Malaysia

With US$20 billion worth of Malaysian residential and commercial projects given the go-ahead in 2017 alone, the global building-products industry sees a ready market for its environmentally friendly technology and smart systems.

Construction is booming in Malaysia. In 2017, according to the Malaysian Institution of Engineers, more than RM83 billion (US$20 billion) of construction projects were awarded, with investment predicted to grow by 10% annually. It is considered one of the country's pillar economic sectors and is forecast to be worth 5.5% of its GDP by 2020.

Significant funding is being channelled into major infrastructure projects, such as the Pan-Borneo Highway, the KL-Singapore High-Speed Railway and East Coast Railway. Alongside this, in 2016 the government launched its five-year Construction Industry Transformation Programme, which aims to increase productivity and environmental sustainability while addressing safety and quality standards and developing tech-driven training programmes.

This, then, was the backdrop to Ecobuild Southeast Asia 2018, an event held in conjunction with Malaysia's International Construction Week (ICW), the largest construction trade event in Malaysia and an important platform for the ASEAN region. In total, it hosted 50 free seminars on topics ranging from construction logistics to nuclear-power plant planning and water management.

Overseas Companies

Among the companies exhibiting at the show was Macau-based Pacilink Construction, a business that aims to become one of the leading integrated construction engineering contractors in China and Southeast Asia. In particular, it wants to bring the expertise gained from large-scale projects in Macau and Zhuhai, such as the Grand Lisboa Palace, Wynn Macau and the Taipa Ferry Terminal, to Malaysia and beyond.

Explaining his company's strategy, Pacilink's Executive Director of Corporate Strategy and Development, Ben Kwok, said: "We set up an office in Kuala Lumpur two months ago and this is our first show. We see a lot of opportunity because of the Belt and Road Initiative, which means that many Chinese companies will invest in construction projects in Malaysia. We want to build our regional base here, develop our supplier network, and then maybe expand into other countries in Southeast Asia."

Liyang-based Jiangsu Baopeng Construction Industrial Materials, a joint venture between Baosteel and Jiangsu Pencheng Steel, is one of the Chinese companies looking to expand their activities in Malaysia. Baopeng used the show to promote its autoclaved aerated concrete block and panel technology for commercial and industrial buildings, which is said to be fireproof, non-permeable, soundproof and comparatively lightweight.

Gu Zhiqiang, Baopeng's Foreign Trade Manager, believes that many Chinese material suppliers are now looking at the Malaysian market, saying: "We grouped together with 10 materials companies from Jiangsu to attend this show, our first in Southeast Asia. We want to expand from China and are looking for opportunities in Southeast Asia, Europe and the US. At the moment, we are registering our products for standards certification in different markets."

Advanced Technology

The utilisation of advanced technologies to optimise productivity and reduce costs while supporting sustainability goals was an overriding theme at this year's show. AECOM Malaysia is the local arm of a Los Angeles-based professional and technical services firm, which specialises in global infrastructure assets.

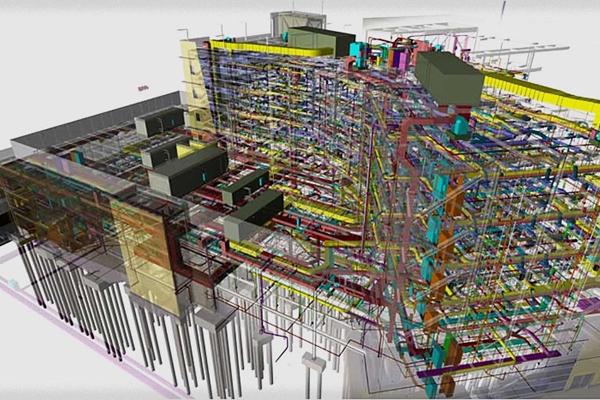

Kesavan Jaganathan, the company's Executive Director and Head of Building Engineering, explained the effect new technology is having on the industry, saying: "Technology is transforming construction. We see 3D-modelling in project cost planning, AI being used in design processes and the Internet of Things helping synchronise everything."

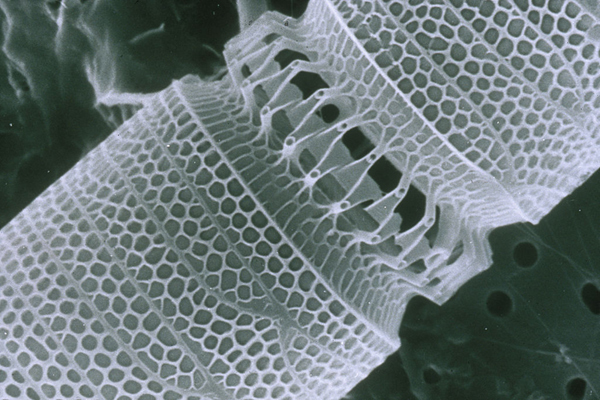

Jaganathan picked out one technology in particular – nanotechnology, the development at an atomic or molecular level of new and improved materials – that is making a particular difference to the industry. He said: "Nanotechnology is revolutionising processes and improving materials used in construction. For example, it is being used to improve the strength of concrete, raise the temperature steel can withstand and enhance the photovoltaic efficiency of solar panelling. Malaysia identified nanotechnology as a potential growth sector in 2009, and has invested a lot of money in its research and development."

One company using IT to enhance its construction services is Smart Build Asia, a Singapore start-up that expanded into Malaysia two years ago. Explaining how it combines industry intelligence with a database subscription model, Gurpreet Khera, the company's Country Manager for Malaysia, said: "We offer subscribers access to the most extensive database of construction projects in both countries. In Malaysia, we collate project data from about 140 government departments and our database enables contractors, sub-contractors and suppliers to find the key stakeholders and ensure that their tenders and quotations are properly tailored to each project."

Others at the show, however, believed that Malaysia still has some distance to go if it is to catch up with other countries when it comes to construction technology. Among those embracing this particular view was ASEAN Engineering, the Southeast Asia distributor for the range of safety equipment – including fire-protection kits and evacuation suits – produced by Prague-based company Nano Technologi.

Explaining how it's developing its market across the region, Sales and Marketing Manager Lukas Krenovsky said: "The Czech Republic is a leader in nanotechnology, and we are growing our customer base across Asia. A lot of our work is in Thailand, Vietnam and Philippines, but less in Malaysia. Here it is very focused on cost and the awareness of our technology is higher in other countries."

James Hadden, Director of Malaysia-based Ninox and its Singapore sister company Argyle, also highlighted the cost factor, saying: "A lot of people in construction see technology as expensive and there has been a slowness to recognise the real benefits of improving processes."

Ninox and Argyle specialise in 3D scanning, 360-degree video and augmented and virtual-reality services for property and infrastructure developers, asset managers, engineering consultants and sales and marketing teams. Last year, it used perimeter scan software developed by 3D robotics for a successful pilot project in Kuala Lumpur.

Going Green

Large construction projects are currently redefining Kuala Lumpur's skyline, and one of the biggest new developments is the 17-acre Tun Razak Exchange (TRX) Lifestyle Quarter, which will integrate a financial district, retail and dining facilities, a hotel, six residential towers, a park and an MRT subway station. Due to be completed in 2020, it is a joint venture between Australian development and infrastructure company Lendlease and TRX City, a wholly owned subsidiary of the Malaysian Finance Ministry.

Describing the development as one of his company's largest current projects, Robert David Whent, Lendlease's EH&S Director for TRX, said: "TRX is currently one of our four largest projects worldwide, alongside the Paya Lebar Quarter in Singapore and two projects in Australia. We are also undergoing a major mobilisation in China and begin work on the International Quarter London later this year."

One of the developers' major aims is to make TRX as environmentally friendly as possible. In line with this, it is looking to be awarded gold ratings under both Malaysia's Green Building Index (GBI) and the global Leadership in Energy and Environmental Design (LEED) certification system. In order to achieve this, it is implementing a number of sustainable processes, including a diversion of operational waste from landfill and reduced energy use through efficient lighting, plant and equipment.

Another company with a distinctly environmentally friendly focus is ESD GreenTech, an environmental design business based in Kuala Lumpur, which helps developers and investors meet green certification requirements. Explaining the difficulties that Malaysia's tropical climate causes for the construction industry in this respect, one of the company's engineers, Colin Timothy, said: "The main challenges for tall buildings in the region are sunlight and heat. They can affect energy utilisation, such as through higher air-conditioning costs, so it's important to create passive low-energy architecture from the outset, while looking at orienting the building so it doesn't face directly east or west."

Building Information Modelling

One topic frequently mentioned during the show was Building Information Modelling (BIM), a system for optimising data through the entire lifecycle of a built asset. Effectively, it provides a 3D virtual construction framework that can be shared between engineers, owners, architects and contractors.

Clive Slattery, Head of Product Certification, Asia Pacific, for the UK-based British Standards Institution, regards BIM as the next major development set to affect the construction industry in Asia. He said: "There is going to be a domino effect across Asia regarding the adoption of BIM. It has become the standard for enhancing productivity and will change the dynamics of the construction supply chain in the region. At present, we have BIM Level 2 being used in Hong Kong and have just announced our first BIM project in China. Now, Malaysia may be the first ASEAN nation to implement BIM."

Last year, Malaysia's Construction Industry Development Board (CIDB), which had one of the largest installations at the show, established a BIM Centre of Excellence. The centre helps to overcome the software cost and knowledge gap that hamper local construction players by enabling interested parties to model building projects in a simulated environment that adheres to BIM standards.

Ecobuild Southeast Asia 2018 took place from 27-29 March at the Kuala Lumpur Convention Centre.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

Development of China-backed Trans-Sabah Gas Pipeline forms part of manifesto of current Malaysian government.

The future prospects of China's first Belt and Road Initiative (BRI) related foray into Malaysia's Liquefied Natural Gas (LNG) sector may depend on the outcome of the forthcoming Malaysian elections. Assuming the incumbent Barisan Nasional Party is returned to power on 9 May, it will look to make good on its manifesto pledge to greenlight the Trans-Sabah Gas Pipeline (TSGP), a project set to be backed by RMB4.53 billion (US$1.16 billion) worth of investment from the Export and Import Bank of China (EXIM).

China's interest in the project is more than understandable. Malaysia is the third-largest LNG exporter globally. In 2016, it accounted for nearly 10% of the world's supply, with plans in place to ramp up production still further. For its part, China is now the world's second-largest importer of LNG, a status that clearly piqued its interest in Malaysia's plans to develop a new pipeline connecting West and East Sabah.

The Malaysian developer of the pipeline is Suria Strategic Energy Resources, a company wholly-owned by the Malaysian Ministry of Finance. Assuming the current government retains its majority, engineering, procurement, construction and commissioning on the project will be led by the Hebei-headquartered China Petroleum Pipeline Engineering Corporation (CPPE), a subsidiary of the China National Petroleum Corporation (CNPC).

Regardless of China's perceived self-interest, the primary purpose of the pipeline is seen as addressing the critical power shortages in East Sabah, a region home to two of the state's largest cities. Currently, the state is reliant on a number of aging power plants, several of which should have long been decommissioned.

A 2011 attempt to build a 300MW coal-fired power station in Lahad Datu, a town on the east coast of Sabah, foundered following a challenge on environmental grounds by the Sabah Environmental Protection Association. It is hoped that the cleaner, gas-fired plant favoured by the Malaysian / Chinese development team will face far less stringent opposition.

In anticipation of the project going ahead, Ranhill Holdings Bhd, a Kuala Lumpur-based conglomerate with interests in the power and environmental-development sectors, has already been briefed by Malaysia's Energy Commission on the development of a 300MW combined cycle gas turbine power plant in East Sabah. The proposed new facility would be constructed by SM Hydro Energy, a wholly owned Ranhill subsidiary, and would be fed by the new TSGP pipeline.

Welcoming the initiative, Abdul Rahman Dahlan, a Malaysian government minister, said: "Thanks to this key energy project, Sabah will be able to move up the value chain, adding value to its local commodities and raw materials. This will reduce the state's dependency on its primary industries and create employment for people throughout the region."

Overall, Malaysia has proved to be one of the Southeast Asian countries most open to participation in the BRI, China's huge international infrastructure development and trade facilitation programme. Speaking in January this year, Najib Razak, the Malaysian Prime Minister, said: "As the world's economic epicentre moves east, it has become clear that Asia's time has truly come and we must make the most of this moment. With this in mind, we must take advantage of the Belt and Road Initiative, which has the potential to become world's largest platform for economic co-operation."

In addition to the TSGP, Malaysia's other major BRI-related infrastructure programmes include the East Coast Rail Link (ECRL), which is currently being developed in partnership with the China Communications Construction Company. Work is also under way on the country's Digital Free Trade Zone, a project being jointly developed with Alibaba, China's e-commerce giant.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

Major hydropower and roadway investments chime well with the overall objectives of the Belt and Road Initiative.

Speculation as to Malaysia's future economic priorities have frequently focused on the country's oil and gas reserves, palm oil production, high-tech manufacturing, real estate and, of course, tourism. While its potential strengths in the hydropower sector have remained largely overlooked, two high-profile dam projects may be about to change all that, with Sarawak's long-mooted Corridor of Renewable Energy now set to become a reality.

Last month, Sarawak Energy Berhad, the power generation company owned and operated by the state government of Sarawak, completed its purchase of the 2,400 mW Bakun Dam from Malaysia's Ministry of Finance. The company paid RM2.5 billion in cash, with a further RM6 billion in loan facilities, to take possession of one of Southeast Asia's most significant – and controversial – power projects. Work on the dam was originally completed in 2010, but the site didn't come fully online until July 2014.

In a further development, in October 2018, work is expected to begin on the construction of the 1,285 mW Baleh Hydroelectric Facility. The project is being jointly undertaken by the China Gezhouba Group, the Wuhan-based construction and engineering giant, and Untang Jaya, a Sarawak-based construction company.

Once completed, Baleh will be the fourth hydroelectric installation to have been co-opted into Sarawak's Corridor of Renewable Energy, an initiative launched in 2008 on Borneo, an island jointly administered by Malaysia, Indonesia and Brunei. This will see it line up alongside the Bakun Dam, the 944 mW Murum Dam and the 100 mW Batang Ai Dam.

Following the completion of the Bakun deal, the Sarawak government, together with its Sarawak Energy subsidiary, now owns all of the state's electricity generation facilities, granting it considerable leverage over the future direction of other local infrastructure projects. This will include the proposed redevelopment of the Bakun Lake region into a prime tourism destination, complete with a range of new hotels and resorts.

Another project with clear links to the Sarawak Corridor of Renewable Energy is a proposed coastal highway. At present, it is anticipated that up to 80% of its construction costs could be covered by Chinese investment in line with the overall objectives of the Belt and Road Initiative. Considered something of a huge undertaking, the project would entail the construction of several bridges, as well as substantial upgrades to roadways in the more rural and forested areas.

Should it get the go-ahead, the coastal highway would only be the latest of the country's array of ambitious transport infrastructure projects. Indeed, work is already under way on the RM16.5 billion, 1,073km Pan-Borneo Highway, a Malaysian government-backed initiative intended to link the country's two Borneo-based states, Sarawak and Sabah. It could also, ultimately, connect to Brunei via the 30km Temburong Bridge. Currently under construction by the China State Construction Engineering Corp, the bridge is scheduled for completion in late 2019.

The first 786km-long phase of the Pan-Borneo Highway is due to be finished a little later – in 2022. Once completed, though, it is hoped that the road will stimulate further investment in infrastructure, public transport, telecoms networks and public-health facilities across the vast tranches of Malaysia's rugged, underdeveloped terrain that the highway extends across.

For its part, the Sarawak government has claimed its bid to take overall control of the state's renewable-energy resources is in line with its long-term ambition to transform the region into a digital-communications hub. To this end, it has already pledged to invest RM2 billion over the next five years in installing fibre-optic cables and satellite connectivity across the state in order to jump-start the local digital economy. The move is part of a wider agenda intended to rebalance the economy and see it shift away from its traditional reliance on the oil and gas, mining, agriculture and forestry sectors.

Outlining the policy, Datuk Amar Abang Johari Tun Openg, Sarawak's Chief Minister, said: "Bakun and the other hydroelectric projects will play a strategic role in powering the digital economy. We believe that the integrated management of the local hydropower facilities will help attract many of the global digital giants to Sarawak."

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

Malaysia-China Kuantan Industrial Park in Malaysia

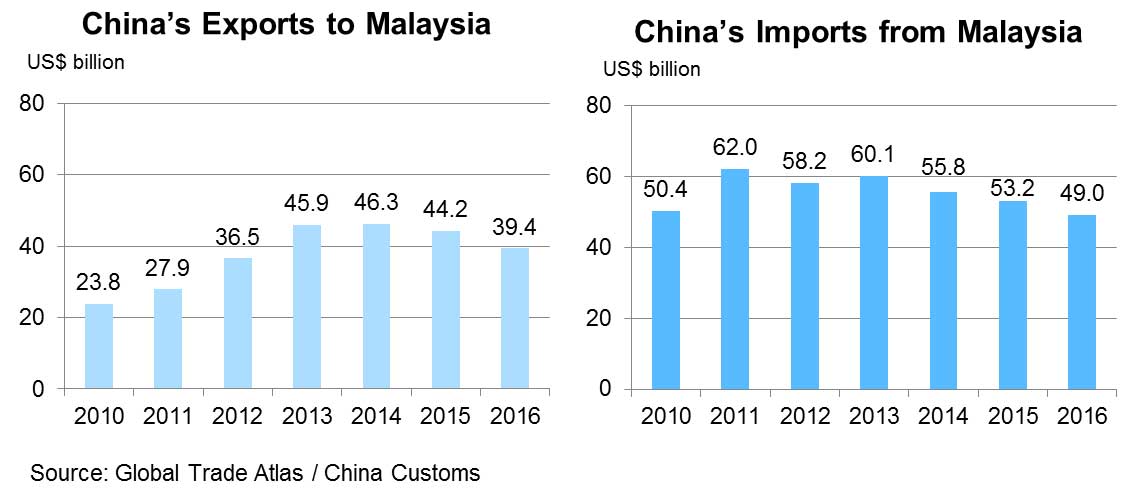

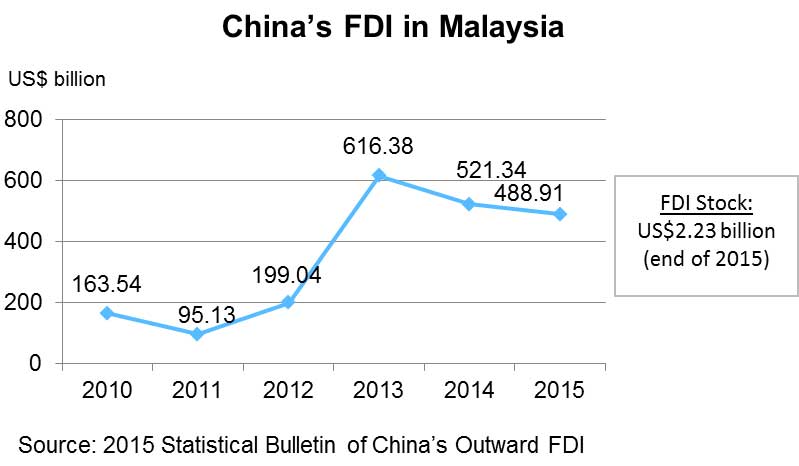

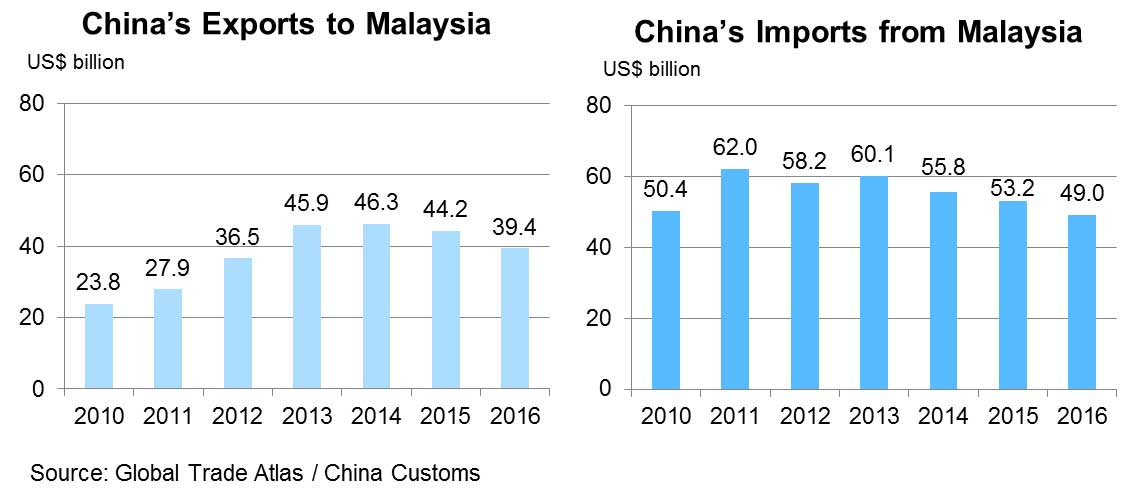

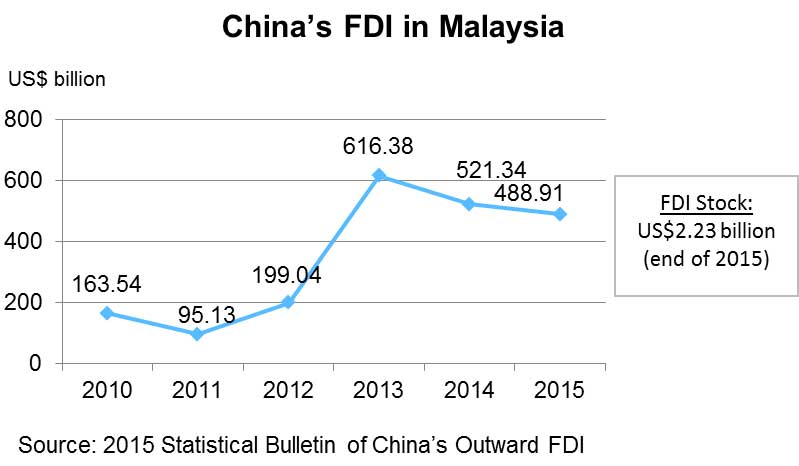

Malaysia, as a major ASEAN economy and an important gateway along the 21st Century Maritime Silk Road, is strengthening its industrial co-operation with China. Industrial parks have been established in Qinzhou in China’s Guangxi Autonomous Region (the China-Malaysia Qinzhou Industrial Park), and Kuantan in Malaysia (Malaysia-China Kuantan Industrial Park, MCKIP). Through this “two countries, twin parks” model of co-operation, China and Malaysia hope to strengthen regional supply chain management, push forward the development of industrial clusters, and promote trade and investment between the two countries. The “Port Alliance” will also be established to improve customs efficiency and expedite trading between the two countries through experiments on joint customs clearance, information sharing and other mechanisms. Malaysia is among China’s largest trading partners and major investment destinations in ASEAN, with the volume of bilateral trade reaching US$88.4 billion in 2016.

MCKIP is a bilateral Malaysia-China government-to-government collaboration. MCKIP Sdn Bhd (MCKIPSB) is a 51:49 joint venture between a Malaysian consortium and a Chinese consortium. IJM Land holds a 40% equity interest in the Malaysian consortium; together, Kuantan Pahang Holding Sdn Bhd and Sime Darby Property hold 30% and the Pahang State Government holds the remaining 30%. The 49% stake of the Chinese consortium is held between the state-owned conglomerate Guangxi Beibu Gulf International Port Group (with a 95% equity interest) and Qinzhou Investment Company (the remaining 5% interest).

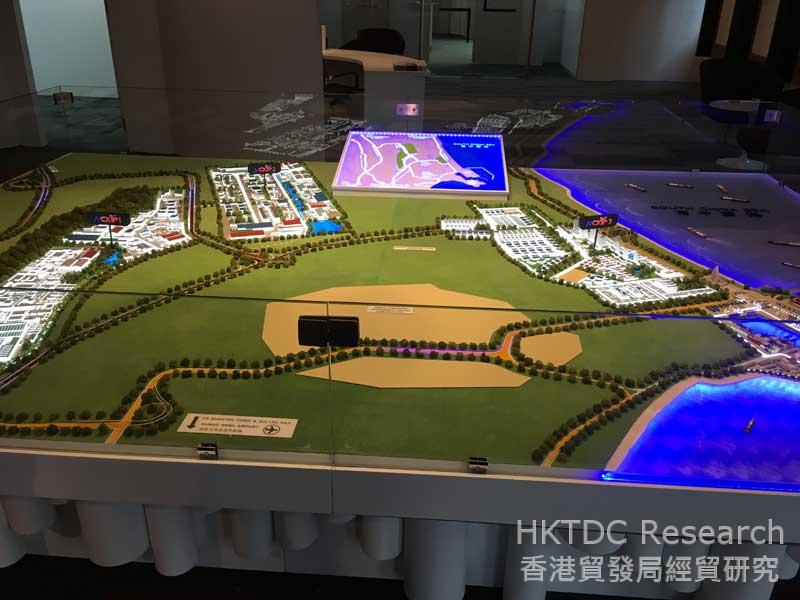

MCKIP is located in the East Coast Economic Region (ECER) in Malaysia. In 2008, the Malaysian government established the East Coast Economic Region Development Council (ECERDC) in order to spearhead the economic development of the East Coast. The five key economic sectors of the ECER are: (1) manufacturing, (2) oil, gas and petrochemicals, (3) tourism, (4) agriculture and (5) human capital development. The launch of MCKIP in 2013 has been one of the key milestones in the economic development of the East Coast.

MCKIP targets heavy industry and high-technology industry. These include energy saving and environment friendly technologies, alternative and renewable energy, high-end equipment manufacturing and the manufacture of advanced materials.

There are three distinct phases within the industrial park. MCKIP 1 consists of 1,200 acres of land. The first investor to be established there is Alliance Steel (M) Sdn Bhd, which was granted approval to invest RM5.6 billion in its facility in 2016. Its production site, which will cover 710 acres, is currently under construction, and the steel mill is expected to be operational by the end of 2017. Once in full service, Alliance Steel expects to generate more than 3,500 jobs.

While MCKIP 2 (1,000 acres) is designated for high-end and high-technology industry development, MCKIP 3 (800 acres) is designated for multi-purpose development (including light industry, commercial property, residential areas and tourism parks). Since MCKIP is intended for an assortment of different business opportunities, it is believed that it will attract foreign investment from a wide variety of countries for various purposes.

Many China-based companies are planning to expand their production bases to MCKIP. For example, Guangxi Zhongli Enterprise Group Co Ltd will invest RM2 billion for the development of manufacturing of clay porcelain and ceramic in MCKIP 1. Meanwhile, ZKenergy (Yiyang) New Resources Science and Technology Co Ltd will invest RM200 million for the development of an engineering and production-based centre that will produce renewable energy for MCKIP’s own consumption. China’s Guangxi Investment Group Co Ltd will invest RM580 million on an aluminium component manufacturing facility. Another is Malaysia’s LJ Hightech Material Sdn Bhd, which will invest RM1 billion in a high-technology production-based plant to produce concrete panels and activated rubber powder for the construction industry. The construction works for these projects in MCKIP are expected to begin in the first quarter of 2017. Once completed, they will create more jobs in Malaysia.

Tax and Investment Incentives

In addition to Malaysia’s current incentives package, the Ministry of International Trade and Industry (MITI), together with the ECERDC, has offered special incentive packages for investors in MCKIP (subject to terms and conditions). Below are some highlights of these fiscal incentives:

- Fifteen years of 100% corporate tax exemption from the year of statutory incomes derived, or 100% Investment Tax Allowance on qualifying capital expenditure incurred for five years. (Corporate income tax rate currently stands at 24% in Malaysia.)

- 15% of income-tax rate for qualified knowledge workers in MCKIP until 31 December 2020. (People in the highest income bracket are currently taxed at 28% in Malaysia.)

- Import duty and sales tax exemption for raw materials, parts and components, and plant machinery and equipment.

- Stamp duty exemption on transfer or lease of land or building used for development.

- Investors can apply for Unit Kerjasama Awam Swasta (UKAS) facilitation fund up to 10% of project cost or RM200 million (whichever is lower) to finance the development of basic infrastructure. UKAS was set up by the Public Private Partnership Unit of the Prime Minister's Department.

Port and Logistics Services

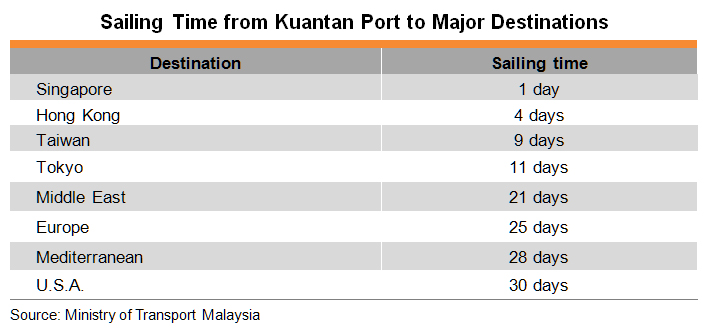

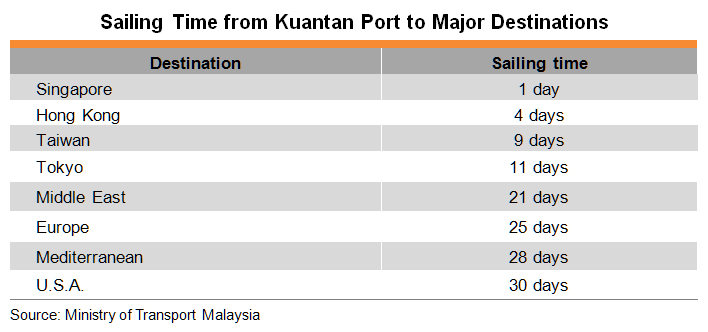

Kuantan Port, located 10km from MCKIP, is the gateway for outbound transportation and logistics services in Malaysia’s East Coast Economic Region. Kuantan Port currently handles mainly break-bulk cargoes and liquid-bulk cargoes, such as steel pipes, sawn timber and plywood, iron ore, fertilisers, palm oil, vegetable oil, mineral oil and petrochemical products. Container business mainly handles automotive components for Pekan Automotive Industrial Park.

Kuantan Port is actively developing new terminals as part of its plan to increase its capability in handling break-bulk cargoes and containers. It is also co-operating with MCKIP in developing a bonded area in order to enhance the business content of the port and the industrial park. It is hoped that the bonded facilities will attract investors to set up export-oriented processing plants in heavy industry and high-technology industry, and that this will in turn boost Kuantan Port’s container-transport business and make it an important container transshipment port in eastern Malaysia.

Phase 1 of the Kuantan Port extension project, which is due for completion in 2018, will continue to handle incoming and outgoing break-bulk cargo. Phase 2 will focus on the construction of a deep-water port for the handling of ocean-going container transport. It is estimated that Kuantan Port will be able to berth and handle 200,000 dwt vessels, including 18,000 TEU ocean-going container ships, and provide port users with incoming and outgoing container transport service to ASEAN and international markets.

Kuantan Port is operated by Kuantan Port Consortium Sdn Bhd (KPC) with a strong network of global shipping connections. At present, major shipping lines that operate at Kuantan Port include Evergreen Marine Corporation Ltd, Jardine Shipping Services, Malaysia International Shipping Corporation Bhd and Pacific International Lines. They mainly serve MCKIP and the Kuantan Port Industrial Area, the Gebeng Industrial Estate and the Pekan Automotive Industrial Park.

KPC told HKTDC Research that since the Kuantan Port was lacking in container business and had little or no experience in operating bonded facilities or international customs mutual assistance, it was keen to seek the co-operation of investors with relevant experience in Hong Kong and elsewhere to develop its container-port business. Since Hong Kong operators have rich experience in business process design, operational systems and information-technology management of container terminals, including using relevant infrastructure facilities, equipment layout and advanced business processes to improve the overall operating efficiency of ports, they should be able to assist Kuantan Port in further developing its international cargo and container shipping business.

Port Business Experience Hutchison Whampoa Limited (HWL) is one of the largest listed companies on the main board of the Hong Kong Exchanges. Its core business includes port and related services. Its flagship company – Hong Kong International Terminals Ltd – is located at the city’s Kwai Chung and Tsing Yi Container Terminals. HWL and its group companies operate a network that covers major ports around the world. In ASEAN, for example, Hutchison Port Holdings Ltd operates container terminals and related businesses in Myanmar (Thilawa in Yangon), Thailand (Laem Chabang Port), Malaysia (Port Klang), Indonesia (Port of Tanjung Priok to the north of Jakarta) and Vietnam (Ba Ria – Vung Tau). Source: Web page of Hutchison Whampoa Limited and Hutchison Port Holdings Ltd |

Future Plans

In June 2016, Kuantan Port received approval from Malaysia’s Ministry of Finance to establish a free-zone port. A bonded area will be set up in some port areas, including sections of MCKIP. Economic activities in the bonded areas will be exempt from tariffs, consumption tax, sales tax and service tax. Companies in the industrial park will be offered a variety of value-added services, including transshipment, trading, unpacking and distribution, inspection and testing, repackaging and labelling. Against this backdrop, Kuantan Port will promote the gradual development of MCKIP into an ideal platform for assisting investors in tapping the market in Malaysia, and even ASEAN.

With regard to the development of ocean-going container transport services and bonded ports, steps will be taken to assist MCKIP in attracting investment from China-based enterprises by helping them leverage the strengths of China and Malaysia in terms of land, energy and production materials to improve their overall production allocation in the Asia-Pacific region and further expand their export markets. Apart from helping these enterprises to cut their overall production costs, this will also help them steer clear of trade barriers, such as anti-dumping measures and countervailing duties imposed by the EU, the US and other countries against some of China’s metal and steel products.

In order to meet these goals, it is necessary not only to comply with the trade measures imposed by the importing countries in Europe and North America on raw materials, place of production and place of origin of the restricted products, but also to satisfy the relevant agreements of international customs organisations and the requirements of the importing countries for bonded arrangements, container terminal operation, international customs clearance procedures and customs declaration system. The “Port Alliance” currently being built by China and Malaysia for co-operation between the 10 Chinese ports of Dalian, Shanghai, Ningbo, Qinzhou, Guangzhou, Fuzhou, Xiamen, Shenzhen, Hainan and Taicang and the six Malaysian ports of Port Klang, Malacca, Penang, Johor, Kuantan and Bintulu is expected to cut total time and costs in the cross-border transportation of goods between the two countries. Connections with the ports and customs in other regions have yet to be developed.

These plans should also leave room for future development and build advance supporting facilities in order to meet future demands for transport and logistics services in the export of high technology and high value-added products as the industrial park develops in the long run. The export mix of MCKIP is expected to shift from heavy industry to other sectors following the completion of future investment projects, such as those in the fields of microelectronics, biomedicine and chemical industry, which would generate a far greater demand for cargo transport and logistics services.

Therefore, it is imperative not just to make early plans for relevant facilities and working rules in areas such as customs, bonded services, and cargo inspection and testing to boost the industrial development of MCKIP, but also to make arrangements for necessary logistics facilities such as cold storage, dangerous-goods warehouses and comprehensive distribution facilities, and make use of new-generation information management systems geared to international standards.

It is necessary not just to improve the efficiency of transport and logistics but also to cater to the globalisation trend of the supply chain and satisfy the exacting requirements of clients in the Asia-Pacific region and other countries for logistics and distribution in an efficient mode of operation and production. Experienced investors in port management and planning are needed both in the planning stage and in the actual operation, while support of professional logistics service providers is also necessary. Therefore, the development of MCKIP and Kuantan Port will generate opportunities for Hong Kong companies.

The majority of heavy-industry and technology industry investors in MCKIP come from China and Malaysia, but the industry park also welcomes foreign companies from ASEAN and other countries. For example, the Kuantan Port extension and related infrastructure construction projects, as well as the multi-purpose area in MCKIP 3, all need investment in logistics facilities, commercial real estate, residential property management and hospitality services. MCKIP will generate opportunities for direct investment for Hong Kong and regional investors. As an international financial centre, Hong Kong could also provide project financing, risk management and other services to mainland and other investors, and make use of its rich international market resources to collect market information to help investors reduce their investment risks.

China is one of the world’s major sources of outbound investment and was the second-biggest cross-border investor, after the US, in 2015. More and more China-based enterprises have gone overseas to make direct investment on their own or through acquisitions or mergers in order to open new markets or secure manpower and other resources and promote their long-term development. As a major service platform for Chinese enterprises “going out”, Hong Kong can provide one-stop financial and other professional services to Chinese enterprises investing in MCKIP. For example, Chinese enterprises investing in Malaysia could use Hong Kong to arry out overseas financing for their investment projects and secure more funding for their long-term development. They could also make use of Hong Kong’s deep and broad financial market and choose suitable financing channels to optimise their sources of funds, lower their overall financing costs and open the ASEAN and world markets through MCKIP.

Co-ordinating the Interests of Different Partners Ironsides Holdings Limited is a Hong Kong-based private-equity investment firm that sources funds from Hong Kong, the US and other territories. The firm invests directly into private companies and projects in a number of areas, including healthcare, agriculture, logistics and technology. Its current investments cover, among others, the Southeast and Central Asian regions. Alex Downs, the Director of the company, said: “Chinese enterprises seem to prefer taking a controlling stake when conducting investment in overseas projects or companies. There is, however, always the choice for them to have a much bigger presence in the overseas markets and explore new business opportunities via co-operation with their foreign counterparts, something that could result in decent profits with reduced risks.” Assessing the pro and cons of equity co-investment, Downs said: “Ultimately, Chinese enterprises may not have the controlling stakes in such co-investment models, with success resting on the participants’ contributions and the effective co-operation among the partners. On the upside, the Chinese enterprises would be given the opportunity to participate in a bigger project and have access to markets beyond that of their original business, thus generating sustainable incomes from their overseas investment. This would be a viable option for those ‘going-out’ enterprises without enough experience, exposure and/or resources.” Remarks: For further details, please see HKTDC research article (August 2016) |

Alliance Steel plans to tap the growing demand for steel in the ASEAN and international markets by setting up production facilities in MCKIP. This modern steel complex will make use of advanced Chinese technologies and manufacturing processes and introduce automated production equipment to make top quality high-carbon steel rods, wire and H-shaped bars, while green measures will minimise the environmental impact. The company will also provide training to improve workers’ grasp of metallurgical technology.

Hong Kong’s financial services may directly offer financing to these projects, but can also provide other investment options and help them co-operate with overseas counterparts in the heavy-industry and technology sectors, allowing them to use their investment in MCKIP to expand their overseas market and beef up their strength.

For example, Hong Kong private-equity investment companies could use their extensive global business links to find overseas partners for mainland investors. Through equity co-investment and other forms of joint-stock co-operation, they could provide more investment options to mainland investors who want to expand their overseas presence while containing investment risks. Through equity co-investment, mainland enterprises will not only be able to find partners to share their investment risks but will also be able to draw synergy from the strong points of their partners to venture into new areas and further advance their businesses.

Please click here to purchase the full research report.

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (1)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (2)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (3)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (5)

Editor's picks

Trending articles

Belt and Road investment priorities and need to boost northern states fuels expansion of Special Economic Zones.

The development of Malaysia's growing number of Special Economic Zones (SEZs) is being shaped by several investment requirements related to the Belt and Road Initiative, as well as by a change in priorities on the part of the country's government.

As the Malaysian government looks to diversify the country's economy, it faces three key challenges, all of which have implications for the SEZ sector. Firstly, it is keen to rebalance economic growth across the country while looking to nurture innovation in the digital-technology sector. On top of that, it is determined to capitalise on the new opportunities emerging from the ASEAN integration programme.

With inward investment focussed almost exclusively on Kuala Lumpur and the southern states of Selangor and Johor, promoting interest in the country's northern regions is seen as a vital part of any move to rebalance the economic map. The key project here is the development of the East Coast Economic Region (ECER), an initiative that was initially green-lit in 2008.

As envisaged, the ECER spans the northern states of Kelantan and Terengganu, as well as Pahang in the east and Mersing in southeastern Johor. It extends across 51% of Peninsular Malaysia, and focuses primarily on the country's traditional strengths in manufacturing, agribusiness, oil, gas, petrochemicals and tourism.

As of May 2016, some 38.5% (US$3.1 billion) of all inbound investment in the ECER had been sourced from Chinese investors. The majority of this funding has been channelled into the Malaysia-China Kuantan Industrial Park. Set in the eastern coastal state of Pahang, this was the first industrial park in the country to be jointly developed by Malaysia and China. Among the more recent investments has been the funding of a $133 million aluminium component manufacturing facility by the Guangxi Investment Group.

In order to create much-needed jobs, however, the northern states require considerably more investment. In line with this, back in 2016, the Terengganu state government lobbied to launch a new SEZ extending across Besut, Setiu, Kuala Nerus, Kuala Terengganu and Marang. The proposed 729,400-hectare development is said to have been modelled on the Shenzhen SEZ in southern China. At present, it is planned that the initial phase will utilise some 221,000 hectares, with the second phase requiring an additional 508,400 hectares.

With improving the country's digital infrastructure one of the key elements in the government's plan to encourage multinationals and SMEs to create new jobs, Malaysia launched the world's first Digital Free Trade Zone (DFTZ) in March this year. The ceremony to mark the formal adoption of the scheme was attended by Najib Razak, the Malaysian Prime Minister, and Jack Ma, the Executive Chairman of Alibaba Group and an adviser on the development of Malaysia's digital economy.

Once completed, the DFTZ will boast an e-fulfilment hub at the Kuala Lumpur International Airport (KLIA) Aeropolis, a 405-hectare development zone focussed on air cargo and logistics as well as the development of an aerospace/aviation cluster. The initial phase will roll out later this year, with Alibaba, Cainiao, Lazada and POS Malaysia already signed up as tenants. The facility will also be the launch site in 2019 for Alibaba's Electronic World Trade Platform – part of the company's bid to streamline global trade arrangements for SMEs.

The second phase of the DFTZ will see the establishment of the Kuala Lumpur Internet City (KLIC). Developed by Catcha Group, the Malaysian/Singaporean internet giant, it is hoped that KLIC will emerge as the key digital hub for global or local internet-related companies looking to target Southeast Asia.

The project will be housed within Bandar Malaysia, a commercial and residential zone located on the site of a former air-force base. The site is being developed by a consortium led by the China Railway Engineering Corp.

In other developments, Bandar Utama, on the outskirts of the capital, will be the terminal for the Kuala Lumpur-Singapore high-speed rail link, scheduled to begin operation in 2026. With a journey time of just 90 minutes, the link is expected to boost business and tourism traffic.

At present, stops are planned at Putrajaya, Seramban, Alor Gajah, Muar, Batu Pahat and Iskandar Puteri in Johor Bahru. All of these locations are intended to be promoted as investment hubs in the coming years, with Iskandar Puteri having something of a head start over the other designated sites.

Forming part of Iskandar Malaysia – the main southern development corridor in the state of Johor – Iskandar Puteri is a 2,217-square-metre SEZ. Established in 2006, it was envisaged as a world-class business, residential and entertainment hub, with its management keen to capitalise on its proximity to Singapore.

Among the businesses already operating within its precincts are Legoland Malaysia, Gleneagles Medini Hospital and Pinewood Iskandar Malaysia Studios. It is also the site of the Medini 'smart city', one of Malaysia's largest urban developments.

Within Medini, investors in six designated sectors – health and wellness, education, financial services, leisure and tourism, the creative industries, and logistics – can take advantage of a number of tax breaks and several other incentive packages. The site is expected to get a further boost in 2019 following the completion of a high-speed rail link to Singapore's Mass Rapid Transit rail system.

In addition to developing domestic SEZs, the country's Ministry of International Trade and Industry has announced that a number of Malaysian companies will be playing key roles in developing several SEZs in neighbouring Laos. These include Savan Park, a commercial and industrial hub jointly funded by the Laos government, and Savan Pacifica Development, a Malaysian consortium.

Among the other projects is the Dongphosy SEZ, a 70-hectare duty-free retail and residential zone intended to promote tourism, which is being jointly developed by Malaysia's UPL Lao and the Laos government. Malaysian companies are also involved in the development of an SEZ in Thakek, southern Laos.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

Industrial Co-operation under the Belt and Road Initiative

In line with the Belt and Road Initiative (BRI), trade co-operation between Malaysia and China has been strengthened by the countries jointly establishing two industrial parks – one in Kuantan in Malaysia, the other in Qinzhou in the Chinese region of Guangxi. Under the context of ‘Two Countries, Twin Parks’ [1], these industrial parks are intended to enhance the regional supply chain management and optimise the flow of trade and investment which runs between Malaysia and China.

One of the chief aims of the BRI is to encourage countries along the BRI to improve investment and the ease of trade facilitation. To this end, the BRI attempts to improve the capability of customs clearances and the coordination of cross-border supervision.

Malaysia is an important gateway for trade along the 21st Century Maritime Silk Road. At present, China and Malaysia are in the process of forming a cooperative ‘port alliance’, which seeks to fast-track trade flows by raising customs efficiency. It has been reported that, in addition to their contribution to trade cooperation, the new industrial parks could also serve as a testing ground for joint customs clearances between the two countries. Such a development might contribute to the advancement of the strategic direction of regional trade facilitation under the BRI.

The Malaysia-China Kuantan Industrial Park (MCKIP) is the first industrial park in Malaysia jointly developed by Malaysia and China, as well as the first to be accorded ‘National Park’ status. Its sister park in Guangxi, China is the Malaysia Qinzhou Industrial Park (CMQIP). Together, the two parks have been identified by both governments as an ‘Iconic Project for Bilateral Investment Co-operation’, which will drive the development of industrial clusters in both countries.

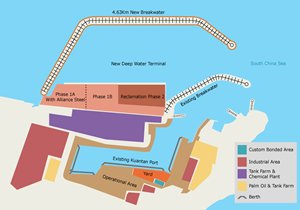

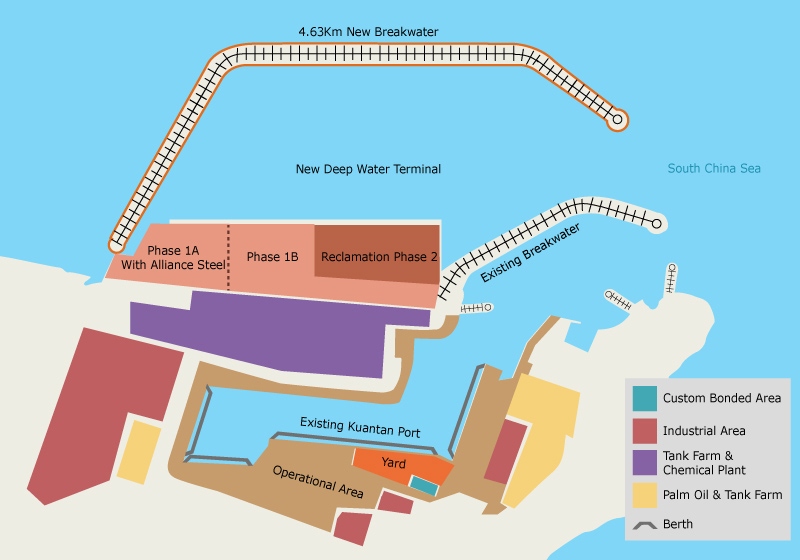

Kuantan Port will be an important gateway for logistics services for MCKIP, which is located just 10 kilometres away. At present, Kuantan Port mainly handles bulk cargoes for nearby industrial areas. In order to meet increased demand in the future, Kuantan Port is currently expanding its bulk cargo terminal. It is developing a new deep-water terminal (NDWT) which aims to become a container port for trans-shipment cargoes.

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a Free Zone port, so that it can provide value-added services for trans-shipment cargoes. Kuantan Port will act as the catalyst for MCKIP, with the synergy between the port and the industrial park forming a dynamic platform for investors expanding their business in the ASEAN region.

MCKIP: A Government-to-government Collaboration

Source: Kuantan Port Consortium

In 2008, the Malaysian government established the East Coast Economic Region Development Council (ECERDC) in order to develop and stimulate growth on the east coast of Peninsular Malaysia. It is a statutory body designed to spearhead the socio-economic development of the East Coast Economic Region (ECER) [2]. The five key economic sectors here are manufacturing, oil, gas and petrochemicals, tourism, agriculture and human capital development. The launch of MCKIP in 2013 has been one of the key milestones for the ECER.

By collaborating with Malaysia on the development of MCKIP, China can further enhance the flow of its trade and investment with Malaysia. At the same time, MCKIP provides a ‘going out’ platform where Chinese companies can expand their production capacities along the Belt and Road countries, in order to get closer to their final markets, in particular within the ASEAN.

MCKIP is a bilateral Malaysia-China government-to-government collaboration. MCKIP Sdn. Bhd. (MCKIPSB) is a 51:49 joint venture between a Malaysian consortium and a Chinese consortium. IJM Land holds a 40% equity interest in the Malaysian consortium; together, Kuantan Pahang Holding Sdn. Bhd. and Sime Darby Property hold 30% and the Pahang State Government holds the remaining 30%. The 49% stake of the Chinese consortium is held between the state-owned conglomerate Guangxi Beibu Gulf International Port Group (with a 95% equity interest) and Qinzhou Investment Company (the remaining 5% interest).

Positioning of MCKIP

MCKIP targets heavy industry and high-end/high technology industry. These include energy saving and environment friendly technologies, alternative and renewable energy, high-end equipment manufacturing and the manufacture of advanced materials. There are three distinct phases within the industrial park, namely MCKIP 1 (which consists of 1,200 acres of land), MCKIP 2 (1,000 acres) and MCKIP 3 (800 acres).

The construction of MCKIP 2 and MCKIP 3 should take place concurrently. While MCKIP 2 is designated for high-end and high technology industry development, MCKIP 3 is designated for multi-purpose development (including light industry, commercial property, residential areas and tourism parks). The entire MCKIP building project is expected to be completed in 2020. Since MCKIP 3 is intended for an assortment of different business opportunities, it is believed that it will attract foreign investment from a wide variety of countries for various purposes.

MCKIP 1 is designated for high technology industries and heavy industries. The first investor to be established there is Alliance Steel (M) Sdn. Bhd. [3] (Alliance Steel), which has been granted approval to invest RM5.6 billion in its facility in 2016. Its production site, which will cover 710 acres of land, is currently under construction. The steel mill is expected to be operation by the end of 2017. Once it is in full service, Alliance Steel expects to generate more than 3,500 job opportunities.

|

Alliance Steel (M) Sdn. Bhd. It’s estimated that the annual local demand for steel in Malaysia is over 10 million tonnes. However, the existing production facilities of some local steel mills are lagging behind in terms of productivity and technology innovation. Bringing in a new investor in the form of MCKIP will enhance the productivity and quality of steel production in Malaysia. Inspired by the Belt and Road Initiative, there are many infrastructure and construction developments now in progress along the 21st Century Maritime Silk Road. With its current production facilities in Guangxi, Alliance Steel is expanding its production facilities in MCKIP in order to meet the rising demand for steel in the ASEAN and international markets. Alliance Steel aims to upgrade levels of production technology and increase the degree of production automation in Malaysia’s new production sites. Its integrated modern steel mill will apply China’s most technologically advanced manufacturing process to produce the best quality high carbon steel rods, wires and H-shaped steel. Within its enclosed integrated steel mill, conveyor belts will be used to ensure the smooth flow of material and thereby streamline the operation. All waste water will be recycled and reused in the production process in order to minimise the impact on the environment. According to Alliance Steel, it will source raw materials from Malaysia as much as possible. Yet, some raw materials may still need to be imported. Maritime transport from China’s Qinzhou Port (in Guangxi) to Malaysia’s Kuantan Port takes just three days. In the early stages of its new operation, Alliance Steel may recruit some technicians from China before training up local talent in Malaysia. Alliance Steel is also co-operating with Malaysia’s institutions to establish a training programmes for local people, in order to enhance their metallurgy operation techniques. In this way, it will further strengthen the social and economic ties between two countries. |

Besides Alliance Steel, many China-based companies are planning to expand their production bases to MCKIP in order to extend their supply chain coverage within the region. For example, Guangxi Zhongli Enterprise Group Co. Ltd. will invest RM2 billion for the development of manufacturing of clay porcelain and ceramic in MCKIP 1. Meanwhile, ZKenergy (Yiyang) New Resources Science and Technology Co. Ltd. will invest RM200 million for the development of an engineering and production-based centre that will produce renewable energy for MCKIP’s own consumption. This will help MCKIP to position itself as a leading ‘green’ environmental-friendly industrial park.

In addition to the aforementioned projects in MCKIP, other investment projects led by China and Malaysia companies are already in the pipeline. The new investors include China’s Guangxi Investment Group Co. Ltd., which will invest RM580 million on an aluminum component manufacturing facility. Another is Malaysia’s LJ Hightech Material Sdn. Bhd., which will invest RM1 billion in a high-technology production-based plant to produce concrete panels and activated rubber powder for the construction industry. The construction works for these projects in MCKIP are expected to begin in the first quarter of 2017. Once completed, they will create more than 3,000 job opportunities.

Investment Environment in MCKIP

MCKIP not only welcomes investors from China and Malaysia, but also from ASEAN region and beyond. In addition to the current ECER incentives package [4], the Ministry of International Trade and Industry (MITI), together with the ECERDC, has offered special incentives packages for investors in MCKIP (subject to Terms and Conditions). Below are some highlights of the fiscal incentives in MCKIP:

-

Fifteen years of 100% corporate tax exemption from the year of statutory incomes derived, or 100% Investment Tax Allowance on qualifying capital expenditure incurred for five years.

-

15% of income tax rate for qualified knowledge workers [5] in MCKIP until 31 December 2020.

-

Import duty and sales tax exemption for raw materials, parts and components, plants and machinery and equipment.

-

Stamp duty exemption on transfer or lease of land or building used for development.

-

Investors can apply for Unit Kerjasama Awam-Swasta (UKAS) facilitation fund up to 10% of project cost or RM 200 million (whichever is lower), to finance the development of basic infrastructure.

Apart from fiscal incentives, MCKIP also offers other competitive incentives [6] and support in order to encourage both local and overseas investment. These include competitive land prices, flexibility in the employment of expatriates and the facilitation of human capital development. At present, MCKIP is still at the early stages of development. By implementing incentives and measures such as these, MCKIP aims to attract a range of investors from various industry sectors.

Synergistic Development of Kuantan Port

Located just 10 kilometres away from MCKIP, Kuantan Port currently handles mainly break bulk cargoes (such as steel pipes, sawn timber and plywood), dry bulk cargoes (such as iron ore, coal and fertilisers), liquid bulk cargoes (such as palm oil, vegetable oil, mineral oil and petrochemical products) and container cargoes. Kuantan Port is an all-weather port with 11.2 meter draft and the capacity to handle vessels up to 40,000 DWT (Dead Weight Tonnage). There are 22 berths at Kuantan Port with bulk cargoes accounting for 95% of throughput. At present, container business is relatively small and mainly handles automotive components for Pekan Automotive Industrial Park.

Kuantan Port is operated by Kuantan Port Consortium Sdn. Bhd. (KPC) [7]. It can offer well-developed port facilities and services, and a strong network of global shipping connections. As such, the port is set to be a catalyst for the development of the industrial and manufacturing activities in MCKIP, as well as those in Kuantan Port Industrial Area [8] and Gebeng Industrial Estate [9].

At present, major shipping lines which operate at Kuantan Port include Evergreen Marine Corporation Ltd, Jardine Shipping Services, Malaysia International Shipping Corporation Bhd. and Pacific International Lines.

Source: Kuantan Port Consortium

As it stands, Kuantan Port provides port services for the nearby high-end and high technology industries and heavy industries, such as those based at the Kuantan Port Industrial Area, Gebeng Industrial Estate and Pekan Automotive Industrial Park. In order to meet the extra port service demand now being created by MCKIP, Kuantan Port is currently under expansion. There will be three phases in the port expansion. Phases 1A and 1B will cover the import and export of bulk cargoes. In Phase 2, a new deep water terminal will be developed, which will be able to handle up to 200,000 DWT or 18,000 TEUs container vessels.

Construction of Phase A1 is now underway and is expected to be completed by the end of 2017. Phase 1A will be able to handle ships up to 150,000 DWT. The expected completion time of Phase 1A is in line with the completion time of Alliance Steel production sites at MCKIP 1. This will enable Alliance Steel to import raw materials from overseas markets and then export its final products to the international markets via Kuantan Port. The construction of Phase 1B is also underway and it should commence operation in late 2018. Both Phase 1A and Phase 1B will target the handling of bulk cargoes. Presently, a new 4.7 kilometres breakwater is under construction, which will create a sheltered harbor. This sheltered basin will allow for berths to operate safely and efficiently throughout the year, even during the monsoon season.

Strategic Partnerships along the New Silk Road

In terms of their potential growth, Kuantan Port and MCKIP go hand in hand. Although Kuantan Port currently handles mainly bulk cargoes, the Phase 2 development is intended to be a container port, in order to handle the import and export of light industry cargoes for MCKIP 3. The new deep-water terminal will become a major trans-shipment hub on the east coast of Malaysia. By the time of completion, it is estimated that Kuantan Port will be able to handle 52 million freight weight tonnes of bulk and container cargoes.

In light of China’s 21st Century Maritime Silk Road development, Kuantan Port will become a key trading gateway. China and Malaysia are forming a ‘port alliance’ to fast-track trade by reducing customs bottlenecks at both ends. Under the port alliance, 10 Chinese ports (including Dalian, Shanghai, Ningbo, Qinzhou, Guangzhou, Fuzhou, Xiamen, Shenzhen, Hainan and Taicang) will collaborate with six Malaysian ports (including Port Klang, Malacca, Penang, Johor, Kuantan and Bintulu). The final details are still being worked out, but the development is geared towards improved trade facilitation and integration within the region. It has been reported that the strategic imperative is to set up joint customs clearance facilities between ports of China and Malaysia, in order to reduce the overall time and cost of moving goods across the borders.

Kuantan Port to Perform Re-distribution Function

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a free zone port [10]. This will strengthen Kuantan Port’s plans to develop into a trans-shipment hub. A Free Zone is defined as a place outside Malaysia where there is no required payment of customs duty, excise duty, sales tax or service tax. According to KPC, the Free Zone in Kuantan Port may cater for commercial activities including trans-shipment, trading, regional distribution, inspection/sampling and related value-added services (such as repackaging, relabelling and break bulking).

By way of example, international distributors who have established their own sales network in the region can consolidate their products destined for Malaysia and other ASEAN and south Asian countries. They can then save costs by shipping them, in the first instance, to Kuantan Port free zone warehouse in the form of FCL (full container load). There, the importer may arrange re-packing or re-labeling for their products before redistributing the products in LCL (less than a container load) to their final market destinations in the region.

Evolving Business Potentials

Most of the current investments in MCKIP come from China-based companies, mainly involving heavy industry and high-end/high technology industry. In fact, MCKIP not only targets investors from China and Malaysia, but also other ASEAN countries and beyond. In particular, with the upcoming development in MCKIP 3 as a multi-purpose zone, new business opportunities may arise in areas such as commercial property development, residential management and hotel management.

MCKIP is the engine for new growth at Kuantan Port. Expecting a sharp increase in demand for bulk cargo services driven by the high-end/high technology industries and heavy industries establishing themselves in MCKIP 1 and MCKIP 2, Kuantan Port’s expansion plans are under way. With the port set to evolve into a trans-shipment hub for the ASEAN, it will become a free zone in order to provide value-added services for the container cargoes. Many investment opportunities exist in the construction of port facilities and other value-added logistics services.

Together, MCKIP and Kuantan Port are being developed into an industrial hub and an integrated logistics centre in Malaysia. These developments have created a new trade platform for companies which are interested in exploring the range of business opportunities in the ASEAN along the 21st Century Maritime Silk Road.

[1] In ‘Two Countries, Twin Parks’, ‘Two Countries’ represents Malaysia and China; ‘Twin Parks’ represents Malaysia-China Kuantan Industrial Park (MCKIP) and China-Malaysia Qinzhou Industrial Park (CMQIP).

[2] The ECER covers Kelantan, Terengganu, Pahang and the district of Mersing in Johor. It occupies an area of 66,000 square kilometres or 51% of the total area of Peninsular Malaysia.

[3] Alliance Steel (M) Sdn. Bhd. is a state owned joint-stock enterprise by Guangxi Beibu Gulf Port International Group Co. Ltd. and Guangxi Sheng Long Metallurgical Co. Ltd.

[4] For details, please refer to ECER investment opportunities.

[5] A non-resident is subject to income tax in Malaysia for his income which only comes from Malaysian sources, at a uniform rate of 28% unless he works less than 61 days in the year or his country of residence has concluded a double taxation agreement with Malaysia.

[6] For details, please refer to Malaysia-China Kuantan Industrial Park.

[7] Kuantan Port Consortium Sdn. Bhd. (KPC) is jointly owned by IJM Corporation Berhad and Beibu Gulf Holding (Hong Kong) Co. Ltd. on a 60:40 equity holdings with the Government of Malaysia having a special rights share.

[8] Kuantan Port Industrial Area is located within the vicinity of the port.

[9] Gebeng Industrial Estate is a world-class petrochemical zone covering 8,600 hectares.

[10] Source: Kuantan Port Consortium Sdn. Bhd.

Editor's picks

Trending articles

Hong Kong-based Design Icon views the SAR as a regional centre for intellectual property protection as it develops its branded photographic design solution. Director Billy Liu says the company aims to establish Hong Kong as an outstanding location on the global design map, while Director Mike Jerome sees the Belt and Road Initiative bringing a new client base to Hong Kong.

Speakers:

Billy Liu, Design Consultant and Director, Design Icon

Mike Jerome, Design Consultant and Director, Design Icon

Related Link:

Hong Kong Trade Development Council

http://www.hktdc.com/

Hong Kong’s Design Icon has been developing products for global and regional clients – and finds its’ own new, branded photographic solution is picking up interest from companies in Malaysia, Thailand and Indonesia, among others, after launching it at the HKTDC Hong Kong Electronics Fair (Autumn Edition). Director Kevin O’Doherty sees the Belt and Road Initiative introducing new countries and consumers to its design services.

Speaker:

Kevin O’Doherty, Design Consultant, Director, Design Icon

Related Link:

Hong Kong Trade Development Council

http://www.hktdc.com/

434 Views

434 Views