GDP (US$ Billion)

107.44 (2019)

World Ranking 61/194

GDP Per Capita (US$)

6,222 (2019)

World Ranking 93/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

46.7 (2019)

Currency (Period Average)

US Dollar

1per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

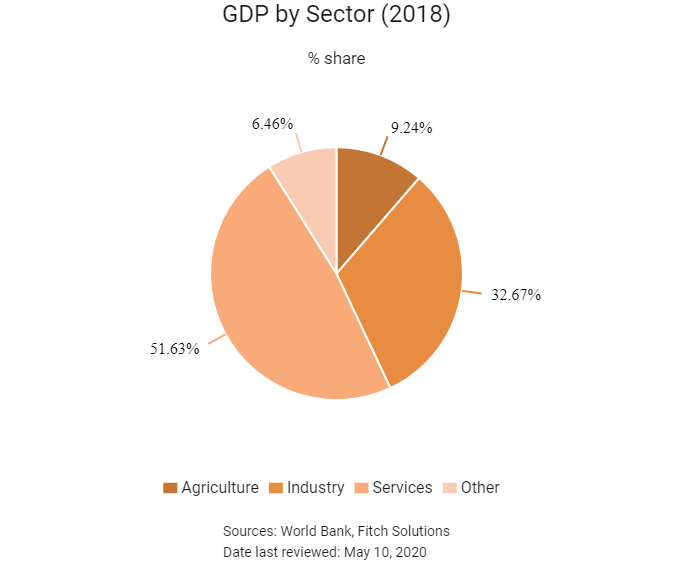

Overview

Ecuador is highly dependent on its hydrocarbon resources, which generally account for more than half of the country's export earnings. In March 2000, Congress approved a series of structural reforms that provided for the adoption of the United States dollar as legal currency. Dollarisation stabilised the economy, and positive growth occurred in the following years mainly because of high oil prices and increased non-traditional exports. Thanks to the boom in oil prices between 2007 and 2014, Ecuador experienced a period of growth and poverty reduction, however lower-for-longer oil prices in the quarters ahead do not bode well for the country’s under-diversified economy. In 2019, the IMF granted Ecuador a USD4.2 billion loan to aid further economic restructuring efforts under the 'Ley Fomento Productivo' – the current economic plan under President Lenín Moreno. Fiscal consolidation and private sector development are pivotal for achieving macroeconomic stability. It is necessary to maintain and create new job opportunities to reduce poverty and make families more resilient to external and natural disaster shocks.

Sources: World Bank, Fitch Solutions, IMF

Major Economic/Political Events and Upcoming Elections

February 2018

President Moreno held a national referendum on six issues, including a decision to overturn the abolition of term limits for the president. The public provided overwhelming support for all of the issues on the referendum, resulting in (among others) the reinstatement of term limits for the office of the president.

March 2019

The IMF announced a USD4.2 billion loan for Ecuador, releasing USD652 million upon the announcement. The funds have been earmarked for support of the Ecuadorean government’s economic policies out to 2021.

October 2019

The Ecuadorian government restored fuel subsidies in a deal with indigenous leaders.

March 2020

Amid the outbreak of Covid-19, the government responded with series of measures to protect the population and support the economy. Ecuador shut all its borders on March 18.

On March 19, measures were announced to support the population and businesses amid the Covid-19 outbreak, such as deferral of payroll contributions, exceptional cash transfer amounting to USD4120 to 400 thousand poor families, later extended to 950 thousands families, distribution of food baskets, and a financing of UDD50 million in credit lines for small- and medium-size businesses.

May 2020

On May 4, Ecuador’s confinement policy changed from social isolation to social distancing and the government had planned steps on the reopening of the economy.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

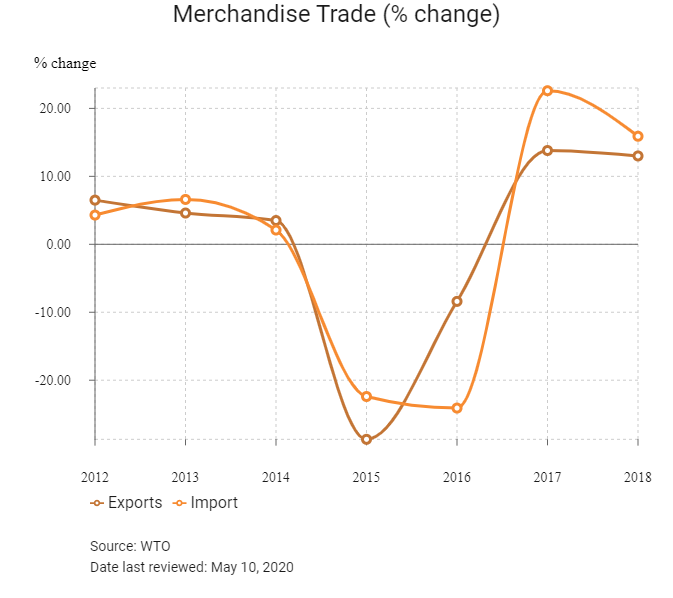

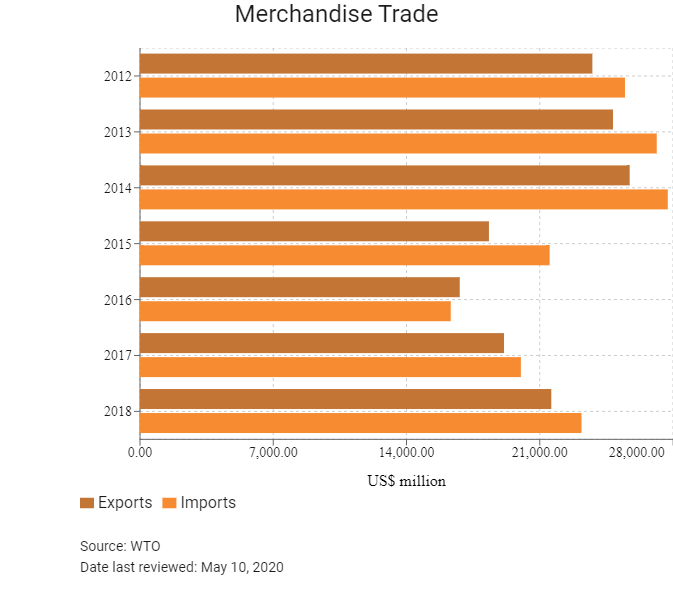

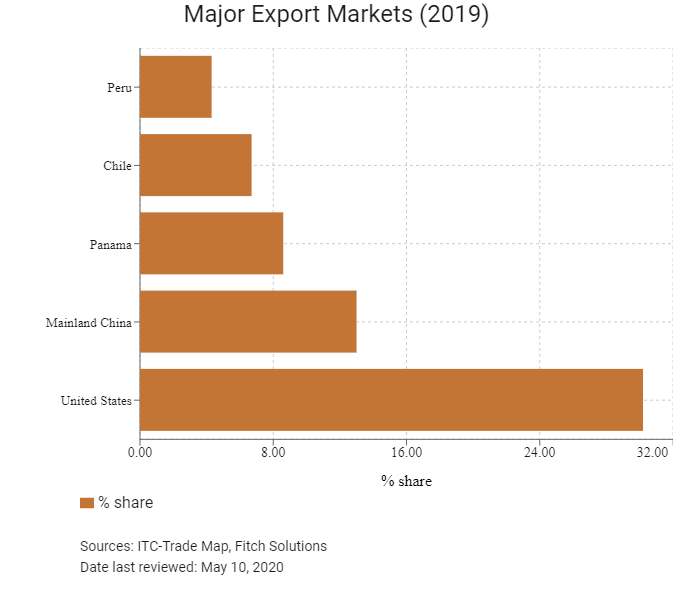

Merchandise Trade

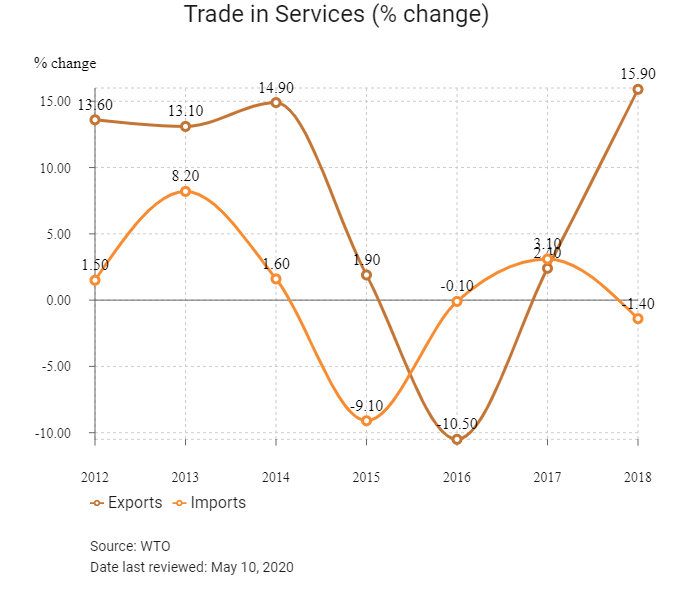

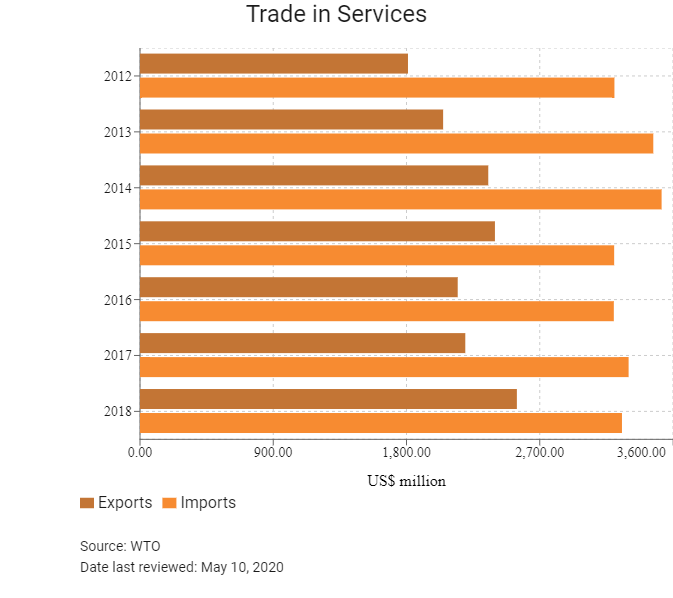

Trade in Services

- Ecuador has been a World Trade Organization (WTO) member since January 21, 1996.

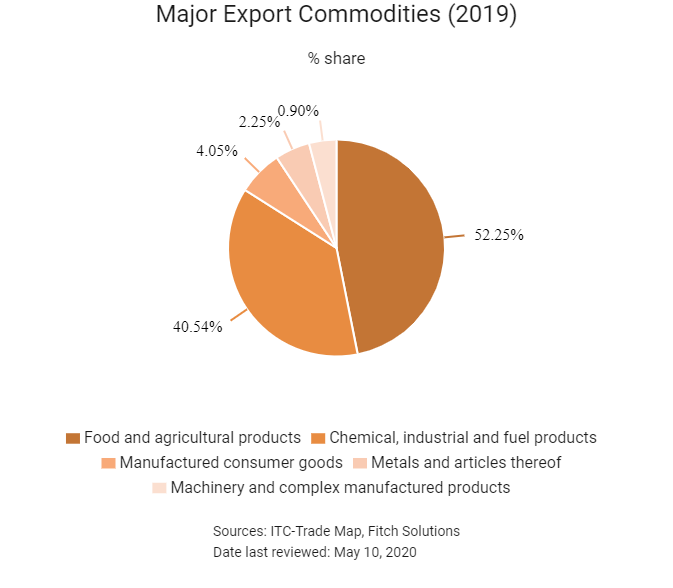

- Despite the sharp fall in their prices, mineral products – and oil in particular – are Ecuador's main export goods. In 2018, they accounted for some 41.8% of total goods exports, a 5.1% increase since 2017. Although food and agricultural products represent 50.5% of all goods exports from Ecuador, the sector is much more diversified. Bananas and crustaceans – mainly shrimp – are the two biggest agricultural and food exports in Ecuador, followed by cocoa and cocoa products, and meat and seafood.

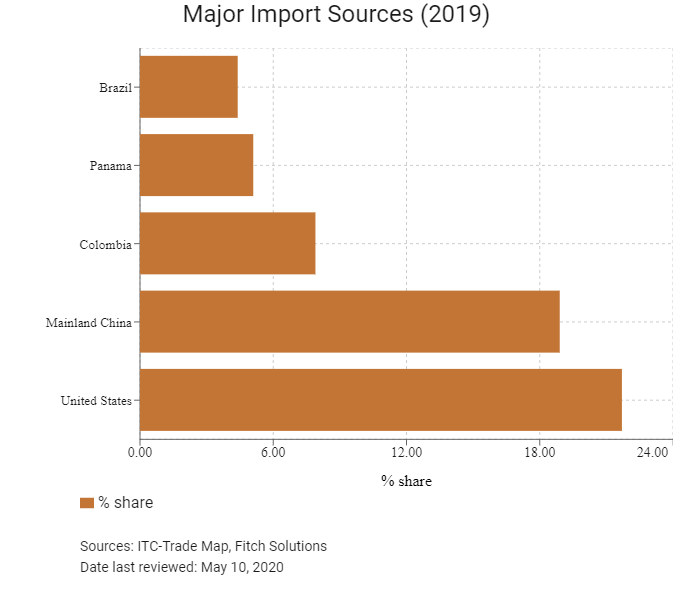

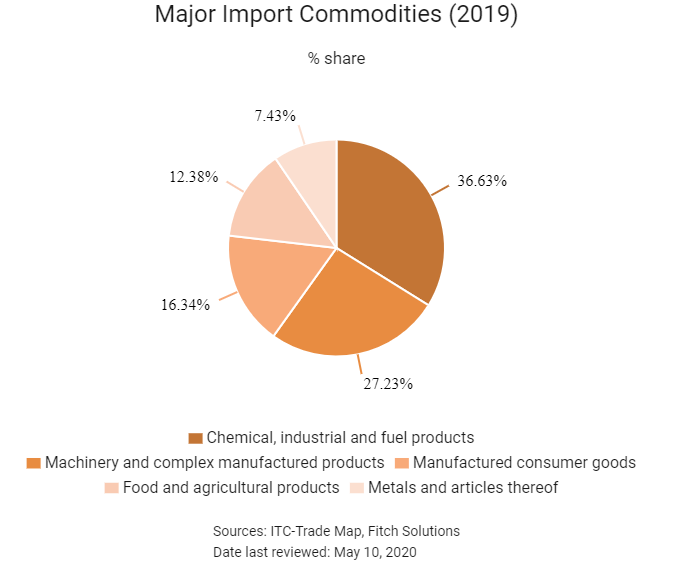

- Although Ecuador is a major oil producer, it lacks the refining capacity to meet domestic demand for refined products and imports oil derivatives: chemical, industrial and fuel products accounted for 33.2% of total imports in 2018. Mineral products – such as refined fuel – represented 19.7% of all imports in the same time period. Machinery and complex manufactured products made up the second-largest category of goods imported by Ecuador in 2018, accounting for an estimated 32.4% of all goods entering the country.

- Ecuador's constitution outlines that the state has sole control of 'strategic' sectors, including: energy in all its forms, telecommunications, non-renewable natural resources, transport and refining of hydrocarbons, biodiversity and genetic heritage, the radio spectrum and water.

- Ecuador participates in multilateral trading systems, where economic interaction between entities are fair and inclusive. Ecuador's stance on multilateral trade is that any outcomes from engagement with international or regional trade should prioritise development and to take into account flexibilities for developing least developed countries.

- Ecuador is a member of the Andean Community (CAN) and the Latin American Integration Association (LAIA).

- Ecuador has yet to submit the ratified Agreement on Trade Facilitation – agreed upon at the 2013 Bali Ministerial Conference among WTO member states. The agreement contains provisions for expediting the movement, release and clearance of goods, including goods in transit. It also sets out measures for effective cooperation between customs and other appropriate authorities on trade facilitation and customs compliance issues; it further contains provisions for technical assistance and capacity building in this area. The WTO notes, however, that Ecuador has taken proactive steps towards facilitating cross-border trade, such as introducing an electronic customs system, ECUAPASS and the Ecuadorian Single Window (VUE) in 2018.

- Ecuador is not a party to the WTO Agreement on Government Procurement and does not participate as an observer in the Committee on Government Procurement.

- As of 2019, Ecuador has banned the export of aluminium and copper wastes and scraps.

- The government has banned the import of air conditioning equipment (as of 2013) and the import of incandescent light bulbs (as of 2010).

- Since Ecuador is a member of the CAN, goods to be imported are classified under the Common Nomenclature of the Andean Countries participating in the Cartagena’s Agreement (NANDINA) Pact, which is based on the Customs Cooperation Council Nomenclature (also known as the Brussels tariff nomenclature). Most consumer goods imports pay 25%, while intermediate goods are usually imported at a 10% or 15% rate. Raw materials and capital goods generally pay 0% to 5%. Ecuador has negotiated exceptions under the Andean common tariff that allow lower duties on certain capital goods and industrial inputs. There is duty-free import of agricultural goods and equipment.

- In addition to import duties, all imports are subject to 12% VAT and other minor taxes that do not exceed 1%. Charges are based on the cost, insurance and freight (CIF) value of the merchandise.

- All Ecuadorian imports and exports are subject to inspection by authorised international verification companies operating in the country (there are some imports exempt from verification). Goods are appraised for value, quantity, quality, and weight at the port of origin.

- A Special consumption tax (Impuesto a los Consumos Especiales or ICE) is imposed on domestic and imported goods that are explicitly listed in the law, including sugared, non-alcoholic and carbonated drinks. This tax is levied at a progressive rate from 5% to 35% on certain automobiles and 15% on airplanes, helicopters, and boats. The taxable basis on cigarettes and alcoholic beverages is obtained by the number of produced or imported cigarettes or degrees of alcohol, respectively.

- Since 2017, a commercial agreement between the European Union (EU) and Ecuador in place, which provides relief on duties upon the importation of certain goods.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The CAN: The community – which came into existence in 1969 – comprises Peru, Colombia, Ecuador and Bolivia. CAN is a Free Trade Area (FTA) with the goal of eventually becoming a customs union. At present, however, trade between members remains unencumbered by tariffs and other formal measures of trade protection. CAN also provides its members with improved bargaining power, given the collective nature of the organisation. The community also promotes the free movement of people, with residents from member states not requiring a visa. 12.4% of all imports originate in fellow CAN members, with 11.5% of all Ecuadorean exports destined for Peru, Colombia and Bolivia.

- EU-CAN: In January 2017, CAN ratified a Free Trade Agreement (FTA) and Economic Integration Agreement with the EU. The agreement eliminates tariffs for all industrial and fisheries products, increases market access for agricultural products, improves access to public procurement and services and further reduces technical barriers to trade. The agreement allows Ecuador to benefit from improved access for its main exports to the EU, such as fish and fish products, cut flowers, coffee, cocoa, fruits and nuts. Bananas also benefit from a preferential rate, but a stabilisation mechanism is in place that allows the Commission to examine and consider the suspension of preferences if an annual threshold is reached, as is currently the case for trade deals with Colombia, Peru and Central America. The FTA also includes commitments to effectively implement international conventions on labour rights and environmental protection, which are monitored with the systematic involvement of civil society. The EU accounts for 14.0% of all Ecuadorean trade.

- Southern Common Market-CAN (Mercosur-CAN): As a member of the CAN, Ecuador is party to commercial agreements with Mercosur (Brazil, Argentina, Paraguay and Uruguay). Mercosur member states present greater economic opportunities for firms in Ecuador and the Agreement brings about greater economic integration. This supports the FTA of the Americas - an agreement that reduces the trade barriers among all countries in Latin America.

- Ecuador-Chile: The Economic Complementation Agreement Chile - Ecuador was signed under the 1980 Montevideo Treaty, which created the Latin American Integration Association. The treaty created an economic space that allows for the free movement of goods, services and factors of production and strengthens political dialogue and cooperation. The agreed-upon rules cover matters such as the tariff reduction programme, unfair trade practices, safeguards, technical standards, scientific and technological cooperation, sanitary and phytosanitary standards, maritime and air transport, dispute resolution, automotive and government procurement, among others. Trade with Chile accounts for 4.5% of all trade.

- Ecuador-Mexico: Mexico is Ecuador's sixth largest import partner. As of 2018, Ecuador received 3.5% of all its imports from Mexico, of which vehicles and vehicle parts made up the highest percentage.

- Ecuador-Guatemala: Guatemala is Ecuador's 38th largest import partner. As of 2018, Ecuador received 0.2% of all its imports from Guatemala, of which residues and waste from food industries and prepared animal fodder made up the highest percentage.

- Ecuador-El Salvador: The bilateral Partial Scope Agreement came into force in November 2017 and covers trade in goods. El Salvador is Ecuador's 28th largest export partner, and as of 2018, Ecuador exported 0.4% of its total exports to El Salvador. The majority of these exports were mineral fuels, mineral oils and products of their distillation.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Invest Ecuador is the Ecuadorian platform for investment projects throughout the country and all strategic sectors.

- Ecuador's Constitution stipulates that the State reserves the right to administer, regulate, monitor and manage strategic sectors – namely: energy in all its forms, telecommunications, non-renewable natural resources, transport and refining of hydrocarbons, biodiversity and genetic heritage, the radio spectrum and water. In these sectors, foreign investment cannot constitute the majority of ownership and must be made in addition to national investment (investment by government, usually in the form of a partnership).

- In 2019, Ecuador made registering property easier by reducing the time required to transfer property and by increasing the transparency of the land administration system.

- No local or provincial government taxes on income are imposed on companies.

- Beyond the list of strategic sectors, there are no restrictions on foreign investment and foreign investors must undergo the same procedures and obtain the same authorisations as Ecuadoreans.

- Ecuador grants general tax incentives for investments in any part of the country. The country also grants sectoral incentives for:

- New businesses which are set up in priority sectors

- Investments in 'depressed areas'

- Public projects implemented by public-private partnerships (implemented in 2015)

- The government also applies an incentives regime for Special Economic Development Zones (ZEDEs), which are customs destinations in delimited zones in the national territory. Goods produced in the ZEDEs should, inter alia, contribute to diversifying the domestic supply for export, and be specifically export-oriented. However, they may be authorized for sale on the domestic market in limited percentages, depending on the product.

- In order to improve the country's attractiveness for FDI, the government passed the Productive Promotion and Attraction of Foreign Investment Law in August 2018. The law introduces a number of tax incentives for both new and existing businesses. The relevant tax incentives require that:

- The productive investment must be understood as being irrespective to the type of property

- The investment aids in the expansion of productive capacity

- The investment promotes the generation of new sources of employment in the national economy

The benefits outlined by the law consist of a 12-year income tax and provide exoneration for any new productive investments realised in the following sectors:

- Agriculture; the production of fresh, frozen and industrialised foods

- Forest and agroforestry chain and its processed products

- Metalworking

- Petrochemistry and oleochemistry

- Pharmaceuticals

- Tourism, cinematography and audio-visuals

- International events

- Renewable energies, including bioenergy or energy from biomass

- Logistics services for foreign trade

- Applied biotechnology and software

- Exportation of services

- Development and software services, production and development of technological hardware, digital infrastructure, computer security, products and digital content, and online services

- Energy efficiency services companies

- Sustainable construction materials and technology industries

- The industrial, agroindustrial and agro-social sector

- Investments made under the Productive Promotion and Attraction of Foreign Investment Law which fall outside of Quito or Guayaquil are subject to reduced exemption periods of 8 years.

- Investments made under the Productive Promotion and Attraction of Foreign Investment Law which fall within ZEDEs are subject to an increased exemption period of 15 years.

- New investments in the following industries are entitled to the exemption of income tax for 15 years:

- Casting and refining of copper and/or aluminium

- Steel foundry for the production of flat steel

- Refining of hydrocarbons

- Petrochemical industry

- Cellulose industry

- Construction and repair of naval vessels

- Under President Rafael Correa, Ecuador’s National Assembly decided to terminate all of its BITs with Argentina, Bolivia, Canada, Mainland China, Chile, Italy, the Netherlands, Peru, Spain, Sweden, Switzerland, the United States and Venezuela. An ad-hoc body – the Investment Treaties Audit Commission – had come to the conclusion that the various bilateral treaties which Ecuador had entered into had 'not brought benefits to the country', but had brought risks and costs instead. Under Correa's successor, Lenín Moreno, the government of Ecuador is seeking to renegotiate and resurrect a number of these agreements. At present, Ecuador is only party to three active bilateral investment treaties, with: Italy, Spain and the Netherlands.

- The tax base for the foreign assets tax is the average monthly balance of cash deposits held in foreign entities by private entities registered in the stock market and regulated by the Superintendent of Banks and Companies. The monthly tax rate is 0.25% (0.35% for assets held in tax haven jurisdictions).

- Remittance tax of 5% is imposed on the transfer of money abroad in cash or through pay checks, transfers, or courier of any nature carried out with or without the mediation of the Ecuadorian financial system, including transfer from foreign bank accounts. Dividends are exempt from this tax, under certain considerations.

- Although it is not considered a tax, companies are obligated to pay 15% of their pre-tax earnings to their employees. This payment is considered a deductible expense for corporate income tax (CIT) computation purposes.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free Trade Zones (FTZs) – ZEDEs/FTZs: Esmeraldas Duty Free Zone, Cuenca Duty Free Zone, Ecuador Duty Free Zone, El Oro Duty Free Zone, Guayas Duty Free Zone, Manabí Duty Free Zone, Manta Duty Free Zone, Quito Duty Free Zone |

- Imports and exports for businesses located within the FTZ are exempt from taxes. |

|

Tax credit on remittances |

5% remittance tax paid on imports of raw materials and goods (as delineated by the Tax Policy Board) and which are used in productive activities, can be used as a tax credit for CIT. |

|

Pro-environment deductions |

Deductions on CIT can be applicable to investments in environmental-friendly assets. |

|

Employee hiring incentives (handicapped and new employees) |

- Handicapped and new employees may provide a business with a tax deduction (on CIT) ranging between 100% and 150% of the employee's remuneration. |

Source: Fitch Solutions

- Value Added Tax: 12%

- Corporate Income Tax: 25%

Sources: Servicio de Rentas Internas, Ministerio de Finanzas

Important Updates to Taxation Information

In December 2017, the Ecuadorian government enacted the Law for the Reactivation of the Economy. The main corporate tax measures derived from this Law, effective for 2018, include: An increase in the CIT rate from 22% to 25%, and from 25% to 28% for companies with foreign shareholders located in jurisdictions qualified as tax havens. There are also exemptions and benefits for small business and companies qualified as usual exporters. In addition there are limitations to the deduction of expenses related to accruals of employer's pension and eviction plans.

In August 2018, the Ecuadorian government enacted the Law for the Incentive of Production, Attraction of Investments, Generation of Employment and Fiscal Stability. The main corporate tax measures and reforms are:

- An amnesty programme on interests and fines before Tax and Social Security Authorities, among other regulatory entities, available until December 28, 2018.

- Exemptions of CIT and remittance tax for new investments.

- Regulations for the determination of the CIT rate applicable from 2019.

- Withholding exemption on dividend distribution.

- Reforms on capital gains tax, value-added tax (VAT), and remittance tax, among others.

On December 31, 2019, the government introduced the Law for Tax Simplification and Progressivity The main corporate tax measures and reforms include: Taxation on the distribution of dividends, reforms of Corporate Income Tax pre-payments, new thin-capitalization rules for intercompany loans, reforms on transactions exempted of Remittance Tax, the introduction of a new temporary contribution, and VAT on the importation of digital services.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

Ranges between 22% to 28% rate. The general CIT rate is 25%; however, a 28% rate should apply if non-resident shareholders are located in a tax haven jurisdiction and additionally there is an Ecuadorian individual shareholder in the ownership structure. Such increase is also applicable when the company's ownership structure is not duly disclosed before the Ecuadorian tax authorities. |

|

Branch Tax |

- 22%-28% on distributed or undistributed profits |

|

Capital Gains Tax |

25% (capital gains are treated as ordinary income) |

|

Withholding Taxes |

The following withholding tax rates apply (residents/non-residents) |

|

VAT |

Levied at the rates of either 12% or 0% on the transfer of goods, import of goods, and the rendering of services, as well as on services rendered within the country or imported. Royalties and intangible property, imported or locally paid, are also levied with a 12% VAT. |

|

Social Security Contributions |

Employers and employees pay contributions to the Social Security at the rates of 12.15% and 9.45%, respectively, on the minimum monthly taxable wages as established for the different contributing categories. These categories are revised annually. |

Sources: Servicio de Rentas Internas, Ministerio de Finanzas

Date last reviewed: May 10, 2020

Localisation Requirements

In theory, with the introduction of the Human Mobility Law, the quota restricting the number of foreign workers has been removed. However, the Ministry of Labour sets a cap of 20% with regard to foreign employees. As such, at least 80% of a workforce must be sourced locally and be comprised of Ecuadorian nationals.

The law requires at least one medical examination prior to employment and one when the employment relationship is over. Based on certain regulatory requirements, and depending on the type of job, medical examinations will be required from time to time. The law states that when an employer from either the public or private sector has more than 25 employees, at least 4% of the workforce must be disabled people or individuals who take care of disabled persons.

Visa/Travel Restrictions

All foreigners intending to work in Ecuador must obtain either a temporary or permanent residence visa. A work visa is not needed for a residency visa. A Permanent Residence Visas may be applied for after holding the temporary residency visa for 21 months. The holder of a temporary residency visa may not travel abroad for more than 180 days across two years, 90 consecutive days, or 90 days in one calendar year. Permanent residency visas have gradually lower travel restrictions applied to them. An applicant may register with the Ecuadorean Institute for Social Security (the IESS) after obtaining a residency visa (temporary or permanent) or opt for private health insurance. A number of visas (applicable in addition to the residency visa) may apply to foreigners wishing to work in the country. A general work visa may be obtained either prior or after entering the country on a residency visa and require the contract of employment to be registered with the Ministry of Labour, as well as providing certification from the company in question indicating a lack of debts owed to the IESS, the SRI (Internal Revenue Service), or the superintendence of Companies.

Sources: Ecuador Ministry of Labour, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Caa3(Negative) |

04/04/2020 |

|

Standard & Poor's |

Selective Default (NM) |

14/04/2020 |

|

Fitch Ratings |

Restricted |

20/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Rating

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

118/190 |

123/190 |

129/190 |

|

Ease of Paying Taxes Index |

145/190 |

143/190 |

147/190 |

|

Logistics Performance Index |

62/160 |

N/A |

N/A |

|

Corruption Perception Index |

114/180 |

93/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

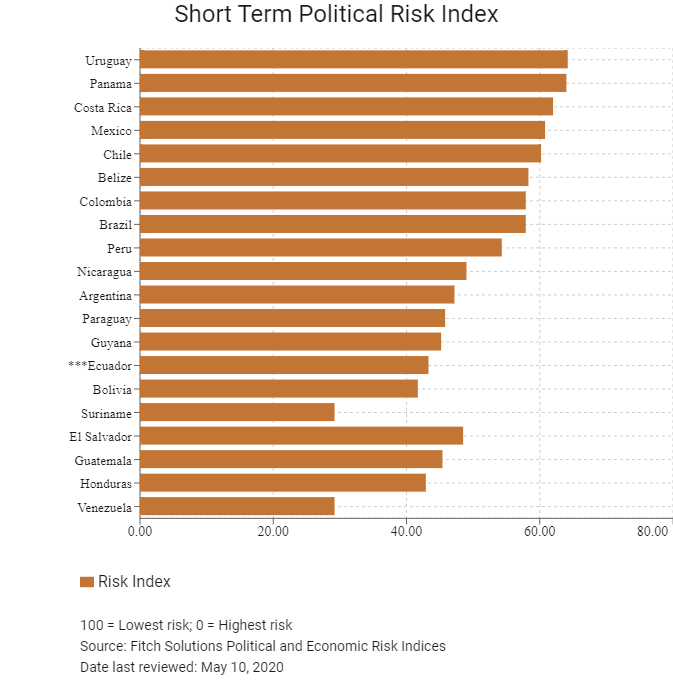

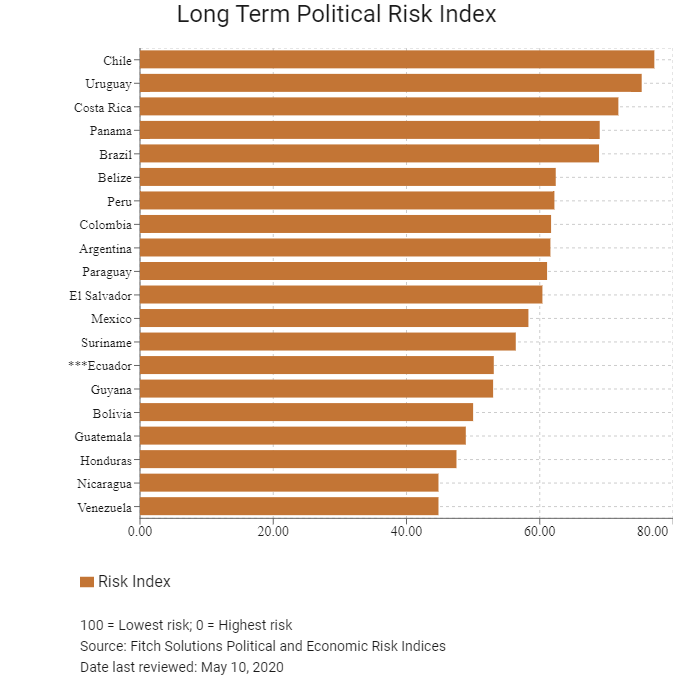

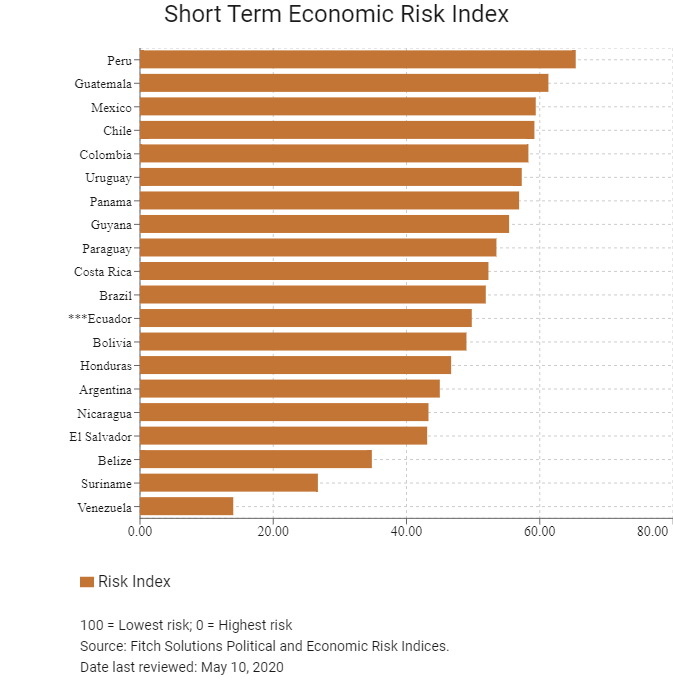

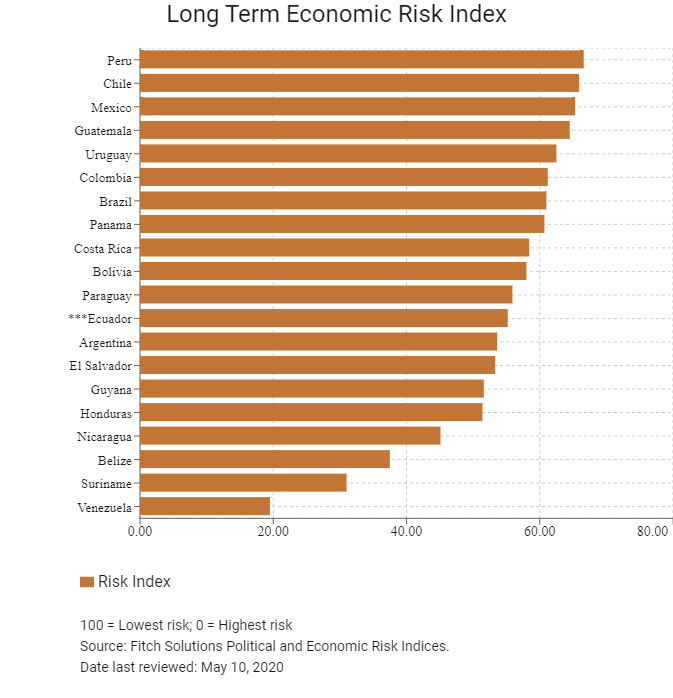

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

67/202 |

82/201 |

89/202 |

|

Short-Term Economic Risk Score |

56 |

46.9 |

49.8 |

|

Long-Term Economic Risk Score |

59.0 |

55.5 |

55.2 |

|

Political Risk Index Rank |

159/202 |

159/201 |

148/202 |

|

Short-Term Political Risk Score |

51.3 |

51.3 |

49.0 |

|

Long-Term Political Risk Score |

49.1 |

49.1 |

53.1 |

|

Operational Risk Index Rank |

118/201 |

117/201 |

117/202 |

|

Operational Risk Score |

45.6 |

46.2 |

45.6 |

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Risk Summary

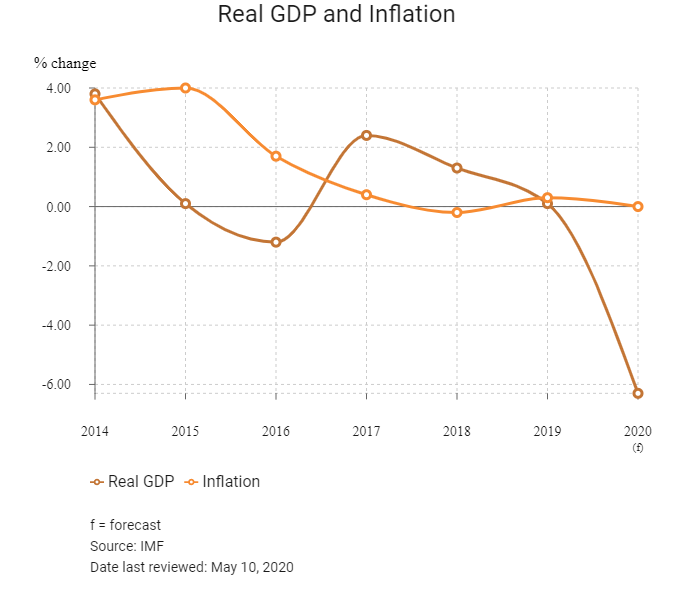

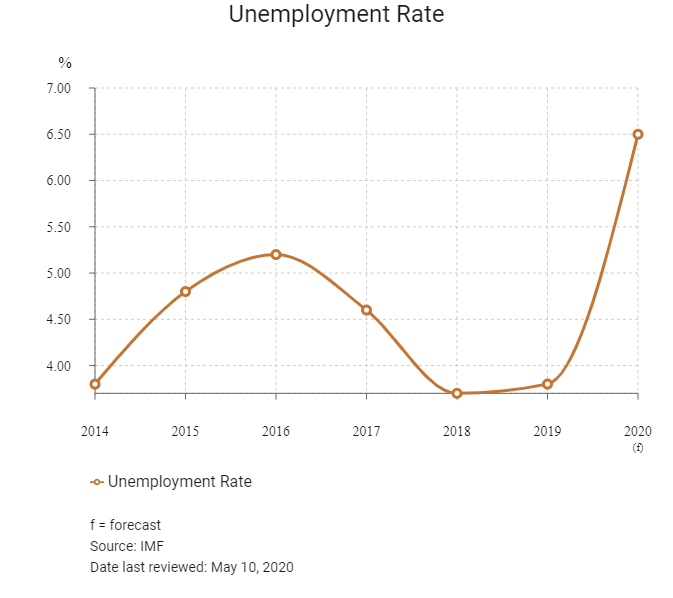

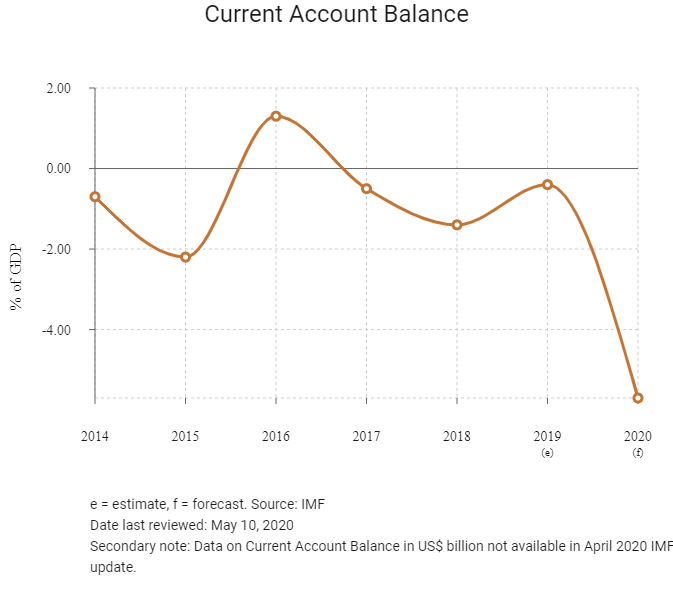

ECONOMIC RISK

Ecuador is substantially dependent on its petroleum resources, which have accounted for more than half of the country's export earnings and around 25% of the public sector revenues in recent years. Ecuador has been experiencing fluctuating growth over the last few years, however the economy is seen returning to growth in 2020 as the government will ease up on its fiscal-tightening measures. Moreover, improved business sentiment should help fixed investment begin to recover, while a pick-up in credit growth should buttress private consumption. The reforms should help deliver a fiscal surplus next year, while gradually restoring foreign reserves amid lower borrowing costs. While President Lenín Moreno has begun to transition to a more business-friendly policy agenda, political constraints will inhibit his ability to make legislative progress. Additionally, it will take some time to ensure investors and improve sentiment. IMF funding and multilateral lending will shore up Ecuador’s near-term financing needs. However, the country will fall into a deep recession in 2020 due to the vast spread of Covid-19 domestically, a weakening of the oil market and severe strains on Ecuador's finances.

OPERATIONAL RISK

A large labour force with improved levels of formal education and favourable logistical environments, such as an excellent transport network, boosts the country's overall operational risk environment. Ecuador faces political instability risks; however, businesses face risks stemming from economically motivated crimes and the high prevalence of organised criminal groups. While President Lenín Moreno intends to pursue more orthodox economic reforms and improve relations with the US, he is likely to face obstacles to implementation due to an economic downturn, increasing discontent surrounding austerity measures. Ecuador's attractiveness will be weighed down by its undiversified economy where many barriers to international trade and foreign investment still exist. Furthermore, red tape to doing business in the form of the tax system, high levels of bureaucracy and corruption all create significant risks.

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Political and Economic Risk Indices

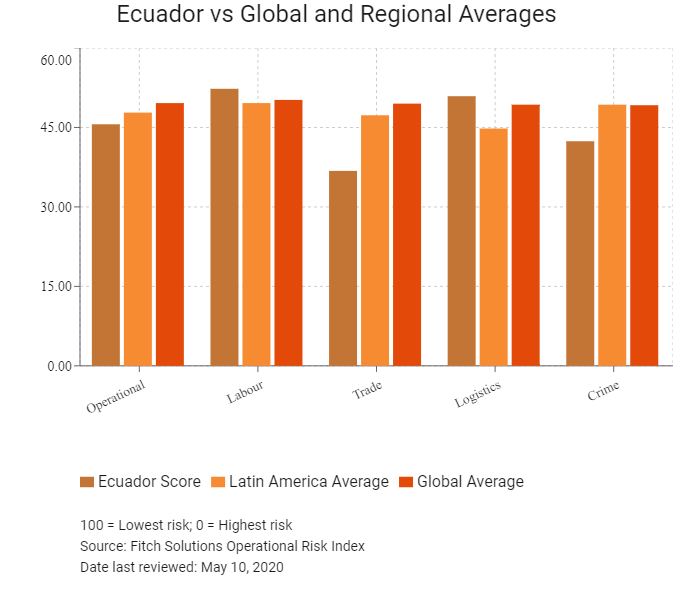

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Ecuador score |

45.6 |

52.3 |

36.8 |

50.9 |

42.4 |

|

Central and South America Average |

46.0 |

49.9 |

44.7 |

46.3 |

43.0 |

|

Central and South America Position (out of 20) |

10 |

7 |

16 |

8 |

9 |

|

Latin America Average |

47.8 |

49.6 |

47.3 |

44.8 |

49.3 |

|

Latin America Position (out of 42) |

30 |

13 |

36 |

9 |

29 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

117 |

84 |

146 |

88 |

128 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Chile |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Panama |

56.1 |

50.6 |

55.9 |

67.1 |

50.6 |

|

Costa Rica |

55.9 |

53.6 |

58.7 |

52.2 |

59.3 |

|

Uruguay |

54.6 |

51.5 |

52.0 |

53.4 |

61.3 |

|

Mexico |

52.2 |

57.5 |

57.9 |

57.4 |

35.9 |

|

Colombia |

51.3 |

57.5 |

52.8 |

51.8 |

43.1 |

|

Brazil |

50.0 |

47.3 |

47.4 |

53.9 |

51.5 |

|

Argentina |

49.3 |

52.8 |

43.6 |

50.5 |

50.4 |

|

Peru |

48.7 |

61.4 |

50.2 |

42.8 |

40.5 |

|

Ecuador |

45.6 |

52.3 |

36.8 |

50.9 |

42.4 |

|

Belize |

42.9 |

51.1 |

41.8 |

40.9 |

37.8 |

|

El Salvador |

42.9 |

45.9 |

44.5 |

48.0 |

33.0 |

|

Suriname |

42.7 |

52.0 |

35.1 |

41.2 |

42.5 |

|

Paraguay |

41.2 |

43.9 |

44.1 |

39.2 |

37.6 |

|

Guatemala |

40.5 |

43.8 |

43.5 |

41.0 |

33.5 |

|

Honduras |

39.4 |

40.1 |

44.5 |

40.1 |

32.7 |

|

Nicaragua |

38.4 |

40.4 |

35.3 |

37.0 |

41.1 |

|

Guyana |

37.3 |

44.4 |

40.7 |

29.6 |

34.6 |

|

Bolivia |

37.0 |

38.9 |

30.2 |

38.2 |

40.6 |

|

Venezuela |

28.4 |

48.5 |

10.1 |

28.4 |

26.8 |

|

Regional Averages |

46.0 |

49.5 |

45.2 |

46.2 |

43.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 10, 2020

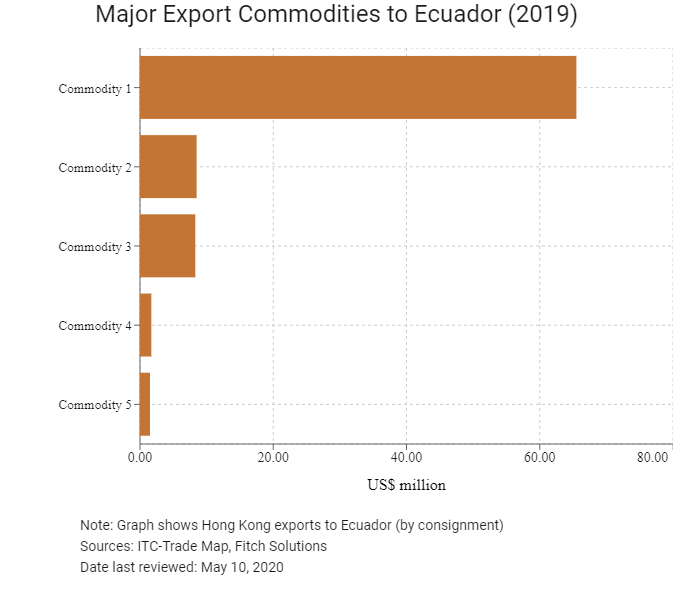

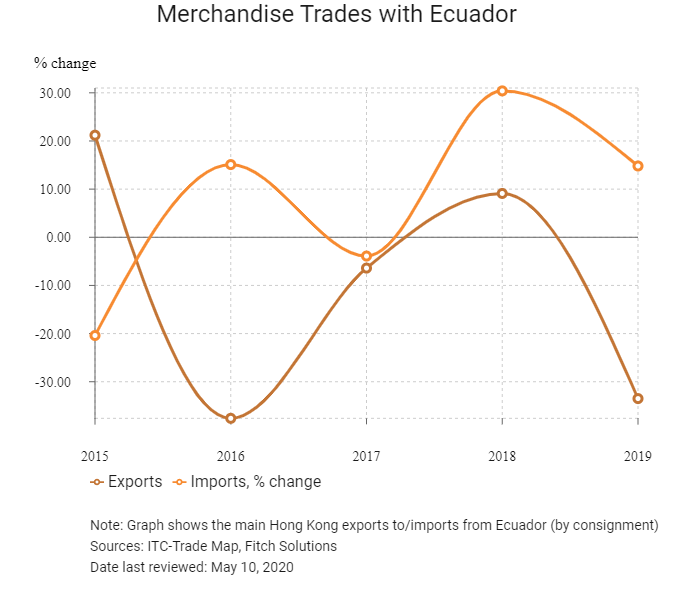

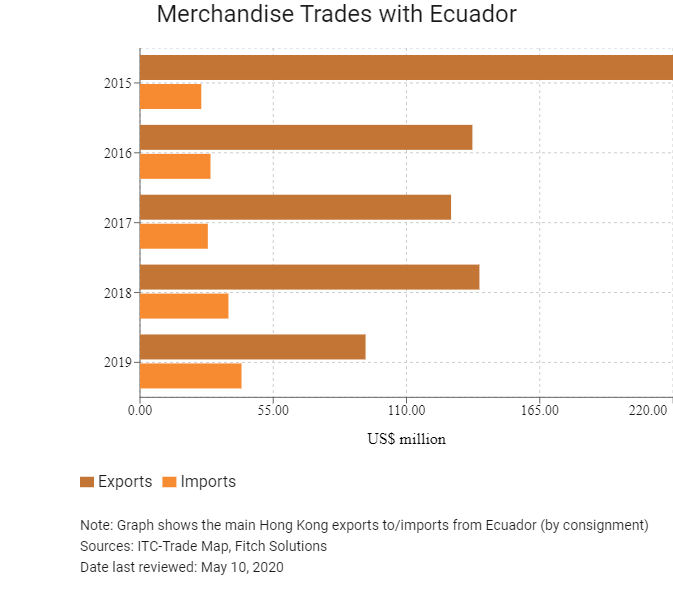

Hong Kong’s Trade with Ecuador

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

65.5 |

|

Commodity 2 |

Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

8.5 |

|

Commodity 3 |

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical |

8.3 |

|

Commodity 4 |

Clocks and watches and parts thereof |

1.7 |

|

Commodity 5 |

Toys, games and sports requisites; parts and accessories thereof |

1.5 |

|

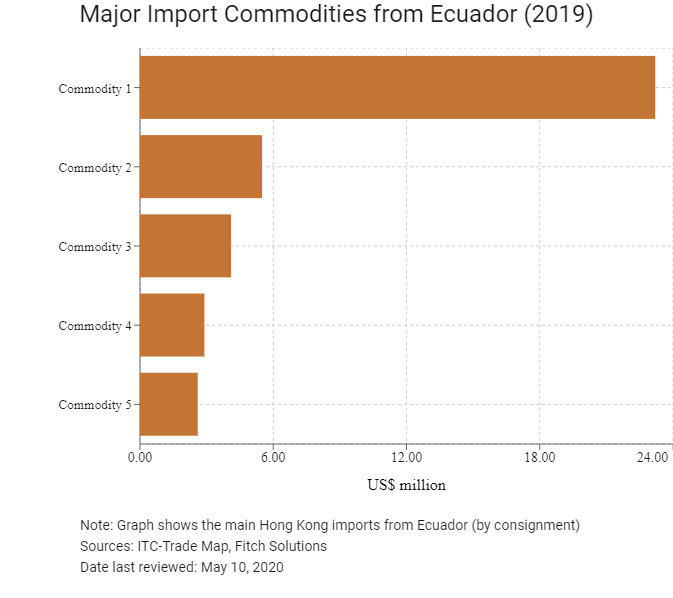

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Edible fruit and nuts; peel of citrus fruit or melons |

23.2 |

|

Commodity 2 |

Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof |

5.5 |

|

Commodity 3 |

Copper and articles thereof |

4.1 |

|

Commodity 4 |

Electrical machinery and equipment and parts thereof |

2.9 |

|

Commodity 5 |

Raw hides and skins (other than furskins) and leather |

2.6 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2018 |

Growth rate (%) |

|

|

Number of Ecuadorian residents visiting Hong Kong |

5,053 |

-4.2 |

|

Number of Latin American residents visiting Hong Kong |

175,111 |

-8.0 |

Source: Hong Kong Tourism Board

Date last reviewed: May 10, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Ecuadorean companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Visa Requirements for Hong Kong Residents

HKSAR passport holders traveling for business or tourism do not need a visa for stays of up to 90 days in any 12-month period. One can request an extension through provincial migration offices. A stay of longer than 90 days will require a visa before arrival.

Source: Immigration Department

Date last reviewed: May 10, 2020

Ecuador

Ecuador