Chinese Mainland

HKTDC Research | 9 Dec 2015

The Singapore Link to the ASEAN Market

The rise of ASEAN means new business opportunities for Hong Kong exporters, providing a hedge against sluggish demand in developed economies. SMEs with little or no experience in ASEAN markets could make use of Singapore as a stepping stone to other ASEAN markets by setting up a presence in the country or working with a local agent or franchising consultant there.

The ASEAN Opportunity

The ASEAN market, which has a combined population of 628 million and a nominal GDP of more than US$2.5 trillion in 2015, is set for robust expansion. According to the International Monetary Fund’s latest forecast, ASEAN-5 countries – Indonesia, Malaysia, the Philippines, Singapore and Thailand – will grow by 5.5% a year from 2016 to 2020, compared with 1.9% a year for major advanced (G7) economies.

ASEAN’s emerging middle class makes it an attractive consumer market. Nielsen estimates that the middle-class population in Southeast Asia will grow from 190 million in 2012 to 400 million by 2020. According to Euromonitor International, retail value (excluding sales tax) in ASEAN countries is expected to see compound annual growth of 6.8% from 2014 to reach US$656.7 billion in 2019.

This represents a number of opportunities for Hong Kong businesses. First, ASEAN’s middle class increasingly demands good quality, affordable, imported consumer goods. Hong Kong exporters, who excel in the mid-to-high-end market, can meet this growing demand.

Second, spending will increase on discretionary items such as dining out, leisure activities, entertainment, education, healthcare and other consumer services that cater to the needs and lifestyles of the middle class. This will create vast opportunities for Hong Kong’s restaurant operators, retailers and service providers.

Third, while local businesses are set to grow with the region, there will be derived demand for producer services such as design, marketing and accounting. These are sectors that tap into Hong Kong’s strength.

The Belt and Road Dimension

Driven by the China-led Belt and Road Initiative, the urbanisation and infrastructure developments in ASEAN countries are expected to create unprecedented opportunities for Hong Kong suppliers.

As an international financial centre in Asia and the world’s largest offshore renminbi centre, Hong Kong has experience in executing structured and project financing schemes of different complexities involving multiple currencies, such as infrastructure projects to be rolled out by the Asian Infrastructure Investment Bank under the Belt and Road Initiative.

On trade and logistics, Hong Kong is the most notable international business centre on Chinese soil, and has gained special access to the mainland market through the Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA). Hong Kong is a premier logistics hub and will further prosper as an entrepôt for the acceleration of China-ASEAN trade. Services can also be extended to include supply chain management, inventory management, quality assurance, return and repair, and distribution, as well as labelling and packaging for compliance in different markets.

With many investment opportunities implicit in the augmentation of China-ASEAN co-operation, the rich pool of professional talents (finance, legal, arbitration, accounting, insurance, construction, engineering, etc.) allows Hong Kong to support the demand for high-quality professional services in the process.

ASEAN: a Diverse Group

Despite the growing integration of the region, one can hardly treat ASEAN as a single market. ASEAN countries are highly diverse in many aspects, such as economic development, business practice, consumer preference, language, religion and culture. For instance, GDP per capita in Singapore is more than 30 times that of Laos, Cambodia and Myanmar. Malaysia has a much younger population than Singapore. Muslims make up the majority of the population in Indonesia, Brunei and Malaysia while Filipinos are mainly Christian.

These diversities, in addition to other problems, such as language barriers and red tape, make ASEAN a challenging market, especially for SMEs with limited resources.

The Singaporean Link

Multinational corporations have long realised the advantages of headquartering in Singapore to manage their operations across ASEAN countries. In fact, these advantages may extend to SMEs with little or no experience in the ASEAN market.

Establishing a Presence in Singapore

The business environment in Singapore is as friendly as in Hong Kong. Both economies share a common legal heritage derived from the United Kingdom. Also, more than 70% of Singapore residents are Chinese. English and Mandarin are the official languages while Cantonese is widely spoken. With the same legal system and languages, it is hassle-free for Hong Kong companies to operate and invest in Singapore.

Businesses in Singapore find the government to be very supportive. While SMEs are usually resource-scared, one can set up a company in Singapore with little cost but make use of the various incentives offered by the government. Some of those provided by the Singapore Economic Development Board are listed in the box below. Other schemes are offered by the Standards, Productivity and Innovation Board of Singapore (SPRING Singapore), which is an agency under the Ministry of Trade and Industry responsible for helping Singapore enterprises grow, and International Enterprise (IE) Singapore, the government agency that promotes Singapore’s international trade and the overseas growth of Singapore-based companies.

Incentives for Business Provided by the Singaporean Government

Source: HKTDC from Singapore Economic Development Board |

Also, businesses can make use of Singapore's extensive network of Free Trade Agreements (FTAs) and Double Tax Agreements (DTAs) to optimise tax benefits and reduce trade barriers and costs. Singapore has signed about 20 FTAs with 31 trading partners and some 70 comprehensive DTAs with various countries.

The advantages of establishing a presence in Singapore go beyond government incentives and optimisation of tax benefits: Singapore is the stepping stone to other ASEAN markets.

Working with an Agent in Singapore

Singapore, the trading and logistics hub in Southeast Asia, is the base of many regional retailers and distributors. Therefore, an alternative to establishing a presence in Singapore is to partner with a local agent who is able to manage the regional distribution. This saves the start-up capital but the trade-off is a lower profit margin when an intermediary is engaged.

Compared with direct deals in individual markets, working with an agent in Singapore can help reduce counterparty risks in the less developed economies. One can also enjoy economies of scale when engaging a regional distributor in Singapore.

Franchising through Singapore

ASEAN consumers increasingly crave the quality, convenience and service associated with brands, making franchising an effective means of business expansion in ASEAN markets. However, the success of franchising an operation hinges on the management of franchisees and continuous support such as training, supply chain, brand building and product innovation. All these could be big challenges to companies with little experience in ASEAN markets.

Hong Kong’s brand holders could consider Singapore a platform for franchising in the ASEAN region. The franchising industry is mature and well-regulated in Singapore, where many experienced franchising consultants can help develop business concepts and match franchisors with franchisees. Singapore is also an ideal place for franchisors to showcase or test their concepts.

Singapore as a Franchising Hub Franchising took off in the early 1990s when the Singapore government started actively promoting the concept as a means of internationalising smaller companies. The leading government agencies promoting franchise development are the Standards, Productivity and Innovation Board of Singapore (SPRING Singapore) and International Enterprise (IE) Singapore. SPRING Singapore offers financial assistance to small- and medium-sized enterprises (SMEs), while IE Singapore helps local companies to franchise abroad. The Franchising and Licensing Association (FLA) in Singapore was set up to promote the use of franchising, branding and licensing as a growth strategy for Singapore enterprises. Among other activities, it caters to the needs of franchisors and franchisees, assisting members in improving their skills and techniques. Another objective is to enlarge the pool of franchise-trained professionals through relevant programmes sourced internationally. The FLA taps into Local Enterprise and Association Development (LEAD) funding to bring in the Certified Franchise Executive (CFE) programme, a certification course that upgrades the skills and capabilities of franchise professionals. Apart from offering CFE to local franchise professionals, the association plans to take the CFE programme to neighbouring countries in Southeast Asia as well. Overseas franchise professionals may also have the option of coming to Singapore to attend the course. With decades of support and promotion by the Singapore government, its multiracial society and a prevalence of English, the international franchising community views Singapore as a strong entry point for the ASEAN market and an ideal location for foreign franchisors to test their concepts. Franchising and Licensing Asia, organised by the FLA Singapore, is an international franchise exhibition and conference in Asia providing a platform for global brands to find the right franchisees in Asia and for Asian franchisors to explore opportunities to expand overseas. According to SPRING Singapore, annual turnover of the franchising sector in Singapore is about US$8 billion, and accounts for 18% of total domestic retail sales. The franchising sector has created approximately 20,000 jobs from more than 500 franchising concepts, 50% of which are imported. Singapore’s food and beverage sector continues to dominate the franchising industry, but education and training franchises are gaining momentum due to the growing corporate training needs of the many multinational companies located in Singapore. Source: “Franchising through Hong Kong: Accessing the Asian Market”, HKTDC, 2014 |

| Content provided by |  |

Editor's picks

Trending articles

Sustainability in the Wood and Paper Supply Chain

In the face of ever more frequent and severe extreme weather events around the world, businesses and consumers have become increasingly aware of green issues. As environmentally-friendly consumerism gains greater credence, a growing number of socially responsible companies have been keen to demonstrate their green credentials, while also expecting their business partners to do the same. According to SCM World’s 2015 Future of Supply Chain survey of more than 1,000 supply chain leaders, 54% believe their supply chains play a “substantial” role in ensuring long-term environmental sustainability. Similarly, the findings of a number of surveys conducted during several HKTDC trade fairs also indicated that buyers now have a growing commitment to sourcing environmentally-friendly products (or products made using eco-friendly materials).

According to Alistair Monument, Asia-Pacific Director of the Forest Stewardship Council (FSC), many consumers now have a distinct penchant for ‘green living’. This includes a preference for the use of natural materials, notably with regard to wood interiors, furnishings and homes. Wood can be an eco-friendly material if it is responsibly harvested, and compared to steel or plastic can have much less impact on greenhouse gas emissions. It also has the advantage of being renewable, reusable and recyclable.

In order to ensure a long term sustainable supply of wood and to contribute to nature conservation, the FSC has introduced a third-party certification system. This has been designed to promote responsible environmentally appropriate, socially beneficial, and economically viable forest management. It also acts to certify that individual products have used wooden materials from a legal and responsibly managed source.

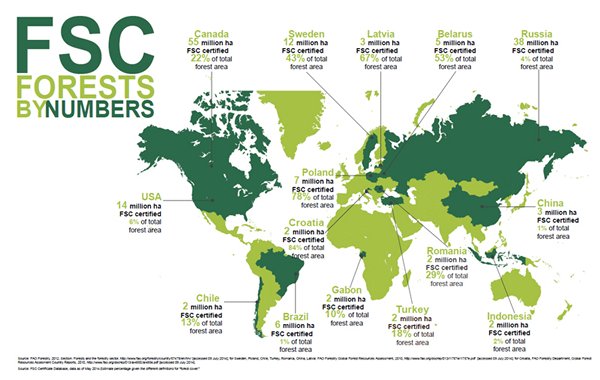

Founded in 1994, the FSC is a global, non-profit making organisation with a remit to promote responsible forest management worldwide. The FSC system features two distinct certifications. The first is a Forest Management (FM) certification and is awarded to forest managers or owners who comply with the standards required for responsible forest management. The second is a Chain of Custody (COC) certificate. This is issued to companies manufacturing, buying or selling FSC-certified materials along an unbroken supply chain.

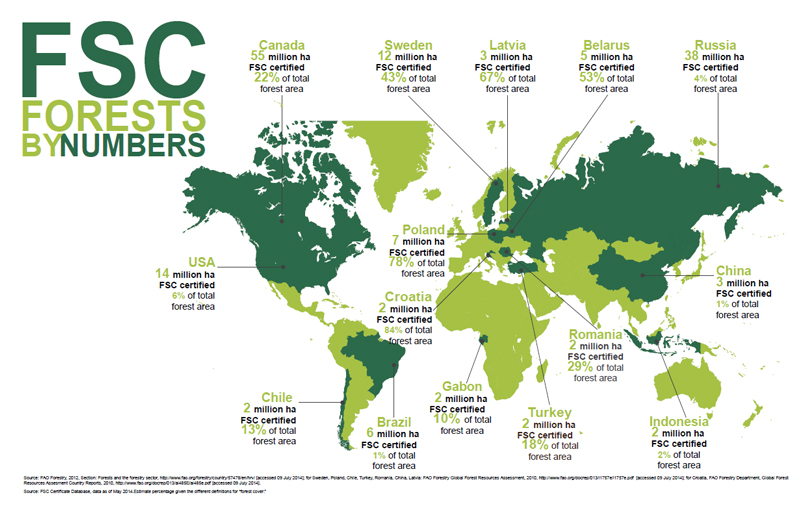

As of November 2015, the FSC had issued more than 30,000 certificates in some 110 countries, a 100% increase on its 2010 figure. Significantly, some 42% of the total number of FSC-certified forest assets are located in countries covered by China’s Belt and Road Initiative [1] – more than 70 million hectares in Europe and seven million hectares in Asia.

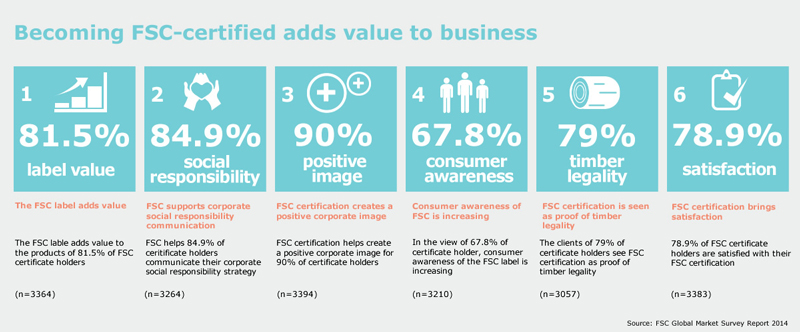

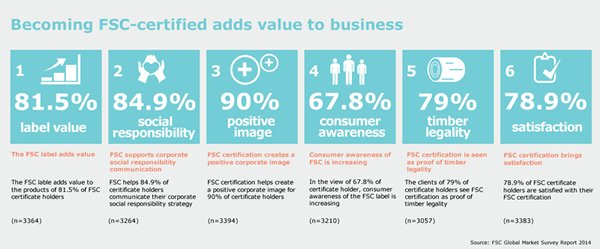

According to the latest FSC Global Market Survey of 3,656 FSC certificate holders from 95 countries (conducted in June-July 2014), the most common reason for becoming or remaining FSC-certified is compliance with the expectations of potential and existing clients and markets. For many of these, FSC- certification is now a part of their sustainability strategy.

FSC-certification is increasingly important for those companies looking to participate in the green building industry. It also helps to ensure compliance with changing timber regulations around the world and the requirement to use legally-harvested timber. Internationally, many public procurement bodies make certification a pre-requisite when selecting construction material suppliers.

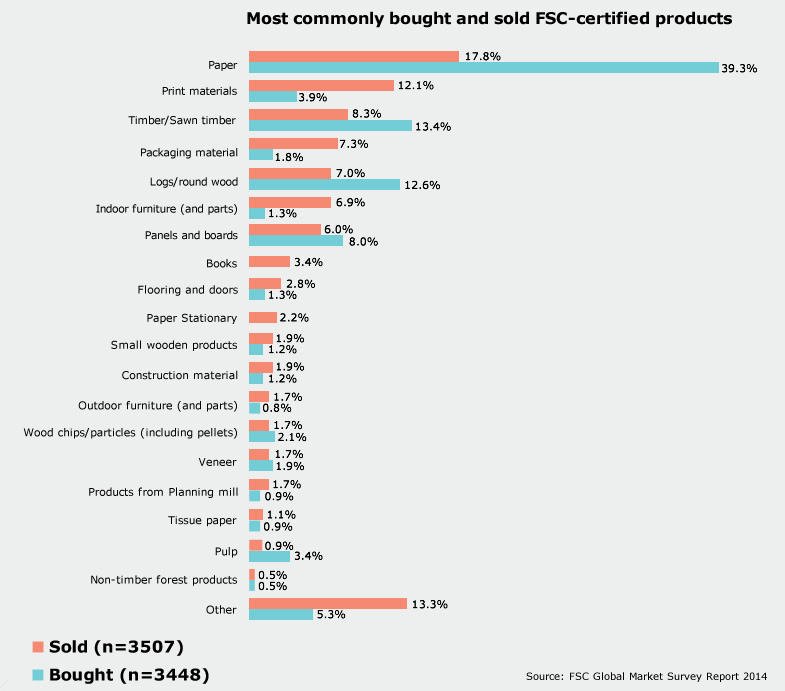

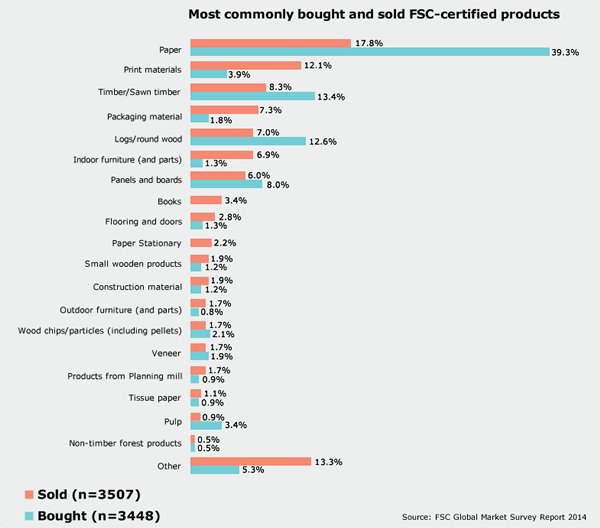

According to the FSC Global Market Survey, building and construction materials aside, the most commonly bought and sold FSC-certified products are paper, books and printed matter, timber, packaging materials, round wood, furniture and stationery.

Many of the items in everyday use – from furniture to paper to textiles to building materials – are originally sourced from forests. By choosing to buy and sell only FSC-certified products, businesses add value in a number of different ways. This is true not only because more consumers want to buy and use environmentally responsible and sustainable products, but also because the EU (and a number of other markets) has regulations and targets in place designed to minimise the environmental and social impact of packaging-related waste, while also increasing recycling rates. This has seen packaging companies come under increasing pressure to demonstrate the highest environmental credentials.

Today, many of the most innovative companies in the world are FSC-certified. Along with addressing the relevant forest issues, a number of these are now committed to designing and manufacturing products that satisfy several of the other concerns of the sustainable design community. These include efforts to improve indoor air quality (IAQ), boost recycling and reduce the use of certain toxic chemicals.

In retail, more and more retailers are choosing FSC certified products as part of their portfolio. The FSC label is an easy way of showing customers that they are buying a product derived from sustainable forest operations. It also demonstrates that manufacturers are committed to protecting the rights of both workers and local communities, while also maintaining forest biodiversity and conserving wildlife.

It is not only in Europe, the region with the highest level of awareness of the FSC label, where consumers are opting for green goods. Outside of Europe, FSC awareness is also on the rise. This includes many of the Asian markets, notably Hong Kong where consumer awareness of the FSC reached 36% in 2013. With increasing recognition of the concept, demand for FSC-certified products has grown considerably, a development that is expected to continue.

Sustainability is far more than a passing trend, however, and it’s vital for successful businesses in increasingly crowded markets to be forward thinking in order to remain relevant. Whether it’s the family dining table, the chopping board, the milk carton, tissues or a humble paper bag, consumers want to know that all of their wood and paper products have been sourced responsibly.

[1] The Belt and Road Initiative aims to promote the connectivity of the continents of Asia, Europe and Africa, as well as their adjacent seas, while also supporting sustainable development in these countries. Under the terms of the initiative, when conducting investment and trade activities in these areas, every effort should be made to promote ecological progress. This would include increased cooperation with regard to conserving the eco-environment, protecting biodiversity and tackling climate change. Ultimately, the aim is to ensure the Silk Road progresses in an environmentally-friendly fashion.

| Content provided by |

|

Editor's picks

Trending articles

South American Infrastructure Projects Vie for Belt and Road Funding

As the terminus of the Belt and Road, South America is a key part of the mainland's ambitious scheme. Many countries in the region have vast infrastructure projects underway, but how many of these are in line with China's grand plan?

South America represents the end point of the Belt and Road Initiative (BRI), the furthest reach of the mainland's ambitious plan to streamline trade routes and facilitate access to markets across the world. Given the huge infrastructure spend envisaged as part of the scheme, there are already a considerable number of logistics-led schemes envisaged or already underway in Central and South America that have considerable synergy with the needs and recommendations outlined in the BRI proposal.

The last five years have seen several new projects announced that will slash the time taken to move goods across South and Central America by rail, road, and canal. One of the most ambitious is a freight railway linking the Brazilian Atlantic coast to a port in northern Peru on the Pacific. One driving factor behind the project is the need to streamline the transport of soy products from Brazil to China. A rail link, followed by shipping from Peru, could prove 30% cheaper than using the existing Panama Canal route.

Trade between China and Brazil soared to US$83.3 billion last year, rising from $3.2 billion in 2002, with iron ore, soy and oil the bulk of Brazilian exports. The majority of soy is grown in the state of Mato Grosso in the west of Brazil, as close to the Pacific coastal ports of Peru as it is to the Atlantic. The beans, though, are currently transported east by road, before being shipped.

According to the Soy Transportation Coalition, overall shipping costs can be 50% higher for Brazilian farmers than for those in the USA. The extra cost is down to the expense of trucking to the Atlantic ports.

The solution – a rail link from Brazil through Peru to Pacific ports – was first conceived in meetings between the Chinese, Peruvian and Brazilian governments in 2014. In July 2014, the three governments agreed to conduct basic studies, with a working group established in November. Officials met again in May 2015 and committed to produce a final report by March 2016. The railway is expected to take at least six years to complete.

China buys 30 million tonnes of soy from the USA at harvest time in the Northern hemisphere – September through November – and a similar quantity from Brazil in February to May. All the Brazilian soy is currently transported via the Panama Canal.

According to US Department of Agriculture data, soy shipments to China represent 60% of Brazil's exports, with the country supplying 35 million tonnes annually. Improved transport in Brazil could reduce costs by $50 a metric tonne – 13% of the average August price for soy – which equates to savings of more than $1 billion annually. This projected annual saving sets a context for the estimated $10-20 billion construction cost.

The train will be the third axis of integration between Brazil and Peru. Road links on the eastern side of the Andes have historically been poor, characterised by slow, roads, often damaged by floods and landslides. Over the past decade, two major highways have also been constructed to link the Western Amazon to the Pacific coastal ports.

Construction on the Interoceanico Sur highway began in 2006, with the official opening taking place in 2011. The highway links the southern Peruvian ports of Matarani and Ilo with Madre de Dios in the Amazon, and then connects to the Brazilian road network in Acre. Interoceanico Norte links the northern port of Paita with Yurimaguas, from where river transport can travel to Iquitos and on to the Atlantic. The road is completed, although the waterways have yet to be modernised.

These road projects will open up areas of the Amazon previously isolated from trade. This will facilitate the export of products through the Peruvian ports and towards Asia, as well as improving the trade links from Peru across South America to Brazil, the regional powerhouse.

The roads are technically difficult solutions to the current inefficient trading routes. For many, a railway crossing the continent of South America at its widest point has not seemed the simplest solution to the bottleneck of traffic at the Panama Canal.

Rivals to the Panama Canal

In Central America, several more projects are at various stages of development. Guatemala, Honduras, Nicaragua, Costa Rica and Colombia all have coastlines on both the Atlantic and Pacific, separated by between 150 and 400 km. While Panama is widening its canal to take bigger ships, four other countries have plans to improve links between the oceans both by road and by rail.

Nicaragua

A scheme to build a canal through Nicaragua, linking the Atlantic to the Pacific was approved by a Nicaragua government committee in July 2014. At around 270 km, it would be more than three times as long as the Panama Canal. The project has been conceived and funded by the Hong Kong Nicaragua Canal Development Investment Company Ltd (HKND Group). The rationale behind the project highlights the increasing size of transport ships, with many bulk carriers already too big to pass through the Panama Canal.

The project has attracted a certain level of opposition, largely because of the environmental disturbance from large ocean going ships passing through the freshwater Lake Nicaragua. On November 5 this year, however, the Government of Nicaragua issued an Environmental Permit. Subsequently, HKND announced it would start construction work this year, with bulk excavation commencing by the end of 2016. The project is now scheduled to be completed before 2022.

Panama

A $5.2 billion expansion of the Panama Canal in order to facilitate the passage of larger vessels began in September 2007 and was said to be 93% complete as of August 2015. HKND contends that this is already out of date and that 17% of the container fleet will soon be too large to pass through even the expanded Panama Canal.

Guatemala

In Guatemala, a scheme to link the two oceans for freight has been under discussion for 15 years. The proposed International Corridor will be 372 km long and 140 m wide. It will include a four-lane highway, a two way freight rail line, and four oil and gas pipelines.

Two deep water ports will also be constructed on the Atlantic and Pacific coasts. Each will have the capacity to accommodate the mega-ships that cannot pass through the Panama Canal, even after its expansion.

For more than a decade this has been a project in search of support and funding. During that time, the organisers have been talking to land-owners and municipal authorities along the route and has taken pains to address the social issues that inevitably accompany such a project. With this in mind, it has ensured that 12% of the income generated will be distributed to local authorities along the corridor. In July 2013, the Guatemalan government announced its support for the project and funding was provided to purchase the land. The project is predicted to be completed by 2020.

Honduras

In Honduras, a transoceanic railway was first mooted in the nineteenth century. More recently, a 2011 feasibility study was followed by a June 2013 announcement by the Honduran government that it was to sign an agreement with a Chinese company for the construction of an interoceanic railway linking the Pacific coast island of Amapala with the Atlantic coast port Castilla, a route of about 375 km. The $20 billion project includes the construction of two ports, a refinery and an oil pipeline.

The interoceanic railway was not included in the National Plan of new President Juan Orlando Hernández upon his election in November 2013. The President, however, has promoted the rapid development of a Logistics Corridor linking the two oceans. He was recently quoted as saying the construction of the four-lane highway linking the coasts was "the most important project in the country". The road is due to be completed by April 2017.

Though there has been no recent news on the rail project, it may still come to pass. On November 2 this year, the President announced that he would be taking representatives from Taiwan on a tour of ports on the Atlantic and Pacific coasts. This was with a view to developing "a Logistics Center for the Americas to complement the interoceanic railway project between the Port of Amapala and Puerto Castilla."

Columbia

Plans to enlist Chinese engineering companies to help Colombia construct a train line connecting the Atlantic and Pacific coasts were announced by President Juan Manuel Santos in 2011. The proposed 220 km rail route would bypass the Panama Canal, but would pass through environmentally sensitive territory and lacks existing port connections.

According to El Pais, the Colombian national daily, the project is part of a larger proposal to build a 791 km railway network linking the interior of the country to an expanded port of Buenaventura, on the Pacific. It would allow up to 40 million tonnes of coal a year to be carried for export to China.

There could be half a dozen more trade and cargo routes from the Atlantic to the Pacific within ten years if all these projects are completed. One hundred years after the opening of the Panama Canal, world trade will be looking at a competitive market in bi-oceanic transport. That is sure to mean lower costs and shorter transit times for cargo.

Just how many of these schemes will come to fruition is, of course, debatable. What is more definite, however, is that many of them are in direct compliance with the avowed Belt and Road objectives, with high level discussions between the Chinese and the relevant national authorities almost certainly already underway. As in Africa and the emerging economies of Eastern Europe, the question is which of these favoured national projects will best be able to piggyback on the vast Belt and Road budget.

John Haigh, Special Correspondent, Lima

| Content provided by |

|

Editor's picks

Trending articles

One Belt, One Road: From Dialogue to Action

By McKinsey & Company

China signaled its intention to revive the economic power of the ancient Silk Road with two new initiatives in 2013 - the Silk Road Economic Belt and a 21st-century Maritime Silk Road. Now is the time to put flesh on these concepts and make China’s One Belt, One Road (OBOR) initiative a reality.

Please click here for the full report.

Editor's picks

Trending articles

Hong Kong Export Credit Insurance Corporation | 31 Dec 2015

Kenya: Leading Role in East African Community

Strengths

- Strategic location - logistical hub for the East African region

- Rich natural resources

- Large and young population

Challenges

- High poverty rate

- Weak economic fundamentals - twin deficits in fiscal and current accounts

- Security issue related to terrorist attack

|

Key Information

|

|

| Capital | Nairobi |

| Population | 44.9 million |

| Currency | Kenya shilling (1 KES = 0.0098 USD as of 19 October 2015) |

| Official language | English and Kiswahili |

| Form of state | Unitary republic |

| Major Merchandise Exports (% of total, 2013) | Major Merchandise Imports (% of total, 2013) |

| Tea (21.0%) | Industrial supplies (29.1%) |

| Horticulture (20.1%) | Machinery & other capital equipment (17.4%) |

| Coffee (4.7%) | Transport equipment (11.3%) |

| Top Three Export Markets (% of total, 2014) | Top Three Import Markets (% of total, 2014) |

| Uganda (11.8%) | India (23.4%) |

| Tanzania (7.7%) | China (21.3%) |

| Netherlands (7.5%) | UAE (7.6%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

Kenya is a constitutional democracy with a bicameral parliament and executive president directly elected by voters. The inauguration of President Uhuru Kenyatta and Deputy President William Ruto in 2013 marked the official launch of decentralisation. The new government intends to push ahead with reforms, including trade liberalisation, privatisation and deregulation, in order to improve the business environment, thereby boosting growth and cutting poverty. Increased use of public-private partnerships and the roll-out of key infrastructure projects will facilitate the process. However, progress is likely to be uneven and subject to delay, including the passage of legislative reforms, because of public-sector capacity constraints and institutional turf wars.

Since late 2011, Kenya has seen an upsurge in violent terrorist attacks. The attacks had affected Kenya's tourism industry, which represented around 12% of GDP, as Western countries had issued travel warnings to their citizens. Official data from Kenya showed that the number of foreign visitors fell 18.3% for the first eight months of 2015.

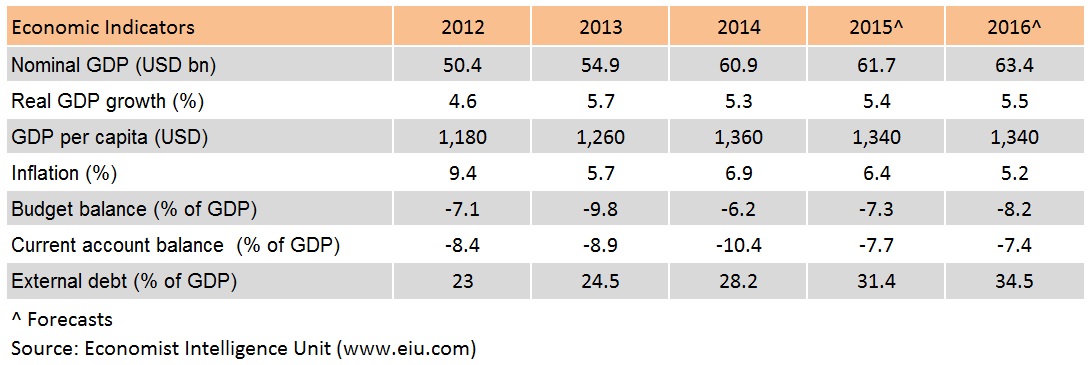

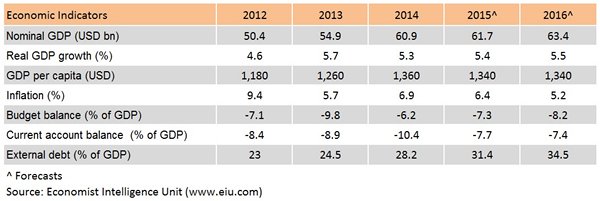

Economic Trend

Kenya is emerging as one of Africa’s key growth centres and is poised to become one of the fastest growing economies in East Africa, supported by lower energy costs, investment in infrastructure, agriculture and manufacturing. Expansion was relatively broad-based with all sectors posting growth except for tourism, which shrank by 0.8% yr/yr. Economic performance is expected to remain solid, though the uncertainty facing global currencies is causing volatility in the domestic money and foreign exchange markets.

Kenya is East African Community’s (EAC's) biggest and most advanced economy, and serves as the logistical hub for the EAC's other landlocked nations. According to the United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2015, Kenya’s FDI inflows rose 95% to a record high of US$989 million in 2014, with FDI flows coming from a wide variety of sources, including the US, Europe, key Asian economies and South Africa. Investors are attracted by Kenya’s relatively diverse economy, pro-market policies and brisk growth in consumer spending.

Kenya maintains wide deficit in both of its budget account and current account, making its economy prone to market capital flow. Meanwhile, Kenya’s current account deficit remains structurally high (around 7-8% of GDP) on the back of low-value exports - mostly tea and horticulture, and strong imports of both capital and consumer goods. Yet, the situation is expected to improve in the medium term as the recent discoveries of oil, gas and minerals in Kenya could do a favorable impact on the country’s external fiscal prospects.

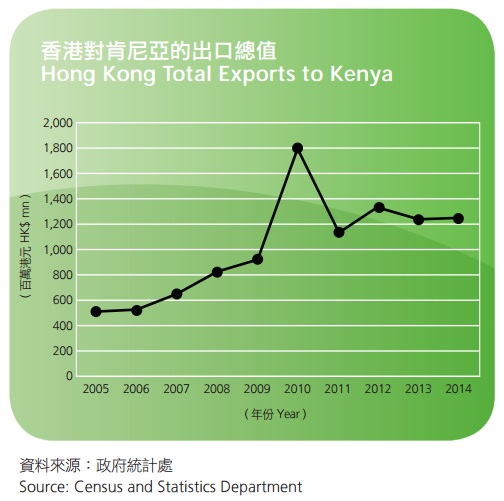

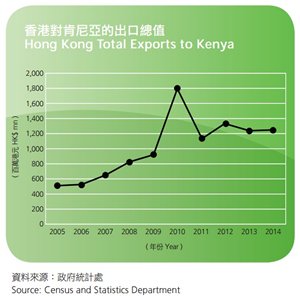

Hong Kong – Kenya Trade

Total exports from Hong Kong to Kenya increased by 0.2% from HK$1,249 million in 2013 to HK$1,251 million in 2014. The top three export categories to Kenya were: (1) telecommunications, audio & video equipment (+8.8%), (2) clothing & clothing accessories (+29.9%), and (3) textiles (-16.7%), which represented 82.2% of total exports to Kenya.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering Kenyan buyers. Currently, the insured buyers in Kenya are mainly small and medium sized companies. For 2014, the number of credit limit applications on Kenya decreased by 6.8%, while the amount of credit limit applications and insured business increased by 7.1% and 232.3% respectively. Major insured products were chemical products, electronics, and toys, which represented 96.6% of ECIC’s insured business on Kenya. The Corporation’s underwriting experience on Kenya has been satisfactory, with no claim payment or payment difficulty case reported from October 2014 to September 2015.

| Content provided by |  |

Editor's picks

Trending articles

Romania: Strong Domestic Demand Fuels Growth

Strengths

- Second largest market in Central and Eastern Europe

- Strong manufacturing base

- Low labour cost

Challenges

- Political uncertainty as general election due in 2016

- Dominance of inefficient SOEs in transportation and energy sectors

- Declining population

Key Information | |

| Capital | Bucharest |

| Population | 21.6 million |

| Currency | Romanian leu (1 RON = 0.2519 USD as of 5 September 2015) |

| Official language | Romanian |

| Form of state | Republic |

| Major Merchandise Exports (% of total, 2014) | Major Merchandise Imports (% of total, 2014) |

| Machinery & equipment (42.4%) | Machinery & equipment (35.8%) |

| Base metals & products (9.0%) | Chemicals & products (10.2%) |

| Textiles & products (7.4%) | Minerals & fuels (9.9%) |

| Top Three Export Markets (% of total, 2014) | Top Three Import Markets (% of total, 2014) |

| Germany (19.2%) | Germany (19.1%) |

| Italy (11.9%) | Italy (11.9%) |

| France (6.8%) | Hungary (7.8%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

Romania is a semi-presidential republic. The cabinet is nominated and headed by the prime minister, who in turn is nominated by the president. Prime Minister Victor Ponta from the centre-left Social Democratic Party (SDP) took office in 2012, but was defeated in the November presidential run-off by Klaus Iohannis, Ponta’s centre-right rival who vowed to tackle corruption and strengthen the independence of the judicial system. The next parliamentary election is scheduled for late 2016 and the SDP is likely to face a greater challenge from the centre-right camp.

While macroeconomic policies since the 2008 global financial crisis have largely corrected internal and external imbalances, further structural reforms are being demanded by the European Commission. The government will need to continue to improve the absorption of EU funds to modernize public infrastructure, address the weaknesses in the financial sector, and re-invigorate delayed state-owned enterprise (SOE) reforms. However, political uncertainty will hinder the progress on structural reforms in the short term.

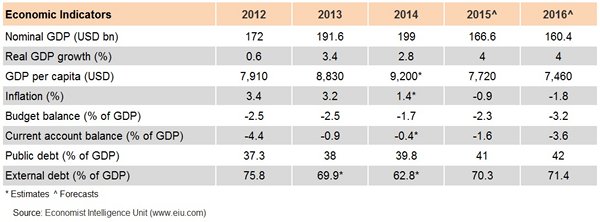

Economic Trend

Romania has a strong base for manufacturing, with over 60 industrial parks all over the country. Romania experienced a deep recession after the global financial crisis, prompting the government to launch a draconian austerity programme and implement long-needed economic and financial reforms, with the support of the World Bank, International Monetary Fund (IMF), and the European Commission. Economic growth in Romania is forecast to remain robust in 2015 and 2016, driven by strong private consumption and recovering investment.

Following years of austerity measures, Ponta is hoping to rally popular support through the pursuit of more populist measures. While a lower VAT rate could provide a boost to consumer sentiment, it implies that the budget deficit might overshoot the EU’s 3% ceiling again in 2016, and pushes the country further into deflation. Romania is not yet a member of the euro area. The Romanian leu has not yet joined the Exchange Rate Mechanism. Romania has set 2019 as its target year to adopt the euro.

Romania’s GDP per capita was relatively low, at only 54% of the EU average in 2014. Income convergence with the EU has been rather slow. Weak public infrastructure partly due to the dominance of inefficient SOEs has emerged as a bottleneck for faster growth. Higher investment in R&D will be needed to underpin convergence.

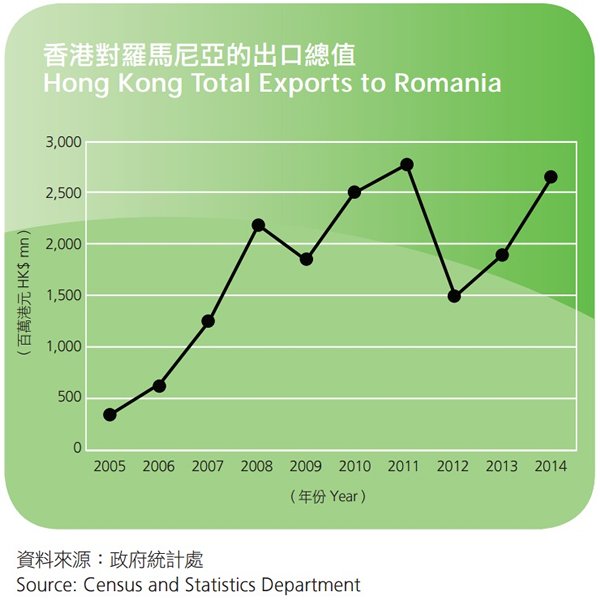

Hong Kong – Romania Trade

Total exports from Hong Kong to Romania increased by 34.7% from HK$ 1,947 million in 2013 to HK$ 2,622 million in 2014. The top three export categories to Romania were: (1) telecommunications, audio & video equipment (+53.6%), (2) electrical machinery, apparatus & appliances, & parts (+8.4%), and (3) office machines & computers (+103.7%), which represented 86.1% of total exports to Romania.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering Romanian buyers. Currently, the insured buyers in Romania range from small and medium sized companies to manufacturing arms of foreign listed companies. For 2014, the number of credit limit applications on Romania decreased by 16.3%, while the amount of credit limit applications and insured business increased by 21.4% and 30.7% respectively. Major insured products were electronics, electrical appliances, and travel goods, which represented 50.5% of ECIC’s insured business on Romania. The Corporation’s underwriting experience on Romania has been satisfactory, with no claim payment or payment difficulty case reported during the past 12 months (from September 2014 to August 2015).

| Content provided by |

|

Editor's picks

Trending articles

Polish Businesses Keen to Capitalise on Belt and Road Opportunities

Disappointed at the one-way traffic that largely characterises Polish-Chinese trade, a number of companies in the country are now hoping that the Belt and Road Initiative will prove a key means of helping to redress that balance.

With the Belt and Road Initiative (BRI) now securing global attention, Poland is one of the many countries looking to capitalise on the array of opportunities opening up as a result of the mainland's huge trade and investment program Addressing the Poland-China Trade Investment Forum in Shanghai late last year, Andrzej Duda, the Polish President, said: "I am convinced that the Directors of Chinese firms looking to invest in Europe will consider Poland as one of the first candidates."

Poland is also one of the 16 European countries to have taken part in the China-Central and Eastern Europe Summit in Suzhou last year. The event saw President Duda accompanied by 80 representatives of Poland's business community, all keen underline their commitment to the Belt and Road Initiative.

Poland's heightened co-operation with China actually pre-dates the formal announcement of the BRI back in 2014. The previous year had already seen the official opening of a new railway line linking the Polish city of Lodz with Chengdu. As a result, rail freight time between the two cities has now been reduced to 14 days.

Despite this improved access, many in Poland remain concerned about one-way trade between the two countries, with the majority of the trains returning to China far less laden than when they arrived. Principally, the rail route has only attracted a limited number of Polish export categories, notably FMCG items, luxury goods and advanced electronic products. Exporters of the more durable goods inevitably still favour the slower, but cheaper, sea freight options.

Despite the growth in exports to China, many in Poland still believe the country is failing to achieve its potential. At present, in value terms, Poland still imports 10 times as much from China as it exports.

In 2014, Poland's exports to China were headed by copper products (valued at US$830 million) and mechanical appliances ($563 million). Now, though, the country looking to nurture those industries that have the potential to successfully export to the mainland.

Among those accompanying Duda to Shanghai were representatives of Selena FM, the construction chemicals group based in Wroclaw, the largest city in western Poland. Recently, the group has grown its mainland business by more than 40%, something that has been taken as an encouraging sign by other Polish businesses.

Commenting on its success, Jaroslaw Michniuk, a Director of the company, said: "We've gained a lot of experience by being present on the Chinese market over the last few years, but we still have a long way to go. Now our priority is to increase our market presence and nurture a higher demand for our products."

Construction chemicals aside, Poland's food industry also has high hopes of success on the mainland, as well as in a number of other key export markets. The country has recently been participating in the Tastes of Europe campaign, an initiative aimed at boosting the global sales of EU agriproducts. With the program set to run for three years, the promotion of Poland's food sector is backed by a $6 million spend, with half of that coming from EU coffers.

As a key means of accessing China – and the wider Asia market – many Polish food companies have looked to Hong Kong as the ideal platform to promote their produce. Among other initiatives, this has seen a dramatic increase in the number of Polish companies exhibiting at the Hong Kong HKTDC Food Expo.

Commenting on the move, Lucjan Zwolak, Deputy President of Poland's Agricultural Market Agency, said: "For years now, Hong Kong has been the gateway to the Chinese market for our food industry. Currently, our food exports to the mainland are valued at around $76 million per annum, but we believe that our potential sales could be significantly higher."

Taking a more cautious approach, Radosław Pyffel, Director of the Centre for Poland-Asia studies, believes Poland needs to develop a long-term strategic agenda if it is to find true success on the Mainland, rather than relying on the momentum created by occasional trade visits. There are, however, signs that this is being addressed, with a number of Polish government agencies now actively promoting and facilitating trade with the mainland. The country's Translation Bureau is also working with many Polish businesses to produce promotional documents in Mandarin.

Ultimately, though, many Polish businesses are on the lookout for investors and partners who understand the demands of the Chinese market and its idiosyncratic ways of doing business. Such developments are likely to be boosted by funding from the Asian Infrastructure Investment Bank. As part of the Belt and Road Initiative, Poland is eligible for a share of the Bank's $100 billion initial funding, with the country's government already lobbying for support for a number of key projects.

Anna Dowgiallo, Warsaw Consultant

| Content provided by |

|

Editor's picks

Trending articles

Building on China’s Overseas Investment

By HSBC Global Research

China is going global: its consumers are travelling abroad, its companies are buying resources from all over the world, and the government is finding new places to invest the country’s USD4trn of foreign reserves. As these trends continue, we think the “next big thing” will be China’s export of capital, especially to infrastructure investment projects in Asia and further afield.

China’s infrastructure boom in recent years has created an economy well suited to designing, building and servicing large infrastructure projects. Although we have argued that there is still plenty of room for China to keep investing in its domestic infrastructure, the peak may have already passed. As such, it makes sense for China to look to overseas markets to put all that capacity to use.

It may not have to look far. We estimate that Asia needs to invest USD11trn in urban infrastructure by 2030. In this report, we update our Asian Infrastructure Measure, and find that while infrastructure development in the region has increased, it is still far below US levels.

At the same time, funding gaps have emerged, especially in Indonesia, India and Thailand. To fill them, Asia may have to rely more on external funding as domestic sources become scarce. With a proposed USD100bn capital base, the China-led Asian Infrastructure Investment Bank (AIIB) offers an alternative source of funding for infrastructure in the region. Spending on infrastructure is essential for growth, so there is potential for a “win-win” situation: China helps to narrow Asia’s funding gap and in the process achieves its own policy objectives, including the internationalisation of the Renminbi.

Please click here to view the article.

Editor's picks

Trending articles

Xi’s New Silk Road Plan

By HSBC Global Research

The recent Asia-Pacific Economic Cooperation (APEC) meeting in Beijing resulted in deals that will have long lasting effects. President Xi Jinping pledged USD40bn for infrastructure investment to build a New Silk Road in the spirit of the centuries-old trading route, comprising a land based economic belt and a maritime route. This follows recent agreements to establish the Asian Infrastructure Investment Bank (AIIB) and the BRICS bank and is in line with the rapid growth of China’s outward investment, which is likely to surpass inflows in 2014.

China’s infrastructure sector has the capacity to meet needs in Asia and further abroad. That investment overseas should also generate demand for China’s exports and help reduce economic slack and disinflationary pressure. The New Silk Road plan should also mean more investment for the less developed central and western parts of the country and generate better long-term returns on foreign reserves.

As we pointed out previously, the still-significant infrastructure gaps in Asia can be met by China’s outward direct investment (ODI) push. The region as a whole should also benefit from increased demand and lower trading costs. Our analysis shows that trade in Australia, Indonesia, Japan, and Korea would increase the most as a result of China’s new strategy. So, while the deals on trade, tariffs and emissions made the headlines at APEC, we believe the New Silk Road plan is likely to have a profound impact on the region.

Please click here to view the article.

Editor's picks

Trending articles

On the New Silk Road III

By HSBC Global Research

Beijing’s publication of a detailed plan of action for the New Silk Road initiative confirms its centrality to Chinese policymakers’ thinking in the short and long run. Following on from our earlier reports Building on China's overseas investment (8 August 2014), and Xi's New Silk New Road plan (18 November 2014), this report looks at how the “One Belt, One Road” strategy is starting to become reality two years after it was first announced.

In the near term, the focus will be on infrastructure investment and promoting cross-border trade to ensure that goods, services and capital can flow easily on land (the “belt” connecting China, Central Asia, Russia and Europe) and sea (the “road” linking China to ASEAN, India and Africa). We estimate that the total could reach RMB1.5 trillion. This should help to support fragile domestic and external demand, the factors behind the downward trends in growth, prices and labour market conditions.

This report provides details on the initial projects, which emphasise upgrading transport links. It also looks at current efforts to make trade easier (e.g. faster customs clearance) and discusses different financing options. Apart from the new Asian Infrastructure Investment Bank and BRICS bank, there are ambitious plans to enable Chinese and foreign companies and governments to raise RMB funds in both China and countries along the ancient trading route.

This initiative is mutually beneficial. Countries with weak infrastructure should benefit from China’s expertise in this area and the new markets will generate demand for China’s exports. But major challenges lie ahead. We believe China’s record of overseas investment needs to improve and it will be important to balance the interests of the many stakeholders, public and private, both at home and abroad.

Please click here to view the article.