Finance

18 Nov 2015

OTG Indonesia – Reality Check

By Standard Chartered Bank

Summary

President Joko Widodo (Jokowi) appears to be struggling to deliver on his promises to the electorate. Some polls suggest the president’s popularity has waned since he assumed office in October 2014. The Jokowi administration is unlikely to meet many of its ambitious economic targets for 2015, including the 5.7% real GDP growth target and 30% increase in tax revenues from last year. We believe financial market players and investors should moderate their expectations of the Jokowi government.

We think an unfavourable global and domestic environment is making it difficult for the government to meet its targets. Weak commodity prices are hampering exports (almost 50% of which are commodity-based). FDI has slowed as a result of pressure on the Indonesian rupiah (IDR) on market concerns over the current account (C/A) deficit and risk of capital outflows when the US Fed starts hiking policy rates. Meanwhile, household consumption and investment slowed in Q1-2015, presumably due to Bank Indonesia‘s (BI’s) monetary tightening stance and slowing economic activity in commodity-producing provinces. Government spending on infrastructure, which was expected to propel real GDP growth this year, also slowed in Q1.

Factoring in recent developments in Indonesia’s economy and the global environment, we revise our real GDP growth forecasts to 4.9% (from 5.2%) for 2015 and 5.3% (from 5.5%) for 2016. We maintain our year-end headline inflation forecasts at 3.7% y/y for 2015 and 4.5% y/y for 2016, but adjust our annual average forecasts to 6.5% (from 6.0%) and 4.5% (from 5.0%). We maintain our call on the BI rate – a 25bps rate cut in Q2 (presumably in May) and 25bps hikes each in Q3 and Q4, to reach 7.75% by end-2015.

We maintain a Neutral outlook on IDR bonds. Although IDR bond valuations have turned somewhat attractive, we see scope for further improvement. The key near-term concerns are IDR weakness and slowing foreign demand for IDR bonds. Given renewed market expectations of further monetary easing, and its spill-over impact on the IDR, we revise higher our trajectory forecast for IDR bond yields.

We maintain our view of continued IDR weakness in the coming months. We keep our USD-IDR forecast at 13,700 by mid-2015 and 13,500 by end-2015. With both domestic and external market conditions favouring an acceleration in IDR weakness, we revise down our short-term FX weighting on the IDR to Underweight from Neutral.

Please click here for the full report.

Editor's picks

Trending articles

HKTDC Research | 19 Nov 2015

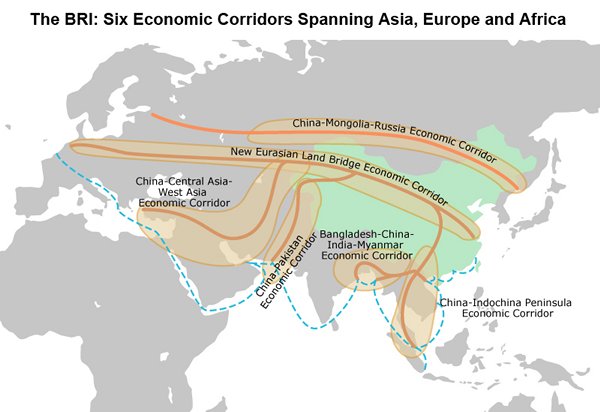

An Overview of Central Asian Markets on the Silk Road Economic Belt

Central Asian countries (CACs), consisting of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, are not yet key export markets or investment destinations for Hong Kong companies, but they are playing an increasingly pivotal role in the China-Central Asia-West Asia Economic Corridor. This is very much integral to the Silk Road Economic Belt (SREB), which is aimed at deepening and expanding mutually beneficial cooperation in such areas as trade, investment, finance, transport and communication. The national development strategies of the five CACs all share common ground with the SREB or the land-based component of the Belt and Road Initiative (BRI) being driven by China. As a "super-connector", Hong Kong is ready to deliver game-changing solutions for the 60-plus countries along the Belt and Road, including China's immediate neighbours in Central Asia.

Central Asia : A Vibrant yet Challenging Region

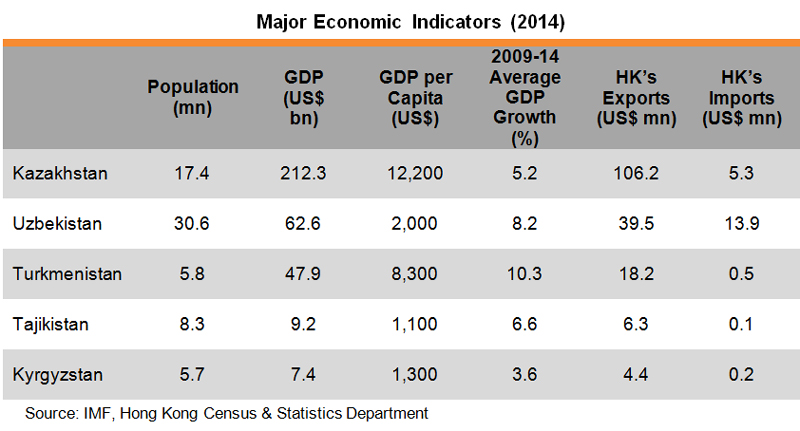

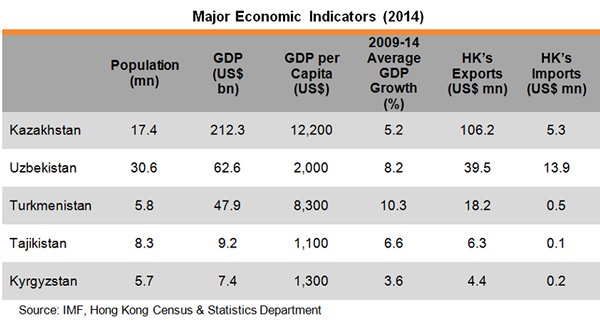

Best known for its trans-Asian commerce, via the ancient Silk Road, harsh geography (a lack of ocean access, an arid or steppe climate and mountainous landscapes) and sparse population are common images of Central Asia. Thanks largely to the region's vast amounts of natural resources, which were underexploited during the Soviet era, the past decade's high commodity prices have boosted the performance of the Central Asian economy. Combined, the five CACs – namely Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan – make Central Asia a US$339-billion, 68 million-strong economy, with varying levels of development and purchasing power.

Benefiting from abundant mineral resources such as petroleum, natural gas, antimony, aluminium, gold, silver, coal and uranium, the energy sector has a key role to play in the economic development of the five CACs. Aside from having rich mineral deposits, the agricultural economy is also an important economic driver, with cotton, meat, tobacco, wool and grapes being major agricultural exports.

Given the abundance of rich and varied resources, economic growth in the five CACs has recently been curbed by nosediving oil and commodity prices. This, together with the spillover from sanctions applied by the West (the EU, the US, Canada, Australia and Norway) on Russia, continues to exert pressure on the overall GDP growth of Central Asia. Against this backdrop, the average growth in the five CACs is therefore estimated to slide from 6.6% in 2014 to 4.4% in 2015, before climbing back up to a brighter 5.3% in 2016.

Intra-regional trade in Central Asia has not been as significant as in Southeast Asia. For instance, in 2014, it only accounted for 7% of the total trade in Central Asia[1]. The relatively low dependency on regional trade, however, indicates a higher readiness to trade with partners further afield, including the CACs’ nearest neighbours, such as Russia and China. Moreover, the need for a more diversified economy, particularly in terms of manufacturing development, also indicates investment opportunities for Chinese companies.

While Central Asia is becoming an increasingly dynamic region connecting Eastern Europe and West Asia under the BRI, it can also be a challenging region for many new-to-the-market traders and investors. For instance, out of the five CACs, only Kyrgyzstan (since 20 December 1999) and Tajikistan (since 2 March 2013) are currently WTO members. Kazakhstan, whose accession is expected in early 2016, and Uzbekistan, are only observer states, while Turkmenistan has not even presented its candidature to the WTO.

Against this backdrop, customs clearance in Central Asia is often said to be overburdened, with bureaucratic obstacles leading to significant delays. Problems such as arbitrary seizures of goods, frequent changes in customs procedures without prior notification, excessive documentation and a lack of proper protocols to ensure that an appropriate appeals process is in place can make the importing process very uncertain, costly and time-consuming.

To a similar extent across all five CACs, business and cultural ties with Russia penetrate almost every area of daily and business life in the region. Not only do most people communicate with each other in Russian, they are also deeply accustomed to Russian culture, including movies and music. Russia also remains the most influential trading partner for most of the CACs, buying large amount of raw materials from and exporting a great deal of consumer and capital goods to all five countries.

The Customs Union, which became the Eurasian Economic Union (EAEU) from January 2015 and involves currently Kazakhstan, Russia, Belarus, Armenia and Kyrgyzstan, has further strengthened Russia’s influence in Central Asia’s trade development. While this has its advantages, it can also cast clouds, however. The recent recession in Russia and the sharp depreciation of the ruble have taken a toll on the Central Asian economy, imperiling the financial lifeblood of many Central Asian households and businesses.

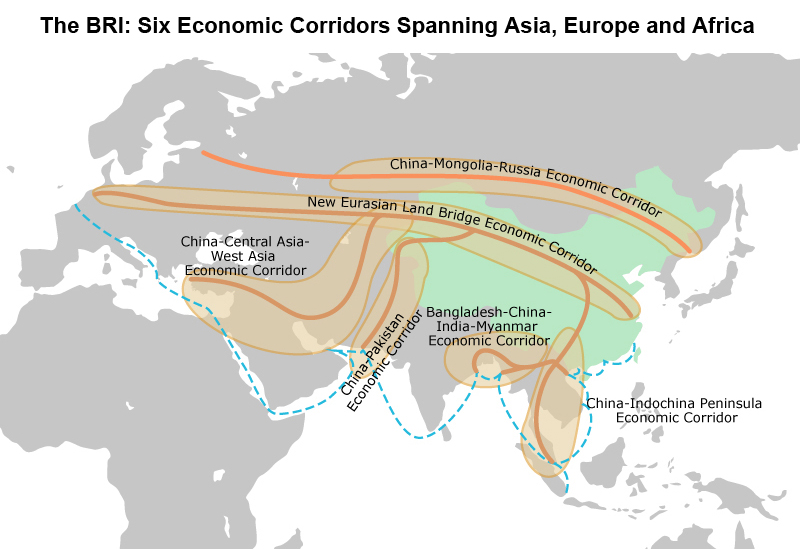

Central Asia Under the Belt and Road Initiative

Central Asia has been crucial to the BRI ever since the Initiative was first suggested by President Xi Jinping in Kazakhstan in September 2013. In particular, the China-Central Asia-West Asia Economic Corridor, one of six economic corridors spanning Asia, Europe and Africa, runs from Xinjiang in China, then exits the country via Alashankou, joining the railway networks of Central Asia and West Asia before extending to the Persian Gulf, the Mediterranean coast and the Arabian Peninsula. The corridor covers all five CACs, as well as Iran and Turkey in West Asia.

In conjunction with the BRI developments, the SinoKazakh Cooperation Centre is located right on the border between China and Kazakhstan, in Khorgas. China's youngest city, Khorgas was officially established on 26 June 2014, and attracted nearly two million traders, from both sides, in that year alone. China is also extending its wings to encompass many of the region’s infrastructure and logistics projects, including various oil and gas pipelines, dry ports and railway tunnels – including a 19-kilometre railway tunnel under the Kamchik Pass in double-landlocked Uzbekistan linking the country’s populous Ferghana Valley with other major cities such as the capital, Tashkent.

China has also signed bilateral agreements on the building of the SREB with Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan, with a view to further deepening and expanding mutually beneficial cooperation in such areas as trade, investment, finance, transport and communication. The national development strategies of the five CACs – including Kazakhstan’s “Path to the Future”, Tajikistan’s “Energy, Transport and Food” (a three-pronged strategy aimed at revitalising the country), and Turkmenistan’s “Era of Might and Happiness” – all share common ground with the SREB’s objectives. Furthermore, at the third China-Central Asia Cooperation Forum held in Shandong, in June 2015, a commitment to “jointly building the Silk Road Economic Belt” was incorporated into a joint declaration signed by China and the five CACs.

Central Asia: A Trading Partner for Hong Kong and the Chinese Mainland

Investment, and therefore improvements in energy and transport infrastructure, under the BRI are expected to boost CACs’ trade, particularly with other Belt and Road economies such as Hong Kong and the Chinese mainland. The resultant trade facilitation will therefore allow CACs to better realise the advantages their resources give them and to increase and diversify their trade in terms of export/import destinations and product variety.

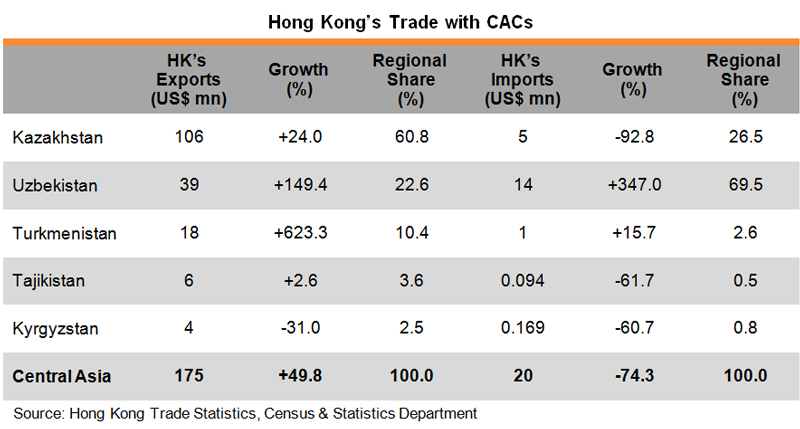

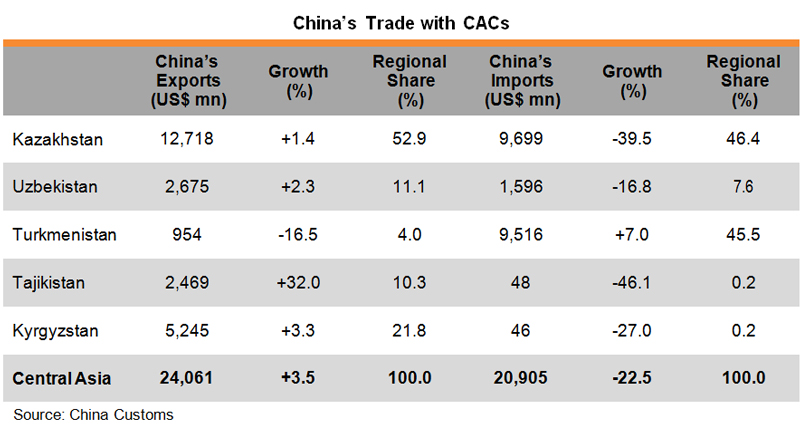

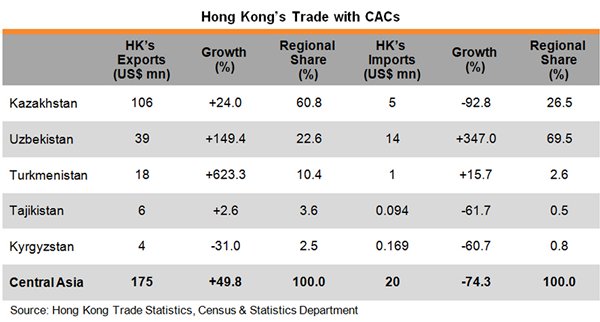

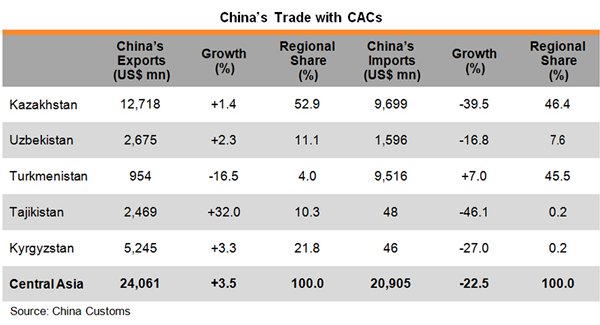

In terms of trade, Kazakhstan is the No.1 Central Asian trading partner of both Hong Kong and the mainland. In 2014, the country accounted for 57% of Hong Kong’s trade with Central Asia and 50% of the mainland’s trade with Central Asia. Also noteworthy is that all the five CACs are overwhelmingly export destinations, rather than sources of imports, for Hong Kong. The pattern is repeated for the mainland, except as regards Turkmenistan.

Product-wise, nearly 90% of Hong Kong’s exports and imports to and from Central Asia in 2014 involved electronics/electricals or related parts and components. A further breakdown shows that Hong Kong’s trade with Central Asia is predominantly concentrated on telephone sets, computers and related parts and components. This is largely due to the fact that more and more Chinese, Russian and even European telecommunications equipment companies have set up production facilities in Central Asia in order to take advantage of cheaper production costs and proximity to markets in Eastern Europe and West Asia, giving rise to a high demand for related inputs.

With respect to the mainland, the trade portfolio is much more diversified. Major exports to Central Asia in 2014 included apparel and clothing accessories (representing 22% of the total), electronics/electricals and related parts and components (21%), footwear (13%), vehicles other than railway or tramway rolling-stock, and parts and accessories (5%), and articles of iron or steel (5%). In the other direction, the mainland’s imports from Central Asia in 2014 were mainly energy resources and commodities, including mineral fuels (representing 71% of the total), chemicals and compounds of precious/rare-earth metals (9%), copper (6%), and ores, slag and ash (6%).

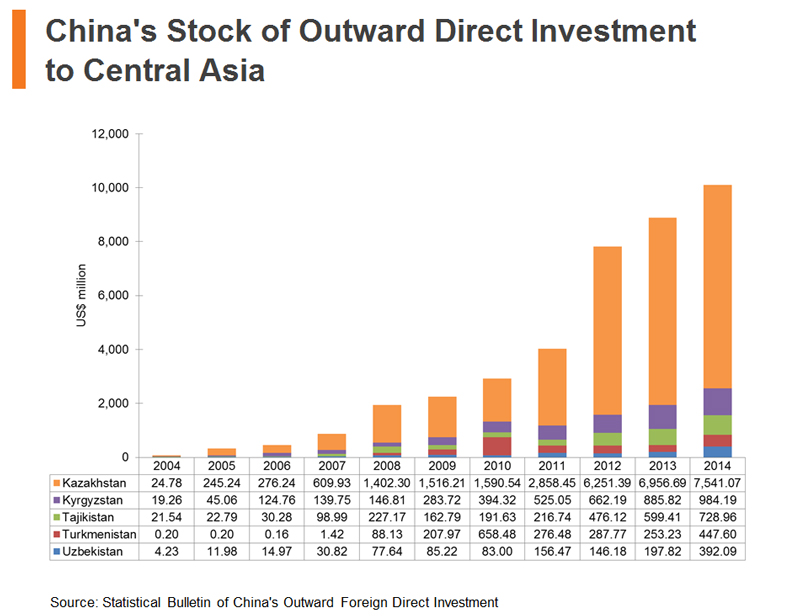

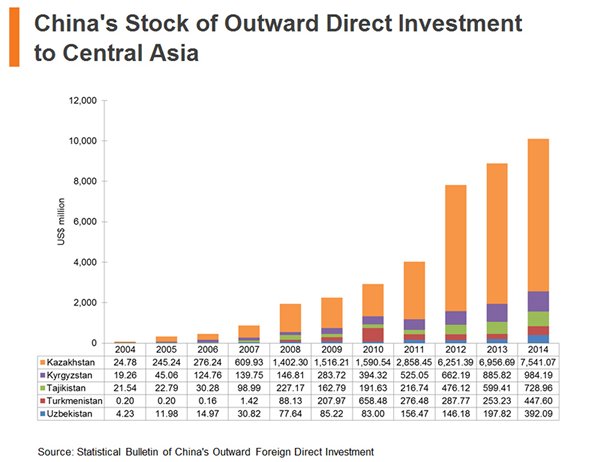

Central Asia: An Investment Destination for Hong Kong and the Chinese Mainland

Prior to any increase in investment stemming from the implementation of the BRI, Kazakhstan is by far the largest recipient of outward direct investment (ODI) from the Chinese mainland, while no significant investment flows between Hong Kong and CACs have so far been tracked. In 2014, Kazakhstan accounted for 75% of the mainland’s ODI in Central Asia, followed by Kyrgyzstan (10%) and Tajikistan (7%). In terms of industrial distribution, oil, gas and metals receive the lion’s share of the mainland’s ODI in Central Asia, while infrastructure projects such as roads, railways and pipelines are also attracting investment.

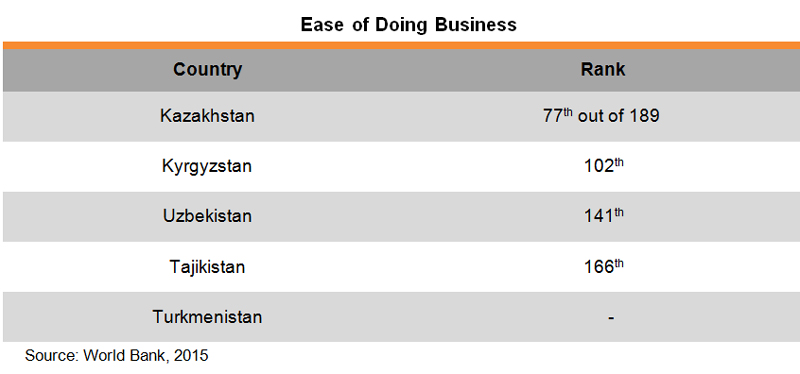

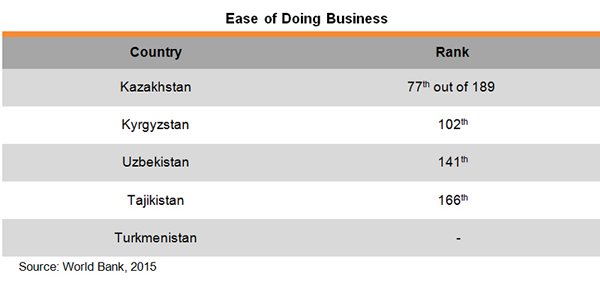

To better encourage foreign investment, all CAC governments have committed to improving their respective business environments, but some have been more successful than others. For instance, the government in Kazakhstan has targeted a reduction in the time required to register a business from ten days to one hour, while the paperwork needed for customs procedures and other business operations is to be cut by 60%. The country has also extended and expanded its visa-free entry scheme for a number of countries in order to boost tourism and foreign investment. Furthermore, a US$3 billion stimulus package in 2015-17, part of the country’s latest five-year economic plan, is aimed at investment priorities such as the development of the transport and logistics sectors, and improvement works on utility networks and energy infrastructure, foreshadowing greater ease and better prospects of doing business.

Tajikistan ranked low in terms of ease of doing business in 2015 but its array of business reforms include the implementation of new software at a one-stop shop for public service delivery and the further simplification of business registration procedures. These changes led it to rank as the top improver out of 189 economies surveyed.

Turkmenistan, however, does not even have an ease of doing business ranking for international investors to assess its business environment. This indicates that foreign investment is rare in the country but also that there is a clear lack of accurate and comprehensive information on different sectors. This makes market entry not only difficult, but also highly risky.

A Closer look at the Five “Stans”

As a regional giant, the size of the Kazakh economy is almost double that of the other four CACs combined. As a more advanced economy, Kazakhstan also leads in purchasing power, which was nearly 50% higher than the first runner-up, Turkmenistan, and 10 times bigger than the least-ranked, Tajikistan. As the region’s second most populous country, Kazakhstan’s average GDP growth rate between 2009 and 2014 was, however, only about half that of Turkmenistan (10.3%), and ahead of only Kyrgyzstan (3.6%) in the region.

Thanks to its significant mineral reserves of oil, natural gas, coal, chrome, lead, tungsten, copper, zinc, iron and gold, Kazakhstan is an important world energy supplier. Processing of metals and steel production are also leading industries in the country. Combined with other smaller manufacturing sectors such as the production of machines, chemicals and food and beverages, industry accounts for about a third of GDP. The rest of the economy is mainly comprised of construction and agriculture, as well as an extensive but mostly small-scale service sector that includes wholesale/retail trade, real estate, finance and insurance.

As an important component in the BRI, Kazakhstan has been striving to upgrade and modernise its logistics and trade infrastructure. Aside from various oil-and-gas pipelines, the passages of the Yuxinou Railway linking Chongqing with Duisburg, Germany and the Chengdu-Europe Express Railway linking Chengdu and Lodz, Poland, the free trade zone developing on the border crossing at Khorgas, on the Kazakh-Chinese border, is expected to open huge prospects for transit of cargo through Kazakhstan.

Together with the Zhetygen-Khorgas and Jezkazgan-Beineu railway lines, the Western Europe-Western China motor road corridor, and the port of Aktau on the Caspian coast, this infrastructure represents a wide array of logistics and distribution options for traders across the region. Meanwhile, expected WTO membership in early 2016 will provide traders with further relief on customs duties and import barriers, making the country an even more attractive transit point for Asian/European-bound cargo and centre for regional distribution.

The economy of the region’s most populous country, Uzbekistan, meanwhile remains highly bound up with the growing and processing of cotton, fruits, vegetables and grain (wheat, rice and corn). Aside from being a world leader on reserves of gas, coal and uranium, Uzbekistan was also the sixth-largest producer and the fifth-largest exporter of cotton in the world in 2014. However, such industries as automotive (General Motors began production of Chevrolets in November 2008, for example), agricultural machinery manufacturing, biotechnology, pharmaceuticals and information technology have increased in importance over the years since independence in August 1991.

Following the signing of an agreement with China in June 2015 regarding the extension of economic cooperation under the framework of the BRI, bilateral cooperation in such sectors as business, transportation and telecommunication will increase between China and Uzbekistan, while bulk stock trading, infrastructure construction and industrial park projects will also be developed. The rapid development and extension of railway and road networks in Uzbekistan, including the 19-kilometre railway tunnel connecting the capital city, Tashkent, with the populous Ferghana Valley, is an early sign of success.

Blessed by large budget surpluses stemming from the exploitation of energy sources and commodities such as gas (abundant gas deposits lie underneath the Karakum Desert – including the Galkynysh gas field, which has the second-largest volume of gas in the world, after the South Pars field in the Persian Gulf), Turkmenistan has the worst record of economic and trade liberalisation among the former republics of the Soviet Union. Unlike countries such as Kazakhstan and Kyrgyzstan, which have rapidly reformed their economies in a more marketoriented direction, Turkmenistan has stuck to a “national way of development” and put less effort into modernising.

As a result, Turkmenistan’s participation in the world economy remains very low, even when compared to its Central Asian neighbours. Not only has Turkmenistan not presented its candidature to the WTO, it is also not a prospective AIIB founding member, the only exception among the five CACs.

In addition to various energy production sharing agreements (PSAs) with the Chinese mainland, Russia and Germany, the gas-rich country has announced plans to boost its gas output and is seeking ways to diversify its portfolio of export markets to encompass Belt and Road countries such as China and Iran, via new pipelines. In line with President Gurbandguly Berdymukhamedov’s leadership and declaration of an “Era of Might and Happiness”, the BRI is poised to give the country new incentives to reach out to other economies along the Belt and Road, including the Chinese mainland, notably in the transportation and infrastructure sectors.

Rich in antimony, aluminium, gold and silver and having substantial hydropower and agricultural (cotton and wheat) potential, Tajikistan is the poorest country in terms of per-capita GDP among the five CACs, thanks in part to its challenging geographic location – 90% of its territory is covered by mountains, with half being 3,000 metres above sea level. Its southern border with Afghanistan often adds uncertainty to the business environment as terrorism and drug trafficking are a menace. NATO’s withdrawal from Afghanistan last year poses a further threat to the country’s stability as the possibility of a spillover of unrest and terrorist activity from Afghanistan increases.

Close ties with Russia notwithstanding, Tajikistan’s trade with China has been increasingly vibrant in recent years, with Chinese enterprises staffing many infrastructure projects, including the Sahelistan Tunnel and Tajik-Uzbek Highway, as well as various resource extraction projects. Thanks to growing Chinese investments, the impoverished state broke its annual production record for cement and increased gold output by roughly 25 percent in 2014.

To revitalise the economy, the Tajik government has set three strategic goals in relation to energy independence, advancement in transport networks and food security. These national goals resemble most if not all of those of the BRI. In particular, more resources are expected to be pumped into the development of telecommunications, transportation and electricity networks. Meanwhile, better use of available infrastructure can make the nation attractive not only for businesspeople, but also leisure travellers. After all, thanks to its varied landscape and dramatic geographical features, Tajikistan was named No 2, behind Malta, in travel guide Globe Spots’ top-10 list of countries to travel to in 2014.

Heavily reliant on the production and export of gold, mercury, natural gas, uranium and agricultural products such as cotton, meat, tobacco, wool and grapes, Kyrgyzstan is a mountainous country with one-third of its population living below the poverty line. Due to its mountainous landscape, livestock farming has a prominent position in the country’s agricultural economy, which also boasts a vibrant food processing industry consisting of sub-sectors encompassing sugar, fruits, vegetables, meat, milk and oil.

Billed as the eastern door to Central Asia, Kyrgyzstan has been a WTO member since 1998. The relatively long tradition of adopting laws according to WTO regulations has helped Kyrgyzstan comply with international standards of trade and business. Furthermore, in May 2015 Kyrgyzstan signed a law ratifying treaties on the country’s accession to become the fifth member of the Kremlin-led Eurasian Economic Union (EAEU). It finally acceded in August 2015, and customs control at eight checkpoints along the Kyrgyz-Kazakh border have been abolished.

Jump-starting Trade and Investment with Central Asia

Situated in Central Asia, deep in the Eurasian continent, Kazakhstan occupies an area of some 2,724,900 km2. It is not only the biggest landlocked country and largest Central Asian economy in terms of geographical territory and GDP, but a good platform and partner for Hong Kong companies to tap into the Central Asian market under the umbrella of the BRI.

As a strategically important player under the BRI, Kazakhstan has signed a series of agreements (33 co-operation agreements worth US$23.6 billion in March 2015 and 25 agreements worth US$25 billion in September 2015) on closer cooperation in various sectors such as railway, electricity, nuclear energy and agriculture. Observing the growing impetus, many Chinese and other Asian companies (such as South Korean companies) have established operations in Kazakhstan.

The country, along with Kyrgyzstan, Tajikistan and Uzbekistan, is a founding member of the Asia Infrastructure Investment bank (AIIB), which is expected to play a pivotal role in supporting the development of infrastructure and other productive sectors, including energy and power, transportation and telecommunications, rural infrastructure and agriculture development, water supply and sanitation, environmental protection, urban development and logistics in the region.

In order to overcome volatility in global energy prices and create a stronger base for economic growth, President Nursultan Nazarbayev announced in November 2014 a new economic plan. "Path to the Future" puts infrastructure development top of the country’s list of priorities. Aside from sizeable infrastructural projects including road, rail and special economic zones, there will also be financial support worth KZT100 billion tenge (US$0.5 billion) for SMEs, creating some 4,500 additional jobs as well as incentives for Kazakh companies to internationalise.

For the time being, Kazakhstan is the only CAC with a consulate office in Hong Kong. This, together with reciprocal 14-day visa-free status for HKSAR and Kazakh passport holders, makes business connections between the two economies far easier than with other CACs. In addition, direct flights (twice a week on Tuesdays and Fridays) between Hong Kong and Almaty – the largest city in Kazakhstan and its key business city – give the country a further advantage over other CACs in terms of being Hong Kong’s first port of call in Central Asia.

Moreover, some Kazakh companies have chosen to list in Hong Kong. Kazakhmys PLC, a leading natural resource group and the first Kazakh company to list on the London Stock Exchange, listed in Hong Kong in 2011, while its marketing and logistics arm also relocated to Hong Kong from London in October 2012. The country’s imminent WTO membership in early 2016 is poised to trigger stronger trade and investment flows to and from Kazakhstan, and will provide a wealth of opportunities in international logistics and financial services for Hong Kong companies.

[1] Intra-regional trade share refers to the percentage of intra-regional trade to total trade of the region. A higher share indicates a higher degree of dependency on regional trade.

| Content provided by |  |

Editor's picks

Trending articles

23 Nov 2015

Down to Earth – Opportunities Offered by China’s One Belt One Road Strategy

Presented by Thomas Chan, China Business Centre, The Hong Kong Polytechnic University on 17 Oct 2015

This is a presentation for the Open Forum: Innovation and Entrepreneurship – Government Policy, Society & Technology co-organised by the University of Warwick, the Hong Kong Polytechnic University Manufacturing Alumni Association Limited and the City University of Hong Kong Engineering Doctorate Society.

Please click to download the presentation file.

Editor's picks

Trending articles

23 Nov 2015

Tajikistan, Central Asia and One Belt One Road Strategy

Presented by Thomas Chan, China Business Centre, The Hong Kong Polytechnic University on 29 Oct 2015

This is a presentation for the Conference on Silk Road Strategy (Series II): Focus on Tajikistan” organised by the China Business Centre, The Hong Kong Polytechnic University and the Silk Road Economic Development Research Center.

Please click to download the presentation file.

Editor's picks

Trending articles

23 Nov 2015

Belt and Road Initiative: Implications for Trade & Investments

Presented by Thomas Chan, China Business Centre, The Hong Kong Polytechnic University on 18 Nov 2015

This is a presentation for the session “Belt and Road Initiative”: Implications and Opportunities for Trade and Investments at Asian Logistics and Maritime Conference held in Hong Kong Convention and Exhibition Centre.

Please click to download the presentation file.

Editor's picks

Trending articles

HKTDC Research | 25 Nov 2015

Tapping the Cross-Strait and Maritime Silk Road Opportunities of Fujian Free Trade Zone

The China (Fujian) Pilot Free Trade Zone (FJFTZ) was officially launched in April 2015, along with the Guangdong and Tianjin pilot free trade zones. The FJFTZ is positioned to build an innovative cross-Strait cooperation mechanism, and streamline investment management measures in a move to open up to Taiwan and other foreign investors. It will also make use of the advantages of Fujian as a port in southeast China, capturing opportunities arising from the 21st-Century Maritime Silk Road under China’s Belt and Road Initiative.

Hong Kong companies can take advantage of both the lower access threshold offered by the FJFTZ to foreign investors and the privileges under CEPA [1] to tap the mainland market. These include cross-border e-commerce facilitation measures and bonded arrangements implemented in the FJFTZ, as well as tax concessions offered to certain industries in the FJFTZ’s Pingtan Area. They can also follow the development directions of the FJFTZ in enhancing the shipping and related industries, and to identify the demand in Fujian province for international shipping and logistics services. Fujian province, as home to major ports along the ancient maritime Silk Road, is stepping up efforts to establish ties with countries along this route and strengthen investment and trade links with them. It can be expected such efforts will generate opportunities for companies wishing to take advantage of the Belt and Road initiative.

Promoting Liberalisation of Investment and Trade between Fujian and Taiwan

According to the overall plan for the FJFTZ, its development goals are to give full play to its Taiwan advantages, adopt innovative cross-Strait cooperation mechanism, and promote the free flow of goods, services, capital and personnel. The move will enhance economic ties between Fujian and Taiwan, as well as serving to take the lead in introducing liberalisation measures for investment and trade with Taiwan, including:

For instance, the FJFTZ has already given the green light to Taiwanese architects holding certificates issued by relevant organisations in Taiwan to start business in the FJFTZ upon obtaining approval. At the same time, Taiwanese professionals who have obtained the mainland’s Class 1 registered architect or registered structural engineer qualification are also allowed to act as partners, and to set up construction and engineering design offices and supply relevant services in the FJFTZ in accordance with the corresponding qualification requirements. [2]

Opening up to Regions Other than Taiwan

The overall plan also pointed out that the FJFTZ will open up to regions other than Taiwan at the same time. This will take advantage of being at the frontline of opening up to the outside world, accelerate the formation of a new pattern of trade interaction at a higher level, and expand in depth and breadth exchanges and cooperation with countries and regions along the 21st-Century Maritime Silk Road under China’s Belt and Road development strategy.

The FJFTZ is among the second batch of free trade zones launched by China in April 2015. [3] Since the launch, steps have been taken to reform the administration and management system, lower the market access threshold for foreign investors and simplify procedures for foreign investment. It is hoped that after three to five years of reform and experimentation, a free trade zone offering investment and trade facilitation, prominent financial innovation features, sound service systems, highly efficient and convenient supervision, and a regulated legal environment will be established. Detailed policies and measures include:

1. Lowering market access threshold for foreign investors

Where foreign investment access is concerned, the FJFTZ, in line with the Shanghai, Guangdong and Tianjin FTZs, has simplified foreign investment management by way of adopting the negative list and record filing system and using the same negative list for approving foreign investment access. As a result, the degree of opening up of all the above mentioned FTZs to the outside world is similar.

In the Special Administrative Measures (Negative List) on Foreign Investment Access promulgated by the State Council on 8 April 2015 (hereinafter called the Negative List), it is stated that for sectors falling outside the scope of the special administrative measures for foreign investment access on the Negative List, the principle of national treatment for foreign and domestic investors will apply. This replaces the system of advance approval for foreign-invested projects and the system of examining and approving the contracts and articles of association of foreign-invested enterprises by the record filing system. Foreign investors’ access to the mainland market by way of investing in FTZs will be greatly enhanced as a result.

The Negative List also specifies that Hong Kong investors in FTZs will be subject to the provisions of the Negative List. However, where liberalisation measures provided for under CEPA are applicable to FTZs and offer even more preferential treatment to qualified investors, CEPA provisions will prevail. Hence, Hong Kong investors wishing to take advantage of the FJFTZ to enter the mainland, especially coastal regional markets such as Fujian, should refer to the provisions of both CEPA and the FTZ Negative List so that they can make full use of the market access advantage to develop mainland opportunities.

[For more information on the Negative List and its relations with CEPA, please see Guangdong Pilot Free Trade Zone: Opportunities for Hong Kong released by HKTDC in June 2015 and Market Opportunities in the Tianjin Pilot Free Trade Zone released in September 2015.]

2. Changing government functions to raise administration efficiency

The FJFTZ is also devoting efforts to accelerating reform of the administrative examination and approval system, as well as improving the mechanisms for such services as intellectual property administration and enforcement, dispute settlement, and arbitration. Meanwhile, government functions, including asset appraisal, certification, and inspection and testing, which used to be undertaken by government departments, will be gradually turned over to professional service suppliers in the legal, accounting, credit rating, inspection, testing and certification sectors. One of the examples is to set up, both at the various areas in the FTZ and online, a unified window and integrated services hall serving companies, as well as implement the “one licence, one code” unified enterprise registration system in a bid to raise the government’s efficiency of administration and management over domestic-funded, Taiwan-funded and other foreign-funded enterprises. [4]

3. Introducing innovative customs clearance mechanism

At the special customs supervision areas within the FTZ, system innovation will be implemented with emphasis on trade facilitation, and efforts will be made to streamline requirements for the submission of certificates of origin by Hong Kong products meeting CEPA rules of origin and by Taiwan goods imports meeting ECFA requirements. This aims to facilitate the development of international trade, bonded processing and bonded logistics, while promoting domestic sale facilitation. Currently, enterprises can use terminals such as mobile phones to make appointment with Customs for inspection, while local Customs uses RFID technology to carry out paperless and fast-track customs clearance of vehicles going through customs. The Fujian entry-exit inspection and quarantine bureau has also reformed and simplified procedures for the issuing of certificates of origin [5].

|

Liberalisation Measures and Tax Concessions in Pingtan Area China’s main objective for launching free trade zones is to advance system innovation, implement administration and management system reform, and strengthen opening up to the outside world, but not to offer preferential policies. As such, the overall plan does not embody any tax and fee reduction or exemption incentives. However, Pingtan Area in the FJFTZ is not only eligible for the liberalisation policies of the FTZ, but also entitled to the preferential policies offered by the Pingtan Experimental Zone, as the Area falls within the Fujian Pingtan Comprehensive Experimental Zone. Pingtan is the largest island in Fujian, with a total area of 392 km2 and a population of about 400,000. The Pingtan Experimental Zone is a demonstration zone playing the role of a first-mover in exploring cross-Strait exchanges and cooperation, as well as a pilot zone for the development of the Haixi Economic Zone. Planning in this zone focuses on undertaking the industries relocated here from Taiwan and other regions to establish an advanced manufacturing base; develop emerging industries, such as electronic information, marine biology and clean energy; as well as developing into a modern ecological island city. [6] Enterprises operating in the Pingtan Experimental Zone can enjoy up to 28 preferential policies, including more relaxed customs supervision, Class 1 port liberalisation, an integrated reform pilot for land management, a cross-border e-commerce pilot, and a marine transport pilot. Moreover, enterprises in Pingtan Experimental Zone engaging in specified industries in encouraged categories are even entitled to a reduced enterprise income tax rate of 15%. These industries include: √ High-technology √ Equipment manufacturing Meanwhile, production-related goods sold to Pingtan from other parts of the mainland will be treated as exports and are thus entitled to the VAT and consumption tax rebate policy. Goods within the area sold between enterprises in Pingtan are also exempted from VAT and consumption tax. As Pingtan Area in the FJFTZ also belongs to the Pingtan Experimental Zone, enterprises wishing to take advantage of Fujian to tap the mainland market and capture export opportunities can consider making use of Pingtan’s special position to enjoy the liberalisaton and preferential policies offered by both the FTZ and the experimental zone. [7]

|

Exploring New Horizons of Trade with Taiwan and Other Regions

Under the premise of opening up to the outside world, the FJFTZ proactively develops all kinds of trade with Taiwan and other regions in the hope of enhancing its competitive edge in foreign trade by way of technology, branding, quality and services. Its key development directions include:

-

Developing cross-border e-commerce, and improving the relevant customs supervision, inspection and quarantine, cross-border payment and logistics systems

-

Building international and domestic bulk commodities trading platforms

-

Allowing the local futures exchange to set up a bonded futures delivery pilot

-

Promoting service outsourcing with regard to creative industries, information/data processing, supply chain management, and aircraft and parts maintenance

-

Establishing a pilot point for parallel imports of automobiles, with importers responsible for after-sale service, product recall and the “three guarantees” (guaranteed repairs, guaranteed replacement and guaranteed return of goods)

|

Exploring Cross-Border E-Commerce Import Opportunities in FJFTZ China has, up to now, approved seven cross-border e-commerce import services pilot cities. According to information released by the Fujian government, Fuzhou and Pingtan are tipped to become new pilot cities. In view of the increasing demand of Fujian and other mainland consumers for quality import products, many companies are devoting greater efforts to developing cross-border e-commerce. Taking advantage of FJFTZ’s determination in developing cross-border e-commerce, these companies can make use of the facilitation measures offered by the FTZ in such areas as customs supervision, inspection and quarantine, and cross-border payment in order to develop e-commerce import business. They can also apply for permission to pay personal postal articles tax on their import goods and enjoy the relevant preferential treatment. This development generates additional opportunities for Hong Kong companies wishing to make a foray into the mainland market by way of the cross-border e-commerce platform. [More …]

|

Enhancing Shipping Services

Apart from goods trading, the FJFTZ also looks into new development systems and operating modes for the shipping industry in the hope of enhancing its shipping services. Fujian is one of the coastal provinces in China which had an early start in development. For instance, Xiamen port in the province is not only one of leading foreign ports in the mainland, but also an international shipping centre in southeast China, a shipping logistics centre on the west coast of the Strait, and a major port for shipping to and from Taiwan. In 2014, Xiamen port’s cargo throughput reached 200 million tons, up 7.4% from a year earlier; while container throughput topped 8.57 million TEUs, up 7.05% from a year earlier. Its container port ranked 8th in China and 17th worldwide. [8]

Against this backdrop, FJFTZ is determined to enhance the province’s international shipping services and strengthen the shipping and industrial development of the ports in the various areas of the FTZ. For example, the positioning of Haicang Bonded Port Zone in the FTZ’s Xiamen Area aids the development of shipping logistics, bonded logistics, bonded processing and international trade. The zone implements the policy of “tax rebate for those entering the zone and tax exemption for equipment imported into the zone”. It also adopts investment, taxation and foreign exchange administration policies applicable to export processing zones, bonded zones and bonded logistics parks. Currently, a number of well-known international companies have established a presence here. These include: Hella, one of the world’s largest suppliers of automotive relays; Xiamen Tungsten, the world’s largest tungsten products company; Kerry Logistics of Hong Kong; and Kodak (China). The zone is now moving in the direction of developing into a modern industrial cluster, with emphasis on high value-added industries and service outsourcing.

The industrial development within different areas in the FJFTZ, together with the seaport and airport of Xiamen, not only serve the international trade in import/export goods conducted inside and outside Fujian province as well as its surrounding regions, but also cross-Strait trade. This will in turn propel the development of related international shipping and logistics industries. Moreover, FJFTZ’s overall plan and measures for enhancing shipping services also include:

-

Allowing the establishment of wholly foreign-owned international ship management enterprises

-

Relaxing restrictions on the foreign equity ratio of Chinese-foreign equity joint-venture and Chinese-foreign contractual joint-venture international shipping enterprises set up within the FTZ

-

Allowing foreign investors to engage in public international ship management business in the form of equity joint venture or contractual joint venture, with foreign equity ratio capped at 51%

-

Streamlining procedures for obtaining international shipping transportation business licences

-

Allowing the FTZ to conduct (on a trial basis) the business of transshipping and consolidating express parcels to and from Taiwan, Hong Kong, Macau and foreign countries

-

Allowing “flag of convenience” cruise ships belonging to mainland-funded cruise enterprises registered in the FTZ to carry out cruise business between the mainland, Taiwan, Hong Kong and Macau, on approval

In fact, under the CEPA framework, Hong Kong companies are, in general, entitled to certain shipping liberalisation measures similar to those offered by the FJFTZ. For instance, under CEPA Hong Kong service suppliers can set up wholly-owned shipping companies in the mainland, as well as set up equity joint-venture enterprises in the mainland holding equities not exceeding 51%, in order to provide third-party international shipping agency service [9]. However, it can be expected that the FJFTZ will introduce more liberalisation measures for shipping services, encouraging cross-Strait and international trade, as well as advancing the business of transshipping and consolidating express parcels to and from Taiwan, Hong Kong, Macau and foreign countries. All these efforts should provide more convenience to Hong Kong companies wishing to expand the coastal markets in southeast China through Fujian.

|

Capturing Opportunities Arising from 21st-Century Maritime Silk Road FJFTZ is positioned to expand the depth and breadth of exchanges and cooperation with countries and regions along the 21st-Century Maritime Silk Road, under China’s Belt and Road development strategy. Fujian province, as home to major ports along the ancient maritime Silk Road, as well an important foreign trade province in the mainland. With its advantages of being an international shipping centre in southeast China, the FTZ is making greater efforts to establish ties with countries along the Maritime Silk Road, in the hope of further promoting investment and trade. It can be expected that its demand for relevant support services will generate opportunities for companies wishing to capitalise on the Road and Belt initiative. [More …]

|

Advancing Financial Liberalisation and Innovation

In order to complement the development of different industries and services in the zone, apart from introducing measures encouraging cross-Strait financial cooperation, the FJFTZ will also further open up its financial sector and enhance investment and financing facilitation and efficiency for the benefit of enterprises within the zone. Specific areas of liberalisation include:

-

Improving the mode of managing RMB foreign accounts, further expanding two-way cross-border RMB financing business

-

Piloting capital account convertibility under a quota system, allowing qualified institutions to conduct such transactions as direct investment, merger and acquisition, debt instruments and financial investment under a quota system

-

Foreign exchange capital under the foreign direct investment account may be settled any time

-

Giving support to multinational companies to centrally operate and manage their RMB and foreign currency two-way capital pool

-

Giving support to the setting up of cross-border RMB equity investment funds to develop two-way cross-border RMB investment

-

Giving support to enterprises to conduct various offshore financing activities, such as international commercial loans

-

Allowing enterprises and financial institutions in the FTZ to issue RMB bonds offshore and channel the funds back to the country for use

-

Advancing RMB interest rate marketisation

-

Allowing banks, payment institutions and trust companies in the FTZ to conduct cooperation in cross-border payment with offshore banks and payment institutions

Under these development directions, the Fuzhou, Pingtan and Xiamen Areas are also planning to undertake different projects in order to complement their own positioning and meet their respective needs for industrial development.

|

Appendix: According to the overall plan for the Fujian FTZ, the FTZ covers a total area of 118.04 km2 and consists of three areas: 1. Fuzhou Area With an area of 31.26 km2, the Fuzhou Area of Fujian FTZ comprises two zones: Fuzhou Economic and Technological Development Zone and Fuzhou Bonded Port Area. The two are further divided into six sub-zones, known as “two zones, six sub-zones”. The Fuzhou Economic and Technological Development Zone has an area of 22 km2 and is divided into four sub-zones: namely Majiang-Kuai’an, Chang’an, Langqi and Nantai Island. The zone also houses two special customs supervision areas: Fuzhou Free Trade Zone (0.6 km2) and Fuzhou Export Processing Zone (1.14 km2). The Fuzhou Bonded Port Area has an area of 9.26 km2 and is divided into two sub-zones: Zone A borders the west port (or Xigang) to the east, Xinjiang Highway to the south, Jinqi Road to the west and Weiliu Road to the north; Zone B borders berth No. 14 to the east, Xinghua Road to the South, the mudflat (or Tantu) to the west and Xinglin Road to the north. The Fuzhou Area will be turned into an experimental ground for reform and innovation with the creation of an international, market-oriented business environment with sound legal system, revolving around the strategic requirements of gaining a foothold across the straits, serving the country and keeping abreast with the world. As pioneer in reform, it will take the lead in promoting investment and trade with Taiwan and give full play to the advantages of being a provincial capital city, with proximity to Taiwan and the ocean, and focusing on the construction of an advanced manufacturing base, important platform for the 21st Century Maritime Silk Road and demonstration zone for cooperation in cross-Strait service trade and financial innovation. 2. Pingtan Area Covering an area of 43 km2, the Pingtan Area of Fujian FTZ will focus on boosting ties with Taiwan and attracting foreign tourists to the island. It will implement more liberal measures to facilitate investment and trade, capital and personnel exchanges. Pingtan Area consists of three functional zones: Port economic and trade zone (16 km2). The zone’s positioning: accelerating the construction of port logistics cluster, business services cluster, and electronics industry cluster; focusing on the development of international trade, modern logistics, business services, and electronic information equipment manufacturing; and building cross-Strait free trade demonstration area, regional comprehensive bonded industries demonstration zone and the cross-Strait electronics industry integrated development cluster; and gradually expanding into an international free port. New- and high-tech industrial zone (15 km2). The zone’s positioning: exploring cross-Strait cooperation in building high-tech industrial bases; connecting the Pingtan high-speed rail hub with the central business district and science, technology, culture and education districts; accelerating the construction of R&D headquarters cluster, marine industry cluster, high-end light manufacturing industry cluster; giving full play to policy advantages of place of origin; focusing on the development of marine life, medical equipment, packaging materials and light equipment manufacturing and other high-tech industries; and promoting cross-Strait in-depth cooperation in high-tech industries. Tourism and business zone (12 km2). The zone’s positioning: being a window to Taiwan, the zone will give full play to the tourism resources including fine beaches, headlands and sand dunes, linking the international tourism development of the city centre and Pingtan, focusing on connecting Taiwan tourism and tourist services, accelerating the construction of coastal tourist enclave, cross-Strait tourism business cluster, agricultural and fishing products processing industry cluster to enhance service standards of international tourism, focusing on the development of coastal resort, sports tourism, leisure and wellness, tourist shopping and other tourism products, extending and expanding the high-end sector of tourism, striving to create an international coastal resort island, international maritime cultural and sports base, international tourism and leisure destination, and gradually expanding into an international tourist island. 3. Xiamen Area The Xiamen Area of Fujian FTZ which comprises the cross-Strait trade centre core zone and the southeast region international shipping centre Haicang port area, is a unique pilot FTZ in China featuring joint development of land and sea ports, airports and cruise homeports. The cross-Strait trade centre core zone covers an area of 19.37 km2 (including the 0.6 km2 Xiangyu Bonded Zone and 0.7 km2 Xiangyu Bonded Logistics Park). The positioning of the zone is the development of new- and high-tech R&D, information consumption, airport-based industries, international trade related services, financial services, professional services, cruise economy and other emerging industries and high-end services as well as building the cross-Strait economic and trade cooperation region to become a regional centre for international trade facing the Asia-Pacific region with foothold in the mainland. The southeast region international shipping centre Haicang port area covers an area of 24.41 km2 (including the 9.51 km2 Haicang Bonded Port). The positioning of the port area is the development of modernised port-based industries such as shipping and logistics, import and export, bonded logistics, value-added processing, service outsourcing, commodities trading, and the building of an efficient and convenient, green and low-carbon shipping logistics network service system to become an important container hub port of the Asia-Pacific region based in Haixi with global shipping resources capacity facing the world, providing service across the Straits.

|

[1] CEPA here refers to the Mainland and Hong Kong Closer Economic Partnership Arrangement and its supplementary agreements.

[2] For details, please see HKTDC’s Business-Alert China article: Fujian FTZ Announces Third Round of Initiatives (29 July 2015).

[3] Following the establishment of the China (Shanghai) Pilot Free Trade Zone in September 2013, the second batch of pilot free trade zones in China was officially launched in April 2015, including China (Guangdong) Pilot Free Trade Zone, China (Tianjin) Pilot Free Trade Zone and China (Fujian) Pilot Free Trade Zone.

[4] Starting from 1 October 2015, Fujian province has fully implemented the “one licence, one code” registration system for enterprises and farmer cooperatives in the province. For details, please see Circular of the Provincial Industry and Commerce Bureau on Deepening the “One Licence, One Code” Registration System Reform forwarded by the Fujian People’s Government Office (Min Zheng Ban [2015] No.130 (16 September 2015)).

[5] For details, please see HKTDC’s Business-Alert China Fujian FTZ Announces Third Round of Initiatives (29 July 2015).

[6] For details, please see Overall Development Plan for Pingtan Comprehensive Experimental Zone (November 2011).

[7] For details on Pingtan’s preferential tax policies, please see Circular on Enterprise Income Tax Preferential Policies and Catalogue of Preferences for Guangdong Hengqin New Area, Fujian Pingtan Comprehensive Experimental Zone, and Shenzhen Qianhai Shenzhen-Hong Kong Modern Services Cooperation Zone (Cai Shui [2014] No.26) and Circular on VAT and Consumption Tax Policies for the Development of Hengqin and Pingtan (Cai Shui [2014] No.51).

[8] Source: Xiamen Port Authority

[9] For details, please refer to the preferential treatments granted to Hong Kong service suppliers under CEPA.

| Content provided by |  |

Editor's picks

Trending articles

Hong Kong’s Growing Ties with ASEAN Countries

Asia has witnessed an increase in integration in recent decades, evidenced by strong intra-regional trade and capital flows, negotiated trade agreements, the formation of trade blocs and, more recently, the Belt and Road Initiative. These developments are highly relevant and important to Hong Kong, which is expected to grow with the region by facilitating trade and investment between China and ASEAN economies, and by providing trade-related fundraising and business services for the region.

Stronger Trade Ties with ASEAN Countries

Bilateral trade between Hong Kong and other Asian countries has ballooned in recent years. In the past five years, Hong Kong’s total trade of merchandise with China and ASEAN countries increased by 9.6% and 10.1% a year, respectively, with electronic parts and components comprising a large and growing segment. To put this into perspective, Hong Kong’s total merchandise trade with traditional markets – the US, EU and Japan – grew at an annual rate of 4.8% in the same period.

The trend has reflected the vertical specialisation in Asia and Hong Kong’s role as a trading and logistics hub. Asia’s transformation from a fragmented production base into a sophisticated production network for electronics engenders heavy intra-regional traffic. Japan, South Korea, Taiwan and Singapore – the more developed economies in the region – supply higher-value electronic components such as semiconductors, while countries including Indonesia, Malaysia, Thailand and China focus on the more labour-intensive production of other electronic components, testing and assembly works. Lately, Vietnam has emerged as an alternative assembly base due to the rising costs of production in China.

Despite the complete implementation in 2010 of the China-ASEAN Free Trade Area, where tariffs between China and ASEAN countries were removed, Hong Kong still assumes an important role by providing efficient logistics and distribution services between them.

Along with the strong trade flows of merchandise, the trade in services between Hong Kong and ASEAN countries has also recorded remarkable growth in recent years. In 2013, this bilateral trade in services amounted to HK$117 billion, representing an increase of 11.1% a year from 2009 to 2013 and accounting for 8.4% of Hong Kong’s total trade in services. Transport, travel and other business services constitute Hong Kong’s major services trade with ASEAN countries.

Further Regional Integration Envisaged

ASEAN countries are expected to see further industrialisation and economic development. An important development in the region is the establishment of the ASEAN Economic Community (AEC) by the end of 2015. The AEC envisages four characteristics: a single market and production base; a highly competitive economic region; a region of equitable economic development; and a region fully integrated into the global economy.

One of the AEC’s goals is the reduction of tariffs on merchandise trade among ASEAN countries, which has largely been realised. However, progress on liberalising non-tariff barriers, movements of people and capital, and trade in services are lagging behind. Pressure to protect domestic industries still runs high and there is little transparency and standardisation in investment regulations. Furthermore, liberalisation has been hampered in many areas by the built-in flexibilities of the AEC, which allows member states to liberalise according to each country’s readiness. The economic, language and cultural diversities among ASEAN countries are also major hurdles in creating a common economic area as envisaged in the AEC’s statement of aims.

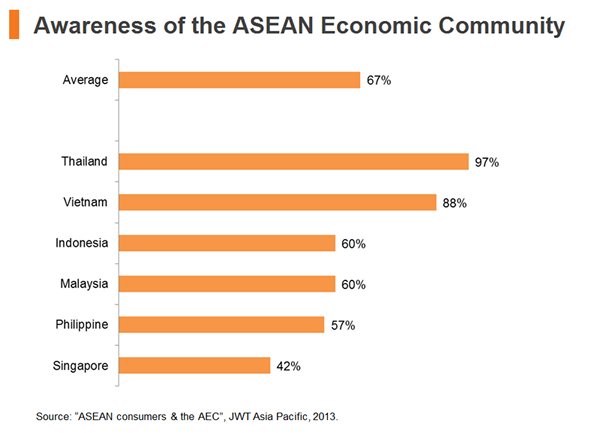

According to a survey conducted by JWT Asia Pacific in 2013, in which a total of 2,400 people aged 20 to 49 in Thailand, Singapore, Malaysia, Vietnam, Indonesia and the Philippines took part, 67% of respondents were aware of the AEC. Awareness was the highest in Thailand (97%) and Vietnam (88%), while the lowest was in Singapore (42%).

Indeed, expectations of the AEC are not running high in Singapore’s private sector, according to our conversations with the trade. The sector generally believes that the AEC will be launched in 2015 but that its initial impact will be minimal. Change will not happen overnight, and 2015 should be seen as the beginning of ASEAN’s economic integration rather than the ultimate deadline.

In any case, the ASEAN bloc is moving towards the goal of an attractive business environment through simplifying tax, customs and foreign investment, stamping out corruption and upholding the rule of law. And with reduced trade and investment barriers, intra-regional trade will increase and investment will be further drawn to lower-cost areas in the region, forcing middle-income countries such as Malaysia, Thailand and Indonesia to move up the value chain.

The Hong Kong-ASEAN free-trade agreement, the negotiations for which are now underway, will be critical in matching the anticipated stronger demand for services in the region. While Hong Kong has minimal production and does not apply any tariffs on imports, the significance of the free-trade agreement will be on the reduction of non-tariff barriers and the promotion of economic, technical and intellectual-property cooperation in areas of mutual interest.

Impetus from the Belt and Road

The China-proposed Belt and Road Initiative will further strengthen regional co-operation. The initiative aims to orient the trade routes towards ASEAN countries with a proposed China-Indochina Peninsula Economic Corridor and a maritime route linking coastal China to Europe through the South China Sea, the Indian Ocean, the Persian Gulf, the Suez Canal and the Mediterranean Sea.

The Chinese government is cooperating with Thailand, Cambodia, Laos, Myanmar and Vietnam – the five ASEAN countries in the Indochina Peninsula – to jointly plan and build an extensive transportation network, as well as a number of industrial co-operation projects. They also aim to create a new mode of cooperation for fundraising and promote sustainable and coordinated socio-economic development. Meanwhile, China and the maritime ASEAN countries are actively investing in their maritime infrastructure.

Leveraging on its strength as an international financial centre in the region, Hong Kong is expected to serve as the fundraising and financial platform for these large-scale infrastructure projects and offer offshore renminbi services, including cross-border trade settlement and bond issuance. Hong Kong’s service professionals will assume an active role by providing services in areas of law, banking, accountancy, insurance, architecture and engineering, etc., amid the expanding trade and economic activities in the region.

| Content provided by |

|

Editor's picks

Trending articles

HKTDC Research | 27 Nov 2015

Vietnamese Businesses Offer Cautious Welcome to Belt and Road

Although some concerns remain over territorial disputes with China, many Vietnamese companies remain upbeat over the country's prospects as part of the Belt and Road initiative, while infrastructure work is already underway.

Vietnam is considered a key part of the maritime component of China's ambitious Belt and Road Initiative. In particular, there has been a focus on Northern Vietnam's Haiphong Port, with plans afoot to complete a major upgrade to its facilities by the end of 2017.

Overall, Haiphong is a key nexus point along two of the proposed trade corridors. The first is along a route connecting Nam Ninh, Lang Son, Hanoi and Haiphong, while a second connects Kunming, Lao Cai, Hanoi and Haiphong. These proposals would see Vietnam playing an enhanced role in the transportation of goods produced in China, while also opening up the local consumer market to more external suppliers. It is also believed that the improved links will also help develop Vietnam's own industrial base.

With Vietnam ideally placed as a transportation hub for a number of other countries along the Mekong River – including Cambodia, Laos, Thailand and Myanmar – the country would play an important logistics role with regard to serving the ASEAN bloc. The only real barrier to such a development is seen as the lingering territorial disagreements between China and Vietnam, particularly with regard to the South China Sea.

Addressing the need to resolve such issues, Xi Jinping, the Chinese President, has gone on record saying: "We must strictly adhere to the important agreements that the leaders of the two countries have achieved. Together, we can handle and control any disagreement over the situation, and maintain peace, and stability on the East Coast."

Mutual benefit

Should any such issues be resolved or even merely set aside, many in both China and Vietnam would welcome the closer economic and logistics ties outlined as part of the Belt and Road proposal. One such advocate is Eric Fang, Director of the Shunfang Company, a Chinese fabric trading company based in Shanghai.

Outlining the possible benefits, Fang said: "Vietnam is one of our major buyers. The fact that Vietnam has agreed to be a part of the Silk Road project is great news for us. We have been working with Vietnamese companies for many years and, up until now, the process of shipping goods by sea has been lengthy, while also requiring the completion of a substantial amount of paperwork. In the future, if we could use rail transportation, there would be a considerable saving in terms of both time and costs."

While the benefits for those Chinese exporters seeking markets for their excess capacity is clear, some have been less certain about the upside for Vietnam. Despite this, the mood of the Vietnamese business community seems to be largely upbeat about the prospects of the initiative, believing it is likely to enhance its own trading prospects in the long-term.

Addressing this issue David Wong, Director of the Wintec Company, a specialist PU foam manufacturer based in Vietnam's Long An province, said: "I expect Vietnam will participate in the Belt and Road project and that, in future, relationships between the two countries will be less complicated. It can only lead to a much improved situation and not only in terms of international trade.

"I believe it will create the ideal conditions to develop and extend our business domestically. It will also benefit other Vietnamese enterprises and the Vietnamese economy in general."

Wong's optimism was echoed by Tran Lam, a Senior Sales Representative of the Au Viet Moc Trading Import Export Company, a wooden furniture manufacturing company based in Hi Chi Minh City. Emphasising the importance of overseas investment, Lam said: "In my opinion, when foreign companies invest in Vietnam, there will inevitably be more job opportunities for the people here. That means the unemployment rate will drop and the overall quality of life will improve. That has to be a good thing."

Highlighting the importance of settling any outstanding territorial matters, Nguyen Van Hoang, Deputy Director of Vietnam Textile and Garment Corporation, said: "In terms of our businesses, if the relationship between Vietnam and China improves, it can only be a good thing. Many of last year's problems relating to the South China Sea had a hugely negative impact on our business. With sales frozen for months, there was nothing for our workers to do. Despite this, we still had to pay our staff in order to retain them."

Power to the People

Overall, the Belt and Road project is seen as offering a number of clear opportunities for the Vietnamese economy. While most obviously offering Vietnam the chance to attract a higher level of investment from overseas companies, especially those based in China, the project will also support the development of the country's infrastructure, particularly in terms of utility and logistics facilities development.

A prime example of this is the work that has already been completed on the hydroelectric power generation plant in Binh Thuan on Vietnam's south central coast. Around 95% of the project's total capital cost of US$1.75 billion came from Chinese venture investors – the Southern China Power Grid Company and Chinese International Power Company, with the remaining 5% being covered by the Vietnam Coal and Mining Group (Vinacomin).

The same consortium is also behind the development of the Vinh Tan thermal power plant in Binh Thuan. With a total capacity of 1,200MW, the initial phase of the project will come on line before the end of 2018, with the second phase scheduled for completion some six months later.

Pham Tuong Vi, Special Correspondent, Ho Chi Minh City

| Content provided by |  |

Editor's picks

Trending articles

1 Dec 2015

Belt and Road Initiative: Myanmar and China’s One Belt One Road Strategy

Presented by Thomas Chan, China Business Centre, The Hong Kong Polytechnic University on 26 Nov 2015

This is a presentation for a seminar on Myanmar – Its Future and Its Role in China’s Maritime Silk Road Strategy.

Please click to download the presentation file.

Editor's picks

Trending articles

HKTDC Research | 4 Dec 2015

China’s 13th Five-Year Plan: Likely Aims and Implications

At the fifth plenary session of the 18th Central Committee of the Communist Party of China, held on 29 October 2015, the Suggestions of the Central Committee of the Communist Party of China on the 13th Five-Year Plan for National Economic and Social Development (Suggestions) were passed. It was later stated at a State Council Executive Meeting that the 13th Five-Year Plan (2016-2020) will be formulated according to the Suggestions [1].

President Xi Jinping and Premier Li Keqiang also remarked that the core goals of the 13th Five-Year Plan are to build a “moderately well-off society” and to overcome such challenges as the “medium-income trap”. While efforts will be made to optimise the economic structure, improve the environment, and enhance the quality and benefit of development, steps will be taken to achieve economic growth. Specific goals include: [2]

-

Maintaining economic growth at a medium to high speed, with average annual growth over 6.5%

-

Raising per-capita GDP to US$12,000 (up from around US$7,600 in 2014)

-

Accelerating industrial upgrade and propelling the economy to develop at medium to high level

-

Balancing urban and rural development and ecological construction

-

Strengthening social fairness and justice and balanced development

Where Hong Kong is concerned, the Suggestions mention that efforts will be made to deepen the joint development of the mainland and Hong Kong (as well as Macau and Taiwan), including giving support to Hong Kong to strengthen its position as an international financial, shipping and trading centre; participate in China’s two-way opening-up and Belt and Road Initiative; consolidate its position as a global hub for offshore renminbi business; and deepen Guangdong-Hong Kong-Macau cooperation.

From the Suggestions and the statements made by the leaders, it can be gathered that the 13th Five-Year Plan to be launched next year is likely to cover the following development directions, which can bring about new opportunities for Hong Kong players.

Encourage Innovation and Enhance Quality of Economic Development

According to the Suggestions, the 13th Five-Year Plan will place emphasis on advancing mass entrepreneurship, encouraging technological innovation, and promoting the development of new industries, in a bid to inject new vigour into the economy. It will focus on developing high technology and high value-added industries, while strengthening supporting infrastructure, revamping related financial systems, and improving the business environment to promote further growth of related industries. The target industries and development sectors will include:

-

Developing emerging industries

This includes developing such emerging industries as energy saving and environmental protection, biotechnology, information technology, smart manufacturing, high-end equipment, and new energy, as well as giving support to traditional industries to undergo upgrade.

-

Bolstering infrastructure construction and encouraging innovation

This includes building high-speed and safe next-generation information infrastructure, as well as quickening the pace of implementing the “Internet +” action plans, developing IoT (Internet of Things) and big data technology and application, and formulating plans to develop the next generation of Internet and related technology.

-

Encouraging corporate innovation

Efforts will be made to encourage R&D, strengthen technology integration capability, and import technology from abroad, targeting advanced technologies including next-generation information communication, new energy, new materials, aviation and space, biomedicine, and smart manufacturing. Action will also be taken to improve tax concession policies for corporate R&D expenses, and expand preferential treatment for accelerated depreciation of fixed assets to encourage enterprises to replace their equipment and apply new technology.

-

Steps will be taken to encourage mainland industries to develop from “Made in China” to “Created in China”, and to achieve the task of industrial upgrade moving “from big to strong”. This includes raising the level of product technology, technical equipment, energy efficiency and environmental protection across the board, as well as liberalising market access for modern services in a bid to promote development of the specialised high-value producer service industry, and assist the manufacturing industry in increasing value-added.

-

Developing new systems

Action will be taken to simplify the industry and commerce administration systems, accelerate the pace of financial system reform, raise the efficiency of the financial sector in serving the real economy, and further develop the capital market in a bid to lower the financing costs of medium, small and micro enterprises.

Based on the above development directions, it can be expected that implementation of the 13th Five-Year Plan will boost the mainland’s demand for various types of new and high technology. However, in certain high-tech industries such as IoT applications and development of the next-generation Internet, as China is currently still short of total and standard solutions and lacks user experience in certain areas, related R&D and technology application is somewhat constrained. Hong Kong’s technical personnel, who are well-versed in advanced foreign technology and excel in using technologies developed by international standards/frameworks to provide technological and management system solutions, can assist in the commercialisation of related projects in the mainland and meet the technological demands listed in the 13th Five-Year Plan.

Meanwhile, the mainland hopes to make use of innovation to facilitate industrial upgrades. For instance, the policy paper “Made in China 2025” stated that enterprises will be encouraged to strengthen their product design capability and brand building so that more enterprises will shift from OEM to ODM, as well as develop their own branded business. This should provide opportunities for Hong Kong’s design and branding service suppliers. A recent survey conducted by the Hong Kong Trade Development Council found that mainland enterprises wish to obtain service support from Hong Kong or foreign countries in the following areas: (i) product development and design; (ii) brand design and promotional strategy; and (iii) marketing strategy. [3]

Hong Kong, as an international financial centre in the region, can provide mainland enterprises with the necessary loan and financing services, such as providing cost-effective capital for relevant technology and industrial projects, helping mainland enterprises to lower financial cost. Also, as Hong Kong is one of the largest venture capital management centres in Asia, a large number of top-notch international fund managers wishing to grasp business opportunities in China have already established a foothold in Hong Kong, which can offer more financing channels for mainland enterprises. It can be expected that during the 13th Five-Year Plan period the mainland will further open up its financial services market, this should bring about more opportunities for Hong Kong financial service suppliers to enter the mainland market.

Balanced Regional Development

The Suggestions also stress that during the 13th Five-Year Plan period efforts will be made to strengthen the balanced development of various regions, including placing equal emphasis on urban and rural development, as well as synchronising the pace of development of the more developed eastern coastal region with that of the central and western regions. The emphasis of the plan is expected to include:

-

Advancing coordinated regional development

This includes deepening the Go West initiative and promoting development of the central region. Emphasis will be placed on encouraging the coordinated development of certain regions, such as advancing the coordinated development of the Beijing-Tianjin-Hebei region and the Yangtze River Economic Belt. Regional development will be achieved by way of optimising urban development planning, encouraging regional transportation integration, and improving regional environmental planning.

-

Advancing new urbanisation construction

Steps will be taken to advance a people-centred new urbanisation plan; enhance the level of urban planning, construction and management; deepen household registration system reform; and assist rural migrants capable of working steadily in urban areas in obtaining urban resident status.

The importance attached by the Suggestions to the strategy of balanced development of the eastern and western regions and urban and rural areas aims to tackle problems brought about by disparities in regional development in the past and by the rapid pace of urbanisation of some localities. These problems include:

-

Insufficient transport facilities, environmental resources and supporting municipal facilities in certain city clusters

-

The polarised development of the urban and rural areas has quickened the pace of people flow into cities, increasing the pressure on urban development

-

As the pressure on the transportation and communication systems continues to grow, the efficiency of logistics services is in dire need of improvement

-

Water and air pollution problems are increasingly serious, creating a strong demand for environmental services, such as energy saving and emission reduction

The rate of urbanisation in the mainland rose rapidly from 36% in 2000 to 55% in 2014. The pace is particularly fast in more developed regions, for instance, the urbanisation rate in some of the YRD provinces exceeds 65%, which has created the problems mentioned above. [4] In view of this, the 13th Five-Year Plan is likely to take a further step in making “new” urbanisation a development direction, devoting great efforts to enriching the content of urban and rural development and making the enhancement of urban quality a development objective, instead of simply seeking urban construction or expanding the boundary of cities.

Against this backdrop, the 13th Five-Year Plan will not only bring about the upgraded development of coastal cities, but will also stimulate the construction and economic activities of urban and rural areas in the central and western regions, as well as the old industrial regions in the northeast. For instance, where building new city clusters is concerned, efforts will be made to strengthen the construction of daily-life supporting facilities in the relevant urban and rural areas, and to upgrade infrastructure, such as cross-regional intercity and trans-regional transport systems.