Chinese Mainland

Munich Re founded in 1880 stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. In the financial year 2018, Munich Re (Group) achieved a profit of €2,275m on premium income of €49.1bn. It operates in all lines of insurance, with more than 41,000 employees throughout the world.

Reinsurance

With premium income of €31.3bn from reinsurance alone, Munich Re is one of the world's leading reinsurers. We offer a full range of products, from traditional reinsurance to innovative solutions for risk assumption. Especially when clients require solutions for complex risks, Munich Re is a much sought-after business partner. Our roughly 12,000 staff in reinsurance possess unique global and local knowledge. Munich Re attaches great importance to its client service, which regularly receives top ratings.

Belt and Road Initiative (BRI)

Munich Re provides services in all relevant BRI countries and has (re-) insurance specialists on the ground. Our main focused segments in 2019/2020 include Property insurance, Engineering insurance, Project Cargo Insurance, and Credit Insurance (for more details, please refer to the attached BRI presentation).

FreightAmigo is a one-stop international logistics digital platform covering sea, air, courier, truck, and rail transportation, connecting business clients with global logistics service providers. We use big data analysis to provide instant freight quotes, cargo information, and cargo status. Offering door-to-door quotes in over 250 countries including the US, Europe, Asia, Africa, and the Middle East, with real-time comparison and booking, saving up to 60% on freight costs. Cargo tracking connects over 1,000 shipping companies, providing real-time updates on the latest status. Customers can search door-to-door freight quotes online 24/7, book warehouses, and manage freight, offering customized solutions, warehousing, customs clearance, trade financing, and cargo insurance, providing comprehensive international logistics services to simplify customers' freight and trade processes. Making trade easier.

By Henry Tillman, Founder and Chairman, Grisons Peak;

Yang Jian, Vice President and Senior Fellow, Shanghai Institutes for International Studies (SIIS); and

YE Qing, Director, Institute for Foreign Policy Studies, Shanghai Institutes for International Studies (SIIS).

Overview

While many analysts, observers, agencies and governments seem focused on plotting "Belt and Road Initiative" (BRI) projects as dots on a map, this paper will not only demonstrate the various components in the title, but also explore the inter-connectivity of each, both within a country (Oman) and extending into a region(the Middle East). There are now over 130 countries which have signed the BRI MoU with China, Oman’s case shows that it has implemented and utilized all 3 components of infrastructure, digital and SEZs, and now all 3 components are becoming fully functional, which may represent the path and characteristics in BRI’s future development.

Oman is located in the transportation hub of South Asia, West Asia, and East Africa along the Arabian Sea and the Red Sea, an important place for economic and trade shipping between Europe and Asia. It also stands at the intersection of the Silk Road on land and Maritime Silk Road. After China's "Belt and Road Initiative" was put forward, the Omani government and many sectors of the business community responded positively. Over the past 40 years since the establishment of diplomatic relations between China and Oman, The two sides have achieved fruitful results in the political, economic and cultural fields, laying a solid foundation for BRI cooperation. On May 25, 2018, China and Oman celebrated the 40th anniversary of the establishment of diplomatic relations. The cooperation between China and Oman is the contemporary embodiment of the historical inheritance of the ancient Maritime Silk Road.

The "Belt and Road Initiative" meets the fundamental needs of Oman's economic development. Oman's economy used to be heavily dependent on resource-based industries such as oil. In order to achieve the goal of economic diversification, the Government of Oman formulated plans such as Oman Vision 2040 in 2016, aimed at enhancing the contribution of agriculture, modern industry, tourism, fisheries and mining to GDP and promoting the construction of airports, seaports and industrial parks. China has technical advantage in all these industrial sectors, and China can provide important technical support, labour training and management experience for Oman.

Economic development is conducive to promoting regional cooperation and harmonious coexistence among the ethnic groups. The geopolitical situation and tension affects investment. Oman is neighboring with Saudi Arabia and Iran, the competing rivals in the Gulf region. Oman shares with Iran the Strait of Hormuz, one of the oil transportation routes. Oman is in an important strategic location and faces more geopolitical risks at the same time. U.S. sanctions against Iran, internal conflicts between Saudi Arabia and Iran, and the domestic conflicts in its neighbour Yemen have created a lot of instability for Oman since 2015. Focusing on economic development will be conducive to get rid of the lasting conflicts. The cooperation between China and Oman has just provided important reference value for the promotion of China's "Belt and Road Initiative" in the Middle East.

Conclusions

There are several interesting observations we can draw from our research on China’s cooperation with Oman.

As stated at the outset of this paper, the authors believe that Oman represents one of the first, if not the first, of the BRI countries to be operational across the BRI’s three initial components of infrastructure, digital and SEZs.

China has played an important role in developing Oman’s 2011 National Infrastructure Plan, with a focus on ports, rail, IT and desalination. While some of these projects (rail) were delayed due to oil price declines and financial strains, they are once again progressing. While AIIB led most of these financings, the 2017 $3.55 billion China-led loan was vital to Oman. It is important to note that all of these loans were multilateral well in advance of the Second Belt and Road Forum (2019).

In the digital component, there have been substantial improvements since 2016, including 8,100 km undersea fibre optic cable becoming active, construction of the national fibre optic broadband network, culminating with the 2019 launch of 5G. The combination of all of these factors will assist Oman in becoming a regional, digitised logistics centre in the Gulf, with links to Africa and the SCO.

As shown above, the China-Oman SEZ, agreed only in 2016, has seen a number of Chinese investments and pledges to date, with plans to grow to $10 billion by 2022. As importantly, Oman has also been able to attract considerable international investment into its SEZAD across many Middle East, Asian and European countries to accelerate its transition to an economy much less dependent on energy. It is also important to point out that SEZs in these regions have also begun to cooperate amongst each other. For example, the UAE has two of the world’s leading SEZs, each of which has a Chinese component.

We therefore believe that the above analysis reflects the interdependence of the BRI components (infrastructure, digital and SEZs)–and how they can function, in effect as a unified package in propelling BRI countries’ economic growth. In the experience of China's regional economic development, "infrastructure connectivity" and "construction of special economic zones" play an important role. It took nearly 30 years for China to develop step by step from infrastructure construction, special economic zone construction to digitisation. Through the case study on Sino-Oman cooperation in the framework of BRI, we can see that the development has the characteristics of being connected by infrastructure, led by SEZs, and upgraded by digitisation. The digitisation and infrastructure construction and SEZs support and promote each other.

It needs to be pointed out that China’s investment has also paved the way for attracting additional non-Chinese investment. Similar to Cambodia, it appears that later stage industrial investments include investors from outside of China, including the UAE, Saudi Arabia, India, Kuwait, ROK, Japan, France, Spain, Netherlands, the United Kingdom to name just a few. This is not a surprise in that a number of these countries have collaborated with China. The concept of 3rd party cooperation among the BRI was a key highlight of the past 2 years of the BRI. The 3rd party cooperation between Japan and China is a great example of this with their agreement signed during the 4th Quarter of 2018.

The Middle East today is facing tremendous challenges, many of the problems that ignited the fire of “Arab Spring” almost a decade ago still exist. Similar to Oman, most countries in the region are eager to develop themselves and have developed their national vision strategies. Therefore, the cooperation between China and Oman will have broader regional repercussions. It will not also only set an example for others to follow, but more importantly, if the expectation for Oman as the regional hub can be realized, it will benefit the whole region by releasing new dynamics to the regional economy. BRI in Oman as an example is of universal significance not only to China-Arab cooperation, but also to China's cooperation with other countries along the "Belt and Road".

Please click to read full report.

Editor's picks

Trending articles

US$1.7 billion, 30km-long structure set to deliver on long-term commitment to link national capital and Temburong.

Work on a major section of Brunei's US$1.7 billion Belt and Road Initiative (BRI)-backed Temburong Bridge was completed late last month. Once fully constructed, the bridge will link Bandar Seri Begawan, the national capital, with Temburong, an enclave separated from the rest of Brunei by Malaysia and Brunei Bay.

The largest infrastructure project in Brunei's history, the 30km-long structure is set to become Southeast Asia's longest ocean-span bridge, easily outreaching the current record-holder – Malaysia's 24km Second Penang Bridge. Work on the project began in 2014, with construction said to be 97% complete. If all goes to plan, the bridge should open to road traffic later this year.

Brunei has high hopes that the project will deliver long-term economic benefits. Essentially, it represents the fulfilment of a long-term commitment to create a customs-free road link between the capital and Temburong, an increasingly popular tourism destination.

With a land area of just 5,765 sq km, Brunei comprises two territories – Brunei-Muara and Temburong – separated by the Malaysian state of Sarawak. Until the bridge opens, commuters travelling between the two must negotiate their way through four frequently congested Malaysia-Brunei immigration checkpoints.

Commissioned in 2014 by Brunei's Ministry of Development as part of efforts to stimulate the country's economic development, the bridge was always visualised as two distinct construction projects – a 11.6km land viaduct crossing the Labu Forest Reserve and the 18km bridge proper extending out across Brunei Bay. China State Construction Engineering Corporation (CSCEC) was appointed to oversee the viaduct, while Seoul-headquartered Daelim – South Korea's longest-established construction company – won the contract to build the bridge.

When CSCEC first began work on the project in October 2015, oppressive heat and humidity, combined with intermittent access to power and fresh water, hampered construction. An added challenge came from the statutory requirement to protect the region's rare mangrove vegetation and wildlife. To overcome this particular difficulty, CSCEC installed major sections of the viaduct using "fishing technology," an innovative construction process that keeps heavyweight equipment from impacting the ground and potentially harming local flora and fauna.

Once the bridge is open, the key beneficiary is expected to be the country's nascent tourism industry. The focus of this will be Temburong's prized, yet relatively unknown, Ulu Temburong National Park. A 50,000-hectare tract of tropical rainforest, it has been described by the Brunei Tourism Bureau as "without a doubt, the crown jewel of Brunei's green landscapes".

An engaging blend of lowland and mountain forests, the park's diverse ecosystem is home to a huge variety of unique species, as well as many of the country's traditional longhouse communities. Once officially opened, the bridge is expected to spur investment across the whole of the region's hospitality sector.

In line with this, work is already underway on Temburong's first luxury eco-resort – 30 riverside villas in the Kampung Perdayan district – which is due for completion later this year. In addition, a new river centre is being developed to service cruise boats heading into the Ulu Temburong National Park.

In preparation for this, Brunei is already actively engaged in moves to attract a higher number of Chinese tourists. In order to facilitate this, Royal Brunei Airlines, the national carrier, is launching direct flights to the new Beijing Daxing International Airport.

Chinese visitors accounted for 23.6% of Brunei's 278,000 inbound air passengers in 2018, a figure it is now hoping to boost to 450,000 in the near term. In a further move, 2020 has been officially announced as Brunei-China Year of Tourism by representatives of the two countries' governments.

Geoff de Freitas, Special Correspondent, Bandar Seri Begawan

Editor's picks

Trending articles

China-financed Jawa 7 coal-fired facility set for key role in connecting whole country to National Grid by year-end.

Late last year, the first phase of Indonesia's Belt and Road Initiative (BRI)-backed Jawa 7 thermal electricity plant came online. A US$1.8 billion coal-fired facility, it is being developed by the PT Shenhua Guohua Pembangkitan Jawa Bali consortium – which is 30% owned by PT Pembangkitan Jawa-Bali, a subsidiary of Indonesia's state-owned electricity company Perusahaan Listrik Negara (PLN), and 70% by China Shenhua Energy, the Beijing-headquartered, state-owned coal-mining giant.

Located in Banten, the westernmost province of the island of Java, the 172-hectare Jawa 7 plant is considered to be one of the most vital electricity-generation projects for Indonesia's fourth-largest landmass and the home of more than half the nation's 264 million population. Once work on the whole project is completed – with the second phase scheduled to come online later this year – Jawa 7 will comprise two 1,000MW generators and provide power throughout the densely populated Java-Bali region.

Jawa 7 is not only Indonesia's largest coal-fired thermal-electricity plant but is also the first such installation in the country to make use of Ultra Super Critical (USC) turbine technology. Essentially, this is an innovative new system that improves power supply efficiency by up to 15% compared with facilities utilising more conventional technology, thus significantly cutting ongoing electricity-generation costs.

Equally importantly, the technology utilised at the Jawa 7 site is seen as representing an environmentally focused template that future coal power projects could adopt as a means of restricting their own level of greenhouse-gas emissions. By incorporating Seawater Desulphurisation – a proprietary process developed by China Shenhua Energy – coal usage is optimised, while emissions of particulate matter, sulphur dioxide and nitrogen oxide are reduced. It is believed this will help cut the nation's carbon footprint, while also improving overall air quality. Its adoption has been seen as particularly timely given that Indonesia currently ranks among the world's 10 largest emitters of greenhouse gases.

The Jawa 7 project was first mooted in 2014, when the Indonesian government invited bids for an ambitious programme intended to increase the country's power capacity by 35,000MW in the run-up to 2020. Some 12 months later, in December 2015, China Shenhua Energy – a specialist in coal mining, production and electricity power projects listed on the Hong Kong and Shanghai stock exchanges – was awarded the build-own-operate contract. Construction work on the plant then began in April 2016, with a financing agreement between the PT Shenhua Guohua Pembangkitan Jawa Bali consortium and the China Development Bank signed the following October.

Ultimately, the Jawa 7 plant represents a key element in Indonesia's drive to step-up its domestic energy-generating capacity as demand for electricity continues to soar from businesses and consumers across the world's largest archipelago. In line with this, the country's government is committed to delivering nationwide electrification by the end of the current year. With this programme set to connect many rural areas to the national grid for the first time, it is anticipated that demand for electricity will again soar.

With a view to meeting any future demand growth, the government published its 2019-2028 Electricity Procurement Plan in February last year. A blueprint for expanding the country's energy supply resources, it proposes developing 33,666MW of new electricity projects via independent power producers (IPPs) over the next eight years. In order to facilitate this, PLN, the state-owned electricity company, will permit subsidiaries to take shares in selected IPP projects in accordance with the build-operate-transfer model. Ownership of the plants built and owned by IPPs will then be transferred to PLN once each power-purchase agreement matures.

Marilyn Balcita, Special Correspondent, Jakarta

Editor's picks

Trending articles

Deming ProDevelop Consultant Agency (China) Limited, the sister company of LONG Engineering Ltd on the mainland, provides one-stop services ranging from professional qualification accreditation to skills enhancement for professional engineers, engineering college students and people with professional skills. As well as its bases in Hong Kong and Macao, Deming ProDevelop has mainland offices in Shenzhen, Guangzhou, Maoming and Zhuhai. The company also plans to open a new branch in Huizhou this year. Chan Chi-man, engineer and executive director with Deming ProDevelop, told HKTDC Research about his experience of setting up and operating businesses in the Greater Bay Area (GBA), providing valuable information for industry players looking to access the GBA market.

Identifying Opportunities

Chan Chi-man has long been keen to identify opportunities for doing business in the mainland market. In 2010, Shenzhen Qianhai was designated a key development planning zone, which was to be part of the Shenzhen-Hong Kong Modern Service Industry Co-operation Zone and would draw on Hong Kong’s experience and international connections. At the time, Chan originally hoped that, with his experience in undertaking engineering projects in Hong Kong, he could participate in the initial project planning for Qianhai. However, most of the civil engineering plans involved massive infrastructure projects, and Chan decided that Hong Kong companies’ advantages in engineering and project management services would not be sufficient for them to compete with their mainland counterparts which had greater experience of handling large-scale projects.

Despite that setback, Chan remained optimistic about the possibilities of accessing mainland markets and continued to draw up strategies of how to do so. Explaining what he believes is required for such a move, Chan said: “As the economy has expanded, the mainland market has developed its own unique culture and demands. Hong Kong companies wanting to tap the mainland market have to know what they are good at, and understand what the market needs, before they can identify business opportunities. Developing the mainland market is no longer a process of simply replicating the success stories of the older generation. Now it is a process that requires fresh learning and understanding.

“The mainland market is also unique in that the planning for each and every region is different. Take industrial parks for example. Normally each park has its own requirements for industry players looking to establish a presence there. An IT industry park, for instance, usually only accommodates companies in the IT sector and related industries. So when a company is looking to select a location to base itself, it must first know whether the planning strategies of the various cities and regions it is looking at are compatible with the company’s development.”

International Qualifications

In recent years, the mainland has staged a large number of innovation and entrepreneurship competitions for young people. The aim is to get young people to participate, enhance the reputation of their companies and increase their exposure to potential clients. The presence of venture capital companies at these competitions can also help participants expand their interpersonal networks in the GBA and lay a foundation for developing their business. In the course of his exchanges with mainland enterprises and government departments, Chan came to understand the kinds of challenges faced by mainland engineering teams and engineers when they try to gain access to the international market.

Chan came to realise that one of the thorniest of these challenges is the accreditation of professional qualifications. Explaining the problem, Chan said: “On the mainland, the Human Resources and Social Security Bureau is responsible for the accreditation of engineers. As the qualification accreditation mechanism on the mainland is different from that in the international market, the accreditation of mainland engineers is often not recognised internationally.

“Following the implementation of the Belt and Road initiative in recent years, an increasing number of mainland enterprises and engineers are participating in international projects. To undertake projects in Belt and Road countries, one must observe international engineering codes and standards. Although mainland companies have a large pool of engineering personnel, the absence of internationally recognised qualification accreditation has made it necessary for them to employ a great number of foreign qualified engineers in order to meet international standards.”

Most mainland engineering enterprises are not familiar with international accreditation. This is an area which Chan excels in, and once he had identified this market demand, Chan focused his mainland business development on qualification accreditation. He helps mainland engineers obtain their international qualification accreditation and thus makes it easier for them to enter the international market.

Business Model

After setting his business development goal, Chan mapped out a new vision for his company, which was to take outstanding mainland engineers to the international arena and help them upgrade their professional skills by offering various kinds of training courses. He explained that the philosophy and mission of the company - helping clients obtain international professional qualifications and capture better career development opportunities - are very important, saying: “Engineers with international qualifications will have a broader scope for career development, and their income will rise significantly. For instance, the annual salary of a supervisory engineer on the mainland ranges between RMB200,000 and RMB300,000. But if he or she has international accreditation which qualifies them to take part in international infrastructure projects, their salary for three months could easily match the annual salary of a supervisory engineer on the mainland.”

Chan admits that other companies would find it difficult to copy Deming ProDevelop’s business model, saying: “I have accumulated years of engineering management experience in Hong Kong and have established good interpersonal networks with the majority of international engineering societies and associations which have set up branches and organisations in Hong Kong. At the same time, I have also spent many years in the mainland market, building up my interpersonal networks and laying down a solid foundation for co-operation with governments and enterprises in areas related to engineering. All this would be difficult for others to replicate within a short time.”

Professional Training

The training programmes offered by Deming ProDevelop on the mainland primarily target three types of clients:

1. Enterprise-led engineers: Businesses select engineers at middle level and above and ask Deming ProDevelop to act as their personal consultant. The engineers sign a contract with Deming ProDevelop and decide for themselves whether or not to join the training programmes.

2. Enterprise-chosen engineers: Businesses handpick engineers wanting to receive training and directly sign a contract with Deming ProDevelop to provide targeted training for these staff.

3. Individual engineers: Engineers sign a contract with Deming ProDevelop on a personal basis to receive international qualification training.

When Deming ProDevelop first started this business, its clients were mostly enterprise-led engineers who were just looking to obtain qualification licences. However, with increasing numbers of engineers wanting to develop enhanced professional skills, Deming ProDevelop has transformed into a business that now provides diverse vocational planning. Noting that this does not come cheap, Chan remarked: “Our fees are by no means low, that’s why we don’t simply help our clients apply for a licence, we help them obtain international professional accreditation, and pave the way for them to enter the international market. I believe that in the near future, the GBA’s demand for professionals with international qualifications will become even stronger.”

Deming ProDevelop serves government agencies, state-owned enterprises and large companies. The company co-operates, for example, with Guangdong Association for Science and Technology in promoting the mutual recognition of international qualifications for engineers. It also provides professional services for the international accreditation of engineers for China Railway First Group, CLP Group and China Merchants Group.

Differing Demands for Accreditation

Although there are excellent transport connections between Hong Kong and most of the cities in the GBA, Deming ProDevelop has opened branch offices in Guangzhou, Shenzhen, Maoming and Zhuhai. The company also plans to open a new branch office in Huizhou in 2019.

Explaining the need for this by pointing to the differences between the various parts of the GBA, Chan said: “Each city in the GBA has its own unique city planning. The positioning of different cities determines the focus of our local business. Shenzhen and Guangzhou, as first-tier cities in the GBA, are places where engineering enterprises cluster and there are also more businesses and engineers there willing to pay for international training and accreditation. That is why we chose these two cities as our first stop.

“Because of the opportunities for co-operation in Maoming, Huizhou and Zhuhai, our business has also expanded to these cities. Other GBA cities such as Dongguan mainly place their emphasis on light industries and high-tech manufacturing, so their demand for engineering qualification accreditation is lower. Unless actual projects and co-operation opportunities arise there, we are unlikely to enter these cities.”

Chan added that the development of the GBA brings about new opportunities. At present, Deming ProDevelop’s mainland branches are mainly responsible for client recruitment, promotion, hosting talks and strengthening co-operation with different enterprises and organisations. The Hong Kong company, meanwhile, is primarily in charge of logistic support, including accreditation of academic and professional qualifications, engineering report and consultancy services, and making arrangements for clients to take exams and providing examination venues. Since most engineering societies are based in Hong Kong, written exams and interviews are held in Hong Kong.

Hong Kong as an Investment Platform

Chan pointed out many of the advantages of being in Hong Kong while looking to access the mainland market. These include its sound, mature financial system and a legal system aligned with the rest of the world. The availability of free capital flow in Hong Kong means that international corporations can move their capital to Hong Kong before investing it in the GBA and mainland China. Likewise, mainland enterprises can invest and expand overseas through Hong Kong. For instance, as Belt and Road projects continue to roll out, more and more mainland enterprises have come to Hong Kong to set up companies and invest in foreign countries through Hong Kong. Moreover, Hong Kong has a good business environment in which the processes of setting up companies, recruiting talents and handling tax matters are clear and simple, and a large pool of companies offering support services is also available. Because of these factors, many foreign and mainland businesses choose to establish a foothold in Hong Kong.

Editor's picks

Trending articles

Work expected to commence imminently on key element of national infrastructure redevelopment programme.

Late last year, the Philippines' National Economic and Development Authority (NEDA) finally gave the go-ahead for phase one of the Mindanao Railway Project (MRP), one of the country's key Belt and Road Initiative (BRI) backed mass transit infrastructure programmes. With this formal endorsement now in place, work is expected to begin imminently on the project – a 102km train line connecting the cities of Digos, Davao and Tagum on the Philippine island of Mindanao. Construction of the Tagum-Davao-Digos segment of the MRP will be carried out by an as-yet-unannounced Chinese contractor in line with the wider objectives of the BRI, China's ambitious global infrastructure development and trade facilitation programme.

Essentially, the Tagum-Davao-Digos line forms the first stage of a proposed 830km project, which has been conceived as ultimately looping around Mindanao, the second-largest island in the Philippine archipelago. It is also the first railway project in the Philippines to be sited outside of Luzon, the country's largest island and home to Manila, the national capital.

Scheduled for completion in 2022, the Tagum-Davao-Digos line is initially projected to handle up to 130,000 passengers a day, with trains travelling at a top speed of 160kph and stopping at six intermediate stations – Carmen, Panabo, Mudiang, Davao, Toril and Santa Cruz. Once fully operational, the service will cut journey times from Tagum to Digos to just 1.3 hours from about 3.5 hours at present, with the Department of Transport predicting that the daily passenger volume will steadily increase, rising to 237,000 by 2032 and to 375,000 by 2042.

Mindanao accounts for two-fifths of the land mass of the Philippines and is seen as badly in need of the economic boost the new rail line is expected to deliver. While the region is the country's primary source of agricultural products, poor transport connections have restricted economic development and deterred investment. It is a problem that has only been exacerbated by years of armed conflict and a series of natural disasters, notably typhoons and earthquakes. As a consequence, although Mindanao is home to just 25% of the Philippines' population, it accounts for 37% of all those living in extreme poverty.

Initially conceived as a twin-track, electrified line, political pressure to complete the Tagum-Davao-Digos railway during the tenure of President Rodrigo Duterte has seen it redesignated as a non-electrified diesel line. As it is located in the south of the country, where Duterte has his political base, it is seen as a particularly sensitive initiative, especially as it has taken so long to reach even this preliminary stage.

In fact, the development of an island-wide Mindanao railway has long been advocated but never before come close to being realised. For his part, Duterte promised to press ahead with the project if elected back in 2015, with NEDA subsequently rubber-stamping the original plans for the Tagum-Davao-Digos section of the line in 2017. Originally intended to be locally financed and to commence construction in 2018, phase one was delayed by a strategic rethink, which also saw the cost dramatically revised upwards. The estimated cost of phase one has more than doubled from the initially proposed PHP35.26 billion (US$695.5 million) to PHP81.69 billion.

This latest figure is expected to be covered by a loan from the China Export-Import Bank (Exim Bank) – due to be signed in April this year – with China now thought to be funding up to 86% of the entire project. With NEDA approval now in place, the next phase will see China submit a shortlist of three companies to bid for the various design-and-build and project contracts. According to local media speculation, the likely contenders are believed to include the China State Construction Engineering Corp, the China Communications Construction Company, the China Railway International Group and the China Civil Engineering Construction Corporation.

Marilyn Balcita, Special Correspondent, Manila

Editor's picks

Trending articles

Postponed following domestic financial concerns, the East Coast Rail Link is now scheduled to arrive in 2026.

Work is now set to resume on the East Coast Rail Link (ECRL), the long-gestating Belt and Road Initiative (BRI) project that will ultimately directly connect the east and west coasts of Peninsular Malaysia by a dedicated train service for the first time. Originally given the go-ahead in 2016, the development has been dogged by Malaysia's domestic financial woes, which led to the plan officially being put on hold in July 2018.

As originally conceived, the ECRL directly aligned with the aims of the BRI, China's ambitious international infrastructure development and trade facilitation programme, while also delivering on Malaysia's own commitment to revitalising its underdeveloped east-coast region and upgrading the transportation links between its cities, towns and rural areas. Although work on the project officially commenced in August 2017, this initial progress was swiftly derailed by a financial scandal that rocked the Malaysian government of the day.

In early 2018, the long-simmering 1MDB scandal, which had seen billions of dollars of public money siphoned out of Malaysia, threatened to wreck the nation's economy. Charged with investigating the illicit activities of his predecessor and determined to restore the country's financial wellbeing, newly elected Prime Minister Mahathir Mohamad halted the project, as well as many others, while its viability and ongoing costs were reviewed.

At the time, Mahathir stated that the previously agreed interest repayments for the MYR65.5 billion (US$15.85 billion) project would be unmanageable, given that the country was now saddled with MYR1 trillion of unanticipated national debt. As a result, the project was formally suspended, with no likely date given for its resumption.

There then followed nine months of heated renegotiation between the Chinese and Malaysian governments, which resulted in a revised and somewhat slimmed-down ECRL financing road map being unveiled in April last year. The following November, updated route details were released for the northernmost section, which runs through Kelantan and Terengganu states. This highlighted a reduction in the line to 640km from 688km, a decision that allowed for savings of MYR44 billion, a third of the previous total. In a revision to the initial schedule – and primarily to allow for the acquisition of land rights in the re-routed areas – it was also announced that that target completion date had been pushed back to December 2026 from June 2024.

As in the original ECRL plan, however, the construction cost is to be underwritten by a loan guarantee from the Export-Import Bank of China (EXIM Bank), while a higher level of participation by local contractors was written into the new agreement. This will involve them working closely with China Communications Construction Company (CCCC), China's state-owned infrastructure development giant, which remains the lead developer on the project.

According to figures provided by the Malaysian government, the construction cost has now dropped to MYR68.7 million per kilometre from MYR95.5 million per kilometre. This is due to a number of changes made to the initial proposals, including shortening the overall length of the railway, removing the northern extension that would have run from Kota Bharu to Pengkalan Kubor near the Malaysian-Thai border, and re-routing some of the planned elevated sections to allow them to run at ground level.

As of November last year, about 12.86% of the project was said to have been completed. Once finished, the single-gauge electric railway will connect Port Klang on the west coast, the country's largest container port, with Putrajaya, its administrative centre. It will also stop at several urban centres and ports along the eastern seaboard and offer a 160kph passenger service and a more sedate 80kph freight service.

For its part, CCCC has further committed to develop logistics hubs at each of the three interchange stations, as well as two industrial parks on the east and west coasts. It will also enter into a 50:50 joint-venture with Malaysia Rail Link Sdn Bhd, the national rail operator, to manage and maintain the ECRL once it comes online.

The one missing element of the revised plan – funding for the local contractors – finally fell into place late last year when the Small Medium Enterprise Development Bank Malaysia (SME Bank) announced it had set aside about MYR1 billion (US$240 million) for that specific purpose. This will now see such workers take on responsibility for up to 40% of the revised project.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

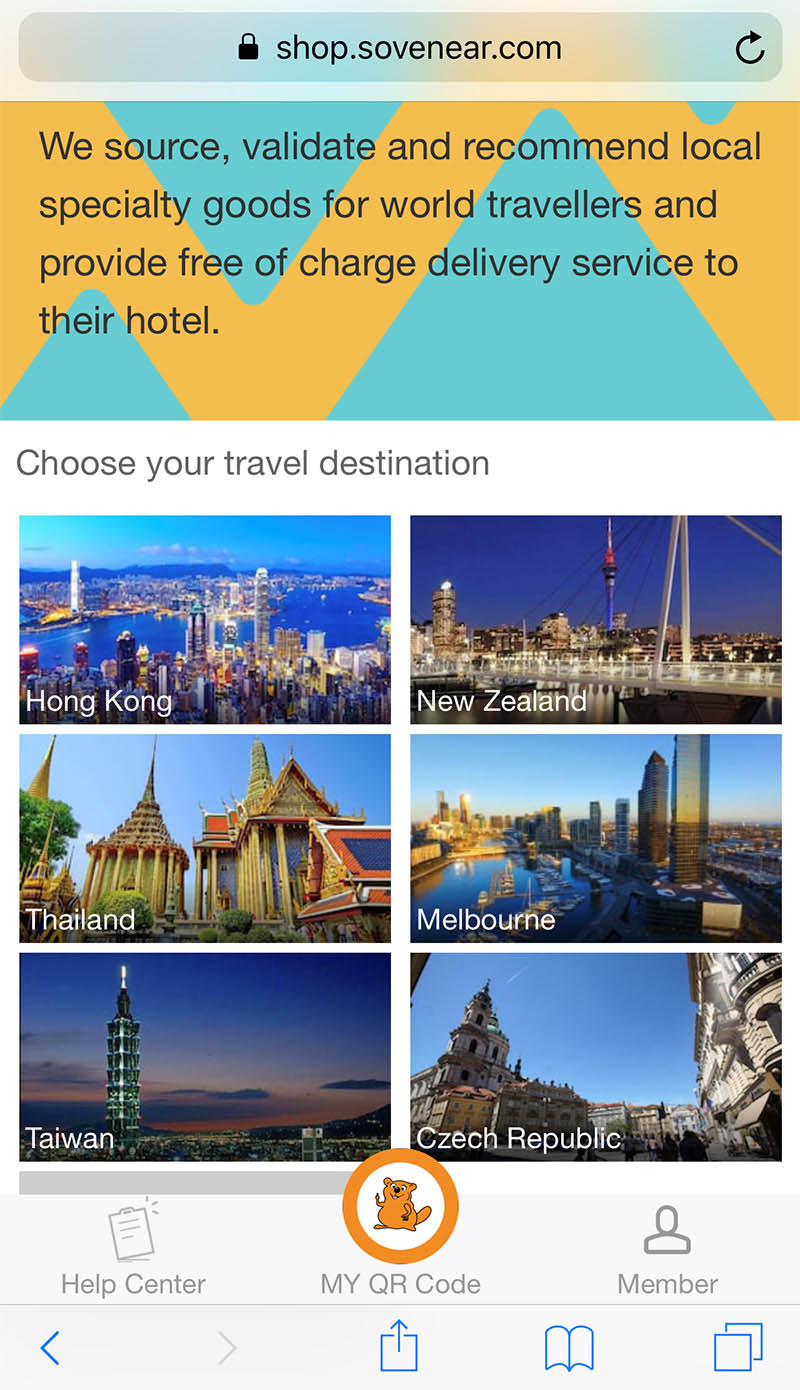

When we travel, most of us are keen to sample produce from the place we’re visiting. The trouble is that we don’t often know where to go to do that. That’s where a platform like SoveNear can be of assistance. Created by Showcase (Hong Kong) Technology Co Ltd, it’s designed to help tourists find that local authenticity without the inconvenience of having to search for it themselves. David Zhang, founder and CEO of Showcase Technology, spoke to HKTDC Research about his experience in establishing the SoveNear platform for goods from tourist destinations around the world and running the company in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

Sourcing Special Local Products

Zhang explained that SoveNear was set up to help tourists keen on buying special local products, saying: “When we travel, we want to experience local culture, try local cuisine and buy special local products. This is how we understand different cultures. But people visiting a city for business or pleasure may know nothing about its special products. Even if they do, they may not have the time to go shopping and can only buy some ordinary souvenirs at the airport.

“Our purpose in establishing SoveNear was to put special products from different countries and places on our online platform. When travellers reach their destination, they can search for and buy special local products online and we can send their purchases to their hotel free of charge to save them time and hassle.”

SoveNear positions itself as a “platform for products of tourist destinations around the world”. Zhang said that it aims to bring together the most representative products of each city, adding: “Products on this platform are not restricted to traditional souvenirs and may include representative brand-name products, designer products and works of art from different places. We hope that travellers can appreciate the characteristics of local culture through these local products.”

Launched in February 2019, the SoveNear platform has already attracted companies from a host of countries and territories, including Hong Kong, Taiwan, Macao, Thailand, Australia, New Zealand and the Czech Republic. Zhang said that SoveNear will continue to expand its services to more places, particularly in South-east Asia and countries along the Belt and Road routes, pointing out: “Most of the Belt and Road countries are developing countries with special commodities not many people know about. Our platform will help tourists visiting these destinations know about the local specialities. As well as boosting the local economy, this will also help promote cultural and economic exchanges between countries.”

Moving to Shenzhen

Zhang established Showcase Technology in Hong Kong in 2018 to design, research and develop online platforms. The company later joined the Shenzhen start-up services pilot scheme organised by the Hong Kong United Youth Association (HKUYA) and set up Showcase (Shenzhen) Technology Co Ltd the following year. Outlining how the move came about, Zhang said: “The Shenzhen start-up services pilot scheme was a scheme to help young Hong Kong people tap GBA opportunities. The HKUYA set up three pilot areas for this scheme in the innovation and entrepreneurship bases in Shenzhen’s Futian, Lohu and Nanshan districts for a period of six months, during which time one-stop support services and preferential measures were offered to start-up companies to lower their cost and help young people planning their future career in the GBA integrate into and align with the mainland market.

“The three innovation and entrepreneurship bases have different distinctive features. I chose Futian. Using the ‘own fund + co-operative fund” model, the Futian base brought together more than 100 leading investment institutions and paired off participating companies with investors to help start-up companies overcome financing problems and provide them with funding support. Companies in different sectors moved into the innovation and entrepreneurship bases. There were also business matchmaking companies. The base would introduce these companies to us to promote co-operation.”

Complementing Companies

Programmers in Showcase’s Hong Kong and Shenzhen offices develop online platforms and WeChat Mini Programs. Zhang explained how the different platforms are aimed at different sets of customers, saying: “Mainland travellers make about 120 million outbound trips each year while the total made by global outbound tourists is roughly 2 billion. Both groups are our target customers. WeChat Mini Programs are mainly designed for mainland travellers, while the web version is mainly intended for overseas tourists. Mainland people prefer using WeChat Mini Program, but there are not that many people capable of developing these programmes in Hong Kong. That is why WeChat Mini Programs are developed in Shenzhen. Conversely, mainland programmers are not familiar with the sort of webpage designs preferred by overseas tourists or their software preferences. So our Hong Kong colleagues are responsible for developing systems for overseas tourists. This division of work is good for both sides.”

Outlining a further distinction between the two parts of the company, Zhang continued: “Our Hong Kong company is mainly responsible for overseas development and establishing ties with businesses in overseas markets. Our Shenzhen company, meanwhile, is mainly responsible for turning mainland tourists into our target customers. With a population of 70 million, the GBA is a huge potential market, which is why we take it as our starting point for attracting customers and learning how to tap mainland tourist resources.

“Advertising campaigns on the SoveNear online platform mainly target overseas tourists and take place in overseas markets. The most effective publicity is to make overseas tourists aware of SoveNear’s services in their own country. In our co-operation with businesses in overseas markets, the most effective approach is to focus our publicity at the sort of places visited by most tourists, like hotels, travel agencies and car rental companies.”

Transport Network Boosts Tourism

The Hong Kong-Zhuhai-Macao Bridge and the Guangzhou-Shenzhen-Hong Kong High-Speed Rail have improved transport links in the GBA. Pointing out how they not only make business travel easier but also help promote the development of tourism in the area, Zhang said: “I live in Hong Kong but go to work in Shenzhen two to three days a week. It is very convenient to go to Futian from West Kowloon, taking only 17 minutes by high-speed rail. Over 20 million mainlanders visited Macao in 2018, while more than 50 million mainland visitors arrived in Hong Kong. The total number of mainland tourists visiting Hong Kong and Macao exceeded 70 million. Our hope is that all mainland tourists visiting Hong Kong and Macao get to know about SoveNear so that we can further expand our services.”

In Zhang’s opinion, each GBA city has a role to play in boosting the region’s economic value. Arguing that co-operation can turn the GBA into an integrated whole and create synergy, with the pooling of talents being the most obvious advantage available, Zhang said: “Dongguan is a manufacturing base. Innovative technology can achieve large-scale production here. Shenzhen is a science and technology centre with large numbers of skilled scientific and technological personnel working in telecoms giants such as Huawei and Tencent. As a financial centre, Hong Kong can help companies raise funds. Diversification of industries in the GBA can reinforce the pooling of talents while stimulating the growth of emerging industries.”

Editor's picks

Trending articles

By Martin Russell, Members' Research Service, European Parliamentary Research Service

Despite being strategically located at the crossroads of Europe and Asia, Central Asia has long been poorly connected: remote, landlocked, cut off from the main population centres of Europe and Asia by empty steppes and rugged mountains. As well as physical barriers, regulatory obstacles and political repression often inhibit the free flow of people, goods, services and ideas. However, in 2013 China announced its Belt and Road Initiative (BRI), one of whose aims is to revive the historic Silk Road trade route connecting Europe to the Far East via Central Asia. Uzbekistan's more open foreign policy since 2016 also favours improved connectivity.

The Belt and Road Initiative has provided impetus for a major transport infrastructure upgrade. Central Asian countries are also dismantling barriers to trade and travel. Many problems still remain – the poor state of physical infrastructure, limited digital connectivity, and regulatory obstacles. Progress has been uneven. In Uzbekistan and Kazakhstan, improved connectivity is driving increased trade and investment, while Kyrgyzstan, Tajikistan and Turkmenistan are lagging behind.

Given the importance of connectivity for Central Asia, it is key to the EU's relations with the region. The EU is making a difference, for example, by supporting educational exchanges and helping to dismantle trade barriers, but its role has not attracted the same attention as China's BRI. The EU's 2018 Connecting Europe and Asia strategy aims to redress the balance by setting out the values that underpin its own vision of sustainable, rules-based connectivity. For the strategy, connectivity is about more than infrastructure, and includes tackling non-physical (e.g. regulatory) barriers to movement. The EU has also expressed concerns about some aspects of the BRI, seen as prioritising China's interests over those of partner countries. However, given Beijing's growing influence, the EU needs to co-exist not only with China but also Russia, which is also a major connectivity player in the region through its Eurasian Economic Union.

Please click to read full report.

1778 Views

1778 Views