Hong Kong

Many enterprises on the Chinese mainland are actively investing in factory automation in order to mitigate labour shortages and enhance competitiveness by turning out higher quality products. In a bid to improve added value and competitiveness, some enterprises pursue high-tech business, while others adopt a brand-building strategy. But the division of roles and responsibilities among different industries is increasingly refined, with domestic and global supply chains becoming more complex. As a result, many businesses need to source service support from third parties to better connect various elements of their operations. Improved connections from research and development, to design, production, sales and after-sales service, as well as enhanced supply chain management, can help companies’ transformation and upgrade strategies.

As pointed out by Shanghai Miller Supply Chain Management Co Ltd (Miller) during a recent interview[1], the mainland traffic and transportation network has come a long way in recent years and efficient logistics has become an integral part of many industries’ operation. In the competitive mainland logistics market, some enterprises use a low-price strategy, whereas others pursue a value-add approach, providing clients with comprehensive supply chain management in addition to logistics supports.

Many companies are making use of transport and procurement platforms in the Yangtze River Delta, Pearl River Delta and even Hong Kong for sourcing or transit at different locations. This enables businesses to secure a wide range of production materials, handle movement of components from different sources and distribute finished products to different destinations. This is particularly the case with the import and export of higher-value products, including high-end electronic parts, where businesses tend to make use of efficient international air transport hubs, such as Hong Kong, to send goods to the mainland or export them to overseas markets.

As Hong Kong is one of Asia’s major electronic parts and components distribution centres, many companies dealing in these items have set up offices there for procurement and transportation of various kinds of electronics through the city. Specific freight and logistics routes vary, depending on individual companies’ specific operation.

According to a Miller executive, the company not only runs logistics facilities in the Shanghai Pilot Free Trade Zone and Pudong Airport, but has also set up branch offices and transit warehouses in Shenzhen and Hong Kong. This enables Miller to support its clients with a third-party freight and logistics network, both domestically inside the mainland and internationally. In addition, it provides one-stop supply chain management through its mainland and Hong Kong network.

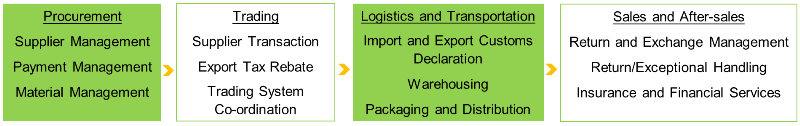

General Supply Chain Services Required

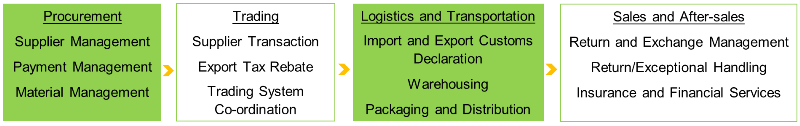

To assist mainland enterprises’ business upgrade strategies, Miller also helps manufacturer clients to identify appropriate technology and production materials, as well as to source key parts and components, including the referral of overseas suppliers and technology partners. It also provides related procurement management services, such as arranging international payment, transaction and export tax rebates. At present, supply chain management services provided by Miller cover the Chinese mainland, Europe, the Americas, Japan and Korea, serving businesses in food products, aircraft parts and components, medical instruments/equipment and a wide range of electronics.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Miller was interviewed jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce in Q1 2018.

Editor's picks

Trending articles

In view of intense market competition and the need for industrial transformation and upgrade, China is encouraging enterprises to enhance their product R&D capabilities and production technologies, while adopting innovative supply-chain management practices. In October 2017, for example, the State Council issued its Guiding Opinions on Actively Promoting Supply Chain Innovation and Application. The hope is that, by 2020, this initiative will see all of China’s major industrial sectors benefitting from new technologies and new supply chain development business models, as well as having access to smart supply-chain systems. [1]

In recent years, the slowing of China’s economic growth has not only affected small and medium-sized enterprises, but has also created challenges for large companies. According to Huayu Automotive Systems (Huayu) [2], a leading mainland automotive parts and components company, the domestic car market is tailing off, the ecology of the global car industry is changing rapidly and the requirements of car buyers are becoming increasingly stringent. As a result, the company has had to constantly improve its corporate systems and enhance its R&D capabilities. At the same time, in order to comprehensively boost its competitiveness, it has had to optimise the structure of its parts and components supply chain in line with the challenges emerging from the slowdown in the market.

Generally, vehicle manufacturers are now adopting a global procurement strategy that requires a zero-inventory approach and a just-in-time production model. As a result, auto parts suppliers along the supply chain are constantly required to upgrade their capacity levels in line with the changing priorities of vehicle manufacturers as they expand into new geographic markets.

As competition among vehicle manufacturers intensifies amid slowing market demand, the ensuing price pressure is passed back along the supply chain to auto parts companies. At the same time, labour costs are rising continuously and raw material prices are in a state of flux. The problems of the automotive manufacturing and auto parts sectors have also been exacerbated by the pressure to develop electric cars and smart cars, whilst continuing a programme of perpetual technological upgrade. Against this backdrop, auto parts companies are also looking to enhance their internal operational efficiency, while forever on the lookout for relevant technology and supply chain resources, either through co-operation with third parties or via mergers / acquisitions.

In Huayu’s case, it is upgrading its related supply-chain deployment and upgrading its management information systems as a means of enhancing its control of its supply-chain resources. It is also establishing a subsidiary in Hong Kong. As well as handling foreign exchange revenues and international payments, this new operational centre will play a key role in sourcing partners, capital, information and technology across the international markets. It is hoped that that this will ensure that the appropriate external resources can be incorporated and that the supportive capabilities of the company’s supply chain will be enhanced. Additionally, in order to meet its future development objectives, Huayu is continually obliged to invest in new projects on a global basis. As, typically, these overseas investment and financing activities necessitate complex financial and commercial transactions and negotiations, it frequently needs to call on the expertise of Hong Kong’s professional services sector.

Huayu is the largest company in the Chinese automotive parts and support market and a tier-one supplier to Chinese and Sino-foreign vehicle manufacturers on the mainland. It is listed on the Shanghai Stock Exchange and its business scope extends across interior and exterior trim parts, metal forming and dies/moulds, electric and electronic parts and new-energy car parts. The company is now looking to advance the internationalisation of its business, which will include expansion into the international automotive electronics products market. Ultimately, its strategy is to emerge as a truly global player.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] For further details, see China Seeks to Establish World Class Smart Supply Chains by 2020 under Regulatory Alert-China.

[2] Huayu was interviewed jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce in Q1 2018.

Editor's picks

Trending articles

In tapping opportunities arising from the Belt and Road Initiative, Chinese enterprises are not confining themselves to investing in major infrastructure projects. In fact, quite a number of them have established distribution channels in Belt and Road markets to sell different kinds of products. Others have chosen to set up manufacturing plants or source raw materials in Belt and Road countries for the Chinese mainland market.

All told, the types of businesses involved are increasingly diversified. In order to boost overall operational performance and foster sustained development of their overseas business, many of these enterprises need a great deal of service support to link up mainland production systems with their overseas business operations. In addition to utilising networks in Shanghai, Hong Kong and elsewhere to improve international logistics efficiency, they also have to strengthen information and capital flow management.

Maitrox, a supply chain service company headquartered in Shanghai, pointed out in an interview [1] that, although many mainland enterprises have high-tech production capabilities and the quality of their products is comparable to that of leading international brands, they need related service support in supply-chain management in “going out” and in developing Belt and Road markets. For example, in selling their own-label products in overseas markets, many enterprises are making considerable gross profits if reckoned only on a sales basis. But, if they want to develop their brand business and maintain brand loyalty and the support of overseas consumers, they would have to provide consumers with efficient after-sales and repair services, either through distributors or directly in the respective local markets. This may involve high fees and costs that might eat into the profits of the business concerned and, if not handled properly, might even affect the image of their brands in overseas markets.

Mainland enterprises are venturing into various overseas markets and Belt and Road related regions to set up comprehensive supply-chain management networks. The coverage spans across Asia, including Southeast Asia and India, Africa and even as far afield as Europe, and North and South America. According to Maitrox, many companies would like to use third-party services to raise the efficiency of such business processes as production, sales and after-sales services, and also to minimise the operation costs of expanding into international markets.

To be able to achieve these objectives, however, the service providers concerned need to have sophisticated IT, such as state-of-the-art big data analytics, before they can offer suitable solutions in designing and setting up networks in procurement, production, inventory, sales and after-sales services. They also need to utilise related financial services to help enterprises plan the income and expenses of each aspect of their business. In addition to improving cash flow in the entire business process and lowering funding costs, they also have to help solve problems in international payments and exchange risks.

Maitrox is currently providing comprehensive supply-chain services to mainland brands and other customers. This includes planning consultation and execution covering the entire production, sales and after-sales processes. For example, Maitrox provides its mobile phone business customers with after-sales supply-chain services to help set up overseas markets service networks. Such networks offer phone replacement, on-site repair, spare parts management, premium-grade repair and testing.

For customers with smaller overseas operations, Maitrox will help organise mail-in repair services by using logistics to send products requiring repairs back to the mainland, such as factories in Shanghai and Shenzhen bonded zones. In these factories, chip-level repairs, replacement and refurbishment will be carried out, before the mobiles are sent back to the overseas consumers expeditiously.

For this, in addition to running a number of repair centres and smart warehouses around the world, Maitrox has also set up a global repairing hub in Hong Kong. This way, with the support of advanced IT management systems, it can make use of Hong Kong’s international logistics network to transfer products, parts, components and spare parts for global distribution. Backed by its supply chains in Shanghai and elsewhere on the mainland, as well as Hong Kong’s financial services, Maitrox can provide customers with cost-effective global supply-chain management services.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Maitrox Smart Supply Chain was interviewed jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce in Q1 2018.

Editor's picks

Trending articles

The Yangtze River Delta (YRD) is one of the major economic engines of China, as well as the biggest source of China’s outward direct investment (ODI). Enterprises in this region are making haste to open and develop markets along the Belt and Road routes in the hope of further boosting their business growth.

An important focus of these enterprises is to more effectively connect the YRD with the industry chains of other mainland regions and international markets through its gradually maturing network of transportation with the outside world. This includes sea and air transport as well as the China-Europe Railway Express line (or CR Express), which has seen rapid development lately, in order to better tap into new markets along the Belt and Road routes and other overseas markets.

CR Express Attracts Much Interest

Many companies have already established distribution channels in Belt and Road markets to sell their products. Their business is wide-ranging and needs the support of transportation networks in the YRD, South China and even Hong Kong in order to improve international logistics efficiency, while connecting their production system on the mainland with overseas business operations (For further details, see Devising “Belt and Road” Supply Chain Management System). Companies in the YRD are actively making use of the sea and air transportation and logistics networks in the region to connect with overseas markets, and more and more companies are beginning to pay attention to the transport of goods by train as an alternative.

Compared with sea and air transport, the freight volume of rail transport is relatively small. In 2016, rail transport only accounted for about 2% of the total freight volume of Jiangsu and Zhejiang and less than 1% of Shanghai’s [1]. Following the accelerated development of CR Express services, however, the service frequency of freight trains running between China and Europe has seen rapid growth in recent years.

Rail links have been extended from inland provinces in the western region to the YRD and other coastal cities. Many logistics service suppliers have come to see the potential of rail transport, and some of them have started to make active use of freight trains to ship goods sourced from coastal and western regions to Europe. A foreign-invested logistics company in the YRD even expressed the hope of leveraging the CR Express to further develop rail freight transport between Japan and Europe through the Chinese mainland. (For further details, see Planning for CR Express Connectivity to “Belt and Road” Logistics Network.)

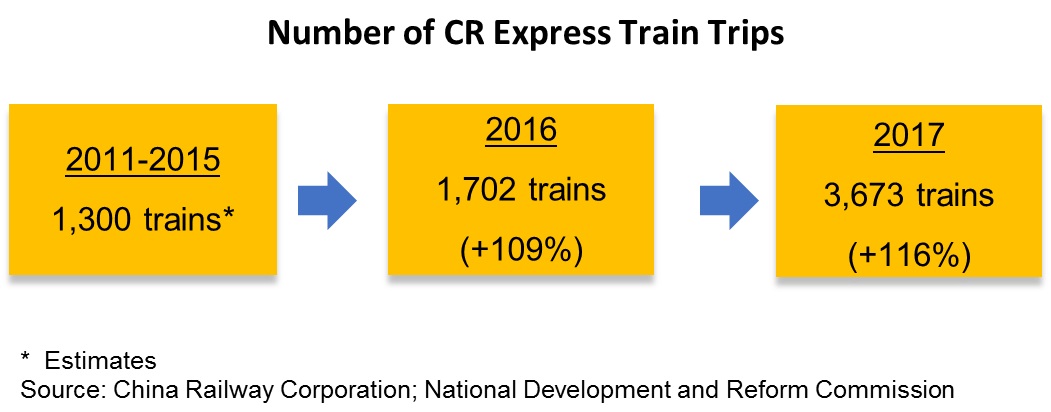

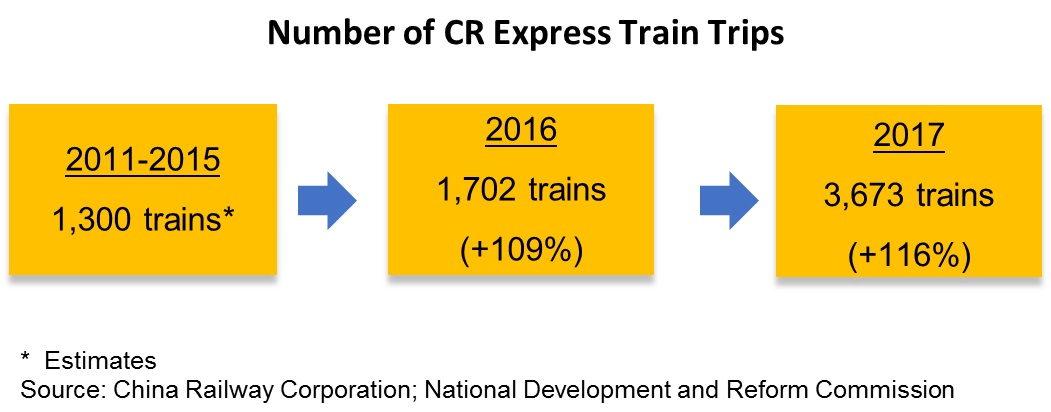

Since the first CR Express train set off from Chongqing to Duisburg (or Yuxinou, the Chongqing-Xinjiang-Europe International Railway) in Germany in 2011, about 6,600 trains had been dispatched up to the end of 2017. [2] In particular, the frequency of such train service has increased significantly in 2017, exceeding the total trips made during the six years between 2011 and 2016. This reflects the fact that mainland companies are relying more and more on trains to deliver goods to Europe.

The service was mainly used to ship Chinese goods to Europe in the early days, but the situation is gradually changing as more companies use rail links to import goods from Europe. In 2017, the number of inbound trains amounted to over half of that of outbound trains [3], putting trade between China and Europe by rail on the path of two-way development.

CR Express Provides an Alternative for Freight Transport

The National Development and Reform Commission announced the Development Plan for CR Express (2016-2020) in October 2016 with the aim of forming a convenient and efficient CR Express service system with steady transport volume by 2020. At the time of the announcement the CR Express had operated a total of 1,881 trips, with 16 departure cities in China and 12 destination cities abroad. [4]

According to the National Development and Reform Commission, departure cities in China had increased to 38 by the end of 2017, and the service had expanded to 36 cities in 13 countries across Europe in just a year. The range of outbound goods has gradually expanded from information technology products in the early days, like mobile phones and computers, to clothing, footwear and headwear, automobiles and auto parts, grain, wine, coffee beans, timber, furniture, chemicals, machinery and equipment.

Development Plan for CR Express (2016-2020) Aim: Increase frequency of freight train service to around 5,000 annually by 2020, with marked increase in freight volume on inbound trains. Western corridor: - Crossing the border at Alataw Pass (Khorgos) in Xinjiang, passing through Kazakhstan to connect to the Siberian Railway in Russia, crossing Belarus, Poland and Germany, and finally reaching other European countries. - Crossing the border at Khorgos (Alataw Pass) and finally reaching Europe after passing through Kazakhstan, Turkmenistan, Iran and Turkey, or passing through Kazakhstan and crossing the Caspian Sea into Azerbaijan, Georgia and Bulgaria, finally reaching Europe. - Connecting to the planned China-Kyrgyzstan-Uzbekistan Railway via the Torugart Pass (Irkeshtam), finally reaching Europe after crossing Kyrgyzstan, Uzbekistan, Turkmenistan, Iran and Turkey. Central corridor: - Crossing the border at Erenhot in Inner Mongolia to connect to the Siberian Railway after passing through Mongolia, finally reaching Europe. Eastern corridor: - Crossing the border at Manzhouli in Inner Mongolia (Suifenhe in Heilongjiang) and reaching Europe after connecting to the Siberian Railway in Russia. Departure/destination cities in China: - Chongqing, Zhengzhou, Chengdu, Wuhan, Suzhou, Yiwu, Shenyang, Changsha, Lanzhou, Beijing, Tianjin, Lianyungang, Yingkou, Qingdao, Urumqi, Xi’an, Hefei, Jinan and Dongguan. |

Besides Chengdu, Chongqing and other cities in western China, increasingly goods originating from production bases along the coastal region are exported through CR Express. For example, after the opening of the CR Express service between Yiwu in Zhejiang and the Spanish capital of Madrid in November 2014, small commodities from Yiwu were continually shipped to the European market via rail transport. On the other hand, goods imported from Europe on inbound trains are also becoming more diversified and cover a much wider range, including food and beverages like wine and olive oil, raw materials such as timber and pulp, and even electrical equipment, solar film, electronic components and machinery.

CR Express has also extended its service to South China. This includes the launch of the service from Shilong of Dongguan to Duisburg of Germany in April 2016 and another service from Guangzhou to Kaluga of Russia in August 2016. Clothing, footwear, computer accessories and electronic equipment produced in the Pearl River Delta (PRD) region can now be shipped by using standard 40-foot containers carried on CR Express. These developments help bring the YRD, PRD and other coastal regions closer to the European markets and suppliers.

It is worth noting that thanks to government support, CR Express can provide one-stop service in inspection, quarantine, customs declaration, customs clearance and other areas. Although trains bound for Russia, Central Asia (such as Kazakhstan) and even Eastern and Western Europe have to change tracks due to gauge differences, the technical problems have been resolved through the arrangement of railway and transportation companies. The logistic companies responsible for shipping the goods will also monitor the complete shipping process, provide the consignors with customs clearance service, and make sure that the goods are delivered to the required warehouses after reaching the respective railway terminals. These services contribute to the development of CR Express.In April 2017, a collaboration agreement was signed by railway departments of seven countries involved in the operation of CR Express, including China, Belarus, Germany, Kazakhstan, Mongolia, Poland and Russia. A broad consensus was reached on rail connectivity, optimisation of transportation organisations, perfection of service safeguards, improvement of customs clearance efficiency, and other issues. CR Express can expect steady growth in future thanks to cross-border collaboration.

The recent rapid expansion and increasing frequency of Europe-bound rail services, and the significantly shorter lead time of 10-12 days for the fastest routes, means rail has gradually become a viable alternative to sea and air transport for export and import businesses. Generally, these freight trains can transport cargo to their European destinations three times faster than shipping by sea for one-fifth of the cost of transport by air. While rail freight is still more costly than sea freight [5], CR Express can work as an adjunct to sea and air transport and attract more and more companies to use rail services to expand China-Europe trade.

These developments will effectively enhance the transport links between China and countries in Asia and Europe and strengthen the capabilities of related logistics providers of cargo transportation and distribution. Under such circumstances, companies not just in the western regions but also along the coast may need to consider the feasibility of the further rail transport use to enhance their flexibility in expanding into Eurasian markets. Furthermore, logistics operators can also strengthen partnerships and co-operation with the relevant railways, helping to connect them to logistics and transport networks in the YRD, South China and even Hong Kong and so enhance their advantage in the international transportation and integrated logistics business.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Source: Jiangsu Statistical Yearbook, Zhejiang Statistical Yearbook, Shanghai Statistical Yearbook.

[2] Estimates.

[3] Source: China Railway Corporation.

[4] June 2016 figures.

[5] Source: National Development and Reform Commission.

Editor's picks

Trending articles

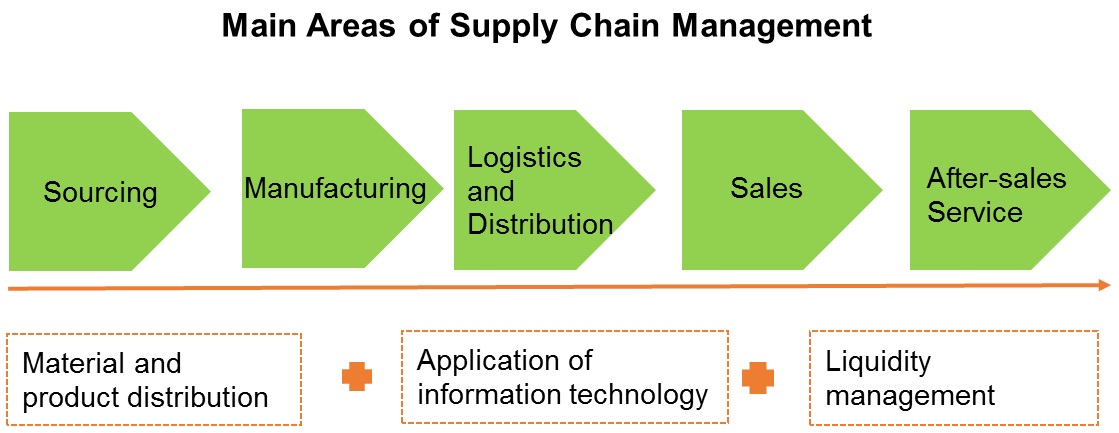

China has become the world’s largest industrial manufacturer. As such, it needs to import a wide range of raw materials and industrial products to sustain its massive manufacturing sector, while exporting all kinds of finished and semi-finished products to overseas markets. As transportation and production networks in Asia continue to develop, the division of labour between mainland enterprises and overseas countries is becoming increasingly complex, making China an important member of the global supply chain. In the wake of this industrial transformation and upgrade, many Chinese enterprises are aiming to enhance their supply chain management capability while focusing on the development of technology and brands. They are looking to improve the efficiency of the sourcing and production of materials and key components, raise the operational efficiency of related distribution and after-sales services, optimise the management of material flow, information flow and money flow, increase the added value of their business, and enhance competitiveness.

As a key driver of China’s economic development, the Yangtze River Delta (YRD) is seeing its internal infrastructure and transportation networks and links with other regions grow steadily. Strengthening the region’s logistics distribution capability and making its logistics and transportation connections with other mainland cities and international markets more efficient would help YRD enterprises in their efforts to establish a modern supply chain management system. Increasing numbers of YRD enterprises are using the industrial resources and advantages of other regions to improve their sourcing, production and sales service systems through industry chains in the coastal and inland provinces. The geographical span of their business is becoming ever wider.

Against this backdrop, YRD enterprises are trying hard to make better connections with overseas markets through logistics and transportation networks in the coastal areas, South China and Hong Kong. They are also using information and financial services to improve their supply chain management system. Hong Kong, as an international financial centre and the regional trading hub, is the preferred platform for many mainland enterprises “going out” as it can provide them with all kinds of professional services to help them expand their international business. With YRD enterprises looking to Hong Kong for help in managing their supply chains, this should generate more opportunities for Hong Kong service providers.

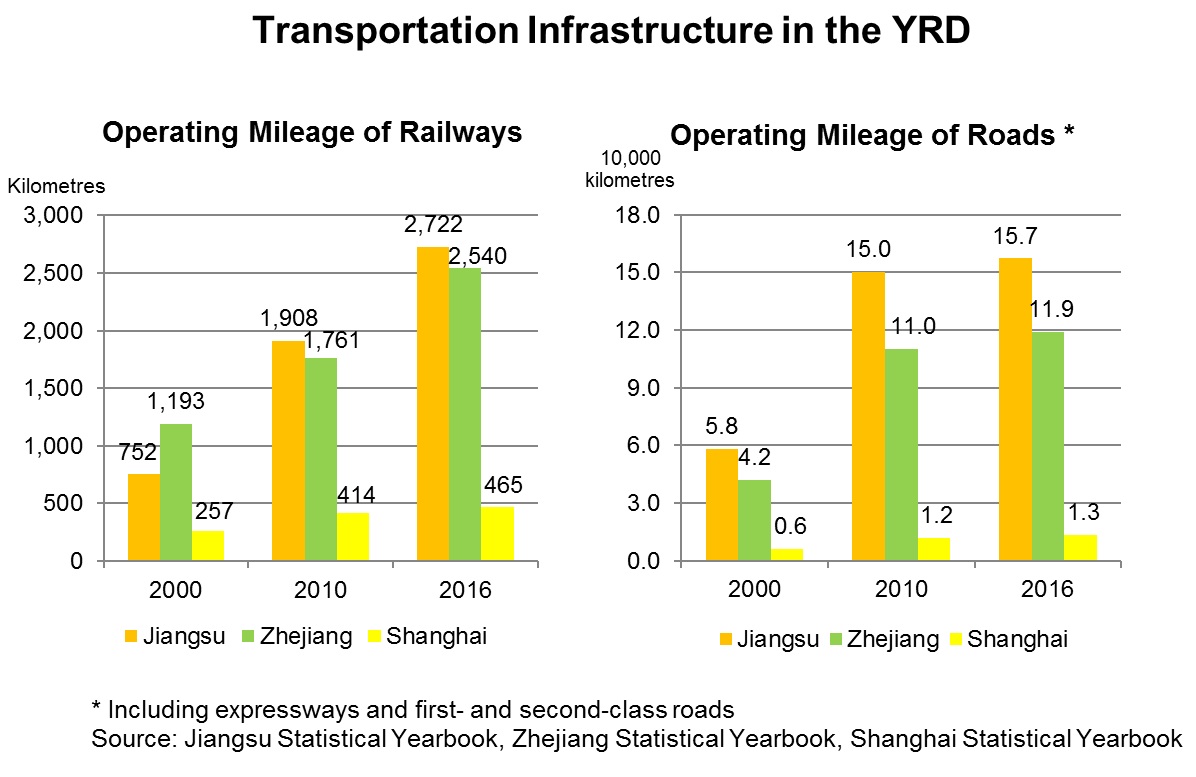

Steady Expansion of Logistics Networks

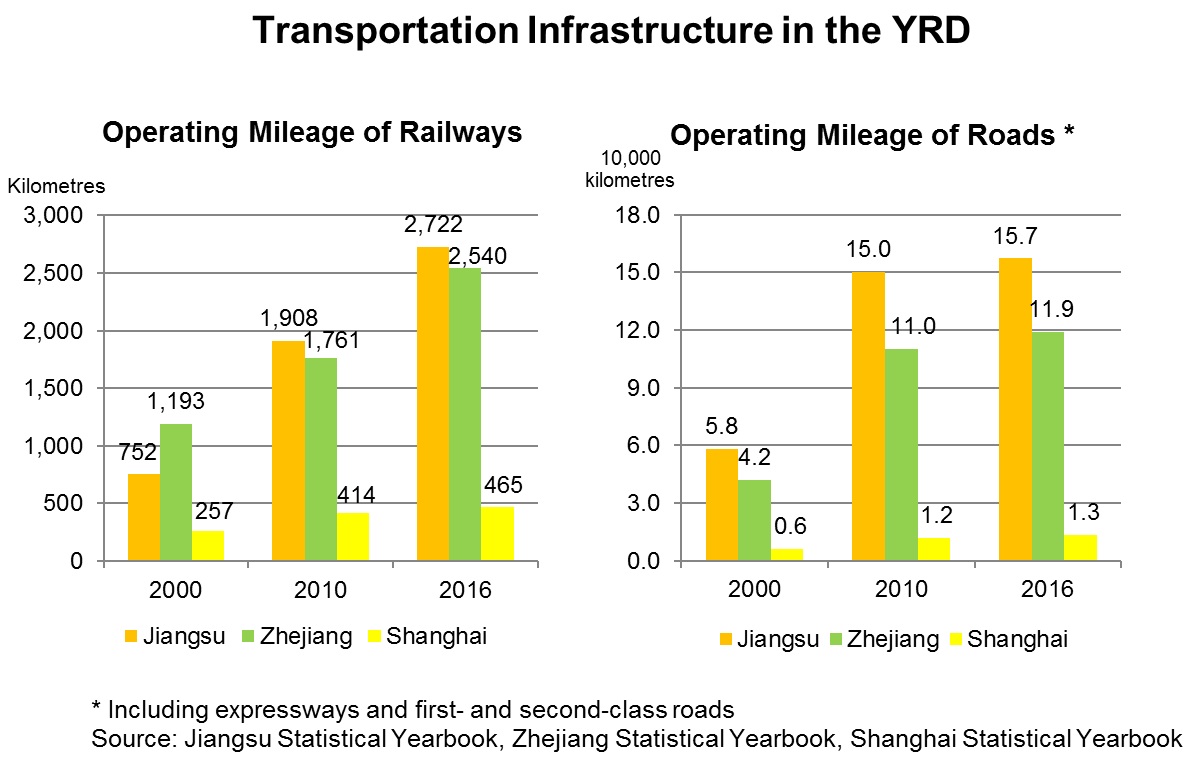

The YRD’s main city Shanghai has not only expanded its sea and air transport networks with other regions and countries in recent years but has also teamed up with neighbouring provinces Jiangsu and Zhejiang to accelerate the development of inter-city and regional transport construction. This has greatly facilitated freight transport services in the region and will improve the efficiency of local and international logistics and transportation services. Since 2000, Shanghai, Jiangsu and Zhejiang have made great efforts to expand their rail and road networks. Important developments include the Shanghai-Nanjing Intercity Railway which runs via Suzhou, Wuxi, Changzhou, and Zhenjiang in Jiangsu, and the Beijing-Shanghai High-Speed Railway which also passes through Jiangsu. Work is underway to electrify the whole of the Shanghai-Hangzhou Railway linking Shanghai with the provincial capital of Zhejiang, which will allow trains to travel the route faster. Jiangsu and Zhejiang have also stepped up the construction of expressways along the Yangtze River and the coastline, as well as intercity and urban highway networks aimed at increasing links between the transportation and logistics networks in the new development areas and new towns in major cities within the region.

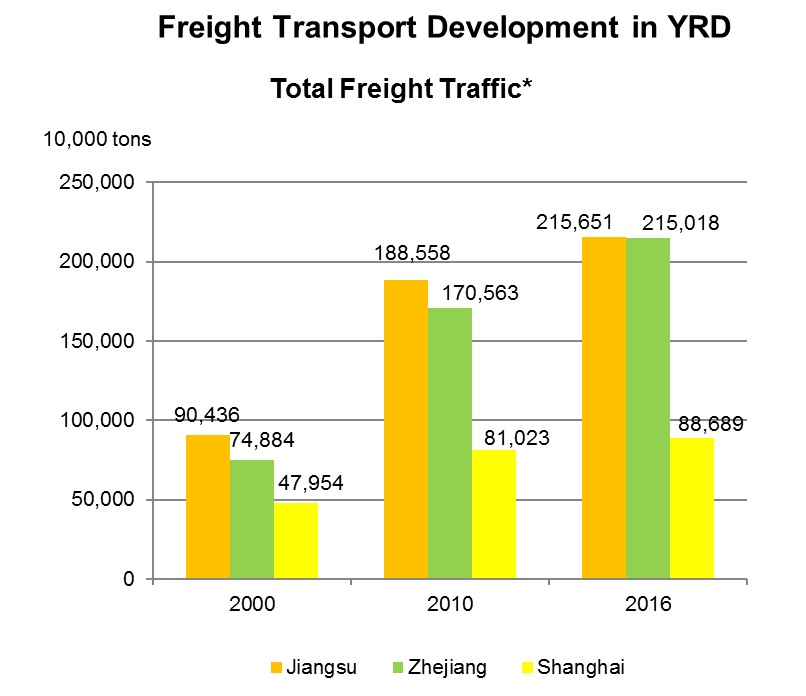

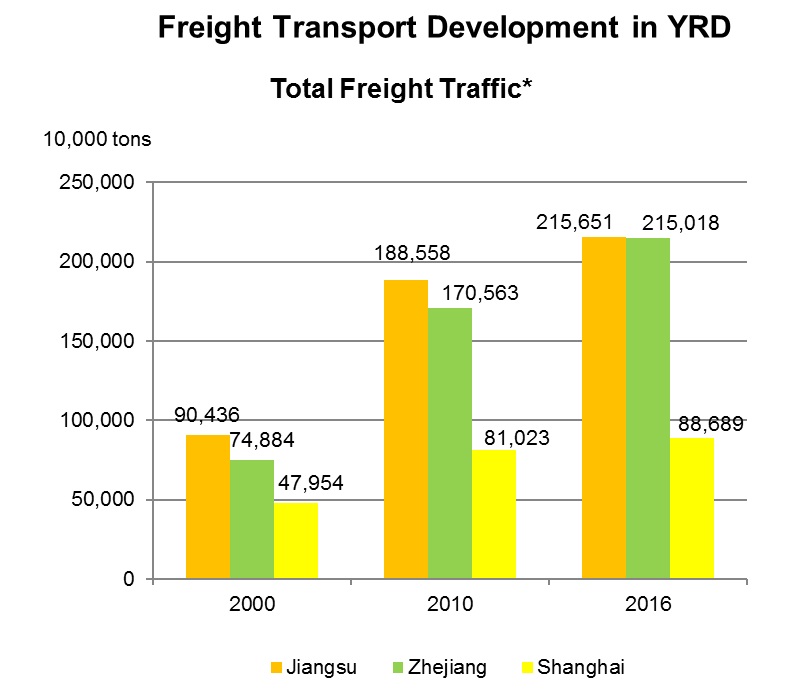

Continuous industrial development in the YRD, the Yangtze River Basin and the neighbouring areas has also increased the demand for logistics and transportation services. This, together with the expansion of transportation networks, has given a great boost to freight traffic in the YRD. Total freight traffic in Shanghai, Jiangsu and Zhejiang has grown exponentially over the past 10 years. Most freight traffic in 2016 was carried on roads linking different production bases in the region. It accounted for 44% of Shanghai’s total freight traffic, 54% of Jiangsu’s and 62% of Zhejiang’s. Railways accounted for just 2% of freight traffic in Jiangsu and Zhejiang and less than 1% of that of Shanghai. [1]

In recent years, however, growing numbers of logistics service providers have noticed the development potential of rail transport. CR Express has been increasing the frequency of its train services and expanding its network from inland provinces in the western part of the country to the YRD region and other coastal cities. Some service providers are actively using CR Express services to collect goods in the coastal and western regions for transport by rail to Europe and to tap business opportunities in China-Europe trade and the Belt and Road initiative. (For further details, see Leveraging CR Express to Tap “Belt and Road” Markets)

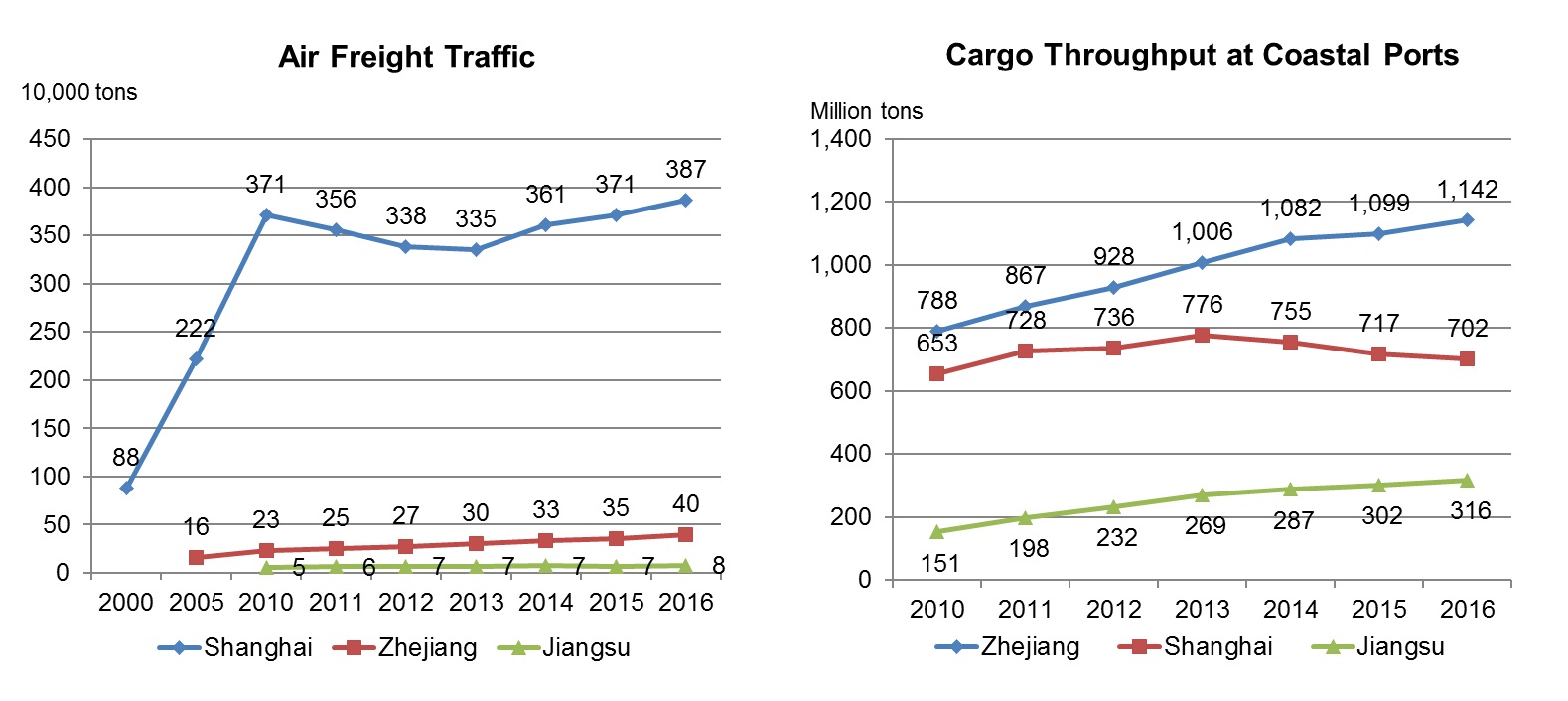

The development of air and sea transport linking the YRD with other regions and international markets varies from place to place. Although air transport accounts for a relatively small share of freight traffic, it is the main form of transport for more up-market commodities and higher value-added products. Demand for air transport is growing increasingly keen as China develops high-tech industries, selling electronic chips and key components of machinery and electronic products. The rapid expansion of the markets for high-quality consumer goods, foodstuffs and fast-moving consumer goods, many of which are imported, has also stimulated the demand for air freight.

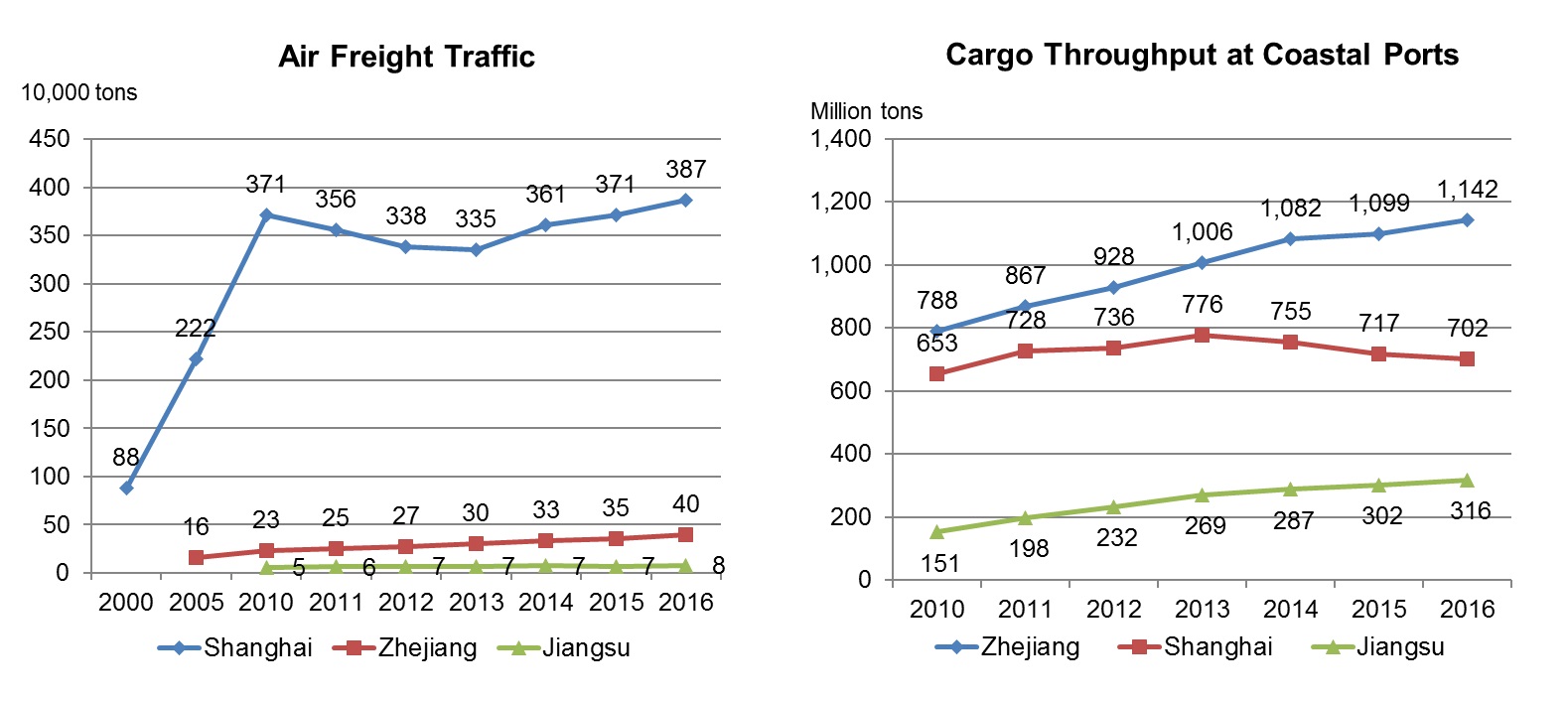

Shanghai’s air freight soared from 880,000 tons in 2000 to 3.87 million tons in 2016 at an average annual growth rate of 10%. In comparison, air freight volume in Jiangsu and Zhejiang is relatively small. This is not just because Shanghai has many international air routes and Pudong and other airports have increased their air freight traffic and handling capacity, but also because Shanghai has been pursuing trade facilitation policies in recent years. For example, the Shanghai Pilot Free Trade Zone has adopted various measures to make customs clearance easier and improve the efficiency of customs declaration and commodity inspection. Shanghai’s inspection and quarantine authority has also improved upon its regulatory model, greatly shortening the time it takes to inspect imported products, including foodstuffs and cosmetics. Facilitating trade has played an important role in making Shanghai the air freight hub of China’s eastern coastal areas.

Each enterprise in the YRD and its neighbouring areas has its own place in the industry chain and has its own specific needs when it comes to logistics services. When deciding on what air transport routes and inter-modal transport system to use, a company will take into consideration a combination of factors alongside cost-effectiveness, such as the characteristics of different categories of products, the customs clearance efficiency and facilitation measures at different customs checkpoints, and the convenience of logistics distribution in the local and international markets. As well as adopting measures to facilitate trade, Shanghai, Jiangsu and Zhejiang have also made great efforts in recent years to upgrade the region’s aviation logistics services by strengthening their links with Hong Kong and other aviation hubs. (For further details, see Using Logistics Solutions to Enhance Air Freight Capability)

As regards freight transport shipped from coastal ports to other regions of China and international markets, the cargo throughput at ports along the Zhejiang coast has witnessed quite remarkable growth, reaching 1.14 billion tons in 2016. This is largely due to the rapid development of the Zhoushan Port in Ningbo. Shanghai’s cargo throughput paled in comparison, amounting to only 700 million tons in 2016. This was due to a drop in domestic trade in recent years. Although cargo throughput at ports in Jiangsu has trailed behind, the province’s Lianyungang Port has registered rapid annual throughput growth of over 13% on average during the 2010-2016 period. This shows that increasing numbers of businesses are beginning to use Jiangsu’s port facilities for trans-regional and even international trade.

Innovation in Supply Chain Management

The continuous expansion of logistics and transportation networks in the YRD has hastened the maturity of industries in the region. With growing competition in mainland and international markets and the need for industrial transformation and upgrade, YRD enterprises have lost no time in upgrading their product development and manufacturing technologies while also focusing their attention on improving their management of the entire supply chain. They hope that by making use of internal resources and third-party services to reform the whole business process, from product design, material sourcing and manufacturing to logistics distribution, sales and after-sales services, the overall operating efficiency and the quality of customer service can be raised.

The Chinese government also hopes to encourage enterprises to make improvements in supply chain management and promote industrial upgrading and development through innovations in management models and the use of technology. In October 2017, the State Council issued the Guiding Opinions on Actively Promoting Supply Chain Innovation and Application. This aims to create a number of new technologies and business models suited to China’s conditions, and to help form smart supply chains covering all key industries in the country by 2020. [2]

China’s economic slowdown has not only affected small and medium-sized enterprises but also created many challenges for big businesses. This has forced mainland enterprises to review their business and strengthen their supply chain management in order to boost their competitiveness.

Huayu Automotive Systems, the leading manufacturer of car parts in China, is a good example of this in action. It is taking steps to improve its car parts supply chain and update its management information system. It hopes this will enhance its ability to control supply chain resources in the light of the slowdown in China’s car market, the rapid changes in the ecosystem of the global automotive industry and the increasingly demanding requirements of its customers. As well as satisfying consumer needs, it also hopes to accelerate the development of its business in related areas.

Many domestic enterprises are currently acquiring the technologies and supply chain resources they need through co-operation with outside partners or mergers and acquisitions. Huayu has established a subsidiary in Hong Kong to handle foreign exchange income and international payments. It uses this foothold in Hong Kong to help find partners, capital, information and technologies in international markets, which it needs to improve its supply chain capability and invest in new projects for future development. Overseas investment and financing activities often involve complicated financial and business manoeuvring, which can best be accomplished using professional services support. Having a platform in Hong Kong is useful for companies seeking such support. (For further details, see Improving Supply Chain Systems in Line with New Market Challenges)

Third-party service providers can also help businesses make use of the transportation networks and facilities of different regions, improve their domestic and international logistics, and strengthen their supply chain management system with the aid of big data analysis and the application of other advanced information technology. Enterprises should also be looking to make use of financial services to manage the flow of funds and lower related costs. Only in this way will they be able to improve supply chain management and enhance their overall operational efficiency.

“Going Out” Stimulates Demand for Supply Chain Management Service

Companies in the YRD are actively investing in production automation to ease the difficulties caused by shortages of labour. They also hope it will help them produce higher quality goods which will allow them to stay competitive amid the increasingly tough conditions on domestic and international markets. Some are looking to develop more high-tech business while others are choosing to develop their own brands. As they diversify, they need more efficient management to cope with their increasingly complex operations. Against this backdrop, many YRD enterprises are looking to third-party service providers for support to help them connect different stages of their businesses, from product development to sales and after-sales service.

An efficient logistics service has thus become an indispensable part of many businesses. However, enterprises also need to improve the efficiency of their supply chain management. For example, many enterprises need to go through one or more transportation and sourcing platforms, such as those in the YRD, Pearl River Delta (PRD) and Hong Kong, and make use of sourcing and cargo transit services in different regions to secure a wide range of materials for production. They also need to make use of advanced management systems to handle spare parts and components or industrial products coming from or heading to different places. To meet these needs, service providers are now providing diversified supply chain management services. (For further details, see Upgrade Strategies Spur Demand for Supply Chain Management Service)

The acceleration of the pace of “going out” to develop trade with and invest in countries along the Belt and Road has further stimulated the demand for these services from mainland enterprises looking to support their growing international business. HKTDC Research commissioned a questionnaire survey in the YRD in 2017 to find out more about this demand.

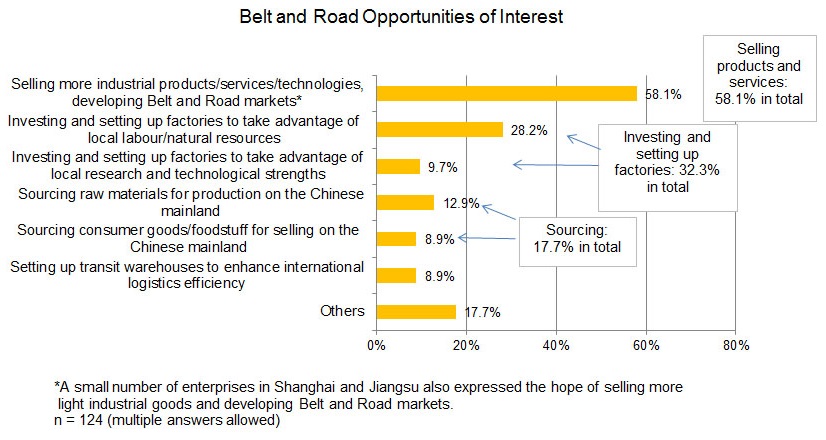

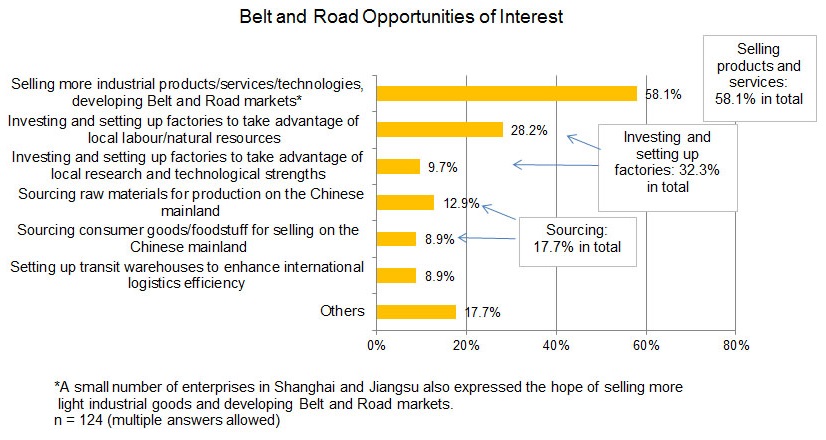

The findings showed that a large majority of mainland enterprises (84% of those who responded) are considering trying to tap opportunities in Belt and Road countries, including those in South-east Asia, South Asia and Central/Eastern Europe, in the next three years. 58% hoped to sell more industrial products and related services and technologies to Belt and Road markets, 32% were looking to invest and set up factories in Belt and Road countries, 18% planned to source consumer goods/foodstuffs to sell on the Chinese mainland or source raw materials for production on the mainland, while 9% hoped to set up transit warehouses there to enhance their international logistics efficiency. (For further details, see Hong Kong Services Help YRD Enterprises Capture Belt and Road Opportunities)

Source: HKTDC survey (For further details, see Hong Kong Services Help Yangtze River Delta Enterprises Capture Belt and Road Opportunities)

It seems that YRD enterprises planning to develop their business in different sectors require various types of services support to strengthen their supply chain management and create better links between their production facilities on the mainland and their overseas operations. According to a company that provides supply chain management services, many mainland enterprises have high-tech manufacturing capability and can produce products comparable to leading international brands, but still need the support of efficient supply chain management services in areas such as logistics, information flow and capital flow to help them tap opportunities in their target markets.

For example, many enterprises are selling their own brands in overseas markets and can reap handsome net profits from product sales alone. However, in order to develop their brand and maintain the loyalty and support of overseas consumers, they need to provide fast and efficient after-sales and maintenance services in the local markets either directly or through distributors. If that is not handled properly, it could involve high costs and could even adversely affect their image in overseas markets. (For further details, see Devising “Belt and Road” Supply Chain Management System)

An increasing number of domestic enterprises in the YRD and elsewhere are trying to improve their service systems for sourcing, production and sales by utilising the industrial resources and advantages of other places through industry chains in the coastal areas and even in the inland provinces. The geographical span of their business is expanding. As a result, many service providers are making use of transportation networks in the YRD, PRD and other places such as Shanghai, Shenzhen and Hong Kong, to enhance their logistics efficiency when serving overseas and international markets. At the same time, they are also helping clients improve their information and capital flow management and ensure the smooth development of their business.

The survey findings also indicate that many enterprises are hoping to seek professional services support both on the mainland and outside the country to help them “go out” and tap Belt and Road opportunities. Hong Kong was the most popular choice for this, with 46% of the businesses which were looking for services support indicating it as their preferred option. This matched the findings of a similar survey conducted by HKTDC Research in South China.

There is no doubt that Hong Kong is the preferred platform for mainland enterprises “going out” to invest overseas. Hong Kong’s service providers have helped many mainland enterprises handle their trade and investment business in Hong Kong and overseas markets over many years. As YRD enterprises look for more supply chain services support in their quest to capture Belt and Road opportunities, the opportunities for the city’s service providers should increase greatly.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Source: Jiangsu Statistical Yearbook, Zhejiang Statistical Yearbook and Shanghai Statistical Yearbook.

[2] For further details, see China Seeks to Establish World Class Smart Supply Chains by 2020, under Regulatory Alert - China.

Editor's picks

Trending articles

Hong Kong, ranked by the Heritage Foundation as the world’s freest economy for 23 consecutive years, is renowned for its straightforward business environment, one where most commercial activities can be conducted free from government intervention. Its transparent, low tax regime, as well as its free flows of capital and information, all combine to effectively lower overall operational costs, while enhancing efficiency, ultimately facilitating rapid access to international market opportunities. Although Hong Kong does not offer specific incentives to target foreign investors, mainland enterprises often see Hong Kong as their preferred service platform when pursuing Belt and Road opportunities, because of the economic and commercial benefits it provides.

Preferred Platform for Foreign Investors

As a result of globalisation, countries and regions are keen to compete for foreign investment. In order to attract investors, many countries – including China, Singapore and other ASEAN countries – have drawn up specific foreign investment policies. These often include items such as preferential terms of tax exemption or concession, discounts on the cost of resources such as land, or talent subsidies. They are designed to encourage multinational companies to set up business operations there, in the hope of stimulating local economic growth and employment.

In contrast, Hong Kong does not offer any financial or other specific incentives to attract foreign investment. Yet it is one of the major recipients of foreign direct investment (FDI) in the world[1]. Hong Kong is the main stepping stone for foreign enterprises looking to invest on the Chinese mainland. Statistics show that, as of the end of 2016, 44.7% of approved foreign investment projects on the Chinese mainland were related to Hong Kong. Of the FDI that was actually utilised, a cumulative total of US$913.7 billion came from Hong Kong, 51.8% of the overall FDI inflow into China[2].

Hong Kong is also a major outbound investment platform for mainland enterprises. In 2016, the Chinese mainland made a total of US$114.2 billion worth of outbound direct investment (ODI) through Hong Kong, 58.2% of its overall ODI for the year. As of the end of 2016, a cumulative total of US$780.7 billion, or 57.5% of China’s cumulative ODI, had been made through Hong Kong[3]. The territory’s ability to attract foreign investment has made it the preferred platform both for foreign companies looking to invest on the Chinese mainland, and also for mainland Chinese enterprises wanting to invest overseas.

Market-oriented Business Environment

Unlike some Asian economies, Hong Kong does not offer specific preferential treatment to foreign companies. Indeed, any concessions and subsidies are available to all companies incorporated in Hong Kong, be they local businesses, or ones from the Chinese mainland or further afield. To discover whether this affected Hong Kong’s ability to compete for foreign investment against Asian economies which do offer preferential treatment, HKTDC Research and the Shanghai Municipal Commission of Commerce jointly interviewed a number of Hong Kong organisations and companies. The study found that although there were pressures on Hong Kong due to the competition in the region, this was more than offset by the territory focusing its development strategy on the provision of a favourable environment for businesses generally. Upholding the principles of impartiality and efficiency, Hong Kong offers a wide range of high-quality professional services to help businesses lower costs and take advantage of opportunities in international markets.

One example of this, often cited by Invest Hong Kong (InvestHK), is that no government approval is required to set up a regular company in Hong Kong. Another is that, because of its transparent low tax regime, the overall tax liability borne by a company in Hong Kong is lower than those in other economies, even those which offer specific tax incentives to foreign companies. Furthermore, Hong Kong’s world-class infrastructure, including international traffic and transport networks and communication facilities, means companies can connect easily and quickly with the Chinese mainland and other parts of the world. Other factors, such as the free flows of capital and information in Hong Kong, have made the territory one of the least restrictive economies in the world. All this has attracted ever increasing numbers of foreign investors who rely on Hong Kong as a service platform for expanding their operations in the Chinese mainland and international markets.

Support for foreign investors is also available through agencies such as InvestHK and other public institutions. They help investors find the professional services and staff they need; assist in liaising with other government departments and completing formalities such as applying for business licences and employment visas; put them in contact with local trade sectors; and provide consultation services to help companies apply for subsidies and start-up support from the Hong Kong government.

Shanghai-Hong Kong Co-operation in Tapping Global Business Opportunities

Under China’s Belt and Road Initiative, mainland enterprises have been stepping up their efforts to “go out” and go global. This is particularly true in the coastal areas that serve as China’s major centres for economic co-operation with foreign countries, and especially so in Shanghai and the Yangtze River Delta (YRD) region. In 2016, 83.4% of the Chinese mainland’s total ODI came from its eastern coastal areas, with Shanghai ranked first among all provinces and cities in terms of ODI volume. Companies in Shanghai and the YRD region have become increasingly active in working through Hong Kong to capture Belt and Road opportunities.

Against this backdrop, HKTDC Research and the Shanghai Municipal Commission of Commerce conducted a survey in Shanghai and the YRD region in the first quarter of 2017. Of those businesses who responded, nearly half (46%) said they regarded Hong Kong as their preferred destination for seeking professional services outside the mainland when looking to take advantage of Belt and Road opportunities[4].

Another survey, conducted by the same two organisations in Hong Kong in the 4th quarter of 2017, was aimed at assessing how Hong Kong can help mainland enterprises expand their international business. Many companies and organisations which responded to the survey acknowledged that local companies and foreign enterprises set up in Hong Kong enjoy the benefits offered by Hong Kong’s business environment.

Investors lacking a thorough knowledge of the picture, however, may be prone to presume that the absence of specific incentives has a negative effect on foreign investment in Hong Kong. Yet once they evaluate the overall costs and benefits available to their projects, it becomes clear that Hong Kong is the ideal and efficient service platform for their investment.

Given that Shanghai and other mainland provinces and cities are stepping up their efforts to strengthen co-operation with Belt and Road countries, Hong Kong is the ideal service platform to support the Chinese mainland, both in making overseas investments and in attracting foreign investors.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] According to the World Investment Report 2017 published by the United Nations Conference on Trade and Development (UNCTAD), Hong Kong was the 4th largest recipient of FDI in the world in 2016, behind the US, UK and Chinese mainland.

[2] Source: China Monthly Statistics

[3] Source: Statistical Bulletin on China’s Outward Foreign Direct Investment 2016

[4] For further details of the survey results, please refer to: Hong Kong Services Help Yangtze River Delta Enterprises Capture Belt and Road Opportunities