical & scientific equipment (13.8%) | Consumer non-durable goods (9.3%) |

| Top three export countries (% of total, 2013) | Top three import countries (% of total, 2013) |

| USA (31.0%) | USA (11.5%) |

| Hong Kong (9.5%) | China (7.9%) |

| UK (6.9%) | Germany (6.6%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

Israel is a country with proportional representation and universal suffrage. The Prime Minister serves as head of government. However, no Israeli administration has completed a full term since the 1984-88 government of national unity. In December 2014, the coalition government under Prime Minister, Binyamin Netanyahu, was in growing divergence over a long list of issues, leading to the dissolution of the government that had just served for less than two years of its four-year term, and prompting an early election in March 2015.

Netanyahu was elected to Prime Minister of Israel for the fourth time during the election in March. The Likud party that he led emerged as the largest party, clearly ahead of the Zionist Union. The new cabinet will need to respond to a number of issues that proved divisive in the outgoing government, including security concerns and continued public discontent over growing income inequality, rising living costs and a shortage of housing, despite relatively healthy economic fundamentals.

On the security front, relations between Israel and the United States appeared to be fraying. In April, Israel issued a formal statement opposing the framework nuclear agreement the P5+1 (the five permanent UN Security Council members plus Germany) agreed with Iran, which had exacerbated its relations with the Obama administration. Meanwhile, security risks in Israel remain elevated despite the Egypt-brokered truce between Israel and Islamist group Hamas in August 2014, as highlighted by protracted violence even after the ceasefire.

Economic Trend

* Estimates ^ Forecast

Source: Economist Intelligence Unit (www.eiu.com)

In 2014, the Israeli economy grew at its lowest rate in the past five years, as the 50-day war against Hamas and other Gaza terror groups in summer weighed down heavily on the country’s tourism and private consumption. Fortunately, the economic impact of the conflicts was proved to be short-term, growth is expected to bounce back to above 3% in 2015, driven by the rebound in domestic demand that followed the end of the Gaza conflict and the projected strengthening of external environment. The economy should also be supported by the ultra-low interest rates, currently at 0.1%, and a pause in fiscal consolidation in 2015. The central bank projected that it will leave the interest rate at its low level in the coming quarters in order to support economic activity and a return of inflation to around the midpoint of the 1-3% target range.

Looking ahead, Netanyahu will seek to promote a policy agenda that emphasizes economic liberalization and low taxes. In fact, Israel’s debt levels have been steadily falling for years, from 81.9% of GDP in 2008 to an estimated 66% in 2014. Currently, Israel was assigned ‘A+’ by S&P for the state’s credit rating with a stable outlook, Still, Israel pays a higher premium on its debt than most other OECD countries. In 2015, Israel was scheduled to pay US$10 billion in interest payments alone, more than two-thirds of its defense spending.

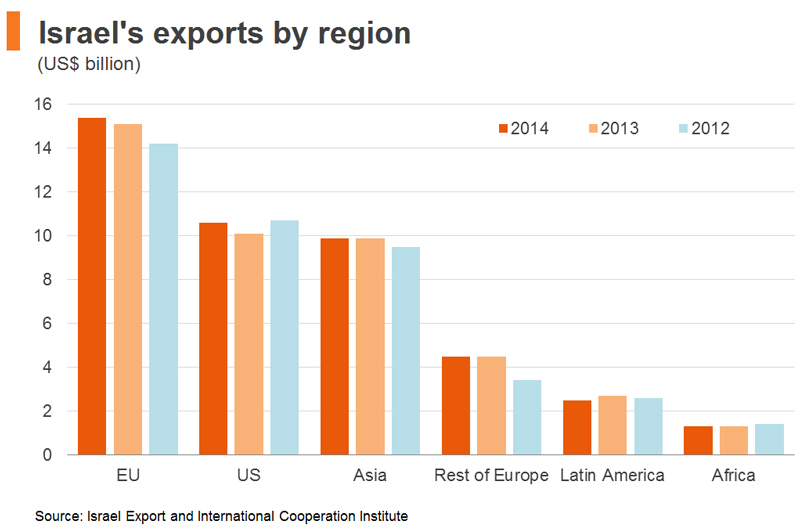

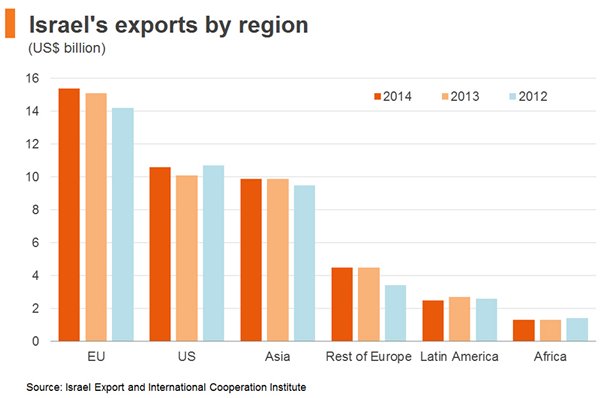

Hong Kong – Israel Trade

Israel was the 25th largest export market for Hong Kong in 2014, with exports value accounting for 0.5% of Hong Kong's total exports. Total exports from Hong Kong to Israel increased by 19.0% from HK$ 16,040 million in 2013 to HK$ 19,083 million in 2014. The top three export categories to Israel in 2014 were: (1) Non-metallic mineral manufactures, nes (+23.1%), (2) Telecommunications, audio & video equipment (+17.0%), and (3) Electrical machinery, apparatus & appliances, & parts (+8.0%), which represented 89.8% of total exports to Israel.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering Israeli buyers. Currently, the insured buyers in Israel are mainly small and medium-sized companies. For 2014, the number of credit limit applications on Israel decreased by 24.2%, but the amount of credit limit applications and Insured business increased by 17.8% and 0.9% respectively. Major insured products were electronics (+21.3%), metallic products (-13.2%) and mineral products (+40.6%), which represented 34.9% of ECIC’s insured business on Israel. The Corporation’s underwriting experience on Israel has been satisfactory, with three payment difficulty cases of small amount reported from April 2014 to March 2015, involving metallic product, electronics and clothing.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 21 Jul 2015

The Belt and Road Initiative and the Opening Up and Sustained Development of the Chinese Economy

If the “reform and opening up” in the past 30-plus years have transformed China from a semi-industrialised, closed and centrally planned economy to the world’s top trading country and processing factory, the role of the Belt and Road initiative is perhaps to further elevate this “world processing factory” into a “world economic nexus” of the 21st century.

If the “reform and opening up” of the past 30-plus years have been China’s uni-directional opening up focusing on its coastal regions, then the Belt and Road initiative is a new phase of comprehensive opening up and development of the Chinese economy that gives equal emphasis to the coastal and inland regions.

If the “reform and opening up” of the past 30-plus years have been a development course of China relying on the capital, technology and markets of advanced economies, then the Belt and Road initiative can be considered a new Chinese development strategy making use of the resources and markets of both the industrial and developing world.

The Belt and Road initiative not only could lead to a change in China’s economic position in the world, it is also instrumental to the transformation and upgrading of China’s own economy, especially in its escape from the “middle-income trap” and its sustainable development.

Silk Roads Past and Present

Ever since Zhang Qian, an official in the Han Dynasty (202 BCE-220 CE), led an envoy to explore the western regions of China (Central Asia) in the second century BCE, for over a thousand years the “Silk Road” was China’s thoroughfare for opening to the outside world as well as the main artery for economic and cultural exchanges between the East and the West. From the Song Dynasty (960-1279 CE) onwards, the Maritime Silk Road has offered a major channel for opening up to the outside world. Due to the limitations set by an agrarian society and by technology, impacts of both the land and maritime silk roads on China’s economy had been limited. It was not until the “reform and opening up” started more than 30 years ago that fundamental changes were brought about to the Chinese economy.

But then time and situations have changed. In particular, after the financial crisis, protectionism has been rising, recovery of European and American economies has been anaemic and emerging markets are on the rise, so China’s development strategy of relying on exports to the industrial economies is now under constraints. No matter in the search for markets, access to resources or technologies, there is a need for new and more comprehensive breakthroughs in China’s “opening up” strategy.

Geographically, the gateways in China created by the Belt and Road initiative constitute an “all-round” pattern of opening up: extending from the coastal regions to the inland; expanding from the east to the west and the south; and evolving from using predominantly sea routes to using both sea and land channels. It also involves the connection of domestic and overseas resources to various markets and a more balanced development of the economies in China’s eastern and western regions.

From a development perspective, the Belt and Road initiative broadens the targets of China’s opening up from developed countries in Europe and America to developing countries in its neighbourhood and along the silk roads. This fittingly reflects the shift of China’s economy from one of being export oriented to catering to domestic and overseas demands and to imports as well as exports; from focusing on processing and manufacturing to paying equal attention to downstream as well as upstream industries, and to a more balanced development of manufacturing and services sectors. This is related to whether or not China’s economy can break up regional, industrial, hierarchical and urban-rural boundaries so that it can raise productivity more comprehensively, escape from the “middle-income trap” and develop in a sustainable manner.

Limitations and Challenges

Nevertheless, the Belt and Road initiative is not without its limitations and challenges. Foremost is that geographic misunderstandings may arise. The land and maritime silk roads were routes for East-West dealings in ancient times and are very different to the extent of coverage of the main transportation and communication networks of today. Furthermore, the centre of world economic gravity in the pre-industrial revolution days is very different to the world economic landscape in the Internet era of today. If we limit China’s opening up to territories along the ancient land and maritime silk roads, we would overlook a lot of vital regions such as North and South America and the African continent.

For sure, in the official elaboration of the Belt and Road concept, it has also been mentioned that the initiative “covers, but is not limited to, the area of the ancient Silk Road. It is open to all countries, and international and regional organisations for engagement...” [1] But objectively misunderstandings can occur regarding the regions covered by the Belt and Road, particularly when shown and mentioned in highly generalised maps and briefings (for example, in the media, we often come across the mentioning of how many countries and how many people are covered by the Belt and Road, as well as other such details). Admittedly the Belt and Road initiative will mainly start with countries on the periphery of China and along the ancient silk roads, but as long as this initiative cannot surpass the scope of the ancient silk roads, it will not be able to achieve its task of guiding the comprehensive opening up of China.

Source: Hong Kong Trade Development Council

Another Belt and Road challenge is how to draw the line between the roles of governments and markets. Though the Chinese government stresses that the initiative has to “follow market operations” and that “it will abide by market rules and international norms, give play to the decisive role of the market in resource allocation and the primary role of enterprises”, in actual practice it is not easy. This is mainly because many of the countries along the silk roads are still developing and their market economies are relatively under-developed. Considering also that they have insufficient infrastructure and their land transportation connections with China are poor, there is a need for massive long-term developmental investments which are not easily undertaken by ordinary private enterprises. This is also the reason why the initiative emphasises policy coordination and promotes intergovernmental cooperation and mutual political trust.

Though the Chinese government and state enterprises have accumulated a lot of experience, and have developed capabilities in domestic infrastructure construction during the past few decades, they are still relatively inexperienced in the area of cross-border investments. It will therefore be a big challenge to strike a good balance between the roles of governments and markets, while abiding by market rules and international norms in places where markets are not well developed and rules are not internationally applicable.

This article originally appeared in Hong Kong Economic Times (20 July, 2015)

[1] Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road, jointly issued by the National Development and Reform Commission, the Ministry of Foreign Affairs and the Ministry of Commerce, March 2015.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 23 Jul 2015

One Belt One Road: Yuxinou Railway Development

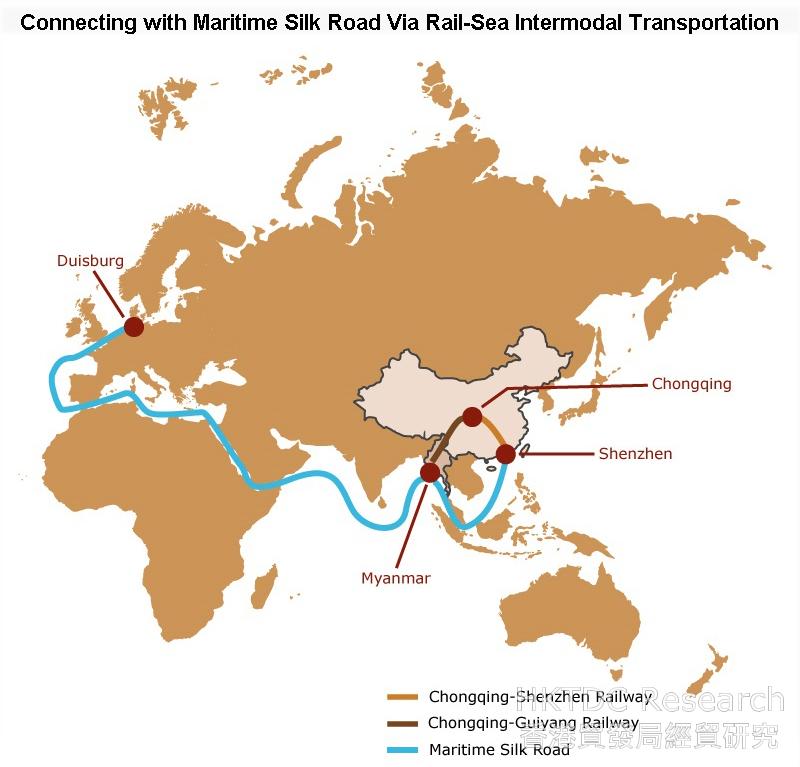

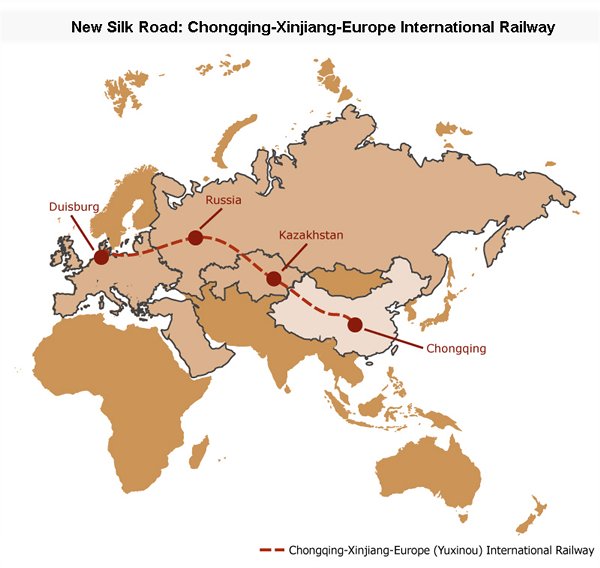

As the transport hub of the Silk Road economic belt and Yangtze economic belt, Chongqing connects China’s eastern and western regions with the European markets. Its functions as a shipping centre in the upper reaches of the Yangtze River and a national logistics hub will be further strengthened in China’s new round of economic reform and opening up and implementation of the “One Belt, One Road” strategy. Rail-sea intermodal transportation connecting Chongqing and the “Maritime Silk Road” also opens international trade routes to South Asia and Southeast Asia. According to the Opinions on Implementing the Belt and Road Strategy and Building the Yangtze Economic Belt issued by the Chongqing municipal government in December 2014, investment by the municipal government in infrastructure projects will reach Rmb1.2 trillion by 2020. Among these, the Chongqing-Xinjiang-Europe international railway will be the main Eurasian land bridge between western China and the European markets. The railway is also known as the Yuxinou railway, an acronym for Chinese characters Yu (which stands for Chongqing), Xin (Xinjiang) and Ou (Europe).

Shortening Transport Time between Chongqing and Europe

The Yuxinou railway starts from Chongqing and runs northwestwards to Xi’an, Lanzhou and Urumqi on the Northern Xinjiang Railway to cross the Chinese border at Alataw Pass, where it enters Kazakhstan after changing gauge. It continues through Russia, Belarus and Poland (change gauge again) to arrive in Duisburg, Germany. Stretching 11,179 kilometres, it is hailed as the “New Silk Road”. Through the co-operation and support of China’s Ministry of Railways and General Administration of Customs and the governments of countries along the railway, this international rail link integrates existing railway networks and introduces “one-stop declaration, inspection and release” for faster customs clearance along the route.

The Yuxinou railway has greatly shortened transportation time between western China and Europe after its official opening on 18 March 2013. In the past, Europe-bound Chongqing exports were first shipped to Shanghai on the Yangtze River, where they were loaded onto larger ocean-going vessels to continue their shipment to Europe. The entire journey of this river-sea intermodal transportation usually took 45-60 days. Using the Yuxinou railway, it only takes 13 days to export goods from Chongqing to Germany. Besides saving time, this also improves the liquidity of working capital. The Yuxinou railway is still working on the improvement of speed. According to China Railway, transport time between Chongqing and Germany will be further shortened to 12 days after the railway becomes fully operational at the end of 2015.

Up to the end of 2014, a total of 233 trips had run on the railway, with freight volume amounting to 5.4 billion tonnes and the value of imports and exports transported totalling US$6.8 billion. Today, it has more than four trains leaving Chongqing for Europe and one train or more returning from Europe each week. It is estimated that about 300 trips will run on the railway in 2015 with onward and return trips each accounting for 50% of the journeys. The Yuxinou railway operates with fixed stations, fixed routes, fixed train numbers, fixed timetables and fixed prices. A more stable train service will enhance Chongqing’s ability to solicit cargo sources from the surrounding areas.

Cargo Sources: Greater Diversity and Larger Catchment Area

Chongqing’s industrial development has always had electronics and automotive industries as its two pillars. Electronic products and auto parts also form the bulk of goods exported to Europe via the Yuxinou railway. As Chongqing’s industries have become more diversified in recent years, the sources of goods have also increased. Today, cargo carried on the Yuxinou railway also includes machinery equipment, food, textiles and light products. The origins of goods also extend from Chongqing to places beyond, with Chongqing itself and the surrounding provinces accounting for 50%, eastern China for 30%, and southern China for 20%. Chongqing’s imports from Europe mainly include cars and auto parts from Germany and high-end consumer goods, timber, machinery equipment, chemicals and instruments from countries like Italy and Spain.

In addition to a larger catchment area for goods, the destinations of cargo shipments have also been extended to cities beyond the Yuxinou railway line to form a unique “1+N” pattern of convergence and distribution network. Here, “1” refers to the main line of the railway from Chongqing to Duisburg, while “N” refers to countries chosen by consignors as their points of convergence and distribution. Today, this has developed into a network of dozens of convergence and distribution points, including Rotterdam in the Netherlands, Antwerp in Belgium, Moscow and Cherkessk in Russia, Kutno in Poland, Pardubice in the Czech Republic, and Almaty and Kostanay in Kazakhstan. From another prospective, these convergence and distribution points may be taken as centres of European exports to Chongqing. Greater diversification of European goods exported from Europe to Chongqing will in turn further enrich the varieties of imported goods in the mainland market.

Railway Transport Cost Drops Steadily

According to a logistics company in Chongqing, goods are mostly exported from Chongqing to Europe by means of river-sea intermodal transportation because both the buying and selling sides are accustomed to this practice. However, as freight rates on the Yuxinou railway keep falling, more companies may consider switching to railway transport. In general, transport costs from Chongqing to Europe on the Yuxinou railway are about 40% lower than by air, but about 100% higher than by river-sea intermodal transportation. For example, it costs about Rmb12/kg to transport ordinary goods from Chongqing to Europe on the Yuxinou railway, about Rmb20/kg by air, and about Rmb5/kg by ship.

The freight rate on the Yuxinou railway was US$1 per TEU/km in 2011, US$0.8 per TEU/km in 2012 and US$0.7 per TEU/km in 2013. It dropped to US$0.55 per TEU/km by April 2015. There should be room for further reduction as freight volume continues to rise. This will enhance Chongqing’s competitiveness as the logistics hub of western China.

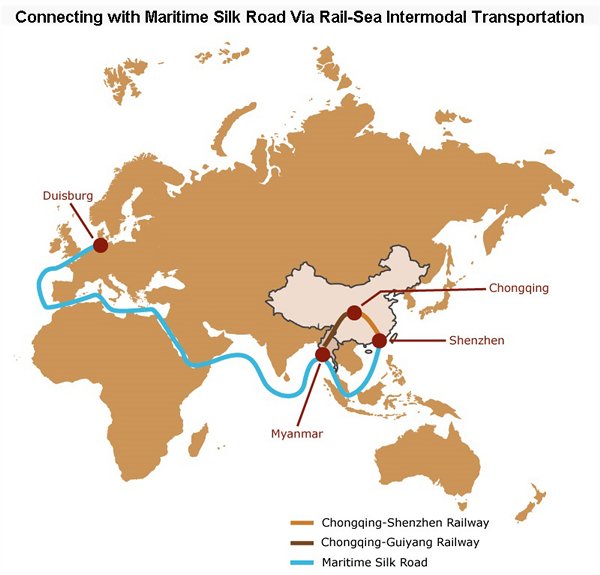

Maritime Silk Road

Apart from the Yuxinou railway, goods may also be exported from Chongqing to Europe by rail-sea intermodal transportation to connect with the Maritime Silk Road for the onward journey to Europe. For example, goods may be sent to Shenzhen’s Yantian Port on the Chongqing-Shenzhen Railway, where they will be loaded onto ships bound for Rotterdam via the Maritime Silk Road. The whole journey takes about 27 days. The Chongqing-Guiyang Railway now under construction will run southwestwards to Guiyang. From there, goods will be exported via Kunming and Ruili to Sittwe port in Myanmar, where they will be loaded onto ships and transported to Rotterdam via the Maritime Silk Road. The whole journey is expected to take more than 30 days.

Besides relying on the “One Belt, One Road” strategy to promote port infrastructure and land-sea intermodal transportation, Chongqing is also exerting efforts to open international trade routes to South Asia and Southeast Asia and integrate with the China-Indochina Peninsula economic corridors. Chongqing will strengthen co-operation in the construction of the Chongqing-Kunming Railway[1] and the new Chongqing-Guiyang Railway[2], and encourage its leading car and motorcycle manufacturing, chemical and energy enterprises to expand to South Asia and Southeast Asia. As an important node connecting the Maritime Silk Road and the Silk Road Economic Belt and with its strong influence on the Yangtze River Economic Belt, Chongqing will invest more to further improve its infrastructure in future.

Opportunities for Hong Kong Businesses

The “One Belt, One Road” initiative is China’s important development strategy during the 13th Five-Year Plan period (2016-2020). Under this strategy, Chongqing, which plays an important role as the main transport hub between western China and Europe, will find great scope and opportunities for development. In addition to the Yuxinou railway, Chongqing’s railway network may also help export goods to the European market via the Maritime Silk Road by means of rail-sea intermodal transportation. The “One Belt, One Road” routes that connect the Asia-Pacific economy with the European economy pass through more than 60 countries and regions in Central Asia, Southeast Asia, South Asia and eastern Africa, where 4.4 billion people live. As Chongqing’s external logistics and transportation costs drop, and with the municipal government’s policy of fostering industrial clusters with special advantages, Hong Kong manufacturers may consider extending their production lines to Chongqing not only for export purposes but also to market their products to consumers in China's central and western regions as well as in countries along the "One Belt, One Road".

Apart from manufacturing enterprises, Hong Kong’s logistics companies may also take the opportunity to expand their business in Chongqing and in countries and regions along the “One Belt, One Road”. As freight volume on the Yuxinou railway grows, the catchment area of goods and destinations of delivery will also increase. In particular, the formation of its unique “1+N” pattern of convergence and distribution network will increase demand for logistics and other supporting services (such as finance and insurance) on a local level. On the other hand, the “One Belt, One Road” strategy will generate plenty of room for co-operation in such fields as infrastructure and finance. Hong Kong’s service providers should look out for new opportunities.

[1] China Railway plans to start construction of the Chongqing-Kunming Railway in 2016. The project is slated for completion in four years. It will only take about 2.5 hours to travel from Chongqing to Kunming when the railway is completed.

[2] The new Chongqing-Guiyang Railway is due for completion at the end of 2017, by which time it will only take two hours to travel from Chongqing to Guiyang.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 28 Jul 2015

The Belt and Road and the Reshaping and Adjustment of World Economic Order

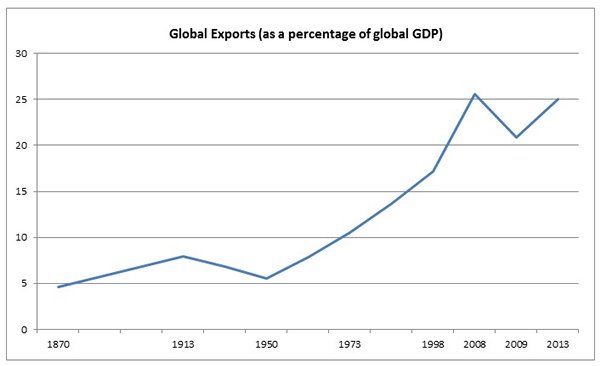

In the wake of the financial crisis, “de-globalisation” sentiments have spread worldwide and protectionism is on the rise. Not only are import controls proliferating, but highly exclusionary and non-transparent regional trade agreements are coming up one after the other, together with rising localism and increasing trade barriers, it is not surprising that the recovery of the global economy is simply anaemic. Seven years after the crisis, world trade (in terms of global output) and cross-border fund flows have yet to recover to their pre-crisis levels. Though the lesson from the Great Depression of the 1930s has been well learnt and the world economy has avoided the pitfalls of that episode, de-globalisation sentiments have been keeping anxiety over the Great Recession alive.

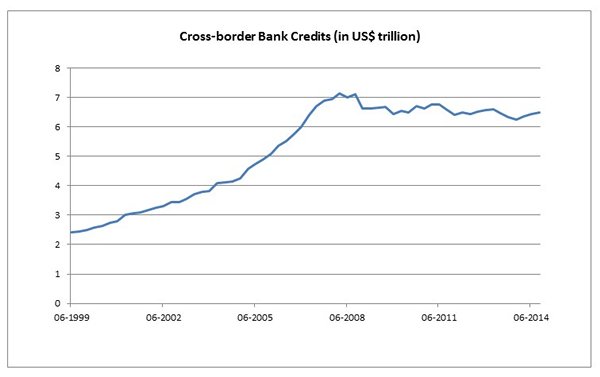

Source: WTO, HKTDC

To revitalise the world economy, we have to thwart protectionism and suppress de-globalisation. Unfortunately, international economic coordination institutions set up after the Second World War, for example, the World Trade Organization, the World Bank and the International Monetary Fund, have all been ageing to one degree or another. In particular, as the gravity of the world economy shifts eastward, and as the growth of the main developing countries accelerates, what the world economy needs is not simple stimulations. What it needs instead is the reshaping of global order and adjustments in multilateral institutions. The Belt and Road initiative is China’s response to the reshaping of world economic order.

Transcending Regional Boundaries