Japanese Companies Leverage Hong Kong’s Strong Business Platform to Expand ASEAN and Mainland Business to Navigate Tariff Uncertainties

For Japanese version, please visit the website of HKTDC Japan at here, or directly to the report at here.

日本語版につきましては、HKTDC Japanのウェブサイト、またはレポートの直接リンクをご参照ください。

Key Takeaways

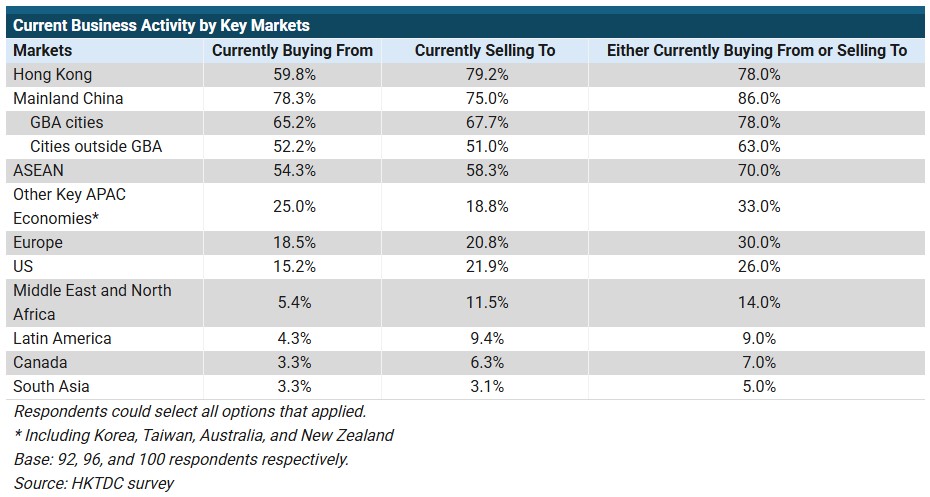

- Hong Kong remains a regional trading hub for Japanese companies, with respondents primarily engaging in sourcing or selling activities in Mainland China (86%), Hong Kong (78%), and ASEAN (70%) markets.

- Japanese firms in Hong Kong show resilience to US tariffs, with nearly three-quarters of respondents expecting only slight or no impact on their revenues as a result.

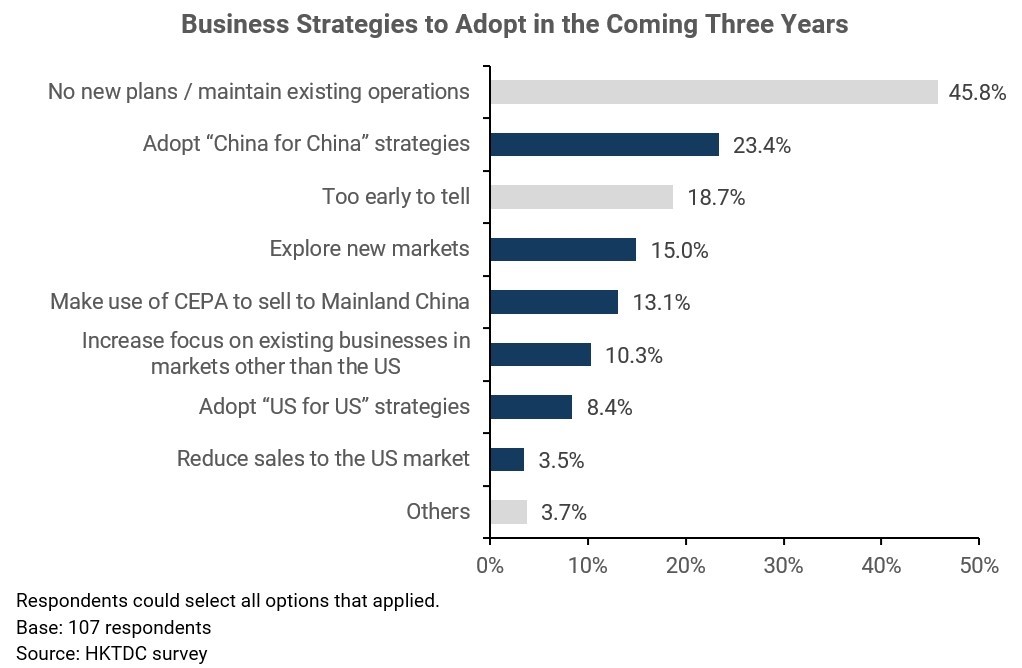

- Facing heightened global trade uncertainty, almost 65% of respondents are in a wait-and-see mode. Among those who plan to act, “China for China” is the leading business strategy Japanese companies in Hong Kong plan to adopt to address global trade uncertainties (23%), followed by diversification into new markets (15%) and leveraging Hong Kong’s free trade port status and CEPA to access Mainland China (13%).

- Against the prospect of continued global trade uncertainties, 72% of Japanese firms in Hong Kong indicated that they intend to increase business activity in many global markets – in particular ASEAN, Mainland China and Europe.

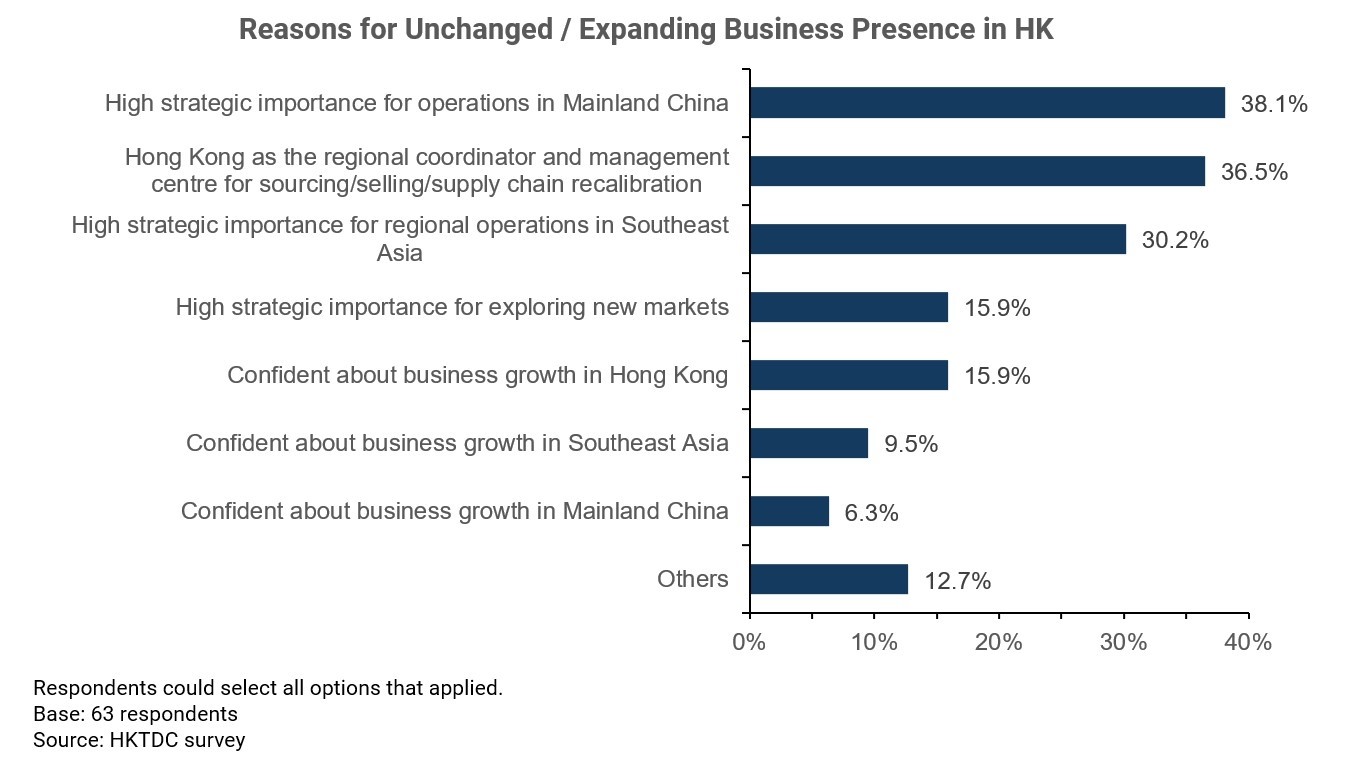

- Close to 60% of respondents who intend to maintain or expand operations in the city cited the high strategic importance for operations in Mainland China (38%), Hong Kong’s role as the regional coordinator and management centre for sourcing, selling, and supply chain recalibration (37%), and its strategic importance for regional operations in Southeast Asia (30%) as the main reasons for doing so.

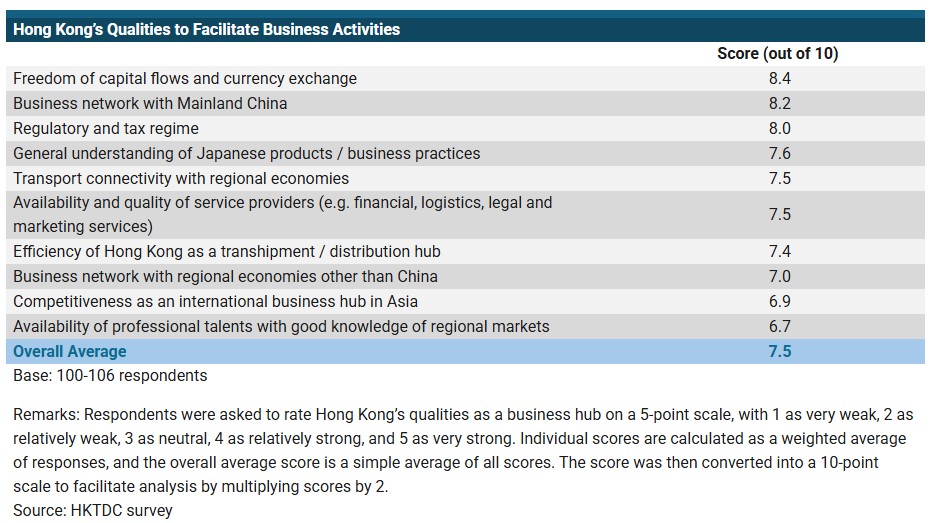

- Japanese companies recognised Hong Kong as a strong business hub to facilitate their business activities, with Hong Kong’s key ability to facilitate current and potential business activity, particularly against a backdrop of global trade uncertainties, scoring a high average of 7.5 out of 10.

Acknowledgements

HKTDC Research would like to thank the Hong Kong Japanese Chamber of Commerce & Industry (HKJCCI) for its support in translating and disseminating the questionnaire to its members for this survey.

Introduction

Hong Kong has long been an important business hub for Japanese companies looking to manage and expand their business abroad, particularly within the Asia‑Pacific region. As of 2024, Hong Kong was home to the regional headquarters or offices of 1,430 Japanese companies1, up from 1,393 in 2018.

Of late, the outlook for global trade and business has become more uncertain. The US administration has rolled out (or threatened) tariffs on global imports, a development that has prompted companies to adapt their business strategies and rethink their supply chains.

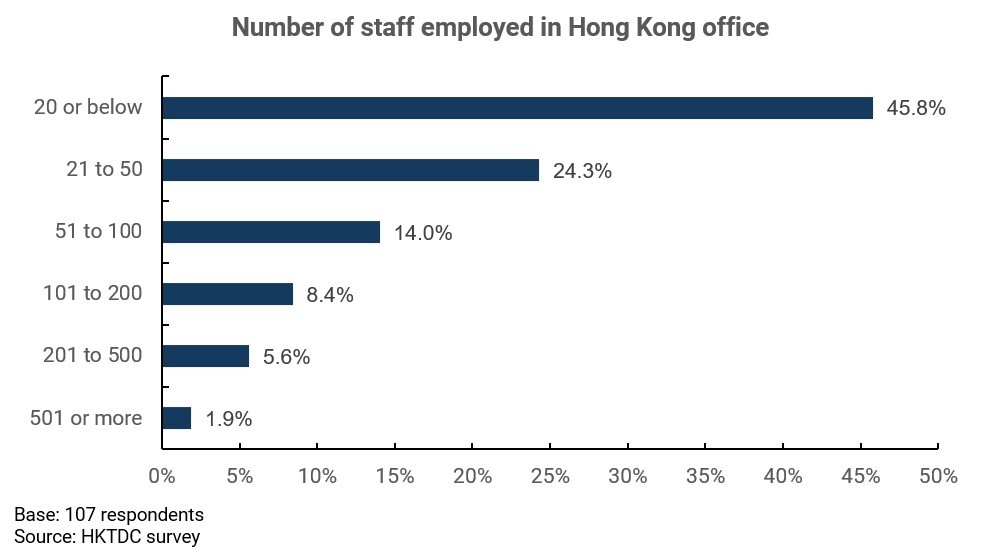

Against this backdrop, between 14 July – 1 August 2025, HKTDC Research ran an online survey of Japan‑affiliated enterprises based in Hong Kong. Conducted prior to the formal announcement of trade deals between the US and a number of other countries, the survey sought to evaluate how US tariffs and global trade uncertainties had impacted such businesses. In addition, it looked to gain a clear understanding of the strategies they intended to adopt in response, as well as the ways in which Hong Kong’s role as a business hub could help navigate the related uncertainties. In all, the questionnaire was sent to 431 companies, with 107 valid responses received.

As the majority of survey responses were received before trade deals between the US and other countries were announced, the findings may not fully capture the more positive sentiment attributable to a lessening of uncertainty in the global trade environment. The US has reached trade agreements, involving lower tariff rates than those announced in April, with its major trading partners. Also, trade talks between Mainland China and the US were extended for another 90‑day period to early November, allowing for further negotiation on the bilateral trade agreement committed to on 11 June 2025. These encouraging developments signify a more auspicious set of conditions for global business.

Hong Kong is a business hub that serves global markets

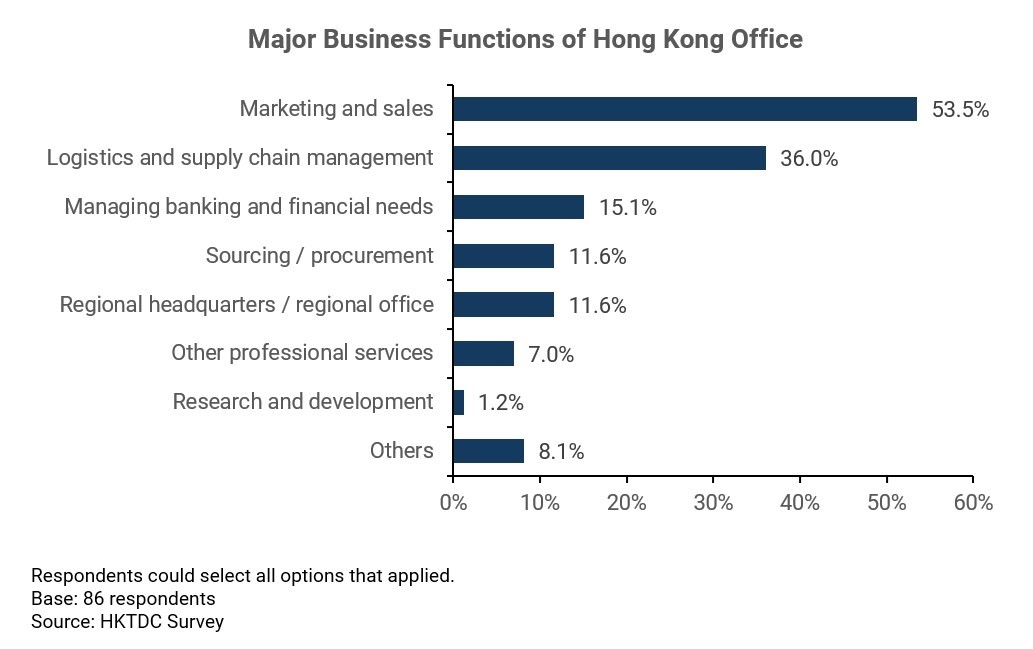

The majority of respondents used their Hong Kong office as a marketing and sales base (54%), followed by logistics and supply chain management (36%) and managing banking and financial needs (15%).

Typically, Japanese companies use their presence in Hong Kong to manage business beyond the local market, with the GBA and the ASEAN bloc being prominent locations for conducting business activity. Overall, close to 80% of respondents indicated that Hong Kong was a market they currently buy from or sell to. In terms of other major markets in the APAC region, 86% of respondents reported doing business with Mainland China, and 70% with the ASEAN bloc, while 33% engage with such key APAC economies as Korea, Taiwan, Australia or New Zealand.

Japanese companies also leverage the Hong Kong platform to conduct business with global markets beyond the APAC region. About 30% of respondents conduct business with Europe, and 26% conduct business with the US. A smaller share of respondents said they engaged in business with the Middle East and North Africa (14%), Latin America (9%), and South Asia (5%). This highlights the global scope of business conducted by Japanese companies in Hong Kong.

Japanese companies in Hong Kong show resilience to US tariffs

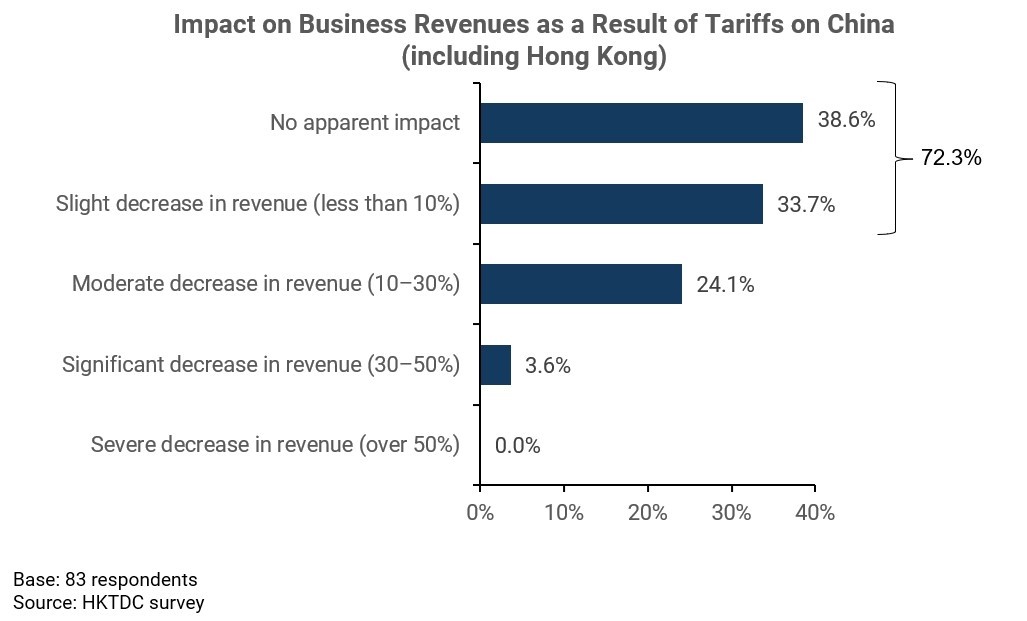

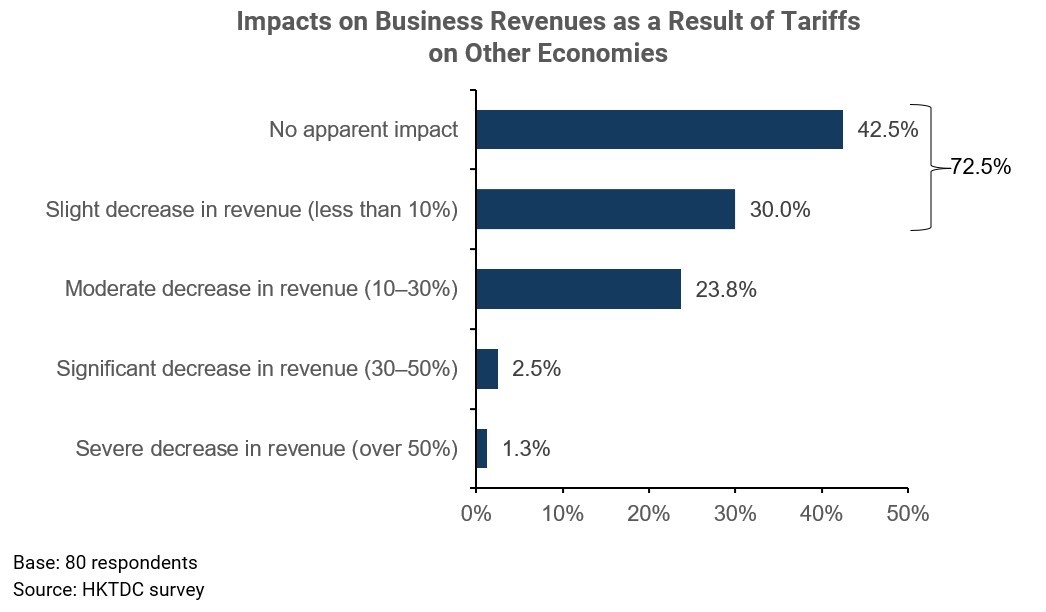

The overwhelming majority of Japanese companies in Hong Kong do not foresee US tariffs as having a significant impact on their business, whether the tariffs are imposed on China or on other economies.

When asked about US tariffs on China (including Hong Kong) and their likely impact on business for their Hong Kong office, about 78% of the respondents mentioned that these tariffs are relevant to their operations, while 22% did not see any relevance at all. Among those who see relevance, 72% expected there to be slight‑to‑no impact on their revenue (39% of respondents expect no impact at all, while 34% expect a slight impact). Some 24% of respondents, however, expect a moderate drop in revenue, while only 3.6% anticipate significant impacts.

When asked as to the likely impact of US tariffs on other economies, respondents similarly expected very limited impact for their Hong Kong offices. Some 75% of the respondents stated that these tariffs are relevant to their operations, while 25% of the respondents did not see any relevance at all. Among these who saw the tariffs as relevant to their business, 73% anticipate slight‑to‑no impacts on revenue (43% expecting no impact at all, 30% anticipating a slight impact). While 24% anticipate a moderate decline in revenue, only 2.5% foresee significant decreases.

China for China is the most popular active business strategy

To adapt to the impacts of US tariffs and global trade uncertainties, almost 65% of businesses indicated a preference for a “wait and see” approach (no new plans/maintain existing operations/too early to tell).

A “China for China" strategy – a focus on producing within China and serving its domestic market – was the most popular active business strategy advocated for the coming three years, with 23% of respondents favouring it. This was followed by exploring new markets (15%), and leveraging Hong Kong’s free trade port status and making use of CEPA to sell into the Mainland China market (13%).

ASEAN is the top market for expansion in the coming three years

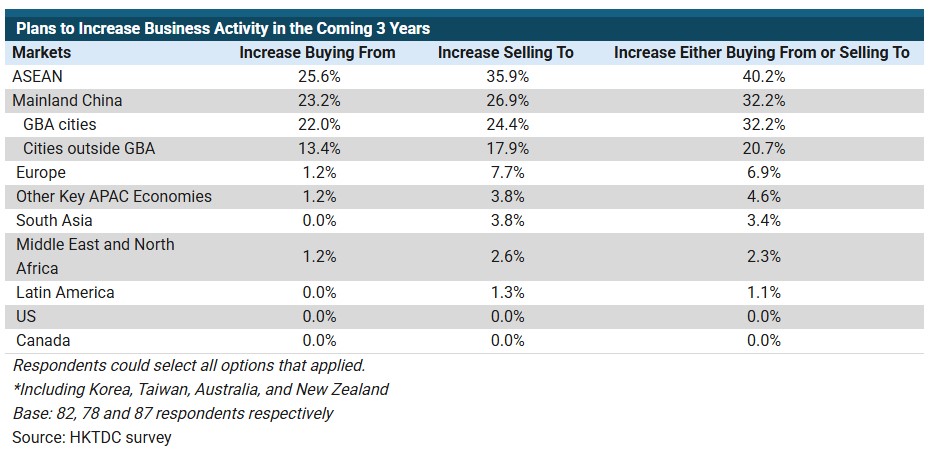

Against the prospect of continued global trade uncertainties, 72% of the respondents indicated that they intend to expand in the coming three years.

Among those who plan to expand business activity, 40% plan to target the ASEAN bloc, followed by Mainland China (32%). Within the Mainland, the GBA is especially favoured, compared to other cities.

Europe ranks a distant third (6.9%), followed by other key APAC economies (4.6%) and South Asia (3.4%). No respondents expressed an intention to expand business activity in the US or Canada markets.

Majority of respondents plan to increase or maintain their Hong Kong presence

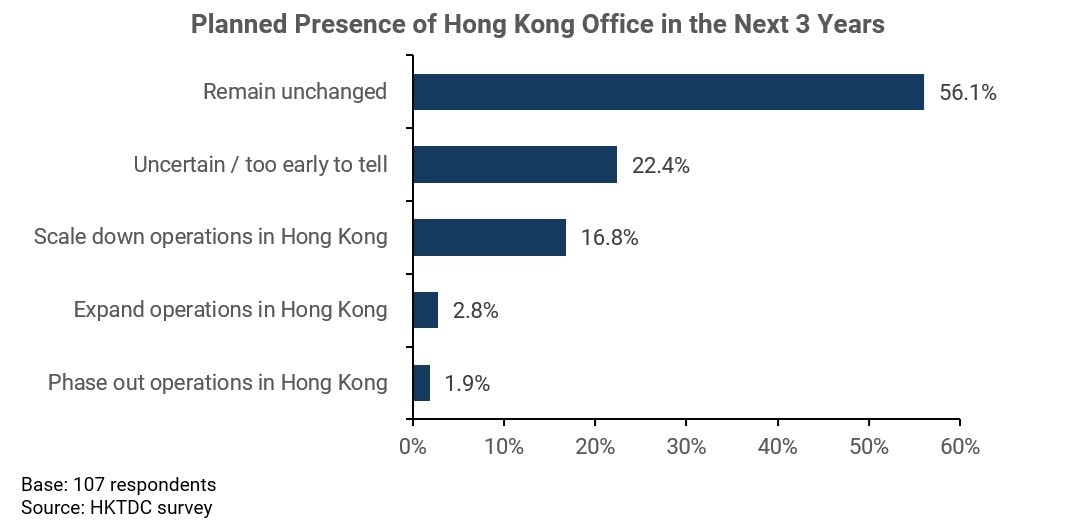

Close to 60% of Japanese companies in Hong Kong intend to increase or maintain their presence over the next three years, recognising the city’s strategic importance in managing their Mainland China and ASEAN business, and its key role as a regional supply chain management centre.

Among those intending to expand or maintain their operations in Hong Kong, respondents most frequently cited the city’s high strategic importance for operations in Mainland China (38%) as the primary reason for doing so. This was followed by Hong Kong’s role as the regional coordinator and management centre for sourcing, selling, and supply chain recalibration (37%), and its strategic importance for regional operations in Southeast Asia (30%).

Meanwhile, 22% of respondents indicated that they were uncertain about their plans, or that it was too early to tell amidst the heightened global trade uncertainties. 17% planned to scale down operations, with the key reason being pessimism about domestic business growth in the Hong Kong market.

Hong Kong a strong business hub facilitating business resilience

Overall, Japanese companies rated Hong Kong highly as a business hub, giving it an average score of 7.5 out of 10. They highlighted several key features of Hong Kong’s role in facilitating business amid global trade uncertainties.

Among these key features, Hong Kong’s freedom of capital flows and currency exchange scored 8.4, while the city’s business network with Mainland China was also highly rated, at 8.2. The city’s regulatory and tax regime was also well‑regarded, and scored 8 out of 10.

Market intelligence on Mainland China, ASEAN and other BRI markets sought

To address potential challenges resulting from US tariffs and global trade uncertainty, respondents highlighted the need for market intelligence on Mainland China, the ASEAN bloc and other Belt and Road markets (32% of respondents). This was followed by a desire for political and operational risk assessment services (23%), and professional services such as business and investment consulting and legal consulting (21%).

Conclusion

Hong Kong will continue to play an important role in facilitating Japanese companies’ business resilience amid global trade uncertainties, as the city offers unparalleled access to the region’s markets, in particular the ASEAN bloc and Mainland China.

Appendix

Original article published in https://hkmb.hktdc.com