Romania: Strong Domestic Demand Fuels Growth

Romania: Strong Domestic Demand Fuels Growth

Strengths

- Second largest market in Central and Eastern Europe

- Strong manufacturing base

- Low labour cost

Challenges

- Political uncertainty as general election due in 2016

- Dominance of inefficient SOEs in transportation and energy sectors

- Declining population

Key Information | |

| Capital | Bucharest |

| Population | 21.6 million |

| Currency | Romanian leu (1 RON = 0.2519 USD as of 5 September 2015) |

| Official language | Romanian |

| Form of state | Republic |

| Major Merchandise Exports (% of total, 2014) | Major Merchandise Imports (% of total, 2014) |

| Machinery & equipment (42.4%) | Machinery & equipment (35.8%) |

| Base metals & products (9.0%) | Chemicals & products (10.2%) |

| Textiles & products (7.4%) | Minerals & fuels (9.9%) |

| Top Three Export Markets (% of total, 2014) | Top Three Import Markets (% of total, 2014) |

| Germany (19.2%) | Germany (19.1%) |

| Italy (11.9%) | Italy (11.9%) |

| France (6.8%) | Hungary (7.8%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

Romania is a semi-presidential republic. The cabinet is nominated and headed by the prime minister, who in turn is nominated by the president. Prime Minister Victor Ponta from the centre-left Social Democratic Party (SDP) took office in 2012, but was defeated in the November presidential run-off by Klaus Iohannis, Ponta’s centre-right rival who vowed to tackle corruption and strengthen the independence of the judicial system. The next parliamentary election is scheduled for late 2016 and the SDP is likely to face a greater challenge from the centre-right camp.

While macroeconomic policies since the 2008 global financial crisis have largely corrected internal and external imbalances, further structural reforms are being demanded by the European Commission. The government will need to continue to improve the absorption of EU funds to modernize public infrastructure, address the weaknesses in the financial sector, and re-invigorate delayed state-owned enterprise (SOE) reforms. However, political uncertainty will hinder the progress on structural reforms in the short term.

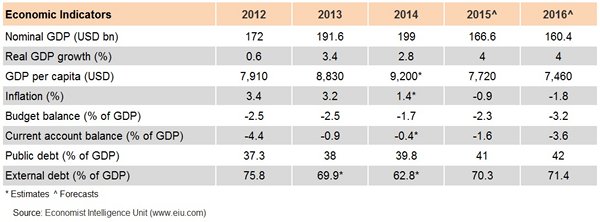

Economic Trend

Romania has a strong base for manufacturing, with over 60 industrial parks all over the country. Romania experienced a deep recession after the global financial crisis, prompting the government to launch a draconian austerity programme and implement long-needed economic and financial reforms, with the support of the World Bank, International Monetary Fund (IMF), and the European Commission. Economic growth in Romania is forecast to remain robust in 2015 and 2016, driven by strong private consumption and recovering investment.

Following years of austerity measures, Ponta is hoping to rally popular support through the pursuit of more populist measures. While a lower VAT rate could provide a boost to consumer sentiment, it implies that the budget deficit might overshoot the EU’s 3% ceiling again in 2016, and pushes the country further into deflation. Romania is not yet a member of the euro area. The Romanian leu has not yet joined the Exchange Rate Mechanism. Romania has set 2019 as its target year to adopt the euro.

Romania’s GDP per capita was relatively low, at only 54% of the EU average in 2014. Income convergence with the EU has been rather slow. Weak public infrastructure partly due to the dominance of inefficient SOEs has emerged as a bottleneck for faster growth. Higher investment in R&D will be needed to underpin convergence.

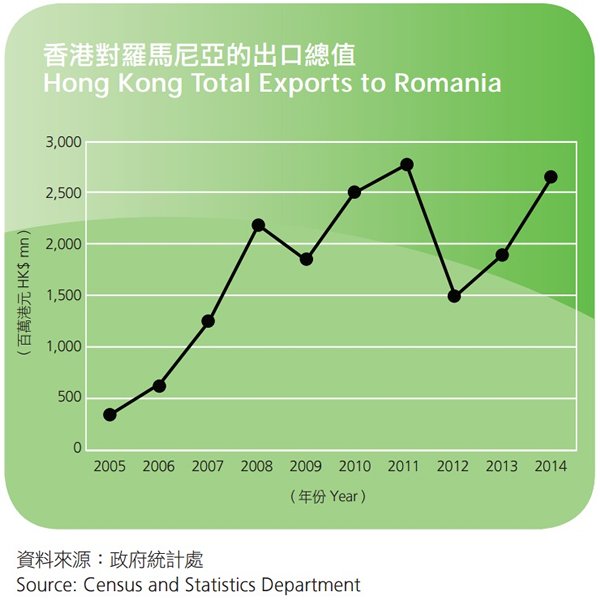

Hong Kong – Romania Trade

Total exports from Hong Kong to Romania increased by 34.7% from HK$ 1,947 million in 2013 to HK$ 2,622 million in 2014. The top three export categories to Romania were: (1) telecommunications, audio & video equipment (+53.6%), (2) electrical machinery, apparatus & appliances, & parts (+8.4%), and (3) office machines & computers (+103.7%), which represented 86.1% of total exports to Romania.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering Romanian buyers. Currently, the insured buyers in Romania range from small and medium sized companies to manufacturing arms of foreign listed companies. For 2014, the number of credit limit applications on Romania decreased by 16.3%, while the amount of credit limit applications and insured business increased by 21.4% and 30.7% respectively. Major insured products were electronics, electrical appliances, and travel goods, which represented 50.5% of ECIC’s insured business on Romania. The Corporation’s underwriting experience on Romania has been satisfactory, with no claim payment or payment difficulty case reported during the past 12 months (from September 2014 to August 2015).

| Content provided by |

|