GDP (US$ Billion)

16.68 (2018)

World Ranking 134/193

GDP Per Capita (US$)

9,169 (2018)

World Ranking 95/192

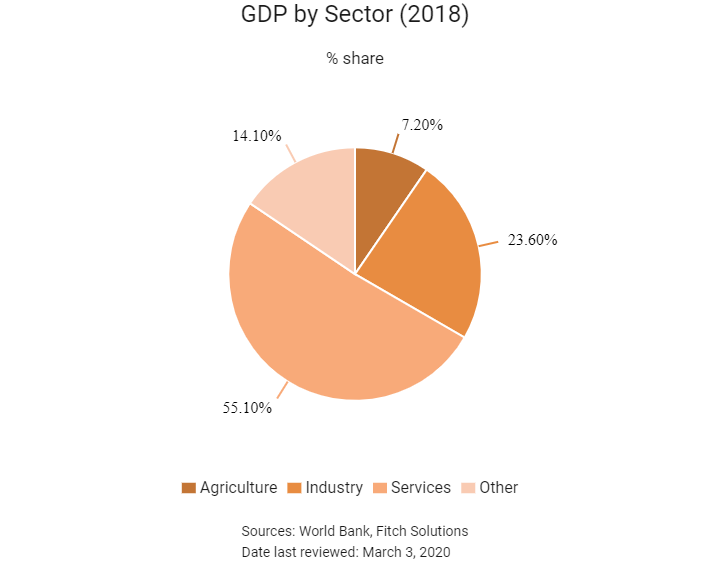

Economic Structure

(in terms of GDP composition, 2019)

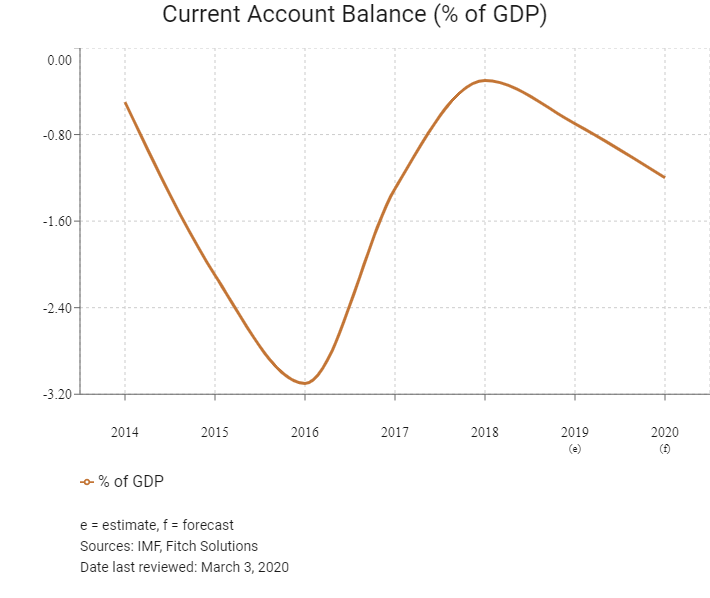

External Trade (% of GDP)

137.3 (2019)

Currency (Period Average)

Macedonian Denar

54.95per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

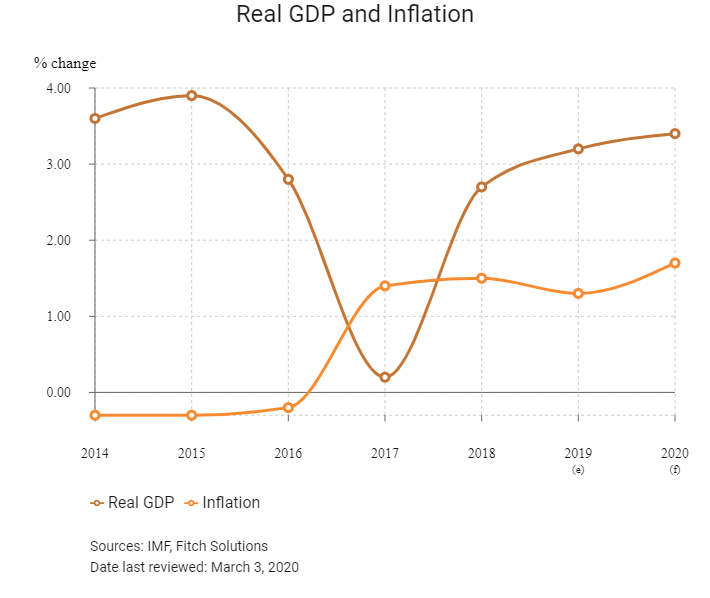

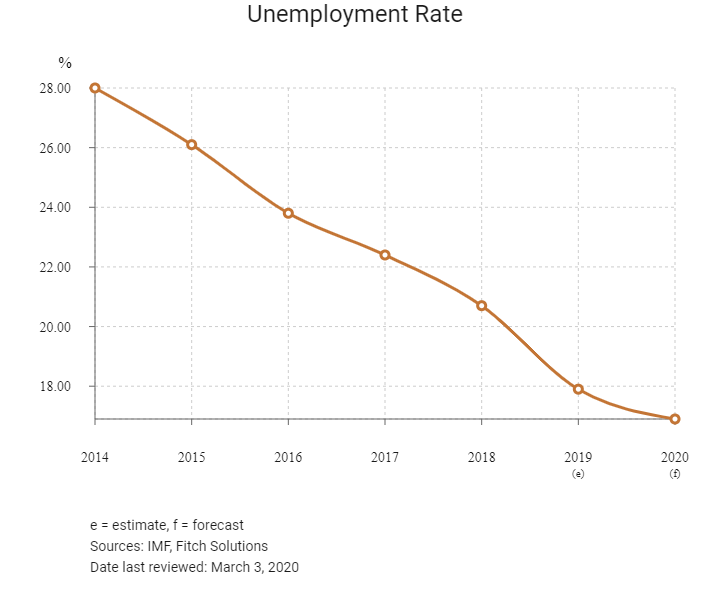

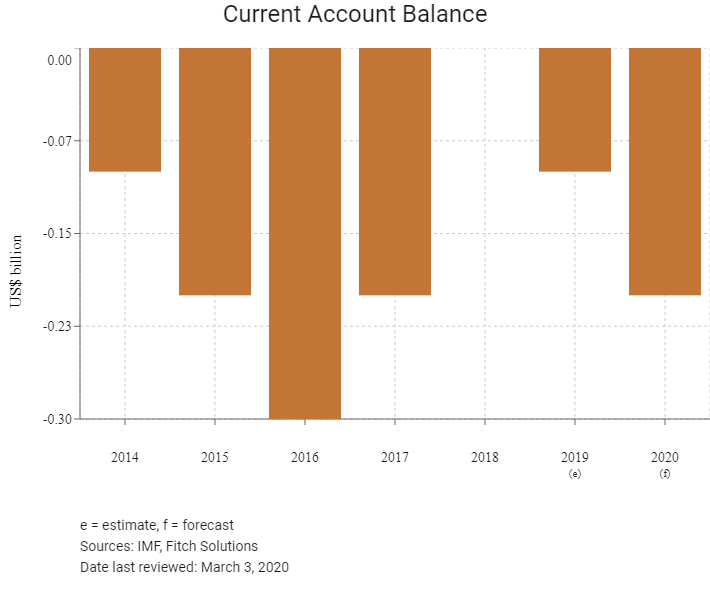

The Republic of North Macedonia is an upper-middle-income country that has made great strides in reforming its economy over the last decade. However, more efforts, including European Union (EU) accession and the implementation of structural reforms aimed at improving the business environment, are still needed to generate broad-based economic growth. Economic activity is expected to continue expanding, driven by consumption, rising exports and an improvement in investor confidence following greater political stability. On the downside, inter-ethnic dynamics, high unemployment and long-standing political risks remain.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2016

The June election was postponed.

December 2016

The postponed early parliamentary elections, intended to end a two-year political crisis, failed to produce an outright winner.

May 2017

Social Democrat Union leader Zoran Zaev formed a coalition government.

September 2018

A referendum was held on September 30, 2018, with voters asked whether they support EU and North Atlantic Treaty Organisation (NATO) membership by accepting the agreement struck with Greece in June 2018. The referendum was later declared invalid due to low voter turnout.

February 2019

Following ratification by the Greek and North Macedonian parliaments, the country name Macedonia was officially changed to North Macedonia, opened the path to EU membership. North Macedonia signed the NATO accession agreement.

April 2019

The country held presidential elections on April 21, 2019 which did not result in a majority for any candidate and led to a re-run. Candidate Stevo Pendarovski won the May 5 presidential election run-off.

February 2020

The government of North Macedonia was seeking a private partner to collaborate with state-run Elektrani na Severna Makedonija (ESM) on a 100MW solar photovoltaic project in the country. The public-private partnership scheme, which would cost around EUR80 million (USD87.2 million), involved construction of two 50MW solar parks in Oslomej. The private partner would provide all funds for the construction, while ESM would provide land as well as other associated services and expertise. During the 35-year agreement, the private investor would pay ESM an annual fee equal to 10% of the revenue from the project's output at market prices, after which the plants' ownership would be transferred to ESM. Interested firms could submit offers by May 8, 2020.

Source: BBC Country Profile – Timeline

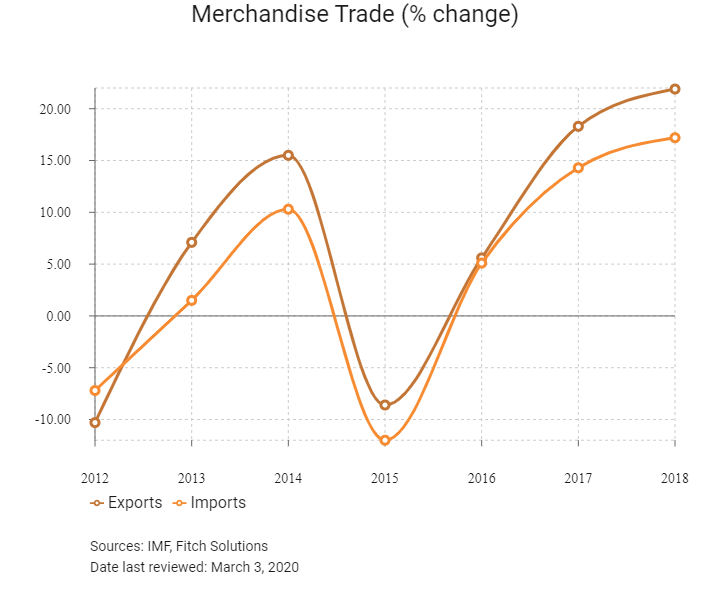

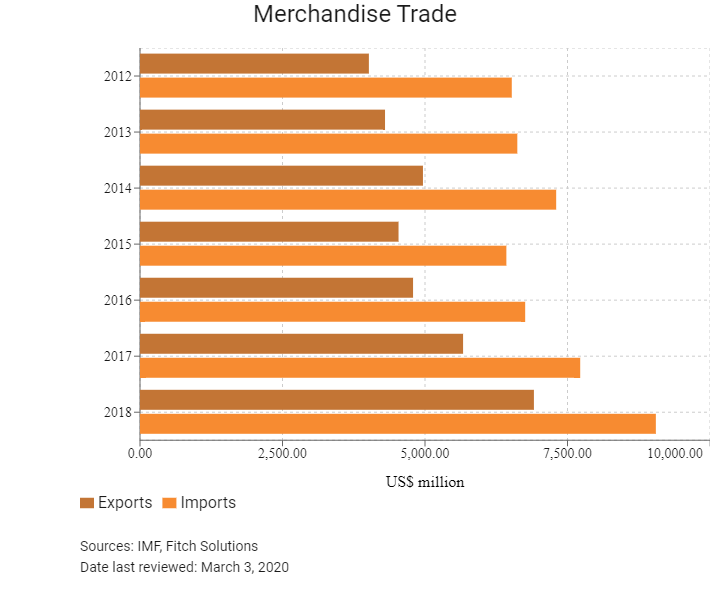

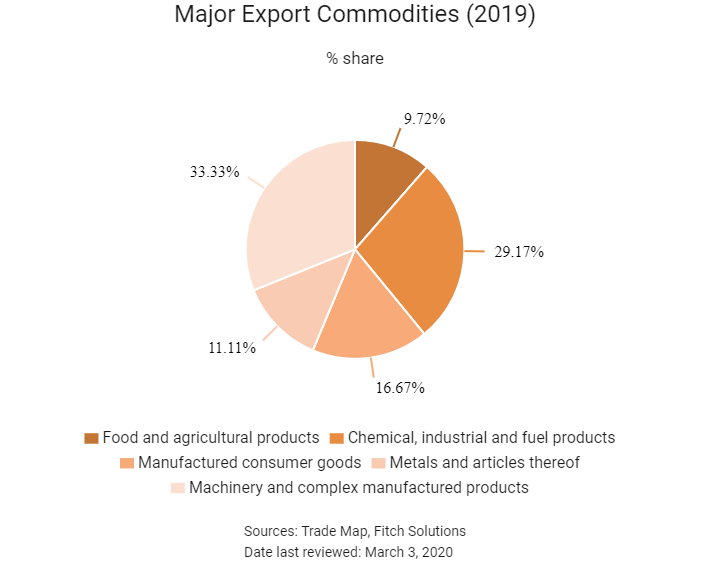

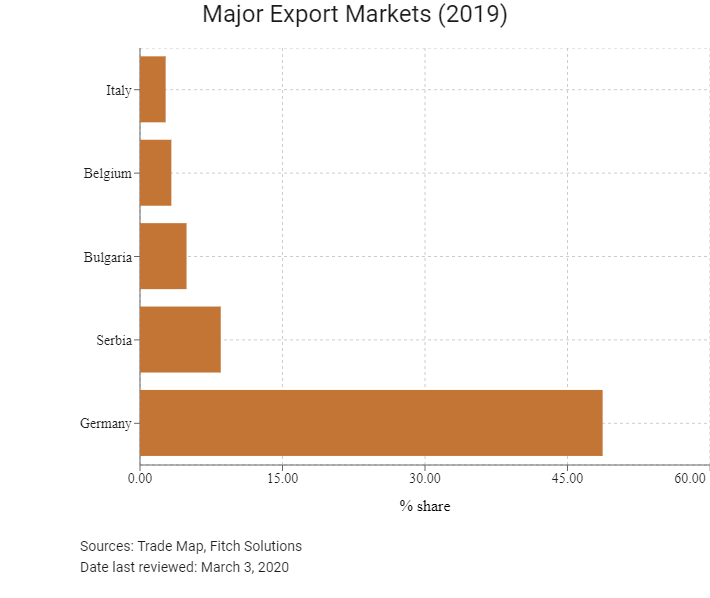

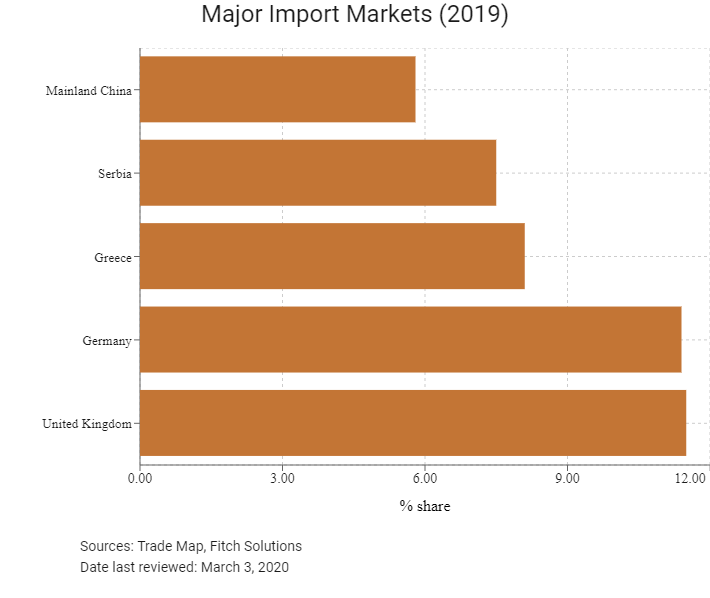

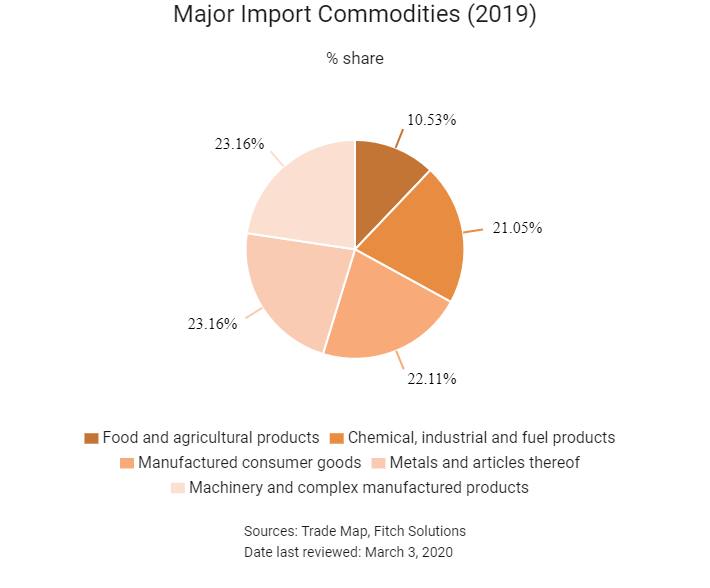

Merchandise Trade

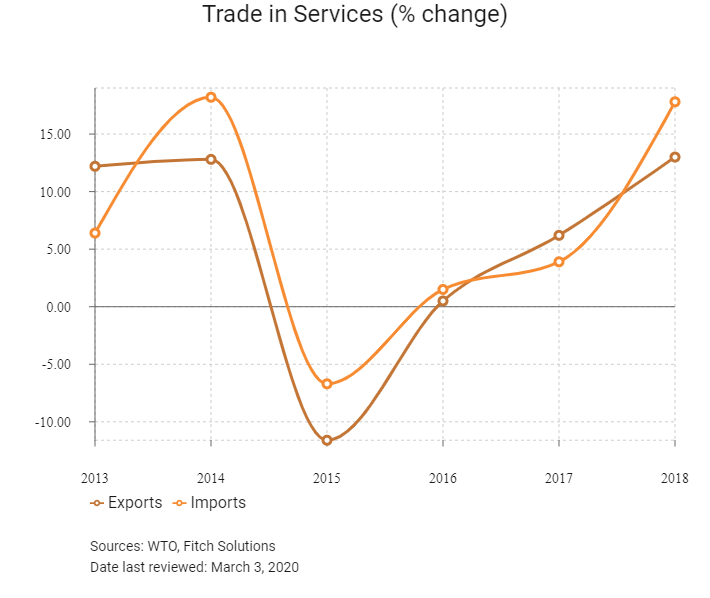

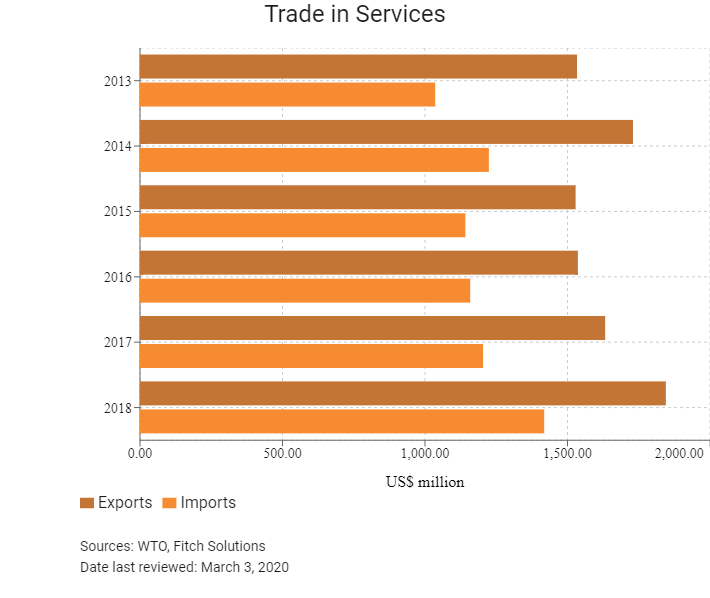

Trade in Services

- North Macedonia joined the World Trade Organization (WTO) on April 4, 2003. As a member of the WTO, North Macedonia regularly notifies the WTO committee on technical barriers to trade and proposes amendments to technical regulations concerning trade.

- North Macedonia acquired EU membership candidate status in December 2005. As an EU aspirant, North Macedonia is harmonising its customs laws with EU laws and regulations.

- Following the changing of its name to North Macedonia, a resolution to the longstanding political stalemate with Greece could finally come to an end. This paved the way for EU accession talks.

- North Macedonia's average tariff rate is the fifth highest in the South East Europe region (out of 12 countries). The average tariff rate on agricultural goods is 16% and 6% on industrial products, on average. However, there are no discriminatory trade policies affecting foreign investors and almost 96% of total foreign trade is unrestricted.

- Customs duties generally apply to most products imported into North Macedonia. The customs rates under the most favoured nation treatment for agricultural products are up to 31%, whereas the customs rates for industrial products are below 23%.

- The import of industrial products with preferential origin and certain raw precious metals are exempt from customs duties.

- North Macedonia has signed trade agreements with Turkey, Ukraine, and the European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland). The country is also a member state to the Central European Free Trade Agreement (CEFTA) and has signed a Stabilisation and Association agreement with European Communities.

- In April 2001, North Macedonia and the EU became signatories to the European Stabilisation and Association Agreement (SAA). The SAA came into effect on April 1, 2004.

- Under the SAA, customs duties on industrial goods are being phased out, with a number of North Macedonian-origin industrial goods already being imported duty free by the EU.

- Excise duties apply to alcohol, cigarettes, mineral oils, tobacco, petroleum coke and passenger vehicles, these duties are determined by the type and quantity of the product and are levied in addition to the customs tariff. The customs tariff on new and used cars is 5%. However, there is no tariff on cars produced in EU countries.

- A number of products in North Macedonia are subject to quality control at customs offices, to ensure that imported goods are in compliance with domestic standards. The products subject to quality control include the majority of agricultural goods, cars, electrical appliances, and products in which poor quality may pose a health risk to consumers. When applicable, products must also pass sanitary, phytopathology or veterinary control.

- Numerous import regulations that are not always available in English pose barriers to importers and exporters.

- In May 2016, the North Macedonian Bank for Development Promotion (MBDP) lowered the export factoring interest rates from 6% to 5% per annum (a rate that is exclusively designated to benefit North Macedonian exporters). The export factoring interest rate is the rate which North Macedonian export-oriented business entities pay as part of the export factoring support (a form of trade finance loans with recourse, offered to businesses for their exporting activities) that the MBDP offers to them exclusively.

- In August 2019, Kosovo banned the import of potatoes and honey from North Macedonia as a reciprocal measure following North Macedonia's introduction of tariffs on fish and roe imports from Kosovo.

- As of January 1, 2020, a new tax on vehicles was introduced. The tax applies to passenger cars and other motor vehicles designed primarily for the transportation of people, including motorcycles, pickup vehicles, as well as vans for combined transportation of people and goods. The new law is subject to only new and used motor vehicles that are imported or are put into use in the country for the first time. This law does not cover freight motor vehicles and exclusively electrically driven vehicles.

Sources: WTO - Trade Policy Review, Fitch Solutions

Trade Updates

Trade and investment ties between North Macedonia and the EU will likely increase now that a diplomatic resolution with Greece has been reached, following the country's name change.

Multinational Trade Agreements

Active

- The CEFTA: CEFTA consists of Albania, Bosnia and Herzegovina, North Macedonia, Moldova, Montenegro and Kosovo and Serbia. CEFTA came into force on July 26, 2007. The agreement helps increase trade between regional counterparts and fosters non-EU bilateral relations. The Central European (CE) countries accounted for approximately 11% of North Macedonia's total trade in 2017. Since coming into effect, total trade between North Macedonia and CE countries has grown by 65%.

- EFTA-North Macedonia Free Trade Agreement (FTA): The bilateral FTA between North Macedonia and the EFTA entered into force in May 2002. EFTA consists of Switzerland, Norway, Liechtenstein and Iceland. The agreement covers trade in goods and provides North Macedonia with export markets for its primary and secondary sectors. The EFTA countries accounted for only 0.8% of North Macedonia's total trade in 2017. However, trade between North Macedonia and EFTA countries increased by 85.4% between 2002 and 2017.

- North Macedonia-EU: SAA and Economic Integration Agreement between North Macedonia and the EU entered into force in June 2001 (for goods trade) and April 2004 (for services trade). The agreements stimulate North Macedonia's already large export and import volumes with EU member countries, including Germany, Bulgaria and Greece. The EU is North Macedonia's largest trade partner, purchasing over 80% of North Macedonia's exports in 2019 and supplying just over 60% of imports.

- North Macedonia-Turkey FTA: The bilateral FTA between North Macedonia and Turkey covers trade in goods and entered into force in September 2000. Turkey is North Macedonia's seventh-largest supplying market as of 2019, with imports from Turkey accounting for 4.8% of North Macedonia's total imports, of which machinery, mechanical appliances, nuclear reactors, boilers and parts made up the highest percentage. Total trade between Turkey and North Macedonia has grown by over 600% since the FTA entered into force.

- North Macedonia-Ukraine FTA: The FTA covers trade in goods and entered into force in July 2001. Ukraine is North Macedonia's 22nd-largest supplying market as of 2019, with imports from the Ukraine accounting for 1.5% of North Macedonia's total imports, of which iron and steel made up the highest percentage.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

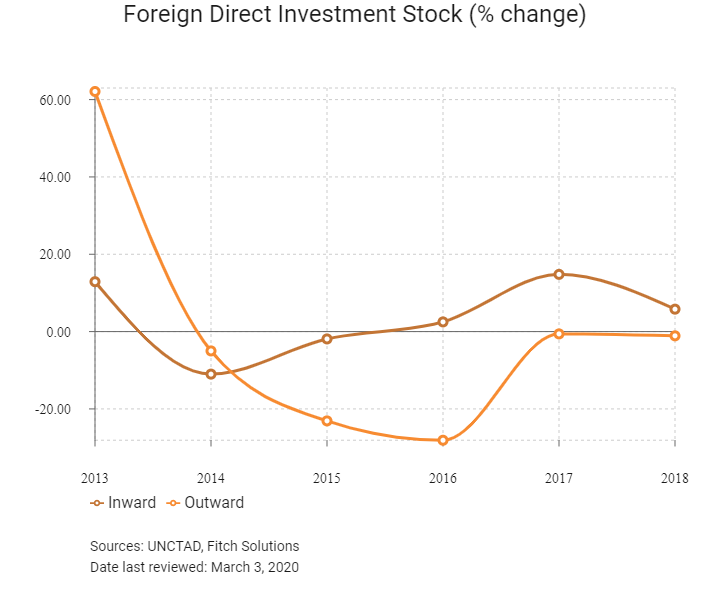

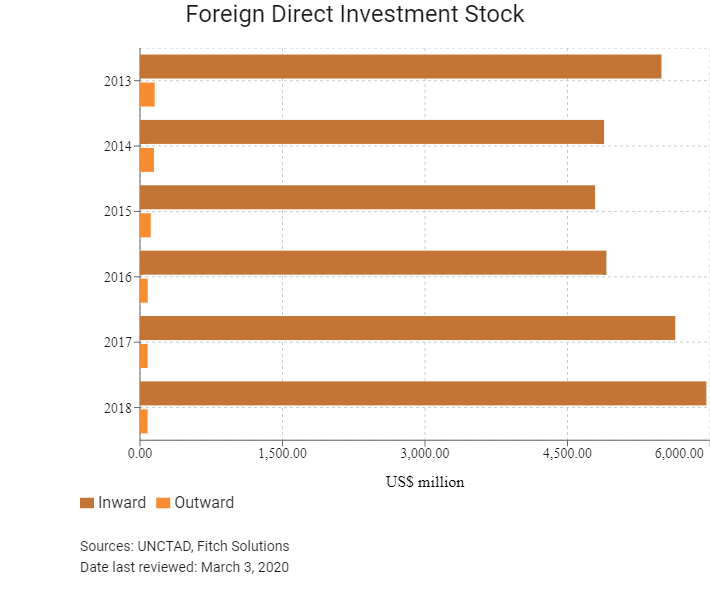

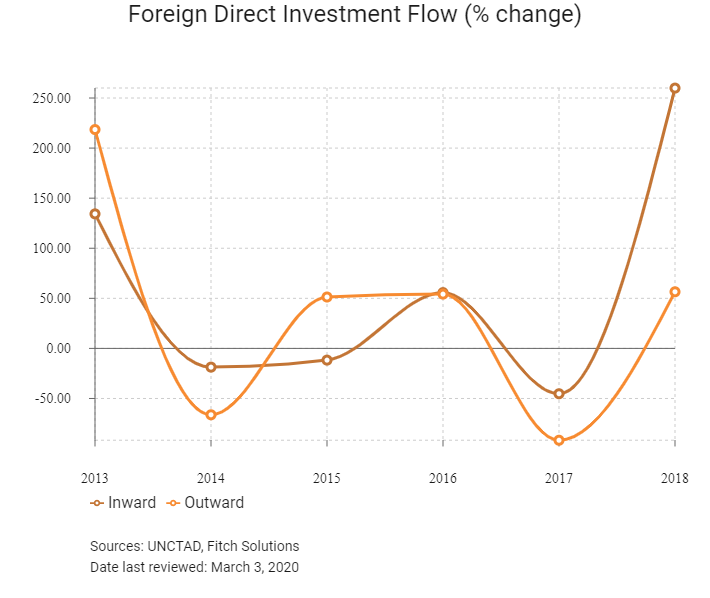

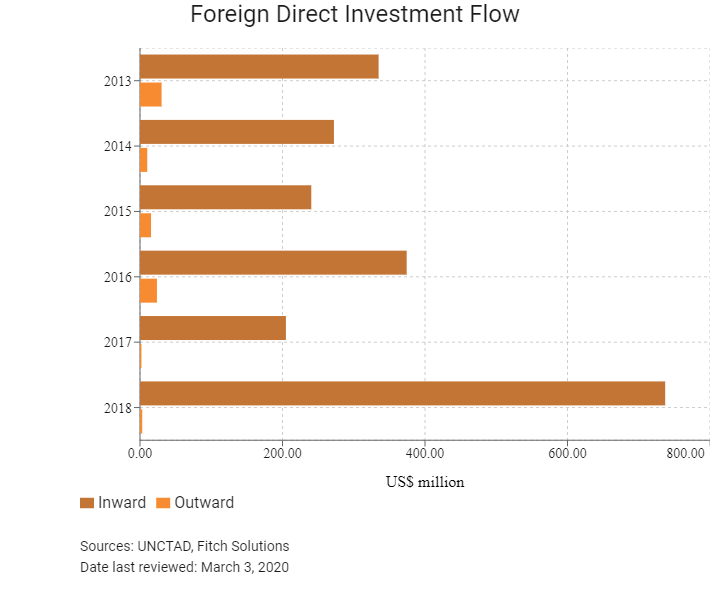

Foreign Direct Investment

Foreign Direct Investment Policy

- Invest North Macedonia is the Agency for Foreign Investors and Export Promotion of North Macedonia, and it is the official government investment and export promotion agency responsible for attracting foreign investments and supporting the export promotion of the country.

- North Macedonia is heavily dependent on FDI for employment and growth, so it welcomes foreign investment that can provide a substantial numbers of jobs. Legislation places foreign and domestic firms on roughly equal footing, with foreign investors regularly receiving national treatment. The government also provides numerous incentives and has promised to institute transparent policies for attracting FDI. North Macedonia has adopted a number of multilateral conventions protecting foreign investors, and has also concluded a number of bilateral investment protection treaties.

- Foreign investors are permitted to invest directly in all industries and business sectors, except those limited by law. Investment in the production of weaponry and narcotics is subject to government approval, and investors in industries such as banking, financial services and insurance must meet specific licensing requirements that apply equally to both domestic and foreign investors. Foreign investment may be in the form of money, equipment, or raw materials. According to the law, foreign investors have the right to receive the full value of their investment in the case of nationalisation, a provision that does not apply to domestic investors.

- Indicative of its liberalisation efforts, North Macedonia has created one of the most attractive tax systems in Europe with a simple flat tax rate of 10% on corporate and personal income. In order to stimulate investment, corporate tax on retained earnings is set at 0%.

- Special tax incentives are offered for companies operating in the Technological Industrial Development Zones (TIDZs), including a 10-year personal and corporate income tax exemption. The aim of the TIDZ is to support the development of modern technologies in North Macedonia. The North Macedonian Free Zones Authority is the governmental managing body responsible for the development of the country's free trade zones and assists foreign investors in the TIDZs.

- The standard value-added tax (VAT) rate is 18%. This rate applies to overall turnover and imports of goods and services. A lower rate of 5% applies to supplies of certain goods and services.

- All legal entities must be registered with the Central Registry of North Macedonia. A one-stop-shop system has made investment easier, making it possible for foreign investors to register a business within a day at a single location.

- Foreign tax credit: The taxpayer is allowed a tax credit for the tax paid on foreign income abroad, up to the amount of tax payable for that income in North Macedonia. However, a tax credit for the withholding tax paid abroad is allowed only if a double tax treaty is in place and in the case where the North Macedonian company obtains proof for the amount of tax paid in the foreign country.

- Taxes on reinvested profit: Corporate Income Tax 2018 introduces a possibility for decreasing the tax base for the year for the amount of profit reinvested for development purposes of the local taxpayer. In order to be able to utilise this tax relief, the taxpayers must maintain ownership over the assets purchased with the reinvested profit for a period of five years as of the day of their purchase.

- North Macedonia has an Agreement for Promotion and Protection of Foreign Direct Investments with the following countries: Albania, Austria, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Mainland China, Croatia, the Czech Republic, Egypt, Finland, France, Germany, Hungary, India, Iran, Italy, Luxembourg, Malaysia, Montenegro, the Netherlands, North Korea, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Taiwan, Turkey and Ukraine.

Sources: WTO - Trade Policy Review, ITA, US Department of Commerce, Invest North Macedonia

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| There are currently 15 Free Economic Zones (FEZs) throughout North Macedonia that are at various stages of development. The Directorate for TIDZ is responsible for developing and supervising 14 FEZs, including two fully operational TIDZs in the capital (Skopje 1 and 2) and one in Stip (the largest town in eastern North Macedonia). The Tetovo TIDZ is a public-private partnership (a privately owned company founded that zone and is responsible for its development and operation). | - Ten-year tax holiday from profit tax for entities performing their business activities in the TIDZs. - Certain exemption from VAT for trade made within the zone and for imports in the zones. - Foreign investors in the special FEZs may employ staff from any country. - Custom exemptions depending on the type of investment. - Exemption of certain construction fees. - Free connection to water, sewerage, gas and power supply networks. - Land in the TIDZs may be leased to foreign investors for up to 99 years. |

| General incentives | - The Law on Customs and the Law on Profit Taxes offer incentives, such as tax breaks and subsidies, to foreign investors for projects that generate jobs. - Foreign investors are eligible for: profit tax exemptions for profits generated during the first three years of operation in proportion to the amount of foreign investment; all profits reinvested in the company; profits invested in environmental protection; and profits invested in 'underdeveloped' regions of North Macedonia. - Companies with at least 20% foreign capital are exempt from customs duties for the first three years after their registration. - 10% flat tax for corporate profits and personal income. - Guaranteed relief from local taxes and fees. - A tax exemption for duties on imported goods, raw materials and equipment/machines. - A symbolic land lease rate. - Direct state aid in the amount of up to EUR500,000. |

Sources: US Department of Commerce, Invest North Macedonia, Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 10%

Source: Ministry of Finance, North Macedonia

Important Updates to Taxation Information

As of January 1, 2020, a new tax on vehicles was introduced. The tax applies to passenger cars and other motor vehicles designed primarily for the transportation of people, including motorcycles, pickup vehicles, as well as vans for combined transportation of people and goods. The new law is subject to only new and used motor vehicles that are imported or are put into use in the country for the first time. This law does not cover freight motor vehicles and exclusively electrically driven vehicles.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate Income Tax | - 10% |

| Withholding Tax | Dividends, interest and royalties are all taxed at 10% |

| Social security contributions (all employers) | - Pension and disability insurance: 18.8% - Health insurance: 7.5% - Employment insurance: 1.2% - Additional health insurance: 0.5% |

| VAT/GST (standard) | 18%; a reduced rate of 5% applies to certain categories of goods |

| Property Tax | Proportional and range from 0.10-0.20% |

| Transfer Tax | Proportional and range from 2-4% |

| Customs duties | - Up to 31% for agricultural products - Below 23% for industrial products |

| Excise duty for passenger motor vehicles | 0% for vehicles valued up to EUR3,000 to 18% for vehicles valued above EUR30,000 |

Source: Ministry of Finance, North Macedonia

Date last reviewed: March 3, 2020

Foreign Worker Permits

Employment of foreign citizens is regulated by the law on employment and work of foreigners. Labour laws apply to both domestic and foreign employees, where both are equally protected. There is no limitation on the number of employed foreign nationals or the duration of their stay. Work permits are necessary for foreign nationals, and a contract has to be signed upon employment.

Visa/Travel Restrictions

A number of international businesses have reported that the processes of obtaining visas and work permits are challenging.

Foreign nationals from Canada, the United States, Europe, New Zealand, Japan and some parts of Latin America, Africa and Asia (including Hong Kong) do not require a visa for visits to North Macedonia of up to 90 days.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | Not Rated | N/A |

| Standard & Poor's | BB- (Stable) | 24/05/2013 |

| Fitch Ratings | BB+ (Stable) | 13/12/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 11/190 | 10/190 | 17/190 |

| Ease of Paying Taxes Index | 29/190 | 31/190 | 37/190 |

| Logistics Performance Index | 81/160 | N/A | N/A |

| Corruption Perception Index | 93/180 | 106/180 | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, Transparency International, Fitch Solutions

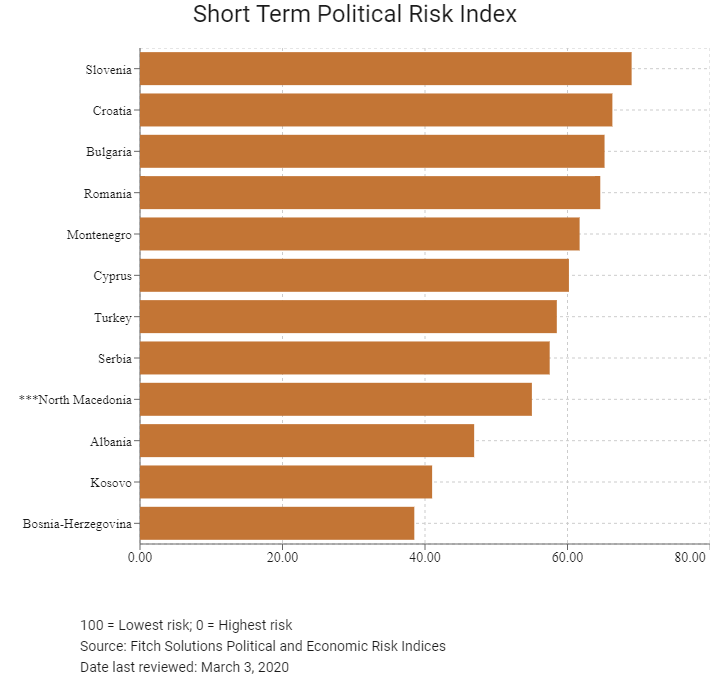

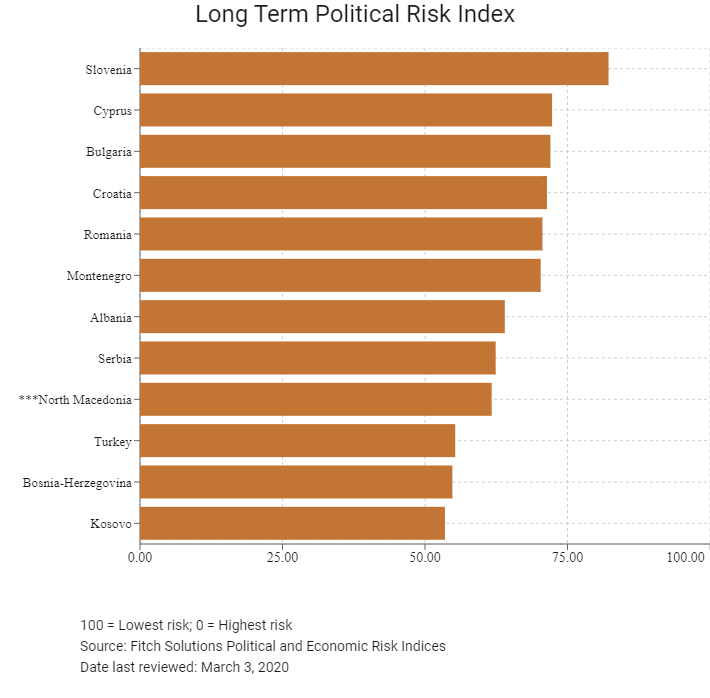

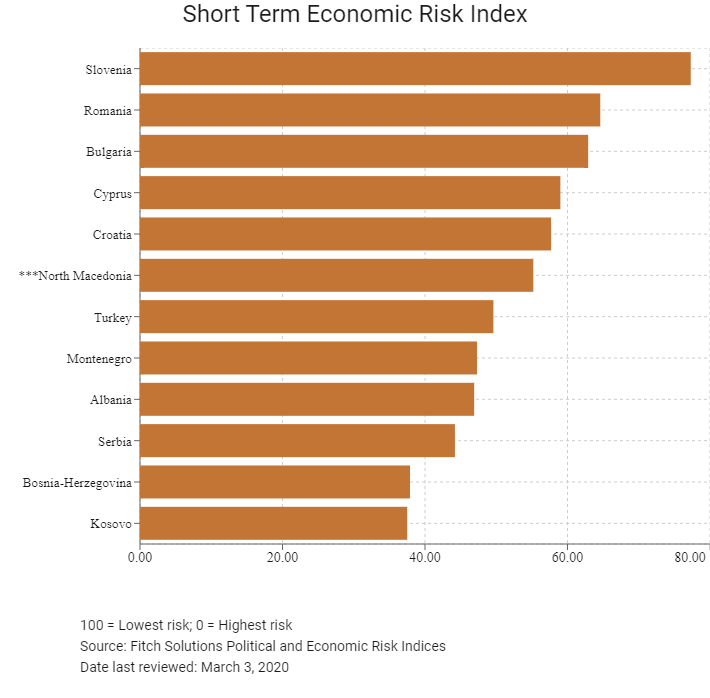

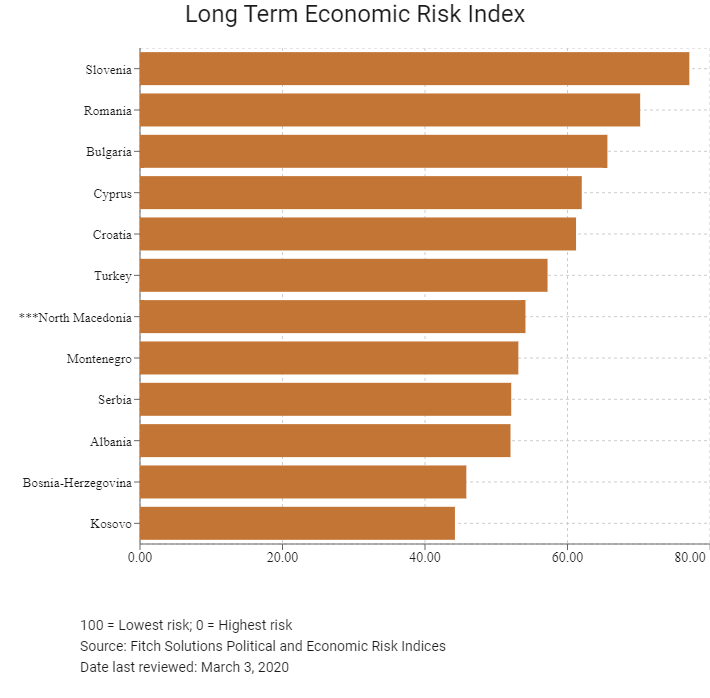

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index Rank | 91/202 | 91/201 | 82/201 |

| Short-Term Economic Risk Score | 48.8 | 54.0 | 55.2 |

| Long-Term Economic Risk Score | 53.9 | 53.3 | 54.1 |

| Political Risk Index Rank | 124/202 | 98/201 | 98/201 |

| Short-Term Political Risk Score | 53.3 | 55.0 | 55.0 |

| Long-Term Political Risk Score | 57.3 | 61.7 | 61.7 |

| Operational Risk Index Rank | 68/201 | 67/201 | 67/201 |

| Operational Risk Score | 56.2 | 56.7 | 56.7 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

High structural unemployment and widespread poverty weigh heavily on North Macedonia's economic risk, despite higher economic activity on account of a robust construction sector. The political environment and the risk of flare-ups of inter-ethnic tensions weigh significantly on investment confidence, and in 2017, gross fixed capital formation contracted by 4.5% y-o-y. Although the registered unemployment rate has dropped below 25% since Q113, it remains elevated, having been recorded at 17.8% in Q119. which weighs on the state’s growth potential.

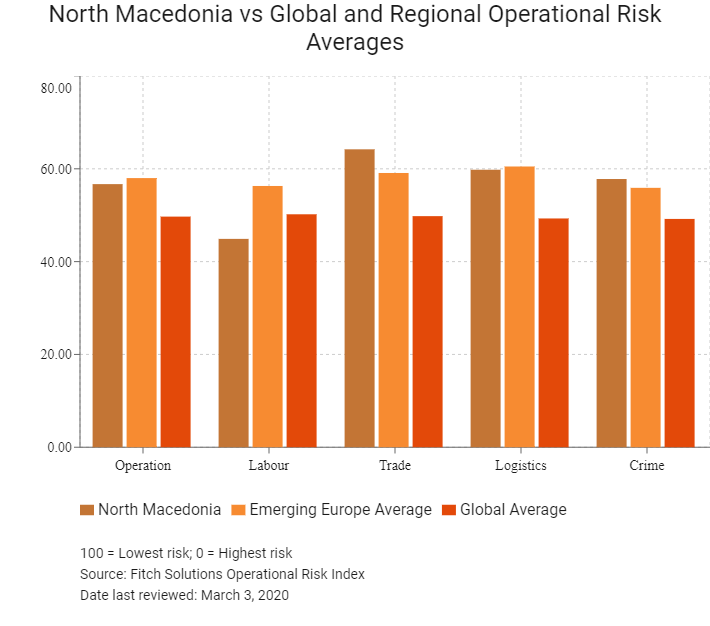

OPERATIONAL RISK

As a landlocked nation, North Macedonia's sea transport relies mainly on ports in neighbouring countries – such as the Port of Thessaloniki in Greece and the Port of Durrës in Albania – through road and rail links. However, with direct flights to many major cities, North Macedonia is well connected to the rest of Europe, the Americas and Asia, via its two airports in Skopje and Ohrid. North Macedonia has a well-established automotive industry, supplying to Western Europe, Russia, Turkey and Africa. It also has a well-established pharmaceuticals industry, supplying primarily finished generic products to more than 30 countries in the region and beyond. These sectors, together with the agribusiness and food processing, information and communications technology, textiles and clothing and electronics industries, are therefore also key sectors for foreign investment.

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| North Macedonia Score | 56.7 | 44.9 | 64.2 | 59.8 | 57.8 |

| Southeast Europe Average | 57.7 | 52.9 | 58.8 | 60.7 | 58.5 |

| Southeast Europe Position (out of 12) | 8 | 11 | 1 | 8 | 7 |

| Emerging Europe Average | 58.0 | 56.3 | 59.1 | 60.5 | 55.9 |

| Emerging Europe Position (out of 31) | 21 | 28 | 8 | 18 | 15 |

| Global Average | 49.7 | 50.2 | 49.8 | 49.3 | 49.2 |

| Global Position (out of 201) | 67 | 133 | 46 | 61 | 68 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

| Slovenia | 69.1 | 57.7 | 63.3 | 74.1 | 81.4 |

| Romania | 63.8 | 60.1 | 61.2 | 66.1 | 67.8 |

| Croatia | 62.4 | 53.2 | 56.7 | 70.3 | 69.5 |

| Cyprus | 62.2 | 56.0 | 64.1 | 63.0 | 65.8 |

| Bulgaria | 61.8 | 58.2 | 63.9 | 60.9 | 64.1 |

| Serbia | 58.4 | 59.6 | 60.9 | 60.7 | 52.4 |

| Montenegro | 57.7 | 56.8 | 58.4 | 57.7 | 58.0 |

| North Macedonia | 56.7 | 44.9 | 64.2 | 59.8 | 57.8 |

| Turkey | 56.1 | 53.2 | 59.8 | 65.2 | 46.1 |

| Kosovo | 49.6 | 44.3 | 48.3 | 48.3 | 57.4 |

| Albania | 48.1 | 46.1 | 46.4 | 50.7 | 49.0 |

| Bosnia-Herzegovina | 47.1 | 45.1 | 58.6 | 51.6 | 33.2 |

| Regional Averages | 58.1 | 54.0 | 58.8 | 61.1 | 58.5 |

| Emerging Markets Averages | 46.9 | 48.5 | 47.4 | 45.8 | 45.9 |

| Global Markets Averages | 49.7 | 50.3 | 49.8 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 3, 2020

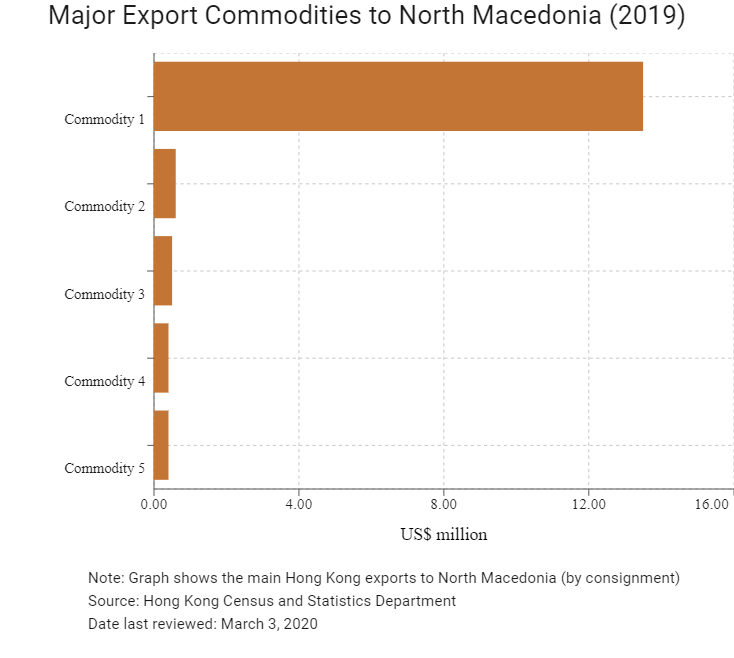

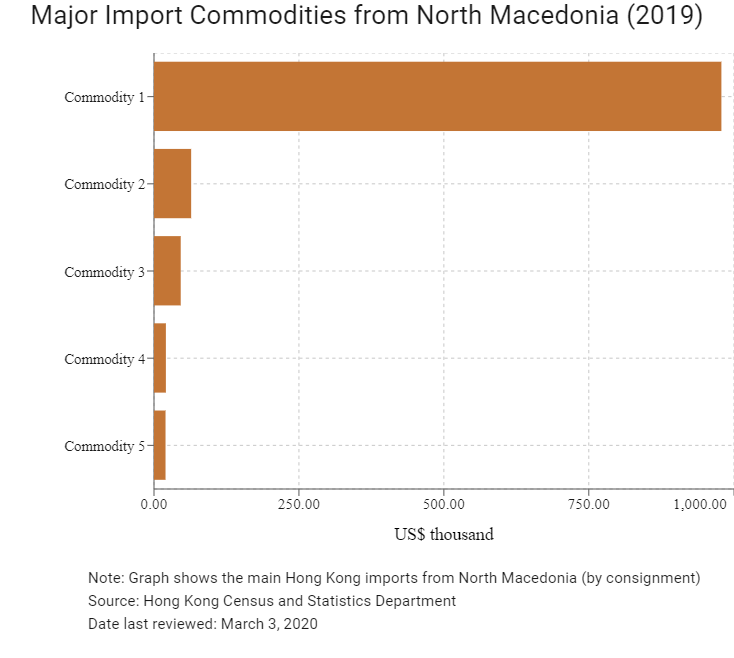

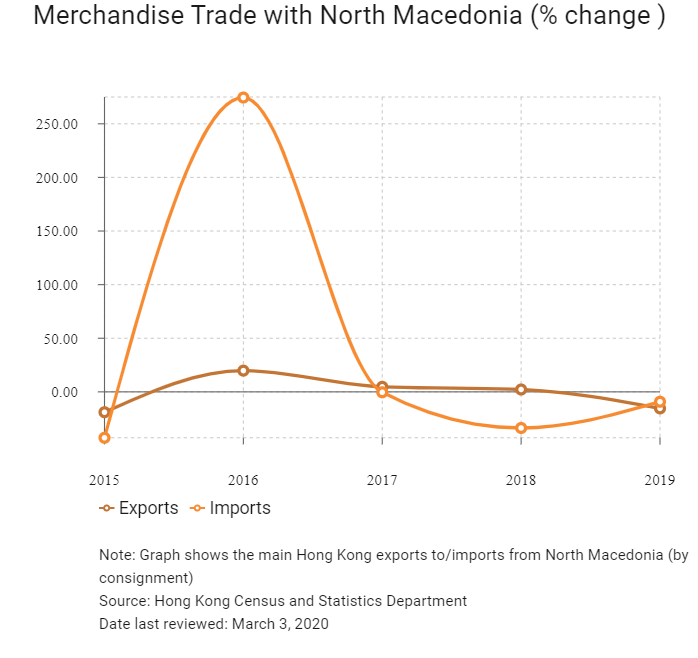

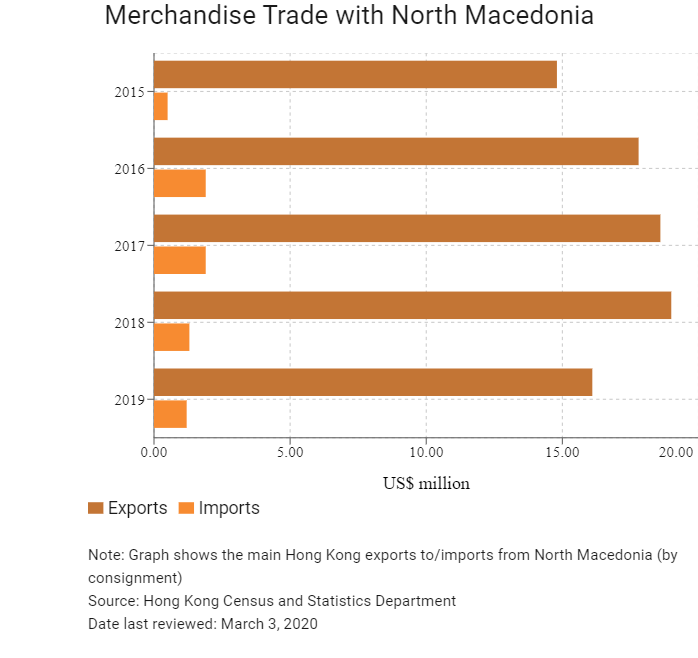

Hong Kong’s Trade with North Macedonia

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 13.5 |

| Commodity 2 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 0.6 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 0.5 |

| Commodity 4 | Miscellaneous manufactured articles | 0.4 |

| Commodity 5 | Office machines and automatic data processing machines | 0.4 |

Import Commodity | Commodity Detail | Value (US$ thousand) |

| Commodity 1 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 978.8 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 64.1 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 46.1 |

| Commodity 4 | Miscellaneous manufactured articles | 20.5 |

| Commodity 5 | Plastics in non-primary forms | 19.9 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

Number of North Macedonian residents visiting Hong Kong | 688 | -24.5 |

Number of European residents visiting Hong Kong | 1,747,763 | -10.9 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate years

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: March 3, 2020

Commercial Presence in Hong Kong

2020 | Growth rate (%) | |

| Number of North Macedonian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong and North Macedonia

- In June 2015 Hong Kong and North Macedonia started the first round of a Double Taxation Agreement (DTA) negotiation.

- The DTA between Mainland China and North Macedonia was signed on June 9, 1997 and entered into force in both countries on November 29, 1997.

Source: State Administration of Taxation

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa for a stay of up to 90 days.

Source: Hong Kong Immigration Department

Date last reviewed: March 3, 2020

North Macedonia

North Macedonia