GDP (US$ Billion)

63.96 (2019)

World Ranking 76/194

GDP Per Capita (US$)

2,299 (2019)

World Ranking 142/193

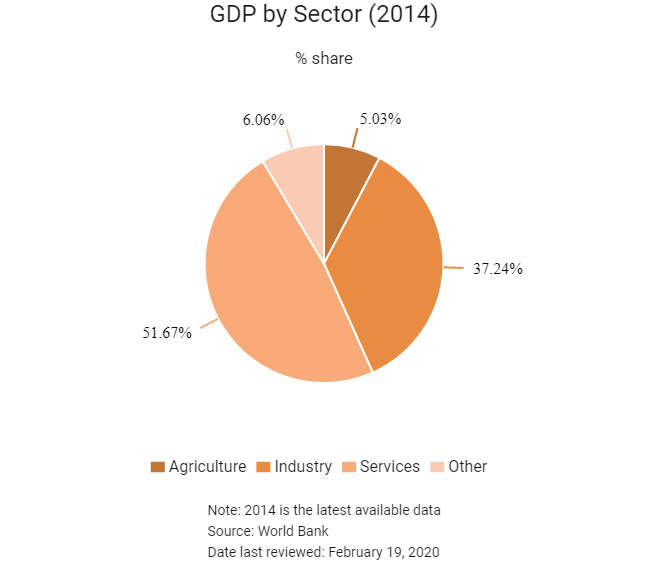

Economic Structure

(in terms of GDP composition, 2014)

External Trade (% of GDP)

48.1 (2014)

Currency (Period Average)

Venezuelan Bolivar

9.98per US$ (2017)

Political System

Federal multiparty republic with a unicameral legislature

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Venezuela is strategically located on the Northern Coast of South America, which facilitates access to the East Coast of the United States, to the Panama Canal, to Central America and to the Caribbean. Venezuela's economy is highly dependent on oil revenues and non-oil sector development has been limited. Venezuela's myriad structural weaknesses will weigh heavily on the country's long-term economic growth trajectory, even under a reformist government. In particular, long-term weakness in the oil sector will act as a key headwind to the country's growth.

Source: Fitch Solutions

Major Economic/Political Events and Upcoming Elections

July 2017

Constituent assembly was elected.

April 2019

Nearly 1 million oil barrels of light, sweet Agbami crude was imported to Venezuela in April 2019, the first crude imports since 2016.

August 2019

On August 5, United States President Donald Trump signed an executive order freezing the property and assets of the Venezuelan government and any individual who assisted officials affected by the order. The order excluded transactions to provide humanitarian aid.

April 2020

The United States Treasury Department had allowed Chevron and key service providers (Halliburton, Schlumberger, Baker Hughes and Weatherford International) to continue operations in Venezuela until April 22, 2020.

Sources: BBC Country Profile – Timeline, Fitch Solutions

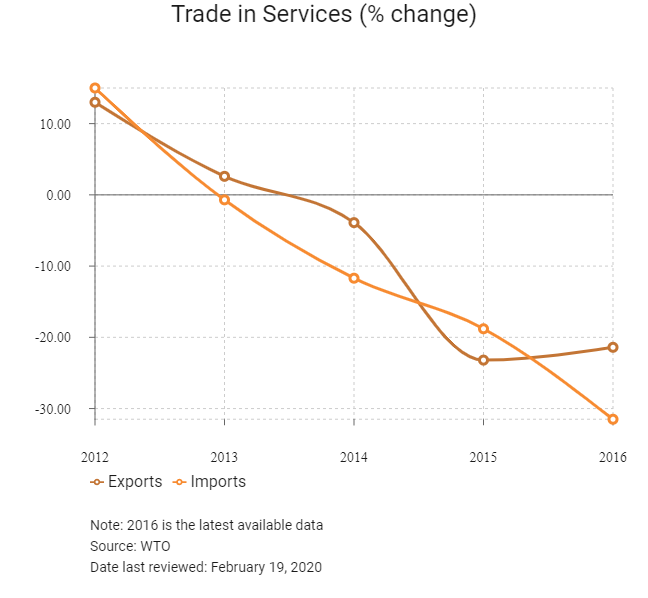

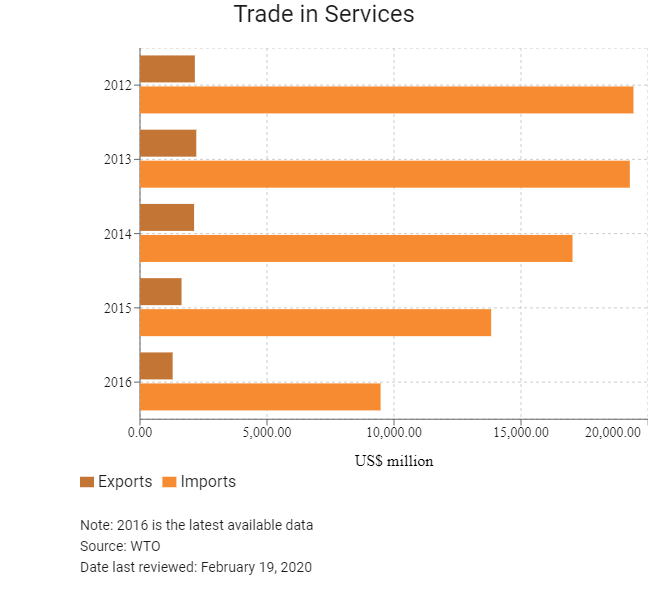

Trade in Services

- Venezuela has been a World Trade Organization member since January 1, 1995 and a member of the General Agreement on Tariffs and Trade since August 31, 1990.

- Importers must get approval from the National Superintendent for the Defence of Socio-Economic Rights and show that they are adhering to government-mandated price controls and profit limits, which are arbitrarily applied according to sector but are often strict and difficult for firms to meet. If the business is able to clear these measures, it will then be issued with a Certificate of Fair Prices, which is required to apply for hard currency.

- In 2015 the government moved the management of import transactions under CORPOVEX, a unit of the currency control commission (CENCOEX). This entity is responsible for all import transactions and has caused further difficulties for private sector firms by preferring state-owned entities (SOEs) for import permits and mandating the use of certain suppliers, quality standards and price controls.

- Businesses must register with the CENCOEX and are required to submit extensive documentation when applying for foreign currency, including certificates stating that the imported goods are not produced domestically, and a guarantee of good reputation with the tax authorities. Approval of requests for foreign currency may be made on an arbitrary basis and will favour industries which the government considers strategic, benefitting SOEs over private enterprises. Businesses are required to navigate a complex and frequently adjusted exchange rate regime in order to obtain foreign currency.

- The average tariff rate on imported goods is among the highest in the region. Venezuela has failed to align its tariffs with the common external tariff required as part of its membership of Mercosur, increasing trade barriers relative to its peers in the trade bloc and contributing to its suspension in December 2016.

- Average applied most favoured nation tariffs range as high as 25.8% on clothing, but are also somewhat elevated for other tariff lines including capital goods and agricultural products. Importers are also required to pay a customs service fee of 1% on the value of the goods, and VAT at 16% on the cost, insurance and freight value of the goods, adding to the cost burden of imports.

- Customs procedures can be complicated and arduous, and may require a customs agent to navigate effectively, while inefficient port management also causes delays. The government reserves the right to place quotas on imports, which generally apply to agricultural products, and obtaining permits to import goods under the tariff quota system can be difficult.

- There is a 35% local content requirement imposed on domestically manufactured vehicles, which, though it has been reduced from 50%, will continue to cause considerable difficulties for autos manufacturers due to the absence of a large and cost-effective domestic autos industry which is able to provide autos parts and intermediate inputs.

- The border with Colombia has been closed for intermittent periods since 2015 as a result of a diplomatic row over smuggling. Closures often occur with little warning and therefore cause considerable unpredictable disruption to supply chains with one of Venezuela's major trade partners. Disputes with Guyana have also led to the blocking of trade in certain goods since 2015, further disrupting trade flows.

- Exports are zero rated. Consequently, VAT is not payable on exports, including exports of in-bond processing companies, technical fees to foreign residents, and sales to in-bond processing companies and companies that export their entire production. Sales of natural hydrocarbon by joint ventures regulated by the Hydrocarbon Law to the National Oil Company (PDVSA) and affiliated companies are also taxable at 0%. Though exporters do not collect VAT on export sales, they may recover VAT charges on their purchases of goods and services by means of a refund certificate. This certificate may be used to pay other tax obligations. If such exporters carry out sales in the country, they will be entitled to recover input VAT related to foreign sales.

- A zero rate applies to independent personal services provided by residents in Venezuela that are used solely by and for the benefit of persons abroad without a fixed base in Venezuela.

- Customs duty incentives are available, such as drawbacks on the import of materials used for exporting products. This may take the form of a tax refund certificate issued by the Ministry of Finance. The certificate is a negotiable bond and will be accepted by the Treasury Funds Office for payment of national taxes. Determination of the amount of the refund will take into account the import duties effectively paid at the time the materials used in the manufacture of the exported product were received in Venezuela.

Sources: Fitch Solutions, national sources

Trade Updates

The United States government expanded its sanctions on Venezuela over the course of 2018 and 2019.

Multinational Trade Agreements

Provisionally Active

- Mercosur: A regional customs union with Brazil, Argentina, Paraguay, Uruguay and Venezuela. The agreement facilitates trade with these neighbouring countries through the removal of tariff and non-tariff barriers. The customs union is still in the process of being fully implemented, however, with some significant exceptions to the common external tariff in individual countries and double-application of import tariffs on goods imported to one member and subsequently moved into another. Mercosur encompasses approximately 75% of South America's GDP and is one of the world's largest economic blocs. However, Venezuela has failed to completely implement the common external tariff, meaning that it is not fully integrated into the Mercosur market. As a result of this and the ongoing political and economic crisis in the country, as of December 2016 Venezuela has been suspended from Mercosur. Businesses are consequently unable to take advantage of the lower tariff and non-tariff barriers to trade with fellow Mercosur members while Venezuela remains suspended.

- Mercosur and associate members: The free trade agreement between Mercosur and associate members facilitates regional trade. However, Mercosur's associate members – Chile, Colombia, Ecuador, Guyana, Peru and Suriname – do not enjoy full voting rights or complete access to markets.

- Mercosur-India Preferential Trade Agreement (PTA): The PTA between Mercosur and India came into force on June 1, 2009. India is an important trade partner. India is expected to grow faster than top trade partner Mainland China over the medium term, creating even greater opportunities for Brazilian exporters.

Under Negotiation

- Mercosur-European Union (EU): Mercosur and the EU are negotiating a trade pact which aims to provide a boost to trade flows with important export markets in the EU and helps to stimulate new trade and investment opportunities. Talks between the two blocs are moving forward and agreement over remaining issues, including maritime transport policy.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The state is entitled to 30% of the volume of hydrocarbons extracted from any deposit, by way of royalties. The National Executive can reduce this within certain limits, when it is shown that certain types of deposits are not economically exploitable. Persons conducting activities related to hydrocarbons must pay the surface tax and tax on own consumption.

- The Gaseous Hydrocarbons Organic Law establishes a system of royalties, determinable by the volumes of gaseous hydrocarbons extracted from any deposit and not re-injected. The state is also entitled to a 20% share for this item. The law also states that additional legislation may obligate these entities to pay taxes on consumed hydrocarbons, such as fuel. However, no additional regulations have been enacted. Additional taxes are provided for in the licence agreements, which vary for each particular case.

- In 2017, Venezuela passed a new foreign direct investment law that repealed and replaced the 2014 Foreign Investment Law. The new law adds some details and definitions that were absent from the previous version, but also places additional government control over investment.

- The Petroleum and Mining Ministry and the Economy, Finance, and Public Banking Ministry regulates its respective sectors, and prospective investors must seek guidance from those specific ministries first.

- Express limits on foreign ownership of investments are generally found in the energy and mining sector. The government has identified a number of activities which are considered of strategic importance and are therefore reserved either completely or partially for state-owned enterprises.

- The most important strategic sector is the hydrocarbons industry in which foreign participation is only permitted as a minority partner (with a maximum stake of 49%) alongside the national oil company, PDVSA.

- The power generation sector faces foreign ownership caps, at 40% for projects in biomass, solar and wind, while electricity transmission and distribution is entirely closed to foreign participation. Media ownership by foreign parties is similarly restricted, at 20% for enterprises in newspaper publishing and television broadcasting.

- New foreign investments in Venezuela must also meet a minimum capital requirement of USD1 million, and must last for at least five years, during which profits may not be repatriated.

- The government may mandate the use of local suppliers, investment in research and development, technology transfer, social contributions and promotion of underdeveloped sectors producing goods for export as part of any investment agreement. Local content requirements are likely to be particularly stringent for public procurement contracts. These demands impose an onerous burden on businesses seeking to establish operations.

- The government imposes stringent performance requirements in order for businesses to meet basic needs such as obtaining foreign currency to purchase imported inputs. These obligations are primarily implemented through the National Superintendent for the Defence of Socio-Economic Rights, which is tasked with ensuring that businesses are charging fair prices and maintaining a profit cap, which is generally set at 30%.

- The United States has applied financial sanctions against Venezuela, which prohibited individuals and entities from the United States from providing new financing, dealing in certain existing bonds and distributing dividend payments to the government of Venezuela. While commercial transactions with the Venezuelan government are not impacted, joint ventures and other partnerships with the Venezuelan government or its subsidiaries could be prohibited activities.

- Foreign investors are unable to repatriate earnings in dollars through official channels. Ostensibly, foreign investors are permitted to remit up to 80% of Venezuelan earnings abroad in a given year, but in practice the currency commission, CENCOEX, has not approved the conversion of bolívars into dollars for the purposes of profit repatriation since 2008.

- Expropriations have affected firms in a wide range of sectors, including food processing, mining, construction, IT and telecommunications, manufacturing and port management. Around 20 investment disputes involving the Venezuelan government are currently under consideration by International Centre for Settlement of Investment Disputes (ICSID), although the large number of cases in which the country has been involved resulted in the government withdrawing from the ICSID in 2012. This means that businesses will no longer be able to use this route to achieve compensation for expropriated assets, creating further uncertainty for investors.

- Telecommunication services providers are subject to tax on the provision of sound and television broadcasting as well as other telecommunication services. The tax is levied on gross income from the telecommunication activity. The applicable rate in the case of sound and television broadcasting is 1% whereas other telecommunication services are subject to tax at 2.3%. The exploitation of orbital resources and associated portions of the radio spectrum, as well as the supply of satellite capacity to authorised operators for the provision of telecommunication services, are subject to a 0.5% tax on the amount billed or collected for supply of satellite capacity.

- The Organic Drug Law stipulates that any company employing 50 or more employees must make an annual contribution from their operating profit equivalent to 1%.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free trade zones are located at Paraguana Peninsula, in Falcon; Atuja in the state of Zulia; the municipalities of Libertador, Campo Elias, and Sucre; and Santos Marquina in the state of Merida |

- Exemption from most import and export duties. |

|

Inbound and capital investment incentives |

- The most commonly used incentives are the investment tax credits. Luxembourg tax law provides for two types of investment tax credits. |

|

General incentives |

- Recovery of VAT on imported inputs of finished products which are exported. |

Source: Fitch Solution

- Value Added Tax: 16%

- Corporate Income Tax: Variable (15-50%)

Source: National sources

Important Updates to Taxation Information

- In February 2020, the Constituent Assembly approved a law that will allow government to levy tax ranging between 5% to 25% above the pre-existing 16% VAT.

- According to Decree N° 4.080, effective the payment of VAT, Import Tax and the rate for the Determination of the Customs Regime on imports are exempt until June 30, 2020. The Decree entered into force on January 1, 2020.

- According to a presidential decree published in the Venezuelan Official Gazette on December 28, 2018, taxpayers that carry out operations in foreign or crypto currencies in Venezuela must determine and pay tax obligations in foreign or crypto currencies. The decree entered into force as of the date of publication.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 15% on 0-2,000 taxable units |

|

Windfall Tax pn oil companies |

- 80% on income from oil priced at USD80-100 per barrel |

|

Withholding Tax |

- 34% on dividends paid by non-hydrocarbons companies |

|

VAT |

16% variable rate on sale of goods and services |

|

Municipal Business Tax on income |

0.1-10% on gross income variable according to activity and area |

|

Propety Tax |

0.48% on property value |

|

Anti-drug contribution |

1% on operating profits |

|

Financial Transactions Tax |

0.75% on large financial transactions |

Sources: National sources, Fitch SolutionsDate last reviewed: February 19, 2020

Foreign Worker Permits/Visas

Venezuela issues tourist visas. Foreign nationals with tourist visas may not work as employees or engage in business in Venezuela. Business visas allow individuals to conduct commercial affairs or to provide technical assistance. Under the Immigration Law, foreign citizens who intend to render services in Venezuela for more than 90 days must obtain a labour permit and a labour visa (Working Transient Visa; known as the TR-L). The company that intends to employ the foreign citizen requests the labour permit.

If a foreign citizen will not be in Venezuela for more than 90 days, neither a labour permit nor a labour visa is required. The process of obtaining work permits for expatriates is highly bureaucratic and burdensome for businesses. In order to employ a foreign worker, employers must file an application with both the Office of Migration and the Ministry of Labour for a work visa and a work permit respectively (both are mandatory).

Both applications must include a number of documents such as detailed tax records of the company, the employment contract and an authorised Spanish translation of the qualification certificates of the employee. This arduous process increases the difficulties businesses will face in employing expatriates.

Localisation Requirements

Investors should be aware that there are legal restrictions on the employment of foreign workers in Venezuela. Expatriates must not exceed 10% of the workforce of a business employing 10 or more workers, and their remuneration should not surpass 20% of the total remuneration for the workforce.

The Ministry of Labour may waive these restrictions on a case-by-case basis, taking into account any special technical knowledge offered by the foreign worker, and the ability of Venezuelan workers to fill the position. This further contributes to the risks businesses will face in attempting to employ foreign workers.

Other Requirements

Venezuela now implements security protocol measures in order to prevent and protect countries from a possible virus outbreak such as Ebola. Therefore, a medical certificate granted by the health authority of the country is required. In the document it must be specified that the applicant during the 21 days prior to the trip or the application does not present symptoms compatible with Ebola, has not been in contact with Ebola patients, or with body fluids, and has not visited a health facility where these patients have received medical attention.

Sources: National sourses, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Action withdrawn |

24/08/2019 |

|

Standard & Poor's |

Not meaningful |

14/11/2017 |

|

Fitch Ratings |

Action withdrawn |

27/06/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

20 |

|

|

Ease of Doing Business Index |

188/190 |

188/190 |

188/190 |

|

Ease of Paying Taxes Index |

189/190 |

189/190 |

189/190 |

|

Logistics Performance Index |

142/160 |

N/A |

N/A |

|

Corruption Perception Index |

168/180 |

173/180 |

N/A |

|

IMD World Competitiveness |

63/63 |

63/63 |

N/A |

Sources: World Bank, IMD, Transparency International

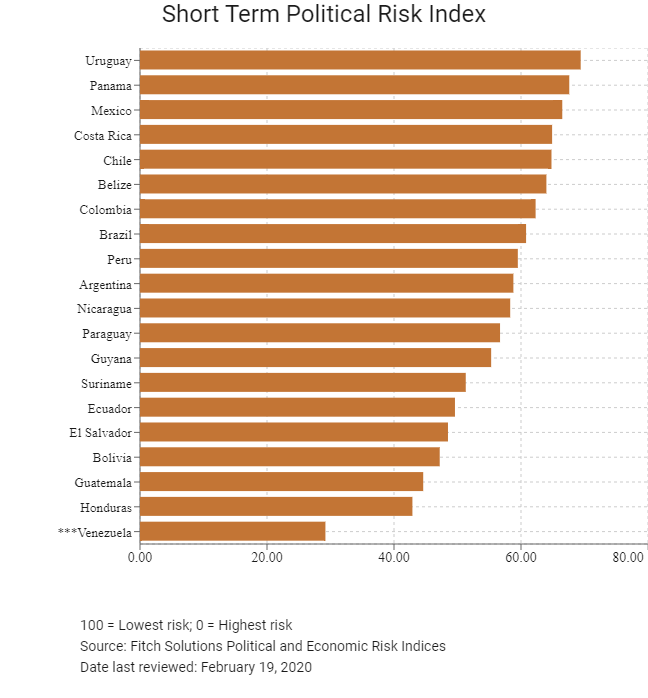

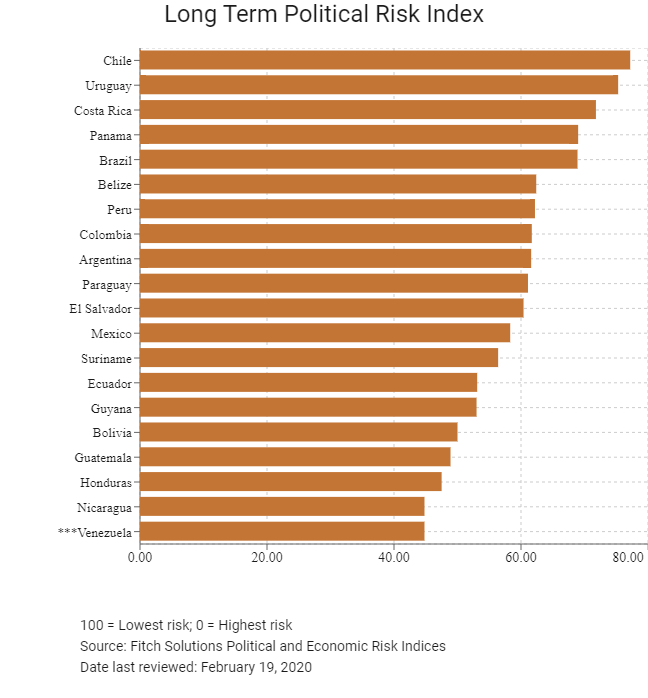

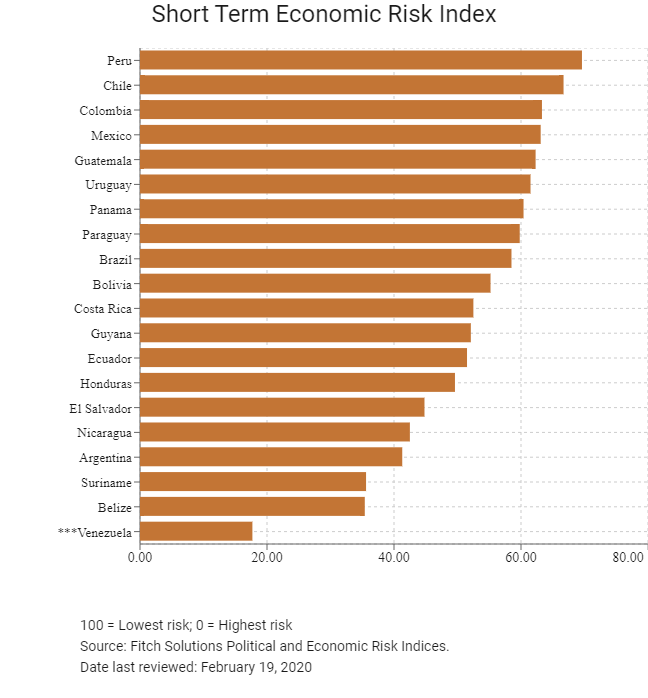

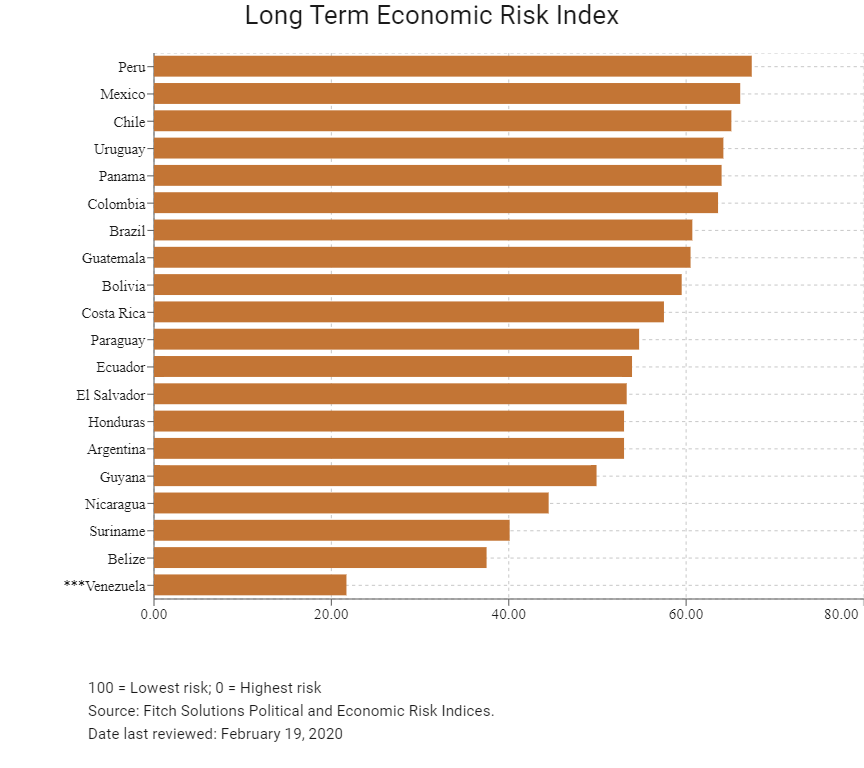

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

195/202 |

200/201 |

200/201 |

|

Short-Term Economic Risk Score |

26.9 |

26.9 |

17.7 |

|

Long-Term Economic Risk Score |

31.5 |

25.6 |

21.7 |

|

Political Risk Index Rank |

172/202 |

171/202 |

171/201 |

|

Short-Term Political Risk Score |

35.8 |

29.2 |

29.2 |

|

Long-Term Political Risk Score |

44.8 |

44.8 |

44.8 |

|

Operational Risk Index Rank |

182/201 |

181/201 |

179/201 |

|

Operational Risk Score |

28.8 |

29.0 |

29.4 |

Source: Fitch Solutions

Date last reviewed: February 19, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

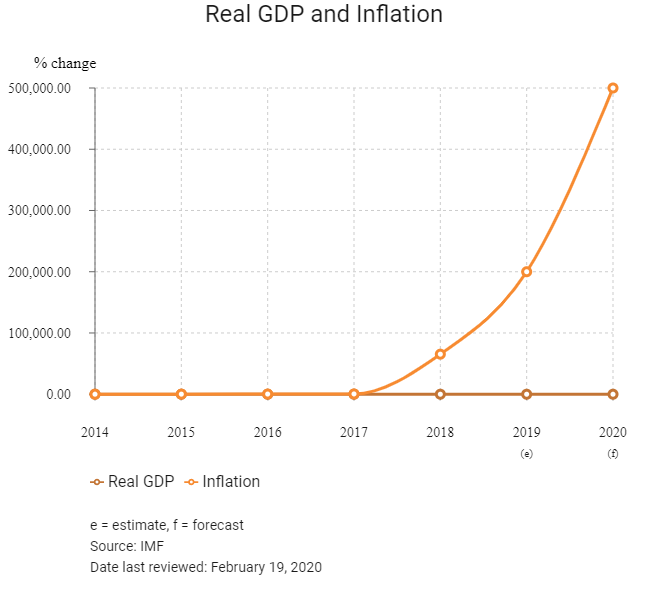

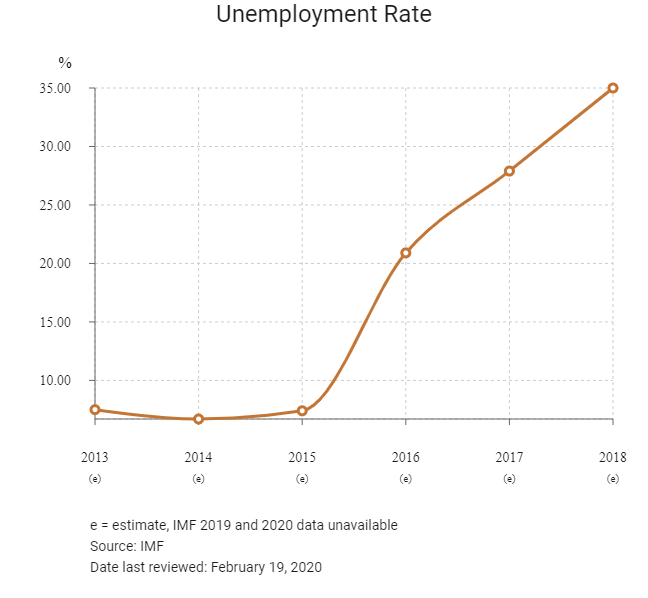

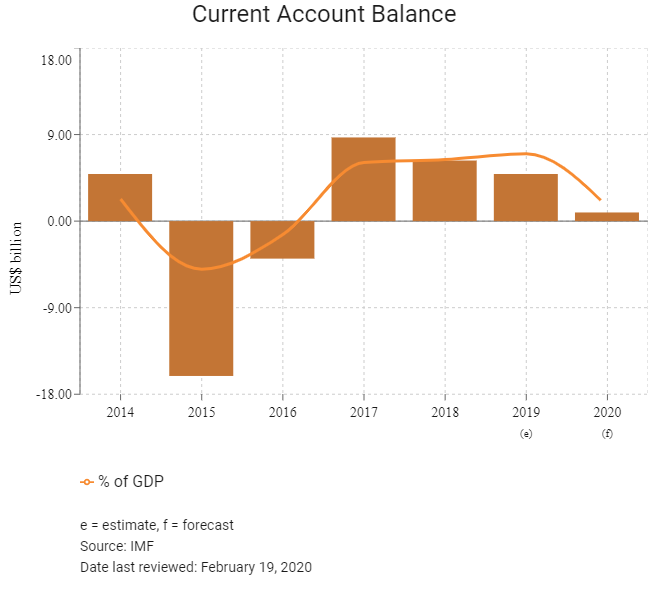

Venezuela's socioeconomic challenges will stretch into a seventh year in 2020. Declining oil production, hyperinflation and a poor business environment will keep the economy in a deep depression. Hyperinflation and a general loss of confidence will keep severe depreciatory pressures on the bolívar, ensuring that the parallel market value of the currency remains weak, despite a recent devaluation and re-denomination of the currency. A rare release of data by the Central Bank of Venezuela in May 2019 revealed the magnitude of the crisis currently gripping the country. Notably, the economy shrunk by about 50% since 2013, with output plunging to levels not seen since the late 1990s. Extremely wide fiscal deficits and Venezuela's inability to access international capital markets also weigh heavily on the country's economy. We expect growth will remain extremely weak in 2020 as the state faces noteworthy challenges in improving the economic environment.

OPERATIONAL RISK

Venezuela's operating environment has deteriorated significantly in recent years to the point that it is notably challenging for private businesses to continue trading and the market is virtually closed to foreign investment. The most pertinent risks relate to the country's weak trade and investment environment, characterised by hostile government policies, foreign currency shortages, trade barriers, limited economic diversification and nationalisation of strategic sectors, undermining the viability of private sector operations. Furthermore, businesses remain highly exposed to the country's volatile crime and security environment. The logistics network presents further challenges, with crumbling infrastructure and supply chain disruptions offsetting the benefits presented by extremely low utility costs. At the same time, Venezuela's hyperinflation, financial sanctions and the oil embargo further worsen the already crippled economy that has been stuck in depression for years.

Source: Fitch Solutions

Data last reviewed: February 19, 2020

Fitch Solutions Political and Economic Risk Indices

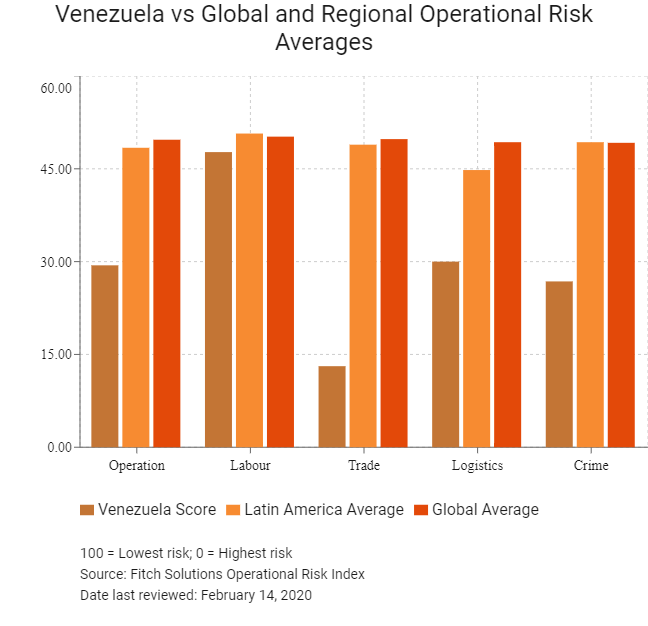

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Venezuela Score |

29.4 |

47.7 |

13.1 |

30.0 |

26.8 |

|

Central and South America Average |

46.2 |

49.5 |

45.2 |

47.0 |

43.0 |

|

Central and South America Position (out of 20) |

20 |

11 |

20 |

20 |

20 |

|

Latin America Average |

48.4 |

50.7 |

48.9 |

44.8 |

49.3 |

|

Latin America Postion (out of 42) |

41 |

29 |

42 |

41 |

41 |

|

Global Average |

49.6 |

50.3 |

49.8 |

49.0 |

49.2 |

|

Global Position (out of 201) |

179 |

117 |

201 |

168 |

177 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Chile |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Costa Rica |

56.3 |

53.6 |

60.3 |

52.2 |

59.3 |

|

Panama |

56.2 |

50.7 |

56.4 |

67.1 |

50.6 |

|

Uruguay |

54.6 |

51.5 |

52.1 |

53.4 |

61.3 |

|

Mexico |

52.3 |

57.5 |

58.2 |

57.4 |

35.9 |

|

Colombia |

51.8 |

57.5 |

54.7 |

51.8 |

43.1 |

|

Brazil |

50.3 |

47.4 |

48.4 |

53.9 |

51.5 |

|

Peru |

49.1 |

61.4 |

51.5 |

42.8 |

40.5 |

|

Argentina |

49.0 |

52.8 |

42.4 |

50.5 |

50.4 |

|

Ecuador |

45.8 |

52.4 |

37.6 |

50.9 |

42.4 |

|

El Salvador |

42.9 |

46.0 |

44.5 |

48.0 |

33.0 |

|

Suriname |

42.8 |

52.0 |

35.6 |

41.2 |

42.5 |

|

Belize |

41.9 |

51.0 |

38.1 |

40.9 |

37.8 |

|

Paraguay |

41.2 |

43.9 |

44.0 |

39.2 |

37.6 |

|

Guatemala |

40.8 |

43.8 |

44.7 |

41.0 |

33.5 |

|

Honduras |

40.0 |

40.2 |

46.9 |

40.1 |

32.7 |

|

Nicaragua |

39.4 |

40.4 |

39.1 |

37.0 |

41.1 |

|

Guyana |

36.8 |

44.5 |

38.3 |

29.6 |

34.6 |

|

Bolivia |

36.6 |

38.9 |

28.7 |

38.2 |

40.6 |

|

Venezuela |

29.2 |

48.5 |

13.1 |

28.4 |

26.8 |

|

Regional Averages |

46.1 |

49.9 |

45.2 |

46.3 |

43.0 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 2, 2020

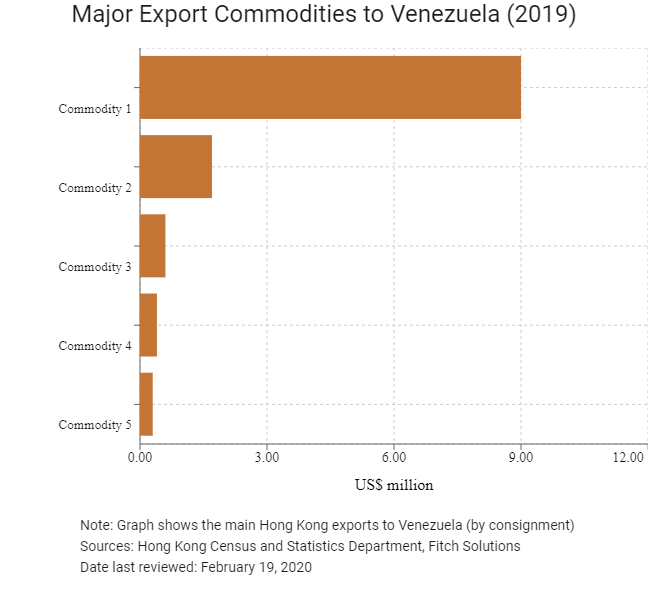

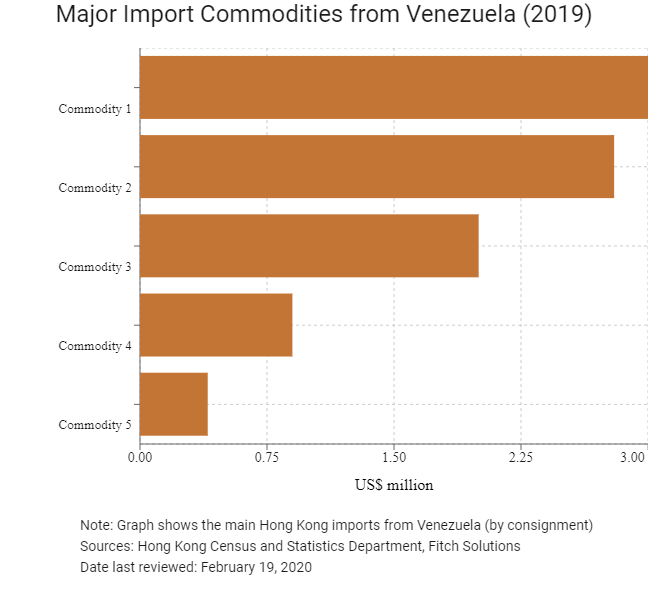

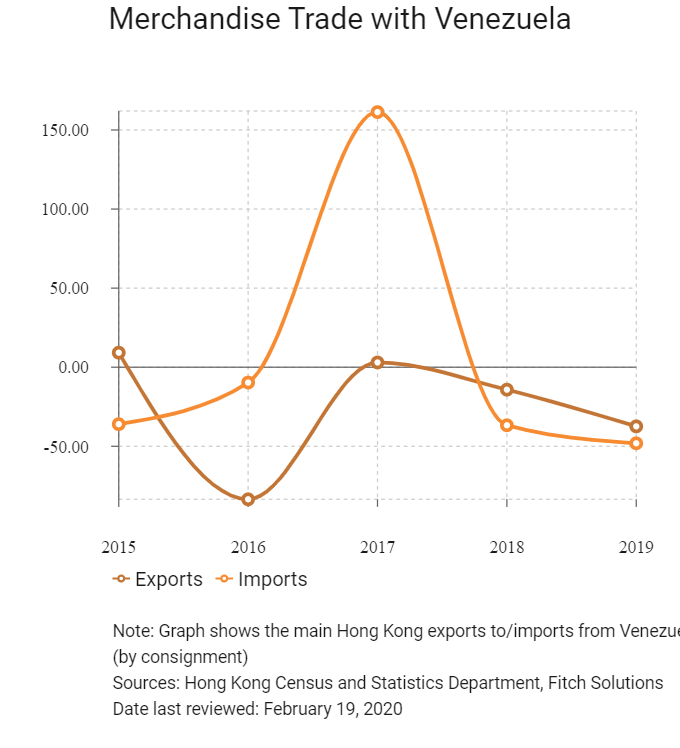

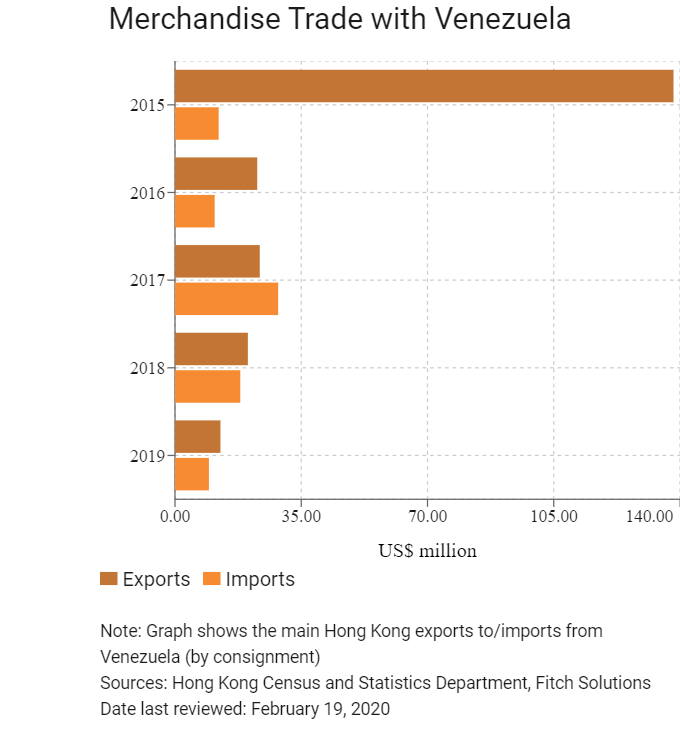

Hong Kong’s Trade with Venezuela

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Office machines and automatic data processing machines | 9.0 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 1.7 |

| Commodity 3 | Articles of apparel and clothing accessories | 0.6 |

| Commodity 4 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 0.4 |

| Commodity 5 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 0.3 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 3.0 |

| Commodity 2 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 2.8 |

| Commodity 3 | Meat and meat preparations | 2.0 |

| Commodity 4 | Metalliferous ores and metal scrap | 0.9 |

| Commodity 5 | Plastics in primary forms | 0.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Venezuela residents visiting Hong Kong |

6,882 |

-17.6 |

|

Number of Latin American residents visiting Hong Kong |

175,111 |

-8.0 |

Source: Hong Kong Tourism Board

Date last reviewed: February 19, 2020

Commercial Presence in Hong Kong

|

2016 |

Growth rate (%) |

|

|

Number of Venezuelan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Consulate General of Venezuala in Hong Kong

Consulate General of Venezuela in Hong Kong

Address: Office 7, 18/F, Dominion Centre, 43-59 Queen's Road East, Wan Chai, Hong Kong

Email: consulve@biznetvigator.com /depconsular@biznetvigator.com

Tel: (852) 2730 8099

Fax: (852) 2736 6519

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

Entry is visa free for HKSAR passport holders for a period up to 90 days for sightseeing purpose; whereas a business visa is required.

Source: Hong Kong Immigration Department

Date last reviewed: February 19, 2020

Venezuela

Venezuela