GDP (US$ Billion)

298.18 (2018)

World Ranking 42/193

GDP Per Capita (US$)

15,902 (2018)

World Ranking 57/192

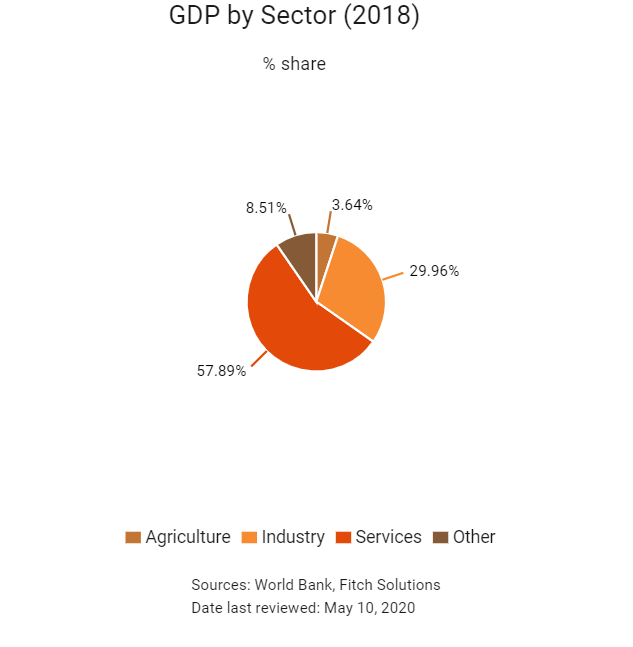

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

57.5 (2018)

Currency (Period Average)

Chilean Peso

702.90per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

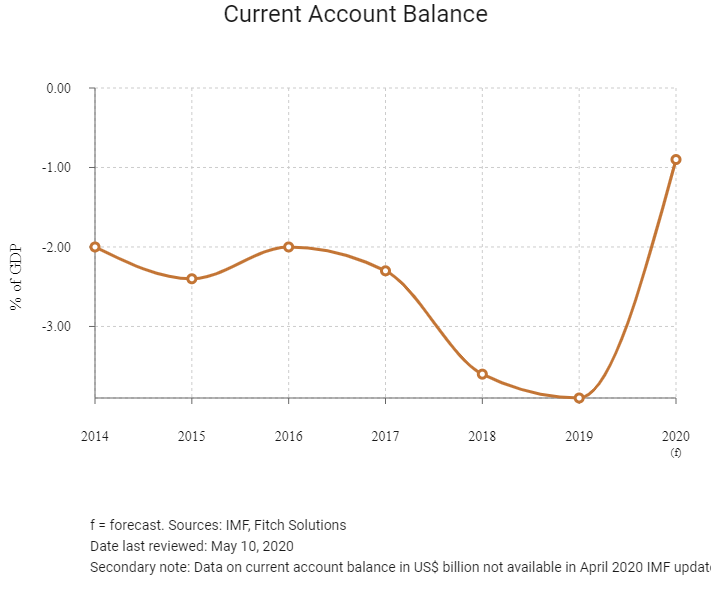

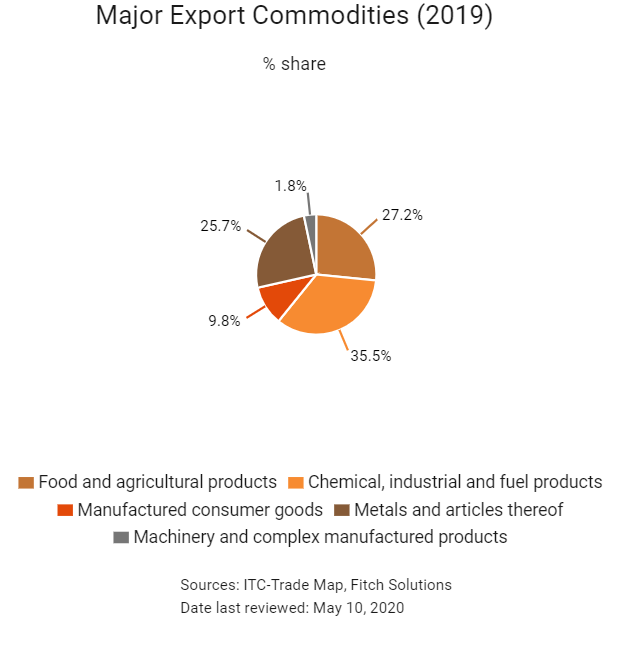

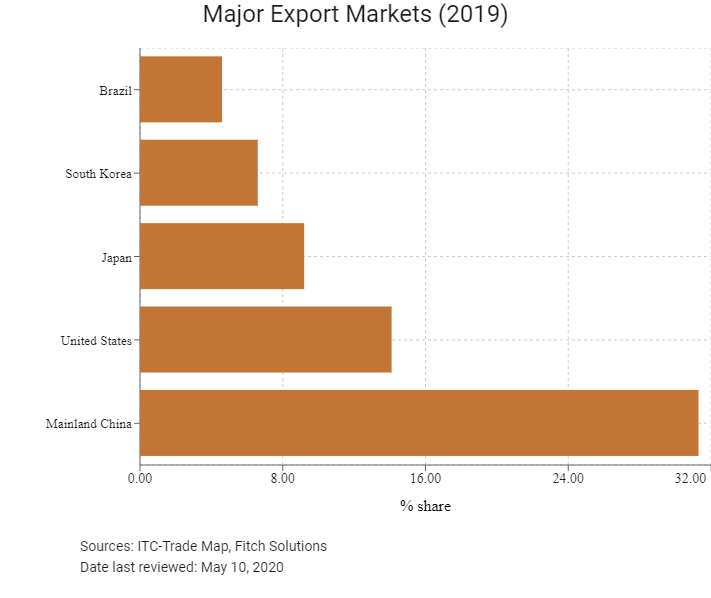

Sound economic policies, maintained consistently since the 1980s, have contributed to steady economic growth, poverty reduction and a rise in foreign investment. The Chilean government conducts a rule-based countercyclical fiscal policy, accumulating surpluses in sovereign wealth funds during periods of high copper prices and economic growth and allowing deficit spending only during periods of low copper prices and growth. Chile has a market-oriented economy characterised by a high level of foreign trade and a reputation for strong financial institutions and sound policy that have given it the strongest sovereign bond rating in South America. Exports account for more than a quarter of the economy, with commodities making up some around 75% of total exports. Over the last several years, Chile has signed free trade agreements (FTAs) with the European Union (EU), South Korea, Mainland China and Japan, among other countries. In May 2010, Chile became a full member of the Organisation for Economic Co-operation and Development (OECD) after a two-year period of compliance with the organisation’s mandates. Encouraging innovation, improving the links between education and the labour market, and promoting the participation of women in the labour market will be essential for improving long-term growth prospects.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

August 2018

Piñera announced plans to reform the state’s tax system.

December 2018

The Comprehensive and Progressive Agreement for TPP – also known as TPP11 – was ratified by the required number of states on November 15, 2018 and came into force on December 30, 2018. The CPTPP encompasses 11 states (Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam) and supersedes a number of existing FTAs that are in place (Chilean FTAs with Japan and Canada, for example). The CPTPP was beneficial for businesses as this gave them tariff-free access to a wider consumer base that would enable them to expand their sales.

July 2019

Chilean authorities unveiled plans to open an international tender for Austral Network, which includes the Carlos Ibáñez del Campo Airport in Punta Arenas. Considering the end of the current concession of the Punta Arenas airport complex, the Airports Directorate of the Ministry of Public Works has developed the Referential Extension and Improvement Project for the airport. The Carlos Ibáñez del Campo Airport had seen a growth rate of more than 7% in the last 20 years. The current airport had an area of 6,700sq m and the new works would increase the area to 16,000square metres. In the new 15-year concession period to 2037, the airport is likely to receive 2.3 million passengers. The works are part of Piñera's Airports Plan.

November 2019

Construction was progressing on the expansion of Arturo Merino Benítez International Airport in Santiago, with completion due in 2021, according to the Ministry Of Public Works, which was executing the project. The USD700 million project included the construction of a new international passenger terminal, the upgrade of the existing passenger terminal and other installations. The project would increase the airport's capacity to accommodate 30 million passengers annually by 2030.

November 2019

Mainstream Renewable Power had reached financial close on the first phase of the USD1.7 billion Andes Renovables wind and solar power project in Chile. The 1.3GW Andes Renovables was a three phase wind and solar generation platform, comprising seven wind and three solar photovoltaic (PV) power plants. All the plants in phase one were expected to become operational in 2021.

January 2020

On January 30, the Banco Central de Chile (BCC) voted unanimously to maintain its benchmark monetary policy rate at 1.75%.

March 2020

On March 19 the government presented a package of fiscal measures in response to the Covid-19 pandemic of up to USD11.8 billion (about 4.7% of GDP), focused on supporting employment and firms’ liquidity. The set of measures included higher healthcare spending; enhanced subsidies and unemployment benefits; a set of tax deferrals; liquidity provision to small- and medium-sized enterprises (SMEs), including through state-owned Banco del Estado; and accelerated disbursements for public procurement contracts.

April 2020

On April 8 the government announced additional support in response to the Covid-19 pandemic for the most vulnerable and independent workers of about USD2 billion and a credit-guarantee scheme (of USD3 billion) that could apply to credits of up to USD24 billion to facilitate firms’ financing.

April 2020

The BCC undertook key Covid-19 response measures, including: two policy rate cuts by cumulative 125 basis points to 0.5%; the introduction of a new funding facility for banks conditional on them increasing credit; the inclusion of corporate securities as collateral for the BCC's liquidity operations and the inclusion of high-rated commercial loans as collateral for the funding facility operations; the initiation of a programme for the purchase of bank bonds (up to USD8 billion); the expansion of eligible currencies for meeting reserve requirements in foreign currencies; flexibility of BCC regulations for bank liquidity; and the expansion of the programme for providing liquidity in pesos and US dollars through repo operations and swaps.

The Financial Market Commission unveiled a package of measures to facilitate the flow of credit to businesses and households, which includes special treatment in the establishment of provisions for deferred loans; the use of mortgage guarantees to safeguard SME loans; adjustments in the treatment of assets received as payment and margins in derivative transactions; and the revision of the timetable for the implementation of Basel III standards.

May 2020

The Ministry of Public Works unveiled a schedule for 14 infrastructure concessions worth USD3.6 billion for the period between April 2020 and March 2021. The Q220 projects included the construction of hospitals in the Biobío region at a cost of USD360 million and the USD300 million Coquimbo hospital. In Q320 theUSD180 million Valdivia health network and USD40 million Digital Bus Stop concession will be tendered. The Ruta 78 Highway Second Concession (USD536 million), the Santiago Airport Road Access Third Concession (USD42 million), the Ruta 5 Highway-Chiloé Longitudinal Road (USD503 million) and La Serena Hospital (USD300 million) will be tendered in Q420. The remaining four projects, worth USD700 million, would be tendered in Q121.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

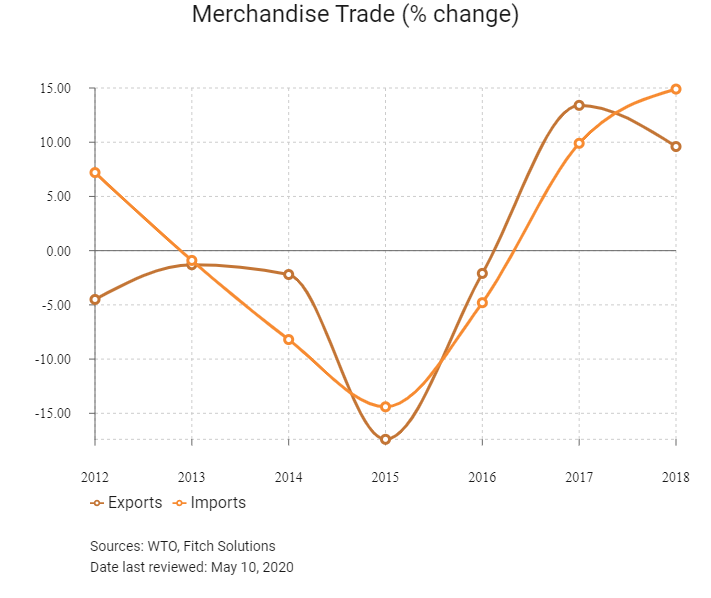

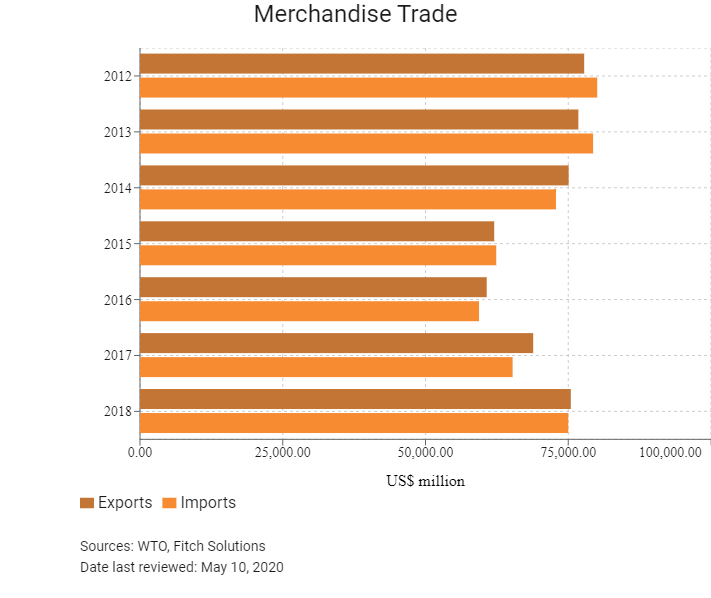

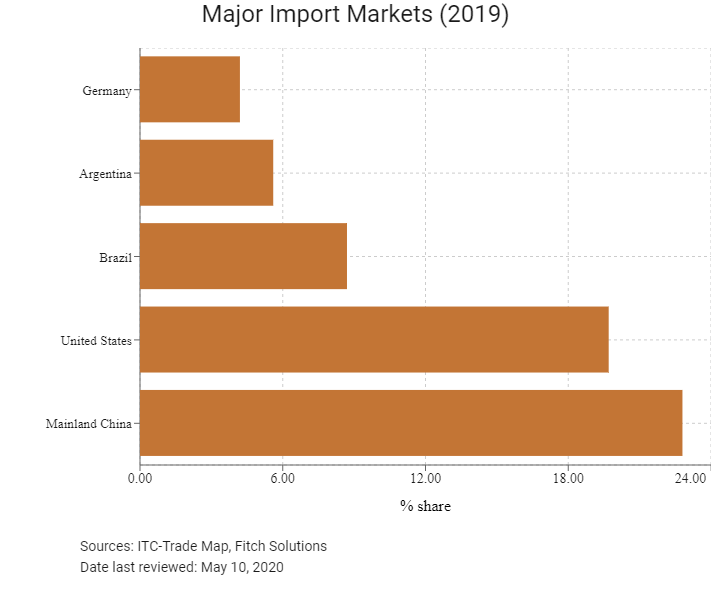

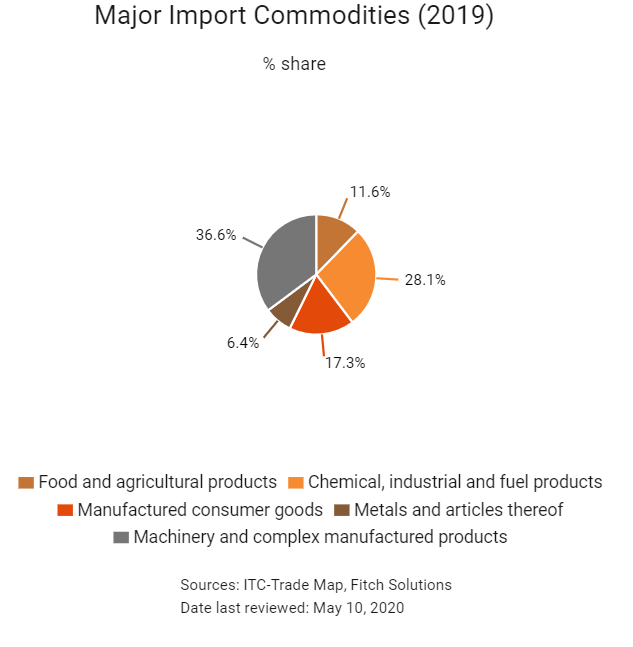

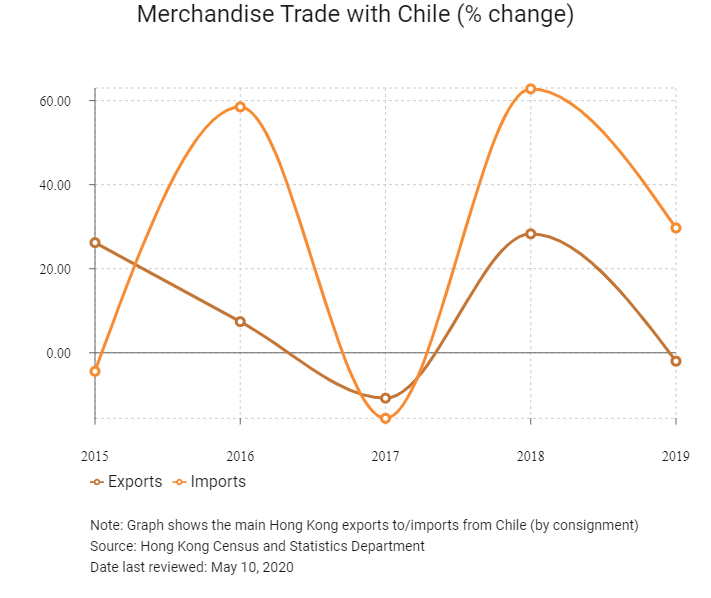

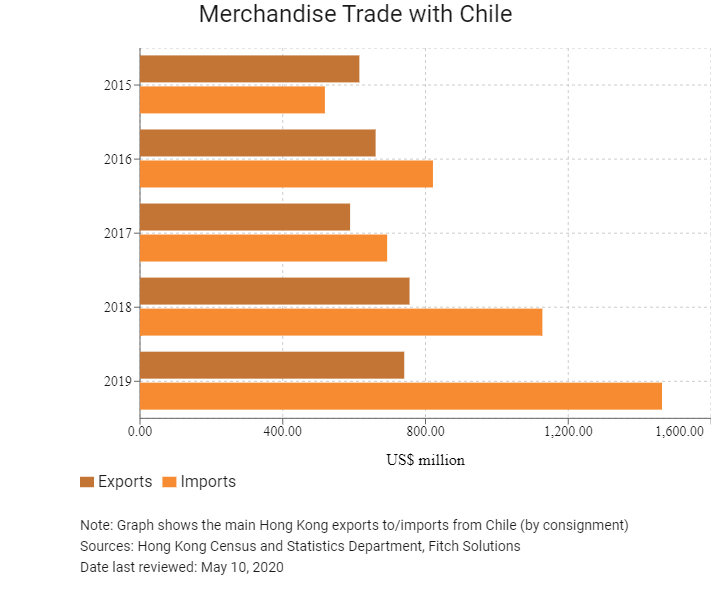

Merchandise Trade

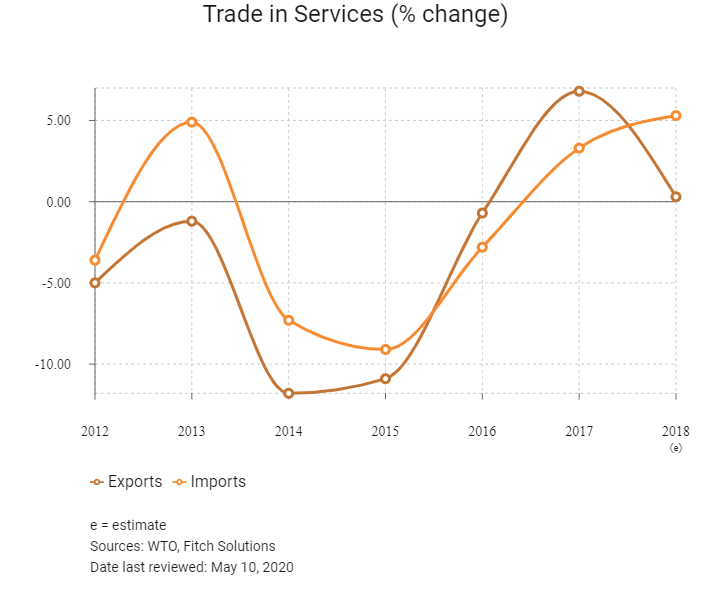

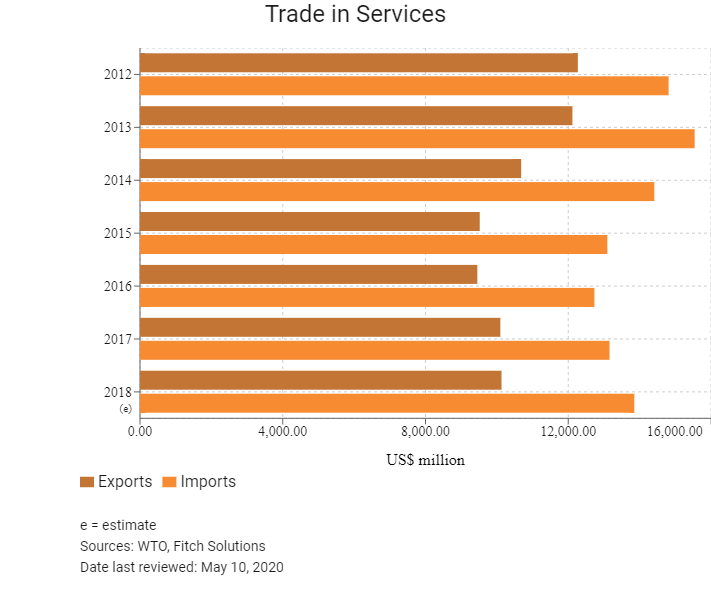

Trade in Services

- Chile has been a member World Trade Organization (WTO) since January 1, 1995. Importers are not subject to any registration requirements. However, they are required to hire an accredited customs broker to enter the merchandise if the free on board (FOB) value of such merchandise is higher than USD500. The use of a customs broker is not mandatory in several other instances, including merchandise entering a free trade zone (FTZ).

- Chile adopts the Harmonised System and affords most favoured tariff treatment to all its trading partners. Virtually all imports are subject to a most favoured nation duty of 6.0% ad valorem. Apart from import duties, products imported or circulated in Chile are essentially subject to a value-added tax (VAT) of 19% on domestic goods as well as excise taxes and other charges, including an airport tax.

- Chile does not have any import quotas in place, neither does it impose any licensing requirements on imports or have any pre-shipment inspection requirements. However, certain goods require approval or certification prior to import, while other goods require approval or certification for customs clearance.

- Over the past two decades, Chile has developed an extensive network of FTAs with a range of partner countries in the Americas, Asia, Europe and the Pacific. Specifically, Chile has signed FTAs with more than 90% of its trade partners, including Australia, Mainland China, Hong Kong, India, Japan, Mexico, the United States, the EU and South Korea. Moreover, Chile is the only member of the original Trans-Pacific Partnership (TPP) Agreement to have an FTA in place with every other TPP signatory. Although United States President Donald Trump signed an executive order formally withdrawing the United States from the trade deal in January 2017, the remaining 11 TPP nations officially agreed on key aspects of the trade pact on November 11, 2017 and signed the document in March 2018. The CPTPP, also known as TPP11, was ratified by the required number of states (seven states as of November 15, 2018) and came into force on December 30, 2018.

- Chile does not impose any limits on the amount of currency derived from trade operations that can be brought into or taken out of the country, but Chilean exporters and importers with a total export or import value of USD5 million or more on an FOB basis in any single year are required to provide certain information to Chile's central bank.

- Chilean standards and technical regulations do not distinguish between foreign and domestic goods. So far, Chile has issued more than 1,000 technical regulations covering a broad spectrum of products. Standards are voluntary and are adopted through consensus among parties from the public and private sectors who are invited to participate in the consultations. The National Institute for Standardisation has overall responsibility for the elaboration of standards. Chile also has labelling regulations in place for a wide range of products. In general, products commercialised in Chile must be labelled with the name or registered brand, the address of the producer or importer, the country of origin and care instructions. The information included must be accurate and provided in Spanish.

- There are three main FTZs in Chile: the FTZ of Iquique (ZOFRI) in the Tarapacá region in the far north, the Free Zone of Punta Arenas (PARANEZON) in the Magallanes province in the far south and the Arica FTZ (located in northern Chile near the Peruvian border). ZOFRI encompasses the free ports of Arica and Iquique and is a major entry point for products bound for Bolivia and Peru, Paraguay and northern Argentina. Each FTZ is equipped with manufacturing, packaging and exporting facilities. Imports entering ZOFRI and PARANEZON are duty free; however, imports leaving the FTZs to enter the Chilean market pay full tariff and VAT charges.

- The broad range of FTAs reduces Chile's average tariff rate, which, at 1.8%, is the third lowest in Central and South America (Peru leads the way with an average tariff of 1.4%, followed by Guatemala at 1.5%).

- In order to protect domestic industries, the Chilean government has imposed various anti-dumping measures, particularly on the steel and metal sectors. On October 22, 2016, the Chilean authorities imposed a provisional anti-dumping duty on the imports of certain steel wire from Mainland China. The rate of duty is 40.6%. On November 22, 2017, the Chilean government imposed a 22.9% duty on certain steel bars from Mainland China in order to counter allegations of dumping. However, the duty has now lapsed, having remained in place for one year.

- The Chilean government has also imposed various safeguards concerning agricultural sectors to protect domestic industries. The Chilean government regularly adjusts the discounts on imported sugar and wheat or meslin flour. These discounts help mitigate some of the effects of the price floors imposed by Chile (which is above the average customs rate). The cost of importing sugar to Chile may thus increase or decrease on the back of government decisions. There were interventions in February, 2020, when the government of Chile increased the applicable reductions on the import tariffs of wheat and wheat or meslin flour. In January 2020 the government changed the applicable discounts on the applicable customs duties on sugar.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Chile-Mainland China FTA and Economic Integration Agreement (EIA): On November 18, 2005, Chile signed an FTA with Mainland China, which came into force on October 1, 2006. Roughly half of Mainland China's exports to Chile in value terms were afforded duty-free treatment when the agreement entered into force. Only some 3.0% of Mainland China's exports are excluded from the scope of the FTA. In November 2017, the Mainland China-Chile FTA completed its upgrade, making it Mainland China's first FTA upgrade with a Latin American country. Furthermore, on April 13, 2008, Mainland China and Chile signed the supplementary agreement on service trade. According to the agreement, Mainland China's 23 sectors and sub-sectors – including service in the computing, management and consulting, real estate, mining, environment, sports, and air transport sectors – and Chile's 37 sectors and sub-sectors – including service in the legal service, construction and architecture, engineering, computing, research and development, real estate, advertisement, management and consulting, mining, manufacturing, leasing, distribution, education, environment, tourism, sports, and air transport sectors – were also opened up under the WTO commitments.

- Chile-Hong Kong FTA and EIA: Hong Kong and Chile signed a bilateral FTA on September 7, 2012, which became effective on October 9, 2014. Under the agreement, approximately 88% of total Chilean goods imports from Hong Kong benefit from duty-free treatment with immediate effect and about 97.7% of all goods imports will enjoy such treatment by the third year. The remaining 2.3% of tariff lines have been excluded from the agreement and will continue to be subject to regular most favoured nation rates of duty, including certain cereals, sugars, textiles, apparel, steel products, concrete, used tyres and household appliances.

- Chile-Southern Common Market (Mercosur): Chile is an associate nation in both Mercosur and the Andean community, which encompasses nine of the 10 biggest economies on the continent. Despite non-membership in these organisations, Chile has entered into FTAs with both trade blocs, giving it similar (if not identical) economic advantages to those which it would accrue with full membership, but with a less binding political commitment.

- Chile-United States FTA and EIA: The agreement came into force in 2004, and as of January 1, 2015, all qualifying products are duty free. To be eligible for tariff-free treatment under the agreement, products must meet the relevant rules of origin. The agreement also provides favourable access for service suppliers. It guarantees protection to United States investors and United States copyrights, trademarks and patents registered in Chile. In addition, Chile has opened up significant government procurements to United States bidders. Principal United States goods exports to Chile include mineral fuel and oil, machinery and parts, aircraft and parts, vehicles and electrical machinery. Principal United States exports of services to Chile include travel, transport, telecommunications and business services.

- Chile-EU FTA and EIA: EU states (particularly Germany, France, Spain, the Netherlands and the United Kingdom) are major trade partners, and the EIA with Chile ensures preferential access to this large market. Bilateral trade between the EU and Chile has more than doubled since the FTA came into effect.

- Pacific Alliance (PA) FTA and EIA: The PA trade bloc consists of Chile, Colombia, Mexico and Peru. It is an important trade agreement for Chile and assists with promoting regional growth. The PA focuses on boosting external trade with strategic partners, including those in Asia, as well as adopting a business-friendly agenda aimed at incentivising investment in the region to enable companies to better access Latin American markets and create intra-regional supply chains. PA members represent nearly 36% of Latin American GDP and exported approximately USD1trillion in 2015.

- Chile-Japan FTA and EIA: The FTA with Japan was finalised in 2007 and will be affected by the CPTPP.

- CPTPP: The agreement – comprising Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – is in effect. The agreement was ratified in Q418, with the deal representing 13.4% of global GDP, making it the third largest trade agreement after the United States-Mexico-Canada Agreement and the EU. The agreement aims to cut tariffs, improve access to markets and set common ground on labour and environmental standards as well as intellectual property protections.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Encouraging foreign investment is a priority in Chile's national growth strategy, with foreign direct investment (FDI) inflows having contributed enormously to the country's economic growth since the first push to attract foreign participation in the 1980s. Major sectors such as mining attract considerable interest from foreign investors, as does the country's burgeoning tourism sector and large agricultural sector.

- Chile offers attractive investment openings in sectors that include mining, services, food, infrastructure, tourism and energy. Under the Foreign Investment Statute regime, foreign investors can opt to sign a contract with the state of Chile, establishing their rights and obligations, which authorises the transfer of capital and other forms of investment into the country.

- Generally, there are no restrictions on most economic activities and businesses may be 100% owned by foreigners, except with respect to air transport, domestic shipping, mass media and fishing. Some strategic activities are also reserved for the state; these include the exploration and exploitation of mineral deposits situated in maritime boundaries subject to the national jurisdiction or those located in areas classified by law as of importance to national security.

- Certain industries require licensing for operations. The telecommunications industry regulators, for example, have a limited number of licences that it may issue at one time.

- Some minerals sectors may be subject to government intervention and companies may be obliged to work in collaboration with state-owned entities.

- Foreign investment in some sectors of the economy can be screened by the government. Foreign ownership is permitted across almost all industries. Exceptions exist with sectors designated as strategic in nascent resource-related industries, transportation and farmland. In such industries, foreign ownership is generally capped at 49%. Nuclear energy and mining industries are restricted to government/state control – companies may, however, be granted concessions from the government for their operation.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

FTZ of Iquique (northern Chile) |

Exemption from corporate tax and custom duties, such as 0% VAT on first sales and 0.8% import tax. |

|

Free Zone of Punta Arenas (southern Chile) |

Exemption from corporate tax and custom duties |

|

Arica FTZ (northern Chile) |

Exemption from corporate tax and custom duties |

Source: Fitch Solutions

- Value Added Tax: 19%

- Corporate Income Tax: 25% or 27%

Source: Servicio de Impuestos Internos

Important Updates to Taxation Information

- The government has introduced a bill to parliament for discussion; The bill aims to restructure and amend the tax code and structure, placing particular emphasis on:

- Replacing the dual regime corporate tax system them with a single method of taxation.

- Denying the 4% Withholding Tax (WHT) rate on interest paid abroad in cases where the foreign bank or financial institution is not the final recipient of the payment.

- Improving the existing Foreign Tax Credit rules by amending or repealing the current distinction placed upon a tax treaty and non-tax treaty jurisdiction.

- Implementing a 35% rate in cases where domestic thresholds need to be calculated.

- Amending or introducing the ability to incorporate foreign tax in Chile.

- Reconsidering the legal concept around the definition of what is considered a permanent establishment of a foreign entity within Chile. The new legal concept follows previous criterions set forth by the Chilean tax authorities, aligned with OECD criterions.

- Proposing a 10% sole, indirect and substitute tax to digital services provided by foreign providers.

- Repealing the 4% limitation on royalty payments abroad.

- As of January 1, 2019, interest will be subject to 10% WHT as a result of a number of double-tax avoidance treaties. Due to the nature of these treaties, the rate of WHT owed by foreigners will vary as according to the treaty.

Dual Tax Regime

|

Tax Rate and Base |

|||

|

Tax Type |

Applicable To |

Regime A |

Regime B |

|

First Category Tax (FCT) |

All |

25% |

27% |

|

Global Complementary Tax (GCT) |

Chilean owners |

0-35% (progressive) |

0-35% (progressive) |

|

Additional WHT |

Foreign shareholders |

35% on taxable earnings |

35% |

|

Possible tax credit on GCT |

Chilean shareholders |

100% of FCT |

65% of FCT |

|

Possible tax credit on WHT |

Foreign shareholders |

100% of FCT |

65% of FCT |

|

Total tax burden on GCT |

Chilean shareholders |

25% (at 0% GCT), 35% with credit (at 35% GCT), 60% without credit |

27% (at 0% GCT), 44.45% with credit (at 35% GCT), 62% without credit |

|

Total tax burden on GCT |

Foreign shareholders |

35% with credit, 60% without credit |

44.45% with credit, 62% without credit |

Note: In addition to the regime-specific set of tax rates, all businesses will still need to pay a standard set of taxes.

Business Taxes (general)

In addition to the regime-specific set of tax rates, all businesses will still need to pay a standard set of taxes.

|

Type of Tax |

Tax Rate and Base |

|

Mining Tax |

0-14% on corporate income of mining companies, variable according to sales. May be deducted as an expense from corporate income tax. |

|

Social security contributions (capped at a fluctuating amount according to an inflation-adjusted monetary unit) |

- 0.95% basic contribution on gross salaries towards accident insurance |

|

VAT |

19% on sale of goods and services |

|

Capital duty |

0.25-0.5% on tax equity (up to approximately USD500,000). |

|

Property Tax |

- 1% on the value of rural property |

Source: Servicio de Impuestos Internos

Date last reviewed: May 10, 2020

Localisation Requirements

Labour regulations continue to restrict the employment of foreign nationals, preventing a large increase in the country's migrant population. The labour law stipulates that at least 85% of a company's workforce must be Chilean, if the business employs more than 25 workers.

Visa/Travel Restrictions

Chilean work visas are regulated by the need for a contract prior to application. The bureaucratic process to obtain work permits and residence visas for foreign nationals in Chile is, nonetheless, relatively simple. Eligibility is generally dependent on skills and education, which facilitates the flow of highly skilled workers. The visa process is easier when the applicant is outside the country, as making changes to the visa status once in the country can be an arduous process and is subject to delays.

Visas, such as the work contract visa and the temporary resident visa, offer provisions for dependents and entitle holders to apply for permanent residency after two years. Foreign employees and their dependents can also gain entry based on FATs that Chile holds with numerous countries. The permitted length of stay varies from six months to one year depending on the profession and position of the applicant. This offers a larger variety of options for companies wishing to hire foreign workers.

Taxes on Foreign Labour

Chile differentiates between resident and non-resident individuals for tax purposes. Residents (those in Chile for longer than six months in a calendar year) are taxed on their worldwide income, and non-residents are only taxed on Chile-sourced income. Foreign residents are taxed on Chile-sourced income for the first three years, after which they are taxed on worldwide income. Individual income tax is paid based on the accrual of monthly taxable units (MTUs), which may be adjusted on a month-by-month basis in accordance with inflation. In December 2018, one MTU was worth around USD74.46. The tax regime on individuals in Chile is relatively unfavourable, with tax rates charged progressively from 0% to 35%. The top rate is among the highest levied in any Latin American state and will cause difficulties for businesses attempting to attract well-paid foreign workers as they may require higher salaries to offset this tax burden. In accordance with the tax reform approved in 2014, the highest marginal rate was reduced to 35% (effective from January 1, 2017), down from 40%.

Sources: Ministry of the Interior and Public Security, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A1 (stable) |

26/07/2018 |

|

Standard & Poor's |

A+ (Negative) |

27/04/2020 |

|

Fitch Ratings |

A (Negative) |

12/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

55/190 |

56/190 |

59/190 |

|

Ease of Paying Taxes Index |

72/190 |

76/190 |

86/190 |

|

Logistics Performance Index |

34/160 |

N/A |

N/A |

|

Corruption Perception Index |

27/180 |

26/180 |

N/A |

|

IMD World Competitiveness |

35/63 |

42/63 |

N/A |

Sources: World Bank, IMD, Transparency International

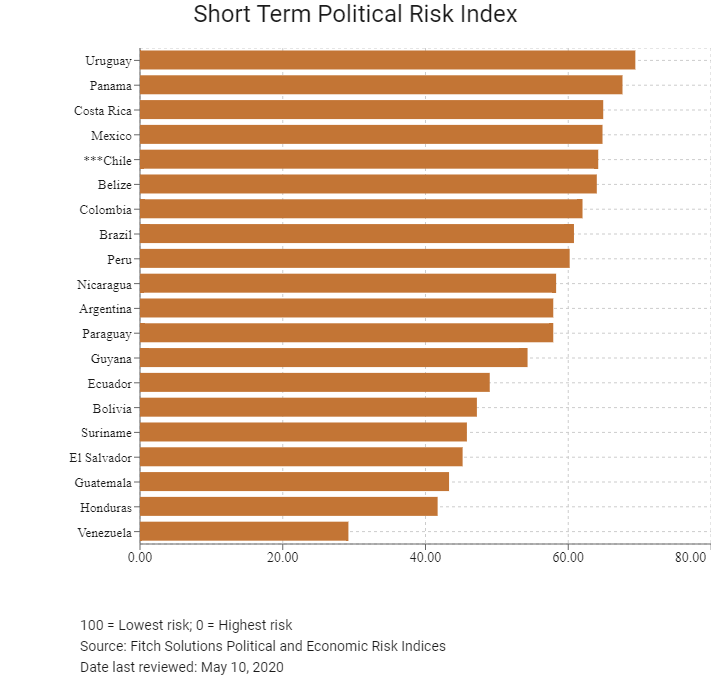

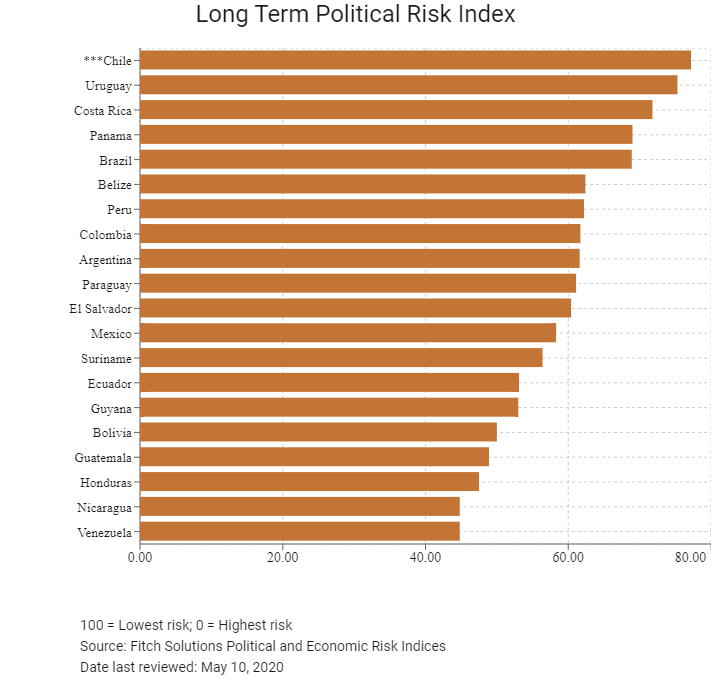

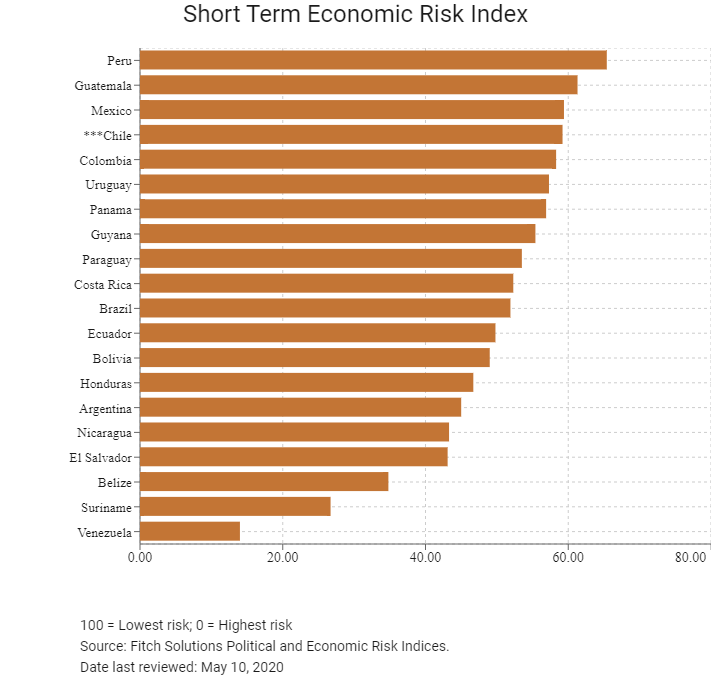

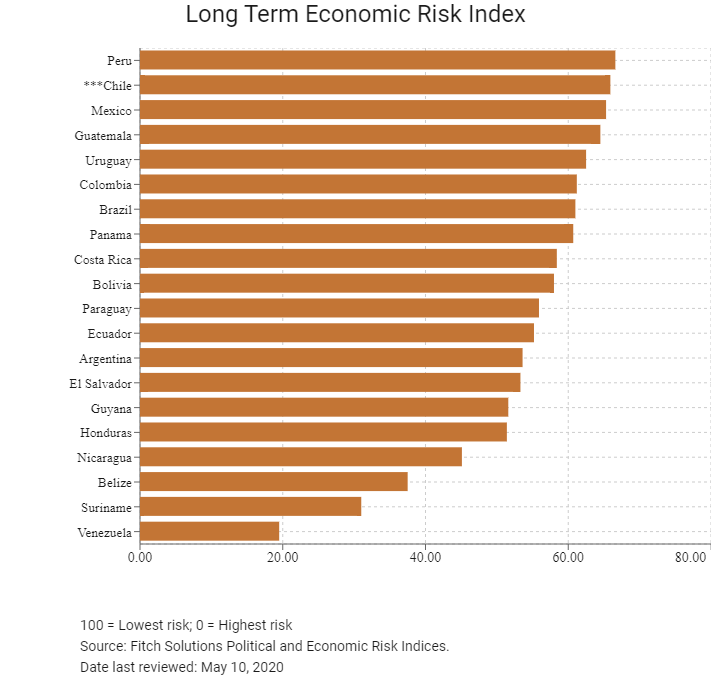

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

45/202 |

41/201 |

48/201 |

|

Short-Term Economic Risk Score |

70.2 |

68.8 |

59.2 |

|

Long-Term Economic Risk Score |

66.6 |

68.0 |

65.9 |

|

Political Risk Index Rank |

22/202 |

21/201 |

37/201 |

|

Short-Term Political Risk Score |

74.8 |

77.1 |

64.2 |

|

Long-Term Political Risk Score |

83.2 |

83.2 |

77.2 |

|

Operational Risk Index Rank |

40/201 |

39/201 |

38/201 |

|

Operational Risk Score |

64.1 |

64.8 |

64.9 |

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Risk Summary

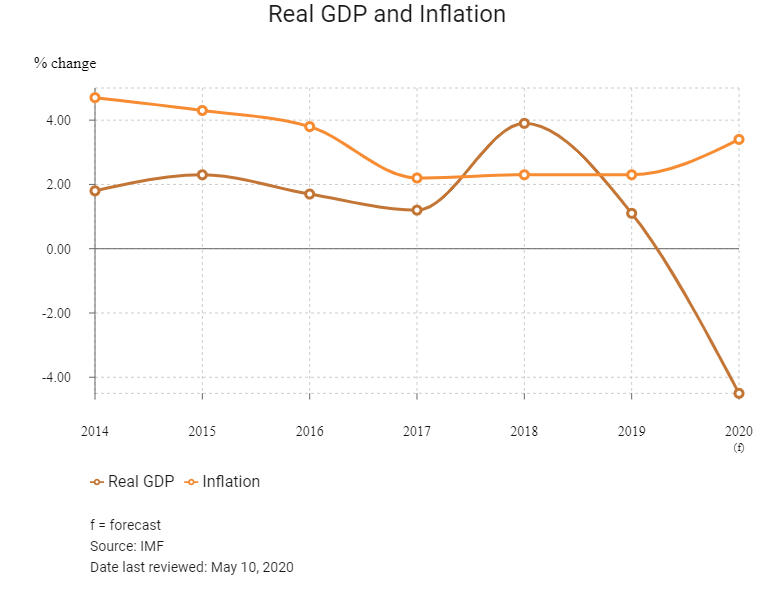

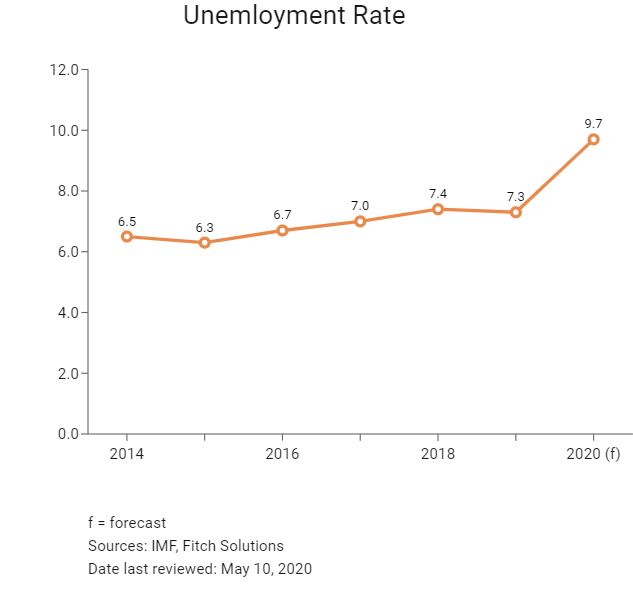

ECONOMIC RISK

Chile’s economy is highly reliant on commodity exports, and the risk of a sharper than expected slowdown in key export markets such as Mainland China as well as risk of subdued copper prices, poses risks to Chile’s trade balance. Capital investment may remain suppressed owing to policy uncertainties stemming from the drafting of a new constitution. A sharp fall in global demand, the growing domestic Covid-19 outbreak and tightening financial conditions pose significant downside risks to economic activity in Chile in 2020.

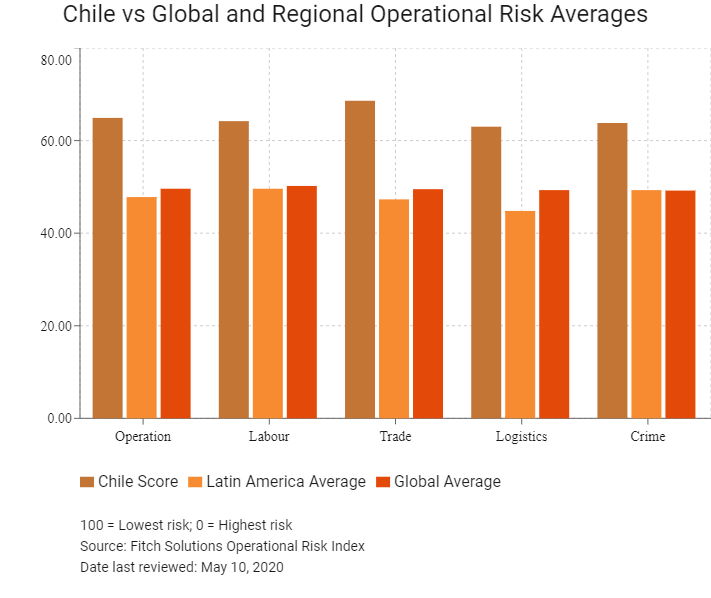

OPERATIONAL RISK

Chile's open economy and strong democratic institutions make it one of the most stable countries for doing business in the region. Much of its appeal lies in the low risks that businesses face from regional criminal activity, which translates to lower security costs and reduced risk of implication in financial crime. The country boasts a wealth of natural resources, and the strong rule of law has provided a basis for economic growth and significant inflows of foreign direct investment, which has been further encouraged by the signing of numerous free trade deals with key regional and global partners. Logistics infrastructure is well developed and more reliable than elsewhere in Central and South America, and while the labour force is somewhat smaller than in countries such as Brazil, Chile benefits from a better-educated workforce and less regulation in comparison with regional peers.

Source: Fitch Solutions

Date last reviewed: May 11, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Chile score |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Central and South America average |

46.0 |

49.9 |

44.7 |

46.3 |

43.0 |

|

Central and South America position (out of 20) |

1 |

1 |

1 |

2 |

1 |

|

Latin America average |

47.8 |

49.6 |

47.3 |

44.8 |

49.3 |

|

Latin America position (out of 42) |

1 |

1 |

2 |

2 |

4 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global position (out of 201) |

38 |

23 |

32 |

55 |

51 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Chile |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Panama |

56.1 |

50.6 |

55.9 |

67.1 |

50.6 |

|

Costa Rica |

55.9 |

53.6 |

58.7 |

52.2 |

59.3 |

|

Uruguay |

54.6 |

51.5 |

52.0 |

53.4 |

61.3 |

|

Mexico |

52.2 |

57.5 |

57.9 |

57.4 |

35.9 |

|

Colombia |

51.3 |

57.5 |

52.8 |

51.8 |

43.1 |

|

Brazil |

50.0 |

47.3 |

47.4 |

53.9 |

51.5 |

|

Argentina |

49.3 |

52.8 |

43.6 |

50.5 |

50.4 |

|

Peru |

48.7 |

61.4 |

50.2 |

42.8 |

40.5 |

|

Ecuador |

45.6 |

52.3 |

36.8 |

50.9 |

42.4 |

|

Belize |

42.9 |

51.1 |

41.8 |

40.9 |

37.8 |

|

El Salvador |

42.9 |

45.9 |

44.5 |

48.0 |

33.0 |

|

Suriname |

42.7 |

52.0 |

35.1 |

41.2 |

42.5 |

|

Paraguay |

41.2 |

43.9 |

44.1 |

39.2 |

37.6 |

|

Guatemala |

40.5 |

43.8 |

43.5 |

41.0 |

33.5 |

|

Honduras |

39.4 |

40.1 |

44.5 |

40.1 |

32.7 |

|

Nicaragua |

38.4 |

40.4 |

35.3 |

37.0 |

41.1 |

|

Guyana |

37.3 |

44.4 |

40.7 |

29.6 |

34.6 |

|

Bolivia |

37.0 |

38.9 |

30.2 |

38.2 |

40.6 |

|

Venezuela |

28.4 |

48.5 |

10.1 |

28.4 |

26.8 |

|

Regional Averages |

46.0 |

49.9 |

44.7 |

46.3 |

43.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 10, 2020

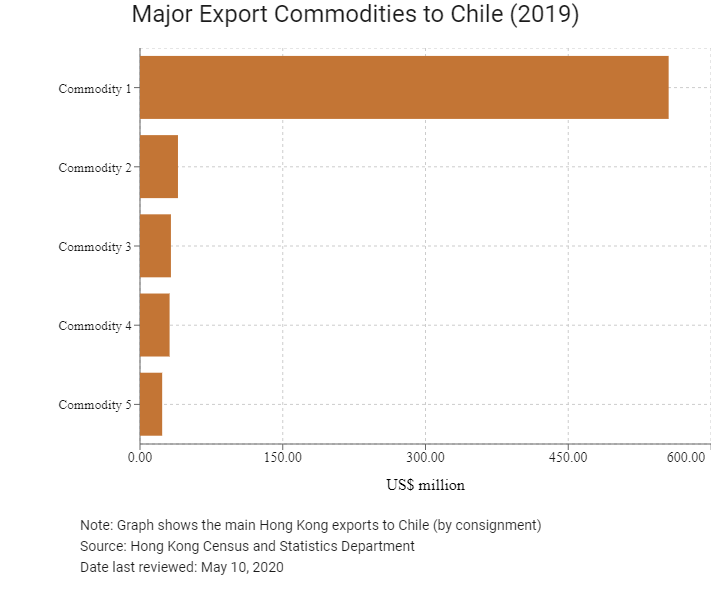

Hong Kong’s Trade with Chile

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

555.5 |

|

Commodity 2 |

Office machines and automatic data processing machines |

39.9 |

|

Commodity 3 |

Articles of apparel and clothing accessories |

32.5 |

|

Commodity 4 |

Miscellaneous manufactured articles |

31.1 |

|

Commodity 5 |

Electrical machinery, apparatus and appliances; and electrical parts thereof |

23.3 |

|

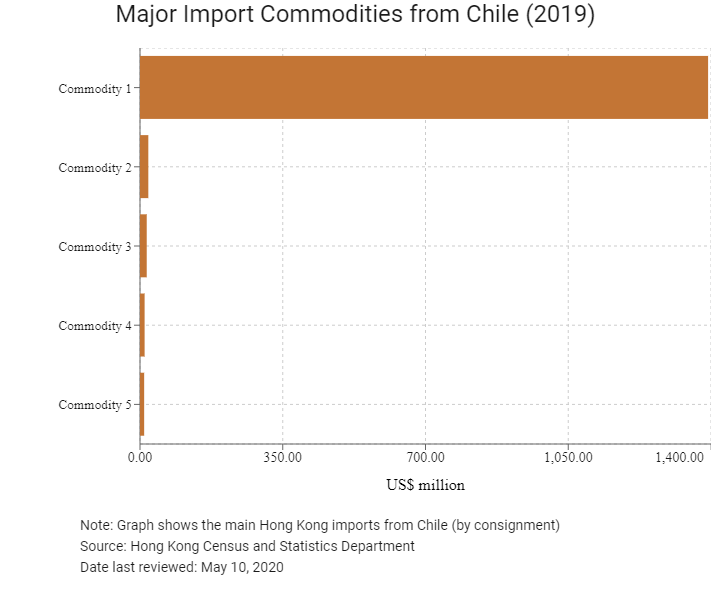

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Vegetables and fruit |

1,392.92 |

|

Commodity 2 |

Fish, crustaceans, molluscs and aquatic invertebrates; and preparations thereof |

20.4 |

|

Commodity 3 |

Beverages |

16.5 |

|

Commodity 4 |

Metalliferous ores and metal scrap |

11.3 |

|

Commodity 5 |

Meat and meat preparations |

10.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.99 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Chilean residents visiting Hong Kong |

14,646 |

-6.1 |

|

Number of Latin American residents visiting Hong Kong |

175,111 |

-8.0 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years

Source: Hong Kong Tourism Board

Date last reviewed: May 10, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Chilean companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and Chile

As an important step in accommodating greater synergies, Hong Kong signed a FTA with Chile on September 7, 2012, which came into force on October 9, 2014. Moreover, Hong Kong and Chile signed an investment promotion and protection agreement on November 18, 2016 – an investment agreement under the FTA between Hong Kong, Mainland China and Chile – which is now pending entry into force.

Sources: UNCTAD, Fitch Solutions

Chamber of Commerce or Related Organisations

Commercial and Economic Section in Hong Kong

Address: Room 05, 30/F, Enterprise Square Three, 39 Wang Chiu Road, Kowloon Bay, Kowloon, Hong Kong

Email: info@chilehkcc.org

Tel: (852) 2155 3027

Source: Chile Hong Kong Chamber of Commerce

Chilean Consulate General in Hong Kong

Address: Unit 3005, 30/F, Enterprise Square Three, 39 Wang Chiu Road, Kowloon Bay, Kowloon, Hong Kong

Email: cghonkong@minrel.gob.cl

Tel: (852) 2827 1826 / 2827 1748

Fax: (852) 3152 2653

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Entry is visa-free for up to 90 days.

Source: Visa on Demand

Date last reviewed: May 10, 2020

Chile

Chile