Chinese Mainland

The Belt and Road Initiative will open a new window for performing arts at Hong Kong’s West Kowloon Cultural District, says Executive Director Louis Yu. M+ museum Executive Director Suhanya Raffel sees the new centre for visual culture as reflecting Hong Kong’s “voice” for the future while CEO Duncan Pescod says the Cultural District will provide new, creative and original artistic offerings encompassing Belt and Road countries.

Speakers:

Duncan Pescod, Chief Executive Officer, West Kowloon Cultural District Authority

Louis Yu, Executive Director, Performing Arts, WKCDA

Suhanya Raffel, Executive Director, M+, WKCDA

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

By Pierre Noël, Senior Fellow for Economic and Energy Security, International Institute for Strategic Studies (IISS)

[Editors’ note: This post is an extract from an article that will appear in the upcoming issue of Survival. See Samuel Charap, John Drennan and Pierre Noël, ‘Russia and China: A New Model of Great-Power Relations’, Survival, vol. 59, no. 1, February–March 2017]

During a presidential summit in Shanghai in May 2014, Russia and China signed a 30-year gas purchase and sale agreement reportedly worth $400bn. CNPC (China National Petroleum Corporation) committed to buy 38 billion cubic metres (bcm) of gas annually from Gazprom. This volume amounts to 20% of China’s 2014 consumption and 60% of its 2014 gas imports. The 38-bcm annual volume should be attained around 2025 after a ramp-up period of several years. The first exports could happen in 2019 or 2020. On the Russian side, the project involves some $70bn of investment, including $20bn for field development, $35bn for the pipeline itself and $15bn for a gas-treatment plant at the Chinese–Russian border, in partnership with Russian chemical company Sibur. Field-development and pipeline-construction work are now proceeding apace. In September 2016, Gazprom and CNPC finalised an agreement to build the cross-border section of the pipeline under the Amur River.

The official view in Russia is that Power of Siberia, as the project is known, is only the first step toward building a strategic gas relationship with China, akin to the one it has with Western Europe. Russian reserves would certainly support a long-term gas trade of 100bcm per year. Power of Siberia will create a physical link between the two countries, worth tens of billions of dollars, supporting a flow of energy worth many times that over three decades.

While this gas relationship between Russia and China necessarily has strategic implications, its significance to the two sides is fundamentally different. The Russian government would like it to be understood as a key strategic bond between the two countries. Energy has been the defining factor of Russia’s post-Soviet international economic policy and diplomatic influence. Establishing a gas relationship with China in the aftermath of the Ukraine crisis is perceived as a major success by Moscow. According to the narrative presented by Russia’s authorities, Power of Siberia signals the natural complementarity between the two countries and demonstrates Russia’s ability to develop new export markets outside of Europe.

For China, the gas relationship with Russia is much more mundane. China does not ‘need’ Russian gas (though some Chinese analysts see the energy relationship with Russia as an opportunity to reduce, in relative terms, the country’s dependence on imports by sea) and is under no pressure to compromise on its interests, economic or political, in order to get it. Some Chinese economic and environmental objectives will be easier to achieve with ample gas supply, but none are dependent on the gas relationship with Russia specifically. Chinese state-owned energy companies have demonstrated their ability to bring energy to China, including natural gas, from a fast-growing number of countries and regions, at prices consistent with (or lower than) international market conditions. Resource holders all over the world are competing to access the Chinese market; Russia is just one of them.

Therefore, the gas relationship does not provide balance to an otherwise asymmetrical relationship; it is an element of the broader asymmetry. Russia needs to export the gas much more than China needs to import it. For Beijing, this asymmetry is a factor to be carefully managed. One key aspect of this management effort was to agree to Power of Siberia in the first place.

Negotiations on the pipeline had lasted for more than ten years amidst a changing geopolitical and international-energy landscape. The Ukraine crisis made the deal a strategic priority for Moscow, which wanted to signal to the US and EU countries that its energy complementarity with China offered it a real alternative to European export markets and could be a building block for a broader strategic economic partnership with Beijing. However, just as the deal became a top priority for Russia, its importance for China was diminishing. The rate of gas-demand growth in China had declined sharply; prospects for Chinese shale-gas production had improved; Turkmenistan was eager to increase its exports to the east; a gas-supply deal with Myanmar had come on line; and, finally, US LNG exports were just over the horizon, contributing to a much brighter outlook for the global LNG market, at least from a consumer’s perspective.

The terms offered by CNPC, the Chinese contracting party, were not acceptable to Gazprom. The project is simply too costly to make Russian gas competitive in China in the current energy market. Eventually, both governments twisted the arms of their national energy companies to sign a deal that makes little commercial sense but is a powerful symbol of the countries’ structural complementarity. Gazprom was forced by the Kremlin into a project with extremely low return on capital, if any. The Chinese government, for its part, decided that the cost of offering Moscow such a symbolic achievement was less than the potential blowback from rebuffing Russia. So it forced CNPC to accept a less-than-optimal gas-import contract.

Two months later, the price of oil began to fall from its highs of $110 per barrel and stabilised at less than half that level. For Gazprom, such a fall, if it lasts after 2020, will transform Power of Siberia from a project providing a small but positive net present value (NPV) into one incurring a loss of up to $17bn (Figure 1). However, such heavy losses could be significantly mitigated if the Russian government were to waive all or part of the 30% natural-gas export duty and, crucially, if Gazprom lowered its discount rate. (The discount rate is a key financial variable that determines the relative value of a dollar today, compared to a dollar in the future. The higher the discount rate, the greater the preference for the present. A low discount rate makes a capital-intensive, long-lived project such as Power of Siberia look better financially, but minority investors in Gazprom would object that there are much better uses for their capital, at comparable risk levels, elsewhere in the market. Typically, governments use lower discount rates for infrastructure investment than for-profit corporations because they can borrow at cheaper rates, reflecting lower risks, and take into account the social benefits that accrue to the wider economy.)

If the discount rate were brought down from 10% – typical of commercial energy projects – to 3.5%, Power of Siberia would break even with an oil price of between $40 to $60 dollars per barrel, depending on the level of the export duty (Figure 2). This compares to $110 per barrel required to break even at a 10% discount rate and the current 30% export duty levied on pipeline gas exports.

For the purpose of cementing its relationship with China, the Russian government is essentially using Gazprom as a non-commercial entity, akin to its Soviet-era incarnation: the Ministry of the Natural Gas Industry. At a recent event with foreign investors, Russian President Vladimir Putin, while acknowledging that government-controlled joint-stock companies such as Gazprom had ‘a significant share of private capital, including foreign capital’, admitted that projects such as Power of Siberia are long-term bets that do not reflect short-term market realities. A more accurate description is that the government is directing Gazprom to undertake a project with a very low expected rate of return on capital, which only makes sense because Moscow values its expected geopolitical benefits.

While this de-commercialisation of Gazprom may have created the conditions for the Power of Siberia deal to be signed, it does not provide a guarantee that the long-term gas relationship will be stable. CNPC will be operating in an ever more competitive domestic market, in which the price of gas could be lower than the price it pays under the Russian contract. It would then incur huge losses that the Chinese government would have to absorb, or else the contract with Gazprom would come under severe pressure. Therefore, Beijing’s political decision to accommodate Moscow on Power of Siberia might not be just a one-off concession; it might have to be sustained for years and potentially decades, depending on the evolution of natural-gas markets in Asia.

Please click to read the full report.

Editor's picks

Trending articles

By Ian Bond, Centre for European Reform

Summary

- There are three main integration projects in the Eurasian landmass: the European Union, the Eurasian Economic Union (EAEU) and China’s ‘One Belt, One Road’ (OBOR) initiative. The EU is the largest economic bloc; the EAEU covers the largest area; OBOR covers the largest population.

- These three projects spring from very different motives. The European Union is an institution which uses economic interdependence to preserve the peace in a part of the world where major wars have been the norm in history, and to make Europeans richer and freer (albeit with mixed results). The Eurasian Economic Union is Russia’s latest attempt to reassemble as many as possible of the former Soviet states around itself, using economic leverage rather than military force. ‘One Belt, One Road’ serves a variety of purposes for China, including encouraging economic development in the west of the country and linking China to Europe by land as well as sea.

- Geographically, the three projects overlap, with OBOR having the largest coverage but the lightest institutional architecture. Historically, if great powers had overlapping spheres of influence there would almost certainly be conflict between them. There are risks in the current situation.

- But there is also an opportunity for the EU, EAEU and China to work together to avoid conflict and to look for synergies between their objectives. The EAEU and China have agreed to pursue convergence between OBOR and the EAEU; and the EU and China are major economic partners, and are looking for opportunities to work together in the countries involved in OBOR. The missing link is a relationship between the EAEU and the EU. The EU is rightly suspicious that the EAEU is more of a Russian geopolitical project than a genuine economic union between its members; but it should not dismiss it out of hand.

- Relationships within and between these initiatives could easily go wrong. There are tensions between the EU and Russia, including over Russia’s invasion of Ukraine and annexation of Crimea in 2014. There are tensions between countries along the ‘Silk Road’ from China to Europe. Russia is pursuing a strategic partnership with China at present, but their interests are not identical and nationalists on both sides occasionally voice suspicion or hostility to the other.

- But there may be scope for an innovative approach to diplomacy and economic co-operation across a huge expanse and for the benefit of an enormous population. The approach would have to be incremental, starting with modest objectives and aiming to build confidence among the parties gradually, given the differences among them.

- There are considerable obstacles in the way of working together. The EU is overwhelmed by internal and external challenges: the continuing problems of the eurozone; failure to control irregular migration from the Middle East and North Africa; tensions in the transatlantic relationship in the era of Donald Trump; and Russian mischief-making in EU countries as well as in Eastern Europe. Russia is economically weak (and will remain so as long as oil prices are relatively low), but compensating by being disruptive internationally, so that other powers are obliged to pay attention to it. China has proclaimed itself a champion of globalisation, but the playing field for foreign businesses in China is still far from level. The differences in values and political systems between the main powers in the region are enormous.

- Nonetheless, Europe can no longer be certain that the US will protect the multilateral order, or that the Trump administration will see America’s interests in Europe and Asia as similar to those of the EU and its member-states. There are shared economic and security interests in Europe and Eurasia that the parties could pursue, albeit with no guarantee of finding common approaches. But it is better for Europeans to try to find some common ground with the former Soviet states and China than to watch passively as the existing order is replaced by something much more hostile to the EU’s values and interests.

“It is worth the EU making the effort to reach out to the members of the EAEU and to China.”

For all the foreseeable difficulties, however, it is worth the EU making the effort to reach out to the members of the EAEU and to China. The EU should certainly see whether China, which has an interest in the smooth flow of goods to and from Europe via Russia, can help to overcome Russia’s suspicion of Western institutions and their intentions; and whether Beijing accepts that it has an interest in the survival of the liberal international order (even if it wants to modify it and ensure that China has more influence in it).

The EU needs to see whether it can make common cause with China because it can no longer be certain that it is on the same side as America when it comes to globalisation and free trade. Europe has been able to rely on the US for the last 70 years, first to create and then to protect international institutions and international order, both economic and political. The Trump administration may undermine the multilateral organisations and ways of doing business on which international order has rested, if it turns the president’s rhetoric into policies. Trump has shown over many years that he does not understand modern international trade; that he categorically believes that deficits are bad and surpluses are good; and that he does not like bodies such as the World Trade Organisation that can punish America for distorting trade.

Hopefully, the US administration will settle down and become more ‘normal’ in its trade policy; but there is no immediate evidence that it will; and Trump’s inaugural address on January 20th 2017 and speech to Congress on February 28th were both protectionist in tone. The EU and its member-states should certainly try to persuade Trump to take a more traditional American stance. But they should also be prepared, in case he continues to behave in untraditional ways. They need to try to find common ground with other major trading partners, difficult though that may be, in order to maintain as much of the global trading system as they can. After the era of the Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership, when it seemed that the West would be able to set standards for international commerce for many years, the EU may find itself trying to negotiate common standards with China and the EAEU instead. It may well not succeed. The greater risk, however, is that the EU does not try, but leaves it to others to shape the future order, and ends up with something much more hostile to European values and interests.

Please click to read the full report.

Editor's picks

Trending articles

By Raya Muttarak, Wittgenstein Centre For Demography And Global Human Capital (Iiasa, Vid/Öaw, Wu), International Institute For Applied Systems Analysis, Laxenburg, Austria

Abstract

Along with the flows of China’s foreign direct investment following the newly implemented ‘One Belt, One Road’ strategy by the Chinese government will likely generate movements of state employees, entrepreneurs, workers and accompanying family members to respective countries along the Belt and Road. It is not clear how large Chinese migration flows into these countries will be, who they are, how the public reception of the host society will be and how well the migrants will be integrated in the destination country. Based on extant data and literature on current Chinese migration, this paper describes trends and patterns of recent Chinese migration in Africa and Asia, analyses host country public perceptions on China and investigates integration patterns of Chinese migrants. Given that the ‘One Belt, One Road’ strategy has only been officially endorsed in 2015, it is still early to analyse its impacts on Chinese migration in the respective countries. Considering earlier Chinese overseas migration in the past decades, this paper presents potential migration and integration patterns one may expect following the Belt and Road initiative.

Conclusion

No doubt, it is too early to draw any conclusions on the implications of ‘One Belt, One Road’ strategies on Chinese migration. Drawing upon the experience of the ‘Going Out’ strategy which results in increases in China’s foreign direct investment and trade overseas, one may expect a subsequent rise in international migration of Chinese laborers and entrepreneurs in the OBOR countries. How these migrants will be integrated in the OBOR countries are likely to depend upon many factors both individual characteristics of the migrants themselves and contextual characteristics of the host society. In order to pinpoint the consequences of the OBOR strategy on Chinese migration requires improvement of current research on Chinese migration and Chinese overseas. Identifying the research gaps such as the lack of accurate data on the distribution and composition of Chinese emigrants and scarce empirical studies on Chinese migrants integration thus can help develop relevant research questions and improve research design for the new research on Chinese migration in the Belt and Road countries.

In particular, to understand the trends and patterns of Chinese migration as well as how migrants in the OBOR countries fare require better official migration data and more precise estimates of migration flows which also account for undocumented workers. Digital records, social media data or mobile network data can potentially be an alternative source to capture mobility patterns and social networks of migrants. It is equally important to know the composition and distribution of the migrants. This information is fundamental for studying how the members of the Belt and Road countries perceive Chinese migrants and how integrated the migrants are in the destination country. Given that economic activities associated with the OBOR strategy will involve not only the large-scale publicly-fund projects but also private and small-scale enterprises as well as individual economic migrants, this diversity needs to be taken into account when studying the implications of Chinese migration in the Belt and Road countries.

Please click to read full report.

Editor's picks

Trending articles

China's stake in Laos' sustainable-energy sector paves way for closer long-term Belt and Road collaboration.

China and Laos jointly initiated work on the second phase of the 1,156 MW Nam Ou Cascade Hydropower Project earlier this year. The project, set on Laos' principal river, is seen as one of the country's key contributions to China's Belt and Road Initiative (BRI).

With Laos' GDP for 2016 recorded at just US$15.9 billion, China has shouldered the bulk of the cost of the $2.8 billion initiative in exchange for the concession to operate the hydropower installation for the next 29 years. Once completed, it will comprise seven dams and hydropower stations and have a projected capacity of 1,156 MW, together with an annual energy output of 5,017 GWh.

The lead on the Chinese side has been taken by Sinohydro, a Beijing-headquartered state-owned hydropower engineering and construction company, which entered into an agreement to develop the project on a joint-venture basis with Electricite Du Laos (EDL), the Laos state electricity corporation, which holds a 15% stake in the site. Under the terms of the project, all electricity generated will be sold to EDL. Significantly, Nam Ou is the first project for which a Chinese enterprise has secured the whole basin rights for planning and development.

With work on Phase One completed more than two years ago – comprising construction of the Nam Ou 2, Nam Ou 5 and Nam Ou 6 plants – the site generated its first electricity on 29 November 2015. In total, the capacity of Phase One is estimated at about 540 MW, almost half the total envisaged for the completed project. The groundbreaking ceremony for the second phase was held some five months later and marked the beginning of the work on the remaining plants – Nam Ou 1, Nam Ou 3, Nam Ou 4 and Nam Ou 7. This second phase is scheduled for completion in 2020.

Emphasising the importance of the initiative, Dr Khammany Inthilath, the Lao Minister of Energy and Mines, said: "Once completed, the Nam Ou Cascade Hydropower Project will have a major role to play in the reduction of poverty across Laos. In particular, it will boost the socio-economic development of Luang Prabang and Phongsaly provinces, immeasurably improving the living standards of local residents.

"It will also play an important role in regulating the seasonal drought problems in the Nam Ou river basin. Ultimately, we hope it will ensure downstream irrigation for the region's plantations on a long-term basis, while also reducing soil erosion."

Despite Inthilath's optimism, the project has attracted criticism on a number of fronts. Firstly, there have been concerns over the possible adverse environmental impact of such large-scale hydropower projects, particularly given the scale and number of hydropower developments currently under way along the Mekong River and its tributaries. In addition to the Nam Ou project, China is also involved with several other hydropower installations, including Don Sahong, Pak Beng and Xayaburi.

A second wave of criticism has come from outside Laos, with a number of neighbouring countries expressing concerns that the cumulative effect of the hydropower projects already under way may adversely impact on the flow of the river. To this end, the governments of Thailand, Vietnam and Cambodia have all gone on record as objecting to the expansion of Laos' hydropower programme.

It is the sheer scale of Chinese investment in Laos, together with the country's resultant indebtedness, that has triggered a third wave of criticism. By the end of 2016, with $5.4 billion worth of funding already in place, China was by far the largest overseas investor in Laos.

According the Lao government's own figures, by the end of 2016 Chinese companies had signed up for $6.7 billion worth of construction projects in the country – some 30.1% of the total earmarked for Laos' infrastructure upgrade. The overall scale of the deals already in place makes Laos the third-largest market for China in the ASEAN bloc.

Overall, though, taking an active role in China's Belt and Road Initiative has been seen as a good fit with Laos' long-held ambition to shift from being a land-locked nation to becoming more of a land-linked economy. Furthermore, Laos' ongoing co-operation with China on a series of energy projects has underlined the positive relationship between the two countries.

Highlighting this, while speaking at the launch ceremony for Phase Two of the Nam Ou Cascade Hydropower Project, Li Baoguang, the Chinese Consul-General in Luang Prabang, Laos' ancient capital, said: "This year marks the 55th anniversary of the establishment of diplomatic ties between China and Laos and there could be no better way of commemorating that than with the commencement of work on this joint venture."

Geoff de Freitas, Special Correspondent, Vientiane

Editor's picks

Trending articles

Major hydropower and roadway investments chime well with the overall objectives of the Belt and Road Initiative.

Speculation as to Malaysia's future economic priorities have frequently focused on the country's oil and gas reserves, palm oil production, high-tech manufacturing, real estate and, of course, tourism. While its potential strengths in the hydropower sector have remained largely overlooked, two high-profile dam projects may be about to change all that, with Sarawak's long-mooted Corridor of Renewable Energy now set to become a reality.

Last month, Sarawak Energy Berhad, the power generation company owned and operated by the state government of Sarawak, completed its purchase of the 2,400 mW Bakun Dam from Malaysia's Ministry of Finance. The company paid RM2.5 billion in cash, with a further RM6 billion in loan facilities, to take possession of one of Southeast Asia's most significant – and controversial – power projects. Work on the dam was originally completed in 2010, but the site didn't come fully online until July 2014.

In a further development, in October 2018, work is expected to begin on the construction of the 1,285 mW Baleh Hydroelectric Facility. The project is being jointly undertaken by the China Gezhouba Group, the Wuhan-based construction and engineering giant, and Untang Jaya, a Sarawak-based construction company.

Once completed, Baleh will be the fourth hydroelectric installation to have been co-opted into Sarawak's Corridor of Renewable Energy, an initiative launched in 2008 on Borneo, an island jointly administered by Malaysia, Indonesia and Brunei. This will see it line up alongside the Bakun Dam, the 944 mW Murum Dam and the 100 mW Batang Ai Dam.

Following the completion of the Bakun deal, the Sarawak government, together with its Sarawak Energy subsidiary, now owns all of the state's electricity generation facilities, granting it considerable leverage over the future direction of other local infrastructure projects. This will include the proposed redevelopment of the Bakun Lake region into a prime tourism destination, complete with a range of new hotels and resorts.

Another project with clear links to the Sarawak Corridor of Renewable Energy is a proposed coastal highway. At present, it is anticipated that up to 80% of its construction costs could be covered by Chinese investment in line with the overall objectives of the Belt and Road Initiative. Considered something of a huge undertaking, the project would entail the construction of several bridges, as well as substantial upgrades to roadways in the more rural and forested areas.

Should it get the go-ahead, the coastal highway would only be the latest of the country's array of ambitious transport infrastructure projects. Indeed, work is already under way on the RM16.5 billion, 1,073km Pan-Borneo Highway, a Malaysian government-backed initiative intended to link the country's two Borneo-based states, Sarawak and Sabah. It could also, ultimately, connect to Brunei via the 30km Temburong Bridge. Currently under construction by the China State Construction Engineering Corp, the bridge is scheduled for completion in late 2019.

The first 786km-long phase of the Pan-Borneo Highway is due to be finished a little later – in 2022. Once completed, though, it is hoped that the road will stimulate further investment in infrastructure, public transport, telecoms networks and public-health facilities across the vast tranches of Malaysia's rugged, underdeveloped terrain that the highway extends across.

For its part, the Sarawak government has claimed its bid to take overall control of the state's renewable-energy resources is in line with its long-term ambition to transform the region into a digital-communications hub. To this end, it has already pledged to invest RM2 billion over the next five years in installing fibre-optic cables and satellite connectivity across the state in order to jump-start the local digital economy. The move is part of a wider agenda intended to rebalance the economy and see it shift away from its traditional reliance on the oil and gas, mining, agriculture and forestry sectors.

Outlining the policy, Datuk Amar Abang Johari Tun Openg, Sarawak's Chief Minister, said: "Bakun and the other hydroelectric projects will play a strategic role in powering the digital economy. We believe that the integrated management of the local hydropower facilities will help attract many of the global digital giants to Sarawak."

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

By Simigh Fruzsina, PAGEO Geopolitical Institute

China’s continuously increasing role in global economy is accompanied by a growing number of challenges concerning security policy, which entails the forced increase of the willingness to make a political or even military intervention. While building One Road, One Belt, China shall ensure a sufficient financial background, or at least a part of it, for the ambitious projects, and not merely through multilateral financial institutions and bilateral agreements.

What Connects and Threatens

The idea that the deepening of economic relations will sooner or later put an end to military conflicts dates back to the 1990s. According to Rosecrance, those states may be successful in the new, emerging world order which ensure a high added value to finished products, supply services and carry out various financial processes. However, since basic production is inseparable from this, the opportunity of economic self-sufficiency is impaired. Thus, the evolving mutual dependency of states contributes to replacing territorial, expansionist goals with a cooperative atmosphere ensuring economic growth. It derives from the fact that continuous trade and a free flow of investments required for this growth are ensured in a peaceful, stable, predictable environment.

However, appropriate logistic, infrastructural and political coordination and cooperation are also required for making it operate as efficiently as possible, especially because geographical connectivity – including adjoining borders or routes crossing them – increases vulnerability at the same time. The better accessibility of routes, however, is a double-edged sword. On the one hand, from the viewpoint of security policy, it improves the opportunities of authorities to act. On the other hand, it also provides human, drug and arms trafficking with more opportunities. However, if regional cooperation is successfully extended over the protection of public goods, the improvement of two-way trade, the development of tourism and interpersonal relationships, all these problems will become resolvable in the long term, parallel with the development of the infrastructure.

Security for Asia

In his speech delivered at the Conference on Interaction and Confidence Building in Asia (CICA ) in Shanghai in May, 2014, Xi Jinping stressed that “we need to innovate our security concept, establish a new regional security cooperation architecture, and jointly build a road for security of Asia that is shared by and win-win to all.” The Chinese President also pointed out that “development is the foundation of security, and security the precondition for development. For most Asian countries, development means the greatest security and the master key to regional security issues.”

It is congruent with the Chinese idea that economic development is the best way of resolving social problems, demonstrated by for example the Chinese “Go West” programme. Within the framework of this programme, Chinese companies are encouraged to relocate their production and operations into the inner, western and, compared to the coastal regions, less developed provinces of the country. They expect this will pacify the of the Uyghur minority living in Xinjiang province in a very tense situation.

Xi also added that the problems of Asia shall be addressed by cooperation within Asia, with peaceful means and “one cannot live in the 21st century with the outdated thinking from the age of Cold War and zero-sum game.” This is primarily directed against “Pivot to Asia”, since China regards it as a hostile, overbearing policy. First and foremost, it wants to achieve the exclusion of the American military force from East Asia. On top of that, each state has the equal right to uphold its security. “A military alliance targeted at a third party is not conducive to maintaining common security. Every country has the equal right to participate in the security affairs of the region as well as the responsibility of upholding regional security. No country should attempt to dominate regional security affairs or infringe upon the legitimate rights and interests of other countries.”

Challenges

However, it is rather easy to mistrust this statement, especially if we consider China’s growing assertiveness on the South China Sea. The countries of Southeast Asia are afraid, as a result of the growing projection of power, of the impairment of their freedom of navigation – it is exactly what China ties to ensure for its own interest. In addition, although China claims it respects, above all, the sovereignty of other states, the countries have increasing doubts about the investments and the companies implementing them, especially if Chinese companies want to enter such strategically sensitive areas of the states as ports, communications or energy infrastructure. The mistrust of China is further fuelled by the fact that the attitude of the countries in the region is not consistent to the question whether it is worth confronting China either on the South or East China Sea, or it is preferable to stay away from the conflict in order to attract Chinese capital and investments. The question arises whether China actually just intends to strengthen its asymmetric position of economic power with the Maritime Silk Road to such an extent that in time it won’t be a question any more in whose favour regional disputes are resolved. Piracy along the maritime route and terrorism, knowing no borders on the mainland, on one of the most important routes in Central Asia mean a constant problem. This latter one threatens Chinese oil extracting companies and Chinese employees working for them not only in the form of the expansion of the Islamic State but also in Afghanistan, and even at home, in Xinjiang as well.

Long-term planning is further hampered by the internal political instability of target countries of investments, owing to which it is not inconceivable that in the case of a change of government, the new leadership will terminate the agreements concluded with China. In addition, civil wars and other armed conflicts are not favourable, either, for the implementation of the Silk Road project.

The Silk Road in Central Asia

The continental corridors of the new Silk Road have to cross either Central Asia or Russia in order to reach the Middle East and Europe. Swanström, however, notes that this is most indicative of China’s lack of military preparedness to protect its interests. In the Lanzhou Military Region in China’s west has a force of only 220,000 troops distributed over an area of 3.4 million square kilometres. This is arguably insufficient given the geographical features, while China still focuses the majority of its military capacity on its eastern shores. In addition to low levels of preparedness, tensions between Central Asian countries routinely see borders closed, which may threaten the freedom and functioning of transport corridors. Furthermore, central government control in countries such as Kyrgyzstan and Tajikistan remains weak with competition between regional elites and fractions undermining stability. In order to resolve this problem, external political and military support is required, which, however, is against the basic principles of Chinese foreign policy and also threatens the sovereignty of the state. But the question arises: if China urges state-building only from outside and orally, but is not willing to provide any political support fearing the consequences of higher-level commitment, how efficient could the investments of the Silk Road be?

Afghanistan

Parallel to the pull-out of NATO-led forces from Afghanistan, the instability of the country potentially spilling into countries of the region is getting increasingly worrying. During his visit in Kabul in 2014, Foreign Minister Wang Yi pointed out that Afghanistan’s “peace and stability has an impact on the security of western China, and more importantly, it affects the tranquillity and development of the entire region.” The weakening and slow fragmentation of the Taliban, on the one hand, present severe challenges to any meaningful engagement in peace talks, but on the other hand, may contribute to entering the region of the Islamic State. Third, the Taliban has recently cut the power lines from Uzbekistan, Tajikistan and Turkmenistan that provide electricity to Afghanistan. Thus they are openly threatening areas that China intends to develop through the Silk Road.

Since the stability of the Afghan state is so closely related to the security of Xinjiang, China stopped urging the pull-out of NATO forces, and even hinted that the pull-out in 2014 might be far too early. The fact that major American forces could not deploy in East Asia during their engagement in Afghanistan also contributed to this. However, it does not change the fact that Asia must act very carefully in Central Asia, since the pull-out and the decline of the Russian economic influence present the opportunity to gain greater influence in the region. However, economic methods will not be sufficient. These challenges may be easier to face if there is cooperation between people, education is promoted and information sharing between countries works, for example through the Regional Anti-Terrorist Structure (RATS) of the Shanghai Cooperation Organisation (SCO).

It must be also noted that although this centre has been set up in Tashkent, it has not been able to come up with any specific results. It would be time for SCO to present a sufficient operating mechanism, with which it is able and willing to combat terrorism, separatism and extremism (the “three evil forces”) threatening the region, as well as organised crime.

Pakistan

The China-Pakistan Economic Corridor is the flagship project of One Belt, One Road. But the planned large-scale investments can go wrong. There is a risk that the Pakistani system will be simply overloaded by the volume of investments China intends for the country. This may easily arouse hostile emotions in local inhabitants, or alienate them at the least. Certain poorer provinces, such as Balochistan and Khyber Pakhtunkhawa, accuse the Punjab-dominated government – with Prime Minister Nawaz Shariff in the lead – of expropriating the advantages of development for the centre, Punjab. In contrast, other provinces would rather stay out of Chinese investments because they see them as a threat to their traditional way of life. They are ready to voice their dissatisfaction even with weapons.

Already existing militant groups, such as ETIM (East Turkestan Islamic Movement), the Pakistani Taliban or other anti-state militant groups extremely endanger the implementation of projects and the people working on them, as well as the trade of goods later. For this reason, the Pakistani armed forces promised to ensure a unit of 10,000 people to protect the Chinese people working on the China-Pakistan Economic Corridor project. However, this is no guarantee that the concerns of locals will be soothed in the long term.

Cultural differences

China tends to ignore or, at best, inaccurately asses the cultural, ethnic and environmental characteristics of the target countries of investment, in the name of pragmatism and neutralism. Balochistan, where Gwadar port can be found and will be connected with Xinjiang through the China-Pakistan Economic Corridor, is Pakistan’s largest and most impoverished province, and has been under attack by separatists, insurgents, and Islamic militants (now including the Islamic State) for over a decade. Although armed insurgences are not at all a new phenomenon in the province (the inhabitants of Balochistan have been fighting for autonomy since the British colonizing period and then as annexed to Pakistan), China cannot ignore what is going on in the province across which it intends to transport 19 million tons of petroleum to China, and where it plans to build 2,000 km of road and railway infrastructure to Kashgar.

China May Also Be Tripped by Itself

There is also a scenario in which the workers of Chinese projects are not faced with external threats but they can hinder implementation themselves. In Western Europe China is regarded a potential security policy risk. The new British government formed after the resignation of David Cameron and led by Theresa May delayed a final decision on a $23 billion project serving the construction of a new nuclear power plant, Hinkley Point C until a review. The prospects of the restart are not improved by the fact that in the meantime the United States initiated a legal proceeding against the workers of CGN (China General Nuclear Power Company, the company having a large stake in the Hinkley Point C project), accusing them of spying and conspiring with the Chinese state in order to illegally develop nuclear technology in China “with the intent to secure an advantage to the People’s Republic of China”. In addition, Western Europe, although willing to trade with China, is still afraid of potential security policy implications which would arise from a Chinese infrastructural investment within the European frontiers.

Land or Sea?

The officers and experts of the Chinese People’s Liberation Army (PLA) don not completely agree whether PLA is prepared to protect the New Silk Road with military instruments as well, if necessary. According to Qiao Liang, the PLA does not have the necessary capabilities; but Chinese fighting capacities have to be strengthened to make Chinese armed forces go global. Zhu Chenghu argues PLA is already prepared enough, but the basic principles of foreign policy prevent PLA from asserting interests more emphatically abroad. According to Major General Ji Minkui not only the PLA but the Shanghai Cooperation Organisation as well, as a coordinating platform, should have a larger role in protecting the Silk Road.

However, there is a consensus that China has to develop a network of places where Chinese armed forces can rely on to extend their operational range in order to protect the Silk Road and strategic Chinese interests.

Is the “String of Pearls” too tight?

The phrase ‘String of Pearls’ was first used in 2005, in a report provided to U.S. Defense Secretary by Booz Allen Hamilton. He alleged that China was adopting a strategy of naval bases stretching from the Middle East to the shores of southern China.

The ports include:

• Colombo and Hambantota on Sri Lanka;

• Gwadar in Pakistan;

• Chittagong in Bangladesh;

• Meday Island in Myanmar;

• Port Victoria on the Seychelles;

• China has been lobbying for the development of a deep-sea port at Sonadia Island;

• and the latest one, Djibouti.

India has been tensely watching all Chinese investments in ports or other infrastructure ever since, being afraid that China is not making measures just to protect oil shipments but also intends to encircle India from the Indian Ocean.

Maritime Silk Road

China has considerable exposure and investments in the middle East and Africa. Since “the majority of China’s seaborne energy imports transit through the Indian Ocean region and the South China Sea Beijing attaches greater importance to the security of the Sea Lines of Communication (SLOCs).” According to BP’s Energy Outlook, China’s oil import dependence will rise from 57% in 2012 to 76% in 2035, while gas dependence will rise from 25% to 41%. The transport system, however, is vulnerable to disruption at key maritime choke points such as the Malacca Straits or the Straits of Hormuz, and such incidents could block energy trade and seriously impact the level and volatility of energy prices and also result in physical supply shortages.

Although economic realities suggest that it is more realistic to be afraid of a terrorist attack than of the United States or any other country supervising the specific straits blocking traversing transport, China wants to mitigate the risks to the minimum.

Taking military realities into consideration, if we regard China as a developing country, it is completely absurd to suppose it may be capable of actual control over the route of the Maritime Silk Road. The American navy is unmatched. In this light, any kind of Chinese military activity to the west of Singapore can only focus on ensuring free access to maritime routes. In short, it means “China has only two purposes in the Indian Ocean: economic gains and the security of Sea lines of Communication (SLOC)”, Bo Zhou, honorary member of the PLA and professor of the Academy of Military Science argues.

By the end of 2013, China had become the largest trader and the largest oil importer in the world, hence the security of SLOCs from Bab-el-Mandeb through the Straits of Hormuz and the Malacca Straits is vitally important for China. Currently, their security mostly depends on two countries, the U.S. and India. The U.S. is the only country that has the full capabilities to cut off the routes at any time, but it is unlikely to exercise such capabilities, unless, perhaps, in an all-out war with China. Despite all friction, India is not likely to cut off China’s oil transport routes, either.

For the present, the ports developed by the Chinese serve mostly commercial and logistic purposes, while Christina Lin calls attention to the fact that China does not need to build or operate naval bases outside its borders, as the US does. Nowadays much greater emphasis is placed on accessibility and rights of use than ownership. In addition, since the investments of the New Silk Road would be used mostly by state-owned commercial companies, there is no barrier in front of the Chinese navy to have access to these bases if necessary.

Gwadar

Although Gwadar port lies in the volatile Balochistan province, it is only 400 km from the Straits of Hormuz. On the one hand, it means that western Chinese provinces will have better access to the oil of the Middle East if the port is successfully built. On the other hand, it also means that the deployment of the PLA may be considerably easier and faster if any problem threatening the import occurs in the Straits of Hormuz.

Djibouti

Although China insists these investments all form parts of the Maritime Silk Road, adding Djibouti to the list raises some questions. The Chinese Ministry of Foreign Affairs argues it is not a military base but an establishment enabling the replenishment of Chinese naval units when they participate in anti-piracy missions of the UN. Djibouti is a country with a strategic location, on the trade route connecting the Suez Canal and the Indian Ocean. In addition, its political system is rather stable, except for the president stepping up strictly against any attempts toward western democracy. China is getting less and less capable of protecting its economic interests in Africa without military presence. Several Chinese citizens were kidnapped by Boko Haram in Kamerun, killed in Mali, taken hostage in Sudan and Egypt, and are subject to regular atrocities in Angola, too. Furthermore, the memory of Libya from which 35,800 Chinese citizens working there had to be evacuated on rented vessels is still vivid. This was the first and the largest non-combatant evacuation operation of the navy of the PLA to date.

China had had the choice of going it alone in Oman. Instead, Beijing chose to go alongside the American and French bases “in an already cramped space”, indicating the PLA is not hiding anything. Although American experts still disapprove China’s growing military capacities near the American Camp Lemonnier, which is home to 4,000 American personnel – civilians and members of the Combined Joint Task Force – participating in anti-terrorism operations. But China’s presence here offers a better opportunity for European countries to explore and experience cooperation with the PLA during evacuation, non-combatant operations.

Despite all these constructions and developments, it is still likely that China will be content with building the ports of the Silk Road for commercial purposes. If it wanted to set up openly military establishments, it would do so in East Africa, where China would have greater room for strategic and diplomatic manoeuvre and the presence of the Unites States is not so intense.

Conclusion

Technology, telecommunications and economy encourage people to be involved in the relationships they create. In today’s globalised, interdependent world appropriate infrastructure, roads, energy networks, communications networks, internet, etc., are essential for development and enrichment. An isolated, poor country, which closes its borders to investments is most probably to remain poor. Chinese One Road, One Belt and its complementary 21th Century Maritime Silk Road are working on building these missing networks. Parallel to this, however, it is necessary to resolve security problems, otherwise transactional costs might increase. If shifting transport from sea to overland is not worthwhile, and China does not manage to build the transport network, there will be no one to use it.

Please click to read the full report.

Editor's picks

Trending articles

By The Italian Institute for International Political Studies (ISPI)

New Belts and Roads: Redrawing EU-China Relations

The impact of OBOR on different EU zones

In general, Western and Northern EU states’ engagement with the One Belt One Road (OBOR) initiative remains mainly limited to their membership in the Asian Infrastructure Investment Bank (AIIB). The Chinese government also appears not to consider this part of the EU one of its priorities regarding OBOR implementation. Still, some states or local governments are more actively involved, trying to take advantage of potential Chinese investments. We selected a few examples to demonstrate how OBOR is impacting or could impact China’s relations with these countries.

Among the Western EU members, Germany is probably the most directly concerned by OBOR as five German-Chinese railway projects (Leipzig-Shenyang, Duisburg-Chongqing, Hamburg-Zhengzhou, Hamburg-Harbin and Nurnberg-Chengdu) have been put in place and more OBOR-labelled railway projects are envisaged. The railway connection between Duisburg and Chongqing has received great attention and strong promotion from both municipalities, leading to regular political and business delegations visiting on both sides. OBOR-related investment forums and research conferences were held in Duisburg in 2015 and 2016. However, while trains importing merchandise from China are generally fully laden with electronic and other products, trains back to China often have problems finding sufficient goods. Russian sanctions on European goods further complicate the situation. Public and private efforts have been made to increase the efficiency and frequency of these railway connections, but there are still technical details, such as the refrigeration system and temperature variations, to be solved.

Since so far, except for the railways, OBOR has not led to further infrastructure investments, nor M&A investments, nor greenfield investments in Germany, Germany has been advocating in Brussels the EU-China Connectivity Platform as a way to ensure that OBOR-related Chinese investments in Europe comply with EU rules and standards. A German director together with two French and Dutch alternative directors hold 15% voting rights on the AIIB board on behalf of the Eurozone members, which could also play an indirect role in shaping OBOR activities. Berlin will certainly take advantage of its G20 presidency in 2017 to integrate OBOR with its development policy and to push forward EU-China connections and cooperation based on mutual interest.

Compared to Germany, France has received much less attention from the Chinese government and few Chinese investments within the OBOR framework. China’s strategy has been very low key in France, consisting mostly of discussing potential economic opportunities and brainstorming with businessmen, officials and researchers. The French government also lacks a clear position on the topic. More actively involved are a few French regions. Lyon, the French “City of Silk”, has welcomed its role as a historic, commercial and political hub in Europe, and seeks opportunities to attract Chinese investment and open the Chinese market. The Chongqing-Duisburg Yuxinou express was extended to Lyon in April 2016. The region of Normandy tries to interest Chinese investors in its deep-water port, Le Havre, and connections to the inland ports of Rouen and Paris. In fact, in recent years, in order to attract Chinese investors many French regions and municipalities have taken active action to promote their local advantages and business ecosystem. A few recent Chinese investments in France have also made headlines, such as the Symbiose Consortium’s acquisition of a 49.9% stake in the operator of the Toulouse Blagnac airport in 2014, Fosun’s full acquisition of Club Med, and Jin Jiang International’s takeover of the Louvre Hotels Group in 2015. Aging French infrastructure and reduced public resources provide privatization potential. Opportunities are also present in sectors such as transportation, telecommunications, tourism and pharmaceuticals. It is, however, rare to find OBOR-labelled projects in France. The only symbolic step has been a Silk Road partnership agreement signed in June 2015 between French shipping company CMA CGM and China Merchants Holdings International. CMA CGM obtained a US$1 billion credit line from the Export-Import Bank of China to purchase Chinese container ships5.

The Netherlands is one of China’s largest trade partners in the EU. Imports from China account for 1/3 of all goods arriving at the port of Rotterdam, which plays a crucial role for the Dutch economy. Schiphol Airport, opening direct links with various Chinese cities in recent years, has spurred fast growth in air freight from the Netherlands to China. Yet on his first visit to the Netherlands in March 2014, President Xi did not mention OBOR, while during his subsequent visit to Germany at the inland port of Duisburg he publicly called for Sino-German cooperation to expand the Silk Road’s overland route. Nevertheless, some companies are actively promoting OBOR-related businesses. One is China COSCO Shipping’s acquisition of a 35% stake in the Euromax Terminal at Rotterdam in May 2016. Another is the weekly freight train between Chengdu and Tilburg started in April 2016, which was further extended to Rotterdam in September 2016. Trains from Chengdu contain consumer electronics from companies such as Sony, Samsung and Fuji, while trains from Tilburg carry products for the oil industry, cars, wine and trees. In July 2016, three Dutch transport companies launched a joint venture called New Silkway Logistics (NSWL), providing service for end-to-end transport of goods via the Duisburg-Chongqing railway.

Although the impact of Brexit is still uncertain, the UK’s engagement in OBOR as a major European country is affirmative. Also, the geographic limits of OBOR have not prevented the UK government and businesses from responding proactively to the initiative. A good demonstration is that the UK was the first European country to join the AIIB in March 2015, which was a political message supporting a Beijing-led institution that the UK sees as being useful in the long-term economic development of Asia and Europe. The primary logic behind the desire to engage with the OBOR initiative is the opportunities it could bring for British companies and “infrastructure alliance” with Chinese companies in third markets through the role of financial hub for OBOR. A major report entitled “One Belt, One Road” issued in 2015 by the CBBC (China-Britain Business Council) highlighted particular opportunities in a range of sectors. The CBBC has produced another report of OBOR case studies in collaboration with Tsinghua University6, citing cooperation between British companies, such as HSBC, BP, Linklaters and KPMG, and Chinese partners in forms of consultancy, engineering, technological know-how and construction expertise. The UK’s proactive attitude indicates the primacy it gives to economic and commercial diplomacy, as well as its pragmatic response to the growth of Chinese influence in global affairs.

Regarding the Northern EU, OBOR’s impact has been even more limited. There are hardly any diplomatic exchanges on the topic of OBOR and few references to OBOR in the public sphere. Although a Swedish high-speed railway and two private windfarm projects are labelled OBOR projects by the Chinese, there are no current OBOR projects in Sweden according to the Swedish Foreign Ministry. It is more likely that these states, already frequently present in Central and Southeast Asia, could contribute to OBOR through participation in activities in third regions and by providing green technology to infrastructure and energy projects.

Please click to read the full report.

Editor's picks

Trending articles

In upgrading and transforming themselves, many companies try to boost competitiveness through various means, including R&D in technology, product design and branding. Modern Precision Dental Instrument Co Ltd in Foshan, however, goes a step further. In seeking to carve out more market space in a severe competitive environment, it implements an appropriate business layout to enhance product value and marginal profit.

High Value-added Products Strategy

Approved by and registered with the Guangdong Food and Drug Administration, Modern Precision is a manufacturer of precision dental instruments. With a production base set up in Foshan in 1989, it now engages in the R&D, manufacturing and sales of dental instruments. It told HKTDC Research that its core advantages include the R&D, design and production of precision parts and components as well as instruments that are up to the requirements of its clients, related health regulators and various technical standards.

Modern Precision says that the parts/components and instruments it produces are hi-tech, high value-added products. The key to the company’s competitiveness, therefore, lies in the technology, quality and reliability of its products as well as its brand name. This is in stark contrast to the strategy of its competitors who snatch market share through low costs and low prices for their uncertified and non-professional medical products. Instead of transferring its production base to minimise costs, the company’s current development strategy is to enhance product value by raising product quality and precision.

Modern Precision has R&D facilities in both Foshan and Henan Province and is investing continuously to build up the capability of its R&D teams. In the next five years, as well as upgrading the functions of its existing products, it will further develop higher-end and higher value-added products, including laser cutting dental equipment, laser treatment equipment, surgical craniotomy machines and precision orthopaedic surgery equipment.

Modern Precision’s only mainland plant in Foshan is equipped with an array of automated production equipment imported from Japan, Germany and Sweden, including a computer numerical controlled machine tool (CNC) for precision production. It is also outfitted with related testing equipment to ensure the high quality of its products. The Foshan plant currently employs about 120 workshop staff, most of whom are technicians responsible for operating the production equipment. Low-tech staff members are a small minority.

Enhancing Brand and Product Values

Modern Precision is serious about building its brand and has been active in advertising and in participating in major exhibitions both at home and abroad. It set up a plant in Gyeonggi-do in South Korea in 2013 so that high-end dental instruments could be produced out of core parts and components made in Foshan, together with locally sourced industrial products to comply with Korean certificate of origin requirements. Modern Precision points out that, currently some mainland enterprises are relying on a low-price strategy, but because the design and quality of their products are often inferior, the reputation of Chinese products suffers. To avoid being tarred with the same brush, Modern Precision uses South Korea as a springboard to expand into international markets and to enhance product value while simultaneously building its brand and boosting marginal profit.

Modern Precision produces dental instruments such as pure titanium or chrome plated copper high-speed drills, low-speed drills, brushless electrical motor drive controls and wireless endodontic motors. Around 60% of its business is in carrying out OEM production for famous brands around the world, while the other 40% is in producing on an ODM or own-brand basis. Currently, some 80% of Modern Precision’s products are for export, and the rest are for domestic sales. Irrespective of their destination, all products are manufactured in compliance with the regulatory requirements of the markets concerned, such as FDA approval from the US or CE certification from the EU. Modern Precision has also set up an office in Hong Kong which, as well as catering to its Hong Kong business, is responsible for handling overseas investment, sales and sourcing and related financial arrangements.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

Editor's picks

Trending articles

In a bid to pursue long-term business development, many technology-intensive and capital-intensive enterprises on the Chinese mainland have, in recent years, been devoting great efforts to formulating their international business plans as well as further exploring market opportunities arising from the Belt and Road. According to Keda Clean Energy Co Ltd of Guangdong, outbound investment in carrying out production offshore should not just take into account labour and direct production costs but also the overall costs, including transportation, logistics and tariffs. Also, investment strategy should be mapped out according to market demand in order to seek maximum benefit for the company’s business.

Keep an Eye on Belt and Road Market Potential

Keda Clean Energy, listed on the Shanghai Stock Exchange, is mainly engaged in building material machineries (building ceramic machineries, wall material machineries, stone material machineries, etc), clean energy for environmental protection (clean coal gas technology and equipment, gas purification technology and equipment), and clean energy materials (dynamic lithium-ion battery negative electrode materials). The company also provides project contracting arrangement, financing and leasing services. It has 27 subsidiaries in Guangdong, Anhui, Jiangsu, Henan and Liaoning, as well as a number of well-known brands in the trade such as Keda, Henglitai, Kehang, Xinmingfeng, Kdneu, Ai’er and Zhuodahao. Today, the company’s products are sold to more than 40 countries and regions.

Where building material machineries are concerned, Keda Clean Energy actively makes use of Chinese-made equipment to expand its overseas markets and has already established itself as a leader in the Asian market.

The company’s director Jason Zhong told HKTDC Research: “The building material machineries produced by Keda Clean Energy are technology- and capital-intensive, with both their quality and technology reaching international levels. This, coupled with the full support of the mainland in supplying metals in the form of raw materials, electronic/electrical parts and components, as well as abundant top-notch design and engineering personnel, is conducive to the production of building material machineries with advanced technology and high price-performance ratio.

“Although labour and production costs in the mainland have been climbing in recent years, Keda Clean Energy still manages to improve its mainland production business, excel in technology and quality, and further develop the market at home and abroad.”

Zhong added that after 30 years of growth, the mainland building materials market is coming of age and the demand of downstream manufacturers for building material production equipment is becoming stable. To seek long-term business development, Keda Clean Energy is gradually expanding its overseas market. It also attaches importance to the development potential of countries along the Belt and Road. Many countries along the route are eagerly trying to import the necessary equipment for the production of building materials locally to support the burgeoning infrastructure construction and building activities in their countries.

Deploying Overseas Investment Based on Cost and Profit

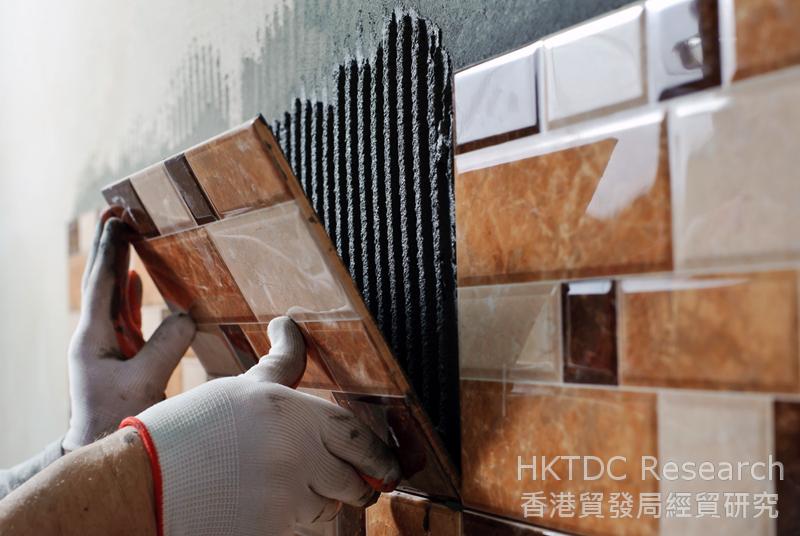

In addition to exporting building material machineries from the Chinese mainland, Keda Clean Energy has also started to invest in production activities offshore. Such investment projects mainly concentrate in downstream business related to building material equipment, including investing in the production of ceramic building material products in African countries. The ceramic tiles production line the company set up in Kenya began operation at the end of 2016, while its factory in Ghana is scheduled for operation in mid-2017. Infrastructure construction work for its building materials project in Tanzania is also in progress.

Although the building materials made in China have the advantage of low cost, manufacturers in the trade often find it difficult to explore distant markets overseas due to the relatively high import tariffs imposed by some countries and the high transportation cost involved. As construction activities in certain developing countries, such as those in Africa, continue to surge, their demand for building materials is strong. Yet there are hardly any large-scale local investors who are willing to set up building material production lines there supplying the local market.

Zhong said: “Against this background, Keda Clean Energy co-operates with some African distributors whereby China-made equipment is exported to the countries concerned to set up building material production lines there, taking advantage of the raw materials available locally to produce ceramic tile products to supply to the African market.

“Actually, taking into account the labour efficiency and other production costs in Africa, the cost of producing ceramic tiles there is not lower than that in the mainland. But the great savings on import tariffs and transportation cost allow Keda Clean Energy to effectively explore the end market for building materials in Africa. Moreover, the keen demand of the African building materials market means that it can accept higher prices, which in turn brings about greater profit. At the same time, it can also drive the company’s equipment sales to Africa.”

Where building material machineries are concerned, Keda Clean Energy has realised localisation of building ceramic machineries and is moving towards its objective of becoming the world’s building material equipment industry leader. The company has two “state-accredited enterprise technology centres”, one “national engineering technology centre”, two “post-doctoral scientific research workstations”, and three “academician workstations” in the mainland. These innovative R&D platforms complement its mainland production bases in providing advanced equipment and relevant technical support services to its building materials clients. At present, the company is one of the leading enterprises in building material machineries in China and has been awarded honours such as China’s top 500 machinery enterprises, national-level high-tech enterprise, national intellectual property demonstration enterprise, and Guangdong’s top 20 innovative enterprises.

(Remark: The above is among the case studies of a research project jointly undertaken by HKTDC Research and the Department of Commerce of Guangdong Province: Shift of Global Supply Chain and Guangdong-Hong Kong Industrial Development. Please refer to the research report of the aforementioned project for more details.)

318 Views

318 Views