Chinese Mainland

Development of China-backed Trans-Sabah Gas Pipeline forms part of manifesto of current Malaysian government.

The future prospects of China's first Belt and Road Initiative (BRI) related foray into Malaysia's Liquefied Natural Gas (LNG) sector may depend on the outcome of the forthcoming Malaysian elections. Assuming the incumbent Barisan Nasional Party is returned to power on 9 May, it will look to make good on its manifesto pledge to greenlight the Trans-Sabah Gas Pipeline (TSGP), a project set to be backed by RMB4.53 billion (US$1.16 billion) worth of investment from the Export and Import Bank of China (EXIM).

China's interest in the project is more than understandable. Malaysia is the third-largest LNG exporter globally. In 2016, it accounted for nearly 10% of the world's supply, with plans in place to ramp up production still further. For its part, China is now the world's second-largest importer of LNG, a status that clearly piqued its interest in Malaysia's plans to develop a new pipeline connecting West and East Sabah.

The Malaysian developer of the pipeline is Suria Strategic Energy Resources, a company wholly-owned by the Malaysian Ministry of Finance. Assuming the current government retains its majority, engineering, procurement, construction and commissioning on the project will be led by the Hebei-headquartered China Petroleum Pipeline Engineering Corporation (CPPE), a subsidiary of the China National Petroleum Corporation (CNPC).

Regardless of China's perceived self-interest, the primary purpose of the pipeline is seen as addressing the critical power shortages in East Sabah, a region home to two of the state's largest cities. Currently, the state is reliant on a number of aging power plants, several of which should have long been decommissioned.

A 2011 attempt to build a 300MW coal-fired power station in Lahad Datu, a town on the east coast of Sabah, foundered following a challenge on environmental grounds by the Sabah Environmental Protection Association. It is hoped that the cleaner, gas-fired plant favoured by the Malaysian / Chinese development team will face far less stringent opposition.

In anticipation of the project going ahead, Ranhill Holdings Bhd, a Kuala Lumpur-based conglomerate with interests in the power and environmental-development sectors, has already been briefed by Malaysia's Energy Commission on the development of a 300MW combined cycle gas turbine power plant in East Sabah. The proposed new facility would be constructed by SM Hydro Energy, a wholly owned Ranhill subsidiary, and would be fed by the new TSGP pipeline.

Welcoming the initiative, Abdul Rahman Dahlan, a Malaysian government minister, said: "Thanks to this key energy project, Sabah will be able to move up the value chain, adding value to its local commodities and raw materials. This will reduce the state's dependency on its primary industries and create employment for people throughout the region."

Overall, Malaysia has proved to be one of the Southeast Asian countries most open to participation in the BRI, China's huge international infrastructure development and trade facilitation programme. Speaking in January this year, Najib Razak, the Malaysian Prime Minister, said: "As the world's economic epicentre moves east, it has become clear that Asia's time has truly come and we must make the most of this moment. With this in mind, we must take advantage of the Belt and Road Initiative, which has the potential to become world's largest platform for economic co-operation."

In addition to the TSGP, Malaysia's other major BRI-related infrastructure programmes include the East Coast Rail Link (ECRL), which is currently being developed in partnership with the China Communications Construction Company. Work is also under way on the country's Digital Free Trade Zone, a project being jointly developed with Alibaba, China's e-commerce giant.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

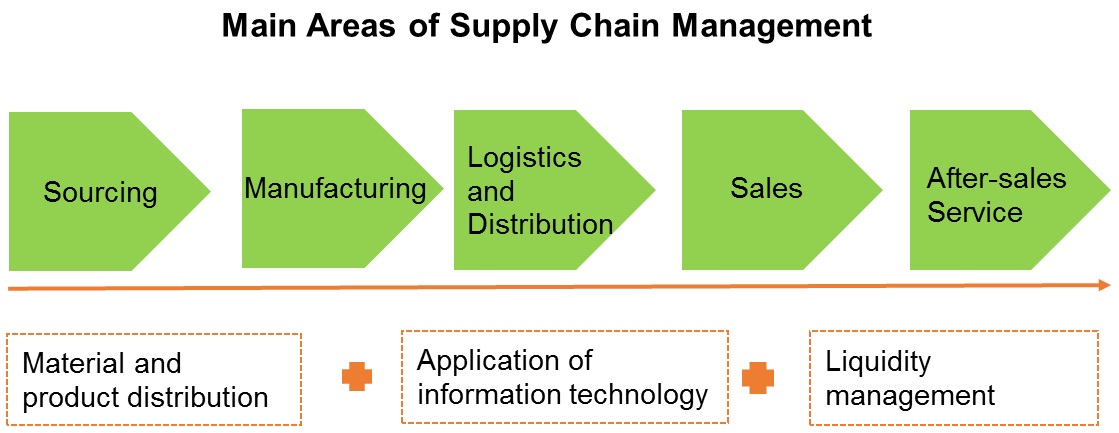

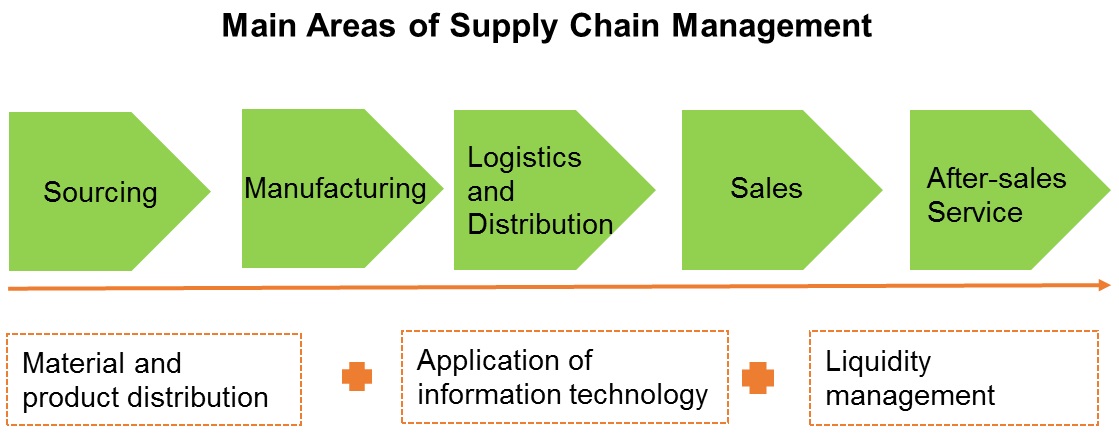

China has become the world’s largest industrial manufacturer. As such, it needs to import a wide range of raw materials and industrial products to sustain its massive manufacturing sector, while exporting all kinds of finished and semi-finished products to overseas markets. As transportation and production networks in Asia continue to develop, the division of labour between mainland enterprises and overseas countries is becoming increasingly complex, making China an important member of the global supply chain. In the wake of this industrial transformation and upgrade, many Chinese enterprises are aiming to enhance their supply chain management capability while focusing on the development of technology and brands. They are looking to improve the efficiency of the sourcing and production of materials and key components, raise the operational efficiency of related distribution and after-sales services, optimise the management of material flow, information flow and money flow, increase the added value of their business, and enhance competitiveness.

As a key driver of China’s economic development, the Yangtze River Delta (YRD) is seeing its internal infrastructure and transportation networks and links with other regions grow steadily. Strengthening the region’s logistics distribution capability and making its logistics and transportation connections with other mainland cities and international markets more efficient would help YRD enterprises in their efforts to establish a modern supply chain management system. Increasing numbers of YRD enterprises are using the industrial resources and advantages of other regions to improve their sourcing, production and sales service systems through industry chains in the coastal and inland provinces. The geographical span of their business is becoming ever wider.

Against this backdrop, YRD enterprises are trying hard to make better connections with overseas markets through logistics and transportation networks in the coastal areas, South China and Hong Kong. They are also using information and financial services to improve their supply chain management system. Hong Kong, as an international financial centre and the regional trading hub, is the preferred platform for many mainland enterprises “going out” as it can provide them with all kinds of professional services to help them expand their international business. With YRD enterprises looking to Hong Kong for help in managing their supply chains, this should generate more opportunities for Hong Kong service providers.

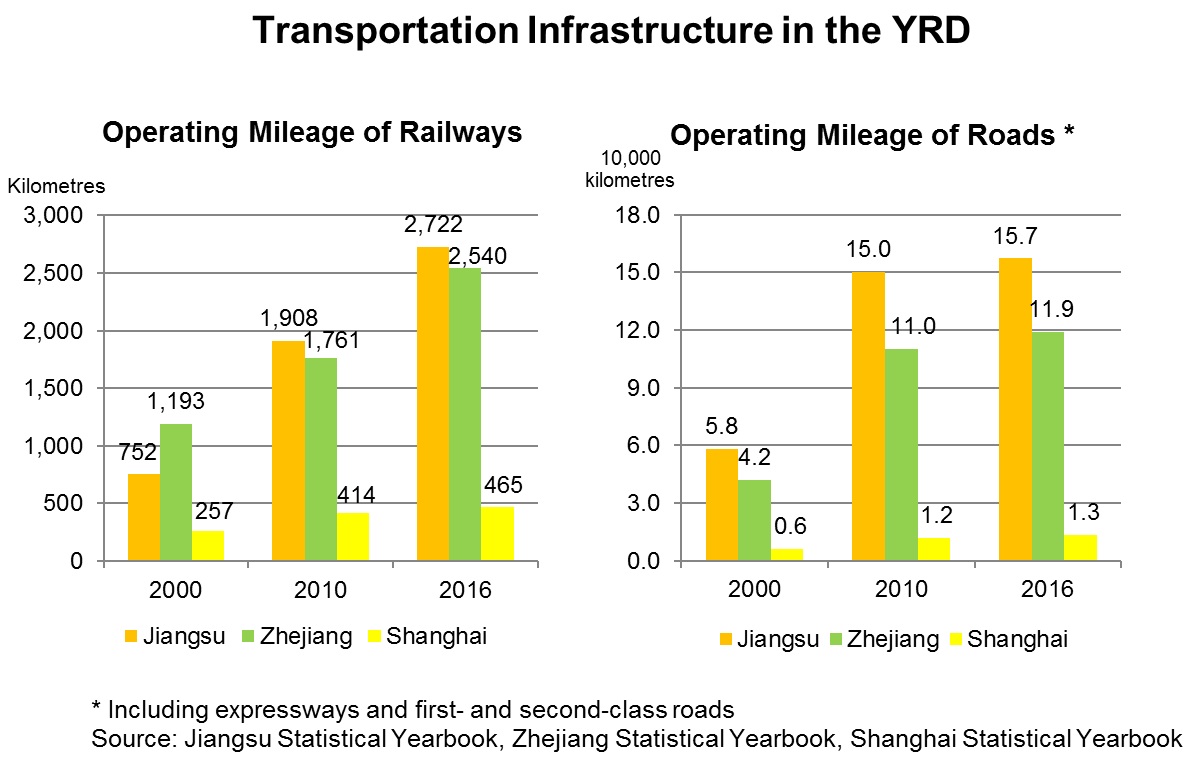

Steady Expansion of Logistics Networks

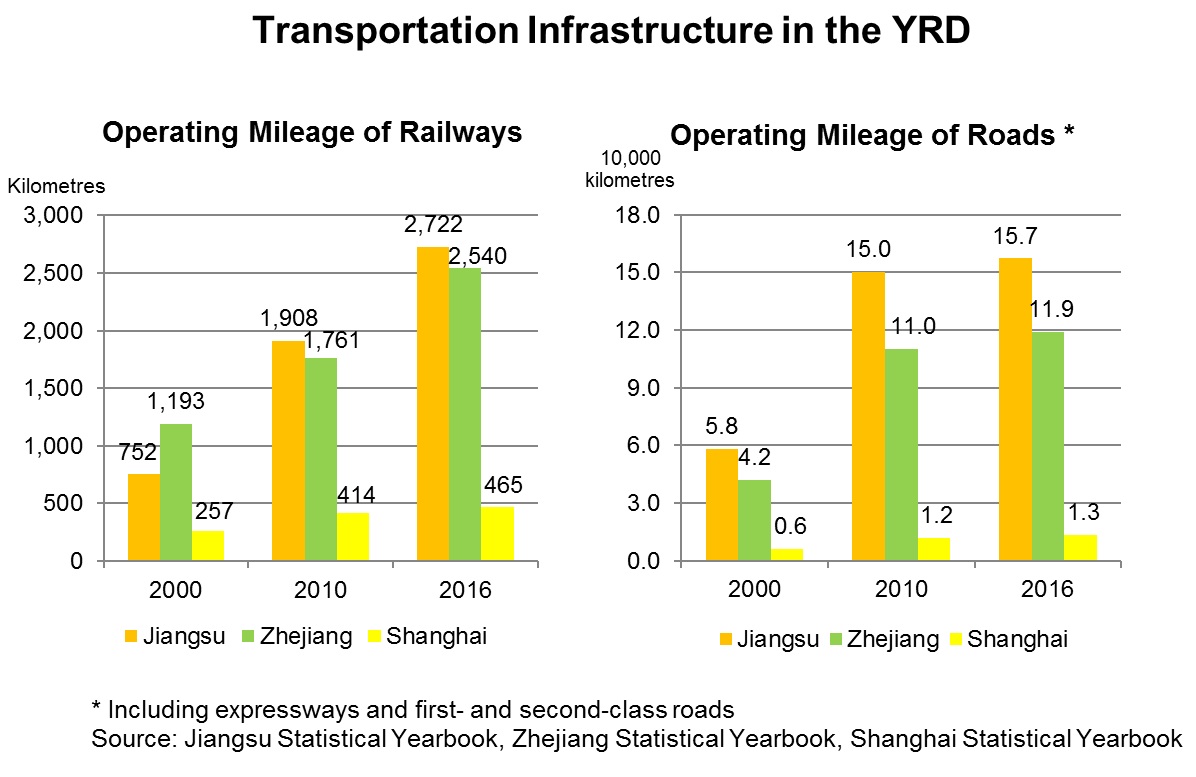

The YRD’s main city Shanghai has not only expanded its sea and air transport networks with other regions and countries in recent years but has also teamed up with neighbouring provinces Jiangsu and Zhejiang to accelerate the development of inter-city and regional transport construction. This has greatly facilitated freight transport services in the region and will improve the efficiency of local and international logistics and transportation services. Since 2000, Shanghai, Jiangsu and Zhejiang have made great efforts to expand their rail and road networks. Important developments include the Shanghai-Nanjing Intercity Railway which runs via Suzhou, Wuxi, Changzhou, and Zhenjiang in Jiangsu, and the Beijing-Shanghai High-Speed Railway which also passes through Jiangsu. Work is underway to electrify the whole of the Shanghai-Hangzhou Railway linking Shanghai with the provincial capital of Zhejiang, which will allow trains to travel the route faster. Jiangsu and Zhejiang have also stepped up the construction of expressways along the Yangtze River and the coastline, as well as intercity and urban highway networks aimed at increasing links between the transportation and logistics networks in the new development areas and new towns in major cities within the region.

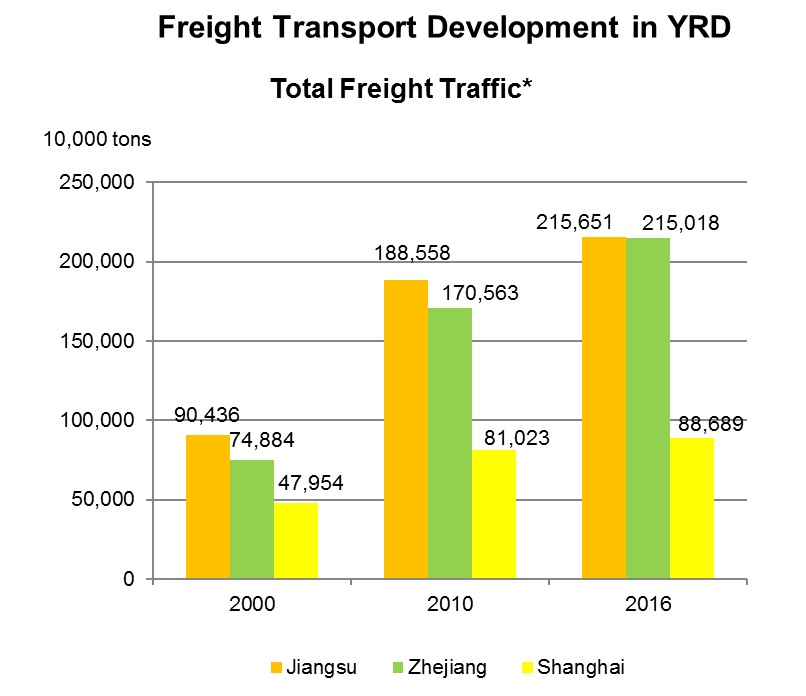

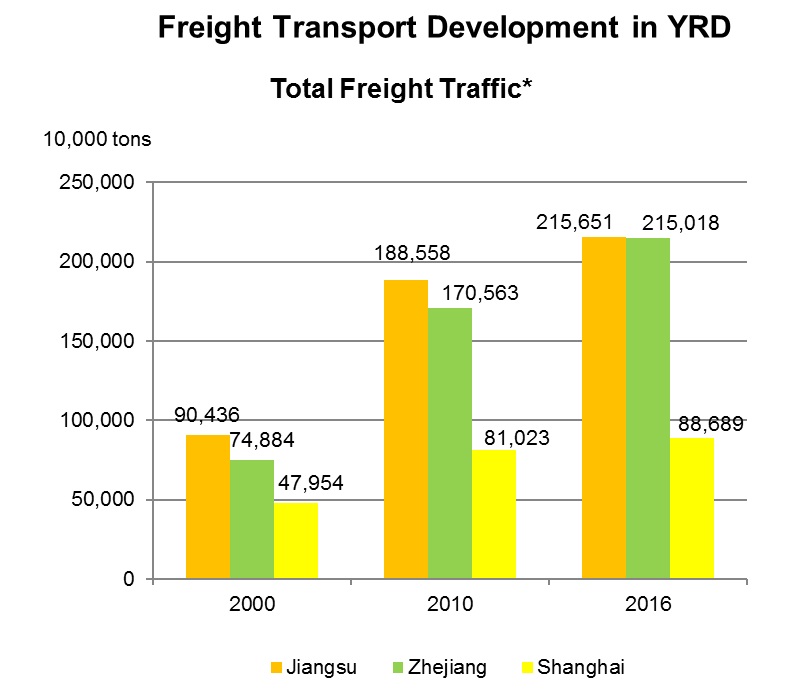

Continuous industrial development in the YRD, the Yangtze River Basin and the neighbouring areas has also increased the demand for logistics and transportation services. This, together with the expansion of transportation networks, has given a great boost to freight traffic in the YRD. Total freight traffic in Shanghai, Jiangsu and Zhejiang has grown exponentially over the past 10 years. Most freight traffic in 2016 was carried on roads linking different production bases in the region. It accounted for 44% of Shanghai’s total freight traffic, 54% of Jiangsu’s and 62% of Zhejiang’s. Railways accounted for just 2% of freight traffic in Jiangsu and Zhejiang and less than 1% of that of Shanghai. [1]

In recent years, however, growing numbers of logistics service providers have noticed the development potential of rail transport. CR Express has been increasing the frequency of its train services and expanding its network from inland provinces in the western part of the country to the YRD region and other coastal cities. Some service providers are actively using CR Express services to collect goods in the coastal and western regions for transport by rail to Europe and to tap business opportunities in China-Europe trade and the Belt and Road initiative. (For further details, see Leveraging CR Express to Tap “Belt and Road” Markets)

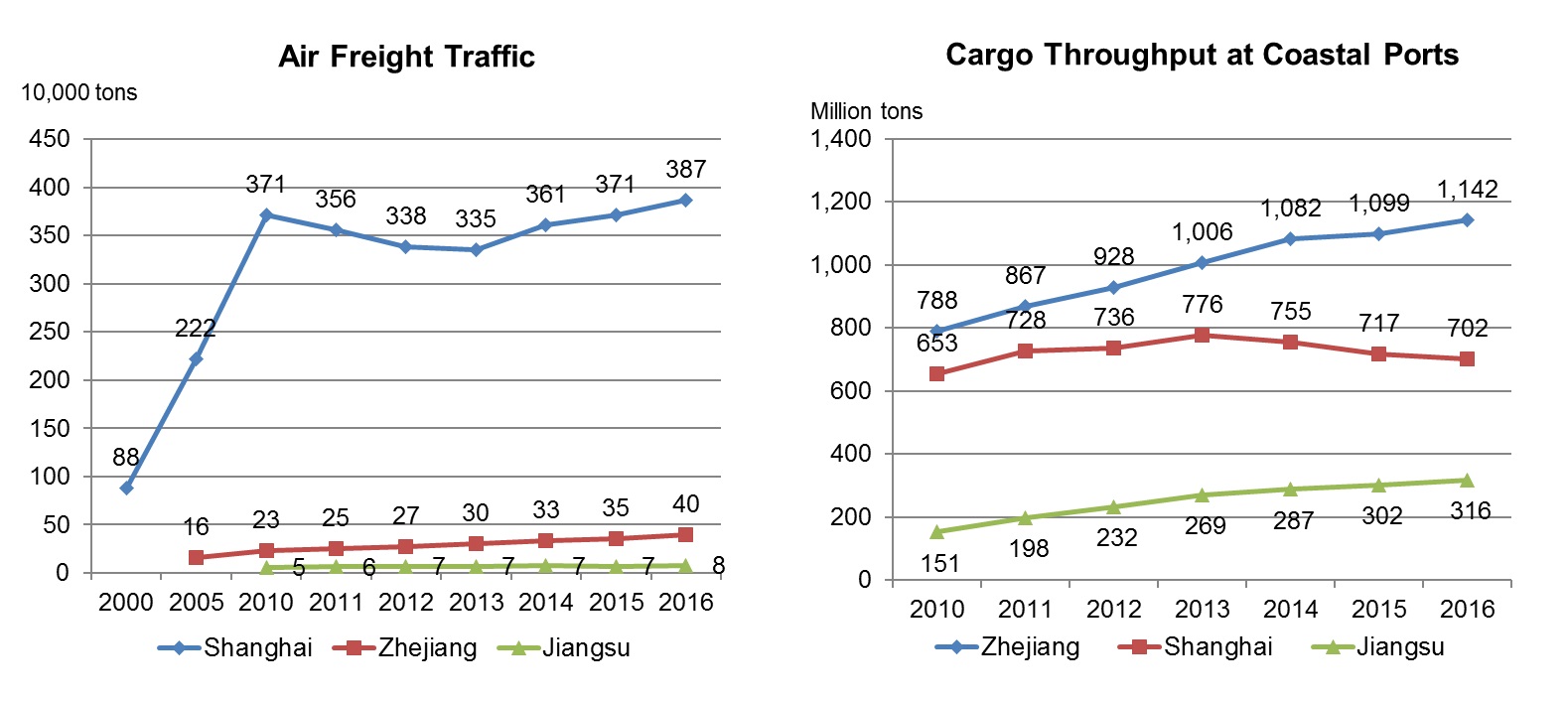

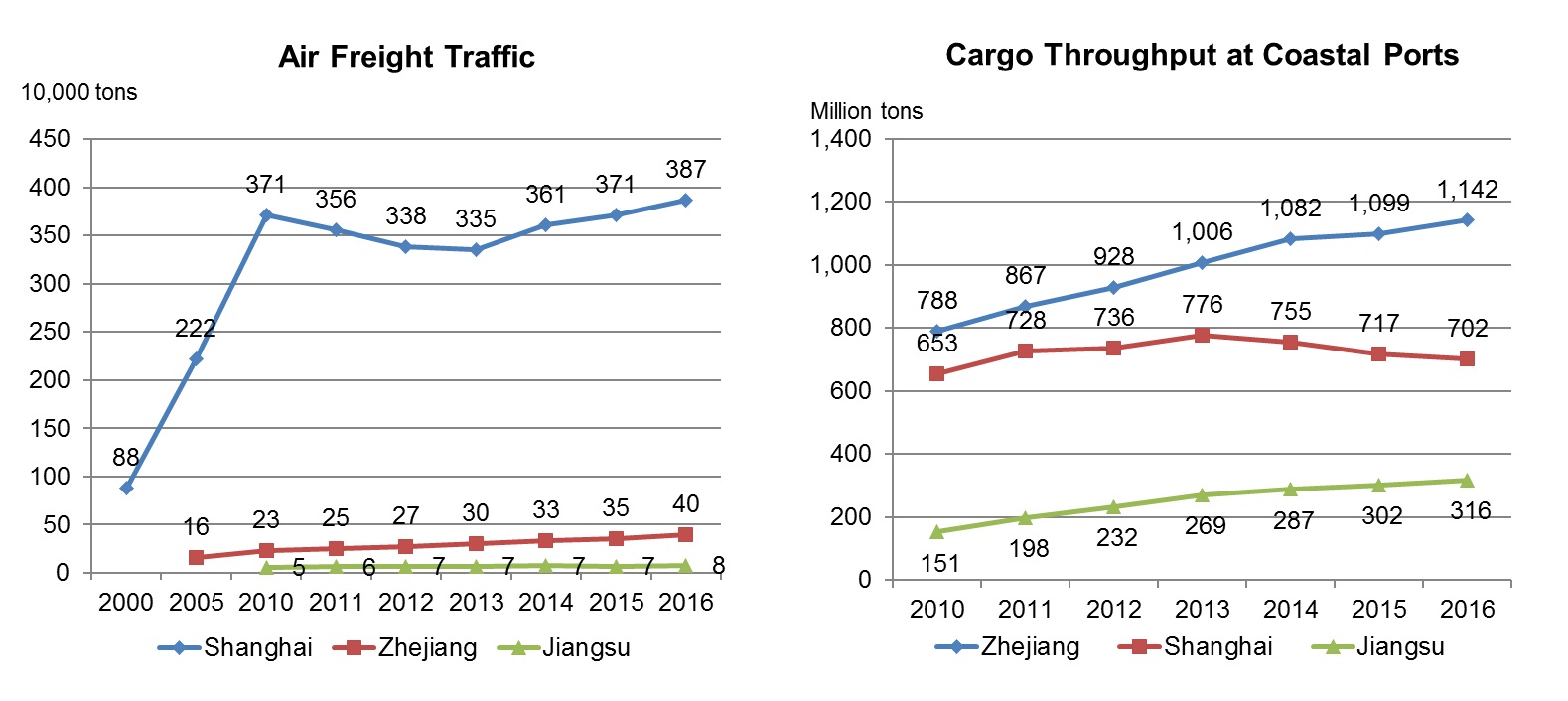

The development of air and sea transport linking the YRD with other regions and international markets varies from place to place. Although air transport accounts for a relatively small share of freight traffic, it is the main form of transport for more up-market commodities and higher value-added products. Demand for air transport is growing increasingly keen as China develops high-tech industries, selling electronic chips and key components of machinery and electronic products. The rapid expansion of the markets for high-quality consumer goods, foodstuffs and fast-moving consumer goods, many of which are imported, has also stimulated the demand for air freight.

Shanghai’s air freight soared from 880,000 tons in 2000 to 3.87 million tons in 2016 at an average annual growth rate of 10%. In comparison, air freight volume in Jiangsu and Zhejiang is relatively small. This is not just because Shanghai has many international air routes and Pudong and other airports have increased their air freight traffic and handling capacity, but also because Shanghai has been pursuing trade facilitation policies in recent years. For example, the Shanghai Pilot Free Trade Zone has adopted various measures to make customs clearance easier and improve the efficiency of customs declaration and commodity inspection. Shanghai’s inspection and quarantine authority has also improved upon its regulatory model, greatly shortening the time it takes to inspect imported products, including foodstuffs and cosmetics. Facilitating trade has played an important role in making Shanghai the air freight hub of China’s eastern coastal areas.

Each enterprise in the YRD and its neighbouring areas has its own place in the industry chain and has its own specific needs when it comes to logistics services. When deciding on what air transport routes and inter-modal transport system to use, a company will take into consideration a combination of factors alongside cost-effectiveness, such as the characteristics of different categories of products, the customs clearance efficiency and facilitation measures at different customs checkpoints, and the convenience of logistics distribution in the local and international markets. As well as adopting measures to facilitate trade, Shanghai, Jiangsu and Zhejiang have also made great efforts in recent years to upgrade the region’s aviation logistics services by strengthening their links with Hong Kong and other aviation hubs. (For further details, see Using Logistics Solutions to Enhance Air Freight Capability)

As regards freight transport shipped from coastal ports to other regions of China and international markets, the cargo throughput at ports along the Zhejiang coast has witnessed quite remarkable growth, reaching 1.14 billion tons in 2016. This is largely due to the rapid development of the Zhoushan Port in Ningbo. Shanghai’s cargo throughput paled in comparison, amounting to only 700 million tons in 2016. This was due to a drop in domestic trade in recent years. Although cargo throughput at ports in Jiangsu has trailed behind, the province’s Lianyungang Port has registered rapid annual throughput growth of over 13% on average during the 2010-2016 period. This shows that increasing numbers of businesses are beginning to use Jiangsu’s port facilities for trans-regional and even international trade.

Innovation in Supply Chain Management

The continuous expansion of logistics and transportation networks in the YRD has hastened the maturity of industries in the region. With growing competition in mainland and international markets and the need for industrial transformation and upgrade, YRD enterprises have lost no time in upgrading their product development and manufacturing technologies while also focusing their attention on improving their management of the entire supply chain. They hope that by making use of internal resources and third-party services to reform the whole business process, from product design, material sourcing and manufacturing to logistics distribution, sales and after-sales services, the overall operating efficiency and the quality of customer service can be raised.

The Chinese government also hopes to encourage enterprises to make improvements in supply chain management and promote industrial upgrading and development through innovations in management models and the use of technology. In October 2017, the State Council issued the Guiding Opinions on Actively Promoting Supply Chain Innovation and Application. This aims to create a number of new technologies and business models suited to China’s conditions, and to help form smart supply chains covering all key industries in the country by 2020. [2]

China’s economic slowdown has not only affected small and medium-sized enterprises but also created many challenges for big businesses. This has forced mainland enterprises to review their business and strengthen their supply chain management in order to boost their competitiveness.

Huayu Automotive Systems, the leading manufacturer of car parts in China, is a good example of this in action. It is taking steps to improve its car parts supply chain and update its management information system. It hopes this will enhance its ability to control supply chain resources in the light of the slowdown in China’s car market, the rapid changes in the ecosystem of the global automotive industry and the increasingly demanding requirements of its customers. As well as satisfying consumer needs, it also hopes to accelerate the development of its business in related areas.

Many domestic enterprises are currently acquiring the technologies and supply chain resources they need through co-operation with outside partners or mergers and acquisitions. Huayu has established a subsidiary in Hong Kong to handle foreign exchange income and international payments. It uses this foothold in Hong Kong to help find partners, capital, information and technologies in international markets, which it needs to improve its supply chain capability and invest in new projects for future development. Overseas investment and financing activities often involve complicated financial and business manoeuvring, which can best be accomplished using professional services support. Having a platform in Hong Kong is useful for companies seeking such support. (For further details, see Improving Supply Chain Systems in Line with New Market Challenges)

Third-party service providers can also help businesses make use of the transportation networks and facilities of different regions, improve their domestic and international logistics, and strengthen their supply chain management system with the aid of big data analysis and the application of other advanced information technology. Enterprises should also be looking to make use of financial services to manage the flow of funds and lower related costs. Only in this way will they be able to improve supply chain management and enhance their overall operational efficiency.

“Going Out” Stimulates Demand for Supply Chain Management Service

Companies in the YRD are actively investing in production automation to ease the difficulties caused by shortages of labour. They also hope it will help them produce higher quality goods which will allow them to stay competitive amid the increasingly tough conditions on domestic and international markets. Some are looking to develop more high-tech business while others are choosing to develop their own brands. As they diversify, they need more efficient management to cope with their increasingly complex operations. Against this backdrop, many YRD enterprises are looking to third-party service providers for support to help them connect different stages of their businesses, from product development to sales and after-sales service.

An efficient logistics service has thus become an indispensable part of many businesses. However, enterprises also need to improve the efficiency of their supply chain management. For example, many enterprises need to go through one or more transportation and sourcing platforms, such as those in the YRD, Pearl River Delta (PRD) and Hong Kong, and make use of sourcing and cargo transit services in different regions to secure a wide range of materials for production. They also need to make use of advanced management systems to handle spare parts and components or industrial products coming from or heading to different places. To meet these needs, service providers are now providing diversified supply chain management services. (For further details, see Upgrade Strategies Spur Demand for Supply Chain Management Service)

The acceleration of the pace of “going out” to develop trade with and invest in countries along the Belt and Road has further stimulated the demand for these services from mainland enterprises looking to support their growing international business. HKTDC Research commissioned a questionnaire survey in the YRD in 2017 to find out more about this demand.

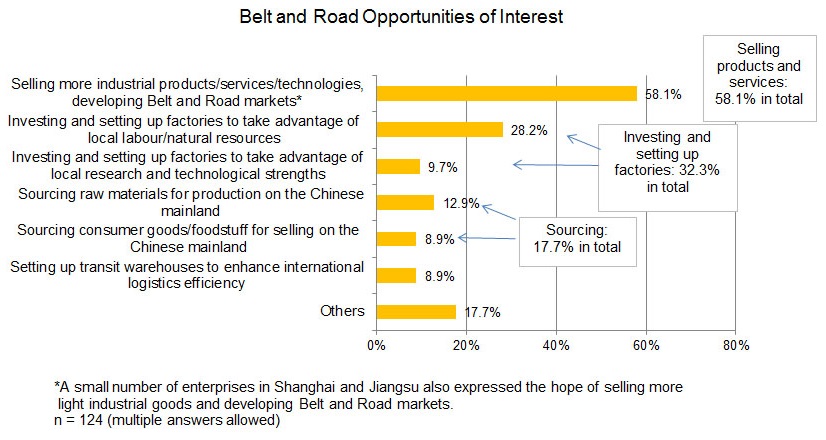

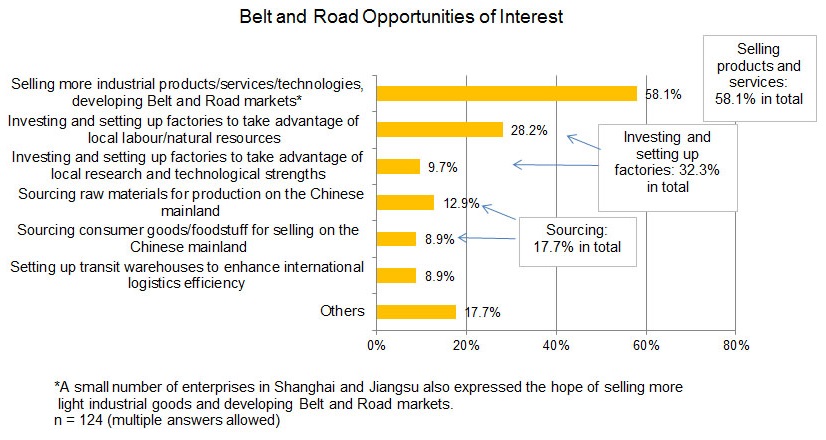

The findings showed that a large majority of mainland enterprises (84% of those who responded) are considering trying to tap opportunities in Belt and Road countries, including those in South-east Asia, South Asia and Central/Eastern Europe, in the next three years. 58% hoped to sell more industrial products and related services and technologies to Belt and Road markets, 32% were looking to invest and set up factories in Belt and Road countries, 18% planned to source consumer goods/foodstuffs to sell on the Chinese mainland or source raw materials for production on the mainland, while 9% hoped to set up transit warehouses there to enhance their international logistics efficiency. (For further details, see Hong Kong Services Help YRD Enterprises Capture Belt and Road Opportunities)

Source: HKTDC survey (For further details, see Hong Kong Services Help Yangtze River Delta Enterprises Capture Belt and Road Opportunities)

It seems that YRD enterprises planning to develop their business in different sectors require various types of services support to strengthen their supply chain management and create better links between their production facilities on the mainland and their overseas operations. According to a company that provides supply chain management services, many mainland enterprises have high-tech manufacturing capability and can produce products comparable to leading international brands, but still need the support of efficient supply chain management services in areas such as logistics, information flow and capital flow to help them tap opportunities in their target markets.

For example, many enterprises are selling their own brands in overseas markets and can reap handsome net profits from product sales alone. However, in order to develop their brand and maintain the loyalty and support of overseas consumers, they need to provide fast and efficient after-sales and maintenance services in the local markets either directly or through distributors. If that is not handled properly, it could involve high costs and could even adversely affect their image in overseas markets. (For further details, see Devising “Belt and Road” Supply Chain Management System)

An increasing number of domestic enterprises in the YRD and elsewhere are trying to improve their service systems for sourcing, production and sales by utilising the industrial resources and advantages of other places through industry chains in the coastal areas and even in the inland provinces. The geographical span of their business is expanding. As a result, many service providers are making use of transportation networks in the YRD, PRD and other places such as Shanghai, Shenzhen and Hong Kong, to enhance their logistics efficiency when serving overseas and international markets. At the same time, they are also helping clients improve their information and capital flow management and ensure the smooth development of their business.

The survey findings also indicate that many enterprises are hoping to seek professional services support both on the mainland and outside the country to help them “go out” and tap Belt and Road opportunities. Hong Kong was the most popular choice for this, with 46% of the businesses which were looking for services support indicating it as their preferred option. This matched the findings of a similar survey conducted by HKTDC Research in South China.

There is no doubt that Hong Kong is the preferred platform for mainland enterprises “going out” to invest overseas. Hong Kong’s service providers have helped many mainland enterprises handle their trade and investment business in Hong Kong and overseas markets over many years. As YRD enterprises look for more supply chain services support in their quest to capture Belt and Road opportunities, the opportunities for the city’s service providers should increase greatly.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Source: Jiangsu Statistical Yearbook, Zhejiang Statistical Yearbook and Shanghai Statistical Yearbook.

[2] For further details, see China Seeks to Establish World Class Smart Supply Chains by 2020, under Regulatory Alert - China.

Editor's picks

Trending articles

By The International Monetary Fund

Economic prospects for the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) and Caucasus and Central Asia (CCA) regions are diverging. Despite the strengthening global recovery, the outlook for MENAP countries remains relatively subdued due to the continued adjustment to low oil prices and regional conflicts. In contrast, the outlook for the CCA region is improving, supported by the more favorable global environment. In both regions, efforts to promote growth-friendly fiscal consolidation, stronger monetary policy frameworks, economic diversification and private sector development should continue. The window of opportunity arising from various integration initiatives and the favorable external environment call for increasing trade openness, while the adoption of financial technologies could increase financial inclusion and facilitate greater access to credit. Together, these actions will help MENAP and CCA countries to secure higher and more inclusive growth.

Chapter 1 - MENAP Oil Exporters: Need to Push Ahead with Fiscal Consolidation and Diversification

Oil exporters in the Middle East and North Africa, Afghanistan, and Pakistan region (MENAP) are continuing to adjust to lower oil prices, which have dampened growth and contributed to large fiscal and external deficits. Oil prices have softened recently, despite the extension of the production cuts led by the Organization of the Petroleum Exporting Countries (OPEC) and the strengthening global recovery. Non-oil growth is generally recovering, but the muted medium-term growth prospects highlight the need for countries to push ahead with diversification and private sector development. Most countries have outlined ambitious diversification strategies and are developing detailed reform plans, but implementation should be accelerated, particularly to exploit the stronger global growth momentum. Oil exporters should continue pursuing deficit-reduction plans to maintain fiscal sustainability and, where relevant, to support exchange rate pegs. Some countries will need to identify additional fiscal consolidation measures, while protecting social and growth-oriented expenditures. Financial stability risks appear low, although pockets of vulnerabilities remain. The outlook for countries in conflict remains highly uncertain, with growth dependent on security conditions.

Chapter 2 - MENAP Oil Importers: Securing Resilience and Inclusive Growth

Growth in oil importers in the Middle East, North Africa, Afghanistan, and Pakistan region (MENAP) is projected to increase to 4.3 percent in 2017, supported by strengthening domestic demand and a cyclical recovery of the global economy. This positive momentum is expected to persist into the medium term, lifting growth further to 4.4 percent in 2018 and 5.3 percent during 2019–22. However, even at this pace, growth will remain below what is needed to effectively tackle the unemployment challenge facing the region. The balance of risks to the regional outlook remains tilted to the downside. To leverage the global upswing and secure resilience, policy priorities continue to include growth-friendly fiscal consolidation and stronger monetary policy frameworks in countries transitioning to more flexible exchange rates. Structural reforms need to accelerate to improve the business environment, create jobs, fully take advantage of the global growth momentum, and boost inclusive growth.

Chapter 3 - Caucasus and Central Asia: No Room for Complacency

Growth in the Caucasus and Central Asia (CCA) started to pick up during the second half of 2016, and is projected to accelerate further in 2017 and beyond. Improved economic conditions in the region’s main trading partners and some firming of commodity prices, combined with continued implementation of structural reforms, are anticipated to support the recovery. However, medium-term growth is forecast to remain below historical norms. Reforms promoting diversification away from remittances and commodities should therefore be accelerated to secure strong, sustainable, and inclusive growth. To capitalize on opportunities for integration into the global economy—including through China’s Belt and Road Initiative—institutional frameworks should be strengthened to facilitate productive investment and foster private sector development. Fiscal consolidation should continue to ensure that buffers are rebuilt, public expenditure channeled efficiently, tax collection improved, and social safety nets protected. Monetary policy frameworks should be strengthened further, including by establishing clear objectives, safeguarding central bank independence, and enhancing communication. Deep-rooted weaknesses in highly dollarized banking sectors— which are not in a position to support growth in some countries—should be addressed promptly.

Chapter 4 - Leveraging Trade to Boost Growth in the MENAP and CCA Regions

For economies in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) and the Caucasus and Central Asia (CCA) regions, the strengthening global recovery provides an important opportunity to boost exports and growth. Illustrative calculations suggest that achieving greater trade openness, coupled with increased global value chain (GVC) participation, export diversification, or product quality could raise the level of income by some 5–10 percent within the following five to ten years. Oil importers are better placed than other countries in the region to take advantage of the improved outlook for global trade, given their better integration into GVCs and more diversified export bases. However, oil importers could still improve the quality of their exports. In contrast, oil exporters should focus on economic diversification to produce and export a broader range of goods and services. Most countries would benefit from deepening access to export markets through trade agreements and by leveraging new integration opportunities, such as China’s Belt and Road Initiative and the Compact with Africa. Structural reforms to foster investment and job creation, as well as targeted fiscal policies to mitigate adjustment costs, may be needed to relieve any negative consequences of increased openness and to ensure the resulting boost to growth is as inclusive as possible.

Chapter 5 Fintech: Unlocking the Potential for the MENAP and CCA Regions

After a late start, fintech is gaining momentum in some countries of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region,2 and there are green shoots in the Caucasus and Central Asia (CCA) region. For both regions, fintech has the ability to address the critical challenges of enhancing financial inclusion, inclusive growth, and economic diversification through innovations that help extend financial services to the large unbanked populations, and facilitate alternative funding sources for small and medium-sized enterprises (SMEs). Fintech could also make an important contribution to financial stability by harnessing technology for regulatory compliance and risk management, and can facilitate trade and remittances by providing efficient and cost-effective mechanisms for cross-border payments, while the use of electronic payments can improve the efficiency of government operations. To unlock this potential, further reforms are needed to close gaps in the regulatory, consumer protection, and cybersecurity frameworks as well as improve the business environment, information communication technology (ICT) infrastructure, and financial literacy.

Please click to read full report.

Editor's picks

Trending articles

By Dean A. Young, Senior Consultant, Mayer Brown JSM

Bill Amos, Partner, Mayer Brown JSM

The demise of Korea’s Hanjin Shipping Co. Ltd. was the largest bankruptcy of a container line in history, and earlier this year it resulted in the biggest ever court sale of ships in Hong Kong, with a total sale price exceeding US$600 million. In this article we consider Hong Kong’s role as a centre for maritime legal services, and the procedures involved in ship mortgage enforcement.

Hong Kong’s Maritime Legal Services

In May 2017, President Xi Jinping welcomed 28 heads of state and government officials to Beijing to discuss China’s ‘Belt and Road’ initiative, referring to the revival of the ancient Silk Road economic belt and a 21st century seafaring maritime route. Connecting China to Europe, the Belt & Road will, if all goes to plan, cover more than 60 countries and repay China’s investment by contributing 80 percent of global GDP growth by 2050. As regards the Belt & Road, Hong Kong’s role as an international legal and dispute resolution centre for the Asia-Pacific region is well known. What is not so well known is Hong Kong’s very high degree of autonomy in shipping affairs. For example, it has its own representation on major international bodies such as the International Maritime Organisation.

About 190,000 vessels, including ocean-going and river vessels, visit the port of Hong Kong each year so a maritime community (numbering around 700 companies) needs legal services to cover transactional work as well as shipping disputes. In 2016, the Hong Kong International Arbitration Centre handled 262 new arbitration cases, of which 22 percent were maritime. Lawyers specialising in maritime law work are available to offer advice and dispute resolution services for shipowners, charterers, cargo owners and, of course, ship finance banks.

Enforceability of ship mortgages

As an international financial centre, Hong Kong has a high concentration of banks providing ship financing services to the local shipping industry as well as foreign shipowners. Financiers both local and foreign can be reassured that the Hong Kong courts have the expertise to help them recover their loans if borrowers become insolvent or breach their loan documents.

The recent bankruptcy of Hanjin Shipping provides a working example. Hanjin’s mortgagees were faced with crippling losses if unsecured creditors succeeded in overcoming their priority. Whenever ships are located in the China-Korea-Japan range, a comparison should be made between Hong Kong and other ports in Asia to determine the safest and least costly location to seize and sell the ships so as to maximise the recovery for mortgagees. Hong Kong is generally the preferred choice for bank mortgagees because:

- Included in the list of admiralty claims is a claim under a mortgage (regardless of the flag of the ship). Hong Kong’s legal system is based on English law and brings with it a fixed order of priorities to the proceeds of sale of a ship. A mortgagee ranks ahead of all claims except for maritime liens (such as collision damage, salvage claims and crew’s wages), possessory claims (such as an unpaid repair yard), and the actual costs of the arrest.

- Hong Kong’s role as an international financial centre is dependent on its legal system continuing to provide certainty and its courts continuing to adjudicate openly, impartially and free from interference or influence. There is no bias for local creditors.

- The application process is clearly established. The mortgagee needs to file an admiralty writ in rem and an application for an arrest warrant with the Court accompanied by an affidavit proving its claim and, when obtained, a warrant of arrest is served on the ship by the Bailiff.

- Once arrested, the procedure is very fast compared to other jurisdictions as the Court has the power to order the sale “pendente lite”, meaning whilst the action is proceeding, the ship is treated as a wasting asset. The proceeds of sale that are paid into the Court stand in place of the ship while the ship can be sailed away by the purchaser.

- The bailiff’s fee of only 1 percent compares favourably with the 2percent-2.5 percent commission charged in other jurisdictions in the region.

- The court will generally permit the bank to apply for payment out of court 30 days from the court sale, ensuring that the sale proceeds and mortgage loan are not tied up in court unnecessarily.

- Lastly, but most importantly, the Court’s bill of sale passes ownership to the purchaser free not just from the mortgage but also all other encumbrances, debts and liens. The ship is clean to begin trading once again.

In the case of five of the largest Hanjin ships handled by Mayer Brown JSM, those that carried containers were allowed to proceed to their destination for discharge and their masters were then ordered to proceed to Hong Kong where each ship was arrested.

A panel of international shipbrokers was instructed to value the ships to ensure that the Court’s reserve price was accurate. In cases where values are hard to appraise on account of few or no current comparisons, a mortgagee bank commonly enters a protective bid to ensure that its vessel is not sold at an undervalue.

The result was the largest ever court sale of ships in Hong Kong, with a total sale price exceeding US$600 million. There were no abandoned crews, astronomical port costs or prolonged periods of idleness. The ships have since been absorbed into the fleets of other container line operators.

This article was first published in the official journal of the Law Society of Hong Kong - “Hong Kong Lawyer” December 2017 issue. Please click to read the full article.

Editor's picks

Trending articles

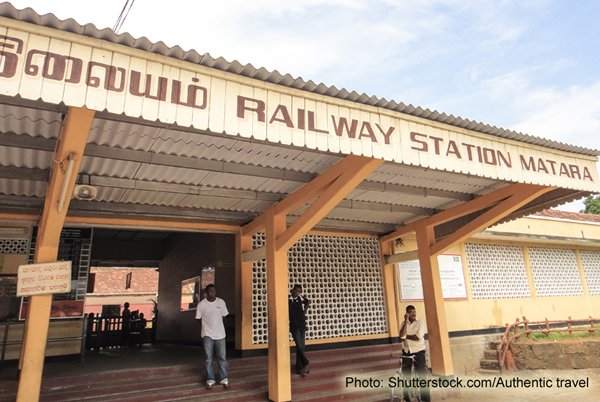

Massive China-funded coastal rail project tipped to boost Sri Lanka's logistics and tourism industries.

Work is now well underway on first phase of Sri Lanka's long-mooted coastal rail link, with much of the funding stemming from the Belt and Road Initiative, China's ambitious international infrastructure development and trade facilitation programme. With the cost estimated at around US$278 million, the project – the Matara-Kataragama Railway – will eventually stretch across 114.5km and is the first new rail line to be constructed in Sri Lanka since the country gained its independence in 1948.

Once it is completed, it is hoped the line will stimulate growth in the industrial and tourism economies of southern Sri Lanka, while also providing a much-needed transport link for local communities. It will also breathe new life into Matara station, which was built back in 1895 and is currently the terminus for services running from Colombo Port, the country's central business district, and Galle, the administrative capital of the country's Southern Province. Until now, however, there has been no rail service extending any further east.

With Sri Lanka seen as a priority link in the BRI network, given the strategic advantages of its port facilities, China was quick to back the Sri Lankan Ministry of Transport & Civil Aviation's plans to revitalise the country's transport infrastructure. To this end, the project is being bankrolled by the state-owned Export-Import (Exim) Bank of China, while construction work is being undertaken by the China Railway Group in association with the China National Machinery Import and Export Corporation.

It is envisaged that the project will be developed in three distinct phases, with the first – the 26.75km Matara-Beliatta line – scheduled to be finished by October. Work on this initial section will require the completion of two bridges and viaducts in order to span the Nilwala River and the Wehella flood plains. It will also require the construction of the country's longest railway tunnel, which will run to some 616 metres.

At 48km, the second phase is almost twice as long and will run from the southern town of Beliatta to Hambantota, a port city already benefitting from substantial BRI investment. Under a deal agreed last year, China Merchants Port Holdings has been granted a 99-year concession to develop and manage the commercial operation of the city's deep-water port, as well as the nearby Sri Lanka-China Logistics and Industrial Zone.

The third and final stage of the new rail link will run to some 39.5km. This will see the line head inland from Hambantota, before terminating at Kataragama, one of the country's most popular tourist destinations.

The development of the coastal line was triggered by the need to establish an integrated national transport network in order to fully capitalise on the BRI-sponsored upgrades to the country's marine and air freight facilities. Without such a move, it was believed Sri Lanka would miss out on a raft of economic benefits, while also failing to attract increased overseas investment.

It's certainly true that the country's existing rail network falls way short of being able to handle any significant increase in freight transportation. Perennially loss-making, Sri Lanka Railways has long been seen as under-invested, under-utilised and technologically backwards. As a consequence, rail accounts for only 5% of the national passenger transport market, having fallen from 7% in 2011.

The national rail operator, however, believes that it could boost its passenger market share to 25% in certain regions, but only by increasing train frequency and improving overall service levels. Prior to China's intervention, the funding for such a transformation seemed unlikely to materialise.

As an additional benefit, the new line is also expected to play a key role in further developing the country's already burgeoning tourism sector. In 2017, the country welcomed 2.12 million overseas visitors, a substantial increase on the 1.27 million arrivals recorded for 2013. With many such tourists bound for the legendary beaches in the south of the country, the new line will inevitably prove one of the primary conduits for this ever-increasing number of sun-seekers.

Overall, tourism is now Sri Lanka's third-largest source of foreign exchange earnings, after remittances from migrant workers and the textiles sector. With the number of annual visitors expected to hit 4.5 million by 2020, the rail line is also seen as one of the prime links in the required supply chain.

Geoff de Freitas, Special Correspondent, Colombo

Editor's picks

Trending articles

One of the incidental benefits of the far-reaching Belt and Road Initiative is the opportunities it has opened up for mainland businesses throughout Southeast Asia, with Indonesia emerging as one of the most lucrative markets on offer.

As well as promoting international infrastructure development, China's Belt and Road Initiative (BRI) has also proved an effective means for mainland manufacturers to access new overseas markets, at least according to exhibitors at the recent China Machinery & Electronic Brand Show (Indonesia). Of these markets, Indonesia – a country with a population of more than 200 million and a rapidly growing manufacturing sector – has emerged, unsurprisingly, as one of the primary targets for any Chinese manufacturer looking to expand into Southeast Asia.

Acknowledging the spur provided by his home country's policy-makers, Martin Lin, Investment Management Head at Fujian-based Keneng Electrical Equipment, said: "Our government has done much to encourage private enterprises to expand beyond China and that played a huge part in bringing us to Jakarta for this event."

Making its first appearance at the show, the company was keen to promote its range of meters, gearboxes, engines and generator sets. It also produces diesel engines in partnership with Lijia Co, another Fujian-based business.

Another Jakarta debutante was Friend Control Systems, a Shandong-based high-tech manufacturing enterprise that produces a proprietary range of pressure-measurement instruments, temperature instruments and flow-measurement systems. Again acknowledging the prompt provided by the BRI, Li Ming, the company's General Manager, said: "This policy has definitely encouraged Chinese companies to look to new markets, particularly those within Southeast Asia.

"There is a huge market for us here Indonesia, largely because of the country's rapidly growing manufacturing sector. I have every hope that our products will be successful here."

In the case of the Beijing-based Valve General Factory, it seemed as though government intervention was even more direct, with Overseas Sales Manager Caroline Ling saying: "We were officially advised to come here to test the Indonesian market and to look for distributors and trading partners."

The company has a 63-year history of producing high, middle pressure and steam-trap valves. To date, it has supplied mainly domestic clients and has had only limited exposure to the key export markets. It currently operates from a 60,000-square-metre plant in the Panggezhuang Industrial Development Park in the Daxing District of southern Beijing and has more than 1,100 employees.

For Shandong-based TigerTec, it was trusting in state-sponsored overseas promotion to help drive sales of its computer numeric control (CNC) machines. Outlining the company's expectations, Sales Manager Tina Li said: "While we already have a partner in Indonesia, we have very few customers here. We hope this new government initiative will help promote our products in Indonesia and in a number of other countries.

"In the case of Indonesia, we are well aware of how competitive a market it is. Despite this, though, we have attracted a lot of interest throughout the course of this expo."

The company's CNC machines primarily have applications within the wood-working, sign-making, model-making, mould-making and stone-engraving sectors. It also manufactures plasma-cutting and rotary-engraving machines.

Another Shandong-based CNC machine manufacturer hoping to capitalise on the expanding Indonesian market was Sinmic Machinery. Maintaining her company had quite a different proposition to other CNC suppliers, Sales Manager Jessica Shu said: "We pride ourselves that we offer configurations suitable to every customers' needs, while also having a number of budgetary options on offer."

Currently on the look-out for Indonesian partners, the company specialises in the provision of woodworking and plastic CNC routers, woodworking machining centres, CNC engravers, sign-making CNC routers, 3D laser scanners, mould-making CNC machines, five-axis machining centres and high-power laser metal-cutting machines.

Concerns that the notoriously price-sensitive Indonesian market might not be willing to invest in higher-quality equipment were widespread at the event. Outlining his own company's solution to this particular problem, Dante Lin, Marketing Director of Superwatt Power Equipment, said: "We are planning to introduce different, more economical products to our standard range in order to meet the price requirements of Indonesian customers."

Shandong-based Superwatt manufactures diesel generator sets, mobile lighting towers, vehicle power stations, and gas generator sets.

Still finding its feet in the Indonesian market was Acepow, a Fujian-based generator manufacturer. Explaining the reasons behind its presence at the event, Sales Manager Clark Zheng said: "This is our way of taking a closer look at the opportunities the country offers. Hopefully, we can find a local partner that will help us grow here as we continue to expand into Southeast Asia.

"For our part, we believe that businesses need generators to ensure a continuous power supply. When you buy from us, what you're really signing up for is power reliability."

Another first-timer at the Jakarta show was the Shanghai Valve Factory. The publicly traded company manufactures valves for use in power plants, petrochemical plants, long-distance pipelines, ships, the metallurgy industry, paper production, the pharmaceutical industry, environmental protection and a number of defence-related sectors.

Seeing a clear synergy with the needs of the Indonesian industrial sector, Overseas Sales Manager Wang Jianwei said: "This could be a huge market for us as the majority of the country's manufacturers are already using similar valves to the ones we produce. Now it's just down to us to give them a good price."

With direct trade between China and Indonesia still something of a logistically and legally thorny issue, one business that was hoping to bridge the gap was Indotrading.com, a Jakarta-based e-commerce platform established to help SMEs promote their products and services online.

Explaining the problem, Rahman Anzi, one of the site's Business Consultants, said: "Indonesia is a huge market and, despite the large number of businesses and manufacturers already active here, there is room for expansion.

"Foreign companies, though, cannot sell directly to customers in Indonesia. In line with government regulations, foreign businesses need to have a local partner in order to trade here. As a result, Chinese companies are not allowed to list their products on our portal unless they have a link to a domestic business, meaning they are missing out on our 4.5 million monthly visitors."

The 2017 China Machinery & Electronic Brand Show (Indonesia) took place at the Jakarta International Expo.

Marilyn Balcita, Special Correspondent, Jakarta

Editor's picks

Trending articles

By CGCC Vision

The Guangdong-Hong Kong-Macao Great Bay Area is a city cluster made up of two special administrative regions, i.e. Hong Kong and Macao, and nine Guangdong Province cities, viz. Guangzhou, Shenzhen, Foshan, Dongguan, Huizhou, Zhongshan, Zhuhai, Jiangmen and Zhaoqing. At first glance, the concept is similar to the old Greater Pearl River Delta (GPRD)’s context of co-development. However, HSBC Asia-Pacific Advisor George Leung pointed out that integration was not one of the old GPRD’s attributes for cooperation. Its purpose was to promote the economic development of the entire region by comprehensively improving production efficiency through coordination between different economic models in various cities.

Set to be among world’s four major bay areas

“After more than a decade of development, the GPRD has accumulated solid strength to prompt the Central Government to decide on the idea of further integrating the region into a great bay area on the back of its existing development foundation.” Leung believes that the most important thing is building a sound transport network and establishing a sound ecosystem that will drive the cities in the region to make better use of their industrial strengths to integrate with each other in order to create greater synergies. The ultimate goal is to become one of the four major bay areas in the world with the New York Bay Area and the San Francisco Bay Area in the US and the Tokyo Bay Area in Japan.

In respect of transport network, Leung said that a dense transport system must be in place within the Great Bay Area to effectively link up different cities. At this stage, the Main Bridge project of the Hong Kong-Zhuhai-Macao Bridge is more than 90% completed and Hong Kong has signed a co-location deal with Guangdong for implementing a joint checkpoint at Hong Kong’s high-speed rail terminus. The transport network in the area, which has now begun to take shape, will help link up the entire industry cluster.

“In fact, the basic development factors in the Great Bay Area are almost complete. On the back of its population of over 60 million people, its residents’ rising spending power, as well as the significant strengths of its cities - e.g. Hong Kong is an international financial center, Shenzhen is an innovation and technology center, Guangzhou is a global trade center and Zhongshan is being developed into a world-class modern equipment manufacturing base - the Great Bay Area will further raise its level of market integration in the future to bring greater economic benefits to the entire region.”

Overcome challenges arising from differences in legal systems

Nevertheless, Leung believes that there are still challenges that must be overcome for Hong Kong to integrate into the Great Bay Area’s development and play a key role. Under the “one country, two systems” principle, Hong Kong’s legal and political systems are different from those of the Mainland cities; in this respect, it is not the same as the three major bay areas of New York, San Francisco and Tokyo. In view of possible future disputes with the nine Guangdong Province cities in corporate finance or other areas, there is the need for early discussions and consultations to determine the regulatory guidelines and legal system to be followed for dispute resolutions. Relevant successful experience can also be applied to different economic systems such as the free trade zones in the future.

Easy integration due to similar cultures

Leung said that Hong Kong can in the future make use of the Great Bay Area’s advantages to further enhance its competitiveness in global financial development. “Digital economy and fintech are the trends of today’s international financial cities. However, Hong Kong’s market has only a few million people. In the long run, it is difficult to support the expanding large-scale financial system to further improve fintech. The Great Bay Area, a huge region, offers such a desirable vast market. In addition, Guangdong has the same culture and language as Hong Kong, and it is a market Hong Kong is familiar with. Therefore, Hong Kong businesses can more easily integrate into the area, which may help accelerate the pace of development and achieve results. It may be more attractive than overseas cities along the Belt and Road.”

Leung stressed that as the traditional financial industries are now lagging behind, Hong Kong has to continue to be at the forefront of financial development. It must seize this important opportunity in the Great Bay Area and devote great efforts to develop fintech by complementing the strengths of other cities in the area to consolidate its status as an international financial center.

This article was first published in the magazine CGCC Vision December 2017 issue. Please click to read the full article.

Editor's picks

Trending articles

By Olga Boltenko, Counsel CMS Hasche Sigle Hong Kong LLP

Nanxi Ding, Researcher, Counsel CMS Hasche Sigle Hong Kong LLP

* The article traces a public lecture held in Hong Kong on 12 July 2017, organised jointly by CMS Hasche Sigle Hong Kong and the Hong Kong International Arbitration Centre. The lecture was delivered by Timothy Histed, head of MIGA’s South and South East Asia operations.

The Origins: Hochtief’s Struggle in Argentina

In 1991, Hochtief AG – a major German contractor – won a concession over one of the largest infrastructure projects in Argentina (see Award, ICSID Case No. ARB/07/31, December 21, 2016). Hochtief was to construct and operate a 608-meter long four-lane cable-stayed bridge linking the cities of Rosario, in Santa Fe province, and Victoria, in Entre Ríos province, through a crossing over the Paraná river. Argentina was to pay regular subsidies towards the project.

In 1998, Argentina spiralled into a major economic crisis. The crisis permeated all aspects of the country’s life, and resulted in economic, financial, institutional, political, and social collapse. When the crisis peaked, Hochtief’s project was well advanced – Hochtief’s bridge was hanging with its ends loose over the Paraná river when the Argentinean Government changed its laws, stopped contributing to the project, and eventually terminated the concession. Hochtief sued Argentina at ICSID for expropriation. In December 2014, following several years of legal battles on jurisdiction and merits, a prominent tribunal comprising Chris Thomas QC, Judge Charles Brower, and Professor Vaughan Lowe QC, issued its decision on liability (see Decision on Liability, ICSID Case No. ARB/07/31, December 29, 2014).

The Hochtief tribunal’s decision is informative in many respects, but its treatment of Argentina’s political risk insurance objections deserves particular attention. Prior to bidding for its concession, Hochtief took out a political risk insurance policy with the German Government under a German Government programme that provides Federal guarantees for direct investment in foreign countries. Having seen its project expropriated, Hochtief applied for compensation under the Guarantees, receiving over €11 million prior to suing Argentina at ICSID.

Argentina objected to the admissibility of Hochtief’s claims before ICSID on the basis that, because the German Government paid the compensation, Germany was subrogated to the rights of Hochtief under the BIT, so Hochtief could no longer pursue its claims. The Tribunal rejected Argentina’s admissibility objection, finding the BIT requires a transfer of rights to claim by provision of law or by a legal act, and that no such transfer happened when Hochtief purchased its political risk insurance.

The Hochtief tribunal further found that a political insurance payment is a benefit which an investor arranges on its own behalf, and for which it pays. Political risk insurance does not reduce the losses caused by a host State’s actions in breach of the underlying BIT. In essence, political risk insurance is an arrangement made with a third party in order to provide a hedge against potential losses. The Hochtief tribunal found that there was no principle of international law that would require such an arrangement to reduce the breaching host State’s liability.

The Hochtief liability decision is one of the rare investment decisions that address political risk insurance objections. However, political risk insurance is by no means a new concept in the world of investment law. Investment in volatile jurisdictions can involve setbacks that include bribery, corruption, or even the total collapse of local economies, wholesale rejection of contracts, political crises and coups and even claims relating to violations of human rights. Despite the ever-present security concerns in conflict-affected states, investors value business opportunities that promise generous returns on their investments, as long as the anticipated returns are high enough to outweigh the increased risks. Political risk insurance has developed alongside foreign direct investment as a way to hedge against a variety of such risks.

Hong Kong is a relatively new market for insurers offering political risk insurance policies. However, the local market is expected to grow, as Hong Kong solidifies its position as an important regional hub for China’s Belt & Road Initiative, a reliable jurisdiction through which foreign investors can channel funds into other Asian jurisdictions that can at times be volatile.

Institutional Insurance: MIGA

The World Bank’s Multilateral Investment Guarantee Agency (“MIGA”) was one of the first international institutions to offer political risk insurance to investors venturing into conflict-affected or volatile jurisdictions. To benefit from MIGA’s insurance policies, a foreign investor must be a national of a MIGA member-State and must seek insurance for an investment into a developing country. In line with that policy statement, MIGA has developed five types of insurance products. MIGA insures investors against losses relating to currency inconvertibility and transfer restrictions, expropriation, war, terrorism and civil disturbance, breach of contract, and non-honouring of financial obligations.

Currency Inconvertibility & Transfer Restrictions

In terms of currency inconvertibility and transfer restrictions, MIGA’s involvement is engaged if the host State imposes transfer restrictions such that the foreign investor is not in a position to convert local currency into hard currencies and transfer it to its country of origin. In those situations, MIGA would pay compensation in the hard currency specified in the contract of guarantee with the investor.

In this respect, most investment lawyers would argue that the majority of treaties contain provisions on transfer of investments and returns. The Hong Kong-Australia BIT, for example, provides in its Art. 8 that “each Contracting Party shall in respect of investments guarantee to investors of the other Contracting Party the right to transfer abroad their investments and returns”. Similar transfer provisions are included in virtually every existing BIT. These provisions often require that the investor be able to convert currency of the funds prior to transfer. The question begs what value MIGA’s policies add to investors if the relevant investment treaties already contain the required guarantees.

For a foreign investor to benefit from the treaty’s transfer provisions however, the investor needs to engage the treaty’s dispute resolution mechanism, go through years of arbitration and/or litigation, and obtain an award confirming (hopefully) that the host State is in breach of the treaty’s transfer provisions and that it owes compensation to the investor. This would be a brilliant outcome, but not the end of the story. The investor would then have to enforce the award against the host State.

MIGA does not require an award to find that the host State has effectively blocked repatriation of funds. MIGA will compensate the investor for the host State’s conduct without the trouble of having the insured investor go through arbitration and enforcement proceedings.

Expropriation

MIGA’s expropriation coverage is wide-ranging. It encompasses everything from nationalisation to “creeping” expropriation. Here again, MIGA does not require an award in the investor’s favour to pay compensation. If equity investment is expropriated, MIGA compensates the insured investor based on the net book value of the insured investment. When funds are expropriated, MIGA pays the insured portion of the blocked funds. For loans and loan guaranties, MIGA insures the outstanding principal and any accrued and unpaid interest. MIGA pays compensation upon assignment of the investor’s interest in the expropriated asset to MIGA.

For all practical means, from the investor’s perspective, getting compensation for expropriation from MIGA is faster and cheaper than investment arbitration. By resorting to MIGA, the foreign investor safeguards its relationship with the host State by avoiding fierce (and often very public) confrontation before an investment tribunal, amongst other benefits.

War, Terrorism & Civil Disturbance

Under the umbrella of its policy for insuring risks against war, terrorism and civil disturbance, MIGA protects insured investors from destruction of tangible assets or from total business interruption caused by politically motivated acts of war or civil disturbance in a host State. For tangible asset losses, MIGA compensates the investor’s share of the lesser of the replacement cost and the cost of repair of the damaged or lost assets, or the book value of such assets if they are neither being replaced nor repaired. For total business interruption, MIGA’s compensation is based, in the case of equity investments, on the net book value of the insured investment or, in the case of loans, the insured portion of the principal and interest payment in default.

Again, the added value of MIGA’s war, terrorism and civil disturbance insurance is that the investor is not required to produce a treaty award in its favour to seek compensation.

Non-Honouring of Financial Obligations

MIGA’s insurance against non-honouring of financial obligations protects against losses resulting from a failure of a sovereign, sub-sovereign, or state-owned enterprise to make a payment when due under an unconditional financial payment obligation or guarantee related to an investment. This coverage is applicable in situations when a financial payment obligation is unconditional and not subject to defences. Compensation would be based on the insured outstanding principal and any accrued and unpaid interest. Here again, MIGA does not require an arbitral award to compensate the insured investor for his losses.

Breach of Contract

MIGA’s breach of contract insurance is the only insurance policy that requires the insured investor to engage a contractual dispute resolution mechanism as a pre-condition for compensation. MIGA would expect the investor to invoke the dispute resolution mechanism set out in the underlying contract. If, after a specified period of time, the investor is unable to obtain an award due to the government’s interference with the dispute resolution mechanism (denial of recourse), or has obtained an award but the investor has not received payment under the award (non-payment of an award), MIGA would pay compensation.

Government-Backed & Private Insurers

In addition to MIGA insurance, which does have its own threshold and membership issues, it is open to foreign investors to purchase political risk insurance from other government-backed and private insurers.

SinoSure (a Chinese State-owned export and credit insurance corporation) has become particularly important in the context of Beijing’s Belt & Road Initiative. SinoSure insures a large part of Chinese investment abroad. Its investment insurance policy is designed to underwrite investors’ economic losses caused by political risks in host States. By virtue of its role, SinoSure also takes the majority of losses when the insured investment goes sour.

A number of private insurers in the region have followed MIGA and SinoSure, and have developed their own sophisticated insurance policies. Zurich Insurance Group, AIG, AXA, Prudential, Allianz, and many other large multinational insurance companies offer more and more elaborate and comprehensive political risk insurance schemes.

Against this backdrop, it is particularly interesting to see whether AIIB, Asia’s major financing institution designed to encourage investment in Asia, will offer political risk insurance policies similar to the World Bank’s MIGA or akin to private insurers.

Interplay of Political Risk Insurance & Investment Arbitration

Political risk insurance is a sophisticated tool to hedge risks of undue government interference with investments in fragile economies and developing states. It is costly, but it guarantees compensation in cases of expropriation, adverse regulation, political instability, or physical destruction of investments. A number of private insurers are adjusting their political risk insurance products to offer coverage of denial of justice and breach of investors’ legitimate expectations, as well.

Most political risk insurance products do not require the insured investor to obtain a treaty award to receive compensation. Public insurers, such as MIGA, have the additional leverage of resolving disputes with local governments before the disputing parties reach a point of no return and before a full treaty dispute crystallizes.

Investment treaty arbitration remains the most efficient tool to recover lost investments where political risk insurance is not available and where all other options fail. If Hochtief v Argentina is followed, treaty tribunals are unlikely to regard political risk insurance as an arrangement that affects the level of compensation or view political risk insurance as an obstacle to admissibility of an investor’s claims.

Political risk insurance and investment arbitration should be seen as complementary concepts that exist to increase investors’ confidence in exporting capital to developing markets.

This article was first published in the official journal of the Law Society of Hong Kong - “Hong Kong Lawyer” October 2017 issue. Please click to read the full article.

Editor's picks

Trending articles

By Charles Allen, Orrick, Partner & Head of Commercial Litigation and International Arbitration

"This decision confirms Hong Kong’s position as an arbitration-friendly jurisdiction”.

This ritual phrase seems to follow every law firm bulletin reporting on the latest judgment staying proceedings brought in breach of an arbitration agreement or granting indemnity costs following unsuccessful applications to set aside arbitral awards, and the like.

The truth of the statement is undoubted, but it is questionable whether it adds much to the debate about the merits of Hong Kong as a seat, or as a forum in which to enforce awards, relative to, say, Singapore. Hong Kong is arbitration-friendly because it has excellent hardware and software: legislation based on the UNCITRAL Model Law, decades of jurisprudence, and good lawyers and judges. A more precise statement, therefore, would be that Hong Kong is a “rule of law-friendly” jurisdiction, because our judges uphold their oaths and do their job in accordance with what the law requires.

Talking about the merits of Hong Kong as a dispute resolution centre, it is interesting to observe the extent to which the litigation departments of many international law firms in Hong Kong are shifting from doing actual litigation to other types of dispute-like work, such as FCPA and other investigations, financial regulatory work, and of course arbitration. In fact, it is probably fair to say that the days of plentiful general commercial knockabout litigation in Hong Kong are largely over. The reality these days is that there are fewer and fewer international law firm solicitors issuing writs, fronting up before the Master on security for costs and Order14 applications, and generally rolling up their sleeves in the High Court. It is also becoming less common these days to see an exclusive jurisdiction clause in a commercial contract identifying the Hong Kong High Court as the forum.

If you doubt this, do a Writ search and see how many banks, listed companies and MNCs are suing and being sued in Hong Kong these days. Whilst true that the courts are busy, and there are plenty of judgments, it is not the large business institutions who are litigating in Hong Kong except in cases where there is nowhere else to go, for instance insolvency matters, shareholders’ disputes, fraud cases, etc.

So, where are the commercial cases going?

That is obviously a difficult question, but the likelihood is that, in cases where there is a choice, parties are choosing courts in other jurisdictions, perhaps even Singapore’s much-hyped International Commercial Court. In addition of course, there is arbitration.

A shift towards arbitration is completely understandable. It has a number of features which are attractive to commercial parties, especially with respect to cross-border transactions, not the least of which is the ease of enforcement under the New York Convention. However there is an aspect of the rise of arbitration, and the general decline in commercial litigation in Hong Kong, that is a slight concern, namely that some of the advantages of litigation over arbitration are occasionally neglected.

Arbitration versus Litigation

Imagine, for a moment, a transaction which has no cross-border elements, where there are no concerns about enforcement outside Hong Kong, and neither party is worried about home-turf advantage.

In those circumstances, not only may there be no compelling reason to choose arbitration, there might in fact be good reasons not to choose it. Two of these reasons are worth particular attention.

The first of these is the right to appeal. The Hong Kong International Arbitration Centre’s excellent website says this: “The main advantages of arbitration can be summarized as follows: … Final and Binding Arbitration awards are usually final and not subject to review on the merits, meaning prolonged court appeal procedures can generally be avoided”.

In other words, arbitration is a good thing because there is no entitlement to appeal against an award.

This has always been one of the so-called advantages of arbitration over litigation that leaves many people baffled.

There is, generally-speaking, no entitlement to appeal against an arbitral award. True, an application can be made to set aside an award in some circumstances on grounds of procedural unfairness etc., but there is no appeal on the merits (except on a point of law if you have opted in to the relevant provisions in the Arbitration Ordinance).

It is quite difficult to understand why parties would agree to this, except as a trade-off against ease of enforcement and some of the other undisputed advantages of arbitration which may be relevant in a particular case. Ask any lawyer who has ever represented a losing party. How likely is it that the client’s first comment will be “I am so glad this decision is final and not subject to review on the merits, meaning I can avoid prolonged court appeal procedures."? Much more likely, in fact 99 times out of 100, the client’s first question will instead be “Can we appeal against this?”.

Perhaps the suggestion is that arbitrators are virtually infallible, such that whilst the law contemplates that whilst they might get the procedure wrong or exceed their jurisdiction, the prospect of them misunderstanding the facts or misapplying the law is negligible.

That is quite obviously not the case. As much as many arbitrators are well-educated, experienced and smart, they still make mistakes. Even the full-time arbitrators, just like judges, sometimes get it wrong, whether it is on the law or on the facts. Arbitrators, like judges, are human. And this is why, in the court system, we are fortunate to have a Court of Appeal and a Court of Final Appeal.

In a sense, the clue is in the question. If parties are absolutely set on arbitration, but either or both of them is not entirely confident that the tribunal will get it right, they can maximise their prospects of an objectively-good outcome by opting into the appeal system. But the reality is that few arbitration clauses are customised in this way, and most contracts contain boilerplate arbitration language, such that the losing party only finds out that it has lost any serious prospect of recourse against the award when it is too late.

The second advantage is the summary judgment procedure. As any experienced litigator will tell you, Order 14 of the Rules of the High Court entitles a Plaintiff to apply for summary judgment on the basis that there is no defence to the claim. There are some minor procedural hoops to get through (ie, Notice of Intention to Defend must have been filed, a Statement of Claim must have been served, and a Summons supported by an Affidavit must have been issued). In addition, the procedure is not available where the claim is based on an allegation of fraud or certain torts. But essentially, Order 14 provides a fast track mechanism to judgment which is especially useful in cases where the Plaintiff’s claim is for a debt. (A similar, but not identical, procedure is available under Order 86, enabling the Plaintiff to obtain summary judgment for specific performance of a contract).

These procedures are not available in arbitration, and this ability to issue a summary judgment application immediately after the Defendant has indicated that it will contest the action is a major advantage. It enables the Plaintiff to demonstrate quickly and cheaply that it means business, and the result is that cases are often settled swiftly. Moreover, even if the Defendant contests the application, and the court is not satisfied that a judgment should immediately be entered, the court may be sufficiently suspicious about the nature and strength of the defence that leave to defend is only granted on a conditional basis, such that security has to be provided for the claim. This ability, in some cases, to force a Defendant to provide security is another important advantage to the Plaintiff. It is also a major disincentive to the Defendant who may prefer to settle rather than tying up its capital as the case proceeds to trial.

It is of course recognised that the parties may agree, or the tribunal might be persuaded, to adopt a short form, expedited, procedure which could result in an award relatively quickly. In some circumstances, moreover, a tribunal might be persuaded to grant an interim or partial award.

In addition, it is appreciated that the courts are busy, the cause lists get full, and that there can be delays getting hearing dates. However, that is not an issue that only afflicts the judiciary: many international arbitrators are extremely busy and difficult to get hold of, and when you have tribunals of three, the problem is tripled. In any case, even where the Defendant does file affidavit evidence in opposition to an Order 14 Summons, and argues the application, the delays are likely to be measured in months rather than years.

Conclusion

The point overall is that whilst Hong Kong certainly is an arbitration-friendly jurisdiction, practitioners should not forget that arbitration is not the universal panacea. The arbitration community is constantly, and correctly, reminding clients and those advising them to take care when drafting jurisdiction and dispute resolution provisions, and in particular to get the arbitration clause right. And very often recommending arbitration is absolutely the right thing to do.

But sometimes it is also right to go back to basics. Appeals are useful for righting wrongs, and summary judgment can help Plaintiffs achieve their objectives relatively quickly.

This article was first published in the official journal of the Law Society of Hong Kong - “Hong Kong Lawyer” July 2017 issue. Please click to read the full article.

Editor's picks

Trending articles

By CGCC Vision

The Guangdong-Hong Kong-Macau Greater Bay Area is an important window for young people in Hong Kong to learn more about the country. With similarities in language and culture, as well as a convenient transportation network, the Greater Bay Area offers the young generation of Hong Kong much prospects to kick off new businesses.

Wong Hak-keung: Transforming into a New Start-up Cradle with GBA

Innovation and technology (I&T) is a key area of development for cooperation between Hong Kong and other cities in the Guangdong-Hong Kong-Macao Great Bay Area (GBA). The 50,000 or so jobs created at the Hong Kong-Shenzhen Innovation and Technology Park (HK-SZ I&T Park) when it is completed would create more opportunities for young professionals who aspire to pursue an I&T career.

Support for young professionals and start-ups

Albert Wong Hak-keung, CE O of Hong Kong Science and Technology Parks Corporation (HKSTP), pointed out that industrial and scientific research is indispensable to realize economic diversification.

Wong cited that the HKSTP holds a job fair every year to recruit science and technology talents and runs several start-up incubation programmes, which have produced great results. “Currently, about 650 local, Mainland and overseas technology companies operate in the park, employing a total of nearly 13,000 people. Nearly 300 of these companies are start-ups, while about 9,000 people are engaged in R&D, which comprises a high proportion of the total workforce. This shows that the HKSTP is providing opportunities for the next generation of professionals who have the interest and potential to build a career or business in I&T. Similarly, we are pleased to see more and more investors coming here to look for promising start-ups and create business opportunities with them.”

Help for I&T talents to realise entrepreneurial dream

The HK-SZ I&T Park, a joint development between Hong Kong and Shenzhen, covers an area of 87 hectares, four times the size of the HKSTP and is situated in an excellent location. Wong said the park can serve as an entrance for Hong Kong and overseas enterprises to access the vast Mainland market. It is also an outlet for Mainland enterprises to tap the international market through the Belt and Road initiative. It could combine the strengths of the two places, i.e. Shenzhen’s advanced scientific research and technology, and Hong Kong’s legal and land administration systems since the park is located in Hong Kong. Thus, this will fully reap the benefits of the “one country, two systems” policy to produce the best mutual benefit and win-win experience in I&T.