Resilient 2026 Lighting Industry Outlook

Hong Kong Lighting Fair (Autumn) Survey Results

The lighting industry remains broadly optimistic, according to an HKTDC survey of 735 exhibitors and buyers conducted onsite during the 2025 HKTDC Hong Kong Lighting Fair (Autumn Edition) as well as the Outdoor Tech Light Expo 2025 (28‑30 Oct). Across the industry, most respondents were upbeat about the overall market outlook and expected sales levels to rise over the next two years. However, they remained mindful that global economic volatility and ongoing inflationary pressures could constrain any future sales expansion.

Growth Confidence Remains Robust

In general, most survey respondents had a broadly optimistic outlook with regard to future market prospects. Notably, 33% anticipated sales growth over the short term (6–12 months) and 61% expected continued expansion in the medium term (12–24 months), while a reassuringly small minority (4% or less) saw the likelihood of any sales decline in either timeframe.

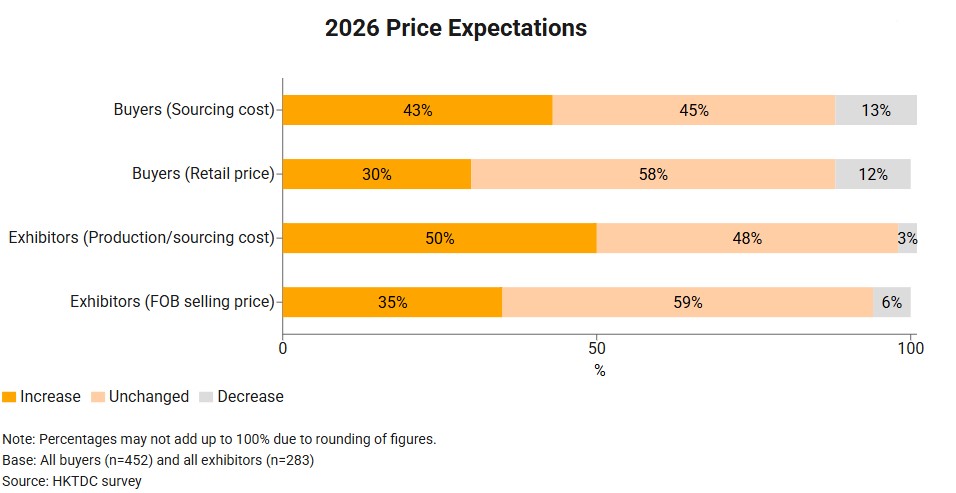

Turning to pricing expectations, about 30% of buyers anticipated retail prices rising in 2026, while 43% expected higher sourcing costs. On the exhibitor side, 35% expected their FOB selling prices to increase, while 50% saw a rise in their production or sourcing costs as likely.

Economic Volatility

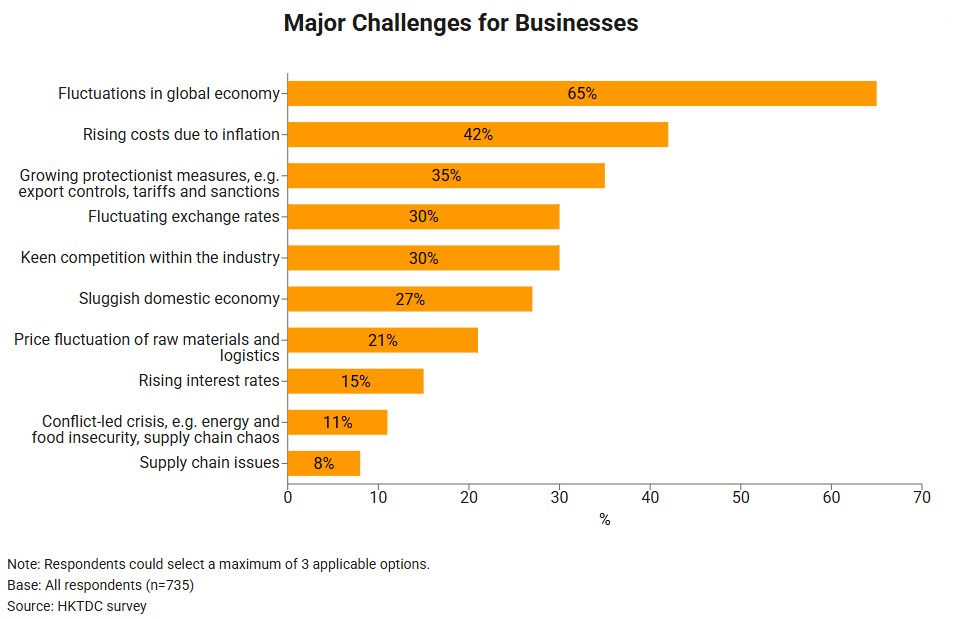

Despite the general optimism, respondents also flagged a number of possible headwinds. In all, fluctuations in the global economy were the most frequently cited concerns (65%), overtaking protectionism as the dominant worry. Other key challenges were seen as inflation‑driven cost increases (42%), protectionist measures including export controls, tariffs, and sanctions (35%), and intensifying industry competition (30%).

Bright Prospects for Emerging Economies

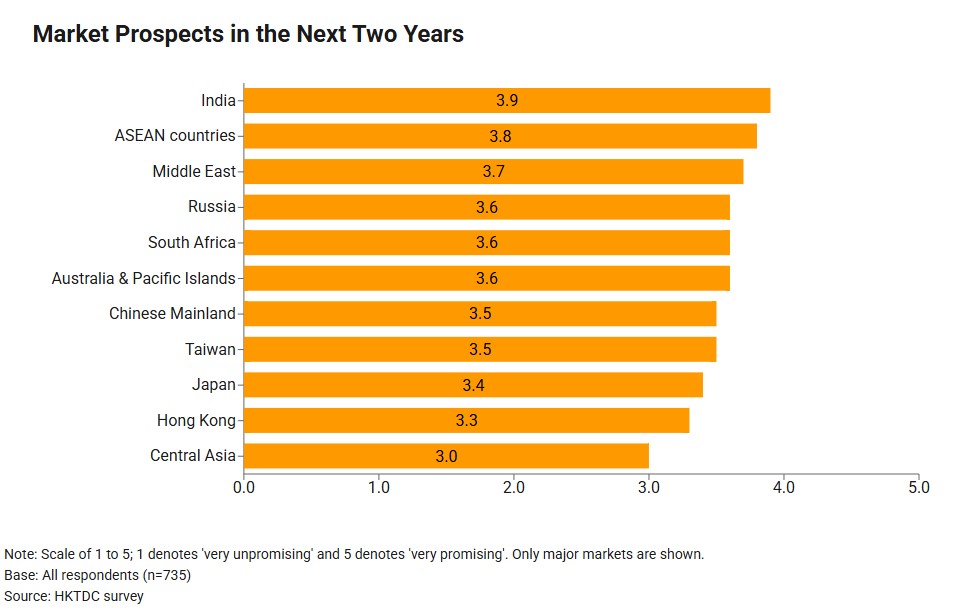

In terms of the outlook for individual markets, optimism was particularly high in the case of many of the emerging economies. When asked to rate markets on a scale from ‘1’ (‘very unpromising’) to ‘5’ (‘very promising’), respondents saw India (3.9) as the most likely to grow over the next two years, followed by the ASEAN bloc (3.8) and the Middle East (3.7).

Residential Lighting Emerges as Top Growth Category

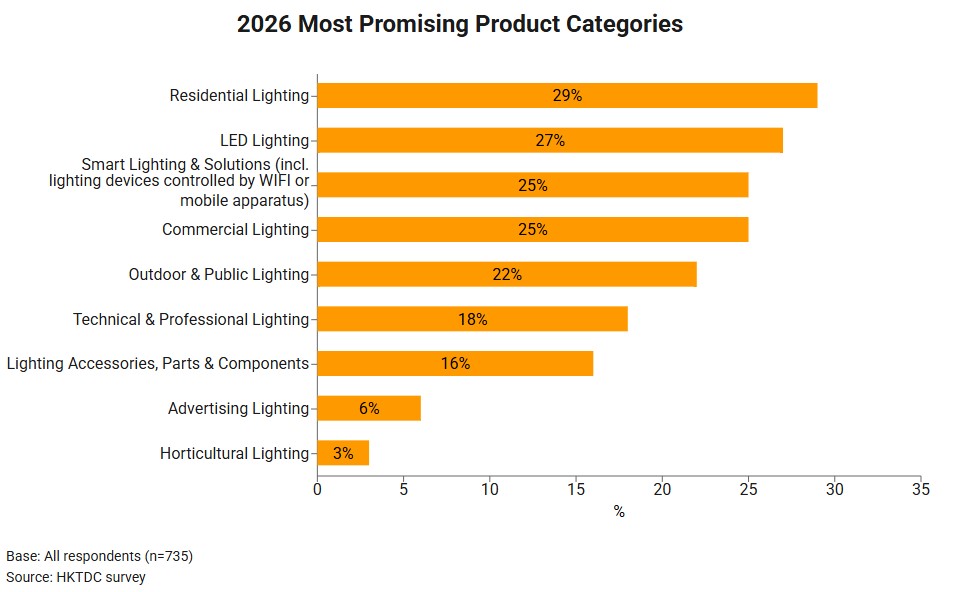

In terms of product categories with the highest growth potential, 29% of respondents saw residential lighting as the frontrunner, followed by LED lighting (27%) and smart lighting and solutions (including lighting devices controlled by WIFI or mobile apparatus) (25%).

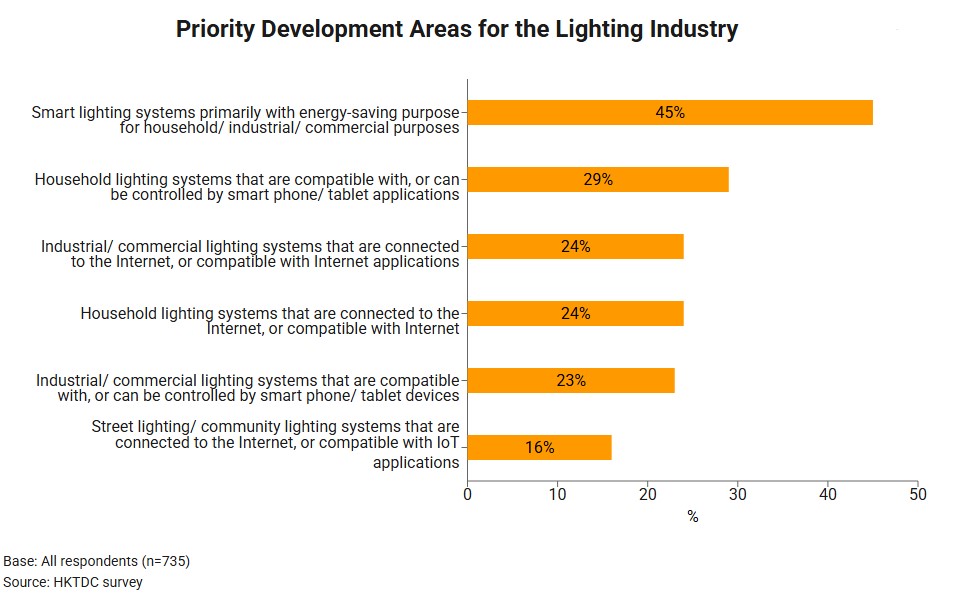

Smart and Energy-Efficient Lighting Seen as Development Priority

In terms of the most promising areas for future industry development, respondents were most hopeful (45%) with regard to smart lighting systems focused on energy efficiency for residential, commercial, and industrial use. This was followed by residential lighting systems controllable via smartphone / tablet apps (29%) and commercial / industrial lighting systems with internet connectivity (24%).

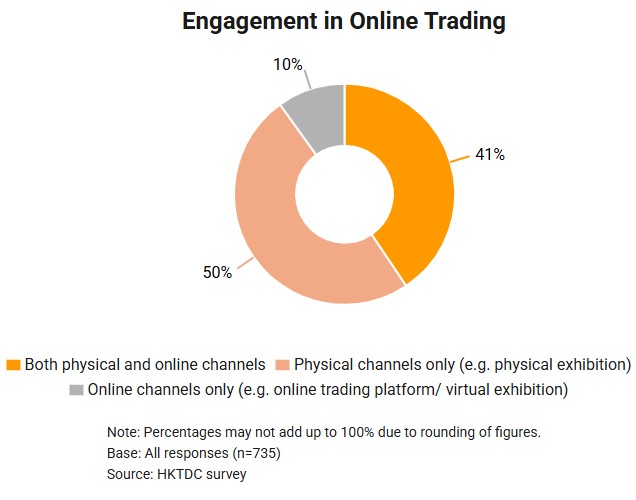

Omnichannel Adoption

The survey also highlighted the growing importance of online sales channels for the lighting sector. In all, 51% of respondents were actively engaged in online sales activity (10% online‑only and 41% utilising both online and offline channels).

Respondent Profiles

- 283 exhibitors – 72.4% from the Chinese Mainland, 17.7% based in Hong Kong, and 9.9% from the rest of the world.

- 452 buyers – 47.6% based in Hong Kong, 13.9% from the Chinese Mainland, 38.5% from the rest of the world.

Original article published in https://hkmb.hktdc.com