GDP (US$ Billion)

46.94 (2018)

World Ranking 89/193

GDP Per Capita (US$)

4,722 (2018)

World Ranking 107/192

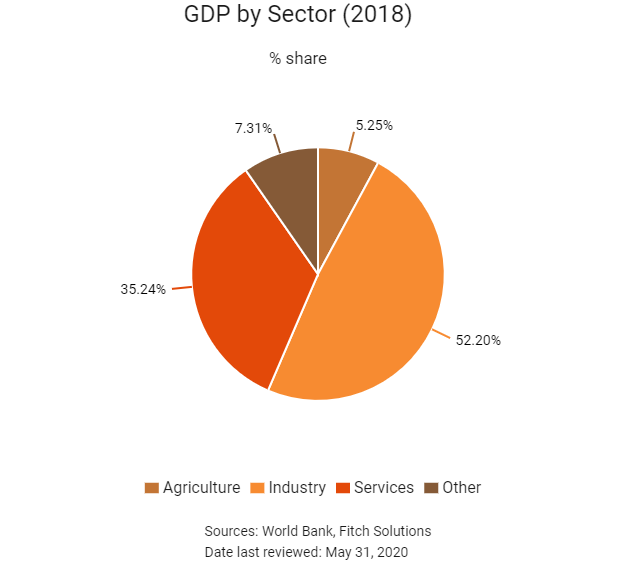

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

92.0 (2018)

Currency (Period Average)

Azerbaijan Manat

1.70per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

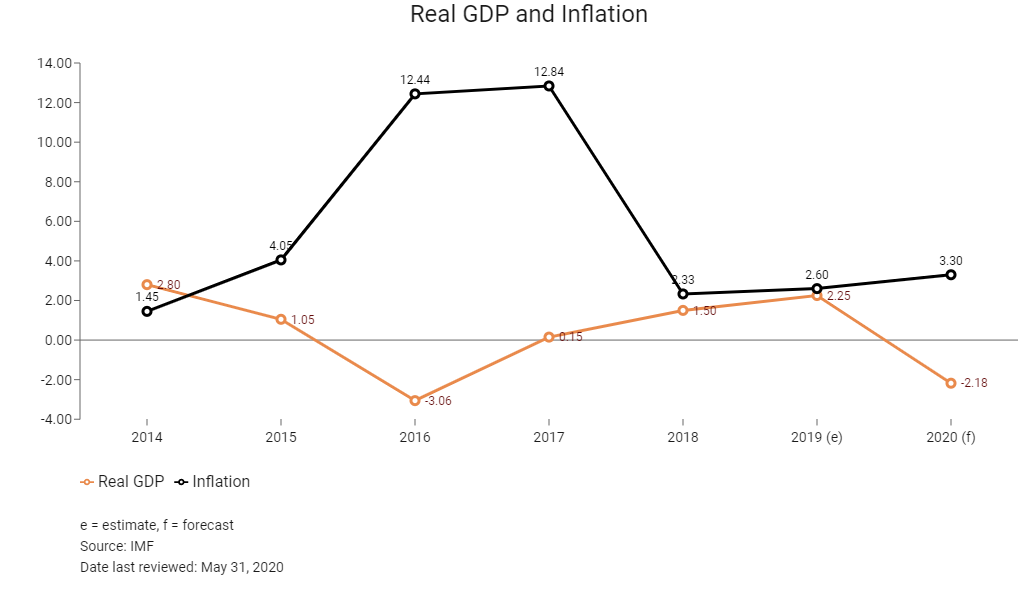

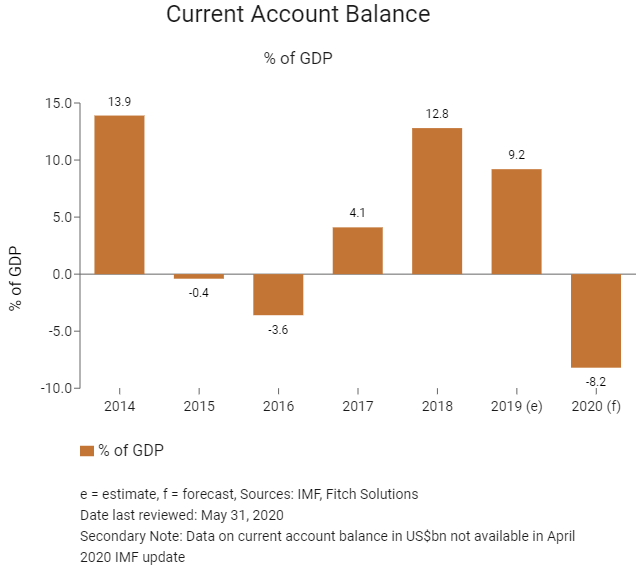

Since the presidential election in April 2018, the government of Azerbaijan has undergone significant changes. These include the nomination of a new Prime Minister and the appointment of several key ministers in charge of education, tax reforms, agriculture and rural development, the environment and energy. The new government has been tasked with continuing reforms in key sectors to recover economic growth. Supported by stable oil production and a modest acceleration in domestic demand, economic growth remains sluggish but in positive territory. Since economic prospects will largely rely on rising gas exports in the near term, broader-based sustainable long-term growth will need to be bolstered by the implementation of structural reforms to boost private sector investment, reduce fiscal imbalances, tackle issues of competitiveness and develop human capital.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

August 2018

Officials from the five littoral Caspian Sea nations – Azerbaijan, Russia, Kazakhstan, Turkmenistan and Iran – agreed upon a legal framework to share the world's largest inland body of water, which bridges Asia and Europe and has reserves of oil and gas.

February 2019

BP announced plans to ramp up production at the Shah Deniz gas field while maintaining flat output at the Azeri-Chirag-Guneshli oil field in 2019.

February 2019

Formula One announced the renewal of the Azerbaijan Grand Prix in Baku until at least 2023. Baku also hosted the EUFA Europa league final in May 2019. The events signify additional engagement with Europe and international bodies.

February 2019

Azerbaijan's Energy Minister Parviz Shahbazov announced that Balkan countries may wish to connect to the SGC (which incorporates the South Caucasus Pipeline, the Trans-Anatolian Pipeline and the Trans-Adriatic Pipeline). He also suggested that Turkmenistan was interested in joining the project, the aim of which is to transport gas from the Caspian region to Europe via Georgia and Turkey.

April 2019

BP and its partners have approved the Azeri Central East (ACE) project, the next stage of development of the Azeri-Chirag-Deepwater Gunashli (ACG) oilfield complex in Azerbaijani waters in Caspian Sea. The USD6 billion development included a new offshore platform and facilities designed to process up to 100,000 barrels of oil per day. The project is likely to start production in 2023 and produce up to 300 million barrels over its lifetime. The development would include new infield pipelines to transfer oil and gas from the ACE platform to the existing ACG Phase 2 oil and gas export pipelines for transportation to the onshore Sangachal Terminal.

2019

The Laki-Gabala railway line in Azerbaijan is expected to be ready by the end of 2019, according to Azerbaijan Railways. The 43km line would connect the Laki station with the Gabala International Airport. The project also included the construction of 103 drainage systems, 16 tunnels and bridges along the railway line. It also included building a station in Garagan-Shikhlar in Agdash district, as well as a train station near the Gabala airport. The route included a 20km mountainous stretch from Laki station to Gabala.

October 2019

Italy-based oil and gas contractor Saipem and its consortium partners Boshelf and Start Gulf FZCO won three contracts from BP for the development of the Azeri-Chirag-Gunashli (ACG) offshore oil and gas field in the Caspian Sea off Azerbaijan's coast, according to a press release from Saipem. Of the three contracts, two are for pipeline design, pipelay and associated works, and the third is for the transport and installation of four jacket pin piles, subsea structure and spools. Saipem's share of the overall contract value is around USD145 million and the ACG complex spans an area of more than 4,000sq km.

February 2020

President Ilham Aliyev's Yeni Azerbaijani Party (YAP) won 73 (out of 125) seats in the National Assembly following parliamentary elections that took place on February 9.

May 2020

As of May 21, the government implemented measures in response to the Covid-19 outbreak in the country. The authorities increased spending on public health (AZN8.3 million) and created a Covid Response Fund, to which it has transferred AZN20 million, with additional contributions from the public and private sectors. The government also announced support to the affected businesses amounting to AZN3 billion (3.5% of GDP).

Sources: BBC Country Profile – Timeline, Fitch Solutions, IMF, Reuters, Azer News

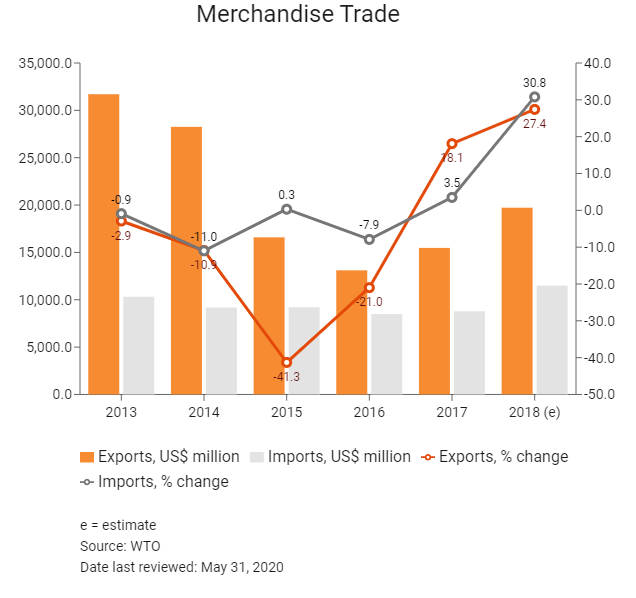

Merchandise Trade

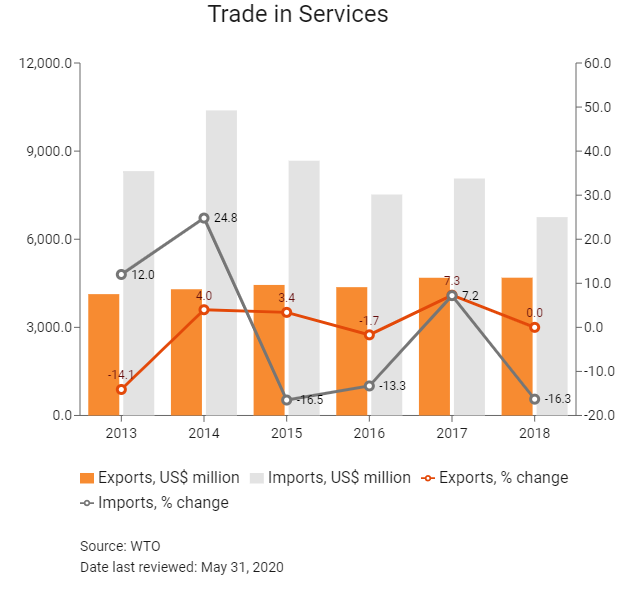

Trade in Services

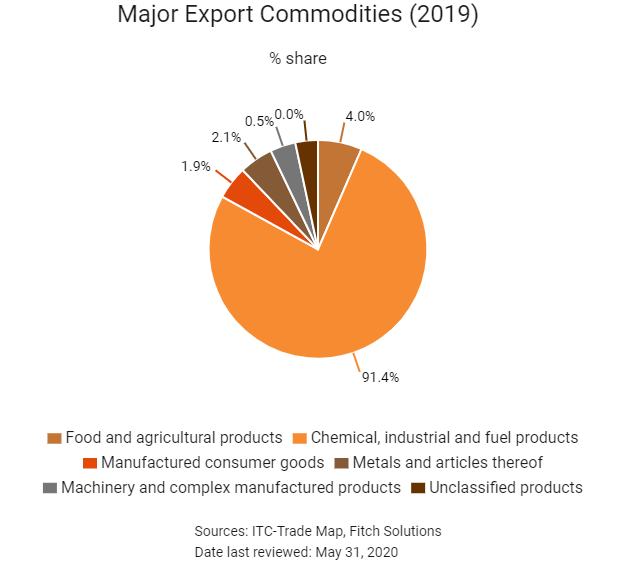

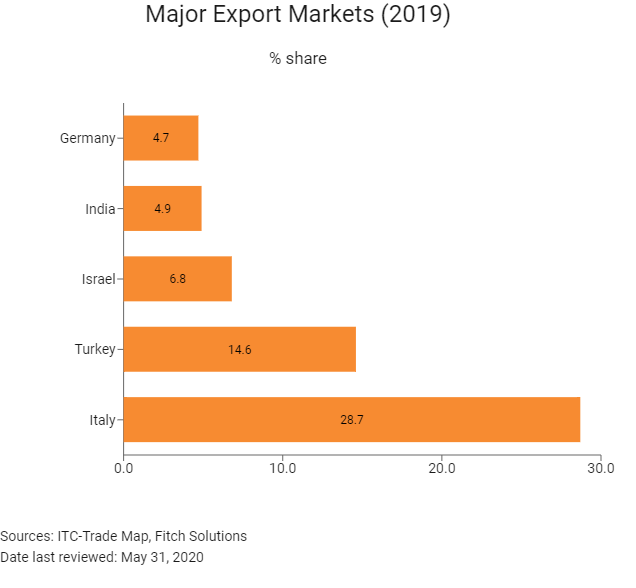

- Azerbaijan's exports remain heavily dominated by oil and petroleum-based products. According to latest available data, exports had an estimated value of USD15.2 billion in 2017, accounting for 40.5% of GDP, with chemical, industrial and fuel being the most important export product (90%). Azerbaijan's overdependence on hydrocarbons has made it difficult to expand other sectors of the economy. As a result, other product exports remain relatively small, totalling around USD1.3 billion. Of that, agriculture is an important component of Azerbaijan's non-oil economy and has significant potential to boost export revenue for the country. Following the privatisation of farm properties in the post-Soviet economy, the focus of Azerbaijan's agriculture shifted to producing profit-yielding crops, such as grain, potatoes, fruits, vegetables and berries.

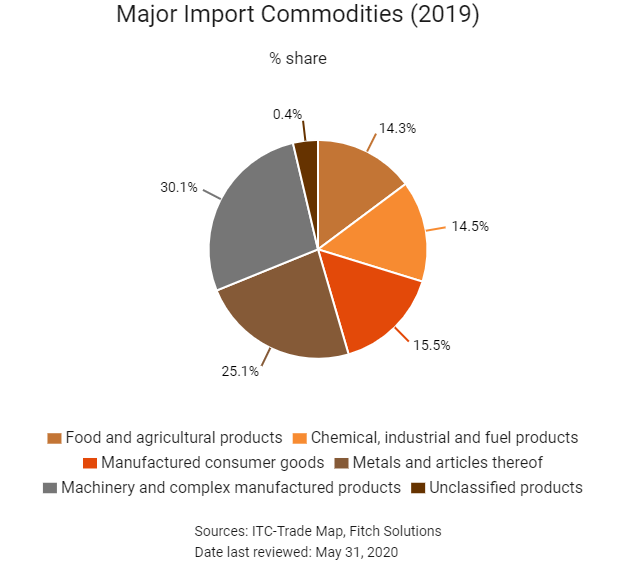

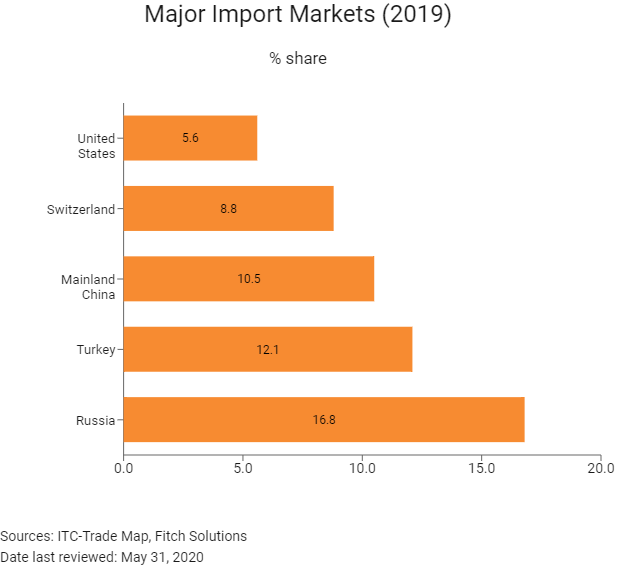

- The value of total imports in Azerbaijan is estimated at USD8.8 billion in 2017, accounting for 40.5% of GDP based on available data. This figure is high by historical standards, with imports expanding from 20.7% of GDP in 2010. The secondary economic sector in Azerbaijan remains largely underdeveloped. The country is thus heavily dependent on manufactured products imports.

- Azerbaijan applied for World Trade Organization (WTO) membership in June 1997 and currently holds observer status. It uses the internationally accepted classification system whereby the value of goods for customs procedures is determined in line with the general principles of the WTO. Regionally, the average tariff rate in Azerbaijan is high, at 5.2%, which is the third highest out of eight states within Caucasus and Central Asia. This is relatively uncompetitive in relation to a regional average of 3.9%. In the long term, a reduction or a removal of tariffs for some countries trading with Azerbaijan is likely, given the country's ongoing WTO accession and simultaneous pursuit of increased cooperation with the European Union (EU) – one of its major trading partners.

- Azerbaijan has shown a preference for bilateral agreements over multilateral trade associations and unions. For instance, Azerbaijan declined to sign an association agreement with the EU in the framework of the Eastern Partnership in 2014. Instead, it signed an agreement to simplify the visa regime with the EU, so the European Neighbourhood Policy functions more as a political arrangement rather than leading to a free trade agreement (FTA). Likewise, the country has made clear its plans to stay outside the EU and has also chosen to remain outside the Commonwealth of Independent States Free Trade Area (CISFTA).

- Azerbaijan has signed bilateral investment treaties with 48 countries and agreements on the avoidance of double taxation with 53 countries – 49 of which have been enacted to date and are in force.

Sources: WTO – Trade Policy Review, Azerbaijan Export and Investment Promotion Foundation, Ministry of Taxes of the Republic of Azerbaijan, Fitch Solutions

Multinational Trade Agreements

Active

- The Russia-Azerbaijan FTA: This agreement came into force on February 17, 1993. Trade volumes in 2014 stood at an estimated USD2 billion. Russia is a net exporter to Azerbaijan.

- The Georgia-Azerbaijan FTA: This agreement came into force on July 10, 1996. Azerbaijan is Georgia's second largest trade partner. The trade turnover between Georgia and Azerbaijan stood at about USD1.8 billion in 2018. Georgia exported goods worth more than USD586 million to Azerbaijan, while it imported over USD502 million worth of Azerbaijani goods and services. Azerbaijan mainly exports petroleum, petroleum oils and gases, gypsum, anhydrite, plaster, and other products to Georgia. Motor cars, live bovine animals, bars and rods of iron, and cement are the most imported goods from Georgia to Azerbaijan.

- The Ukraine-Azerbaijan FTA: This agreement came into force on September 2, 1996. Trade volumes between the two countries stood at an estimated USD824.8 million in 2018. Key areas include agricultural products, machinery, boilers, articles of iron and steel, and other manufactured goods. Azerbaijan exports raw materials, such as fuel products, to Ukraine.

- The Uzbekistan-Azerbaijan FTA: This agreement, set up in 2015, stresses the importance of expanding bilateral relations between the business communities of both countries and the implementation of joint projects to enhance economic cooperation.

- Black Sea Economic Cooperation (BSEC) Organisation: The BSEC Organisation came into existence on May 1, 1999 as a unique and promising model for regional multilateral political and economic cooperation. The member states are Albania, Armenia, Azerbaijan, Bulgaria, Georgia, Greece, Moldova, Romania, Russia, Serbia, Turkey and Ukraine. Areas for cooperation include agriculture and agro-industries, banking and finance, combatting crime, culture, customs, education, emergency assistance, energy, environmental protection, the exchange of statistical data and economic information, healthcare and pharmaceuticals, information communication technologies, institutional renewal and good governance, science and technology, small and medium enterprises, tourism, trade and economic development, and transport. This agreement continues to bolster trade between the member states.

Under Negotiation

- A bilateral FTA with Mainland China: An FTA between the two countries is still under negotiation. The impact of regional integration is significant, especially for small, open economies – such as Azerbaijan – entering into an FTA with a large economy, such as mainland China. At the same time, the FTA will have mutual economic and geopolitical benefits for both parties, as mainland China is a significant global consumer of fuel products and raw materials, which constitute over more than 90% of Azerbaijan's export basket.

- The CISFTA: CISFTA is a free trade area that came into force in September 2012 between Russia, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan and Ukraine. Azerbaijan's economy will benefit from the country entering the free trade zone (FTZ). The nation's products – particularly its fruits and vegetables, which are already popular in CIS countries – will be much easier to export. The FTZ area was designed to reduce all trade fees on a number of goods between participating countries. Overall, the move will induce investment in Azerbaijan's economy, ease trade and stimulate employment.

- EU-Azerbaijan PCA: The EU's bilateral trade relations with Azerbaijan are governed by a PCA which has been in force since 1999. In terms of trade, these are non-preferential agreements – ensuring most-favoured nation treatment and prohibiting quantitative restrictions in bilateral trade. Azerbaijan would benefit from this agreement, since the EU accounts for over more than 50% of Azerbaijan's total trade volumes. The PCA envisages progressive regulatory approximation of legislation and practices to the most important EU trade-related standards, including technical regulations, intellectual property rights protection and customs issues. This should lead to better access to EU markets for goods. Ratification is contingent on the Azerbaijani government's willingness to change regulations in line with EU standards. The EU has shown its willingness to negotiate a deep and comprehensive FTA with Azerbaijan, contingent on the country joining the WTO.

Sources: WTO Regional Trade Agreements database, European Commission, BSEC, Fitch Solutions

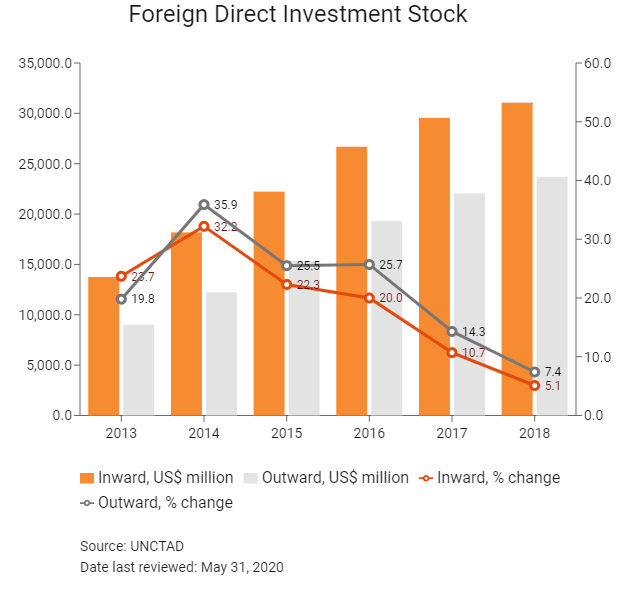

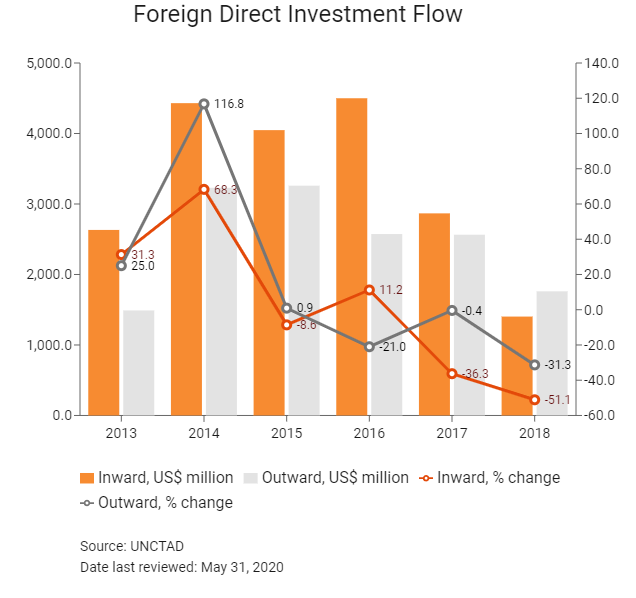

Foreign Direct Investment

Foreign Direct Investment Policy

- Azerbaijan welcomes foreign direct investment (FDI), and the country has attempted to boost its investment profile on the international stage. However, key structural challenges that the economy faces are hampering the development of non-oil sectors. Despite this, there has been increasing interest in the country, particularly from other emerging markets. The foreign investment regime in Azerbaijan has been liberalised in recent years as part of the government's commitment to diversify the economy and to make the country more attractive in the international marketplace. Foreign investors are free to engage in investment activities in most sectors. However, foreign citizens and organisations may not own land and can only lease it, which affects the security and cost of investment in many sectors.

- Under Azerbaijani law, foreigners may freely establish, acquire and dispose of interests in business enterprises. There are thus, technically, no foreign equity limits. Investors may engage in the privatisation of government-owned properties and can invest in the private sector through joint ventures with local companies, or by establishing subsidiaries that are wholly owned, as well as through representative offices and branches of foreign legal entities. Azerbaijani law also offers foreigners a 10-year protection provision in the event of less favourable legislation being implemented, thereby shielding foreign investors and keeping the country an attractive investment prospect. This does not, however, apply to tax legislation, which poses considerable risks in the event of significant corporate tax hikes.

- Foreigners legally enjoy investment freedom; however, access to markets, credit and other business operations is, in practice, often impeded by cumbersome bureaucratic roadblocks. Certain industries are faced with licensing and heavy regulatory requirement-related risks.

- The Azerbaijan Export and Investment Promotion Foundation emphasises an ever-improving reformist business environment and 10 best-practice principles that support a good investment climate:

- no state inspections (excluding tax, human health and state security reasons)

- no discrimination between foreign and domestic investors

- no prior authorisation requirement for foreign investment

- no licensing for currency operations involving the movement of capital

- no foreign exchange restrictions

- no limits on the amount of foreign capital in companies

- no technology transfer restrictions

- no legal limitation on ownership

- no restrictions on repatriation of profits

- no local counterpart requiremen

- In January 2016, President Ilham Aliyev issued a decree on measures to promote inward investment. Rules were approved for issuing an investment promotion document that would serve as the basis for granting tax and customs benefits to any approved new business that is in a desired area of economic activity, is located in one of five designated regions and has a minimum amount of investment. Incentives lasting seven years include exemption from value-added tax, customs duties, land tax, property tax and 50% reduced corporate income tax.

- Although Azerbaijan is richly endowed with oil and gas, the government has begun to look at developing the renewable energy sector, creating the State Agency on Alternative and Renewable Energy Sources (SAARES) in 2013. According to SAARES, the potential renewable energy in Azerbaijan from wind, solar, biomass, geothermal and small rivers might total 25,000MW. The government has included the waste-to-energy process among its renewable energy development plans, with public investment directed to the construction of solid and municipal waste-incineration plants.

- Azerbaijan has natural advantages in the agriculture sector, hosting nine climatic zones. The country's strategic location next to the large consumer markets of Russia and the Middle East makes it a suitable hub for export-orientated production. Azerbaijan is among the world's leading producers of sour cherries, chestnuts, cranberries, currants, figs, hazelnuts, persimmons, quinces and raspberries.

Sources: National sources, United States Department of Commerce, Azerbaijan Export and Investment Promotion Foundation

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Industrial parks: There are five industrial parks for which Azerbaijan has created integrated infrastructure and reduced the costs of doing business by offering attractive tax incentives and simpler customs procedures | Sumgait Chemical Industrial Park was established in December 2011. Investors benefit from the availability of universities specialising in scientific studies; a vocational school on site specialising in the fields of chemistry, mechanics and construction; a specific laboratory on site supplied with modern equipment; skilled scientific personnel, offering a full range of analytical services, laboratories, a strong research and development (R&D) network and on-site tests; and seven different workshops that will serve R&D and studies. Balakhani Eco-Industrial Park was established in December 2012. This park is strategically located and investors benefit from a road connection to the Balakhani-Binagady highway. The park was established close to a waste landfill, and a waste-to-energy plant provides raw materials and energy to the park residents, which include firms involved in the polyethylene, cooking oil and waste, plastic, and paper sectors. Mingachevir Industrial Park was established in February 2015. This park aims to attract companies operating in light industries, including the manufacture of textile, cotton and leather products. The investment projects planned for the park include the production of shoes, yarn, dyeing, weaving, sewing and medical cosmetics. Garadagh Industrial Park was established in June 2015 to the south of the Absheron peninsula, near the Garadagh district of the Baku-Astara highway. The park hosts one resident, namely Baku Shipyard, the most modern shipbuilding and ship-repair facility in the Caspian Sea. The attracted investment has reached USD470 million. As with the other parks, the government is developing the physical infrastructure to enable businesses to operate in the park. The park is focused on the production of competitive products for the shipbuilding industry, using modern production techniques and practices. Pirallahi Industrial Park was established in September 2016. This park focuses on companies operating in the pharmaceutical industry. There are currently three projects being implemented worth USD100 million. Investors receive incentives and support in getting established through the availability of a one-stop-shop, including support in receipt of technical conditions, permits and licences; work permits; environmental monitoring; favourable tariff costs for utilities; and registration of a seven-year tax holiday from corporate and income tax, property tax, land tax, and value-added-tax (VAT) for facilities and goods imported for production purposes. |

| Agro-Parks: There are three agro-parks, established to try to boost agriculture | Established in 2015, Garabagh Agrarian Industrial Park is in Barda. The facility includes a 5,000 tonne logistic center, cattle-breeding complexes, a meat-cutting and processing factory, and a fodder plant. Building on this initiative, two new agro-parks, Shamkir and Yalama, have been developed. Shamkir includes a logistics centre, a cold storage centre, and a calibration hall for fruit and vegetables. The facilities use the latest technology in calibration, packaging and labelling. Yalama has a modern, gravity-powered irrigation system that enables spring corn to be sown. Investors in the agro-park will be exempt from income tax and VAT. |

| High-tech parks (HTPs) for fields such as mobile technology, information technology, software engineering, space and telecommunications, robotics and mechanics, LED technology, biotechnology, research in energy efficiency, alternative energy, and other innovations. Two such parks currently exist in Baku and Mingachevir | Investors benefit from the availability of office spaces along with R&D and assembly facilities that will be made available for eligible resident and partner companies. Both local and international academic institutions will be signed on as partners to provide training for resident and partner employees and will also generate a streamlined, local and qualified workforce. Start-ups, residents and partner companies will be provided with a wide range of business support services, including business plan development, local marketing, sourcing support and investor relations. Residents and companies operating in HTPs are eligible to rent-subsidised offices, facilities and land. Residents and companies operating in HTPs are also exempt from paying the VAT on imported infrastructural and technological goods and services. Residents and companies located on HTP land are exempt from profit taxes for the seven-year period during which they operate in the park. |

Sources: US Department of Commerce, Azerbaijan Export and Investment Promotion Foundation, Ministry of Taxes of the Republic of Azerbaijan, Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 20%

Source: Ministry of Taxes of the Republic of Azerbaijan

Important Updates to Taxation Information

In December 2019 the Law of the Republic of Azerbaijan on Amendments to the Tax Code of the Republic of Azerbaijan was adopted. The law is effective from January 1, 2020.

According to the Law, recognition of taxable turnover for VAT purposes mainly has been shifted to the cash basis method. Beginning from 1 January 2019, new incentives for micro, small, and medium enterprises were introduced in the Tax Code of the Republic of Azerbaijan.

- The Ministry of Taxes reported in February 2019 that further economic reform of the tax code was intended to fight tax evasion, eliminate the shadow economy and improve tax administration with the aim of expanding the possibilities for small businesses and reducing the overall tax burden. Furthermore, the government has agreed the criteria for classification of entrepreneurs based on the average number of employees and annual income: micro, 1-10 employees and income of up to ANZ200,000; small, 11-50 employees and income of ANZ200,000-3 million; medium, 51–250 employees and income of ANZ3-30 million; and large, 251 employees and upwards of ANZ30 million.

- According to the Azerbaijani government, there are three distinct tax regimes that are applicable in the country: the statutory regime; the regime applicable to oil hydrocarbon companies and mining companies operating under production sharing agreements (PSAs); and the regime for companies working under host government agreements (HGAs). Each agreement has its own separate tax regime. The Ministry of Taxes publishes a tax article covering the tax regime for that particular agreement because there are differences between agreements, besides differing tax rates (for example, taxation of foreign subcontractors) and reporting requirements. Furthermore, tax protocols for each PSA and HGA outline specific guidance regarding how to pay the taxes and file reports. PSA contractor parties and foreign subcontractors are subject to tax only on their corporate income. Contractor parties pay profit tax on income derived from hydrocarbon activities, and foreign subcontractors are subject to tax only on income from services and mark-up on goods supplied in Azerbaijan. Local subcontractors are subject to the statutory tax regime. No corporate tax is applicable to HGA subcontractors. HGA participants pay tax only on their transportation income.

Business Taxes

Type of Tax | Tax Rate and Base |

| Resident company: Corporate Tax | The standard corporate income tax rate is 20% of operating profits |

| Resident company: Capital Gains Tax | Proceeds from the disposal of capital assets are included in ordinary taxable income |

| Social security contributions (all employers) | 25% of gross salaries (22% contributed by the employer and 3% deducted from the employee); In addition, 0.5% is deducted from the employee's gross salary and 0.5% is paid by the employer for each employee as an unemployment contribution to the State Social Protection Fund. |

| Simplified Tax | For an enterprise not registered to pay VAT or with gross annual revenue below AZN200,000, the simplified tax is payable at a rate of 4% in Baku and 2% elsewhere in the country. This option is unavailable if engaged in oil and gas production activities. Enterprises engaged in trading and catering services with monthly gross revenue above AZN200,000 may choose to pay simplified tax but should pay at a rate of 6% and 8% respectively. |

| VAT/GST (standard) | Standard rate of 18% on value of the products |

| Withholding Taxes | - 10% on dividend income, may be reduced if a double taxation agreement exists - 10% on interest, may be reduced if a double taxation agreement exists - 14% on rent and royalties, may be reduced if a double taxation agreement exists |

| Property Tax (buildings exceeding AZN5,000) | Property tax is levied on both movable and immovable property owned by individuals and companies. Property tax of legal entities is imposed on the average annual residual value of the taxable property at the rate of 1%. |

| Land Tax | - AZN0.06 per unit for agricultural land used for intended purposes or not available for the intended purposes of irrigation, reclamation and other farming reasons - AZN2 per 100 square metres of land considered for agricultural use, but not used for that purpose - The rate of land tax for industrial, construction, transport, telecommunications, trade and housing servicing, and other dedicated land varies from AZN0.1 to AZN20 per 100 square metres, depending on the city or region |

| Mining Tax | Paid by persons or enterprises extracting minerals from sub-surface strata of the earth on the territory or Caspian Sea belonging to the republic at a rate of 26% on the wholesale price of oil, 20% on the wholesale price of natural gas and 3% on the wholesale price of ores |

Source: Ministry of Taxes of the Republic of Azerbaijan

Date last reviewed: May 31, 2020

Foreign Worker Permits

Foreign nationals travelling to Azerbaijan to take up employment have to obtain work and temporary residence permits. The State Migration Service issues these for a period of up to one year. The term of validity can be extended every year for another period of up to one year. Work permits are not required by:

- Permanent residents

- Persons engaged in entrepreneurship activities in Azerbaijan

- Staff of diplomatic missions, consulates and international organisations

- Heads and deputy heads of organisations established by international agreements

- Persons employed by relevant executive authorities

- Persons on secondment in certain statutorily listed areas for no more than 90 days a year

- Heads and deputy heads of branches and representative offices of foreign legal entities in Azerbaijan

- Heads and deputy heads of legal entities founded in Azerbaijan by a foreign legal entity or a foreign individual

- Some other categories of foreign nationals

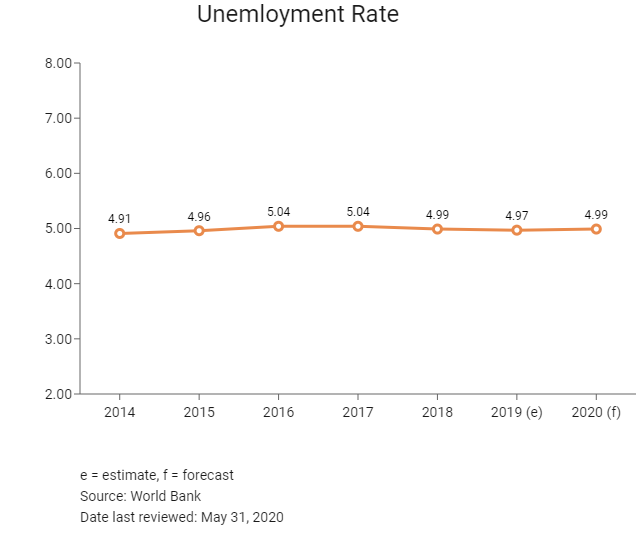

Localisation Requirements

Azerbaijan operates a quota for migrant workers, set at 12,000, and the government encourages businesses to hire from the domestic labour pool unless specialist skills are required that cannot be supplied by the Azerbaijani labour market. This makes it more difficult to import skilled foreign workers as there is an imposed limit on work permits for expatriates. Generally, in order to obtain a work permit in the country, a foreigner must have at least five years of experience in the field. This blocks the flow of unskilled workers from abroad and encourages more effective use of local labour. On the positive side, the process of obtaining permits for foreign workers has been streamlined since the introduction of the one-window service, whereby applications are submitted to one government department – the State Migration service – which then works with other agencies to issue work permits and other necessary documentation. This eases the bureaucratic burden of employing foreign workers.

Visa/Travel Restrictions

Citizens of the following nine countries can visit Azerbaijan without a visa for up to 90 days: Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Ukraine and Uzbekistan. Citizens of the following countries can obtain a visa for Azerbaijan on arrival, valid for 30 days, at any international airport: Bahrain, mainland China, Indonesia, Israel, Japan, Kuwait, Malaysia, Oman, Qatar, Saudi Arabia, the Republic of Korea and the United Arab Emirates.

Sources: Government websites, Azerbaijan Export and Investment Promotion Foundation, Republic of Azerbaijan Ministry of Foreign Affairs, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | Ba2 (Stable) | 12/04/2019 |

| Standard & Poor's | BB+ (Stable) | 26/01/2018 |

| Fitch Ratings | BB+ (Negative) | 10/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 57/190 | 25/190 | 34/190 |

| Ease of Paying Taxes Index | 35/190 | 28/190 | 40/190 |

| Logistics Performance Index | N/A | N/A | N/A |

| Corruption Perception Index | 152/180 | 126/180 | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International

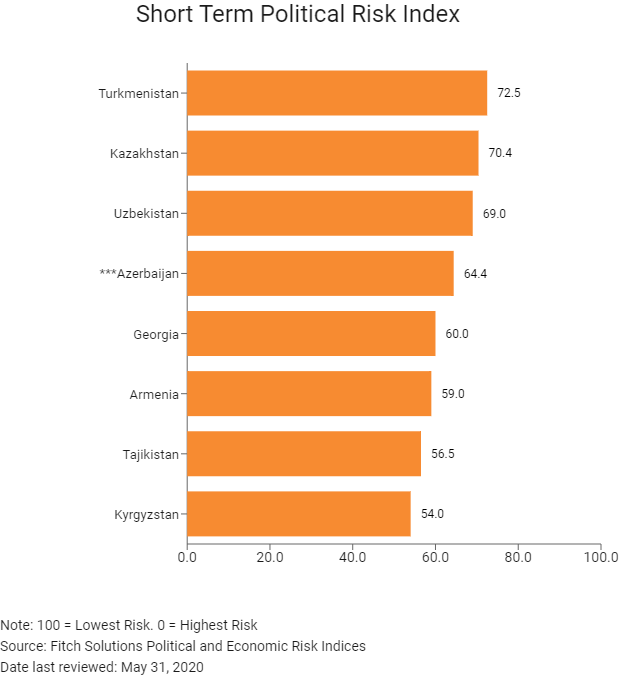

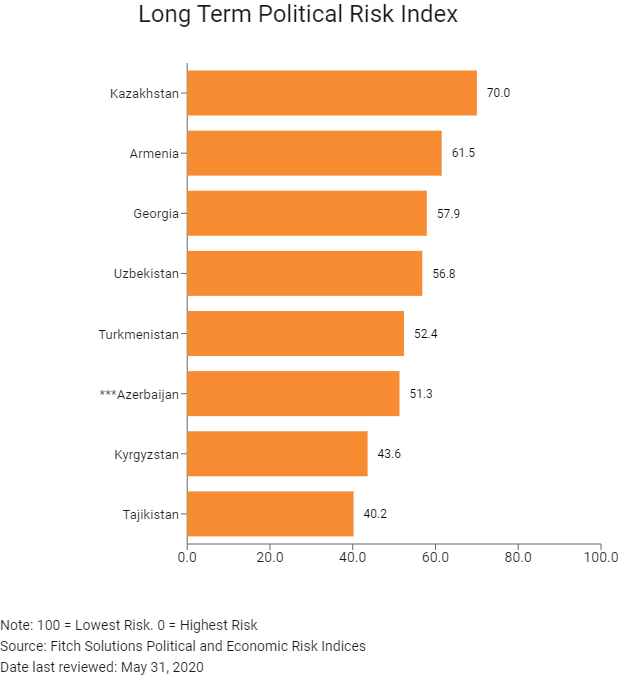

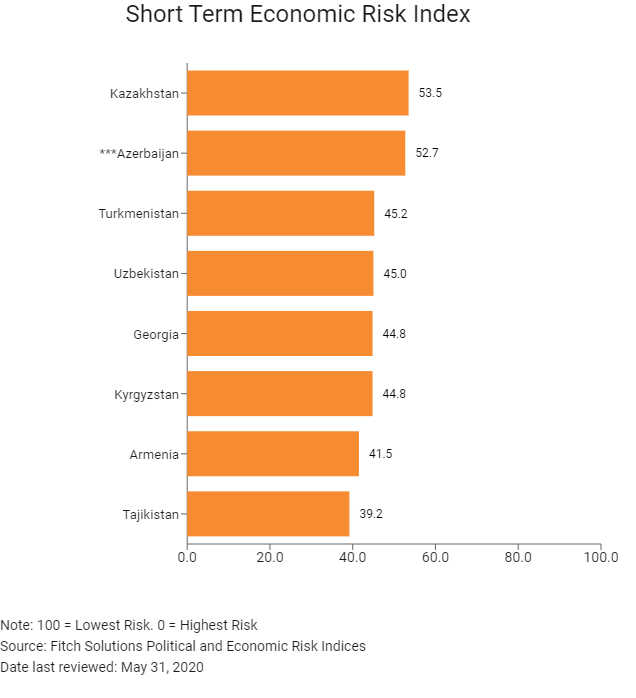

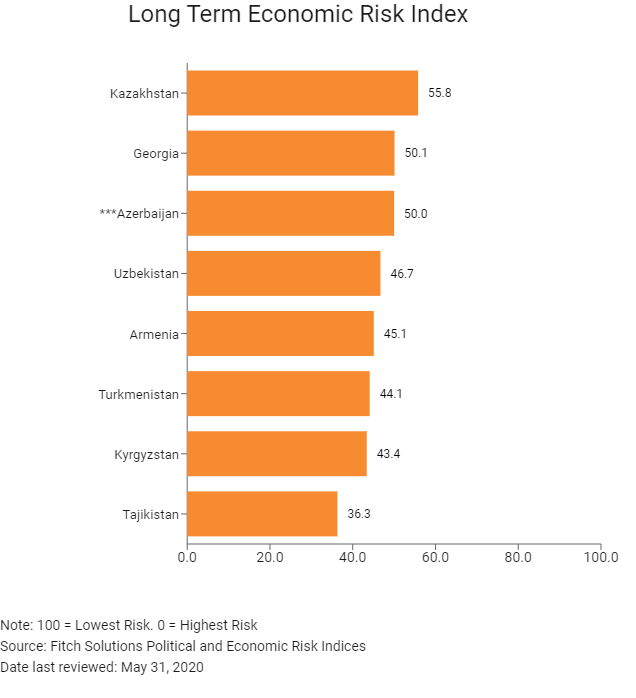

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index Rank | 112/202 | 120/201 | 113/201 |

| Short-Term Economic Risk Score | 52.1 | 51.7 | 52.7 |

| Long-Term Economic Risk Score | 49.9 | 49.6 | 50.0 |

| Political Risk Index Rank | 156/202 | 153/201 | 154/201 |

| Short-Term Political Risk Score | 62.9 | 64.4 | 64.4 |

| Long-Term Political Risk Score | 49.8 | 51.3 | 51.3 |

| Operational Risk Index Rank | 62/201 | 55/201 | 57/201 |

| Operational Risk Score | 57.6 | 60.8 | 60.5 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The economic growth outlook for Azerbaijan remains subdued, amid a weak external backdrop and low oil prices due to the Covid-19 pandemic, as the country remains overwhelmingly dependent on oil and gas revenue for GDP growth. About 90.0% of Azerbaijan's exports rely on energy and 40.0% of economic output. With oil prices set to remain subdued in the years ahead, the government will only gradually carry out its economic diversification and privatisation plans. In effect, the government will not significantly reduce its footprint in the economy, which will hinder the development of the non-oil sector and attract foreign direct investment.

OPERATIONAL RISK

Azerbaijan has one of the more competitive operating environments for businesses in the Caucasus and Central Asian region. The country's performance is boosted by its labour market dynamics and logistics profile, with key areas of strength being the good levels of education present among its labour force, the quality and extent of its transport network, as well as its domestic power generation and refining capacities. Areas of weakness include the lack of diversity in Azerbaijan's economy, which is highly dependent on crude exports, elevated legal risks and the security environment, which stems from Azerbaijan's ongoing dispute with neighbouring Armenia over the Nagorno-Karabakh territory.

Source: Fitch Solutions

Date last reviewed: June 4, 2020

Fitch Solutions Political and Economic Risk Indicies

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Azerbaijan Score | 59.0 | 61.1 | 62.5 | 59.5 | 52.8 |

| Caucasus and Central Asia Average | 50.4 | 56.7 | 53.4 | 46.6 | 44.9 |

| Caucasus and Central Asia Position (out of 8) | 2 | 3 | 2 | 1 | 3 |

| Emerging Europe Average | 57.6 | 55.9 | 59.1 | 58.6 | 56.8 |

| Emerging Europe Position (out of 31) | 14 | 5 | 12 | 16 | 18 |

| Global Average | 49.7 | 50.3 | 49.8 | 49.0 | 49.8 |

| Global Position (out of 201) | 58 | 35 | 51 | 57 | 86 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

| Georgia | 62.3 | 63.5 | 71.2 | 56.1 | 58.3 |

| Azerbaijan | 60.5 | 62.5 | 60.0 | 66.4 | 53.2 |

| Kazakhstan | 60.1 | 73.5 | 58.6 | 57.0 | 51.5 |

| Armenia | 56.9 | 60.4 | 59.1 | 53.9 | 54.2 |

| Tajikistan | 44.5 | 54.7 | 38.5 | 41.4 | 43.2 |

| Kyrgyzstan | 44.1 | 54.1 | 41.7 | 43.1 | 37.7 |

| Uzbekistan | 44.0 | 54.8 | 50.1 | 39.2 | 31.7 |

| Turkmenistan | 39.1 | 42.8 | 37.1 | 47.3 | 29.4 |

| Regional Averages | 51.4 | 58.3 | 52.0 | 50.5 | 44.9 |

| Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

| Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

Hong Kong’s Trade with Azerbaijan

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Azerbaijan residents visiting Hong Kong | 409 | -18.8 |

Sources: Hong Kong Tourism Board, Fitch Solutions

2019 | Growth rate (%) | |

| Number of European residents visiting Hong Kong | 1,747,763 | -10.9 |

| Number of emerging Europe citizens residing in Hong Kong | 114 | 29.5 |

Note: Growth rate is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

| Number of Azerbaijan companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong, Mainland China and Azerbaijan

A bilateral investment treaty has been in force between Mainland China and Azerbaijan since April 1, 1995.

Sources: Investment Policy Hub, UNCTAD

Visa Requirements for Hong Kong Residents

Hong Kong residents are required to apply for a 30-day or 90-day visa to visit Azerbaijan.

Source: Ministry of Foreign Affairs of The Republic of Republic of Azerbaijan

Date last reviewed: May 31, 2020

Azerbaijan

Azerbaijan