GDP (US$ Billion)

13.57 (2018)

World Ranking 131/193

GDP Per Capita (US$)

30,668 (2018)

World Ranking 33/192

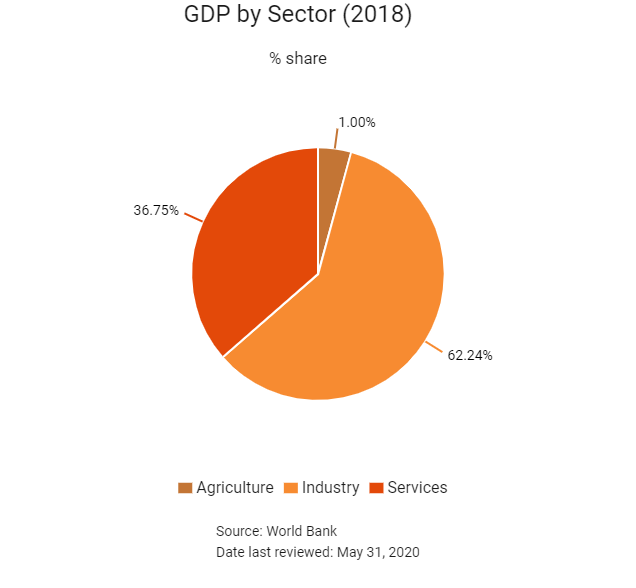

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

93.9 (2018)

Currency (Period Average)

Bruneian Dollar

1.36per US$ (2019)

Political System

Monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

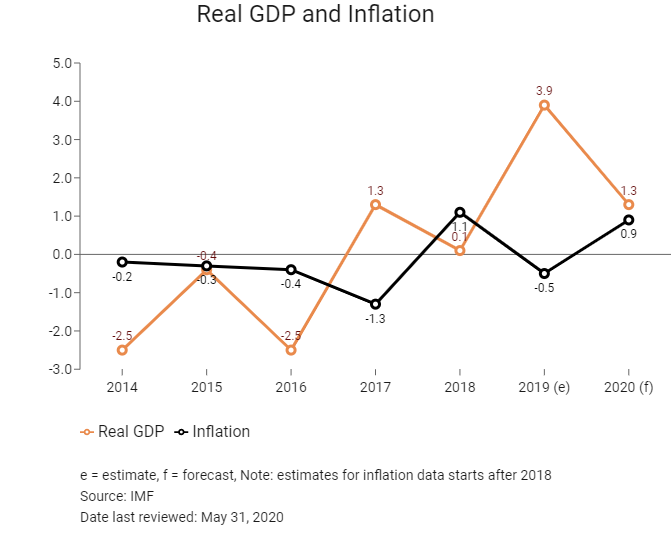

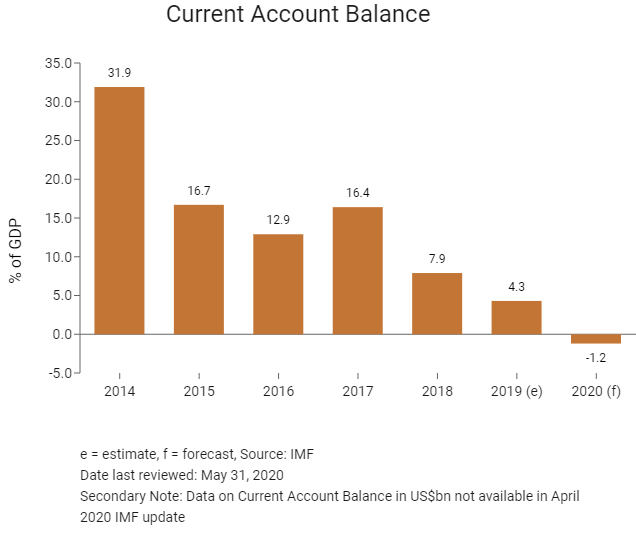

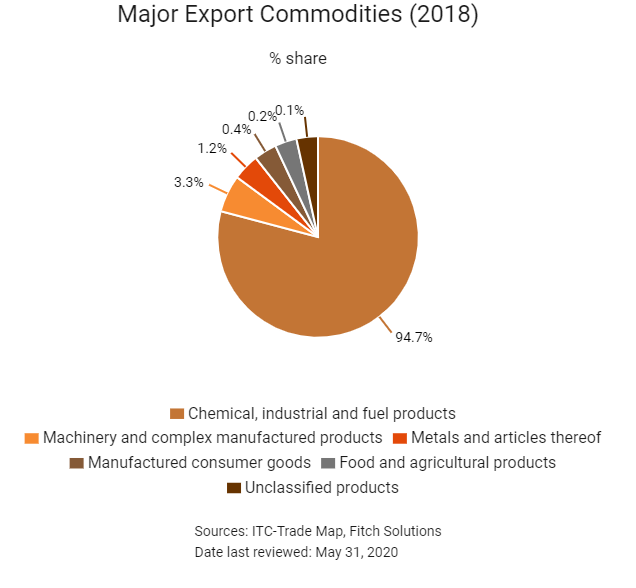

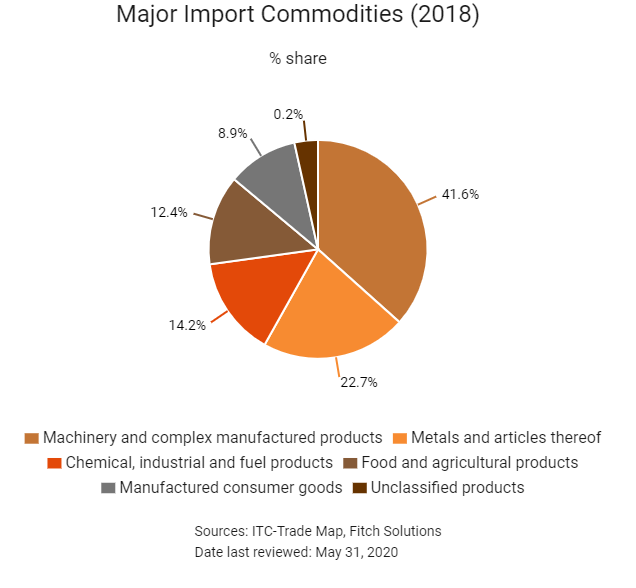

Brunei is located on the north coast of the island of Borneo, facing the South China Sea, and is surrounded by East Malaysia. Having gained independence from the United Kingdom in 1984. Its economy is heavily resource-dependent, with the oil and gas sector accounting for almost two-thirds of its GDP. The country's large foreign reserve assets, low external debt and high import cover reduce overall risks, although a dip in oil-related revenues may place pressure on fiscal revenues. While the country is largely seen in the international community as a producer of oil and gas, it is currently undertaking a number of projects in a bid to further diversify its economy. Furthermore, the country’s political stability, low rates of inflation, high standard of living and wealthy population (GDP per capita) provide tailwinds to Brunei's long-term growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2018

South Korea signed new defence agreements with Brunei.

April 2019

The large Pulau Muara Besar refinery and petrochemical plant, a joint project between the Bruneian government and Hengyi, is set to come online in 2019. Hengyi has also reportedly committed up to USD12 billion for the second phase of the facility’s development, meant to come online in 2022, which includes plans to manufacture products like aromatics and industrial chemicals. Meanwhile, construction of a USD1.8 billion industrial fertiliser plant by BFI is also moving ahead, with current estimates suggesting it will come online completely by 2021. Indeed, with capacity to refine 175,000b/d of crude, the Pulau Muara Besar plant is set to turn the country into a net exporter of refined products.

March 2020

Since reporting its first case of Covid-19 in March 2020, the government had implemented strict travel restrictions and a ban on all mass gatherings. Schools and universities had been closed since end of March.

On March 19, the Minister of Finance and Economy announced interim measures (for six months effective April 1) to alleviate the financial burden on sectors hit hard by the Covid-19 pandemic. Effective April 1, businesses in the tourism, hospitality/event management, restaurants/cafes, and air transport sectors (“affected sectors”) would be given a six-month deferment of their principal repayments of financing/loans; the deferment is also extended to importers of food and medical supplies; and all bank fees and charges (except third party charges) that were related to trade and for payments of transactions in those affected sectors will be waived for a period of six months. Brunei’s total Economic Stimulus Package in response to the coronavirus crisis amounts to BND450 million (3.2% of GDP).

May 2020

The country started easing some of its restrictions in May.

Source: BBC Country Profile – Timeline, IMF, Fitch Solutions

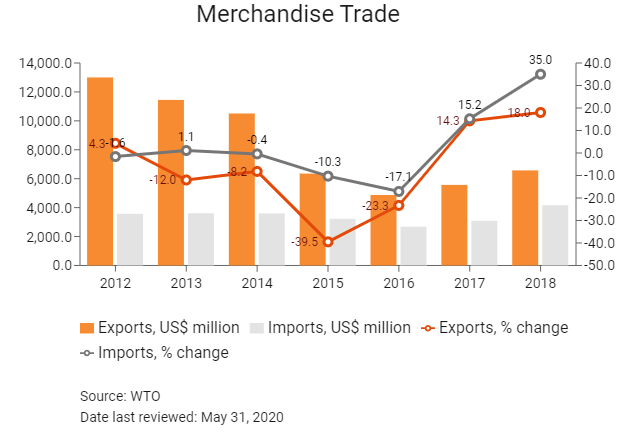

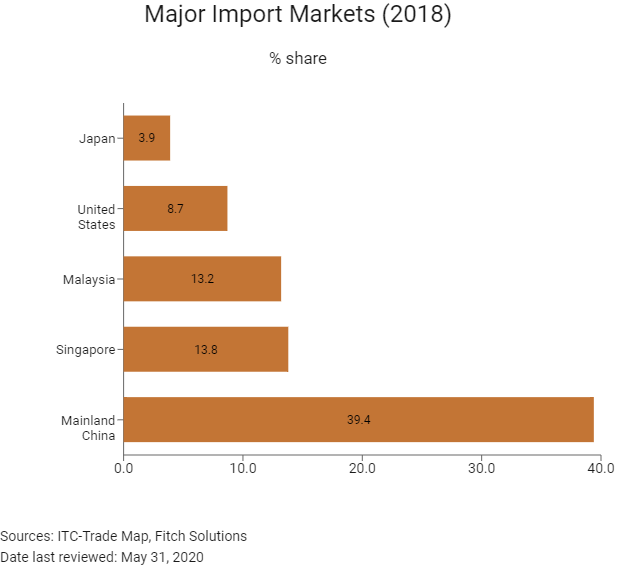

Merchandise Trade

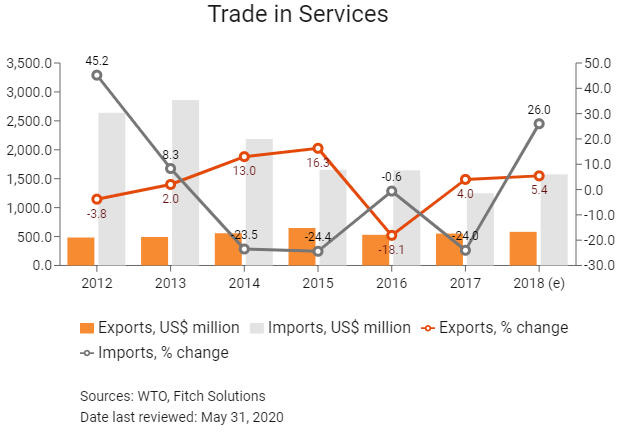

Trade in Services

- Brunei joined the World Trade Organization (WTO) in January 1995 and has been a member of the General Agreement on Tariffs and Trade (GATT) since December 1993.

- The Customs Import Duty Order 2012 and Excise Duty Order 2012 were created to facilitate trade and to attract foreign direct investment. Basic foodstuffs and goods for numerous industrial uses are exempt from import duties. There is no tax on computers and peripherals. Excise duties are levied on certain goods, including cars at 20% and 15% for heavy vehicles. Other consumer products, such as perfume, cosmetics, clothes, carpets, shoes, jewellery, office equipment, telephones, television sets, lamps and cameras are taxed at 5%. Import duties are also 5% for electronically operated industrial machines.

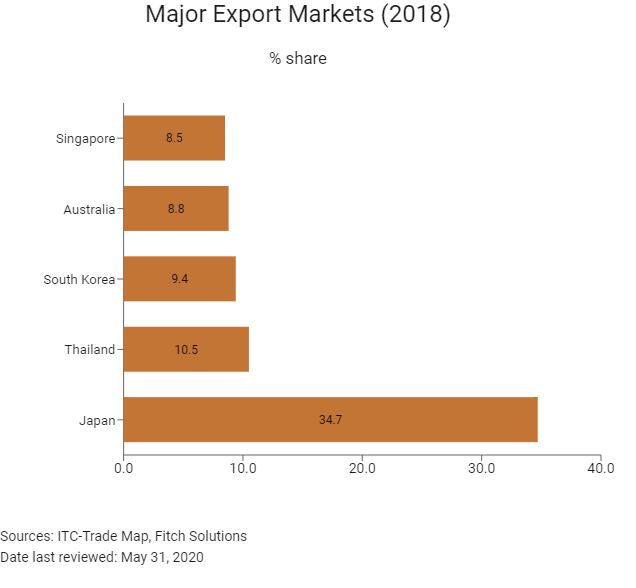

- Brunei views free trade agreements (FTAs) as a vital part of its foreign trade policy. To date, Brunei, through the Association of South East Asian Nations (ASEAN), has concluded FTAs with Australia, New Zealand, mainland China, India, Japan and South Korea.

- Bilaterally, Brunei has concluded an Economic Partnership Agreement (EPA) with Japan (the Brunei-Japan EPA) and a multilateral agreement with Chile, New Zealand and Singapore (the Trans-Pacific Strategic EPA) (TPSEP).

- As the signatories to the TPSEP, Brunei is involved in the negotiations for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- Brunei is emphasising its halal food industry as one of its key industries in an effort to diversify its economy. The country is promoting its own halal food certification regime that is entirely different from other halal certification organisations, which requires Bruneian inspectors to travel to production facilities in the country of the food exporter, at the exporter’s expense, to inspect the food production process.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Association of Southeast Asian Nations (ASEAN)-Mainland China: The ASEAN-Mainland China FTA covers goods and services. The FTA for goods came into force on January 1, 2005, and the FTA for services came into force on July 1, 2007. The ASEAN-Mainland China Free Trade Area came into force on January 1, 2010. The FTA aims to eliminate tariffs, encourage investment and address the barriers that impede the flow of goods and services. In August 2019, amendments to the FTA came into force, which simplified the rules for trade and investment between the two parties. In 2018, the total volume of trade between Mainland China and ASEAN hit a record high of USD587.87 billion, up 14.1% from 2017, overtaking the United States for the first time since 1997.

- ASEAN-India: The ASEAN-India trade in goods agreement came into force on January 1, 2010 for goods and on July 1, 2015 for services with the aim of minimising barriers and deepening economic linkages between the parties. The agreement will lead to the progressive elimination of tariffs on all goods. ASEAN accounted for 10.2% of India's imports and 12% of India's total exports in 2017.

- ASEAN-South Korea: The ASEAN-South Korea FTA (AKFTA) came into force in June 2007 and May 2009 for goods and services respectively. The investment agreement entered into force in June 2009. AKFTA aims to create more liberal, facilitative market access and investment regimes between South Korea and ASEAN. A business council was set up in December 2014 to enhance economic cooperation between the parties and boost total trade to USD200 billion by 2020. ASEAN was the recipient of 11.2% of South Korea's exports in 2017 and the source for 16.6% of imports. Total trade between ASEAN and South Korea grew by 68% between 2007 and 2017.

- ASEAN-Japan FTA: Japan provides a huge market for a wide range of goods, with tariff-free trade. This benefits a number of important sectors, including manufacturing, agriculture, mining and chemicals production.

- ASEAN-Australia-New Zealand: The ASEAN-Australia-New Zealand FTA and Economic Integration Agreement for goods and services came into force on January 1, 2010.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN commenced negotiations on the creation of of an FTA and an Investment Agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and drafted the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods and services, investment, economic and technical co-operation, dispute settlement mechanism and other related areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and Investment Agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but it will take time for all members of ASEAN to comply as implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process; Hong Kong's potential as a key export market increases the importance of AHKFTA.

Not Yet In Force

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): The agreement was signed in March 2018, with seven of the 11 participating countries so far (Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam) having entered into the agreement.

Sources: WTO Regional Trade Agreements database, Ministry of Foreign Affairs (Brunei), Fitch Solutions

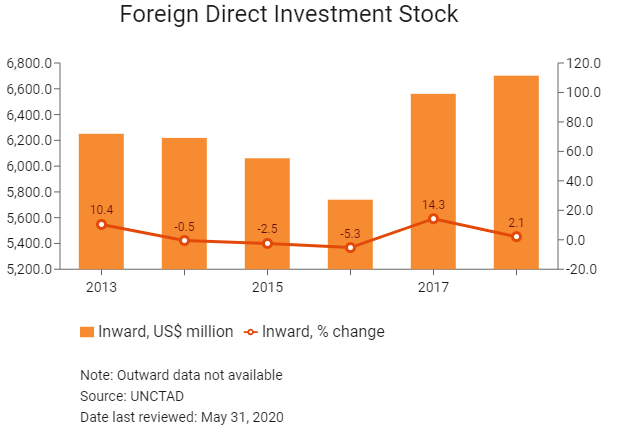

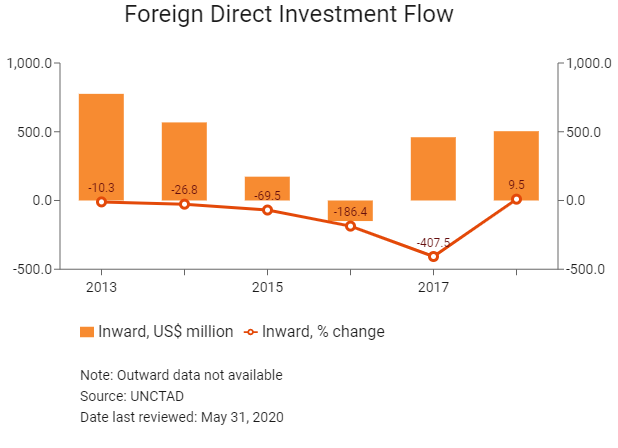

Foreign Direct Investment

Foreign Direct Investment Policy

- Brunei has an open economy that is favourable to foreign direct investment (FDI) as the government continues its economic diversification efforts to limit its long reliance on oil and gas exports.

- In 2014, Brunei released an Energy White Paper outlining its vision of leveraging its oil wealth to diversify its economy, create local employment, increase FDI and sharply increase the use of renewable energy by 2035.

- Brunei encourages FDI in the domestic economy through various investment incentives offered by the Energy and Industry Department, the prime minister’s office, and through activities conducted by the Ministry of Foreign and Trade and the Brunei Economic Development Board.

- Major FDI projects underway include the Hengyi Refinery at Pulau Muara Besar and Brunei Fertilizer Industries at the Sungai Liang Industrial Park. These projects contribute towards achieving the Vision 2035 development plan.

- Brunei amended its laws to make it quicker and easier and quicker for entrepreneurs and investors to establish businesses. The Business License Act (Amendment) of 2016 exempts several business activities (eateries, boarding and lodging houses and other places of public resort; street vendors and stalls; motor vehicle dealers; petrol stations including places for storing petrol and inflammable material; timber store and furniture factories; and retail shops and workshops) from needing to obtain a business licence. The Miscellaneous License Act (Amendment) of 2015 reduces the wait times for new business registrants to start operations, with low-risk businesses, such as eateries and shops able to start operations immediately.

- There is no restriction on total foreign ownership of companies incorporated in Brunei. The Companies Act requires locally incorporated companies to have at least one of the two directors – or if more than two directors, at least two of them – to be ordinarily resident in Brunei, but exemptions may be obtained in some circumstances. The rate of corporate income tax is the same whether the company is locally or foreign owned and managed.

- Companies involved in the exportation of agriculture, forestry and fishery products can apply for tax relief on export profits. For non-pioneer enterprises, the tax relief period is eight years and up to 11 years for pioneer enterprises.

- The corporate income tax (CIT) rate in Brunei has been reduced from 30.0% (2007 and earlier) to the current rate of 18.5% (from 2015 onwards).

- In 2018, Brunei was recognised by the World Bank in its Ease of Doing Business report as the most improved in the world, climbing 28 spots to 56th in the overall rankings between 2016 and 2018. As of 2019, the country has continued to climb in the WB Doing Business ratings, to the 55th spot, including coming in at number one globally in the sub-category measuring ease of access to credit. This comes after the introduction of a collateral registry system (which allows moveable property to be used as collateral for loans), and more recently, the introduction of a credit scoring system that allows banks to evaluate lending more efficiently. The steady improvement to the business environment has already resulted in growing interest from international firms, including the recently announced plans by shipping firm DHL for a BND1.8 million investment to expand its facilities in the country.

- Currently, the government’s focus is on attracting investment in diversified sectors such as agriculture, aquaculture, biotechnology, business process outsourcing, downstream oil and gas, food processing, data centre hosting, digital media, financial services, the halal food industry, Internet of Things, medical tourism, petrochemicals, and transport and logistics.

Sources: WTO – Trade Policy Review, The International Trade Administration, US Department of Commerce, Ernst & Young, Borneo Bulletin, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Muara Export Zone (MEZ) |

Muara Port is Brunei's main seaport with an established free trade zone called the MEZ, which was established to promote and develop Brunei as a trade hub of the region. |

Sources: Government websites, Fitch Solutions

- Value Added Tax: 0%

- Corporate Income Tax: 18.5%

Sources: OECD, Brunei Darussalam Ministry of Finance and Economy

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Tax |

18.5% charged on a threshold basis as follows: |

|

Income Tax for companies engaged in the exploration and production of oil and gas |

0.55% |

|

Capital Gains Tax |

0% (activities otherwise taxed as part of income tax) |

|

Sales Tax |

0% |

|

Social Security Contributions |

5% of gross salaries to be paid by employer |

Sources: Brunei Darussalam Ministry of Finance and Economy, Asean Tax Bureau

Date last reviewed: May 31, 2020

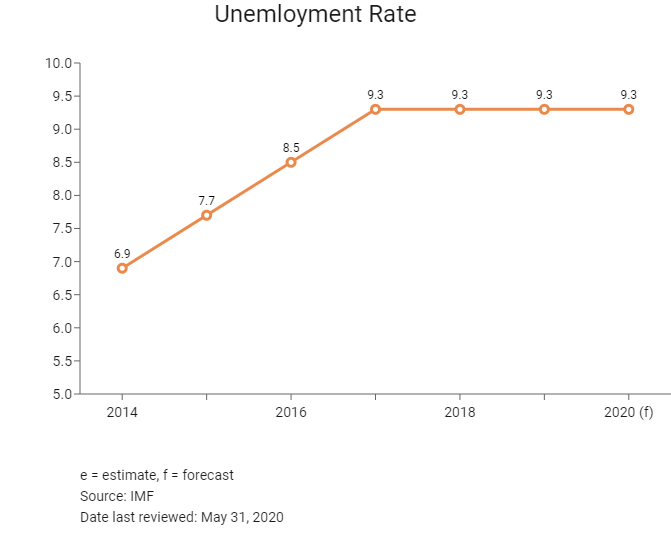

Foreign Worker Permits

Brunei seeks to increase the number of Bruneians working in the private sector. Brunei's 2014 Energy White Paper calls for the number of people employed in the energy sector to increase from 20,000 in 2010 to 50,000 in 2035, and for the number of locals employed in the sector to increase from 10,000 to 40,000 during the same period. To advance this goal, all companies competing for a tender in the oil and gas industry are required to have at least half of their employees be Bruneian.

The authorities in Brunei have introduced a foreign worker licence – or Lesen Pekeria Asing. Before applying for the licence, employers need clearance from JobCentre Brunei and must obtain an endorsement from the Employees Trust Fund (Lesen Pekerja Asing).

Visa Selection

Expatriate employment is controlled by a labour quota system administered by the labour department and the issuance of employment passes by the immigration department. Brunei allows new companies to apply for special approval to expedite the recruitment of expatriate workers in selected positions.

Foreigners coming to Brunei for employment purposes need a valid employment visa and employment pass before entering the country. However, there are some exceptions to this rule, with residents from certain countries (Cambodia, Canada, Indonesia, Japan, Laos, Liechtenstein, Maldives, Myanmar, Norway, mainland China, the Philippines, Peru, Qatar, Switzerland, Thailand and Vietnam) able to visit Brunei without an employment visa for a period of 14 days. Citizens of Australia, Iceland, Malaysia, New Zealand, Norway, Oman, Singapore, South Korea, the United Arab Emirates and Ukraine may travel without an employment visa for a maximum period of 30 days. Citizens of the United States and the European Union are allowed a visa-free business visit for 90 days.

Sources: Government websites, ASEAN Briefing, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

N/A |

N/A |

|

Standard & Poor's |

N/A |

N/A |

|

Fitch Ratings |

N/A |

N/A |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

56/190 |

55/190 |

66/190 |

|

Ease of Paying Taxes Index |

104/190 |

84/190 |

90/190 |

|

Logistics Performance Index |

80/160 |

N/A |

N/A |

|

Corruption Perception Index |

31/180 |

35/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

88/202 |

93/201 |

83/201 |

|

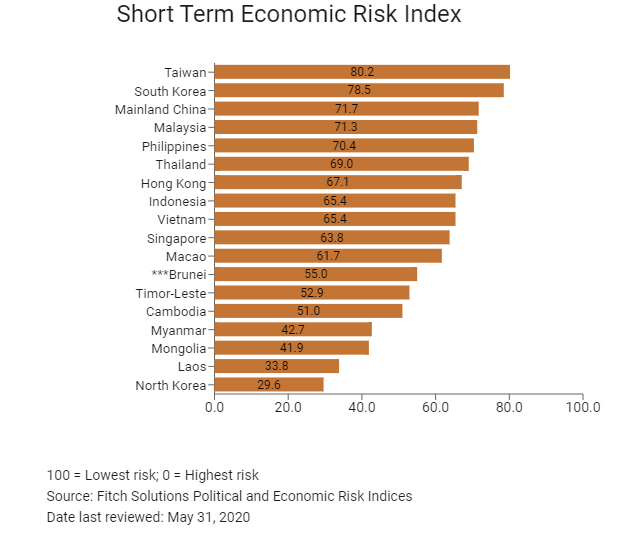

Short-Term Economic Risk Score |

51.9 |

58.8 |

55.0 |

|

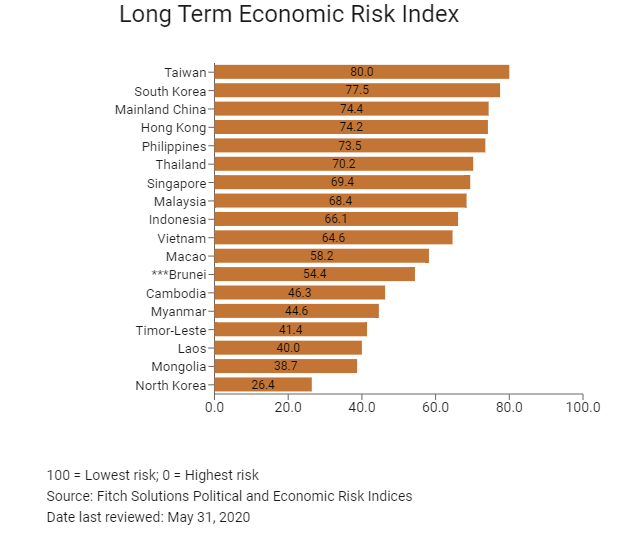

Long-Term Economic Risk Score |

53.5 |

53.1 |

54.4 |

|

Political Risk Index Rank |

87/202 |

104/201 |

104/201 |

|

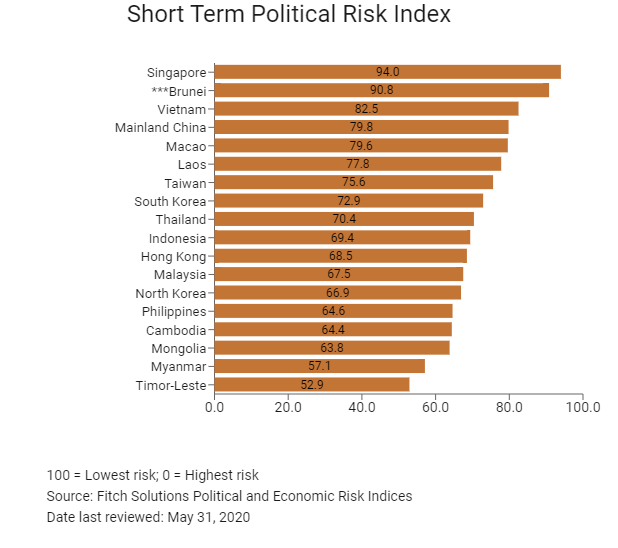

Short-Term Political Risk Score |

90.8 |

90.8 |

90.8 |

|

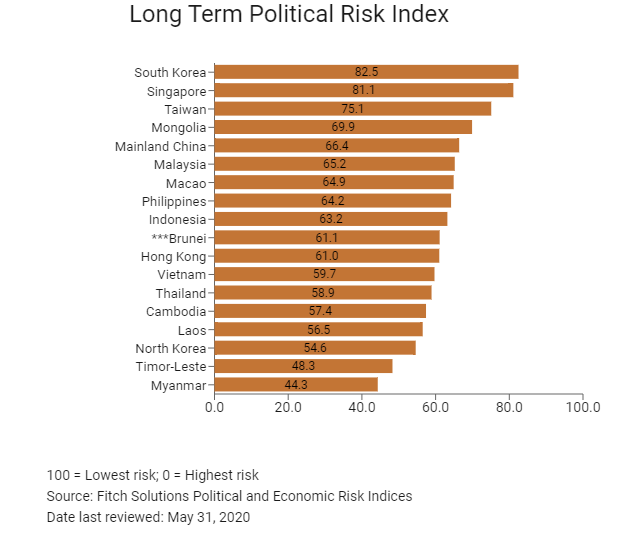

Long-Term Political Risk Score |

65.1 |

61.1 |

61.1 |

|

Operational Risk Index Rank |

53/201 |

53/201 |

53/201 |

|

Operational Risk Score |

61.4 |

62.3 |

61.3 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The Covid-19 outbreak in Mainland China and key economies in Asia will likely weigh on tourism and external demand, which bodes poorly for economic growth in 2020. Moreover, Brunei’s economy will face a structural slowdown over the coming years, as upstream oil production slows as fields mature and the cost of production thereby increases. That said, downstream production is likely to see a gradual rise, as output capacity will pick up with the new refinery and petrochemical complex being built in the country, partially offsetting the slowdown in upstream production. The high standards of living and wealthy population (per capita GDP) provide tailwinds to Brunei's long-term economic growth. However, while economic diversification efforts will move ahead gradually, Brunei is still highly vulnerable to sharp swings in commodity prices. Should we see a lower-for-long oil prices, this would pose risks to the country's fiscal and balance of payments dynamics as well as growth.

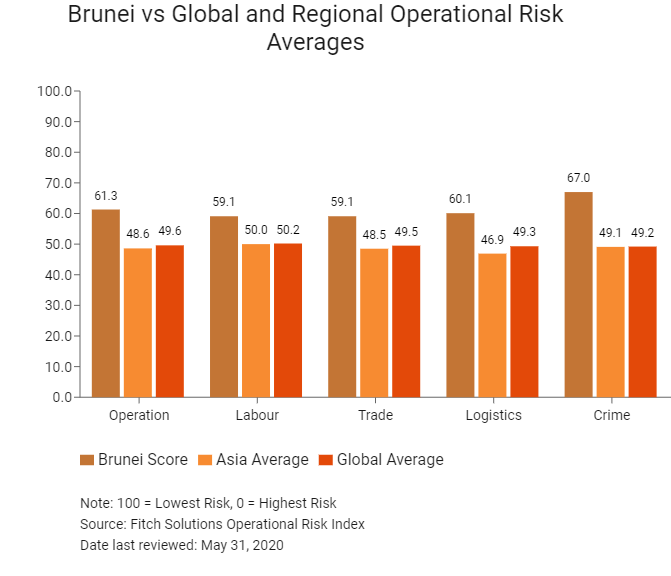

OPERATIONAL RISK

Energy-rich Brunei boasts strong infrastructure and a government intent on attracting foreign investment and projects. Brunei enjoys a high level of political stability compared with the rest of the region, and the country has made efforts to attract foreign investment and create an open and transparent investment regime. This trend is likely to remain in place over the short- to medium term, supported by extensive welfare services funded by wealth derived from oil and gas, an absolute monarchy and limited external threats. With a relatively free and open trading regime, as well as a small, but highly educated workforce, Brunei sees engagement on free trade agreements as an important step in ensuring that its people, goods, services and investments have continued access to wider markets around the world. However, registering property and trading across borders remain cumbersome, and together with an expensive and small labour force, Brunei's operational risk environment must develop further if it is to catch up with its larger Association of Southeast Asian Nations peers.

Source: Fitch Solutions

Date last reviewed: May 30, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Brunei Score |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

7 |

7 |

9 |

8 |

6 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

7 |

7 |

9 |

9 |

6 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

53 |

47 |

63 |

60 |

44 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

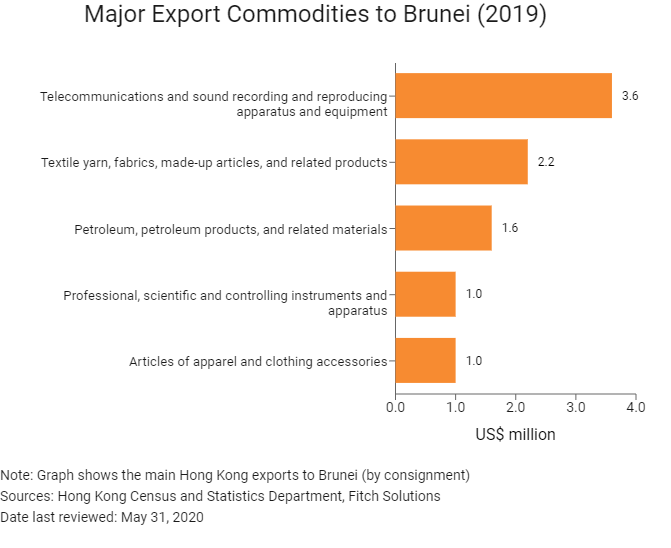

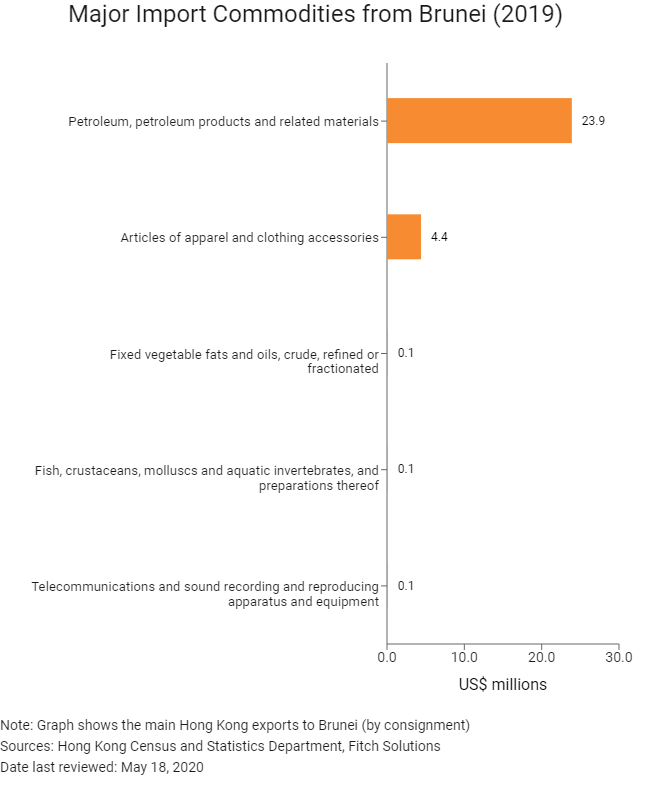

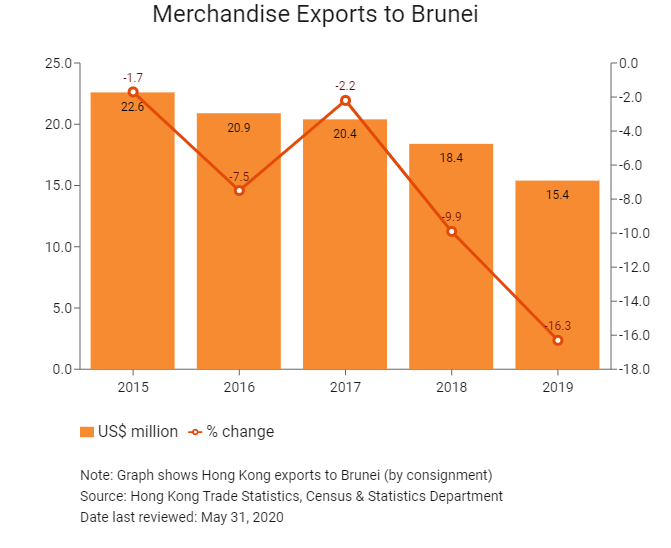

Hong Kong’s Trade with Brunei

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2018 |

Growth rate (%) |

|

|

Number of Brunei residents visiting Hong Kong |

4,388 |

-30.8 |

|

Number of Asian residents visiting Hong Kong |

52,326,248 |

-14.2 |

Source: Hong Kong Tourism Board

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Brunei companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Brunei

Brunei has a comprehensive double taxation agreement with Hong Kong that entered into force in December 2010.

Source: Hong Kong Department of Justice

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate General of Brunei Darussalam in Hong Kong, People's Republic of China

Address: Room 05-07, 24/F, Tower 2, Lippo Centre, 89 Queensway, Admiralty, Hong Kong

Email: hongkong.china@mfa.gov.bn, information@bruneiconsulate.com.hk

Tel: (852) 2592 3900 / 2592 3917 / 2592 3918

Fax: (852) 2522 3715

Source: Consulate General of Brunei Darussalam in Hong Kong, People's Republic of China

Visa Requirements for Hong Kong Residents

Hong Kong residents do not need a visa to travel to Brunei for a period of up to 14 days.

Source: Consulate General of Brunei Darussalam in Hong Kong, People's Republic of China

Date last reviewed: May 31, 2020

5661 Views

5661 Views

Brunei

Brunei