GDP (US$ Billion)

8.09 (2018)

World Ranking 145/193

GDP Per Capita (US$)

1,293 (2018)

World Ranking 163/192

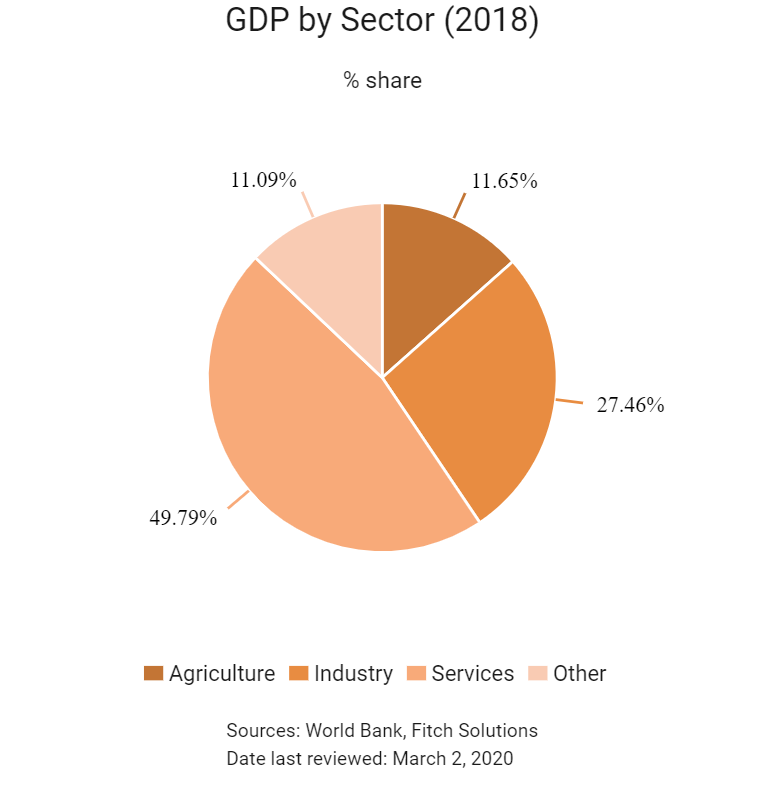

Economic Structure

(in terms of GDP composition, 2019)

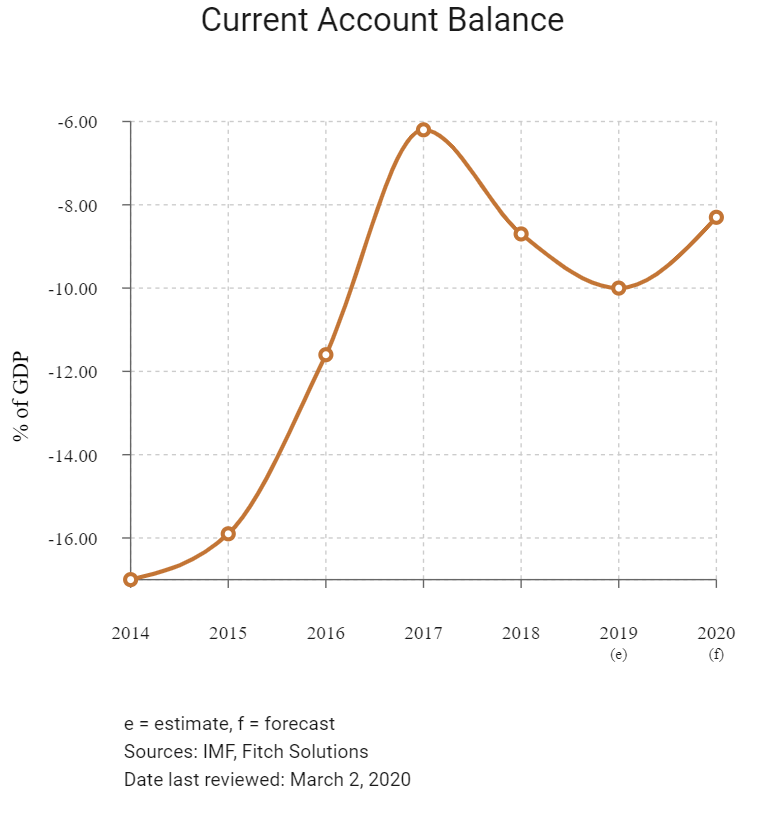

External Trade (% of GDP)

103.1 (2019)

Currency (Period Average)

Kyrgyzstani Som

69.79per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Kyrgyzstan is a land-locked, lower-middle-income country that has rich endowments, including minerals, forests, arable land and pastures, and there is significant potential for the expansion of its agriculture sector, hydroelectricity production and tourism industry. Following peaceful elections in November 2017, the coalition government (which is accountable to the parliament) embarked on an ambitious reform agenda. However, the economy is vulnerable to external shocks owing to its reliance on one gold mine, Kumtor, which accounts for about 10% of GDP, and on worker remittances, equivalent to about 27% of GDP in 2018.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2016

Kyrgyzstani voters approved a raft of constitutional changes in a referendum which strengthened prime ministerial powers.

October 2017

Sooronbai Jeenbekov was elected president.

April 2019

The Asian Development Bank approved financing worth USD100 million for the modernisation of the Uch-Kurgan hydropower plant installed along the Naryn River cascade in Kyrgyzstan. Ageing equipment would be upgraded under the project. The project would restore full operation of all four generating units of the plant to increase the capacity from 180MW to 216MW. The scheme also entailed reinforcing hydraulic steel structure and dam infrastructure of the plant, while making all eight bottom outlet gates operational. Work also includes the removal of undertake silt and sedimentation to help restore proper operation of the plantˈs hydro-mechanical equipment. ADB would also administer a USD45 million loan from the Eurasian Development Bank for the modernisation.

August 2019

Activity at the Zhong Ji Mining company gold mine was suspended following clashes between local residents and mine workers in the central Naryn province.

October 2019

Canadian firm Centerra, owner of Kumtor – Kyrgyzstan’s only commercial gold mine – announced that gold production increased by 64% during the first half of the year.

Sources: BBC Country Profile – Timeline, ADB, Fitch Solutions

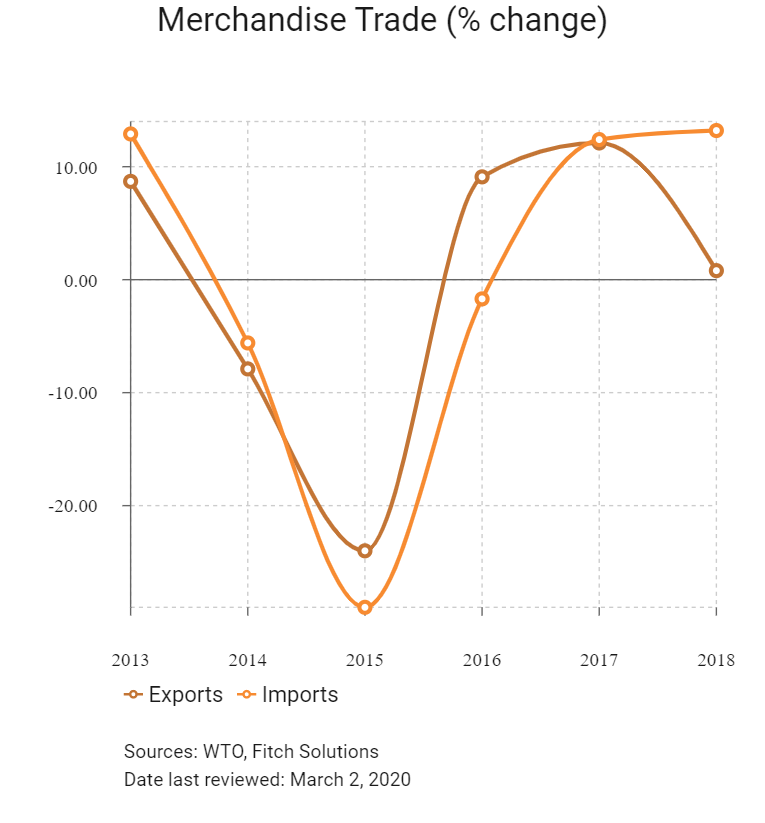

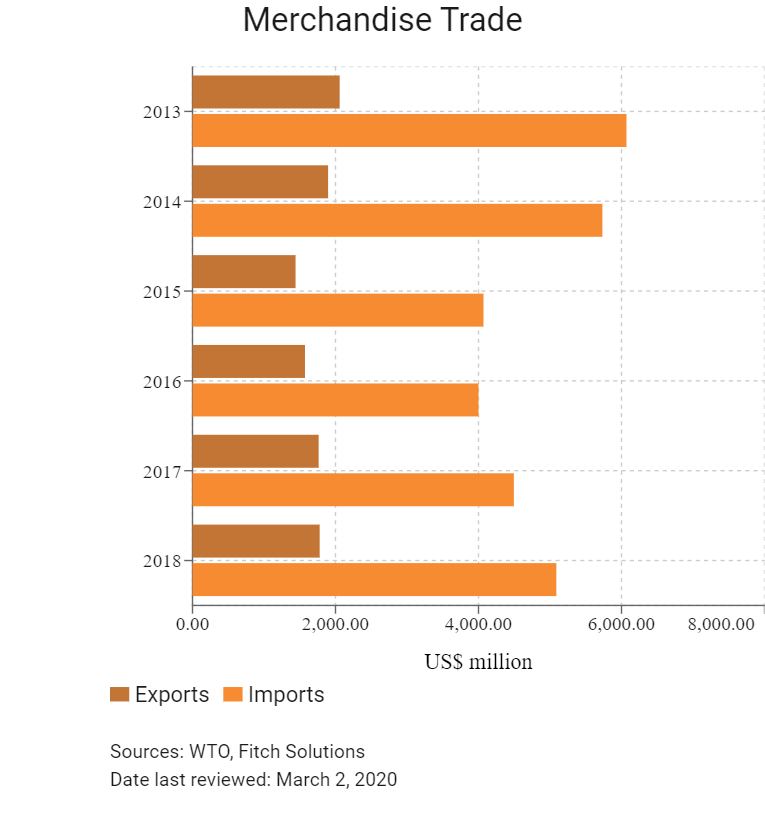

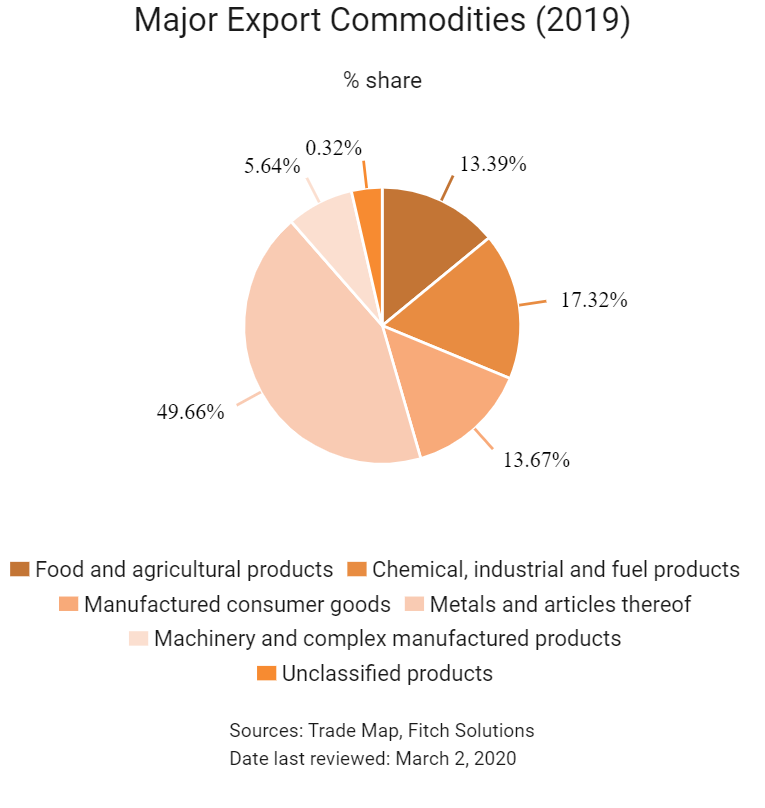

Merchandise Trade

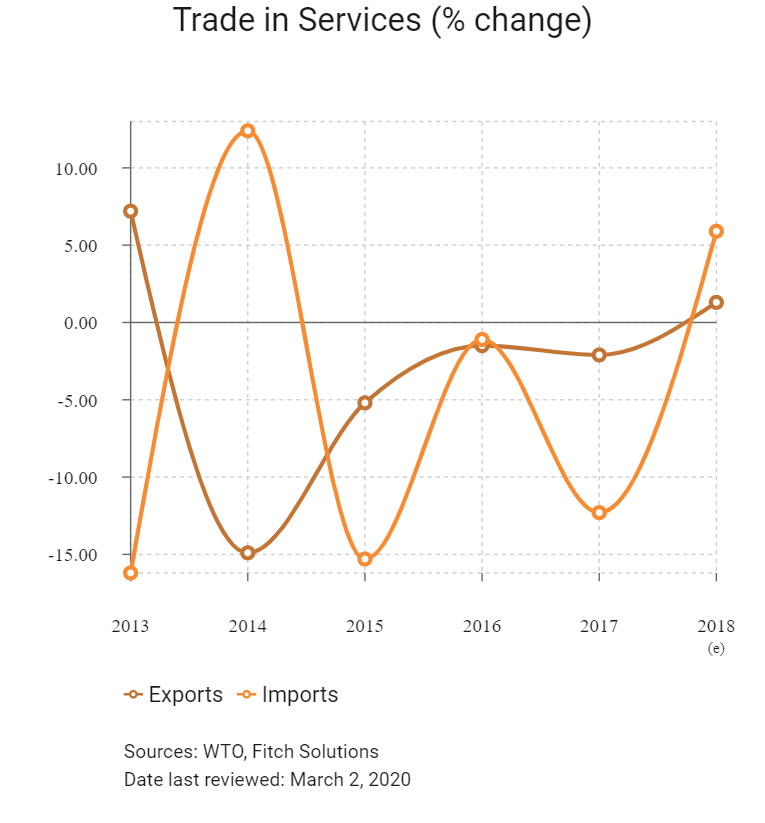

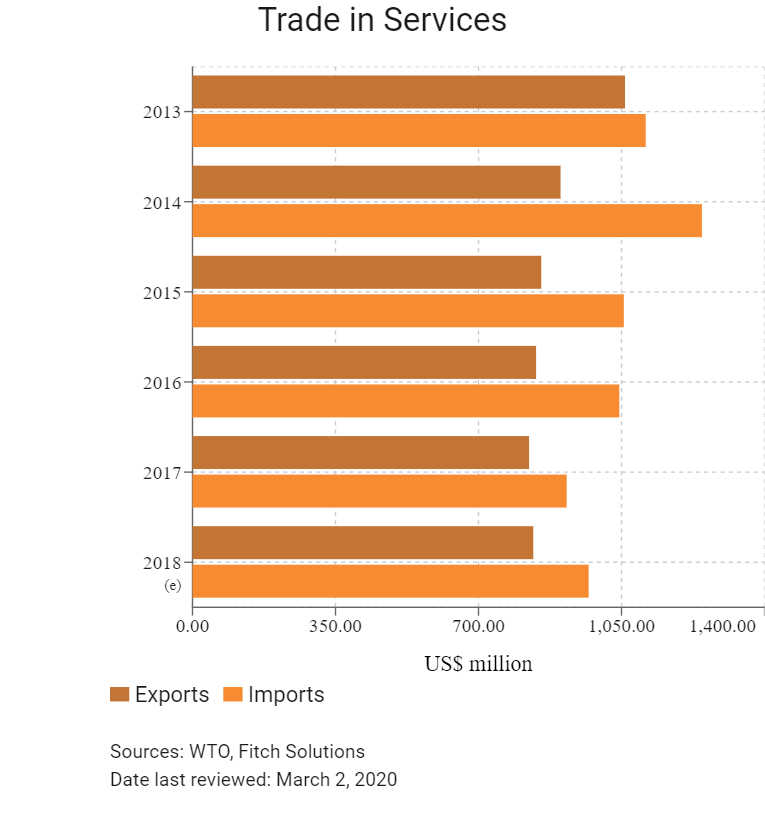

Trade in Services

- Kyrgyzstan joined the World Trade Organization (WTO) in 1998.

- Kyrgyzstan's trade profile received a significant boost when the country ascended to the Russian-led Eurasian Economic Union (EAEU) single market trading bloc in 2015. It is a member along with Russia, Belarus, Kazakhstan and Armenia. The EAEU single market provides for the free movement of goods, people, capital and services between member states, with a common external tariff regime.

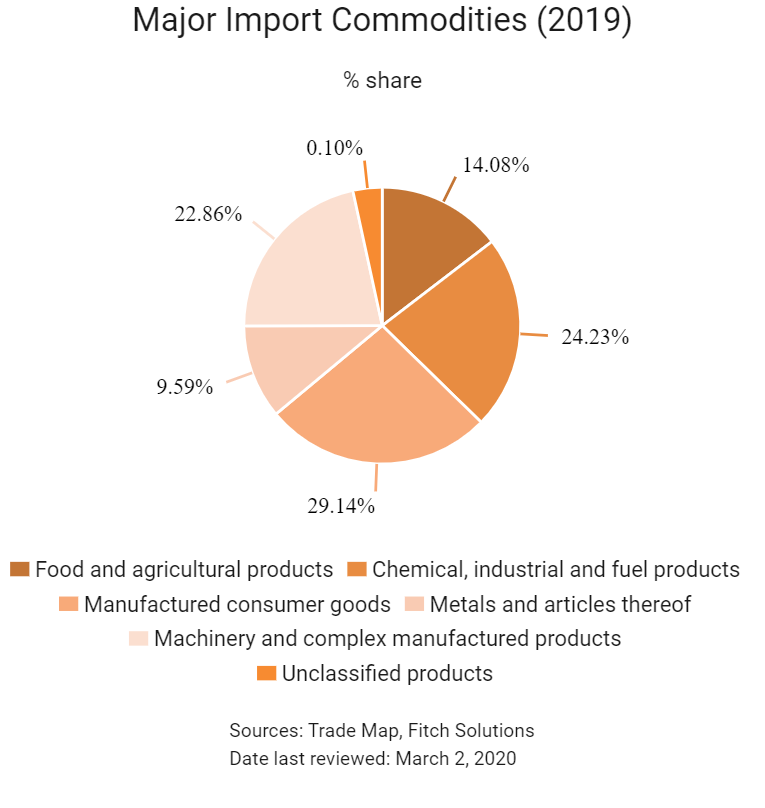

- Various anti-dumping measures were imposed on products from Ukraine, autos parts and steel products from Mainland China, and autos from various countries. The country is highly dependent on imports for consumer and industrial needs. This makes accessing them from non-EAEU markets significantly more expensive. Given that Mainland China is Kyrgyzstan's neighbour, this has significantly impacted trade flows between the two countries. In October 2019 Ukraine initiated dispute complaints against Kyrgyzstan and Armenia to challenge anti-dumping duties imposed by on steel pipes originating from Ukraine.

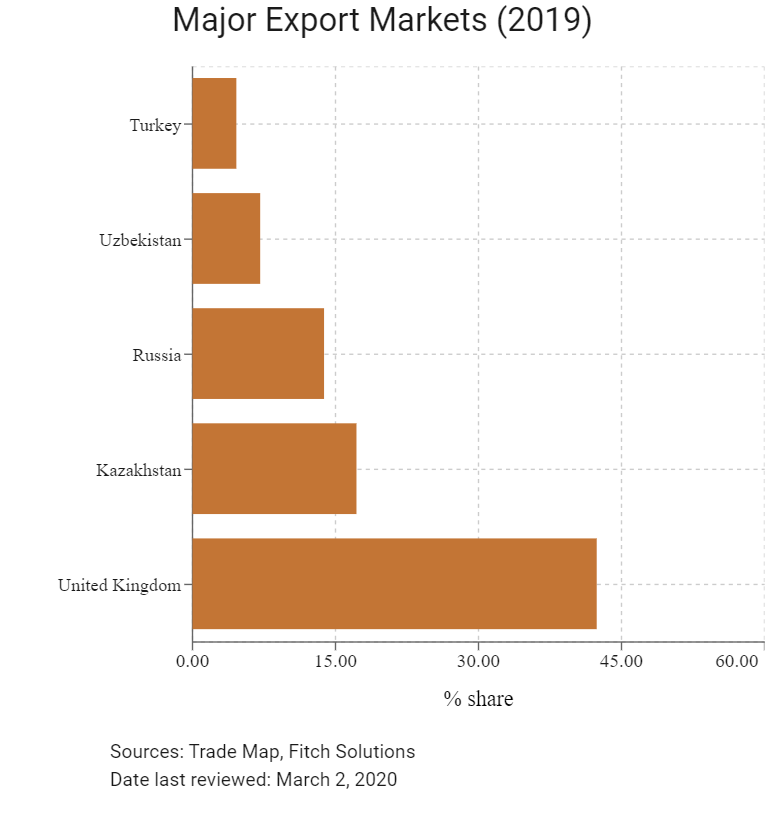

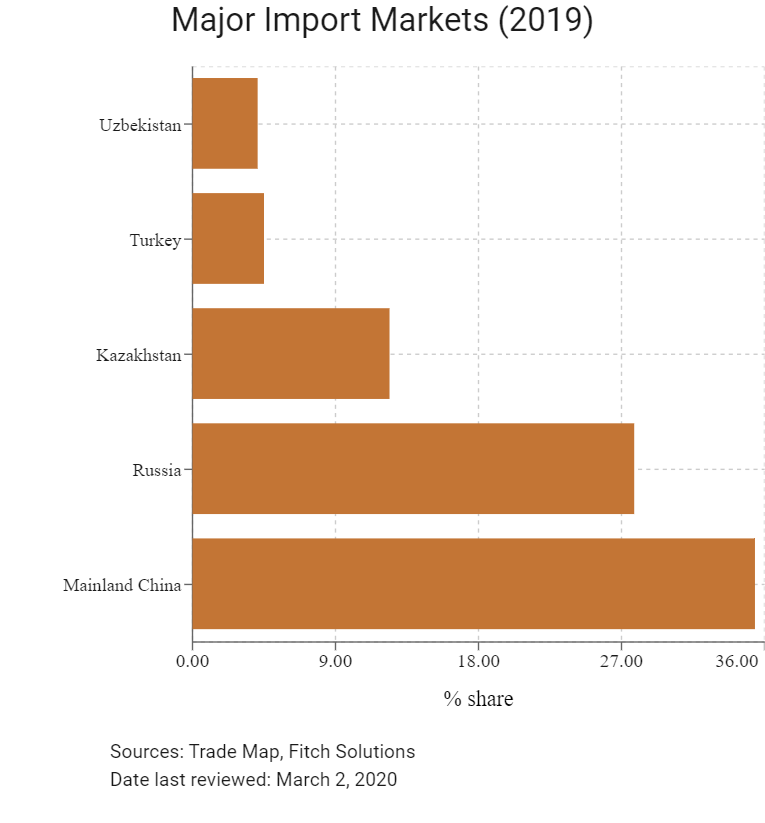

- The country's landlocked status has meant that in the past it has largely traded with its immediate neighbours, such as Russia and Mainland China. Trade with Russia has benefitted from Kyrgyzstan's accession to the EAEU.

- Mainland China has become Kyrgyzstan's most important source of goods. Mainland China is the source of nearly two-fifths of all goods brought into Kyrgyzstan. Machinery, clothing goods and other manufactured products make up the bulk of the basket of items bought by Kyrgyzstan from Mainland China.

- Kyrgyzstan has double taxation treaties with over 20 countries including Armenia, Austria, Belarus, Canada, Mainland China, Finland, Germany, India, Iran, Kazakhstan, Lithuania, Malaysia, Moldova, Mongolia, Pakistan, Poland, Russia, Switzerland, Tajikistan, Turkey, Ukraine, and Uzbekistan.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

The EAEU-Mainland China agreement was signed on May 29, 2018. The EAEU and Iran signed an interim agreement on a free trade zone in May 17, 2018, during the Astana Economic Forum. Two years of negotiations resulted in a three-year arrangement to reduce import customs duties on approved goods.

Active

- Commonwealth of Independent States Free Trade Agreement (CISFTA): Most of Kyrgyzstan's main trade partners are now included in the EAEU, which has somewhat superseded the CISFTA.

- Kyrgyzstan-Tajikistan (effective date from January 2006): Kyrgyzstan mainly imports fruits, nuts and tobacco from Tajikistan. Kyrgyzstan's exports to Tajikistan include coffee, tea and milk as well as preparations of cereals, spirts and vinegar.

- EAEU (Kyrgyzstan, Russia, Kazakhstan, Armenia and Belarus): While opening up markets in major trade partners Russia and Kazakhstan, the deal increases trade barriers with neighbouring Mainland China.

- EAEU-Vietnam FTA: Vietnam is not a major export or import partner of Kyrgyzstan. However, the promulgation of this FT in October 2016 provides another tariff-free market for Kyrgyzstani exports and may allow Vietnam to overtake some of Mainland China's dominance in the textiles and manufactured goods markets.

- EAEU-Singapore FTA: The EAEU and Singapore agreed to begin negotiations for an FTA in December 2016 and concluded five negotiation rounds. The two parties signed the FTA on October 1, 2019. The agreement aims to strengthen collaboration between the two parties in areas such as trade and investment, intellectual property rights protection, customs cooperation and competition enforcement.

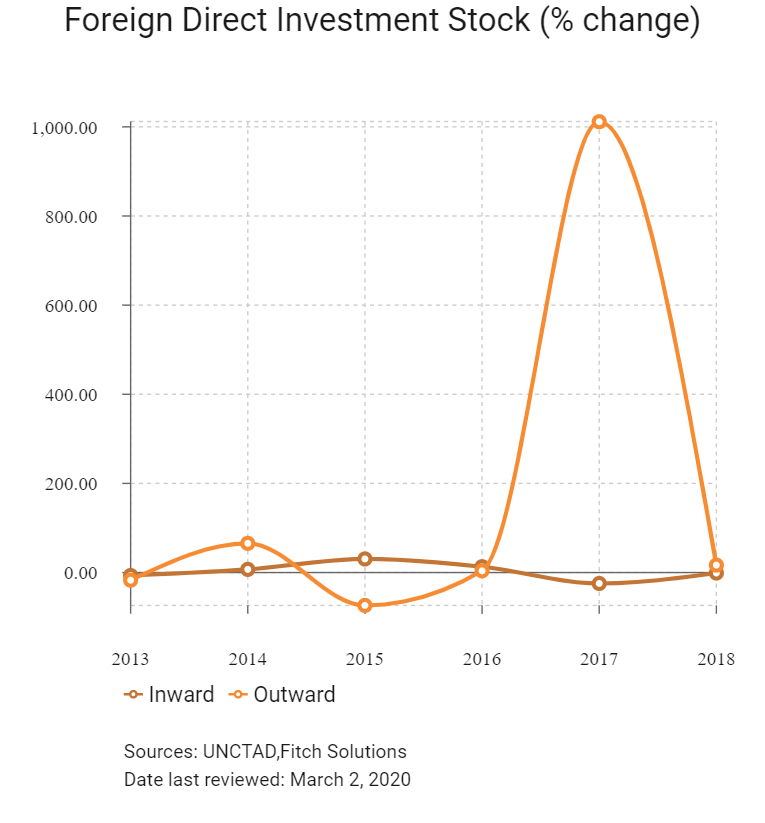

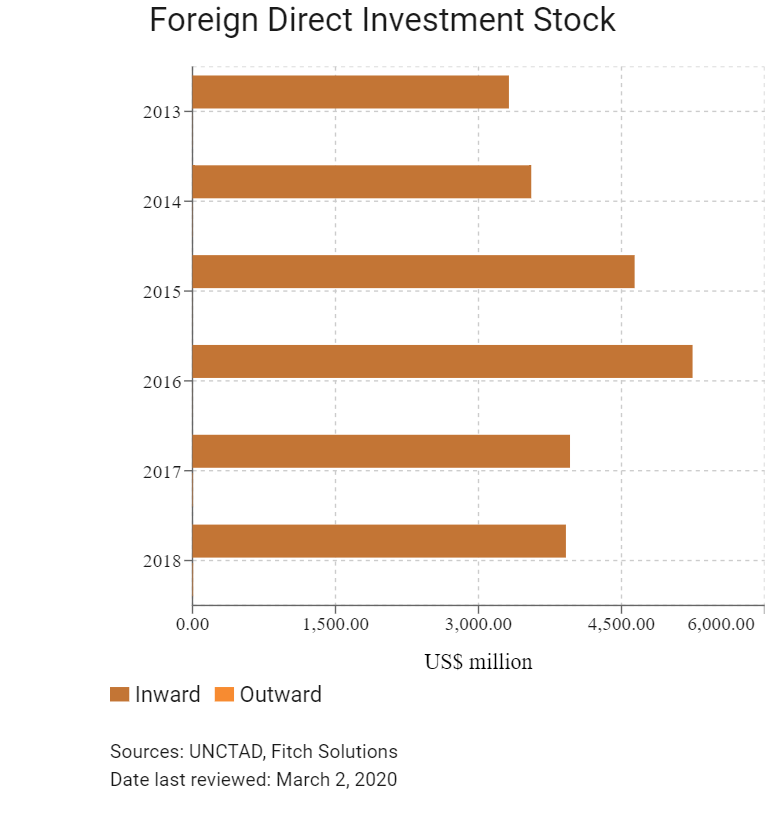

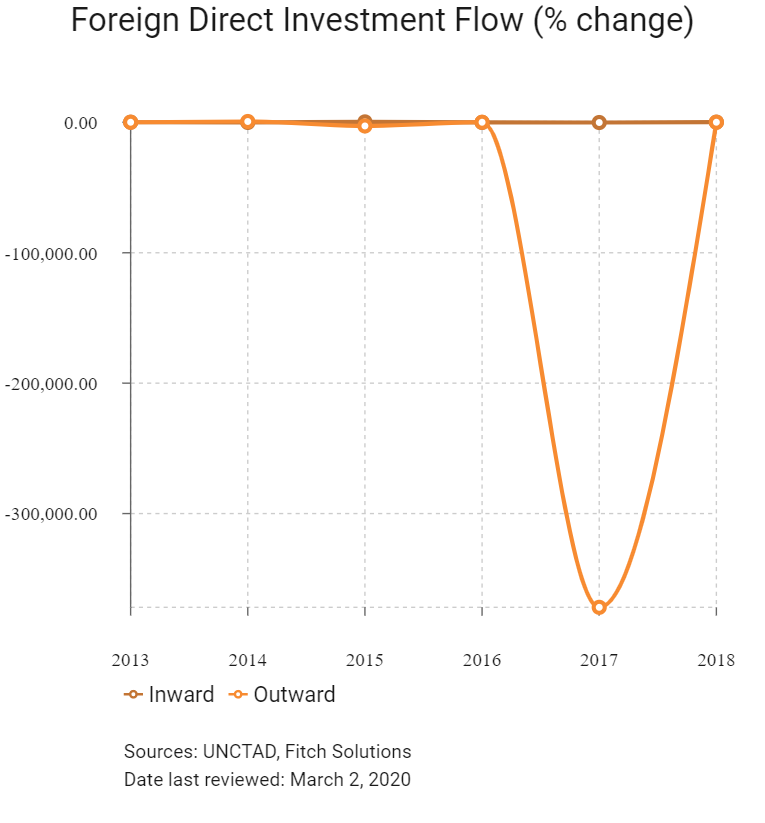

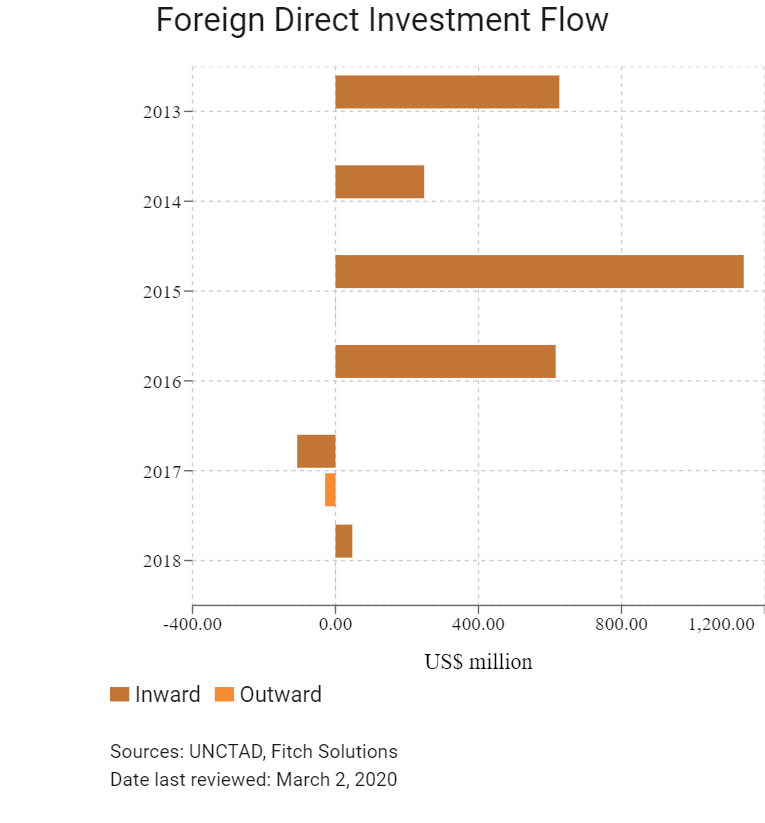

Foreign Direct Investment

↵

Foreign Direct Investment Policy

- Kyrgyzstan attracts significant inward foreign direct investment (FDI) flows to the mining sector and has a clear and incentive-driven FDI legal framework. Significant hurdles have made foreign investors wary of the country as a destination for doing business. These include the inconsistent application of FDI laws by the Kyrgyzstani government, which has seen them involved in several large-scale international lawsuits with foreign mining companies; resource nationalisation in the mining sector; and significant limits on foreign ownership of land.

- Foreigners can neither own agricultural land nor own or use any land except residential land which has been foreclosed under a mortgage loan agreement under Kyrgyzstani law.

- The Kyrgyzstani government, Centerra Gold (which operates the largest gold mine in the country) and Kumtor were involved in court battles regarding government participation in the mine.

- Many high-profile mining companies have had to renegotiate their mining contracts, have had their mining licenses revoked or have been charged high penalties for alleged environmental policy non-compliance. Sectors which employ a large portion of the population or contribute significantly to tax revenue may find themselves subject to additional audits, fines applying to instances which happened many years prior, licensing and/or permit disputes or have additional local workforce hiring requirements imposed on them.

- Investors face significant barriers from the high levels of corruption and weak protection of intellectual property rights in Kyrgyzstan.

- Since 2016 all local transactions for payment of goods and services have had to be made in local currency.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free Economic Zones (FEZs) located in Bishkek, Naryn, Karakol and Maimak |

- Efficient transport connections |

|

Park of Innovative Technologies |

- Exemption from profit tax |

|

Profit tax exemption |

If profit earned by a resident company stems from own-produced or re-processed goods in Kyrgyzstan, while also only using equipment purchased after April 30, 2015, then the tax on profits is waived; however, companies need to fulfil one of the following criteria in order to be eligible for the exemption: |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 12%

- Corporate Income Tax: 10%

Source: State Tax Service under the Government of the Republic, Kyrgyzstan

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 10% on profits |

|

Gold Industry Exports Tax |

Varies between 1-20% of revenues from sales of gold ore and alloys, depending on world prices |

|

Real Estate Tax |

0.8% for property used in business activities |

|

Withholding Tax |

10% on dividends, royalties and interest income paid to non-residents |

|

Pension fund contributions |

15% on gross salaries |

|

Medical insurance contributions |

2% towards medical insurance fund for employees |

|

Health Fund |

0.25% towards healthcare fund for employees |

|

VAT |

- 12% on sale of goods and services |

Source: State Tax Service under the Government of the Republic, Kyrgyzstan

Date last reviewed: March 2, 2020

Localisation Requirements

The Kyrgyzstani government sets specific quotas for how many foreign workers can be employed. These quotas are set by the Ministry of Labour on an annual basis and differ from region to region within the country. In order to acquire a foreign worker permit, an employer must demonstrate that the skills needed for the specific position cannot be sourced within the domestic labour market.

Visa/Travel Restrictions

The country still has fairly low female workforce participation rates, estimated at around 48%. Significant cultural and religious barriers remain and women do not enjoy the same pay or career opportunities as men, further restricting the pool of talent to choose from.

Foreign Worker Permits

While citizens of other EAEU and Commonwealth of Independent States countries may be employed without obtaining a special work permit, this is not the case for foreign workers from countries outside these regional arrangements. In order to be legally allowed to employ foreign workers, a business must first obtain permission from the Ministry of Labour. In order to be issued a foreign worker permit (which usually takes around 35 days), the employer must demonstrate that the skills needed for the specific position cannot be sourced within the Kyrgyzstani labour market. Preference is usually given to granting foreign worker permits to highly skilled professionals

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 (Stable) |

01/03/2019 |

|

Standard & Poor's |

Not rated |

23/09/2016 |

|

Fitch Ratings |

Not rated |

Not rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

77/190 |

70/190 |

80/191 |

|

Ease of Paying Taxes Index |

151/190 |

150/190 |

117/191 |

|

Logistics Performance Index |

108/160 |

N/A |

N/A |

|

Corruption Perception Index |

132/180 |

126/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

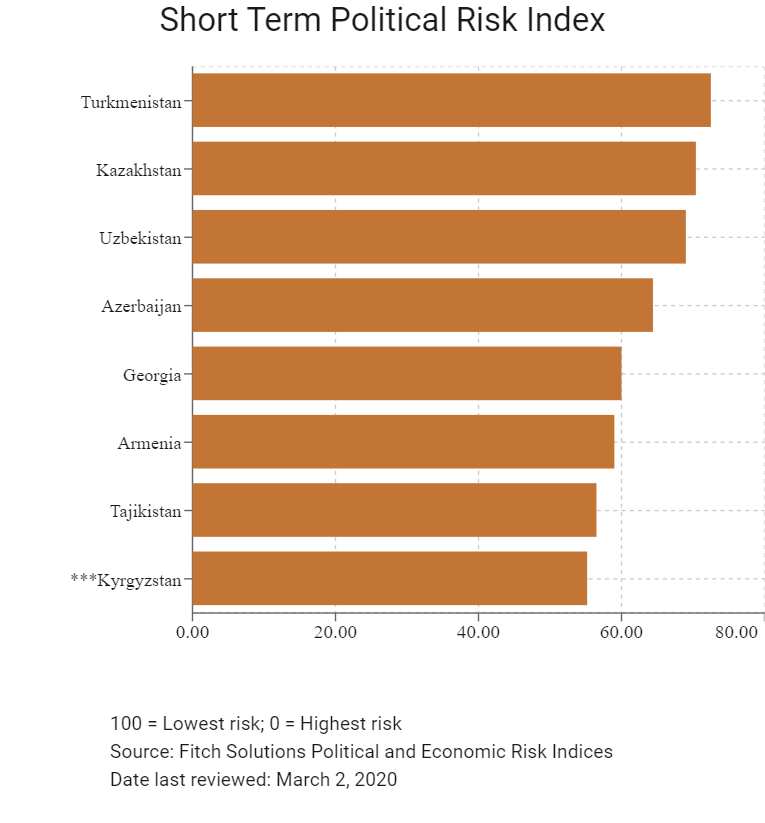

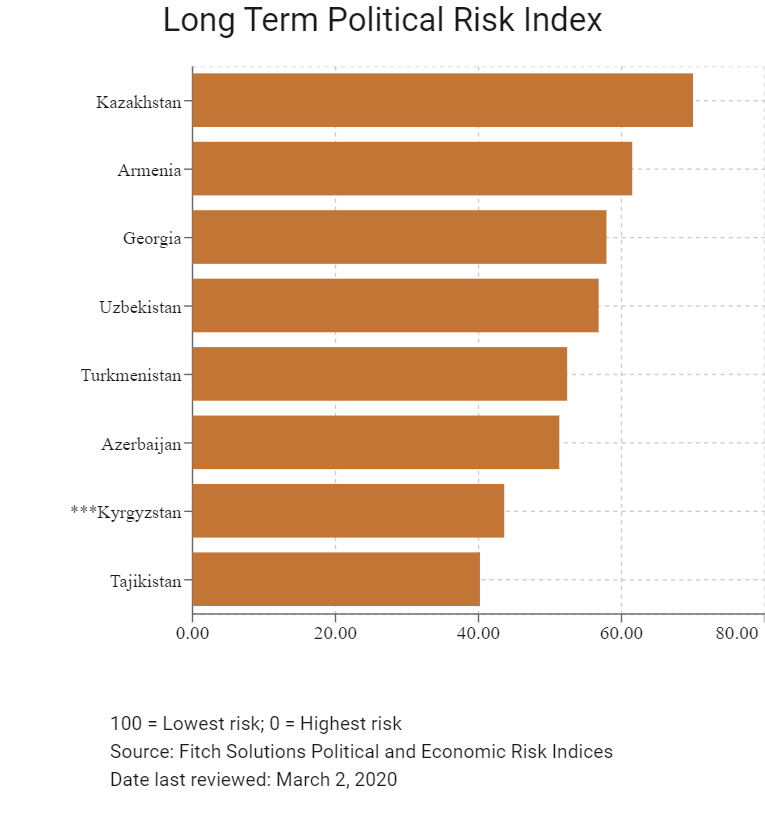

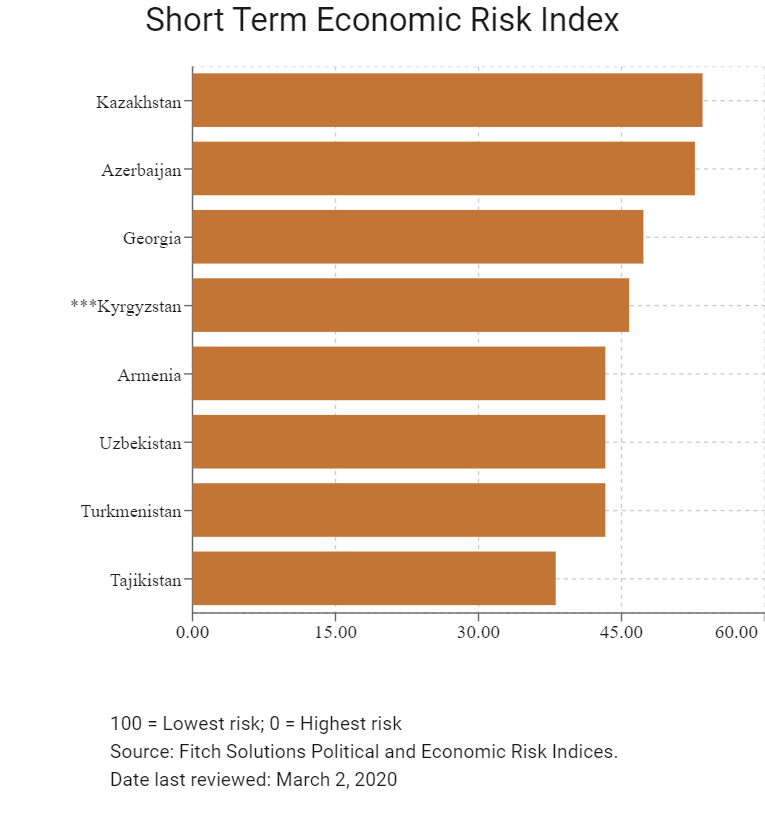

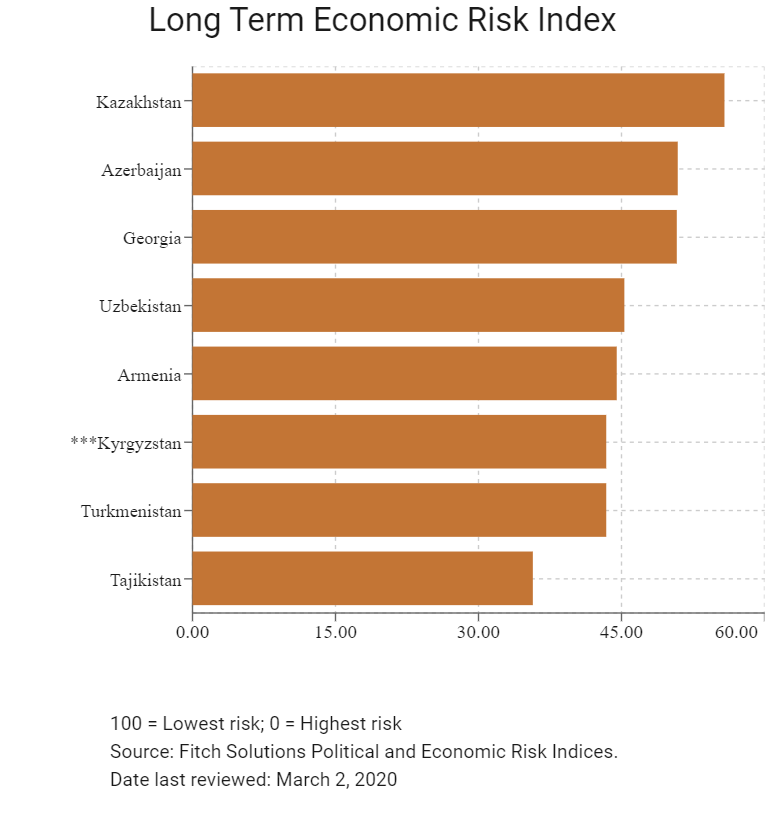

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

158/202 |

163/201 |

153/201 |

|

Short-Term Economic Risk Score |

44.8 |

44.0 |

45.8 |

|

Long-Term Economic Risk Score |

41.2 |

41.8 |

43.4 |

|

Political Risk Index Rank |

176/202 |

176/201 |

176/201 |

|

Short-Term Political Risk Score |

58.8 |

55.2 |

55.2 |

|

Long-Term Political Risk Score |

43.8 |

43.6 |

43.6 |

|

Operational Risk Index Rank |

128/201 |

121/201 |

121/201 |

|

Operational Risk Score |

42.7 |

44.8 |

44.9 |

Source: Fitch Solutions

Date last reviewed: March 2, 2020

Fitch Solutions Risk Summary

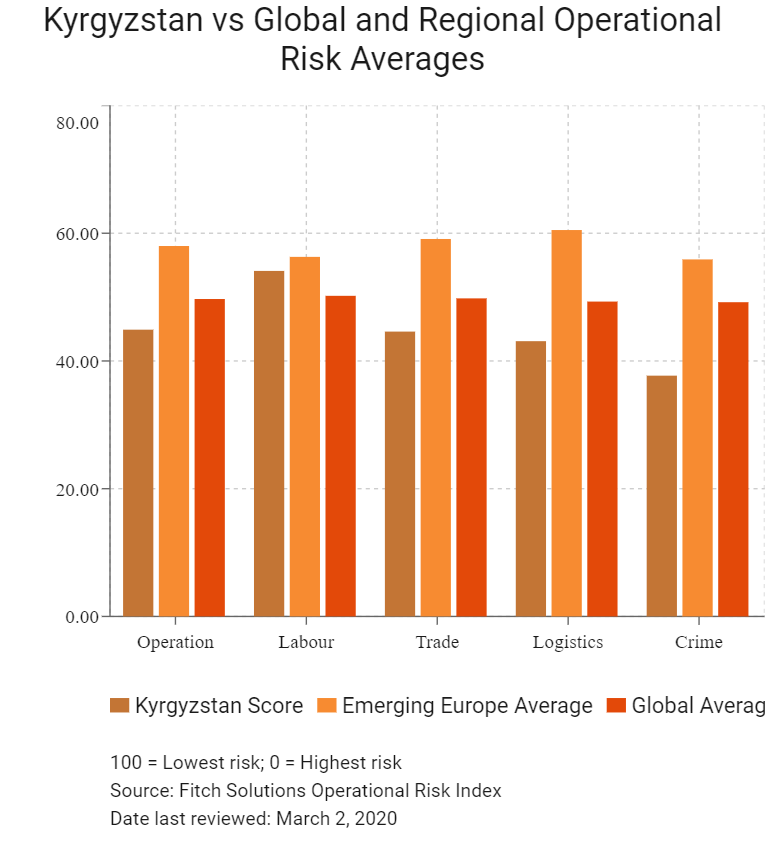

OPERATIONAL RISK

Kyrgyzstan became an official member of the Kremlin-led EAEU in 2015. The EAEU comprises Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. This will have major implications for Kyrgyzstan's prospects for economic development and diversification. For instance, Moscow has announced support for Kyrgyzstan's agricultural sector, which is expected to expand in the coming years as Russia will also benefit from cheap Kyrgyz food exports. In the near term the economy is set to gain traction on robust gold mining production, aided by new investments and a supportive commodities price environment. Despite a slowdown in global activity, the external sector is seen contributing positively to the print on a surge in export growth. Downside risks to this outlook stem from weakness in Russia, which could lower remittances and volatile commodity markets.

ECONOMIC RISK

Kyrgyzstan's small market size, limited industrial base and remote location has prevented it from developing into a major trading nation. The market exposes businesses to a number of operational risks. Businesses will also be hampered by the country’s poor logistics infrastructure, largely owing to the country’s underdeveloped transport network, which has been limited by its mountainous terrain. Labour risks are also elevated, with the largely low-skilled workforce on offer often necessitating the importation of labour; however, relatively light labour regulations reduce labour costs. The increased risk of clashes between mine workers and local residents is likely to dampen investor sentiment in the mining sector. On a positive note, Kyrgyzstan's government has established clear frameworks for foreign direct investment and low tax rates. In addition, bureaucratic procedures will potentially become more efficient as a result of e-government investments.

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Political and Economic Risk Indicies

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Kyrgyzstan Score |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Caucasus and Central Asia Average |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

5 |

7 |

6 |

6 |

6 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

28 |

22 |

29 |

29 |

27 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

121 |

74 |

127 |

114 |

140 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.4 |

56.1 |

58.3 |

|

Azerbaijan |

61.2 |

62.5 |

62.5 |

66.4 |

53.2 |

|

Kazakhstan |

60.2 |

73.5 |

58.9 |

57.0 |

51.5 |

|

Armenia |

56.8 |

60.5 |

58.6 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Uzbekistan |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Tajikistan |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Turkmenistan |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Regional Averages |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 2, 2020

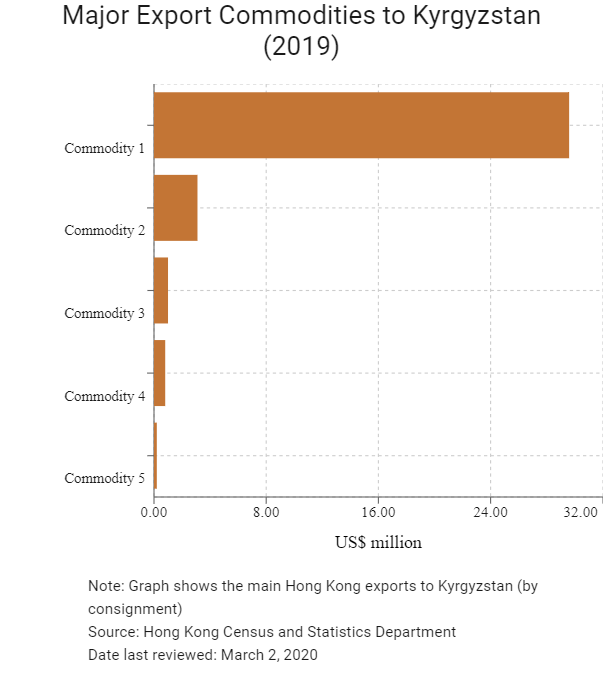

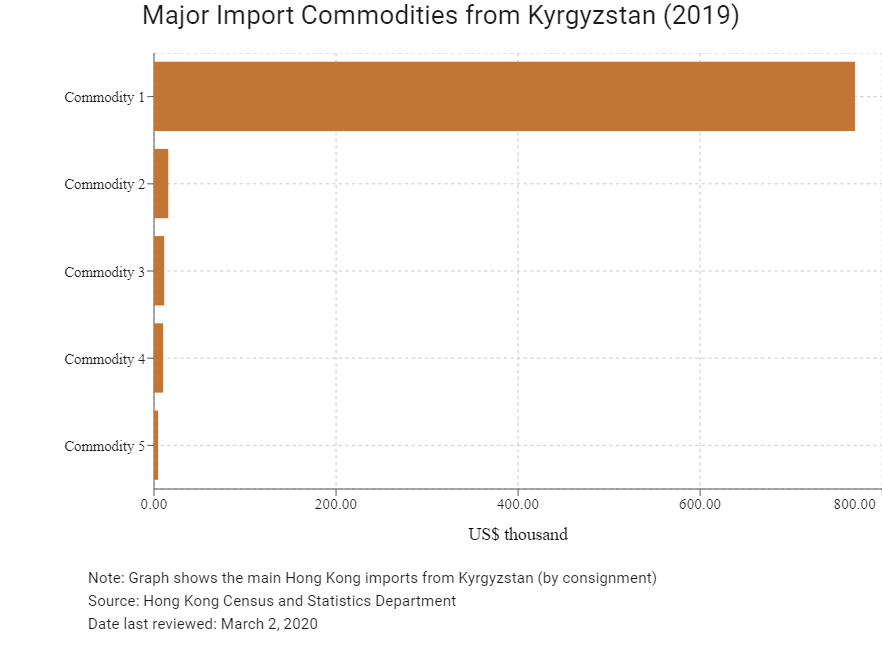

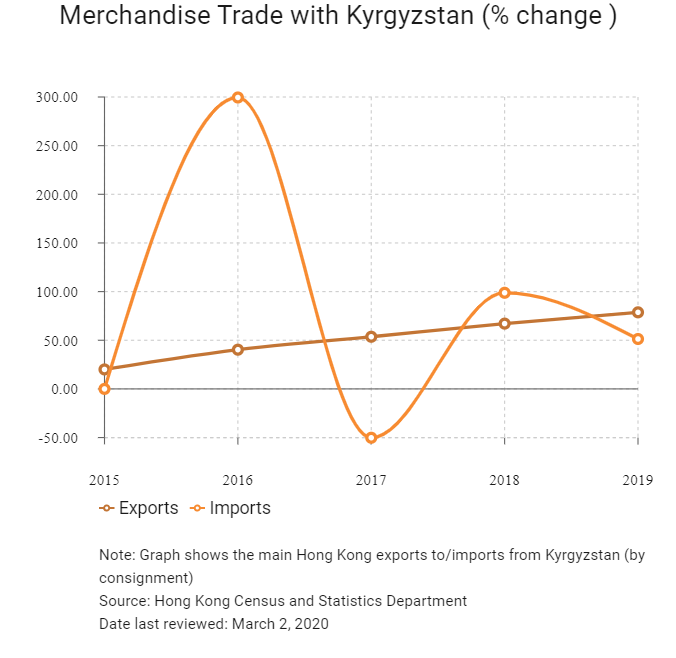

Hong Kong’s Trade with Kyrgyzstan

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

29.6 |

|

Commodity 2 |

Photographic apparatus, equipment and supplies; optical goods; and watches and clocks |

3.1 |

|

Commodity 3 |

Office machines and automatic data processing machines |

1.0 |

|

Commodity 4 |

Electrical machinery, apparatus and appliances; and electrical parts thereof |

0.8 |

|

Commodity 5 |

Professional, scientific and controlling instruments and apparatus |

0.2 |

|

Import Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

770.1 |

|

Commodity 2 |

Sugar, sugar preparations and honey |

15.7 |

|

Commodity 3 |

Miscellaneous manufactured articles |

11.2 |

|

Commodity 4 |

Electrical machinery, apparatus and appliances; and electrical parts thereof |

10.0 |

|

Commodity 5 |

Office machines and automatic data processing machines |

4.6 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: March 2, 2020

|

2019 |

Growth rate (%) |

|

|

Number of Kyrgyzstani citizens residing in Hong Kong |

174 |

0.6 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: March 2, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Kyrgyzstani companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Kyrzyzstan

Kyrgystan and Mainland China have a Bilateral Investment Treaty which came into force in September 1995.

Source: UNCTAD Investment Policy Hub

Visa Requirements for Hong Kong Residents

HKSAR passport holders need a visa before travelling to Kyrzyzstan.

Source: Kyrgyztan Mission

Date last reviewed: March 2, 2020

Kyrgyzstan

Kyrgyzstan