Belt and Road SME Corner

- For the garment sector

- For the garment and footwear sectors

- For unskilled garment workers in Gujarat state

- Depends on region

- The minimum wage is on daily basis, assuming 25 working-days/month for a rough indication

- Effective on 1 January 2019, the minimum wage is standardised nationwide at RM1,100 per month

- The minimum wage is for general workers, based on daily minimum wage and assumption of 25 working-days/month. Higher minimum wages are stipulated for professionals

- Ranking among 190 economies

Working population: World Bank

Minimum wage: World Bank, Eurostat and various sources including news reports for rough indication only

Ease of doing business: Doing Business 2019 Report, World Bank

| Pros | Cons |

|---|---|

|

|

Suitable Industries: basic garments, footwear, leather goods

- the Better Factories Cambodia (BFC) project with the country’s garment industry, grew out of a US-Cambodia trade agreement, under which Cambodian garment exporters would be given better access to US markets in exchange for improved working conditions

- investment incentives to foreign investors, including exemption from import duty on materials and equipment used in production, exemption from VAT for exports, corporate income tax exemption of up to nine years

Free Trade Zones and Incentives

- Cambodia has developed more than 40 special economic zones (SEZs), with 19 operational SEZs targeting different industries. Apart from the SEZs in key cities and ports, such as the well-known Phnom Penh SEZ and Sihanoukville SEZ, there are SEZs clustered along the borders with Thailand and Vietnam.

- the exemption period for the Tax on Profit shall be provided for a maximum period of nine years

- import duty and VAT exemption on the import of production equipment, construction materials, raw materials and intermediate goods

Further Readings for More Information

Practical Tips for Manufacturing in Cambodia

Cambodia: Manufacturing Relocation Opportunities (1)

Cambodia: Manufacturing Relocation Opportunities (2)

Cambodia: SEZs in Focus

Cambodia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments, footwear, toys, auto parts, construction materials

- the government assigned the status of Special Economic Zone to 10 areas specialising in particular industries, ranging from palm/rubber processing, automotive to fisheries, logistics and tourism

- these zones offer preferential tax and customs arrangements

Free Trade Zones and Incentives

- Batam Island Free Trade Zone (FTZ) is the largest FTZ

- investors are not required to apply for additional implementation licenses (location, construction, and nuisance act permits and land title)

- import duty, VAT and sales tax exemption on imported capital goods

Further Readings for More Information

ASEAN in Focus: Prospects for Production Bases in Indonesia

Indonesia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, rubber and plastic products, food processing (especially Halal food), petrochemical products

- there are over 500 industrial estates or parks and 18 Free Industrial Zones (FIZs)

- specialised parks (e.g. Kulim Hi-Tech Industrial Park) cater for technology-related manufacturing and R&D activities

- electronic industry clusters mainly located in Penang, Klang Valley and Johor

- Malaysia is one of the world’s major natural rubber producers, with well-developed downstream industries, including latex products and general rubber goods

- Malaysia’s halal certification system is well recognised by Muslims across the world

- there are 14 Halal Parks in Malaysia, where manufacturers are eligible for halal industry tax incentives, including 10-year income tax exemption

Free Trade Zones and Incentives

- in Free Industrial Zones (FIZs) or export processing zones, companies enjoy duty free imports of raw materials, machinery, parts and components for export-oriented manufacturing

- Pioneer Status: 5-year partial exemption of income tax; or investment tax allowance of 60% of capital expenditure incurred within five years, which can be used to offset against 70% of its statutory income for each year of assessment

- reinvestment allowance (RA) of 60% on the qualifying capital expenditure incurred, which can be offset against 70% of its statutory income for the year of assessment. RA will be given for a period of 15 consecutive years beginning from the year the first reinvestment is made

Further Readings for More Information

Prospects for the Malaysia-China Kuantan Industrial Park and Kuantan Port

Malaysia: A Leading Global Halal Food Hub

Malaysia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments, footwear

- industrial zones and special economic zones (SEZs) were set up across Myanmar

- three SEZs in Thilawa, Dawei and Kyaukphyu, each with its own Foreign Investment Law to provide additional incentives, including exemptions and relief on import tax and commercial tax, in designated sectors, including garments, food processing

- the Kyaukphyu SEZ will be in a good position to develop itself as a logistics hub over the longer term with an increase in transportation efficiency

Free Trade Zones and Incentives

- SEZs located at Thilawa (open), Dawei and Kyaukpyu (under construction)

- income tax exemption for 3, 5 or 7 years, depending on location

- exemption of custom duty on raw materials for export-processing, machinery and construction materials

Further Readings for More Information

Practical Tips for Manufacturing in Myanmar

Myanmar Rising: Industrial and Special Economic Zones

Myanmar Rising: The Mandalay Opportunity

Myanmar Rising: The Garment Sector Takes Off

Myanmar Rising: Opportunities in Asia’s Final Production

Frontier

Myanmar Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics (semiconductors, computers, electronic components, peripheral equipment and accessories), processed food

- manufacturing is an FDI magnet in the Philippines and priorities are given to export manufacturing and low-pollution light industries that can generate local employment, such as semiconductors and consumer electronics

- freeport zones converted from former military bases such as Clark and Subic possess comprehensive infrastructure for manufacturing

Free Trade Zones and Incentives

- incentives offered by the Philippines Board of Investment include, for example, income tax holidays of four-to-six years, customs duty exemption on capital goods, raw materials and intermediate inputs, simplified customs procedures

- the Philippines Economic Zones Authority (PEZA) manages the economic zones and companies established under PEZA receive the same incentives listed above as well as a 5% tax rate on gross income following the expiration of the income tax holiday

Further Readings for More Information

The Philippines: The Prospect for Manufacturing

Relocation

The Philippines Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: food and agribusiness, electronics and electrical appliances, automotive and auto parts, rubber and plastics

- abundance of natural resources allowing 80% of the ingredients used in the food industry to be sourced locally

- the SEZs provide incentives to business entities if their investment relates to one of 13 prioritised business sectors – agriculture and fisheries; ceramics; garments, textiles and leather; furnishings/furniture; gems/jewellery; medical equipment, automobiles and parts; electrical appliances and electronics; plastics; pharmaceuticals; logistics; industrial estates and tourism

- the incentives include corporate tax reductions, zero import duty for machinery and raw materials, land occupation rights, etc.

Free Trade Zones and Incentives

- there are 12 Special Free Zones for manufacturing for exports located in Chonburi, Lampun, Pichit, Songkhla, Samut Prakarn, Bangkok (at Lad Kragbang), Ayuddhya, and Chachoengsao

- businesses may import raw materials and export finished products free of duty (including value added tax)

Further Readings for More Information

ASEAN in Focus: Prospects for Production Bases in

Thailand

Thailand Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments, footwear, electronics

- targeting to attract investment from higher value-added industries, such as precision engineering, pharmaceuticals and healthcare, building materials

- the northern provinces of Vietnam are home to more capital-intensive manufacturing activities, such as automobile, electronics and office equipment

- a number of industrial zones in facilitating industrial investment enterprises in the zones can enjoy preferential treatment, including tax incentives

Free Trade Zones and Incentives

- 270 industrial zones and export processing zones across the country

- foreign investors are exempt from import duties on goods imported for their own use and which cannot be procured locally, including: machinery, vehicles, components and spare parts for machinery and equipment, raw materials, inputs for manufacturing

- projects in industrial zones are entitled to investment incentives such as lower corporate income tax, exemption of import tariffs, or land rental

Further Readings for More Information

Vietnam Utilises Preferential Zones as a Means of Offsetting

Investment Costs

Vietnam Connects its Cost Advantages with China: The Scenario of

an Industrial Park in Hai Phong

Vietnam, an Alternative Production Base

Vietnam Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments, leather goods

- Bangladesh has evolved into the world’s second-largest clothing exporter after China

- a considerable level of local company participation in the garment sector

- leather goods manufacturing may benefit from local leather supply

Free Trade Zones and Incentives

- Bangladesh has export processing zones (EPZs) and economic zones in different parts of the country and different zones may have specific incentives

- general incentives for EPZs include, for example, the valued-added tax rate on exports is zero, companies that only export, import duties are waived for imports of capital machinery, import duties are also waived for EPZ industries for imports of raw materials

- general incentives for economic zones include, for example, tax holidays of five to seven years for new enterprises in textiles, pharmaceuticals, plastics, ceramics, iron and steel, fertilisers, computer hardware, petrochemicals, agricultural and industrial machinery

Further Readings for More Information

Practical Tips for Manufacturing in Bangladesh

Production in Bangladesh: Recent Development and

Opportunities

Production in Bangladesh: Overcoming Operational

Challenges

Production in Bangladesh: Industrial Transformation through

Relocation

Bangladesh Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, electrical appliances, machinery and equipment, ICT, chemical, food processing

- national priority to develop export-oriented high-tech industries such as ICT, logistics, home appliances, electronics and electrical equipment

- world-class reputation for machinery manufacturing, chemical engineering, petrochemicals, light industry (e.g. textiles, knitting, sewing, footwear, and household electrical appliances) and food processing

- free economic zones (FEZs), led by China-Belarus industrial park Great Stone, provide generous investment incentives, including preferential arrangements on corporate income, real estate and land taxes

Free trade zones and incentives

- Belarus has FEZs in Brest, Gomel, Grodno, Minsk, Mogilev and Vitebsk.

- general incentives for FEZs include, for example, 5 years profit tax exemption since first profit, zero property tax, zero customs duties for imports of raw materials and equipment, 50% VAT discount for the production of import substitution goods, and exemption from paying National Agriculture Support Fund

Further Readings for More Information

Belt and Road Initiative: The Role of Belarus

Belarus Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, automobiles and auto parts, ICT

- high-value industries such as R&D and advanced technology receive generous incentives

- home to many world-class engineering services providers such as MB Tech Bohemia and Porsche Engineering Services

Free Trade Zones and Incentives

- the Czech Republic provides financial support to investments in manufacturing industry, technology centres and business support services centres. The financial support ranges from 25% of eligible costs of a large enterprise to 45% of eligible costs of a small enterprise. Eligible costs include fixed assets and two years wage of the newly created jobs

- investors could also benefit from 10-year corporate income tax relief, and cash grants for job creation and training

Further Readings for More Information

The Czech Republic: A Belt and Road Link in CEE

The Visegrad Four (V4) Nations: Early Adopters of the Belt and

Road Opportunity

Belt and Road Opportunities in Central and Eastern

Europe

Czech Republic Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, automobiles and auto parts

- Hungary boasts the largest electronics producer in CEE, representing more than one-fourth of the region’s total electronics output

- over 40 of the top 100 global OEM parts suppliers have set up in Hungary

Free Trade Zones and Incentives

- Hungary eliminated free trade zones but provides incentives such as cash subsidies, development tax allowances, training subsidies, and job creation subsidies, to investments in manufacturing plants, logistics facilities, services centres, research and development facilities, bioenergy facilities and tourism

Further Readings for More Information

Hungary: Leading the Way in BRI Co-operation

The Visegrad Four (V4) Nations: Early Adopters of the Belt and

Road Opportunity

Belt and Road Opportunities in Central and Eastern

Europe

Hungary Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, electrical appliances, automobile and auto parts, processed food

- preferential access to domestic and regional consumer markets in EU and CIS

- special economic zones (SEZs) scattered throughout Poland with income tax exemptions, real estate tax exemptions and competitive land prices

Free Trade Zones and Incentives

- Poland has 14 SEZs along major routes of the supply chain throughout the country.

- the residents of the SEZs enjoy exemptions from customs duties and VAT, competitive land prices, zero property and income tax, and good access to high-quality local suppliers.

- government aid and investment grants are also available to SEZ residents depending on the region, size of business and activities performed. In general, better favour would be given to less developed regions, small- and medium-sized enterprises, research and development, and the use of renewable energy

Further Readings for More Information

Poland: Profiting from Increasing Asia-Europe Rail

Traffic

The Visegrad Four (V4) Nations: Early Adopters of the Belt and

Road Opportunity

Belt and Road Opportunities in Central and Eastern

Europe

Poland Market Profile

| Pros | Cons |

|---|---|

|

|

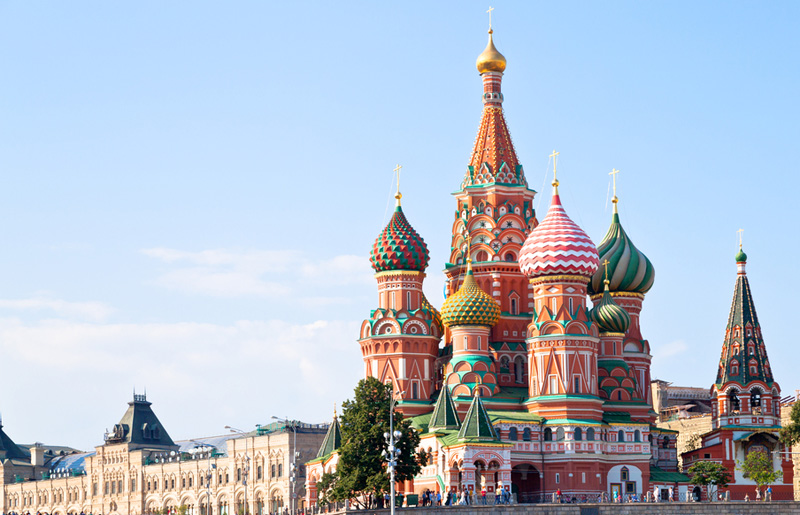

Suitable Industries: electronics, metal products, automotive, textiles, machinery

- promoting investment in import-substituting industries such as non-ferrous metal, aircraft and components, automobiles, electronics and food machinery

- SEZs and IPs across the country allow cost-savings up to 30-40% through tax and customs incentives land plots with ready-to-use infrastructure and free connection to energy resources

Free Trade Zones and Incentives

- Russia has SEZs, innovation centre and advanced development zones (ADZs) in different parts of the country and focusing on different industries

- general incentives for SEZs include, for example, exemption from customs duties and VAT on imports, reduced corporate income tax, reduced property tax, discounts on infrastructure expenses, and access to ‘One Window’ special administrative regime

- residents of the Skolkovo Innovation Centre (Moscow) are exempted from profit tax, VAT, property tax, customs duties and VAT on imports

- general incentives for ADZs which target the Far East and Eastern Siberia include, for example, 5 years exemption of profit tax, land tax, and property tax

Further Readings for More Information

Russia: A Rapidly Developing Belt and Road Technological

Partner

Russia: A Prime Belt and Road Investment Destination

Russia: World Cup, International Sanctions

Russia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics, automobiles and auto parts

- boasting the highest per-capita car production in the world, Slovakia has become a magnet for export-oriented manufacturing industries such as automotive and electronics, and a hotspot for shared services centres (SSCs) and business process outsourcing centres (BPOs)

- the Slovakian government is stretching its wings to Asia, with initiatives such as a plan to start a double tax treaty negotiation with Hong Kong

Free Trade Zones and Incentives

- Slovakia provides incentives to investments in industrial production, technology centres and business service centres. The value of the incentives varies across region and sector, while the less developed regions generally enjoy preferential treatment. The incentives could be in the form of income tax relief, lower property price, a cash grant for the acquisition of material assets and immaterial assets, or contribution for job creation

Further Readings for More Information

Slovakia: An Emerging Hub on the New Silk Road

The Visegrad Four (V4) Nations: Early Adopters of the Belt and

Road Opportunity

Belt and Road Opportunities in Central and Eastern

Europe

Slovakia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: electronics and electrical appliances, textiles, garments, auto parts, processed food

- located at the crossroads of Europe, Asia, Middle East and Africa, Turkey has long been a highly strategic hub for global trade, logistics and manufacturing

- import-substituting industries, such as machinery, transport equipment, chemicals, enjoy favourable government incentives, including exemptions from value-added tax (VAT) and customs duty, social security and interest rate support and land allocation

Free Trade Zones and Incentives

- Turkey has 17 free zones located throughout the country and two ambitious incentive programmes, namely the “Investment Incentive Programme” and the “Project-Based Incentive Scheme” which offer different incentive packages

- the free zones provide an exemption from VAT, customs duty, and stamp duty. Manufacturing companies are also free from corporate income tax

- investors, both local and foreign, can be eligible under different schemes for various support measures according to their investment size, region, sector and product. Measures include VAT exemption, customs duty exemption, tax deduction, social security premium support for employer’s share, interest rate support, land allocation and VAT refund. For investments in the least developed region of Turkey (Region 6), income tax withholding support and social security premium support for the employee’s share are also available

Further Readings for More Information

Turkey: A Strategic Trade-Manufacturing-Investment

Nexus

Turkey’s Competitive Incentive Schemes

Turkey Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: textile and low-skill assembly industries

- Djibouti could experience positive spillover from Ethiopia’s fast-growing textiles industry. The majority of Ethiopia’s manufacturing exports are shipped internationally via Djibouti. This could create an opportunity for textile firms operating in Ethiopia to set up operations in Djibouti in order to save on transport costs.

- Other low-skilled assembly industries such as paper products, packaging and toys and games could be compatible with the low level of skilled labour and limited geographic footprint available in Djibouti’s free trade zones.

Free Trade Zones and Incentives

- There are three major free zones in Djibouti – Djibouti Free Zone, DAM Commercial Free Zone and Djibouti International Free Trade Zone.

- The Investment Code contains three preferential regimes which provide different tax incentives such as zero consumption tax on inputs.

Djibouti: An Emerging East African Trading Hub

Manufacturing in East Africa: Djibouti

Djibouti Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments and textiles, leather, automotive and other advanced parts manufacturing

- The garment and textile industry is central to the government’s industrial manufacturing strategy. Chinese companies are among the top investors in this industry, but there is a strong interest or presence among companies from other countries, such as India, Bangladesh and Turkey.

- Ethiopia mainly exports finished leather, but has a fast-growing shoe export sector.

- There is also growing investment in the country’s automotive industry. International auto brands such as Kia and PSA Peugeot Citroën have set up vehicle assembly plants in Ethiopia.

Free Trade Zones and Incentives

- State industrial parks are complemented by private industrial parks developed mainly by Chinese businesses, including Huajian Group Industrial Park and George Shoe Industrial Park.

- Industrial parks, both state-run and private, have favourable investment, tax and infrastructure incentives, particularly beneficial to manufacturing sector. Income tax exemption, custom duty exemption and export credit guarantee are some examples.

Further Readings for More Information

Manufacturing in East Africa: Ethiopia

Ethiopia Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garments, automobiles, pharmaceutical, ICT hardware

- The garment sector is dominant within the EPZs. The US receives around three-quarters of Kenyan textile exports, in part due to the African Growth and Opportunity Act, which provides favourable market access for Kenyan textile exporters to the US domestic market.

- Kenya's comparatively strong infrastructure and close transport links to the rest of East Africa will continue to make the country a natural hub for autos production in the coming years.

- As part of a national ‘ICT Masterplan’, the government is encouraging development of ICT hardware manufacturing capacity. Electronics export capacity is currently concentrated in mobile phone and storage technology.

Free Trade Zones and Incentives

- Export manufacturing is clustered in Export Processing Zones (EPZs). By 2017, Kenya had 71 designated EPZs, located in various towns and cities including Nairobi, Mombasa, Athi River, Kilifi and Kerio Valley.

- General incentives for EPZs include, for example, ten-year corporate tax holiday, 100% investment deduction on capital expenditure for 20 years and VAT exemption on industrial inputs.

- General incentives for Special Economic Zones (SEZs) include, for example, reduction in corporate tax rate from 30% to 10% for the first ten years.

Further Readings for More Information

Kenya: The Key Economic Hub in East Africa

Manufacturing in East Africa: Kenya

Kenya Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: garment, machinery and electronics

- Rwanda benefits from the African Growth and Opportunity Act (AGOA) duty-free privileges on clothing exports to the US. Rwanda also has an EBA status, allowing it to export garments (amongst other products) to the EU duty free.

- Mobile phone parts and accessories have dominated electronic exports. The vast majority of these exports have been regional within East Africa.

Free Trade Zones and Incentives

- Rwanda has established the Kigali Free Zone as a Special Economic Zone. Bonded warehouse facilities are available both in and outside of Kigali for use by businesses importing duty-free materials.

- Other incentives under Kigali SEZ include corporate tax exemption and flexible work permit for expatriate staff.

Further Readings for More Information

Manufacturing in East Africa: Rwanda

Rwanda Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: textiles, cosmetics, autos

- There is an established domestic textile sector and textile exports are the country's largest manufacturing export. A growing share of these exports are sent to the US, aided by the African Growth and Opportunity Act (AGOA).

- Cosmetics is a fast-growth manufacturing export sector in Tanzania. At present, the vast majority of these exports are to regional destinations, particularly Uganda.

Free Trade Zones and Incentives

- As of March 2018, there were 14 designated EPZ/SEZ industrial parks, 10 of which are in development, and 75 factories granted with EPZ status.

- EPZs promote investment and growth mainly aimed at manufacturing firms. Within the zones, 80% or more of goods produced need to be exported, favouring the heavy manufacturing companies.

- Incentives for SEZ include, for example, property tax exemption for the first 10 years and on-site customs inspection of goods.

Further Readings for More Information

Manufacturing in East Africa: Tanzania

Tanzania Market Profile

| Pros | Cons |

|---|---|

|

|

Suitable Industries: agri-processing, autos, pharmaceuticals, iron and steel

- Manufacturing in Uganda consists predominantly of last-stage assembly and raw materials processing, a high share of which is food processing. Agri-processing firms account for about 39% of manufacturing establishments in Uganda.

- Iron and steel is the largest non-food manufacturing export sector in Uganda, with Tanzania receiving almost one-third of exports in 2018.

Free Trade Zones and Incentives

- The government has established over 20 industrial districts in the country, which enjoy various investment incentives. Majority of them focus on agri-processing.

- A range of incentives including annual VAT deferments, five-year income tax exemption and depreciation allowances are available.

- However, manufacturing is not one of the four priority sectors that receive particularly favourable treatment. The priority sectors are information and communication technology, tourism, value-added agriculture and value-added investments in mineral extraction.

Further Readings for More Information

Manufacturing in East Africa: Uganda

Uganda Market Profile