GDP (US$ Billion)

95.94 (2017)

World Ranking 65/192

GDP Per Capita (US$)

17,664 (2017)

World Ranking 46/192

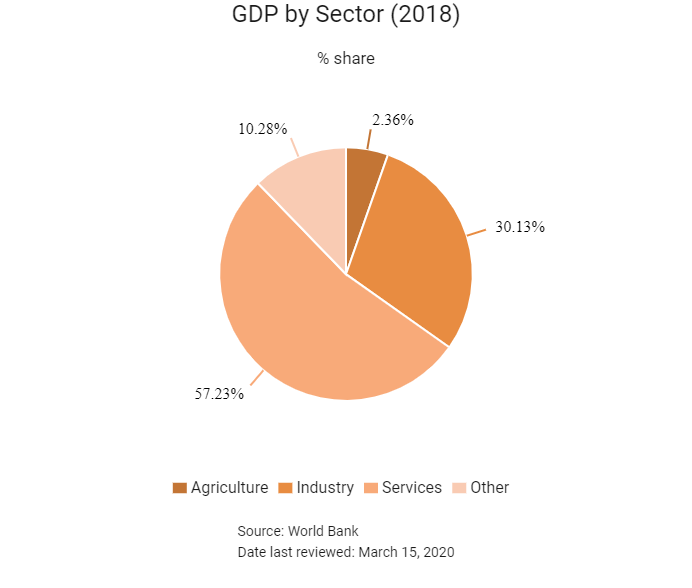

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

185.7 (2016)

Currency (Period Average)

Euro

0.89per US$ (2017)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

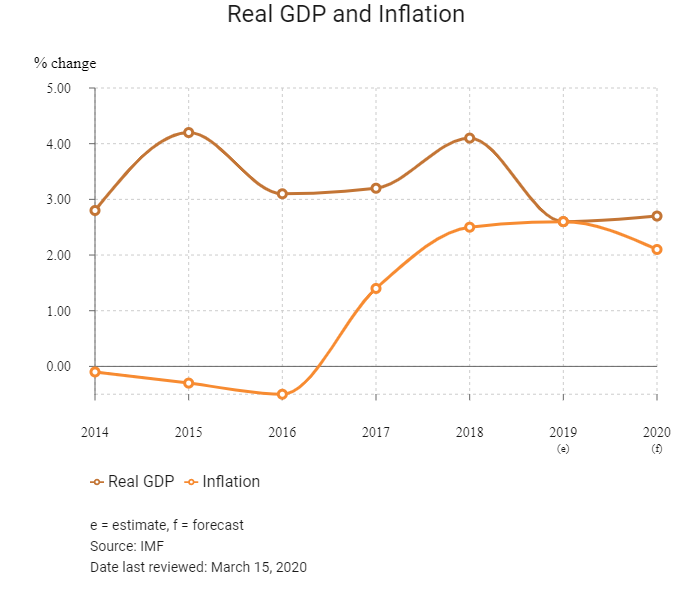

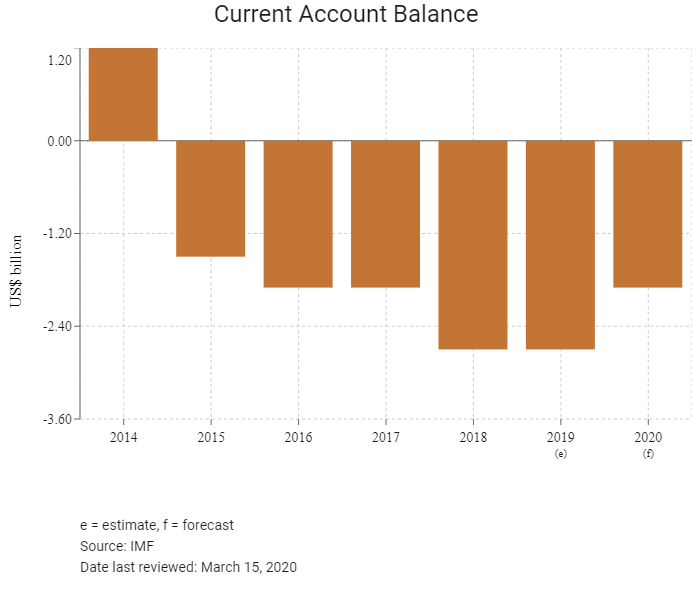

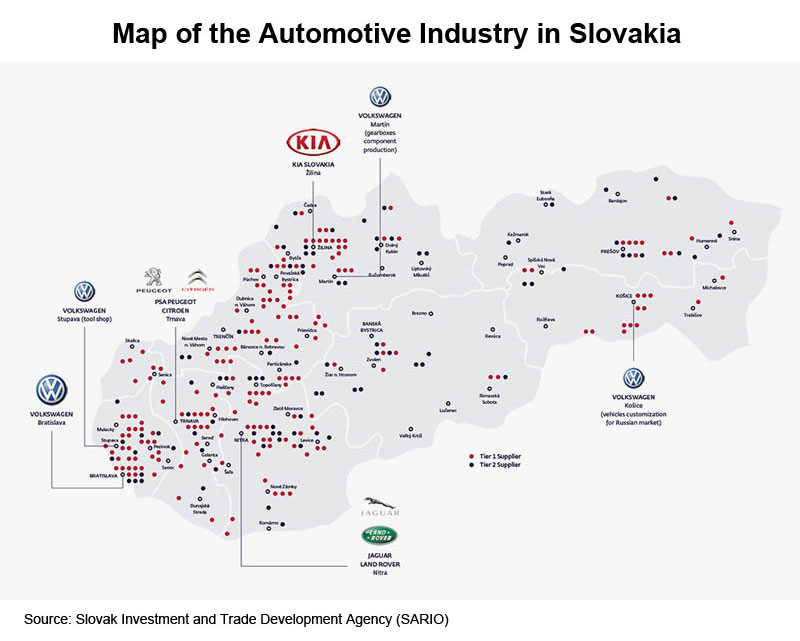

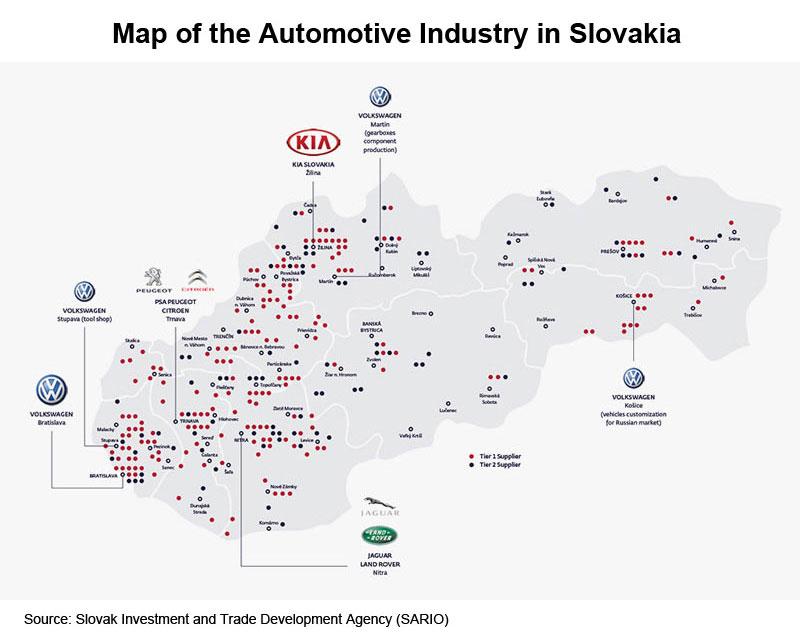

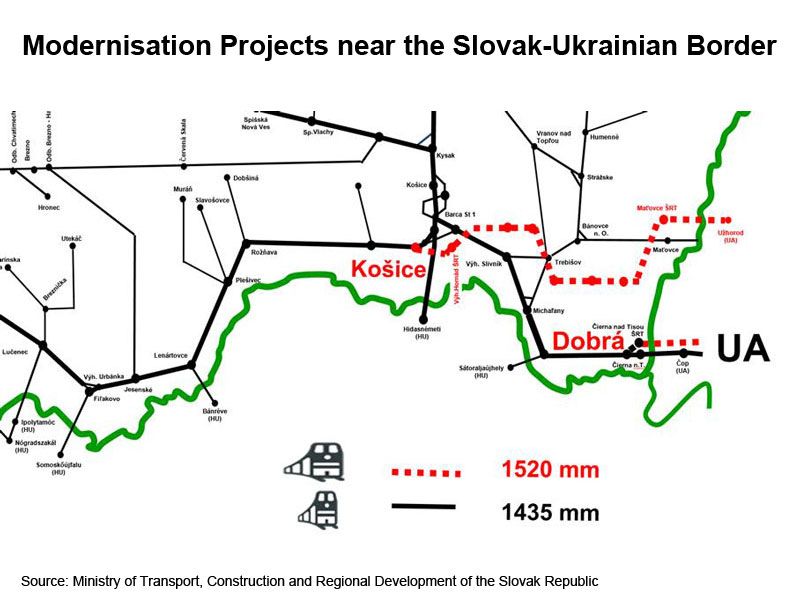

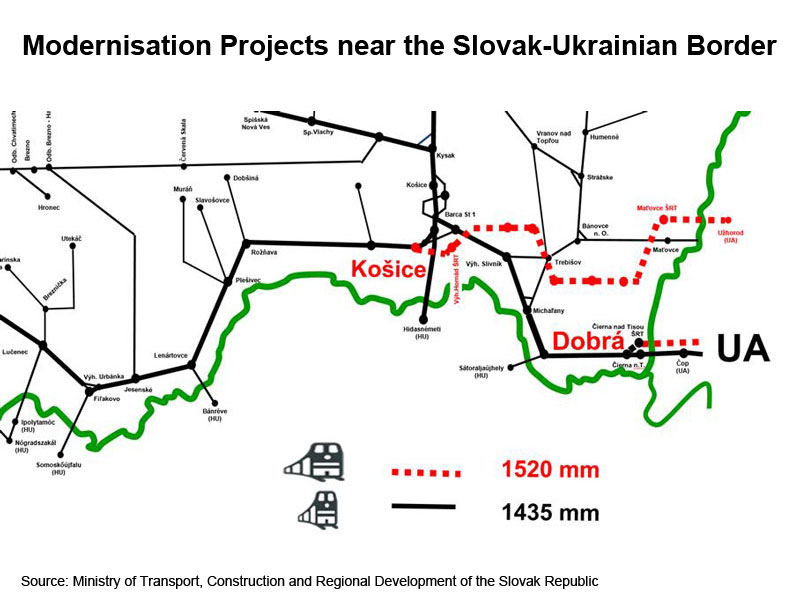

Slovakia's open economy has benefitted from access to the European Union (EU)'s Customs Union, with exports estimated to account for nearly 100% of Slovakia's GDP in 2018. Although this has enabled the country's export-led growth over the past six years, it also poses challenges in the future, such as economic volatility. Slovakia's automotive industry will remain a major source of export growth and deficit financing through foreign direct investment inflows. Slovakia is a transit hub for the Belt and Road Initiative, which will influence the development and upgrading of transport infrastructure to facilitate anticipated increases in cargo traffic between Europe and Asia. Economic growth in Slovakia is to remain solid and broad-based over the coming quarters, outperforming its regional and eurozone peers. Slovakia is well positioned to transition towards a more value-added economic model, which would raise its long-term economic growth potential, especially in light of Parliament's approval to cap the retirement age at 64.

Sources: national sources, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2016

Robert Fico's Smer party lost its majority after parliamentary elections in which the far-right People's Party Our Slovakia, led by Marian Kotleba, entered parliament for the first time.

July 2016

Slovakia assumed the EU's rotating presidency.

March 2018

After Slovakia's then-president Andrej Kiska called for either substantial changes in the government or snap elections, Prime Minister Robert Fico resigned on March 15. Peter Pellegrini replaced him a week later.

July 2018

At a bilateral meeting with Mainland China's Prime Minister Li Keqiang in Sofia, Bulgaria, Pellegrini expressed Slovakia's ambition to become the gateway for Chinese investment in Europe. He also said that Slovakia wanted to play a strategic role in the East-West transportation of oil and natural gas and that he hoped that Mainland China would be interested in investing in a Slovakian terminal planned as part of that transport infrastructure.

January 2019

During the New Year's address, then-president Andrej Kiska, a political outsider until 2014, confirmed his earlier decision not to run for a second term in office.

March 2019

Zuzana Caputova became Slovakia's first female president.

April 2019

Jaguar Land Rover (JLR) announced that it would build its next-generation Land Rover Defender model in Slovakia.

September 2019

GAZ-SYSTEM started construction of the Polish section of the Poland-Slovakia gas interconnector, which would link the gas node in Strachocina (Podkarpackie Voivodeship) with the Slovak compressor station in Vel'ké Kapusany. GAZ-SYSTEM and Slovakia-based Eustream were jointly carrying out the 165km pipeline project. Towards Poland, the capacity would be 5.7 billion cubic metres (cu m) a year, and it would be 4.7 billion cu m per year towards Slovakia. The project was financed by EU funds under the Trans-European Energy Networks and Connecting Europe Facility.

October 2019

South Africa and Slovakia signed a joint protocol agreement during the fifth session of the joint council on economic cooperation (JCEC) between the countries.

March 2020

Slovakia’s anti-corruption Ordinary People (OLANO) party, the winner of the February 2020 election, agreed to a four-party governing coalition after the parties struck a deal on cabinet seats. OLANO’s coalition would dislodge the long-ruling centre-left Smer party that had led the government since 2012.

Sources: BBC Country Profile – Timeline, Slovak Spectator, Fitch Solutions

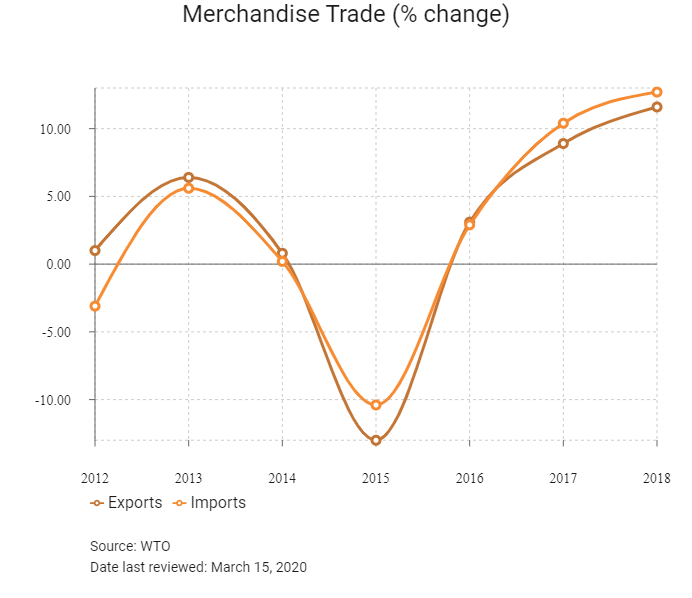

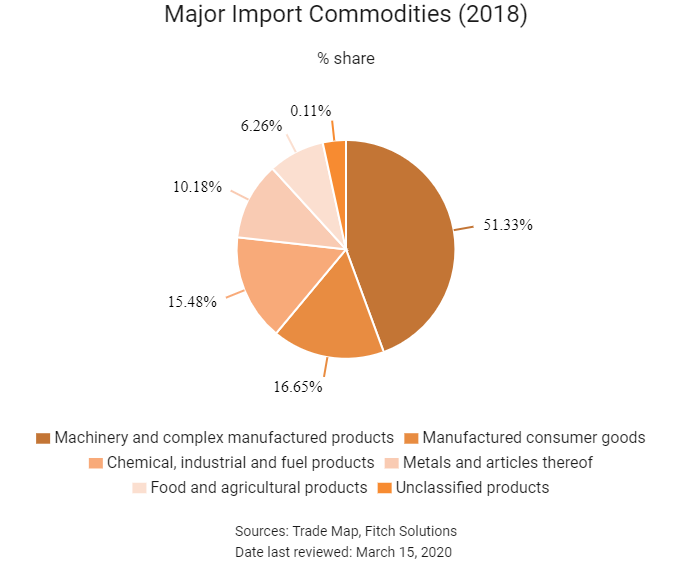

Merchandise Trade

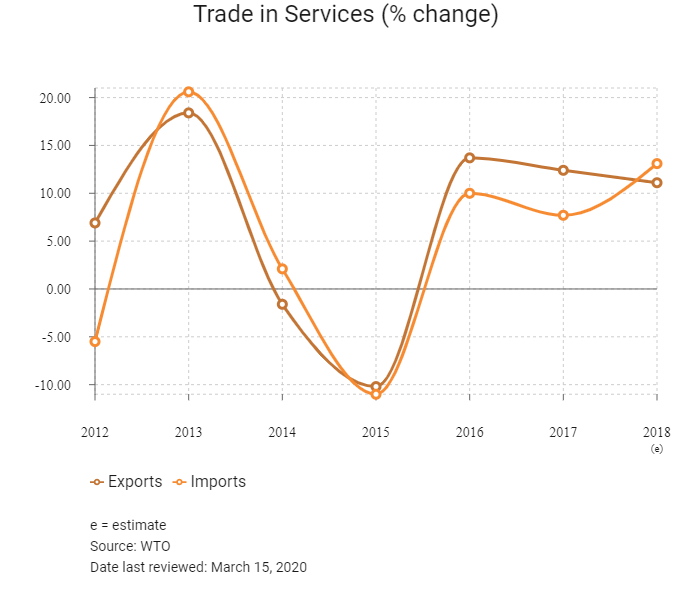

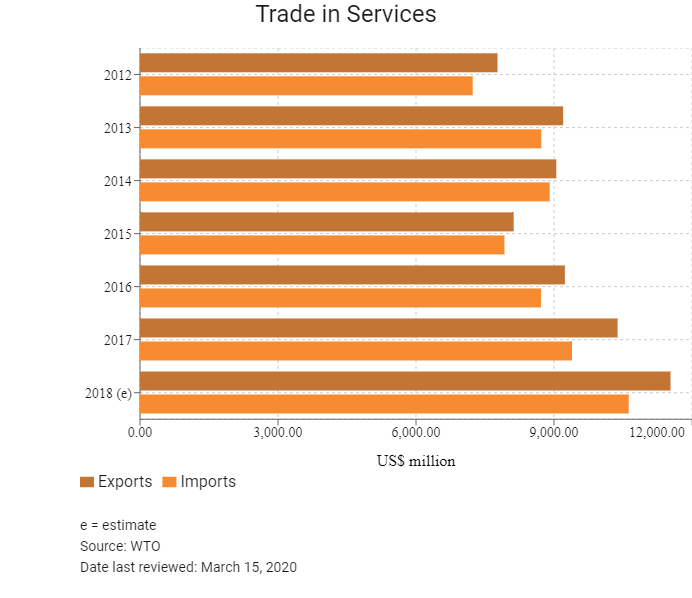

Trade in Services

- Slovakia became a member of the World Trade Organization in January 1995.

- As a member of the EU since 2009, Slovakia is part of a customs union and single market that allows it to benefit from tariff-free trade with its EU counterparts. Intra-EU trade accounts for about 85% of Slovakia’s exports.

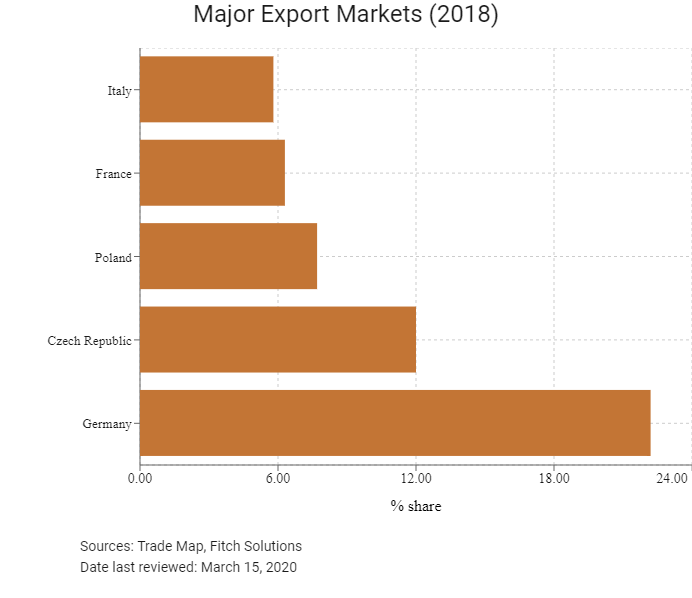

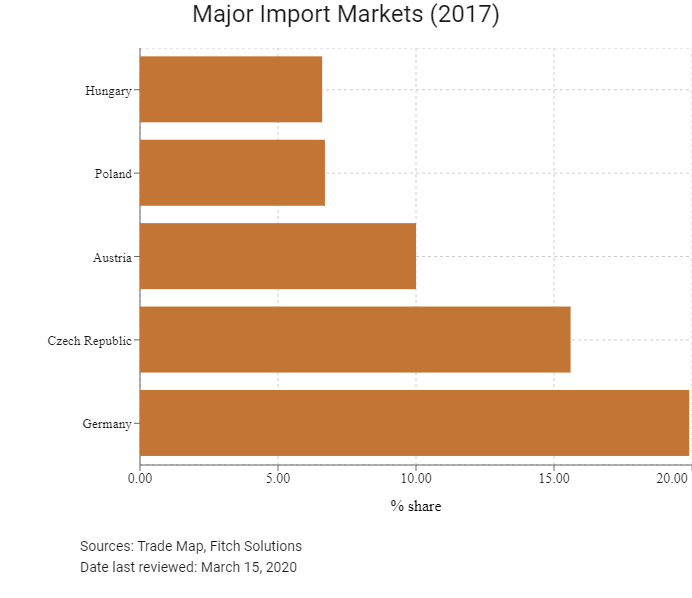

- Slovakia has one of the lowest average tariff rates (along with its fellow EU members) in the Central and Eastern Europe region at 1.5%, thereby putting it ahead – from a trading-cost perspective – of many of its non-EU regional counterparts. Slovakia is very eurocentric, as its top five exporting partners are all EU members (Germany, Czech Republic, Poland, France and Italy).

- Bilateral investment treaties exist between Slovakia and the following countries: Austria, Belarus, the Belgium-Luxembourg Economic Union, Bosnia and Herzegovina, Bulgaria, Canada, China, Croatia, Cuba, Denmark, Egypt, Finland, France, Germany, Greece, Hungary, Iran, Israel, Jordan, Kazakhstan, North Korea, South Korea, Kuwait, Latvia, Lebanon, North Macedonia, Malaysia, Malta, Mexico, Moldova, Montenegro, Morocco, the Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Singapore, Slovenia, Spain, Sweden, Switzerland, Syria, Tajikistan, Turkey, Turkmenistan, Ukraine, the United Arab Emirates, the United Kingdom, the United States, Uzbekistan and Vietnam.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The EU Common Market: There is free movement in the transfer of capital, goods, services and labour between member nations. The common market extends to the 28 member nations of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

- European Economic Area (EEA)-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting exporters and importers.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in both sides nearly EUR1 billion annually. According to the European Commission (EC), the agreement will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86.0 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and eSwatini): An agreement between the EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of the SADC that are not included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking EPAs with the EU as part of other trading blocs such as the East African Community and the Economic Community of Central African States.

Provisionally Active

The Comprehensive Economic and Trade Agreement (CETA): The CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and EU Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%; it also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

Ratification Pending

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties have ratified the agreement as of October 2018). The agreement has been provisionally applied since 2013.

- EU-Singapore Free Trade Agreement (FTA) and Investment Protection Agreement: The parties signed the agreement in October 2019 and the European Parliament consented to the agreement in February 2019. The EC states that the ratification process is ongoing. On November 8, EU member states endorsed the trade agreement between the EU and Singapore. This means the agreement will enter into force as soon as November 21, 2019.

- EU-Vietnam FTA: In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement (IPA). In June 2019, the final text of the agreement was signed by both parties in Hanoi, Vietnam. It is now awaiting consent from the Vietnamese National Assembly and the European Parliament.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017, and bilateral trade in services added EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up for the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but will require consent from the European Council's 28 members, a majority within the European Parliament, as well as both Houses of Congress and President Donald Trump, to be passed.

- EU-New Zealand: In June 2018, the EU and New Zealand launched trade negotiations to remove trade barriers for goods and services, and the development of trade rules to facilitate easier and sustainable trade between both parties.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

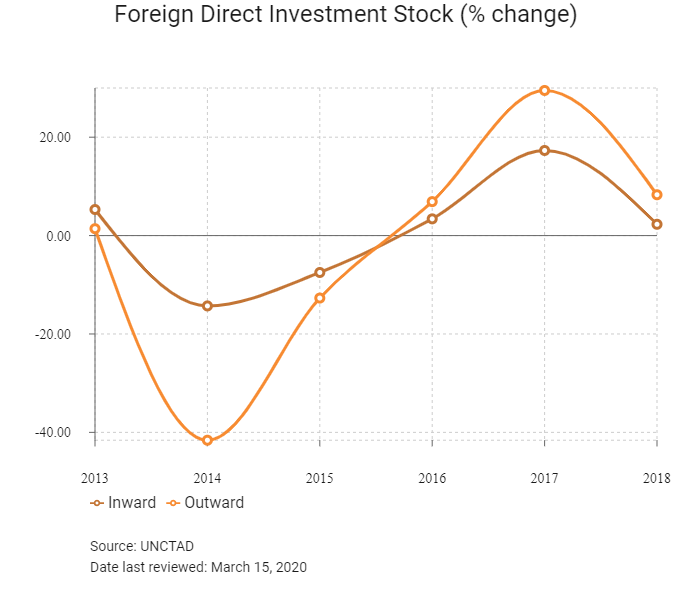

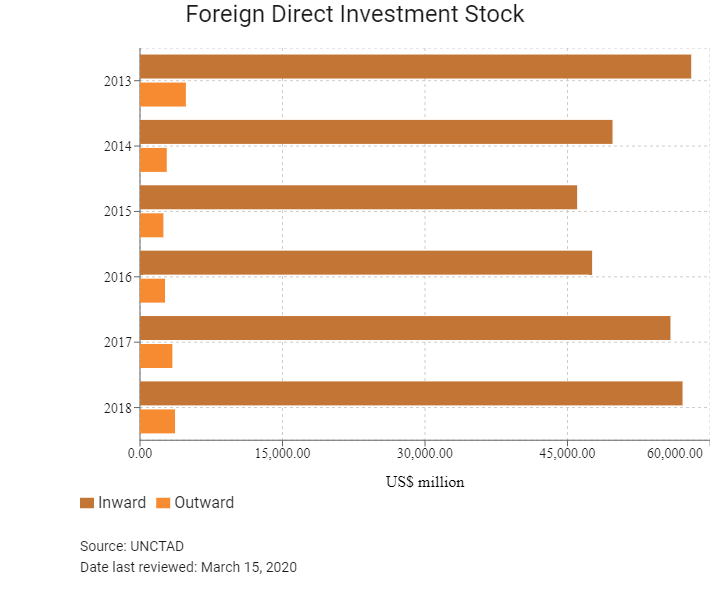

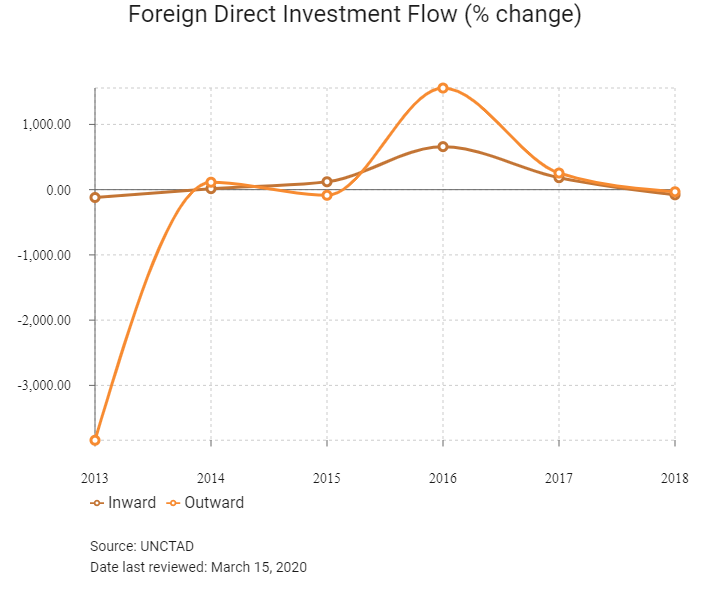

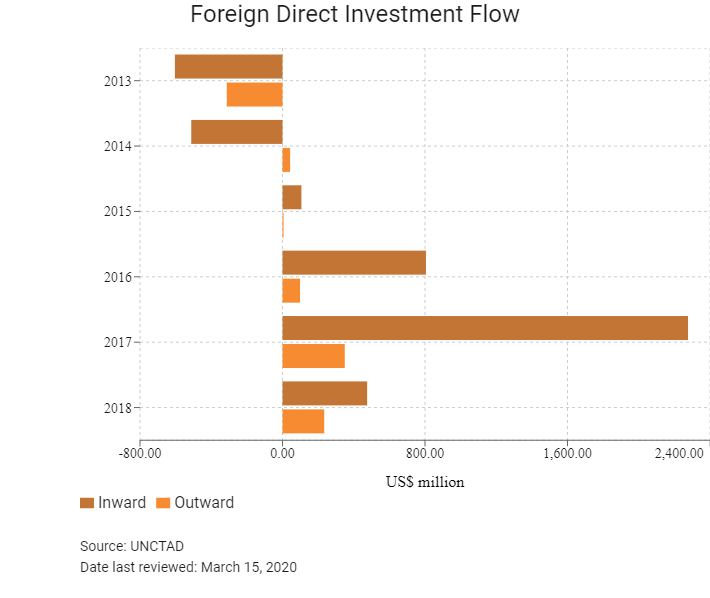

Foreign Direct Investment

Foreign Direct Investment Policy

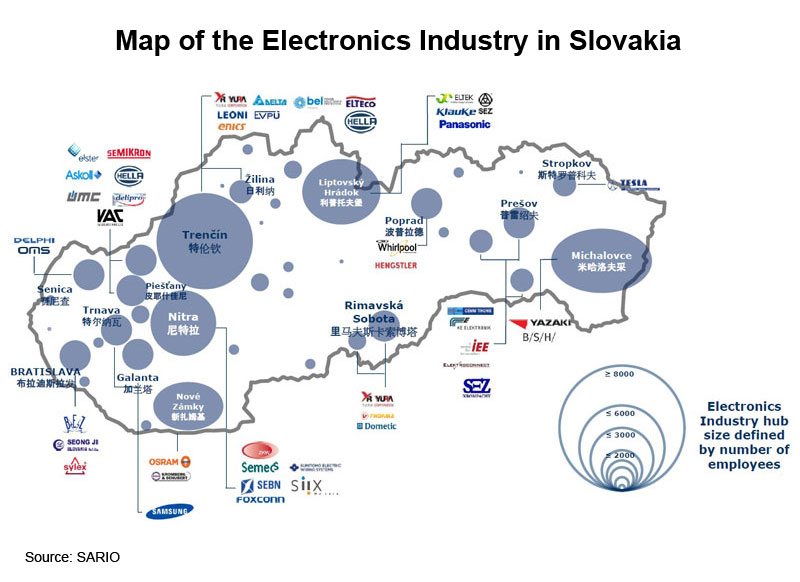

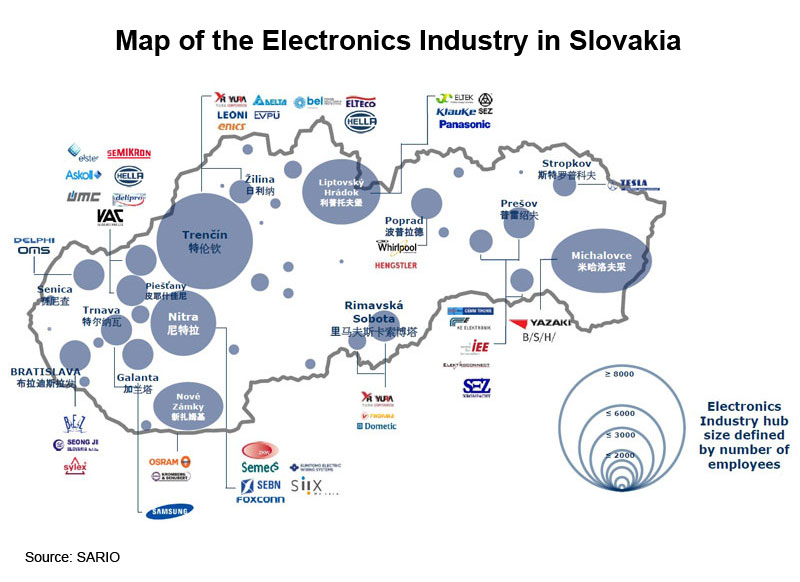

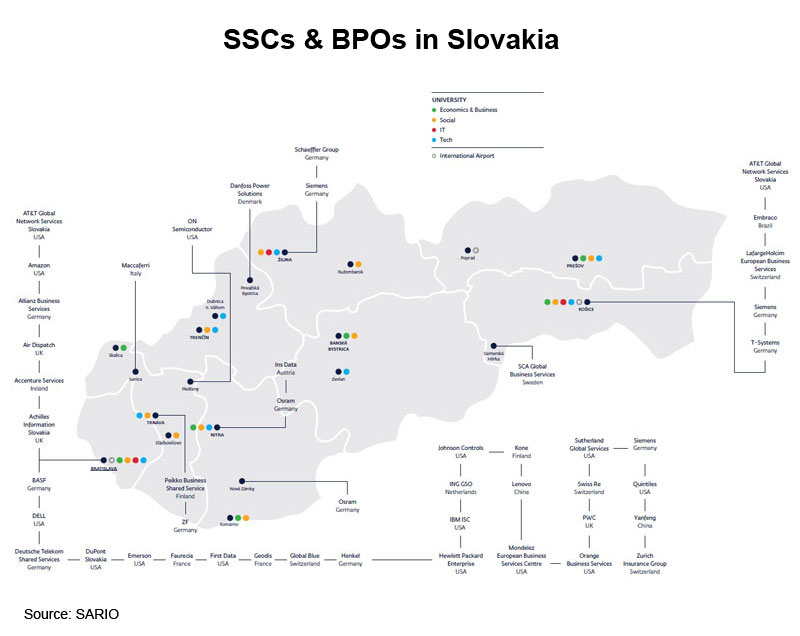

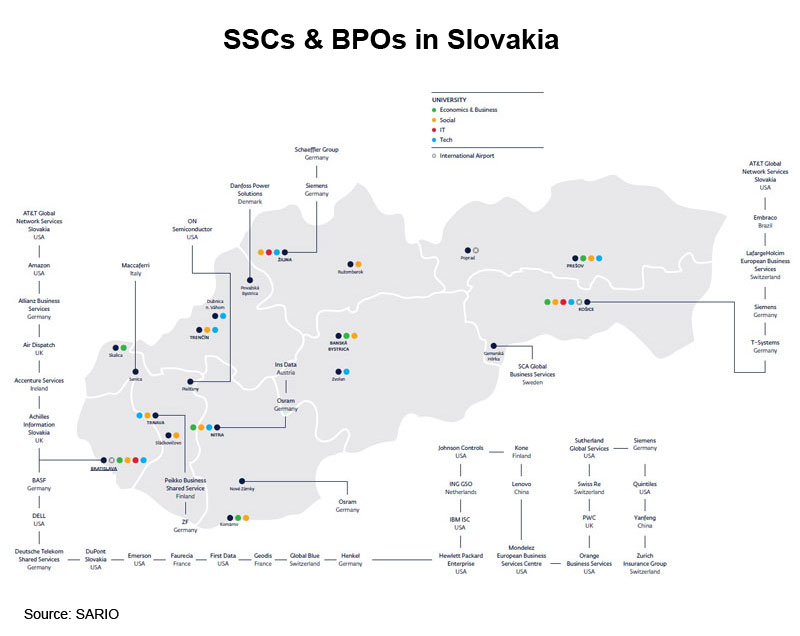

- The government has established the Slovak Investment and Trade Development Agency (SARIO) in order to provide new investors with information on the Slovakian economy and investment opportunities. The SARIO also aims to encourage foreign direct investment inflows to targeted development sectors, including heavy industry and manufacturing, technology centres, business services and outsourcing, and tourism.

- There are no domestic ownership requirements for Slovak business entities and foreign investors, and businesses generally have the right to engage in any business activity in the country. However, there are some obligations regarding liquidated companies when transferring out of Slovakia.

- Foreign investors can freely participate in the privatisation programmes of state-owned enterprises (SOEs), with the exception of sectors considered ‘strategic’ by the government (for example, energy). This programme has resulted in a scaled-back role for the government in the economy, which means that private businesses face fewer unfair disadvantages due to the presence of SOEs.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Nitra Industrial Park |

- The basic legal framework for the Slovak authorities' provision of investment aid is fully harmonised with EU legislation. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 21%

Source: Ministry of Finance for the Slovak Republick

Important Updates to Taxation Information

- While the country's high corporate taxation rate has been reduced from 22% to 21%, a witholding tax of 7.0% (35% for dividends received from non-treaty jurisdictions) has been re-introduced that may apply to certain dividend payments.

- As of January 2019, the corporate income tax base of controlled foreign companies will be included in the corporate income tax base of its Slovak controlling company and taxed in accordance with the Slovak tax legislation.

- The government is currently discussing the introduction of a patent box regime which would support industrial research and development by partially exempting from tax any income for the use of granted and registered patents, utility models and software created by the taxpayer.

- In December 2018, Slovakia’s parliament approved legislation to tax retail chains 2.5% of their reveunues in order to raise money to support the marketing of local food production. The tax will be applicable to retailers where foodstuffs account for more than 25.0% of their revenues and are present in more than two regions in the country.

- In November 2019, Slovakia’s government approved doubling a special banking sector tax to 0.4% of adjusted balance sheet in 2020. The tax, imposed on banks’ liabilities after subtracting basic capital, was introduced in 2012 to help build a buffer for potential crises and was scheduled to expire at the end of 2020.

- In October 2019, the president of Slovakia signed the Law of September 18, 2019, on amendments to the Income Tax Act that provide for the introduction of a reduced income tax rate for companies and individual entrepreneurs with business income not exceeding EUR100,000 per year. The reduced rate is 15%, which is down from the standard 21% rate for companies and the standard 19% or 25% rates for individuals. For companies, advance tax will still need to be paid based on the standard 21% rate with the 15% rate applied after the final income amount is determined, if eligible.

- The term microtaxpayer will be introduced into law with effect from 2021 – an individual or a corporation with an annual business income of up to EUR49,790 (VAT registration threshold). This cannot be applied in the case of a taxpayer who is considered to be related for income tax purposes. The microtaxpayer will be entitled to apply the tax deduction of assets freely during the depreciation period. There will be no limits regarding the tax loss utilisation and creation of tax deductible provisions on receivables.

- A tax rate for individuals – entrepreneurs with a turnover below EUR100,000 – will be decreased from 21% to 15% for 2020.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) |

21% |

|

Capital Gains Tax |

Capital gains from the disposal of assets are included in the CIT base. The tax treatment of capital losses depends on the type of asset on which they arose. |

|

VAT |

20%, with exceptions for certain medical products, printed materials and 'basic goods' (such as bread, meat, milk and butter), which have a rate of 10%. |

|

Special Tax on regulated industries |

There is a special tax that becomes liable when the accounting profit exceeds EUR3 million from the activities of entities in regulated industries, which includes energy, electronic communications, pharmaceuticals, railway transport, public water distribution and air transport, among others. The tax is calculated as a multiple of the tax base, coefficient and the tax rate. Currently, the annual rate of the special tax can be up to 8.71%. This will decrease to a maximum of 6.54% per annum in 2019 and 2020, and to a maximum of 4.35% per annum in 2021. |

|

Social security contributions payable by employers |

Employer’s health insurance and social security contributions total 34.4% of employee remuneration. Employers also pay injury insurance contributions of 0.8% of employees’ total salary costs per month, which are not capped. |

|

Withholding Taxes (rate for foreign parties where no double taxation agreement exists) |

- 35% on dividend income |

Sources: Ministry of Finance for the Slovak Republick, Reuters

Date last reviewed: March 15, 2020

Foreign Worker Permits

There are few restrictions for visas and work permits, allowing businesses to import workers efficiently and at a low cost. Slovakia has visa-free arrangements with 141 countries, which is one of the highest in the region. EU citizens, EEA citizens, Swiss citizens (and members of their family) do not require a work permit to be employed in Slovakia, which is a major advantage for businesses operating in the country. Non-EU/EEA/Swiss citizens must get a work permit from the National Employment Agency and the permit must be requested by an employer for those with a specific skill or specialised knowledge. It is issued for one year and can be renewed for a further three years.

Localisation Requirements

Membership of the EU means that Slovakia has minimal restrictions for foreigners. Slovakia is considering implementing a range of immigration-supporting economic policies; however, the country is struggling to attract significant levels of migrant workers, which is partly attributable to inadequate compensation levels compared with competing emerging Europe states.

Visa/Travel Restrictions

Most citizens outside the Schengen Area require a visa to travel to Slovakia. Citizens from Hong Kong do not need a visa to travel to Slovakia (valid for a stay of 90 days).

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A2 (Positive) |

27/09/2019 |

|

Standard & Poor's |

A+ (Stable) |

31/07/2015 |

|

Fitch Ratings |

A+ (Stable) |

08/11/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

39/190 |

42/190 |

45/190 |

|

Ease of Paying Taxes Index |

49/190 |

48/190 |

55/190 |

|

Logistics Performance Index |

53/160 |

N/A |

N/A |

|

Corruption Perception Index |

57/180 |

59/180 |

N/A |

|

IMD World Competitiveness |

55/63 |

53/63 |

N/A |

Sources: World Bank, IMD, Transparency International

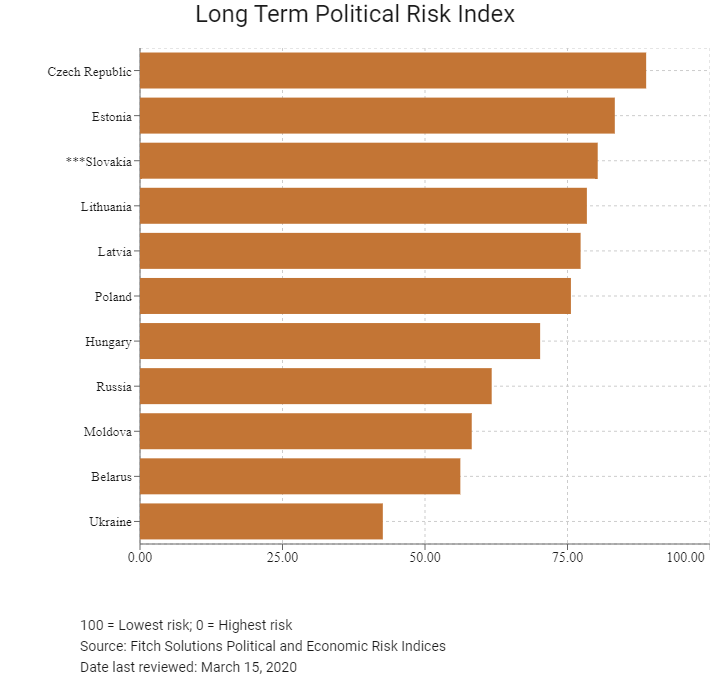

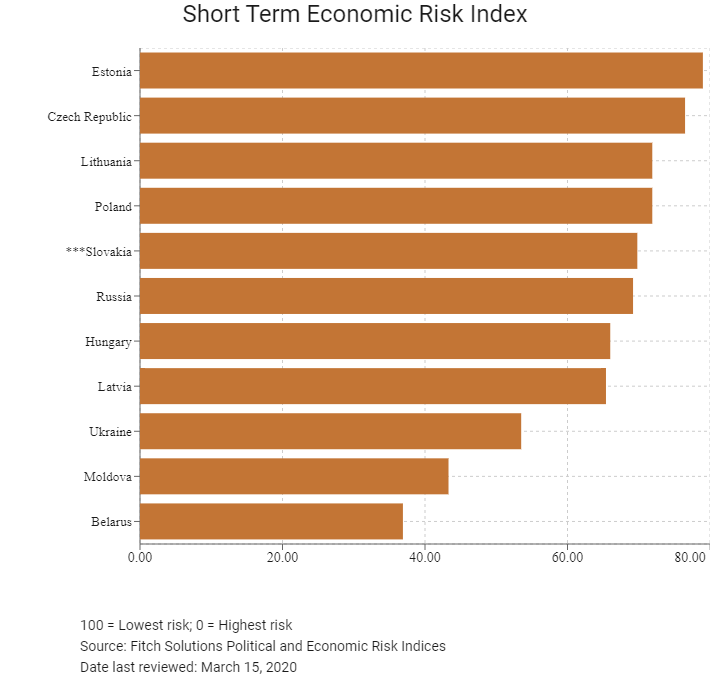

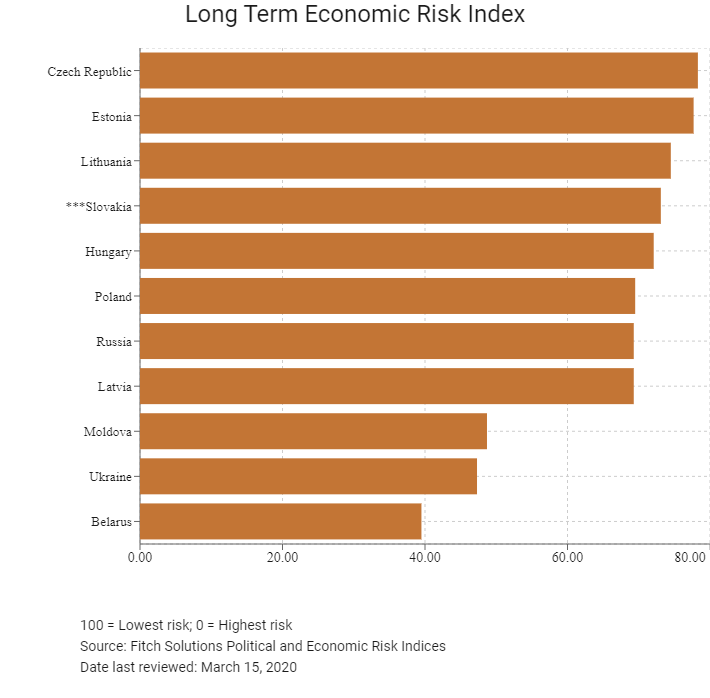

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

26/202 |

30/201 |

28/201 |

|

Short-Term Economic Risk Score |

79.8 |

68.1 |

69.8 |

|

Long-Term Economic Risk Score |

73.5 |

72.6 |

73.1 |

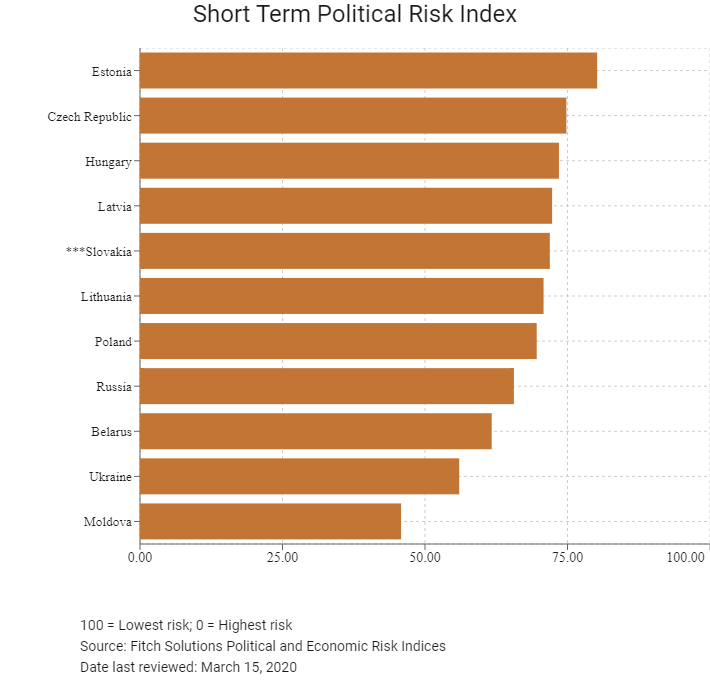

|

Political Risk Index Rank |

31/202 |

31/201 |

30/201 |

|

Short-Term Political Risk Score |

71.9 |

71.9 |

71.9 |

|

Long-Term Political Risk Score |

80.3 |

80.3 |

80.3 |

|

Operational Risk Index Rank |

44/201 |

43/201 |

44/201 |

|

Operational Risk Score |

63.6 |

63.7 |

63.8 |

Source: Fitch Solutions

Date last reviewed: March 15, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

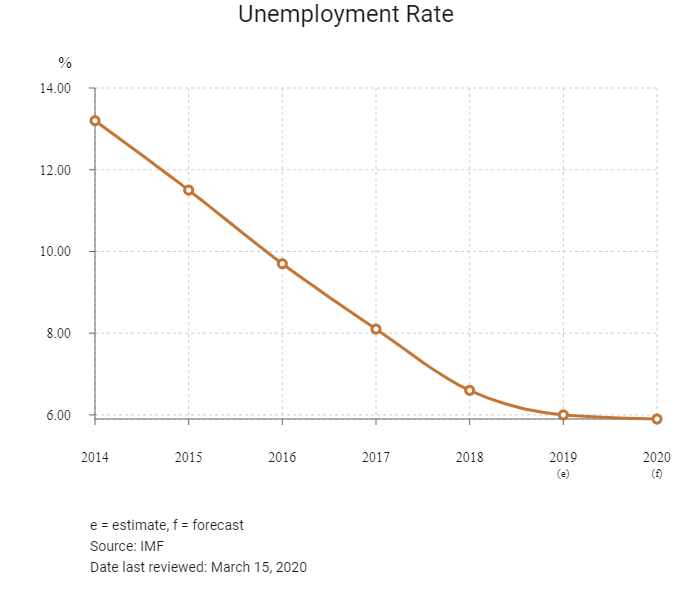

Slovakia's open economy remains broadly stable and has benefitted from access to the EU Customs Union. Although this has facilitated the country's export-led growth over the past six years, it will also pose challenges in the future. Eurozone growth is expected to remain below pre-crisis levels; however, domestic demand will remain robust, aided by a strong consumer outlook. Economic growth should remain broadly stable in 2020, despite the challenging external backdrop. Strong household spending, underpinned by a tight labour market, should support the economy, while investment growth is seen picking up amid increased EU funds inflows and growing car production capacity. However, Brexit and prolonged weakness in Germany pose risks to the outlook.

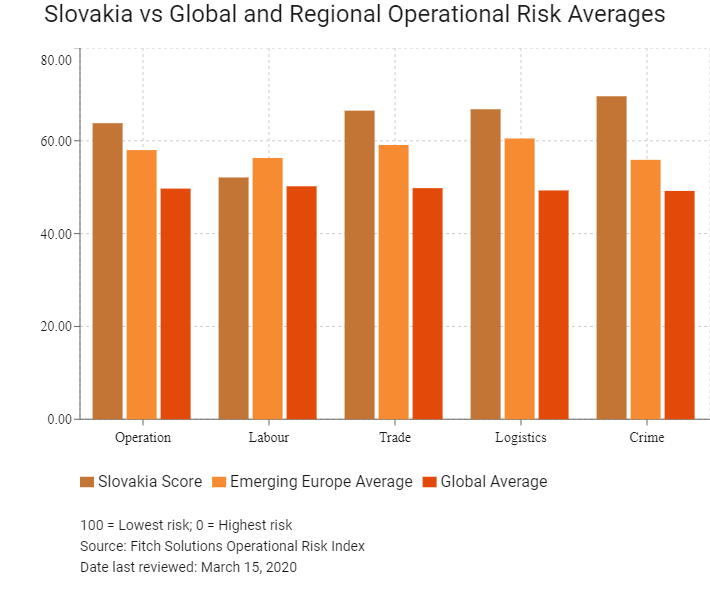

OPERATIONAL RISK

Slovakia has an attractive investment profile supported by its welcoming attitude to foreign direct investment, few restrictions on foreign ownership and openness to trade. The country boasts an extensive road network which forms part of several major trans-European corridors and offers good connectivity to its major trading partners and regional peers. This is boosted by the fact that Slovakia's key trading partners (Czech Republic, Germany, Hungary and Austria) are also members of the EU, which is highly beneficial to the country's export-orientated manufacturing sector as businesses face minimal trade barriers. Slovakia gives businesses easy access to credit via a well-developed banking sector, boasts a good quality power infrastructure network, and carries a low security risk. This reduces the need for costly security expenditure to protect foreign employees and company premises. The country's competitiveness is somewhat undermined by rising labour costs and higher levels of corruption compared with its peers in the EU.

Sources: US Department of Commerce, Fitch Solutions

Date last reviewed: March 17, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Slovakia score |

63.8 |

52.1 |

66.5 |

66.8 |

69.6 |

|

Central and Eastern Europe Average |

62.7 |

58.5 |

63.5 |

67.4 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

6 |

10.0 |

6.0 |

8.0 |

5.0

|

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

8 |

25 |

7 |

10 |

6 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

44 |

86 |

39 |

45 |

35 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

71.2 |

63.1 |

76.3 |

71.0 |

74.3 |

|

Czech Republic |

69.6 |

60.6 |

67.8 |

73.6 |

76.5 |

|

Lithuania |

69.5 |

61.2 |

71.4 |

74.3 |

71.0 |

|

Poland |

69.2 |

59.2 |

69.3 |

75.5 |

72.8 |

|

Latvia |

66.8 |

63.4 |

67.1 |

69.4 |

67.4 |

|

Slovakia |

63.8 |

52.1 |

66.5 |

66.8 |

69.6 |

|

Hungary |

63.5 |

55.7 |

62.0 |

70.1 |

66.3 |

|

Belarus |

59.1 |

60.1 |

58.6 |

66.6 |

51.3 |

|

Russia |

58.3 |

65.9 |

58.6 |

67.9 |

40.6 |

|

Moldova |

49.8 |

44.7 |

51.7 |

53.4 |

49.3 |

|

Ukraine |

48.7 |

57.9 |

49.0 |

54.4 |

33.6 |

|

Regional Averages |

71.2 |

63.1 |

76.3 |

71.0 |

74.3 |

|

Emerging Markets Averages |

69.6 |

60.6 |

67.8 |

73.6 |

76.5 |

|

Global Markets Averages |

69.5 |

61.2 |

71.4 |

74.3 |

71.0 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 15, 2020

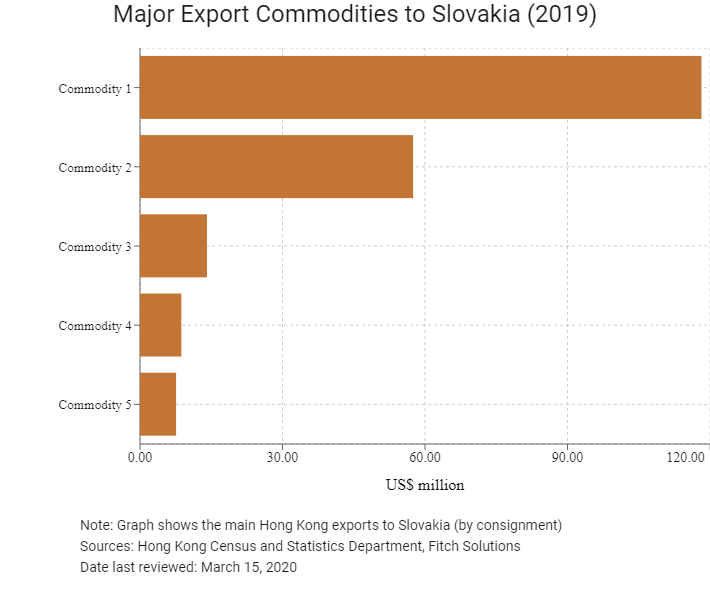

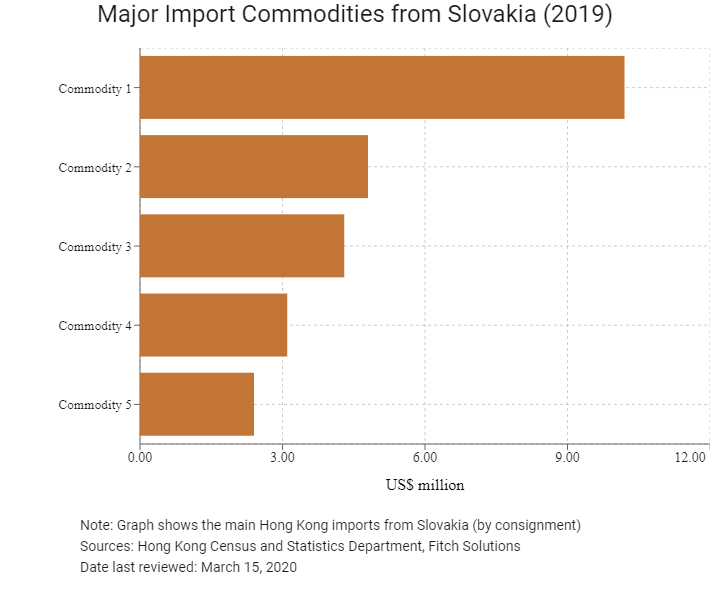

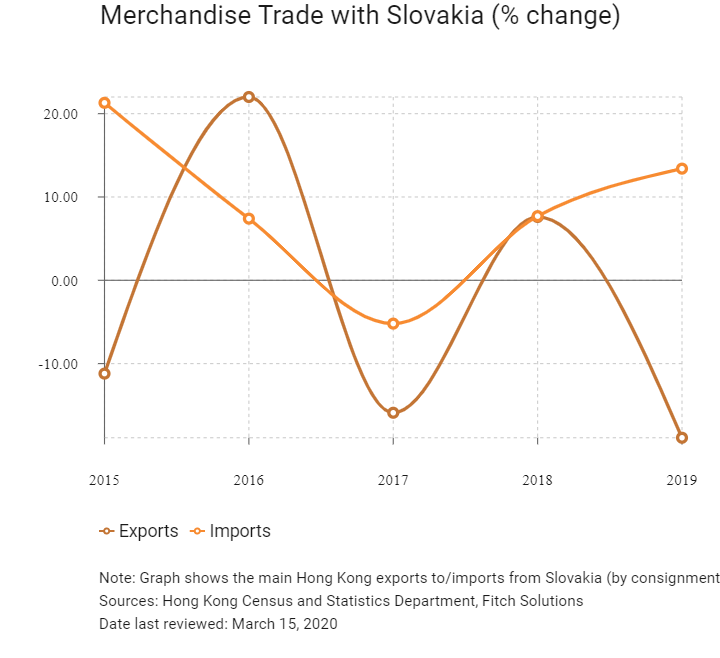

Hong Kong’s Trade with Slovakia

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 118.2 |

| Commodity 2 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 57.5 |

| Commodity 3 | Professional, scientific and controlling instruments and apparatus | 14.1 |

| Commodity 4 | Office machines and automatic data processing machines | 8.7 |

| Commodity 5 | Manufactures of metals | 7.6 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 10.2 |

| Commodity 2 | Photographic apparatus, equipment and supplies; optical goods; and watches and clocks | 4.8 |

| Commodity 3 | Office machines and automatic data processing machines | 4.3 |

| Commodity 4 | Road vehicles (including air cushion vehicles) | 3.1 |

| Commodity 5 | Professional, scientific and controlling instruments and apparatus | 2.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Slovakian residents visiting Hong Kong |

5,154 |

-15.1 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board

Date last reviewed: March 15, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

2,316 |

-0.5 |

|

- Regional headquarters |

507 |

1.8 |

|

- Regional offices |

746 |

6.0 |

|

- Local offices |

1063 |

13.3 |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Slovakia

- Slovakia and Mainland China have a bilateral investment treaty that came into force in December 1992, but it does not apply to Hong Kong.

- Slovakia's double taxation treaty with Mainland China came into force in December 1987, but it applies only to the Mainland China and excludes Hong Kong.

Source: Investment Policy Hub

Chamber of Commerce (or Related Organisations) in Hong Kong

Slovakian Consulate in Hong Kong

Address: 11/F, Milo's Industrial Building, 2-10 Tai Yuen Street, Kwai Chung, New Territories, Hong Kong

Email: slovakconsulatehk@milos.com.hk

Tel: (852) 2484 4568

Fax: (852) 2194 0722

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not require a visa if the maximum duration of stay is less than 90 days in any 180-day period.

Source: Hong Kong Immigration Department

Date last reviewed: March 15, 2020

Slovakia

Slovakia