Chinese Mainland

Guangdong Enterprises Tapping Belt and Road Opportunities: Yulan Wall-coverings Uses Hong Kong Services to Meet International Standards

In order to ensure that its products meet the requisite quality and fire safety standards of overseas clients, the popular mainland wallpaper brand Yulan relies on inspection and testing services in Hong Kong. Now, by employing Hong Kong’s professional services which deal with matters such as market and financial information, Yulan is actively expanding its markets in Southeast Asia, Eastern Europe and other countries along the Belt and Road. In doing so, the company is also promoting the long-term development of its international business operations.

Famous Brand Expands Global Business

Yulan Decorative Materials Co Ltd (Yulan Wallcoverings) is based in Dongguan, Guangdong province. It plans to take advantage of China’s Belt and Road Initiative and venture out into selected countries along those routes. The company is mainly engaged in the research, development, design, production and marketing of wallpaper, wallcoverings, fabrics and household goods. It has won much industry acclaim, including being named in 'Top 100 Chinese Home Furnishings Companies' and 'Famous Chinese Trademarks'. It has also been granted over 50 national patents for design and production.

At present, around 70% of Yulan’s business comes through domestic sales. Its main export markets include Southeast Asia, South America, Eastern Europe and Iran. Competition within the domestic market has intensifying in recent years as the number of mainland wallpaper producers has increased. Advanced countries in Europe and North America still have many competitive wallpaper production lines in operation. This poses pressures for Yulan in terms of sales of higher-end products. For this reason, the company hopes to open up further export markets to enable its long-term development.

Wallpaper production is not considered to be a labour-intensive industry. It relies mainly on machinery. Yulan mainly uses imported materials in its production processes, including backing, plastics, matt vinyl and moulds brought in from Europe, the US, South Korea and other countries. As far as the production of higher-end products is concerned, the company only has a limited overall cost advantage over its European and North American equivalents. Therefore it has to keep improving its R&D capability and quality management in an attempt to improve the competitiveness of its products. Yulan also plans to boost its production capacity on the mainland in order to expand domestic sales and exports.

Meeting Demands of 'Belt and Road' Buyers through Hong Kong

In practice, wallpaper export trade faces many restrictions. For example, wallpaper may not be appropriate in territories such as Australia where humidity is particularly high. Equally, some countries with lower purchasing power may prefer cheaper products, even reproduction wallpapers, but this is not conducive to the marketing of name-brand products.

Yulan told HKTDC Research that some East European consumers are acquiring the habit of buying wallpapers for DIY home decoration, just like their counterparts in Western Europe. Moreover, Muslim consumers in countries along the Belt and Road prefer products featuring Islamic patterns and design. Hence, there is tremendous potential out there waiting to be tapped. Yulan intends to quicken its pace in opening up the Belt and Road markets and developing its brand in these countries.

On the other hand, building construction is on the upswing in many Asian countries and major contractors often call for subcontractor bids from Hong Kong. Besides seeking competitive subcontractors, they also want to make use of Hong Kong's inspection and testing services. This enables them to ensure that the subcontractor projects measure up to the required quality and fire safety standards. Yulan already has experience of taking on indoor wallcovering and decoration contracts for Macau and some Southeast Asian countries, such as Malaysia. In the future, it plans to bid for more subcontracts of this kind via Hong Kong.

Yulan’s Hong Kong office manages the import of materials and the export of products. It also gathers information on overseas markets and keeps abreast of the requirements of overseas buyers and contractors for product technology and specifications. When necessary, it makes use of relevant services provided by Hong Kong companies in order to ensure that its products meet the standards of its overseas clients.

HKTDC Research wishes to express its appreciation to the Department of Commerce of Guangdong Province and the Bureau of Commerce of Dongguan City for their assistance in conducting research studies and company visits.

| Content provided by |

|

Editor's picks

Trending articles

16 Dec 2016

Can the Trans-Pacific Partnership multilateralise the 'noodle bowl' of Asia-Pacific trade agreements?

By Jeffrey D. Wilson - Perth USAsia Centre

Executive Summary

- The Trans-Pacific Partnership offers more than just a set of market access opportunities for Australia. It also promises ‘systemic change’ in the Asia-Pacific trade architecture.

- The spread of bilateral FTAs in the last decade has caused fractures in the regional trade system, known as the ‘noodle bowl problem’.

- The TPP may help resolve this problem by ‘multilateralising’ existing agreements under one umbrella. Its size, ambitious reform agenda and status as a ‘living agreement’ make it especially suited to this task.

- Australia stands to gain considerably if the TPP’s high-standard and multilateral approach becomes a template for trade liberalisation in the region.

- Businesses and policymakers should be aware of these systemic implications when evaluating participation in the TPP.

Introduction

The Trans-Pacific Partnership (TPP) is one of the most significant developments on the trade and foreign policy agendas in the Asia-Pacific today. It is huge agreement, comprising twelve member states that collectively account for one-third of global economic activity. Its scope is extensive, combining a wide array of tariff reductions with commitments in 24 ‘new’ trade policy areas, such as services, intellectual property and e-commerce. In a region that has recently been dominated by proliferation of bilateral free trade agreements (FTAs), its multilateral approach to trade liberalisation is also a novel development. It has also been implicated in geopolitical rivalries in Asia, particularly the emerging rivalry between the US and China for regional leadership. …..

Please click to read full report.

Editor's picks

Trending articles

Deloitte | 19 Dec 2016

"One Belt, One Road" The Internationalization of China's SOEs

Decades have passed since China’s state-owned enterprises (SOEs) started their internationalization. Many impressive achievements have been made, yet there is still room for improvement. On September 13, 2015, the Central Committee of the CPC and State Council published a top-level government policy paper entitled ”Guidelines to Deepen Reforms of SOEs”, in fact a de-facto blue-print for the further reform of SOEs. The guidelines stated that SOE reforms aim to achieve a socialist market economy and improve the modern enterprise system. What this means, in effect, is that SOEs, especially larger SOEs, should compete in global markets, allocate resources across the world, and increase operational efficiency. Step by step, China is implementing its national strategy for a new era of economic development and opening up to the outside world, i.e. the Silk Road Economic Belt and the 21st-century Maritime Silk Road (“One Belt, One Road” or “OBOR”) Initiative. These initiatives have created more favorable external conditions for SOEs to invest abroad and thus ushered in a new age of internationalization. It is also likely that the internationalization of SOEs will change focus from mere expansion to improving operations management and enhancing global competitiveness by taking advantage of the OBOR Initiative. Through surveys of middle and senior-level SOE managers, we obtained insights into SOE participation in the OBOR Initiative as well as learning about the challenges they face. This paper presents several representative solutions to such challenges, and aims to offer some new ideas on how Chinese SOEs can successfully internationalize.

Please click to read the full report.

| Content provided by |  |

Editor's picks

Trending articles

20 Dec 2016

Review of Maritime Transport 2016

UNCTAD

Executive Summary

The present edition of the Review of Maritime Transport takes the view that the long-term growth prospects for seaborne trade and maritime businesses are positive. There are ample opportunities for developing countries to generate income and employment and help promote foreign trade.

Seaborne trade

In 2015, world gross domestic product expanded by 2.5 per cent, the same rate as in 2014. Diverging individual country performances unfolded against the background of lower oil and commodity price levels, weak global demand and a slowdown in China. In tandem, global merchandise trade by volume weakened, increasing by only 1.4 per cent, down from 2.3 per cent in 2014.

In addition in 2015, estimated world seaborne trade volumes surpassed 10 billion tons – the first time in the records of UNCTAD. Shipments expanded by 2.1 per cent, a pace notably slower than the historical average. The tanker trade segment recorded its best performance since 2008, while growth in the dry cargo sector, including bulk commodities and containerized trade in commodities, fell short of expectations.

UNCTAD expects world gross domestic product to further decelerate to 2.3 per cent in 2016, while, according to estimates by the World Trade Organization, merchandise trade volumes are expected to remain steady and grow at the same rate as in 2015. Growth in world seaborne trade shipments is expected to pick up marginally in 2016, with the estimated pace remaining relatively slow on a historical basis.

While a slowdown in China is bad news for shipping, other countries have the potential to drive further growth. South–South trade is gaining momentum, and planned initiatives such as the One Belt, One Road Initiative and the Partnership for Quality Infrastructure, as well as the expanded Panama Canal and Suez Canal, all have the potential to affect seaborne trade, reshape world shipping networks and generate business opportunities. In parallel, trends such as the fourth industrial revolution, big data and electronic commerce are unfolding, and entail both challenges and opportunities for countries and maritime transport.

Maritime businesses

The world fleet grew by 3.5 per cent in the 12 months to 1 January 2016 (in terms of dead-weight tons (dwt)). This is the lowest growth rate since 2003, yet still higher than the 2.1 per cent growth in demand, leading to a continued situation of global overcapacity.

The position of countries within global container shipping networks is reflected in the UNCTAD liner shipping connectivity index. In May 2016, the bestconnected countries were Morocco, Egypt and South Africa in Africa; China and the Republic of Korea in Eastern Asia; Panama and Colombia in Latin America and the Caribbean; Sri Lanka and India in South Asia; and Singapore and Malaysia in South-East Asia.

Different countries participate in different sectors of the shipping business, seizing opportunities to generate income and employment. As at January 2016, the top five shipowning economies (in terms of dwt) were Greece, Japan, China, Germany and Singapore, while the top five economies by flag of registration were Panama, Liberia, the Marshall Islands, Hong Kong (China) and Singapore. The largest shipbuilding countries are China, Japan and the Republic of Korea, accounting for 91.4 per cent of gross tonnage constructed in 2015. Most demolitions take place in Asia; four countries – Bangladesh, India, Pakistan and China – accounted for 95 per cent of ship scrapping gross tonnage in 2015. The largest suppliers of seafarers are China, Indonesia and the Philippines. As countries specialize in different maritime subsectors, a process of concentration of the industry occurs. As each maritime business locates in a smaller number of countries, most countries host a decreasing number of maritime businesses, albeit with growing market shares in the subsectors.

Policymakers are advised to identify and invest in maritime sectors in which their countries may have a comparative advantage. Supporting the maritime sector is no longer a policy choice. Rather, the challenge is to identify and support selected maritime businesses. Policymakers need to carefully assess the competitive environment for each maritime subsector they wish to develop, and to consider the value added of a sector for the State economy, including possible synergies and spillover effects into other sectors – maritime and beyond. Policymakers should also take into account the fact that the port and shipping business is a key enabler of a country’s foreign trade. Apart from possibly generating income and employment in the maritime sector, it is generally even more important to ensure that a country’s traders have access to fast, reliable and cost-effective port and shipping services, no matter who is the provider.

Freight rates and maritime transport costs

In 2015, most shipping segments, except for tankers, suffered historic low levels of freight rates and weak earnings, triggered by weak demand and oversupply of new tonnage. The tanker market remained strong, mainly because of the continuing and exceptional fall in oil prices.

In the container segment, freight rates declined steadily, reaching record low prices as the market continued to struggle with weakening demand and the presence of ever-larger container vessels that had entered the market throughout the year. In an effort to deal with low freight rate levels and reduce losses, carriers continued to consider measures to improve efficiency and optimize operations, as in previous years. Key measures included cascading, idling, slow steaming, and wider consolidation and integration, as well as the restructuring of new alliances.

The same was true of the dry bulk freight market, which was affected by the substantial slowdown in seaborne dry bulk trade and the influx of excess tonnage. Rates fluctuated around or below vessels’ operating costs across all segments. As in container shipping, measures were taken to mitigate losses and alliances were reinforced, as illustrated by the formation in February 2015 of the largest alliance of dry bulk carriers, Capesize Chartering.

Market conditions in the tanker market, however, were favourable. The crude oil and oil product tanker markets enjoyed strong freight rates throughout 2015, mainly triggered by a surge in seaborne oil trade and supported by a low supply of crude tanker fleet capacity.

Ports

The report describes the work of UNCTAD in helping developing countries improve port performance, with a view towards lowering transport costs and achieving better integration into global trade. It explores new datasets in port statistics and presents an overview of what these reveal about the port industry in 2015.

The overall port industry, including the container sector, experienced significant declines in growth, with growth rates for the largest ports only just remaining positive. The 20 leading ports by volume experienced an 85 per cent decline in growth, from 6.3 per cent in 2014 to 0.9 per cent in 2015. Of the seven largest ports to have recorded declines in throughput, Singapore was the only one not located in China. Nonetheless, with 14 of the top 20 ports located in China, some ports posted impressive growth, and one (Suzhou) even grew by double digits. The top 20 container ports, which usually account for about half of the world’s container port throughput and provide a straightforward overview of the industry in any year, showed a 95 per cent decline in growth, from 5.6 per cent in 2014 to 0.5 per cent in 2015.

Legal issues and regulatory developments

During the period under review, important developments included the adoption of the 2030 Agenda for Sustainable Development in September 2015 and the Paris Agreement under the United Nations Framework Convention on Climate Change in December 2015. Their implementation, along with that of the Addis Ababa Action Agenda, adopted in July 2015, which provides a global framework for financing development post-2015, is expected to bring increased opportunities for developing countries.

Among regulatory initiatives, it is worth noting the entry into force on 1 July 2016 of the International Convention for the Safety of Life at Sea amendments related to the mandatory verification of the gross mass of containers, which will contribute to improving the stability and safety of ships and avoiding maritime accidents. At the International Maritime Organization, discussions continued on the reduction of greenhouse gas emissions from international shipping and on technical cooperation and transfer of technology particularly to developing countries. Also, progress was made in other areas clearly related to sustainable development. These included work on technical matters related to the imminent entry into force and implementation of the International Convention for the Control and Management of Ships’ Ballast Water and Sediments (2004) and on developing an international legally binding instrument under the United Nations Convention on the Law of the Sea on the conservation and sustainable use of marine biological diversity of areas beyond national jurisdiction.

Continued enhancements were made to regulatory measures in the field of maritime and supply chain security and their implementation. Areas of progress included the implementation of authorized economic operator programmes and an increasing number of bilateral mutual recognition agreements that will, in due course, form the basis for the recognition of authorized economic operators at a multilateral level. As regards suppression of maritime piracy and armed robbery, in 2015, only a modest increase of 4.1 per cent was observed in the number of incidents reported to the International Maritime Organization, compared with 2014. The number of crew members taken hostage or kidnapped and those assaulted, and the number of ships hijacked, decreased significantly compared with 2014. In this respect, a circular on combating unsafe practices associated with mixed migration by sea and interim guidelines on maritime cyber risk management were approved at the International Maritime Organization. In the context of International Labour Organization conventions, progress was also made on the issue of recognition of seafarers’ identity documents and on improving their living and working conditions.

Please click to read full report.

Editor's picks

Trending articles

HKTDC Research | 21 Dec 2016

Russia Looks to Boost Coffers Through Belt and Road Co-operation

Faced with natural resources export uncertainties, Russia hopes to capitalise on its strategic geographic advantages.

Russia is looking to capitalise on its geographical advantages as a primary trade corridor between East and West. To this end, it is counting on its participation in a number of international infrastructure projects – most notably China's Belt and Road Initiative (BRI) – to have a knock-on effect to its wider economy, reducing its reliance on revenue from the sale of natural resources, a sector vastly exposed to fluctuations in price.

According to recent research by the Russian Ministry for Economic Development, less than 7% of the country's potential as a trade route is currently being exploited. The same research also highlighted the importance of further developing Russia's two principal transit corridors – East-West (including the Trans-Siberian route) and North-South (the Baltics to the Persian Gulf, as well as the Arctic Route).

This future development is seen as hinging on successfully marrying Russia's own infrastructure projects with developments prioritised under the BRI initiative. Working with fellow members of the Eurasian Economic and Customs Union (EECU) – Armenia, Belarus, Kazakhstan and Kyrgyzstan – on a number of projects of mutual interest has also been identified as a priority.

To date, the Sino-Russian joint working group charged with exploring potential areas of co-operation has identified 20 projects as worthy of further development. As well as infrastructure initiatives, projects relating to power generation, agriculture and machinery have also been green lit.

A number of these projects are now under way, including work on the Europe-Western China International Transport Route, the Taman Seaport Bulk and Container Cargo Terminal and the Yamal-SPG Natural Gas Pipeline. A number of other projects, however, remain at the planning stage, most notably the Western China-Kazakhstan-Russia-Belarus Highway, the Moscow-Beijing Highway, the Siberia Strength 2 Pipeline and the hydro-power generation stations earmarked for Heilongjiang.

At present, the current level of sea-freight rates versus railway tariffs makes it uneconomical to deliver most China-Europe cargoes via Russian territory. In order to make the land routes viable, deliveries would have to take half the time required for marine freighting, with the reduction in associated costs mitigating the higher rail fees.

As an alternative – and one favoured by the Eurasian Economic Integration Think-tank – land delivery costs should be cut by up to 40%, making the service highly competitive with its marine counterpart. The Think-tank also emphasised its belief that the aims of the BRI could only be delivered by nurturing the Central Asian markets and by developing new logistics chains along the China-Europe-China transit corridors.

Despite these reservations, Russia is set to be one of the key beneficiaries of the BRI, with many of the proposed trade routes crossing its territory. Similarly, the country will also benefit from other members of the EECU becoming more actively involved in the global logistics sector.

This year, some 74% of the cross-Russia trade flow originated in China, up from just 41% in 2015. Although the majority of such cargo is ferried by China's rolling stock, the Russian Railways Corporation also saw its volume of China-Europe cargo grow by 7% this year.

In addition to rail freight, it is now widely expected that China will increasingly look to road haulage as a means of increasing its trade flow into Europe. To this end, it is expected to become a signatory to the TIR Convention, an international treaty governing the transportation of freight by road across all of its 70 member countries. Any such move would inevitably boost the level of deliveries by truck in Northeastern China, Russia's Far East and Eastern Siberia.

Any improvements in road or rail freight connectivity and competitiveness, however, will need to be matched by increased efficiency and reduced processing time when it comes to customs procedures. To this end, the Eurasian Economic Commission has announced plans for a unified transit document, ultimately removing the need for national customs declarations. The proposed documentation is currently being trialled on a number of China-Europe cargo routes.

Leonid Orlov, Moscow Consultant

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 22 Dec 2016

Tapping Belt and Road Opportunities: Views and Service Demand of Huizhou Enterprises in Guangdong

Many enterprises from Huizhou in Guangdong Province would like to tap the opportunities afforded by China’s Belt and Road strategic development initiative, in order to further expand their export business. This fact emerged at a recent seminar held by HKTDC Research. To make an effective entry into the Belt and Road markets, though, Huizhou businesses would first need to engage with the Hong Kong hub in order to obtain useful information about those territories. This could cover a whole variety of subjects from the condition of supply chains, the sourcing activities and product standards of local buyers, to related support services such as marketing and risk management.

Some attendees indicated that they are open to making direct investments in Belt and Road countries. However, before that could happen they would require professional consulting services to help them to understand local business cultures and investment risks. This would allow them to assess the feasibility of investing and setting up factories in these countries. Other respondents noted that certain Southeast Asian and South Asian territories are currently tightening up their policies and approval procedures relating to foreign direct investments. Therefore, these companies are very keen to keep abreast of the very latest developments within these markets.

On the whole, Huizhou enterprises wish to take advantage of the Belt and Road opportunities for overseas expansion. They intend to seek professional services in Hong Kong to help them address practical issues such as marketing and foreign investment procedures, or securing cost-effective funds to finance their overseas operations.

Huizhou Enterprises to Tap Belt and Road Opportunities

Continuous growth within the Pearl River Delta (PRD) economy has led to the gradual expansion of its production and commercial activities, from the Pearl River estuary to its eastern and western flanks. Huizhou is located in the north-eastern part of the PRD adjoining Shenzhen and it has already benefited from the influx of foreign capital over the years. To date, more than 9,000 foreign-invested enterprises have set up operations in the city. TCL, Desay, Adayo and Cosun, all of which figure among China's top 500 electronic information enterprises, are amongst the many well-known mainland companies who have established their corporate headquarters in Huizhou[1]. In doing so, they have contributed directly to the rapid development of the city's economy.

With Guangdong province’s foreign trade and economic activities on the rise, over recent years Huizhou companies have been active in going abroad in search of business expansion. Simultaneously, they have been exploring the Belt and Road opportunities. Statistics show that, to date, some 83 Huizhou enterprises have invested a total of US$460 million directly overseas, mainly in Hong Kong, Taiwan, Macau and the United States. Through their foreign arms, some of these companies have even reinvested either directly or indirectly in destinations such as Vietnam, Cambodia and Ethiopia[2].

In recent times, China has leapt into position as the world's second largest source of FDI[3]. It has also been strengthening its ties with Belt and Road territories, by means of investments and economic partnerships. Throughout, the South China region has stayed at the forefront of the country's external trade and economic co-operation activities.

During mid-2016, HKTDC Research conducted surveys in selected cities throughout Guangdong and Guangxi, in order to gauge the interest of mainland enterprises in exploring Belt and Road opportunities and their demand for related support services[4]. As part of this exercise, a business seminar was held in Huizhou in the third quarter of 2016 to garner the views of local production and trade enterprises. Their views are summarised as follows:

-

Focus on Southeast Asian market

Over the years, many enterprises in Huizhou have developed into large or medium-sized companies, while engaging in the production of high-tech products such as switching power supplies, fine-pitch printed circuit boards and other precision electronics. They now have many years’ experience in international marketing and their customers include multinational companies from Europe, the United States and certain Asian countries. Some of them are listed on the mainland stock exchanges and are among the leading manufacturers in China.

As China presses ahead with its Belt and Road initiative, most companies in Huizhou seem to recognise the importance of keeping abreast of new Belt and Road information so that they don't miss out on potential business opportunities. In order to facilitate the future expansion of their export business, many enterprises intend to further explore the Belt and Road markets, especially those Southeast Asian countries neighbouring China. Some even aspire to develop brand business within the Southeast Asian market.

-

Lack of practical market information

A number of the companies questioned are now familiar with the US and European markets and the large amount of relevant macro data which the government has provided to them. Nevertheless, most conceded that they are still unable to develop a clear concept of the Belt and Road initiative, which covers a huge number of countries and regions. Many companies expressed a fundamental lack of understanding about these markets, even those ASEAN countries which are geographically close to China. Businesses appear to require more data on the socio-economic environment, laws and regulations, industry policies, business culture and commercial risks relating to these territories. Information on local supply chains, the sourcing activities of buyers and product standards is also inadequate at present.

When it comes to market access, what these companies need most urgently is practical information to help them set up sales channels in the Belt and Road countries. In particular, they lack business intelligence about the specific needs of local markets, the characteristics of potential customers and other practical information about import requirements. Some enterprises highlighted the difficulties of effectively reaching buyers from Belt and Road markets solely through traditional trade fairs. Another matter for concern for these companies is the protection of intellectual property rights such as trademarks and patents within the Belt and Road markets, as they wish to avoid substantial losses which can result from third party infringement.

In the circumstances, Huizhou enterprises are eager to locate relevant support services via Hong Kong which could help them to further explore Belt and Road opportunities. Besides, they hope to utilise Hong Kong's financial market to secure funds for their overseas business. According to representatives of these companies, they first plan to expand their export trade, followed by investment in and establishing of factories overseas, and then, in the longer term, the acquisition of foreign brands.

-

Focus on market risk management

The general paucity of market information has created difficulties for enterprises in controlling their business risks and has hindered their efforts to develop the Belt and Road markets. For example, over the past few years the dealings of some small home appliance exporters in the European market have been affected by the weakness of the Euro. Though this situation has stabilised more recently, many Huizhou firms still prefer to focus on this familiar market rather than taking risks by venturing into uncharted territories.

Some enterprises who are engaged in domestic sales, including some brand owners which distribute diving and swimming gear in the mainland, indicated that the mainland market remains buoyant. As such, it would continue to be the focus of their business development. They remarked they were largely unfamiliar with the Belt and Road markets and believed that heading into these markets would entail greater risks. In all, they would not consider developing Belt and Trade operations for the time being, unless suitable risk management solutions become available.

Meeting the specific requirements of Belt and Road buyers poses some major challenges. Some companies with experience in shipping industrial and consumer goods directly to European and US buyers observed that, due to different product standards in the importing country, commercial disputes can arise. This is even in spite of the fact that the products have already passed factory inspections and tests prior to shipping. To minimise these risks, some enterprises intend to work alongside Hong Kong companies when exploring the Belt and Road markets. They believe that their Hong Kong partners could help to avert problems relating to product specifications and compliance of foreign standards.

-

Assess investment opportunities in Southeast Asia

On the subject of direct investment in Belt and Road countries, most enterprises indicated that preference would be given to territories within Southeast Asia. In order to assess the feasibility of investing in and setting up factories in certain Southeast Asian destinations, they said that they would seek practical advice from investment consultants.

Specifically, the information they are looking for would cover investment policies, industry facts, national and regional supply chains, the availability of production materials and logistics support and so on. Enterprises interested in investing abroad intend to use consultancy services and other professional amenities in Hong Kong, so as to obtain practical information for the assessment of investment projects in Belt and Road countries. They also hope to raise funds via Hong Kong in order to finance these investment projects.

-

Concern about investment climate and policy risks

Some companies pointed out that, due to the continuous inflow of foreign capital into Asia over recent years, some Southeast Asian and South Asian countries have gradually tightened their policies and approval procedures for FDI projects. Now they tend to give priority to higher value-added investment projects. As a result, it has become increasingly difficult for enterprises engaged in lower value-added, labour-intensive operations to find suitable investment destinations within Asia. Therefore, it is crucial for them to learn about the latest developments in these countries and assess future policy risks before making any investment decisions.

Setting up factories in some low-cost regions in Asia in order to produce export-oriented goods may help ease the problem of rising production costs on the Chinese mainland. However, these facilities would still have to pass audits by overseas buyers and comply with the relevant labour, environmental protection and social responsibility standards. At this stage, some low-cost Asian territories may not be able to meet the stringent requirements of these buyers.

-

Assessing other investment factors

While the cost of labour in some Southeast Asian countries is relatively low, the lack of skilled labour and technical personnel in some areas of production, such as jewellery processing, could make it difficult for businesses to support processing activities. This problem is further compounded by the lack of supplementary materials for industrial production. In view of this, some enterprises indicated that they wouldn't consider relocating production activities to Belt and Road countries in the short term.

Another important factor which businesses must consider before relocating their production lines is human resources management. One respondent to the study was an automotive electronics company which has gone abroad to invest and set up factories in Malaysia and Poland. They confessed that, although they have established a comprehensive global sales network, they still lack the talent to manage their expanding overseas investment projects and international sales. At present, their overseas factories are managed by local employees and as a result, cultural differences have led to some administrative problems. The company therefore wish to employ Hong Kong professionals with a global vision and knowledge of foreign cultures, in order to help them manage their business and enhance their overall operational efficiency.

HKTDC Research wishes to express its appreciation to the Department of Commerce of Guangdong Province and the Bureau of Commerce of Huizhou City for their assistance in conducting the research studies and company visits, as well as the Huizhou Association of Enterprises with Foreign Investment for their help.

[1] Source: Bureau of Commerce of Huizhou City

[2] Figures as at July 2016. Source: Bureau of Commerce of Huizhou City

[3] 2015 figures. Source: Statistical Bulletin of China’s Outward Foreign Direct Investment 2015

[4] For more details of the surveys, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

| Content provided by |  |

Editor's picks

Trending articles

23 Dec 2016

How TPP Critics Muddle Facts, Fictions, and Unfounded Fears: A Point-by-Point Analysis

By Nigel Cory and Stephen Ezell

Introduction

Consideration of the Trans-Pacific Partnership (TPP) agreement during the final months of the Obama administration will initiate a new phase of legitimate debate, but also a massive campaign of misinformation and hyperbole designed to sink the agreement. The problem policymakers face is that while a small portion of the criticism is valid, the majority of it is not. Some specific technical criticism, like of the agreement’s exemption of financial services from data localization limits, is constructive. However, the lion’s share of the criticism raised by opponents represents an attempt to kill the deal by a thousand cuts, for these opponents fundamentally oppose what the TPP represents: the next step in deep global economic integration and trade liberalization. In sifting through this, policymakers must not lose sight of the bigger picture and ultimate goal: a truly integrated global economy.

Indeed, what’s fundamentally at stake in the debate over the Trans-Pacific Partnership is nothing less than the future of globalization. There are three camps when it comes to the political economy of trade in the United States. One camp—the “globalists”—broadly supports the TPP’s objective of furthering the globalist enterprise by developing a next generation trade agreement, among a large block of nations in the world’s fastest growing economic region (the Asia-Pacific), and that installs new disciplines and rules in reducing barriers and distortions to manufacturing and services trade, expands the size of global markets, and creates conditions in which the most innovative enterprises, regardless of size or nationality, can thrive. To be sure, some in this group might seek technical or pragmatic improvements to some aspects of the TPP—e.g., stronger prohibitions again localization requirements in the financial services sector, more disciplines related to currency manipulation, greater services sector liberalization, stronger protections for intellectual property rights in the life sciences—but they are fundamentally supportive of the TPP’s animating geopolitical objectives. The Information Technology and Innovation Foundation (ITIF) is firmly in this camp.

A second camp—the “liberal Keynesians”—views the TPP through its prism of focusing on privileging worker (as opposed to consumer) welfare and focusing more on equity than growth. 1 As such, many liberal Keynesians are skeptical of globalization and trade, especially trade with low-wage nations.2 This is because they believe that trade, especially with low-wage nations, reduces wage growth for some workers. As the liberal Economic Policy Institute (EPI) writes, “Trade and globalization policies have major effects on the wages and incomes of American workers.”3 In this case, they mean negative effects. In addition, by privileging worker welfare, liberal Keynesians oppose labor market disruption, even if, on net, it produces economic benefits. For them, even a trade deal that would result in net GDP growth might be undesirable if it means that some workers are hurt. In other words, a deal that has mixed employment effects on different sectors—fewer textile or apparel workers but more aerospace and e-commerce workers—would be too disruptive, even if it would move the United States in the direction of being a higher-skill, higher wage, higher value-added economy over the long run. Moreover, they resist global competition because it requires competitive business climates, which mean some limits on how much companies can pay lower-skilled workers and how much regulators can regulate. Better to return to the postwar world of strong unions and an active regulatory state before the post-1990s round of globalization.

But it’s the third group—the “anti-globalists”—that has been most vocal in its opposition to the TPP and most willing to engage in misleading negative messaging. These opponents, who are primarily on the political left (though with some common cause on the Tea Party right), view globalization and multinational corporations as the fundamental problem.4 This collection of voices, under the banner of coalitions such as “Expose the TPP,” fundamentally rejects a world in which multinational corporations are major producers and where global economies are tightly integrated. The anti-globalists view multinational companies, global supply chains, global markets operating according to harmonized rules, and the rise of a consumer-based global middle class as somehow inherently suspect and therefore undesirable. For them, the TPP is the abhorrent hallmark of this globalist enterprise. The anti-globalists believe that every corporate benefit comes at the expense of public benefit and that small and local is inherently more beautiful. They seek a return to an idealized prior world of nationalistic and even localized economies where most products and services would be produced by small businesses (ideally worker-owned co-ops) in close geographic proximity to where they are consumed. For them, the rise of localization barriers to trade—policies that seek to balkanize local production, such as local facilities for information and communications technologies (ICT) for local markets—are preferable, because they fear that they lack the ability to compete on level terms in a homogenized, “corporatized” world of large enterprises that efficiently serve global consumer markets.

In essence, what’s at stake isn’t just the TPP itself: It’s the future of globalization. On the one hand stands a vision of a globally integrated economy that is increasingly market driven, rules-based, and competitive. In such an economy, the corporations (whether large or emerging) that produce and market the most innovative products and services can compete at global scale. This global economic system can maximize innovation, productivity, and ultimately consumer and worker welfare. The other vision is more hidebound and conservative, wishing to revert to fragmented, localized production—often enabled by government policies that limit competition or balkanize production—in other words, a set of policies that will lead to less productivity, less innovation, and ultimately lower consumer and worker welfare.

The TPP is poised to play a pivotal role in the next phase of globalization. First, the TPP promotes the goal of global trade liberalization by establishing a higher-standard trade agreement that should become a model for other global trade agreements going forward. Second, the TPP creates new rules and imposes new disciplines that make substantial progress toward preventing discriminatory, anticompetitive trade policies that a growing number of nations have tried to implement in recent years. This is vital, for continued global integration must come with a strong commitment to open and non-distorted markets on the part of U.S. trading partners. Indeed, if U.S. enterprises and workers are going to be able to compete on fair and equitable terms in global markets—a competition in which they should be well positioned to succeed, especially if the United States ever gets around to putting in place a domestic national competitiveness strategy—it is imperative that we enact trade deals that go substantially beyond the relatively limited World Trade Organization (WTO) trade regimes now in place. Third, and related, is the notion that the TPP can become a “docking station” that enrolls additional nations—and, notably, possibly China in the future—in a high-standard trade agreement that perpetuates the world’s most robust set of trade rules in a more enforceable manner.

Given the importance of the TPP, this report responds to and rebuts many, if not most, criticisms of the agreement, pushing back on the distorted fear campaign being used by opponents. The first section rebuts the strategic claim made against the TPP—that it is bad for the American economy and American workers. For example, opponents claim the TPP will harm America’s consumers, but America’s consumers actually benefit from the more robust global competition that trade engenders and the fact that competition forces producers—foreign or domestic—to innovate and to develop products and services of the best quality and value at the lowest cost. Opponents further claim that the TPP will harm American workers, when in reality the agreement will create conditions in which America’s most innovative and fastest-growing industries and enterprises can thrive in global competition and thus support growing workforces. Moreover, if they carried the day, many of the critics’ objections to the intellectual property (IP) provisions of the TPP—from their complaint that the TPP is too IP friendly or that its antipiracy provisions are too robust— would actually significantly harm the interests of U.S. workers involved in the production of IP-enabled goods and services. But beyond that point, critics further miss that job creation shouldn’t be the focal point on which the merit of trade agreements is assessed. From an international economics perspective, trade neither creates nor reduces the total number of jobs; it redistributes them, ideally toward higher value-added production. Rather, the test should be whether a particular trade agreement engenders the conditions— e.g., large markets that enable economies of scale, particularly for innovation-based industries; robust and market-based competition that keeps firms on their toes; and the ability of nations to specialize in the facets of production in which they are most productive and efficient. When these conditions expand, economic growth can flourish to the maximum extent possible.

The report then examines a variety of issues—including the investor-state dispute settlement mechanism, currency manipulation, and various IP provisions. The report identifies legitimate criticisms of the TPP on some issues, while showing that, in the vast majority of cases, the criticism is simply not valid. Indeed, a substantial portion of the criticism is intentional misdirection by opponents who have an ideological bias against corporations, globalization, intellectual property, or some mix of the three. The report concludes by observing that the TPP represents a vital step in continuing the momentum for wealth-creating global economic integration and trade liberalization.

Please click to read full report.

Editor's picks

Trending articles

HKTDC Research | 29 Dec 2016

Guangdong Enterprises Tapping Belt and Road Opportunities: Huizhou Welon Ventures into Sporting Goods Market in Southeast Asia

At present, Huizhou-based Welon (China) Ltd is looking to expand its own-brand business in Southeast Asia. The company hopes to use its mainland and overseas designing and technological resources to develop high-end indoor and outdoor sporting goods. Welon provides ODM services to famous mainland and international brands. It also uses the brand advantage of foreign partners to open up both domestic and overseas markets.

Expand Own-brand Business in Overseas Markets

Founded in 2001, Welon mainly engages in the design, production and marketing of indoor and outdoor sporting goods such as darts, billiards, skateboards and various types of balls. In addition, it handles diving, beach and underwater sports equipment and sports fashion items such as swimming costumes, beach wear and caps. The company has clients in developed markets within Europe and North America as well as on the Chinese mainland. Others clients include some of the countries along the Belt and Road, including Southeast Asia, Russia and Africa.

Welon provides OEM services to famous mainland and overseas sporting goods brands. In order to provide ODM service to clients, the company maintains a design team at its Guangzhou office and works with designers from Germany, Australia and other countries to produce designer products. It also develops own-brand business in suitable markets, such as selling goods under its own WINMAX label. The company began 'going out' to bring foreign brands into the country many years ago. For example, it imported a US brand of extreme sports goods into the mainland and made direct investment in Germany through acquisition. This was in a bid to break into the German and European darts market with German brand goods.

Develop Belt and Road Markets via Hong Kong

When branching out in overseas markets, Welon has to address many practical issues, particularly in countries along the Belt and Road. The company told HKTDC Research that it tried to sell own label products to Southeast Asia several years ago, only to find that its attempts to enter these markets were blocked by the pre-emptive trademark registration of some of its brands there. Another hurdle which emerges when tapping into these markets is the lack of market information, such as sales channels and consumer preferences in Asian countries and other markets along the Belt and Road.

Welon has set up an office in Hong Kong to facilitate financing for its offshore business and the handling of its financial and tax affairs. Information obtained through Hong Kong should help to improve its understanding of overseas markets. To further tap market opportunities along the Belt and Road, the company plans to make use of Hong Kong’s marketing and brand management services. This would help with issues including the formulation of marketing strategies, brand management and intellectual property rights protection (such as application for trademark and design patent registration).

HKTDC Research wishes to express its appreciation to the Department of Commerce of Guangdong Province and the Bureau of Commerce of Huizhou City for their assistance in conducting research studies and company visits.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 5 Jan 2017

Exploring the Belt and Road Markets: An Opportunity for Guangdong’s Jiangmen Enterprises

HKTDC Research recently held a seminar in Guangdong’s Jiangmen city in order to canvas the views of local businesses about the host of opportunities arising from the current Belt and Road Initiative. Many enterprises in Jiangmen are looking to sell more consumer goods and industrial products to markets along the Belt and Road. In particular, they are interested in certain developing countries where demand for value-for-money products is strong. These countries offer good opportunities for Jiangmen motorcycle and furniture manufacturers with a competitive edge, enabling them to make an entry into this market and develop their brands there.

Belt and Road markets in which Jiangmen enterprises are most interested include countries in Southeast Asia, South Asia and West Asia like Iran. Industry players in the city also wish to use Hong Kong as a source of information on the demands, sales channels, and trade and commercial practices of markets along the Belt and Road. Hong Kong also offers them a wellspring of support in financial affairs and other business matters.

Some enterprises in Jiangmen plan to import quality raw materials from the Belt and Road countries for production, but only a small number of them suggest they would invest in setting up manufacturing facilities there. Actually, when enterprises set out to invest in establishing factories in overseas countries, they are careful to consider the entire supply chain and the pace of investment of their downstream clients in the target region. As such, they would not hastily relocate their production activities abroad merely for the sake of labour supply or lower production costs.

Jiangmen Enterprises “Going Out” to Expand Overseas Business

Today China is not only the world's second largest source of outbound direct investment (ODI)[1]. Under its Belt and Road development strategy, it has also made concerted efforts to strengthen investment in and economic co-operation with countries along these routes. The Pearl River Delta (PRD) region is one of China’s key production bases as well as a leading gateway to the outside world. Thanks to the inflow of foreign investment, Jiangmen city, situated in the western part of the PRD, has been growing in leaps and bounds economically in recent years. At present, apart from engaging in processing activities, many of the enterprises in Jiangmen are also hoping to expand their business abroad and further develop their sales channels in overseas markets.

It's worth noting that Jiangmen has developed into one of the leading production bases of motorcycles in China. The city not only has a comprehensive motorcycle industry chain. It also produces motorcycle parts, components and accessories supplying to factories locally and in other provinces, as well as exporting them to foreign markets. According to statistics, the annual output of motorcycles in Jiangmen exceeds 3 million units, accounting for over 40% of Guangdong's provincial total and about 14% of the national total[2].

To further promote business, in recent years Jiangmen businesses have been actively 'going out' to seek various opportunities, including those for selling to Belt and Road markets, as well as exploring the feasibility of sourcing and investing in them. Current statistics show that 64 enterprises in Jiangmen have filed for 'going out' to make offshore investments, with a cumulative total investment amounting to US$710 million. Of this, 87% has first flowed into Hong Kong, before later reaching its final investment destinations overseas[3].

In mid-2016, HKTDC Research conducted a survey in selected locations in Guangdong and Guangxi. The aim of this was to investigate the intentions of those mainland enterprises who are 'going out' to explore business opportunities created by Belt and Road Iinitiative, as well as their demand for the necessary professional services[4]. The findings summarised in this article also include views expressed by Jiangmen businesses, both manufacturers and traders, which attended the above-mentioned seminar in the third quarter of 2016. Key points of the findings are as follows:

-

Deepening penetration into Belt and Road markets

In particular to Jiangmen's motorcycle industry, local manufacturers of parts and components supply to domestic and Sino-foreign joint-venture motorcycle assembly plants in the mainland. Additionally, though, some of them sell parts and components to foreign markets (including Pakistan), through the global sourcing system of their Japanese automotive clients.

In a move to further tap into overseas markets, parts and components enterprises are actively negotiating with their motorcycle clients in the hope of providing more support to these clients' production activities in other countries. A number of enterprises have plans to develop direct contact with other motorcycle assembly plants and components distributors in India and Indonesia. By so doing, they wish to conduct more direct selling to clients in overseas markets. This is in a bid to develop their brands, as well as to sell their own brand components in Belt and Road markets.

Some developing countries along the Belt and Road have a marked demand for value-for-money motorcycles with lower fuel consumption and power output. Hence motorcycle assembly plants in Jiangmen, currently producing on an OEM basis for Japanese brands for sale in the mainland, have now turned their attention to Belt and Road markets like India, Pakistan and West Asia such as Iran.

Other Jiangmen-based producers of consumer goods indicate that they wish to export to Belt and Road markets in Southeast Asia. They are currently faced with challenges such as the lacklustre market on the mainland and currency depreciations in certain developing countries (such as the Russian rouble and currencies in some African countries). To combat this, many enterprises are eager to develop markets along the Belt and Road in order to expand their brand business and diversify market risks.

-

Obtaining market intelligence

In the past, Jiangmen enterprises mainly focused their business on the mainland market and carried out OEM processing activities for clients overseas. As such, they have little knowledge of what's required in exporting directly to overseas markets. Nor do they have access to effective sales channels in foreign countries. The number of countries along the Belt and Road is large, with each of them having different market environments, cultures, languages and sales conditions. Therefore it's particularly difficult for small and medium-sized enterprises to stay well informed when trying to develop such markets.

Despite this hurdle, most enterprises in Jiangmen hope to seek trading partners via Hong Kong as well as to take advantage of Hong Kong's international market resources to acquire detailed market information on Belt and Road countries. This would include details on market demand, import and sales channels, as well as trade and commercial practices of individual countries, so as to develop these markets in depth. Some enterprises also revealed that they wish to obtain trade financing through Hong Kong to support the expansion of their business overseas.

-

Following in the footsteps of clients

There are also those enterprises which follow in the footsteps of their clients in exploring the Belt and Road markets. In particular, Jiangmen enterprises involved in motorcycle production are actively looking to establish logistics facilities abroad, in order to meet the stringent requirements of their clients with motorcycle assembly plants based overseas. These clients mostly operate under the just-in-time model. They have stringent requirements for product quality and reliability, as well as the logistics and distribution of parts and components supply.

At present, high-tech production activities overseas are increasing. In addition, factories are being established along the Belt and Road by downstream clients to produce a wide range of products such as auto parts and components, electronic products and different kinds of higher-value furniture, In light of this, some upstream production materials suppliers who are currently supplying primarily to mainland clients, for instance those engaged in new materials, nano materials and other new and high-tech materials, are also expected to follow in the footsteps of their clients by setting up sales channels along the Belt and Road routes. With this they aim to support the offshore production activities of their clients while exploring the industrial market along the Belt and Road.

-

Yet to consider setting up factories

Despite the previous development, the majority of enterprises in Jiangmen currently have no concrete plans for relocating production activities away from the mainland. As a matter of fact, the development strategy of most enterprises is to conduct trade with countries and territories along the Belt and Road first before considering investment projects such as backing the establishment of industry parks. Even for larger enterprises, such as certain former state-owned enterprises, their current objective is to pursue transformation and upgrading in a move to enhance their technology and value-added content of their business in order to meet an array of challenges.

In general, enterprises in Jiangmen view the central government’s Belt and Road initiative as a clear opportunity for business development. As such, apart from developing export business, some enterprises also plan to partner with their industry peers in Belt and Road countries by way of business matching. This would enable them to look into industrial upgrading, such as developing higher technology business like bio-technology, LED and optoelectronics, as well as implementing more high-tech co-operation projects with their business partners.

There are those Jiangmen enterprises who are looking to make direct investment in or else to engage in mergers and acquisitions with Belt and Road markets at a later stage. Most of them said that they would take further advantage of Hong Kong in order to raise funds for their offshore projects, manage their overseas staff and handle international tax matters.

-

Importing from Belt and Road

As well as achieving sales, certain Jiangmen enterprises also wish to import quality raw materials from the Belt and Road region as inputs for production on the mainland. For instance, enterprises manufacturing chemical fibres and other high-tech products in Jiangmen are not only actively raising the level of R&D and production. They are also seeking more quality raw materials, including various kinds of chemical raw materials, to support further business expansion. These enterprises are most interested in sourcing these raw materials from petroleum products-producing countries in the Middle East and Southeast Asia. Some Jiangmen enterprises indicated that they are actively searching for relevant information from Hong Kong and other channels in the hope of importing the right raw materials from the Belt and Road markets to support their production activities locally in the city.

HKTDC Research wishes to express its appreciation to the Department of Commerce of Guangdong Province and the Bureau of Commerce of Jiangmen City for their assistance in conducting research studies and company visits.

[1] 2015 figures. Source: Statistical Bulletin of China’s Outward Foreign Direct Investment 2015

[2] Source: Jiangmen Association of Enterprises with Foreign Investment

[3] Source: Bureau of Commerce of Jiangmen City

[4] For details on the surveys, please see Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

| Content provided by |  |

Editor's picks

Trending articles

10 Jan 2017

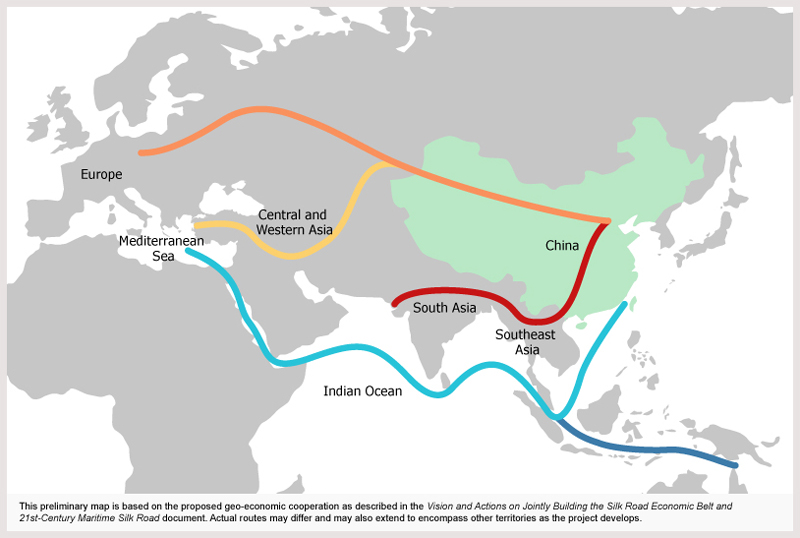

“One Belt, One Road” - Mapping China’s main outbound route

By Pinsent Masons

Pinsent Masons has supported The Economist Corporate Network to create,'One Belt, One Road: an economic roadmap', a series of guides to areas including Africa, Asia, the Middle East and Eastern Europe.

The publication provides informed consideration about the opportunities and implications of OBOR. Along with mapping investment routes and opportunities, the reports feature insight on:

- Infrastructure projects and plans

- The likely impact of local political conditions on investment

- Key economic indicators

- A transparency and stability index.

The regional sections list infrastructure project pipelines with analysis of the infrastructure need in the constituent countries. The analysis examines the progress of prominent OBOR projects and conclude with a series country profiles that offer brief but detailed political-economic portraits.

The country profiles include an “infrastructure risk radar” that succinctly relates the state of core elements in a nation’s infrastructure base: port facilities, air transport facilities, retail and distribution network, telephone network, road network, power network, rail network and IT infrastructure.

The profiles list population and key economic indicators and contain a table on operating risk measures. The operating risk measures look at risk levels for security, political stability, government effectiveness, legal and regulatory conditions, the macroeconomy, foreign trade and payment, finance, tax policy, the labour market and infrastructure.

The Economist Intelligence Unit Democracy Index 2015 and its previous annual editions provide further context for describing a country’s system of government, governance quality and environment for transparency.

Please click to view the profiles of over 44 countries, ranging from Albania to Zimbabwe.