GDP (US$ Billion)

421.14 (2019)

World Ranking 30/194

GDP Per Capita (US$)

39,180 (2019)

World Ranking 26/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

160.9 (2019)

Currency (Period Average)

Emirati Dirham

3.67per US$ (2019)

Political System

Federation

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

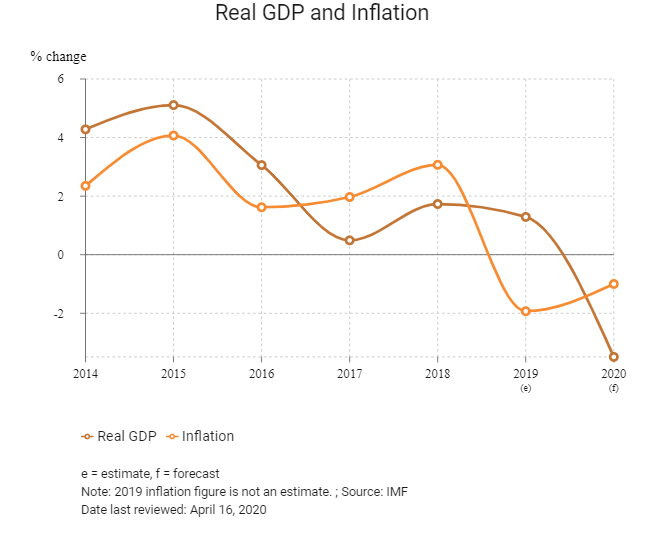

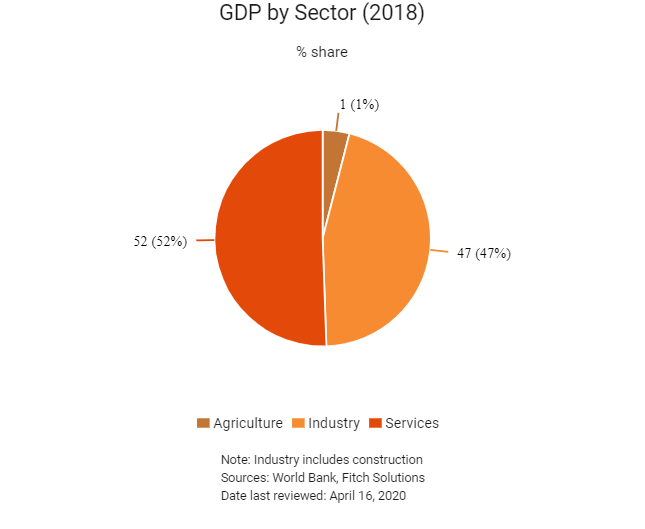

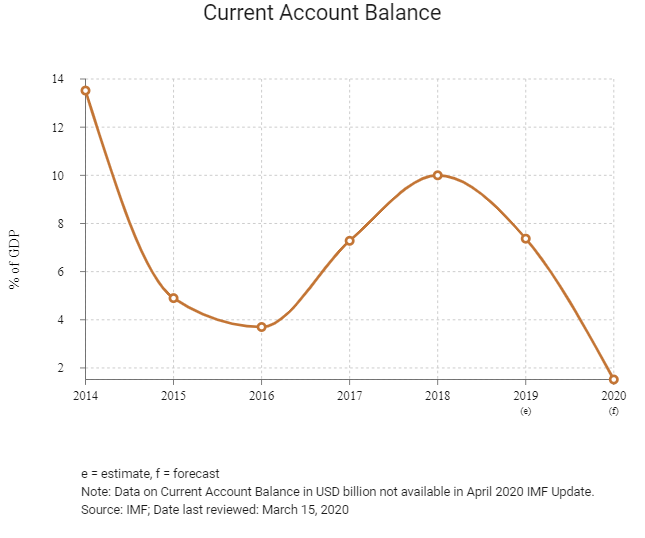

The United Arab Emirates (UAE) has well-established infrastructure, a stable political system and one of the most liberal trade regimes in the Gulf region. It continues to be increasingly important, relevant and attractive to businesses from around the world as a place to do business and as a hub for the region and beyond. While the oil sector continues to make up a significant proportion of Gulf Cooperation Council economies, the UAE is successfully diversifying its economic base from over-reliance on the energy sector. In the medium term, firmer oil prices and the easing of fiscal consolidation had been expected to promote economic activity, especially as investments ramped up ahead of Dubai's Expo 2020, but the decision to delay that event by one year (with all that implies for tourist inflows and the delays to business spending that would have coincided with the event), low oil prices and slowed production have weakened the outlook. The developing disruption caused by the global fallout from the coronavirus pandemic, including commodity price shocks, means that the healthy upside of economic reforms will likely offer only limited protection from the downside risks damaging economic growth.

Sources: BBC Timeline, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2018

The UAE and the Saudi Arabia signed the first double taxation treaty (treaty) between members of the Gulf Cooperation Council (GCC).

July 2018

The UAE accepted setting up a comprehensive strategic partnership with Mainland China.

September 2018

Crown Prince Mohammed bin Zayed of Abu Dhabi announced the approval of a three-year, AED50 billion fiscal stimulus package for the emirate. The package, titled 'Ghadan 2021', or 'Tomorrow 2021', would focus on four key objectives: stimulating investment, creating jobs, spurring innovation and improving quality of life.

July 2019

Emirates Water and Electricity Company launched a tender for a 2GW solar photovoltaic power project in Abu Dhabi. Successful bidders would have a 40% equity stake in the facility, while local entities would hold the remaining share. Deadline for the submission of bids was the fourth quarter 2019 and the facility was slated to begin operations in 2022.

October 2019

The UAE and Russia signed six deals in the energy, advanced technology and health sectors worth over USD1.3 billion during Russian President Vladimir Putin’s visit on his Gulf tour.

During a 10-day trip to Asia and the Middle East by President Jair Bolsonaro it was announced that Brazil and the UAE had agreed to expand trade between the two nations and to foster investment fund partnerships in sectors such as agribusiness, infrastructure, energy and defence.

January 2020

The Federal Electricity and Water Authority (FEWA) of the UAE launched tender seeking expressions of interest for the development of 500MW solar photovoltaic (PV) park in Umm al-Quwain. The selected developer would be responsible for designing, building, financing as well as operating the project, which would be developed under Independent Power Producer framework. The developer would hold a 40% stake in the project, while the remaining would be held by FEWA and the government of Umm Al Quwain. FEWA would also enter into long-term power purchase agreement with the developer as the sole off-taker of electricity from the project.

February 2020

The UAE announced the discovery of 80 trillion standard cubic feet of shallow gas resources in place between Saih Al Sidirah and Jebel Ali in the emirates of Abu Dhabi and Dubai respectively. The discovery would likely trigger a substantial upgrade in proved gas reserves over the coming years.

The UAE formed a Food Security Council amid concerns about food supply vulnerabilities because of the emerging coronavirus pandemic.

March 2020

The Dubai authorities had recommended that the Bureau International des Exposition agree to a one-year delay to the Expo that was due to start in October 2020. Around 11 million overseas visitors had been expected to attend and more than USD8 billion had been spent in preparation.

Abu Dhabi-based hospitals provider NMC Health revealed that it had discovered USD3 billion of debt the board was unaware of and had not approved. The revelation was in addition to the USD2.1 billion of debt reported in June 2019.

April 2020

The Dubai Future Foundation released a report identifying the massive increase of online traffic, from streaming services and remote working policies, as highlighting the need for a reassessment of regional telecom infrastructure and regulatory change.

The Department of Economic Development in Abu Dhabi announced an increase of 68% in new commercial licences (4,786 issued) in the first quarter of 2020.

The head of the immigration department in Dubai announced that in response to the coronavirus pandemic flexible visa extension programmes had been established and visa transfers from one company to another would be permitted.

Q1 2020

In response to the Covid-19 pandemic, authorities announced a stimulus package amounting to AED26.5 billion (USD7.2 billion) in various fiscal measures. Among these include AED16 billion approved by the federal government to support the private sector by reducing various government fees and accelerating existing infrastructure projects.

Sources: BBC country profile – Timeline, national sources, Fitch Solutions

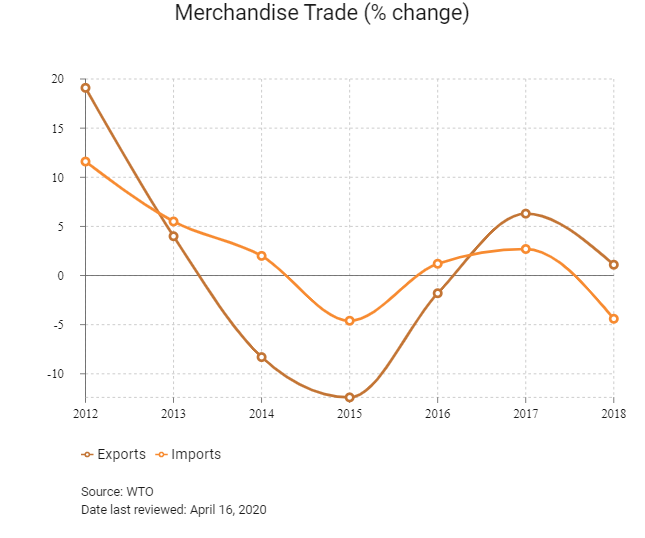

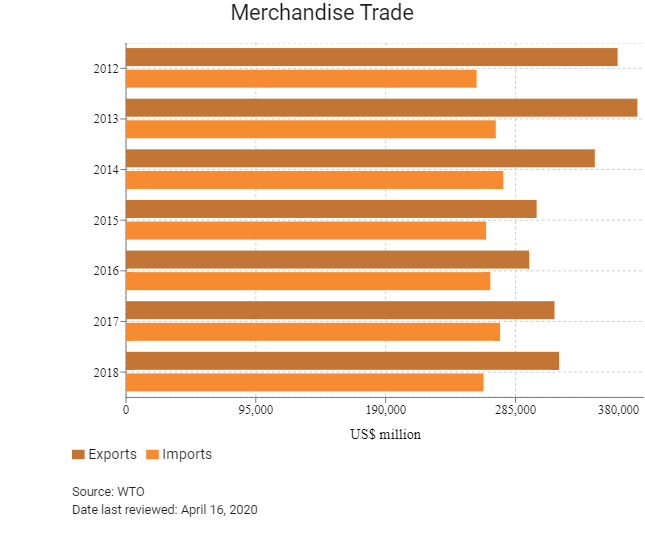

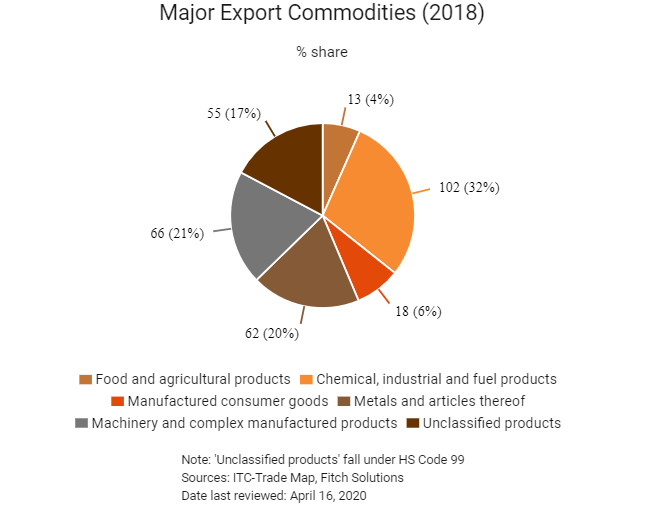

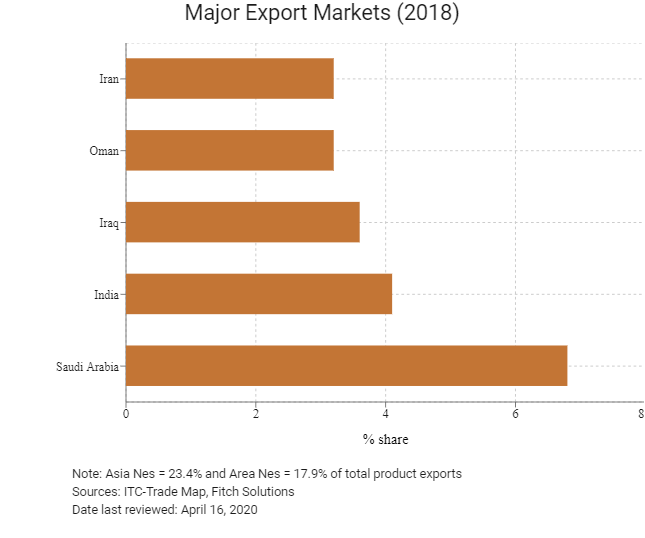

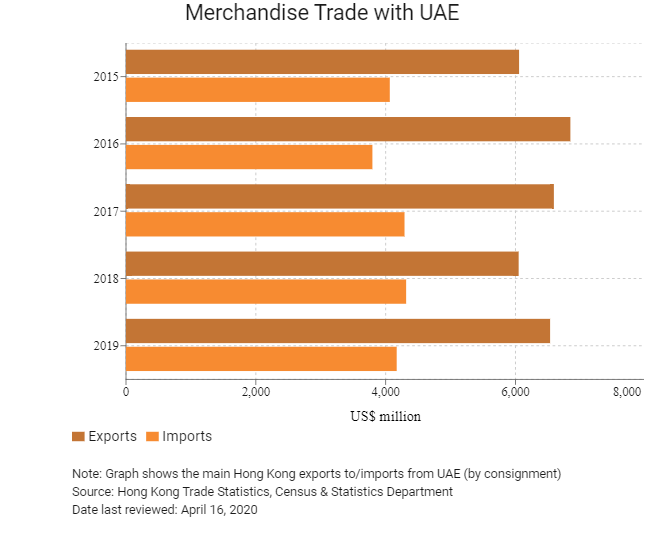

Merchandise Trade

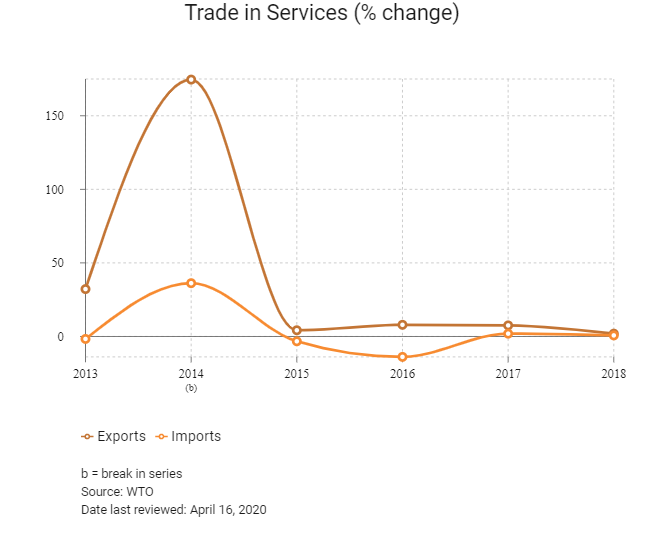

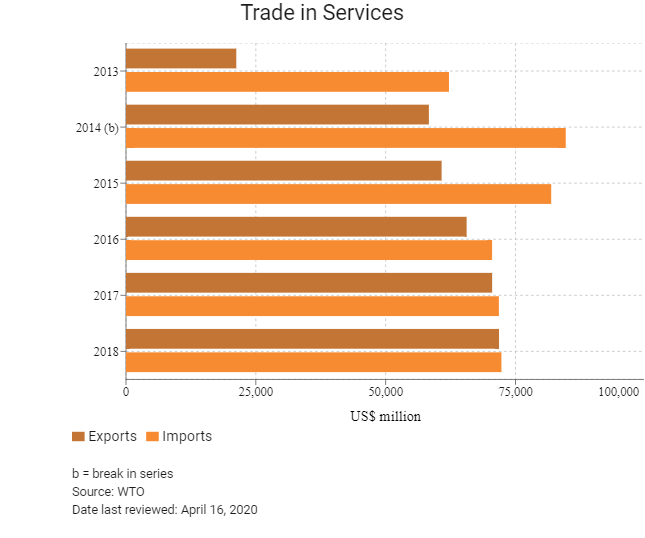

Trade in Services

- The UAE has been a member of the World Trade Organization (WTO) since April 10, 1996, and a member of the General Agreement on Tariffs and Trade since March 8, 1994.

- The UAE is a member of the GCC alongside Kuwait, Oman, Saudi Arabia, Bahrain and Qatar. GCC membership means that the UAE is part of a single market and customs union with a common external tariff. Under the accord, goods imported into the GCC area can be freely transported throughout the region without paying additional tariffs.

- Generally, a customs duty of 5% is imposed on the cost, insurance and freight value of imports.

- A 5% VAT was introduced in the UAE as of January 1, 2018. The tax will apply to almost all goods and services except basic food items, education and healthcare. The 0% VAT rate also applies to goods and services exported outside the VAT-implementing GCC member states, international transportation, crude oil/natural gas, the first sale of residential buildings and some specific areas.

- On October 1, 2017, the UAE implemented an excise tax on tobacco products, carbonated drinks and energy drinks. The tax applies to both locally manufactured and imported goods. The applicable tax rates are 50% for carbonated drinks and 100% for tobacco products and energy drinks. Since January 1, 2020, the tax has applied to electronic cigarettes (with or without nicotine or tobacco) and liquids used in them (both at a rate of 100%) as well as beverages with added sugar or sweeteners (50%).

- Prohibited products include live swine and other products prohibited on security, health and safety grounds. Restricted products include pig meat products and alcoholic beverages, which require import licences and, in most cases, the tariff on these products is 200%. Certain medicines can be imported or exported only after receiving the necessary permits from the authorities.

- Trading (importing and/or exporting) in the UAE requires a trading licence and a trader code, which is available from the customs department of each emirate and is valid throughout the UAE. Import and export licences are dependent on ownership rules, with certain industries requiring a domestic partner with a share of 51% of ownership in the importer or exporter in order to obtain the relevant permits. These ownership rules changed in 2018 and are further outlined below (see FDI Policy section).

- Imports of all live animals, animal products (except food products of animal origin) and fodder need an import permit issued by the Ministry of Climate Change and Environment. Additionally, all live animals, animal products, plants and plant products are subject to quarantine requirements and need to be accompanied by health certificates.

- The UAE aims to achieve long-term prosperity for current and future generations through Vision 2021, which aims to forge a sustainable and diversified economy that is flexible in adopting new economic models and capitalises on global economic partnerships. Among the 12 key performance indicators it has set to achieve this are: non-oil real GDP growth, net inflow of Foreign Direct Investment as a percentage of GDP, the share of UAE nationals in the workforce, the 'Emiratisation Rate' in the private sector and the contribution of small and medium-sized enterprises to non-oil GDP.

Sources: WTO – Trade Policy Review, United Arab Emirates, Fitch Solutions

Negotiations for a free trade agreement (FTA) between the European Union (EU) and the GCC started in 1990 but were suspended in 2008. The region represents an important export market for the EU and ongoing cooperation between the two led to a more structured informal dialogue on trade and investment being launched in May 2017. The EU has had a delegation to the UAE since 2013 and in January 2018 a cooperation agreement was signed with the UAE Ministry of Foreign Affairs and International Cooperation to scale up EU–UAE relations and strengthen cooperation on key issues of mutual interest including trade, innovation, research and multilateral cooperation.

6.1 Multinational Trade Agreements

Active

- WTO: The UAE has been a member of the WTO since April 1996.

- The GCC Customs Union: This customs union, which entered into force on January 1, 2003, seeks to enhance ties between member countries and allows the free movement of local goods among member states. The UAE's trade with these countries is tariff-free. Other members are Bahrain, Kuwait, Oman, Qatar and Saudi Arabia. This agreement helps member states to leverage each other's industrial capacity and logistics networks. The geographic proximity of these countries and their general adoption of free-trade economic policies are factors that foster a competitive business environment. Only imports of certain sensitive goods from GCC countries face tariffs, and there is freedom of movement between GCC countries without customs or non-customs restrictions. All members benefit from having common regulations and procedures and unified standards and specifications for all products. There is freedom of movement between GCC countries for the vast majority of goods without restrictions, reducing the overall time and cost burdens for supply chains.

- The Pan-Arab Free Trade Area (PAFTA): PAFTA was established in order to create an Arab economic bloc that could effectively compete with other countries while ensuring that member countries increased trade with each other. PAFTA entered into force on January 1, 1998. The most important aspect of the agreement was that over the next decade (to 2008), each member country would seek to reduce customs fees by 10% per annum as well as gradually eliminate trade barriers. In March 2001, the member countries decided to reduce the period over which the reductions in tariffs could be made so as to speed up the process and in January 2005 the elimination of most tariffs among the PAFTA members was enforced. Parties to PAFTA include Algeria and the Palestinian Authority as well as the original signatories: Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, the UAE and Yemen.

- GCC–European Free Trade Association (EFTA – Iceland, Liechtenstein, Norway and Switzerland): The GCC and the EFTA states signed a FTA with the GCC which came into force on July 1, 2014. The agreement covers the progressive elimination of tariffs on trade in services and manufactured goods, as well as investment, and other trade-related issues, such as protection of intellectual property, and is fully consistent with provisions of the WTO. In addition, bilateral arrangements on agricultural products between individual EFTA states and the GCC form part of the instruments establishing the free trade area between both sides.

- GCC–Singapore FTA: The GCC–Singapore FTA (GSFTA) applies to the trade in goods and services and became effective on September 1, 2013. The GSFTA eliminates most tariffs (99%) on Singapore's exports to the GCC. This is a comprehensive agreement covering trade in goods, rules of origin, customs procedures, trade in services and government procurement, among others. Key sectors benefitting from the agreement include telecommunications, electrical and electronic equipment, petrochemicals, jewellery, machinery and iron and steel-related industry. The recognition of the halal certification of Singapore's Majlis Ugama Islam Singapura will also pave the way for trade in halal-certified products to gain faster access to the GCC countries.

Signed But Not Yet in Effect

The Trade Preferential System of the Organization of the Islamic Conference (OIC): The agreement would see to the promotion of trade between member states by including most-favoured nation principles, harmonising policy on rules of origin, exchanging trade preferences among member states, promoting equal treatment of member states and special treatment for the least developed member states, and providing for regional economic bodies made up of OIC nations to participate as a block. The agreement will cover all commodities groups. The OIC comprises 57 members, which means fully realising such an agreement would be highly impactful, encompassing approximately 1.8 billion people. Although the framework agreement, the protocol on preferential tariff scheme and the Rules of origin have all been agreed on, members are required to update and submit their concessions list for the agreements and system to be able to come into effect. As of April 2020, only 14 nations, the UAE among them, have done so.

Under Negotiation

- Australia–GCC: Australia and the GCC share a significant economic relationship, encompassing trade and investment across a broad range of goods and services. The GCC is a key market for agricultural exports such as livestock, meat, dairy products, vegetables, sugar, wheat and other grains. The agreement provides an opportunity to address a range of tariff and non-tariff barriers related to food exports that will benefit the food and drink sectors in the UAE. To date, there have been four rounds of Australia–GCC FTA negotiations, with the last one held in June 2009. An Australia–GCC FTA would provide an opportunity to reduce barriers to trade in mineral commodities and automotive parts. Provisions on investment would both encourage inward investment from the GCC as well as enhance security for Australian investments in GCC countries themselves, including in such areas as mining or the development of educational campuses. No progress is expected on an FTA with the GCC while the intra-Gulf tensions, which commenced in June 2017, remain unresolved.

- GCC–Mainland China: The first-round negotiations of the GCC–Mainland China FTA commenced on April 27, 2005. Greater trade liberalisation will help develop the industrial and service sectors. Trade liberalisation with the GCC will help the group integrate and grow with mutual cooperation and comprehensive tariff reduction. In 2017 Mainland China accounted for 12% of the GCC's total global trade. Thus far, the two parties have held nine rounds of negotiations and have reached an agreement on the majority of issues concerning trade in goods.

- IGCC–India: The GCC and India are negotiating an FTA. The agreement is expected to remove restrictive duties, push down tariffs on goods and pave the way for more intensive economic engagement between the nations. More than 50% of India's oil and gas comes from the GCC countries.

- GCC–Japan: Japan and the GCC are negotiating an FTA. This agreement will seek to reduce tariffs and liberalise services trade and investment. Japan mainly imports aluminium, natural gas, liquid natural gas and petroleum products from the GCC, while Japan mainly exports electronics, vehicles, machinery and other industrial products to the GCC.

- Other: A number of other GCC FTAs are currently under negotiation. The countries engaged in negotiations include Pakistan, New Zealand, South Korea, the Mercosur bloc and Turkey.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The UAE is a federation of seven emirates (Abu Dhabi, Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain). Currently, the UAE does not have a federal corporate income tax regime; however, most of the emirates introduced income tax decrees in the late 1960s, and taxation is therefore determined on an emirate-by-emirate basis.

- Investment promotion agencies exist depending on the emirate. For example, the Sharjah Investment and Development Authority, or Shurooq, is an independent government agency that assists investors in finding partnerships in the respective emirate. However, the UAE government has, as of October 2018, created an additional special unit within the Ministry of Economy to help attract foreign investors. The unit will offer significant benefits to investment firms by stipulating that foreign investment firms which secure licences under the decree will be treated like national companies, significantly cutting back on red tape.The UAE is the largest recipient of foreign direct investment in the Middle East.

- Under the emirate-based tax decrees, CIT may be imposed on all companies (including branches and permanent establishments) at rates of up to 55%. However, in practice, CIT is currently only enforced with corporate entities engaged in the production of oil and gas or extraction of other natural resources in the UAE.

- Previously, foreign companies or individuals were limited to 49% ownership or control in any part of the UAE (with the exception of some free trade zones), pursuant to law. A foreign business in these cases was obliged to have a UAE national sponsor, agent or distributor, with at least a 51% ownership interest of the business. However, in October 2018 the UAE government approved a new foreign direct investment (FDI) law that removed limitations on foreign-ownership in select sectors and has enabled 100% foreign ownership depending on the emirate and the industry. The list of sectors (as delineated by the 'negative list') in which foreign ownership would remain limited include the following:

- Oil exploration and production

- Investigation, security, and military-related industries

- Banking and financing activities

- Insurance

- Pilgrimage and Umrah services

- Certain recruitment activities

- Water and electricity provision

- Fishing and related services

- Post, telecommunication and other audio visual services

- Road and air transport

- Printing and publishing

- Commercial agency

- Medical retail (including pharmacies)

- Blood banks, quarantines and venom/poison banks

Other sectors, included on the 'positive list', will be open to increased foreign ownership. The new FDI law also provides the Cabinet with the ability to add or remove sectors and industries from the respective lists and provides the Cabinet with the power to oblige a company or its shareholders to meet certain requirements before greater foreign investment is allowed (in the case whereby a change in listing occurs). - In July 2019, acting under the new FDI law, the UAE Cabinet approved 122 economic activities across 13 sectors that will become eligible for up to 100% foreign ownership. The sectors are: transport and storage; agriculture; space; manufacturing; renewable energy; hospitality and food services; information and communication; professional, scientific and technical activities; administrative services and support services; educational activities; healthcare; art and entertainment; and construction.

- Branch offices of foreign companies are required to have a national agent with 100% UAE national ownership, unless the foreign company has established its office pursuant to an agreement with the federal or an emirate-level government.

- Certain transactions in goods between companies established in FTZs have special treatment under the UAE VAT law and may not be subject to VAT. The supply of services within FTZs is subject to VAT in accordance with the UAE VAT legislation.

- VAT exemption applies to certain financial services, as well as to the residential real estate sector. Furthermore, transactions in bare land and domestic passenger transport are also exempt.

- Most emirates impose a municipality tax on properties, mostly by reference to the annual rental value. It is generally the tenants' obligation to pay the tax. In some cases, separate fees are payable by both tenants and property owners. For example, in Dubai, the municipality tax on residential property is currently imposed at 5% of the annual rental value for tenants or at 5% of the specified rental index for property owners.

- When a public joint stock company lists in the UAE, there is a 51% GCC ownership requirement. UAE nationals must chair and be the majority of board members of any public joint stock company.

- The law requires that foreign principals distribute their products in the UAE only through exclusive commercial agents who are either UAE nationals or companies wholly owned by UAE nationals.

- A registration fee may be levied on transfer of ownership of land or real property. For example, a land registration fee is levied in the emirate of Dubai at a rate of 4% of the sale value of the property (a cost generally shared between the buyer and seller), payable to the Dubai Land Department. In Dubai, the registration fee may also apply on the direct or indirect transfer of shares in an entity that owns real property. These levies are imposed and administered differently by each emirate.

- Effective from 1 December 2019, the UAE amended the definition of Qualified Investor to include foreign governments and their entities, institutions and authorities or companies wholly owned by any of them.

- The UAE is party to 51 active bilateral investment treaties with countries or economic unions, including one with Mainland China. An additional 37 treaties have been signed but are not yet in force (including one with Hong Kong).

- The UAE is party to seven treaties with investment provisions (including an investment promotion and protection agreement with Hong Kong that entered into force in March 2020).

- Currently, there are over 45 FTZs (and business parks) in the UAE, the majority of them in Dubai. Each emirate has its own rules but generally offers tax holidays to businesses (and their employees) set up in the FTZ for a period of between 15 and 50 years (which are mostly renewable). Certain FTZs also offer exemption from customs duties. The laws and regulations granting these tax holidays and exemptions are not consistent across the various FTZs, therefore each FTZ needs to be considered separately. Dubai has implemented a 'One Free Zone Passport' that allows companies to operate across Dubai's 24 FTZs with one just licence.

The current oil projects pipeline is focused on brownfield expansion and enhanced oil recovery; this will contribute the bulk of the growth over the next decade. The prospects for greenfield growth are also improving, with national oil companies in Abu Dhabi, Ras al Khaimah and Sharjah pushing to renew exploration activities. The government is putting increasing focus on developing the country's domestic gas resource. The bulk of the resources are sour, with major projects in the pipeline including the North West Area project, for which tendering was ongoing in 2020. The downstream oil and gas sector continues to expand and Abu Dhabi National Oil Company (ADNOC) plans to further raise capacity by an additional 600,000 barrels per day at the al-Ruwais refinery, although in April 2020 it agreed to reduce output as part of an OPEC deal to ease a supply glut created by reduced demand because of the coronavirus pandemic. Oil and gas demand will continue to rise, extending the country's dependence on imported fuels, pipeline gas and LNG. The pace of demand growth will slow owing to a mix of fuel switching, efficiency gains and subsidy reform.

Sources: WTO – Trade Policy Review, The International Trade Administration, US Department of Commerce, national sources

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

Free Trade Zones (FTZs) are located throughout the country, with some open to all sectors and some catering for specific industries (for example, financial services or ports and logistics). FTZs are subject to strict control criteria; required to have security procedures in place to control the movement of goods and people to and from the designated zone; and required to have Customs procedures to control the movement of goods into and out of the designated zone. FTZs include, but are not limited to: | - FTZs have their own rules and regulations and generally offer tax holidays to businesses (and their employees) set up in the FTZ for a period between 15 and 50 years (which are mostly renewable) |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 5%

- Corporate Income Tax: N/A

Source: United Arab Emirates Ministry of Finance

Important Updates to Taxation Information

- In January 2018, the UAE Cabinet approved two double tax agreements concluded by the territory in 2017 with Moldova and Croatia.

- There is a growing trend of tax reforms in the Middle East region and this may result in changes to the tax laws in the UAE. Based on public sources, the UAE is in the early stages of studying a federal corporate tax regime for the country.

- On October 1, 2017, the UAE implemented excise taxes on certain goods.

- VAT was implemented in the UAE on January 1, 2018, with a standard rate of 5%. This follows the ratification by the UAE of the Common VAT Agreement of the GCC for the introduction of VAT in the GCC region.

Business Taxes

Type of Tax | Tax Rate and Base |

CIT | No federal taxation currently exists in the UAE, although each of the individual emirates (Abu Dhabi, Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain) has issued corporate tax decrees that theoretically apply to all businesses established in the UAE. Under the emirate-based tax decrees, CIT may be imposed on all companies (including branches and permanent establishments) at rates of up to 55%. However, in practice, CIT is currently only enforced with corporate entities engaged in the production of oil and gas or extraction of other natural resources in the UAE |

Branches of foreign banks tax | 20% levied by some of the Emirates which have their own specific banking tax decrees to impose corporate income tax on branches of foreign banks |

Social security contributions | Only for nationals of the UAE and GCC. A contribution of 17.5% of gross remuneration is payable, with 12.5% paid by the employer and 5% by the employee, except in Abu Dhabi where the rate is 20% (and the employer pays15%) |

Value added tax | 5% applies to supplies of goods or services, unless those are specific goods or services deemed to be zero rated such as healthcare and education or exempt such as certain financial services |

Property taxes | Most individual emirates in the UAE levy a municipality tax on propery, normally according to the annual rental value and then payable by the tenant. In Dubai the municipality tax on property is 2.5% on annual rental value for commercial properties (paid by property owners) and 5% for residential properties (paid by tenants). The transfer of ownership of land or real property can also attract a levy. For example, in Dubai a land registration fee is levied at a rate of 4% of the fair market value of the property (generally shared between buyer and seller), payable to the Dubai Land Department. The registration fee may also apply on the direct or indirect transfer of shares in an entity that owns real property |

Stamp duty | No stamp duties or taxation are levied in the UAE |

Hotel tax | Most emirates impose levies on service and entertainment provided in restaurants, hotels, hotel apartments and resorts. One or more of the following taxes might apply: 10% on the room rate, 10% service charge, 10% municipality fee, a 6 -10% city tax or a 6% tourism fee. In Abu Dhabi a fee on hotel stays is levied at 4% of the total bill. |

Sources: United Arab Emirates Ministry of Finance, Fitch Solutions

Date last reviewed: April 16, 2020

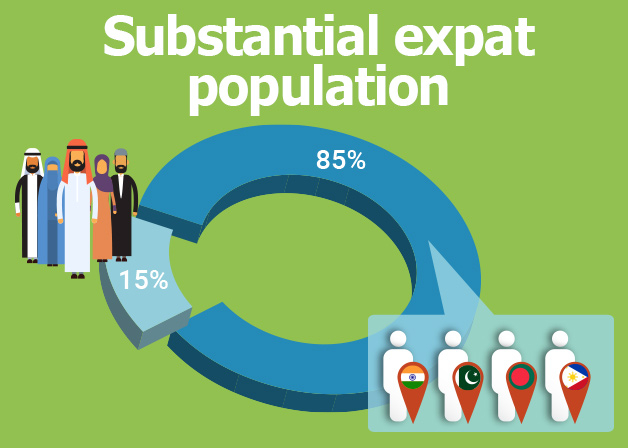

Localisation Requirements

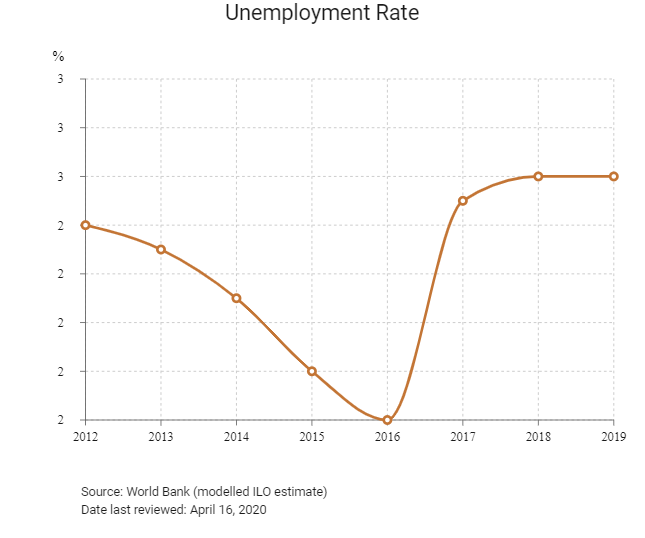

Developing human capital and increasing nationals' workforce participation constitute key elements of the GCC member states' economic diversification plans and will continue to drive labour market policies across the region over the coming decade. The UAE government has launched a policy of 'Emiratisation', similar to that of 'Saudisation' in neighbouring Saudi Arabia, which is intended to boost the employment of Emirati nationals in the private sector and reduce reliance on expatriate labour. There are specific local hiring quotas which must be fulfilled for companies with 50 employees or more, and companies in the banking, insurance and retail sectors. Specific jobs are reserved for Emirati citizens through legislation, such as Human Resources managers, secretaries and government liaison personnel. These local hiring requirements are not applicable to companies with their operations based in the UAE's free trade zones.

Work Permits for Skilled Workers

Citizens who are not from the GCC need to be sponsored by their employer, and therefore need to have a job offer in order to be able to apply for a work permit. Various documents such as educational and professional qualifications, results of medical examinations and a signed copy of the job contract all need to be lodged with the UAE Ministry of Labour before the work permit will be granted.

Work Sponsorship System

Typically, as a result of relatively small domestic populations and the fact that a large portion of the domestic working-age population is employed by the public sector in all six of the GCC states, employing foreign workers to fill low-skilled and high-skilled positions for the private sector has been relatively easy. The large presence of migrant workers in many GCC states – the UAE is second only to Qatar in having the greatest number of migrant workers – is attributed to the 'kafala' (sponsorship) system, which emerged in many GCC states in order to regulate the relationship between employers and migrant workers in these countries. The employer is seen as the foreign worker's sponsor and is entirely responsible for their visa and legal status. A downside risk is that some foreign workers have had their passports and wages illegally withheld by GCC employers, and some risk not being allowed to leave the country or change employers without their current employer's permission.

The main objective of the 'kafala' system is to facilitate the steady supply of temporary and rotating labour rapidly to such countries during times of economic boom – a labour force that could then be expelled fairly easily in less prosperous periods. However, owing to increasing pressure on GCC states from human rights groups about the exploitation of foreign workers under this system changes came into effect from January 1, 2016, to better protect workers' rights under the 'kafala' system. These changes included job contracts that must specifically reflect the terms offered to the employee verbally and must be signed by both parties prior to being submitted to the Emirate Ministry of Labour as part of the formal work permit application; also that a contract of employment has come to an end if an employer has not met their contractual obligations (for example, failed to pay their employees for 60 days or more). The changes allow workers greater freedoms in terms of seeking alternative employment within the UAE and, therefore, obtaining a new work permit through a new employer.

Visa/Travel Restrictions

Citizens of other GCC and European Union states do not need a visa to visit the UAE. Citizens from North American states, Central Asian states and Asian states in general can obtain a visa on arrival, and citizens of African and South American states are required to arrange a visa in advance. Visa processing times are estimated at being four- to six weeks.

New visa rules have been implemented (effective October 21, 2018) by the Ministry of Human Resources and Emiratisation (MoHRE) which allow visitors and tourists to apply for new UAE entry visas without leaving the country, and grant one-year residency extensions to widows and divorced women. The new rules will also allow visitors to be granted a new entry permit (valid for 30 days), but only twice. Extension of entry permits will require a payment of AED600 (not applicable to citizens of GCC nations).

Regulation surrounding long-term visas now offers:

- 5-year residency visas to persons owning real estate in the UAE worth a minimum of AED5 million

- Renewable 10-year visas to persons with investments in the country worth a minimum of AED10 million (if non-real estate investments make up at least 60% of the total portfolio)

- 5-year visas for entrepreneurs

- 10-year visas for specialised talents and researchers with top qualifications in the fields of science and knowledge such as doctors, scientists, inventors and creative individuals in culture and art.

- 5-year visas for 'outstanding students'

Source: United Arab Emirates, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

Moody's | Aa2 (stable) | 25/03/2019 |

Standard & Poor's | AA (stable) | 02/07/2007 |

Fitch Ratings | AA | 31/10/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

Ease of Doing Business Index | 21/190 | 11/190 | 16/190 |

Ease of Paying Taxes Index | 1/190 | 2/190 | 30/190 |

Logistics Performance Index | 11/160 | N/A | N/A |

Corruption Perception Index | 23/180 | 21/180 | N/A |

IMD World Competitiveness | 7/63 | 5/63 | N/A |

Sources: World Bank, IMD, Transparency International

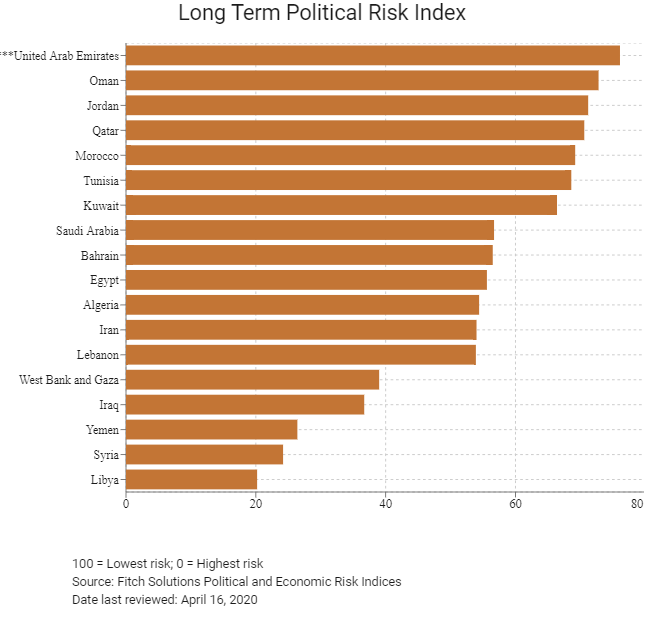

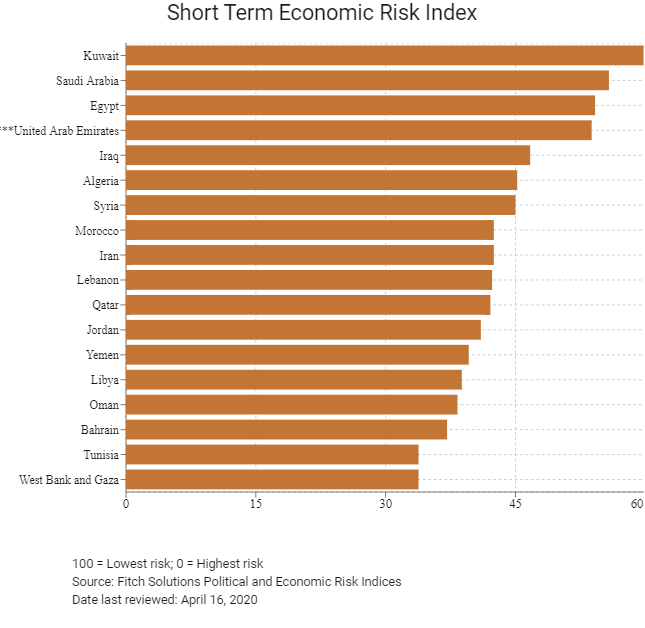

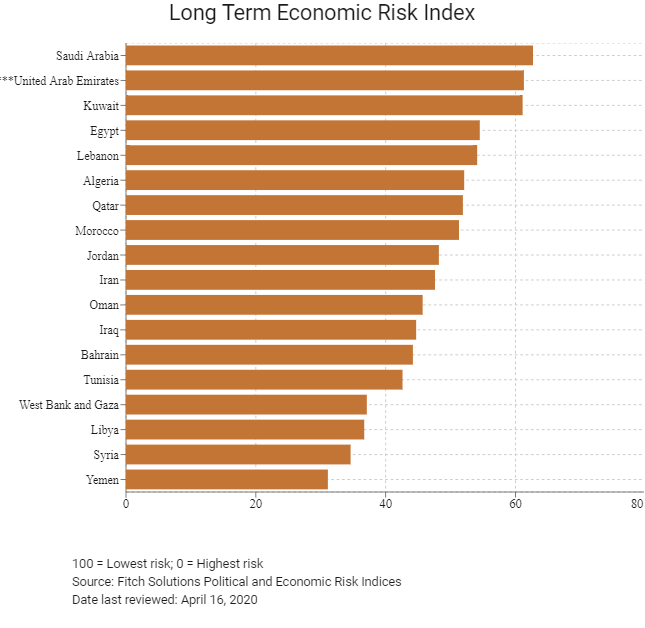

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

Economic Risk Index Rank | 56/202 | 58/201 | 62/201 |

Short-Term Economic Risk Score | 65.4 | 60.4 | 53.8 |

Long-Term Economic Risk Score | 63.8 | 62.5 | 61.3 |

Political Risk Index Rank | 74/202 | 38/201 | 38/201 |

Short-Term Political Risk Score | 83.1 | 86.7 | 86.7 |

Long-Term Political Risk Score | 69.6 | 76.1 | 76.1 |

Operational Risk Index Rank | 20/201 | 17/201 | 20/201 |

Operational Risk Score | 73.8 | 72.2 | 71.6 |

Source: Fitch Solutions

Date last reviewed: April 16, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The UAE has been the most successful of the Gulf States when it comes to diversifying its economy away from oil, which accounts for just under 35% of GDP. However, with diversification has come greater exposure to the global economy, tougher regulations (focusing on 'concentration risks' and more stringent loan-to-value ratios for mortgages) for banks that have come into force in the past two years will go some way towards creating a more sustainable development model over the long run.

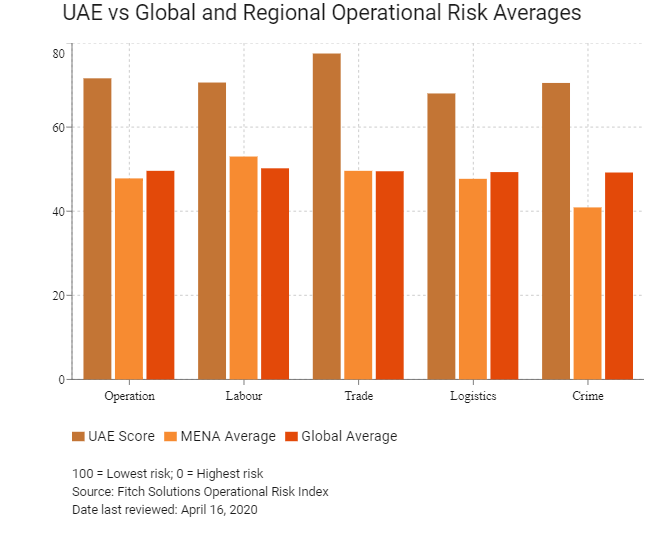

OPERATIONAL RISK

The UAE has been the most successful of the Gulf States when it comes to diversifying its economy away from oil industries, which account for just under 35% of GDP (down from 79% in 1980). However, with diversification has come greater exposure to the global economy. The economy will contract in 2020 due to the impact of both a delay to Dubai Expo 2020 and wider economic disruptions from Covid-19. Renewed OPEC+ supply cuts - effective May 1 - will exert additional pressure on the country's oil sector. However, we anticipate a sharp recovery in 2021 as Expo – to be held in H221 – revives business sentiment and drives non-oil activity. Tougher regulations (focusing on 'concentration risks' and more stringent loan-to-value ratios for mortgages) for banks that have come into force in the past two years will go some way towards creating a more sustainable development model over the long run.

Source: Fitch Solutions

Date last reviewed: April 18, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

UAE Score | 71.6 | 70.6 | 77.5 | 68.0 | 70.5 |

MENA Average | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

MENA Position (out of 18) | 1 | 1 | 1 | 3 | 1 |

Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

Global Position (out of 201) | 20 | 9 | 7 | 42 | 33 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

UAE | 71.6 | 70.6 | 77.5 | 68.0 | 70.5 |

Bahrain | 66.5 | 65.5 | 75.4 | 71.6 | 53.6 |

Qatar | 66.0 | 66.7 | 62.3 | 73.7 | 61.2 |

Oman | 64.9 | 62.7 | 63.4 | 64.2 | 69.2 |

Saudi Arabia | 63.6 | 68.3 | 65.8 | 62.5 | 57.7 |

Jordan | 57.1 | 58.4 | 62.9 | 54.8 | 52.3 |

Kuwait | 55.5 | 58.7 | 56.2 | 50.8 | 56.2 |

Morocco | 54.6 | 45.0 | 65.3 | 54.9 | 53.2 |

Egypt | 49.4 | 50.7 | 48.8 | 55.2 | 42.9 |

Tunisia | 47.1 | 41.0 | 58.5 | 46.7 | 42.3 |

Lebanon | 43.6 | 54.0 | 49.8 | 40.9 | 29.7 |

Iran | 43.1 | 48.7 | 36.4 | 52.8 | 34.4 |

Algeria | 39.6 | 48.6 | 32.7 | 41.0 | 36.2 |

West Bank and Gaza | 31.6 | 48.3 | 34.1 | 27.1 | 17.0 |

Libya | 29.3 | 43.4 | 29.9 | 26.6 | 17.1 |

Syria | 28.6 | 42.6 | 29.2 | 27.6 | 15.0 |

Iraq | 26.7 | 43.5 | 24.1 | 26.9 | 12.4 |

Yemen | 21.8 | 37.8 | 19.6 | 13.9 | 16.1 |

Regional Averages | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 16, 2020

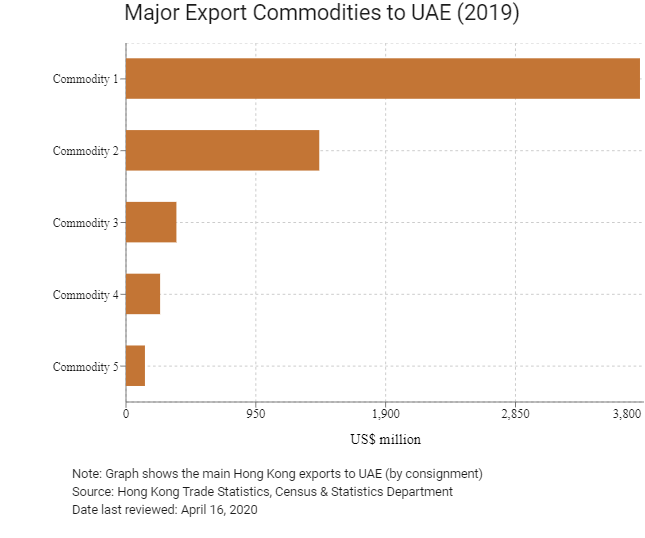

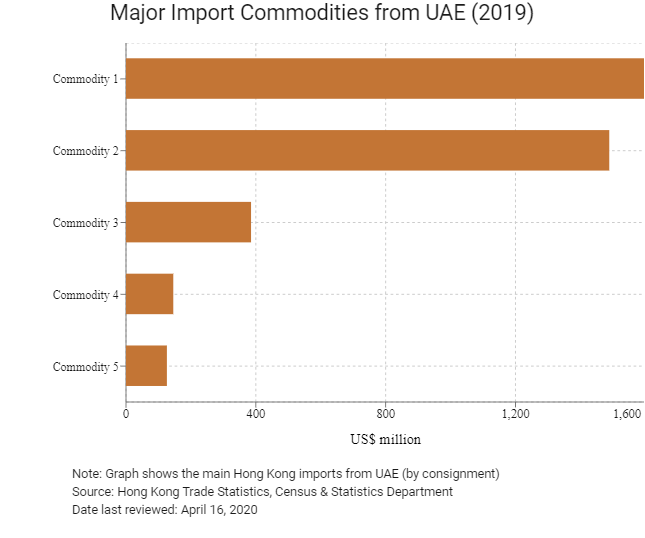

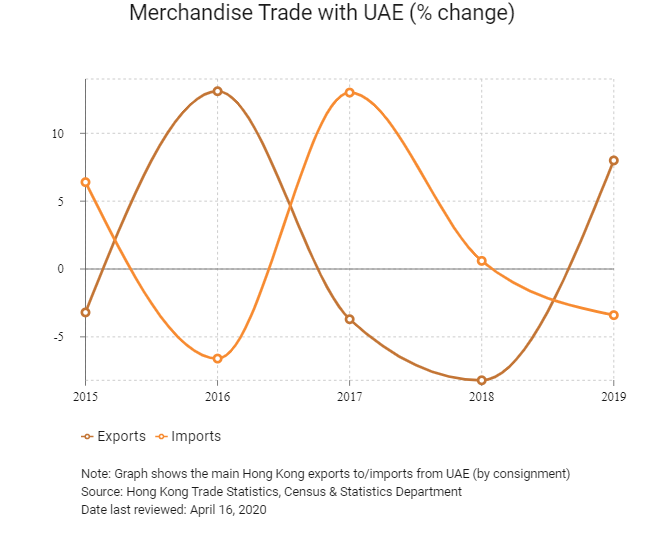

Hong Kong’s Trade with the United Arab Emirates

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 3,761.1 |

| Commodity 2 | Non-metallic mineral manufactures | 1,414.2 |

| Commodity 3 | Miscellaneous manufactured articles | 368.9 |

| Commodity 4 | Office machines and automatic data processing machines | 249.6 |

| Commodity 5 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 138.6 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Miscellaneous manufactured articles | 1,600.0 |

| Commodity 2 | Non-metallic mineral manufactures | 1,489.0 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 385.3 |

| Commodity 4 | Power generating machinery and equipment | 145.7 |

| Commodity 5 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 126.0 |

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

Number of UAE residents visiting Hong Kong | 16,031 | -12.8 |

Number of Middle East residents visiting Hong Kong | 113,849 | -12.8 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: April 16, 2020

Commercial Presence in Hong Kong

2020 | Growth rate (%) | |

Number of United Arab Emirates companies in Hong Kong | N/A | N/A |

- Regional headquarters | ||

- Regional offices | ||

- Local offices |

Source: Hong Kong Trade Statistics, Census & Statistics Department

Treaties and Agreements between Hong Kong and the United Arab Emirates

- Hong Kong and the UAE signed Comprehensive Double Taxation Agreements in December 2014 and the deal came into force in December 2015.

- Hong Kong and the United Arab Emirates signed bilateral investment treaties in June 2019. As of October 17, 2019, the treaties are not yet in force.

- The UAE and Hong Kong signed an investment promotion and protection agreement in June 2019 and it entered into force in March 2020.

- The UAE signed a bilateral investment treaty with Hong Kong in June 2019 but it is not yet in force and it signed a bilateral investment treaty with Mainland China in July 1993 that entered into force in September 1994.

Sources: Inland Revenue Department, United Arab Emirates Ministry of Finance, Hong Kong Trade and Industry Department, UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry

The Arab Chamber of Commerce & Industry was established in Hong Kong in 2006 as a leading organisation at promoting commercial ties between Hong Kong and Mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Source: The Arab Chamber of Commerce and Industry

Consulate General of the United Arab Emirates Hong Kong

Address: Unit 4903-06, 49/F, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong

Email: hongkongcon@mofaic.gov.ae

Tel: (852) 2866 1823

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

- Holders of HKSAR passport: a visit visa will be granted for 30 days, free of charge, upon arrival to the UAE. The passport will simply be stamped with the visit visa when passing through the immigration section at any of UAE checkpoints.

- Holders of BNO passport: an entry visa is required before departure from Hong Kong. To submit a visa application, please contact one of the following UAE sponsors:

- Travel Agents: Specialist visa agents are the primary providers of tourist / visitor visas. Either look for travel agents online or contact the hotel or airline and they may recommend an agent.

- Friends / relatives residing in the UAE: Friends / relatives can apply for a visa as the sponsor through the local immigration office in the UAE.

- Hong Kong Document of Identity: not recognised as an applicable travelling document by the United Arab Emirates Authority.

- Visa may be granted for government officials on official missions to the UAE on a case-by-case basis.

Source: Visa on Demand

Date last reviewed: April 16, 2020

United Arab Emirates

United Arab Emirates