Finance

Effects of CNH Exchange Rate on Offshore RMB Interest Rate

Since November 2014, the exchange rate of offshore RMB to USD (CNH exchange rate) has depreciated while choppy CNH HIBOR led to a significant increase in capital cost. This article will discuss whether this phase of RMB interest rate fluctuation has a causal relationship with the depreciation of RMB and the dynamics of such relationship.

Effects of different sources of funds in offshore markets on RMB interest rates

Interest rate is the cost paid by those who demand capital. Hence, in order to answer the first question, we have to understand the channels for obtaining RMB capital in the offshore market and their impact on interest rates.

Unlike onshore parties who gain liquidity mainly from repurchase agreement (Repo) and the interbank market, parties in the offshore market gained RMB liquidity from the following three ways, namely, CNH swaps, interbank lending and CNH CCS. These three channels have different impacts on offshore RMB interest rates.

CNH swap refers to the use of foreign currency (mainly USD) to swap with RMB, which is similar to using USD as collateral for RMB loans. Currently, RMB swaps average approximately USD 20 billion in daily trading volume, much higher than that of interbank lending (on average USD 5-8 billion per day), and are the main channel for obtaining capital in the offshore RMB market. The “CNH Implied Yield” from CNH swap trading has also become the unofficial benchmark rate in the offshore RMB market.

Interbank lending requires the lender to pre-approve a credit line to the borrower in advance. Since such lending is essentially unsecured loans, there are certain requirements for participating institutions, limiting the capital pool available for interbank lending. Therefore, interbank lending is not as active as CNH swaps. One should also note that the quotations of offshore interbank lending are calculated mainly using CNH Implied Yields of the corresponding tenor. Therefore, price changes in offshore RMB capital will first be reflected in CNH Implied Yield and then be transmitted to interbank lending rates. As shown in the diagram below, CNH Implied Yield and CNH HIBOR Fixing are closely correlated, but the latter one is a bit less choppy as it is merely a daily fixing rate and does not represent actual market transactions.

To view the full article, please go to page top to download the PDF version.

| Content provided by |

|

Editor's picks

Trending articles

Mergers and acquisitions: Cultural alignment for successful integration

Cultural alignment is a prerequisite, opportunity, and challenge for directors and CFOs to create value and synergies in post-merger integration

Too often companies put together matches look great on paper but are fraught with management and structural problems that end up turning deals into busts. Acquiring companies often underestimate the problems that unalike company cultures can inflict on a merger. In fact, the difference between success and failure of deal-making is often not a matter of strategy or money, but rather of relationships, culture and politics.

Putting two companies together normally gives the combined entity the resources and capabilities to compete with the market giants. It would also create dominant positions in many markets around the world. However, that was not the case for advertising giants Publicis Groupe SA and Omnicom Group Inc. After the merger, the two CEOs, Publicis’s Maurice Lévy and Omnicom’s John Wren, agreed to be co-CEOs for 30 months; while that sounded good, the reality was that they couldn’t agree on a management team, the way of splitting their duties, or even on which firm should be listed as the acquirer from an accounting perspective. The deal was eventually scuttled in 2003.

The challenge of putting the companies together can be further exacerbated if the two companies have vastly different business models and cultures. For example, in Valeant Pharmaceuticals’s long-running hostile takeover campaign of Allergan Inc., the Botox-maker, the company executives of Allergan have expressed their disagreement with Valeant’s proposal to slash the amount of money that the company spends on research, a move that would probably lead to layoffs of hundreds or even thousands of its employees. As such, Allergan has disregarded Valeant Pharmaceuticals’s proposal and instead, agreed to be sold to generic pharmaceutical manufacturer Actavis plc., a company that shares similar values.

How cultural issues affect the success of an M&A transaction

Integration can be defined in general terms as the process of combining two companies into one entity at every level. Post-merger integration, the most often-cited concern that could significantly impact the success of an M&A transaction, is the top concern for directors and CFOs. Post-merger integration has to be multi-dimensional, with inputs from various perspectives, including strategy, new management, organisation, business, finance and accounting, tax and legislation, information system, and human resources. Yet, studies have pointed out that plenty of M&A transactions fail to yield desired expectations or even erode shareholder value. The little secret about M&As is that the human dimensions and culture are at least as important, if not more critical, than the strategy, pricing, and positioning. Cultural unfitness is commonly found to have a direct and indirect linkage to integration failure. Unsuccessful cultural integration could lead to organisation distractions, loss of key talents, and failure to achieve critical milestones or synergies.

Cultural integration is the key to a successful merger

Many studies agree that cultural alignment is critical to a successful merger. Yet, due to the intangible nature of culture and time constraints, management would rather focus on things that are tangible and measurable, such as financial data and legal matters. Cultural integration is then left unattended and postponed to the post-deal phase. Nevertheless, culture is not something that can be changed or integrated without well-organised plans; it requires time and attention to bring two cultures together and blend into a new collaborative environment.

Approaches to cultural integration

So, how can two different cultures be integrated to achieve full value? First of all, we have to understand the term ‘culture’. Corporate culture is the beliefs and behaviours that determine how a company’s management and employees interact and handle outside business transactions. Often, corporate culture is implied, not expressly defined, which develops organically over time from the cumulative traits of the people that the company hires. A company’s culture can be reflected in its dress code, business hours, office setup, employee benefits, turnover, hiring decisions, client satisfaction and other operational aspects. No companies are cultural twins and thus careful attention is required in understanding the cultures of both merging companies and managing the cultural integration process.

Having said that, it is highly recommended to start the cultural assessment early and make sure that the human dimensions of the combination are incorporated into your due diligence and integration planning from the beginning, instead of an afterthought. Organisations can start with cultural assessment during the due diligence stage, which provides preliminary indications on cultural alignment or misalignment of the two merging companies and whether the existing cultures can be aligned with the overall business strategy. With the cultural and strategic alignment assessments, organisations can reach a tailored sale and purchase agreement and formulate integration strategies that facilitate smoother transition and more effective integration to capture post-merger synergies. The time spent on cultural assessment needs not to be long but should be good enough to obtain a basic understanding on the cultural and strategic background of both companies.

Second, more time should be spent on development and management of the action plan. Due to its intangible nature, culture-related issues are likely to be unpredictable and thus addressing the issues can be a challenging task for the management. In most M&A transactions, companies focusing on cultural integration tend to achieve post-merger synergies – apart from analysis of cultural differences, those companies also evaluate the cultural opportunities and obstacles, which guide their efforts to the right directions. The companies would also take initiatives in redesigning the organisational structure, determining leadership assignment, and modifying human resources practices such as compensation and benefits.

This is followed by communication to employees regarding the company’s new directions and meaning of the changes. Changes may create frustration and stress to employees, yet proper communication from management with a clear vision for the integration can relieve scepticism and doubt. Accompanying with employees retention strategies and other team building activities, companies can establish a new culture and concentrate on the post-merger business goals.

Potential value of cultural alignment

“People are valuable assets to an organisation and play an integral part to the success of a business. Effective people management is the key to achieving post-merger synergies so as to maximize the optimal outcome,” says Barry Tong, Transaction Advisory Services Partner of Grant Thornton Hong Kong. As cultural integration is one of the key factors of a successful merger, it is important to have a dedicated team to manage and oversee the whole integration process.

The causes of merger failure can be complex and varied case-by-case, and there is no perfect model to apply. Nonetheless, culture misalignment is commonly considered as a direct and indirect hurdle and mismanagement of any cultural unfitness can hinder the company from realizing synergies during the integration process. Cultural and strategic alignment, active management of cultural integration, as well as proper communication between management and employees, are the suggested measures that ensure smooth cultural integration and contribute to a successful merger.

Conclusion

Cultural compatibility can have significant impact on the ultimate success of an M&A transaction. It is suggested that a separate cultural integration plan be studied, created and worked upon in the early stages of a merger. Proper management of cultural issues is the key to realise successful post-merger integration, especially from a people perspective.

| Content provided by |

|

Editor's picks

Trending articles

"One Belt, One Road" Initiative: The Implications for Hong Kong

The “One Belt, One Road” Initiative – the Silk Road Economic Belt and the 21st Century Maritime Silk Road – is key part of China’s development strategy. The Vision and Actions on Jointly Building the Silk Road Economic Belt and the 21st Century Maritime Silk Road (the “Vision and Actions”) issued by the National Development and Reform Commission on 28 March 2015 outlines the initiative’s framework, co-operation priorities and co-operation mechanisms.

The Belt and Road Initiative aims to promote connectivity in infrastructure, resources development, industrial co-operation, financial integration and other fields along the Belt and Road countries. These strategic objectives are also closely connected to the “going out” strategy of many Chinese businesses. In light of the Vision and Actions document, as well as other related information sources, the “One Belt, One Road” initiative, with its extensive reach across a number of regions, represent clear development opportunities for Hong Kong.

Vision and Actions: The Key Points

The “One Belt, One Road” initiative aims to promote “connectivity in five respects”: policy co-ordination, facilities connectivity, unimpeded trade, financial integration and people-to-people bonds. These may be summed up as follows:

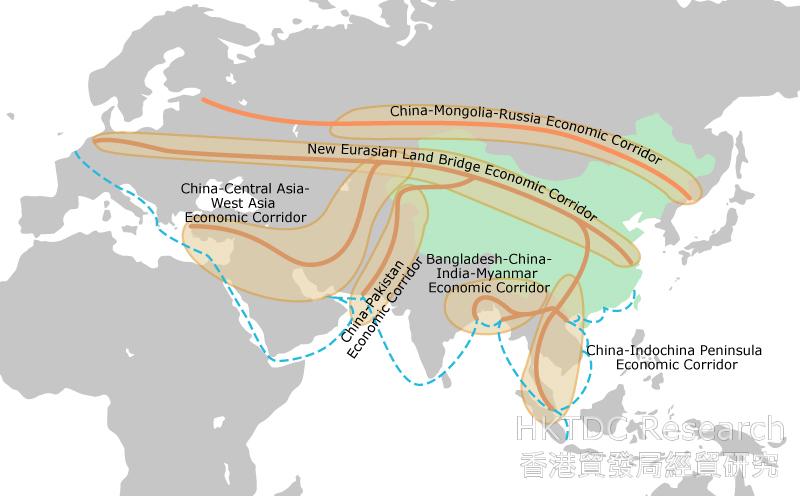

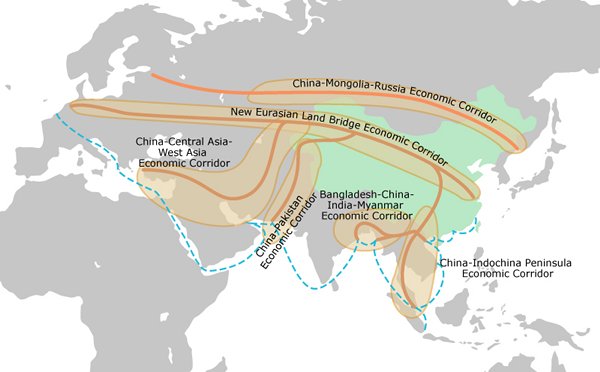

The Silk Road Economic Belt focuses on bringing together China, Central Asia, Russia and Europe (the Baltic); linking China with the Persian Gulf and the Mediterranean Sea through Central Asia and West Asia; and connecting China with Southeast Asia, South Asia and the Indian Ocean. The 21st Century Maritime Silk Road is designed to go from China’s coast to Europe through the South China Sea and the Indian Ocean and from China’s coast through the South China Sea to the South Pacific. On land, the initiative will take advantage of international transport routes, rely on core cities along the Belt and Road, and use key economic and trade zones and industrial parks as co-operative platforms. At sea, it will focus on jointly building smooth, secure and efficient transport routes, connecting major seaports along the Belt and Road.

Facilities connectivity: Priority will be given to removing transport bottlenecks and promoting port infrastructure construction and co-operation in order to deliver international transport facilitation. Priority will also be given to the construction of regional communications trunk lines and networks in order to improve international communications connectivity.

Economic Corridors of the “One Belt, One Road”

Investment and trade co-operation: Efforts will be made to resolve the problems of investment and trade facilitation; hold discussions on opening free trade zones; expand traditional trade and develop modern service trade and cross-border e-commerce; promote trade through investment, strengthen co-operation with relevant countries in industrial chains, promote upstream-downstream and related industries to develop in concert, and build overseas economic and trade co-operation zones; and encourage Chinese enterprises to participate in infrastructure construction and make industrial investments in countries along the Belt and Road.

Financial integration: Efforts will be made to promote the development of the bond market in Asia and push forward the establishment of the Asian Infrastructure Investment Bank, the BRICS New Development Bank and the Silk Road Fund; support the efforts of Belt and Road countries and their companies/financial institutions in issuing RMB bonds in China; encourage Chinese financial institutions and companies to issue bonds denominated in both RMB and foreign currencies outside China; give full play to the role of the Silk Road Fund and that of sovereign wealth funds of the Belt and Road countries, and encourage commercial equity investment funds and private funds to participate in the construction of the key projects of the initiative.

People-to-people bonds: Efforts will be made to strengthen educational and cultural co-operation, including cross-nation student and education exchanges; enhance co-operation in tourism; and support think tanks in the Belt and Road countries to jointly conduct research and hold forums.

Fully leverage the comparative advantages of various regions in China:

Northwestern and northeastern regions: The initiative will give full scope to Xinjiang’s geographical advantages and make it a core area on the Silk Road Economic Belt, while giving full scope to the advantages of Inner Mongolia and Heilongjiang province with regard to their proximity to Russia and Mongolia, as well as improving the rail links connecting Heilongjiang with Russia.

Southwestern region: The initiative will give full play to the unique advantages of Guangxi and Yunnan, speed up the opening up and development of the Beibu Gulf Economic Zone and the Zhujiang-Xijiang Economic Zone (also known as the Pearl River-Xijiang Economic Zone), and develop a new focus for economic co-operation in the Greater Mekong Sub-region.

Coastal regions and Hong Kong, Macau and Taiwan: The initiative will support the Fujian province in becoming a core area of the 21st Century Maritime Silk Road; give full scope to the roles of Qianhai (Shenzhen), Nansha (Guangzhou), Hengqin (Zhuhai) and other locations in opening up and co-operation, and will help to build the Guangdong-Hong Kong-Macau Big Bay Area; will strengthen port construction in a number of coastal cities, such as Shanghai, Tianjin, Ningbo-Zhoushan, Guangzhou, Shenzhen, Zhanjiang, Shantou, Qingdao, Yantai, Dalian, Fuzhou, Xiamen, Quanzhou and Haikou, and will strengthen the functions of several international hub airports, notably Shanghai and Guangzhou.

Inland regions: With a focus on city clusters along the middle reaches of the Yangtze River and around Chengdu and Chongqing, the initiative will establish Chongqing as an important pivot for developing and opening up the western region, while making Chengdu, Xian and Zhengzhou leading areas for opening up in the inland regions, and developing railway transportation in the China-Europe corridor.

Co-operation mechanisms and platforms: The initiative will make full use of existing multilateral co-operation mechanisms, such as the Shanghai Co-operation Organisation (SCO), ASEAN Plus China (10+1), Asia-Pacific Economic Co-operation (APEC), Asia-Europe Meeting (ASEM). In addition to existing forums and exhibitions, it is also proposed that an international summit forum on the Belt and Road Initiative should be established.

Infrastructure: Taking Precedence in the “One Belt, One Road” Initiative

The Asian Development Bank estimated that the Asian economies would need to invest US$8 trillion in infrastructure to bring their facilities up to average world standards between 2010 and 2020. According to reports, China is conducting feasibility studies on four outbound high-speed railways, including the Europe-Asia high-speed rail, the Central Asia high-speed rail, the Pan-Asia high-speed rail and the China-Russia-America-Canada line. The domestic sections of the first three projects are reportedly underway, while negotiations are still being carried out on the last project, as well as on the overseas sections of the first three projects.

Apart from railway networks, other cross-border projects and the building of port facilities, airports, highways, and even electricity and communications projects in the Belt and Road countries are also targets for China’s “going out” funds. In addition to investment, there will also be a considerable number of opportunities for the international contracting of construction and machinery exports.

Industrial Co-operation: Stimulating Trade Flows

In terms of resource development, several provinces in China are planning to take advantage of the Belt and Road Initiative in order to encourage competitive industries to go global and undertake co-operation in advanced technologies. Chinese enterprises are also being encouraged to increase overseas investment in the exploitation of mineral resources in order to improve China’s supply of energy resources.

According to the Department of Outward Investment and Economic Co-operation of the Ministry of Commerce, China has established 118 economic and trade co-operation zones in 50 countries around the world. (These are set up in the host countries, with Chinese enterprises forming the mainstay based on the market situation, the investment environment, and the host government’s policies when it comes to managing investment to attract enterprises to set up production there.) Of these zones, 77 are established in 23 countries along the Belt and Road. These overseas economic and trade co-operation zones have become China’s platforms for overseas investment co-operation, as well as platforms for the clustering of industries.

There are 35 co-operation zones in countries along the Silk Road Economic Belt, including Kazakhstan, Kyrgyzstan, Uzbekistan, Russia, Belarus, Hungary, Romania and Serbia. There are also countless economic and trade co-operation zones along the 21st Century Maritime Silk Road. There are, for example, Chinese industrial parks in Laos, Myanmar, Cambodia, Vietnam, Thailand, Malaysia and Indonesia, and in South Asia, as well as even in Pakistan, India and Sri Lanka. The Belt and Road Initiative, then, will generate more development opportunities, including the building of industrial parks, facilitating investment projects and boosting international trade by the private sector.

Supporting Development Through Financial Co-operation

In order to provide financial support for the development of the Belt and Road Initiative, China is actively promoting the establishment of the Asia Infrastructure Investment Bank, the BRICS New Development Bank and the Silk Road Fund. The Silk Road Fund was officially established at the end of December 2014. According to Silk Road Fund chair, Jin Qi, the fund will mainly invest in infrastructure, energy development, and industrial and financial co-operation, and will support the export of high-end technologies and production capacity. The Belt and Road Initiative does not have strict geographical boundaries and the fund will participate in any project relating to connectivity.

The Silk Road Fund may set up sub-funds for investment in particular industries. Some of these sub-funds may have particular industries as entry points. For example, an electricity sub-fund may be established as many companies may choose to invest in electricity projects. Another sub-fund may target particular regions. Where there are enough qualified people well familiar with a particular region, a sub-fund may be established for that region.

According to Zhou Xiaochuan, Governor of the People’s Bank of China, the Belt and Road Initiative will generate development and investment opportunities as it has diverse financing needs, with the role of the investment bank being to match investment demand and supply through proper financial arrangements. In terms of the demand for qualified personnel, Zhou said that staff members must have experience in investment and international exposure, in addition to a sound understanding of particular countries. They must also have expertise and social connections, together with an engineering background (especially in financing for engineering projects), possess considerable knowledge or experience in key industries, and speak a relevant foreign language.

Driving Increased Levels of Domestic Investment

Chinese provinces are responding positively to the Belt and Road Initiative. According to reports, as of 5 February 2015, more than two-thirds of the 28 mainland provinces that had held their local people’s congresses and political consultative conferences have made their own plans for the initiative. In infrastructure planning, for instance, Chongqing has issued its Opinions on Implementing the Belt and Road Strategy and Building the Yangtze Economic Belt and is expected to invest Rmb1.2 trillion in infrastructure before 2020. This will generate opportunities for co-operation in construction, planning, management, finance and other related fields.

Implications for Hong Kong

In terms of industry sector, infrastructure may be the first stage in the development of the Belt and Road Initiative. It requires investment, project contracting and will drive demand for relevant services. In this connection, Hong Kong should be able to find a considerable array of opportunities in financing, project risk/quality management, infrastructure and real estate services (IRES), as well as several other related fields.

A number of Chinese enterprises may become involved in mergers and acquisitions in the course of “going out”. According to some analysts, China’s aviation industry should also plan to “go out” through mergers and acquisitions. To date, Hong Kong has been the key platform for the mainland’s outward investment. By the end of 2013, Hong Kong accounted for 57.1% of China’s outward investment stock, with the cumulative value standing at US$377.1 billion. The increase of investment and merger and acquisition activities will increase the demand for the respective professional services in Hong Kong.

The launch of the Belt and Road Initiative will increase people-to-people exchanges between China and the countries concerned, as well as boost demand for international logistics. Hong Kong has a leading edge in global logistics links and operation. In addition to freight services, Hong Kong can give further leverage to its functions as a maritime services centre. As Nansha in the Guangdong Free Trade Zone also intends to develop maritime services, Hong Kong may explore co-operation possibilities with the district.

Another area in which Hong Kong can play a substantial role is financial services. Hong Kong can provide additional services here, including fund raising, financing, bonds, asset management, insurance and offshore RMB business. Hong Kong can also seek to play a bigger role in the Asian Infrastructure Investment Bank, BRICS New Development Bank and Silk Road Fund, including encouraging these institutions to set up their headquarters and branches in the territory and make greater use of Hong Kong’s international talent, as well as inviting the Silk Road Fund to set up sub-funds in Hong Kong. In addition, passenger and freight transport, aircraft leasing and other aviation-related financial services also represent a considerable number of opportunities.

In terms of industrial co-operation, China’s overseas economic and trade co-operation zones will become platforms for overseas investment and co-operation for Chinese enterprises, as well as platforms for the clustering of industries. Southeast Asia, South Asia and Central Asia may further develop into a more extensive network of bases for industrial relocation and even open up as consumer markets. The demand for logistics, supply chain management, consumer products and services may increase with the growth of these regions. Following the opening of logistics hubs in Central Asia, there will be railways linking China with the region. For example, Hong Kong businesses may consider using the Chongqing-Xinjiang-Europe railway to transport goods directly from Chongqing to the Central Asian market, thus saving time and money.

With regard to regional development, apart from Southeast Asia, South Asia, and even Central Asia, Central and Eastern Europe, the demand of mainland provinces for infrastructure investment and logistics services in support of the Belt and Road Initiative will also generate business opportunities for the relevant industries.

Hong Kong can also play a more proactive role in the Belt and Road co-operation platform. For example, Hong Kong may strive to regularly host international summits/forums and work with think tanks and cultural and educational institutions in the Belt and Road countries in conducting research, training, co-operations and exchanges. It could also act as a platform for personnel exchanges/training in relevant fields, such as logistics, infrastructure and finance.

| Content provided by |

|

Editor's picks

Trending articles

Made in China: Sourcing in the “New Normal”

Finding the Right Balance

VF is a USD 12 billion apparel and footwear powerhouse, with an incredibly diverse, international portfolio of brands and products, including The North Face, Nautica, Timberland, Vans, and more. VF has sourcing relationships with more than 1,000 product manufacturing facilities in Asia-Pacific region countries, including China, Bangladesh, Vietnam, Indonesia, Thailand, Cambodia, Pakistan, and India.

China Focus interviews Veit Geise, VP Sourcing of VF, on his opinion of China as a sourcing destination and what trends and challenges to expect when operating there.

How important is China for you compared to other production countries?

This largely depends on the brands and whether we are looking at export or at Chinafor-China business. Price-sensitive brands continue to move or have already moved their activities to other countries several years ago, while very technical brands with a complicated outerwear segment, for example, still depend on China to a large extend. Growing sales & marketing activities in China continue to result in an increase of the Chinafor-China volume, which compensates for a loss of export volume. China, therefore, will continue to be one of the most important sourcing destinations in the future.

What factors do you consider when deciding to stay or move your production location?

This, too, depends on the brands that you are looking at. A price-sensitive business will react very fast to labour cost increases or a change in the geopolitical environment. The more technical a brand is, the less you will be inclined to move volumes to other areas for small incentives. A supplier who understands the complexity and DNA of a technically complex brand, is worth a lot more than saving a few pennies by moving countries. Nonetheless, depending on the product, a supplier’s readiness to react and adapt to changes is critical.

Is price the only factor for your customers?

Definitely not, although it is clearly a driver for making sourcing decisions. Gross margin pressure will not become less in the future, and with inflation at the sourcing locations and little chances to increase retail prices in general, the price pressure will not go away. It is the right balance and mix that you need to find and manage for each brand individually.

What are the challenges you face now in China and beyond? How do you overcome them?

The sourcing business has become much more complex over the past years, and we can anticipate even more complexity in the years to come. Today we require a much greater level of transparency from our factories than we have done in the past. CSR requirements, as well as responsible sourcing, have become very important factors in a relationship. The only way to build successful alliances in the future is an even closer partnership between the buyer and the seller. We will continue to see a further decline of purely transactional business.

To view the full article, please go to page top to download the PDF version.

| Content provided by |

|

Editor's picks

Trending articles

Grant Thornton: Growing Appetite for M&A in China

According to the recent Grant Thornton International Business Report (IBR), China mainland businesses’ appetite for M&A activity continuously grows and the M&A market sets to grow further over the next 12 months. Businesses' M&A plans are becoming more focused as the quality of available targets improves and the willingness of potential vendors to contemplate a sale increased.

M&A activity forecast in China for 2015 up of 10%

“To buy” and “to sell” are key elements for a successful M&A market. The IBR reveals that the year of 2014 witnessed an active M&A market in China. 26% of business leaders seriously considered at least one acquisition opportunity, up from 10% in 2013. Meanwhile, the M&A activity forecast for 2015 increased to 20%, a rise from 10% over the past year. While the willingness of potential vendors grows, the percentage of businesses planning to sell up is also on the rise. The proportion of businesses expecting a change in ownership in the next three years rose from 6% to 9% over the past year.

Confidence in the ability to fund transactions is vital for an active M&A market. Whilst retained earnings (52%) remain a significant source of funding, the proportion of businesses planning to use bank debt to finance deals has risen to 51% from 22% in the last year. The percentage of businesses expecting to finance growth through private equity also increased from 8% to 24%. Meanwhile, despite of the recovery of IPO market, China has seen no increase in the businesses planning to finance deals through public listing (14%).

Xu Hua, CEO of Grant Thornton China, says, “The year of 2014 witnessed an M&A boom. Both the number and the total volume of transaction broke a new record. With the further reform of state-owned enterprises and businesses’ increasing ‘going out’, China’s domestic and overseas M&A markets are both expected to be more active in 2015. CBRC issued the revised edition of Guidelines for Risk Management by Commercial Banks of Loans Extended for Mergers and Acquisitions, easing some M&A financing restrictions which had troubled businesses. This benefits the businesses which starve for financial support for M&A activities.”

The greatest appetite for acquisition in North America

From a global perspective, the IBR reveals that 33% of businesses are planning to grow through M&A over the next three years, a steady rise from 31% in 2013. North American business leaders remain the most bullish (45%), ahead of Latin America (38%), Europe (32%) and Asia Pacific (22%). Meanwhile, 43% of business leaders seriously considered at least one acquisition opportunity over the past 12 months, up from 39% in the previous period. The proportion of businesses expecting a change in ownership in the next three years rose from 11% to 14% over the past year. Finland (38%) is the most bullish for sell, followed by Latvia (32%) and South Africa (29%).

Regarding to different sectors , mining & quarrying industry is the most bullish industry with 60% of businesses planning acquisition in the next three years, ahead of financial service (53%), electricity, gas & water supply (53%), and agriculture, hunting, forestry and fishing (44%). Transport is the most cautious (26%) sector.

| Content provided by |

|

Editor's picks

Trending articles

Royal Institution of Chartered Surveyors | 8 May 2015

RICS Singapore Commercial Property Monitor Q1 2015

Flat market but prime office still expected to post gains

Key macroeconomic trends

The economy grew by 2.1% on a year-on-year basis in Q1 due at least in part, to stronger growth in construction activities and service sector businesses. The bad news is that faced with continued global instability, the performance of the manufacturing sector has been quite disappointing. Singapore’s manufacturers recorded a fourth straight monthly drop in output in March. Moving in tandem with the PMI trend, industrial production figures in January and February decreased by 1.2% year-on-year partly as a result of the weak demand for electrical products abroad. Interestingly, weak manufacturing activity has continued to weigh on the industrial property market. Manufacturers have been reluctant to increase the size of space occupied. According to the Q1 RICS survey, this has contributed to the industrial rental outlook remaining quite gloomy. Meanwhile, we expect a slight pick-up in GDP growth in 2015 and this reflects the expectation of a gradual improvement in economic activity.

Occupier Market

- The Occupier Sentiment Index remained in broadly neutral territory at +2 which signals little change occurred over Q1.

- Tenant demand picked up fairly strongly in the office sector but remained flat in the retail area of the market. Meanwhile the industrial sector experienced a modest decline.

- Alongside this, supply of leasable space increased further in all areas of the market in Q1.

- Near term rent expectations remained flat in general but saw a more material downturn in the industrial sector (-27). The twelve month view has a broadly similar pattern with rents in aggregate projected to rise by 1.4%.

Investment Market

- The Investment Sentiment Index remains in negative territory albeit a little less so, at -9, than in the preceding quarter.

- Investment enquiries improved significantly in the office sector. Meanwhile, they continue to fall in the industrial and retail areas of the market, albeit at a slower pace than previously.

- This was broadly mirrored in the attitude of foreign buyers.

- The supply of commercial property for sale picked up quite notably within each market segment.

- Capital values are anticipated to rise further in the office sector but dip in the retail and industrial sectors over the next twelve months.

- The aggregate increase over the period is projected at 0.3%, but prime office space is expected to record growth of 9.5%.

To view the full article, please go to page top to download the PDF version.

| Content provided by |  |

Editor's picks

Trending articles

Bank of China (Hong Kong) | 25 May 2015

Headwind? Tailwind!Examining the Direct Impacts of the RMB’s Possible Inclusion into the SDR

The International Monetary Fund (IMF) unofficially begins its quintuple review of the SDR basket in recent days, with official result to be expected in October, and implementation at the beginning of 2016. Taking into account of the progress made by the RMB in the past several years including the RMB’s use in cross border trade settlement, investment and reserve assets, its approaching the freely usable standard argues strongly for its inclusion into the SDR this time around. The market is generally optimistic about odds of this outcome because it is a matter of when not if. If successful, it will have direct implications to the RMB internationalization in terms of its policy and market drivers.

I. The RMB meets the basic requirements

IMF generally conducts review of its SDR currencies basket every five years. During the last review in 2010, the RMB was the only candidate being seriously considered for inclusion. China already met IMF’s first criterion at that time, with its exports of goods and services during the five-year period ending 12 months before the effective date of the revision having the largest value. In 2010, China was the world’s third largest exporter of goods and services. Since then, China continues to make headways. Its foreign trade totaled RMB25.42 trillion in 2012, second in the world, and RMB25.83 trillion in 2013, surpassing that of the US to lead the world. In 2014, China retained the crown with foreign trade totaling RMB26.43 trillion. In 2014, China’s GDP reached USD10.38 trillion, second only to the US. In the meantime, the foreign direct investment (FDI) China attracts is also second only to the US, and China’s outbound direct investment (ODI) is right behind Japan and the US amongst G20. The dollar amount has been basically at par with that of FDI. China’s real economy, especially trade and investment growth, sets a solid foundation for the RMB to qualify for the SDR. It is not unreasonable to claim that the RMB internationalization is lagging behind China’s economic clout.

The second criterion is that it has to be determined by the IMF under Article XXX (f) to be a freely usable (FU) currency, which concerns the actual international use and trading of currencies. To help make the decision, the IMF refers to four quantitative indicators: the Currency Composition of Official Foreign Exchange Reserves (COFER) complied by the IMF itself, the international banking liabilities compiled by the Bank of International Settlements (BIS), the international debt securities statistics also compiled by BIS, and the global forex markets turnovers captured by BIS’ Triennial Central Bank Survey.

Overall, the RMB’s strength lies in offshore deposits and forex trading. In 2014, offshore RMB deposits amounted to RMB2.8 trillion or USD440 billion, making it the fifth largest currency right behind the four SDR currencies. And based on the global forex markets turnovers captured by BIS’ Triennial Central Bank Survey, the RMB is ranked the ninth with a market share of 2.2/200. At the end of 2014, it was the sixth most actively traded currency.

The RMB’s weakness is in central banks holdings and the RMB international bond market. On one hand, COFER has not been able to single out the RMB in its statistics. It was included in other currencies that accounted for 3.1% of the total in 4Q14. On the other hand, the offshore RMB bond market’s size of RMB480 billion at the end of 2014 results in a small share of 0.4% of the total.

It is worth noticing that of these four indicators, three are linked to the offshore market, showcasing the importance of the offshore RMB market’s development to its SDR ambition. Moreover, those indicators are not meant to be used mechanically. IMF also emphasizes that the Executive Board’s judgment is necessary. Combined with Christine Lagarde’s latest comment that it is a matter of when, not if, the RMB makes it into the SDR, and the RMB internationalization’s progress in the past several years, the RMB stands a fairly good chance to pass IMF’s internal assessment of being freely usable in this year’s review.

To view the full article, please go to page top to download the PDF version.

| Content provided by |  |

Editor's picks

Trending articles

Fung Business Intelligence | 2 Jun 2015

Asia Sourcing Update May 2015

WORLD BANK PREDICTS CAMBODIA’S ECONOMIC GROWTH TO S LOW SLIGHTLY

In its East Asia and Pacific Economic Update released in April, the World Bank predicts that the real GDP growth in Cambodia will moderate slightly from 7.0% yoy last year to 6.9% yoy in 2015 and 2016, and 6.8% yoy in 2017. The slowdown is attributable in part to the concerns over reduced competitiveness in the garment industry and the modest growth in the agricultural sector amid weak agricultural commodity prices.

The garment industry, which accounted for 77% of the country’s total exports last year, is facing increasing challenges. The 28% wage increase at the beginning of this year makes Cambodia’s garment exports less competitive among its neighbouring sourcing countries. At the same time, the appreciation of the US dollar, to which the Cambodian riel is pegged, also makes garment exports to the EU – the largest export market for Cambodia’s garments – less competitive in euro terms.

According to Ken Loo, secretary general of the Garment Manufacturers Association of Cambodia (GMAC), only 13 new export-oriented garment factories opened in 1Q15, compared to 40 exportoriented factories opened in the same period last year. While the World Bank’s prediction is among the least optimistic, the Asian Development Bank and Cambodia’s Prime Minister both forecast that Cambodia’s real GDP growth will accelerate to 7.3% yoy in 2015.

GARMENT EXPORTS GROW 11% YOY IN 1Q15

Cambodia exported US$1.73 billion worth of garments in 1Q15, up by 11% over the same period last year, according to data from the Ministry of Commerce. The figure points to a possible recovery of the garment industry, which grew a mere 4% yoy in terms of export value in 2014 due to falling orders.

By export destination, Cambodia’s garment exports to the EU increased by 16% yoy to US$680 million in the first quarter, while those to the US fell 1% yoy to US$537 million. Garment exports to other markets rose 21% yoy to US$521 million, indicating that the country’s efforts in diversifying its export markets have started to pay off.

The EU has accounted for an increasingly large share in Cambodia’s garment exports, overtaking the US as the largest export market for Cambodia’s garments. This is due mainly to the duty-free privileges granted by the EU to Cambodia under the “Everything but Arms” arrangement.

As labour strikes over minimum wage have gradually subsided, the growth of garment exports is likely to accelerate in the rest of the year.

VARIOUS PROJECTS UNDERWAY TO BOOST ELECTRICITY SUPPLY

Cambodia’s state energy provider Electricité du Cambodge (EDC) announced in March its plan to develop a high-voltage distribution network that can enhance the transmission capacity in a number of provinces along the Tonlé Sap Lake.

The project, funded by a concessional loan from China, will include the construction of a distribution network connecting Battambang, a province in north-western Cambodia, to the Siem Reap, Kampong Thom and Kampong Cham provinces. Another network will also be constructed to connect the Kampong Speu province to Takhmao, a city in the Kandal province, via a circular-grid network crossing the Tonlé Sap Lake, upper and lower Mekong River and Bassac River. To be completed over the next three years, together the new grids will extend the existing networks by about 450 kilometres in length.

To meet the growing domestic demand for power and reduce the reliance on imported electricity, Cambodia has been actively developing electricity generation capacity by coal and hydropower.

The Russei Chrum Krom River hydroelectric dam has begun operating in January. With power generation capacity of 338 megawatts, the dam is so far the largest hydropower station in Cambodia. It is the fifth dam built by Chinese investors in the country. The sixth one, with power generation capacity of 246 megawatts, will also become operational later this year.

To view the full article, please go to page top to download the PDF version.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 3 Jun 2015

Guangdong Pilot Free Trade Zone: Opportunities for Hong Kong

Summary

The objective of the China (Guangdong) Pilot Free Trade Zone (GDFTZ), officially launched on 21 April 2015[1], is to further open up the mainland to the world through in-depth co-operation between Guangdong, Hong Kong and Macau, and to streamline foreign investment management by way of implementing the negative list and record filing system. Currently, Hong Kong, capitalising on CEPA[2] concessions, can enter the increasingly buoyant mainland market ahead of foreign investors in areas such as services incidental to manufacturing, telecommunication services, financial services, legal services, and technical testing and analysis services. It can be expected that the GDFTZ policies and the CEPA framework will deepen liberalisation of trade in services between Guangdong, Hong Kong and Macau, and will provide more scope for Hong Kong companies to enter both the Guangdong and the entire mainland markets.

As to trade in goods on the mainland, Hong Kong companies may choose between either the GDFTZ’s facilitation measures and bonded arrangements that are available to cross-boundary e-commerce operators, or the zero tariff preferential treatment granted to Hong Kong products under CEPA, and pick the appropriate sales channel for their circumstances. Moreover, the various GDFTZ measures introduced to encourage Guangdong, Hong Kong and Macau to jointly develop the international market and strengthen trade ties among the economies along the Maritime Silk Road will also serve to consolidate Hong Kong’s position as a trade and shipping hub in the Asia-Pacific region.

The GDFTZ is making great efforts to deepen financial co-operation between Guangdong, Hong Kong and Macau. These include promoting cross-boundary renminbi business, a development that is bound to strengthen Hong Kong’s position as an offshore renminbi centre. A plan to launch pilot reforms of foreign exchange control will also help expedite the pace of internationalisation of the renminbi. Meanwhile, the Hong Kong business platform is the top choice for mainland enterprises, especially Guangdong enterprises, in their “going out” strategy of making outward direct investment. Coupled with the fact that the GDFTZ is proactively leading the Pearl River Delta (PRD) region to “go out” and undergo transformation and upgrade, this development will create more opportunities for Hong Kong service suppliers.

Positioning: In-depth Co-operation Between Guangdong, Hong Kong and Macau

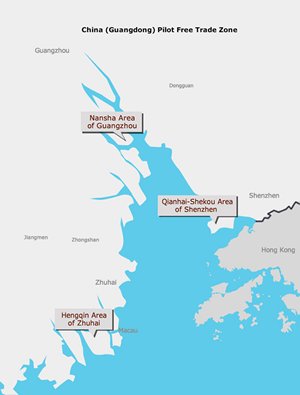

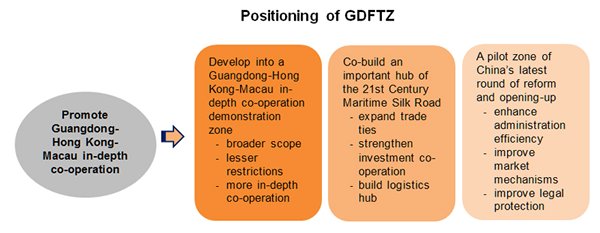

The GDFTZ covers (i) Nansha Area of Guangzhou; (ii) Qianhai-Shekou Area of Shenzhen; and (iii) Hengqin Area of Zhuhai. According to the Overall Plan for the China (Guangdong) Pilot Free Trade Zone issued by the State Council in April 2015, the GDFTZ, which includes Hong Kong and Macau, aims to serve the mainland and open it up to the world. Efforts will be made to build the GDFTZ into a Guangdong-Hong Kong-Macau in-depth co-operation demonstration zone. It will be an important hub for the 21st Century Maritime Silk Road and a pilot zone of China’s latest round of reform and opening up. The development objectives of the GDFTZ are: to establish a new and open economic system based on pilot reforms implemented over a period of three to five years; to deepen Guangdong-Hong Kong-Macau co-operation; create new advantages in international economic co-operation; and set up a free trade park with a regulated environment meeting high international standards, and offering investment and trade facilitation, leader functions, and safe and highly efficient supervision.

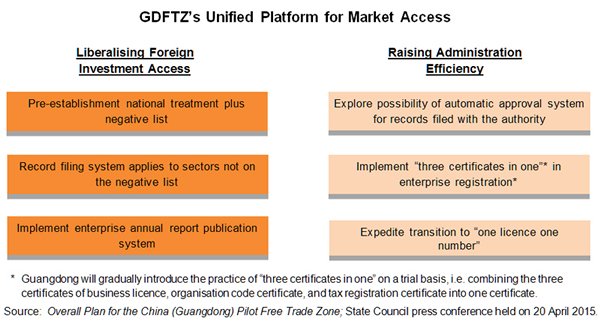

Reducing Market Access Restrictions on Foreign Investment

One of the major tasks of the GDFTZ is to create an international, market-oriented and regulated business environment. Apart from optimising the regulated environment and building a new administration and management system to raise administration efficiency, emphasis will be placed on establishing a market access and supervision system featuring “low entry threshold, high control standard”. This new system will implement a foreign investment negative list that reduces or removes access restrictions on foreign investments, expands the liberalisation of the service sector and manufacturing industry, and increases the degree of opening up and transparency.

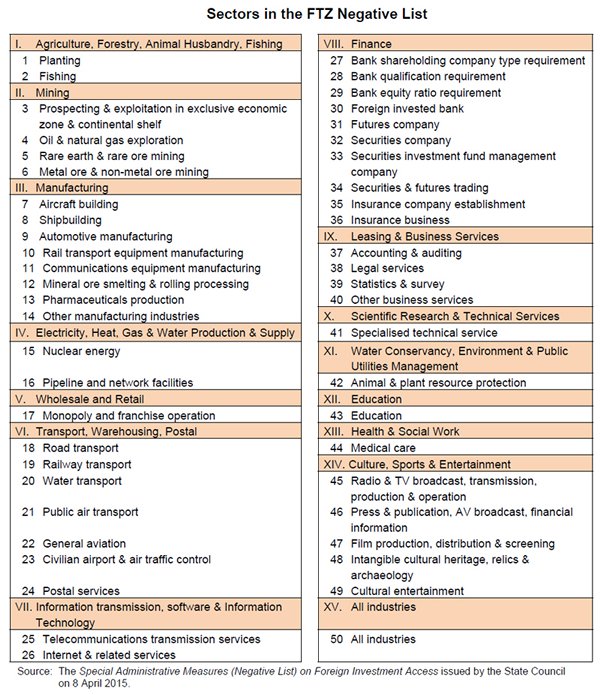

The Special Administrative Measures (Negative List) on Foreign Investment Access, issued by the State Council on 8 April 2015, sets out the special management measures for businesses and industries in which foreign investment does not qualify for national treatment. These special measures apply to the four free trade zones (FTZs) of Guangdong, Shanghai, Tianjin and Fujian. For sectors falling outside the scope of the negative list, the prior approval requirement for foreign-invested projects, as well as the examination and approval of contracts and articles of association of foreign-invested enterprises, will be replaced by record filing requirements based on the principle of same treatment for foreign and domestic investors.

Special administrative measures relating to national security, public order, public culture, financial prudence, government procurement, subsidies, special procedures and tax-related matters not on the negative list are subject to existing provisions. Foreign investment concerning national security is subject to review in accordance with the Tentative Measures for the National Security Review of Foreign Investment in Free Trade Zones.

Hong Kong Companies Entitled to Both FTZ and CEPA Concessions

Based on China’s Industrial Classification for the National Economy[3], the negative list issued by the State Council contains 50 project types under 15 categories, with 122 items subject to special administrative measures. It is specifically stated that Hong Kong investors investing in the FTZs must comply with the negative list. However, if the measures offered under CEPA and its supplements are applicable to the FTZs – and prove to be more open and preferential for qualified investors – then the CEPA provisions shall prevail[4]. In light of this, Hong Kong investors should check the provisions set out in CEPA and the FTZ negative list and choose whichever is more beneficial to them in developing their market access to the mainland and Guangdong.

Meanwhile, the Agreement between the Mainland and Hong Kong on Achieving Basic Liberalisation of Trade in Services in Guangdong (the Guangdong Agreement), signed under the CEPA framework and which came into effect in March 2015, contains both negative and positive listings for Hong Kong companies entering the Guangdong market. Under the Guangdong agreement, Guangdong opens up 153 service sub-sectors to Hong Kong, accounting for 95.6% of the 160 sub-sectors[5]. Some of its measures are even more liberal than the FTZ negative list. Thus Hong Kong companies entering the Guangdong market can simultaneously enjoy the liberal market access requirement of the GDFTZ as well as the preferential measures offered in CEPA and the Guangdong Agreement. In light of this, Hong Kong companies have an advantage over foreign investors, by being able to expand into the Guangdong and even the entire mainland markets in greater breadth and depth. For instance:

-

Mining, Prospecting and Exploration

Under the CEPA Guangdong Agreement where access to “services incidental to mining” in Guangdong has been added, Hong Kong companies are granted national treatment. However, according to the negative list applicable to GDFTZ, foreign investors are still subject to various restrictive measures in areas such as certain types of prospecting and exploration, oil and natural gas exploration, and rare earth and metal ore mining and processing.[6]

-

Manufacturing

With the exception of those industries classified under the prohibited category in the Catalogue for the Guidance of Foreign Investment in Industries, Hong Kong companies are allowed under CEPA to provide “services incidental to manufacturing” on the mainland. These take the form of equity joint ventures, contractual joint ventures or wholly owned enterprises, with no restrictions on taking controlling stakes. However, foreign investors wishing to invest in manufacturing projects in the GDFTZ – which are not even listed under the prohibited category[7] in the Catalogue for the Guidance of Foreign Investment in Industries, such as aircraft building, shipbuilding, automotive/rail transport equipment manufacturing, and communications equipment manufacturing – are still subject to various restrictions like taking controlling stakes.[8]

-

Gas, Heat and Water Supply

CEPA stipulates that when Hong Kong companies engage in the construction or operation of gas, heating, water supply and drainage networks in Guangdong cities larger than one million people, the mainland party must take a controlling stake in the project. But in the GDFTZ, if foreign investors wish to engage in such business in Chinese cities with a population of more than 500,000, the mainland party must take a controlling stake.

-

Telecommunications Services

Under the positive list of the CEPA Guangdong Agreement, Hong Kong service suppliers are allowed to establish joint-venture or wholly owned enterprises in Guangdong to provide telecommunication services on the mainland including multi-party communications, store and forward, call centre services, and Internet access services for online users (with business scope limited to Guangdong Province).

By contrast, foreign investors in the GDFTZ are only allowed to invest in those telecommunications services liberalised under the commitments made when China joined the World Trade Organization (WTO). Also, the negative list states that foreign equity ratio in value-added telecommunications services (except for e-commerce) may not exceed 50%. The mainland stake in basic telecommunications services may not be less than 51%.

-

Banking

CEPA has listed in detail the lower market access requirements on Hong Kong banks entering the mainland. For instance, Hong Kong banks wishing to set up wholly owned banks or branches on the mainland must have assets totalling US$6 billion at the end of the year preceding their application. This is much lower than the US$20 billion threshold imposed on foreign banks. Besides, the Guangdong Agreement further removes the minimum operation period and profit requirements on Hong Kong banks wishing to establish business arms in Guangdong to conduct renminbi business. The minimum amount requirement on operating funds that incorporated banks established on the mainland must transfer to their Guangdong branches has also been lifted.

In the banking sector, the FTZ negative list sets out the shareholding company type requirements as well as the qualifications and equity ratio of the banking institutions. For example, foreign-invested financial institutions must satisfy a total assets requirement of a certain amount. Some restrictive conditions are also imposed on foreign banks, such as the head office of foreign bank branches must transfer operating funds to them at no cost, and the funds must exist in a specific form meeting corresponding administration requirements. The relevant departments have yet to promulgate the relevant detailed regulations and measures.

-

Legal Services

Under CEPA, Hong Kong law firms that have set up representative offices on the mainland are allowed to operate in association with between one and three mainland law firms. The positive list in the Guangdong Agreement stipulates specifically that in Guangdong, mainland law firms can assign mainland-practising lawyers to the representative offices of Hong Kong law firms to act as mainland legal consultants. Meanwhile, Hong Kong law firms can assign Hong Kong lawyers to mainland law firms to act as Hong Kong-related or cross-boundary legal consultants. Also, Hong Kong law firms can operate in partnership with their mainland counterparts in Qianhai, Nansha and Hengqin in Guangdong on a pilot basis.

However, foreign law firms can only set up representative offices in the GDFTZ and are not allowed to handle Chinese legal matters, nor employ Chinese lawyers.

-

Technical Testing and Analysis

Under CEPA, Hong Kong testing organisations accredited by the Hong Kong Accreditation Service (HKAS) are allowed to co-operate with designated mainland organisations to undertake testing of all products processed in Hong Kong that require China Compulsory Certification (CCC). These organisations can also undertake testing on food items and other products subject to voluntary certification in Guangdong on a pilot basis. Moreover, the positive list in the Guangdong Agreement accords them the right to co-operate with designated mainland organisations to undertake testing under CCC of audio and visual products that are designed and prototyped in Hong Kong and processed or manufactured in Guangdong. But no such measures are offered to foreign industry players.

-

Individually-owned Businesses

According to CEPA, Hong Kong permanent residents with Chinese citizenship may set up individually-owned businesses in various mainland cities and provinces to engage in designated business without being subject to the approval procedures applicable to foreign investments or any restrictions on the number of employees and the business area (excluding franchise operations). The Guangdong Agreement further expands the designated business scope for Hong Kong individually-owned businesses.

However, the FTZ negative list states that foreign investors may not engage in business activities as investors in individually-owned businesses or individually wholly-owned enterprises in the FTZ.

(Note: For details and measures on the above, please refer to relevant documents such as the FTZ negative list and CEPA.)

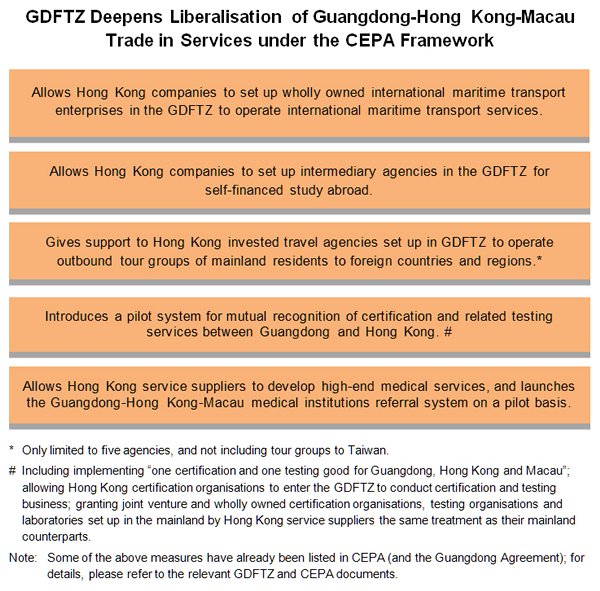

Advance Liberalisation of Trade in Services between Guangdong, Hong Kong and Macau

In addition to market access, the overall GDFTZ plan also states clearly that, under the CEPA framework (and the Guangdong Agreement), efforts will be made to deepen liberalisation of trade in services between Guangdong, Hong Kong and Macau and to further expand the scope of opening up the service sector to Hong Kong and Macau. Action to be taken includes exploring the possibility of removing or liberalising the access restrictions on qualification criteria, equity ratio, and business scope imposed on Hong Kong and Macau investors, with an emphasis on services serving the financial, transportation and shipping, commercial, professional and technical sectors. Meanwhile, steps will also be taken to look into the feasibility of offering a special arrangement between Guangdong, Hong Kong and Macau that mutually recognises the professional qualifications of employees in the service sector. In view of this, Hong Kong companies entering the service market in Guangdong, while capitalising on CEPA’s facilitation measures, should also pay close attention to the detailed facilitation measures introduced by the GDFTZ.

Strengthen International Trade Functions

Meanwhile, the GDFTZ will encourage Guangdong, Hong Kong and Macau to jointly strengthen trade ties with countries and regions along the 21st Century Maritime Silk Road in a move to expand the international market. Enterprises will be encouraged to set up headquarters in the GDFTZ and establish operations centres integrating the functions of logistics, trade and settlement. Action will be taken to jointly develop offshore trade with Hong Kong and Macau. Efforts will also be made to strengthen co-operation between Guangdong, Hong Kong and Macau in the convention and exhibition industry. This will allow industry players to set up bonded goods displays and trading platforms in special customs supervision zones under the premise of strictly implementing the policy of levying taxes on import and export goods. Other measures include:

- Support parallel import of automotives on a pilot basis;

- Encourage the development of innovative financing and leasing business;

- Support development of futures bonded delivery and warehouse receipt financing in special customs supervision zones;

- Develop an innovative interactive development mode for e-commerce between Guangdong, Hong Kong and Macau; actively develop cross-boundary e-commerce;

- Set up an intellectual property operation centre for the south China region;

- Actively undertake service outsourcing, and advance the development of such services as software development, industrial design and information management;

- Strengthen Guangdong-Hong Kong-Macau co-operation in product inspection and testing technology as well as standards formulation.

As for building a logistics hub on the 21st Century Maritime Silk Road, the GDFTZ will set up an interactive mechanism for seaports and airports in Guangdong, Hong Kong and Macau. It will explore the feasibility of aligning regulations and standards with Hong Kong and Macau in freight forwarding and freight transportation. The GDFTZ will also proactively develop such industries as international maritime transport, international ships management, international crew services, and international shipbroking. Support will be given to Hong Kong and Macau enterprises to invest in international ocean-going and air transport services. Industry players will be allowed to operate, on a trial basis, the business of consolidation and transit of air courier items from foreign countries, Taiwan, Hong Kong and Macau. Meanwhile, action will be taken to liberalise the equity ratio restriction on Chinese-foreign contractual joint ventures engaged in international shipping.

Hong Kong is a trade and shipping hub in the Asia-Pacific region, and an important gateway to the international market for Guangdong and other provinces in China. The city hosts large numbers of ship owners, consignors and traders, and has developed a full spectrum of shipping services: shipping financing, insurance, broking, ships management and related legal services. Many Hong Kong companies conduct international trade in Guangdong and, by capitalising on the development of Hong Kong’s trading and shipping services support industry, have broadened the horizons of Hong Kong’s trading and shipping sectors.

For instance, even before it was officially launched in the GDFTZ, the Nansha Area of Guangzhou had made it a priority to develop producer services. This included relying on Hong Kong’s position as an international financial, trade and shipping centre to promote Guangdong-Hong Kong-Macau co-operation in related industries. As at the end of April 2015, about 800 Hong Kong-invested enterprises had established a presence in Nansha. Among them is Kingboard Chemical Holdings Ltd, whose petrochemical production and distribution project in Nansha carries out the production and distribution of chemical products such as epoxy and Tetrabromob ispheno1-A. The Nansha Cargo Park Co Ltd in Panyu, Guangzhou, invested and set up by the Henry Fok Ying Tung Group, engages in integrated logistics in Nansha, including wharf operation, bonded supervision, logistics and delivery, freight forwarding and insurance, and logistics solution consultation. Meanwhile, Enpro Supply Chain Management Ltd of Hong Kong operates a plastics packaging supply chain centre in the Nansha Bonded Logistics Park. The firm takes advantage of the bonded logistics facilities in Nansha and the international shipping network of Hong Kong to provide a one-stop plastics packaging supply chain, as well as regional delivery services for the Chinese mainland and Southeast and Northeast Asia.

As the GDFTZ strengthens trade ties with economies along the Maritime Silk Road jointly with Hong Kong and Macau in the hope of becoming a logistics hub on the Maritime Silk Road, this is bound to provide Hong Kong industry players with extra room for development, as well as enhancing Hong Kong’s position as a trade and shipping centre in the Asia Pacific.

|

Trade in Goods: Cross-border E-commerce Operators and CEPA Concessions One of the focusses where trade in goods is concerned is cross-border e-commerce import. Currently, Guangzhou and Shenzhen are among the designated pilot cities authorised to conduct e-commerce imports[9]. Some cross-border e-commerce operators have already started business in the Qianhai and Nansha sub-zones in the GDFTZ. These industry players enjoy facilitation in customs clearance, inspection and quarantine for their imports, and also take advantage of the FTZ’s bonded import and warehousing arrangements to lower costs and to apply for personal postal articles tax for their goods. Goods imported into China under “general trade” are subject to import tariffs and 17% VAT. But cross-border e-commerce operators in pilot bonded areas may adopt the “bonded reserve goods mode”, whereby merchandise sourced from foreign countries in bulk can be delivered to designated cross-border warehouses in the bonded area first. After the consumer has placed an order online, the e-commerce operator will then complete customs clearance procedures and make a customs declaration for the goods concerned to be imported as “personal articles” and pay personal postal articles tax. After verification by Customs, the merchandise is delivered to the consumer by courier companies. Currently, four tax rates apply to personal postal articles:

However, cross-border e-commerce operators conducting imports in the form of “personal articles” must meet the above criteria of placing orders online and delivery by courier company, as well as observe the principle of “for personal use and in reasonable quantity”. The value of personal postal articles carried by an international traveller is limited to Rmb1000[10] per trip, otherwise, these articles would be treated as imported goods under “general trade” and are subject to customs clearance and payment of import tariff and VAT[11]. The import of “personal articles” is tax free if the tax amount is below Rmb50. The lower 10% personal postal articles tax rate applies to certain goods, but for other items it remains as high as 20% or more. However, if the goods meet the Hong Kong origin requirement, Hong Kong companies may consider taking advantage of the zero tariff rate concession offered under CEPA and paying the 17% VAT[12]. As to which import arrangement is more advantageous, it all depends on the type of product imported, the applicable tax rate, the country of origin, and the sales strategy of the company concerned. |

Deepen Financial Co-operation between Guangdong, Hong Kong and Macau

The GDFTZ devotes great efforts to deepening financial co-operation between Guangdong, Hong Kong and Macau. It implements financial reform and innovation in order to strengthen and give full play to Guangdong, Hong Kong and Macau’s joint role in advancing the mainland’s financial reform and innovation. It also promotes liberalisation of trade in services between the three places and propels economic transformation and upgrade. Detailed development directions include:

-

Promoting development of cross-boundary renminbi business between Guangdong, Hong Kong and Macau:

-

To turn the renminbi into the major denomination and settlement currency for cross-border large-amount transactions and investments between the GDFTZ and Hong Kong, Macau and foreign countries.

-

To advance two-way renminbi financing between the GDFTZ and Hong Kong and Macau.

-

To allow banking financial institutions in the GDFTZ to conduct cross-boundary renminbi lending business with their Hong Kong and Macau counterparts.

-

To allow non-banking financial institutions such as securities companies, fund management companies, futures companies and insurance companies in the GDFTZ to conduct cross-boundary renminbi business with their Hong Kong and Macau counterparts.

-

-

Further opening up to Hong Kong and Macau:

-

To look into the possibility of introducing cross-boundary renminbi credit assets transfer business under the CEPA framework.

-

To improve the negative-list management approach for the financial sector in a bid to promote further liberalisation of the financial services sector in the GDFTZ to Hong Kong and Macau.

-

-

Strengthening financial services for enterprises “going out”:

-

This includes giving support to financial institutions in Guangdong, Hong Kong and Macau to jointly set up renminbi overseas investment funds in the GDFTZ.

-

In addition to promoting Guangdong-Hong Kong-Macau financial co-operation, the GDFTZ will also enhance investment and financing facilitation and make use of innovative measures to meet the financial needs of enterprises in the FTZ. These include:

- To launch a new management model for local and foreign currency accounts, and introduce innovations in such areas as account opening, account business scope, funds transfer, and dynamic monitoring mechanism.

- To look into the possibility of rolling out innovative cross-boundary financing business by way of free trade account and other risk control methods.

- To introduce, under the premise of risk control, foreign exchange control pilot reforms with emphasis on renminbi convertibility under the capital account.

- To allow organisations in the FTZ to bring in, under the macro-prudential framework, local and foreign currency funds from abroad and to issue local and foreign currency bonds offshore.

- To introduce on a pilot basis renminbi convertibility under the capital account within a set limit, allowing qualified organisations to carry out transactions such as direct investment, mergers and acquisitions, bond instruments and financial investment within the set limit.

|

Enhancing Hong Kong’s Position as an Offshore RMB Centre In recent years, many financial institutions in Hong Kong have been making use of the mainland’s increasingly open financial policies and CEPA’s market liberalisations to gradually participate in the mainland financial market and develop business. By doing so, they accumulate practical operation experience in the hope of acting as first-movers when the mainland further liberalises its relevant policies, as well as identifying business opportunities brought about by liberalisation. For instance, Qianhai, in Shenzhen, had already identified trial financial reforms and innovation as the focusses of its liberalisation policies even before the GDFTZ was officially launched. The aim is to create a modern services systems and mechanisms innovation zone, as well as a pioneer zone for close co-operation between Hong Kong and the mainland. It also explored the possibility of broadening the channels for diverting renminbi funds from overseas to support the development of offshore renminbi business in Hong Kong, and to build an innovative pilot zone for cross-boundary renminbi business. As of 30 April 2015, some 1,335 Hong Kong-invested enterprises had established a presence in Qianhai, with the total registered capital reaching Rmb215.4 billion[13]. Among the different industries, the financial sector is one of the major areas of Qianhai-Shenzhen-Hong Kong co-operation. For instance, commercial banks including the HSBC, Hang Seng Bank, Bank of East Asia, Standard Chartered Bank and China Merchants Bank have set up branches in Qianhai. Many of these banks make use of Qianhai’s advantages to develop cross-boundary renminbi business and participate in lending projects related to Qianhai. Since Qianhai launched its cross-boundary renminbi lending projects on 22 January 2013, the total cross-boundary loans obtained by Qianhai enterprises from Hong Kong reached Rmb82.6 billion by the end of 2014[14]. These loans have supported the development of the real economy in Qianhai, and have contributed to financial innovations of the existing currency supply mechanism and renminbi exchange rate system. The renminbi’s role in cross-boundary transactions, as well as the renminbi lending business of Hong Kong’s financial institutions, have been strengthened, effectively further enhancing Hong Kong’s position as an offshore renminbi trading centre. As the GDFTZ further implements reforms and opening up to deepen financial co-operation between Guangdong, Hong Kong and Macau, this move helps to promote cross-boundary renminbi business. The possibility of further opening up the FTZ to Hong Kong and Macau under the CEPA framework is also bound to bring about greater market opportunities for Hong Kong industry players. |

Engine for Regional Development

The GDFTZ will also develop into an important platform leading the development of the Pearl River Delta and other regions, including:

-

Leading the transformation and upgrade of the PRD:

-

To build public service platforms for technology R&D, industrial design and intellectual property serving the transformation and upgrade of processing trade.

-

-

Creating a Pan-PRD integrated service zone:

-

Relying on closer co-operation with Hong Kong and Macau, efforts will be made to encourage enterprises in the GDFTZ to conduct co-ordinated international and domestic trade, support and foster integrated foreign trade services enterprises, and provide such services as customs clearance, financing, tax refunds and international settlement for small and medium-sized enterprises.

-

-

Building an important window for mainland enterprises “going out”:

-

Relying on the advantages of Hong Kong and Macau in financial services, information, international trade networks, and risk management, action will be taken to build the GDFTZ into a window and integrated service platform for mainland enterprises and individuals embracing the “going out” strategy, while support will be given to mainland enterprises and individuals to participate in the building of the 21st Century Maritime Silk Road.

-

|

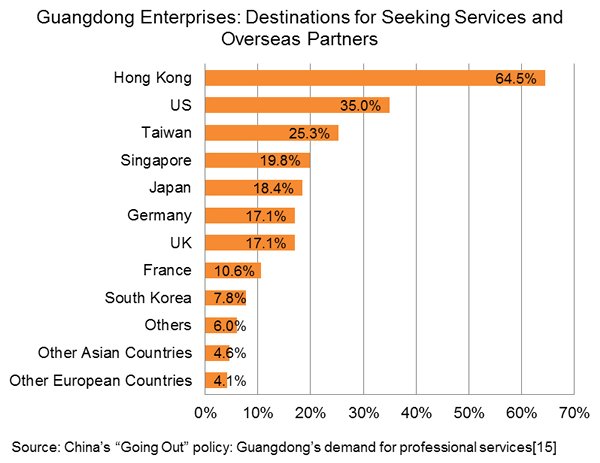

Helping Guangdong Undergo Transformation and Upgrade in “Going Out” Guangdong has long been one of the important provinces in China’s foreign economic and trade co-operation. The province plays an active role in promoting the development of the south China region and pan-PRD. It is also a major source of China’s outward investment, especially non-financial investment. It is worth noting that currently a majority of Guangdong enterprises are eager to undergo transformation and upgrade. They want to make use of the “going out” strategy, and “bring in” the advantages of their business partners, in order to develop the mainland and overseas markets simultaneously – and the Hong Kong service platform is the top choice of those enterprises. According to an HKTDC survey conducted in 2013 in Guangdong province on the “going out” strategy and “transformation and upgrade”, more than 90% of the surveyed enterprises indicated that they would consider, or had already, increased investment as a way of boosting competitiveness. Their most sought-after service support included financial and professional services such as brand design, product development, marketing, business consultancy, and legal/accounting and banking/financing. Meanwhile, 91% of the enterprises indicated that they would “go out” to seek co-operation partners. The majority of enterprises expressed interest in sourcing services and business partners from Hong Kong, accounting for 65% of the surveyed enterprises[15]. Hong Kong service suppliers have handled matters relating to trade and investment in Hong Kong and foreign markets on behalf of mainland enterprises for many years. The GDFTZ is leading the PRD region in transforming and upgrading, and is becoming an important window for the mainland’s “going out” policy. It can be expected that more detailed measures will be introduced to help enterprises in the FTZ make use of the Hong Kong platform to acquire services and co-operation partners. This is bound to create more opportunities for Hong Kong service suppliers. |

Opportunities for Hong Kong

Under the premise of in-depth co-operation between Guangdong, Hong Kong and Macau, the GDFTZ has liberalised market access for foreign investment. The record filing system has been introduced on top of the negative list in order to streamline foreign investment administration. This, coupled with the liberalisation and concessionary measures offered to Hong Kong under CEPA, has greatly expanded the scope for Hong Kong companies to enter and develop the Guangdong and the entire mainland markets.

Under CEPA and the Guangdong Agreement, Hong Kong already enjoys market access and preferential measures in many sectors, and is a step ahead of foreign investors in expanding the increasingly buoyant mainland market. Preferential policies applicable to Hong Kong are wide ranging. They cover services incidental to mining and manufacturing, as well as services in the areas of telecommunications, finance, legal, and technical testing and analysis services.

The GDFTZ’s liberalisation measures provide Hong Kong companies with even more options to develop the mainland market. For instance, where trade in goods is concerned, Hong Kong companies can choose either the GDFTZ’s facilitation measures and bonded arrangements offered to cross-border e-commerce operators, or the zero tariff preferential treatment granted to Hong Kong products under CEPA. Companies can select the right channel for selling to the mainland market based on their situation.