Chinese Mainland

Joint signing by Malaysian and Chinese businesses follows reactivation of two suspended BRI projects.

Malaysia is to get its first dedicated artificial intelligence (AI) industrial park. As part of a deal agreed at the recent Beijing-hosted Second Belt and Road Forum for International Cooperation, G3 Global Bhd, the Selangor-based business that is one of Malaysia's lead AI developers, signed a memorandum of understanding (MoU) with Hong Kong's SenseTime Group, a fellow AI developer, and the China Harbour Engineering Company (CHEC), a Beijing-headquartered civil engineering contractor, with a view to delivering on the project within the next five years.

With an estimated build cost of US$1 billion, it is hoped the completed park will rapidly establish itself as one of Asia's leading AI development platforms across a range of related disciplines, including computer vision, speech recognition, synthetic language development and humanoid robotics. It will also become a training hub, with a particular focus on AI and machine-learning skills.

Speaking after the signing of the MoU, a spokesperson for SenseTime said: "Ultimately, we envisage the park as becoming the regional epicentre for the development of technology and talent, data management and R&D in the AI field, as well as a self-sustaining commercial ecosystem."

Although full details of the project and its financing are yet to be released, it is believed that G3 Global's primary role within the consortium will be co-ordinating the overall development of the park. SenseTime, meanwhile, will be tasked with the implementation of the required supercomputing and AI systems, while also having a watching brief over the development of the park's technology training resources. This will leave CHEC to manage all the infrastructure requirements.

The move is very much aligned with Malaysia's long-term objective to establish itself as one of Asia's leading digital economies, a somewhat lofty aspiration given it is widely perceived as lagging behind neighbouring countries in terms of its current level of AI adoption. Indeed, a recent study jointly conducted by Microsoft and IDC Asia Pacific, a Singapore-headquartered technology-research consultancy, indicated that Malaysia is far from AI-ready and needs to step up its related data management and investment programmes.

In addition to providing a robust framework for the development of the park, the signing of the MoU has also been seen as a clear indication of Malaysia's willingness to once again become an active participant in the delivery of the overall objectives of the BRI, with the attendance of Mahathir Mohamad, the Malaysian Prime Minister, at the Beijing Forum giving added weight to that perception. This follows a period when a change of government saw many of Malaysia's BRI-related projects put on hold while the incoming administration reassessed their viability and reviewed the level of external debt the country was incurring.

The first signs that the Malaysian government was happy to return to the BRI party came in the immediate run-up to the Forum. First it was announced that China had agreed to reduce the fee structure related to the East Coast Rail Link project – a 640km train line connecting a number of Malaysia's key industrial zones with Port Klang, the country's largest maritime logistics hub – from MYR65.5 billion (US$15.6 billion) to MYR44 billion.

Days later, a second announcement broke the news that work would be recommencing on the construction of Bandar Malaysia, a 486-acre integrated property development. Once completed, this will comprise 10,000 affordable housing units and a people's park. As part of the revised deal that revived the project, a higher percentage of local workers are to be involved in its construction, while the use of domestically sourced materials is also to be prioritised.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

By 2022 Foundation

Many local and foreign companies are interested in the GBA and are exploring business opportunities in the region. The GBA will be a major experimental zone and a leader in reforms for China. Many things will happen first in the GBA and then will be rolled out elsewhere in China. This means companies can see aspects of China’s future in the GBA; can work on pilot projects and programs that will eventually spread to the rest of China; can seek out leading-edge Chinese partners for business inside and outside of China; can try out their own business models in the GBA first before bringing them to the rest of China; and can interact with China’s major initiatives, such as the “Belt- and Road,”, Made in China 2025, Internet Plus, Go Global, and the Digital Silk Road in the GBA. All of this argues that companies should have a strong presence in the GBA as a window into China’s future development and their opportunities within it.

The Hong Kong Trade Development Council (HKTDC) notes that the GBA is included in China’s national strategies, including in its 13th Five-Year Plan, and maintains that Hong Kong’s development will benefit from new opportunities that are created. In a May 2018 report, AmCham Hong Kong and Ipsos Business Consulting reported that 70% of 230 survey respondents were positive that operating in the GBA will increase their revenue and just over half of the respondents already have an office presence in the GBA. The top reasons given for expanding in the GBA were “access to consumer market of about 67 million people,” “to leverage benefits from the close connection between Hong Kong and the GBA,” and as a “launchpad into the rest of China / new export markets.”

The American Chamber of Commerce in South China’s 2018 survey found that Guangzhou ranked as the most popular city for investment among members followed by Shenzhen and then Shanghai and Beijing. This is the first time since the annual study commenced in 2003 that Guangzhou and Shenzhen took the top two spots. More than half of the 215 companies responding to the survey chose southern China mainly because of the potential for market growth, and most were confident that this growth would continue. Over 80% of respondents considered the business environment in southern China to be “good” or “very good.”

Interviews of business leaders by KPMG and the Australian Chamber of Commerce Hong Kong (AustCham) indicated that Hong Kong has a significant opportunity to benefit from the GBA initiative, and to participate in creating a globally competitive business region. A 2018 report by CPA Australia on a member survey with 351 responses indicated nearly half of the respondents intend to expand their business or career into the rest of the GBA in the next five years. According to business leaders interviewed by the Hong Kong Institute of Certified Public Accountants (HKICPA) in November 2017, the “GBA has the potential to be game-changing on a national level” and noted that some big accounting firms were already managing their resources from a “southern China regional perspective” with a view to better coordinating their Hong Kong and Guangdong operations.

A September 2017 KPMG and Hong Kong General Chamber of Commerce (HKGCC) report based on a survey of 614 business executives from around the GBA concluded that the GBA will be an important growth engine for the Mainland, with 90% of survey respondents indicating that the GBA is likely to have a positive impact on China’s economy, and that being part of the GBA will be good for Hong Kong. In 2018, KPMG, the HKGCC, and HSBC published results of a similar survey. Seventy-seven percent of the more than 700 respondents expect the GBA’s economic growth to exceed that of the rest of China over the next three years and 57% said that their company has a strategic plan for the GBA.

Identifying the Opportunities

There are five main sources of GBA-related opportunities for Hong Kong, Hong Kong people, and Hong Kong companies. These are opportunities that stem from the economic size and growth of the region driven by underlying economics and policy, from greater connectivity in the GBA, from further economic opening to Hong Kong companies, from people-centric policies and developments in the GBA, and from Hong Kong’s distinctive position through “One Country-Two Systems.”

Opportunities from Economic Size and Growth

The GBA has a population of approximately 70 million people and a GDP in excess of USD 1.5 trillion. If the population and economic projections made for the region hold, that will become at least 80 million people and USD 3.5 trillion in GDP by the early 2030s. By that time, the GBA’s GDP should be larger than all but four countries. Such a change not only would result in a larger market, it would result in a completely different market.

The consumer market will change dramatically with increasing affluence and the development of a more permanent population. The result will be a broadening and upscaling of the consumer goods market, the emergence of a medium and high-end consumer services market, and the emergence of a much larger market for public services and amenities.

The industrial market will also be transformed as GBA companies vertically integrate to add more value, source more of their inputs and equipment from within the region, and become more sophisticated in their use of producer services. The result will be a diversified regional economy, including light, medium, and heavy industry; high, medium, and low-tech industries; producer, consumer, and public services; final assembly, components, inputs, machinery, equipment, and supporting services; and so on.

Economic growth will not just take place in the existing core cities of the GBA (Hong Kong, Macao, Guangzhou, and Shenzhen), rather GBA development is rapidly spreading to what were once more peripheral cities in the region, which are becoming increasingly attractive as markets and production locations.

In addition to natural economic evolution, specific sectors will receive substantial support from Central, Provincial, and Municipal Governments in Guangdong. The Outline Development Plan calls for the specific targeting of dozens of sectors, including numerous high-tech industries, advanced manufacturing industries, business service sectors, education and medical services, logistics, leisure industries, and others. If the implementation is similar as for other Mainland documents of this type, that will mean streamlined approvals, land and infrastructure provision, R&D funding, education and training funding, preferential financing, and other government policies to support these industries. Many Hong Kong companies operating in the PRD cities of the GBA in these industries will be eligible for several types of support in the PRD. The Plan specifically calls for support of Hong Kong as an international maritime center, a business and professional service center, a financial center, a trade center, an aviation hub, a logistics and transport center, a legal and dispute resolution center, a commercialization center for regional innovation, and an IP trading center. All of these represent opportunities for Hong Kong.

Opportunities from Greater Connectivity

The opening of the Hong Kong-Zhuhai-Macao Bridge, the XRL, the new Liantang/Heung Yuen Wai Boundary Control Point, additional crossings across the Pearl River, and improved transportation within Guangdong is a game changer for Hong Kong. Better connectivity gives Hong Kong service providers the ability to reach much wider markets. Better connectivity gives Hong Kong manufacturing and trading companies much more choice in setting up supply chains in the region as well as a much better ability to sell into the GBA. Hong Kong companies, particularly SMEs, can also manage a much wider set of corporate activities, such as headquarters, R&D, marketing and sales, production, after sales service, and logistics across a much broader area than previously.

Better connectivity provides Hong Kong people with a much greater opportunity to either live in Hong Kong and work or study in Guangdong or live in Guangdong and work or study in Hong Kong. Better connectivity also opens up the entire GBA’s cultural and leisure resources to Hong Kong people to an unprecedented extent. It is now possible to wake up in Hong Kong, have breakfast in Shenzhen, lunch in Guangzhou, dinner in Zhuhai, catch a show in Macao, and return to Hong Kong all in one day. It is only a matter of time before Hong Kong people, particularly Hong Kong young people, are taking advantage of these resources.

The Plan calls for the completion of infrastructure projects already committed, such as the ShenzhenZhongshan Bridge, the Shenzhen-Maoming Railway, links to the Pan-Pearl River Delta provinces, and numerous projects inside the region. One goal is to reduce the travel time between any two major cities in the GBA to one hour or less. Once this achieved, these cities will be essentially integrated from a transport, logistics, and economic standpoint. The Plan also calls for significant streamlining of boundary crossing rules and practices to enhance intraregional flows. Specific mention is made of further improving connectivity to Hong Kong and streamlining Hong Kong-Mainland travel and boundary crossing.

Opportunities from Further Economic Opening

Hong Kong companies and people have already benefitted greatly from economic opening due to CEPA, the Guangdong Free Trade Zone, and numerous demonstration zones for Guangdong-Hong Kong-Macao service sector cooperation. The Plan commits to substantial additional opening that will benefit Hong Kong companies. It calls for the nine PRD municipalities to develop systems and regulations in line with advanced international practice for investment and trade. It calls for deepening the implementation of liberalization for the service sectors of Hong Kong and Macao under the respective CEPAs. It calls for cooperation between the Mainland, Hong Kong, and Macao in developing a wide range of professional services, cooperation that should result in additional opportunities for Hong Kong professionals. It calls for a strengthening of cooperation on dispute resolution, greater investment facilitation, greater trade liberalization (particularly for Hong Kong and Macao companies), expanding the scope of mutual recognition of professional qualifications, and facilitation of crossboundary practice in the GBA. It also encourages Hong Kong entities to set up research, development, and other innovation-related activities on the Mainland; opening of Mainland-funded research projects and activities to be open to Hong Kong entities and individuals; and the use of Hong Kong as a place to commercialize and internationalize developments in the GBA.

The Plan also provides specific roadmaps for further opening and reform in Qianhai, Nansha, Hengqin, and other cooperation or development zones. For Qianhai, the Plan calls for more extensive links with Hong Kong in high-end services, cooperation between the Qianhai Mercantile Exchange and Hong Kong Exchanges and Clearing Limited in commodities trading, developing platforms for trade cooperation and globalization, enhancing cooperation with Hong Kong in legal matters (including dispute resolution for the Belt and Road Initiative and IP protection). Nansha is to cooperate with Hong Kong and Macao in innovative development, financial services, and logistics. In Hengqin, the Plan calls for much more extensive cooperation with Macao, but also greater opening to Hong Kong. It supports several specific examples of cooperation with Hong Kong with Shenzhen, Dongguan, Foshan, Jiangmen, and others, and calls for support for each of the nine PRD cities to set up cooperation zones with Hong Kong and Macao, an initiative that could dramatically expand Hong Kong’s opportunities in several of the PRD cities.

Greater opening to Hong Kong and Macao companies and individuals is also specifically identified by the Plan in investment, trade, a wide range of financial services, transport, logistics, education, healthcare, accounting, legal services, arbitration, social services, cultural and creative industries, management consultancy, testing and certification, construction and engineering, and tourism. All of these represent significant opportunities for Hong Kong, Hong Kong people, and Hong Kong companies.

Opportunities from People-centric Policies and Developments in the GBA

Opportunities for Hong Kong can also be found in the people-centric policies and developments in the GBA, many of which are reflected in the Plan. The governments in the GBA have been working together on environmental issues for more than a decade. The Plan calls for the implementation of major conservation, restoration, and remediation projects in the region. It calls for more stringent implementation of environmental regulations; an increased focus on environmental protection; active programs to reduce air, land, and water pollution; and promotion of a clean, green, low-carbon environment.

The Plan also promotes progress and cooperation in education, culture, tourism, and social security to develop a quality living circle for living, working, and traveling. In education, the Plan calls for support for joint operations of institutions by Guangdong, Hong Kong, and Macao entities; encourage educational exchanges and mutual recognition of academic credits; bringing world-class universities into the region; encouraging and facilitating Hong Kong and Macao students to study in Guangdong; cooperate in vocational education; and encourage cooperation and exchanges for primary and secondary schools. The Plan calls for the development of a talent pool in the PRD drawing on Hong Kong Macao experience.

In culture, the Plan calls for cross-boundary programs to protect cultural heritage sites, organize cultural heritage exhibitions and performances, and support promotion of Lingnan culture. It also calls for joint promotion of cultural development, and specific programs related to the Hong Kong Palace Museum, the Xiqu Centre in the West Kowloon Cultural District, and Hong Kong-based creative talents and events, like the Hong Kong International Film & TV Market, the Hong Kong Book Fair, and the Business of Design Week. In tourism, the Plan calls for support for Hong Kong as an international tourism hub, and a cruise terminal center, as well as including Hong Kong in multi-destination tourism efforts and promotion.

In employment and entrepreneurship, the Plan specifically calls for efforts to make it easier for Hong Kong and Macao residents (particularly young people) to live and work in the Mainland. Experimental zones for employment and entrepreneurship for Hong Kong and Macao people are to be established in Qianhai, Nansha, and Hengqin. Local subsidies and support in the Mainland will be extended to qualifying Hong Kong entrepreneurs and SMEs and several Hong Kong and Macao youth innovation and entrepreneurship support programs are described. Since the release of the Plan, it has also been announced that Hong Kong people can be eligible for favorable tax treatment should they choose to work in the Mainland.

In the health area, the Plan calls for increased ability of Hong Kong and Macao healthcare providers to set up in the PRD, and for further cooperation with Hong Kong and Macao centers for Chinese medicine. It also encourages Hong Kong and Macao professionals to visit the PRD on academic exchanges and short-term private practice, and for cross-boundary consultation and referrals to be enhanced. The Plan also calls for exploring allowing Hong Kong and Macao resident working and living in Guangdong to the same treatment as Mainlanders for education, medical services, elder care, housing, and transport. If enacted, this would significantly reduce one of the issues that prevents Hong Kong people from living and working in the PRD. Hong Kong and Macao investors are also encouraged to establish social service institutions, such as elder care.

The result of all of these initiatives will be to improve the living environment in the GBA and to significantly increase the access of Hong Kong people to services and opportunities in the PRD.

Opportunities from “One Country-Two Systems”

The Central and local governments involved in the GBA are committed to the “One Country-Two Systems” arrangement, which includes separate membership of the People’s Republic of China, Hong Kong, and Macao in the WTO. These arrangements have been cited repeatedly by senior Chinese officials as key advantages for the region that provide substantial benefits to China as a whole. The Plan continues this policy:

To adhere to “one country, two systems” and act in accordance with the law. To integrate the adherence to the “one country” principle and the respect for the differences of the “two systems”, stay committed to the basis of “one country”, and leverage the benefits of “two systems”. To integrate the upholding of the Central Government’s overall jurisdiction and the safeguarding of a high degree of autonomy in the special administrative regions, respect the rule of law, and act strictly in accordance with the Constitution and the Basic Laws. To integrate the needs of the country with the strengths of Hong Kong and Macao, fully leverage the market-driven mechanism, foster complementarity among Guangdong, Hong Kong and Macao, and achieve joint development.

In fact, the Plan calls for taking “One Country-Two Systems” farther. Hong Kong is called a “core city” of the GBA which should be strengthened in its own right and through linkages with the rest of the region. Much of the Plan discusses streamlining the interaction between Guangdong (or the Mainland), Hong Kong, and Macao further through infrastructure, cooperation, and additional opening. Most of the additional opening is to provide Hong Kong and Macao companies and people with greater access to the Mainland, including in trade, investment, services, R&D programs, access for work, access to social services, and business support programs. At the same time, Hong Kong’s positioning as a market-oriented and open economy, with rule of law, advanced business environment, international linkages, strong capabilities, and a distinct system are also retained and emphasized. Many of the special aspects of Hong Kong and its economy are highlighted and its complementary nature with respect to Guangdong and the Mainland highlighted.

The net result of the provisions of the Plan is to reaffirm the commitment to “One Country-Two Systems,” while supporting Hong Kong to extend its present roles, take on new roles, and extend its cooperation with the rest of the region. Hong Kong’s major business sectors are acknowledged and supported, connectivity between Hong Kong and the rest of the region is streamlined, and substantial new opportunities for Hong Kong companies and Hong Kong people in the Mainland are described. The thrust is one in which Hong Kong will have additional new opportunities related to “One CountryTwo Systems” going forward.

GBA Opportunities for Hong Kong in Perspective

The opportunities for Hong Kong, Hong Kong people, and Hong Kong companies in the GBA are clearly enormous.

The combination of the GBA’s economic size and growth, Mainland support policies, increased economic opening, better connectivity, more comprehensive people-centric policies , and Hong Kong’s position under “One Country-Two Systems” provides opportunities for Hong Kong business to expand its traditional roles (in management, professional services, financial services, trade, logistics, and international marketing and sales) and develop new roles (as a clearing house for international idea flows, data and information flows, and new types of financial services). The same combination will allow Hong Kong to perform these traditional and new roles for traditional industries (assembly manufacturing, business and financial services, trade and logistics, etc.) as well as for new industries (including AI, big data analysis, new types of health services, the high-tech industries of the PRD, and the new heavy industries and services sectors in the PRD). The same combination will also allow Hong Kong to perform these traditional and new roles for traditional geographies (Hong Kong, Macao, Shenzhen, Dongguan, Guangzhou, and Foshan) as well as for new geographies (Zhuhai, Huizhou, Zhongshan, Jiangmen, and Zhaoqing). In fact, the largest economic opportunity for Hong Kong today is extending its roles, industry coverage, and geographic coverage in the GBA.

For Hong Kong people, the combination of the GBA’s economic size and growth, Mainland support policies, increased economic opening, better connectivity, and more comprehensive people-centric policies should provide opportunities to improve their employment and livelihood potential, their physical environment, their working and living options, their cultural and leisure opportunities, and enhance their overall well-being.

Further involvement in the GBA by Hong Kong people is a matter of choice. There are opportunities for those who wish to pursue them, but no requirement to pursue them for those who choose not to. However, the GBA initiative literally opens new horizons for many Hong Kong people and for the first time provides a realistic possibility of Hong Kong and Hong Kong people having a real “domestic market” and “hinterland” behind them and not being as limited by space constraints, congestion, high costs, and the business and employment opportunities of a small and specialized economy. Hong Kong’s future is linked to that of the GBA and in many ways, the level of interaction that could make the GBA one of the world’s “super regions” has just begun.

Please click to read full report.

Editor's picks

Trending articles

Responding to the launch of the Belt and Road Initiative (BRI) and looking to expand by “going out”, many mainland businesses are actively investing in infrastructure construction projects in countries along the Belt and Road routes, as well as making forays into mature markets abroad. However, with the global economic climate becoming more uncertain in recent years, they face grave challenges, and as a result are looking to strengthen their risk management. One of these companies, a leading Shanghai group specialising in electric equipment, has adopted a strategy of using Hong Kong’s professional services to avoid risks in outbound investment while at the same time taking advantage of Hong Kong’s financial market to optimise its financial structure and funding sources, so that its overseas business can achieve sustainable development.

Ensuring Compliance in Overseas Markets

(Photo courtesy of Shanghai Electric)

Representatives from HKTDC Research and the Shanghai Municipal Commission of Commerce recently interviewed Shanghai Electric Group Co[1] at its headquarters. During the interview, the group confirmed that it is currently expanding the functions of its Hong Kong subsidiary in order to take advantage of the territory’s excellent professional and financial services and help develop Shanghai Electric’s engineering projects overseas.

According to Shanghai Electric, when making offshore investments, the group needs the support of sound professional services. An example of this is its use of Hong Kong’s legal and accounting services to carry out due diligence investigations of the legal, business and market environments of its investment destinations, in order to ensure that the group’s overseas business operations comply with local laws and regulations, construction projects are implemented according to law, and financial risks are professionally managed. This ensures that the sustainability of its construction projects can be guaranteed.

The group also needs staff with a great deal of international exposure and management experience to ensure that its overseas business is managed well. Professional services can help the group localise and manage its overseas business, including day-to-day project management and subcontracting, and also keep the group abreast of local market intelligence and developments in the business environment so that it can respond promptly and appropriately.

Shanghai Electric is the largest comprehensive electric equipment manufacturing group in China. Its core products include high-efficiency clean-energy equipment, new-energy and eco-friendly equipment, industrial equipment, and modern services. The group currently has 47 business arms around the world, including 26 subsidiaries, seven branch companies, five overseas technical centres, and nine offices. The sales revenue of its overseas business in 2018 was RMB11.2bn, accounting for 11% of the group’s total business revenue. This included sales to more than 30 BRI countries.

Strong Demand for Risk Management Service

The global spread of the BRI, which covers Europe, Asia and many other countries and territories, creates huge potential for market growth. At present, Shanghai Electric mainly focuses on developing energy projects in more familiar surroundings, such as Asia and certain African countries. These projects include:

(1) offshore power plants - power plant EPC (engineering, procurement and construction) and energy island projects in 25 countries including Pakistan, India, Indonesia, Thailand and Tanzania; and

(2) offshore power transmission and distribution facilities - constructing a large number of 220kV power transformers and over 1,300 km of power transmission lines in Ethiopia, Angola, Cameroon, Djibouti, Sri Lanka, Pakistan, Malaysia and Kuwait.

It is worth noting that many BRI countries are currently undergoing political realignments which may lead to changes in investment policies. This, coupled with the absence of a sound legal system in some of these countries, undoubtedly creates a great deal of uncertainty for overseas investors. Moreover, most of the countries along the BRI routes are developing or emerging economies, with some of them undergoing significant economic transformation. This tends to create a lack of information about these markets, which makes it difficult for businesses to gain a good understanding of local practices and market changes, and thus creates extra risks for investment projects. Investors, therefore, are in dire need of professional services which can give them a clear picture of the local market and map out the right risk prevention solutions. Companies entering overseas markets may need help countering trade remedy measures such as anti-dumping and anti-subsidy policies, avoiding potential political and market risks, formulating suitable contingency plans, recovering account receivables and loans, protecting intellectual property rights, and circumventing obstacles to trade.

Overcoming Difficulties in BRI Projects

While many countries and territories along the BRI routes have a strong demand for infrastructure construction, industry leaders from Europe, the US, Japan and South Korea have already gained an upper hand in many of these markets and mainland enterprises “going out” face fierce market competition. Moreover, with companies from these regions already taking the lead in setting business practices and industry standards, “Made in China” and “Chinese Standards” are struggling to gain influence and acceptance on the international market. As a result, mainland enterprises may not be able to use their China experience to enter BRI markets successfully. In view of this, they desperately need partners and management personnel with international project management experience and an in-depth knowledge of overseas infrastructure construction systems to help them capture global business opportunities.

Explaining why this means that it looks to Hong Kong for assistance, Shanghai Electric told us: “As well as recruiting more talents to help manage overseas projects, the group also has to deal with the problem of over-concentration of investment and financing modes for its overseas business. As such, the company cannot optimise its capital sources to find the most cost-effective way to invest in BRI projects.

“Hong Kong has a great deal of experience in infrastructure construction of an international standard. As Hong Kong’s construction companies and talents are not only well-versed in Chinese and western cultures but also in the business practices in international markets, they can effectively help Shanghai Electric as well as other mainland enterprises to implement overseas infrastructure investment projects.

“Also, Hong Kong, being a highly efficient financial platform and financing hub, has attracted a cluster of construction companies from all over the world as well as a great diversity of infrastructure project investors, bankers and other financial institutions. This, coupled with Hong Kong’s multiple financing channels and sound professional services, can provide more financing solutions and financial options for the group.”

Shanghai Electric is currently accelerating the conversion of its Hong Kong subsidiary into a fully-fledged offshore base providing comprehensive support to the business development of the group. At the same time, the group is taking advantage of Hong Kong’s excellent financial services to provide a full range of services to its overseas engineering projects, including traditional loan and bond financing/guarantee/letter of credit services, investment services in the form of funds, offshore capital and exchange risk management, and so on. This in turn helps to fuel the company’s drive to “go out” and invest in engineering projects overseas.

[Remark: For more information, please refer to HKTDC research article: Hong Kong as the Major Service Platform for “Going-out” Enterprises: 2019 YRD Survey Results]

Editor's picks

Trending articles

By Agatha Kratz, Associate Director, Rhodium Group

Allen Feng, Senior Analyst, China Markets Research Team, Rhodium Group

Logan Wright, Director, Rhodium Group

A new study published by the Rhodium Group brings to light new data on the question of the “debt trap”. Here are the researchers’ three main findings:

-

Debt renegotiations and distress among borrowing countries are common. The sheer volume of debt renegotiations points to legitimate concerns about the sustainability of China’s outbound lending. More cases of distress are likely in a few years as many Chinese projects were launched from 2013 to 2016, along with the loans to finance them.

-

Asset seizures are a rare occurrence. Debt renegotiations usually involve a more balanced outcome between lender and borrower, ranging from extensions of loan terms and repayment deadlines to explicit refinancing, or partial or even total debt forgiveness (the most common outcome).

-

Despite its economic weight, China’s leverage in negotiations is limited. Many of the cases reviewed involved an outcome in the favor of the borrower, and especially so when host countries had access to alternative financing sources or relied on an external event (such as a change in leadership) to demand different terms.

Please click to read full report.

Editor's picks

Trending articles

China, the world’s second largest economy, enjoys vibrant trade and economic ties with international communities. Although the world economy is affected by uncertainty due to the recent trade conflict between China and the US, many mainland Chinese enterprises are still pursuing their “going out” and “bringing in” strategies with the aim of opening new markets and diversifying their market risks. They are also looking to improve their sustainable development capability by bringing in outside partners and optimising their business portfolios.

Against this backdrop, mainland enterprises increasingly need professional services that are in line with international practices to support their growing international business, while helping them adapt to the increasingly complicated investment environment. Shanghai and the coastal provinces in the Yangtze River Delta (YRD) are among the centres for economic cooperation with foreign countries, as well as major sources of outflows of foreign direct investment (FDI) in China. Enterprises in these areas are actively seeking professional services to help them improve their “going out” strategies.

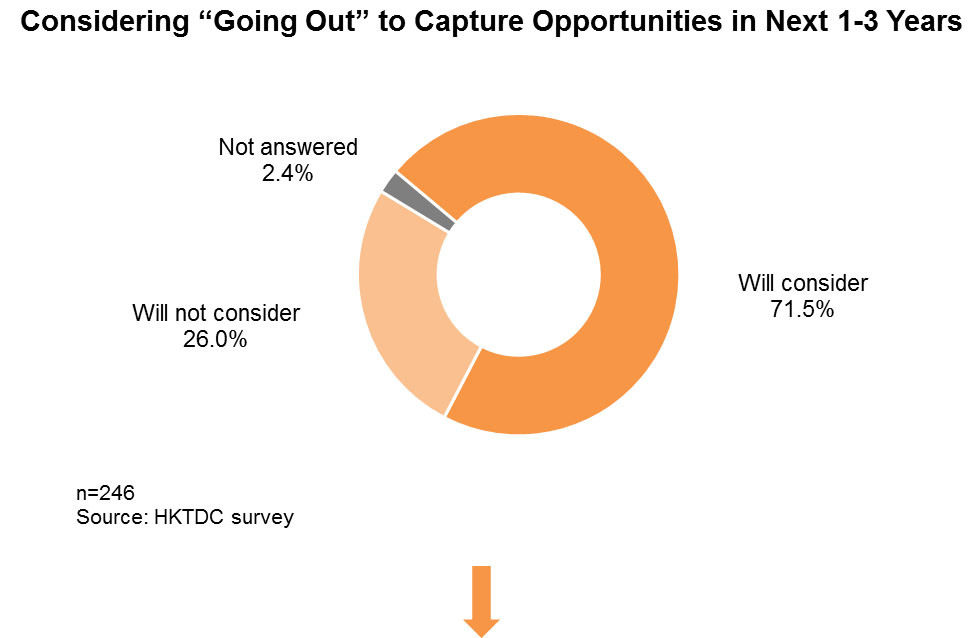

To assess the latest developments, HKTDC Research conducted a new round of questionnaire survey with mainland enterprises in the YRD in the first quarter of 2019, with the support of the Shanghai Municipal Commission of Commerce. Despite the on-going China-US trade dispute, 72% of the mainland enterprises surveyed said they would consider exploring business opportunities in overseas countries in the next one to three years, including the advanced economies as well as those along the Belt and Road Initiative (BRI) routes. Of these, 45% indicated that Hong Kong was their preferred choice when seeking professional services outside the mainland. Among those mainland enterprises with clear overseas destinations in mind, more than half said Hong Kong was their preferred service platform for “going out”.

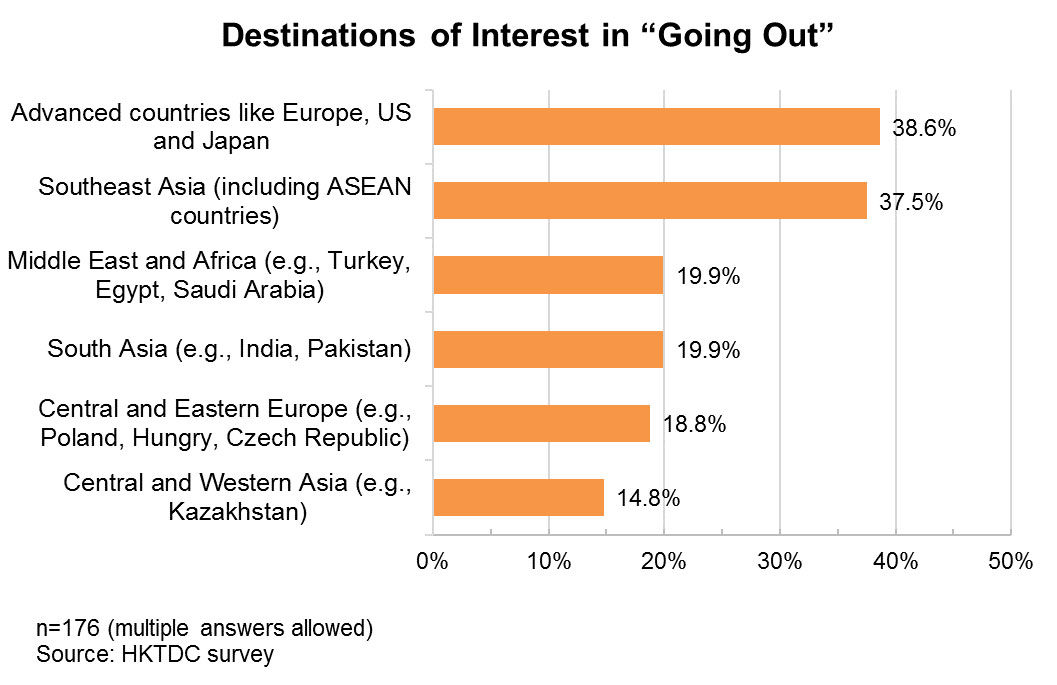

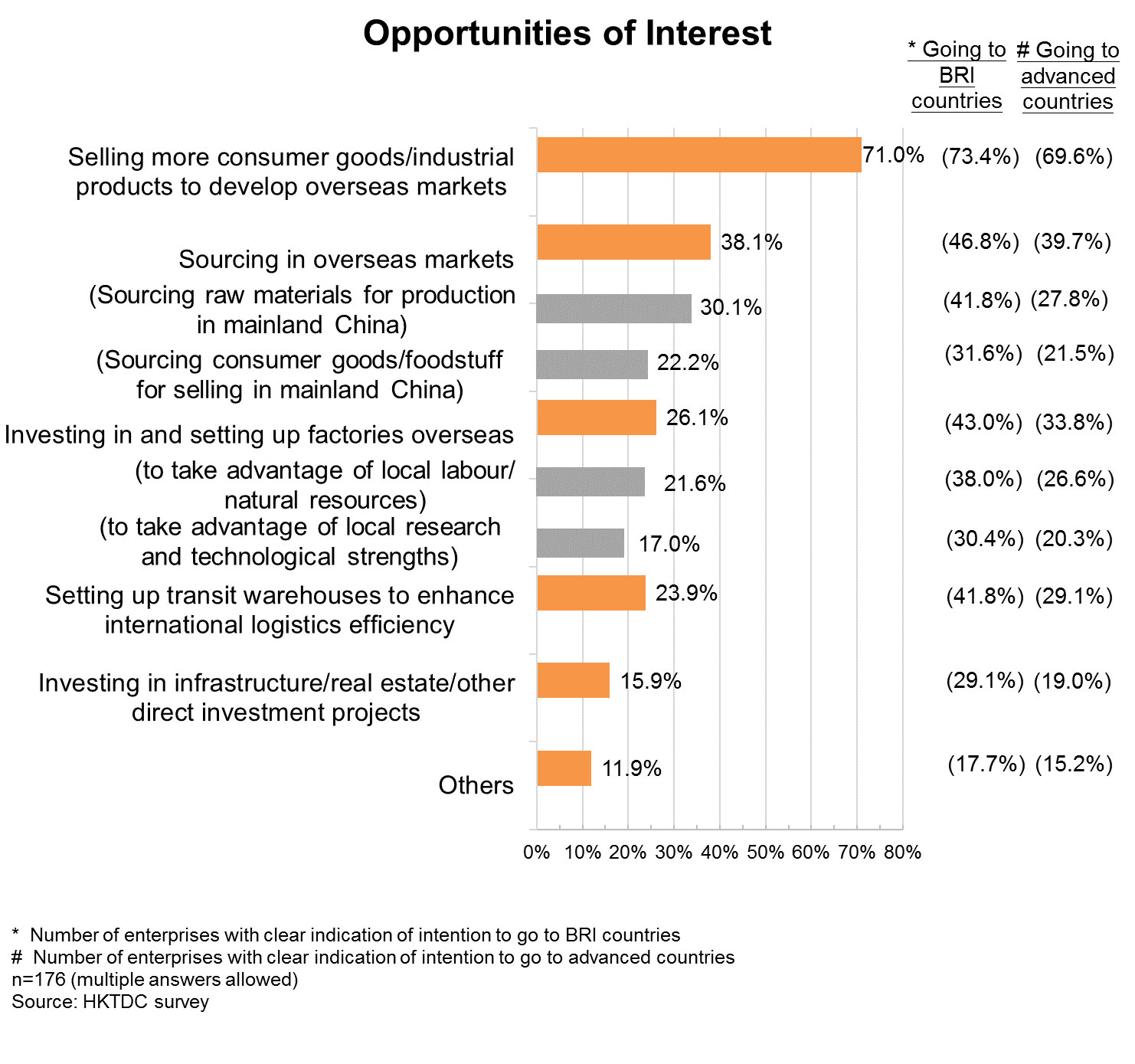

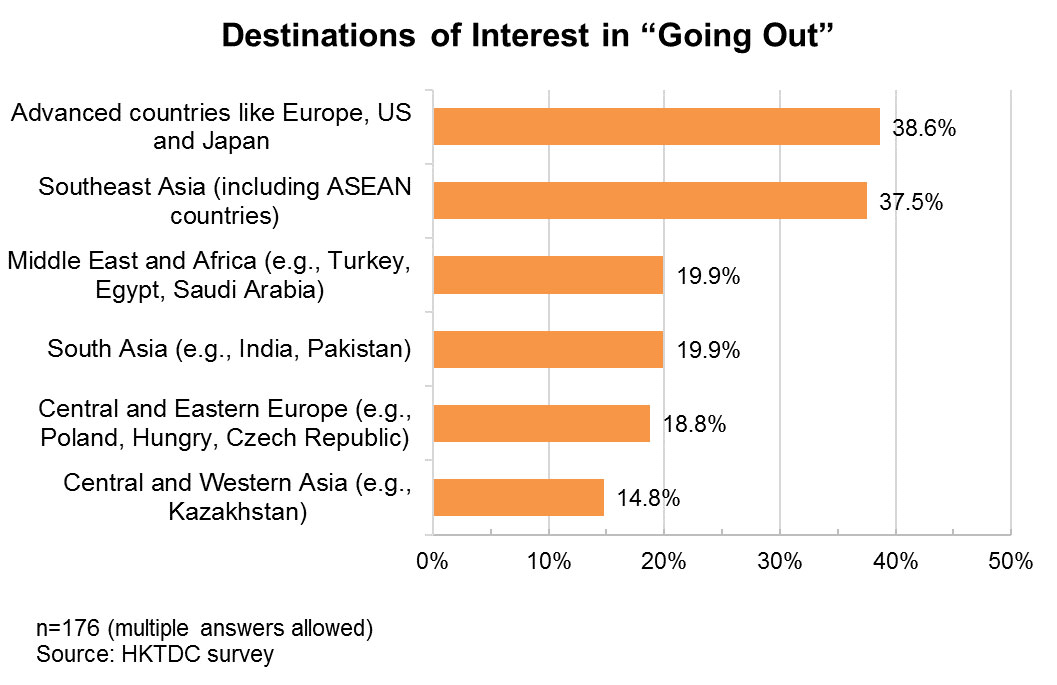

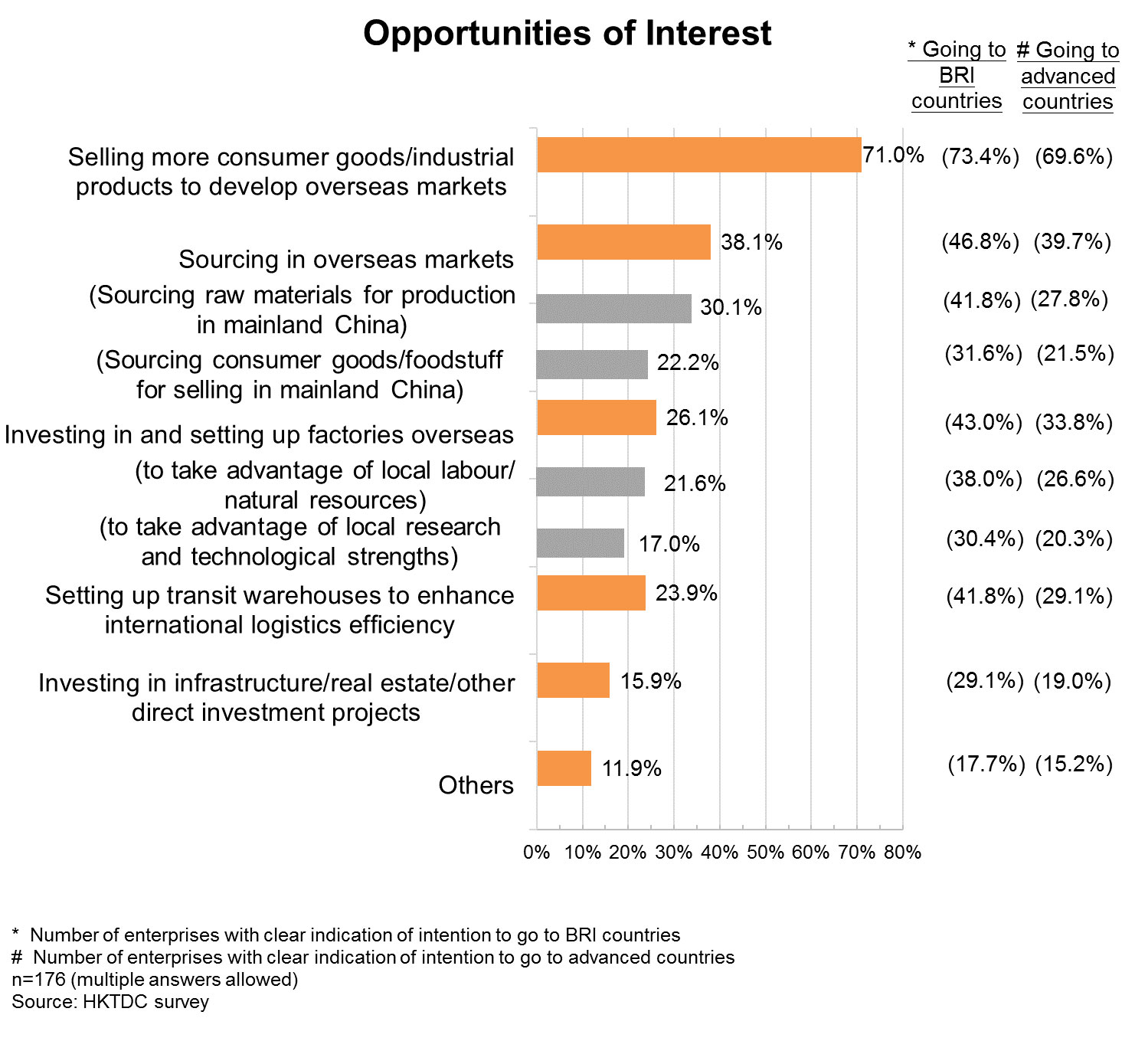

Overseas destinations that respondents showed the greatest interest in exploring included advanced economies such as Europe, the US and Japan (39%) and BRI regions like Southeast Asia (38%). 71% said they were interested in selling more products to overseas markets, 38% were looking to source goods abroad, while 26% were looking to invest in and set up factories.

Hong Kong service suppliers have been providing a wide range of professional services to mainland enterprises and helping them conduct trade and investment activities in Hong Kong and overseas markets for many years. Their services make Hong Kong the preferred platform for mainland enterprises to manage their “going out” businesses. Further efforts by mainland/YRD enterprises to capture overseas business opportunities are therefore bound to generate more business for Hong Kong.

“Going Out” to Expand Business Overseas

Mainland enterprises are increasingly involved in economic activities overseas. China’s foreign trade volume stood at US$4.6 trillion in 2018, higher than any other country [1]. Total trade with BRI countries amounted to US$1.3 trillion, up 16.3% from the year before, and accounted for 27.4% of China’s total foreign trade last year. On the other hand, China was ranked as the second-largest source of FDI outflows only after Japan last year [2]. Chinese figures showed that outflows of FDI in non-financial sectors by mainland investors totalled US$120.5 billion in 2018 (up 0.3% year-on-year), and encompassed 5,735 companies in 161 different countries and regions [3]. FDI outflows to BRI countries in particular saw sustained growth. Direct investments in non-financial sectors by Chinese enterprises in 56 BRI countries reached US$15.64 billion, up 8.9% year-on-year and comprised 13% of China’s total non-financial FDI outflows last year. Most of this was in countries like Singapore, Laos, Vietnam, Indonesia, Pakistan, Malaysia, Russia, Cambodia, Thailand and the United Arab Emirates. [4]

Despite the uncertain world economic outlook, China is still promoting its “going out” and BRI development strategies and encouraging enterprises to go overseas to capture business opportunities. “Going out” has become an important driving force for the development of mainland enterprises. As Hong Kong has always been the preferred service platform for these enterprises, further “going out” and the development of BRI is expected to spur demand for various types of professional services from mainland enterprises.

HKTDC Research conducted a questionnaire survey with mainland enterprises in Shanghai and Jiangsu, visiting some of these enterprises and holding business forums with the support of the Shanghai Municipal Commission of Commerce in the first quarter of 2019 to find out more about the challenges facing businesses in the region. The survey also considered how these enterprises were adjusting their business strategies, their intention of “going out” to mature markets in advanced countries or BRI countries, and their demand for relevant professional services.

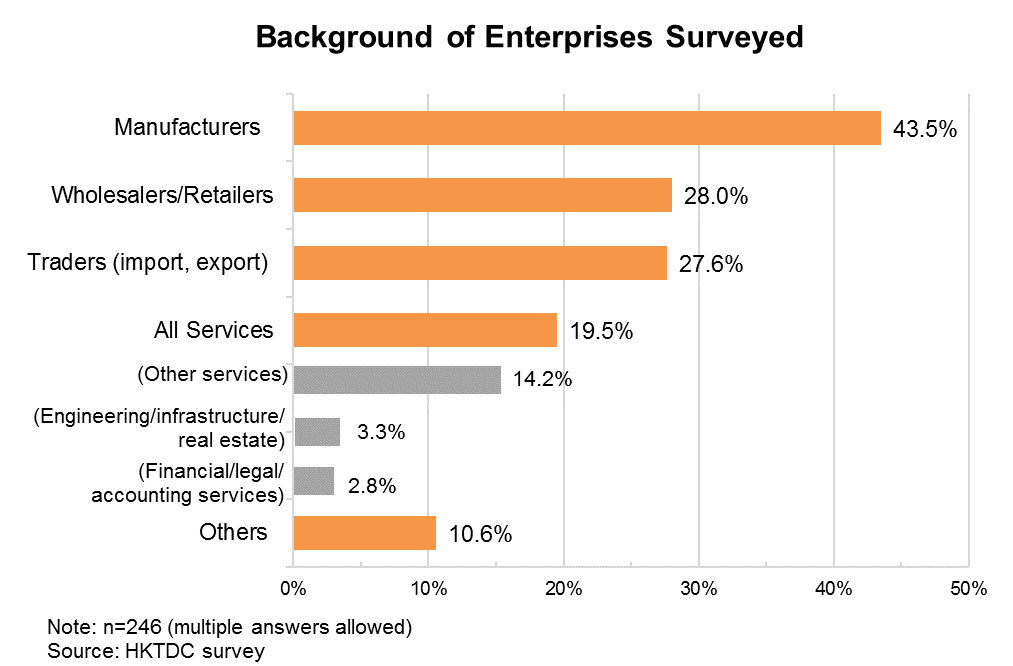

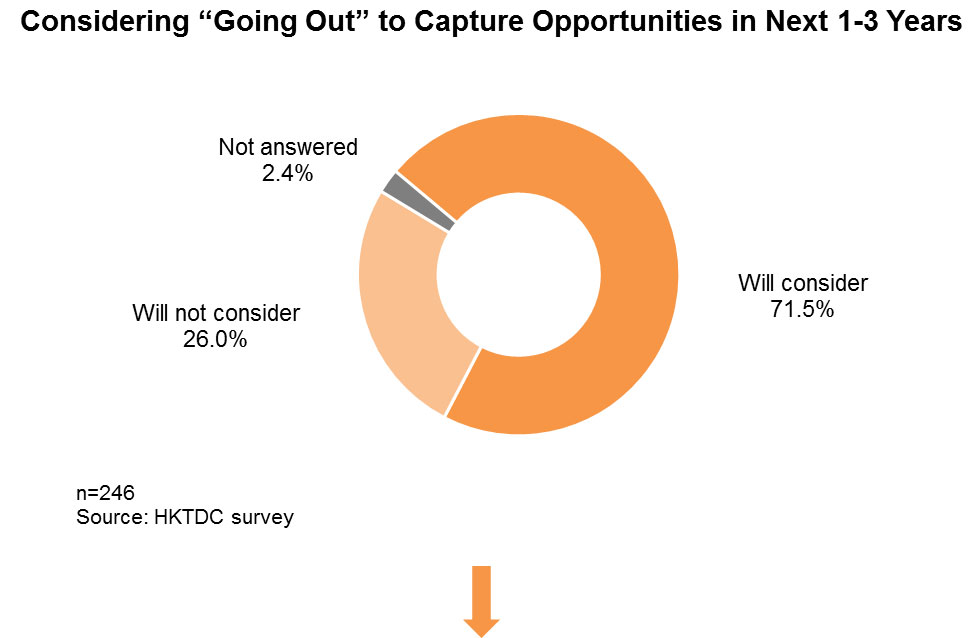

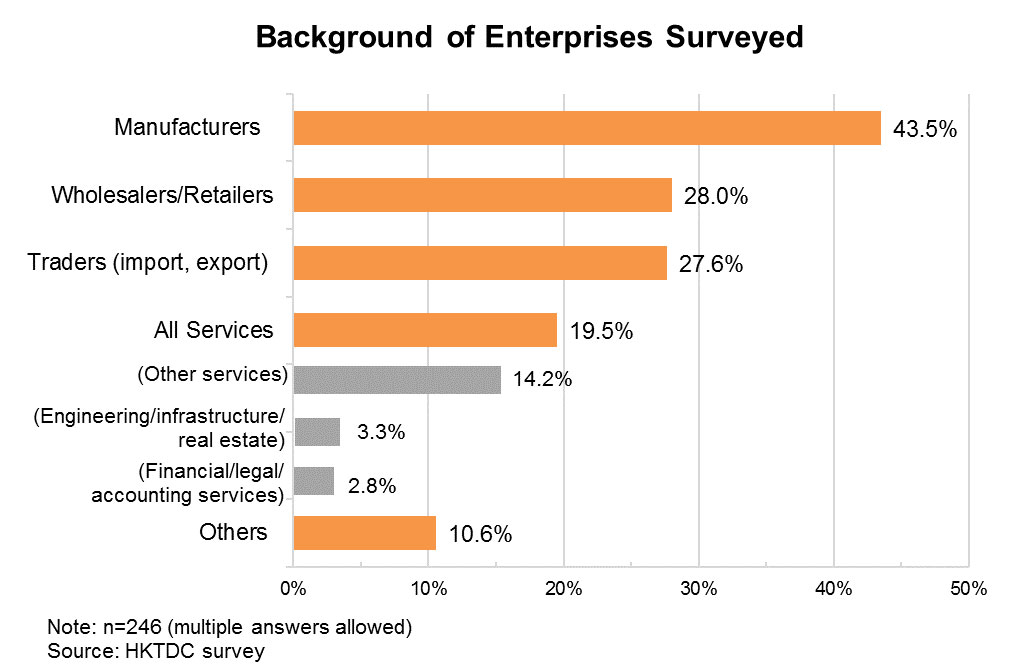

This survey was similar to the one conducted by HKTDC Research in 2016-2017. This time a total of 310 questionnaires were collected. Of these, 246 valid questionnaires were completed by mainland enterprises, including manufacturers, traders and service suppliers. What follows is a summary of the views expressed by these 246 mainland enterprises on “going out” to develop business overseas.

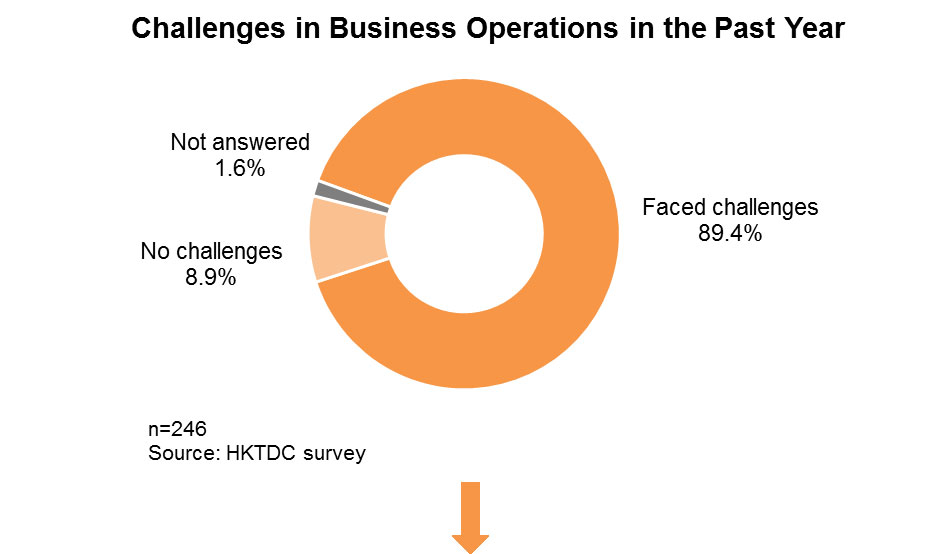

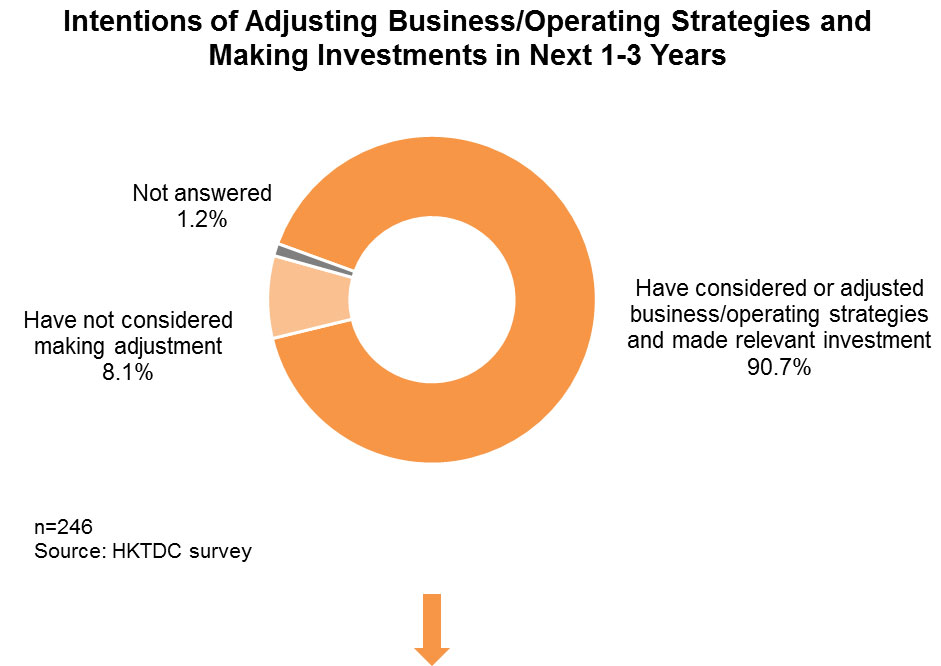

Major Challenges: Inadequate Orders and Rising Costs

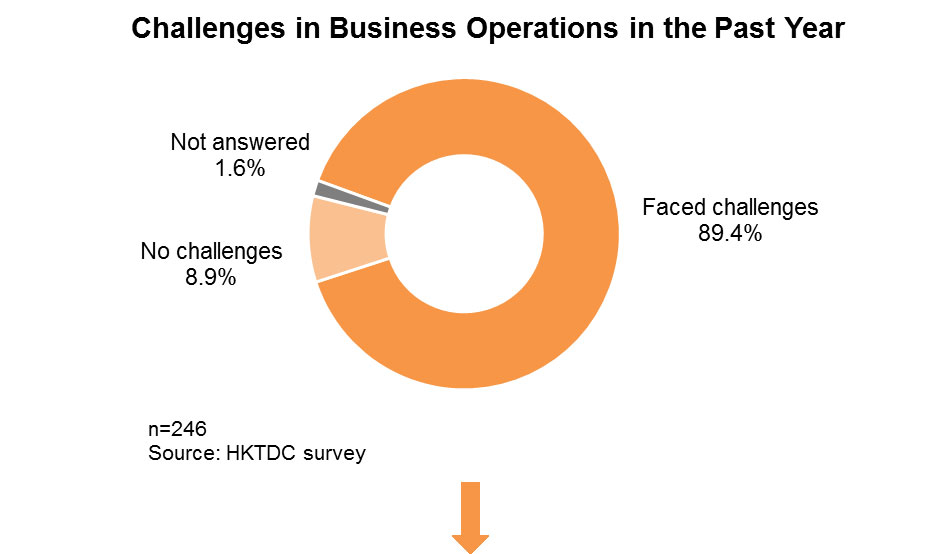

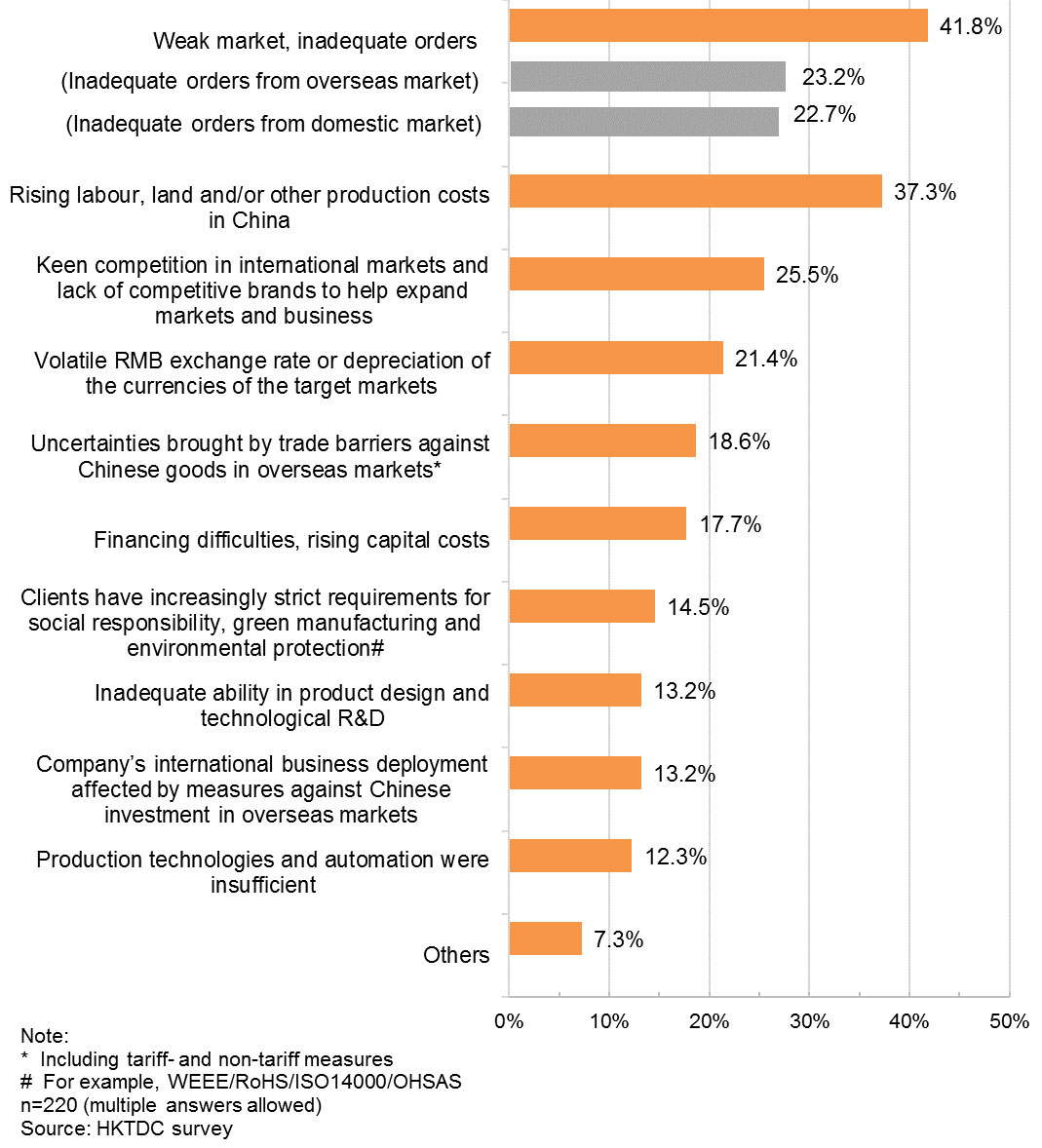

89% of the respondents said their business operations faced a variety of challenges over the past year. 42% said their foremost concerns were weak overseas and local markets and inadequate orders, while 37% said they were affected by rising labour, land and/or other production costs on the mainland. Other challenges included keen competition in international markets/lack of competitive brands (25%), a volatile RMB exchange rate (21%) and uncertainties caused by trade barriers against Chinese goods in overseas markets (19%).

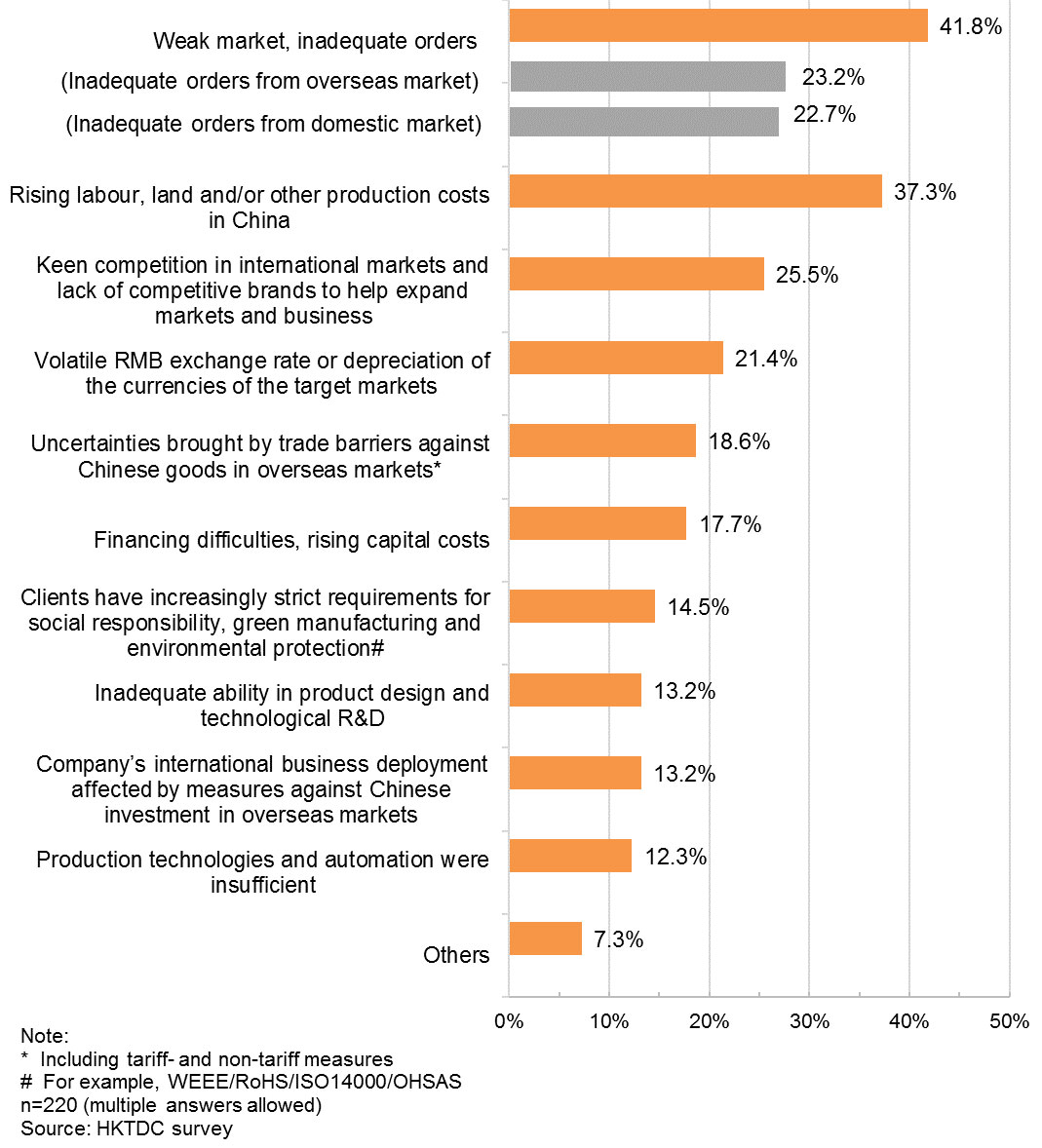

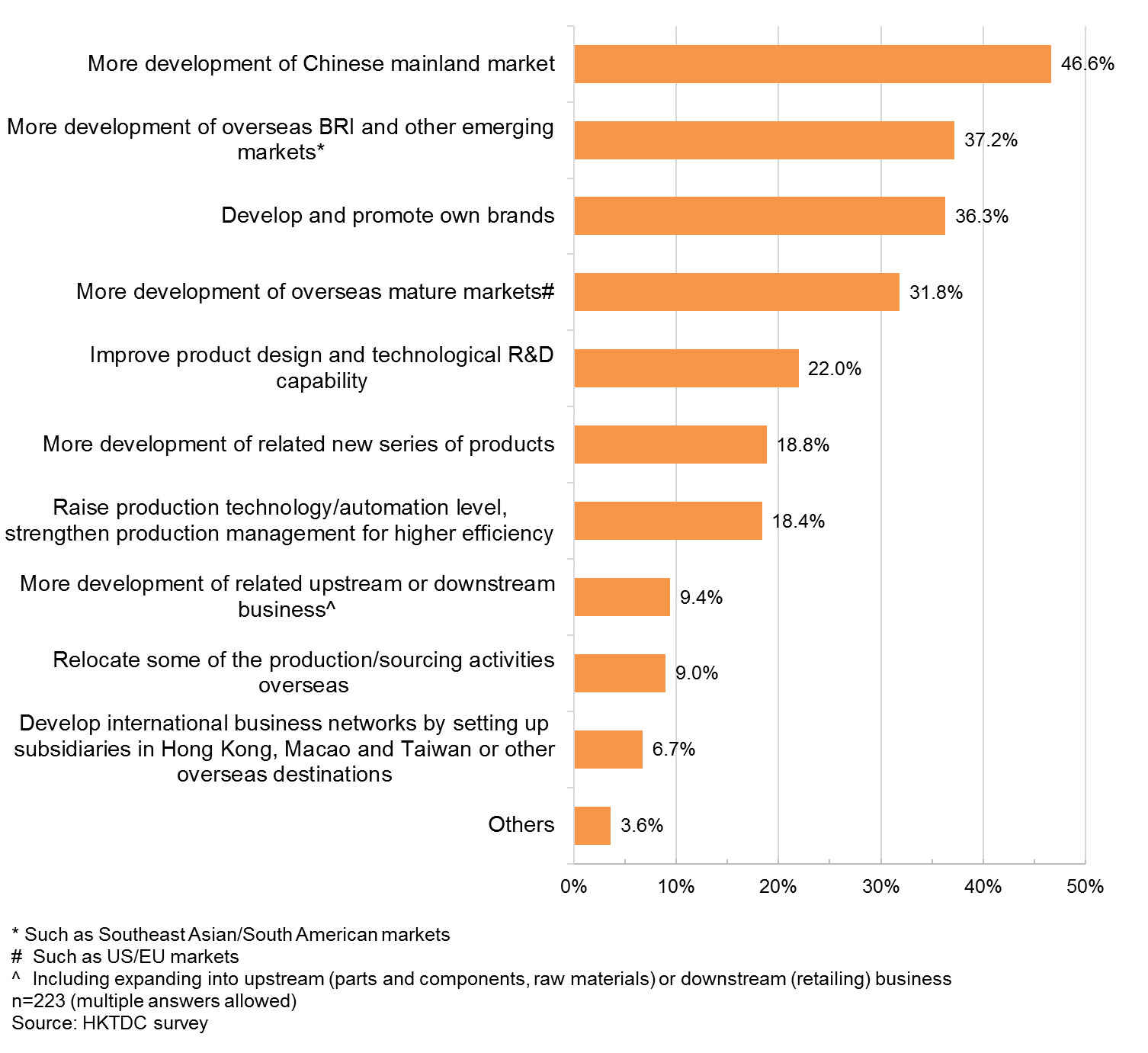

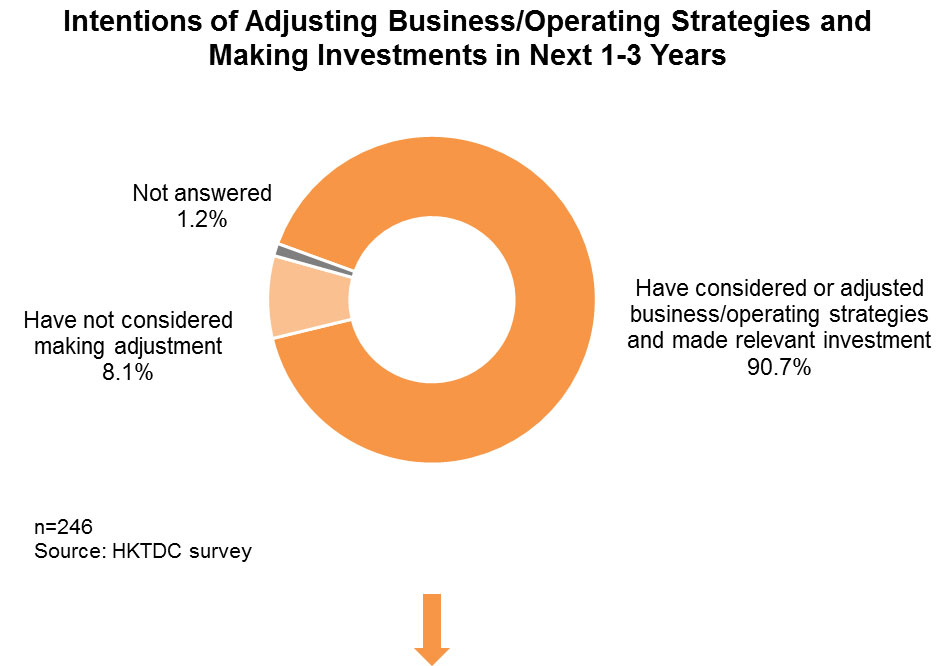

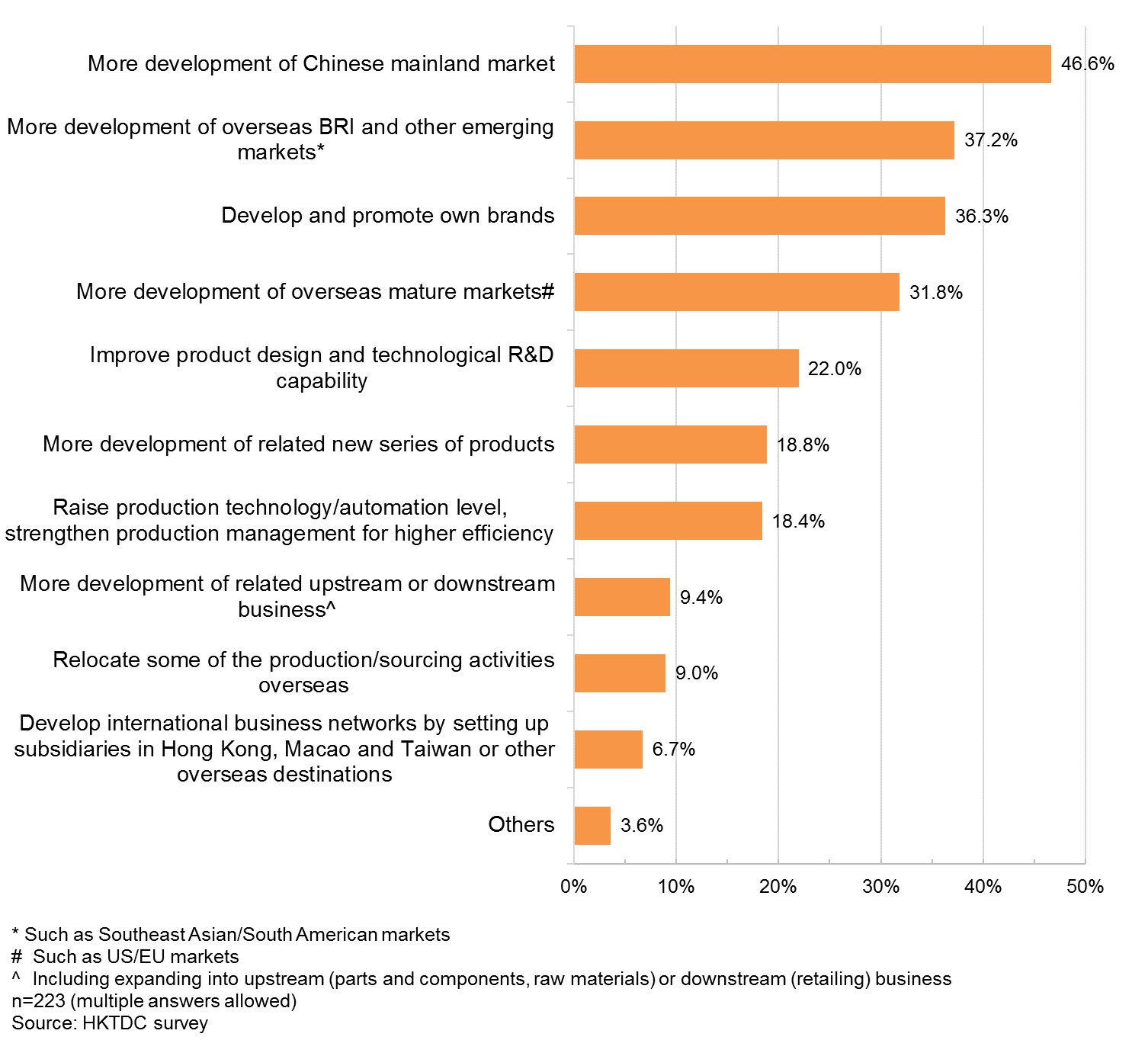

Stepping up Business Development in mainland China and BRI Markets

To tackle these challenges, 91% of the enterprises polled indicated they would consider adjusting their business/operating strategies and making relevant investments in the next one to three years, or had already done so. Among these, 47% indicated that their preferred option was to develop the mainland market, 37% said they would like to develop more BRI and other emerging markets (such as Southeast Asian and South American markets), and 36% said they would develop/promote their own brands. Meanwhile, 32% said they would focus on overseas mature markets, such as the US and the EU.

Continue “Going Out” to Develop International Business

Although the external investment environment is becoming increasingly complicated and the international market has been affected by the China-US trade dispute, 72% of the respondents still said they would consider “going out” to capture opportunities abroad in the next one to three years. Among these, 39% said they were interested in Europe, the US, Japan and other mature markets, while 38% said they would look to Southeast Asia, including the 10 ASEAN countries / other BRI countries. Only 20% said they would choose the Middle East and Africa, South Asia was also favoured by 20%, while 19% picked Central and Eastern Europe and 15% opted for Central and Western Asia.

Among those enterprises interested in “going out”, 71% said they hoped to sell more consumer goods/industrial products in overseas markets. 38% were interested in “going out” for sourcing activities, including 30% looking to source raw materials for production in mainland China and 22% wanting to source consumer goods/foodstuff to sell in the mainland. 26% said they hoped to invest in and set up factories for production overseas and 24% were looking to set up transit warehouses to enhance international logistics efficiency. 16% said they hoped to go overseas to invest in infrastructure/real estate and other direct investment projects.

It is worth noting that, whether enterprises were looking towards advanced economies or BRI and other emerging markets, there was little difference in their business interests. Their main objective was to sell more products to overseas markets and conduct sourcing from abroad, which suggests that most companies interested in “going out” are looking to develop in a similar direction.

HKTDC Research conducted workshops and visited some enterprises in the YRD with the help of the Shanghai Municipal Commission of Commerce to discover more about the wants and needs of mainland enterprises considering “going out”.

Remark: For further details, please see: Mainland Firm Uses Hong Kong Professional Services to Overcome Offshore Investment Challenges |

Keen Demand for Professional Services

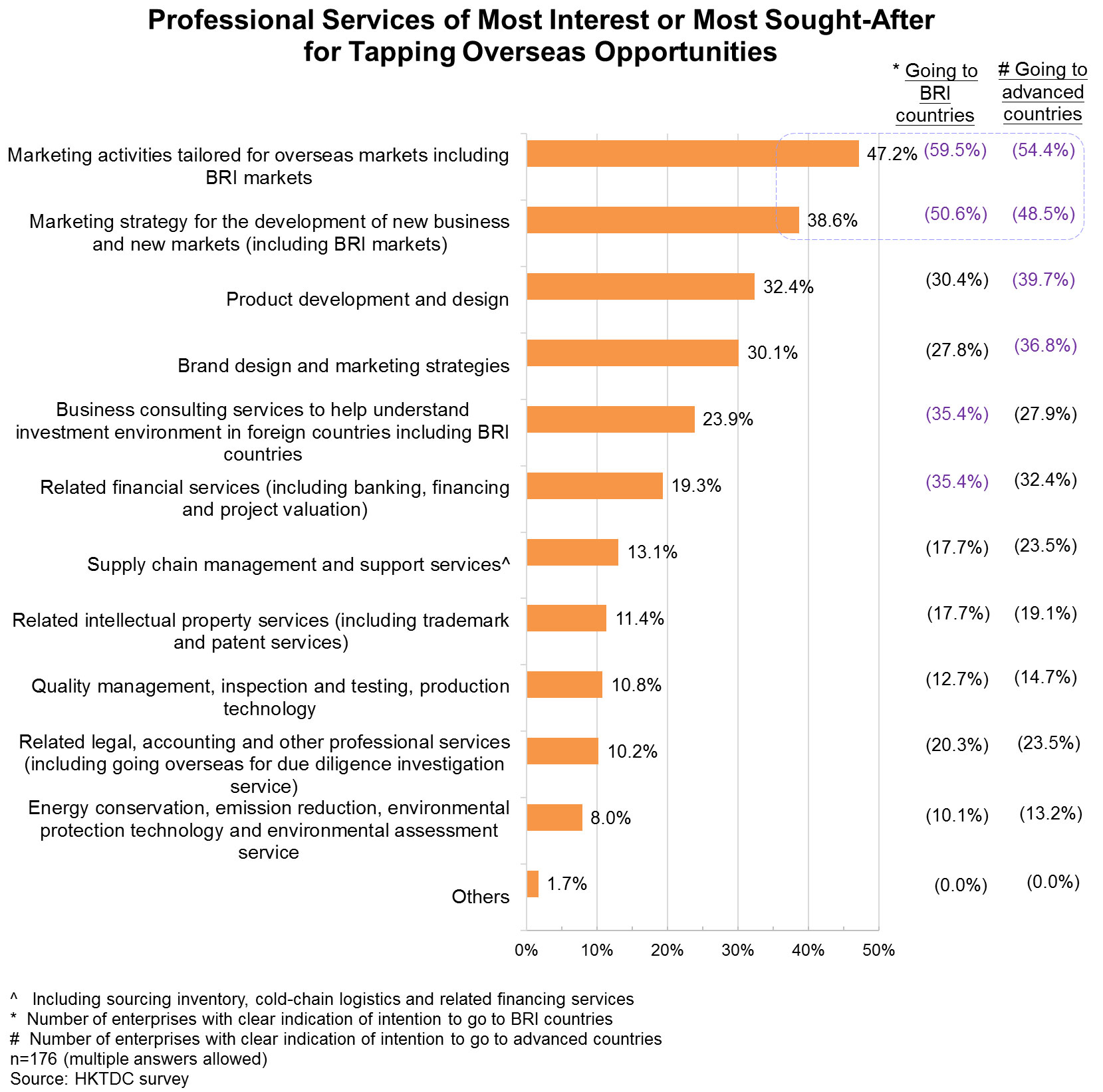

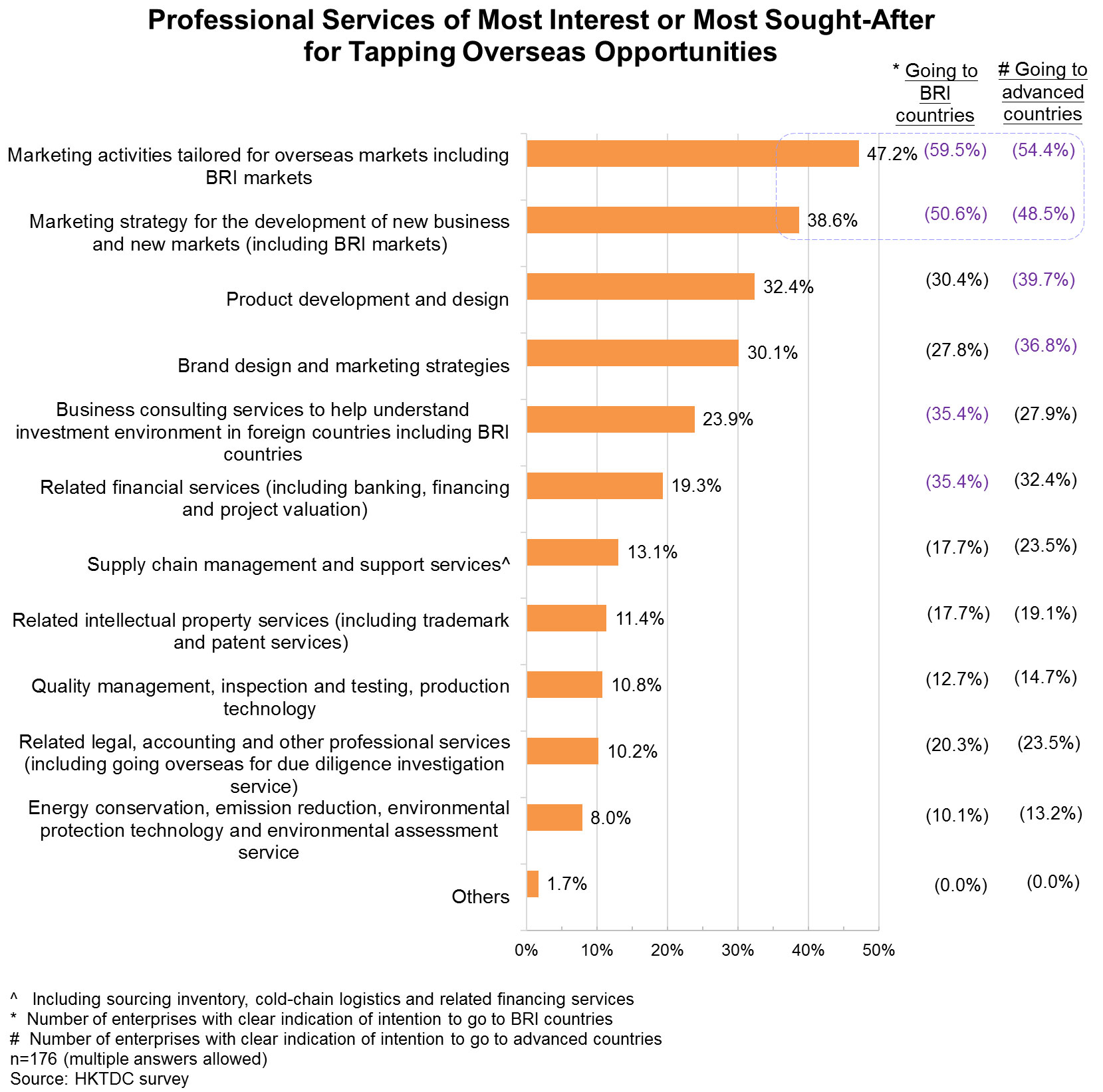

Most enterprises interested in developing their overseas business said they needed professional services support. Among those respondents considering “going out”, 47% said they were interested in marketing activities tailored for overseas markets, while 39% were looking for marketing strategies for the development of new business and new markets. Enterprises intending to develop BRI and advanced markets [5] all said they needed support in these two areas the most.

Many enterprises looking to tap into BRI opportunities also said they would require business consulting services to help understand the investment environment and related financial services (35%) in BRI countries. 40% of enterprises targeting advanced markets said they needed professional services’ support in the field of product development and design, while 37% cited a desire for help with brand design and marketing strategies.

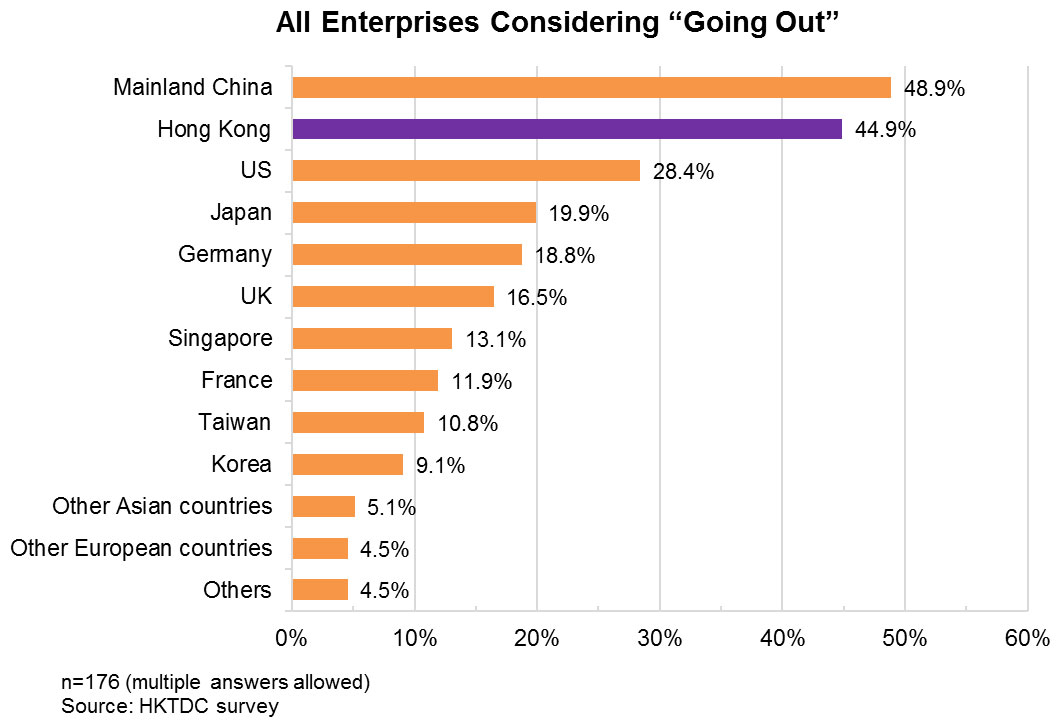

Hong Kong As Preferred Service Platform for “Going Out”

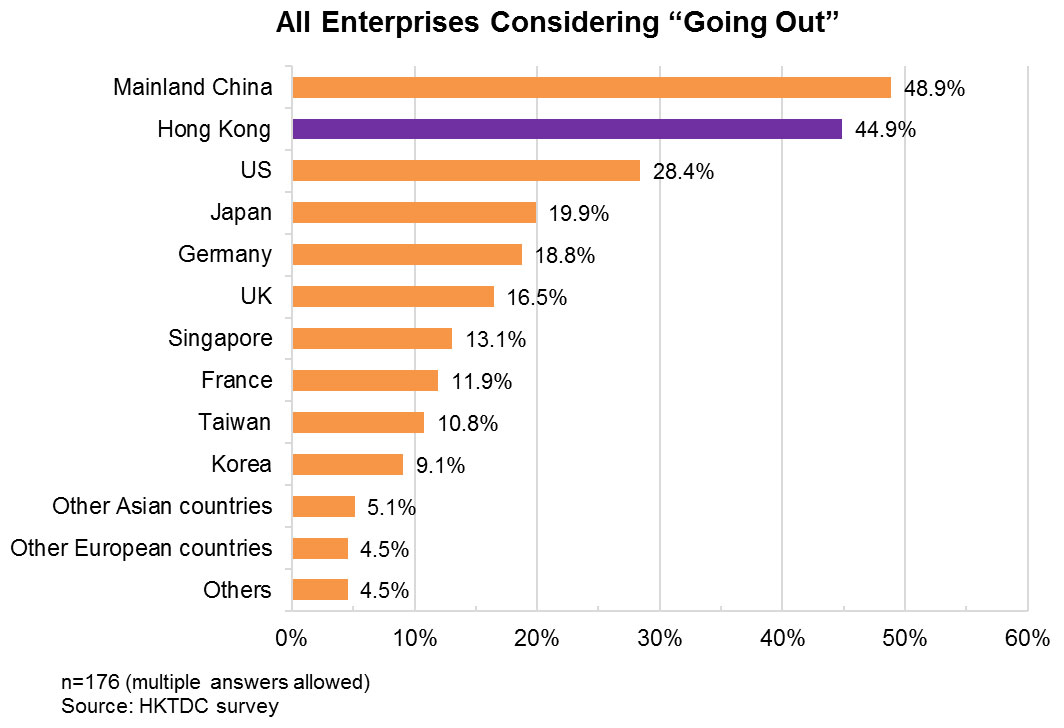

When looking for professional services support, nearly half (49%) of all enterprises considering “going out” said they would first try to source it locally. However, a significant number said they would also seek various professional services outside the mainland. Hong Kong was the preferred destination for 45% of enterprises considering “going out”. 28% said they also would look to the US, 20% to Japan and 19% to Germany.

Hong Kong was the top choice for professional services among those enterprises clearly indicating their intention to explore BRI opportunities, with 53% picking Hong Kong as their preferred location. Hong Kong was also the most preferred location among enterprises with a clear intention of “going out” to advanced countries (52%). However, among those enterprises without a clear “going out” destination in mind, most would first look for services support locally (58%) and only 30% would look to Hong Kong. Overall, though, the survey findings show Hong Kong is regarded as an important services platform for mainland enterprises considering “going out”.

Preferred Destinations for Seeking Professional Services

| Mainland China | Hong Kong | US | Japan | Germany | |

| All enterprises with “going out” intention, of which: | 48.9% | 44.9% | 28.4% | 19.9% | 18.8% |

| Enterprises with clear indication of intention to go to BRI countries | 50.6% | 53.2% | 34.2% | 25.3% | 22.8% |

| Enterprises with clear indication of intention to go to advanced countries | 41.2% | 51.5% | 41.2% | 32.4% | 27.9% |

| Enterprises without clear indication of destination | 58.0% | 30.1% | 17.5% | 13.3% | 9.8% |

n=176 (multiple answers allowed)

Source: HKTDC survey

HKTDC Research would like to acknowledge the help extended by the Shanghai Municipal Commission of Commerce in conducting the survey.

[1] Source: China Customs, World Trade Organisation

[2] Source: “World Investment Report 2019”, UNCTAD

[3] Source: Ministry of Commerce of China

[4] Source: Ministry of Commerce of China

[5] Do not include the number of enterprises that only indicated they would consider “going out” but did not have a clear destination.

Editor's picks

Trending articles

The Asia Pacific region is the world’s fastest-growing semiconductor market. Many key global players in the automotive, mobile, and computer sectors have their headquarters or operate in China, Japan or South Korea, while Greater China (the mainland, Hong Kong, Macao and Taiwan) is the world’s leading region for ODMs (Original Design Manufacturers) and EMS (Electronic Manufacturing Services) providers.

Over a period of some 40 years, STMicroelectronics has established itself as a major player in the Asia Pacific region’s semiconductor industry. In terms of revenue, the company is among the top 10. It began operations in Asia in 1969, setting up an assembly and test plant in Singapore. Since then, it has built a strong integrated presence in the region that spans mainland China, Taiwan, Hong Kong, India, Japan, South Korea, Malaysia, the Philippines, and even Australia and New Zealand. It operates R&D, advanced IC design, and application support centres in Shenzhen, Shanghai, Beijing and Taipei, while Hong Kong plays a major role as one of its primary sales and marketing offices for the region, and as the base for one of the company’s three Asian distribution centres.

In addition, design centres in Singapore, India, and China provide customised design support to ST’s customers around the world, while competence centers in Beijing, Noida (India), Seoul, Shanghai, Shenzhen, Singapore, Taiwan and Tokyo deliver reference solutions, technical support, and joint development resources for a wide range of applications tailored to the needs of the local markets. Across the whole region, the company employs about 18,000 people.

‘Smart’ Uplift in the Greater Bay Area

ST is a business-to-business company focused on key applications for “smart” living – smart driving, smart cities, smart homes, smart industries and smart products. It is especially committed to R&D, with some 7,400 employees globally working on R&D and product design. Its major customers include mainland Chinese technology giant Huawei, Apple, Bosch, Cisco, Samsung and HP, while mainland display producer TCL and smart product firm Midea Technologies are also among its clients.

Explaining how the company is organised, Marco Longhi, Regional Business Controller for the Asia Pacific Region said: “ST’s manufacturing process is divided between front-end and back-end manufacturing, as well as research and development and sales and marketing.”

With the rapid growth of smart applications in China, and across the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) in particular, STMicroelectronics sees huge opportunities there. Longhi stressed the importance of the GBA to the company, saying: “Overall, the GBA will be of particular benefit for ST; we hope to take advantage of opportunities in Hong Kong, Shenzhen and other cities to match the expected explosive transformation of the IT ecosystem now underway.”

Damien Leconte, the company’s Key Accounts Senior Director for Asia Pacific market, pointed out that ST was one of the first foreign semiconductor firms to set up manufacturing in Shenzhen in 1994 and still maintains a joint venture factory there, which conducts a wide spectrum of assembly and testing procedures, while employing a staff of around 5,000. With sales offices in Hong Kong, Shenzhen, Guangzhou and Zhuhai, ST covers a very wide customer base across the GBA.

Hong Kong’s Leading Role

ST views Hong Kong as playing an interactive and increasingly significant role within the GBA. The company sees it as a GBA’s major sales, marketing, logistics and business connector, as well as a standard bearer for the Belt and Road Initiative (BRI). Furthermore, Hong Kong’s close relationship with the Shenzhen Special Economic Zone and the development of the proposed Lok Ma Chau Loop innovation and technology park on the boundary with Guangdong Province are expected to lead to the establishment of a more coherent international technology hub, which will be particularly focused on artificial intelligence (AI) and Internet of Things (IoT) research, and for bringing practical solutions to market.

Outlining Hong Kong’s advantages, Longhi said: “Regarding the availability of talent and resources, both Hong Kong and Shenzhen are viable locations. When we want to hire talent, we can find that quite easily, although very specialised technical staff resources are always hard to find, given the competition in the market.” He added that, in terms of operational costs, although Hong Kong is more expensive when it comes to wage expectations, it benefits from a lower and more straightforward tax regime.

Highlighting another of Hong Kong’s key advantages – the convenience and speed with which one can travel and meet business partners – Longhi said: “I see Hong Kong as an important site for distribution and for meetings and exchanges – we hold a lot of meetings there on a very frequent basis. Each quarter we organise one week of meetings which involve 200 to 300 visitors from Asia Pacific and Europe, both from ST and from our Asia distribution partners.”

Leconte also singled out Hong Kong’s standing as a jurisdiction with a high regard for protecting intellectual property (IP), which he said was a critical factor for a hi-tech company like ST and was why many of the company’s commercial agreements relating to China are arranged under Hong Kong law. Hong Kong’s mature financial and banking system is another advantage available, although as Longhi admitted, ST – which has its main headquarters in Switzerland – does not particularly need local financial services for capital market launches for the time being.

Linking the Belt and Road Initiative

Hong Kong is also a major stakeholder in China’s Belt and Road Initiative (BRI), a programme that links China and south-east, south and central Asia with the Middle East, Africa and Europe. Longhi explained that this is particularly helpful to a global company like ST, saying: “Hong Kong provides big opportunities, for example, in our connections with Europe in general.”

He added that one important aspect of Hong Kong’s BRI links is air connectivity with Belt and Road countries through Hong Kong International Airport. With much of the company’s distribution of semiconductor chips being implemented by air, ST maintains a warehouse adjacent to the airport.

The company is now actively seeking to strengthen its links with Hong Kong. Leconte said he envisaged a greater degree of connectivity with Hong Kong academic institutions and the Hong Kong Science and Technology Parks Corporation, for example, on issues like smart cities, smart driving and AI. In addition, with regard to HKTDC trade shows, it took part in the HKTDC International ICT Expo in April 2019 and the concurrent HKTDC Hong Kong Electronics Fair (Spring Edition), during which it took a lead role in the ICT event as part of the ground-breaking ‘So French So Innovative’ pavilion, which featured more than 30 French companies offering ‘smart’ opportunities.

Editor's picks

Trending articles

Growing numbers of mainland companies have gained considerable experience in construction and engineering in recent years through their involvement in massive infrastructure projects across China. Their achievements are remarkable by any standards. Logistics service providers supporting these projects have also benefitted, continuously innovating and offering total logistics solutions to construction projects with advanced technologies and specialised equipment.

However, the standards that Chinese companies in the construction and engineering project logistics fields currently work to are not the same as those used in overseas markets. Even companies with many projects under their belt have difficulty winning overseas business opportunities solely on the strength of their track record. In order to overcome this hurdle, some are hoping to gain international recognition by servicing construction projects in Hong Kong, in the expectation that this will help them explore overseas and Belt and Road markets. A Shanghai-based engineering project logistics firm told HKTDC Research that mainland enterprises may also use their overseas experience to gain access to the Hong Kong market.

(Photo courtesy of China Shipping Vastwin)

Daisy Liu, Deputy Director of the Engineering Design Centre of China Shipping Vastwin Project Logistics Co (China Shipping Vastwin) [1], explained how working in Hong Kong can help mainland businesses win contracts overseas, saying: “Construction projects in Hong Kong are up to international standards in their design, quality and safety requirements. They are also in line with international industry standards and certification systems. Leading Hong Kong and international construction firms and related service providers have won international recognition for their track record, and also know very well how to meet the requirements of their overseas peers. Mainland companies can gain valuable experience and become proficient in international industry standards, technological requirements and certification systems by participating in construction projects in Hong Kong. This way they can effectively bridge the gap between Chinese and overseas standards.”

A joint venture between COSCO Shipping Logistics Co - a subsidiary of the China COSCO Shipping Group - and the Jiangsu Vastwin Logistics Holding Co, China Shipping-Vastwin specialises in project logistics. Capitalising on its core engineering design capabilities, China Shipping-Vastwin focuses on ocean engineering, oil and gas refining, municipal infrastructure, new energy and special engineering projects. It offers on-time, safe and cost-effective total logistics solutions to clients in the electricity/new energy, petroleum/coal chemical industry and specialised logistics subcontracting fields, using advanced transportation equipment.

China Shipping-Vastwin runs an office in Hong Kong. As well as using the territory’s financial services platform to handle funds for projects in the Middle East, the US and other overseas markets, it also makes use of its innovative engineering technologies and specialised transportation equipment to provide logistics services for Hong Kong’s infrastructure projects. An example of this would be the delivery of various types of modular structures and complete units of oversize or overweight load. Liu hopes to provide more logistics services to large-scale construction projects in Hong Kong, such as the airport extension project and the construction of roads and bridges, and team up with Hong Kong companies looking to take advantage of Belt and Road opportunities.

[Remark: For more information, please refer to HKTDC research article: Hong Kong as the Major Service Platform for “Going-out” Enterprises: 2019 YRD Survey Results]

Editor's picks

Trending articles

Ramboll Hong Kong Limited is a wholly owned subsidiary of Ramboll – an international technical and scientific consultancy providing state-of-the-art scientific, engineering, and strategic risk management assistance to clients worldwide including national and international industrial and commercial concerns, law firms, developers and property managers, trade associations, lending institutions, insurance professionals, and public sector agencies.

Ramboll Hong Kong limited provides comprehensive environmental management consultancy services ranging from air quality, noise, water quality, waste management, hazard, land contamination, ecological impact, drainage and sewerage impact assessment`s to BEAM Plus/ LEED certification and green building design.

Ramboll Hong Kong Limited is ISO9001 and ISO14001 certified and we have over 10 BEAM Professionals registered with the Hong Kong Green Building Council, a LEED Accredited Professional registered with the US Green Building Council and a WELL Accredited Professional. Staffs of Ramboll are also familiar with the requirement of Air Ventilation Assessment in Hong Kong. Staff of Ramboll has undertaken over 1,000 individual environmental assessment studies locally in Hong Kong on a variety of projects for public utilities companies, Government departments, and the private sectors in the past decade. Ramboll has proven track record of 100% success rate in all Environmental Impact Assessment (EIA) undertaken under the EIA Ordinance since its enactment in 1998.

Apart from EIAs, Ramboll also acts as the environmental consultant for hundreds of town planning applications. Ramboll is familiar with statutory and non-statutory requirement for town planning applications and has also participated in consultation process with District Council and other stakeholders.

HKEA Group Limited is a group company diversifies in Security Protection, Education, Property, Hospitality, Trading, LED Lights and Investment in 7 divisions with Head Office in Hong Kong and local offices in China Mainland, Singapore, Thailand and the United Kingdom.

HKEA has over twenty years’ experience of installing CCTV, alarm system and security protection for many sectors. HKEA is awarded the authorization by the Hong Kong government SGSIA to design, maintain and install security system.

HKEA manages a portfolio of local and overseas property investment and at the same time providing the same service for clients. HKEA’s trading section ships as far as Brazil and Columbia and as close as Hong Kong, Singapore and Thailand.

HKEA’s procurement Strategy helps our buyers to maximize profit and minimize risk in the procurement of goods, services and work.

During this twenty over years, every single client, every project, every investment, HKEA deals with them with heart. Adopting western management culture, fuses with Chinese sociable culture, HKEA serves with the aim to help clients yield far more than their expectation. We welcome you to join us to be part of our network.

GRN Consulting (Hong Kong) Limited focus on advance green technology application and consultancy service on Food, Hygiene and Environment. Our team equipped with strong science & engineering background, and experienced with wide spectrum in cleaner technology included Ozone Technology / Advance Oxidation Process / Ion Exchange Process / Acid Retardation Process etc.. With years of R&D works, our own invented and patented technology, the Atomized Ozonated Water (AOW®), combined ozone with fine water droplets in mist-form shown great advantage in cost and ease of application including air-purification, disinfection and agricultural use. The technology has also been awarded with the Silver Medal in the 1st ASIA EXHIBITION OF INVENTIONS HONG KONG. The more efficient, safer and greener technology broaden a new horizon on ozone and other green technology applications; widen GRN service scope to numerous residential, industrial and commercial sectors in our city.

1897 Views

1897 Views