GDP (US$ Billion)

34.88 (2018)

World Ranking 99/193

GDP Per Capita (US$)

18,033 (2018)

World Ranking 48/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

119.7 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

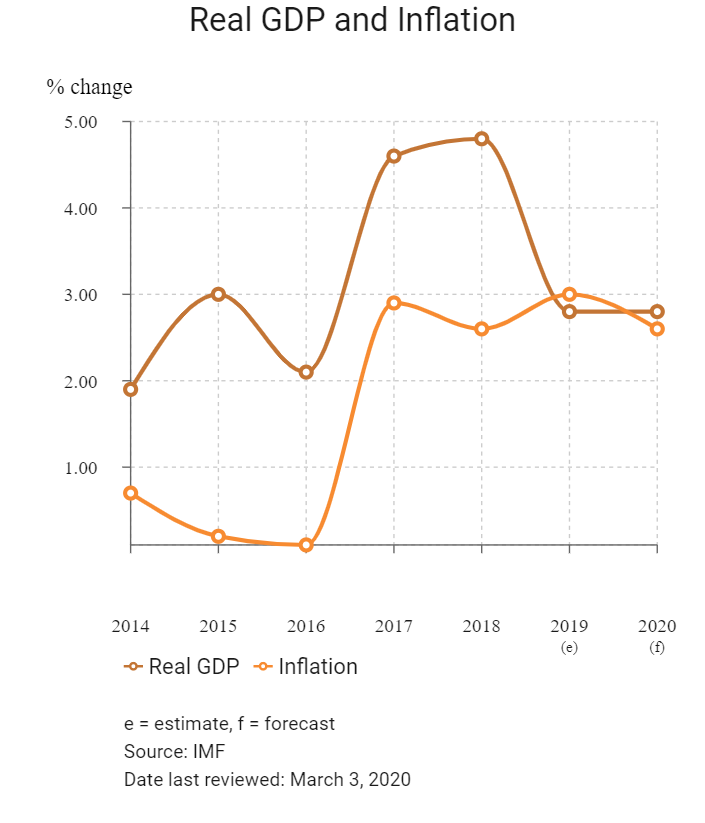

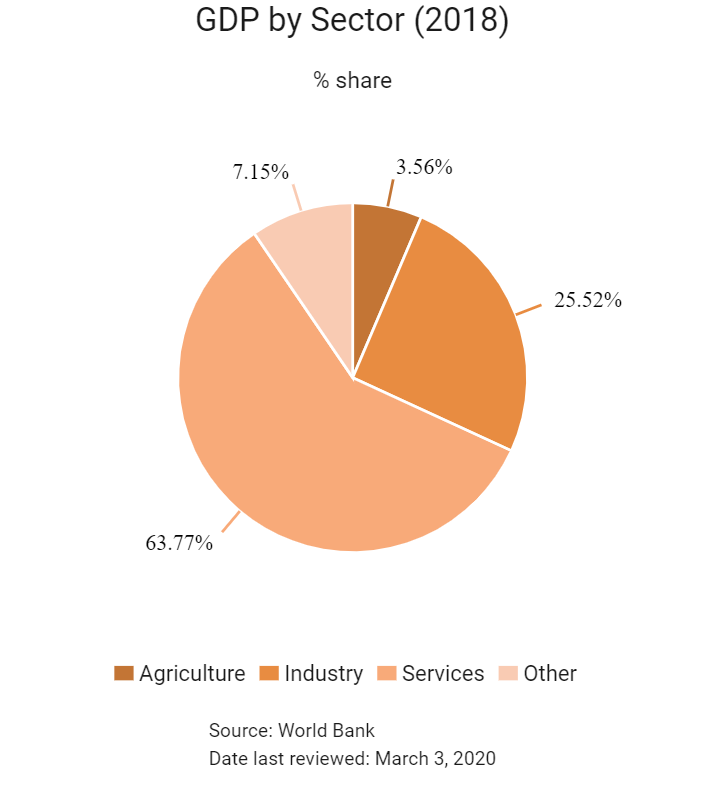

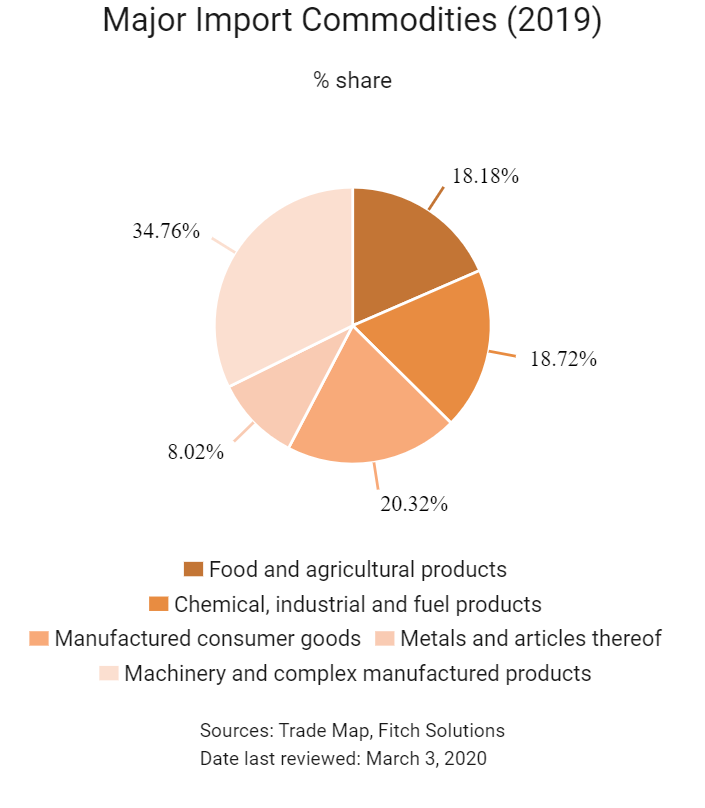

Latvia's economy is primarily based on service industries, including transportation, information technology and financial services. At the same time, the construction industry plays an important role, as well as forestry, food and light industries. Tourism is growing rapidly. However, the transition towards stronger growth and economic stability will remain challenging due to the extent of deleveraging required in Latvia's domestic banking system as well as the necessary adjustment to household balance sheets. A World Bank report indicated that Latvia should improve its tax system and identified four areas for specific attention: broadening the tax base, increasing tax rates, reducing tax evasion and increasing tax progressivity. The report argued that increases in tax compliance and decreases in tax evasion are simultaneously achievable. Within the European Union (EU), Latvia has been a beneficiary of various funds in recent years but the ongoing 2021-2027 budgetary discussions in the EU indicate that funding for Latvia may be reduced significantly.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2016

Maris Kucinskis took over as Prime Minister at the head of the existing coalition.

April 2017

Latvia, which had the Baltic region's only underground natural gas storage facility, liberalised its natural gas market and opened it to competition.

January 2018

Japan's Prime Minister Shinzo Abe made an official visit to Latvia during a five-day tour of the Baltic and Eastern Europe.

October 2018

The Pro-Russia Harmony party emerged as the largest bloc in parliament after elections.

January 2019

Arturs Krisjanis Karins became Prime Minister of a coalition that excluded the Harmony party.

June 2019

The Three Seas Initiative Investment Fund was announced, which would focus on transport, energy and digital infrastructure projects in the Three Seas region. Latvia was one of the 12 EU member states involved, all located between the Adriatic, the Baltic and the Black seas.

July 2019

The EU Cohesion Fund announced an investment of EUR318.5 million to electrify 308km of Latvia's east-west railway network as well as replace diesel-powered locomotives.

September 2019

Security officials from the United States Department of Defense met with representatives from eight Nordic and Baltic nations, including Latvia, to discuss Arctic security and cooperation.

December 2019

The United States removed its sanctions against Latvia's Ventspils Free Port after the Latvian government took control of the port from businessman Aivars Lembergs. The port was an important transit point for oil exports from Belarus.

January 2020

The United Kingdom officially left the EU on January 31, 2020.

January 2020

Latvia, Estonia and Finland launched a three-country single marketplace for natural gas.

February 2020

Latvia, Lithuania and Estonia were due to synchronise their power grid with the rest of Europe in the next five years and withdraw from the transmission framework shared with Russia and Belarus.

Latvia signed a joint declaration with the United States on 5G security.

Sources: BBC country profile – Timeline, Fitch Solutions, Global Railway Review, LSM.LV

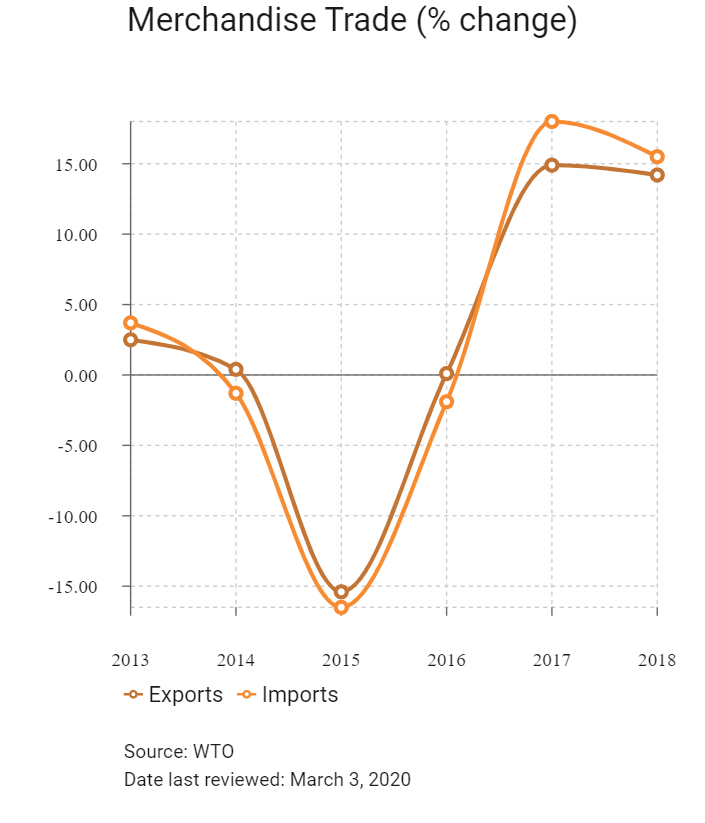

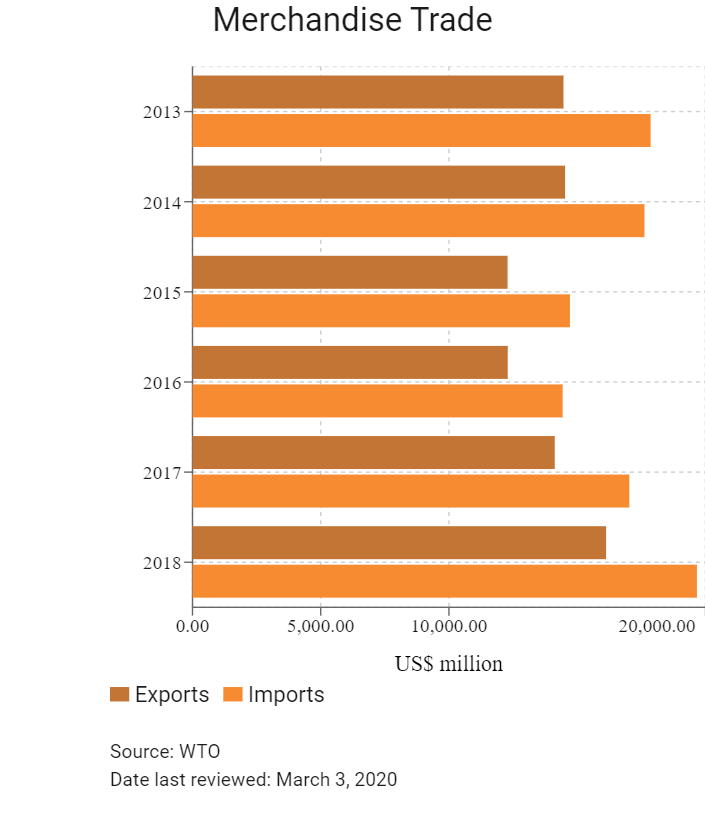

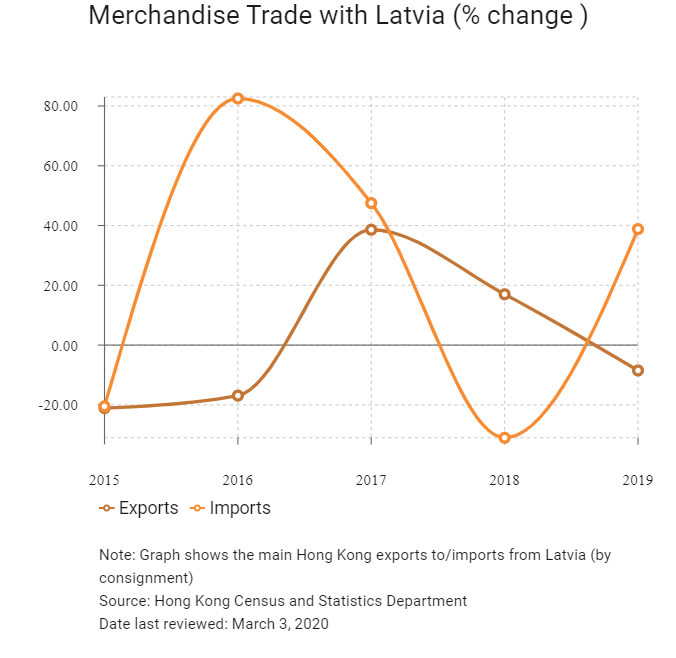

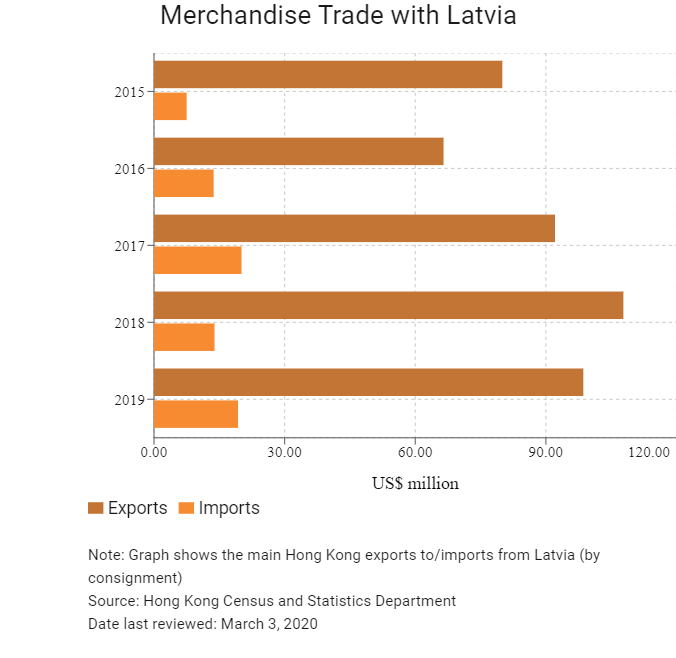

Merchandise Trade

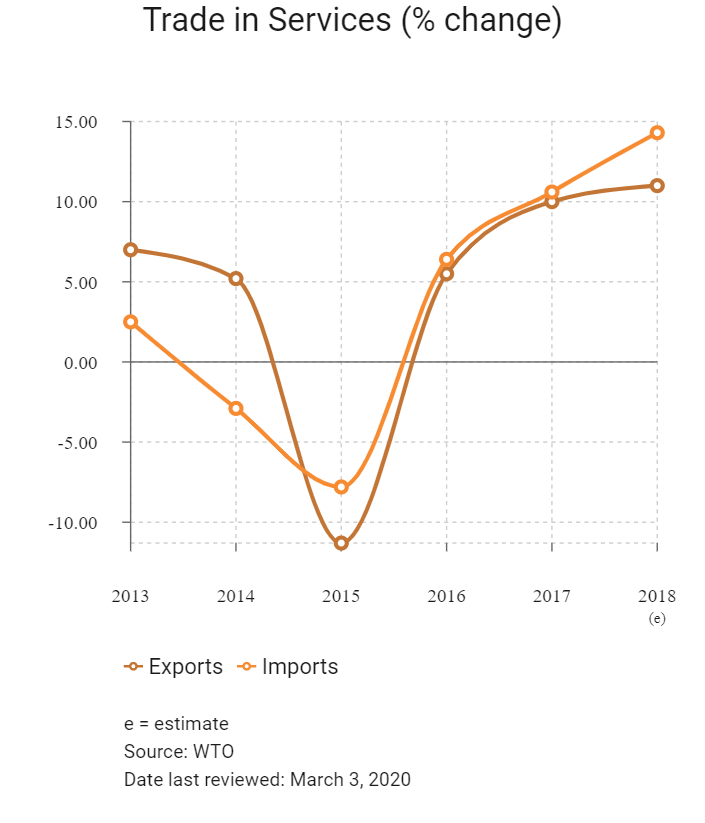

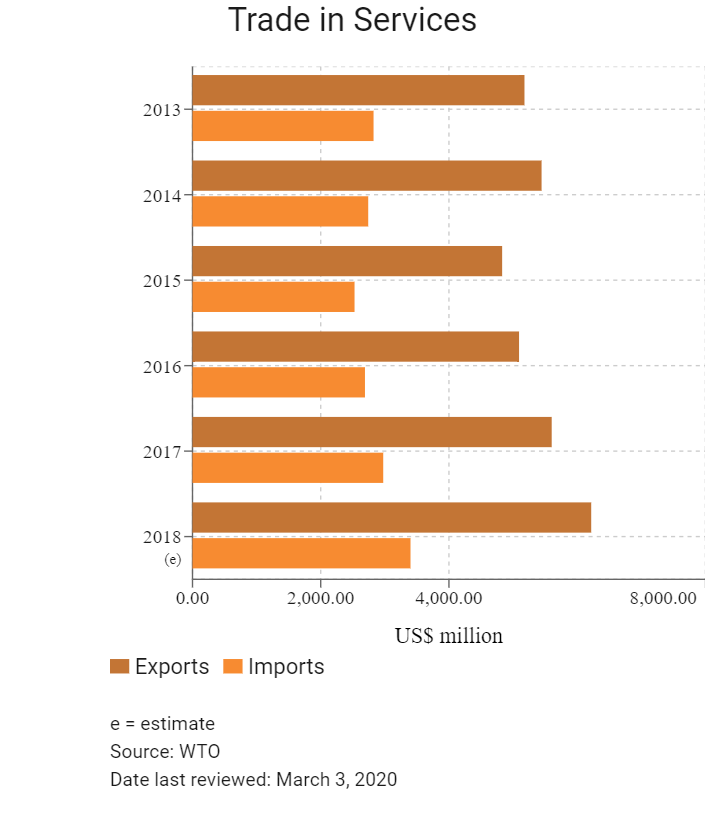

Trade in Services

- Latvia joined the World Trade Organization (WTO) on February 10, 1999, and on May 1, 2004, it joined the EU.

- As a member state of the EU, Latvia incorporates EU regulatory norms. As a eurozone member, Latvia adopted the euro as its legal tender from January 1, 2014.

- As a member state of the EU, Latvia has a common set of tariffs and customs levied on various imports and exports. The trade policy is largely identical to that of the wider regional bloc. The EU updated its trade policy (and, by extension, its import tariffs, customs, duties and procedures) in 2017 and 2018. Once goods are cleared by customs authorities upon entry into any EU member state, these imported goods can move freely among EU member states without any additional customs procedures.

- The EU has an overall simple tariff of 5.1%. The duties for non-European countries are also relatively low, especially for manufactured goods (4.2% on average). However, textile, clothing items (high duties and quota system) and food-processing industry sectors (average duties of 17.3% and numerous tariff quotas) still see protective measures.

- In 2018 the EU modernised its trade defence instruments, with a view to shielding EU producers from damage caused by unfair competition. Anti-dumping and anti-subsidy regulations have been amended to better respond to unfair trade practices and to furnish Europe's trade defence instruments with more transparency, quicker procedures and more-effective enforcement. In exceptional cases, such as in the presence of distortions in the cost of raw materials, the EU will be able to impose higher duties through the limited suspension of the lesser-duty rule.

- Nine types of goods imported into the EU are subject to licensing. These goods are (broadly) textiles, various agricultural products, iron and steel products, ozone-depleting substances, rough diamonds, waste shipment, harvested timber, endangered species and drug precursors. Currently, no quotas are imposed on textiles and clothing exports or non-textile product exports from Hong Kong and Mainland China.

- The European Commission (EC) has introduced an import licensing regime for certain iron, steel and aluminium products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- In order to protect domestic industries, a number of products from Mainland China are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards and solar glass, which are of interest to Hong Kong exporters. For example, in November 2016 the EC imposed a provisional anti-dumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5% and 81.1% of the net, free-at-union-frontier price before duty, depending on the company. By way of comparison, the rate of duty for similar goods from Belarus is 12.5% of the net, free-at-union-frontier price before duty. As of February 2020, the EU did not apply any anti-dumping measures on imports originating from Hong Kong. In October 2019, following an appeal heard by the General Court of the EU, a judgement was issued that annuls the anti-dumping duties imposed on imports of solar glass from Mainland China.

- In March 2016, the EC imposed a definitive countervailing duty (8.7% or 9%) on imports consisting largely of textiles products originating in India.

- A multitude of issues persists with regard to the respect for intellectual property rights in Mainland China, which means many Latvian manufacturing and retail businesses face additional risks when importing finished or intermediate goods from this trading partner.

- To combat the spread of the Asian long-horned beetle, in July 1999 the EU introduced emergency controls on wooden packaging material originating in Mainland China. Wood covered by the measures must be stripped of its bark and free of insect bore holes greater than 3mm across or have been kiln-dried to below 20% moisture content.

- For health reasons, the EU has adopted a directive on the control of the use of nickel in objects intended to be in contact with the skin, such as watches and jewellery. The EU has also adopted a directive to ban the use of some phthalates in certain PVC toys and childcare articles on a permanent basis, which came into effect from January 16, 2007. In addition, the EU has adopted a directive to prohibit the trading of clothing, footwear and other textile and leather articles that contain azo-dyes, from which aromatic amines may be derived.

- In the second quarter of 2015, the EC issued regulations on trade restrictions with Turkey regarding cattle, beef, watermelons and prepared tomatoes to protect domestic agriculture and regional farming businesses.

- On January 1, 2017, the EU imposed additional import duties on certain fruit and vegetables if the quantity of the goods exceeded the trigger volume level within the specified application period. On November 15, 2017, the EC allocated a total value of EUR62 million (USD74.4 million) for funding promotional campaigns of EU agricultural products implemented in the internal market for 2018. The budget consists of various promotional topics of EU goods in the internal market with an additional focus on the promotion of fruit, vegetables and sheep or goat meat.

- The EU has adopted a number of directives for environmental protection, which may have an impact on the sale of a wide range of consumer goods and consumer electronics. Notable examples include the directive on Waste Electrical and Electronic Equipment (WEEE) implemented in August 2005, and the directive on Restriction of Hazardous Substances (RoHS) implemented in July 2006. A recast WEEE directive entered into force in August 2012 as a result of which member states must adhere to higher collection/recycling targets (a 45% collection rate as of 2016 and 65% from 2019). The directive is also wider in scope, covering all electric and electronic equipment, while establishing producer responsibility as a means of encouraging greener product designs. The recast RoHS directive was published on July 1, 2011, and entered into force on January 2, 2013. The new directive continues to prohibit electrical and electronic equipment that contains the same six dangerous substances as listed in the original RoHS directive. Since July 22, 2019, the new directive has widened the scope of the previous directive by including any electrical and electronic equipment that will have fallen out of the old RoHS directive's scope, with only limited exceptions. Following those recast directives, the EU's new framework directive for setting eco-design requirements for energy-related products (ErP) is now in place. The ErP Directive is no longer limited to electrical and electronic equipment (as it was under its predecessor, the energy-using product or EuP Directive), but potentially covers any product that is related to the use of energy, including shower heads and other bathroom fittings, as well as insulation and construction materials.

- REACH, an EU regulation which stands for Registration, Evaluation, Authorisation and Restriction of Chemicals, entered into force in June 2007. It requires EU manufacturers and importers of chemical substances to gather comprehensive information on the properties of these substances produced or imported in volumes of one tonne or more per year, and to register such substances prior to manufacturing in or importing into the EU.

- The EU has the largest web of preferential trade agreements in the world, being party to some 70 free trade agreements (FTAs) spanning five continents, and, consequently, access to other markets of the countries concerned is currently mediated through those agreements. The EU's scheme on generalised system of preferences (GSP) entered into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row. As a result, the number of countries that enjoy preferential access to EU markets was reduced from 176 to less than 80. While Mainland China remains a beneficiary, many of its exports – such as toys, electrical equipment, footwear, textiles, wooden articles and watches and clocks – have already been graduated from the preferential treatment. Regarding Hong Kong, the territory has been fully excluded from the EU's GSP scheme since May 1, 1998.

- With talks between the EU and the United States a Transatlantic Trade and Investment Partnership having been suspended at the end of 2016, in April 2019 the EU and United States' chemical industries proposed an enhanced aligned approach that could serve as a global blueprint for regulatory cooperation to reduce barriers and increase trade in the chemicals sector.

Sources: WTO – Trade Policy Review, European Commission, Fitch Solutions

Major Multinternational Trade Agreements

Active

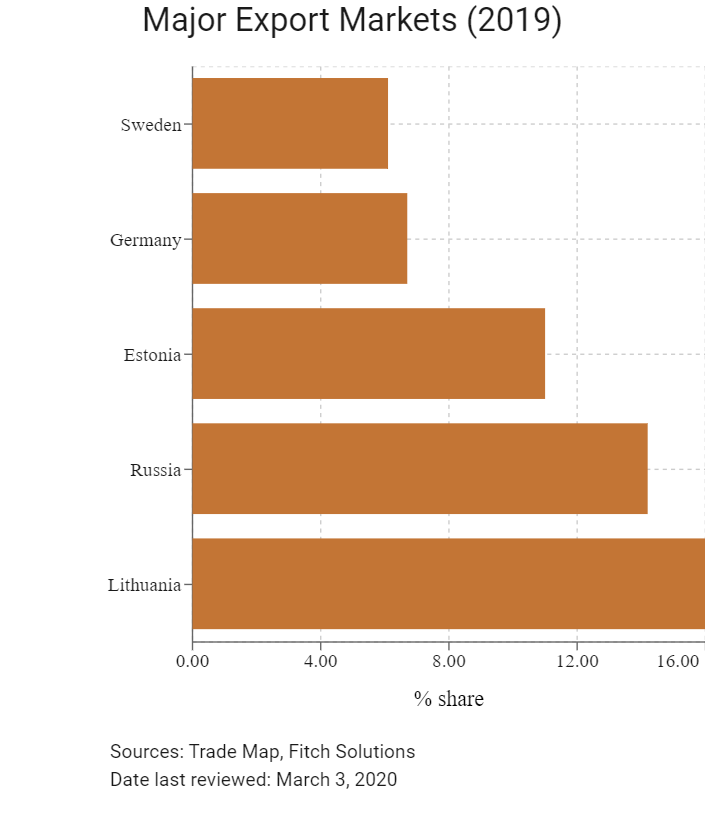

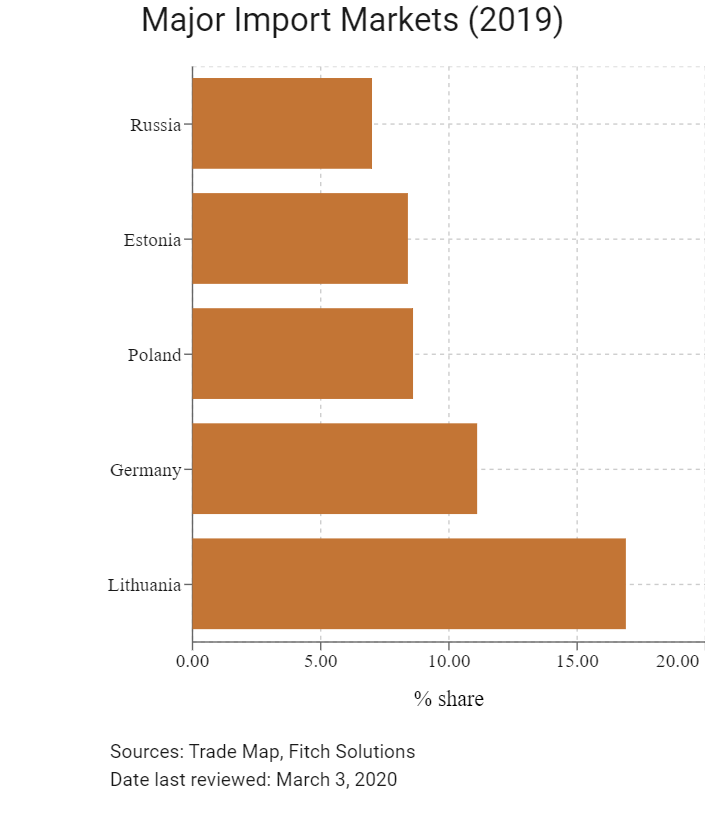

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely: Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden. Because Latvia's main trade partners are in the EU, accounting for more than two-thirds of exports and imports, the absence of customs charges with member countries greatly enhances its trade volumes.

- European Economic Area (EEA)–European Free Trade Association: This economic integration agreement entered into force on January 1, 1994. The agreement unites the EU member states, the three non-EU member states of the EEA (Iceland, Liechtenstein, Norway) that are also members of EFTA and Switzerland, which is a member of EFTA but not of the EU or EEA, into an internal market governed by the same basic rules. These rules aim to enable goods, services, capital and persons to move freely about the signatory countries in an open and competitive environment, a concept referred to as the four freedoms. Although the agreement enhances trade flows between the EFTA countries and the EU, only Switzerland is a fairly major trading partner.

- EU–Japan Economic Partnership Agreement (EPA): The agreement entered into force on February 1, 2019, creating the largest open trade zone in the world. The EU and Japan trade deal promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU–Japan EPA creates a trade zone covering 600 million people and nearly one-third of global GDP. The result of four years of negotiation, the EPA was finalised in late-2017 and was signed in July 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products, and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second-largest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments and electrical machinery.

- EU–Turkey Customs Union: The EU and Turkey are linked by a Customs Union agreement, which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999, and is a member of the Euro-Mediterranean partnership. The Customs Union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. Turkey is the EU's fourth-largest export market and fifth-largest provider of imports. The EU is by far Turkey's number one import and export partner. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the Customs Union agreement covers all industrial goods, but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural as well as coal and steel products. In December 2016, the EC proposed the modernisation of the Customs Union and to further extend the bilateral trade relations to other areas, such as services, public procurement and sustainable development.

- EU–Canada Comprehensive Economic and Trade Agreement (CETA): CETA is expected to strengthen trade ties between the two regions, having provisionally entered into force on September 21, 2017. Some 98% of trade between Canada and the EU is duty-free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU–Southern African Development Community (SADC) Economic Partnership Agreement (EPA): An agreement between the EU and and a group of SADC countries (Botswana, Eswatini, Lesotho, Mozambique, Namibia and South Africa) was signed on June 10, 2016, with Angola having an option to join the agreement in the future. The agreement provisionally entered into force for most countries on October 10, 2016, but only became fully operational after Mozambique began applying the EPA in February 2018. Nine of the remaining members of SADC not included in the deal (Comoros, the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, the Seychelles, Tanzania, Zambia and Zimbabwe) have or are seeking economic partnership agreements with the EU as part of other regional trading blocs – such as with East, Central or Southern African communities.

Ratification Pending

- EU–Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama): An agreement between the parties was reached in 2012 and is awaiting ratification (31 of the 33 parties have ratified the agreement as of February 2020). The agreement has been provisionally applied since 2013.

- EU–Mercosur Trade Agreement: An agreement between the parties was reached on June 28, 2019. The agreement means the EU is the first major partner to make a trade pact with the Mercosur bloc, which comprises Argentina, Brazil, Paraguay and Uruguay. The agreement will cover a population of 780 million and gives EU-based companies easier entry into a market with an enormous economic potential, saving them EUR4 billion in duties annually. Currently, EU–Mercosur trade in goods amounts to approximately EUR87 billion, but this is down from EUR100 billion just a few years ago, with Mainland China having outpaced the EU as Mercosur's first trading partner. The EU is the biggest foreign investor in Mercosur, with stock of EUR381 billion, while Mercosur's investment stock in the EU is worth EUR52 billion. The agreement contains specific commitments on labour rights and environmental protection, including the implementation of the Paris climate agreement and related enforcement rules. The EU will not fully open its market for imports of agri-food products, although beef, poultry and honey imports from the Mercosur countries will be permitted to increase over a five-year phasing in period.

- EU–Vietnam FTA and Investment Protection Agreement (IPA): On June 30, 2019, the EU and Vietnam signed the final texts for the EU–Vietnam FTA and the EU–Vietnam IPA. As of February 2020, the FTA and IPA await approval by the European Parliament and national parliaments before being concluded. Once in force, the agreements will provide opportunities to increase trade and support jobs and growth on both sides by eliminating 99% of all tariffs, reducing regulatory barriers and overlapping 'red tape', ensuring protection of geographical indications, opening up services and public procurement markets, and establishing the means to ensure the agreed rules are enforceable.

- EU–Singapore FTA (USFTA): On February 13, 2019, the European Parliament passed the agreement, signed earlier on October 19, 2018, which would see the creation of the EUSFTA. The agreement provisionally entered into force on November 21, 2019, but before the investment protection agreement is implemented, all the states involved need to ratify the agreement through their individual legislatures (Latvia did so on October 7, 2019).

Under Negotiation

- EU–Australia FTA: The EU, Australia's second-largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR66 billion in 2018, and bilateral trade in services added an additional EUR32 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or other trade agreements with Australia. The Council of the EU authorised the opening of negotiations for a trade agreement between the EU and Australia on May 22, 2018, and on June 18, 2018, negotiations were formally launched. The fifth negotiation took place in October 2019.

- EU–United States (Transatlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the Trump administration in the United States against the backdrop of rising global trade tensions.

- EU–Indonesia FTA: Negotiations were launched in July 2016 and in December 2019 the ninth round took place. The objective of the FTA is to facilitate trade and investments and address various issues, such as tariffs, non-tariff barriers to trade, the production of palm oil, trade in services and investment, trade aspects of public procurement, competition rules and intellectual property rights, as well as sustainable development.

Sources: WTO Regional Trade Agreements database, Australia Department of Foreign Affairs and Trade, Fitch Solutions, The Baltic Times

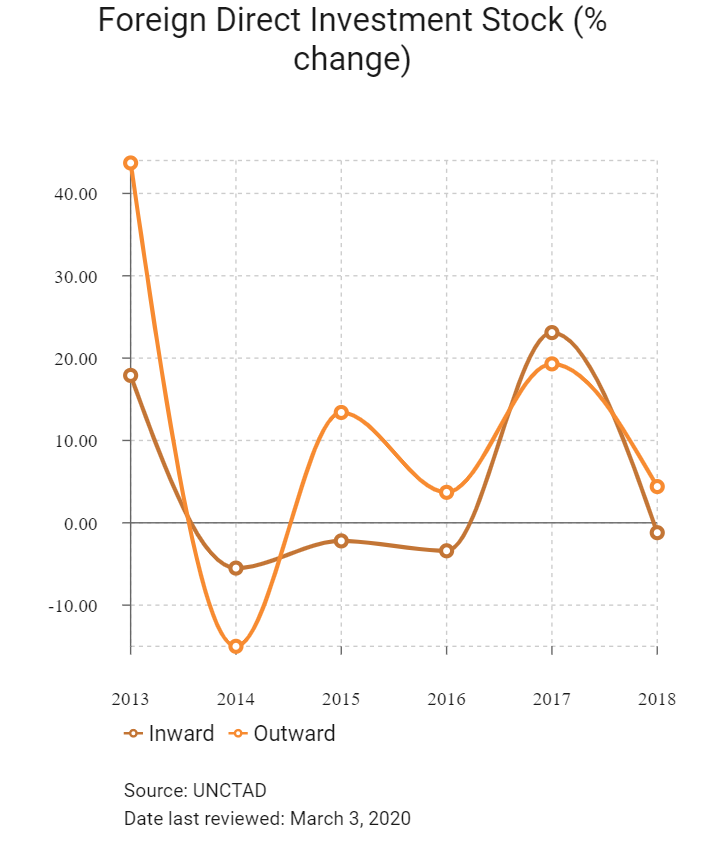

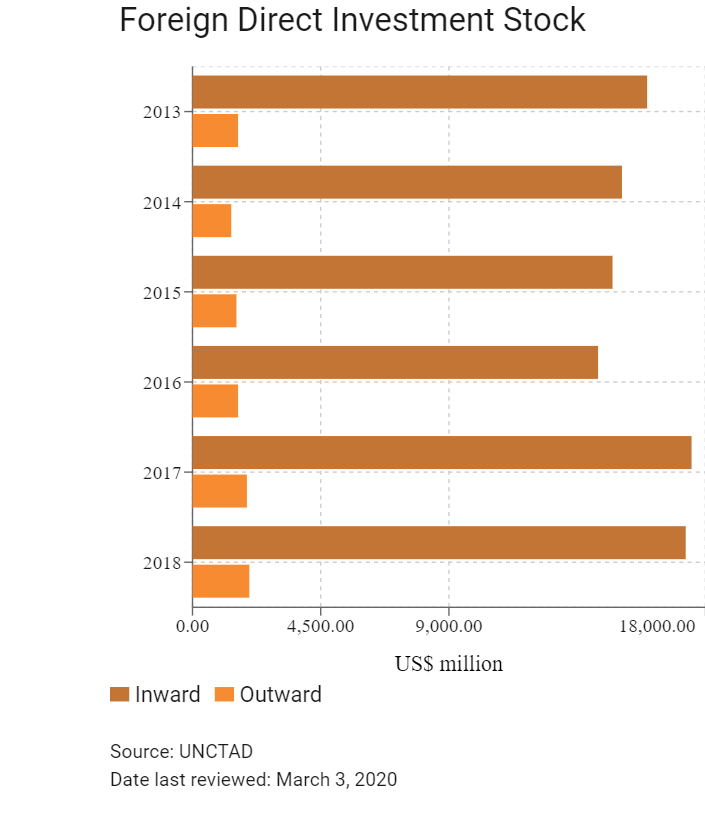

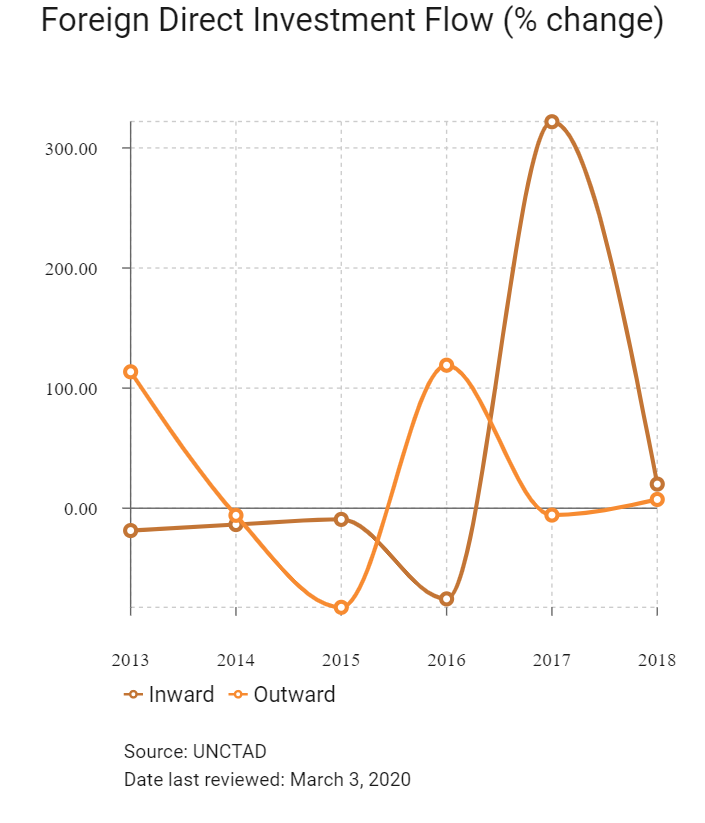

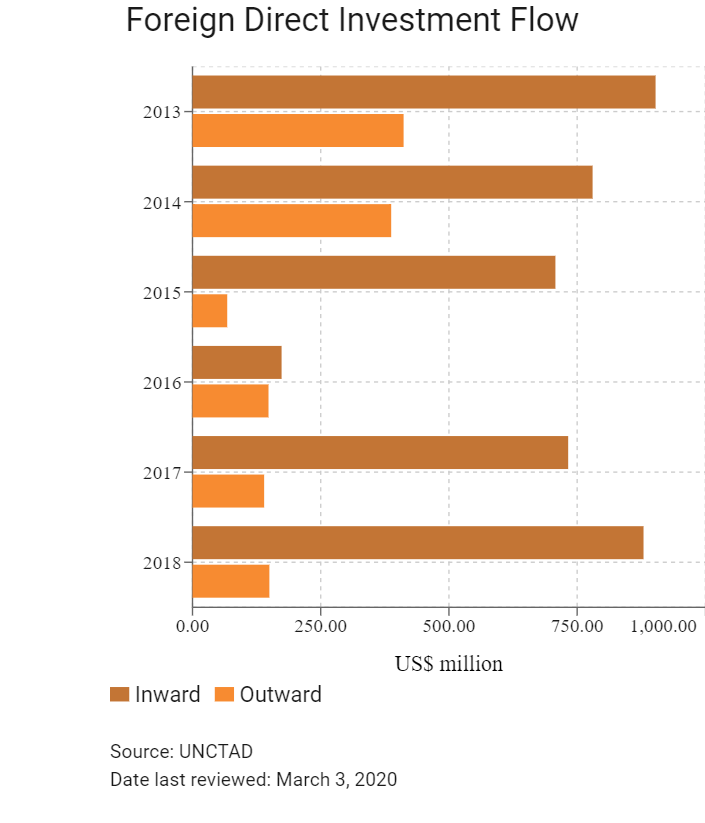

Foreign Direct Investment

Foreign Direct Investment Policy

- The Investment and Development Agency of Latvia (LIAA) aims to promote business development by facilitating foreign investment. LIAA supports companies in Latvia trading internationally as well as overseas businesses seeking partners or locations in Latvia. A business can be registered in Latvia in a single day.

- The Latvian government actively encourages foreign direct investment (FDI) and works with investors to improve the country's business climate. To strengthen these efforts, LIAA introduced the POLARIS process: a mechanism designed to create an alliance between the public sector (including national and local governments), the private sector (including national and international companies) and major Latvian academic and research institutions to encourage FDI and spur economic growth.

- The commercial environment is generally friendly to foreign companies and EU directives are implemented and observed. The Latvian government has adopted modern laws establishing copyrights, patents and trademarks, and the means of enforcing their protection. In 2012, the government adopted a number of favourable rules on the taxation of interest, dividends and intellectual property, thus fostering the holding company regime in Latvia.

- The Latvian government meets annually with the Foreign Investors Council in Latvia, which represents large foreign companies and chambers of commerce, with the express purpose of improving the business environment and encouraging foreign investment.

- Latvia has identified eight sectors where it sees promising opportunities for foreign investments:

- Forestry and woodworking

- Metalworking, machinery and electronics

- Transportation and logistics

- Food processing

- Information Technology

- Healthcare services

- Eco-technology

- Life sciences

- Latvia reserves the right to enact policies and legislation that discriminate against foreign investors in the following areas:

- Control of defence industries

- Manufacturing and sale of narcotics, weapons and explosives

- Control of newspaper, television and radio broadcasting stations, or news agencies

- Recovery of all renewable and non-renewable natural resources including resources found on the continental shelf

- Fishing

- Hunting

- Air transportation services and port management

- Ownership and control of land

- Brokerage or real property, gambling and lotteries

- Private security and surveillance services

- Auditing services

- The cross-border provision of banking and financial services

- The cross-border provision of insurance and private pension services

- In March 2017, Latvia passed new legislation that, on the basis of national security concerns, requires governmental approval prior to transfers of significant ownership interests in the energy, telecommunications and media sectors.

- With these limited exceptions, physical and legal persons who are citizens of Latvia or of other EU countries may freely purchase property. In general, physical and legal persons who are citizens of non-EU countries ('third-country nationals') may also freely purchase developed property. However, third-country nationals may not directly purchase certain types of agricultural, forest and undeveloped land.

- As an EU member, Latvia maintains liberal policies in order to attract investment and export-oriented companies. Creating favourable conditions for foreign direct investment and openness to foreign trade is an essential part of the country's economic strategy.

- Investments in Latvia by other EU member states are governed by the provisions of the Treaty of Rome and by EU law. Latvia has bilateral investment treaties (BITs) with 43 countries or economic blocs around the world: Armenia, Austria, Azerbaijan, Belarus, BLEU (the Belgium–Luxembourg Economic Union), Bulgaria, Canada, Mainland China, Croatia, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Israel, Kazakhstan, Kuwait, Kyrgyzstan, Lithuania, Moldova, the Netherlands, Norway, Poland, Portugal, Romania, Singapore, Slovakia, South Korea, Spain, Sweden, Switzerland, Ukraine, the United Kingdom, the United States of America, Uzbekistan and Vietnam.

- Latvia has treaties with investment provisions (TIPs) in force with 56 individual countries and economic blocs worldwide. A further 17 have been signed but are not yet in force.

- Latvia has concluded double taxation agreements with 62 states, including one with Mainland China that came into force on January 27, 1997 (amended May 19, 2012), and one with Hong Kong that came into force on November 24, 2017.

- Latvia is a member of the Organisation for Economic Co-operation and Development (OECD), the WTO and the United Nations Conference on Trade and Development.

Sources: WTO – Trade Policy Review, The International Trade Administration, US Department of State, UNCTAD, Inland Revenue Department of the Government of Hong Kong, Ministry of Finance Republic of Latvia, Investment and Development Agency of Latvia

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are five special economic zones (SEZs) in Latvia. Riga Free Port and Ventspils Free Port, Liepaja SEZ (a port city in western Latvia), Rezekne SEZ (a city in the middle of the eastern Latvian region that borders Russia) and Latgale SEZ covering much of the poorest region of Latvia, which borders Russia and Belarus |

- Somewhat different rules apply to each of the five zones

- CIT rebate for large-scale investment projects:

- To qualify for tax relief and other benefits, companies must receive permits and sign agreements with the appropriate authorities: the Riga and the Ventspils port authorities for the respective free ports, the Liepaja SEZ administration, the Rezekne SEZ administration or the Latgale SEZ administration - The SEZs are expected to be in place until 2035 |

|

Incentives for R&D |

- The Horizon 2020 programme offers a large variety of funding opportunities for research and innovation activities

- The Horizon 2020 programme encourages small and medium-sized enterprises to participate and has available EUR80 billion over seven years, with maximum funding of 70%–100% of total eligible project costs |

Sources: US Department of Commerce, Investment and Development Agency of Latvia, Fitch Solutions

Value Added Tax: 21%

Corporate Income Tax: 20%

Source: State Revenue Service

Important Updates to Taxation Information

- Due to the CIT reform, the approach to calculating CIT has changed fundamentally as of January 1, 2018. Under the new regime all undistributed corporate profits are exempt. This exemption covers both active and passive types of income. It also covers capital gains arising on the sale of all types of assets, including shares and securities, except for the sale of immovable property by non-residents.

- Amendments to the CIT Act that are applicable as of January 1, 2019 prescribe that a Latvian company owning a substantial share in a foreign company (owning more than 50% of a foreign company's shares directly or indirectly or being entitled to more than 50% of its profit) should pay CIT on profit in proportion to that share if the foreign company is a non-genuine (artificial) arrangement established to obtain CIT advantage and no substantial business is carried on by the CFC. If these criteria are met, then any profit made by a CFC that is based or incorporated in a tax haven will be taxable in Latvia from the first eurocent, while a CFC registered elsewhere will not attract CIT unless its profits reach EUR750,000 and/or passive income exceeds EUR75,000.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

20% |

|

Capital Gains Tax |

- Subject to the same fiscal treatment as CIT and taxed at 20%. |

|

Withholding Tax |

|

|

Social security contributions (all employers) |

35.09% (consisting of a contribution by the employer of 24.09% and a deduction of 11% from the employee). |

|

Value Added Tax/Goods and Services Tax (standard) |

- 21% |

|

Real Estate Tax |

- 3 % (An annual or quarterly tax rate of 1.5% of the cadastral value of land and buildings used for economic activity, and an additional 1.5% for uncultivated agricultural land). |

|

Branch Profit Tax |

20% |

|

Stamp duty |

2% |

|

Microbusiness Tax (MBT) |

15% , provided the microbusiness has shareholders who are individuals, does not exceed five employees and does not exceed EUR40,000 revenue in a calendar year (excess will attract 20% MBT). |

Sources: State Revenue Service, Ministry of Finance Republic of Latvia

Date last reviewed: March 3, 2020

Foreign Worker Permits

Non-EU citizens require a work permit in order to work within the country. EU citizens do not require a work permit, but their employer must inform the job office about their employment. Citizens of the EEA) – the EU member states, Iceland, Norway, Lichtenstein and Switzerland – do not require a visa to enter, reside and work in Latvia. In cases where no visa or residence permit is required, anyone staying more than 90 days must obtain a registration card from the Office of Citizenship and Migration Affairs. Different conditions and procedures might apply to those who have a Blue Card.

Employers may invite seasonal workers for a period of up to six months, having first registered a vacancy with the state Employment Agency and after 30 days going to the Office of Citizenship and Migration Affairs (OCMA) to submit an application with all the required documentation.

Sources: Government websites, Fitch Solutions

Blue Card

The Blue Card is intended for any stay associated with highly qualified employment. A foreigner holding a Blue Card may reside in the country and work in the job for which the Blue Card was issued, or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which has lasted for at least three years. Alternatively, a minimum of five years' relevant professional experience relating to the activity for which the work permit is being granted. The Blue Card is issued with a term of validity three months longer than the term for which the employment contract has been concluded, but for a maximum period of three years. The Blue Card can be extended. One of the conditions for issuing the Blue Card is a wage criterion – the employment contract must stipulate a gross monthly or yearly wage that is at least 1.5 times more than the gross average annual wage.

Localisation Policies

Under Latvian immigration law, if employers intend to employ a foreign national, they must register a job vacancy with the State Employment Agency (SEA) at least one month before applying to the SEA for approval of invitations for visas or sponsorship for residence permits. Foreign nationals must receive separate work permits if they will work for more than one employer or in several positions. Where the employment of foreign nationals relates to short-term stays in Latvia that do not exceed 90 days in a six-month period, work permits can be issued in accordance with the validity of visas.

Visa Requirements

Latvia is one of 26 countries in the Schengen Area, which means that there is one common visa and no border controls for all nationals of the EU, the EEA or a third country national holding a residence permit of a Schengen state. Latvia signed the Schengen agreement on April 16, 2003, and started its implementation on December 21, 2007. Other than EU passport holders, Latvia waivers visas for 67 other countries globally, including Hong Kong and Macao, but all non-EU/EEA/Swiss nationals who wish to stay for longer than 90 days in any 180-day period will need to apply for a long-term visa or residence permit. For citizens of Hong Kong and Macao, repeated entry into Schengen countries including Latvia is possible after a 90-day interval subsequent to leaving the Schengen area. Those entering Latvia should have a valid health insurance policy that guarantees the covering of expenses related to health care in Latvia, including repatriation in the case of a serious illness or death.

Sources: Ministry of Foreign Affairs of the Republic of Latvia, State Employment Agency, Office of Citizenship and Migration Affairs, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A3 (Stable) |

31/05/2019 |

|

Standard & Poor's |

A (Stable) |

21/02/2020 |

|

Fitch Ratings |

A- (Stable) |

11/10/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

19/190 |

19/190 |

19/190 |

|

Ease of Paying Taxes Index |

13/190 |

13/190 |

16/190 |

|

Logistics Performance Index |

70/160 |

N/A |

N/A |

|

Corruption Perception Index |

41/180 |

44/180 |

N/A |

|

IMD World Competitiveness |

40/63 |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

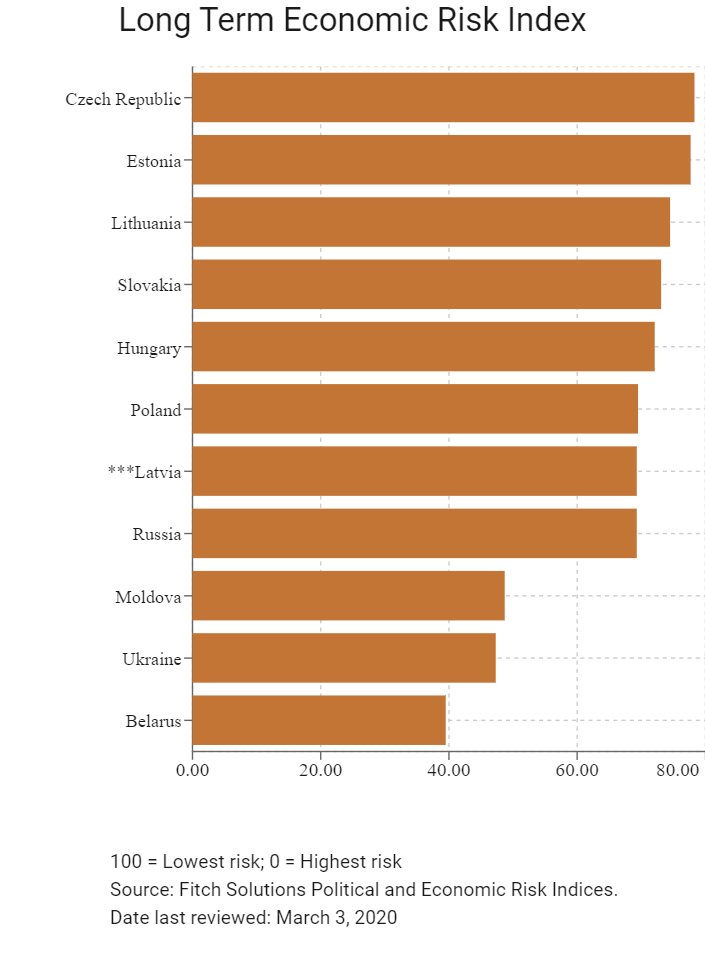

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

57/202 |

39/201 |

39/201 |

|

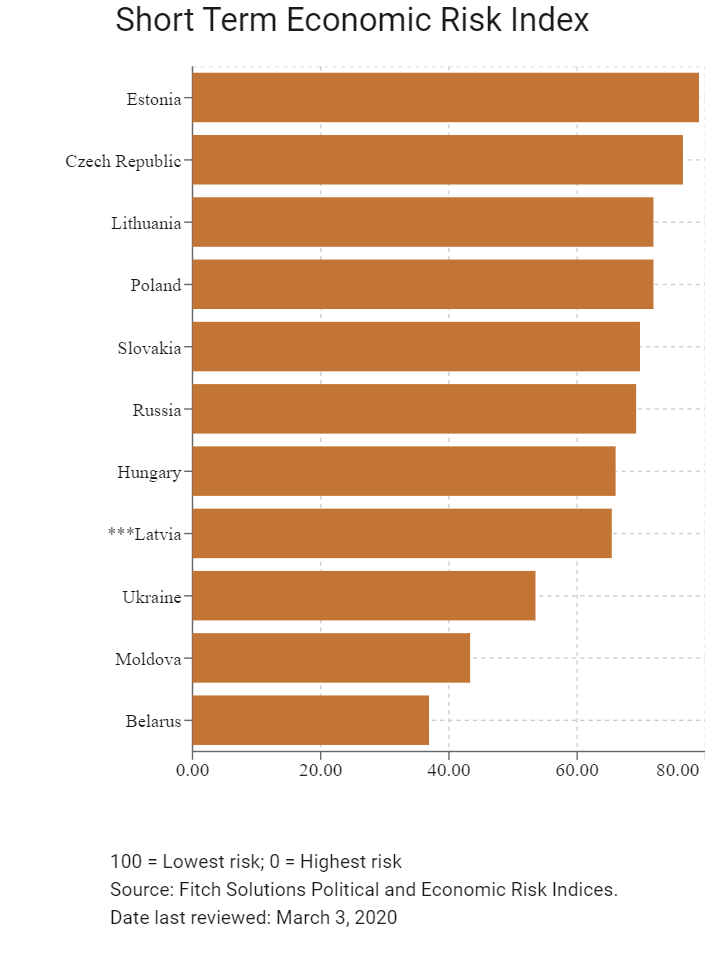

Short-Term Economic Risk Score |

71.0 |

67.1 |

65.4 |

|

Long-Term Economic Risk Score |

63.4 |

68.1 |

69.3 |

|

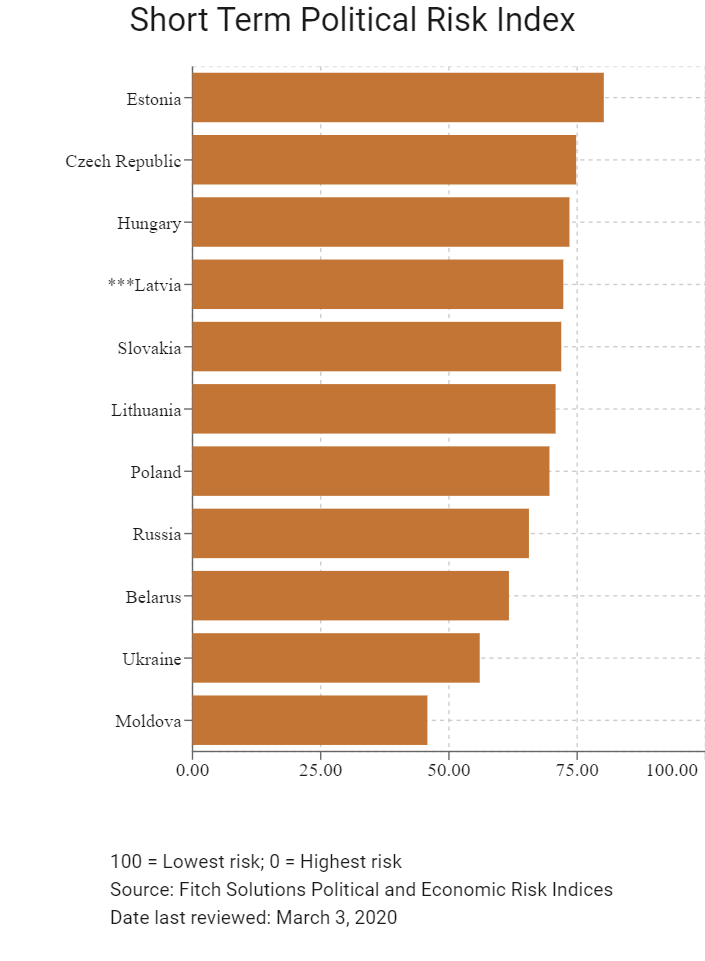

Political Risk Index Rank |

38/202 |

37/201 |

36/201 |

|

Short-Term Political Risk Score |

71.0 |

72.3 |

72.3 |

|

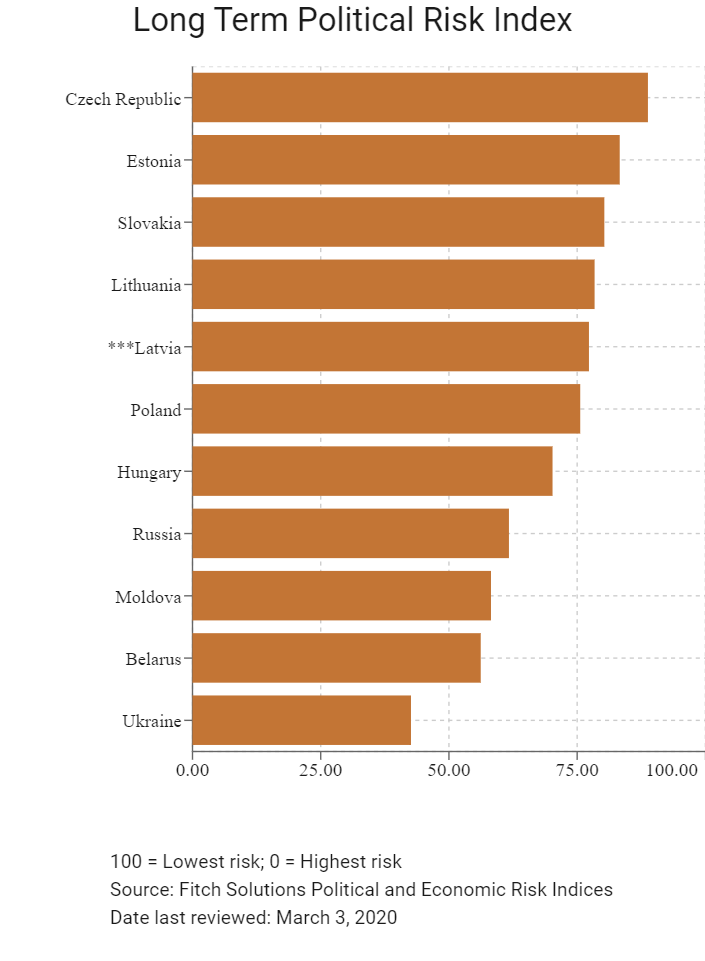

Long-Term Political Risk Score |

77.3 |

77.3 |

77.3 |

|

Operational Risk Index Rank |

36/201 |

36/201 |

35/201 |

|

Operational Risk Score |

66.00 |

66.10 |

66.8 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

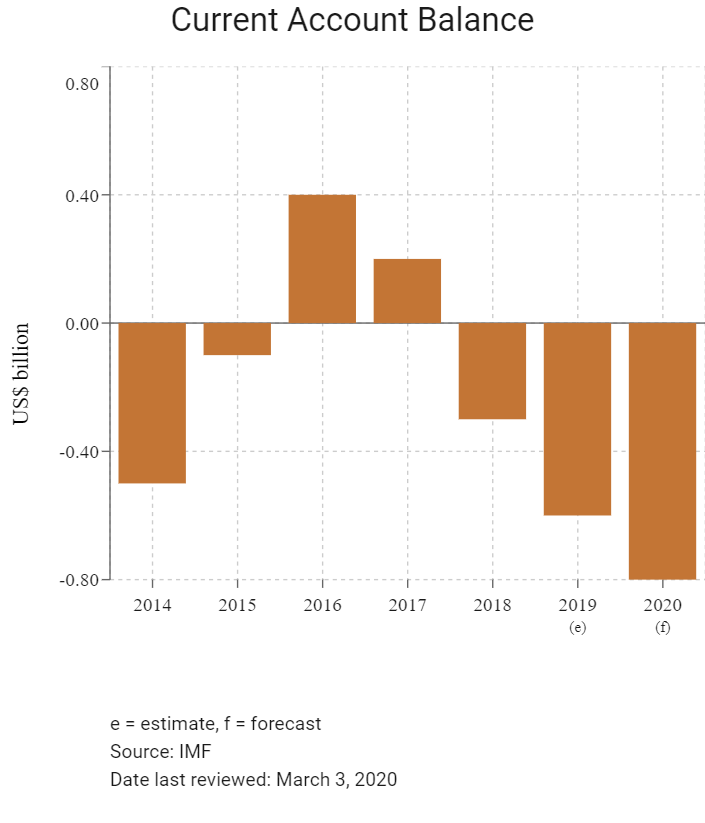

The main economic risk is the continued rise in the minimum wage rate, which threatens to undermine the country's external competitiveness. Additionally, an economic shock in the eurozone could undermine exports, which make up a large share of Latvia's GDP. The extent of deleveraging required in the domestic banking system, as well as the necessary adjustment to household balance sheets, will ensure that the transition towards strong growth and economic stability will remain a slow and challenging process. In the meantime, the banking sector is likely to remain weak, weighed down by the proliferation in non-performing loans in the aftermath of the credit bubble.

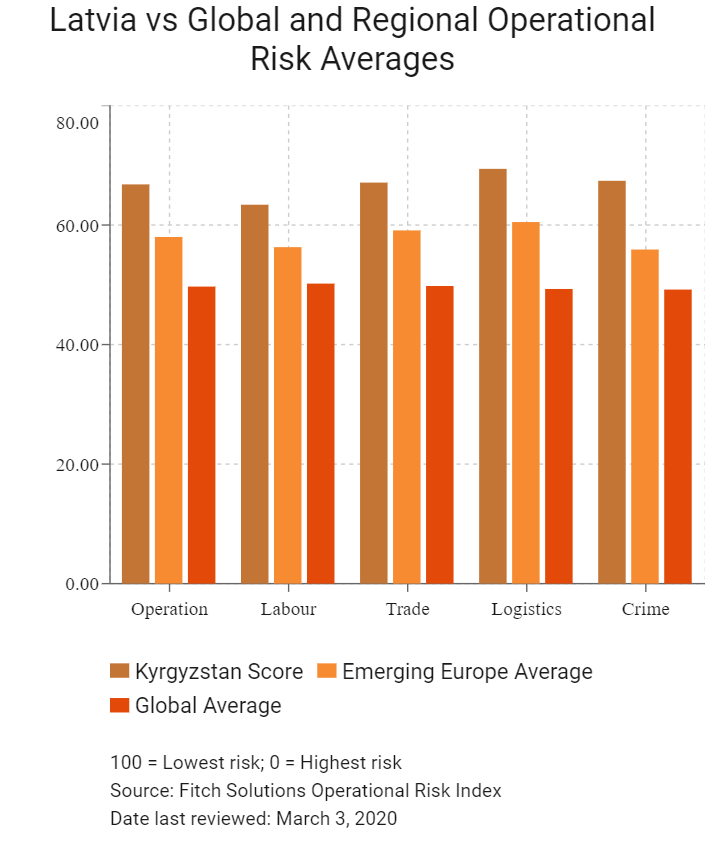

OPERATIONAL RISK

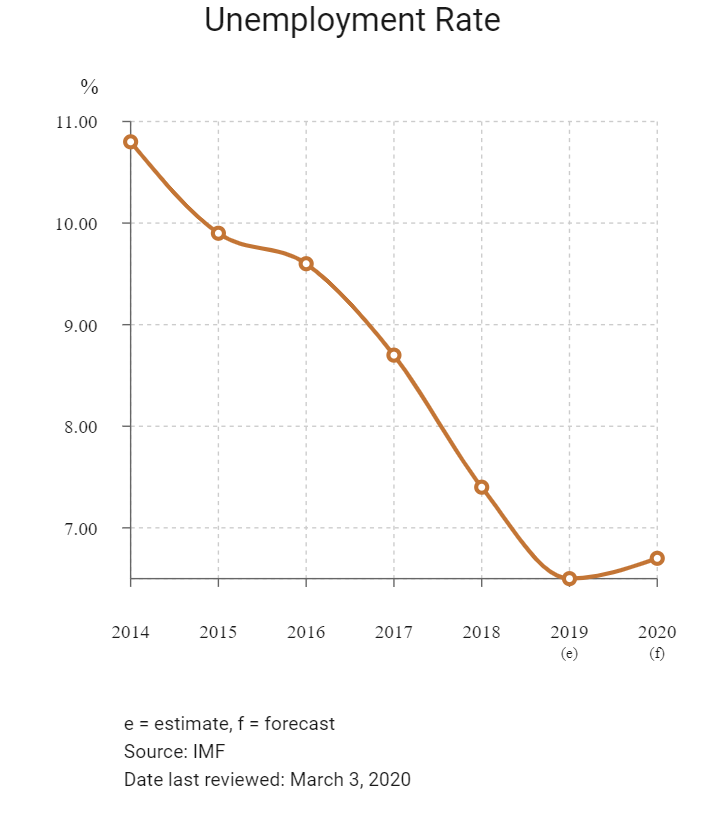

Latvia's geographical position, providing strategic access to the EU and Russia and Central Asia to the east means that the country has the potential to act as a regional hub for a wide range of service-based industries. The commercial environment is generally friendly to foreign companies and EU directives are implemented and observed. Sustained private consumption growth fuelled by an improving labour market and a solid increase in fixed investment, coupled with a more-effective absorption of EU structural funds, bode well for the country's long-term outlook. However, the government is under increasing pressure to cut back on social expenditure and, to prevent an escalation in the fiscal deficit, public investment in Latvia's infrastructure will likely suffer over the medium term. The telecommunication and electricity services are modern, and the real estate market provides modern housing and business premises. The legal system, tax structures and trade and other regulations have been significantly modified to meet EU standards because most EU directives have been transposed into Latvia's national legislation. However, the country suffers from among the worst population projections in the Europe, Middle East and Africa region, with low birth rates compounded by high levels of emigration, primarily from the young, working age segment of the population seeking better-paid employment abroad, which will leave an ageing population that will place the social security system under great strain over time.

Source: Fitch Solutions

Date last reviewed: March 2, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Latvia Score |

66.8 |

63.4 |

67.1 |

69.4 |

67.4 |

|

Central and Eastern Europe Average |

62.7 |

58.5 |

63.5 |

67.5 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

5 |

2 |

5 |

6 |

6 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe position (out of 31) |

6 |

4 |

6 |

8 |

9 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

35 |

26 |

38 |

39 |

43 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

71.2 |

63.1 |

76.3 |

71.0 |

74.3 |

|

Czech Republic |

69.6 |

60.6 |

67.8 |

73.6 |

76.5 |

|

Lithuania |

69.5 |

61.2 |

71.4 |

74.3 |

71.0 |

|

Poland |

69.2 |

59.2 |

69.3 |

75.5 |

72.8 |

|

Latvia |

66.8 |

63.4 |

67.1 |

69.4 |

67.4 |

|

Slovakia |

63.8 |

52.1 |

66.5 |

66.8 |

69.6 |

|

Hungary |

63.5 |

55.7 |

62.0 |

70.1 |

66.3 |

|

Belarus |

59.1 |

60.1 |

58.6 |

66.6 |

51.3 |

|

Russia |

58.3 |

65.9 |

58.6 |

67.9 |

40.6 |

|

Moldova |

49.8 |

44.7 |

51.7 |

53.4 |

49.3 |

|

Ukraine |

48.7 |

57.9 |

49.0 |

54.4 |

33.6 |

|

Regional Averages |

62.7 |

58.5 |

63.5 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 3, 2020

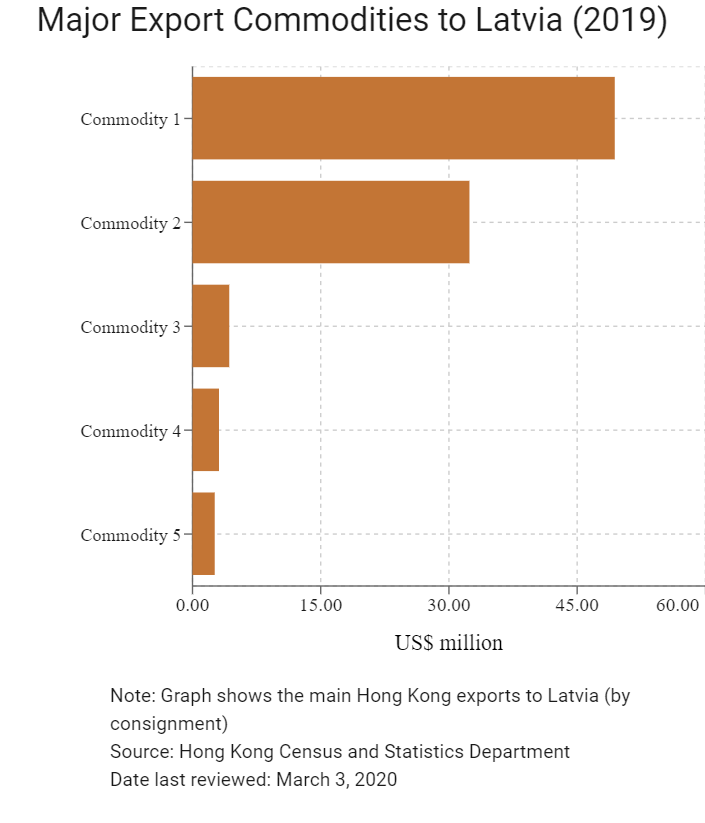

Hong Kong’s Trade with Latvia

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

49.4 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

32.4 |

|

Commodity 3 |

Miscellaneous manufactured articles |

4.3 |

|

Commodity 4 |

Office machines and automatic data processing machines |

3.1 |

|

Commodity 5 |

Road vehicles (including air-cushion vehicles) |

2.6 |

|

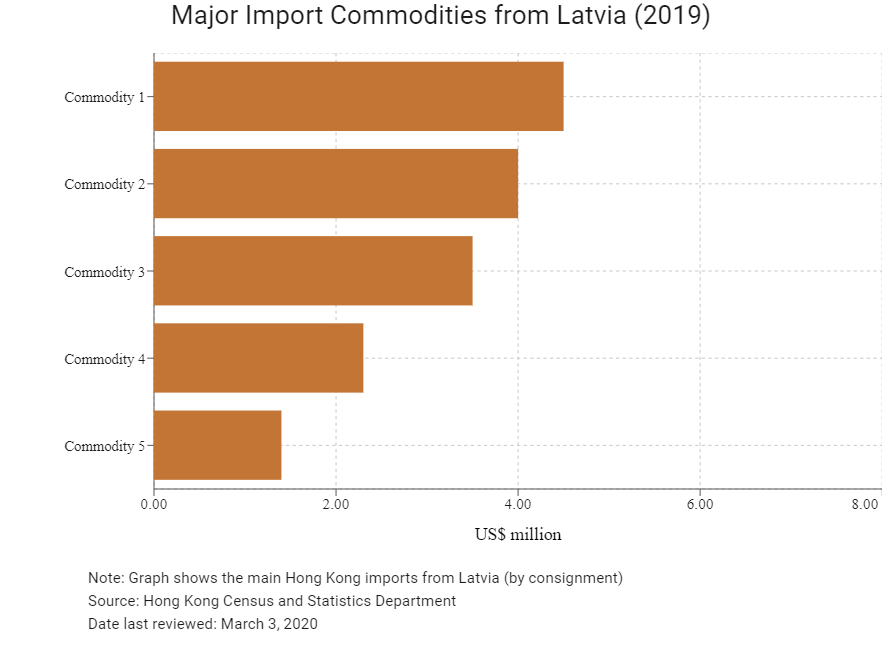

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances and electrical parts thereof |

4.5 |

|

Commodity 2 |

Telecommunications and sound recording and reproducing apparatus and equipment |

4.0 |

|

Commodity 3 |

Photographic apparatus, equipment and supplies and optical goods, watches and clocks |

3.5 |

|

Commodity 4 |

Office machines and automatic data processing machines |

2.3 |

|

Commodity 5 |

Road vehicles (including air-cushion vehicles) |

1.4 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

Source: Hong Kong Trade Statistics, Hong Kong Census and Statistics Department

|

2019 |

Growth rate (%) |

|

|

Number of Latvian residents visiting Hong Kong |

2,725 |

-8.9 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of emerging Europe citizens residing in Hong Kong |

114 |

29.6 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: March 3, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Latvian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Trade Statistics, Census & Statistics Department

Treaties and Agreements between Hong Kong, Mainland China and Latvia

- Latvia does not have a BIT with Hong Kong but does have one with Mainland China that entered into force on February 1, 2006. The agreement concerns the encouragement and reciprocal protection of investment and is intended to create favourable conditions for investors from both countries.

- The double taxation agreement (DTA) between Mainland China and Latvia was signed on June 7, 1996 and entered into force in both countries on January 27, 1997.

- Latvia has a DTA with Hong Kong that entered into force on November 24, 2017.

Sources: Hong Kong Department of Justice, Fitch Solutions, UNCTAD

Latvian Consulate in Hong Kong

Baltic Hong Kong Trade Association (Latvia)

Email: lukaboss@gmail.com

Tel: (371) 2707 8731

Website: www.facebook.com/BHKTA/

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Latvian Consulate in Hong Kong

Address: 22/F Lyndhurst Tower, No.1 Lyndhurst Terrace, Central, Hong Kong

Email: sk@violethillpartners.com

Tel: (852) 2877 5638

Fax: (852) 2281 6708

Sources: Embassy of the Republic of Latvia in Hong Kong, Ministry of Foreign Affairs of the Republic of Latvia

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa for Latvia for a period of up to 90 days.

Source: Hong Kong Immigration Department

Date last reviewed: March 3, 2020

Latvia

Latvia