GDP (US$ Billion)

40.76 (2018)

World Ranking 94/193

GDP Per Capita (US$)

7,065 (2018)

World Ranking 87/192

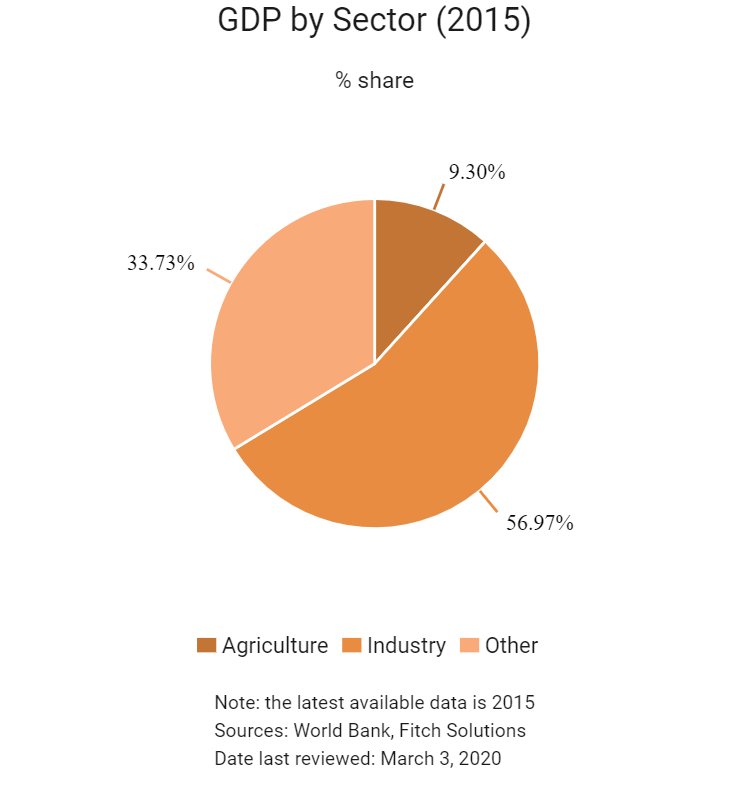

Economic Structure

(in terms of GDP composition, 2015)

External Trade (% of GDP)

35.2 (2018)

Currency (Period Average)

Turkmenistani Manat

3.50per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

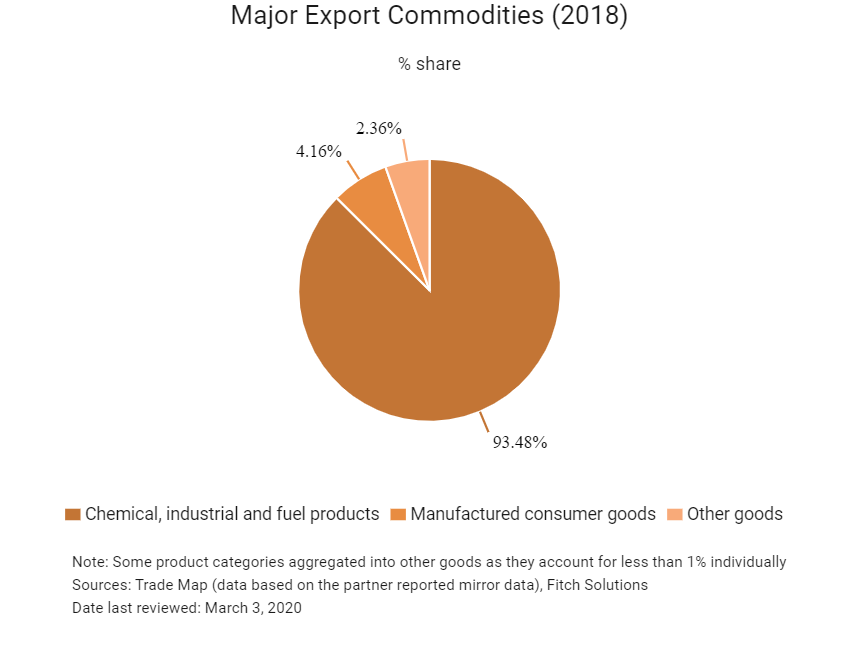

Turkmenistan is a large but sparsely inhabited country with abundant hydrocarbon resources, particularly natural gas, and located in a strategically important region. Turkmenistan's gas reserves are estimated to be the world's fourth largest, representing about 10% of global reserves. In addition, the country is a major producer of cotton and a net exporter of electricity. It is also rich in petroleum, sulphur, iodine and several other inputs to the chemical and construction industries. That said, the public sector and bureaucratic state-owned entities continue to dominate the economy and the labour market. Apart from the hydrocarbon sector, foreign direct investment remains limited and principally linked to suppliers' contracts. The government's industrial policy looks to reduce imports, diversify its gas export routes beyond the existing pipeline network – such as the construction of the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline project, launched in 1995 – to avoid overreliance on a single client, and to promote non-hydrocarbon activity. Nevertheless, tight administrative controls, difficulties with foreign currency shortages and the sclerotic public sector's large overall role in economic activity remain the key obstacles to private sector development and economic diversification in Turkmenistan.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2016

Constitutional changes extended the presidential term limit from five years to seven years, ahead of a presidential vote on February 12, 2017. The constitutional amendment also removed the age limit of 70 and now allowed the president to serve without term limits.

January 2017

Gas supplies to Iran were cut in a dispute over pricing.

February 2017

President Gurbanguly Berdymukhamedov won a third term in office.

September 2017

Turkmenistan launched the USD1.5 billion Garabogazkarbamid nitrogen fertiliser plant, located near the Caspian coastal city of Garabogaz, in the Balkan Region. The project also involved the construction of a 50MW natural gas-fired combined heat and power plant, as well as an access road to Bekdash port and a new water-treatment plant.

October 2017

President Berdymukhamedov signed a decree to gradually phase out subsidies for water, gas and electricity, stating that the money saved would help to fund a seven-year investment programme.

February 2018

Regional leaders strengthened construction work on the Afghanistan section of the TAPI natural gas pipeline that will link Turkmenistan to Pakistan and India.

August 2018

The five littoral Caspian nations (Azerbaijan, Iran, Kazakhstan, Russia and Turkmenistan) agreed upon a legal framework to share the world's largest inland body of water, which bridged Asia and Europe, and had reserves of oil and gas.

November 2018

The Asian Development Bank approved a USD500 million loan in November 2018 for the USD675 million National Power Grid Strengthening Project. The loan aimed to boost Turkmenistan's transmission network and make power supply in the country more reliable. When complete in 2023, the project would help to boost Turkmenistan's capacity to trade electricity and increase the volume of current electricity exports to Afghanistan.

January 2019

President Berdymukhamedov announced the start of construction of a new highway, by a specially set up company Turkmen Autobahn, that would connect Ashgabat and Turkmenabat, to which USD2.3 billion had been allocated.

The president's son was appointed deputy governor of Ahal province.

March 2019

Representatives from Pakistan and Turkmenistan met to discuss connecting the two countries' power grids in order to export and import electricity between the two. The connection would supply Afghanistan with power. Currently, Afghanistan relied on imported electricity for the majority of the power that it consumes.

April 2019

Deputy Prime Minister Dadebay Amangeldyev announced that Turkmenistan would reconstruct the 225-kilometre highway from the city of Turkmenbashi (formerly Krasnovodsk) on the Caspian Sea coast to the border with Kazakhstan to help boost internal trade and with neighbouring states.

July 2019

Turkmenistan signed a five-year contract to supply Russia with natural gas. In 2016 Russia had suspended supplies of gas from Turkmenistan.

August 2019

The inaugural Caspian Economic Forum was hosted in Awaza, Turkmenistan, and it was attended by Russia, Iran, Azerbaijan and Kazakhstan. Territorial issues were discussed in relation to exploitation rights in the Caspian Sea.

October 2019

The European Union (EU) lifted a ban on flights by Turkmenistan Airlines within EU territories, which had been in place since February because of concern over compliance with air safety standards.

November 2019

At the end of 2019 the European Bank for Reconstruction and Development had more than EUR290 million invested in various sectors of the Turkmen economy within 75 investment projects throughout the country.

February 2020

President Berdymukhamedov allocated USD1.5 billion to build a new city in Ahal province.

Sources: BBC Country Profile – Timeline, national sources, European Bank for Reconstruction and Development, Fitch Solutions

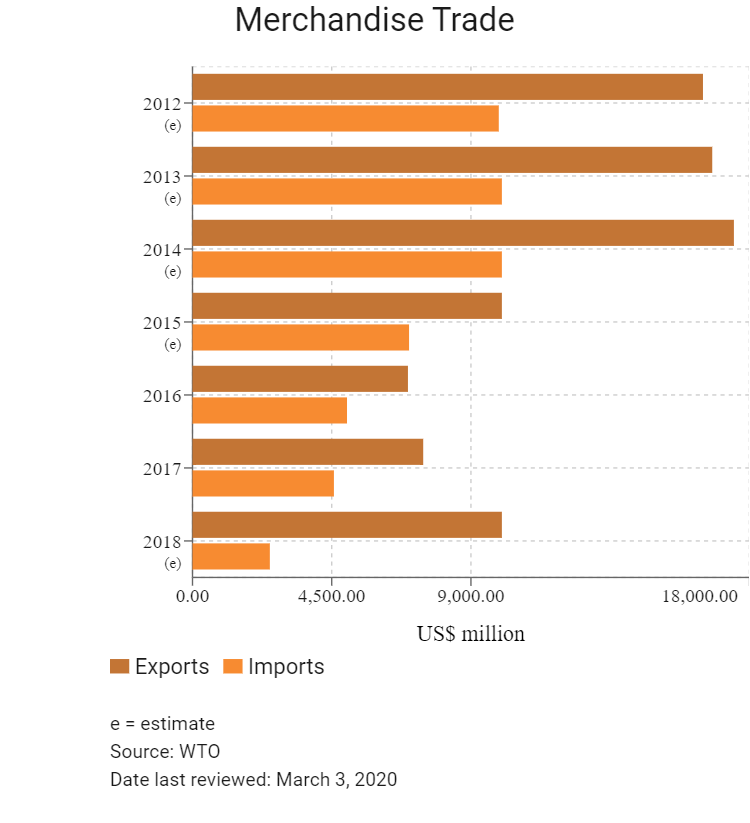

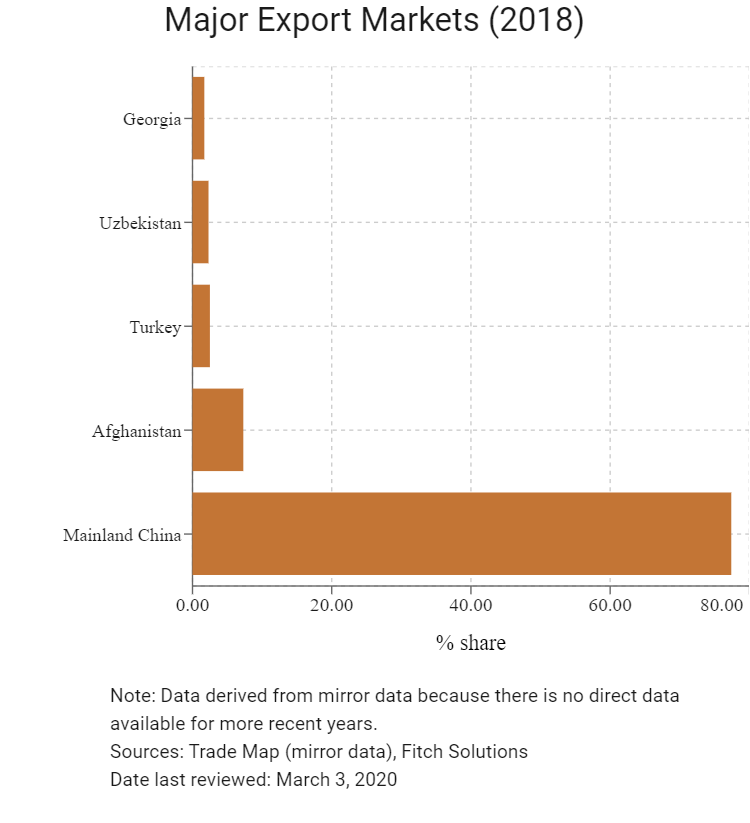

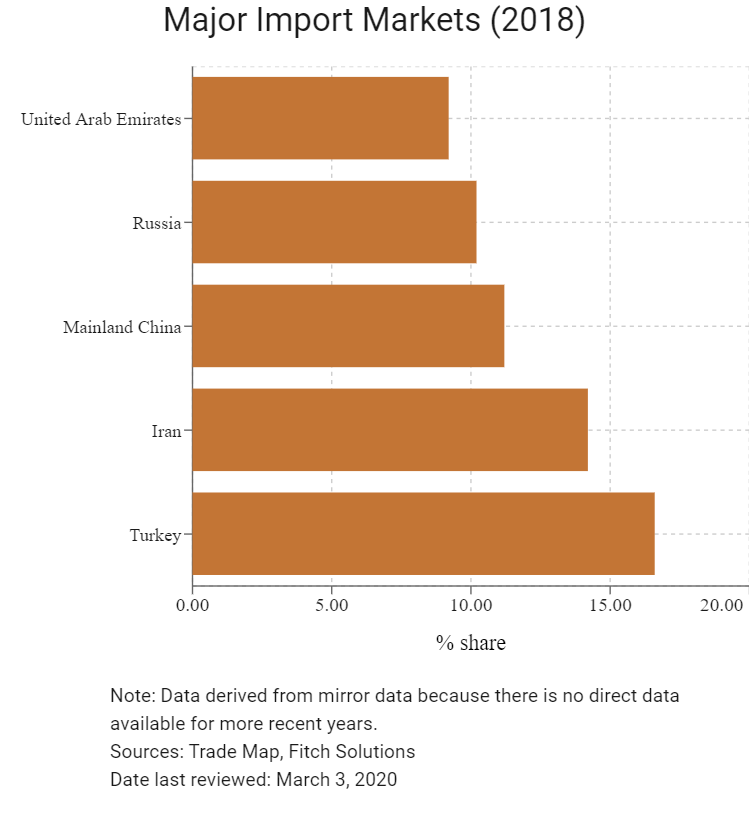

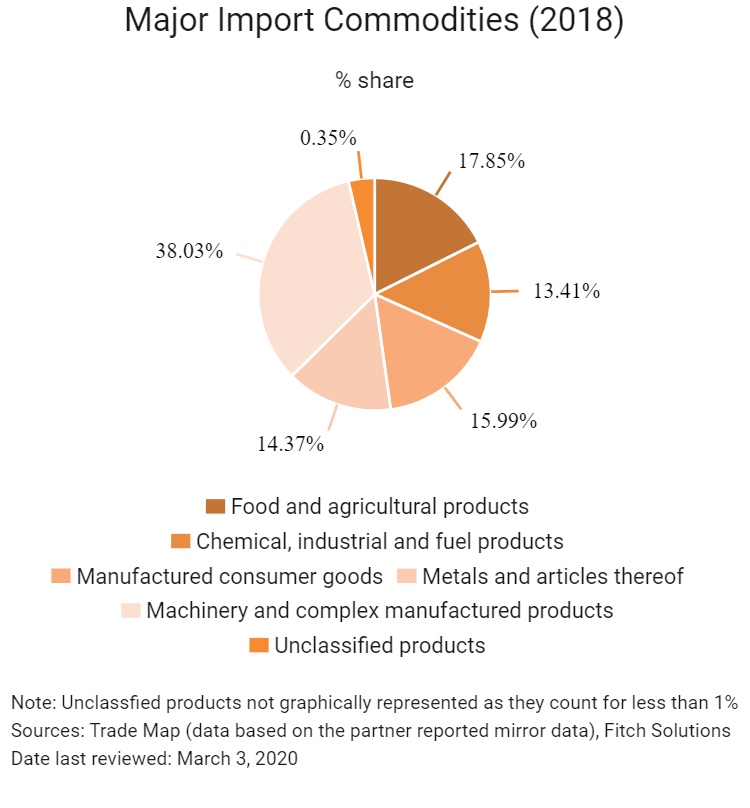

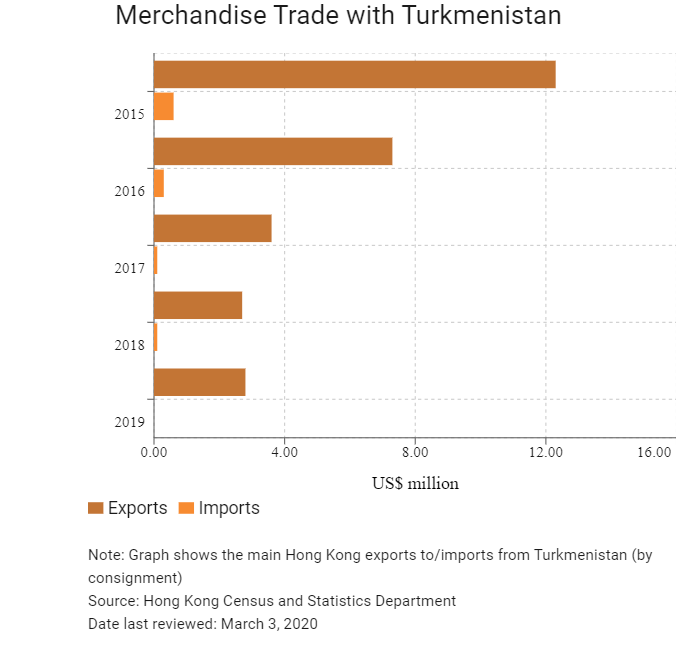

Merchandise Trade

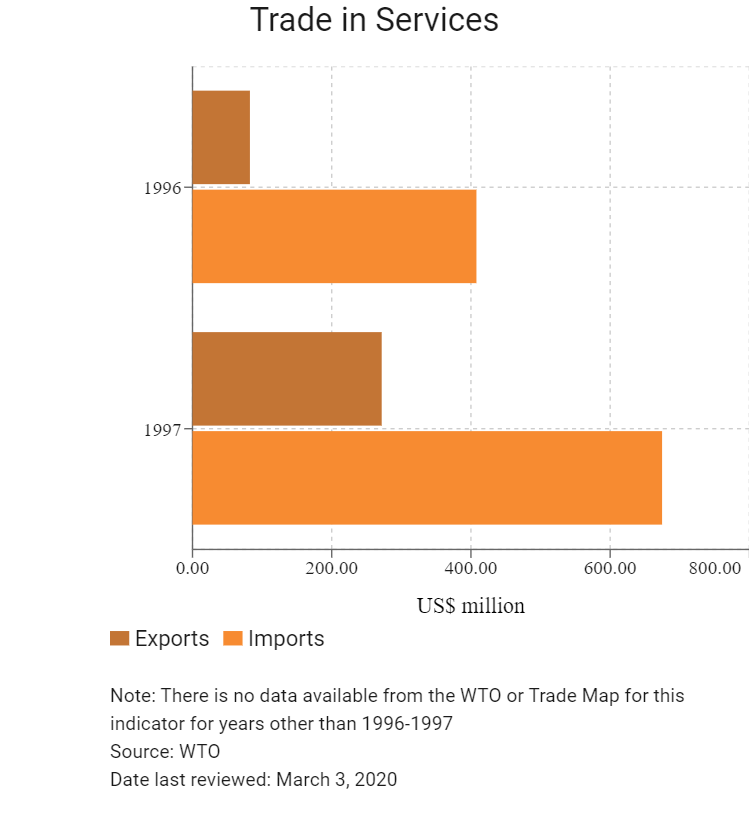

Trade in Services

- Turkmenistan is not a member of the World Trade Organization (WTO); however, when drafting laws and regulations, the government usually includes a clause that states that international agreements and laws will prevail in case there is a conflict between local and international legislations.

- Turkmenistan pursues a policy of neutrality (acknowledged by the United Nations in 1995) and does not join regional blocs. Turkmenistan is currently a member of the Economic Cooperation Organization, a 10-member intergovernmental organisation created in 1985 to promote trade and economic co-operation among its members.

- Turkmenistan requires that all export and import contracts and investment projects be registered at the State Commodity and Raw Materials Exchange (SCRME) and at the Ministry of Finance and Economy. The procedure applies not only to the contracts signed at the SCRME, but also to contracts signed between third parties. The SCRME is state-owned and is the only exchange in the country. The contract registration procedure includes an assessment of price justification.

- All import contracts must be registered before goods are delivered to Turkmenistan. The government generally favours long-term investment projects that do not require regular hard currency purchases of raw materials from foreign markets.

- The import of goods into Turkmenistan is generally subject to 2% customs duty. The taxable base is determined as the customs value of imported goods. There is a list of certain items that are subject to specific customs duty (around 50 items), and the rates of specific customs duties may vary from 5% (for products such as cement) to 100% (for example, for carbonic acid) depending on the type of imported goods. There is also a customs clearance fee of 0.2% from the customs value of imported goods. Excise tax is paid on goods or products that are considered in the list of excised goods or products. Normally, excised goods consist of alcoholic beverages, tobacco products, jewellery and automobiles. Excise rates vary based on the type of goods as well as by domestic production or import.

- In an attempt to diversify gas exports, Turkmenistan is embarking on the construction of the TAPI pipeline and, after a summit of the heads of the Caspian states, is considering the Trans-Caspian Gas Pipeline. In addition, the potential resumption of gas supplies to Russia as well as the possibility of exporting gas to the South Caucasus by using gas swaps with Iran would help to diminish the risk of overreliance on a single client. The resumption of natural gas supplies to Russia will take pressure off the government to boost electricity exports to Pakistan, Afghanistan and Turkey to raise revenue.

- The government introduced an amendment to the Administrative Offences Code that raises the fines for illegal foreign exchange transactions (selling and purchasing foreign currency via informal channels) and trading in foreign currency on the territory of Turkmenistan. The currency is not easily convertible, and an inability to convert enough Turkmenistan manat into hard currency is problematic for many companies operating in the country.

- In 2015, Turkmenistan has purchased a policy of import substitution and there are reports of rising customs duties. Turkmenistan has introduced new customs fees for a list of six types of imported goods, including fruits and vegetables, juices and other unannounced products. A presidential resolution may waive all or some customs duties and taxes, including the excise tax. There are no standards-setting consortia or organisations besides Turkmen State Standards and the licensing agency. There is no independent body for filing complaints. Financial disclosure requirements are neither transparent nor consistent with international norms.

Sources: WTO – Trade Policy Review, State Commodity and Raw Materials Exchange, International Monetary Fund, State Department, Fitch Solutions

Multinational Trade Agreements

Active

- Armenia–Turkmenistan Free Trade Agreement (FTA): This bilateral FTA on goods was signed on October 3, 1995, and came into effect on July 7, 1996 and enabling the free flow of goods between the two countries at preferential tariffs and trade terms. In May 2017, Serzh Sarkisian, Armenian president at the time, called for the launch of large-scale joint economic projects by Armenia and Turkmenistan. Hydrocarbon-rich Turkmenistan was Armenia’s principal supplier of natural gas until the Armenian government signed a long-term deal with Russia’s Gazprom monopoly in late-1990s. In 2017, the Armenian government indicated its desire to resume imports of Turkmen gas via neighbouring Iran.

- Azerbaijan–Turkmenistan: This bilateral FTA on goods came into force in March 1996, but has not been notified to the World Trade Organization. Trade between the countries remains limited.

- Russia–Turkmenistan: This bilateral FTA on goods was signed on November 11, 1992, and came into force (GATT notified) on April 6, 1993. The FTA enables the free flow of goods between the two countries at preferential tariffs and terms.

- Georgia–Turkmenistan: This bilateral FTA on goods was signed on March 20, 1996, and came into force on January 1, 2000. The FTA enables the free flow of goods between the two countries at preferential tariffs and terms and streamlines customs procedures.

- Ukraine–Turkmenistan: This bilateral FTA on goods was signed on November 5, 1994, and came into force on November 4, 1995. The FTA enables the free flow of goods between the two countries at preferential tariffs and terms and streamlines customs procedures. Turkmenistan's exports to the Ukraine consist mainly of mineral fuels, mineral oils and products of their distillation, plastics and articles thereof, cotton, and machinery. The main items Turkmenistan imports from Ukraine are sugar, dairy produce, cocoa and cocoa preparations, and articles of iron and steel.

Under Negotiation

- The Commonwealth of Independent States Free Trade Area (CISFTA): After it came into effect in September 2012, this agreement created a free trade area between eight of the 11 CIS states – Russia, Ukraine, Belarus, Moldova, Armenia, Kyrgyzstan, Tajikistan and Kazakhstan. Uzbekistan became the ninth member when it joined in April 2014. Turkmenistan is an associate member and, like Azerbaijan, remains in negotiations to join. CISFTA provides for the free movement of goods within the territory of the CIS, non-application of import customs duties, non-discrimination, gradual decrease of export customs duties and abolishment of quantitative restrictions in mutual trade between the CISFTA member states.

- EU–Turkmenistan: A Partnership and Cooperation Agreement was concluded between the two parties in 1998 but has not yet been ratified by all the EU member states. Pending ratification an Interim Agreement on trade and trade-related matters entered into force on August 1, 2010. Other areas of cooperation are based still on the Trade and Cooperation Agreement signed with the Soviet Union in 1989 and subsequently endorsed by Turkmenistan.

Sources: WTO Regional Trade Agreements database, The United Nations Economic and Social Commissions for Asia and the Pacific, Asian Development Bank, European Commission

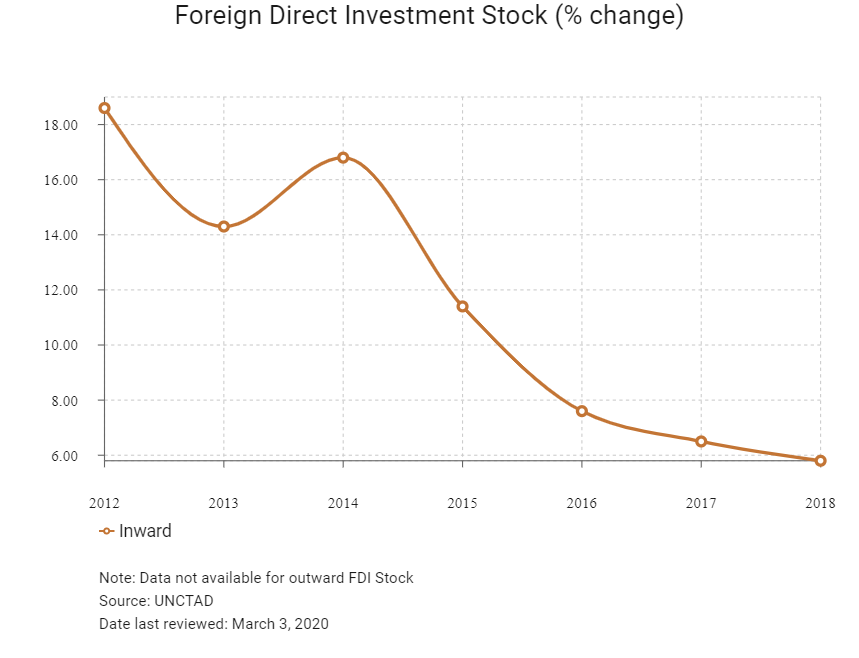

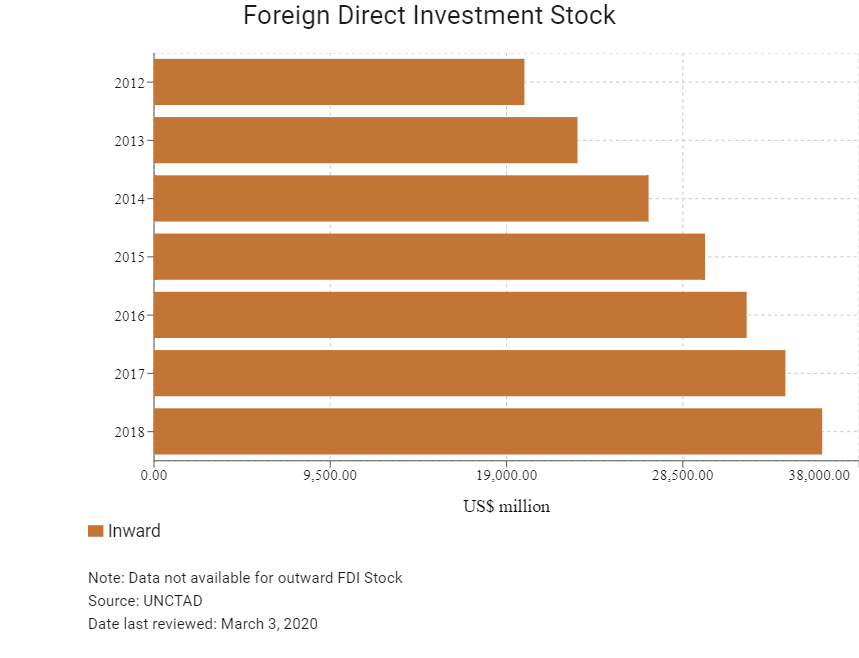

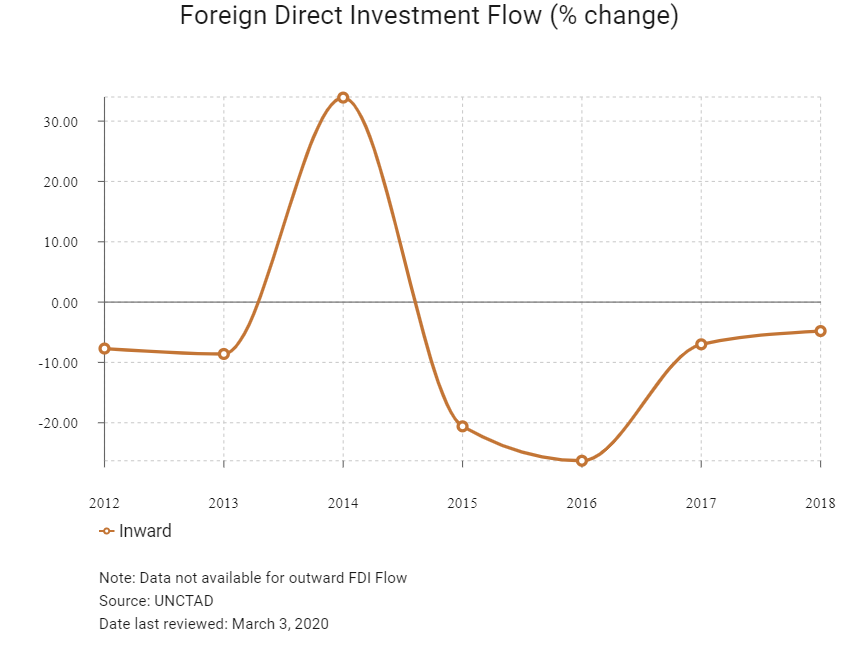

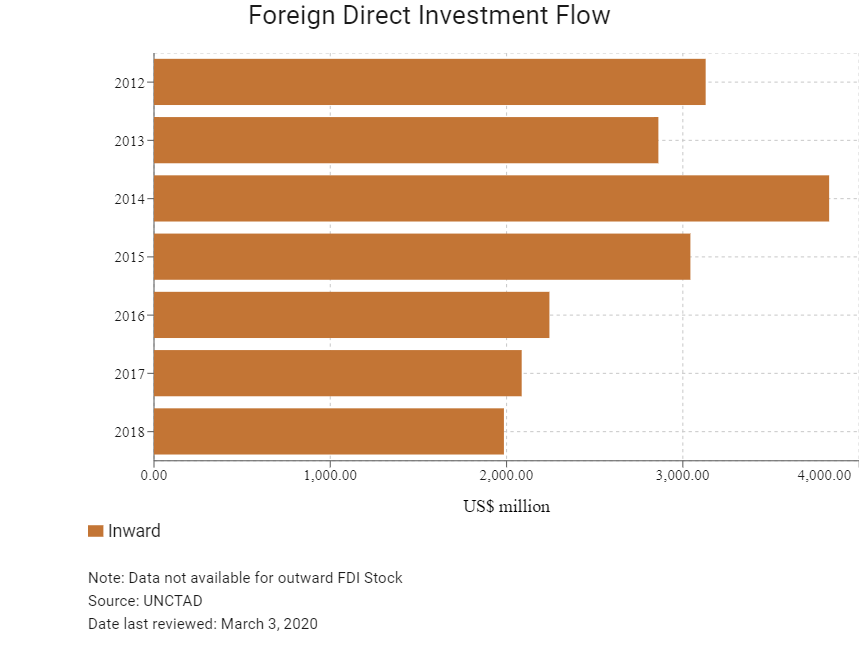

Foreign Direct Investment

↵

Foreign Direct Investment Policy

- In January 2013, Turkmenistan created the Agency for Protection from Economic Risks to oversee international investments in Turkmenistan. The agency is responsible for conducting a comprehensive review of foreign companies wishing to enter Turkmenistan's market, which includes an assessment of the financial and political risks associated with allowing the company to do business in Turkmenistan. According to the 2008 Law on Foreign Investment, all foreign and domestic companies and foreign investments must be registered at the Ministry of Finance and Economy. The Cabinet of Ministers of Turkmenistan and its authorised state body develop and implement public policies to attract foreign investment, investment coordination and assistance to foreign investors. The Agency for Protection from Economic Risks under the Ministry of Economy and Development makes a decision on whether to provide any investment-related services to potential foreign investors based on criteria such as the financial status of the investor.

- Turkmenistan is a signatory to the United States–Central Asia Trade and Investment Framework Agreement (TIFA), a treaty with investment provisions, which has been in force since 2004 with the US, Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan. TIFA also acts as a regional forum to improve the investment climate and expand trade within Central Asia.

- In 2018, Turkmenistan's president put out a seven-year economic and social development plan for 2018–2024, which demonstrates intent to continue with reforms to improve the country's macroeconomic prospects. Among other things the plan aims to encourage greater participation by the private sector and reduce the dominance of the public sector. This includes the privatisation of state-owned enterprises, the creation of special economic zones and simplifying administrative procedures and regulations in an attempt to attract domestic and foreign private investment.

- Turkmenistan has entered into a five-year Country Partnership Strategy (CPS) with the Asian Development Bank (ADB), and this should aid in the country's reform initiatives until 2021. The ADB aims to help Turkmenistan to become a catalyst for regional cooperation and integration by helping it to diversify its markets and reposition itself as a trade and transport hub. The ADB stated that the CPS will support the country in three ways: promoting energy trade, diversifying non-hydrocarbon sectors by enhancing connectivity through investments in transport infrastructure and spurring the private sector, and providing knowledge on economic diversification and reforms.

- The Government of Turkmenistan has not undergone an investment policy review by the Organisation for Economic Cooperation and Development or the World Trade Organization (WTO). While Turkmenistan has expressed interest in exploring the WTO accession process and has created an intergovernmental commission in January 2013 to review the benefits of accession, the country has not yet formally applied to join. Nevertheless, Turkmenistan has signed bilateral investment agreements with 19 countries (Belgium, Mainland China, Egypt, France, Georgia, Germany, Iran, Israel, Luxembourg, Romania, Russia, Slovakia, Spain, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom and Uzbekistan) and a further eight have been signed but are not yet in force (Armenia, Azerbaijan, Bahrain, Indonesia, Italy, Malaysia, Pakistan and Tajikistan).

- The Petroleum Law of 2008 (last amended in 2012) regulates offshore and onshore petroleum operations in Turkmenistan, including petroleum licensing, taxation, accounting and other rights and obligations of state agencies and foreign partners. The Petroleum Law supersedes all other legislation pertaining to petroleum activities, including the Tax Code.

- According to the Land Code (2004), foreign companies or individuals are permitted to lease land for non-agricultural purposes, but only the president has the authority to grant the lease. Foreign companies may own structures and buildings.

- Incoming foreign investment is regulated by the Law on Foreign Investment (last amended in 2008), the Law on Investments (last amended in 1993) and the Law on Joint Stock Societies (1999), which pertains to start-up corporations, acquisitions, mergers and takeovers.

- Turkmenistan adopted a Bankruptcy Law in 1993. Other laws affecting foreign investors include the Law on Investments (last amended in 1993), the Law on Joint Stock Societies (1999), the Law on Enterprises (2000), the Law on Business Activities (last amended in 1993), the Civil Code enforced since 2000 and the 1993 Law on Property.

- Most foreign investment is governed by project-specific presidential decrees, which can grant privileges not provided by legislation. Legally, there are no limits on the foreign ownership of companies. Although Turkmenistan regularly amends its laws, ostensibly to meet international standards, the country often fails to implement investment-related legislation. A lack of established rule of law and an opaque regulatory framework remain serious problems limiting inward investment.

- Tax and investment incentives may be negotiated on a case-by-case basis. The president has often issued special decrees granting taxation exemptions and other privileges to specific investors. However, since adopting a new edition of the Tax Code in 2004, this practice has been significantly reduced. Cross-border transactions are normally scrutinised by tax authorities during statutory tax audits in view of withholding tax and reverse-charge VAT implications. Foreign tax credits are available to tax residents of Turkmenistan based on the provisions of the respective tax treaties.

- Private entities in Turkmenistan have the right to establish and own business enterprises. The 2000 Law on Enterprises defines the legal forms of state and private businesses (state enterprises, sole proprietorships, cooperatives, partnerships, corporations and enterprises of non-government organisations). The law allows foreign companies to establish subsidiaries, although the government does not currently register subsidiaries. The Civil Code of Turkmenistan and the Law on Enterprises govern the operation of representative and branch offices in Turkmenistan and all firms must be registered with the Ministry of Finance and Economy.

- Turkmenistan's legislation is not clear about acquisitions and mergers involving foreign parties, nor does it have specific provisions for the disposition of interests in business enterprises, either solely domestic and those with foreign participation. Governmental approval is necessary for acquisitions and mergers of enterprises with state shares.

- On January 1, 2012, Turkmenistan's banks switched to International Financial Reporting Standards. Government agencies transitioned to National Financial Reporting Standards in January 2014. Despite these positive steps, Turkmenistan remains one of the most-closed economies in the region and some financing of large projects remains off the banks' books.

- The nature of government-awarded contracts may vary in terms of the requirements for ownership of a local enterprise. All contractors operating in Turkmenistan for a period of at least 183 days a year must register at the Main State Tax Service. National accounting and international financial reporting standards apply to foreign investors. In the energy sector, Turkmenistan precludes foreign investors from investing in the exploration and production of its onshore gas resources. The government owns all land in Turkmenistan. The State Migration Service of Turkmenistan requires that citizens of Turkmenistan make up 90% of the workforce of a company owned by a foreign investor.

- Although there is no specific legislation requiring foreign investors to receive government approval to divest, in practice they are expected to co-ordinate such actions with the government. Moreover, there are several tax examinations, licence extension permits, and customs clearance and visa issuance obstacles that investors face. In most cases, the government has insisted on maintaining a majority interest in any joint venture.

- There are no legal limits on the foreign ownership or control of companies. In practice, the government has only allowed fully owned foreign operations in the oil sector and, in one case, in cellular communications. Foreigners may establish and own businesses and engage in business activities within the boundaries of domestic laws, but repatriation of revenues is very challenging because currency conversion remains a major issue in the country. According to the Law on Foreign Investments, foreign investors, especially those operating in the free economic zones, may enjoy some incentives and privileges including licence and tax exemptions, reduced registration and certification fees, land leasing rights and extended visa validity.

- On October 9, 2017, Turkmenistan introduced a new Law on Free Economic Zones (FEZs). The law provides simplified administrative procedures for establishing new ventures and provides significant tax, customs, licensing and other regulatory benefits. The following types of zone can be established: commercial, industrial, technical, service (specialising in financial, banking, tourist recreational and other services), logistics, agro-industrial and zones with combined activities.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, Asian Development Bank

Free Trade Zones and Investment Incentives

| Free Trade Zone/Incentive Programme | Main Incentives Available |

| There are 10 FEZs in Turkmenistan: Mary-Bayramaly, Okarem-Hazar, Turkmenabat-Seidi, Bakharden-Serdar, Ashgabat-Annau, Ashgabat-Bezmein, Serakhs, Guneshli, Ashgabat International Airport and Dashoguz Airport. | The Law on Economic Zones for Free Enterprise was originally enacted in 1993, and guarantees the rights of businesses, both foreign and domestic, to operate in FEZs without profit ceilings. The law forbids the nationalisation of enterprises operating in the zones and discriminating against foreign investors. In October 2017 the government announced that FEZs were exempt from: • Land lease fees for the first three years of operation of the land and 50% fee exemptions for the next seven years. • Business licence requirements for the duration of FEZ membership. • VAT for the duration of FEZ membership. • Property tax for the first 10 years of operation at an FEZ. • Corporate income tax for the first 10 years of operation at an FEZ. • Customs duties for both imported and exported goods. |

| Awaza (Avaza) tourist zone (ATZ) | Turkmenistan created the ATZ in 2007 to promote tourism and the development of its Caspian Sea coast. Tax incentives were granted to entities willing to invest in the construction of hotels and recreational facilities. Amendments to the Tax Code in October 2007 exempted construction and tourist facilities in the ATZ from VAT. Services offered there, including catering and accommodation, are also exempt from VAT until 2020. In general, tax and investment incentives for the ATZ can be negotiated on a case-by-case basis. |

Source: US Department of State, national sources, Fitch Solutions

- Value Added Tax: 15%

- Corporate Income Tax: 8%-20%

Source: Turkmenistan State Tax Service

Important Updates to Taxation Information

Legal entities (qualified as small-and-medium-sized enterprises) operating under the simplified tax regime are required to pay 2% CIT from revenue in the form of advance payments from the date when they receive revenues to their bank accounts. Banking institutions act as a tax agents and perform the withholding of 2% CIT from the taxpayer's funds and make the respective tax payments to the State Budget of Turkmenistan.

Business Taxes

|

Type of Tax

|

Tax Rate and Base |

|

CIT Income Tax |

- 8% for resident non-governmental entities (or 2% in cases where the company qualifies as a small-or medium-sized enterprise). |

|

Subsurface-use tax applicable to legal entities and individual entrepreneurs extracting natural resources and using land or subsoil waters for the extraction of chemical products. |

Taxable operations include the sale of natural resources extracted by taxpayers and utilisation of natural resources for consumption. Tax rates vary depending on the goods being extracted. Natural or associated gas extraction is taxed at 22%, and crude oil extraction is taxed at 10%. Tax rates for other mineral resources vary depending on profitability (internal rate of return) from 0% to 50%. |

|

Social security contributions (all employers) |

Employers are subject to a 20% pension fund contribution (PFC) to the State Pension Fund of Turkmenistan for obligatory pension insurance. The PFC does not apply to foreign personnel (unless they permanently reside in Turkmenistan). Employers can be subject to obligatory professional pension insurance at a rate of 3.5% with respect to certain types of employees (eg, those who work in hazardous conditions/military service/civil aviation). |

|

A special purpose duty aimed at improving urban and rural territories is imposed on registered entities |

1% of the taxable base (contractors and subcontractors operating under the umbrella of the petroleum |

|

Development fund contributions |

Agriculture Development Fund is 3%, and the contribution rate for the Ashgabat City Development Fund is 0.5% of the accounting income. Generally, contractors and subcontractors operating under the umbrella of the petroleum law may be exempt from these contributions. |

|

VAT/goods and services tax (standard) |

15%; a zero rate applies to exports of goods (except for oil and gas) and international transport services. Generally, contractors operating under the umbrella of the petroleum law may be exempt from this tax. |

|

Withholding Tax |

- Income from dividends and interest : 15% |

|

Property Tax |

1% on the average annual net book value of fixed assets and average annual value of tangible assets used for business purposes and located in Turkmenistan. Generally, contractors operating under the umbrella of the petroleum law may be exempt from this levy. |

Source: Turkmenistan State Tax Service

Date last reviewed: March 3, 2020

Localisation Requirements

Turkmenistan's government seeks to implement a labour rule that requires foreign companies to hire nine local employees for every one international staff member employed in the country. The State Migration Service of Turkmenistan insists that citizens of Turkmenistan make up 90% of the workforce of a company owned by a foreign investor. The regulation does not differentiate between senior management and other employees. Generally, as far as the issuance of work permits to foreign individuals is concerned, the principle of the State Migration Service is that Turkmenistan citizens should be given priority when filling vacant positions and that companies should adhere to the regulation establishing a nine to one ratio for the number of nationals and foreign individuals working at a company.

Special Skills Requirements

An invitation to a foreign specialist to hold a position of the head of a company, division, department, workshop or similar unit must be accompanied by copies of documents confirming the work positions held by such a specialist within the last five years. The sponsor (the inviting organisation) must submit the application for a work permit to the State Migration Service. A work permit is usually issued for one year and should be renewed each subsequent year. There is no maximum number of work permit renewals. Foreign individuals or stateless persons can apply for residence permits if they have resided in Turkmenistan for two years.

Visa Requirements

In accordance with the law, citizens of all countries require a visa to visit Turkmenistan. There are 19 types of visa: diplomatic, official, business (two types), investment, work, family, sports (two types), humanitarian, private (two types), student, tourist, transit (two types), health, driver's and exit. To obtain a tourist visa for Turkmenistan, all foreign nationals must supply an invitation letter issued by an agency licensed in Turkmenistan. A work permit is required if a person arrives in the country for business (employment) purposes and intends to stay in the country for more than one month. A business stay in the country for 30 days or less does not require a work permit. The State Migration Service controls access to the country and monitors the movement of foreign citizens. All visitors staying for more than three working days, excluding the day of entry, are required to register with the State Migration Service on entry. Representatives of foreign businesses seeking to enter Turkmenistan for the first time may have difficulty obtaining an entry visa unless invited by a government agency or by a local business partner.

Travel to most border areas requires a special permit. A special permit, issued prior to arrival by the Ministry of Foreign Affairs, is required if visiting the following places: Atamurat, Cheleken, Dashoguz, Serakhs and Serhetabat.

Foreign citizens and stateless persons may enter and stay in Turkmenistan on the basis of an entry visa to Turkmenistan, unless otherwise stipulated by international treaties to which Turkmenistan is a signatory. For members of diplomatic missions, consular offices and other equivalent representative offices of foreign states and international organisations in Turkmenistan and foreign journalists accredited in Turkmenistan and their families, an accreditation card issued by the Ministry of Foreign Affairs of Turkmenistan and written or electronic requests from these missions, agencies or organisations is required.

Sources: Government sources, State Migration Service of Turkmenistan, Fitch Solutions

Sovereign Credit Ratings

| Rating (Outlook) | Rating Date | |

|

Moody's |

WR (RWR) |

09/09/2010 |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

Not rated |

Not rated |

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

N/A |

N/A |

N/A |

|

Ease of Paying Taxes Index |

N/A |

N/A |

N/A |

|

Logistics Performance Index |

126/160 |

N/A |

N/A |

|

Corruption Perception Index |

161/180 |

165/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

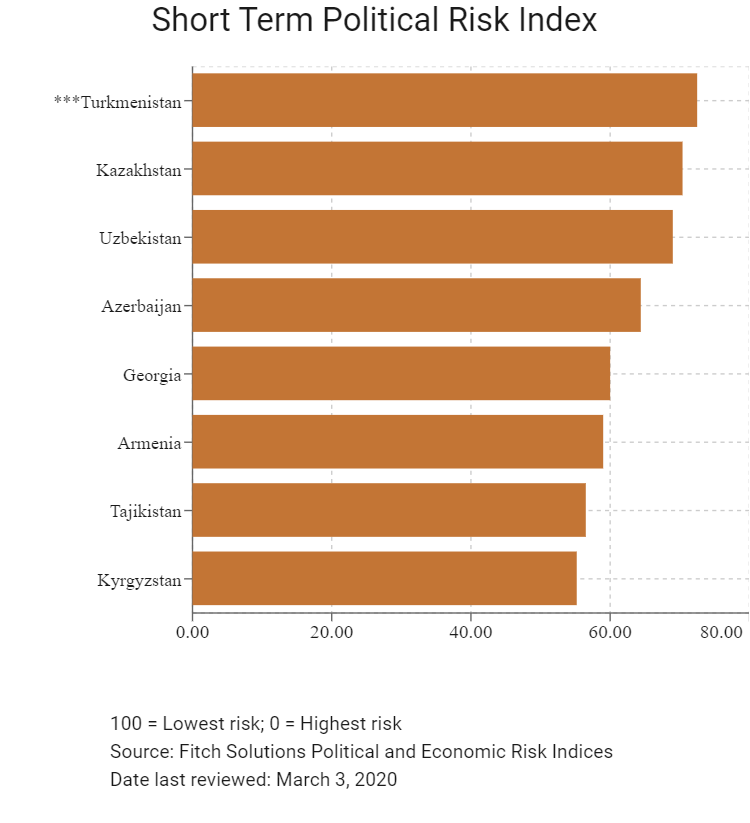

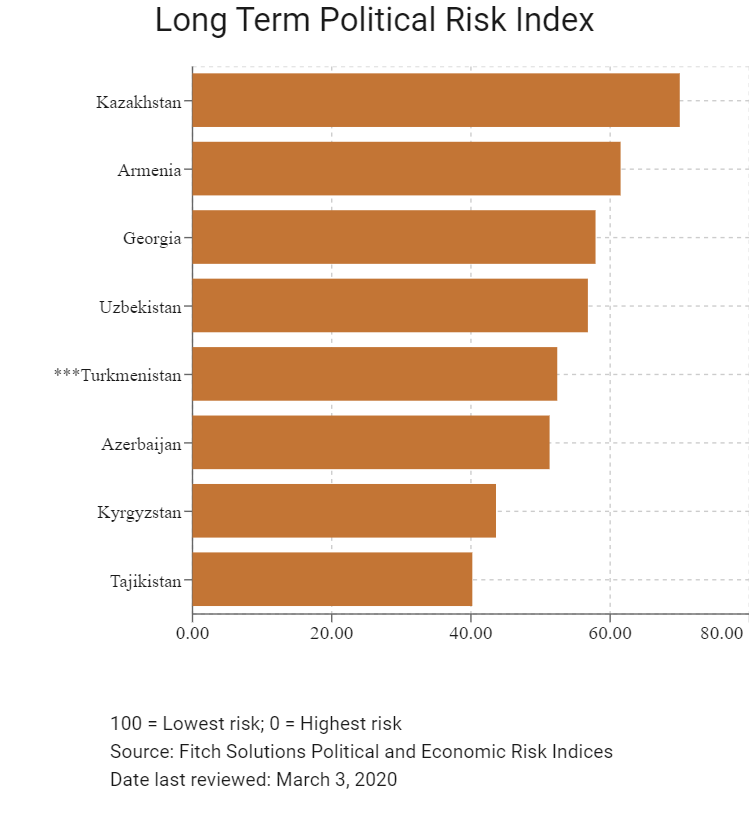

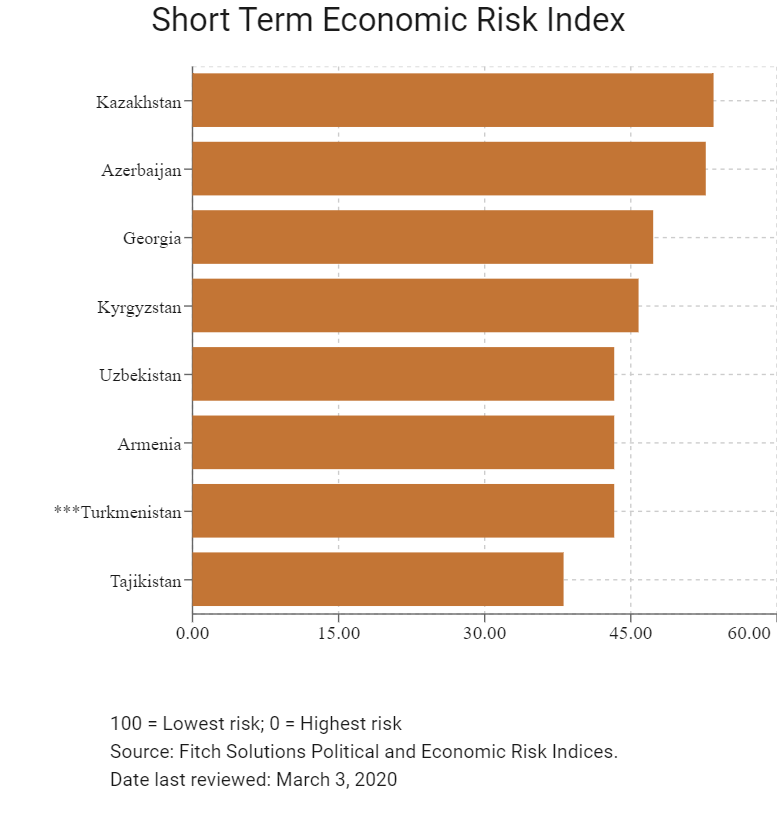

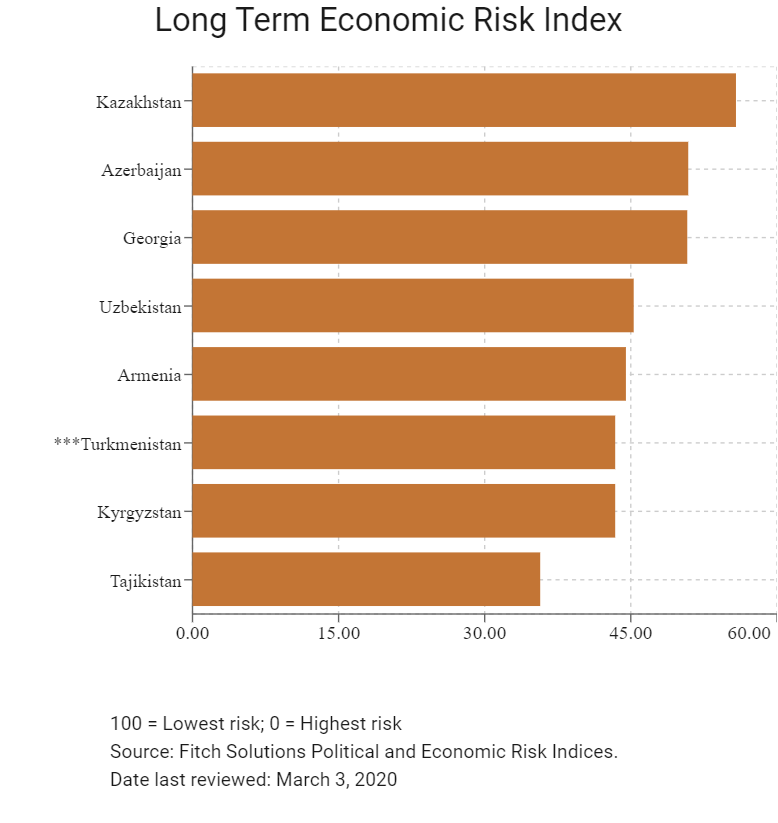

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

155/202 |

154/201 |

153/201 |

|

Short Term Economic Risk Score |

37.1 |

40.6 |

43.3 |

|

Long Term Economic Risk Score |

42.0 |

43.4 |

43.4 |

|

Political Risk Index Rank |

149/202 |

151/201 |

152/201 |

|

Short Term Political Risk Score |

73.1 |

72.5 |

72.5 |

|

Long Term Political Risk Score |

53.2 |

52.4 |

52.4 |

|

Operational Risk Index Rank |

146/201 |

143/201 |

139/201 |

|

Operational Risk Score |

37.7 |

38.6 |

39.6 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Turkmenistan's economic growth prospects will remain flat over the coming years owing to its heavy reliance on hydrocarbon and electricity exports and a narrow economic base. Despite a ramp-up in demand for gas from Mainland China, Turkmenistan's gas exports to the country are unlikely to increase significantly as a substantial part of this demand will be met by liquefied natural gas imports from Australia over the near term. Over the longer term, however, gas exports to Mainland China are likely to pick up following the completion of Line D of the Central Asia–Mainland China Pipeline set for 2020. The TAPI gas pipeline construction has also started in Afghanistan and will lead to new gas markets for the country. However, its completion date cannot be estimated at this stage. Furthermore, Turkmenistan has shown a willingness to conduct reforms over the coming years as seen from its ambitious seven-year plan, and the government is likely to adopt them at a gradual pace, which will be positive for the business environment.

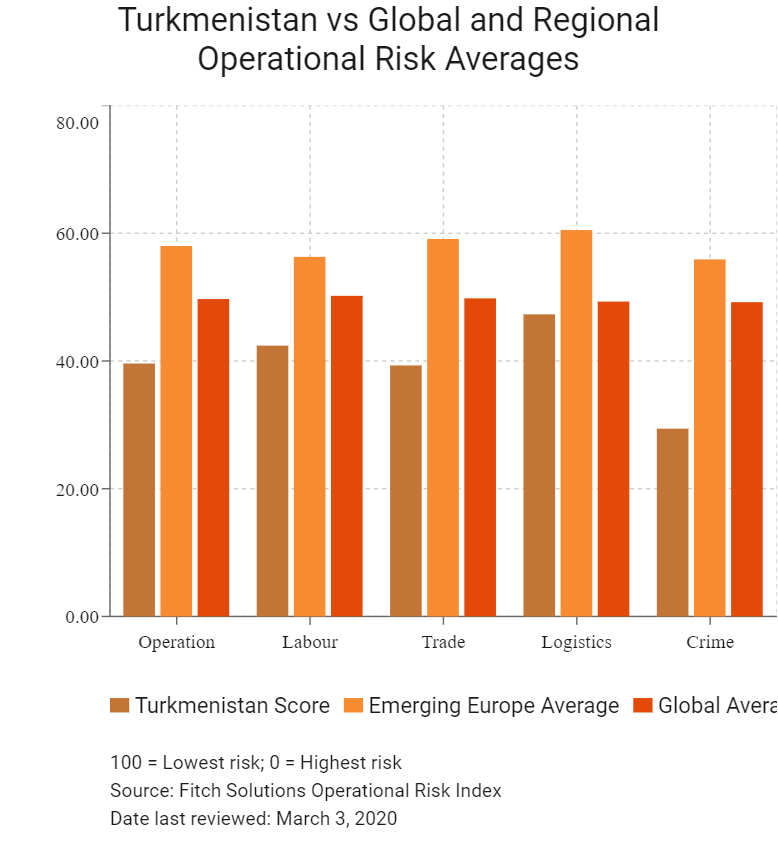

OPERATIONAL RISK

Turkmenistan imports the vast majority of its industrial equipment and consumer goods. The government's foreign exchange reserves and foreign loans pay for industrial equipment and infrastructure projects; however, the country's exports remain heavily exposed to fluctuations in global oil and gas prices due to the narrow basket of key export products. The abundant gas deposits underneath the Karakum Desert, which occupies 70% of the land area of Turkmenistan, remain the backbone of the economy. Logistics risks remain elevated due to the lack of sufficient overland connectivity and limitations in utilities infrastructure. Regional infrastructure development projects in the energy space bode well for logistics capacity enhancements in the years ahead. Furthermore, labour market risks remain elevated due to foreign worker limitations and relatively uncompetitive domestic skills development.

Source: Fitch Solutions

Fitch Solutions Political and Economic Risk Indicies

↵

Fitch Solutions Operational Risk Index

|

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

|

Turkmenistan Score |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Caucasus and Central Asia Average |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

8 |

8 |

7 |

5 |

8 |

|

Emerging Europe Average |

58 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

31 |

31 |

30 |

28 |

31 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

139 |

148 |

136 |

103 |

171 |

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.4 |

56.1 |

58.3 |

|

Azerbaijian |

61.2 |

62.5 |

62.5 |

66.4 |

53.2 |

|

Kazakhstan |

60.2 |

73.5 |

58.9 |

57 |

51.5 |

|

Armenia |

56.8 |

60.5 |

58.6 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Uzbekistan |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Tajikistan |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Turkmenistan |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Regional Averages |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March , 2020

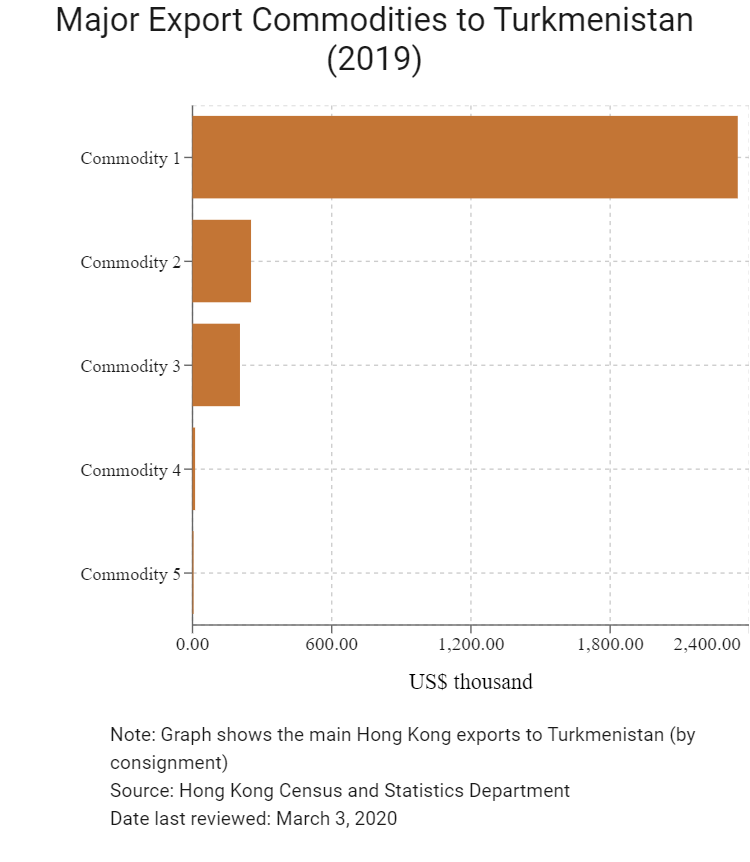

Hong Kong’s Trade with Turkmenistan

|

Export Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

2,350 |

|

Commodity 2 |

Office machines and automatic data processing machines |

252.3 |

|

Commodity 3 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

204.6 |

|

Commodity 4 |

Metalworking machinery |

11.2 |

|

Commodity 5 |

Special transactions and commodities not classified according to kind |

4.6 |

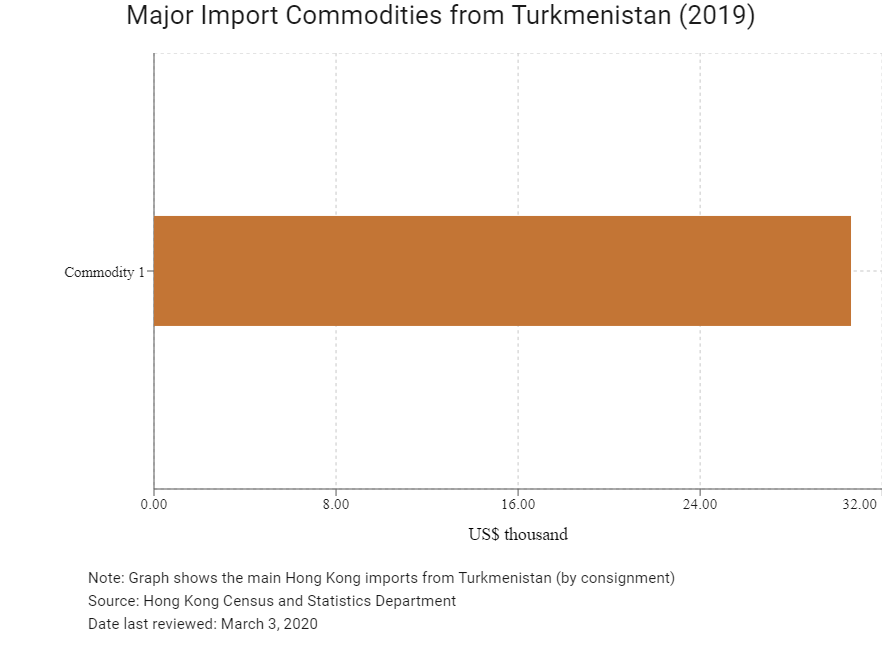

| Export Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

30.63 |

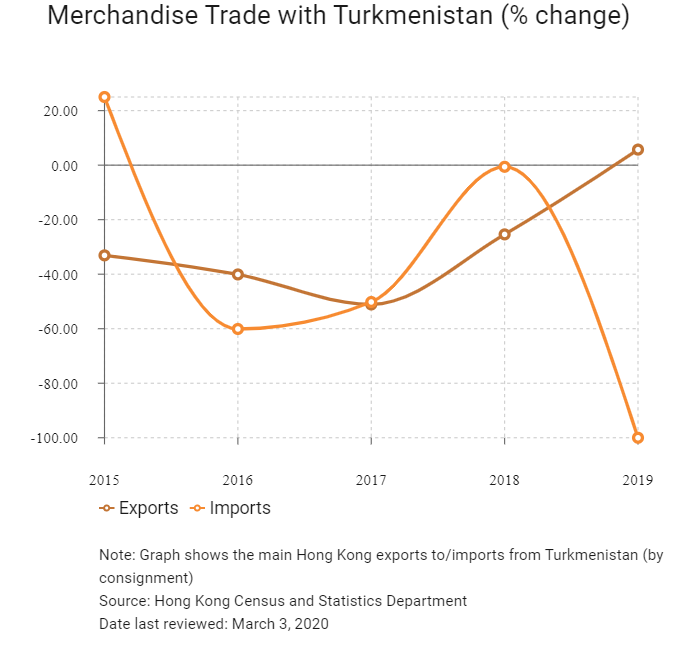

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

Sources: Hong Kong Census and Statistics Department, Fitch Solutions

|

2019 |

Growth Rate (%) |

|

|

Number of Turkmen residents visiting Hong Kong |

42 |

82.6 |

Source: Hong Kong Tourism Board

|

2019 |

Growth Rate (%) |

|

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

|

Number of Emerging Europe citizens residing in Hong Kong |

114 |

29.6 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: March 3, 2020

Commercial Prescence in Hong Kong

|

2020 |

Growth Rate (%) |

|

|

Number of Turkmen companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Trade Statistics, Census & Statistics Department

Treaties and Agreements between Hong Kong and Turkmenistan

- Turkmenistan has a bilateral investment treaty with Mainland China that entered into force on June 4, 1994.

- A double tax agreement (DTA) between Mainland China and Turkmenistan and its corresponding protocol came into force on May 30, 2010. The DTA will apply to taxes withheld at source from income derived on or after January 1, 2011, as well as other taxes collected in any taxable year starting January 1, 2011.

Source: UNCTAD

Visa Requirements for Hong Kong Residents

HKSAR passport holders require a visa for Turkmenistan for up to 90 days stay. All foreigners require a visa to enter Turkmenistan and transit visas are the only visas issued without a letter of invitation. Permits are needed to visit the border regions of Turkmenistan. The nearest embassy to Hong Kong is in mainland China. The Embassy of Turkmenistan requires that the applicants submit their visa applications directly as they may require an in-person appointment.

The following areas are termed ‘class one’ border zones and entry without documentation is not possible: Eastern Turkmenistan Farab, Atamurat (Kerki) plus adjoining areas, Kugitang Nature Reserve, Tagtabazar and Serkhetabat. Northern Turkmenistan Entire Dashoguz region including Konye-Urgench, Dargan-Ata and Gazachak. Western Turkmenistan Bekdash, Turkmenbashi, Hazar, Dekhistan, Yangykala, Gyzyletrek, Garrygala, Nokhur and surrounding villages. Ashgabat, Mary, Merv, Turkmenabat and Balkanabat are not restricted, but anywhere outside these areas should be listed on a general visa, thus giving permission to go there.

Sources: State Migration Service of Turkmenistan, Fitch Solutions

Date last reviewed: March 3, 2020

Turkmenistan

Turkmenistan