香港

Transformation and upgrading process, many companies from technology research and development, product design, brand promotion and other aspects to enhance competitiveness. And Foshan City, Mendel Precision Oral Medical Devices Co., Ltd. (hereinafter referred to as "Mendel"), while the appropriate business layout to enhance product value, marginal profit, in a competitive environment to broaden the market space.

High value-added product strategy

Mendel is a manufacturer and exporter of precision dental medical equipment approved by the Guangdong Provincial Food and Drug Administration. It has established a production base in Foshan since 1989. It is mainly engaged in the research and development, production and sales of dental medical equipment. Mendel pointed out to the HKTDC's economic and trade research that the company's core strengths include precision components and equipment R & D design and production capacity, and can meet customers and related health regulatory authorities, technical standards.

Mendel said the company's parts and equipment are high-tech and high value-added products, market competition key factors include product technology, quality, reliability and brand, and lack of certification, non-professional medical products at low cost, low price promotion The strategy of snatching the market is quite different. Therefore, the company's current development strategy is to improve the quality and precision of the product, and improve the market value of the product, rather than transfer production to reduce costs.

The company has a research and development base in Foshan and Henan Province, and continue to invest in strengthening the strength of R & D team, in addition to enhance the functionality of existing products, in the next 5 years will further develop more high-end and high value-added products, including dental laser cutting equipment, Treatment equipment, surgical craniotomy machine, surgical precision orthopedic surgical treatment equipment.

Mendel has only factory facilities in Foshan, China, and has imported all kinds of automatic production equipment from Japan, Germany and Sweden, including computer numerical control machine (CNC) for precision production, and set relevant testing equipment to ensure product High quality level. The plant currently employs about 120 workshop workers, mostly technicians, responsible for the operation of the production equipment, while the low-skilled workers only a small proportion of the staff.

Enhance brand and product value

Mendel also focused on the development of brand business. In addition to general publicity activities, to participate in large-scale exhibitions in the Mainland and overseas, the company set up factories in Gyeonggi-do in Gyeonggi Province in 2013, from the Mainland to the core components produced in Foshan to South Korea, with local procurement of industrial products and in line with South Korea Origin of the provisions of the high-end oral medical equipment products. Moder pointed out that some companies in the Mainland focus on low-cost strategy, but the product design and quality varies greatly, a direct impact on China's product image. In order to avoid the impact of the situation, Moder use Korea as a springboard to South Korea to create an image of the international market, enhance product value, while the establishment of Moder's brand business, expand the marginal profit.

Mendel products include titanium and copper chrome high-speed mobile phones, low-speed dental drill, electric motors without carbon brush and wireless root canal and other dental medical equipment, 60% of the business is well-known brands around the customer to provide original production (OEM) services, and 40 % Is the original design (ODM) or its own brand products. At present, about 80% of the company's products are for export to overseas markets and the rest are mainly sold in the Mainland. All products meet the hygienic and technical specifications of the relevant regulatory authorities in different sales markets and are certified by the US FDA and the European Union CE standards. On the other hand, the company has offices in Hong Kong, in addition to the Hong Kong market, the main deal with the company's overseas investment, sales, procurement and other business and related financial arrangements.

(Note: The above is the Hong Kong Trade Development Council and the Guangdong Provincial Department of Commerce Cooperative Research project global supply chain transfer and Guangdong and Hong Kong industrial development relationship between the business case. For more details, please refer to the aforementioned study.

編輯推薦

熱門文章

為長遠業務發展,不少中國內地的技術和資本密集型企業,近年加緊布局國際業務,並進一步發掘「一帶一路」市場商機。廣東科達潔能股份有限公司(下稱科達潔能)表示,對外投資不應單看勞動力和直接生產成本,全盤生產布局更需考慮交通運輸、物流、關稅等整體成本,並根據市場需求定位有關投資策略,務求為公司業務尋求最大效益。

著眼「一帶一路」市場潛力

在上海交易所上市的科達潔能,主要從事建材機械(陶瓷機械、牆材機械、石材機械等)、環保潔能(清潔煤氣技術與裝備、煙氣治理技術與裝備)與潔能材料(鋰離子動力電池負極材料)等三大業務,並提供工程總承包管理和融資租賃服務。該公司旗下設有包括位於廣東、安徽、江蘇、河南、遼寧等地27家子公司,並擁有科達、恒力泰、科行、新銘豐、科達東大、埃爾、卓達豪等行業內知名品牌,目前銷售遍及40多個國家和地區。

在建材機械方面,科達潔能積極利用國產裝備,拓展海外市場,現已在亞洲市場處領先地位。該公司董事鍾應洲先生向香港貿發局經貿研究介紹:「科達潔能的建材機械生產屬技術及資本密集型,在質量和技術方面均達國際水平,加上內地無論在金屬原材料、電子/電氣零部件等支援一應俱全,亦不乏高端設計和工程技術人才,有利生產高技術和『高性價比』的建材機械。雖然內地近年經歷一般勞動力及生產成本上漲,但科達潔能仍集中完善內地的生產業務,以技術和質量取勝,進一步發展內地和海外市場。」

他表示,內地建材市場經過30年發展已邁向成熟,而下游生產商對建材生產裝備需求亦轉趨平穩。為業務的長遠發展,科達潔能正逐步開發海外市場,並且十分重視「一帶一路」沿線國家的市場發展潛力,特別是不少沿線國家亟欲引進有關生產裝備,在本國生產建材以支援當地不斷增加的基礎建設、建築活動。

依據成本利潤布局海外投資

科達潔能除了從中國內地出口建材裝備,近年亦開始在海外布局投資生產業務,但有關投資項目卻集中與建材裝備相關的下游業務,包括在非洲國家投資生產陶瓷建材產品。該公司目前在非洲肯尼亞設立的磁磚生產線,已在2016年底開始投產,而在加納的廠房預計在2017年中開始運營,另外在坦桑尼亞的建材生產項目亦處於基礎建設階段。

雖然中國制建材擁有低成本優勢,但建材生產商往往因部分國家徵收較高的進口關稅,加上建材運輸成本高昂,難以為中國製產品開拓距離較遠的海外市場。另一方面,部分發展中地區如非洲等地,建設活動不斷增加,對建材需求殷切,但缺乏具規模的本地投資者,在當地設立建材生產線供應本地市場。

鍾先生指出:「在這背景下,科達潔能與部分非洲分銷商合作,輸出中國生產的裝備往有關國家設立建材生產線,利用當地原材料生產磁磚產品供應非洲市場。事實上,在計及勞動力效率及其他生產成本,在非洲生產磁磚的成本不比內地便宜,但卻大大省卻進口關稅和運輸成本,使科達潔能可有效開拓非洲的建材終端市場。而且,非洲建材市場在需求帶動下能承受較高價格,可帶來更高利潤,同時帶動公司的裝備業務銷售往非洲。

在建材機械領域方面,科達潔能已實現陶瓷機械裝備國產化,並邁向「世界建材裝備行業強者」的目標。該公司在內地設有2個「國家認定企業技術中心」、1個「國家工程技術中心」、2個「博士後科研工作站」和3個「院士工作室」等創新研發平台,配合內地的生產基地,為建材生產客戶提供先進裝備和相關的技術支援服務,現已是中國內地建材機械的龍頭企業之一,獲中國機械500強、國家級高新技術企業、國家知識產權優勢企業、廣東創新企業二十強等殊榮。

(註:上文是香港貿發局與廣東省商務廳合作研究項目全球供應鏈轉移與粵港產業發展關係的企業個案之一。更多詳情,請參考前述的研究報告。)

編輯推薦

熱門文章

面對激烈競爭市場環境,以及工資和原材料成本上漲等問題,部分中國內地企業正考慮轉移生產往較低成本地區營運。可是,也有不少企業選擇採取轉型升級策略,增強競爭力以應對各種挑戰。廣東省佛山市的南海區遠山汽車設備有限公司(下稱「遠山」),正積極提升自動化生產設備,同時制訂策略性的生產布局,希望進一步擴大市場份額。

引進機械人解決技術員短缺問題

遠山從事的汽車舉升機/液壓設備的研發和製造業務,主要倚賴技術和質量取勝。隨著外部環境轉變,一些內地企業正轉移生產方法以降低成本,但遠山卻積極增強研發能力,並引進焊接機械人和其他自動化生產設備,包括經改造的電腦數控(CNC)鋸床、沖床和自動送料設備,一方面紓緩技術員短缺問題,同時加強製造高技術及高質量產品能力。

遠山的代表向香港貿發局經貿研究指出:「汽車舉升機生產屬資本及技術密集型製造活動,所需的非技術工人數量很少,反而需要聘用熟練的『師傅』級技術員從事焊接和裝嵌工序,但轉移生產往海外低成本地區,往往不能解決技術員短缺問題。而且,有關作業需取得上游供應商在原材料方面的支援,包括優質鋁材、鋼鐵等供應,利用合適的機械和生產設備,配合完善的質量控制系統,以保證產品能符合內地和海外市場嚴格的技術和質量要求。

「在東南亞部分低成本地區,其實也欠缺技術工人,而且當地原材料供應鏈仍有待發展,如利用中國生產的金屬物料維持當地生產,所涉及的運輸成本不菲,若只為了享受當地較低的非技術勞工成本而進行遷移,可能得不償失。事實上,廣東省擁有成熟的供應鏈及物流配套服務,為解決技術員供應不足問題,遠山近年開始引進自動焊接機械人,並與一些高校、技術學院合作,以培訓更多操作機械人和自動生產線的技術人才。」

不過,遠山其實已在美國建立生產線,利用自動化設備生產和組裝舉升機及液壓產品,並預計在2017年下半年正式投產,有關產品主要供應北美、南美和歐洲市場。這些舉措顯然不是為了降低生產成本,而是通過在美國組裝降低有關產品(或原材料)進口美國的關稅,及為當地客戶提供更好的銷售和售後服務,同時利用當地完善的物流網絡降低物流成本和運輸時間,以支援鄰近美國其他市場的銷售活動。

遠山在1999年成立,目前擁有先進的生產設備和高技術、管理人才團隊。產品包括具專利技術的單柱、雙柱、四柱和剪式汽車舉升機,均按美國標準協會(ANSI)及/或歐盟CE等技術標準設計、製造,達到相關質量檢測標準,這些產品主要出口往海外市場,2016年該公司銷售額約達1,700萬美元。

(註:上文是香港貿發局與廣東省商務廳合作研究項目全球供應鏈轉移與粵港產業發展關係的企業個案之一。更多詳情,請參考前述的研究報告。)

編輯推薦

熱門文章

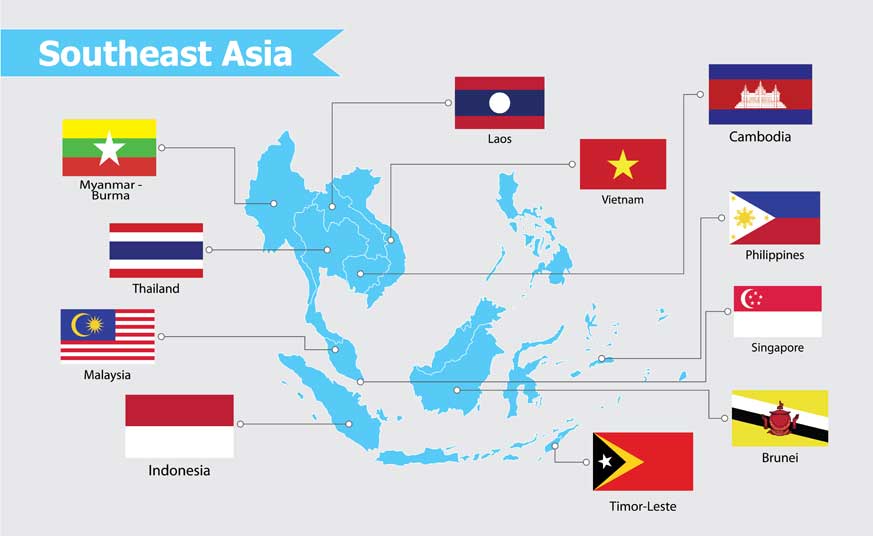

全球化發展促使區域供應鏈不斷整合,不少在中國內地從事生產的企業近年積極「走出去」,轉移部分生產業務往東南亞及其他地區,以應對內地生產成本上升挑戰,優化整體生產布局。總部位於香港的聯泰控股有限公司(下稱「聯泰」)執行副總裁陳祖恆先生指出,企業亦須考慮生產成本以外的一系列因素,例如外國貿易措施、轉移生產地的供應鏈狀況,和最終客戶需求等,才能有效提升整體的生產及營運效率。

貿易優惠影響生產布局

陳祖恆先生對香港貿發局經貿研究表示:「勞動力和土地供應等當然會直接影響生產成本,但外國給予部分生產地的貿易優惠,亦可能對降低產品出口外國市場成本起關鍵作用。例如輸往歐美的成衣及手袋等產品,一般進口關稅率可高達雙位數字(視乎產品而定),不過,若果能享受關稅減免,有關好處可能超過減省生產成本的幅度。」

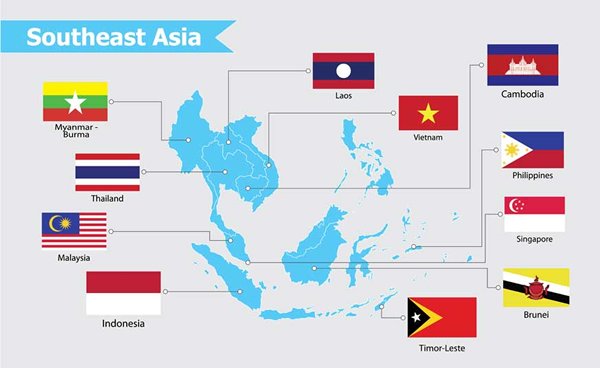

他舉例:「受惠於美國放寬普及特惠關稅制度(GSP),緬甸及柬埔寨等受惠國所生產的皮包產品出口至美國,現已獲免關稅待遇。另外,根據個別不同的GSP協議或自由貿易協定,兩地出口手袋產品至歐盟、日本及中國等,亦獲得免關稅待遇。為把握機會,聯泰近年於菲律賓及柬埔寨致力提高產能,並整合部分成衣生產設施轉為生產皮包,加快在當地發展手袋製造業務,以享受有關稅務優惠。」

提供策略性生產服務

聯泰是全球領先的消費品生產及供應鏈集團之一,現時在香港交易所上市。聯泰專業生產休閑服、時裝及毛衣等成衣,和時款手袋、背包等配飾產品,利用具競爭力的價格、高質量、快速回應等優勢,為國際知名品牌提供原設備製造(OEM)和原設計生產(ODM)服務。該公司業務策略之一,包括在中國內地、菲律賓、柬埔寨、越南、印尼等建立區域性生產網絡,利用不同地點的生產優勢,為客戶提供策略性的生產服務。

聯泰於上世紀80年代在香港開展成衣生產業務,並在廣東省的東莞、番禺、梅州等建立生產網絡。隨著近年內地生產成本上升、出現勞動力不足等問題,聯泰在過去十年已逐步在東南亞布局生產活動,以降低生產成本和享受當地的關稅優惠。

陳先生補充:「不是每一個低成本地區都適合承接從內地轉移的生產,視乎個別企業及實際情況而定。例如部分『一帶一路』國家不是熱門的外來投資接收地,企業可能不瞭解當地的法律法規、本地文化,又不熟悉當地的勞工和生產支援情況,直接影響前往這些地點投資設廠的可行性。而且,低成本可能是因為缺乏供應鏈/生產物料支援、較差的交通基建和運輸物流服務的結果。此外,部分國家擁有不俗的非技術勞動力供應,但缺乏熟練工人和技術人才,難以承接較高質量和高增值生產活動的業務。」

符合國際客戶的業務發展

「生產因素以外,客戶要求亦至關重要。國際知名品牌客戶均快速回應市場變化,特別是近年全球經濟增長緩慢,不同品牌競相追逐消費者有限的購買力,相繼提升產品的設計、用料、質量水平等,他們大多願意把有關生產留在中國內地和其他擁有較成熟供應鏈的生產地,以便快速回應激烈的市場競爭。但對於部分較標準、或生命周期較長產品,例如一些T恤、內衣和運動型包袋,客戶可能較著重低成本而願意承擔較高的生產風險、較長的生產周期,有關生產便可能需要轉移到低成本的較落後的生產地點,例如孟加拉和埃塞俄比亞。」

聯泰成功之道,除了有效利用中國內地和其他海外生產地點的不同優勢,以滿足客戶不同要求外,亦積極配合客戶的整體品牌發展策略。特別是知名品牌十分注重他們的品牌和企業形象,要求生產商嚴格實踐企業公民責任;而聯泰致力遵守各生產地的法律法規,確保符合相應的勞工和道德標準,並採取有效的環境保護措施,以符合客戶要求,達致業務可持續發展的目的。

(註:上文是香港貿發局與廣東省商務廳合作研究項目全球供應鏈轉移與粵港產業發展關係的企業個案之一。更多詳情,請參考前述的研究報告。)

編輯推薦

熱門文章

亞洲地區快速發展,不少區內企業以及跨國公司相繼調整業務策略,以適應不斷變化的投資環境。位於香港的騰訊科技亞太有限公司(下稱「騰訊亞太」),主要從事資訊科技及電源產品業務,近年亦加緊整合其中國內地的生產活動,包括升級在廣東省的生產設施,同時強化其深圳設計中心的研發能力,並轉移部分零部件生產往較低成本的菲律賓廠房。騰訊亞太希望在未來進一步利用東南亞國家低廉的勞動力,生產電源零部件以支援其廣東省的生產業務,利用不同地區優勢精確布局生產業務,以便更好服務亞洲地區及歐美市場客戶。

升級中國生產業務

騰訊亞太中國區董事總經理張錦雄先生表示,生產成本優勢以外,不少東南亞國家其實只擁有簡單的生產條件和供應鏈體系。相對而言,中國內地擁有成熟的電子產品集群,零部件及生產支援服務一應俱全,技術人才充裕,無論在物料供應、模具設計製造、技術支援和提供解決方案等,均能有效為內地和區內的下游生產客戶提供全面服務。所以,中國在可見將來仍會是該公司發展生產業務的主要地區。

張先生向香港貿發局經貿研究表示:「面對內地生產成本上升、勞動力短缺等問題,騰訊亞太多年前已轉移深圳的生產業務往中山廠房,以降低生產成本,並積極利用內地的科技資源強化深圳設計中心的研發能力。事實上,公司近年進一步升級中山廠房、引進自動化生產設備,已大大紓緩勞動力不足問題,而公司亦可從事更高技術的生產活動。此外,公司更前往位處廣東省西面較偏遠的羅定市建立生產線,利用當地較充裕的勞動力和較低的勞動力成本來擴充產能。」

為分散生產過分集中內地的風險,美國雅特生科技集團(騰訊亞太的母公司)在多年前通過該公司併購在菲律賓地區擁有廠房。面對目前內地生產成本上漲問題,菲律賓廠房無疑為該公司提供另一選項。張先生解釋,菲律賓僱員擁有不俗的英語水平,能有效與香港及來自世界各地的管理人員溝通,又因廠房員工流失率相對偏低,工人就業穩定有助生產管理及人才培訓。加上菲律賓與中國之間的交通運輸便利,物流成本位於合理區間,致使雅特生科技近年不斷擴充菲律賓廠房產能,享受當地較低的生產成本優勢生產電子零部件,以支援廣東省的生產業務。

精確部署生產業務

「無論在供應鏈、生產配套和支援服務,以至技術人才供應方面,菲律賓仍處於發展中階段,所以公司主要利用當地的勞動力資源,來生產相對勞動力密集的電源零部件,和需求比較穩定的電源供應器。至於中山和羅定生產線,在珠三角成熟供應鏈的支援下,主要負責生產高技術和廣泛的終端產品。此外,公司亦加強工程設計,使產品能更多利用標準零部件以配合自動化生產要求,一方面減少在內地僱用非技術工人的需要,同時更多利用菲律賓的低成本勞動力生產電源零部件,善用不同地區優勢精確部署生產業務,達到為下游客戶提供具成本效益產品的目的。」

騰訊亞太是美國雅特生科技集團(Artesyn Embedded Technologies Inc.)成員之一,主力負責中國內地的生產業務。美國雅特生科技集團是高可靠性電源轉換和嵌入式計算解決方案設計和製造先行者,其解決方案和產品適用於通訊、計算、醫療、軍事、航太和工業自動化等多種行業和領域,並且是全球從事嵌入式電源業務最大的企業之一,為客戶提供標準型的 AC-DC 產品,和多種 DC-DC 電源轉換產品。該集團目前在全球擁有超過 20,000 名員工,10個卓越的工程中心、4個世界頂級的製造工廠以及全球銷售和支援辦事處。

(註:上文是香港貿發局與廣東省商務廳合作研究項目全球供應鏈轉移與粵港產業發展關係的企業個案之一。更多詳情,請參考前述的研究報告。)

編輯推薦

熱門文章

先達國際物流網路四通八達,管理組織高效,貨物運輸時間因此可減少達百分之五十。該公司的執行董事林進展表示,中國「一帶一路」倡議帶來新機遇,貨品更容易打進倡議中沿線60多個國家的市場,大大促進物流業發展。

講者:

先達國際執行董事林進展

相關資料:

香港貿易發展局

https://www.hktdc.com/tc/

香港貿發局「一帶一路」資訊網站

https://beltandroad.hktdc.com/tc/

亞洲工業發展面貌正經歷新一輪改變。自上世紀末先進國家大規模把生產活動轉移往低成本地區,亞洲的工業生產活動大幅增加,特別是中國目前已成為全球最大的工業生產國。不過,中國內地的投資環境近年亦開始轉變,勞動力及生產成本上漲等問題正促使一些外資和本地企業調整業務策略,他們一方面轉移部分生產往其他亞洲地區,同時升級內地業務,以提升競爭力。

粵港企業重整業務布局

在廣東省從事生產及貿易的粵港企業,其實在多年前已開始採取不同策略應對珠三角投資環境轉變,包括轉移部分生產和採購活動往中國內地其他較低成本地區,少部分則選擇同時前往東南亞等屬於「一帶一路」的地區設廠生產,或在當地採購各種商品和原材料,希望利用外部資源降低成本。不過,隨著近年全球和內地市場增長放緩,以及來自其他低成本地區的競爭日益激烈,粵港企業更進一步在控制成本以外制訂策略轉型升級,從勞動力密集轉往高增值業務方向發展,希望在中、長期而言達到業務可持續發展目的。

當中不少企業積極投資自動化生產,一方面紓緩勞動力短缺問題,同時因應國際市場需求日趨嚴格,希望通過自動化設備生產更高質量和更高精密度的產品在市場競爭。一些企業則加強投資科技研發,爭取發展高技術業務,也有部分選擇開發自家品牌以提升產品價值。隨著全球化步伐加速,不同產業之間的分工日益精細,以致全球供應鏈發展轉趨複雜,粵港企業亦因應不斷轉變的外部環境調整策略,務求達到更理想的轉型升級效果。

中國/亞洲供應鏈日漸發展

珠三角擁有成熟的供應鏈體系和豐富的生產性支援服務,大部分海外地區難以相比。因此,粵港企業在規劃未來業務時,大多繼續選擇在珠三角及廣東省和鄰近地區,保留甚至進一步發展較高增值和較高技術的生產業務。與此同時,隨著亞洲其他低成本地區的工業活動日漸增加,中國與亞洲、包括東盟等地已逐漸建立緊密的供應鏈關係,為粵港企業提供更為廣闊的市場和採購空間。

目前不少企業從珠三角及中國其他地區運送大量工業物料,前往亞洲及其他「一帶一路」沿線國家支援當地的工業生產,部分更向這些低成本地區轉移生產和進行採購活動。有關企業在這些地區生產或採購的產品一方面會銷往先進國家,同時會把相關的工業物料、零部件等運返珠三角等地以支援內地較高端的生產活動。隨著亞洲地區分工日漸明顯,中國和亞洲不同地區的上、下游供應商和生產商之間的貿易關係日趨密切,也刺激亞洲地區內部貿易快速擴張。

優化區域業務布局

由於亞洲較低成本地區普遍只擁有基本的生產條件,物流及其他配套服務有待提升,並且缺乏技術人才,所以企業轉移生產大多局限較低端的勞動力密集工序,以及產品生命周期較長的輕工產品和零部件。除工資成本外,企業在海外生產亦須顧及運輸物流、物料供應和管理等整體成本,加上跨區安排涉及較長的周轉時間,需要高效的供應鏈管理才能配合企業把握多變的國際市場商機。因此企業部署海外生產時,宜從多方面考慮因素出發,例如是否有利開發當地市場。而歐、美及其他出口市場實施的貿易壁壘和關稅優惠,亦可以影響相關企業的區域生產和採購布局。

總括而言,在競爭越趨激烈的國際市場,以及全球供應鏈發展不斷演變的情況下,粵港企業已不再是單靠降低直接生產成本,而是積極採用轉型升級、提升業務價值策略,同時考慮市場需求及整體成本效益,優化區域業務布局以增強競爭力。

在這背景下,粵港兩地可加強合作,制訂合適政策促進兩地企業進一步發展,例如引導他們聚焦應用智能製造技術以協助產業進一步升級,同時推進兩地企業的科技合作、加速科研成果商業化;此外,粵港須進一步完善兩地之間的運輸物流網絡,便利兩地企業更有效布局他們的區域業務,並且鼓勵企業攜手「走出去」發掘「一帶一路」商機,利用香港的專業服務制訂長遠發展策略和控制風險,進一步連結亞洲日漸發展的區域供應鏈,更好利用不同地區資源開拓內地和國際市場。

請按此購買這份研究報告。

1114 瀏覽次數

1114 瀏覽次數