GDP (US$ Billion)

2,075.86 (2018)

World Ranking 8/193

GDP Per Capita (US$)

34,321 (2018)

World Ranking 27/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

60.1 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

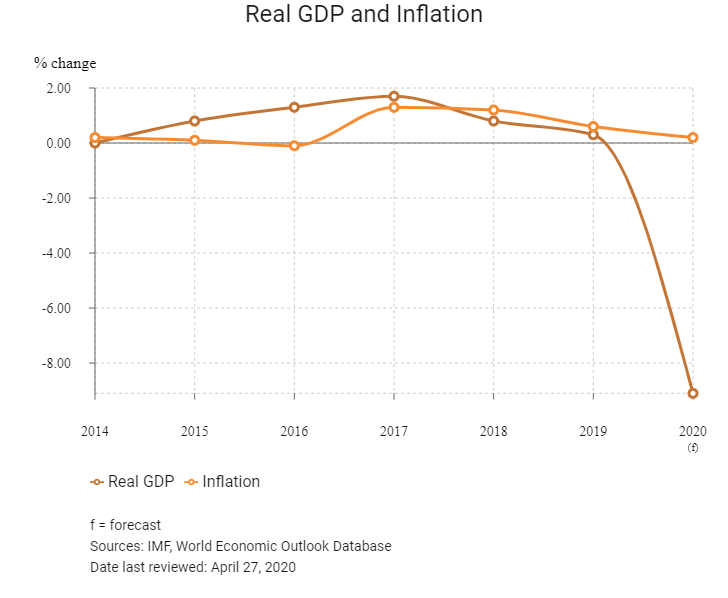

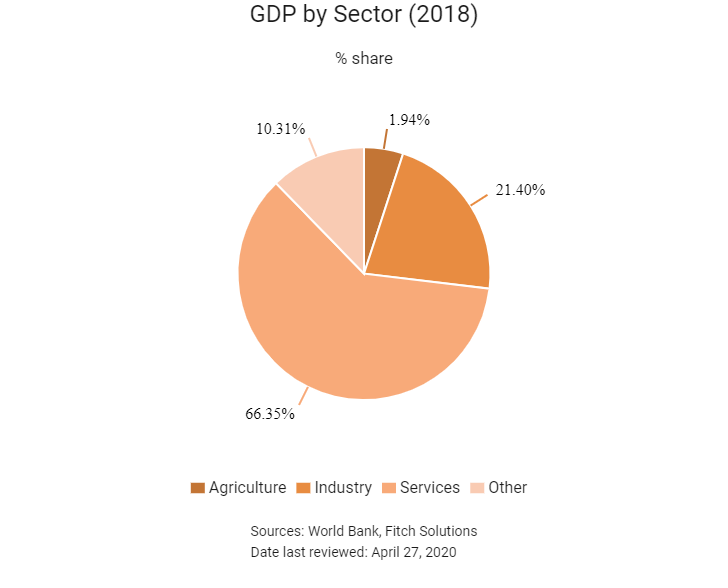

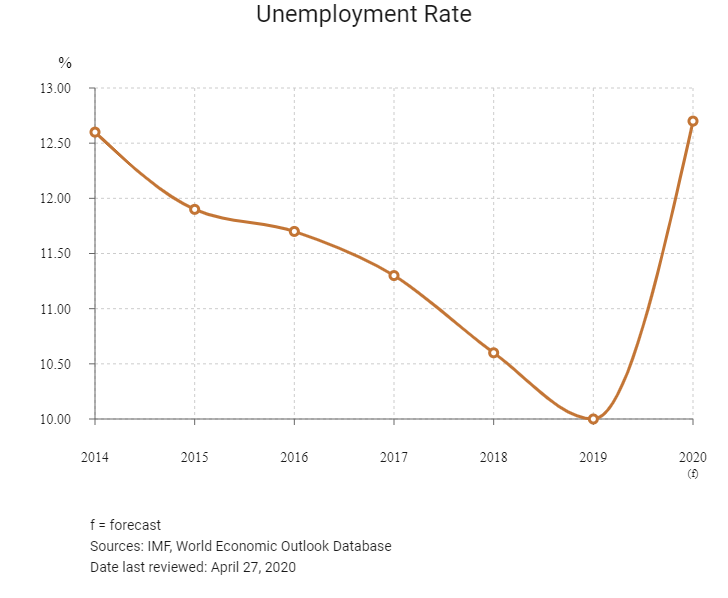

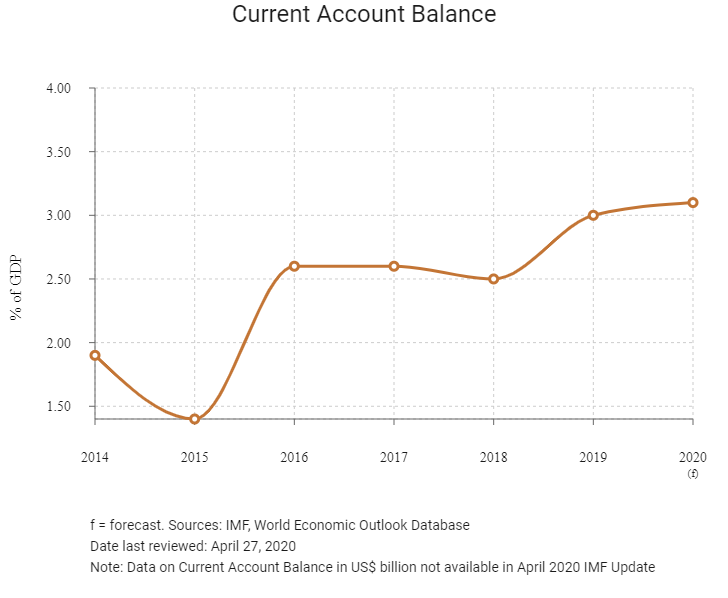

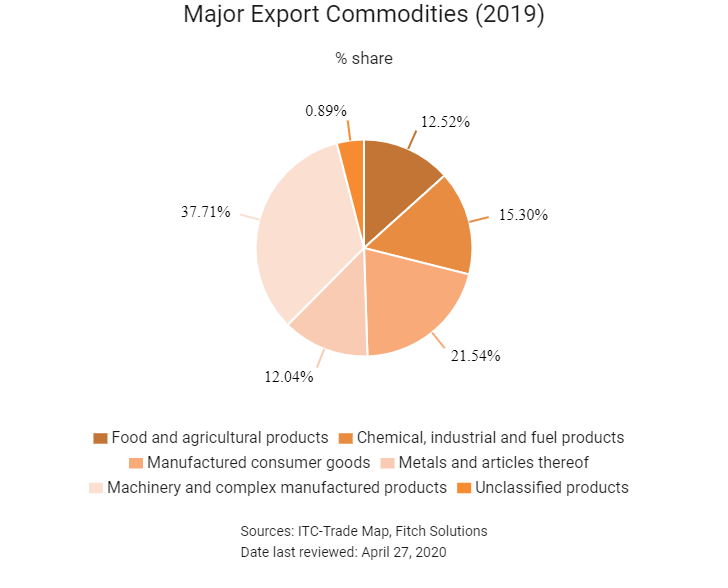

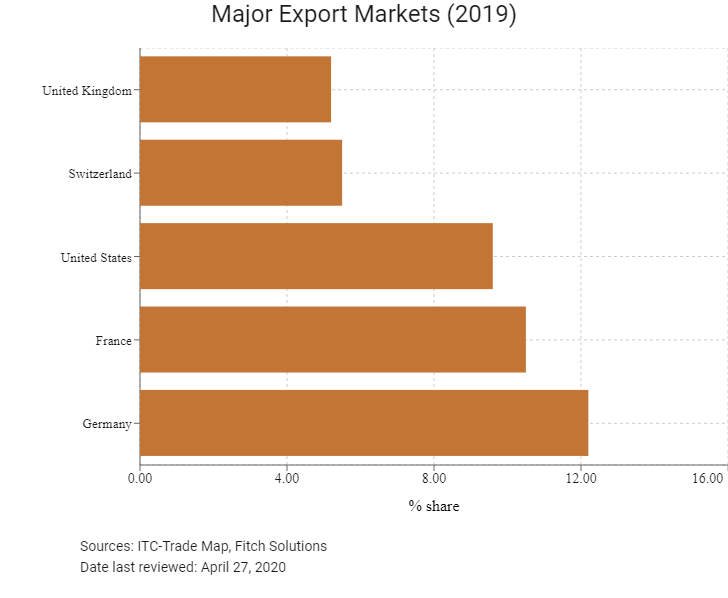

Italy's economy, which ranks among the top 10 largest in the world, is largely diversified and dominated by small- and medium-sized firms which comprise 99% of Italian businesses. Economic growth has been driven by exports, tourism, private consumption and investment. However, the economy's exporting sector, which has been shifting towards higher value-added products, has underperformed compared with its eurozone competitors, and this is expected to continue owing to long-standing competitiveness issues and Italy's rigid labour market. Government policies, such as the Industry 4.0 programme, and labour market and education reforms, have begun to address these problems. Italy's relatively affluent domestic market, access to the European Common Market, proximity to emerging economies in the Middle East and North Africa, and assorted centres of excellence in scientific and information technology research remain attractive to many investors. The impact on Italy's economy of the Covid-19 pandemic has been so severe that the government has taken action in response to fears that good but distressed Italian companies – especially the small- and medium-sized businesses that are the lifeline of the national economy – could be acquired at temporarily low prices.

Sources: OECD, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2018

The Government was forced to scale back budget spending plans after EU objections.

January 2019

The Italian economy slipped into recession in the last quarter of 2018.

February 2019

The port of Trieste officially opened its new FREEeste free trade zone (FTZ) area, which was linked to the railway station at Aquilinia.

February 2019

The Italian parliament's 18-month moratorium on oil and gas exploration permits, intended to assist with the transition to a low-carbon future, affected 70 pending permits and was a blow to an already struggling industry. The ban increased Italy's reliance on hydrocarbon imports.

March 2019

The port of Trieste and China Communications Construction Company signed an agreement to develop transport infrastructure that would enable the port of Trieste to join Mainland China's Belt and Road Initiative. The governments of Mainland China and Italy also signed a memorandum of understanding formalising an expanded role for firms from Mainland China in Italy, especially in infrastructure and the expansion of northern Italy's port facilities.

The government introduced generous subsidies to stimulate the electric vehicle market, with a total budget of EUR60 million. However, accessed to charging station infrastructure remains limited.

April 2019

The economy edged out of recession in the first quarter of 2019 after two successive quarters of contraction. The expansion, although low (at 0.2%), was supported by the external sector, while domestic demand dragged on growth.

June 2019

The European Investment Fund and Banco BPM signed an agreement allowing Banco BPM to make available EUR330 million in loans to small- and medium-sized enterprises in Italy.

The European Commission (EC) approved, under EU state aid rules, a scheme with an estimated budget of EUR5.4 billion to support electricity production from renewable sources in Italy.

July 2019

The EC decided that the Italian government's mid-year budget of July 1 meant that Italy had made an additional fiscal effort to ensure compliance with the Stability and Growth Pact and that progress with structural reforms should ensure higher growth and a decreased debt-to-GDP ratio. That effort meant it was not necessary to open an Excessive Deficit Procedure against the country.

August 2019

League party leader Matteo Salvini withdrew from the government in the hope of triggering early elections. However, the Five Star Movement and centre-left Democratic Party agreed a new coalition without the League party.

September 2019

The new coalition government between Five Star Movement and the Democratic Party was sworn in. Giuseppe Conte retained his position as Prime Minister.

November 2019

Italian electricity transmission system operator Terna began operating an undersea power cable linking Montenegro and Italy, the country's first electrical bridge to the Balkans.

January 2020

The United Kingdom officially left the European Union (EU) on January 31.

January 2020

The governments of Israel, Greece and Cyprus signed an agreement for the construction of the USD7 billion Eastern Mediterranean (EastMed) natural gas pipeline connecting East Mediterranean resources to Greece via Cyprus and Crete. Initially, the pipeline was expected to transport 10 billion cubic metres of gas annually, which was projected to double in the future. A final investment decision on the project was expected by 2022 and the pipeline was expected to be completed by 2025.

Italy declared a state of emergency for six months in response to the severe effects being felt in the country of the Covid-19 global pandemic.

April 2020

The Italian government extended (until December 31, 2020) the Golden Power Law (GPL) to protect Italian companies from being acquired cheaply by foreign interests. GPL now includes any critical infrastructure, whether physical or virtual, including energy, transport, water, health, communications, media, data processing or storage, aerospace, defence, electrical or financial infrastructure; also critical technologies and dual-use items, including artificial intelligence, robotics, semiconductors, cybersecurity, nanotechnologies and biotechnologies.

A bacterial infection caused by spittlebug insects had been causing widespread damage to olive trees in Italy, wiping out some ancient groves. To avert significant losses action is needed that would probably result in a rise in olive oil prices.

The Renzo Piano-designed replacement bridge in Genoa for the Morandi bridge that collapsed in August 2018 was inaugurated and was expected to open to traffic in July. The new bridge restores an important route for commercial trade between Italy and France.

Milan announced an ambitious scheme to reduce car use after the Covid-19 lockdown by giving over 35 kilometres of city streets to pedestrians and cyclists.

May 2020

Italy began cautiously to ease the lockdown enacted to tackle the Covid-19 pandemic, restarting the economy by reopening some businesses and workplaces. Italian bonds had dropped the most in the eurozone.

Venice announced it was postponing the introduction of its day visitor tourist tax until July 1, 2021.

The Italian government announced plans to inject EUR3 billion into Alitalia to save the national airline from collapse.

Sources: BBC Country Profile – Timeline, Ports Europe, Port of Trieste, European Commission, Fitch Solutions

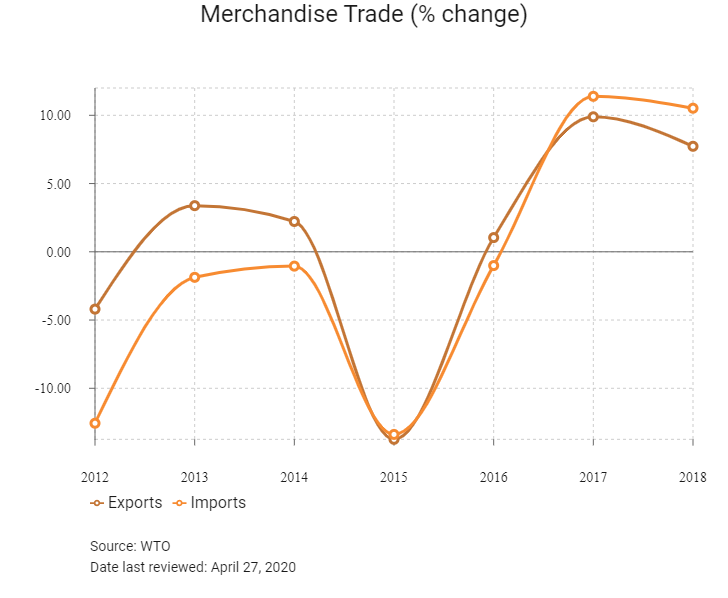

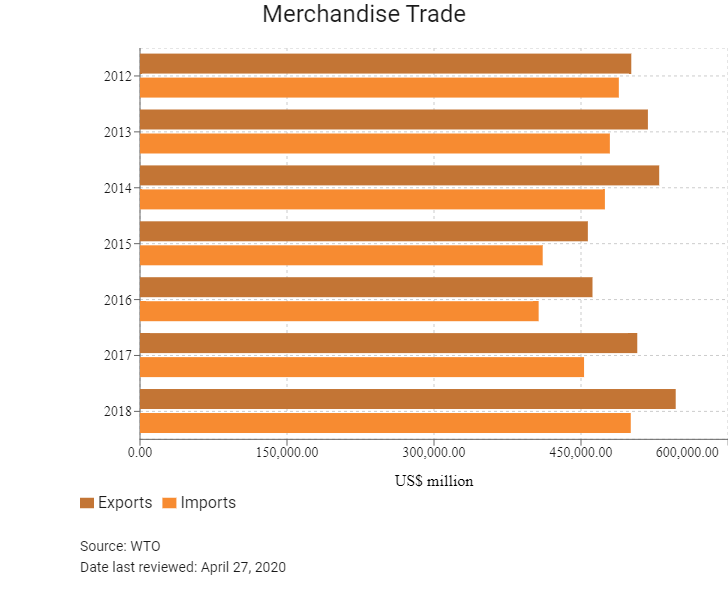

Merchandise Trade

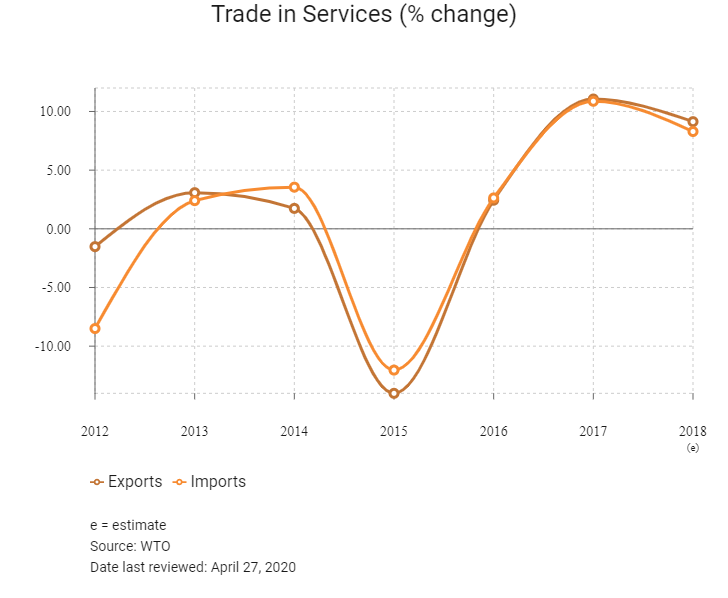

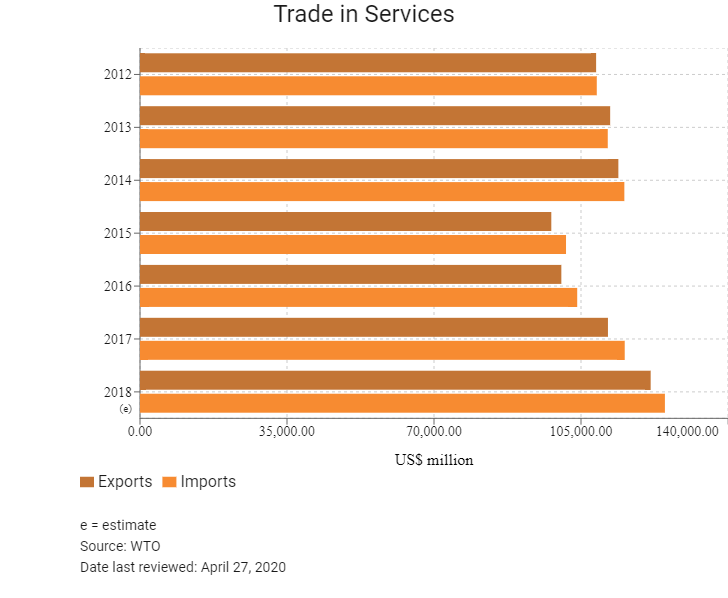

Trade in Services

- Italy has been a member of the World Trade Organization (WTO) since January 1, 1995, and a member of the General Agreement on Tariffs and Trade since May 30, 1950.

- Italy is a member of the EU, which has a common set of tariffs and customs levied on various imports and exports. Trade policy is largely identical to that of the wider regional bloc. The EU updated its trade policy (and by extension its import tariffs, customs, duties and procedures) in 2017 and 2018. Once goods are cleared by customs authorities on entry into any EU member state, they can move freely among EU member states without any additional customs procedures.

- The EU has an overall simple tariff of 5.1%. The duties for non-European countries are also relatively low, especially for manufactured goods (4.2% on average). However, textile, clothing items (high duties and quota system) and food-processing industry sectors (average duties of 17.3% and numerous tariff quotas) still see protective measures.

- Trade bureaucracy and customs delays are a significant hindrance to foreign investors, particularly those outside the EU. Although there are increasing efforts to reduce trade bureaucracy, paper-based procedures remain cumbersome and costs and connectivity issues add to market barriers.

- As a member state of the EU, Italy incorporates EU regulatory norms. When developing new draft regulations, the Italian government submits a copy to the WTO for review to ensure that the prospective legislation is not inconsistent with its WTO obligations.

- As a eurozone member, Italy adopted the euro as its legal tender in January 1, 2002.

- The EU has the largest web of preferential trade agreements in the world, being party to some 70 free trade agreements (FTAs) spanning five continents, and access to other markets of the countries concerned is currently mediated through those agreements. The EU's Generalised System of Preferences (GSP) entered into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row. As a result, the number of countries that enjoy preferential access to EU markets has been reduced from 176 to less than 80. While Mainland China remains a beneficiary, many of its exports – such as toys, electrical equipment, footwear, textiles, wooden articles, and watches and clocks – have already been graduated from preferential treatment. Hong Kong has been fully excluded from the EU's GSP scheme since May 1, 1998.

- Nine types of goods imported into the EU are subject to licensing. These goods are (broadly) textiles, various agricultural products, iron and steel products, ozone-depleting substances, rough diamonds, waste shipment, harvested timber, endangered species, and drug precursors. No quotas are currently imposed on textiles and clothing exports or non-textile product exports from Hong Kong and Mainland China.

- In order to protect domestic industries, a number of products from Mainland China are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards, and solar glass, which are of interest to Hong Kong exporters. For example, in November 2016 the EC imposed a provisional anti-dumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5% and 81.1% of the net free-at-union-frontier price before duty, depending on the company. In October 2019, following an appeal heard by the General Court of the EU, a judgement was issued that annuls the anti-dumping duties imposed on imports of solar glass from Mainland China. As of May 2020 the EU did not apply any anti-dumping measures on imports originating from Hong Kong.

- In March 2016, the EC imposed a definitive countervailing duty (8.7% or 9%) on imports consisting largely of textiles products originating in India.

- A multitude of issues persists with regard to the respect for intellectual property rights in Mainland China, which means many EU manufacturing and retail businesses face additional risks when importing finished or intermediate goods from this trading partner.

- In 2018 the EU modernised its trade defence instruments with a view to shielding EU producers from damage caused by unfair competition. Anti-dumping and anti-subsidy regulations have been amended to better respond to unfair trade practices and furnish Europe's trade defence instruments with more transparency, quicker procedures and more effective enforcement. In exceptional cases, such as in the presence of distortions in the cost of raw materials, the EU will be able to impose higher duties through the limited suspension of the lesser-duty rule.

- The EC has introduced an import licensing regime for certain iron, steel and aluminium products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- To combat the spread of the Asian long-horned beetle, in July 1999 the EU introduced emergency controls on wooden packaging material originating from Mainland China. Wood covered by the measures must be stripped of its bark and be free of insect bore holes greater than 3mm across or have been kiln-dried to below 20% moisture content.

- For health reasons the EU has adopted a directive on the control of the use of nickel in objects intended to be in contact with the skin, such as watches and jewellery. The EU also adopted a directive to ban the use of some phthalates in certain PVC toys and childcare articles on a permanent basis, which came into effect from January 16, 2007. In addition, the EU has adopted a directive to prohibit the trading of clothing, footwear, and other textile and leather articles that contain azo-dyes, from which aromatic amines may be derived.

- In the second quarter of 2015, the EC issued regulations on trade restrictions with Turkey regarding cattle, beef, watermelons and prepared tomatoes to protect domestic agriculture and regional farming businesses.

- On January 1, 2017, the EU imposed additional import duties on certain fruit and vegetables if the quantity of the goods exceeded the trigger volume level within the specified application period. On November 15, 2017, the EC allocated a total value of EUR62 million (USD74.4 million) for funding promotional campaigns of EU agricultural products implemented in the internal market for 2018. The budget consists of various promotional topics of EU goods in the internal market with an additional focus on the promotion of fruit, vegetables and sheep or goat meat.

- The EU has adopted a number of directives for environmental protection, which may have an impact on the sale of a wide range of consumer goods and consumer electronics. Notable examples include the directive on Waste Electrical and Electronic Equipment (WEEE) implemented in August 2005, and the directive on Restriction of Hazardous Substances (RoHS) implemented in July 2006. A recast WEEE directive entered into force in August 2012. As a result, member states must adhere to higher collection and recycling targets (a 45% collection rate as of 2016 and 65% from 2019). The directive is also wider in scope, covering all electric and electronic equipment while establishing producer responsibility as a means of encouraging greener product designs. The recast RoHS directive was published on July 1, 2011, and entered into force on January 2, 2013. The new directive continues to prohibit electrical and electronic equipment that contains the six dangerous substances listed in the original RoHS directive. Since July 22, 2019, the new directive has widened the scope of the previous directive by including any electrical and electronic equipment that might have fallen out of the old RoHS directive's scope, with only limited exceptions. Following those recast directives, the EU's new framework directive for setting eco-design requirements for energy-related products (ErP) is now in place. The ErP directive is no longer limited to electrical and electronic equipment (as it was under its predecessor, the energy-using product or EuP Directive), but potentially covers any product that is related to the use of energy, including shower heads and other bathroom fittings, as well as insulation and construction materials.

- The EU's Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation entered into force in June 2007. It requires EU manufacturers and importers of chemical substances to gather comprehensive information on the properties of these substances produced or imported in volumes of one tonne or more per year and to register such substances prior to manufacturing in or importing into the EU.

- In April 2019, the chemical industries of the EU and the United States proposed an enhanced aligned approach that could serve as a global blueprint for regulatory cooperation to reduce barriers and increase trade in the chemicals sector.

Sources: WTO – Trade Policy Review, European Commission, Fitch Solutions

Trade Updates

As a member of the EU, Italy is party to the same trade agreements as its 26 peer states. The region negotiates and enters into trade agreements as a collective owing to the single-market nature of the union. In total, the EU has approximately 70 preferential trade agreements in place. It is expected that membership of the eurozone will lead to further convergence towards EU economic policymaking norms.

Multinational Trade Agreements

Active

- EU Common Market: The transfer of capital, goods, services and labour between member nations enjoys free movement. The common market extends to the 27 member states of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden. (Since January 1, 2020, the United Kingdom is no longer a member state.) Because Italy's main trade partners are in the EU, the absence of customs charges with member countries greatly enhances its trade volumes.

- European Economic Area (EEA)-European Free Trade Association (EFTA) Agreement: This economic integration agreement entered into force on January 1, 1994. The agreement unites the EU member states with Iceland, Liechtenstein, Norway and Switzerland into an internal market governed by the same basic rules. These rules aim to enable goods, services, capital and people to move freely about the signatory countries in an open and competitive environment, a concept referred to as the four freedoms. Although the agreement enhances the trade flows between the EFTA countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Japan Economic Partnership Agreement (EPA): The agreement entered into force on February 1, 2019, after the European Parliament ratified the agreement in December 2018, creating the largest open trade zone in the world. The EU and Japan trade deal promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU-Japan EPA has created a trade zone covering 600 million people and nearly one-third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and was signed in July 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products, and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second-biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery. Negotiations continue separately for an Investment Protection Agreement with Japan.

- EU-Turkey Customs Union: The EU and Turkey are linked by a Customs Union agreement, which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999 and is a member of the Euro-Mediterranean partnership. The Customs Union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. Turkey is the EU's fourth-largest export market and its fifth-largest provider of imports. The EU is Turkey's largest import and export partner. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the Customs Union covers all industrial goods, but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural, coal and steel products. Although the EC proposed, in December 2016, the modernisation of the Customs Union and to further extend the bilateral trade relations to other areas, such as services, public procurement and sustainable development, opinion since then – and reiterated in June 2019 – is that Turkey has been moving further away from the EU and that the accession negotiations have effectively come to a standstill and no further work on modernisation of the Customs Union is foreseen.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): CETA is expected to strengthen trade ties between the two regions, having been signed in October 2016 and entering into force provisionally on September 21, 2017. Some 98% of trade between Canada and the EU is duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport. During CETA's first full calendar year of implementation, the EU's trade surplus with Canada rose by 60% and the EU's most important export items all saw significantly stronger export performance when compared to the average of the three previous years.

- EU-Southern African Development Community (SADC) EPA: An agreement between the EU and a group of SADC countries (Botswana, eSwatini, Lesotho, Mozambique, Namibia, and South Africa) was signed on June 10, 2016, with Angola having an option to join the agreement in the future. The agreement provisionally entered into force for most countries on October 10, 2016, but only became fully operational after Mozambique began applying the EPA in February 2018. Nine of the remaining members of SADC not included in the deal (Comoros, the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, the Seychelles, Tanzania, Zambia and Zimbabwe) have or are seeking economic partnership agreements with the EU as part of other regional trading blocs – such as with East, Central or Southern African communities.

Awaiting Ratification

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (31 of the 35 parties have ratified the agreement as of May 2020). The agreement has been provisionally applied since 2013.

- EU-Mercosur Trade Agreement: The EU and Mercosur (Argentina, Brazil, Paraguay and Uruguay) signed a trade deal on June 28, 2019, after two decades of negotiation. Although the agreement still needs to be ratified by the EU Parliament and EU member states for it to be enforced, the EU is the first major partner to make a trade pact with the Mercosur bloc. The trade agreement for goods and services will cover nearly 25% of global GDP, almost 800 million people and gives EU-based companies easier entry into a market with an enormous economic potential. The deal is expected to cut duties on EU exports to Mercosur by EUR4 billion annually and eliminate tariffs on 93% of Mercosur’s exports to the EU and 91% of EU exports to Mercosur states. Currently, EU–Mercosur trade in goods amounts to approximately EUR87 billion, but this is down from EUR100 billion just a few years ago, with Mainland China having outpaced the EU as Mercosur's first trading partner. The EU is the biggest foreign investor in Mercosur, with stock of EUR381 billion, while Mercosur's investment stock in the EU is worth EUR52 billion. The agreement contains specific commitments on labour rights and environmental protection, including the implementation of the Paris climate agreement and related enforcement rules. The deal will also include access to public procurement contracts. The EU will not fully open its market for imports of agri-food products, although beef, poultry and honey imports from the Mercosur countries will be permitted to increase over a five-year phasing in period. Mercosur states will greatly benefit from increased access to the EU for agricultural goods, which has resulted in opposition to the deal by European farmers. European firms, especially those in the manufacturing and industrial sector, will have an advantage over other competitors after the removal of high tariffs.

- EU-Vietnam FTA and Investment Protection Agreement (IPA): On June 30, 2019, the EU and Vietnam signed the final texts for the EU–Vietnam FTA and the EU–Vietnam IPA. The FTA and IPA are expected to be ratified by the Vietnamese National Assembly in May 2020, having been approved by the European Council. The EU describes the agreement as the most ambitious it has ever concluded with a developing country, expecting it to increase EU exports to Vietnam by around 29% and Vietnam's exports to the EU by around 18%. Once in force, most likely in early summer 2020, the agreements will provide opportunities to increase trade and support jobs and growth on both sides by eliminating 99% of all tariffs, reducing regulatory barriers and overlapping 'red tape', ensuring protection of geographical indications, opening up services and public procurement markets, and establishing the means to ensure the agreed rules are enforceable.

Under Negotiation

- EU-Australia FTA: The EU, Australia's second-largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR66 billion in 2018, and bilateral trade in services added an additional EUR32 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or other trade agreements with Australia. The Council of the EU authorised the opening of negotiations for a trade agreement between the EU and Australia on May 22, 2018, and on June 18, 2018, negotiations were formally launched. The sixth round of negotiations took place in February 2020 in Canberra. A seventh was scheduled for May 11 in Brussels.

- EU-United States Transatlantic Trade and Investment Partnership (TTIP): This agreement was expected to increase trade in goods and services, but talks were suspended at the end of 2016. In January 2019, the EC published its draft negotiating directives, which include a trade agreement focused on the removal of tariffs on industrial goods, excluding agriculture. On April 15, 2019, the EU member states gave the EC their approval to start formal negotiations. The negotiating directives for the TTIP are no longer relevant.

- EU-Indonesia Comprehensive Economic Partnership Agreement: Negotiations were launched in July 2016 and in March 2020 the tenth round took place. The objective of the FTA is to facilitate trade and investments and address various issues, such as tariffs, non-tariff barriers to trade, the production of palm oil, trade in services and investment, trade aspects of public procurement, competition rules and intellectual property rights, as well as sustainable development.

Sources: WTO Regional Trade Agreements database, European Commission, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Italy is bound by EU laws on foreign direct investment. Italy has an investment promotion agency to facilitate foreign investment. The Italian Trade Agency (ITA) is administered by the Ministry of Economic Development. The ITA has offices in 70 countries worldwide and has a unit dedicated to facilitating the establishment and development of foreign companies in Italy, with key sectors identified as aerospace, agri-food, automotives, chemicals and pharmaceuticals, consumer goods, the green economy, electronics, ICT, infrastructure, life sciences, machinery and real estate.

- Invitalia, a company wholly owned by the Ministry of Economy and Finance, was created as the central point of reference for businesses wishing to establish themselves in Italy. Invitalia offers a free one-stop shop for foreign investors (helping with permits, location scouting and all aspects of setting up a business) and financial aid in the form of capital grants and soft loans or a combination of the two.

- Italy's main business association (Confindustria) aims to retain existing companies in Italy and to support and promote the Made in Italy brand worldwide, from foodstuffs to cruise ships built in Italian shipyards. Confindustria stresses that 85% of its members are small enterprises that have fewer than 50 employees.

- Exceptions to foreign participation include access to government subsidies for the film industry (limited to EU member states), capital requirements for banks domiciled in non-EU member countries and restrictions on non-EU-based airlines operating domestic routes. Italy also has investment restrictions in the shipping sector.

- To drive economic growth, the Italian government has put in place comprehensive reforms, such as new labour legislation, new financial tools for real estate and dedicated business courts to resolve disputes involving foreign investors. Fiscal incentives include a 25% tax credit for private investment in research and development (R&D) (50% for projects with universities, research institutes or equivalent centres); a patent box regime to promote investment in the R&D of intangible assets (50% tax deduction from corporate income tax (CIT) for income from the direct use or licensing of qualified intangible assets); a 15% tax credit for investment in machinery and capital goods to promote investment in industries such as electro-mechanical, tourism, agri-food processing, fashion, life sciences and chemicals; and a tax regime for new residents to attract high-net-worth individuals (investor visa for Italy) to transfer their tax residence to Italy, thereby enhancing investment in Italy through a range of strategic asset investment incentives.

- The Italian constitution permits the expropriation of private property for public purposes, defined as essential services or measures indispensable for the national economy. In such instances, prompt, adequate and effective compensation must be paid to the property holders.

- EU and Italian anti-trust laws provide Italian authorities with the right to review mergers and acquisitions on the grounds of market dominance. In addition, the Italian government may block mergers and acquisitions involving foreign firms under the Golden Power Law if the domestic firm involved is determined to be essential to the national economy – for example, if the companies are operating in strategic sectors (defence and national security, energy, transport, and telecommunications). The Golden Power Law always applies in cases in which the potential purchaser is a non-company and is extended to EU companies if the target of the acquisition is involved in defence or national security activities.

- Although many former monopoly operators have been partially or fully privatised, the state retains a controlling interest, either directly or through the state-controlled national development fund Cassa Depositi e Prestiti.

- Italy has a business registration website, available in Italian and English, administered through the Union of Italian Chambers of Commerce (Unioncamere). Foreign companies may use the online process. Before registering a company online, applicants must obtain a certified email address and digital signature, a process that may take up to five days. A notary is required to certify the documentation. The precise steps required for the registration process depend on the type of business being registered.

- The minimum capital requirement to register a business varies by type of business. Generally, companies must obtain a VAT account number from the Agenzia delle Entrate (the Italian revenue agency), register with the Istituto Nazionale della Previdenza Sociale (INPS, the social security agency), verify adequate capital and insurance coverage with the Istituto Nazionale per L'Assicurazione contro gli Infortuni sul Lavoro (INAIL, the Italian workers' compensation agency) and notify the regional office of the Ministry of Labour.

- Italy is a member of the Organisation for Economic Co-operation and Development, the WTO and the United Nations Conference on Trade and Development.

- Italy has 60 bilateral investment treaties (BITs) in force and 12 others are signed but not yet in force.

- Italy has treaties with investment provisions in force with 55 individual countries and economic blocs worldwide.

- According to the 2019 FDI Confidence Index compiled by A.T. Kearney, Italy had risen two places to eighth, its highest ranking since 2002. The improvement may be a result of a less volatile political environment compared with a year ago as well as the enduring appeal of the country's strong brands and robust manufacturing sector.

Sources: WTO – Trade Policy Review, ITA, Confindustria, Italian Trade Agency, Invitalia, Ministry of Economic Development, UNCTAD, Agenzia delle Entrate, Unioncamere, Cassa Depositi e Prestiti, A.T. Kearney

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

The Italian government operates two FTZs: the Free Port of Trieste (northeast of Italy) and the Free Port of Venice. | - These zones offer exemptions from VAT for non-EU goods in transit, deferred VAT payment on merchandise imported into the EU, non-discriminatory right of entry for ships and cargos, and no customs intervention. |

Other areas | - Italy has numerous general warehouses located throughout port areas and cities. |

Other investment incentives | - Incentives include grants, low-interest loans, deductions and tax credits. - A tax credit equivalent to 6% of the relevant cost basis, with a maximum annual amount of EUR1.5 million, for textile and fashion, footwear, eyewear, gold, furniture and ceramic sector enterprises that have used design and aesthetics to conceive and create new products and samples. |

Sources: European Commission, Venice Free Zone, Italian Trade Agency, Fitch Solutions

- Value Added Tax: 22%

- Corporate Income Tax: 24%

Source: Italian Agency of Revenue - Agenzia delle Entrate

Important Updates to Taxation Information

- On 27 December 2019, the Italian parliament approved the 2020 Budget Law. The Law reintroduces the Notional Interest Deduction (NID) regime previously repealed by the 2019 Budget Law.1 The deduction rate is set at 1.3% and applies as of the fiscal year following the one in course on 31 December 2018 (ie, FY2019 for calendar year entities). The NID regime replaces the reduced CIT measure introduced by Law Decree n. 34/2019 of 30 April 2019 which, therefore, never became applicable.

- Italy's 2020 Budget Law introduces a 3% indirect tax on revenue derived from certain digital services (DST) by building on the DST measure already contained in the country's 2019 Budget Law which never entered into force. Italian and foreign entities are liable for the tax – either stand-alone or at the group level – with worldwide annual revenue of at least EUR750mn and Italian annual revenue stemming from qualifying digital services of at least EUR5.5mn. The new DST is effective as of 1 January 2020.

- Italy's 2020 Budget Law includes plastic and sugar taxes. The plastic tax is a specific indirect tax levied at EUR0.45 p/kg of plastic contained in non-recyclable packaging products. The sugar tax was introduced on certain sweetened soft drinks levied at EUR10 per hectolitre in the case of finished products and at EUR0.25 p/kg in the case of products to be diluted prior to use.

- The 2019 finance bill reintroduced an updated and tightened version of the digital services tax (DST) or web tax, which was previously introduced in 2018. The tax has been applicable to digital services applicable since January 1, 2019. Corporations are obliged to pay a 3% tax on the value of specified digital services, net of VAT. A taxpayer will be eligible if their worldwide revenue exceeds EUR750 million and the amount realised in Italy is EUR5.5 million or higher.

- From January 1, 2019, CIT was reduced from 24% to 15% on a portion of income – profits which have been reinvested in certain activities (including new hirings and purchasing instrumental goods). However, in May a decree expected to be converted into law repealed the reduced-rate CIT and proposed a 1.5% overall reduction for 2019 (22.5%), a further 1% for 2020 (21.5%), a further 0.5% for 2021 (21%) and a further 0.5% for 2022 (20.5%).

Business Taxes

Type of Tax | Tax Rate and Base |

CIT | - 24% for IRES (CIT) and |

Capital Gains Tax | 24% |

Branch Tax | 24% (IRES) and 3.9% (IRAP) |

Withholding Tax | Generally, the rate for non-residents is 26% on dividend income and interest and 30% on technical service fees and royalties from patents and suchlike. Different rates may apply if a country has a tax treaty. For example, if the country of residence is Hong Kong the rates levied are 10% on dividends, 0% on interest (12.5% on government bonds) and 15% on royalties. |

VAT | The standard rate is 22%. Reduced rates apply for the supply of some goods and services, such as 4% for listed food, drinks and agricultural products; 5% for some health and transport services; and 10% for electric power supplies and listed drugs. Supplies of specific goods and services are zero rated, including education, insurance services, specific financial services and the leasing of particular immovable property. |

Property Tax | - 0.76% and 0.1% |

Social Security Contribution | The total rate of social security contribution is around 40% of the employee's gross compensation, with the employer paying 30% and the employee 10% (the rate can vary depending on the employee's job and the work activity and size of the company). |

Source: Italian Agency of Revenue - Agenzia delle Entrate

Date last reviewed: May 5, 2020

Working Permit

Non-EU member citizens require a work permit in order to work in the country; EU member citizens do not require a work permit, but their employer must inform the local Labour Immigration Office about their employment. Once the permit has been obtained by the employer, within four months the would-be employee must apply for the work visa at the consulate where they live. If the work visa is granted (approval usually takes place within 30 days), the employee has six months to collect it. The employee must sign anemployment contract at the Labour Immigration Office within eight days of their arrival in Italy. Citizens of the EEA (the EU member states plus Iceland, Norway and Lichtenstein) and Switzerland do not require a visa to enter, reside and work in Italy. No work permit is needed by foreigners from outside the EU if they have a permanent residence or family reunion permit, have been granted asylum, study in Italy or have a Blue Card.

Obtaining Foreign Worker Permits

Employers must first apply for a permit to hire foreign workers. A permit is granted once no suitable candidate can be found in Italy or in other EU member states. The vacant position must be reported to the local district labour office and cannot be changed at a later stage to fit the profile of a potential employee. The candidate must then apply for a work permit. The government issues the permit for a maximum of two years, which can be repeatedly prolonged but always for a maximum of two years, and may be renewed as many times as needed. The permit process takes an average of one month. In April 2019, Italy published its 2019 Immigration Quota Decree, issued annually, which allows non-EU nationals who qualify to obtain a work permit. The total quota level for 2019 was 30,850 permits allocated among three categories: non-seasonal workers (3,000 permits), conversion of existing permits (9,850 permits) and seasonal workers (18,000 permits). Employers were instructed to evaluate their need for work permits for non-EU nationals in the appropriate categories and apply as soon as possible. As of May 8 the 2020 level had not yet been announced.

Blue Card

The Blue Card is intended for a highly qualified employee. A foreigner holding a Blue Card may reside in Italy and work in the job for which the card was issued or change that job under the conditions defined. A high qualification means a duly completed university education or higher professional education which has lasted for at least three years. Alternatively, a minimum of five years' relevant professional experience relating to the activity for which the work permit is being granted is required. The Blue Card is issued with a term of validity three months longer than the term for which the employment contract has been concluded, for a maximum period of two years. The Blue Card can be extended. One of the conditions for issuing the card is a wage criterion – the employment contract must stipulate a gross monthly or yearly wage that is at least 1.5 times the gross average annual wage.

Short-Term Work Visa

These can be granted by the embassy on application for a maximum period of 90 days and must be used within 180 days. The visa must be for the purpose of employment and the application must be submitted along with general requirements, such as a work permit, an employment contract and proof of securing accommodation.

Visa/Travel Restrictions

Italy is one of 26 countries in the Schengen Area, which means that there is one common visa and no border controls. All non-EU, EEA and Swiss nationals who wish to stay in Italy for longer than 90 days need to apply for a long-term visa.

Sources: Ministry of Foreign Affairs and International Cooperation, European Commission, Ministry of Interior, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

Moody's | Baa3 (Stable) | 19/10/2018 |

S&P Global | BBB (Negative) | 26/10/2018 |

Fitch Ratings | BBB- (Stable) | 28/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

Ease of Doing Business Index | 46/190 | 51/190 | 58/190 |

Ease of Paying Taxes Index | 112/190 | 118/190 | 128/190 |

Logistics Performance Index | 19/160 | N/A | N/A |

Corruption Perception Index | 53/180 | 51/180 | N/A |

IMD World Competitiveness | 42/63 | 44/63 | N/A |

Sources: World Bank, IMD, Transparency International

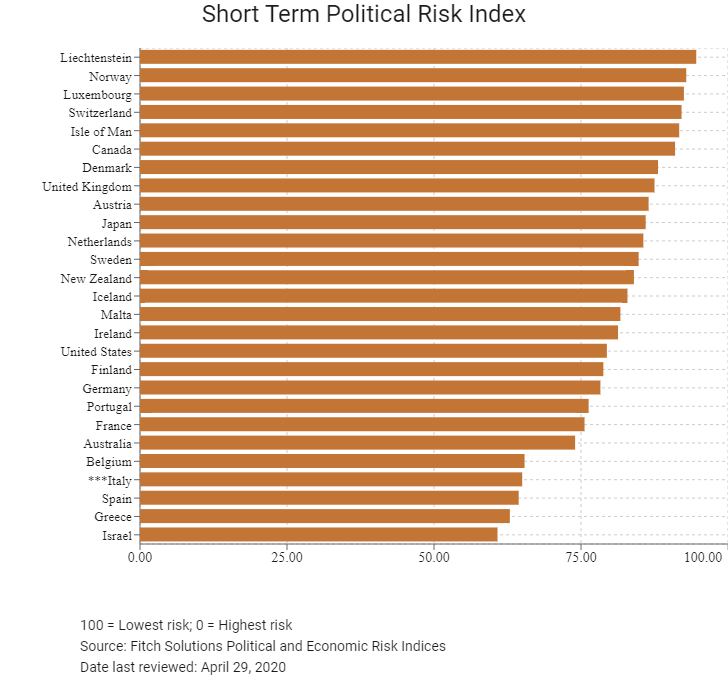

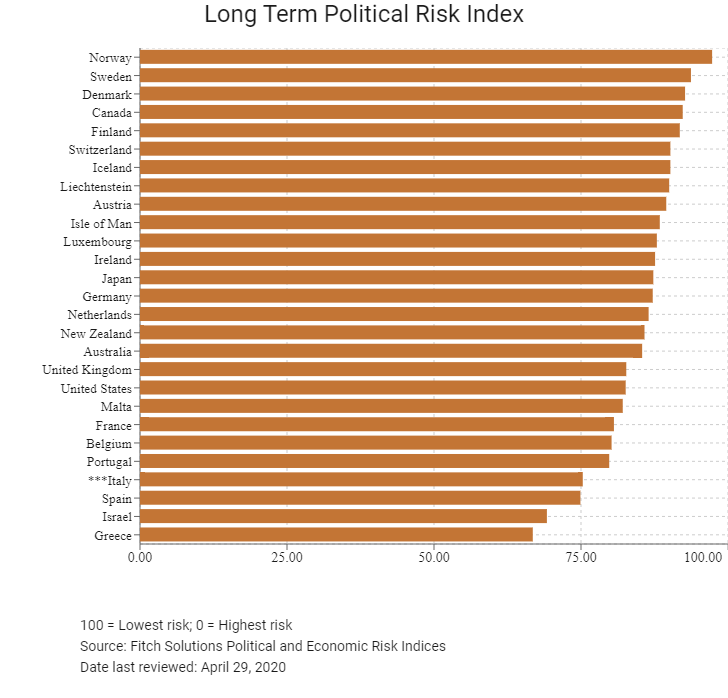

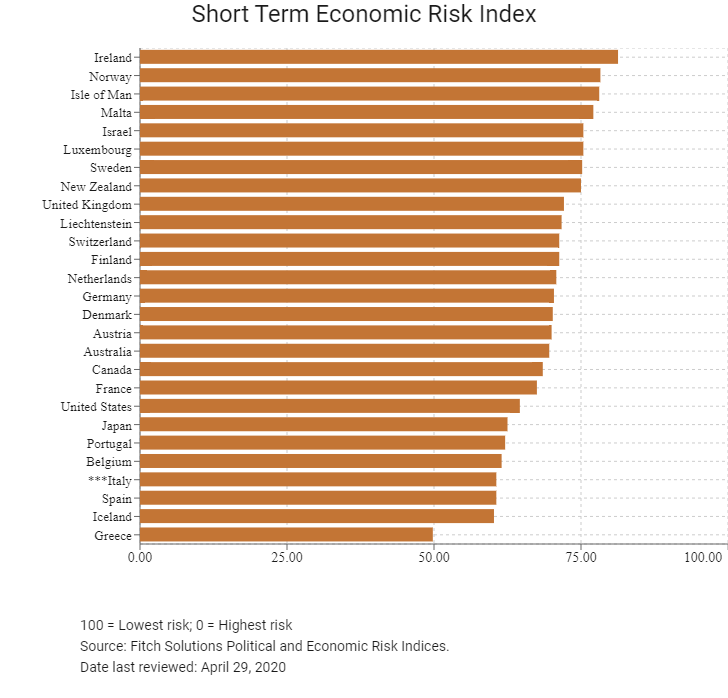

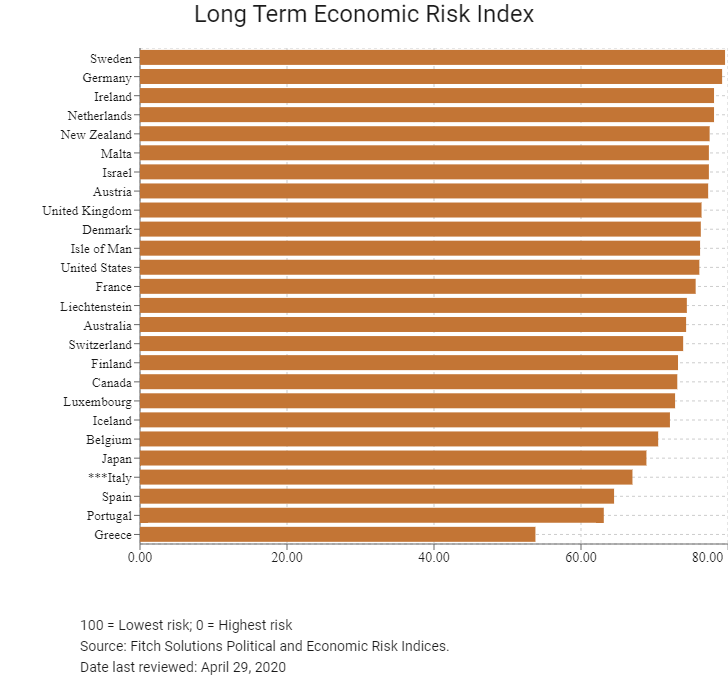

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

Economic Risk Index Rank | 46/202 | 46/201 | 44/201 |

Short-Term Economic Risk Score | 66.5 | 61.5 | 60.6 |

Long-Term Economic Risk Score | 66.4 | 66.8 | 67.0 |

Political Risk Index Rank | 36/202 | 43/201 | 43/201 |

Short-Term Political Risk Score | 65.2 | 65.0 | 65.0 |

Long-Term Political Risk Score | 77.6 | 75.3 | 75.3 |

Operational Risk Index Rank | 41/201 | 44/201 | 42/201 |

Operational Risk Score | 64.1 | 63.6 | 63.8 |

Source: Fitch Solutions

Date last reviewed: April 29, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Despite its challenges, Italy remains among the world's top 10 largest economies, with a comparative advantage in a number of areas, including industrial design and innovation, fashion, and clothing. Relative to some other eurozone economies, Italy did not utilise the global financial crisis and eurozone debt crisis to expedite the enactment of structural reforms aimed at addressing the country's cumbersome operating environment, massive public debt load and long-term decline in productivity growth. Italy remains firmly on a low growth trajectory, and the domestic political situation will ensure that progress tackling Italy's long-standing competitiveness issues remains sluggish at best in the coming years. Italy's business environment remains bogged down by bureaucratic inefficiencies and structural rigidities, which impede competition and investment and weigh on external competitiveness. The public debt pile is expected to remain a significant weight on the economy and the need to stimulate the economy has seldom been greater in the wake of the shock caused by shutting down activity in response to the Covid-19 pandemic, making technical recession inevitable and presenting the government with some major macroeconomic challenges because the government has limited capacity to provide fiscal stimulus to the economy.

OPERATIONAL RISK

The government remains open to foreign investment in shares of Italian companies – albeit with a temporarily expanded Golden Power Law in response to the economic shock caused by the Covid-19 pandemic – and continues to make information available online to prospective investors. Italy's economy is struggling to emerge from its longest recession in recent history, and the current government has been making slow progress on improving Italy's investment climate. However, comprehensive reforms of the labour market, the education system, competition policy and a general simplification of bureaucracy could induce a reversal of trend in the brain drain that has characterised the country over the past 30 years. Although Italy's manufacturing sector has suffered owing to competition from Mainland China and other low-cost centres, the country has the human capital and capital resources to move higher up the value-added chain. Doing so would open up new markets, especially in emerging countries.

Source: Fitch Solutions

Data last reviewed: May 10, 2020

Fitch Solutions Political and Economic Risk Indices

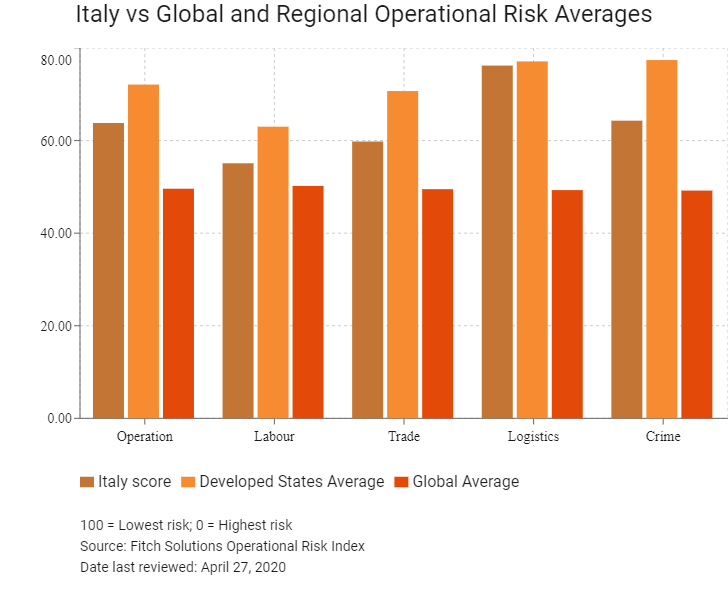

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

Italy Score | 63.8 | 55.1 | 59.8 | 76.2 | 64.3 |

Developed States Average | 72.1 | 63.0 | 70.7 | 77.1 | 77.4 |

Developed States Position (out of 27) | 25 | 20 | 25 | 17 | 25 |

Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

Global Position (out of 201) | 42 | 66 | 60 | 21 | 48 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

Denmark | 79.5 | 70.5 | 76.6 | 88.5 | 82.3 |

Switzerland | 78.4 | 74.4 | 76.9 | 79.3 | 83.2 |

Netherlands | 78.3 | 65.4 | 78.2 | 88.8 | 80.7 |

United States | 77.7 | 79.7 | 75.8 | 85.9 | 69.3 |

Sweden | 77.3 | 66.8 | 76.9 | 86.7 | 78.6 |

New Zealand | 76.9 | 72.0 | 74.5 | 73.0 | 88.3 |

Canada | 76.2 | 73.6 | 74.4 | 75.1 | 81.6 |

United Kingdom | 76.1 | 70.2 | 77.9 | 78.3 | 78.2 |

Norway | 76.0 | 63.8 | 71.1 | 81.2 | 87.9 |

Austria | 74.8 | 61.9 | 72.1 | 83.6 | 81.5 |

Finland | 73.9 | 54.9 | 72.2 | 84.7 | 83.7 |

Ireland | 73.5 | 66.6 | 78.1 | 70.4 | 79.0 |

Luxembourg | 73.4 | 54.3 | 77.6 | 82.5 | 79.3 |

Australia | 72.4 | 68.7 | 72.5 | 68.4 | 79.9 |

Germany | 72.1 | 66.2 | 67.9 | 80.8 | 73.6 |

Spain | 71.9 | 61.0 | 70.0 | 80.6 | 76.0 |

France | 71.5 | 60.7 | 70.1 | 82.6 | 72.8 |

Iceland | 71.4 | 59.8 | 67.6 | 70.0 | 88.1 |

Belgium | 71.4 | 57.0 | 75.1 | 82.3 | 71.1 |

Japan | 71.2 | 69.9 | 65.9 | 77.5 | 71.5 |

Portugal | 70.0 | 52.5 | 67.4 | 81.7 | 78.4 |

Israel | 67.9 | 71.3 | 67.3 | 70.2 | 62.7 |

Malta | 64.9 | 54.3 | 68.6 | 63.0 | 73.7 |

Isle of Man | 64.4 | 49.9 | 68.6 | 56.6 | 82.4 |

Italy | 63.8 | 55.1 | 59.8 | 76.2 | 64.3 |

Liechtenstein | 63.1 | 47.0 | 57.1 | 65.1 | 83.2 |

Greece | 57.9 | 53.2 | 48.9 | 69.9 | 59.6 |

Developed Markets Averages | 72.1 | 63.0 | 70.7 | 77.1 | 77.4 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 27, 2020

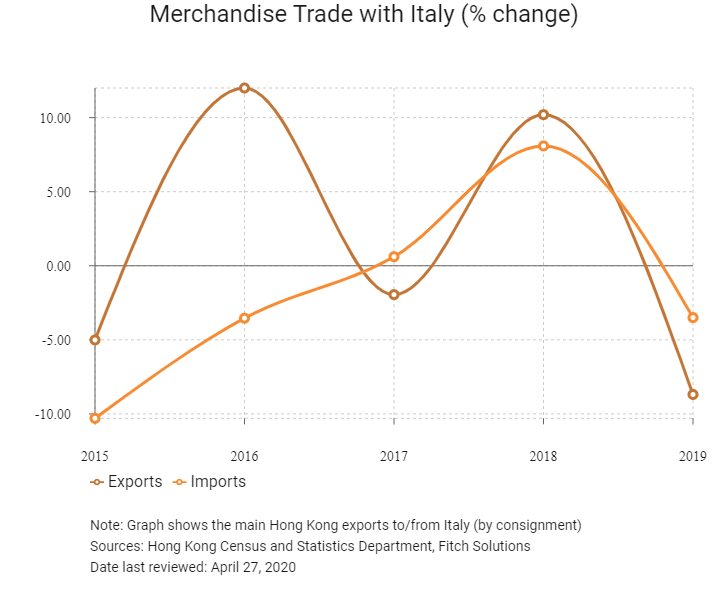

Hong Kong’s Trade with Italy

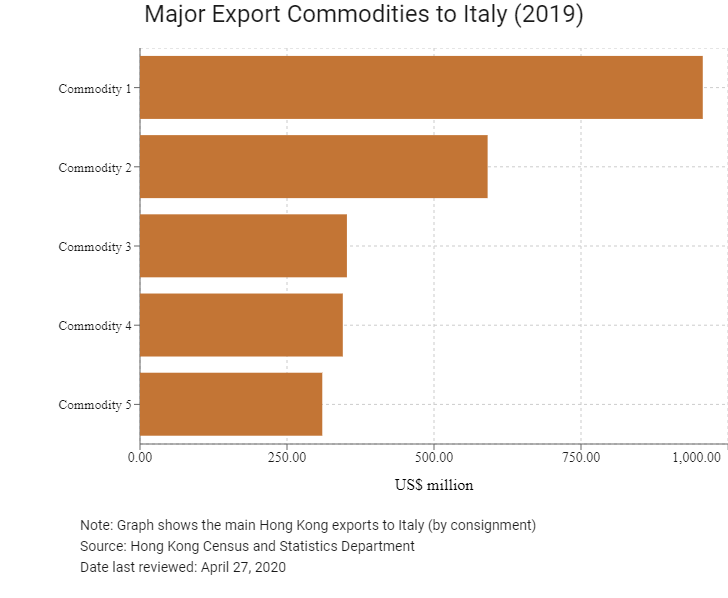

Export Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 957.1 |

Commodity 2 | Photographic apparatus, equipment and supplies; optical goods; and watches and clocks | 591.2 |

Commodity 3 | Electrical machinery, apparatus and appliances; and electrical parts thereof | 351.9 |

Commodity 4 | Miscellaneous manufactured articles | 344.9 |

Commodity 5 | Articles of apparel and clothing accessories | 310.0 |

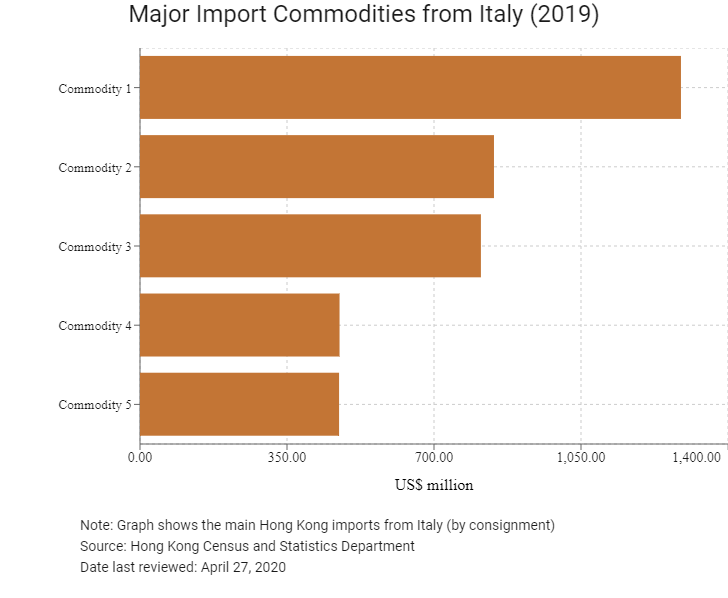

Import Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Articles of apparel and clothing accessories | 1,288.0 |

Commodity 2 | Travel goods, and handbags and similar containers | 842.8 |

Commodity 3 | Miscellaneous manufactured articles | 811.7 |

Commodity 4 | Footwear | 475.1 |

Commodity 5 | Photographic apparatus, equipment and supplies; optical goods; and watches and clocks | 474.0 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

Number of Italian residents visiting Hong Kong | 89,783 | -12.6 |

Number of European residents visiting Hong Kong | 1,747,763 | -10.9 |

Source: Hong Kong Tourism Board

2019 | Growth rate (%) | |

Number of Italians residing in Hong Kong | 831 | 2 |

Number of developed state citizens residing in Hong Kong | 83,786 | 29.6 |

Sources: United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: April 29, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

Number of Italian Companies in Hong Kong | 177 | 7.9 |

- Regional headquarters | 40 | 2.6 |

- Regional offices | 65 | 4.8 |

- Local offices | 72 | 14.3 |

Source: Business Expectation Statistics Section of the Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong, Mainland China and Italy

- Hong Kong and Italy have a comprehensive double taxation agreement that has been effective from August 10, 2015.

- Italy has a BIT with Hong Kong that entered into force on February 2, 1998, and a BIT with Mainland China that entered into force on August 28, 1987.

- Italy has a tax treaty with Mainland China that has been applicable since January 1, 1990.

- Italy and Mainland China have an avoidance of double taxation agreement which entered into force on November 14, 1989.

Sources: Inland Revenue Department, Trade and Industry Department, UNCTAD, OECD

Chamber of Commerce or Related Organisations

Italian Chamber of Commerce in Hong Kong and Macau

Address: 19/F, 168 Queen's Road Central, Central, Hong Kong

Email: icc@icc.org.hk

Tel: (852) 2521 8837

Fax: (852) 2537 4764

Source: Italian Chamber of Commerce in Hong Kong and Macau

Association France Hong Kong

Email: marc.allard@hktdc.org

Tel: (33) 1 4742 4150

Website: www.association-france-hongkong.org

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate General of Italy in Hong Kong

Address: Suite 3201, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong

Email: visti.hongkong@esteri.it

Tel: (852) 2522 0033 / 2522 0034

Fax: (852) 2845 9678

Sources: Consulate General of Italy in Hong Kong, Hong Kong Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa to the Schengen area for a stay up to 90 days in any 180-day period. For information on the stay period in the Schengen area, please visit the European Commission website.

Source: Visa on Demand

Date last reviewed: April 29, 2020

Italy

Italy