GDP (US$ Billion)

54.06 (2018)

World Ranking 84/193

GDP Per Capita (US$)

26,146 (2018)

World Ranking 36/192

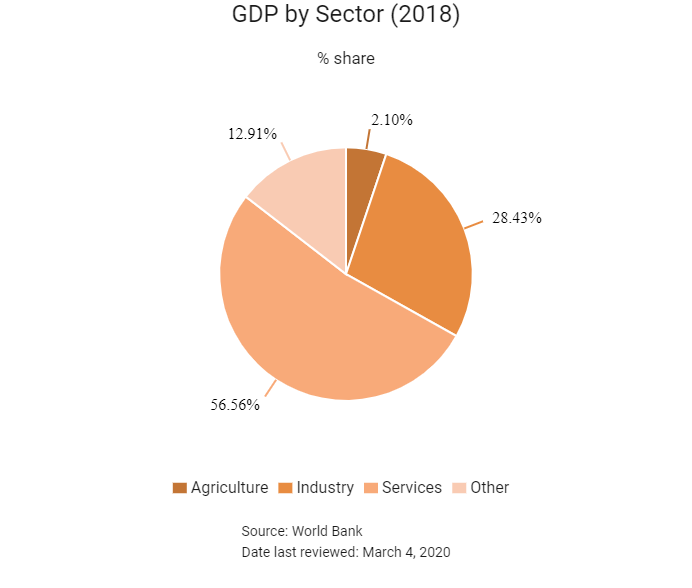

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

159.7 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

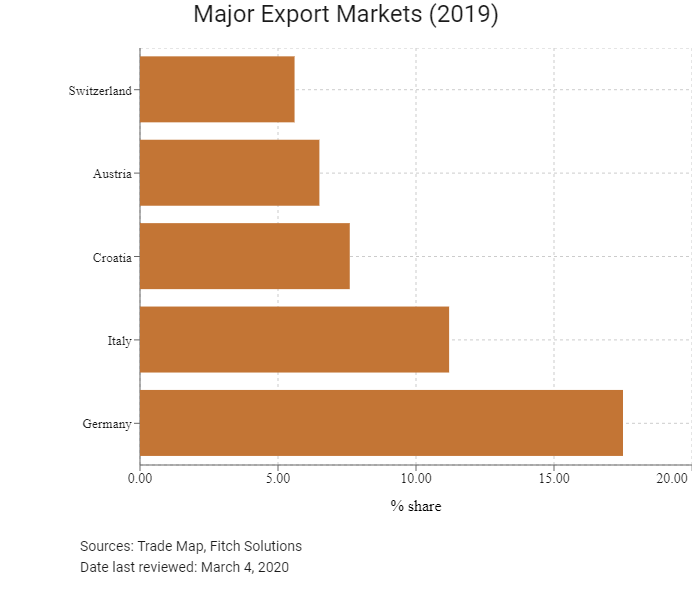

Slovenia's favourable geographical location has enabled it to become a strong regional and international player with an export-oriented manufacturing sector. However, the global economic crisis of 2008 hit hard and structural reforms are needed (through greater privatisation, improved openness to foreign investment, investor-friendly changes to taxes, labour flexibility to support greater economic competitiveness) and rising exports have the potential to lift Slovenia's long-term growth and prevent the resurfacing of imbalances that emerged before 2007. Efforts to address the threat of a rapidly ageing population are also necessary to ensure public finances remain on a sustainable trajectory. In addition, Slovenia's five-party minority coalition government continues to enjoy a strong level of public support, but will face further challenges as it attempts to tackle sensitive healthcare and welfare reforms.

Sources: World Bank, The Slovenia Times, Hong Kong Information Services Department, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2017

Gregory So, Hong Kong’s Secretary for Commerce and Economic Development, visited Ljubljana to co-host an event with The Slovenia Times to discuss the opportunities that would accompany the Belt and Road Initiative, emphasised the importance of connectivity and the joint economic and investment opportunities that would arise.

April 2017

Slovenia and Hong Kong signed a memorandum of understanding that would facilitate cooperation in wine-related businesses. The agreement might serve as a model for other Slovakian businesses to make use of the advantages offered by Hong Kong as a means to reach the East Asia markets.

June 2017

An international court of arbitration decided in favour of Slovenia in its maritime dispute with Croatia, ruling that it should have direct access to international waters in the Adriatic Sea using a corridor that crosses Croatian waters.

March 2018

Miro Cerar resigned as prime minister after the Supreme Court struck down a major railway project.

June 2018

Although former Prime Minister Janez Janša's Slovenian Democratic Party of Slovenia (SDS) made significant gains in elections, SDS did not achieve a ruling majority coalition. Marjan Serec's relatively new Lista Marjana Sarca (LMS) party formed a centre-left minority government and governs with the support of the leftist Levica party.

September 2018

Sarec, of the LMS, was sworn in as head of a centre-left minority government after the SDS failed to form a coalition.

April 2019

Slovenia’s finance minister, Andrej Bertoncelj, met with the IMF and World Bank representatives (as part of the institutions’ spring meetings) to discuss how the country is reconciling the need to improve people’s lives while maintaining fiscal stability.

April 2019

The Slovenian government issued a decree for the Divača-Koper railway line track construction contract with state-owned TDK2, to the value of USD1.1 billion. TDK2 would build the 27km second track. It would also conclude a contract based on mutual rights and obligations.

August 2019

The EU Cohesion Fund was to provide EUR101 million to modernise a railway section between Maribor and Šentilj in Slovenia. The project would increase the number of trains running on the route from 67 to 84 per day. Maribor Tezno, Maribor, Pesnica and Šentilj stations would also be refurbished under the project, while improvements would be made at the Šentilj tunnel. The project would also cover construction of the Pekel tunnel. The new railway line was expected to start operations by February 2023.

September 2019

Marjan Sarec of the LMS was sworn in as head of a centre-left minority government, after the SDS failed to form a coalition.

October 2019

The new Bank of Slovenia regulations, consumer loans other than mortgages could no longer exceed maturity of 7 years while borrowers’ debt servicing costs, including mortgages, could not exceed 67% of income.

October 2019

The Slovenian parliament passed legislation on bank bail-in repayments under which the Bank of Slovenia would have to cover all possible repayments to those who lost their investments during the country’s 2013 overhaul of the banking industry.

January 2020

Slovenian Prime Minister Marjan Šarec announced on January 27 that he would resign, citing the failure of his five-party minority coalition government to pass legislation. Hours before his announcement, Finance Minister Andrej Bertoncelj from the prime minister's own party (List of Marjan Šarec (LMŠ) also resigned over the government’s plans to cover losses of the national health system in the Slovenian budget.

February 2020

The European Investment Bank had agreed to provide a EUR90 million (USD97.5 million) loan to Slovenia-based firm Družba za avtoceste v Republiki Sloveniji (DARS) to modernise and extend the Karavanke tunnel that links the motorway between Slovenia and Austria. DARS would expand the tunnel with a new tube, revamp the existing tube and boost tunnel safety. Additionally, the bank would provide a separate loan of EUR95 million (USD102.9 million) to Austrian firm ASFINAG to link the existing highway in Austria to the new 8km tunnel.

February 2020

Telekom Slovenije and Iskratel would cooperate to support the development of smart industries in Slovenia. Increased investment in 5G would foster the adoption of advanced technologies, opening up opportunities for Slovenian businesses to benefit from the fourth industrial revolution. Smart manufacturing would be a key focus of this partnership, with the sector being paramount for the country’s economy.

Sources: BBC Country Profile – Timeline, Hong Kong Information Services Department, European Commission, Fitch Solutions, Total Slovenia News, Reuters

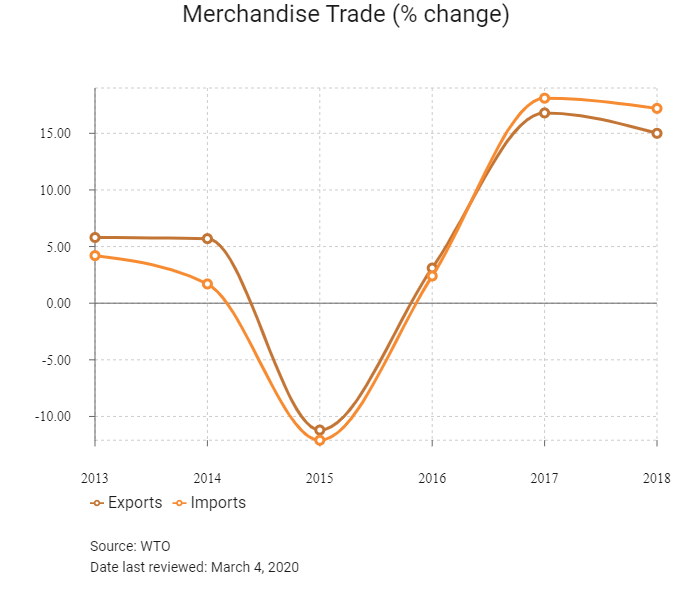

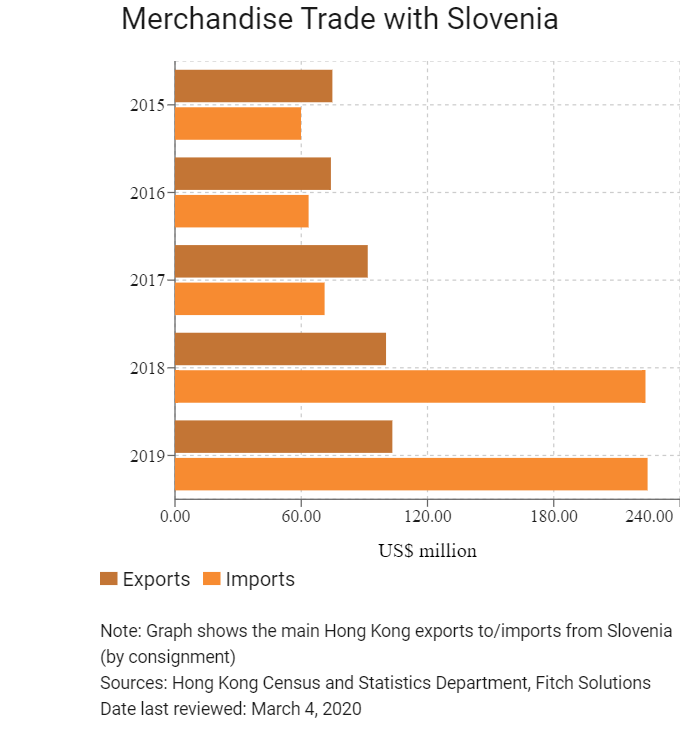

Merchandise Trade

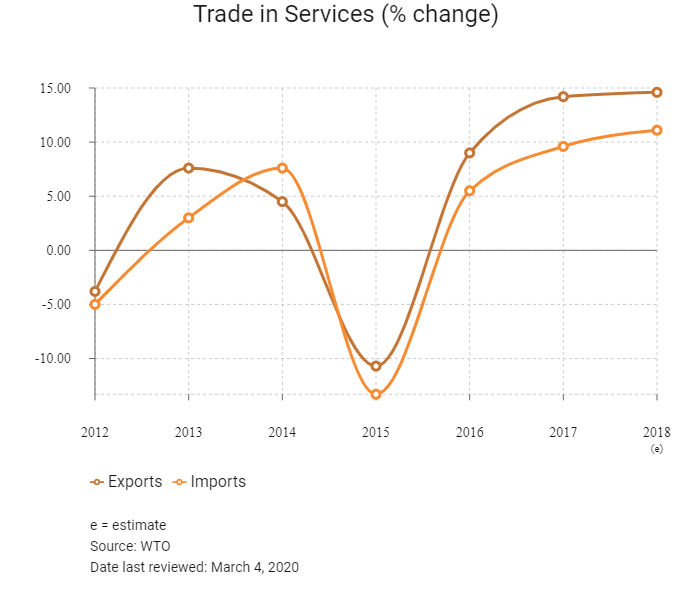

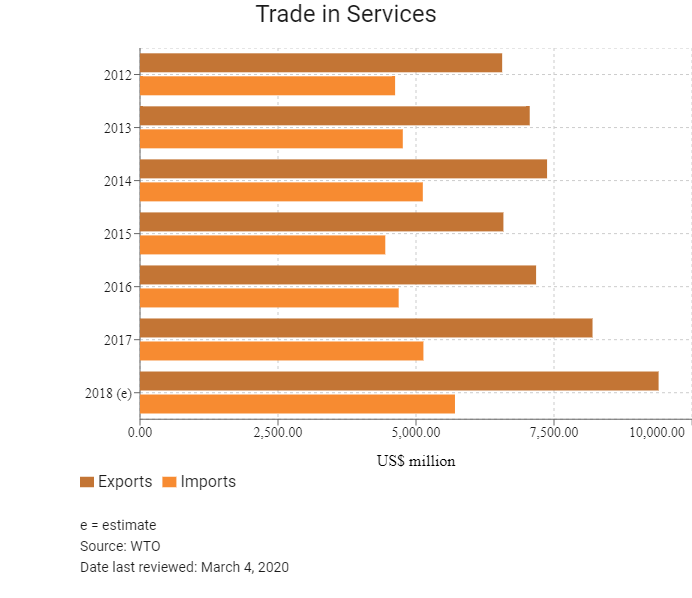

Trade in Services

- Slovenia has been a member of WTO since 30 July 1995 and a member of GATT since October 30, 1994. Slovenia became a member state of the European Union (EU) on May 1, 2004.

- Tariff rates in Slovenia are low, at an average of 1.57%, ensuring lower costs for exporters and importers, particularly if trade is taking place within the EU's customs union.

- Average import tariffs for goods from outside the EU are highest for agricultural products and processed food. The highest applied tariff for non-agricultural goods is for clothing, at 11.5%, duties for electrical machinery are significantly lower, at 2.4%, as are duties for petroleum, at 2.0%. These low tariffs facilitate trade for Slovenia – even with countries outside the EU.

- As an EU member state, Slovenia applies the Integrated Tariff of the Community which is designed as communal standards on goods and standards entering the bloc.

Sources: WTO – Trade Policy Review, Global Trade Alert, Fitch Solutions

Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 28 member nations of the EU, namely: Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

- European Economic Area (EEA)-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting importers and exporters.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the European Commission, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. After four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019 after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second-largest trading partner in Asia, after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-SADC EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and eSwatini): An agreement between the EU and the Southern African Development Community (SADC) was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of SADC not included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs – such as with the East African Community and the Economic Community of Central African States.

Provisionally Active

The Comprehensive Economic and Trade Agreement (CETA): CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and the EU Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy, utilities and public transport.

Ratification Pending

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (31 of the 34 parties have ratified the agreement as of May 2019). The agreement has been provisionally applied since 2013.

- EU-Singapore Fair Trade Agreement (EUSFTA): On February 13, 2019, the European Parliament passed the agreement which would see the creation of the EUSFTA. However, before the agreement is implemented, all the states involved will need to ratify the agreement through their individual legislatures; in this case, the FTA may become provisionally active along the lines of states which have already ratified the agreement.

- EU-Vietnam FTA: In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement. In 2019, the final text of the agreement was signed by both parties and is awaiting conclusion.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017, and bilateral trade in services added an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the Trump administration in the United States against the backdrop of rising global trade tensions.

- EU-New Zealand: In June 2018, the EU and New Zealand launched trade negotiations to remove trade barriers for goods and services, as well as the development of trade rules to facilitate easier and sustainable trade between both parties.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Slovenian Public Agency for the Promotion of Entrepreneurship, Innovation, Development, Investment and Tourism promotes foreign direct investment (FDI) and advocates for foreign investors in Slovenia. Its mission is to enhance Slovenia’s economic competitiveness through technical and financial assistance to entrepreneurs, businesses, and investors.

- Slovenia’s Promotion of FDI and Internationalisation of Enterprises Act covers the main goals and measures for the promotion of FDI. These include free of charge consultation services for foreign investors, promoting Slovenia as an investment destination, improving Slovenia’s competitiveness and financial incentives.

- In 2010, Slovenia signed the Organisation for Economic Co-operation and Development (OECD) convention and became a member of the OECD. Slovenia is also one of only three emerging European countries that have been able to adopt the euro, which it did in 2007, enabling its exporters and capital markets to benefit from reduced transaction costs.

- Foreign companies that conduct business in Slovenia have the same rights, obligations, and responsibilities as domestic companies. The Law on Commercial Companies and the Law on Foreign Transactions guarantees companies’ basic rights and helps to ensure that foreign companies are accorded equality under the law.

- Both foreign and domestic private entities have the right to establish and own business enterprises and engage in different forms of remunerative activity. Slovenia has relatively few limits on foreign ownership or control. There are limits on banking and investment services, private pensions, insurance services, asset management services, and settlement, clearing, custodial, and depository services provided in Slovenia, but headquartered in non-EU countries. In the video game industry, there is a 20% cap on foreign ownership. In the air transport industry, registration of an aircraft is only possible for aircrafts owned by Slovenian or EU nationals or companies controlled by them. Companies controlled by Slovenian nationals or carriers complying with EU regulations on ownership and control are the only entities eligible for Air Operator's Certificates for performing airline services. In the maritime transport industry, the law forbids majority ownership by non-EU residents of a Slovenian flag maritime vessel unless the operator is Slovenian or an EU national.

- In order to establish a business in Slovenia, a foreign investor must produce capital of at least EUR7,500 for a limited liability company and EUR25,000 for a stock company.

- Slovenian Sovereign Holding manages a privatisation portfolio of companies acquired as a result of state bail-outs during the financial crisis, including assets held by the Bank Assets Management Company.

- Slovenia has signed 35 bilateral investment treaties, around a quarter of which are with non-EU countries. Treaties with Russia, Belarus and India, were signed in 2000, 2006 and 2011 respectively, but have not yet entered into force.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Invest Slovenia, UNCTAD

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free Economic Zones (FEZs): Koper and Maribor |

- FEZs may be established by one or more domestic legal persons. The founders must provide the resources necessary for the establishment and commencement of operation, as well as suitable technical, organisational, ecological and other conditions for the performance of business activities. |

|

Free Customs Zone (FCZ): Port of Koper |

- Under the Customs Act, actors operating in FCZs are not liable for the payment of customs duties, nor are they subject to other trade policy measures until goods are released into free circulation. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 22%

- Corporate Income Tax: 19%

Source: Financial Administration of the Republic of Slovenia

Important Updates to Taxation Information

- Based on the Amendments of the Slovene Personal Income Tax Act, a new tax bracket was introduced for 2017 and onwards between the previous second and third brackets, with a tax rate of 34%. In addition, the tax rate in the fourth tax bracket was reduced from 41% to 39%.

- In October 2019, the Slovenian lawmakers approved a package of tax changes, which includes higher capital-gains tax, lower personal-income tax, and a lower limit to effective tax rates for corporations. The government also sated that it wants to fast-track the procedure so they can enter into force with the start of 2020. Capital-gains tax to be raised to 27.5% from 25%.

- Personal income tax will be lowered in second and third tax brackets – to 26% from 27% and 33% from 34%. The introduction of a minimum corporate tax rate of 7% that includes limitations on the application of tax reliefs and tax losses.

- As of 1 January, 2020, the amendment CIT-2R, which regulates corporate taxation, will come into effect. CIT-2R limits investment allowances and transferred tax loss allowances to 63% of the tax base. An amendment to the Tax Procedure Act will also come into effect from 2020.

- As of 1 January, 2020, a super reduced VAT rate of 5% applies for the supply of books and newspapers in physical or e-form.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Income Tax |

The standard corporate income tax rate is 19%. Investment funds may be taxed at a rate of 0% if certain conditions are met. |

|

Resident company: Capital Gains Tax |

Capital gains are treated as ordinary income and the full amount of the realised gain is subject to tax at 19%. |

|

Social security contributions (paid by both employers and employees) |

- Employers contribute 16.10% and employees contribute 22.10%. |

|

VAT |

- Standard rate of 22% |

|

Real Estate Transfer Tax levied on the acquisition of real estate |

2% of the purchase price of real estate |

|

Financial Services Tax |

8.5% applied to the fee for any services provided by banks and financial institutions |

|

Payments to foreign affiliates |

Such payments are normally subject to withholding tax if there is no right to apply exemptions in accordance with Slovenian legislation or double taxation treaties. Payments similar to dividends, including disguised distribution of profit, are not tax deductible. Any other payments to foreign affiliates are tax deductible if they are made in accordance with the arm’s-length principle. |

|

Tax relief for investment in Pomurje |

Entities based in the Pomurje region of Slovenia may claim additional employment incentives and additional tax relief for investment. These extra benefits are available until 2019. Provided certain conditions are met, such entities are entitled to a 70% tax allowance for investment in equipment and intangible assets as well as to certain employment allowances. |

|

Withholding Taxes (tax must be calculated and withheld on the payments made by residents and non-residents on Slovenian-sourced income to recipients outside Slovenia) |

The rate is 15% each on dividend income, royalties and interest, which may be reduced if a double taxation agreement exists. |

Source: Financial Administration of the Republic of Slovenia

Date last reviewed: March 4, 2020

Foreign Worker Permits

Although the EEA and Swiss citizens do not require visas to work in Slovenia, they must apply for a residence registration certificate for stays longer than three months. Residents are eligible to apply for permanent residency after a period of five years of uninterrupted residence. When employing citizens of EEA countries and Switzerland, an employer is obliged to register the employment details to the Employment Service of Slovenia within eight days of starting a job. The EU Blue Card Regime makes it easier for highly skilled workers outside of the EEA to enter Slovenia.

Localisation Requirements

Third country nationals in Slovenia are eligible to attend a free programme for the initial integration of immigrants that includes learning about Slovenian society and lessons in Slovene language. The length of the course varies acccording to the type of residence permit.

Visa/Travel Restrictions

Non-EU nationals staying longer than three months must apply for a residence permit. EU nationals staying beyond three months must obtain a residence registration certificate in the area where they live.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa1 (Positive) |

26/04/2019 |

|

Standard & Poor's |

AA- (Stable) |

14/06/2019 |

|

Fitch Ratings |

A (Stable) |

17/01/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

37/190 |

40/190 |

37/190 |

|

Ease of Paying Taxes Index |

58/190 |

41/190 |

45/190 |

|

Logistics Performance Index |

35/160 |

N/A |

N/A |

|

Corruption Perception Index |

36/180 |

35/180 |

N/A |

|

IMD World Competitiveness |

37/63 |

37/63 |

N/A |

Sources: World Bank, IMD, Transparency International, national sources

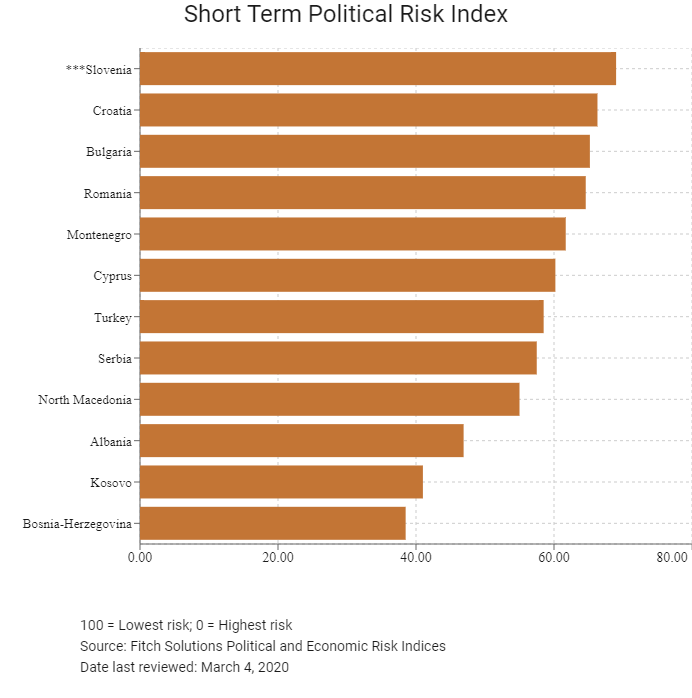

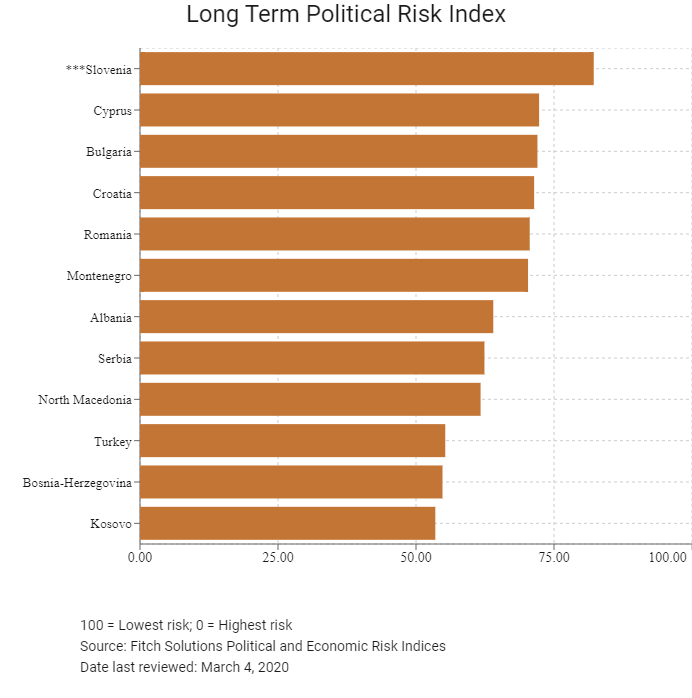

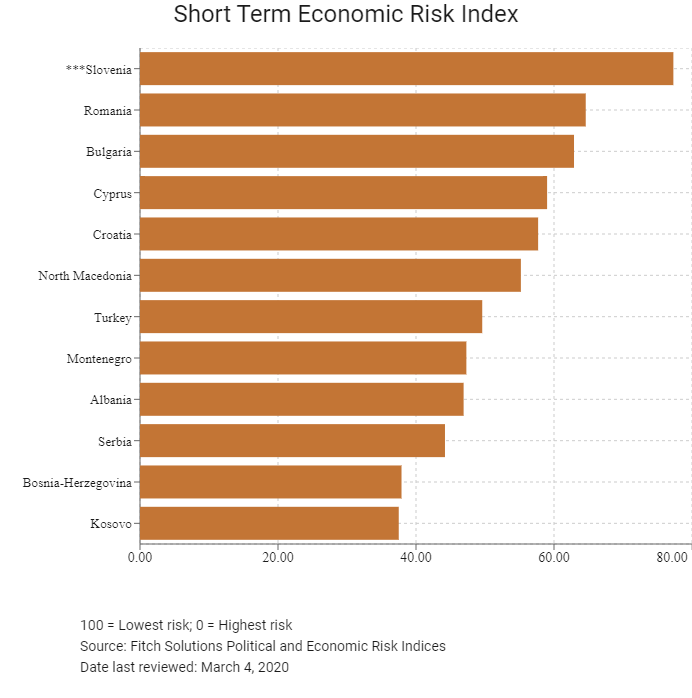

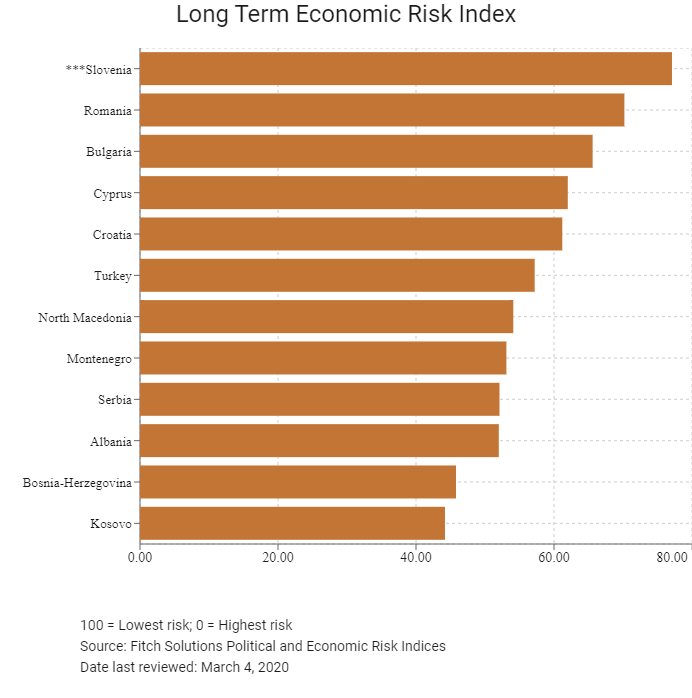

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

24/202 |

14/201 |

15/201 |

|

Short-Term Economic Risk Score |

80.2 |

78.1 |

77.3 |

|

Long-Term Economic Risk Score |

73.6 |

76.5 |

77.1 |

|

Political Risk Index Rank |

20/202 |

19/201 |

25/201 |

|

Short-Term Political Risk Score |

69.8 |

70.6 |

69.0 |

|

Long-Term Political Risk Score |

84.7 |

84.7 |

82.2 |

|

Operational Risk Index Rank |

32/201 |

33/201 |

32/201 |

|

Operational Risk Score |

67.9 |

68.9 |

69.1 |

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Risk Summary

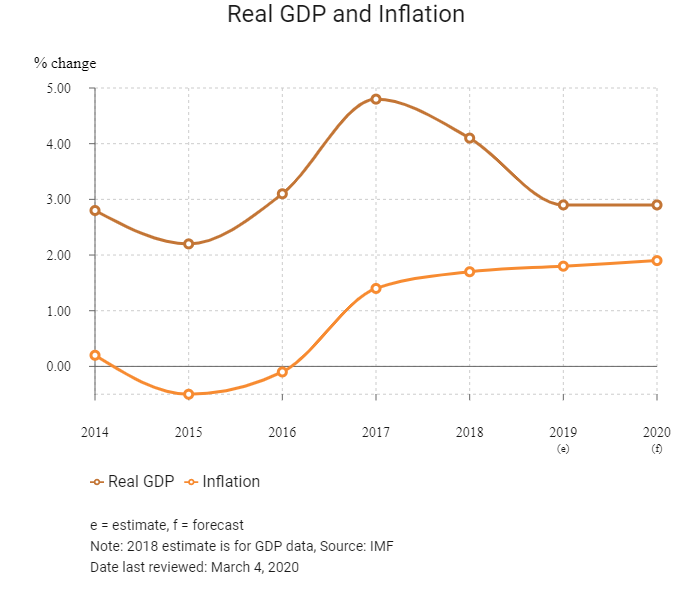

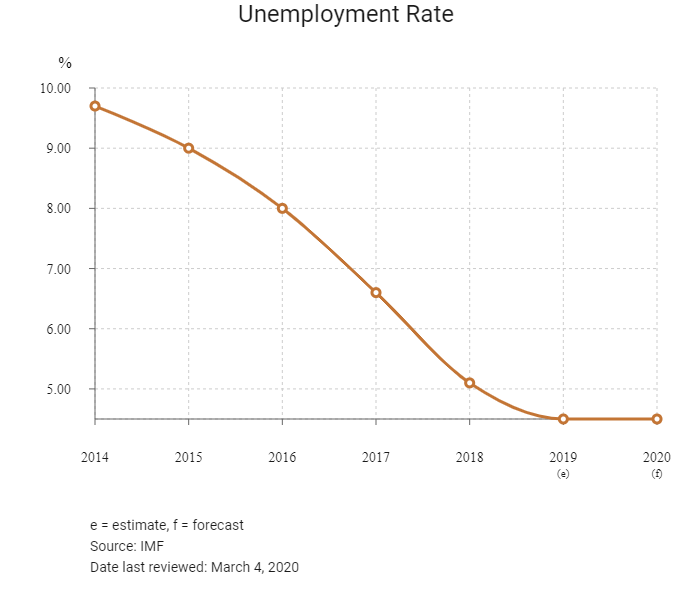

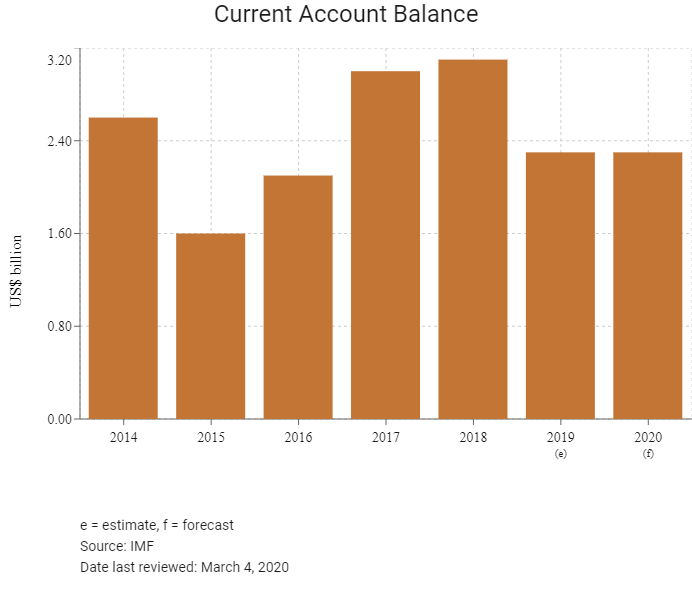

ECONOMIC RISK

Growth is projected to soften in 2020 on a continued slowdown in regional demand on the country's key export-facing manufacturing sector and rising external headwinds. Reduced absorption of EU funds and lower levels of capacity utilisation will constrain fixed investment growth, while the government’s tighter fiscal stance will drag on overall domestic demand. Private consumption should continue expanding at a healthy pace owing to a tight labour market and higher wages. Slovenia's long-term growth performance will remain dependent on the state’s ability to carry out difficult reforms aimed at addressing the challenges posed by an ageing population, skilled labour shortages and capacity constraints. Plans to increase financial sector supervision and regulation will assist anti-inflation policies and restrain unsustainable credit growth. As an open economy, Slovenia remains vulnerable to external shocks, such as the impact of global trade tensions and faltering regional demand.

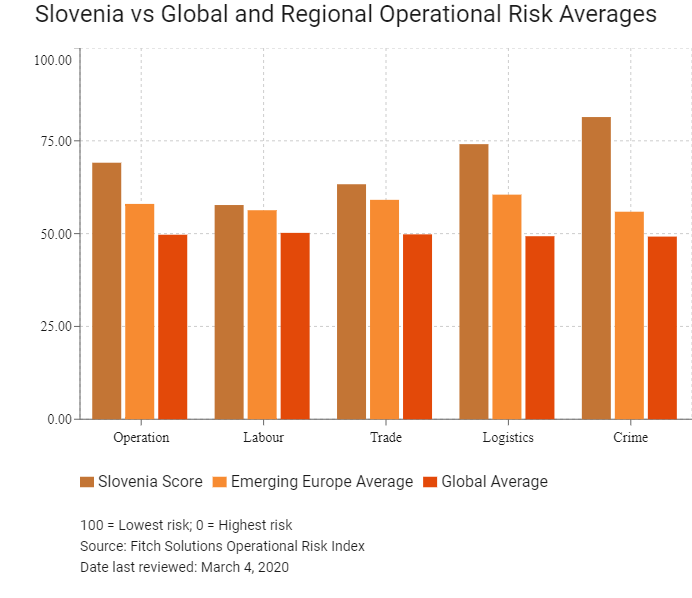

OPERATIONAL RISK

Slovenia presents the most attractive business environment in South East Europe. The country’s most positive attributes stem from a positive performance in terms of crime and security risks. This includes the low risk of terrorism, interstate conflict or criminal threats for businesses and supply chains, and successful anti-graft campaigns. The country also benefits from a relatively well-developed and well-integrated transport network and utilities sectors. The main downsides are attributed to Slovenia’s increasing corporate tax rates and the country’s small and costly workforce, resulting in a highly uncompetitive market compared with other manufacturing-oriented states in the wider emerging Europe region. An ageing and declining population weighs on the country’s attractiveness as an investment destination.

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Slovenia Score |

69.1 |

57.7 |

63.3 |

74.1 |

81.4 |

|

Southeast Europe Average |

57.7 |

52.9 |

58.8 |

60.7 |

58.5 |

|

Southeast Europe Position (out of 12) |

1 |

4 |

4 |

1 |

1 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

5 |

16 |

11 |

3 |

1 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

32 |

52 |

50 |

25 |

13 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Slovenia |

69.1 |

57.7 |

63.3 |

74.1 |

81.4 |

|

Romania |

63.8 |

60.1 |

61.2 |

66.1 |

67.8 |

|

Croatia |

62.4 |

53.2 |

56.7 |

70.3 |

69.5 |

|

Cyprus |

62.2 |

56.0 |

64.1 |

63.0 |

65.8 |

|

Bulgaria |

61.8 |

58.2 |

63.9 |

60.9 |

64.1 |

|

Serbia |

58.4 |

59.6 |

60.9 |

60.7 |

52.4 |

|

Montenegro |

57.7 |

56.8 |

58.4 |

57.7 |

58.0 |

|

North Macedonia |

56.7 |

44.9 |

64.2 |

59.8 |

57.8 |

|

Turkey |

56.1 |

53.2 |

59.8 |

65.2 |

46.1 |

|

Kosovo |

49.6 |

44.3 |

48.3 |

48.3 |

57.4 |

|

Albania |

48.1 |

46.1 |

46.4 |

50.7 |

49.0 |

|

Bosnia-Herzegovina |

47.1 |

45.1 |

58.6 |

51.6 |

33.2 |

|

Regional Averages |

58.1 |

54.0 |

58.8 |

61.1 |

58.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.4 |

45.8 |

45.9 |

|

Global Markets Averages |

49.7 |

50.3 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 4, 2020

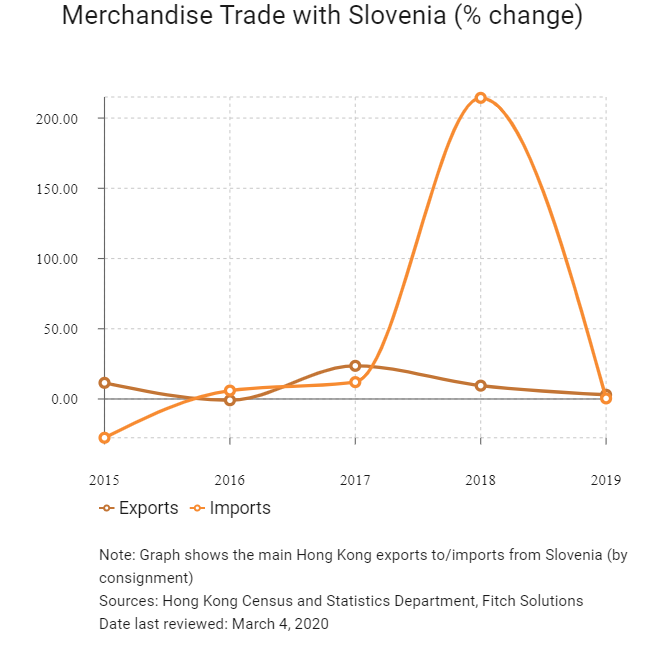

Hong Kong’s Trade with Slovenia

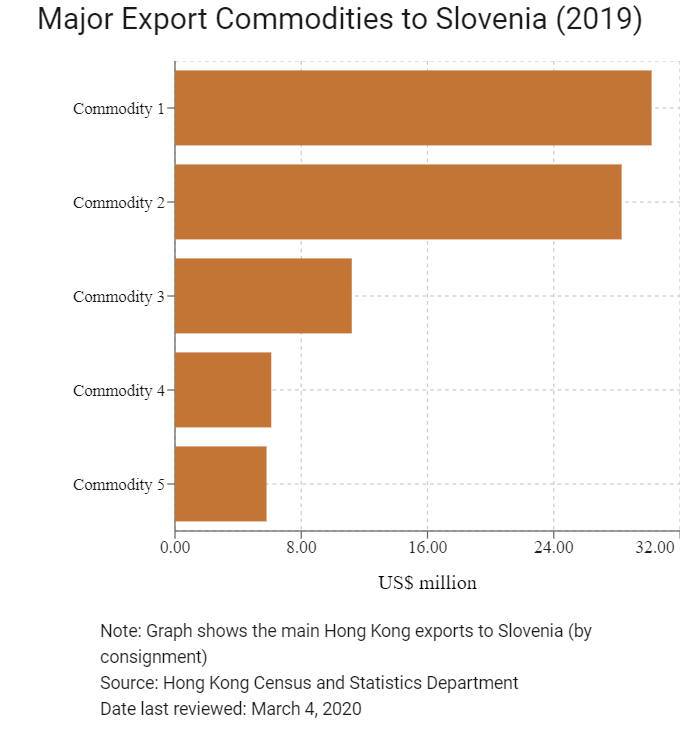

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 30.2 |

| Commodity 2 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 28.3 |

| Commodity 3 | Office machines and automatic data processing machines | 11.2 |

| Commodity 4 | Miscellaneous manufactured articles | 6.1 |

| Commodity 5 | Tobacco and tobacco manufactures | 5.8 |

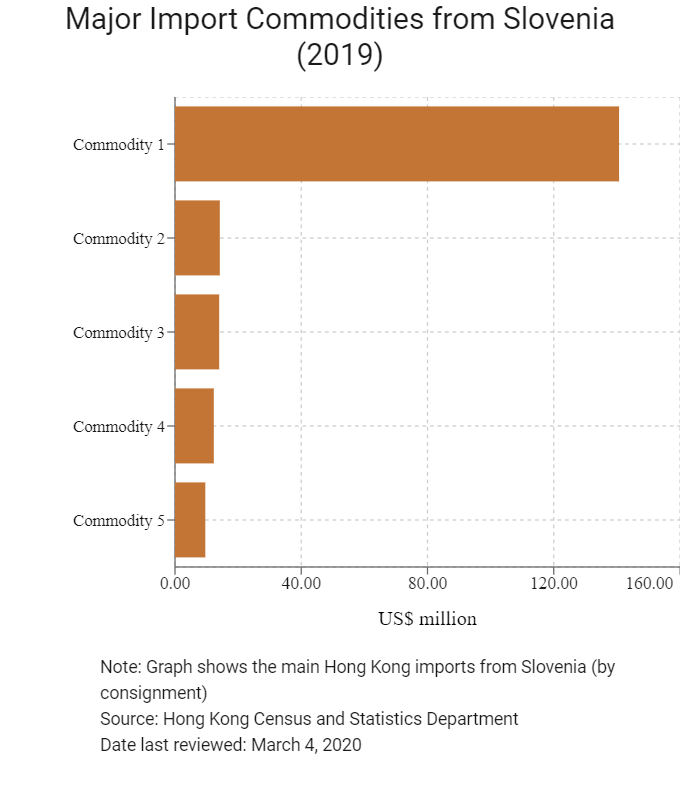

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Road vehicles (including air cushion vehicles) | 140.7 |

| Commodity 2 | Photographic apparatus, equipment and supplies; optical goods; and watches and clocks | 14.2 |

| Commodity 3 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 14.0 |

| Commodity 4 | Professional, scientific and controlling instruments and apparatus | 12.3 |

| Commodity 5 | Metalliferous ores and metal scrap | 9.6 |

|

2019 |

Growth rate (%) |

|

|

Number of Slovenian residents visiting Hong Kong |

2,445 |

-22.2 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: March 4, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

1,253 |

N/A |

|

- Regional headquarters |

507 |

7.8 |

|

- Regional offices |

746 |

6.0 |

|

- Local offices |

1063 |

13.3 |

Sources: Hong Kong Census and Statistics Department, Fitch Solutions

Treaties and Agreements between Hong Kong and Slovenia

- Double taxation agreement with Mainland China (effective from December 1995)

- Agreement between the Mainland Chinese government and the Slovenian government concerning the encouragement and reciprocal protection of investment (came into force in January 1995)

Source: Hong Kong Department of Justice

Chamber of Commerce (or Related Organisations) in Hong Kong

Honorary Consulate General of Slovenia in Hong Kong

Address: 9/F, Fu Hing Building, 10 Jubilee Street, Central, Hong Kong

Email: phlandpt@biznetvigator.com

Tel: (852) 2545 2107

Fax: (852) 2543 4669

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

Visa on arrival valid for 90 days in any 180-day period.

Source: Hong Kong Immigration Department

Date last reviewed: March 4, 2020

Slovenia

Slovenia