Czech Republic

TMF Group helps global companies expand and invest seamlessly across international borders. Its expert accountants and legal, HR and payroll professionals are located around the world, helping clients to operate their corporate structures, finance vehicles and investments in different locations. With operations in more than 80 countries providing global business services, TMF Group is the global expert that understands local needs

Grant Thornton is one of the leading business advisers of independent assurance, tax and advisory services that helps dynamic organisations unlock their potential for growth. Our brand is respected globally, as one of the major global accounting organisations recognised by capital markets, regulators and international standards setting bodies. As a US$4.7bn global organisation of member firms with 40,000 people in over 130 countries, we have the scale to meet your changing needs, as well as the insight and agility that helps you to stay one step ahead. Privately owned, publicly listed and public sector clients come to us for our technical skills and industry capabilities but also for our different way of working. Our partners and teams invest the time to truly understand your business, giving real insight and a fresh perspective to keep you moving. Together with our International Business Centres (IBCs), we can draw on the resources and supports from Grant Thornton’s global network, deep knowledge of the latest regulations, techniques and business practices in major jurisdictions worldwide. Whether a business has domestic or international aspirations, Grant Thornton can help you unlock your potential for growth.

PwC China/Hong Kong is the largest professional services firm in China. PwC’s network firms operate in 157 countries with more than 195,000 partners and staff including almost all of the territories under the Belt and Road Initiative. PwC provides a full range of advisory, consulting, tax and assurance services, including but not limited to valuation strategy services, financial modelling, mergers and acquisitions advisory, investment and project structuring, financial due diligence, tax planning and due diligence and strategic advice to investors in identifying and building capabilities required for this initiative. These successful developments of the Belt and Road Initiative will invariably require some or all of the professional services noted above. PwC will be able to provide local knowledge and expertise in most of the territories under the Belt and Road Initiative.

Crowe Horwath (HK) CPA Limited is a full-service CPA member firm of Crowe Horwath International and is based in Hong Kong. We provide a comprehensive range of professional services including audit, tax, risk management, merger and acquisition, trust, estate planning, data security and IT audit, ESG and sustainability consulting, business and property valuation, human resources, executive coaching and business advisory services to clients in the Greater China region.

As one of the pioneer accounting firms exploring the China market, we are accustomed to the culture, economy and business environment in Hong Kong and Mainland China. We have also built up strong connections with both the public and private sectors in China. Together with the support from member firms of the top 9 accounting network globally, we assist Chinese enterprises to access the international markets and at the same time help our international clients to establish presence in the vast China market.

BDO Limited is the Hong Kong member firm of BDO International Limited, the fifth largest worldwide accountancy network with over 1,300 offices in more than 150 countries and almost 60,000 people, including 31 offices in Mainland China as well as covering all the major countries and cities within the One Belt One Road.

BDO Limited has 50 directors and a staff of over 1,000 in Hong Kong. Our professional services include assurance, taxation, business recovery, forensic accounting, litigation support, matrimonial advisory, risk advisory and business services. Our professionals are well-versed in all accounting and auditing standards, tax and investment regulations prevailing in Hong Kong, Mainland China as well as other major countries. We conform to the highest international standards in a full range of professional services.

The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group, which serves around 48 million customers through four global businesses: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. The Group serves customers worldwide from over 6,100 offices in 72 countries and territories in Asia, Europe, North and Latin America, and the Middle East and North Africa. With assets of US$2,572bn at 30 June 2015, HSBC is one of the world’s largest banking and financial services organisations.

HSBC Commercial Banking

For 150 years we have been where the growth is, connecting customers to opportunities. Today, HSBC Commercial Banking serves businesses ranging from small enterprises to large multinationals in around 55 developed and faster-growing markets around the world. Whether it is working capital, trade finance or payments and cash management solutions, we provide the tools and expertise that businesses need to thrive. With a network covering more than three quarters of global commerce, we make HSBC the world’s leading international trade and business bank.

Citi, a leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

The Czech Republic is home to the biggest airport of any of the newer EU member countries and also to one of the densest railway networks in Europe. As a result, many multinational companies have set up regional logistics centres there. It has some of the best, if not the best, passenger flight connections of any Central and Eastern European Country (CEEC) with the Chinese mainland – and the increased belly cargo capacities, plus the new all-cargo flights between Hong Kong and the Czech capital Prague, have further improved the country’s competitive advantage in the eyes of Asian traders and investors.

Following a boom in the manufacturing and IT sector in recent decades, many Czech enterprises are ripe for development, with their owners considering growing the businesses in co-operation with a reliable foreign partner or selling the businesses outright. Meanwhile, relations between the country and China have improved markedly since Czech President Miloš Zeman assumed office in 2013, and reached a high point following the historic three-day state visit by Chinese President Xi Jinping to the Czech Republic in March 2016.

This has helped to create a more business-friendly atmosphere between the two countries. Some investment deals involving Czech companies have actually been done through Hong Kong, while several Czech businesses are now focussing their attention on Asian markets with their own presence in Hong Kong.

A Crucial Logistic Interface in One Way or Another

The Czech Republic has overcome the disadvantage of being a landlocked country by developing one of the best, if not the best, air transport links with Asia of any of the CEECs. These include excellent connections with the Chinese mainland and Hong Kong. Václav Havel Airport Prague (PRG) now has regular direct passenger flights with three Chinese cities – Beijing, Shanghai and Chengdu.

The belly cargo capacities on these passenger flights, in addition to the all-cargo services between Hong Kong and Prague operated by Slovakia-based Air Cargo Global (ACG) since May 2017 (with a technical stop at Turkmenbashi (KRW) airport in Turkmenistan), have increased the Czech Republic’s ability to handle cargo demand from Chinese and Asian companies on the look-out for ways to take better advantage of the cross-border e-commerce bonanza happening across Europe.

Unlike the other V4 countries, the Czech Republic does not have a common border with the Commonwealth of Independent States (CIS) area, and so cannot profit directly from serving as a major railway junction for the trans-shipment of containers between the broad-gauge (1,520mm) trains used in former Soviet countries, such as Russia, Kazakhstan and Belarus, and the standard-gauge (1,435mm) trains used in China and the EU.

But the country’s well-connected airport, together with its dense rail network (one of the densest in Europe, after only Luxembourg and Belgium), means the country remains highly competitive and attractive for multinationals such as Foxconn and Amazon looking to set up regional logistics centres for the European-wide distribution of high value-added electronics and the fulfillment of online orders.

It’s not just in creating a logistics hub that the Czech Republic’s railways are important to the country. 200 years of Czech rail industry tradition, coupled with the wave of railway privatisation in Europe in recent decades, has helped to make the country a global leader in rail applications and given it another way to contribute to the expanding rail development between Europe and Asia.

Many Czech companies are heavily involved in the rapid expansion of railway systems worldwide. One such company is the wheelset manufacturer GHH-Bonatrans. As the largest European producer of railway wheelsets and a premium supplier of rail-bound transportation worldwide, GHH-Bonatrans won a MTRC contract to supply wheels for passenger trains in 2015 and established its first Asia presence – Bonatrans Asia Limited – in Hong Kong last year.

Source: Bonatrans Asia Limited

Source: Bonatrans Asia Limited

The company’s tilt towards Asia involves doing business not only with Hong Kong and the Chinese mainland, but with many other Asian countries too, including India and ASEAN. With the Hong Kong office as its sales and service arm for Asia and its manufacturing and servicing facilities in India, GHH-Bonatrans can better promote its new-built and after-sale solutions for clients such as China Railway Rolling Stock Corporation (CRRC) in Asia, which was estimated to account for about 12% of the company’s deliveries in 2015/16.

Czech rail applications suppliers, riding on their price competitiveness, are looking to cash in on Asia’s fast-growing rail network. In China, for example, the amount of high-speed railway mileage reached 22,000km in 2016. While China’s dependency on imported rail applications is actually decreasing with the emergence of domestic versions [1] of high-speed train wheelsets and axles, Czech suppliers which can meet the strictest requirements for train components running at speeds up to 450kph remain a much sought-after partner for Chinese rail operators. Also important is, Czech state-of-the-art technology for noise reduction and rail-wheel contact protection.

The combination of railways which lead the world in terms of safety, reliability, customer service and cost efficiency, and a professional services cluster with extensive global networks and affiliations, has made Hong Kong a natural destination for Czech enterprises hoping to grow with Asian investors under the framework of such regional and/or interregional development initiatives such as China’s Belt and Road Initiative (BRI). Already a conduit for China’s outbound direct investment (ODI), Hong Kong serves as a crucial link in providing not only the important capital flows, but also highly sought-after local knowledge and assurance to new-to-the-market Czech enterprises.

Boom Time for China-led M&As

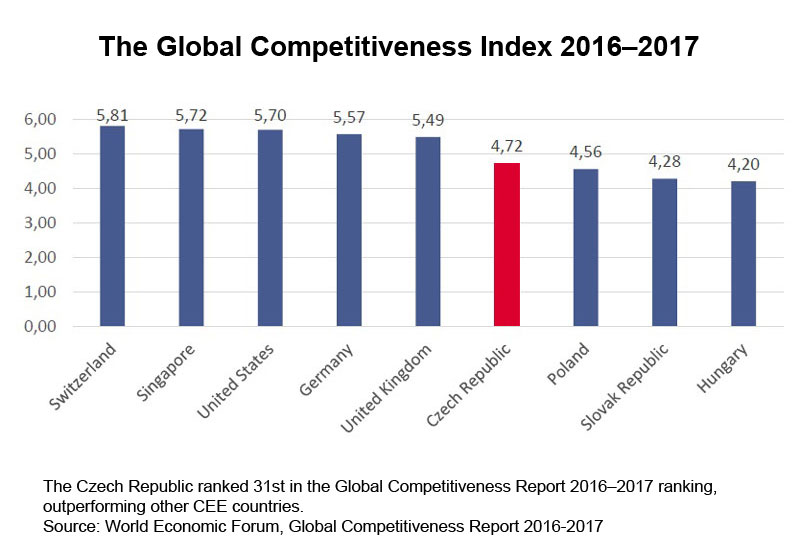

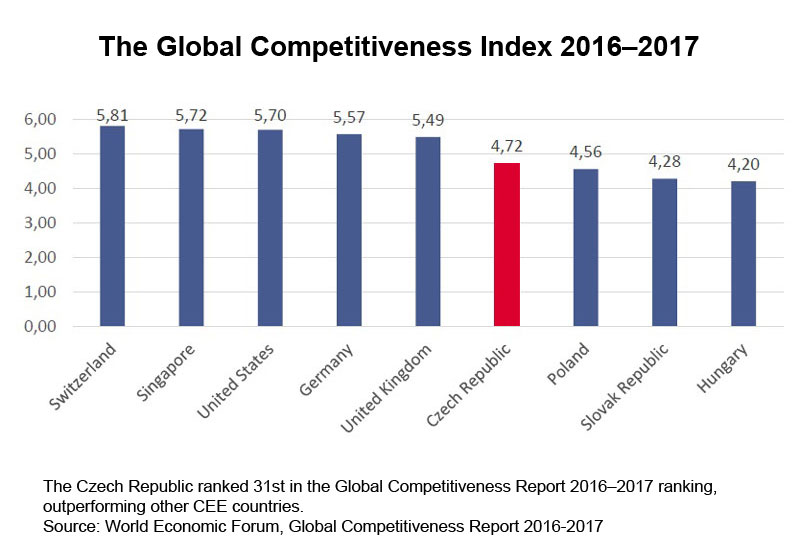

Another trump card of the Czech economy is its strong and highly competitive industrial base. The Czech Republic is the EU’s most industrialised country, with industry accounting for more than 47% of its total economic activity. Its competitiveness ranks higher than CEEC peers such as Poland and Slovakia (see graph), which gives it a significant advantage in the race to attract foreign investment.

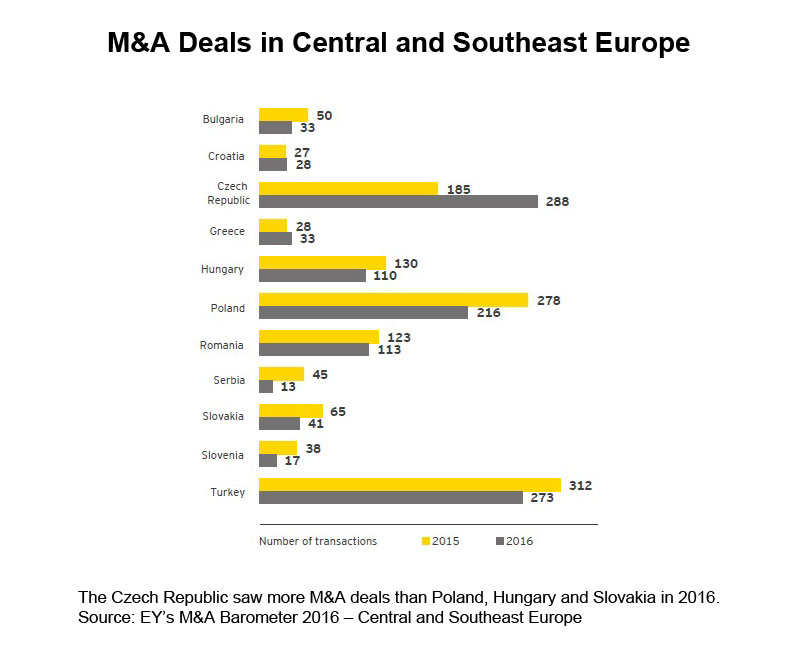

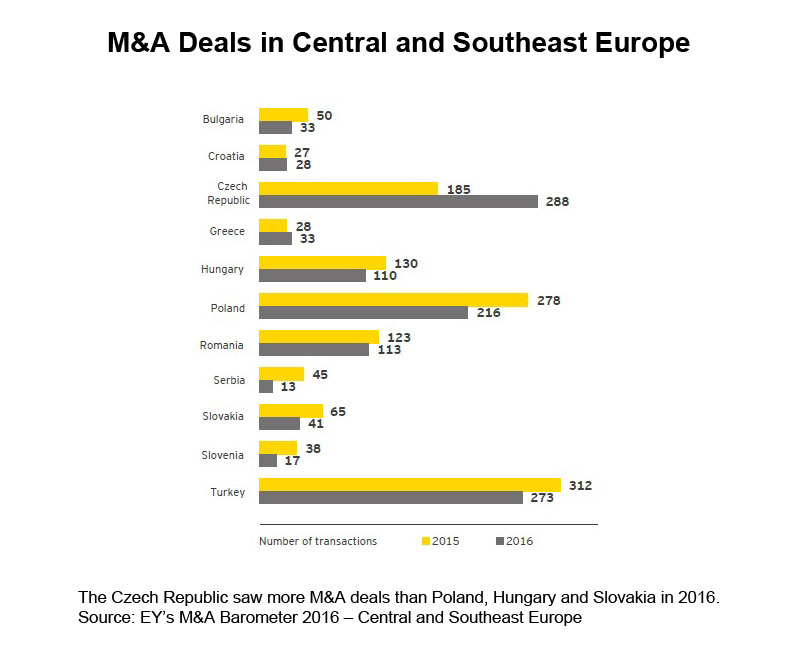

Following a boom in the manufacturing and IT sectors in recent decades, many homegrown Czech enterprises (largely family-owned businesses) are now ripe for scaling up. Some owners are considering development in co-operation with a reliable foreign partner, while others are looking to sell their businesses outright. Such a pool of acquisition targets has made the Czech Republic the region’s most active country in terms of M&A deal volume in 2016, with 288 transactions completed at a total estimated value of US$9.9bn.

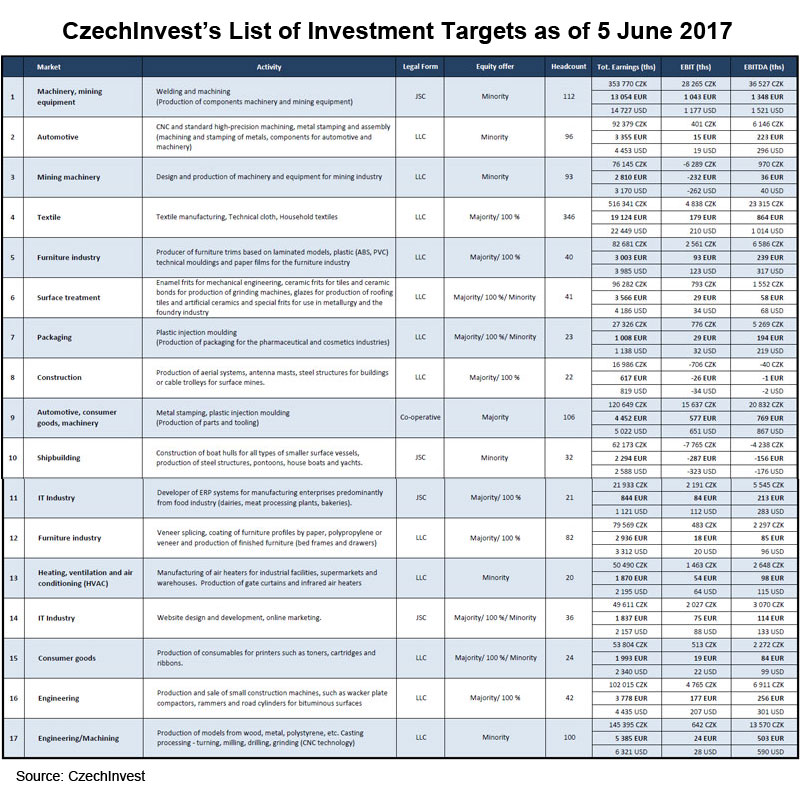

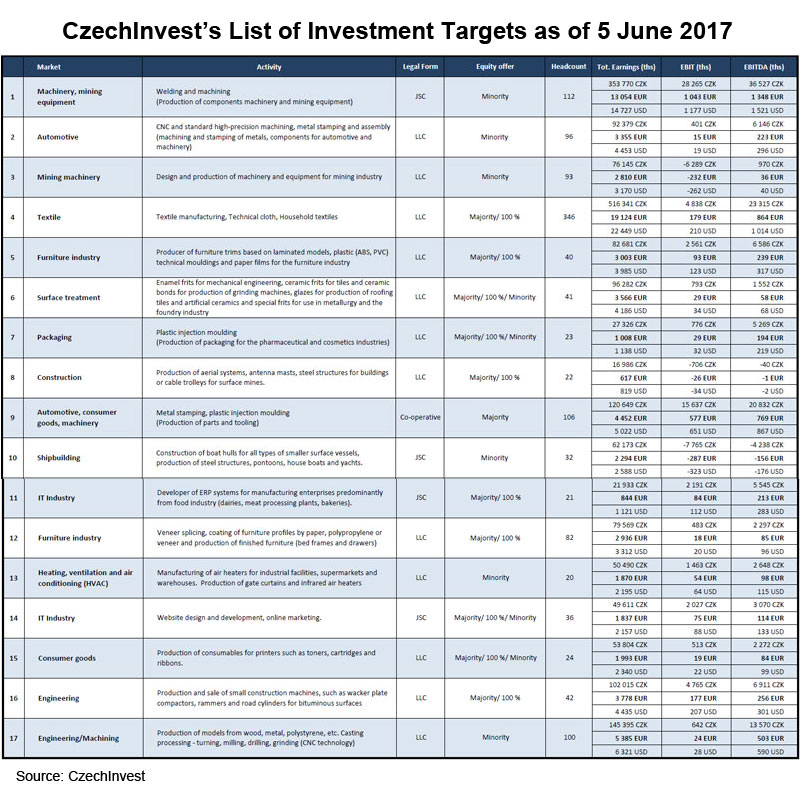

To help Czech companies at the negotiation table, the country’s business and investment development agency CzechInvest, has launched the “CzechLink project” to facilitate qualified investor search and enable the pre-audit project stage. From time to time, a list of Czech companies referred to as “Targets” (companies that are actively looking for a partner/investor for joint venture projects or acquisition) will be published on the agency’s website, while further company profiles can be made available to potential investors, including private equity funds and investment consultants, after signing a non-disclosure agreement.

Also oiling the wheels of the M&A frenzy is the significant improvement in business-friendly Sino-Czech relations. These have taken a marked turn for the better since the arrival in office of Czech President Miloš Zeman in 2013 and reached a high point following the historic three-day state visit by Chinese President Xi Jinping in March 2016. As of March 2017, the total number of domestic Czech companies owned by Chinese investors amounted to 2,101, boasting a capitalisation of about CZK5.5bn (US$0.24bn).

By far the largest Chinese investor in the Czech Republic is CEFC China Energy Company Limited (CEFC China), which is considered a key driving force behind many of these China-led investment deals. The Shanghai-based company has established its second headquarters in Prague and has contributed to a number of sizeable, iconic M&A transactions since September 2015, including the biggest Czech airline company Travel Service, the largest Czech online travel agency Invia.cz, the fifth largest Czech brewer Pivovary Lobkowicz Group, five-star hotels such as Mandarin Oriental Prague and Le Palais Art Hotel Prague, Prague’s largest office building Florentinum, media organisations like Médea Group, Empresa Media and Barrandov Television Group, high-end, metallurgy and engineering company ŽĎAS and even the oldest Czech football club SK Slavia Praha.

Aside from promoting its own investment, CEFC China has continuously been building platforms for Chinese enterprises to invest in the Czech Republic. Following its acquisition of J&T Finance Group (JTFG) in March 2016, which made it the first private Chinese enterprise to own a European bank, CEFC China launched the China-CEE Investment Fund together with Industrial and Commercial Bank of China (ICBC) in a bid to better bridge China-CEE investment, especially for potential Belt and Road projects.

Hong Kong’s Roles as a Business Conduit

Hong Kong, as a conduit for China’s investment, handling nearly 60% of China’s ODI, is one of the leading Asian investors [2] in the Czech Republic, actively participating in the country’s China-led M&A spree and overall Sino-Czech investment. Some of the China-led investment deals in the Czech Republic have actually been done through Hong Kong. One such notable deal is the acquisition of one of Czech’s biggest DIY and garden equipment firms Mountfield by the Chinese mainland-background, Hong Kong-based Eurasia Development Group in December 2016.

Source: www.mountfield.cz

Some visionary Czech companies are also increasingly tilting using a presence in Hong Kong as a safe and clear-cut gateway to markets in Asia. Examples include famous Czech glass and lighting companies such as Lasvit and Preciosa, which have set up either a regional representative office or holding company in Hong Kong to stay close to both the production base on the Chinese mainland and the rosy residential and commercial property market in Asia. Apart from doing bespoke lighting installations and glass artworks at deluxe hotels, upscale office buildings and premium residences, some of them use Hong Kong as a test bed to ascertain the feasibility of building a bigger foothold in Asia.

Effective since 24 January 2012, the Comprehensive Double Taxation Agreement (CDTA) between Hong Kong and the Czech Republic has afforded Czech companies greater certainty and transparency in planning their investment and expansion activities with the involvement of Hong Kong. Thanks to the tax flexibility, Lasvit, which runs a holding company in Hong Kong to oversee its sales and projects in Asia, has worked with the luxurious department store Lane Crawford to introduce its household retail collections.

As a duty free port with efficient logistics and transparent regulations, Hong Kong’s strong position as a centre of trade and proximity to China’s high-value manufacturing base has made itself a strong choice for Czech companies such as GHH-Bonatrans, Lasvit and Preciosa which are looking to showcase their technology and find prospective investors to turn up-and-coming business ideas into reality. This role goes hand-in-hand with buoyant Sino-Czech investment and is further sharpened by Sino-CEE co-operation through the BRI and 16+1 format.

[1] For instance, Taiyuan Iron and Steel (Group) Co., Ltd. (TISCO) produced its first batch of China’s homemade wheelsets and axles in 2014 and completed the necessary tests in 2016.

[2] Hong Kong, holding an FDI stock of US$23.7 million as of end-2015, ranked 7th on the list of Czech Republic’s inbound foreign investors from Asia, trailing South Korea, Japan, the Chinese mainland, Singapore, India and Thailand.

Editor's picks

Trending articles

Central and Eastern European Countries (CEECs) have played an increasingly pivotal role in China’s foreign policy considerations and are key partners to the Belt and Road Initiative (BRI). Cash-rich Chinese white knights have become highly sought-after by many struggling but promising CEE businesses, while generous funding for mega government-to-government (G-to-G) infrastructure projects and seed capital for start-ups are also providing valuable impetus to rejuvenate the CEE economy and restore its industrial and commercial prowess.

CEECs as a Key Partner to “16+1” and BRI

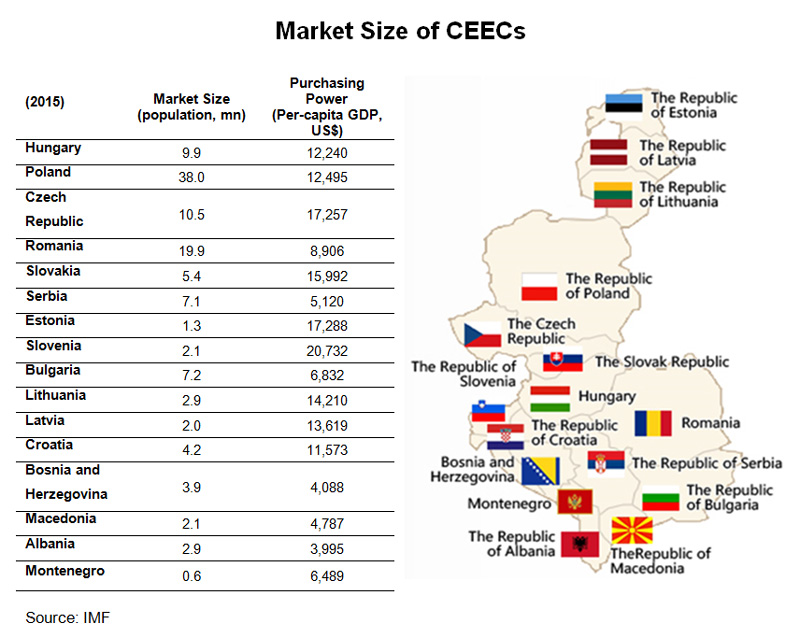

In 2011, China revived its co-operation with a group of 16 Central and Eastern European countries (CEECs), namely Albania, Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Macedonia, Montenegro, Poland, Romania, Serbia, Slovakia and Slovenia. In 2012, the first meeting at a heads of government level was held in Warsaw, marking the official launch of the 16+1 format or mechanism under which China provides preferential financing to support investment projects that use Chinese inputs such as equipment “through business means”.

Since its establishment, the 16+1 format has not only been well-received by member countries, but is increasingly used as a leeway to allow cash-strapped CEECs to sidestep possible violations of EU restrictions on sovereign debt levels. Strengthening Sino-CEEC co-operation and connectivity is also conducive to the successful implementation of the BRI, which aims to facilitate and promote greater integration among the 60-plus countries along the Belt and Road. CEECs, providing a strategic link between Asia and West Europe, are vital to the success of the BRI.

Sino-CEEC Investment and Trade Continue to Blossom

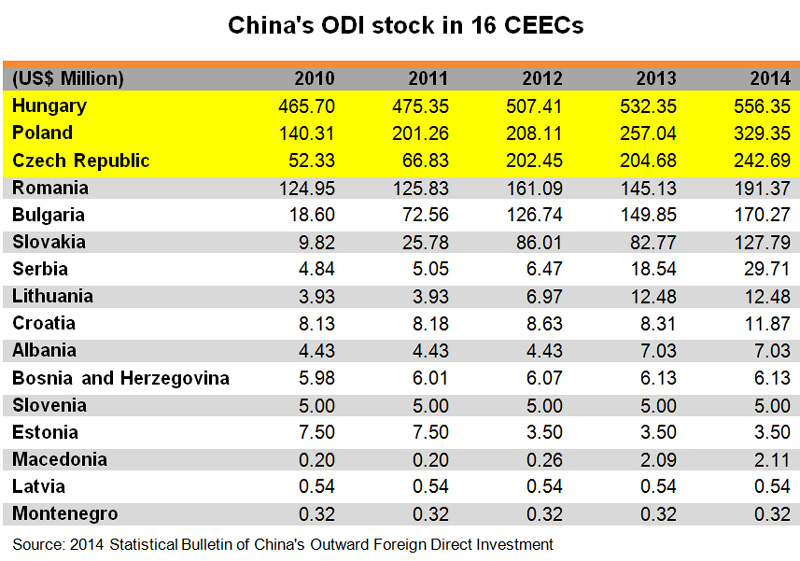

Banking on good Sino-CEEC relations and China’s implementation of a “going out” strategy at the turn of the century, Chinese investors have been investing in projects across the CEECs for some time. China’s outbound direct investment (ODI) in CEECs has been flourishing, while bilateral trade has also blossomed.

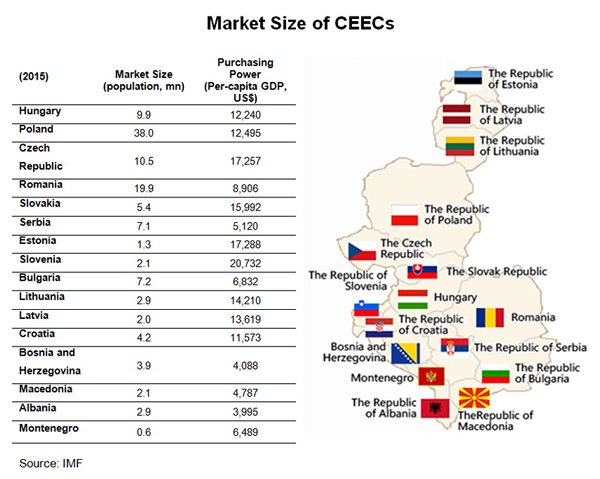

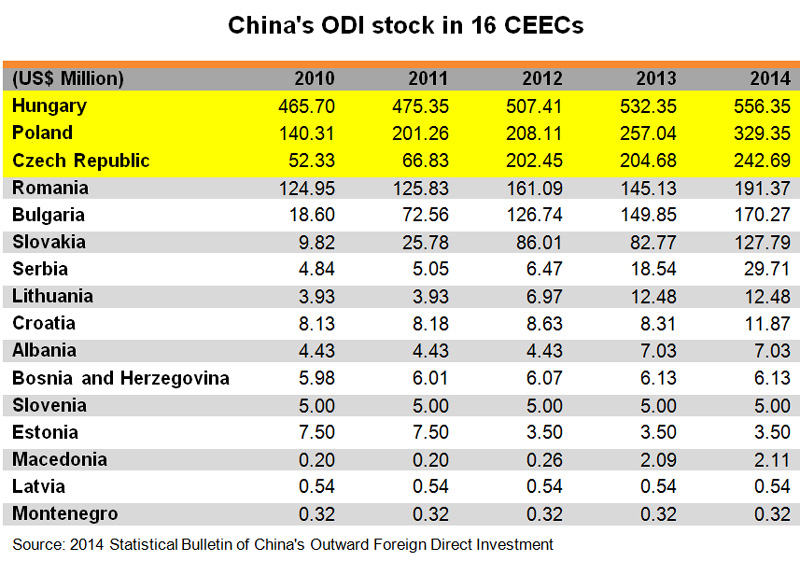

In the five years ending 2014, China’s ODI to CEECs grew by nearly 100% from US$853 million to US$1.7 billion. Among the 16 CEECs, three countries – namely Hungary, Poland and the Czech Republic – accounted for more than two-thirds of the total, followed by Romania, Bulgaria and Slovakia, which together accounted for another 30%.

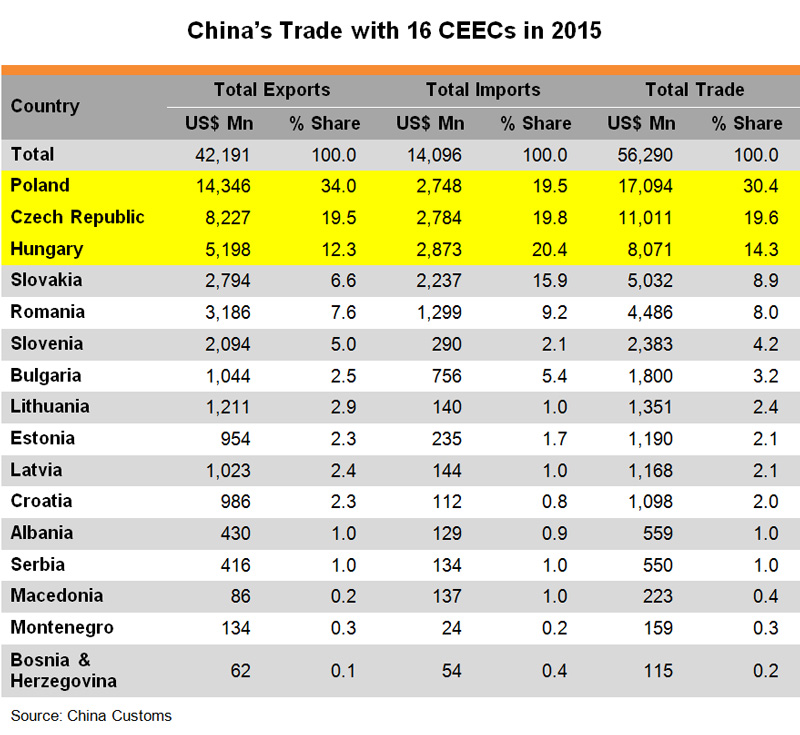

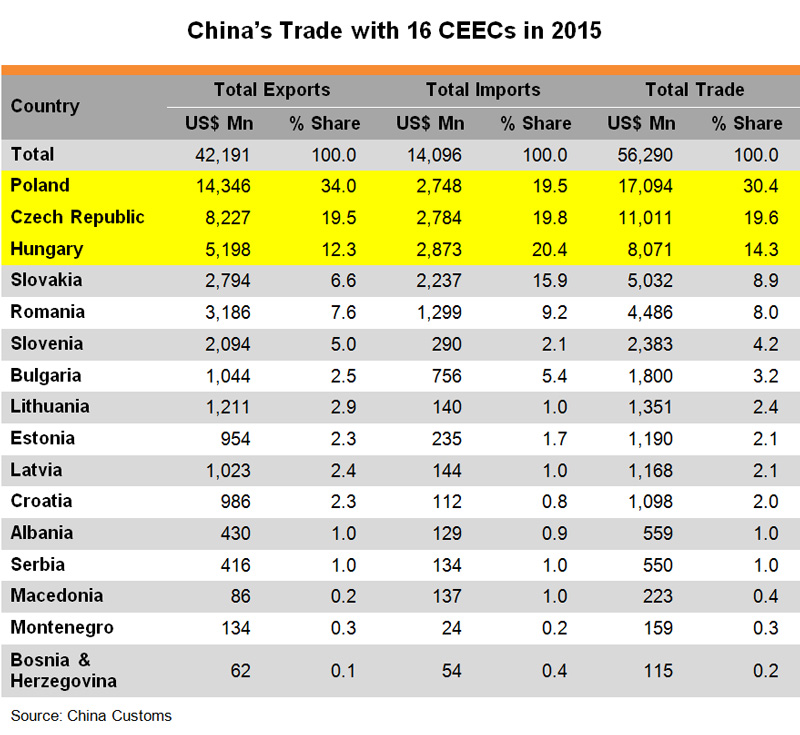

Trade between China and CEECs has remained unbalanced, however. In 2015, China’s exports were nearly twice the size of its imports from the 16 countries. This huge trade imbalance has provided a rallying cry for a new development model featuring enhanced connectivity with greater investment in infrastructure such as railroads, highways, tunnels, bridges, power plants, electric grids, industrial and logistic parks, seaports and airports.

In fact, there is already a balancing trend in Sino-CEEC trade, due mainly to an increase in demand for products such as metals, minerals, chemicals and food and beverages from CEECs. Between 2011 and 2015, China’s trade with 16 CEECs grew by a mere 6.4% from US$52.9 billion to US$56.3 billion. The country’s exports to CEECs increased in that period by only 5.0% but imports from the 16 countries saw a 10.5% expansion. Similar to the pattern seen in China’s ODI to CEECs, Poland, the Czech Republic and Hungary were China’s top three trading partners among the 16 CEECs, accounting for more than 64% of all Sino-CEEC trade in 2015.

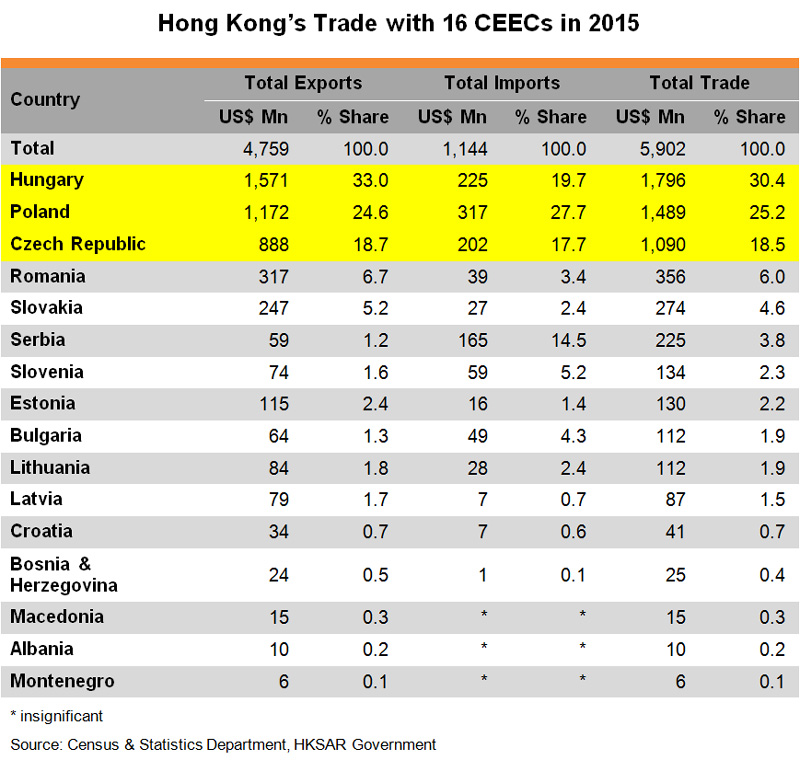

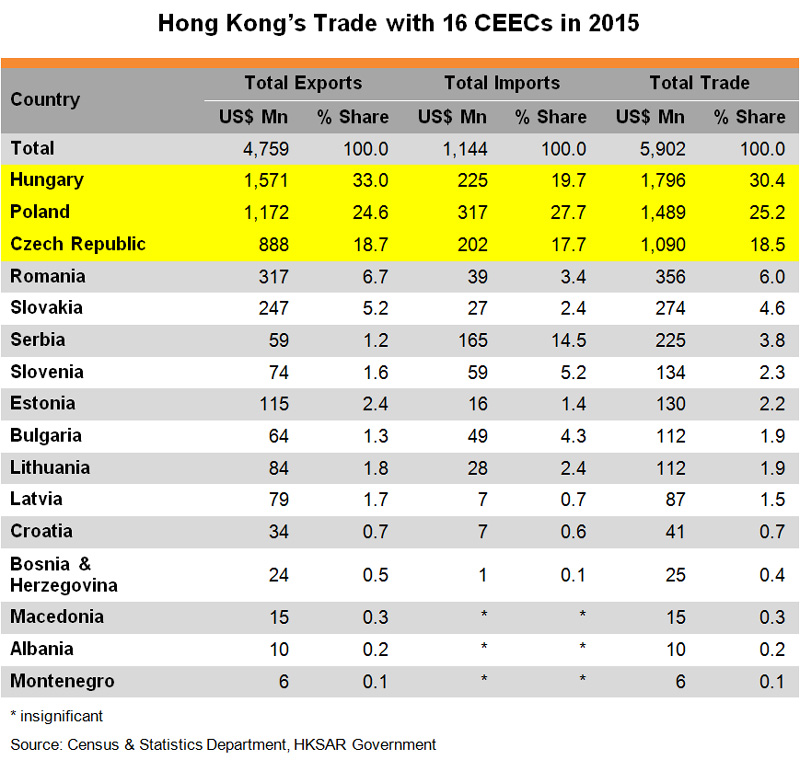

Though Hong Kong’s investment in the 16 CEECs is far from significant, its trade pattern is consistent with Sino-CEEC trade overall, with Hungary, Poland and the Czech Republic accounting for nearly 75% of Hong Kong’s total trade with the 16 CEECs in 2015. Boasting a similar year-on-year growth of 24% in the first half of 2016, compared to the 13% regional average, Hungary and Poland are not only sizeable markets among the CEECs, but fast-growing export destinations for Hong Kong traders.

Looking ahead, better alignment of the 16+1 format with the BRI is expected to provide new opportunities to widen and deepen trade and investment co-operation between China and the CEECs. Moving from being export destinations to becoming investment partners in production, technology, finance and infrastructure development, CEECs are likely to see new trade patterns with China, involving higher value-added goods and services with higher technology content.

While different good and services may experience different fortunes in the CEECs, electronics – Hong Kong’s largest merchandise export earner – has fared well in the region. This is especially the case in countries where electronics manufacturing outsourcing clusters are becoming increasingly prominent in the face of rising production costs in other more distant production bases and in light of a greater need for proximity to key markets and better inventory management.

To this end, Hungary has been specialising in the production of transport vehicles since Soviet times, and boasts a long history of auto parts and electronics manufacturing. Hungary is the largest electronics producer among the CEECs, representing some 30% of the region’s total electronics output. Meanwhile, the Czech Republic is often regarded as the most successful Central and Eastern European country in terms of attracting foreign investment, thanks to its strong automotive cluster. For its part, Poland has the largest domestic market and ranks high in terms of manufacturing and automation.

Examples of BRI in Action in the CEECs

While most, if not all, of the CEECs are supporters of the BRI, some have shown greater participation than others. For instance, Poland, with its well-developed industrial market and logistical importance (it is estimated that 25% of all road transport in Europe is operated by Polish companies) has not only established a strategic partnership with China but is also a founding member of the Asian Infrastructure Investment Bank (AIIB) – the only CEEC joining the bank so far.

As an important conduit linking Asia and Western Europe in the BRI, in 2013 a high-speed railway started operating from Chengdu, the provincial capital of Sichuan province, in Southwest China, to Łódź, in Poland. The freight train takes only 10-12 days to ship goods from China to Poland, twice as fast as sea transport. Goods arriving in Łódź can then be transported to warehouses or customers in London, Paris, Berlin and Rome via Europe’s rail and road networks.

So far, railway lines for container trains have opened up in 16 Chinese mainland cities, heading to 12 European cities including many CEECs such as Łódź in Poland, Pardubice in the Czech Republic and Košice in Slovakia. Last year, Sino-European freight trains made a total of 815 trips, representing a year-on-year increase of 165%.

To better enhance co-operation between companies from both countries, Poland started offering consular services in Chengdu, while the Łódź government has also set up an office in the city. Such cooperation at sub-national levels has been institutionalised and increasingly offers a best-practice way forward in Sino-CEEC relations.

Meanwhile, Hungary – the first European country to sign a memorandum of understanding (MoU) on BRI co-operation with the Chinese mainland – has also signed deals to build a high-speed rail line between Budapest, its capital, and Belgrade, the capital of Serbia. With the line expected to be completed in 2017, the 85% Chinese-financed project will shorten the travel time between the two capitals from eight hours to three.

As an important country in the Balkan Peninsula, Serbia became China’s first strategic partner among the CEECs, in 2009. This favorable bilateral relationship is very much focused on economic co-operation under the BRI. China’s landmark projects in Serbia include the “Mihailo Pupin” Bridge on the Danube River in Belgrade, the construction of sections of the Corridor 11 highway, and the expansion of coal mines near the “Kostolac” thermal power plant.

The further extension of the Budapest-Belgrade high-speed rail line to Skopje, the capital of Macedonia, and to Athens, the capital of Greece, will give China-bound freight trains another alternative to gain access to the Aegean and Mediterranean Seas. To achieve better synergy, China’s state-owned shipping giant Cosco has recently acquired a majority stake in the Piraeus Port Authority, which complements the 35-year concession to operate Piers II and III at Piraeus port it acquired in 2009.

As the closest port in the Northern Mediterranean to the Suez Canal, Piraeus is not only one of the largest ports in the Mediterranean, but a strategic trans-shipment hub for Asian exports to Europe. China’s exports could reach Germany, for example, seven to 11 days earlier thanks to the abovementioned high-speed rail connection.

Under discussion or pending implementation are Chinese plans to invest on the construction and upgrading of port facilities in the Baltic, Adriatic, and Black Seas, with a focus on production capacity cooperation among ports and industrial and logistic parks along the coastal areas.

Hong Kong’s Unique Role in Sino-CEEC Economic Co-operation under the BRI

A new development model characterised by enhanced connectivity and greater multilateral investment will likely take Sino-CEEC economic co-operation to a higher level. The balancing trend in Sino-CEEC trade, plus the CEECs’ ongoing improvements to industrial capacity and logistical accessibility are highly conducive to the successful implementation of BRI.

Investment opportunities linked to the BRI can include cooperation in logistics along and beyond the Eurasian landbridge which directly connects Asia and Europe. Maritime finance, infrastructure bidding, project management and financing are all highly sought-after by project owners looking for competitive funding/co-operation options and Asian investors looking for more lucrative investment opportunities under Europe’s low interest-rate environment.

With about 60% of Chinese ODI being directed to, or channelled through, Hong Kong, the city, as a regional financial centre in Asia, will continue to be the bridgehead for Chinese mainland enterprises exploring “going out” through investing in greenfield schemes and joint investment projects. These may include smart cities/factories incorporating digital processes that use the Internet of Things (IoT) and Big Data, or conducting mergers and acquisitions (M&As) to reinvigorate companies, or even whole industries. Hong Kong is therefore ideally placed to help enterprises from CEECs look for investment partners from Asia, especially the Chinese mainland.

Possessing definite advantages and extensive experience in helping Chinese mainland enterprises make overseas investments, Hong Kong can play a pivotal role in the expected surge in Sino-European trade and Chinese ODI to CEECs under both the 16+1 format and the BRI, which aims to help companies co-ordinate their global supply chains.

Simultaneously, Hong Kong’s extensive link to other parts of Asia and privileged free-port status, coupled with the presence of cost-effective multimodal logistics options and professional services providers, offer CEECs a wealth of opportunities to make inroads into the burgeoning Asian market. Hong Kong’s position will be further strengthened as the Second Eurasian Land Bridge takes shape and new railway routes start operating.

Viewing Hong Kong as an ideal platform and super-connector to promote their products in mainland China and other markets in Asia, more and more companies from CEECs are using trade fairs and conferences in the city to reach out to Asian buyers and partners. For instance, Poland, as the regional leader in food exports to the Chinese mainland, has run a national pavilion at HKTDC Food Expo since 2013, occupying almost 300 square metres in 2016. This trend is expected to strengthen as companies from CEECs pay more and more attention to Asia due to European markets’ lack of growth drivers such as a sizeable youth population and growing incomes.

1621 Views

1621 Views