GDP (US$ Billion)

161.18 (2018)

World Ranking 57/193

GDP Per Capita (US$)

16,484 (2018)

World Ranking 54/192

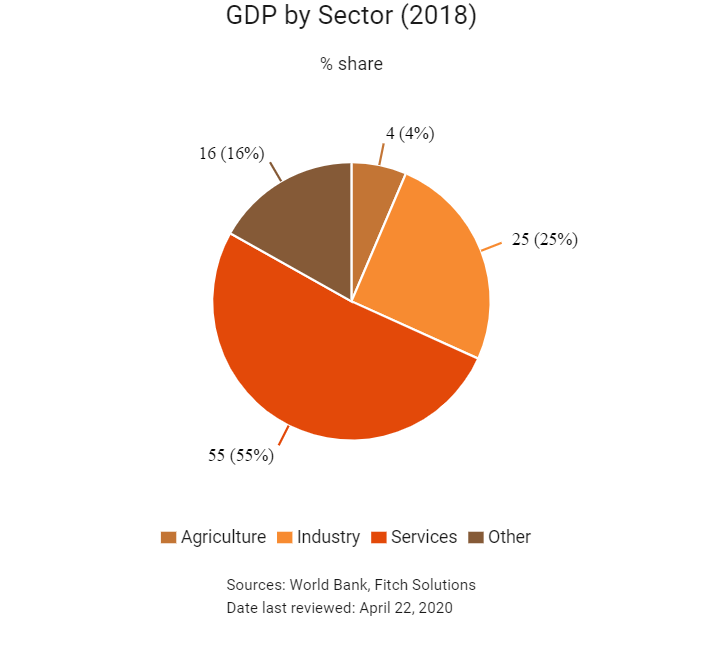

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

163 (2019)

Currency (Period Average)

Hungarian Forint

290.66per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

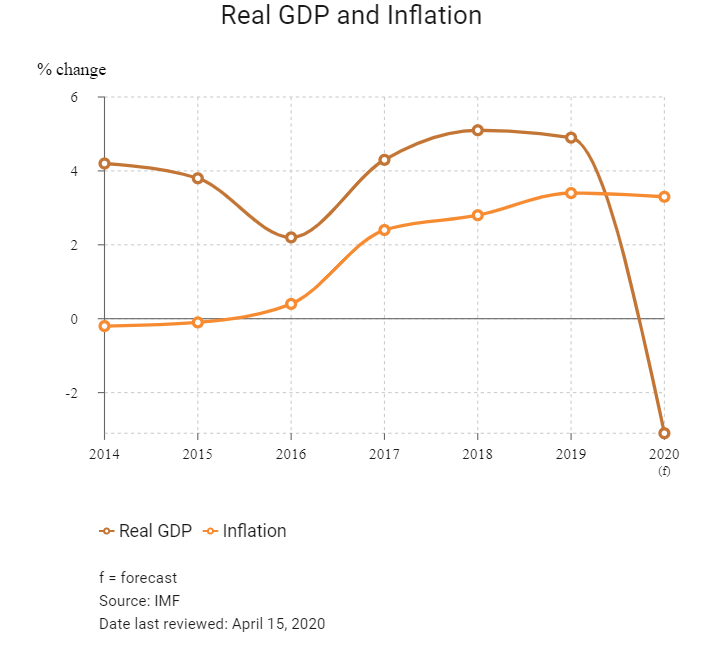

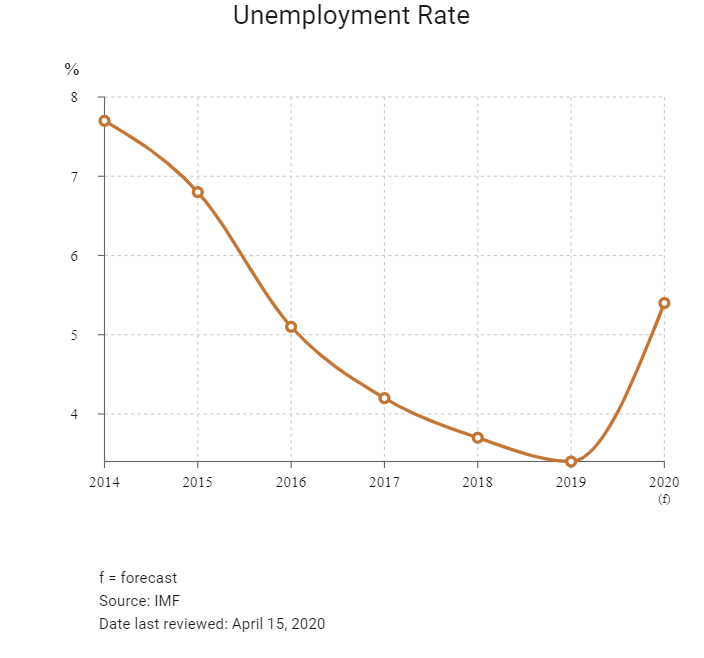

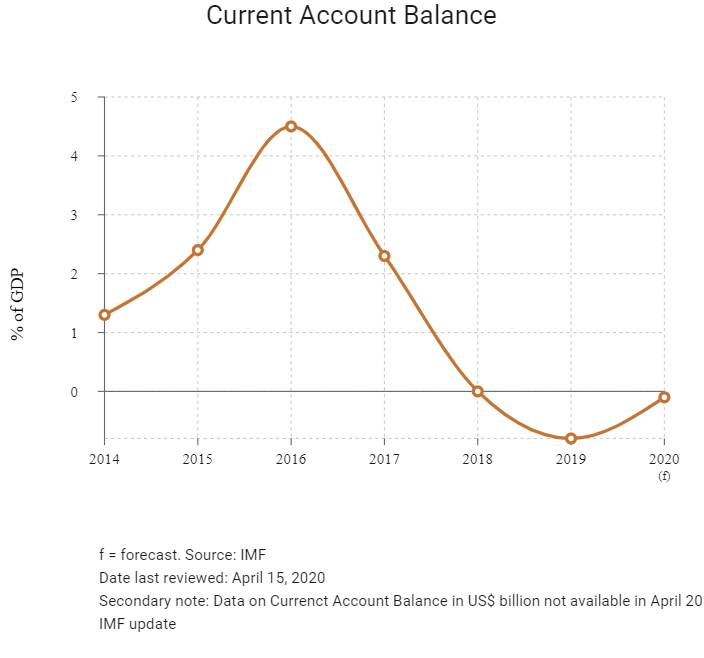

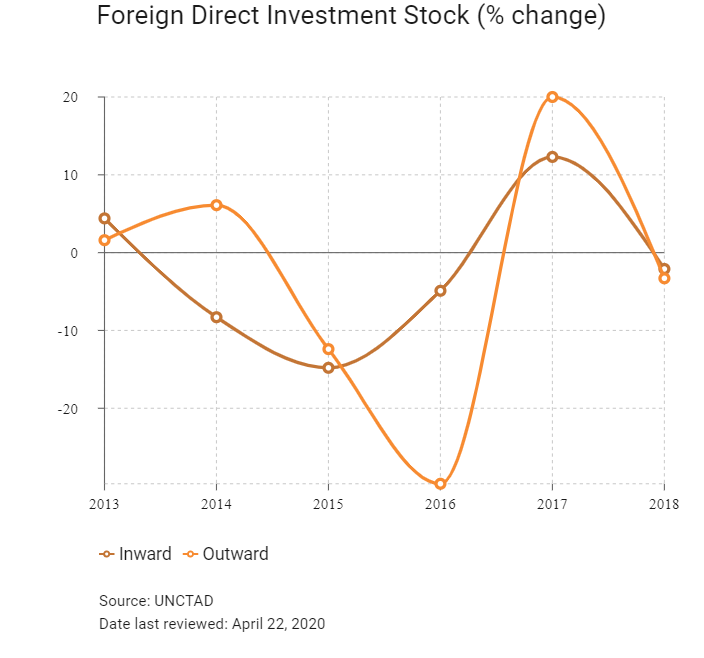

Since transitioning from a centrally planned economy to a market economy, Hungary has made significant economic progress. Investment and private consumption are now among the key drivers of growth, supported by the recovery of credit to the private sector. Economic growth rates in Hungary will ease in the coming years, but remain comfortably higher than in more developed European Union (EU) peers. Emerging from a protracted period of private deleveraging, the economy will be boosted by stronger consumer demand. However, a large public debt load and precarious operational risk backdrop will weigh on Hungary's growth potential relative to some emerging EU peers. Major headwinds facing Hungary's economy are its tight labour market, severe labour shortages and worsening demographic profile, which pose risks to the country's foreign direct investment (FDI) and export-orientated growth model.

Source: Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2018

Prime Minister Viktor Orbán was re-elected for a fourth term; his Fidesz party won a supermajority in the national assembly.

September 2018

The European Parliament initiated Article 7 proceedings against Hungary, which could result in EU structural funding cuts in the future.

March 2019

France-based automotive supplier GMD Group announced plans to build a vehicle parts factory in Dorog, northern Hungary, with an investment of HUF14.5billion (USD52 million).

March 2019

Hungary's governing Fidesz party was suspended from the European People's Party.

October 2019

MOL Group laid the foundation stone for a EUR1.2 billion (USD1.3 billion) polyol manufacturing plant in Tiszaújváros, Hungary. The Government of Hungary would contribute EUR131 million (USD143.5 million) via tax allowances and an investment grant towards the project. The facility would be equipped with technology such as the HPPO process (propylene oxide from hydrogen peroxide) developed by thyssenkrupp and Evonik Industries. The plant was expected to become operational in 2021.

March 2020

To mitigate the spread of Covid-19, Hungary declared a state of emergency on March 11. Containment measures include banning of public gatherings and restrictions on travel and economic activity.

On March 19, the government imposed a moratorium on all loan repayments for individuals and companies until the end of 2020.

Hungary passed a new law on March 30, which granted Prime Minister Viktor Orbán the power to rule by decree. Parliament was suspended for the rest of 2020.

April 2020

In response to the coronavirus pandemic, on April 9, Hungary announced an Economy Protection Fund as one of its support packages. The Fund would be financed through primarily through reallocations from ministries’ resources. It aimed to protect jobs, notably by subsidising wages to companies for workers who were put on shortened work hours; created jobs by supporting investments worth a total of HUF450 billion; and supported priority sectors, including tourism, health, food, agriculture, construction, logistics, transport, film and entertainment industries.

April 2022

Parliamentary elections scheduled.

Sources: BBC Country Profile – Timeline, Fitch Solutions

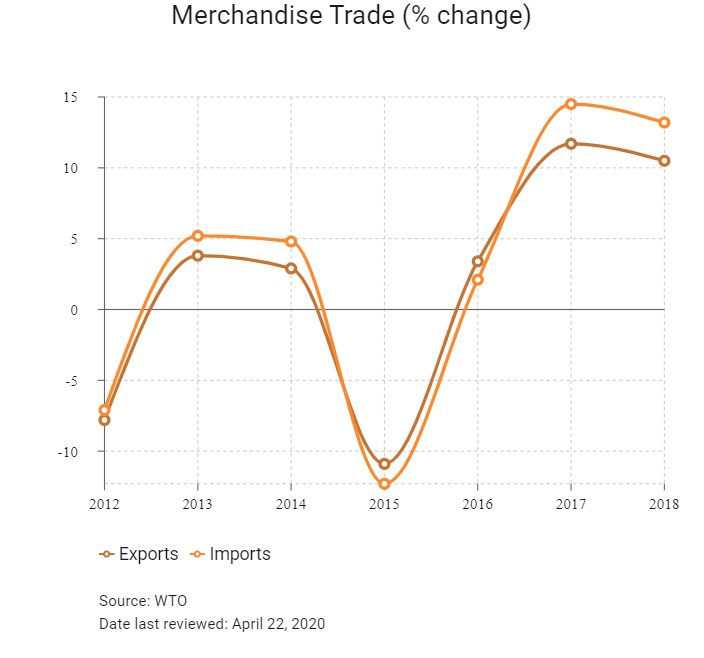

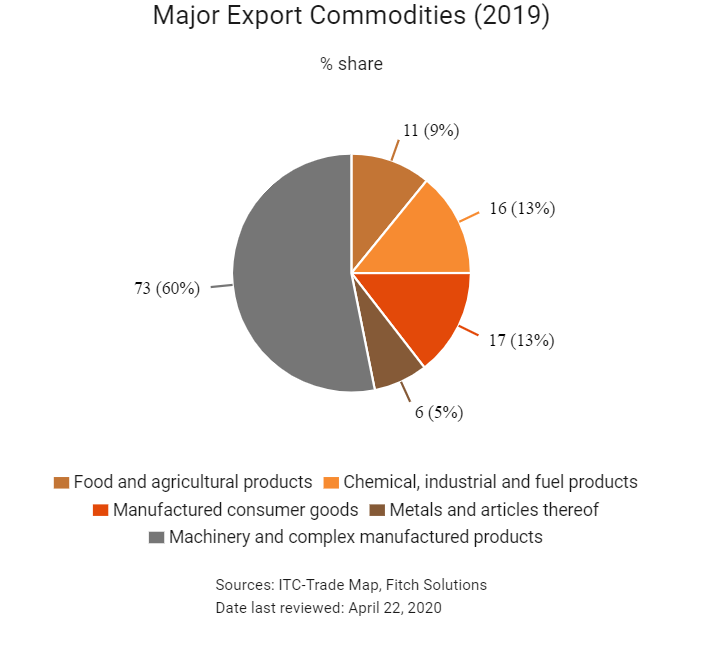

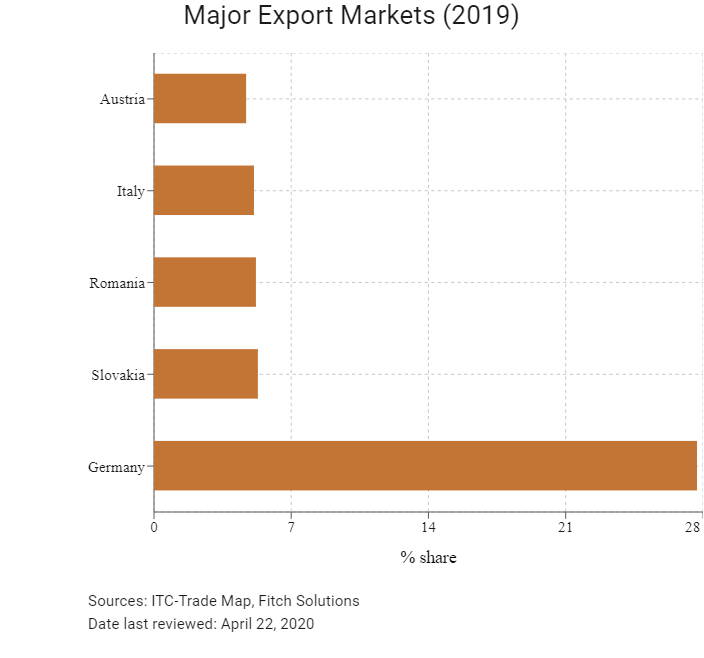

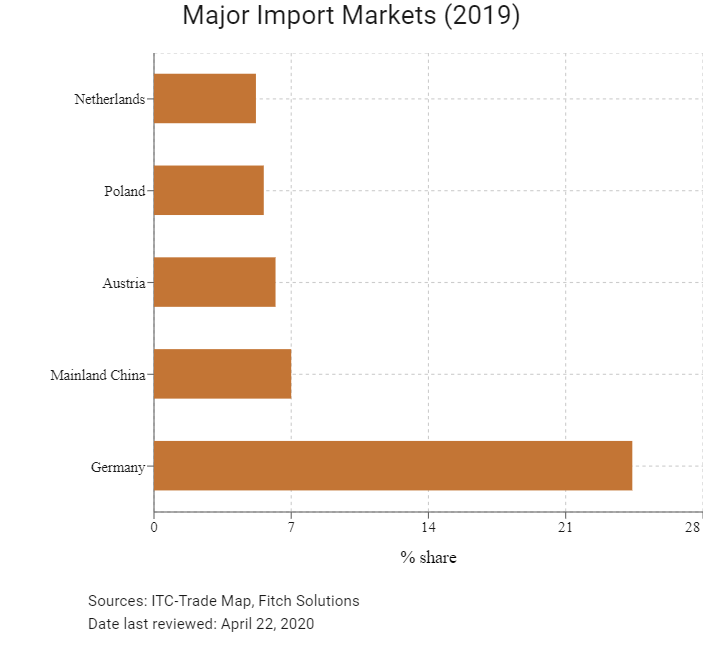

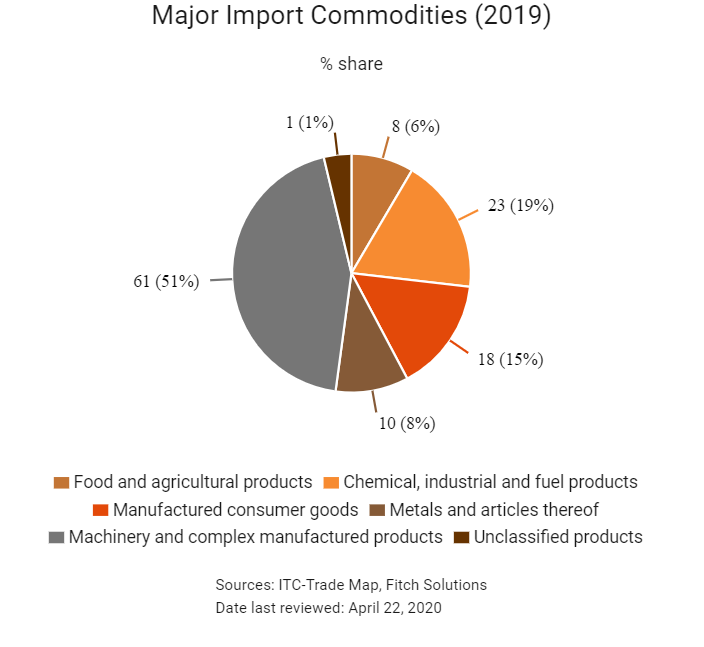

Merchandise Trade

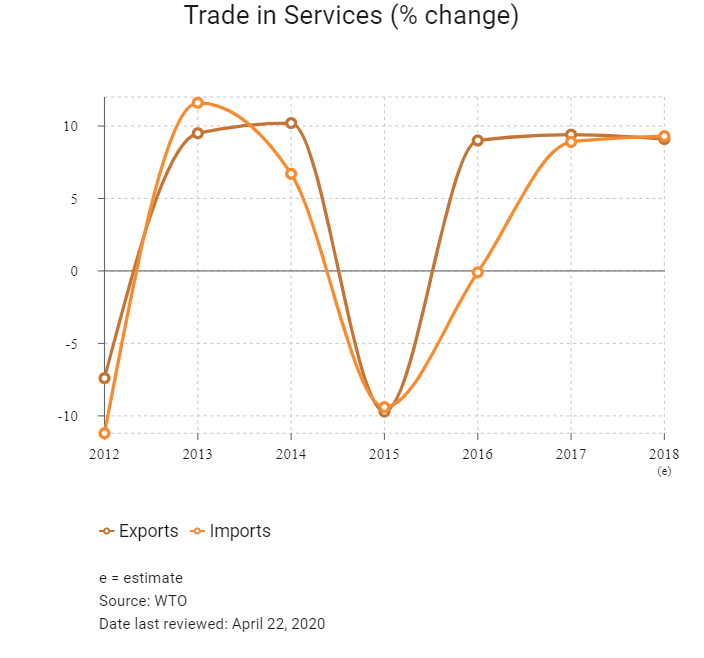

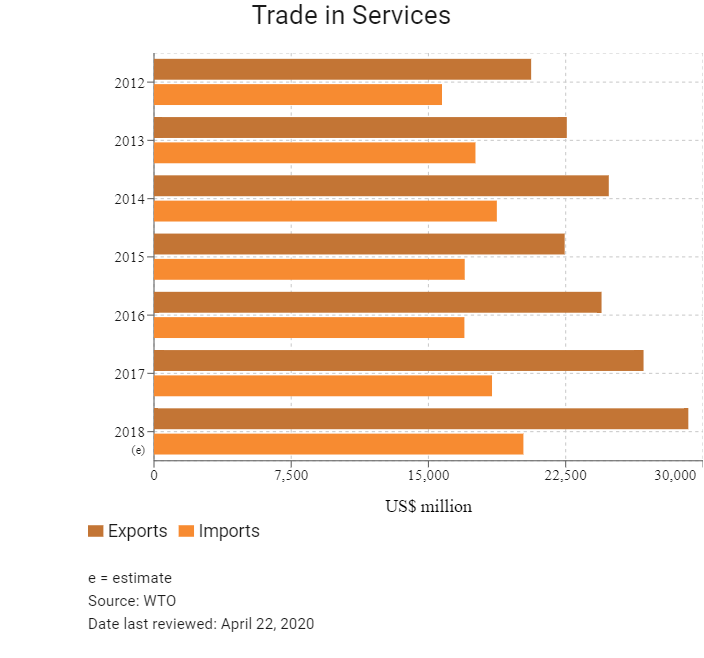

Trade in Services

- Hungary has been a member of the World Trade Organization (WTO) since January 1, 1995 and a member state of the EU since May 1, 2004.

- Hungary's main trade partners are in the EU, and the absence of customs charges supports large volumes of trade. All EU member states adopt common external trade policy and measures. The country's trade policy is largely identical to that of the wider regional bloc.

- Hungary applies the EU's Common External Tariff, which means that goods manufactured and imported from within the EU are not subject to customs charges. The EU updated its trade policy (and by extension its import tariffs, customs, duties and procedures) in 2017 and 2018. The average tariff rate for EU states is just 1%, among the lowest globally, although goods imported from outside the EU incur duties of between 0% and 17%. Most of the country's major trade partners are within the EU, and risks are thus less pronounced, such that Hungary's average tariff rate stands at 1.5%. Once goods are cleared by customs authorities upon entry into any EU member state, these imported goods can move freely among EU member states without any additional customs procedures.

- In December 2016, EU states agreed on a proposal to modernise the EU's trade defence instruments with a view to shielding EU producers from damage caused by unfair competition. The proposed regulation amends current anti-dumping and anti-subsidy regulations to better respond to unfair trade practices and furnishes Europe's trade defence instruments with more transparency, quicker procedures and more effective enforcement. In exceptional cases, such as in the presence of distortions in the cost of raw materials, it will enable the EU to impose higher duties through the limited suspension of the lesser duty rule. This will provide some protection to Hungary's secondary and tertiary sectors.

- In 2016, the European Commission (EC) introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020. In Q215, the EC issued regulations on trade restrictions with Turkey on cattle, beef, watermelons and prepared tomatoes. This will help protect domestic agriculture and regional farming businesses.

- In June 2018, the EU imposed import duties on 182 goods from the United States in reaction to the steel and aluminium import duties imposed by Washington on the EU. Daimler AG and BMW have stated that they will be putting their Hungarian investments on hold in response to lower demand and fears of a disproportionately large impact on the autos industry resulting from auto tariffs from the United States.

- The EU is party to about 50 free trade agreements (FTAs) and, consequently, access to other markets of the countries concerned is currently mediated through those agreements. The EU's Generalised Scheme of Preferences (GSP) came into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row. Regarding Hong Kong, the territory has been fully excluded from the EU's GSP scheme since May 1, 1998.

- A number of products orginatingfrom Mainland China are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards and solar glass. As of December 2017, the EU did not apply any anti-dumping measures on imports originating from Hong Kong.

- In December 2019, the EU issued a regulation imposing additional import tariffs on a number of fruits and vegetables for the period 2020 to 2021.

Sources: WTO – Trade Policy Review, Global Trade Alert, Fitch Solutions

Trade Updates

- As a member of the EU, Hungary is part of the same trade agreements as its 27 peer states. The region negotiates and enters into trade agreements as a collective owing to the single market nature of the union. In total, the EU has approximately 70 preferential trade agreements in place.

- Hungarian Prime Minister Viktor Orbán met with Mainland China’s President Xi Jingping in April 2019 in Beijing in order to promote the development of relations and cooperation between Mainland China and the countries of the Central and Eastern European region. Orbán was in Mainland China in order to attend the second international forum on the Belt and Road Initiative, from which Hungary is set to benefit, in addition to conducting bilateral talks with Mainland China.

Multinational Trade Agreements

Active

- Hungary has been a member of the EU since May 1, 2004, adopting the EU's common external trade policy and measures. The EU is a political and economic union of 27 member states that are primarily located in Europe. Within the Schengen Area, passport controls have been abolished. A monetary union was established in 1999; it is composed of 19 EU member states that use the euro currency. However, Hungary maintains its own currency – the forint.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): This has provisionally been applied since September 21, 2017, having been signed in October 2016. CETA is expected to strengthen trade ties between the two regions. The agreement is expected to boost trade between partners by more than 20%. Hungary expects CETA to improve trade in goods and services between the two countries while also boosting FDI. According to Hungarian authorities, USD11 billion in FDI has already arrived in Hungary from Canada, highlighting the importance of further market and trade liberalisation. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- Europe Free Trade Association (EFTA): the EFTA includes Switzerland, Norway, Liechtenstein and Iceland. The European Economic Area (EEA) unites the EU member states and the three EEA EFTA states into an internal market governed by the same basic rules. These rules aim to enable goods, services, capital and persons to move freely about the EEA in an open and competitive environment, a concept referred to as the four freedoms.

- EU-Turkey: The EU and Turkey are linked by a customs union agreement which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999 and is a member of the Euro-Mediterranean partnership. The customs union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. Turkey is the EU's fourth largest export market and fifth largest provider of imports. The EU is Turkey's largest import and export partner. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the customs union agreement covers all industrial goods but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural as well as coal and steel products. In December 2016, the EC proposed the modernisation of the customs union and the extension of the bilateral trade relations to areas such as services, public procurement and sustainable development.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the European Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Eswatini, Lesotho, Mozambique, Namibia and South Africa): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of SADC included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking EPAs with the EU as part of other trading blocs – such as with East or Central African communities.

Signed, Awaiting Ratification

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (30 of the 34 parties have ratified the agreement as of October 2019). The agreement has been provisionally applied since 2013.

- EU-Vietnam FTA: In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement. As of October 2019, the final text of the agreement has been finalised and is awaiting signature and conclusion. On March 30 2020, the EU Council concluded the FTA between the EU and Vietnam. Once the Vietnamese National Assembly also ratifies the FTA, the agreement will enter into force before end 2020.

- EU-Mercosur: The EU and Mercosur (Argentina, Brazil, Paraguay and Uruguay) signed a trade deal on June 28, 2019, after 20 years of negotiations. The trade agreement for goods and services will cover nearly 25% of global GDP and almost 800 million people. The deal is expected to cut duties on EU exports to Mercosur by EUR4 billion annually and eliminate tariffs on 93% of Mercosur's exports to the EU and 91% of EU exports to Mercosur states. The deal will also include access to public procurement contracts. Mercosur states will greatly benefit from increased access to the EU for agricultural goods, which has resulted in opposition to the deal by European farmers. European firms, especially those in the manufacturing and industrial sector, will have an advantage over other competitors after the removal of high tariffs. Along with other Central and Eastern European countries, Hungary is likely to benefit substantially from the deal as high valued-added automotive and other mechanical parts are a significant export to South America.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017 with bilateral trade in services adding an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018. Negotiations were still underway as at March 2020.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under United States President Donald Trump's administration against a backdrop of rising global trade tensions.

Sources: WTO Regional Trade Agreements database, European Commission, Fitch Solutions

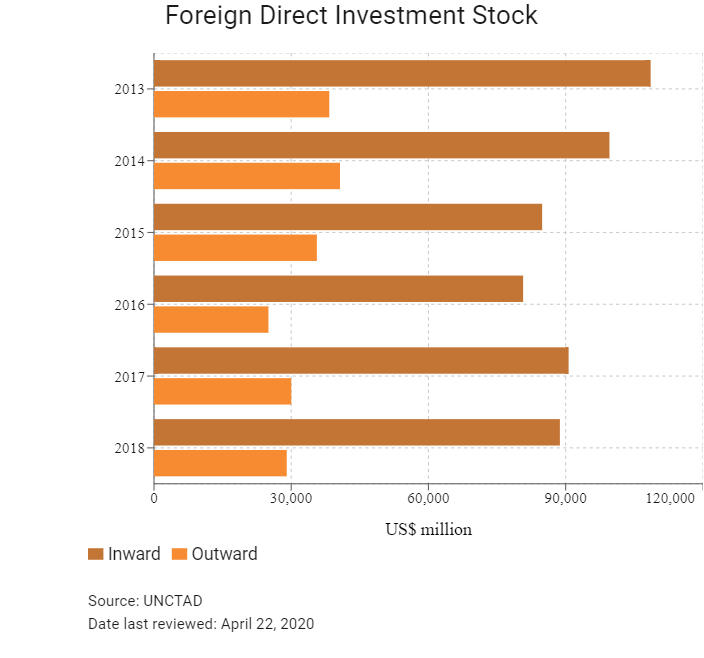

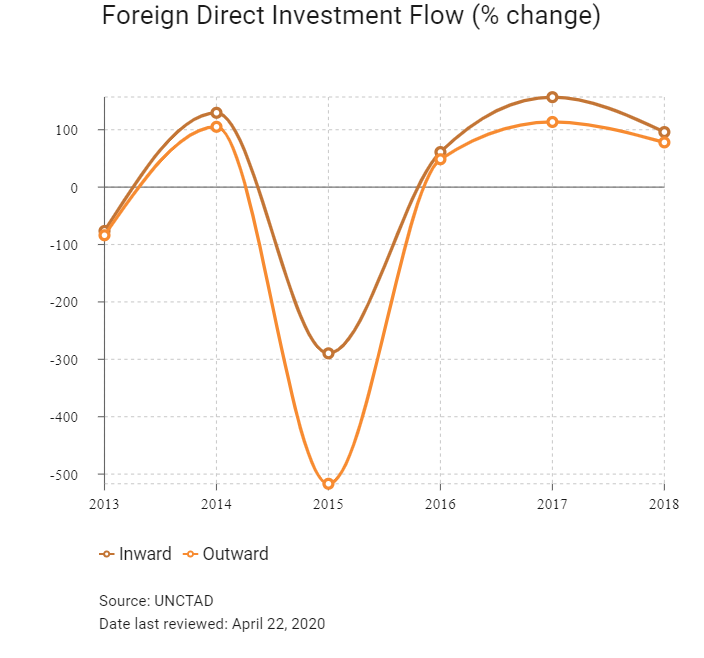

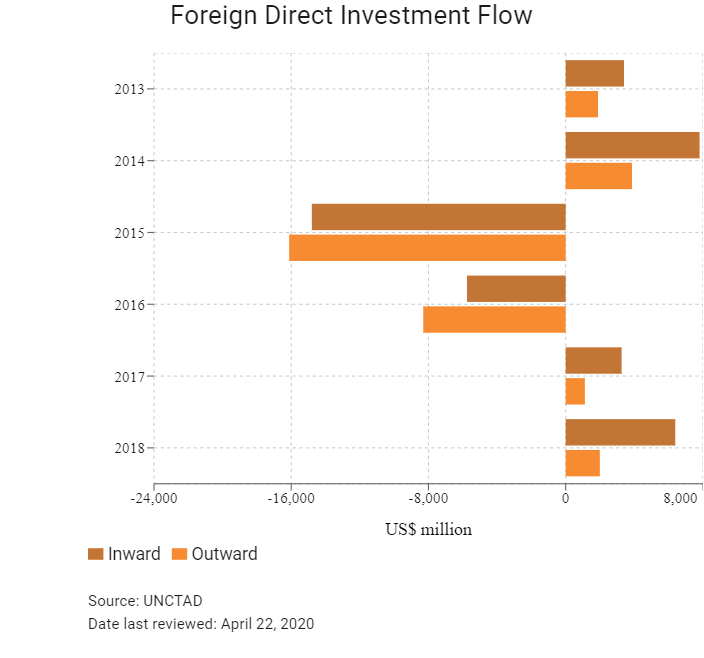

Foreign Direct Investment

Foreign Direct Investment Policy

- The Hungarian Investment Promotion Agency (HIPA) offers management consultancy services to address the needs of investors and is governed by the Ministry of Foreign Affairs and Trade. HIPA also acts as a mediator between business and government, preparing policy proposals to improve the business environment.

- Hungary's accession to the EU was accompanied by the tightening of legal protection for foreign investment, and the government has attempted to guide capital inflows towards targeted sectors such as manufacturing facilities, research and development, IT, automobiles, and tourism. The property rights of foreign investors are also guaranteed against expropriation or nationalisation, except in cases of national security, in which the private owner is entitled to fair compensation.

- The EU formally adopted region-wide legislation on the screening of FDI in February 2019, with new guidelines issued in March 2020 and implementation expected to continue until end 2020. The new legislation will allow member states to screen FDI regarding critical infrastructure, both physical and virtual; sensitive facilities and investments in land and real estate; critical technologies, such as artificial intelligence, cybersecurity, quantum technology, nuclear technology and biotechnology; critical inputs, such as food or fuel; media which threaten pluralism or the freedom thereof; and any services or products which may compromise data security. Hungary previously had no such rules, but the implementation of such oversight will bring it in line with the practices of a number of EU peers.

- There are no legal restrictions on foreign ownership in any sector, and under the Foreign Investment Act of 1988, international companies are guaranteed equal treatment alongside Hungarian businesses, with full freedom regarding the repatriation of profits.

- The manufacturing sector, particularly automobiles, as well as the IT and biological science sectors, have traditionally been the major recipients of FDI owing to their high value-added and export-led focus. The Hungarian government encourages investments in both export-oriented manufacturing and high value-added sectors, such as research and development, and service centres. There are also considerable opportunities that exist in biotechnology, information and communications technology, software development, the automotive and defence industries, and tourism.

- Currently, foreign firms control 66% of the manufacturing sector, 90% of the telecommunications sector and 35% of the energy sector. The private sector currently produces about 80% of Hungary's economic output. Foreign investors interested in financial institutions and insurance companies must officially notify the government of their intentions, but do not need authorisation in advance.

- Under the Investment Act, companies incorporated in Hungary are permitted to purchase and own real estate to support their economic activities. Nevertheless, only private Hungarian or EU citizens resident in Hungary with a minimum of three years of experience working in agriculture or holding a degree in an agricultural discipline can purchase farmland, according to the 2014 Land Law. All others may only lease farmland.

- The Hungarian government regulates the prices of certain goods, setting upper and lower limits to which the private sector must adhere. Price-regulated sectors include energy and pharmaceuticals, and companies operating in these fields have suffered losses in cases where the government has been too slow to adjust upper limits or has failed to meet subsidy obligations, as in the case of medicinal goods and electricity.

- The Hungarian government has publicly declared that reducing foreign bank market share in the Hungarian financial sector and tightening regulations governing non-government organisations are key priority areas. Accordingly, several state-led initiatives over the past several years have targeted the banking sector and reduced foreign participation.

- Regulations in 2015 obligated banks to retroactively compensate borrowers for interest rate increases on certain consumer loans. Increasing entry barriers in certain sectors could have undermined previous sunk-cost investments, contributing to a general sense of policy-induced uncertainty regarding the protection of intangible assets.

- Performance requirements, such as job creation or investment minimums, can be imposed as a condition for establishing, maintaining or expanding an investment. Hungary's rules and regulations regarding labour mobility are broadly in line with EU directives. Most non-EU citizens require a work visa and permit in order to enter and work in Hungary, which generally takes about a month to obtain. There is a large amount of bureaucracy that businesses must contend with when trying to bring in foreign workers from non-EU states.

- As part of the country's EU accession, Hungary eliminated foreign trade zones. Although the Ministry of National Economy had plans to nominate customs-free zones, there currently seems to be little demand. Nevertheless, Hungary offers a well-developed incentive system for investors, which is anchored by a special incentive package for investments over a certain value-typically more than USD11 million. Administered by HIPA and managed by the Ministry of National Development, the incentive system is compliant with EU regulations on competition and state aid.

- In 2013 the government established free entrepreneurial zones in remote and underdeveloped regions of the country, which aim to promote economic growth and job creation. Businesses located in these zones will benefit from a lower qualification threshold and fewer stipulations for a range of tax incentives. Free entrepreneurial zones are open to all types of businesses, although the government will be more inclined to provide generous incentives for targeted industries, including manufacturing and research and development. Additional government aid incentives are available at varying rates depending on the location of investment.

- International investors benefit from bilateral investment agreements with more than 50 partners, including Mainland China, Germany, Russia and the United Kingdom. There is no investment agreement with the United States, but Hungary has a double taxation treaty with Washington and 50 other governments, which eliminates the risk of double taxation. Hungary has also signed almost 50 strategic cooperation agreements with international companies, including Coca-Cola, General Electric and Hewlett-Packard, which aim to consolidate the investment of foreign companies in Hungary and improve cooperation between investors and the government.

Sources: WTO – Trade Policy Review, the International Trade Administration, United States Department of Commerce, Hungarian Investment Promotion Agency

Free Trade Zones And Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

The free entrepreneurship zone contains more than 900 settlements in underprivileged areas of Hungary designated by the government and coordinated by the regional business development agency that consists of individual regions separated by public administration, borders and topographical lot numbers and which are treated jointly for regional development purposes. |

Investors who establish one of the following centres or facilities stand to benefit from incentive packages: |

Sources: Hungarian Government websites, Fitch Solutions

- Value Added Tax: 27%

- Corporate Income Tax: 9%

Sources: Hungary National Tax and Customs Administration

Important Updates to Taxation Information

- The government aims to further decrease the labour tax rate (especially the social contribution tax rate) over the period 2020 to 2022. The proposed reduced social tax rate is 15.5% for FY2020 down from 19.5% (if certain conditions are met) and further reductions are expected (the final proposed rate is 11.5%) by FY2022, subject to certain conditions.

- On December 12 2019, the Hungarian National Tax and Customs Administration issued a guide of value added tax (VAT) changes for 2020. The changes include: 1) a rate reduction for accommodation services to 5% from 18%, subject to a 4% tourism development contribution; 2) the harmonisation of intra-EU deliveries of goods; 3) the determination of the place of performance in a chain transaction; 4) rules for tax-free intra-EU sales; and 5) the allowance of VAT base reductions for bad debt claims. These changes took effect January 1, 2020.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

9% |

|

Dividends |

5% on net earnings (except distribution by companies in the oil and gas sector). |

|

Capital Gains Tax |

9% |

|

Mines, energy producers and energy distribution system operators are subject to energy suppliers’ income tax |

31% |

|

Local Business Tax |

2% on turnover or gross margin |

|

Social security contributions |

- 19.5% on gross salaries paid by employer. |

|

Innovation contribution |

0.3% |

|

VAT |

- 27% on sale of goods, services and imports |

Source: Hungary National Tax and Customs Administration

Date last reviewed: April 22, 2020

Localisation Requirements

Hungary's rules and regulations regarding labour mobility are broadly in line with EU directives. Most non-EU citizens require a work visa and permit in order to go and work in Hungary, which generally takes about a month to obtain.

Obtaining Foreign worker permits for skilled workers

There are certain requirements that businesses must meet when trying to bring in foreign workers from non-EU states. First, a workforce demand is required. The hiring company must advertise the job at the Hungarian Labour Office for a fixed period (around 15 days). This is to give unemployed Hungarian citizens a chance to apply for the position. Thereafter, a work permit may be processed. Most work permits and working visas are issued for two years. Both these documents can be renewed to extend the stay in Hungary if the employee continues to fulfil the application requirements. Generally, the highest number of foreign workers employed with a work permit at the same time in the territory of Hungary cannot exceed the number of announced applications in an average month in the year before the year in question. The quota is set at 57,000 work permits in 2019.

Blue Card

The Blue Card is intended for the stay of a highly qualified employee. A foreigner holding a Blue Card may reside in Hungary and work in the job for which the Blue Card was issued or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which lasted for at least three years. The Blue Card is issued with a term of validity three months longer than the term for which the employment contract has been concluded; however, this is for a maximum period of two years. The Blue Card can be extended. One of the conditions for issuing the Blue Card is a wage criterion – the employment contract must contain gross monthly or yearly wage at least 1.5 times the gross average annual wage.

Visa/Travel Restrictions

Nationals of Canada, Australia and the United States intending to stay in Hungary for more than 90 days need to apply for a long-term stay visa, whereas EU nationals staying for longer than 90 days need only register with the immigration department. In addition, citizens of many other countries may travel to Hungary without a visa and stay for a maximum period of 90 days. For Hong Kong, this exemption applies only to Hong Kong passport holders.

Schengen Visa

Hungary has been part of the Schengen Agreement as of since December 7, 2017, which has made traveling between member countries much easier and less bureaucratic. The Schengen visa and entry regulations are only applicable for a stay not exceeding 90 days. In the wake of the migrant crisis in Europe, the Schengen states have tightened controls at their common external borders to ensure the security of those living or travelling in the Schengen Area.

Sources: Hungarian Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa3 (Stable) |

23/11/2018 |

|

Standard & Poor's |

BBB (Stable) |

28/04/2020 |

|

Fitch Ratings |

BBB (Stable) |

14/02/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

48/190 |

53/190 |

52/190 |

|

Ease of Paying Taxes Index |

93/190 |

86/190 |

56/190 |

|

Logistics Performance Index |

31/160 |

N/A |

N/A |

|

Corruption Perception Index |

64/180 |

70/180 |

N/A |

|

IMD World Competitiveness |

47/63 |

47/63 |

N/A |

Sources: World Bank, IMD, Transparency International

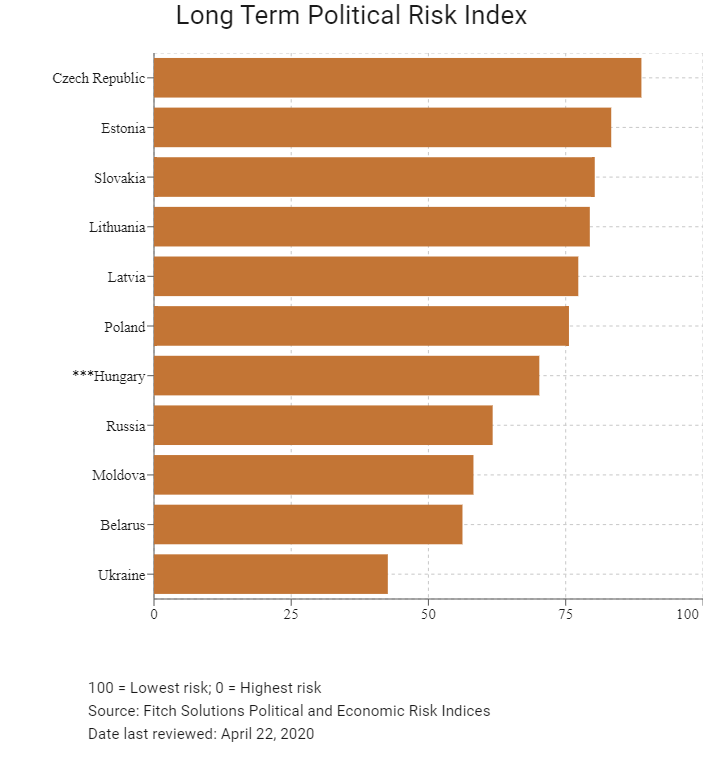

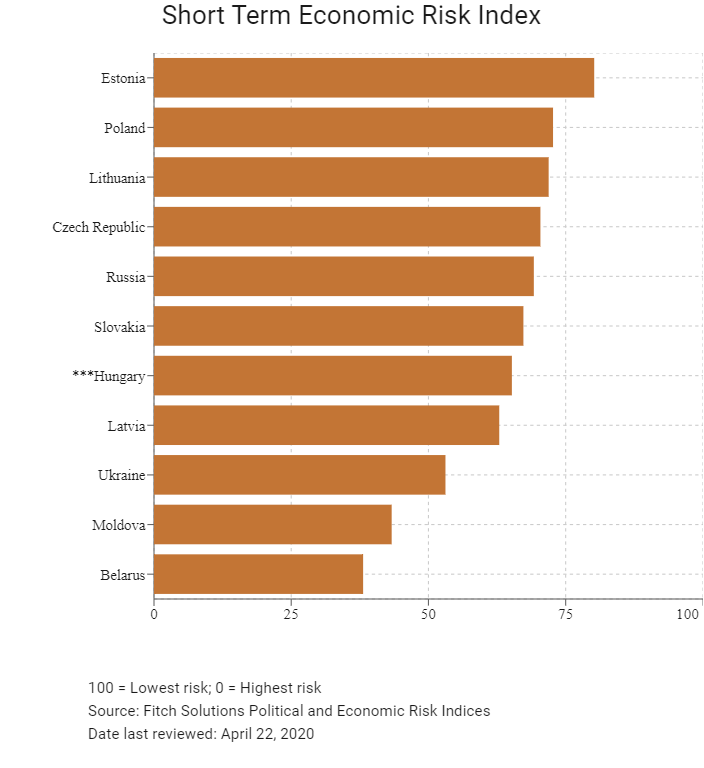

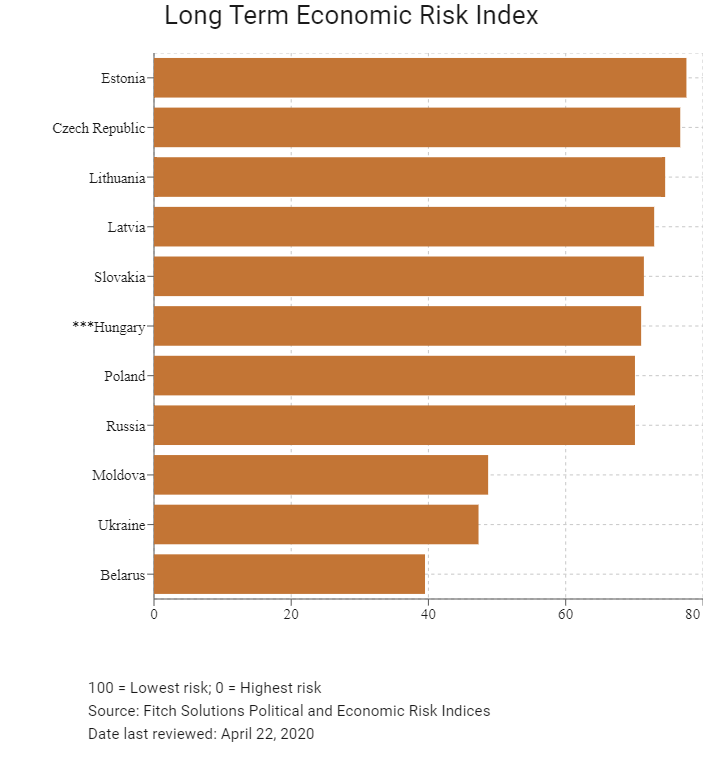

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

36/202 |

34/201 |

33/201 |

|

Short-Term Economic Risk Score |

71.5 |

67.7 |

65.2 |

|

Long-Term Economic Risk Score |

69.8 |

70.1 |

71.0 |

|

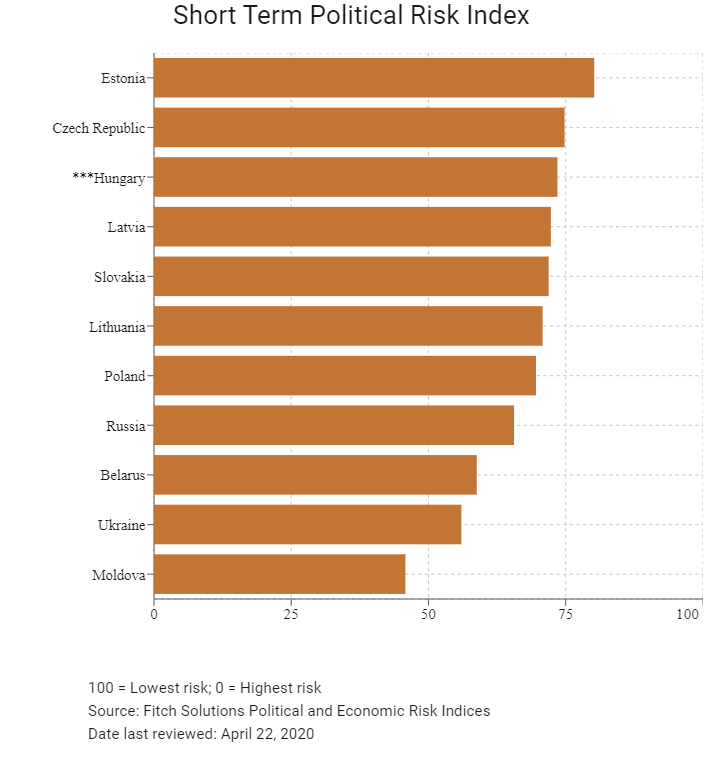

Political Risk Index |

69/202 |

71/201 |

68/201 |

|

Short-Term Political Risk Score |

73.5 |

73.5 |

73.5 |

|

Long-Term Political Risk Score |

70.2 |

70.2 |

70.2 |

|

Operational Risk Index |

39/201 |

46/201 |

46/201 |

|

Operational Risk Score |

64.3 |

63.5 |

63.6 |

Source: Fitch Solutions

Date last reviewed: April 22, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Economic growth rates in Hungary will slow in the coming years. An increasingly tight labour market and weakening external demand backdrop due to Covid-19 will weigh on output. Gross external debt will remain somewhat high by regional standards, although the downward trajectory and high proportion of intercompany loans will ensure it is sustainable in the medium term.

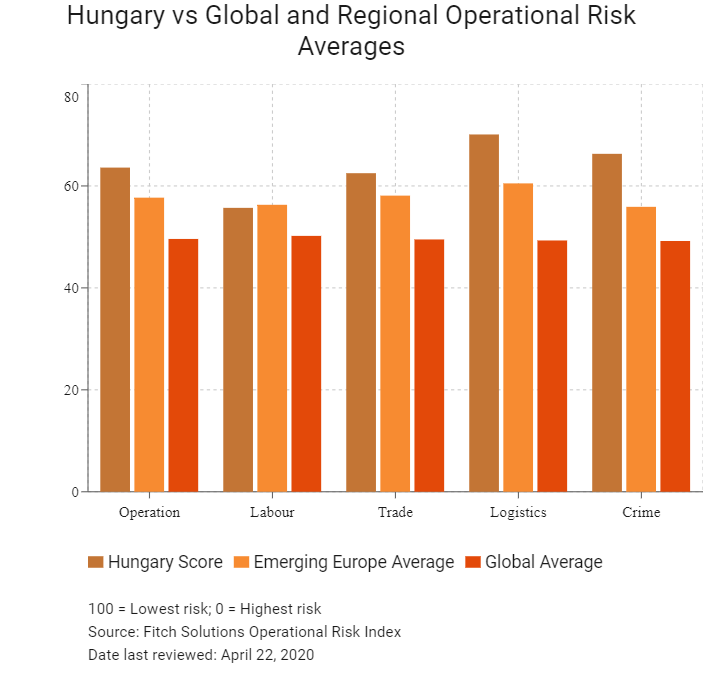

OPERATIONAL RISK

Investors in Hungary benefit from the country's relatively stable operating environment and a highly urbanised labour force with a strong skills base. As a member of the EU, Hungary offers open markets and an increasingly competitive corporate tax regime, while its geographic location and strong overland transport links consolidate its position as a major regional trade hub within Central and Eastern Europe. Despite an above-average score, Hungary ranks less competitively against its regional peers as investors face mounting risks associated with high utility costs, compounded by energy import reliance and labour shortages in key sectors, which dent competitiveness in manufacturing industries. Policy uncertainty poses downside risks to the operating environment.

Source: Fitch Solutions

Date last reviewed: April 28, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Hungary Score |

63.6 |

55.7 |

62.5 |

70.1 |

66.3 |

|

Central and Eastern Europe Average |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

7 |

9 |

7 |

5 |

7 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

9 |

19 |

12 |

7 |

10 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

46 |

62 |

53 |

36 |

46 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

70.9 |

63.1 |

75.0 |

71.0 |

74.3 |

|

Czech Republic |

69.4 |

60.6 |

67.0 |

73.6 |

76.5 |

|

Lithuania |

69.4 |

61.3 |

71.1 |

74.3 |

71.0 |

|

Poland |

68.1 |

59.2 |

64.9 |

75.5 |

72.8 |

|

Latvia |

67.1 |

63.5 |

68.2 |

69.4 |

67.4 |

|

Slovakia |

63.7 |

52.1 |

66.2 |

66.8 |

69.6 |

|

Hungary |

63.6 |

55.7 |

62.5 |

70.1 |

66.3 |

|

Belarus |

59.2 |

60.1 |

58.7 |

66.6 |

51.3 |

|

Russia |

58.0 |

65.9 |

57.4 |

67.9 |

40.6 |

|

Moldova |

49.7 |

44.8 |

51.4 |

53.4 |

49.3 |

|

Ukraine |

48.6 |

57.9 |

48.4 |

54.4 |

33.6 |

|

Regional Averages |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 22, 2020

Hong Kong’s Trade with Hungary

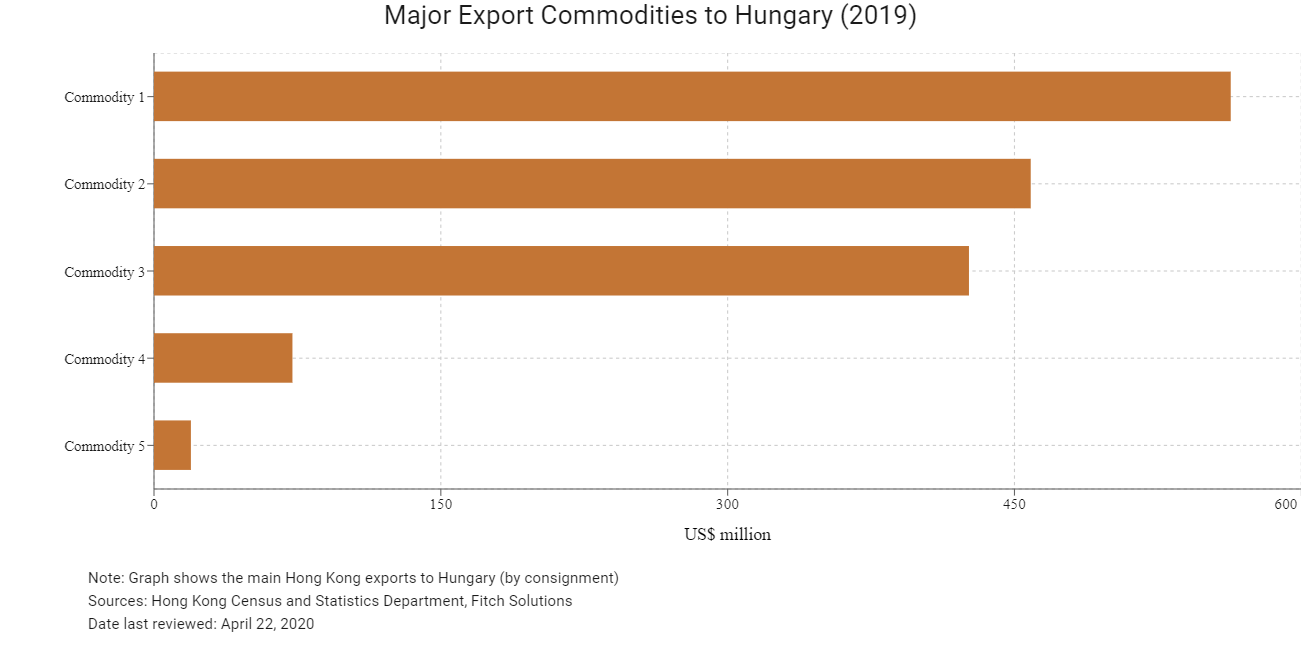

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 563.1 |

| Commodity 2 | Office machines and automatic data processing machines | 458.5 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 426.2 |

| Commodity 4 | Miscellaneous manufactured articles | 72.4 |

| Commodity 5 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 19.3 |

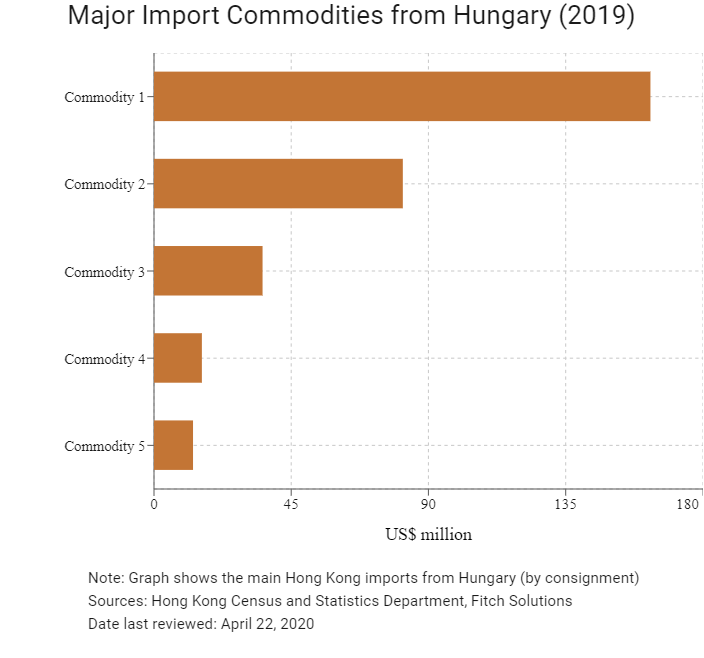

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 162.8 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 81.6 |

| Commodity 3 | Office machines and automatic data processing machines | 35.6 |

| Commodity 4 | Meat and meat preparations | 15.7 |

| Commodity 5 | Miscellaneous manufactured articles | 12.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Hungary residents visiting Hong Kong |

9,636 |

-6.4 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board, Fitch solutions

Date last reviewed: April 22, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

2334 |

22.5 |

|

- Regional headquarters |

507 |

14.2 |

|

- Regional offices |

764 |

23.0 |

|

- Local offices |

1063 |

26.5 |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Hungary

Hungary has a Double Taxation Avoidance Agreement (DTA) and investment promotion and protection agreement with Mainland China, which it concluded on June 17, 1992. This entered into force in both countries on December 31, 1994.

A DTA between Hong Kong and Hungary was signed on May 12, 2010 and entered into force on February 23, 2011.

Sources: OECD, Hong Kong Inland Revenue Department, UNCTAD, Fitch Solutions

Chamber of Commerce or Related Organisations

The European Chamber of Commerce in Hong Kong

The European Chamber of Commerce creates business opportunities via its network of Chambers, business associations and government agencies.

Address: Room 1302, 13/F, 168 Queen’s Road, Central, Hong Kong

Email: info@eurocham.com.hk

Tel: (852) 2511 5133

Fax: (852) 2511 6833

Source: The European Chamber of Commerce in Hong Kong

Hungary-Hong Kong Business Association

Email: laszlo.meszaros@hktdc.org

Tel: (36) 1 224 7766

Website: www.hhkba.hu

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate General of Hungary in Hong Kong

Address: Suites 1208-09, 12/F, ICBC Tower, Three Garden Road, Central, Hong Kong

Email: mission.hgk@mfa.gov.hu

Tel: (852) 2878 7555

Fax: (852) 2878 7010

Visa Requirements for Hong Kong Residents

Hungary has been a member of the Schengen Area since December 21, 2007. The Consulate General of Hungary in Hong Kong does not issue Schengen visas; therefore, all Schengen visa applications are handled by the Netherlands Consulate General in Hong Kong. HKSAR passport holders do not require a visa for the Schengen area for stays of up to 90 days.

Source: Consulate General of Hungary in Hong Kong

Date last reviewed: April 22, 2020

Hungary

Hungary