GDP (US$ Billion)

23.59 (2018)

World Ranking 133/193

GDP Per Capita (US$)

6,654 (2018)

World Ranking 117/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

125.8 (2019)

Currency (Period Average)

Mongolian Tughrik

2663.54per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

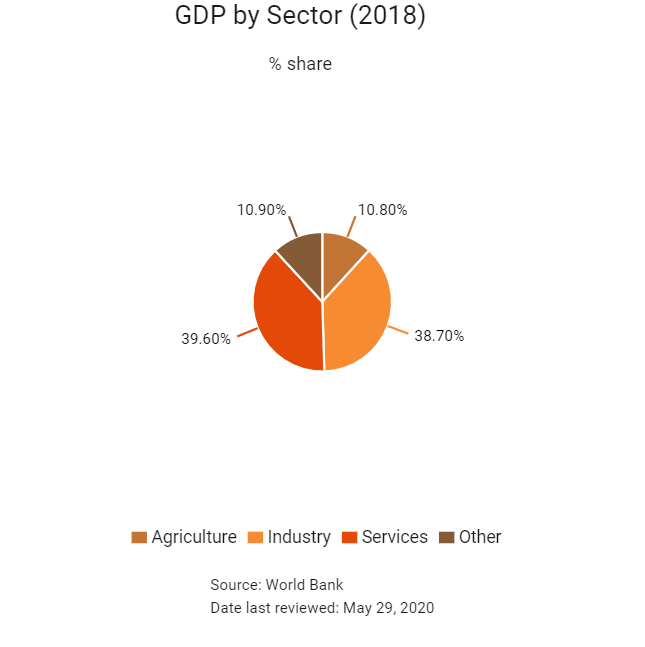

Overview

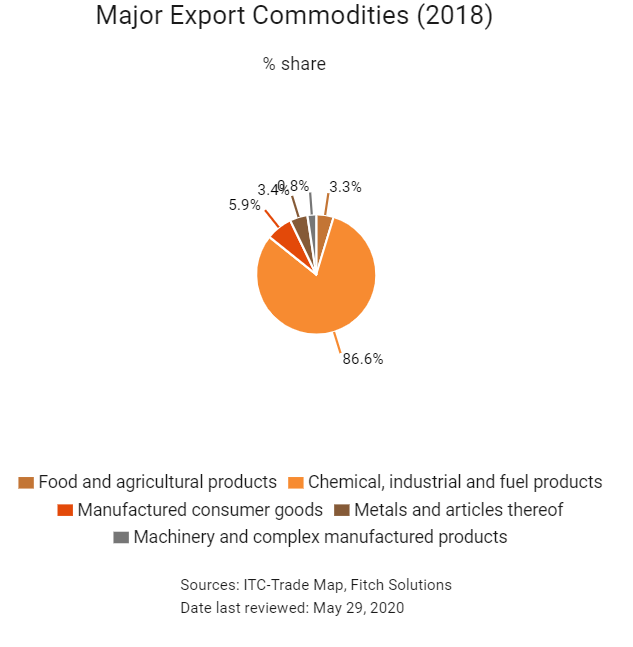

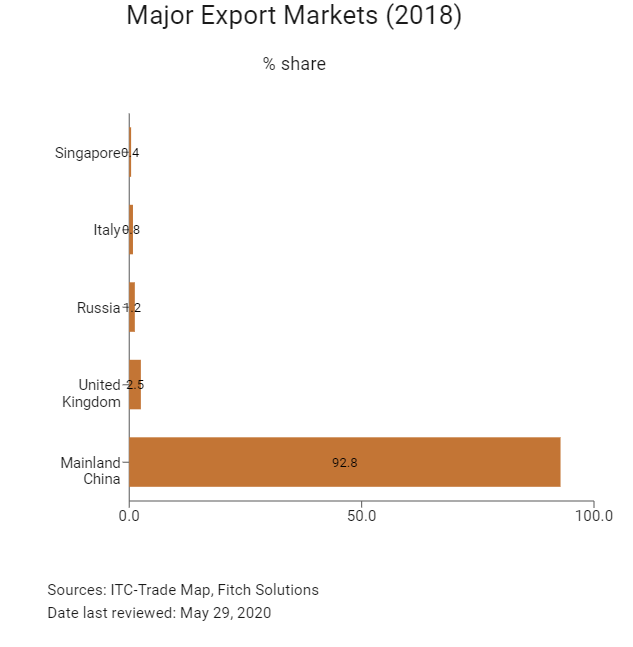

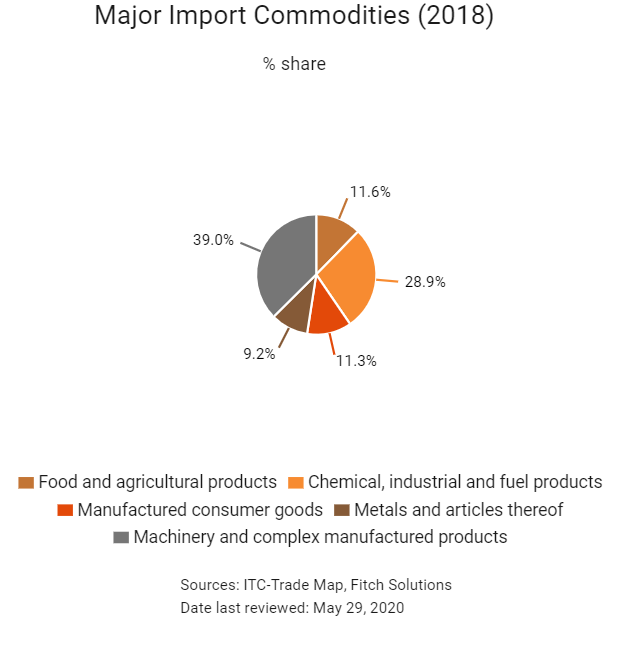

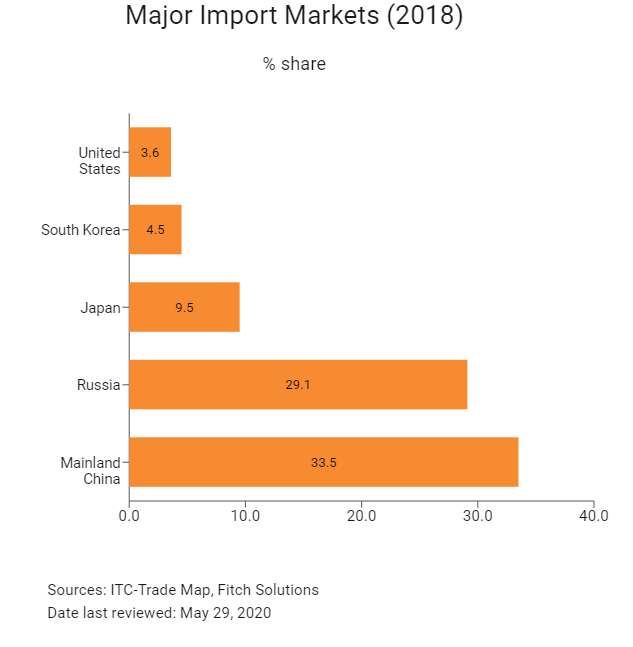

Over the past 25 years, Mongolia has transformed into a vibrant democracy, tripling its GDP per capita since 1991. With vast agricultural and mineral resources and an increasingly educated population, Mongolia’s long-term development prospects are promising. Since its transition to a free market economy, the country has pursued an open trade regime that remains largely dependent on the exports of its mining sector. Although the government has tried to promote the development of other key exports, notably machinery and textiles, the country's economic diversification process has been somewhat slow to unravel. Mongolia is geographically landlocked between Mainland China and Russia, which not only limits its international connectivity for exports, but also makes it overly reliant on Mainland China and Russia for imports of crucial products - such as manufactured goods and energy. This raises the risk for Mongolia from external shocks such as a sustained rise in oil prices or a slowdown in Mainland China.

Sources: World Bank, MONTSAME News Agency, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2018

Mongolia's government extended a ban on migration from rural areas to Ulaanbaatar, introduced in 2017, until 2020 to try to reduce high levels of air pollution in the capital city. Officials were trying to design a programme to encourage migration back to the provinces.

December 2018

Mining company Rio Tinto signed a deal with Mongolia for the supply of power to Rio Tinto's giant copper mine extension at Oyu Tolgoi by 2023. Construction of a 300MW plant close to the Tavan Tolgoi coalfields will start in 2020.

March 2019

Representatives from Mainland China, South Korea, North Korea, Russia and Japan attended a strategy meeting, the North East Asia Regional Power System Interconnection, which was co-organised by the Mongolian Ministry of Energy and the Asian Development Bank. Mongolia has enough renewable energy potential to become an important supplier of energy to the regional market, where demand for energy is expected nearly to double by 2040.

October 2019

The Asian Development Bank (ADB) approved a USD158.34 million multitranche financing facility for a healthcare programme in Mongolia. The programme covers three projects, which include construction of 10 family health centres in Ulaanbaatar and six provincial-level health centres. The scheme also includes building a gender-sensitive district hospital in Chingeltei district, modernising Khan Uul district hospital in Ulaanbaatar as well as expanding Khovd and Uvs sub-district hospitals. The programme will run until 2019.

October 2019

ADB, International Finance Corporation and the Municipality of Ulaanbaatar City in Mongolia have signed a memorandum of understanding for the construction of 10,000 energy efficient houses under the Ulaanbaatar Green Affordable Housing and Resilient Urban Renewal Sector Project. The houses, to be built in 20 new environmentally friendly districts, include 1,500 units for social housing, 5,500 for affordable housing and remaining to be sold at market rate. The USD570.2 million project will be financed using grants and some funding from private lenders.

October 2019

The government of Mongolia signed loan agreements worth USD103 million with the ADB for three projects in the country. Financing worth USD60 million will be used for the Regional Road Development and Maintenance Project, which includes revamp of the 118km Darkhan-Altanbulag and 58km Khuiten Valley-Arvaikheer road sections. Work will also be carried out on the 204km Ulaanbaatar-Darkhan section. USD27 million will go towards the Regional Improvement of Border Services Project, which is currently under way. The scheme will modernise border-crossing points in Bichigt and Borshoo, which border China and Russia, respectively. The remaining loan amount will support the ongoing Fourth Health Sector Development Project. The scheme includes construction of Songinokhairkhan district hospital, which is likely to be completed in December, according to a press release from the ADB.

May 2020

The ADB has approved a USD100 million loan to the Government of Mongolia to mitigate the severe health and economic impacts of the Covid-19 pandemic.

May 2020

Minister of Finance Ch.Khurelbaatar and Ambassador of South Korea to Mongolia Lee Yeo-hong signed an exchange of letters on the extension of the General Agreement between the Governments of Mongolia and the Republic of Korea on loan from the Economic Development Cooperation Fund until the end of 2020. Under the general agreement that was established on January 16, 2018, the Mongolian government is receiving a soft loan of KRW equalling to USD700 million that has an annual interest of 0.2% and 30 years of repayment term with a 10-year grace period.

May 2020

The European Commission was considering to create a new authority to police financial crime and monitor banks more strictly. In an action plan sent to the EU’s 27 governments, the Commission, the EU executive, said the Union needed a system to tackle money laundering and financial crime with an EU-level supervisor. The Commission also published a new list of countries where it says more needs to be done to curb money-laundering. The revised list is set to take effect from October 2020. Companies in any of the listed states are banned from receiving new EU funding. The Commission added the Bahamas, Barbados, Botswana, Cambodia, Ghana, Jamaica, Mauritius, Mongolia, Myanmar, Nicaragua, Panama and Zimbabwe.

Sources: BBC Country Profile – Timeline, Fitch Solutions, United Nations, The Guardian, MONTSAME News Agency, Reuters, Bloomberg

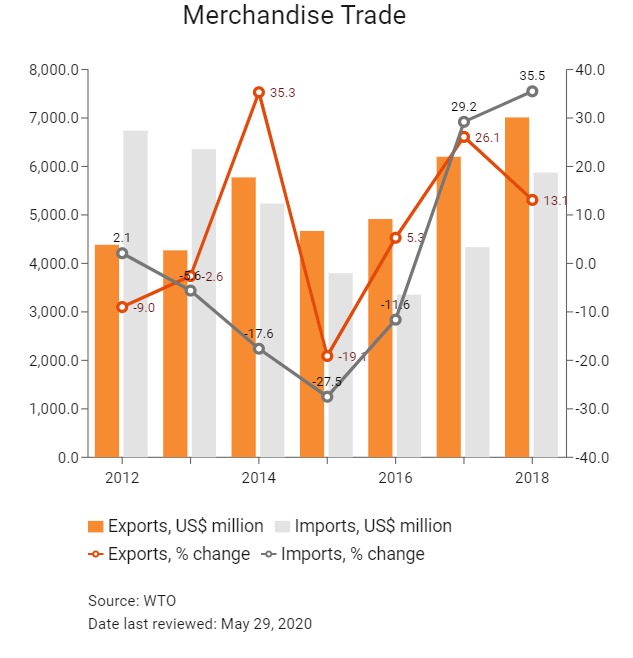

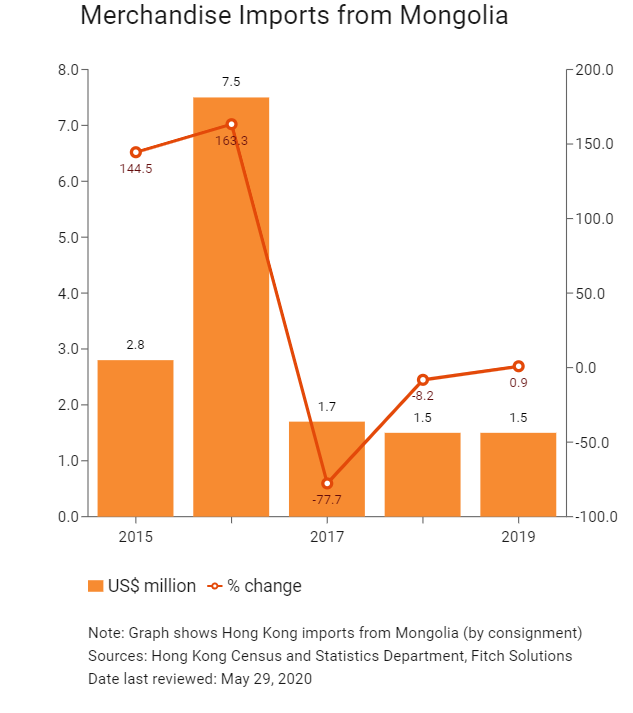

Merchandise Trade

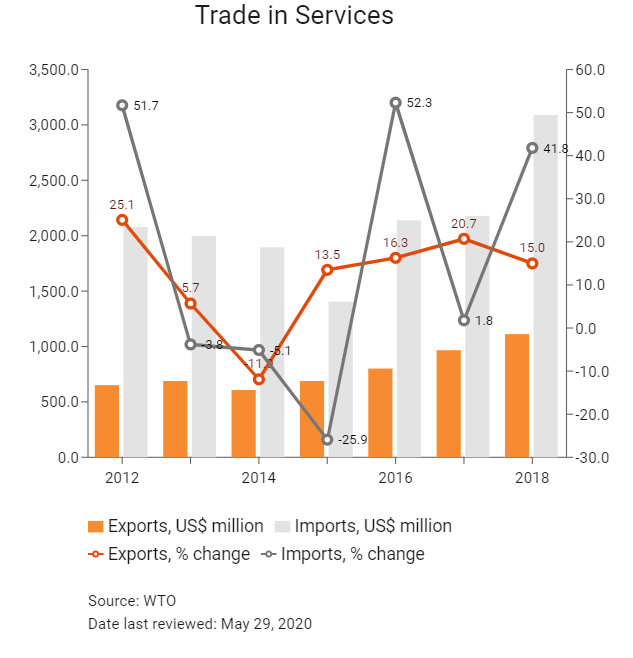

Trade in Services

- Mongolia joined the World Trade Organization (WTO) in 1997, which opened the door to equal rights to trade with many countries worldwide and, in addition, has enabled Mongolia to contribute to decision-making in the rules of global trade and economic cooperation.

- Mongolia currently has a 4.57% average tariff rate that applies to most imported goods. A zero tariff rate is applied to 49 other tariff lines, including live animals for breeding, information dissemination equipment, machines for information development, transistor diodes and various types of medical equipment. Additionally, the seasonal import duty rate of 15% is applied on flour and vegetables to protect domestic producers between August 1 and April 1, yearly. Outside this period, the rate is 5%.

- There are some goods that are prohibited in Mongolia, usually for health and safety reasons, including drugs/narcotics, narcotic plants, equipment used to manufacture drugs/narcotics, devices, spirits and scrap metal. Highly toxic chemicals, organs and donor blood for medical purposes, guns, rifles, weapons, military equipment and devices and their spare parts, and explosives face high import and export restrictions in Mongolia.

- Licence requirements – Mongolia also requires a licence for importing and exporting certain food and agricultural products that are defined as critical to national security. Strategic goods, as defined in the Law on Food, include: liquid and powdered milk; cattle, goat, camel and sheep meats; flour and potable water. The licensing of the above products is based on an open tender for any given year.

- There are existing Bilateral Investment Treaties (BITs) between Mongolia and the following 37 countries: Austria, Belarus, the Belgium-Luxembourg Economic Union (EU), Canada, Mainland China, Cuba, the Czech Republic, Denmark, Egypt, Finland, France, Germany, Hungary, Indonesia, Israel, Italy, Kazakhstan, Kuwait, Laos, Lithuania, Malaysia, the Netherlands, the Philippines, Poland, Romania, Russia, Singapore, South Korea, Sweden, Switzerland, Tajikistan, Turkey, Ukraine, the United Kingdom, the United States and Vietnam. Six others are signed but not yet in force.

- Mongolia, the EU and Argentina initiated the Alliance for Torture-Free Trade, on September 18, 2017, which aims to end the trade in goods used for capital punishment and torture.

- Mongolia has double taxation agreements with 25 countries.

- On September 20, 2018, Mongolia and the United States declared they had agreed an expanded comprehensive partnership. The two reiterated their commitment to implementing their obligations under the WTO agreement on Trade Facilitation and reaffirmed their interest in regional economic cooperation and bilateral trade and investment, and to closely cooperating in future in the areas of agriculture, water, energy, mining, financial services, infrastructure, development cooperation and supporting private businesses.

Sources: WTO – Trade Policy Review, UNCTAD, US Embassy in Mongolia, Ministry of Foreign Affairs of Mongolia, Fitch Solutions

Multinational Trade Agreements

Active

- Japan-Mongolia Economic Partnership Agreement (EPA): The deal was entered into on February 10, 2015, but entered into force on June 7, 2016, with a view of liberalising and facilitating the flows of trade and investment and to create a regulatory framework for further cooperation on the improvement of the business environment between the two countries. The EPA promises room for growth and the chance to balance a trade relationship that is currently skewed towards Japanese exports.

- EU-Mongolia Partnership and Cooperation Agreement (PCA): The Agreement was signed in 2013, endorsed by the respective parliaments by February 2017 and entered into force on November 1, 2017. The PCA replaces the 1993 Agreement on trade and economic cooperation and provides a general framework for promoting bilateral, regional and international cooperation between Mongolia and the EU in all areas of cooperation, such as trade and economy, development aid, agriculture, rural development, energy, climate change, research and innovation, education and culture. The agreement consists of 65 Articles, which include areas of cooperation of mutual interest in the economy, financial services, tax, industrial policy and small and medium-sized enterprises, science, technology, education, culture, energy, transport, the environment, agriculture, the development of rural areas, public health, social protection and statistics. The decision of the EU to establish this PCA reflects its desire to support the building of a strong free-market economy in Mongolia and a healthy climate for business and foreign investments, as well as to provide aid to foster trade relations.

Under Negotiation

- Mainland China: In 2018, Mainland China accounted for over 90% and 30% of Mongolian exports and imports respectively. A free trade agreement would cement trade ties between the two nations.

- Russia: Mongolia is creating transport infrastructure between Russia, Mongolia and Mainland China. Trade volumes between Russia and Mongolia have been increasing greatly in recent years.

- South Korea: Mongolia would benefit from trade preference in terms of tariff exemption or reduction under a trade agreement with South Korea that would allow Mongolia to export its abundance of primary commodities and foster investment from South Korea, thus building a base for industrial diversification and value addition in the country.

- Mongolia and EAEU: According to the European Commission, Mongolia was considering seeking membership in the EAEU, which entered into force in January 2015 and ends its implementation period in 2025. At present, the EAEU consists of the Russia, Kazakhstan, Kyrgyzstan, Armenia and Belarus.

Sources: WTO Regional Trade Agreements database, Xinhuanet, European Union, Ministry of Foreign Affairs of Mongolia

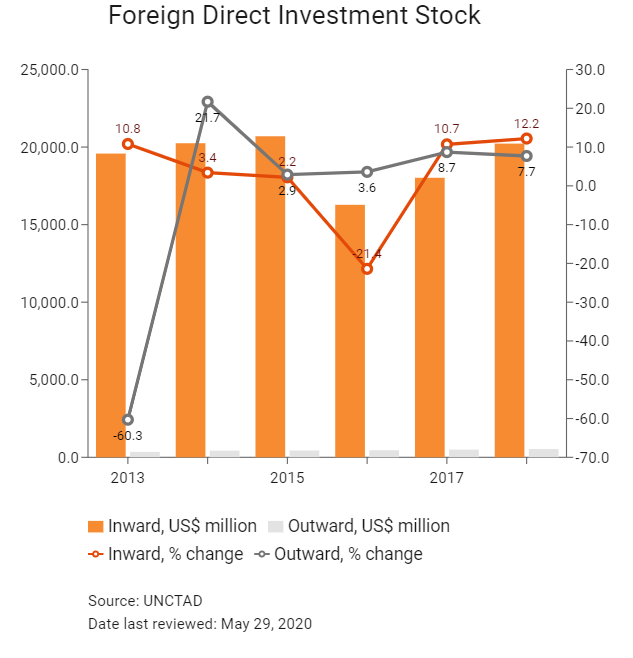

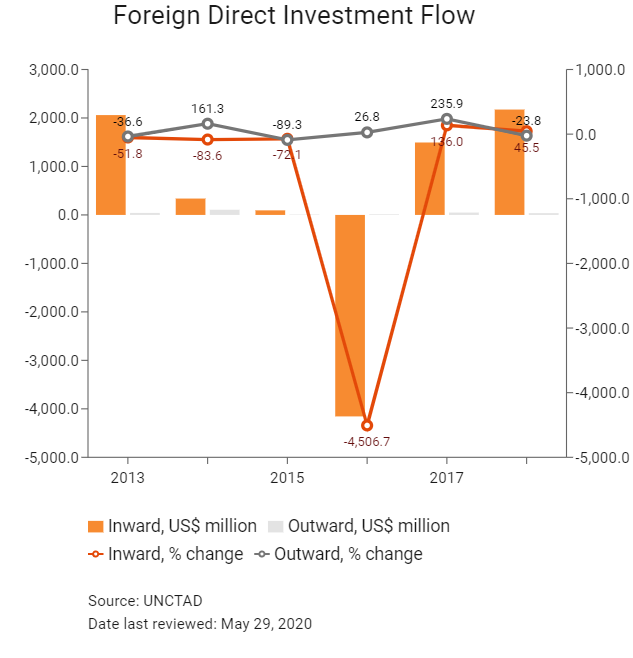

Foreign Direct Investment

Foreign Direct Investment Policy

- Foreign businesses benefit from very few restrictions on the repatriation of capital, which pertain to taxes. Although all business transactions in the country must be settled in the local currency, prices are often quoted in foreign currencies, predominantly the United States dollar.

- Foreigners may invest a minimum of USD100,000 cash or the equivalent value of the capital material. In both law and practice, foreigners may own 100% of any registered business, except those listed as areas of strategic importance. These include mining, banking, finance and media, information and communications. However, the legislation does not clearly define which businesses are included in each category; therefore, those potentially affected are advised to get legal advice.

- Foreign ownership: The government of Mongolia passed a law in May 2012 that was meant to limit the participation of foreign firms in strategic sectors, such as mining, by restricting foreign ownership to 49% and requiring government approval for foreign equity purchases in sectors, such as banking and finance, mining and communications. Dubbed the Strategic Entities Foreign Investment Law (SEFIL), the regulation aims to limit the ability of foreigners to create a monopoly or alter market prices for Mongolian exports.

- Government approval: As a result of the SEFIL, an amendment was passed in April 2013 to exempt privately owned foreign companies from the law. However, all foreign state-owned enterprises are still obliged to obtain the approval of Mongolia's Cabinet to buy equity in a Mongolian firm. For purchases of stakes of more than 49%, the approval of parliament will also be required.

- The government of Mongolia has been eager to promote foreign direct investment in priority sectors, including agriculture, the exploration of oil and gas, coal, iron ore, and other minerals, construction, fur and leather processing, and food and timber production, among others. To attract investors, the state has begun reforming the legal environment, while providing tax incentives to foreigners.

- Foreign companies that export over 50% of production are eligible to receive corporate income tax (CIT) exemption for the first three years of their investment, in addition to 50% tax relief in the following three years. Moreover, foreign investment directed to power and thermal plants and their highways, airways, railways, and engineering construction, among other sectors, are eligible for 10 years of tax exemption and 50% tax relief for the five subsequent years. Additionally, investors in oil and goal, chemical production, metallurgy, machinery and electronics receive five years of tax exemption and 50% tax relief in the following five years.

- On February 25, 2019, the Invest in Mongolia Centre was officially unveiled by the National Development Agency. The intention is to create more-favourable conditions for foreign investors by giving simplified access to relevant information, including the legal investment framework, company registration, taxation, incentives, immigration and social insurance.

Sources: WTO – Trade Policy Review, Government sources, National Development Agency, Fitch Solutions

Free Trade Zones And Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Altanbulag, Zamyn-Uud, Tsagaan Nuur | - Goods imported to free trade zones (FTZs) are not subject to value added tax (VAT), customs and excise taxes. - If goods are to be transferred from the customs territory to the FTZs, there will also be no such taxes on those goods and any previously paid taxes will be reimbursed accordingly based on related documents. - Buildings and facilities built and registered in FTZs are exempt from the immovable property tax. Financial assistance is available to investment projects involving innovative technology. Business entities using innovative and enhanced technology in their businesses shall be exempt from CIT for five years from when they first become profitable. - Individuals and businesses may request land ownership and usage right in FTZs. In addition, equipment imported for construction purposes may be exempt from customs duties and VATs. Zero VAT will apply on domestic goods transferred from custom territory to FTZs. - Businesses operating to improve infrastructure, such as energy and heating sources, the pipeline network, clean water supply, wastewater sewage, road, railway, airport and basic communication will be exempt from any land payment for the first 10 years from the start of operations. - Streamlined verification and registration processes. Foreign investors who have made investments in Mongolia will be provided with multiple visas and residential permissions permission for them and their families under the applicable laws of Mongolia. - No VAT will be applied on goods and services manufactured/provided and sold in FTZs by individuals and businesses registered in FTZs. - Land lease and use for up to 60 years on the basis of a contract, with one extension of the contract duration for up to 40 years under the contract's primary conditions. - Businesses that have invested USD500,000 or more in infrastructure, such as energy and heating sources, the pipeline network, clean water supply, wastewater sewage, road, railway, airport, and basic communication line shall receive a CIT credit equal to 50% of their invested capital in the FTZs. Businesses that invested USD300,000 or more in building warehouses, loading and unloading facilities, hotels, tourist camps, or manufacturers of export and import substituted goods in the FTZ shall receive a CIT credit equal to 50% of their invested capital in the FTZ. - After completing the development stage, businesses can use their accumulated tax losses, reflected on their income tax return, within five consecutive years. - Businesses operating in the trade, tourism and hotel sectors are fully exempt from any land ownership and usage right payment for the first five years from the start of the operation start. This payment is further reduced up to 50% for the three subsequent years. - Foreign labour force quota ratios are not applicable when employing foreign individuals in the FTZ. Entities employing and providing income for foreign individuals are exempt from the fee for employing foreign employees. - For FTZs established on border ports, citizens from bordering countries will be granted 30 days visa-free access to FTZs and citizens from non-bordering countries will be regulated according to the government's international agreements. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 10%

- Corporate Income Tax: 10-25%

Source: Mongolia General Department of Taxation

Important Updates to Taxation Information

- The General Law on Taxation, the Corporate Income Tax Law, the Value Added Tax Law and Personal Income Tax Law have been substantially revised by the Mongolian Parliament, under the government’s tax reform packages. The new tax rules are effective on January 1, 2020 and will have changes that may have material impact on taxpayers.

- In 2018, it became a new administrative obligation for companies holding land rights or exploration and mining licences to disclose and register their beneficial owners with the Legal Entity Registration Office and tax authority no later than June 1, 2018. Another important change in 2018 made to the tax treatment of 'indirect transfer' for the sale of an entity owning land rights or exploration and mining licences. A concept of an 'ultimate holder' of a legal entity was newly introduced for tax purposes. Any change of ultimate holder of a legal entity that maintains a mining licence or land-use (or possession) right is now deemed as a sale of its mining licence or land-use right and subject to a 30% corporate income tax. Importantly, a tax obligation is imposed on the legal entity holding such rights, but not the person who earns the income from the transaction. 'Ultimate holder' refers to the following types of persons who exercise control over management and assets of a legal entity, directly or indirectly, with a chain of ownership at one or more levels of legal entities through a number of shares, percentage of participation, or a number of voting rights: holders of a majority of voting rights of a legal entity; holders of a majority number of shares or shares with the highest market value of a legal entity or similar others. In general, taxable income shall be assessed based on the value of rights pro-rated to the number of shares or percentage of participation that are transferred from a right-holding entity or its ultimate holders.

Business Taxes

Type of Tax | Tax Rate and Base |

| CIT | - 10% (annual taxable income - 25% (annual taxable income>MNT3 billion) |

| Capital Gains Tax | - 10% (annual taxable income - 25% (income>MNT3 billion) - Gains derived from the sale of immovable property are subject to tax a rate of 2% on a gross basis |

| Dividends | 20% on net earnings for non-residents; 10% for permanent residents |

| Interest (non-resident companies) | - 20% on net earnings - 10% for interest on bonds issued by Mongolian commercial banks (from January 1, 2015) |

| Branch Tax (non-resident companies) | 20% on net earnings |

| Royalties (non-resident companies) | 20% on net earnings |

| Real Estate Tax | - 0.6%-1% of asset value is levied annually - As stated in capital gains, sale of an immovable property attracts tax at 2% |

| VAT | - 10% on value of the products - Some products are zero-rated, such as domestic food staples and some types of mining equipment |

| Social security contributions | Employer’s contribution is not capped, depends on the industry type and is subject to rates of 12%-14% of taxable earnings |

| Withholding Taxes | - 10% on dividend income, 10% on royalties and - 10% on interest for residents, 20% on each for non-residents. The double taxation agreement with Mainland China renders these rates 5%, 10% and 10% respectively |

| Sale of rights (mining licences, and other rights granted by the authorised organisations for conducting specific activities) | 30% |

Source: Mongolia General Department of Taxation

Date last reviewed: May 29, 2020

Localisation Requirements

The government of Mongolia sets a foreign worker quota (updated annually), for both locally owned and foreign invested companies operating in Mongolia. In 2019, the quota ranged from 10% to 60% depending on the industry sector and number of employees. For some sectors that are not directly mentioned in the Resolution, the total number of foreign employees should not exceed 5% of the total headcount. In general, the quota is high for businesses seeking to import skilled labour as well as for businesses in the construction industry, whereas it is low for low-skilled occupations, such as agriculture, fishing and hunting.

Visa/Travel Restrictions

Foreigners are required to have a Mongolian visa to enter the country. However, the Mongolian government has an open policy towards outside investment and the requirements for a work permit are comparatively less strict and the cost is relatively not high.

An organisation employing workers and specialists from abroad is required to pay a fee for employing a foreigner. Unless otherwise noted in trade agreements with specific countries, the fee must be paid on a monthly basis. The fee is linked to a minimum concentration amount that is periodically updated and approved by the government. The revenue generated from this fee is used to fund government programmes designed to combat unemployment in Mongolia.

Nationals from many countries around the world can generally access Mongolia visa free, especially for stays less than 30 days. Business visitors must generally limit their activities, such as attending business meetings, negotiations, participating in exchange programmes, conferences, seminars or congresses and taking part in workshops on trade and economic questions.

Foreign employees must be sponsored by a local Mongolian company in order to obtain permits for the country and work legally.

There are different types of visas in Mongolia. Expatriates wishing to enter employment in Mongolia require a work permit from the Labour Office, an HG visa and a long-term residency permit. HG visas will be issued for as long as the work permit has been issued, up to a maximum of 12 months, with the possibility to extend each year.

A T visa is a special visa given to either an investor or a foreign executive director of a foreign company. A maximum of three may be issued per company – two for individual investors in a company and one for the executive director of the company. Like an HG visa holder, a T visa holder will need to register with immigration within seven days of arrival or face stiff penalties. T visas are valid for a year and can be renewed annually. The advantage of a T visa is that the holder does not need to have a work permit to work (or pay the associated workplace fee), and the T visa holder does not count against a company's quota of foreign workers. If the foreign invested Mongolian company has a corporate shareholder, that company is limited to a single T visa for the executive director.

Sources: Ministry of Foreign Affairs Mongolia, Mongolia Immigration Agency, Reuters, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | B3 (Negative) | 08/05/2020 |

| Standard & Poor's | B (Stable) | 09/11/2018 |

| Fitch Ratings | B (Stable) | 29/05/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 62/190 | 74/190 | 81/190 |

| Ease of Paying Taxes Index | 62/190 | 61/190 | 71/190 |

| Logistics Performance Index | 130/160 | N/A | N/A |

| Corruption Perception Index | 93/180 | 106/180 | N/A |

| IMD World Competitiveness | 62/63 | 62/63 | N/A |

Sources: World Bank, IMD, Transparency International

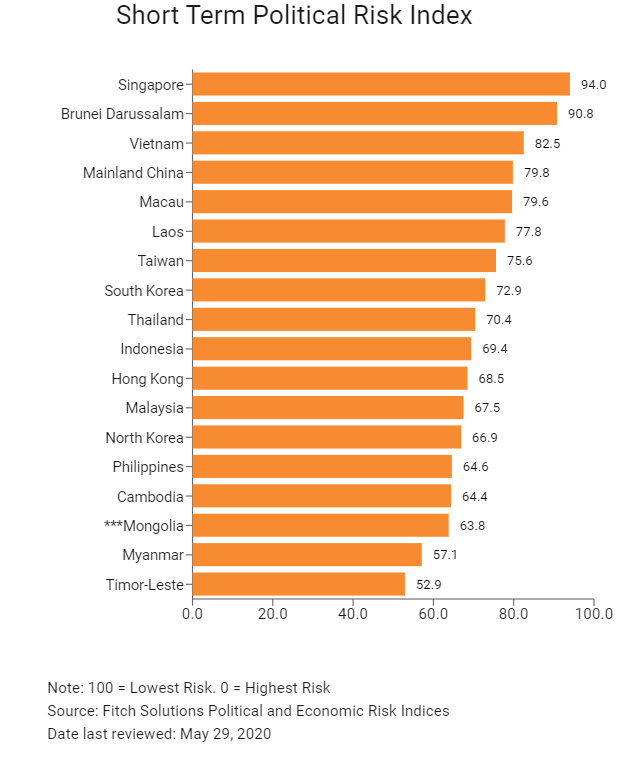

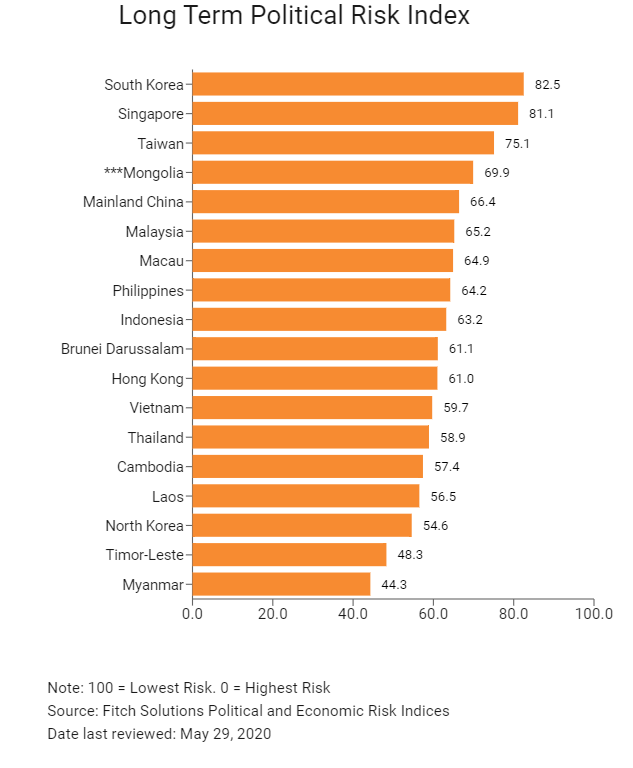

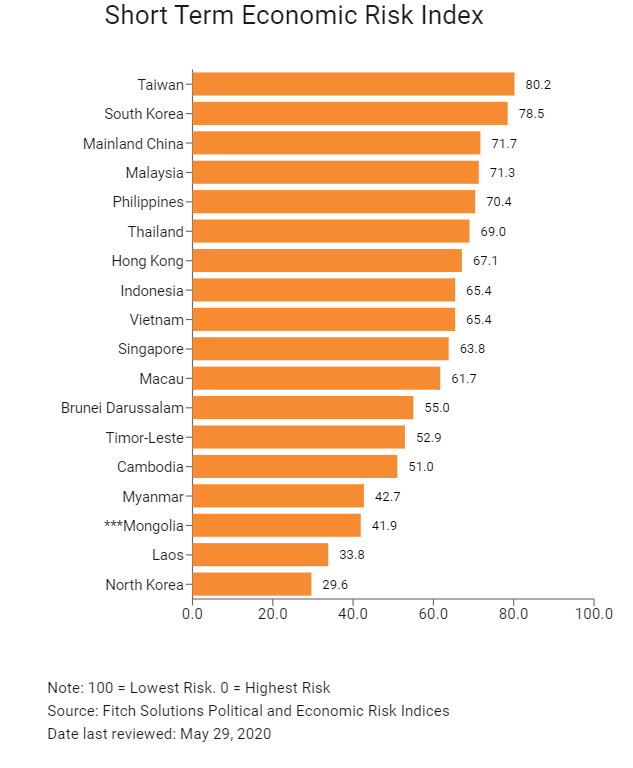

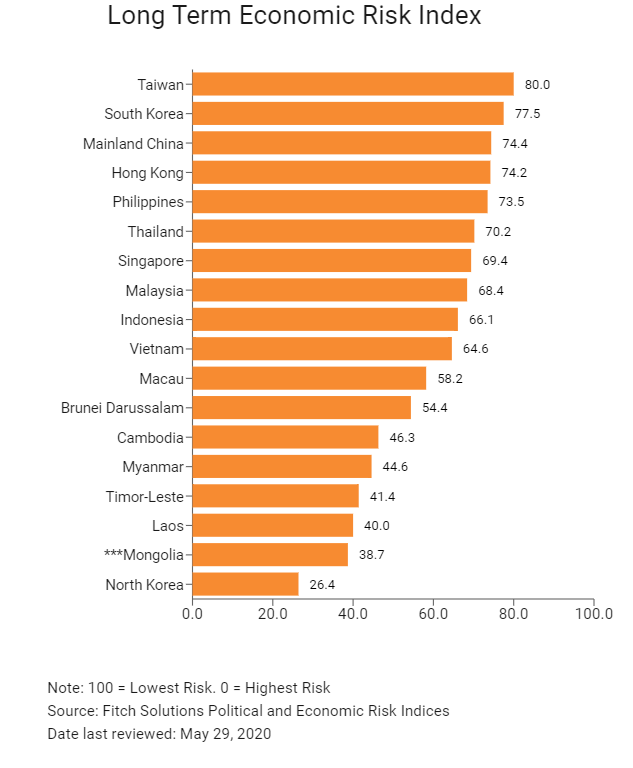

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index | 166/202 | 173/201 | 173/201 |

| Short-Term Economic Risk Score | 45 | 42.7 | 41.9 |

| Long-Term Economic Risk Score | 39.7 | 39.9 | 38.7 |

| Political Risk Index | 70/202 | 73/201 | 70/201 |

| Short-Term Political Risk Score | 64.6 | 63.8 | 63.8 |

| Long-Term Political Risk Score | 69.9 | 69.9 | 69.9 |

| Operational Risk Index | 89/201 | 87/201 | 89/201 |

| Operational Risk Score | 51.3 | 51.6 | 51.1 |

Source: Fitch Solutions

Date last reviewed: May 29, 2020

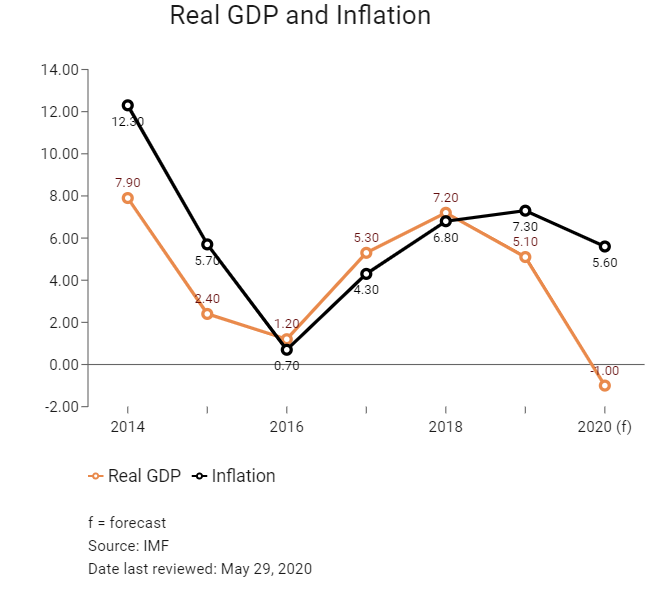

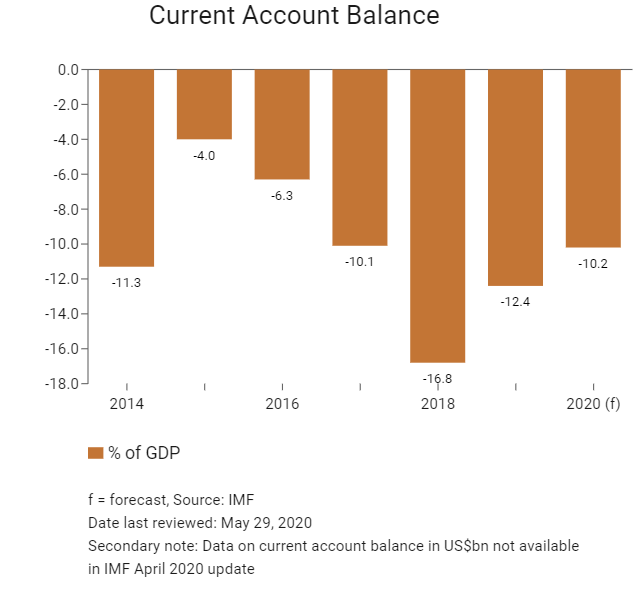

Fitch Solutions Risk Summary

ECONOMIC RISK

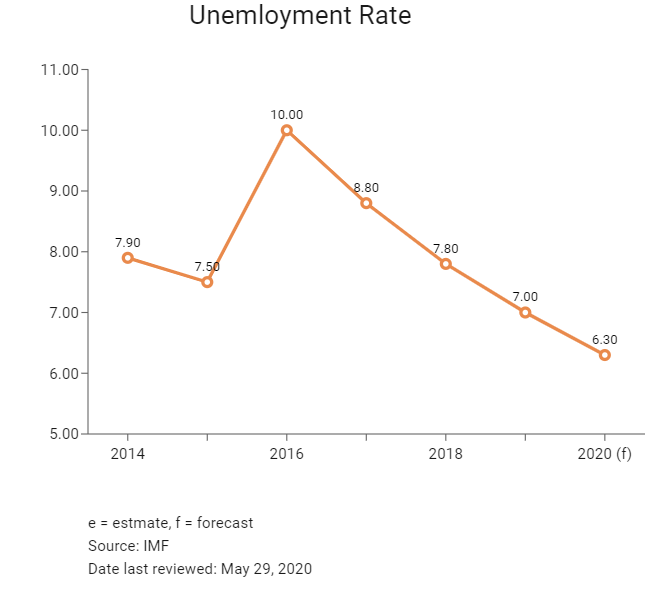

Despite Mongolia's enormous current account deficit and large net negative international investment position, the country's overall balance of payments position will remain sustainable over the coming years. While the mining sector output capacity is likely to grow over the coming years, there are increasing downside risks due to a resurgence of resource nationalism in Mongolia. The ruling MPP government has moved to renegotiate agreements governing the Oyu Tolgoi mine run by Rio Tinto, which has resulted in greater costs for the latter. Should this trend persist, the country's long-term economic outlook would be at risk. The economy is expected to contract slightly in 2020, as the external sector suffers from low global commodity demand and constrained spending weighs on domestic activity. Uncertainty in commodity markets, rising political tensions and a slower pace of reforms to the banking sector are the key downside risks going forward.

OPERATIONAL RISK

Mongolia offers an attractive proposition for investors, with an impressive growth rate, a booming mining sector and a reasonably well-educated labour force. The key areas of concern for businesses looking to operate in the country are its logistics and trade and investment environments. Despite being rich in natural resources, the country is still heavily reliant on Russia for electricity imports. Additionally, insufficient and poor road and rail networks, as well as high levels of trade bureaucracy, mean that getting goods into and out of Mongolia is both timely and costly. The local economy is heavily centred around commodities production and, with a poor businesses environment, has struggled to attract foreign investment in other areas. The country's security and labour environments are more attractive as Mongolia is considered politically stable and has a fairly large, young labour pool. Education levels are considered adequate by global standards, and trends in migration from rural to urban centres mean that the skills base is developing away from agriculture towards more technical roles.

Source: Fitch Solutions

Data last reviewed: May 29, 2020

Fitch Solutions Political and Economic Risk Indices

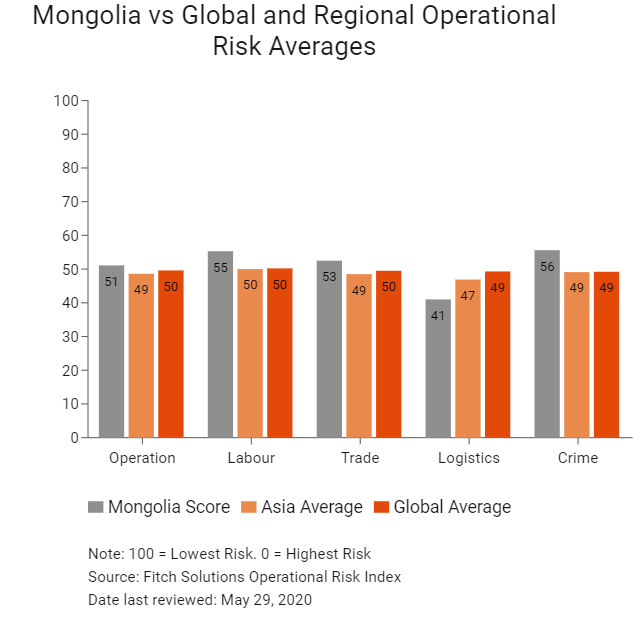

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Mongolia Score | 51.1 | 55.3 | 52.5 | 41.0 | 55.6 |

| East and Southeast Asia average | 55.9 | 56.4 | 57.8 | 55.6 | 53.6 |

| East and Southeast Asia position (out of 18) | 12 | 10 | 12 | 13 | 8 |

| Asia average | 48.6 | 50.0 | 48.5 | 46.9 | 49.1 |

| Asia position (out of 35) | 13 | 11 | 13 | 19 | 11 |

| Global average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 89 | 64 | 88 | 123 | 78 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk |

| Singapore | 83.3 | 77.5 | 90.3 | 79.0 | 86.3 |

| Hong Kong | 81.5 | 72.0 | 89.0 | 80.7 | 84.5 |

| Taiwan | 73.0 | 68.3 | 75.3 | 76.3 | 71.9 |

| South Korea | 70.8 | 62.4 | 70.5 | 79.7 | 70.4 |

| Malaysia | 69.6 | 62.6 | 74.9 | 74.0 | 66.8 |

| Macau | 63.9 | 60.9 | 69.5 | 56.2 | 69.1 |

| Brunei Darussalam | 61.3 | 59.1 | 59.1 | 60.1 | 67.0 |

| Thailand | 60.7 | 56.6 | 67.7 | 69.2 | 49.4 |

| Mainland China | 58.8 | 54.9 | 61.4 | 71.8 | 47.3 |

| Indonesia | 54.4 | 55.1 | 55.1 | 55.7 | 51.8 |

| Vietnam | 53.4 | 49.3 | 57.5 | 57.8 | 49.0 |

| Mongolia | 51.1 | 55.3 | 52.5 | 41.0 | 55.6 |

| Philippines | 47.3 | 57.5 | 49.7 | 45.5 | 36.2 |

| Cambodia | 40.6 | 44.5 | 43.0 | 35.2 | 39.8 |

| Laos | 38.4 | 39.5 | 35.5 | 41.0 | 37.6 |

| Myanmar | 33.1 | 47.8 | 39.1 | 27.8 | 17.8 |

| North Korea | 32.4 | 51.1 | 18.5 | 27.8 | 32.3 |

| Timor-Leste | 31.9 | 40.3 | 32.5 | 22.5 | 32.3 |

| Regional Averages | 55.9 | 56.4 | 57.8 | 55.6 | 53.6 |

| Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

| Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 29, 2020

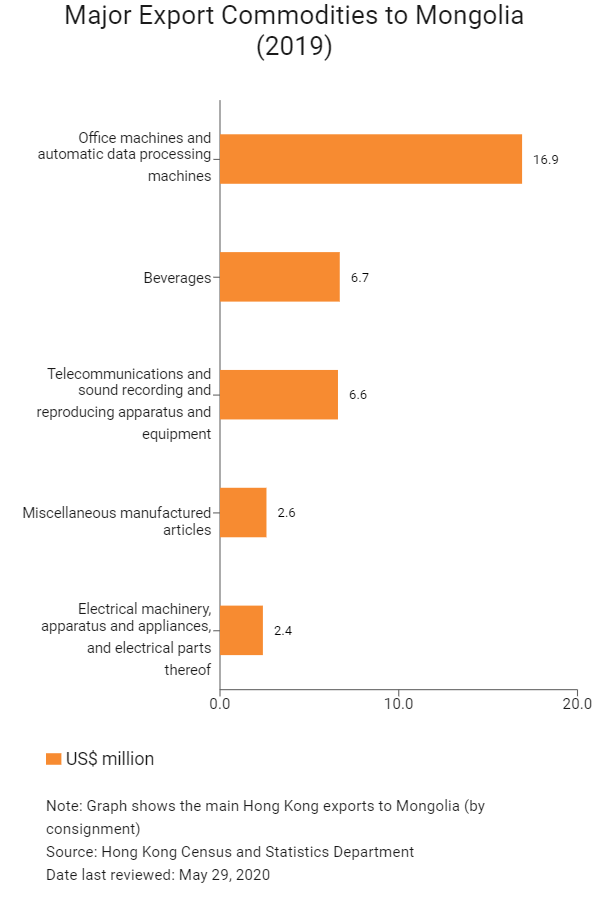

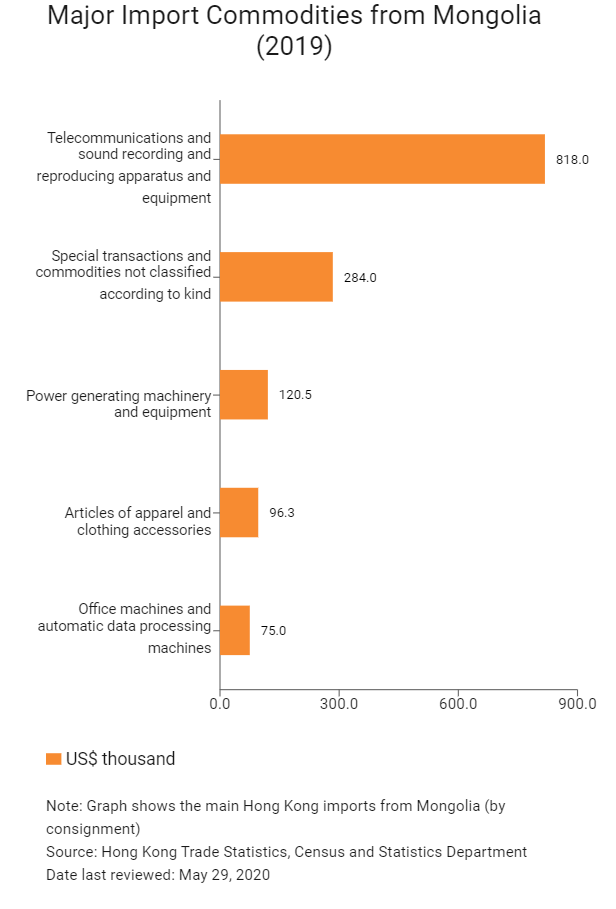

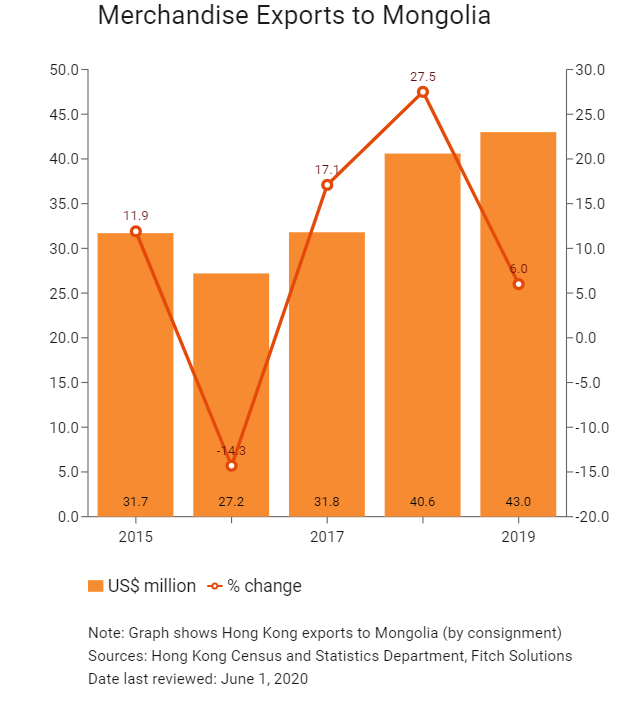

Hong Kong’s Trade with Mongolia

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Mongolian residents visiting Hong Kong | 29,702 | 8.8 |

Source: Hong Kong Tourism Board

2019 | Growth rate (%) | |

| Number of Asia Pacific residents visiting Hong Kong | 52,326,248 | -14.3 |

| Number of East Asians residing in Hong Kong | 2,788,077 | 3.0 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate years

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: May 29, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

| Number of Mongolian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong and Mongolia

Mongolia and Mainland China have a Bilateral Investment Treaty, which came into force in November 1993.

Source: Investment Policy Hub

Chamber of Commerce (or Related Organisations) in Hong Kong

Commercial and Economic Section in Hong Kong

The Mongolian Chamber of Commerce in Hong Kong was founded in 2014.

Address: Suite 409, 4/F, Jardine House, 1 Connaught Place, Central, Hong Kong

Email: batzul@moncham.com

Tel: (852) 9841 8871

Source: LinkedIn

Consulate General of Mongolia in Hong Kong

Address: Unit 1203, 12/F, Tower 2, Lippo Centre, 89 Queensway, Admiralty, Hong Kong

Email: hongkong@mfa.gov.mn

Tel: (852) 2522 2400

Fax: (852) 2522 2405

Source: Consulate General of Mongolia in Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not require a visa if the duration of stay is less than 14 days. If the duration is longer than 14 days, a visa will be required. Diplomats/officials from Mainland China do not require a visa when visiting Mongolia for a maximum of 30 days.

Visa Requirements for tourists:

- Visa application

- One photo

- Passport in original

- A copy of hotel booking or accommodation information in Mongolia

- A copy of flight/train tickets

For business visa:

- Visa application

- One photo

- Passport in original

- Approval from Mongolian side

- Company cover letter

- A copy of hotel booking or accommodation information in Mongolia

- A copy of flight/train tickets

Source: Visa on Demand

Date last reviewed: May 29, 2020

Mongolia

Mongolia