GDP (US$ Billion)

364.14 (2018)

World Ranking 35/193

GDP Per Capita (US$)

64,579 (2018)

World Ranking 8/192

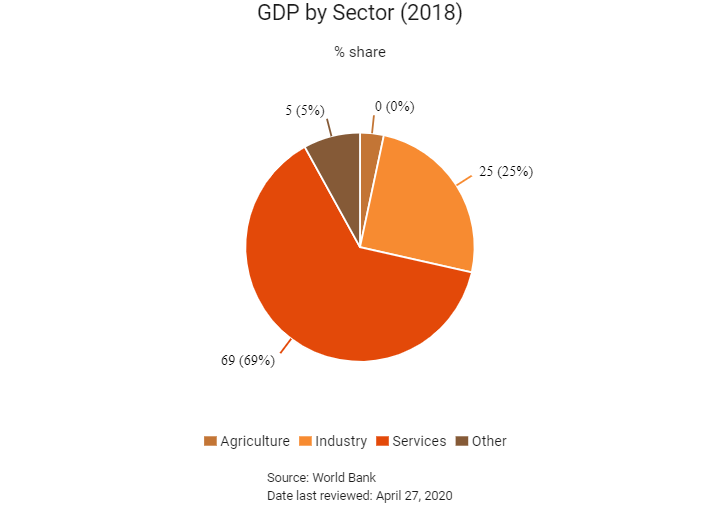

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

319.1 (2019)

Currency (Period Average)

Singapore Dollar

1.36per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

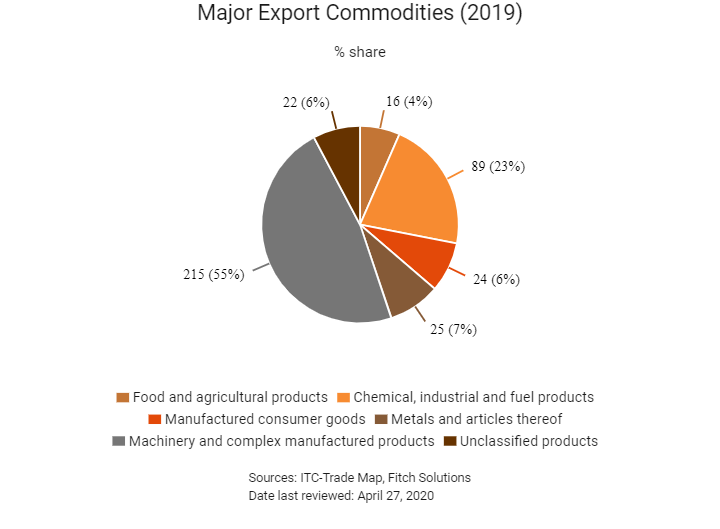

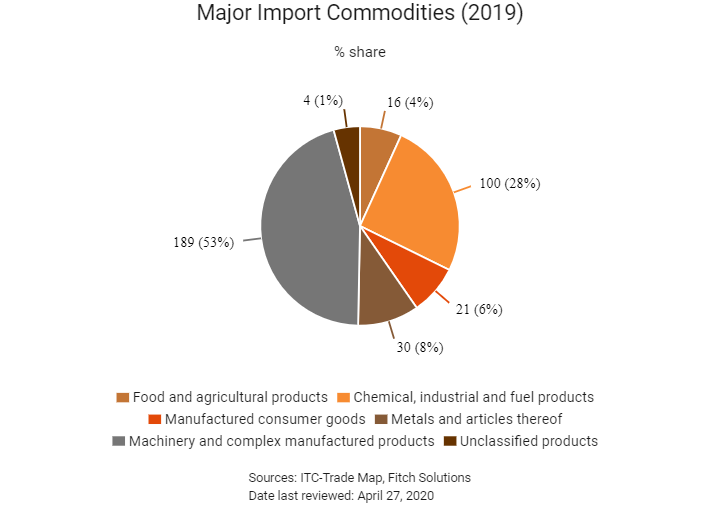

Singapore is one of the world's most prosperous countries and is ranked among the world's most competitive economies. The city-state benefits from strong international trade links and a per capita income level comparable to, or exceeding that of, many Western European nations. The government's far-sighted economic policies have helped to transform the economy into an Asian powerhouse in recent years and economic diversification efforts continue to be implemented, which bodes well for the sustained expansion of economic activity. The economy is heavily reliant on exports, particularly in information technology products and pharmaceuticals, and its vibrant tourism, retail and financial services sectors. Therefore, it may be vulnerable to global trends such as the shifting demand for electronic goods and ongoing trade tensions between the United States and Mainland China. The city-state offers a large, highly skilled workforce and one of the world's most business-friendly regulatory environments for local entrepreneurs. With strong financial support from the government, the country's 'SkillsFuture' initiative aims to boost the flexibility of the workforce by providing continuing education that deepens technical and managerial skills across sectors. Furthermore, the Smart Nation project coordinated by the Singapore government is a successful smart city concept, and is widely touted as model for smart city implementation in the region.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2016

Singapore announced that it would spend more than USD1.5 billion on expanding the capacity of its military training bases in Australia, as part of a 25-year agreement.

September 2017

After Tony Tan's term as president ended in August 2017, elections were scheduled for September. Halimah Yacob was deemed as the only eligible candidate by the country's election department and ran unopposed. She was inaugurated as the president of Singapore on September 13. This was the first election in Singapore after the country amended its constitution to create a provision for elections to be reserved for candidates from specific ethnic or racial groups on a rotating basis.

April 2018

Singapore hosted the first of two ASEAN summits.

November 2018

Singapore hosted the 33rd ASEAN Summit.

March 2019

Malaysia and Singapore agreed to suspend their mutual port limits as they continue negotiations to resolve the maritime dispute between the two parties. They also agreed to halt commercial activities in the disputed area and to ensure that their respective vessels present in the area comply with the United Nations Convention on the Law of the Sea.

May 2019

Singapore's non-oil domestic exports declined by 15.9% y-o-y. This was the third consecutive month of double-digit decline and was driven by a 9.1% and 32.4% y-o-y drop in the export of manufactured goods, and machinery and transport equipment respectively.

July 2019

The Government of Malaysia stated that it had halted the export of sea sand in October 2018. Malaysia accounts for the majority of Singapore's imports of the commodity, which Singapore is using in its infrastructure-expansion drive.

November 2019

Malaysia decided to proceed with the construction of a cross-border rapid transit system (RTS) link with Singapore with certain amendments. The planned 4.2km RTS would connect Woodlands North station in Singapore with Bukit Chagar station in Johor Bahru, Malaysia. The proposed amendment involved using a light rail transit system, instead of the originally planned mass RTS for the link. Both countries were now discussing the changes to the project, and an amended agreement was expected to be signed in early 2020. The project was scheduled to start operations by December 2024.

February 2020

The government announced it would take over the payment of between 25% and 75% of individual wages (capped at SGD4,600) on behalf of businesses for nine months and a 25% tax rebate.

February to March 2020

The government announced a number of financial packages towards supporting workers and businesses during the coronavirus crisis. The Stabilisation and Support Package provided support to businesses (about SGD35.3 billion), which included wage subsidies, an enhancement of financing schemes and additional support for industries directly affected by the coronavirus outbreak, such as those in the transport, tourism and food services industries.

The Monetary Authority of Singapore (MAS) also announced a swap facility of USD60 billion with the US Federal Reserve to provide liquidity for Singapore financial institutions.

April 2020

On April 8, the MAS announced a SGD125 million support package to sustain and strengthen capabilities in the financial services and FinTech sectors. The support package, funded by the Financial Sector Development Fund, had three main components: (i) supporting workforce training and manpower costs; (ii) strengthening digitalisation and operational resilience; and (iii) enhancing FinTech firms’ access to digital platforms and tools.

April 2021

Singapore's next parliamentary general election would be held in April 2021. According to the Constitution, the Parliament of Singapore's maximum term was five years from the date of the first sitting of parliament following a general election, after which it was dissolved by operation of law.

Sources: BBC Country Profile – Timeline, Fitch Solutions

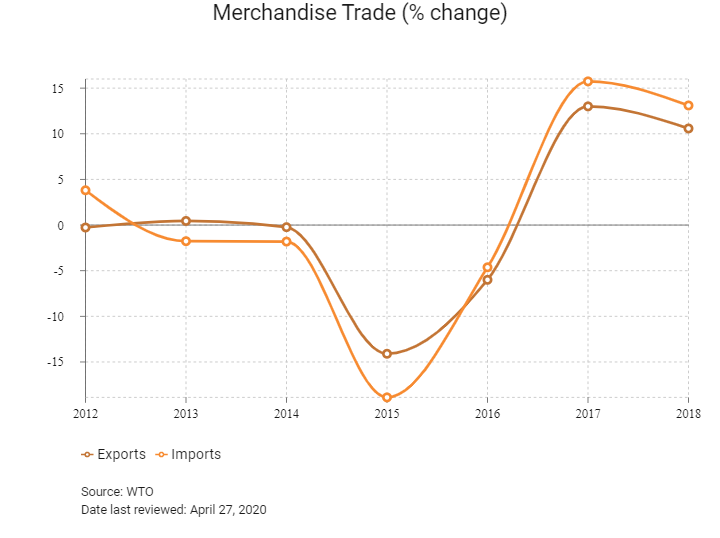

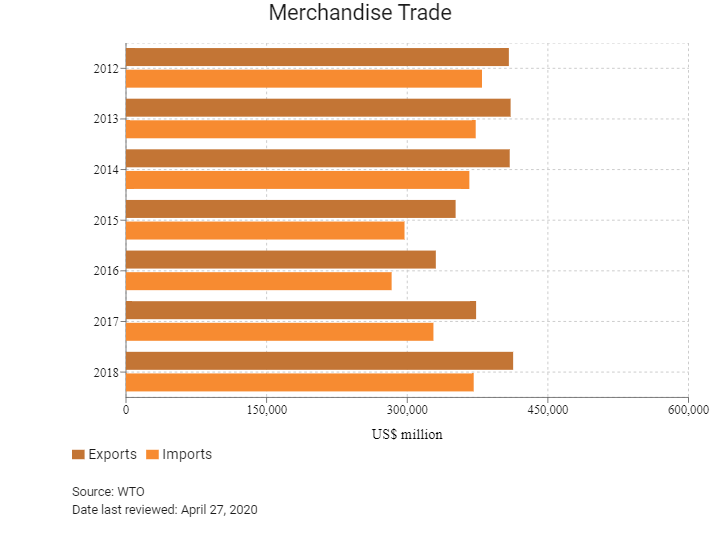

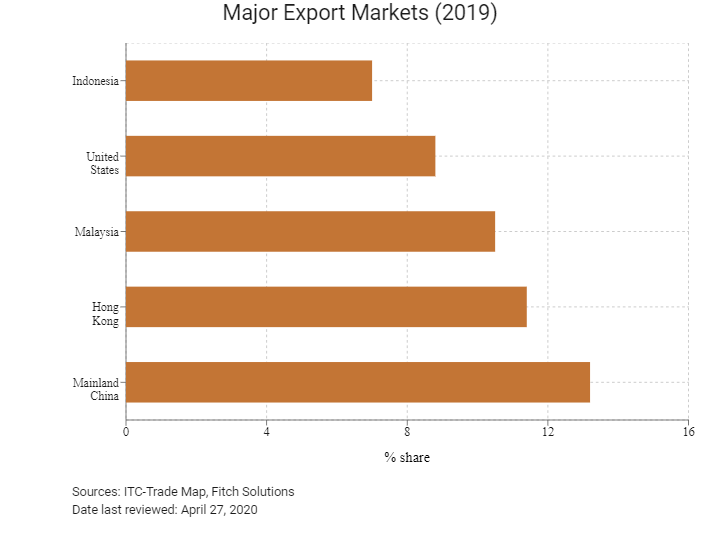

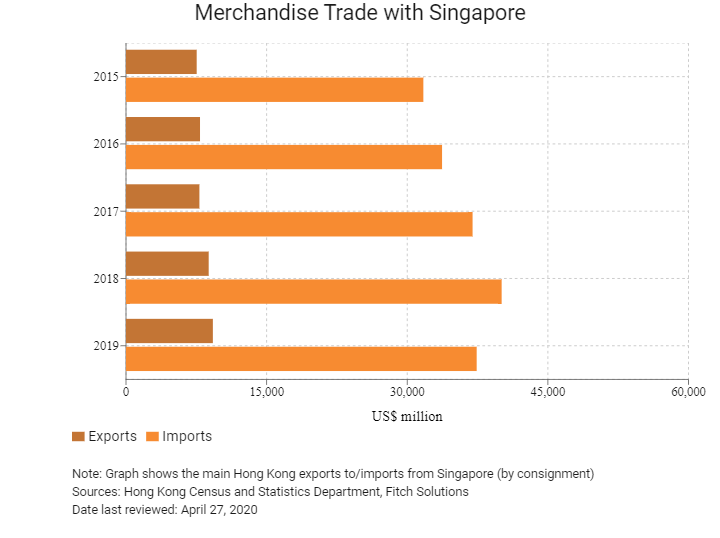

Merchandise Trade

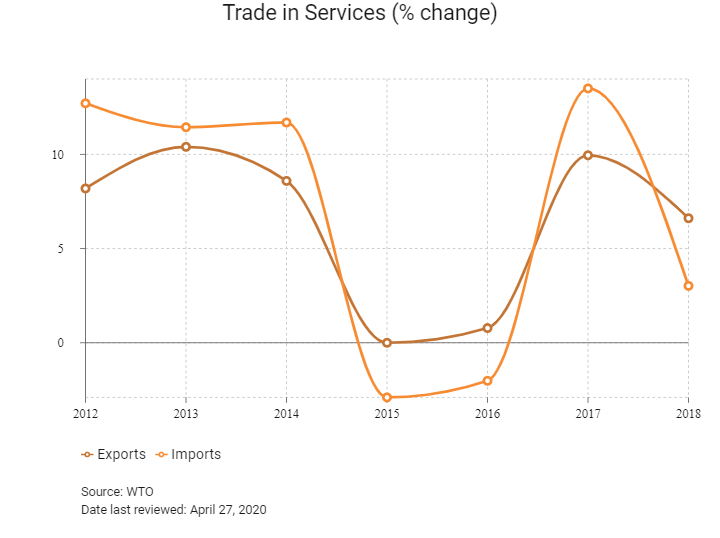

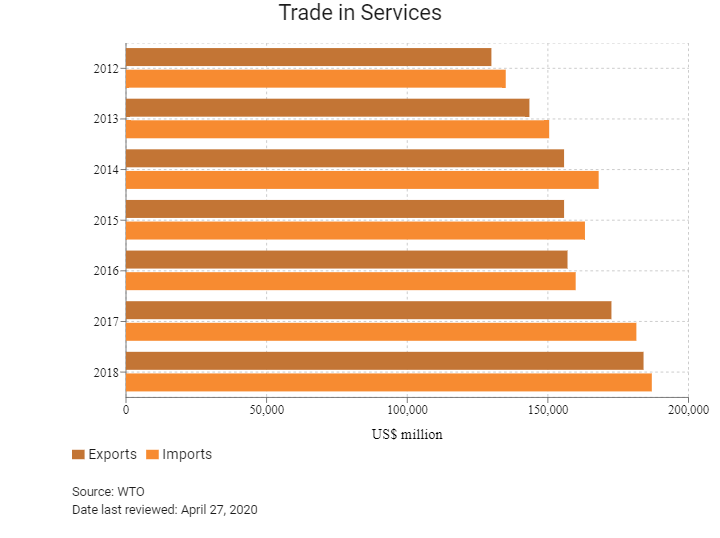

Trade in Services

- Singapore has been a member of the World Trade Organization (WTO) since January 1, 1995.

- Singapore is generally a free port and open economy, and the average tariff is 0%. Around 99% of all imports into Singapore enter duty free.

- For social and environmental reasons, Singapore levies high excise taxes on beer, wine and liquor, tobacco products, motor vehicles and petroleum products. Singapore also restricts the import and sale of non-medicinal chewing gum.

- The Singaporean government introduced a carbon tax in May 2019 to reduce greenhouse gas emissions. The tax will be applied upstream on power stations and other large direct emitters.

- A goods and services tax (GST) of 7% is levied on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of business. It was announced in the 2018 budget that this rate would be increased to 9% between 2021 and 2025. The only exemptions from the GST are prescribed financial services (including life insurance), the sale or rental of residential properties and the import and local supply of investment precious metals.

- GST was not previously charged on imports of services, but this changed from January 1, 2020, with the introduction of a reverse charge on local businesses that make exempt supplies and those that do not make any taxable supplies to account for GST on the services they import. Another change was that the government is now exempting cryptocurrency transactions from GST.

- For dutiable goods, the taxable value for GST is calculated based on the CIF (Cost, Insurance and Freight) value, plus all duties and other charges. In the case of non-dutiable goods, GST will be based on the CIF value plus any commission and other incidental charges whether or not shown on the invoice. If the goods are dutiable, the GST will be collected simultaneously with the duties. Special provisions pertain to goods stored in licensed warehouses and free trade zones (FTZ).

- Labels are required on imported food, drugs, liquor, paint and solvents, and the country of origin must be specified.

- There are two levels of labelling requirements for medicinal products. Administrative labelling requirements are not statutory requirements and are specified in the Health Sciences Authority (HSA)'s Guidance on Medicinal Product Registration in Singapore. Compliance is checked during the product registration process before marketing approval is granted. Legal labelling requirements are stipulated in the legislation related to medicinal products regulation in Singapore and are subject to the HSA's surveillance programme.

- The 'Safety Mark' is used for selected electrical and electronic products, and gas appliances that are sold to consumers for use in Singaporean households. All registered controlled goods must be tested to specific international and national safety standards and certified safe by designated product certification bodies.

- The 'Accuracy Label' covers weighing and measuring instruments intended for trade use. In Singapore, all weighing and measuring instruments used for trade purposes (such as price computing scales in supermarkets, baggage weighing machines at airports and seaports, and fuel dispensers at petrol stations) are regulated under the Singapore Weights and Measures Act and Regulations.

Sources: WTO – Trade Policy Review, Inland Revenue Authority of Singapore, Fitch Solutions

Trade Updates

Singapore is a member of a number of free trade agreements (FTAs) that create a legally binding agreement between two or more countries to reduce or eliminate barriers to trade. The country first signed an FTA under the ASEAN Free Trade Area in 1992 and has since expanded its network to cover more than 23 regional and bilateral FTAs with different trading partners. As a member of ASEAN, Singapore participates in all group FTAs.

Multinational Trade Agreements

Active

- ASEAN: In addition to Singapore, members include Brunei, Cambodia, Indonesia, Laos, Myanmar, the Philippines, Malaysia, Thailand and Vietnam. Since 2015 almost all tariffs among member states have been removed in the ASEAN Free Trade Area. The FTA eliminates tariffs on 98.6% of goods and lower tariffs within the area have seen regional trade booming. The ASEAN Economic Community (AEC), which is currently under negotiation, will also serve to strengthen regional economic ties and improve trade volumes in Singapore. The AEC creates new opportunities and makes the investment case for business in South East Asia more compelling. ASEAN is Singapore's largest trading partner and top investment destination.

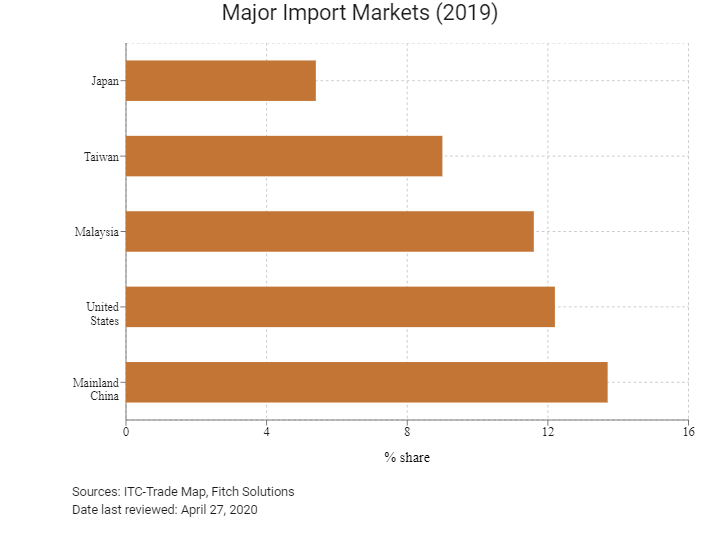

- Mainland China-Singapore FTA: The FTA between Mainland China and Singapore entered into force on January 1, 2009, and was revised in November 2018. The agreement enhances economic co-operation between the two nations as the free trade accord facilitates productive competition. It also contributes to the economic integration of East Asia and the Asia Pacific region. Under the FTA, the two countries have accelerated the liberalisation of trade in goods on the basis of the Agreement on Trade in Goods of the Mainland China-ASEAN FTA and further liberalised trade in services. Mainland China has been Singapore's single largest trading partner since 2013, accounting for 12.2% of exports and supplying 13.4% of imports in 2018.

- India-Singapore: The Comprehensive Economic Cooperation Agreement (CECA) between Singapore and India entered into force on August 1, 2005. The third CECA review was launched in September 2018 and focuses on trade facilitation, customs and e-commerce. Under the agreement, Singapore's goods exported to India enjoy tariff reduction or elimination, making them more competitive. Singaporean service providers also enjoy preferential access to India's services sector.

- Japan-Singapore Economic Partnership Agreement (JSEPA): The JSEPA entered into force on November 30, 2002. Under the existing agreement, Japan increased its zero-tariff commitments from 34% of total tariff lines under the WTO to 77%. The JSEPA also liberalised trade in services significantly, expanding its commitments from 103 services sectors under the WTO to 135. The scope of the JSEPA can be categorised into three main areas: trade liberalisation and market access through concessions for trade in goods and services, enhanced co-operation for non-trade areas and institutional arrangements centred on a dispute settlement mechanism. Singapore also benefits from the ASEAN-Japan Comprehensive Economic Partnership.

- United States-Singapore FTA and Economic Integration Agreement: Under this FTA, firms in Singapore benefit from reduced trade barriers and a large market with a high propensity for consumption of manufactured goods. The FTA entered into force on January 1, 2004. The United States is one of Singapore's most important trading partners, accounting for 7.7% of exports and 11.4% of Singapore's imports in 2018.

- ASEAN-Mainland China: This FTA, which came into effect in January 2005 for goods and July 2007 for services, is a comprehensive economic cooperation agreement between ASEAN member states and Mainland China. The goal of the agreement is to eliminate tariffs and address behind-the-border barriers that impede the flow of goods and services. The FTA overlaps somewhat with the Singapore-Mainland China FTA.

- ASEAN-India: The ASEAN-India trade in goods agreement came into force on January 1, 2010, for goods and on July 1, 2015, for services with the aim of minimising barriers and deepening economic linkages between the parties. The FTA involves the liberalisation of tariffs on more than 90% of products traded between the two regions, including the so-called special products, such as palm oil (crude and refined), coffee, black tea and pepper. The agreement will lead to the progressive elimination of tariffs on all goods. The framework agreement envisages the establishment of an ASEAN-India Regional Trade and Investment Area (RITA) as a long-term objective. The agreement overlaps with the India-Singapore FTA.

- ASEAN-South Korea FTA (AKFTA): AKFTA came into force in June 2007 and May 2009 for goods and services, respectively, and allows 90% of the products traded between ASEAN and South Korea to enjoy duty-free treatment. The investment agreement entered into force in June 2009. AKFTA aims to create more liberal, facilitative market access and investment regimes between South Korea and ASEAN. A business council was set up in December 2014 to enhance economic cooperation between parties and to boost total trade to USD200 billion by 2020.

- ASEAN-Japan FTA: Japan provides a huge market for a wide range of goods, with tariff-free trade. This benefits a number of important sectors, including manufacturing, agriculture, mining and chemicals production. The FTA entered into force on April 14, 2008, and overlaps with the Singapore-Japan FTA.

- ASEAN-Australia-New Zealand FTA and Economic Integration Agreement (AANZFTA): This agreement for goods and services came into force on January 1, 2010. The FTA aims to eliminate tariffs for at least 90% of all tariff lines within specified timelines.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN commenced negotiations for an FTA and an investment agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investment, economic and technical cooperation, dispute settlement mechanism and other related areas. The agreements will bring legal certainty, better market access, and fair and equitable treatment in trade and investment, thus creating business opportunities and enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and investment agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but it will take time for all ASEAN members to comply as implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process. Hong Kong's potential as a key export market increases the importance of AHKFTA.

- Eurasian Economic Union (EAEU)-Singapore FTA: The EAEU and Singapore agreed to begin negotiations for an FTA in December 2016 and concluded five negotiation rounds. The two parties signed the FTA on October 1, 2019. The agreement aims to strengthen collaboration between the two parties in areas such as trade and investment, intellectual property rights protection, customs cooperation and competition enforcement.

- European Union (EU)-Singapore FTA: The FTA between the EU and Singapore aims to eliminate duties for industrial and agricultural goods in a progressive step-by-step approach. The FTA entered into force on November 21, 2019. The agreement creates opportunities for market access in services and investments, and includes provisions in areas such as competition policy, government procurement, intellectual property rights, transparency in regulation and sustainable development. The EU is Singapore's third largest trading partner in goods and its largest services trading partner. Under the agreement, 84% of Singapore's exports will enter the EU duty free, while tariffs for the remaining goods will be removed within the first five years.

- The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): The agreement – comprising Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – came into force on December 30, 2018, and represents 13.4% of global GDP. It aims to cut tariffs, to improve access to markets and to establish common ground on labour and environmental standards, and intellectual property protection. Under the agreement, 94% of Singapore's trade with other CPTPP countries will be tariff free.

Under Negotiation

- Regional Comprehensive Economic Partnership (RCEP): Negotiations on a framework agreement for the RCEP have stalled after India announced its withdrawal from the trade pact at a RCEP summit held in Bangkok in November 2019. Expectations had been for negotiations to conclude in 2019, paving the way for the agreement to enter force by late 2020. RCEP negotiations without India may now be concluded in 2020, but the withdrawal of India is a setback in attempts to counter the growing wave of protectionism in the United States and other parts of the world. The RCEP will have broader and deeper engagement with significant improvements over existing regional FTAs and agreement will need to be reached on politically sensitive issues, including trade in services, investment rules and protection for intellectual property rights, and tariffs, where the target is to remove trade barriers on at least 92% of products within ten years. Formally launched in 2012, RCEP is a Mainland China and ASEAN-led project which, before the withdrawal of India, involved 16 countries, namely the 10 ASEAN countries and the ASEAN Free Trade Partners (Australia, China, India, Japan, South Korea and New Zealand). It would have been the world’s largest trade pact covering nearly half the world’s population, one third of global GDP and around 29% of global trade.

- Pacific Alliance-Singapore FTA: The proposed FTA is between Singapore and the group comprising Chile, Colombia, Mexico and Peru, of which Singapore already has individual FTAs.

- MERCOSUR-Singapore: The negotiations for an FTA between Singapore and the South American customs union (comprising Argentina, Brazil, Paraguay and Uruguay) began in July 2018.

Sources: WTO Regional Trade Agreements database, Enterprise Singapore, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The government body responsible for foreign direct investment (FDI) promotion, licensing and regulations – the Economic Development Board (EDB) – was established in 1961. Singapore's investment promotion strategy has been framed to pull in major investment towards high value-added manufacturing and service activities. As one large special economic zone, Singapore offers a number of incentives to investors across a range of industries.

- Tax incentives are administered by various government agencies, including the EDB, International Enterprise Singapore, the Monetary Authority of Singapore (MAS) and the Maritime and Port Authority of Singapore. The broad categories of activities that could qualify for tax concessions include manufacturing, services, trade and finance.

- There are various tax incentives available to taxpayers involved in specified activities or industries identified as being beneficial to Singapore's economic development. Tax incentive applications are typically subject to an approval process, during which the administering agency evaluates the applicant's business plans in detail. Generally, applicants are expected to carry out substantive, high-value activities in Singapore and are required to commit to certain levels of local business spending and skilled employment.

- The Productivity and Innovation Credit (PIC), which previously ran from 2011 to 2018, has been replaced from 2019 with a scaled-down incentive programme called the Productivity Solutions Grant (PSG). Overall, the PSG should support up to 70% of the cost of adopting off-the-shelf solutions, with the aim of incentivising improvements to productivity. For businesses in Singapore, this will aid efforts at remaining competitive in the face of cheap labour elsewhere in the region. The initiative is a particularly valuable contribution to manufacturing industries.

- Under Singapore's liberal foreign investment legislation, there are virtually no restrictions on the types of activity that may be carried out. However, any company providing financial and telecommunications services, as well as manufacturing operations engaged in the production of certain restricted items, require licences from the appropriate governmental authorities prior to investment from foreign sources. Certain industries are unavailable to foreign investors. These industries are air transport, public utilities, newspaper publishing and shipping.

- Singapore's transport infrastructure sector is almost entirely driven by government investment plans, although private and foreign companies generally find ample opportunities to participate in the design, consulting, construction and operations of projects. Although Singapore's current infrastructure stock of roads, rail transit, airports and ports is well developed by international standards, it has not kept up with population growth and immigration rates. To address capacity constraints, the government has a sizeable pipeline of planned and ongoing infrastructure investments, largely in the rail sector. Within the ports segment, long-term plans to relocate port facilities away from the city centre will sustain activity over the next decade.

- Singapore adopts a one-tier taxation system, under which all Singapore dividends are tax exempt in the shareholder's hands. Tax on corporate income is imposed at a flat rate of 17% on profits. A partial tax exemption and a three-year, start-up tax exemption for qualifying start-up companies are available.

- Foreigners in Singapore face restrictions in the real estate market and are not allowed to acquire all the apartments within a building or all the units in an approved condominium apartment without prior approval. Prior approval is also required for landed homes (houses) and vacant residential land. There are no restrictions on the foreign ownership of industrial and commercial real estate.

- According to the 2018 budget (announced in February 2018), there will be a requirement for overseas vendors providing digital services to register for GST with effect from January 1, 2020, if their global turnover is more than SGD1 million annually and their online sales to Singapore consumers exceed SGD100,000.

- Since January 2005, qualifying banks licensed by the government have been able to open at a maximum of 25 locations. Non-resident banks in the retail banking sector are not afforded national treatment. Although the government has removed a 40% ceiling on the foreign ownership of local banks, it has stated that it will not approve the foreign acquisition of any local bank.

- All businesses (local and foreign) must be registered with the Accounting and Corporate Regulatory Authority. The government screens investment proposals to check if they qualify for incentive packages.

- Foreign and local firms in Singapore have equal access to the FTZ facilities. Foreign companies operating in Singapore must work with local transporters and traders in order to obtain a licence to access the FTZs. Singapore has nine FTZs.

- According to the 2019 budget (announced in February 2019), the MAS has streamlined regulations governing venture capital managers and has invested USD5 billion in a programme aimed at attracting international private equity firms to the market.

Sources: United States Department of Commerce, Inland Revenue Authority of Singapore, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

FTZs: Brani Terminal, Keppel Distripark, Pasir Panjang Terminal, Sembawang Wharves, Tanjong Pagar Terminal, Keppel Terminal, Jurong Port, Airport Logistics Park of Singapore, Changi Airport Group and the Changi Airport Cargo Terminal Complex |

- VAT and GST are suspended for imported goods deposited in an FTZ, and will only be payable on removal from the FTZ for local consumption. |

|

Incentives for internationalisation |

The double tax deduction scheme for internationalisation allows companies expanding overseas to claim a double deduction for eligible expenses for specified market expansion and investment development activities. This includes manpower expenses incurred when Singaporeans are deployed to overseas entities. |

|

PIC/PSG |

Certain activities are subject to approval or minimum ownership requirements. With the expiry of the PIC scheme in 2018, the following deductions (under the banner of the PSG regulation) have been introduced for the years of assessment (2019 to 2025):

Overall, the PSG should support up to 70% of the cost of adopting off-the-shelf solutions, with the aim of incentivising improvements to productivity – particularly in light of the increased competition for cheap labour from neighbouring Malaysia. |

|

Headquarters schemes |

Approved regional headquarters in Singapore are taxed at a concessionary rate of tax of 15% on qualifying overseas income. Depending on their level of economic commitments to Singapore, international headquarters can apply for various tax incentives. |

|

Maritime Sector Incentive (MSI) scheme |

The MSI scheme is the umbrella incentive for the maritime sector. Incentives offered include tax exemption for shipping companies and a 10% concessionary tax rate for international freight and logistics operators. Approved ship investment managers are also taxed at 10% on qualifying management-related income. The scheme also includes approved ship investment vehicles, which are tax exempt on their qualifying vessel lease income; approved container investment enterprises, which are taxed at 5% or 10% on qualifying income from container leasing; and approved container investment management companies, which are taxed at 10% on qualifying management fees. |

|

Global Trader Programme (GTP) |

International traders are taxed at concessionary rates of 5% or 10% on qualifying income from physical trading, brokering of physical trades and derivative trading income. |

|

Mergers and acquisitions allowance |

- The mergers and acquisitions allowance allows a write-off, over five years, of 25% of the value of qualifying mergers or acquisitions deals executed between April 1, 2015, and March 31, 2020, subject to a cap of SGD5 million (SGD10 million for deals executed from April 2016 to March 31, 2020) per year of assessment. - This incentive is available to companies that are incorporated, tax resident and conducting business in Singapore; however, this requirement may be waived for companies under the headquarters schemes and the MSI. - A 200% tax allowance is also granted on transaction costs (capped at SGD100,000 per year of assessment) incurred on qualifying deals. The allowance is granted consecutively over a period of five years and may not be deferred. |

|

Investment allowance |

- Under the investment allowance, a tax exemption is granted on an amount of profits based on a specified percentage (of up to 100%) of the capital expenditure incurred for qualifying projects or activities within a period of up to five years (up to eight years for assets acquired on hire purchase). - Capital expenditure incurred for productive equipment placed overseas on approved projects may likewise be granted integrated investment allowances. - Investment allowances of 100% of capital expenditure (net of grants) may be granted to businesses seeking to make substantial investment in automation, subject to a cap of SGD

10 million per project. |

|

The Pioneer incentive |

Corporations manufacturing approved products with high technological content or providing qualifying services may apply for tax exemption for five to 15 years for each qualifying project or activity under the pioneer tax incentive. Corporations may apply for their post-pioneer profits to be taxed at a reduced rate under the Development and Expansion Incentive. |

|

Financial services incentives (FSI) |

Under the FSI scheme, income from certain high growth, high value-added activities, such as services and transactions relating to the bond market, derivatives market, equity market and credit facilities syndication, may be taxed at 5%, while a broader range of financial activities will qualify for a 12% tax rate. This rate has been increased to 13.5% for awards granted or renewed from June 1, 2017, and the scope of qualifying income has been expanded (broadly speaking, certain currency, counterparty and investment instrument restrictions have been removed). The tax incentive period may last for five, seven or 10 years, subject to certain conditions being met. |

|

Development and Expansion incentive |

- Under the Development and Expansion Incentive, corporations engaging in new high value-added projects, expanding or upgrading their operations, or undertaking incremental activities after their pioneer period can apply for their profits to be taxed at a reduced rate of not less than 5% for an initial period of up to 10 years. - The total tax relief period for each qualifying project or activity is subject to a maximum of 40 years (inclusive of the post-pioneer relief period previously granted, if applicable). |

|

The Venture Capital Funds incentive |

- Gains derived from the disposal of approved investments, interest from approved convertible loan stocks and dividends derived from approved investments are exempt from tax, or taxed at a concessionary rate of not more than 10% for a period of up to 10 years. - Extension periods of up to five years each may be available, but the maximum total incentive period is 15 years. |

Sources: United States Department of Commerce, Fitch Solutions

- Value Added Tax: 7%

- Corporate Income Tax: 17%

Source: Inland Revenue Authority of Singapore

Important Updates to Taxation Information

- The main changes announced in the 2018 budget related to corporate income tax and value-added tax regimes will be implemented over the short to medium term. These include enhancements of the tax rebates and adjustments to the Partial Tax Exemption and Start-up Tax Exemption schemes that are being implemented over 2018-2020. A 250% tax deduction for qualifying research and development projects, and 200% tax deductions for the first SGD100,000 of qualifying intellectual property (IP) registration costs and the first SGD100,000 of qualifying IP licensing costs were also introduced.

- Singapore imposes a GST. GST is expected to be raised to 9%, from the current 7%, between 2021 and 2025. GST on imported services, including foreign digital service providers, took effect from January 1, 2020.

- The Singapore government introduced a carbon tax (May 2019) to reduce greenhouse gas emissions. The proposed carbon tax will be applied upstream on power stations and other large direct emitters. The carbon tax will be implemented after consultation with stakeholders.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

17% |

|

Royalties |

Withholding tax of 10% |

|

Skills development levy |

0.25% of gross salaries – minimum of SGD2.0 and a maximum of SGD11.25 per month |

|

Property Tax |

10% of non-residential property value |

|

Interest on loans and rentals |

Withholding tax of 15% |

|

GST |

7% on the value of products, some products are zero rated |

|

Social security contributions |

Employer's contribution is up to 17% on monthly wages up to an income ceiling of SGD6,000. |

Sources: Inland Revenue Authority of Singapore, World Bank – Doing Business 2019, Fitch Solutions

Date last reviewed: April 27, 2020

Employment Pass (EP)

The EP is applicable to foreign individuals employed as managers, executives and skilled professionals. It is valid for two years and may be renewed thereafter for up to three years at a time. It is generally applicable to individuals with a minimum monthly salary of SGD3,600 (as of April 2019). Applicants may also apply for a pass for their dependants, such as spouses and unmarried children under the age of 21. The EP must be applied for by the employer on behalf of the individual. The average time needed to obtain an EP is five weeks and falls under the auspices of the Ministry of Manpower (MoM).

S Pass (SP)

The SP is identical to the EP, but is applicable to individuals with a minimum monthly income of SGD2,300 (and SGD6,000 in order to receive benefits for dependants). The average time needed to obtain an SP is three weeks and falls under the auspices of the MoM.

Personalised Employment Pass (PEP)

The PEP is applicable to high-earning individuals who already have an EP or are overseas foreign professionals. The minimum monthly income for an applicant already in possession of an EP is SGD12,000, whereas foreign professionals require a minimum monthly income of SGD18,000 to qualify. The PEP allows holders to switch jobs without the need to reapply for a pass and permits the individual to stay in Singapore for an additional six months before securing their next job. The PEP is only valid for three years. After the three years, the individual needs to obtain an EP. The process to obtain a PEP takes roughly eight weeks and falls under the auspices of the MoM.

Entrepreneur Pass (EntrePass)

The EntrePass is applicable to foreign individuals who wish to start a business in Singapore. The pass is valid for two years and the applicant may apply for it themselves. The EntrePass may be renewed if the applicant's company obtains funding from an accredited source, holds intellectual property (IP; registered with a recognised IP institution), does research with a recognised institution, or is being incubated by a government-supported incubation programme. Applicants may also apply for a dependant pass for their family members.

Work Permit

The work permit applies to semi-skilled jobs in manufacturing and construction, and jobs in the services sector. A work permit is valid for up to two years and is only applicable to companies that pay a levy and security bond, meet the quota criteria and provide the applicant with healthcare. Work permits do not allow for dependants and take up to seven working days to be processed.

Training Employment Pass (TEP)

The TEP is valid for three months and applicable to individuals undergoing practical training for jobs of a professional, managerial, executive or specialist nature in Singapore. The applicant must also earn a minimum of SGD3,000 a month. The TEP is not renewable.

Training Work Permit (TWP)

The TWP is applicable to unskilled or semi-skilled foreign trainees or students on practical training in Singapore for up to six months. Students are subject to a levy. An employer may only have 5% of its total workforce or 15 employees (whichever comes first) working under TWP regulations.

Employment Charges

The Foreign Worker Levy is a monthly levy of up to SGD950 that employers are liable to pay for each foreign employee hired. The levy rate depends on the employee's qualifications, the employer's industry and the ratio of foreigners to Singaporeans and permanent residents employed in the company. The government has announced that levy increases for work permit holders in the marine and process sectors that were originally proposed for July 1, 2016, will be deferred for another year until July 1, 2019.

Visa Requirements

Citizens of Afghanistan, Algeria, Bangladesh, the Commonwealth of Independent States, North Korea, Egypt, Georgia, Ukraine, India, Iran, Iraq, Jordan, Kosovo, Lebanon, Libya, Mali, Morocco, Nigeria, Mainland China, Pakistan, Saudi Arabia, Somalia, Sudan, Syria, Tunisia, Turkmenistan and Yemen require a visa to travel to Singapore.

Workplace Quota

According to the 2019 budget, the government has revised workforce quotas aimed at the services sector. These include lowering the Dependency Ratio Ceiling (DRC) from 40% to 38% effective from January 1, 2020, with a further decrease to 35% set to take effect from January 1, 2021. The government also lowered the sector's SP sub-DRC from 15% to 13% effective from January 1, 2020, and will further lower to 10% effective from January 1, 2021. These revised limits will be applicable as and when companies apply for permit renewals.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aaa (Stable) |

12/11/2018 |

|

Standard & Poor's |

AAA (Stable) |

06/03/1995 |

|

Fitch Ratings |

AAA (Stable) |

23/08/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

2/190 |

2/190 |

2/190 |

|

Ease of Paying Taxes Index |

7/190 |

8/190 |

7/190 |

|

Logistics Performance Index |

7/160 |

N/A |

N/A |

|

Corruption Perception Index |

3/180 |

4/180 |

N/A |

|

IMD World Competitiveness |

3/63 |

1/63 |

N/A |

Sources: World Bank, IMD, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

30/202 |

38/201 |

38/201 |

|

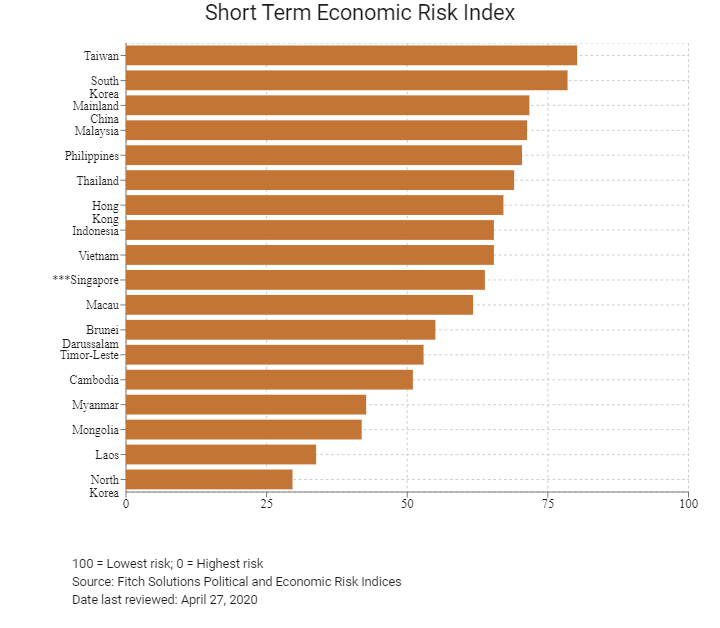

Short-Term Economic Risk Score |

72.7 |

67.1 |

63.8 |

|

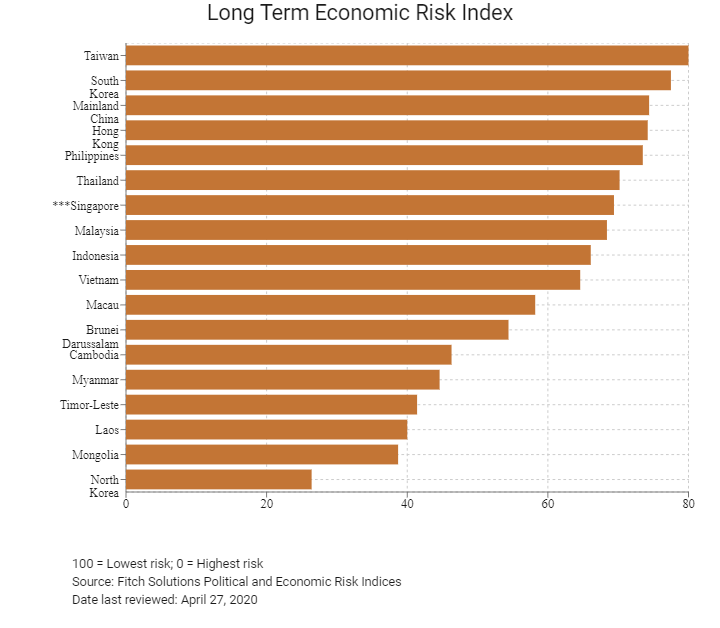

Long-Term Economic Risk Score |

72.6 |

69.4 |

69.4 |

|

Economic Risk Index |

28/202 |

28/201 |

27/201 |

|

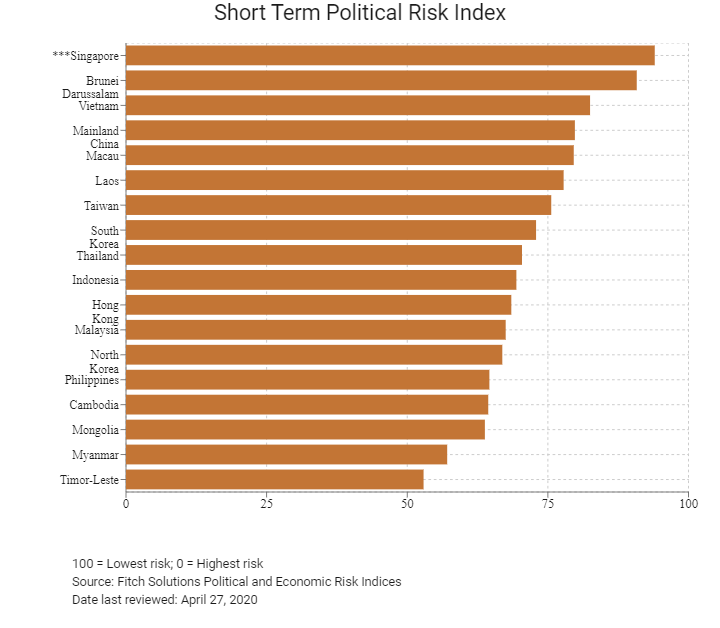

Short-Term Political Risk Score |

94.8 |

94 |

94.0 |

|

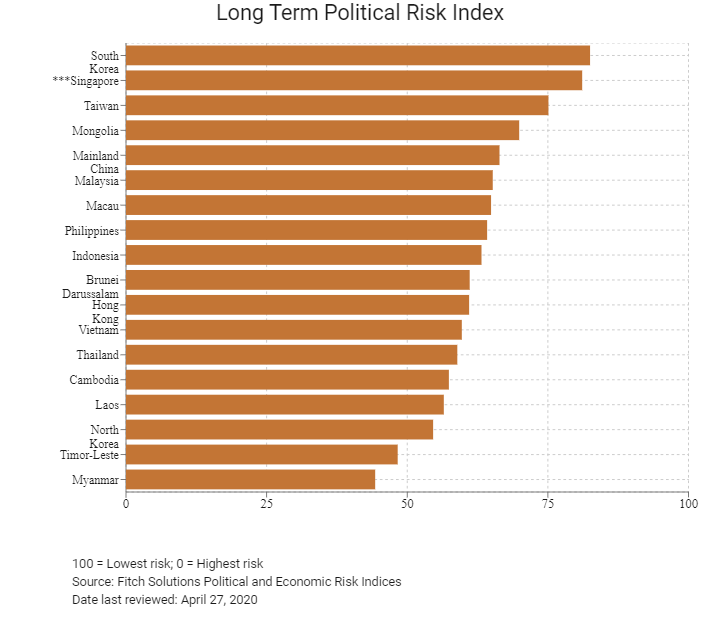

Long-Term Political Risk Score |

81.1 |

81.1 |

81.1 |

|

Operational Risk Index |

1/201 |

1/201 |

1/201 |

|

Operational Risk Score |

83.1 |

83 |

83.3 |

Source: Fitch Solutions

Date last reviewed: April 27, 2020

Fitch Solutions Risk Summary

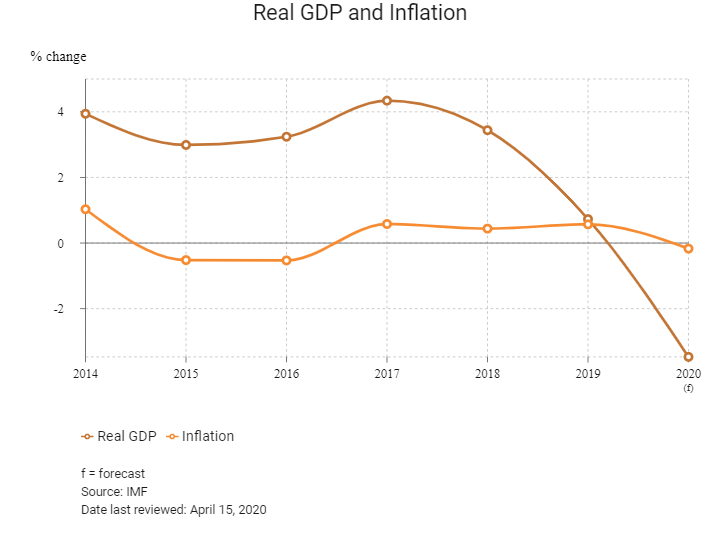

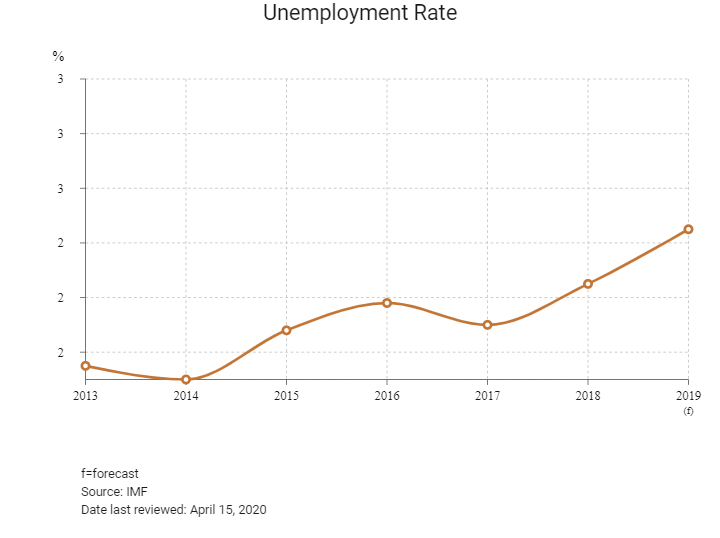

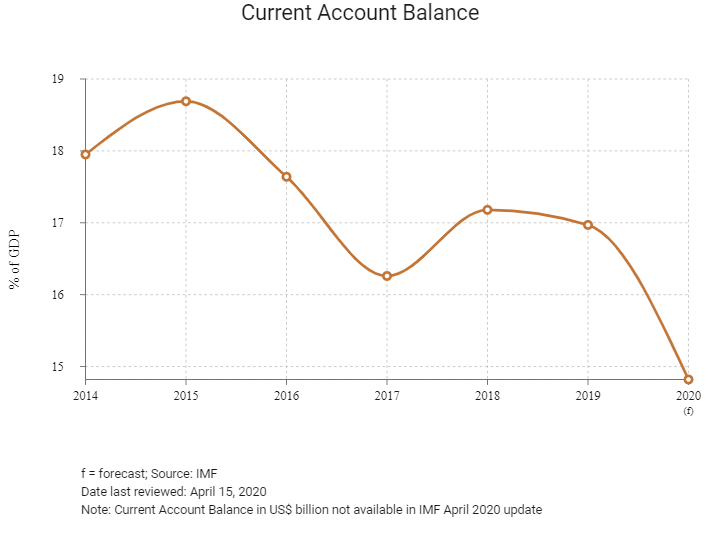

ECONOMIC RISK

Singapore's heavy dependence on international trade places it in a particularly vulnerable position at a time global trade protectionism is threatening global growth. Its significant exposure to demand dynamics and potential supply chain disruptions in the Asia region also presents downside risks. In the short term, the Singapore economy faces severe downside risks following the aggressive spread of the Covid-19 pandemic around the world. Additionally, the containment measures taken by governments around the world are likely to put further pressure on Singapore’s small and open economy. We expect the economy to contract in Q220, before a slow recovery takes place closer to Q420. Over the longer term, we maintain our stance that Singapore's strong political leadership should ensure effective management of the country's economic fundamentals.

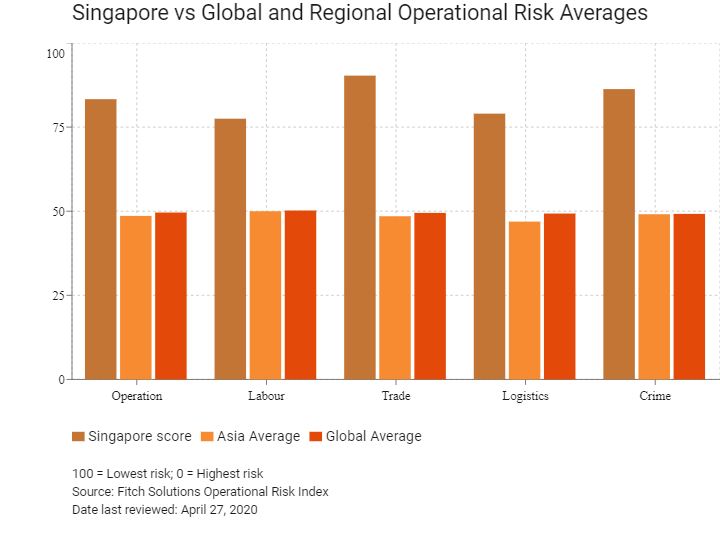

OPERATIONAL RISK

Singapore offers one of the most secure and stable business operating environments globally. This is supported by strong public institutions, stable economic policies, freedom of investment, a non-compromising approach to enforcing the law and very low crime levels. Foreign investors are further attracted by the availability of a world-class logistics network, reliable utilities and an open economy anchored on highly investor-friendly policies. The labour market is an additional attraction for businesses seeking highly skilled workers as Singapore boasts one of the best education systems in the world. That being said, the balance of risks remains tilted to the downside in the near term outlook amid a still-uncertain external backdrop, due to the coronavirus and lingering trade tensions. Furthermore, tightening regulations on the employment of foreign nationals, moderate cybercrime risk and heavy reliance on trade and services industries that are highly sensitive to the state of the global economy, are key downside risks in the medium-to-long term. Overall, however, Singapore offers diverse attractions that outweigh potential downside risks.

Source: Fitch Solutions

Date last reviewed: April 28, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Singapore score |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

East and Southeast Asia average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia position (out of 18) |

1 |

1 |

1 |

3 |

1 |

|

Asia average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia position (out of 35) |

1 |

1 |

1 |

3 |

1 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

1 |

2 |

1 |

17 |

4 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest Risk; 0 = Highest Risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 27, 2020

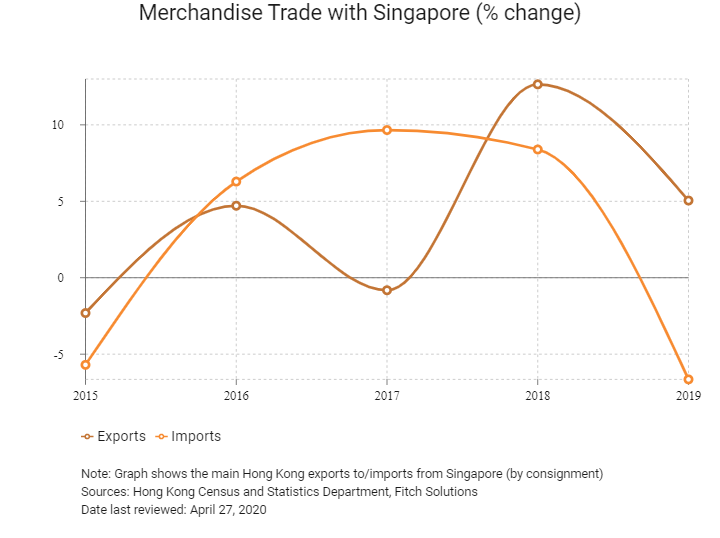

Hong Kong’s Trade with Singapore

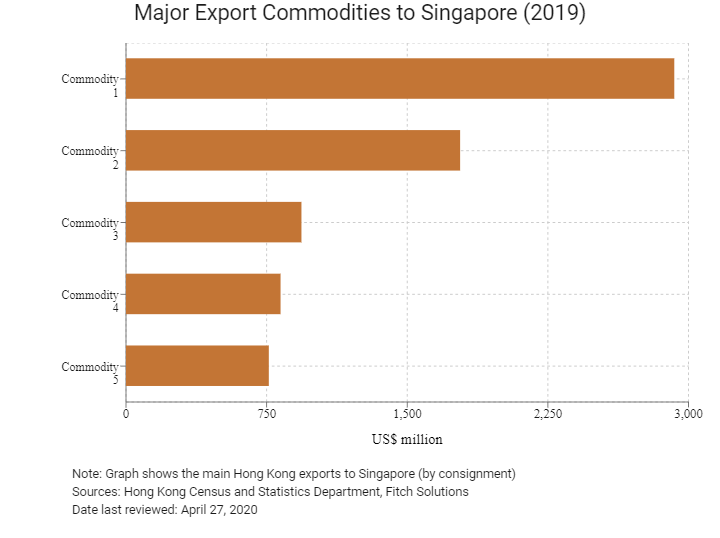

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 2,924.2 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,782.0 |

| Commodity 3 | Office machines and automatic data processing machines | 935.7 |

| Commodity 4 | Power generating machinery and equipment | 824.3 |

| Commodity 5 | Miscellaneous manufactured articles | 761.7 |

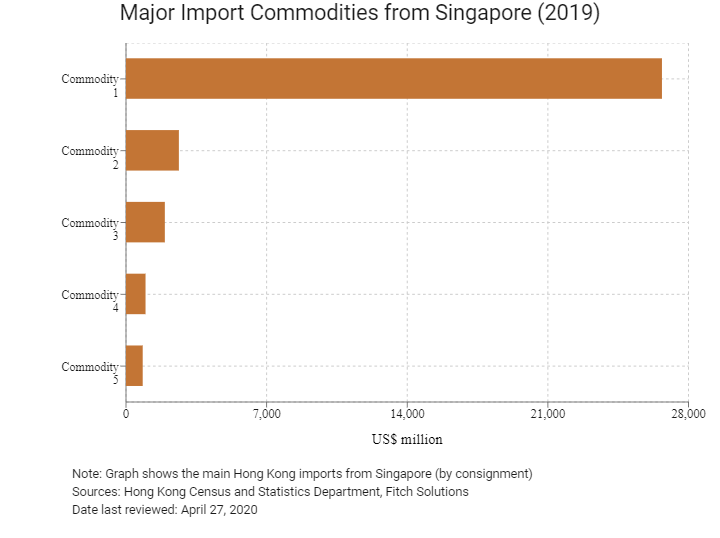

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 26,678.3 |

| Commodity 2 | Petroleum, petroleum products and related materials | 2,632.0 |

| Commodity 3 | Office machines and automatic data processing machines | 1,933.5 |

| Commodity 4 | Essential oils and resinoids and perfume materials; toilet, polishing and cleansing preparations | 972.6 |

| Commodity 5 | Telecommunications and sound recording and reproducing apparatus and equipment | 831.6 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

| 2019 | Growth rate (%) | |

| Number of Singapore residents visiting Hong Kong | 453,182 | -25.8 |

| Number of Asia Pacific residents visiting Hong Kong | 52,326,248 | 14.3 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division

| 2019 | Growth rate (%) | |||

| Number of Singaporeans residing in Hong Kong | 12,799 | 29.6 | ||

| Number of East Asians and South Asians residing in Hong Kong | 2,834,871 | 3.4 | ||

Note: Growth rate is from 2015 to 2019, no UN data available for intermediate years

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: April 27, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Singaporian companies in Hong Kong |

446 |

4.4 |

|

- Regional headquarters |

47 |

2.2 |

|

- Regional offices |

103 |

-2.8 |

|

- Local offices |

296 |

7.6 |

Sources: Hong Kong Census and Statistics Department – Business Expectation Statistics Section, Fitch Solutions

Treaties and agreements between Hong Kong/PRC and Singapore

- Singapore has a Bilateral Investment Treaty (BIT) with Mainland China which entered into force on February 7, 1986.

- Singapore has double taxation agreements (DTAs) with Mainland China and concluded a DTA with Hong Kong on November 19, 2004.

Sources: Hong Kong Inalnd Revenue Department, UNCTAD, Fitch Solutions

Chamber of Commerce or Related Organisations

The Singapore Chamber of Commerce (Hong Kong)

The Singapore Chamber of Commerce (Hong Kong) was incorporated in Hong Kong in September 1995 with the support of the Singapore Consulate-General, the then Singapore Trade Development Board, the Singapore EDB and the Singapore Tourism Board.

Address: Unit 702, 7/F, China Hong Kong Tower, 8-12 Hennessy Road, Wan Chai, Hong Kong

Email: scc@scchk.com.hk

Tel: (852) 2838 3733

Fax: (852) 2838 3390

Source: The Singapore Chamber of Commerce (Hong Kong)

Hong Kong Singapore Business Association

Email: secretariat@hsba.org.sg

Tel: (65) 6730 9285

Website: www.hsba.org.sg

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate-General of the Republic of Singapore in Hong Kong

Address: Unit 901-2, 9/F, Admiralty Centre Tower I, 18 Harcourt Road, Hong Kong

Email: singcg_hkg@mfa.sg

Tel: (852) 2527 2212

Fax: (852) 2861 3595

Source: Singapore Ministry of Foreign Affairs

Visa Requirements for Hong Kong Residents

All foreign visitors must ensure that they meet or possess the entry requirements stated by the Singapore Immigration and Checkpoints Authority. A Singapore tourist visa is not required for citizens of Hong Kong (with a valid Hong Kong passport) for a stay of up to 30 days. To apply for an entry visa for business or social visits, holders of a Hong Kong document of identity will need the following documents: a duly completed Form 14A, a recent passport-sized colour photograph taken within the last three months and a photocopy of the passport biodata page (valid for at least six months from the date of entry into Singapore). Additional supporting documents (eg, Form V39A - Letter of Introduction for Visa Application) may be required on a case-by-case basis. These travellers are advised to apply for an entry visa within 30 days prior to arrival in Singapore.

Source: Singapore Ministry of Foreign Affairs

Date last reviewed: April 27, 2020

Singapore

Singapore