Chinese Mainland

Lithuania: A Maritime Link between East and West

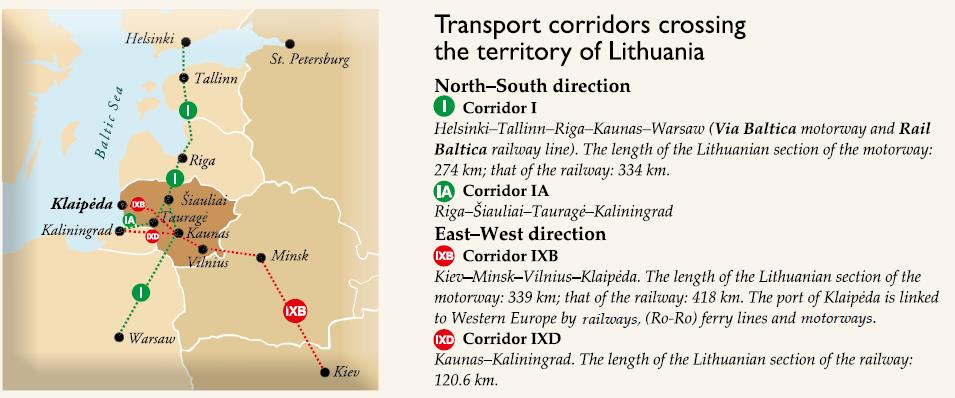

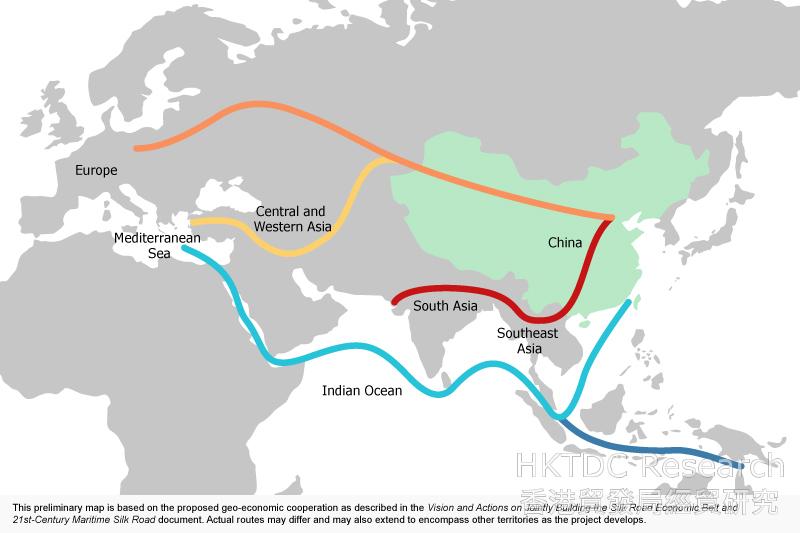

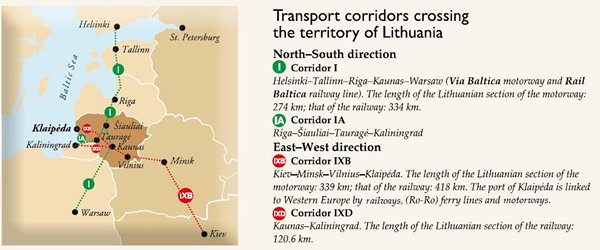

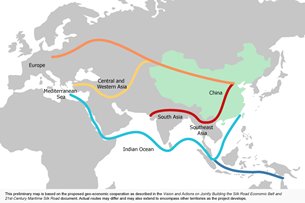

As the largest country among the Baltic States in terms of population, territory and size of economy, Lithuania has been the largest recipient of China’s outbound direct investment (ODI) in the Baltics in recent years. Home to the region’s largest container port and its largest retail chain, Lithuania provides an important maritime and distribution link not only to the Western markets of the EU and Scandinavia, but also the Eastern markets of Russia and other former Soviet states. The recent decision by China Merchants Group (CMG) to invest in the Klaipeda Container Terminal and the Kaunas Free Economic Zone, as well as a joint venture to develop the Klaipeda-Minsk rail corridor and a “One Belt, One Road Cooperation Centre” in the country, are notable examples of how Lithuania is becoming a crucial link between East and West under the Belt and Road Initiative (BRI).

The fastest-growing economy and the largest recipient of China’s ODI in the Baltics

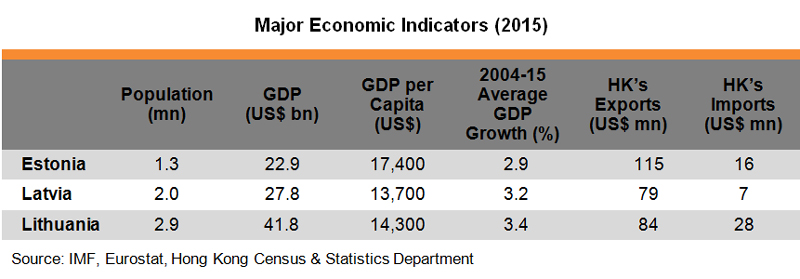

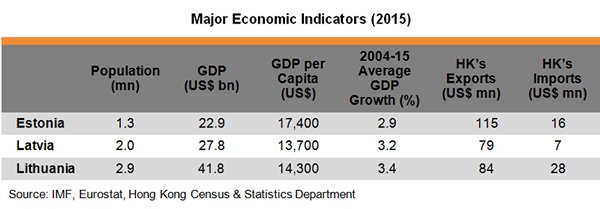

Boasting nearly half of the region’s population and GDP, Lithuania is the largest and southernmost of the three Baltic States. Thanks to its extensive liberalisation and privatisation programmes initiated after independence in 1991 and the benefits gained from accession to the EU in 2004, Lithuania has enjoyed robust growth. Since 2004, it has had the fastest growth of the three Baltic states, and its average growth of 3.4% between 2004 and 2015 mean it has outpaced not only Latvia and Estonia, but the EU, (which registered, on average, only 1.3% growth over the same period) as a whole.

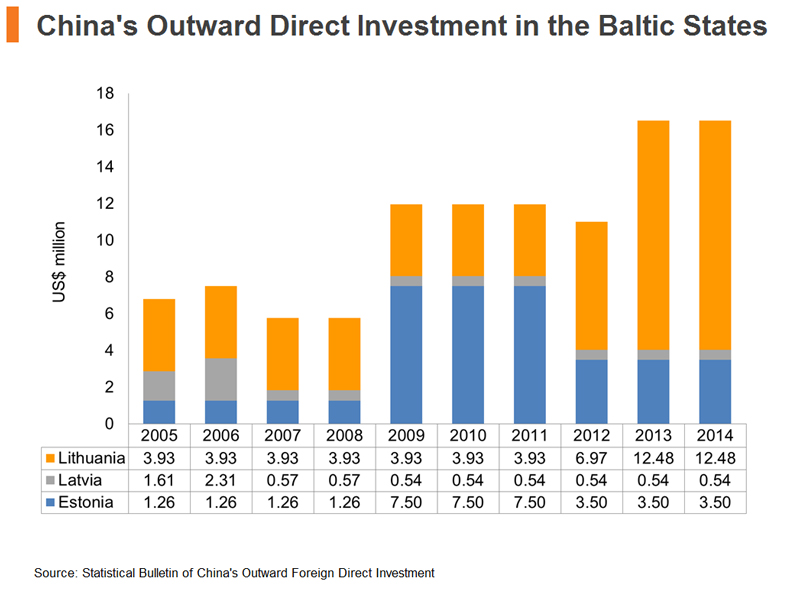

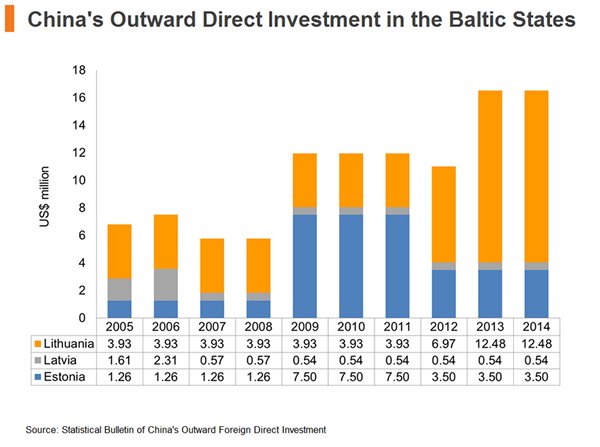

Given its larger population and industrial base relative to the other Baltic nations, Lithuania has been a magnet for foreign investment. While the Nordic countries (Denmark, Finland, Norway and Sweden), the US, the UK and Germany remain the top investors in Lithuania, China’s investment in the country witnessed a massive increase of 218% over the decade ending 2014. Now accounting for more than 75% of China’s outbound direct investment (ODI) in the Baltics, Lithuania has seen ever-rising interest from Chinese investors, especially in the manufacturing, technology and IT sectors, with first-movers including Huawei and ZTE. The growing presence of Chinese enterprises in Lithuania prompted the establishment of the Lithuania-China Business Council in January 2014 to further promote bilateral investments between the two countries.

The Council’s membership encompasses such diverse players as the North China Power Engineering Co., Ltd. (NCPE[1]), which is part of the China Power Engineering Consulting Group, Hanil Exhibition & Planning Co., Ltd, the ALITA Group (alcoholic beverages), LITEXPO (exhibitions and conferences), the management company of Klaipeda Free Economic Zone and the Lithuanian Association of Sea Stevedore Companies.

Sino-Lithuanian investment will likely extend further with the gradual implementation of the BRI. There have already been some clear signals showing China’s intention to partner with Lithuania for long-term investment projects related to the BRI, including the “One Belt, One Road Cooperation Centre”, an industrial park in Minsk (the capital of neighbouring Belarus), a container terminal at the Port of Klaipeda (the largest in the Baltic region) and a rail corridor linking Klaipeda (Lithuania’s third-largest city) and Minsk.

The largest container port in the Baltic region

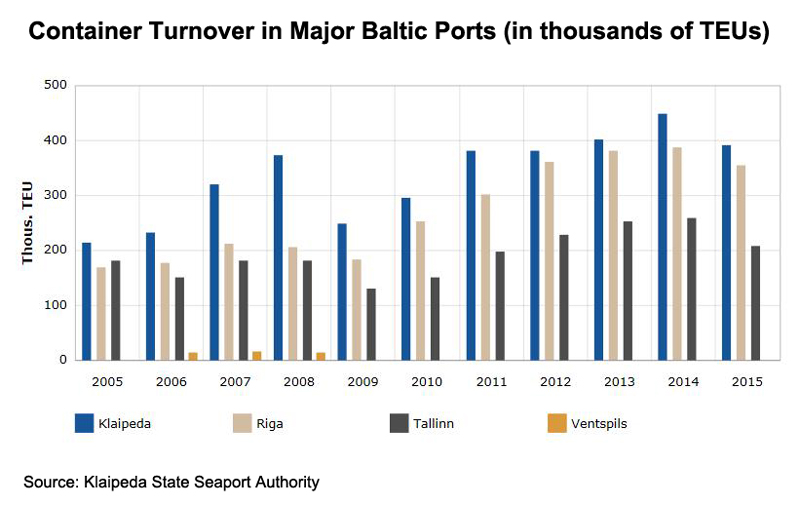

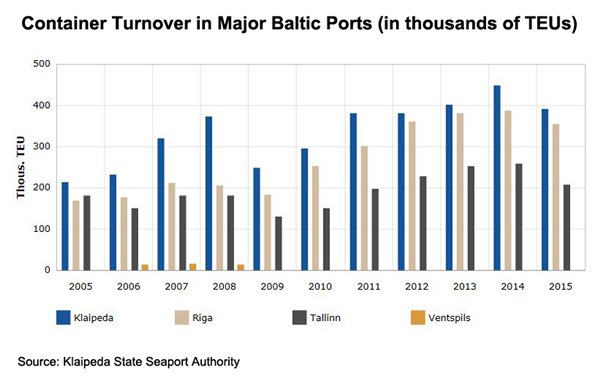

Despite a 3% year-on-year decrease in general cargo turnover, the Lithuanian Port of Klaipeda registered record overall cargo turnover (including general, liquid, dry and bulk cargo) in 2015, as it reached 38.51 million tonnes, up 5.8% on 2014 and 5.2% higher than the previous record of 36.59 million tonnes achieved in 2011. As the region’s biggest container port, the Port of Klaipeda handled 392,000 TEUs (twenty-foot equivalent units) in 2015, compared to 355,000 in the Port of Riga and 208, 000 in the Port of Tallinn.

Many Asian manufacturers, especially Chinese enterprises, are looking to take advantage of lower production costs in inexpensive overseas labour markets. As they have tried to get closer to the EU market, CIS countries such as Kazakhstan, Belarus and Ukraine have become favourable options for both Asian and EU companies who had previously produced their goods in coastal China.

With the strengthening of intra-regional road and rail connectivity, attractive alternative cargo routes to and from China are now possible and are becoming a catalyst for drawing freight traffic to Lithuania for distribution in Europe, especially Scandinavia. With ocean freight, it takes on average 35-45 days for goods shipped from Coastal China to arrive at the Port of Klaipeda by sea, while the enhanced Eurasian rail routes such as the Yuxinou railway (a freight rail route linking southwest China with Germany) can shorten this to 15-18 days. It is true that rail transport can easily cost 80-100% more than sea shipping; however, the alternative land routes remain attractive for cargo that is not so urgent that it must be shipped by air, but time sensitive enough that shipping by sea would be too long.

Source: Klaipeda State Seaport Authority

In conjunction with the development of the New Silk Road Economic Belt (SREB), this gives the Port of Klaipeda an unrivalled advantage as it provides the shortest connection with industrial regions in Russia, Belarus and Ukraine. Investment incentives such as tax breaks on corporate incomes, dividends and real estate offered in the Klaipeda Free Economic Zone (FEZ), one of seven special economic zones in Lithuania, are also attractive.

According to the Klaipeda FEZ Management Company, companies from Thailand are now producing plastic products and Japanese businesses are producing electronics for trucks operating in the FEZ. It also makes good business sense for Chinese investors to set up their logistics, production, warehousing and services units (excluding banking and finance) to better serve the Baltics, Scandinavia and the rest of Europe, given both the strategic location and generous investment incentives available.

Last year, the China Merchants Group (CMG) – one of China’s largest state-owned enterprises and a leading port operator – signed several agreements with the Klaipeda port authority, the Klaipeda FEZ and the Lithuanian Railways. Its investments will see it become a partner for the port’s future development, establish a logistics park for Chinese manufacturers in Klaipeda and also a logistics joint venture to handle freight transportation between Lithuania, Belarus and China.

These investment initiatives, together with the CMG’s ongoing plan to enhance cooperation between the FEZ in Kaunas, Lithuania’s second largest city, and the Industrial Park Great Stone near Minsk, are clear signs of the country’s strategic importance in conjunction with New Silk Road developments. In addition, the heavy reliance of Belarus on the port of Klaipeda will create a new wave of business opportunities for regional supply chain operations.

According to Lithuanian Prime Minister Algirdas Butkevičius, CMG has shown a clear intention to choose Lithuania as a partner for implementation of the BRI. CMG has plans to set up a “One Belt, One Road Cooperation Centre” in Lithuania to better coordinate the increasing and more diversified (away from fertilisers, oil products, grains and minerals) flow of freight passing through Lithuania from other Belt and Road countries, for example landlocked countries in Central Asia.

Other BRI benefits and opportunities

Besides the opportunities stemming from the ongoing improvements in multimodal connectivity and deepening Sino-Lithuanian cooperation under the BRI, Lithuania is also striving to boost its export competitiveness through product and market diversification.

Riding on a solid foundation in industries such as electronics, chemicals, machinery, textiles, apparel and food processing under the Soviet regime, Lithuania excels in many different fields of engineering and technology, including cutting-edge life sciences and biotechnology related to innovative cancer treatments and scientific laser applications.

Some Lithuanian companies, such as those developing laser technology, have already successfully made inroads into the Chinese mainland market. However many remain hesitant to make their debuts for fear of intellectual property difficulties and the massive marketing inputs required by such a vast market.

Source: Chocolate Naive

To this end, Hong Kong can be an ideal marketplace and IP trading hub in Asia for Lithuanian technology companies, while professional services providers such as intellectual property law firms and multi-disciplinary branding and marketing agencies (both local and international) can be ready partners.

Aside from technology, Lithuania has also been promoting a number of consumer goods that may hold promise for export to Asia. In addition to Baltic amber, which is key to Lithuania’s national heritage, organic cosmetics (BIOK laboratorija) and food and beverage items such as natural mineral water (Vytautas, Birutė, Akvilė), chocolates (Chocolate Naive), beer (Svyturys), cheese (Dziugas), liqueur (Stumbras 999), sparkling wine (Apriori), cider (KISS), natural dried fruits (Ramkalni), cold meats, cereals and condensed milk are among the country’s products believed to be marketable in Asia, particularly the Chinese mainland market.

According to the Chemcentral Group – the agent for Svyturys Beer and BIOK cosmetics in Hong Kong and the Chinese mainland – many Lithuanian consumer goods companies are looking for new markets but generally find it difficult to handle the intricate marketing and distribution dynamics abroad.

When selling to Asia, the problems Lithuanian companies encounter usually relate to limited fulfillment capacity, brand recognition and product standards compliance. In line with the country’s positioning as a niche supplier of high-quality products (instead of a mass-market supplier), Lithuanian products, especially food and beverages, may not be price competitive in Asia where many well-established brands from developed markets such as Western Europe, Australia and the US have long been known and consumed.

Source: BIOK laboratorija

To overcome this difficulty, Lithuanian companies are taking advantage of fairs and exhibitions in Hong Kong to better promote their products and brands in Asia, where people are seeing ongoing improvement in their living standards. Also, by appointing agents and/or distributors in the city, Lithuanian companies are in a better position to calibrate their regional distribution strategies and handle product-specific issues such as labelling, product testing and even trademark registration.

[1] It is a large state-owned enterprise specialising in engineering survey and design, engineering consultation and general contracting.

| Content provided by |

|

Editor's picks

Trending articles

Special Report: China’s Bond Markets – The Start of a Golden Age

By Standard Chartered Bank

Summary

China’s onshore bond market is now the world’s third largest, and its credit market has become the second largest. We expect the market to more than double to CNY 100-105tn by end-2020 (from CNY 48tn at end-2015), rising to c.100% from 62% of nominal GDP.

We see strong supply during the 2016-20 period, boosted by local government debt swaps, a likely wider budget deficit, the transition of China’s credit extension model from loans to bonds, and the significant relaxation of regulations on credit bond issuance in 2015.

We expect strong demand. Asset managers could become much larger holders, driven by the centralisation of pension investments and fast growth in the mutual fund and insurance industries amid China’s growing wealth and ageing population. Banks’ holdings are likely to decline. We expect foreign ownership to rise sharply following the interbank bond market liberalisation, to 4-7% by 2020.

We provide a detailed analysis of the supply outlook for each bond type, and the outlook for demand from banks, pension funds, mutual funds, insurers and foreign investors. We summarise key regulatory changes and discuss on- and offshore FX and rates hedging options.

Please click here for the full report.

Editor's picks

Trending articles

China Has No Desire for World Leadership

By Tung Chee Hwa (Chairman, China-United States Exchange Foundation)

The following are excerpts of the remarks by C.H. Tung, former Chief Executive of Hong Kong SAR and Chairman of China-United States Exchange Foundation at a luncheon in New York hosted by the AmericaChina Public Affairs Institute on Jan 25.

What is China pursuing internationally? What is China's long-term strategic intent? For China to realize its vision, it needs, not just for now but in the long term, to pursue peace with its neighbors and with countries around the world.

Having lost a third of its land mass due to foreign aggression towards the end of the Qing Dynasty, the China of today will strongly protect its territorial integrity. Nevertheless, China is pursuing this objective through peaceful means.

There are people in the United States who believe that, as China grows in strength, it will take over America's global leadership position. But, look at several facts. First, the United States has the most enviable position geographically, with only two countries, Canada and Mexico, as its neighbors, and separated from the rest of the world by the Pacific Ocean, the Atlantic Ocean, and the Caribbean Sea. The United States also holds an unassailable position in science, technology and innovation, with some of the best universities in the world. It is also a country to which the best and brightest want to migrate, blessed with natural resources that others can only envy.

By contrast, China has 14 neighbors, more than any other country on Earth, some of which it has had a troubled history. China has more than 20% of the population of the world, but only 7% of the world's arable land, and it is poor in other natural resources. With a population of over 1.3 billion people, the burden of achieving a reasonable degree of wealth for all the people of the country is really a huge challenge. Therefore, although blessed with other advantages, the Chinese leadership knows the country has to constantly keep running forward in order not to slip-up. Indeed, China's modern-day success has not come easily.

It is true, because of its huge population, that China's total economy, in terms of GDP, will one day surpass that of the United States, but its GDP per capita will still be a fraction of that of the United States. In 10 years, assuming current growth rates, the two countries' GDPs may come close to each other. But because of the difference in the size of their populations, the US GDP per capita will still be four times greater than China's per capita GDP.

Yet, in spite of China's enormous disadvantages, there will always be people thinking that China will one day want to lead the world. This perspective is erroneous.

The truth is that China has no ambition to lead the world. China's domestic needs are so enormous, and her challenges are so difficult, that this is where China's focus must be.

Even when China joins the developed world in 2049, as it is hoped, it will have no aspirations or incentives to colonize or conquer foreign lands. Indeed, the Chinese people remember the pain and suffering of being occupied. Nor does it uphold any religious or ideological motives to influence other people or to take over foreign lands. In the height of the Ming Dynasty, when China had 30% of the GDP of the world, China remained peaceful and did not make incursions into foreign lands.

There is also the view that China will want to rewrite global rules. However, the fact is that modern-day China is a beneficiary of today's global governance. What China would like, like so many other developing nations, is to have a larger voice, to ensure the needs of the developing world can be met. The Asian Infrastructure Investment Bank (AIIB) is a case in point. Asia's infrastructure development needs cannot be met by the World Bank or the Asian Development Bank.

The fact is also that, globally, we live in a very complex world that is facing many challenges. These challenges need to be handled by all the countries working together. China certainly, as it moves up the economic ladder, will want to be a force for good for the world. From this point of view, it is important for China to maintain a stable and constructive relationship with the United States. If the U.S. and China can work together on global issues, many challenges can be overcome.

Let us take a look at some of these global challenges, and what the United States and China can and are doing together to address these challenges.

The first that comes to mind is the climate change conference in Paris last December. This was a huge success only because of the efforts of the two working together. Second is co-operation on global hot-spots, such as the Iranian nuclear deal, and China's active participation in Afghanistan's nation-building effort. Third is the need to intensify collaboration by the two countries to bring about peace and de-nuclearization on the Korean Peninsula. Fourth is to fight global terrorism in a determined manner.

As we enter 2016, the global economy is at best sputtering along, and many talk about an imminent global recession. America has the largest economy in the world, and China has the second largest. If the two countries work together in a coordinated fashion with other leading economies, we can add vigor into the global economy.

China's “One Belt, One Road” initiative is designed to boost the economies of the nations in Southeast Asia, South Asia, Central Asia, the Middle East and parts of Eastern Europe. China believes that infrastructure building in these areas will lay the foundation for economic growth, and can become a new driver of the world economy. Collaboration in infrastructure building in Africa will not only help the economy, but also improve livelihoods and reduce the flow of refugees. US-China collaboration in these areas will be very important.

If the U.S. and China fail to co-operate, the chances of overcoming the challenges will be much more difficult. If the two countries confront each other, collaboration becomes impossible. This is why eight presidents of the United States, from Nixon up to Obama, and five leaders of China, from Chairman Mao to President Xi Jinping, have steadfastly promoted better relations between the two countries. They obviously have known that this is important to the world.

China and the U.S. are working together, and they need to do more. The fact is, there is still too much mistrust. There is also too much misunderstanding. After all, the two countries have different histories and different cultures; they are at different stages of development, therefore their needs are different. As a result, differences do occur between the two countries. Fortunately, these differences have so far been managed.

But this is not adequate. The two countries need to intensify their efforts to build trust and promote understanding. The best way to achieve that is to expand exchanges at all levels of society. The two presidents now meet three or four times every year. The strategic and economic dialogue teams from both countries meet twice every year. On an official level, there is a great deal of interaction.

But the communication between the Senate and House of the U.S. side and the National People's Congress on the Chinese side can be much better. People-to-people exchanges need to be further expanded. It is heartening to note that there are 300,000 students from China studying in the United States. Meanwhile, the US is making a major effort to increase the number of US students studying in China. 2016 is US-China Tourism Year, which is an effort by the leaders of both countries to expand tourism between the two countries. Greater efforts between the two countries in other forms of exchanges need to be made, such as between think tanks, universities and the press, as well as through cultural interchange, trade, commerce and investment activities. These will all help, and lead to greater understanding and trust.

Just remember the relationship of the two countries today began with a ping-pong game in 1970. If China and the U.S. can do all the above, over time there is no limit to how close the two countries can get to, and how much benefit the people of the two countries can receive. Indeed, there will be no limit to the common good the two can do together around the world.

Please click to read the full article on the website of China-United States Focus.

Editor's picks

Trending articles

Daunting Challenges Ahead for 2016

By He Yafei (former Vice Minister, State Council Office of Overseas Chinese Affairs)

As we look ahead into the year ahead, the world seems full of uncertainties and challenges.

Firstly, “it's the economy, stupid” as usual. The year 2016 will witness continued global slow growth and accumulation of financial risks. The world economy is still on the bottom of an L-shaped groove. According to Consensus Forecasts, global growth is expected to be 2.8%, slightly up from 2.6% in 2015. Aside from the US and UK, advanced nations face a bleak picture with GDP growth all below 2% in 2016.

There are a few key things to watch closely in global economic landscape this year:

1. With the Fed's rate increases and a strong dollar, some debt-ridden developing nations are experiencing capital flight, credit crunches and fiscal tightening that can break their economies. A debt crisis also seems imminent in Euro-zone and some resource-exporting countries. Systemic financial risks and contagion still exist. Since 2009, major central banks have created cheap dollar liquidity in the amount of $12 trillion, and as a result global debt has risen an additional $57 trillion since 2007. The Bank of International Settlement calls this level of debt “frightening”.

2. Prices of bulk commodities will keep falling, especially that of petroleum, as global demands remain depressed with weak growth. This will adversely impact resource-exporting countries like Brazil, Russia, South Africa, Indonesia, Australia and Canada. Brazil and Russia were already in negative growth of -3.5% and -3.8% in 2015, and the trend is expected to continue.

3. Global investment and trade will shrink again as economic uncertainty mounts, which will further dampen an already depressed world market. World trade is growing at an average of 3% in the last few years as compared with 7% before the 2008 financial crisis. The uncertainty that lies in wait includes any potential Fed rate increase, the Euro-zone's weak demand and high unemployment, and possible systemic financial risks spreading from debt-ridden countries to the whole world.

Secondly, geopolitical turmoil persists in regions like the Middle East involving ever-deepening rivalry among big powers, which will not only worsen regional conflicts but also deal heavy blows to global economic growth. With the US presidential election in sight, election-year fever will make any regional conflict much more complex and difficult to resolve.

Let us take a panoramic view of trouble spots worldwide:

1. The Ukraine crisis continues to fester with no sign of an end to the military conflict, producing a strategic stalemate between Russia and the US that affects the future security of Europe as well as Russia's relationships with the European Union and the US. The four-prong conflict among Ukraine, Russia, the US and EU will be with us for some time to come.

2. There is no “light at the end of the tunnel” for the complex and dangerous situation in the Middle East. With the recent severance of diplomatic ties between Saudi Arabia and Iran, with Bahrain and Sudan following the Saudi lead, the conflict and “proxy wars” between Sunni and Shiite Muslims in the region and beyond will get even worse. The recent years' US strategic retrenchment cycle involves a retreat from the Middle East and a refocus on Asia with more determined efforts to implement “rebalance in Asia”.

But the Iranian Nuclear Agreement touted by the US Administration as a major foreign policy score seems to be a catalyst for worsening relations between Sunnis and Shiite as represented respectively by Saudi Arabia and Iran. US allies in the region including Israel and Saudi Arabia are less sure of America's commitment to them. It seems that direct military confrontation can't be ruled out in this situation.

Another aspect of the regional conflict is the spread of IS and its terror campaign all over the world. Though IS suffered a few losses of land in Iraq recently, it is certainly not in retreat and there is no telling how it can be defeated even if many experts are predicting its demise this year.

3. The South China Sea and the Western Pacific will witness rising tension and possible military skirmishes in the year ahead as the US moves more aggressively to enforce its sacrosanct rule of the freedom of navigation worldwide, as defined by itself. Recent “mistaken entry” into airspace over the island under Chinese sovereignty is a typical example of American adventurism. With American support, Japanese warships and fighter planes patrolling in the South China Sea is in the pipeline, and the Philippines seems determined to place its bet on the upcoming ruling of the Maritime International Court, no matter what the outcome is for its presidential election.

Geopolitical turmoil and upheavals are getting more acute and complex day by day and they are bound to affect global economic environment negatively.

Thirdly, global governance and rule-making enters a substantive period this year, with greater involvement by big powers, which will continue to shape the world political and economic order in the 21st century.

The year 2015 saw much evolution in global governance, with developing countries as a whole and China in particular gaining ground by proactive actions in improving its architectural reform.

Just take a few examples.

China moves up in the scale of assessments for the United Nations regular contributions at close to 8% and those for peace-keeping operations at over 10%, taking the 3rd and 2nd positions respectively.

The Asia Infrastructure Investment Bank (AIIB) was fully operational by the end of 2015. This new addition to the global financial system represents both China's contribution to global governance and her determination to provide an alternative to the developing nations that need financing for infrastructure-building. The over-subscription to AIIB by so many economies, both advanced and developing, indicates that the existing global financial governance structure is definitely over-burdened and needs supplements and reinforcement. It also tells us that global governance is in critical need of new ideas like “the Belt and Road Initiative” as proposed by China.

China's RMB was officially listed as part of the SDR basket of currencies by the IMF late 2015, effective October 1, 2016. This demonstrates once again that the global monetary system is undergoing reforms to make it more robust and effective. The long-overdue implementation of decisions by the IMF and the World Bank to increase the shares of voting power for developing nations was finally settled late last year, giving the world much hope that global governance reform is indeed the common aspiration of all nations.

All above advances reveal movement from “governance by the West” to “co-governance by both East and West”, figuratively speaking. This mega-trend in global governance will no doubt continue in 2016 as China will chair the G20 Summit in September in Hangzhou. China is expected to propose new ideas on how the world economy should be restructured to bring about new momentum for growth.

Fourthly, big power co-operation and friction will both increase in the year, an interesting development of interaction reflecting the reshaping of big-power relations. There are at least three areas where big powers should co-operate closely in order to make the world a better place for all.

Needless to say, the G20 must do a better job of macro-economic coordination. The global economy has lost steam with the outdated mode of growth and has been desperately seeking new paths for economic development. In this transition, almost all countries are engaged in structural adjustments. Without close co-operation and policy coordination, the global economy will teeter and fall down again. The G20, with over 80% of world GDP under its belt, has replaced the G7 as the primary platform for global economic coordination and its members are duty-bound as major stakeholders in the global economy to make it work again. The need to avoid negative spillovers of national economic policies is obvious. The timing of the Fed's rate increases is a case in point.

The next critical thing is the close co-operation and consultation by big powers to reduce tensions in various hot spots and to fight terrorism, most notably in the Middle East. The role of the UN needs to be enhanced and greater support be given to its efforts both in making peace and keeping peace.

China has taken the lead in proposing building “new type of big-power relations” based on co-operation and consultation. In this connection, both the US and China, being permanent members of the Security Council and core members of the G20, should play a leadership role in shaping their relationship along these lines.

It is easy to list problems and difficult issues that need to be solved. It is quite another to put all of our wits and determination together in offering feasible solutions to these problems. This is exactly what should be done at the beginning of the new year!

Please click to read the full article on the website of China-United States Focus.

Editor's picks

Trending articles

Economic Alert: India – Budget Target Is A Positive; Quality Could Suffer

By Standard Chartered Bank

Summary

The positives in India’s FY17 budget were strong: Much to the surprise of the markets, including us, the finance minister announced a tough fiscal deficit target for FY17 (year ending March 2017) of 3.5% of GDP (FY16: 3.9% of GDP). This is in line with the original fiscal consolidation plan and comes despite a challenging economic environment. We believe adherence to the original target for FY17 will enhance both policy credibility and macroeconomic stability for India, a big advantage in today’s volatile global environment. With the government adhering to its promise, we expect the Reserve Bank of India (RBI) to reduce the repo rate at its 5 April policy meeting, if not sooner. An inter-meeting cut cannot be ruled out. The ongoing focus on select infrastructure projects, such as roads and railways investment, is another positive.

Aspirations to improve the quality of fiscal consolidation are unlikely to be realised: We expect the government to adhere to the 3.5% of GDP fiscal deficit target irrespective of any adverse developments, much in line with the trend since FY14. However, we think the government will have to reduce its capital expenditure (excluding for roads) in FY17 to meet this target. This is because we think the government has (1) overestimated one-off receipts by 0.35-0.40% of GDP; (2) underestimated recurrent expenditure related to the implementation of the seventh pay commission and food subsidies by 0.10-0.15% of GDP; and (3) provided a lower-than-expected allocation for bank recapitalisation which could increase over FY17.

Please click to read the full report.

Editor's picks

Trending articles

OTG: Pakistan – Steady As She Goes

By Standard Chartered Bank

Summary

February marks Pakistan’s entry into the last six months of its three-year IMF Extended Fund Facility (EFF). Staff-level agreement on the 10th review was reached last month, with the programme likely to be concluded by August 2016. The Fund’s mission chief, Harald Finger, has described the prospects of a successful programme as “quite good”. We believe policy makers will continue to focus on meeting programme targets – particularly fiscal consolidation and building FX reserves – as they enter the last few reviews.

Despite tighter fiscal policy, we believe domestic demand requires little stimulus after 350bps of cuts since November 2014 (On the Ground, 9 November 2015, ‘Pakistan – Spotlight on domestic demand’). Credit flows to the private sector in 7M-FY16 were twice the level in FY15, and consumer confidence was at an all-time high. However, we maintain our FY16 GDP growth forecast of 4.4% on supply-side constraints (e.g., energy shortages and a lower cotton crop) and trade weakness, partly on real effective exchange rate (REER) strength.

Rising import demand and declining exports widened the non-oil goods trade deficit (FOB) by c.90% y/y in 7M-FY16. Despite low oil prices, the goods trade deficit was nearly flat (-1.3% y/y). Remittance growth slowed to 6% from 17%; we expect similar growth for the full financial year ending June on weaker GCC growth. We raise our current account (C/A) deficit forecast to 1.3% of GDP from 0.6%. Against this backdrop and stable inflation, we expect the central bank to keep the policy rate steady at 6% in FY16.

Please click here for the full report.

Editor's picks

Trending articles

Opportunities Arising from China's 13th Five-Year Plan: An Overview

The 12th National People's Congress (NPC) adopted the Outline of the 13th Five-Year Plan for National Economic and Social Development of the People's Republic of China (the 13th Five-Year Plan) at its fourth session in March 2016. The document expounds on the need to fully implement a development concept based on the tenets of "innovation, coordination, green growth, opening up and sharing". It aims to enhance the quality of development in order to ensure the establishment of a moderately prosperous society, despite the challenges of changing domestic and international environment.

Following this, China will take promotion of innovation as the primary driving force for economic and social development in the next five years (2016-2020), while pushing forward “new-style” urbanisation and making increased efforts to contain pollution. Externally, it stresses the needs to form a new pattern of all-round opening up and promote win-win cooperation with countries along the Belt and Road.

The 13th Five-Year Plan is set to have a significant impact on China's economic development, and the subsequent changes brought about by its implementation will generate new opportunities for relevant industries. Hong Kong is not just the bridgehead of the mainland for foreign trade and economic cooperation, but also the first port of call for mainland enterprises seeking financial, legal and other professional services. The 13th Five-Year Plan clearly states that China will deepen the cooperation between the mainland and Hong Kong, and support Hong Kong in consolidating its position as an international financial, shipping and trade centre playing a part in China's two-way opening up and in the Belt and Road Initiative.

Along with further deepening of the liberalisation of trade in services under CEPA [1] and the country's further promotion of pan-Pearl River Delta (PRD) regional cooperation [2], these policies will give Hong Kong companies greater access to different economic and service sectors on the mainland. Hong Kong businesses should therefore pay close attention to the implementation details of the Plan in order to seize opportunities.

New Concepts

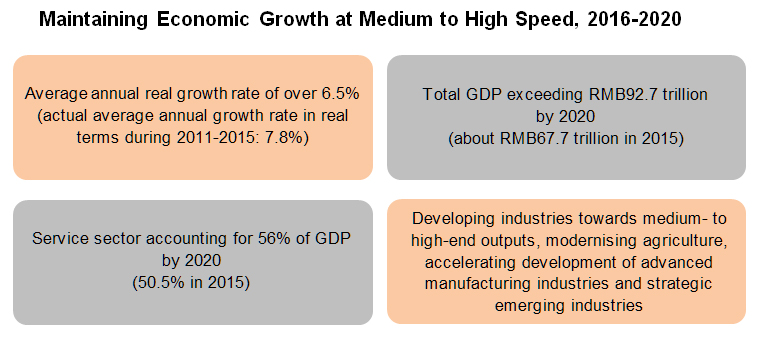

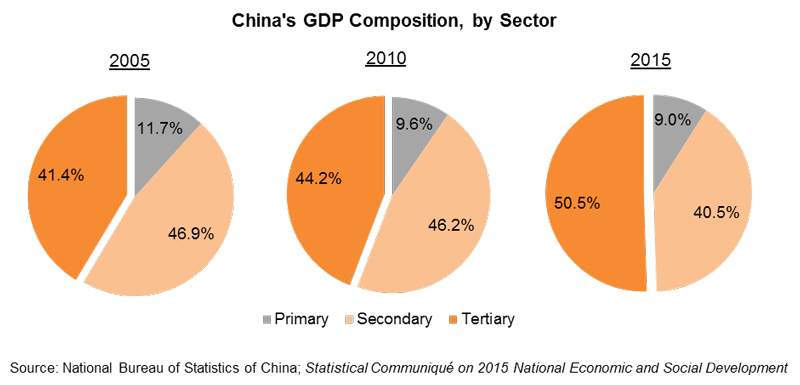

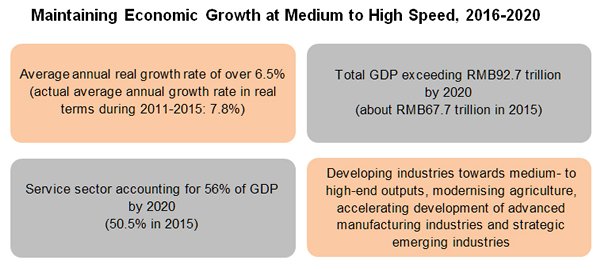

As regards the promotion of economic and social development, the 13th Five-Year Plan sets out the goals of maintaining a medium to high level of growth, and doubling China's gross domestic product (GDP) by 2020 from the 2010 level on the basis of balanced and sustainable development in the next five years. It also calls for efforts to promote industrial upgrading and agricultural modernisation, while increasing the share of the service sector further in terms of GDP. The specific targets of development include:

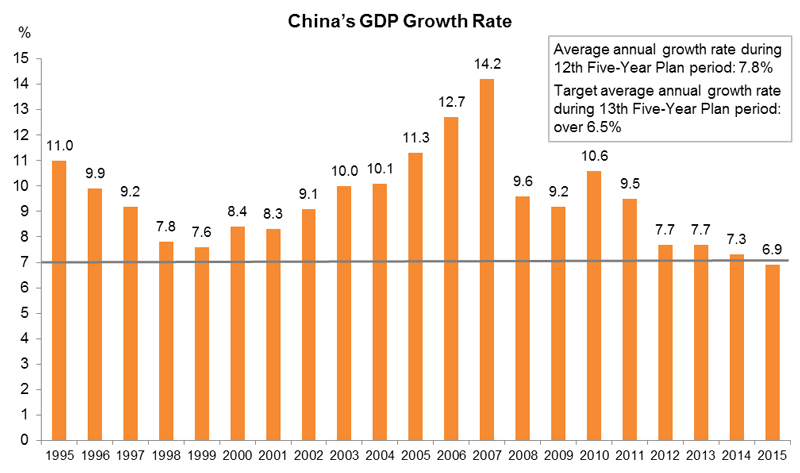

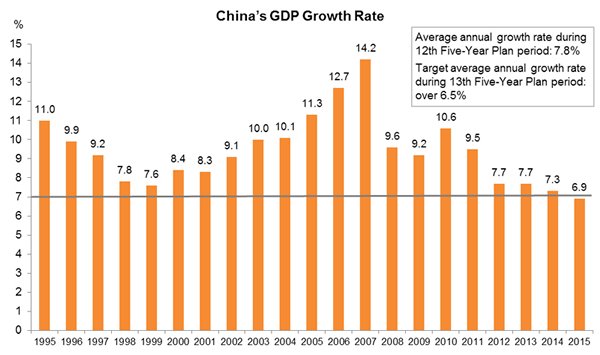

Compared with development in the last two decades, the 13th Five-Year Plan clearly adopts a target of slower economic growth by lowering the average annual target growth rate (in real terms) from 7.8% in the previous five years to over 6.5% annually over the next five years. Under the impact of factors such as global economic slowdown and trade decline, China has recently seen a contraction in foreign trade. Sluggish investment growth and overcapacity in certain industries spell difficulties for some enterprises. The economy will unavoidably face downside pressure for some time to come.

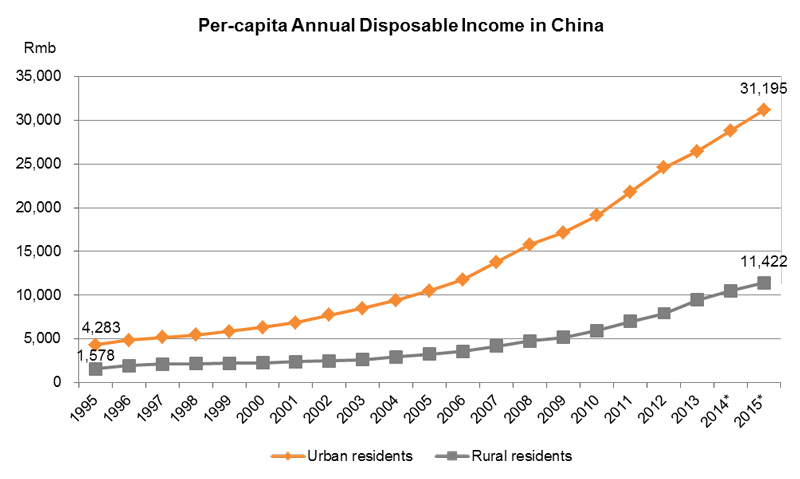

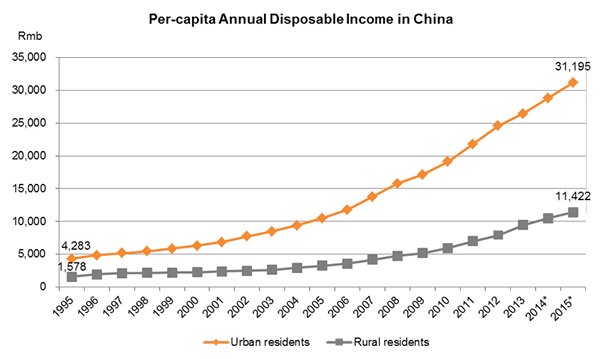

In spite of this, China's GDP has in fact overtaken many advanced economies after years of rapid growth. With GDP amounting to RMB67.7 trillion in 2015, [3] China is the world's second largest economy after the US. Moreover, people’s living standards have improved significantly. For example, the per-capita disposable income of urban residents soared from about RMB4,300 in 1995 to RMB31,200 in 2015. During the same period, per capita income in rural areas also increased from RMB1,600 to RMB11,400. Higher income stimulated consumption. Total retail sales of consumer goods in 2015 amounted to RMB30 trillion, an increase of over 90% on RMB15.7 trillion in 2010, and not far off the retail sales volume of the US. [4] China’s tremendous growth spurt makes it one of the world's biggest consumer markets.

Premier Li Keqiang pointed out in the Government Work Report delivered in March 2016 that every percentage point of GDP growth today is equivalent to 1.5 percentage points of growth five years ago. This suggests that although China’s economy may slow down somewhat in the next few years, given a fairly high base and a steady pace of growth, the actual increases in economic activities and income amount may not be much different from that of the 12th Five-Year Plan period.

* Figures of new statistical method.

Sources: National Bureau of Statistics of China; Statistical Communiqué on 2015 National Economic and Social Development; Government Work Report, March 2016; and 13th Five-Year Plan

In order to achieve sustainable development, another priority of the 13th Five-Year Plan is to find new drivers for economic growth to prevent the economy from becoming stagnant under the constraints of the past development model and falling into the "middle income trap" due to a lack of growth momentum. Although the Chinese economy is booming and industrial and commercial activities are growing, rising economic costs and social problems caused by a mode of economic development which seeks to achieve capacity expansion and growth by continuously increasing labour, energy and other inputs, have aroused great concerns among the government and the public. Environmental and pollution problems in many regions are directly affecting people's livelihoods. There is also a general shortage of labour in the coastal areas. This, coupled with land shortage as a result of rapid urbanisation and industrial development, has caused problems like higher land costs and recruitment difficulties in many economic spheres. Rising production and other business costs have become the norm in recent years.

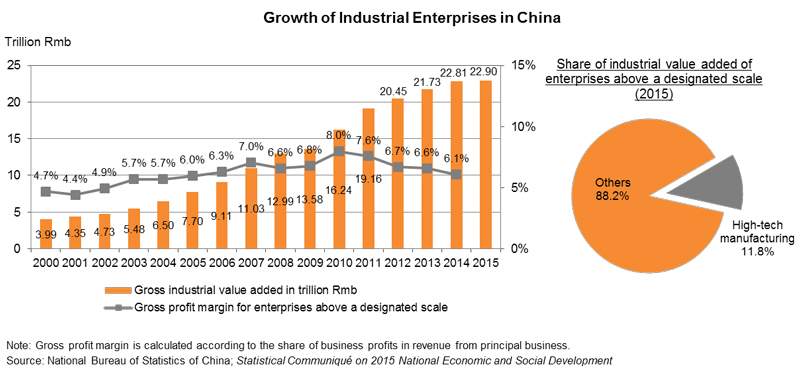

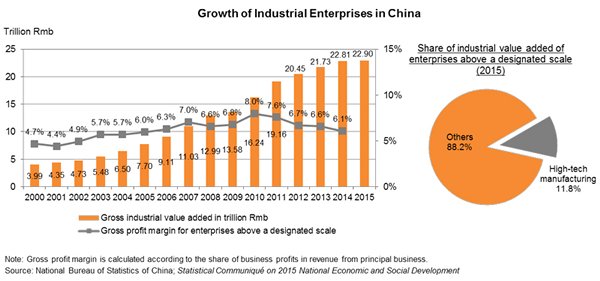

On the other hand, with the rapid expansion of industries, the value added by China's industries soared from RMB4 trillion in 2000 to RMB22.9 trillion in 2015. Undoubtedly, China is the leader in the production of many consumer and industrial goods. Its garments, toys, home appliances and consumer electronics, for instance, account for the lion’s share in the global market. Also, rising costs and sluggish overseas markets have led many enterprises to increase their competitiveness through transformation and upgrading in recent years. Despite these, most industrial activity is still concentrated on the production of low technology products through labour-intensive processes for relatively slim profits. High-tech production activity currently only accounts for 11.8% of the country's total industrial value added. Thus, accelerating industrial upgrading, encouraging enterprises to shift from low value-added business to medium- and high-end manufacturing, eliminating inefficient and outdated production capacity, while bringing industrial and production activities to a higher level, are all problems to be solved in the 13th Five-Year Plan.

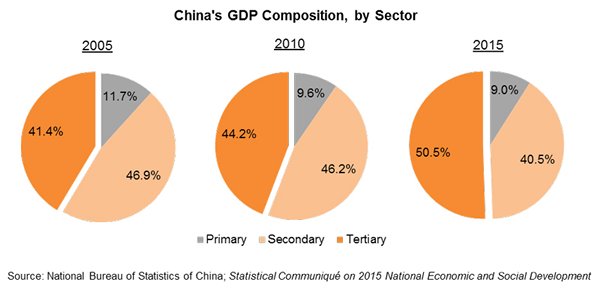

After years of structural reform and market liberalisation, foreign and private capitals have not only found their way into different industrial sectors, but have also gained access to a wide range of services, gradually altering China's economic landscape. The service sector accounted for more than half the country's GDP for the first time in 2015, reaching the level of 50.5%. The contribution of consumption to economic growth also reached 66.4%, suggesting that the economy is shifting from one dominated by traditional industries to one with services and consumption as the main drivers. The 13th Five-Year Plan thus also focuses on ways to produce innovations in the investment regime, reduce market intervention, and further open the market in an orderly manner, while promoting upgraded consumption and stimulating the growth of modern services.

Against this backdrop, the 13th Five-Year Plan will focus on innovation and implementation of an innovation-driven strategy in economic and social development, increase the contribution of consumption to economic growth, and improve the efficiency of investment and enterprises in the 2016-2020 period. It also clearly states that action will be taken to improve the quality of urbanisation, coordinate and optimise regional development, improve the overall ecological environment, and continuously expand the scope of opening up to enhance the country's capabilities of utilisation of global resources.

Innovation, Industry Upgrade and Online Economy

The 13th Five-Year Plan makes innovation the primary driver of economic development. It contemplates to find new drivers by making use of scientific innovations and encouraging mass innovation and entrepreneurship. It also announces the launch of six key scientific and technological (S&T) projects and nine other major projects under the "Scientific Innovation 2030" initiative [5], as well as the implementation of the "Made in China 2025" strategy for building a strong manufacturing country to improve the manufacturing sector’s innovation capacity and competitive edge, while promoting the development of strategic emerging industries. Additionally, it will promote the application of information technology and seek to expand the scope of the online economy. Target industries and areas of development include:

Boosting scientific innovation

- Increase R&D/GDP ratio to 2.5% by 2020 (2.1% in 2015) |

Efforts will be made to encourage R&D, to strengthen technology integration capability, and to import technology from abroad, targeting advanced technologies including next-generation information communications, new energy, new materials, aviation and space, biomedicine, and smart manufacturing. Action will also be taken to improve tax concession policies for corporate R&D expenses, and expand preferential treatment for accelerated depreciation of fixed assets to encourage enterprises to upgrade their equipment and apply new technology.

-

Promoting mass entrepreneurship and mass innovation

The Mass Entrepreneurship and Mass Innovation initiative encourages the development of new technologies, new products and new business formats and the establishment of technology transfer platforms to provide support services to startup firms. The cultivation of entrepreneurship will be improved and greater scope will be given to the role of government venture capital in guiding funds. At the same time, the regulatory regime will be improved to regulate the development of rewards-based and equity-based crowdfunding and online lending activities.

-

"Made in China 2025"

The "Made in China 2025" policy document will be implemented to strengthen the fundamental capacity of industry, including manufacturing of key basic materials and core parts and components, accelerate the development of intelligent and other new types of manufacturing, and strengthen quality and brand building. Steps will be taken to promote the upgrading of traditional industries and actively eliminate backward capacity.

-

Developing strategic emerging industries

This includes boosting emerging industries such as next-generation information technology, new energy vehicles, biotechnology, green and low-carbon industries, high-end equipment and materials and digital creativity, as well as developing strategic industries such as space and sea navigation, information networks, life sciences and nuclear technology.

-

Increasing network speeds and expanding the online economy

- Internet-fixed broadband penetration rate to increase to 70% by 2020 (40% in 2015)

- Internet-mobile broadband penetration rate to increase to 85% by 2020 (57% in 2015)

This includes building safe and high-speed next-generation information infrastructure, accelerating the implementation of the “Internet Plus” action plan, developing wireless broadband, the IoT (Internet of Things) and big data analytics technology and application, and formulating plans to shape the next-generation Internet and related technologies. -

Developing new systems and reducing enterprise burdens

Action will be taken to improve administrative efficiency by simplifying industry and commerce administration systems, accelerate reform of the financial system, further promote the development of the capital market, and raise the efficiency of the financial sector in serving the real economy. Efforts will also be made to reduce contributions and unreasonable charges payable to the so-called "five social insurances and one fund” [6] and alleviate the tax burdens on enterprises. [7]

Based on these development directions, it can be expected that implementation of the 13th Five-Year Plan will boost the mainland’s demand for various types of new and high technology. In certain high-tech industries, such as IoT applications and development of the next-generation Internet, China currently lacks expertise, which means related R&D and technology application is somewhat constrained. However, Hong Kong’s technical personnel are well-versed in advanced foreign technology and excel in using technologies developed to international standards/frameworks. They can therefore assist in the commercialisation of related projects in the mainland in order to meet the technological demands listed in the 13th Five-Year Plan.

Advancing mass entrepreneurship and mass innovation is a long-term strategy for promoting economic growth under the 13th Five-Year Plan. Makers and investors are rushing into different technological ventures in spite of risks. This has produced huge demand from “technopreneurs” for not only financial resources but also support in areas such as technology, market connections and entrepreneurial development. Technology players and investors based in Hong Kong may take advantage of the city’s long-standing advantages, such as free flow of information and capital, to become important partners for mainland technopreneurs and satisfy their demand for all kinds of services.

Meanwhile, the mainland hopes to make use of innovation to facilitate industrial upgrades. For instance, the policy paper “Made in China 2025” stated that enterprises will be encouraged to strengthen their product design capabilities in order to shift from OEM to ODM, and develop their own branded business. This should provide opportunities for Hong Kong’s design and branding service suppliers. A recent survey conducted by HKTDC Research found that mainland enterprises wish to obtain service support from Hong Kong or foreign countries in the following areas: (i) product development and design; (ii) brand design and promotional strategy; and (iii) marketing strategy. [8]

Hong Kong, as an international financial centre in the region, can provide mainland enterprises with loan and financing services, including cost-effective capital for technology and industrial projects, and help mainland enterprises to lower financial cost. Furthermore, as Hong Kong is one of the largest venture capital management centres in Asia, a large number of top-notch international fund managers wishing to grasp business opportunities in China have already established a foothold in Hong Kong, which can offer financing channels for mainland enterprises. It can be expected that during the 13th Five-Year Plan period the mainland will further open up its financial services market, which should bring about more opportunities for Hong Kong financial service suppliers.

Modern Infrastructure and Balanced Regional Development

The 13th Five-Year Plan also emphasises the need to optimise the spatial distribution pattern of development and better support economic and social development. This will happen through the construction of efficient, intelligent and green infrastructure facilities, including modern intercity transport networks, land, sea and air transportation systems connecting different parts of the country, neighbouring countries and those along the Belt and Road, as well as energy storage and transport networks and other comprehensive modern transport systems. Efforts will also be made to promote “new-style” urbanisation and coordinated regional development. This covers the following main areas:

-

Advancing new urbanisation construction

- Urbanisation rate to reach 60% by 2020 (56.1% in 2015)

Steps will be taken to advance a people-centred new urbanisation plan; enhance urban planning, construction and management; deepen household registration system reform; and assist rural migrants capable of securing a stable job in urban areas in obtaining urban resident status.

-

Advancing coordinated regional development

This includes deepening the Go West initiative and promoting development of the central region. Emphasis will be placed on encouraging the coordinated development of certain regions, such as advancing the coordinated development of the Beijing-Tianjin-Hebei region and the Yangtze River Economic Belt. Regional development will be achieved by way of optimising urban development planning, encouraging regional transportation integration, and improving regional environmental planning.

In attaching importance to the strategy of balanced development of the eastern and western regions and urban and rural areas, the 13th Five-Year Plan aims to tackle problems brought about by disparities in regional development in the past and by the rapid pace of urbanisation of some localities. These problems include:

- Insufficient transport facilities, environmental resources and supporting municipal facilities in certain city clusters;

- The polarised development of the urban and rural areas quickening the pace of migration into cities, increasing the pressure on urban development;

- Heightened pressure on transportation and communication systems; and

- Increasingly obvious water and air pollution problems, which have created demand for energy saving and emissions reductions.

The rate of urbanisation in the mainland rose rapidly from 36.2% in 2000 to 56.1% by end-2015 [9]. The pace is particularly fast in more developed regions – for instance, the urbanisation rate in some of the YRD provinces exceeds 65% [10], which has created the problems mentioned above. In view of this, the 13th Five-Year Plan makes “new-style” urbanisation a development priority, with efforts devoted to enriching the content of urban and rural development and making better urban living a development objective, instead of simply seeking urban construction or expanding the boundaries of cities.

Against this backdrop, the 13th Five-Year Plan will not only bring about upgrades to coastal cities but also stimulate the construction and economic activities of urban and rural areas in the central and western regions, as well as the old industrial regions in the north-east. For instance, where building new city clusters is concerned, efforts will be made to strengthen the construction of daily-life supporting facilities in the relevant urban and rural areas, and to upgrade infrastructure, such as cross-regional intercity and trans-regional transport systems.

Hong Kong is not only an international financial centre that can support urban development in the mainland with extensive project financing channels, but also an important commercial services platform in the Asia-Pacific region. With a pool of local and foreign infrastructure construction service suppliers in extensive fields, Hong Kong has rich experience in different modes of urban development and management. Meanwhile as the scope of urban construction continues to expand in the mainland, infrastructure enterprises with full-service capabilities are needed to satisfy market demand for infrastructure and overall planning. Also, as mainlanders' income level continues to rise, they are becoming more demanding with regard to the quality of urbanisation. Hence, when government departments in charge of planning and developers set out to advance urbanisation, priority is given to development quality over speed and quantity. This will create opportunities for qualified service suppliers wishing to tap the China market.

Moreover, regional development and urbanisation are bound to change the urban landscape rapidly in different regions. The emergence of new commercial districts will prompt the distribution and retail sector to shift toward modern business modes, besides bolstering development of the consumer markets in small coastal cities and in the central and western regions. Hong Kong companies wishing to enter these “emerging markets” must assess local purchasing power, pay attention to the consumption patterns of different cities, and withstand intense price competition from online businesses.

Furthermore, under the 13th Five-Year Plan, the mainland may quicken its pace of building smart city clusters and apply next-generation information technology to raise the efficiency of city management. This should directly boost the demand for the application of IoT technology in a number of areas, such as transport, environmental monitoring and municipal management, generating opportunities for relevant service suppliers to enter the market.

As the development of transport logistics network in the mainland matures, it will bring about further development of logistics services and e-commerce. For instance, as demand for cold chain logistics rises rapidly, it is in urgent need of importing advanced cold chain solutions in order to raise overall operation efficiency and quality. Moreover, while domestic online shopping grows in leaps and bounds, cross-border e-commerce and related logistics services have yet to develop. In comparison, Hong Kong not only has rich experience in cold chain logistics management but also a sound e-commerce and logistics platform. Hong Kong is therefore well positioned to capture such opportunities presented by the 13th Five-Year Plan.

Green and Sustainable Development Goals

Both the 13th Five-Year Plan and the Party leadership have stressed on many occasions that while efforts will be made to advance social and economic development, action will also be taken to bring about a resource-efficient and eco-friendly society and strengthen environmental protection in order to ensure sustainable progress. Indeed, environmental problems have accumulated on the mainland, with serious smog, water and soil pollution in some places. Against this background, the 13th Five-Year Plan sets out the following development plans:

-

Accelerating improvements to the ecological environment

This includes rationally controlling land development intensity, increasing ecological space, promoting the optimisation of industry in the development zones (such as those in the Beijing-Tianjin-Hebei, YRD and PRD regions) in a high-end, low pollution and low land use direction, and also implementing a negative list approach for operations in key ecological areas. In addition, measures will be taken to cut down on energy, water and land use, and develop a circular economy.

- Strengthening resources and environmental management (2020 target compared with 2015 cumulative figure)

~ Water consumption per RMB10,000 of GDP 23% ↓

~ Energy consumption per unit GDP 15% ↓

~ Carbon dioxide emissions per unit GDP 18% ↓

~ Raising the share of non-fossil fuels in the country’s primary energy mix to 15% (12% in 2015)

Strengthening pollution control

Steps will be taken to implement the pollution control action plans, strictly enforce various environmental indexes, promote pollutant discharge standards and emissions reduction measures (including orderly relocation and transformation or closure of heavily polluting enterprises in the built-up areas of cities), and carry out clean production transformation in key industries. Greater efforts will be made to contain air, water and soil pollution; regulatory requirements for industrial pollution sources to meet emissions standards will be fully implemented; polluting enterprises will be transformed and projects that cause serious pollution will be banned; urban domestic sewage and refuse treatment will be fully advanced; and enforcement of relevant laws will be strengthened.

- Reduce total emissions of major pollutants (2020 targets compared with 2015 cumulative figure)

~ Chemical oxygen demand 10% ↓

~ Ammonia nitrogen 10% ↓

~ Sulphur dioxide 15% ↓

~ Nitrogen oxides 15% ↓-

Developing green and environmental industries

This includes supporting innovation in technical equipment and service modes; encouraging the development of energy-saving and environmental technologies and services; promoting performance contract arrangements for energy and water management; enhancing energy-saving environmental engineering technology and equipment manufacturing capacity; and establishing a green financial system with green credit and green securities to accelerate the building of a green supply chain industrial system.

During the 13th Five-Year Plan period, the mainland will further strengthen energy saving, emissions reduction and environmental protection policies. In particular, the new Environmental Protection Law, which came into effect on 1 January 2015, aims to tackle environmental pollution issues, including authorising environmental protection departments to close down facilities which have caused serious environmental pollution and to order units emitting excessive pollutants to limit or cease production. It also sanctions heavier penalties and punishments for non-compliance. [11]

Demand from mainland enterprises and relevant units for environmental protection services such as energy saving and pollution prevention and containment is bound to rise rapidly, supported by government measures. They will be encouraged to take greater initiative in seeking environmental protection services to meet requirements for energy saving, emissions reduction and emissions standards. In view of this, the 13th Five-Year Plan should provide environmental protection service and technology companies possessing the right technology and expertise with extensive room for market expansion.

Hong Kong’s environmental protection companies and technical personnel have accumulated rich experience in specialised project management over the years. As such, they possess advantages in providing one-stop services and excel in combining advanced environmental protection technology from foreign countries with low-cost parts and components from the mainland. With the support of various financial services in Hong Kong, they can also provide mainland clients with project financing services, such as performance contracting for energy and water efficiency. They are therefore well-positioned to make forays into the mainland environmental protection market. Moreover, Hong Kong’s favourable business environment makes its companies ideal cooperation partners for foreign environmental protection technology players interested in undertaking technology transfer and licensing in the mainland.

It is worth noting that Hong Kong companies wishing to capitalise on environmental protection opportunities in the mainland have to obtain a qualification licence issued by the relevant department of the mainland government. For instance, if they wish to provide environmental protection system engineering design services or environmental protection facilities operation services, they may need to obtain a qualification licence from the relevant national or local environmental protection department. However, CEPA has introduced a lot of liberalisation measures facilitating Hong Kong companies' provision of environmental protection services in the mainland (including establishing wholly-owned enterprises in the mainland to provide such services as sewage and waste treatment) and to apply for qualifications to operate environmental pollution control facilities. Furthermore, as Hong Kong has signed an agreement on the liberalisation of trade in services with the mainland, Hong Kong service suppliers entering the mainland environmental protection market are entitled to national treatment. This has given Hong Kong companies the advantage of entering the mainland environmental protection market earlier than their foreign counterparts. [12]

A New Horizon in Opening Up

In recent years China has significantly liberalised administrative measures on outbound investment to encourage enterprises to “go out” and invest overseas, establishing sales networks in foreign markets, while at the same time “bringing in” the advantages of foreign partners in order to enhance competitiveness. The government is also proactively encouraging free trade zones in Shanghai, Guangdong, Tianjin and Fujian to open up, as well as advancing the Belt and Road initiative in the hope of leveraging the comparative advantages of the PRD, YRD and Bohai Rim in order to strengthen economic ties with countries along the route. Against this backdrop, the 13th Five-Year Plan will strengthen liberalisation in the following ways:

-

Strengthening two-way opening up

Steps will be taken to strengthen the construction of ports and infrastructure facilities in inland border areas, build cross-border multimodal transport corridors, and bolster the development of border economic cooperation zones and cross-border economic cooperation zones. Action will also be taken to accelerate the optimisation and upgrading of foreign trade; develop producer services trade; actively expand imports; optimise the import mix; raise the level of foreign capital utilisation and outbound investment; and give enterprises support in expanding outbound investment in order to deeply integrate with the global industrial chain, value chain and logistics chain.

-

New opening-up measures

Action will be taken to create a level playing field by implementing a system of pre-establishment national treatment in the form of a negative list for foreign investment. Meanwhile, the system of outbound investment management will be improved to facilitate outbound investment and promote investment by individuals abroad. In addition, steps will also be taken to further open up the service sector to the outside world, in particular expanding the two-way opening-up of the financial sector, realise the convertibility of the renminbi under the capital account, and pave the way for the internationalisation of the renminbi.

-

Advancing the Belt and Road initiative

This includes improving bilateral and multilateral cooperation mechanisms; encouraging enterprises to invest in countries and regions along the route; advancing infrastructure connectivity and unimpeded trade; strengthening energy, resource exploration and supply chain cooperation with emphasis on domestic processing at the Belt-and-Road countries. At the same time, cooperation in such areas as education, technology, culture and environmental protection will be expanded. Detailed measures include enhancing cooperation with international financial institutions; participating in the development works of the Asian Infrastructure Investment Bank and BRICS Development Bank; giving full play to the role of the Silk Road Fund; and attracting international funds to jointly build a diversified financial cooperation platform.

The 13th Five-Year Plan enhances foreign trade and economic cooperation and introduces active import policies. The central government also encourages Guangdong and Hong Kong to jointly expand international markets and strengthen trade ties with economies along the Maritime Silk Road. These efforts should help to consolidate Hong Kong's position as a trade and shipping hub in the Asia-Pacific region.

With regard to further financial sector opening up, the 13th Five-Year Plan also supports financial cooperation between Hong Kong and the mainland. In recent years many Hong Kong companies have proactively taken advantage of the mainland’s liberalising financial policies and CEPA concessions to gradually participate in the mainland financial market, set up networks and accumulate practical operation experience. Today, Hong Kong is a leading renminbi offshore trading centre and has developed cross-border renminbi lending business via Qianhai. All these factors will give Hong Kong financial players first-mover advantage during the 13th Five-Year Plan period as the mainland further liberalises.

Moreover, China's Belt and Road initiative will further encourage mainland enterprises to invest in countries along the route. The 13th Five-Year Plan supports Hong Kong's participation in the country's two-way opening up and Belt and Road initiative and encourages mainland and Hong Kong businesses to give play to their respective advantages by expanding their overseas investment activities in various ways. This, coupled with a deepening of service trade liberalisation between the mainland and Hong Kong under CEPA, will further increase opportunities for Hong Kong firms to enter the mainland market and service mainland enterprises in "going out".

Hong Kong has long acted as the bridgehead for the mainland's foreign trade and economic cooperation activities, and is also the mainland's preferred service platform for making offshore investments. In the past, Hong Kong has handled trade and investment business in overseas markets for a lot of mainland enterprises, providing a full range of professional services, such as financial, legal, taxation, sustainability risk assessment, and international certification and testing services. With the 13th Five-Year Plan strengthening the “going out” strategy and advancing the Belt and Road initiative, it can be expected that fresh opportunities will be made available to Hong Kong service suppliers.

Enhanced Social Development and Living Standards

The 13th Five-Year Plan aims to build a moderately prosperous society in all respects, improve people's living standards and quality of life, and raise the ratio of the middle-income population. In line with the aim of building a moderately prosperous society, the 13th Five-Year Plan also mentions the need to strengthen public services and ensure people’s basic livelihood. It covers the following areas of reform and development related to consumption and social development:

-

Upgrading consumption

Steps will be taken to support new-style consumption, including information consumption, green consumption, fashionable consumption and quality consumption, promote the development of O2O and other new modes of consumption, implement the consumer goods quality improvement project, and promote the expansion of service consumption.

-

Promoting balanced population growth

The two-child policy is to be fully implemented, and proactive action will be taken to tackle the problem of an ageing population, and the elderly care service market will be fully liberalised.

-

Reforming social security

This includes improving the employee pension insurance system, broadening social insurance fund investment channels, strengthening risk management, and raising investment return rates. Action will be taken to improve the sustainable development of the medical insurance system and deepen medical and health system reform, including introducing separation of consultation from medication, and establishing a basic medical and health system and modern hospital management system covering both urban and rural areas.

-

Strengthening food safety

Steps will be taken to improve the system of food safety laws and regulations, raise the standards of food safety, strengthen management of food sources, and implement the traceability system for the whole food industry supply chain.

A larger middle income population not only means a larger consumer market but suggests higher demand for quality. As middle-class consumers become more mature, they will come to know more about product quality and will have a keener demand for medium- to high-end products and niche brands that can reflect their personality. In addition, China's measures to adopt a more proactive import policy, while encouraging consumers to spend domestically rather than overseas, are expected to generate more market opportunities for the import of foreign consumer goods.

In a bid to promote balanced population growth, China has started full implementation of the two-child policy since January 2016. This represents a step to further improve the country's population control policy after introducing the policy of allowing single-child parents to have two children in late 2013. According to the estimates of the National Health and Family Planning Commission, the new second child generation will mainly concentrate in urban areas, accounting for 76% of all newly-born second children. It is projected that by the year 2030 China's total population will reach 1.45 billion. And by 2050, the population of the labour force aged 15-59 will increase by about 30 million, helping to alleviate the problem of ageing population and contribute to optimise population structure.

In the short term, the introduction of the two-child policy can directly stimulate the demand for maternity, baby and infant products and services, such as food, health food, daily use articles, as well as mother and child health services and child care services. In the long run, it will boost the demand for housing, education and medical care services. As mainland parents are to attach more and more importance to product quality and safety, as well as to the quality of professional services such as education and medical care, relevant Hong Kong companies can capture the corresponding opportunities.

The 13th Five-Year Plan also aims to accelerate the pace of old-age insurance and medical insurance system reform, which is bound to stimulate growth in the insurance market. Currently, as China liberalises its financial and services markets, financial and insurance industry players stand to benefit from the emerging market opportunities.

As China's population gradually ages and the pace of life quickens in tandem with rapid urbanisation, the health care expenses of mainlanders continue to rise, particularly among citizens with middle-class incomes or higher. Coupled with the proposal put forward in the 13th Five-Year Plan for medical system reform and market liberalisation, this will generate opportunities for Hong Kong service suppliers in related fields. By combining health, medical and leisure services and taking advantage of the policy allowing Hong Kong players to set up wholly-owned hospitals and traditional Chinese medicine hospitals in the mainland on a pilot basis starting from mid-2014, Hong Kong suppliers can tap the mainland's high-end health and medical services market. Besides capitalising on Hong Kong's financial services to offer strategic recommendations on financing arrangements for these health and medical projects, Hong Kong companies can also make use of next-generation IoT technology and their experience in providing sustainable medical care services in Hong Kong to offer customised management solutions for mainland projects.

The 13th Five-Year Plan also devotes great attention to food safety. It can be expected that the central government will strengthen food safety systems management as well as food certification, supervision and random check measures in order to protect public health. At the same time, in order to boost consumer confidence, many food production enterprises have joined voluntary food certification schemes, including food safety as well as green and organic certification. These developments will directly bolster market demand for food testing, inspection and certification services. Under CEPA, Hong Kong companies are granted concessions to enter the mainland testing and inspection service market. This includes allowing Hong Kong testing and inspection organisations offering certification services to expand their business scope to cover food products and voluntary food certification in Guangdong province on a pilot basis.

Conclusion

With the building of a moderately prosperous society in all respects as its goal, the 13th Five-Year Plan sets the direction for China's economic and social development for the next five years on the basis of the tenets of innovation, coordination, green growth, opening up and sharing. The detailed plans are bound to bring changes to different economic sectors and create new opportunities for different industry players. The 13th Five-Year Plan also clearly states that steps will be taken to deepen cooperation between the mainland and Hong Kong (and Macau and Taiwan), including giving support to Hong Kong in consolidating and enhancing its status as an international financial, shipping and trading centre; strengthening its position as a global hub for offshore renminbi business and its function as an international asset management centre; developing innovation and technology businesses; taking part in the country's two-way opening up and the Belt and Road initiative; encouraging cooperation between mainland and Hong Kong enterprises in "going out"; and accelerating Guangdong-Hong Kong (Macau) cooperation. Against this backdrop, Hong Kong businesses should pay close attention to relevant plans announced by different mainland government departments and by various provinces and cities in order to seize opportunities created by the 13th Five-Year Plan to further tap the vast mainland market.

[1] CEPA here refers to the "Mainland and Hong Kong Closer Economic Partnership Arrangement" and its supplementary agreements.

[2] The State Council issued the Guiding Opinions on Deepening Pan-PRD Regional Cooperation on 15 March 2016 to promote the development of broader pan-PRD regional cooperation, including joint efforts to foster new opportunities for opening up, active participation in the Belt and Road Initiative, and closer cooperation between the mainland and Hong Kong in major infrastructure projects, industries, key cooperation platforms, and social affairs.

[3] Calculated at an average exchange rate, China's GDP amounted to about US$10.9 trillion in 2015. According to estimates made by the Bureau of Economic Analysis under the US Department of Commerce in February 2016, US GDP was about US$17.9 trillion in 2015.

[4] Calculated at an average exchange rate, China's total retail sales of consumer goods amounted to about US$4.8 trillion in 2015. According to estimates made by the Census Bureau under the US Department of Commerce in March 2016, retail sales of consumer goods in the US totalled about US$5.3 trillion in 2015.

[5] For more long-term development up to 2030, the 13th Five-Year Plan makes it clear that China will launch a number of key S&T projects and major development projects of national strategic significance. The six key S&T projects cover the fields of aviation engine and gas turbines; deep underwater stations; quantum teleportation and quantum computers; neuroscience and brain-like intelligence studies; national cyberspace security; and deep space exploration and on-orbit service and maintenance systems for spacecraft. The nine major development projects include independent innovation in the farming industry; efficient and clean use of coal; smart grid; integrated space-terrestrial information networks; big data analytics; smart manufacturing and robotics; research and application of major new materials; comprehensive environmental improvement of the Beijing-Tianjin-Hebei region; and healthcare.

[6] "Five social insurances and one fund" refers to the social benefits that the government requires enterprises to provide to their employees. They include old-age insurance, medical insurance, unemployment insurance, work injury insurance and maternity insurance, as well as access to the housing provident fund.

[7] Premier Li Keqiang said in the Government Work Report delivered in March 2016 that China will further alleviate the burdens on enterprises. Business tax will be completely replaced by value-added tax, with effect from 1 May 2016, and the pilot scheme will be extended to cover the fields of real estate and construction, finance and consumer services. VAT on the newly acquired immovable assets of all enterprises will be included in the scope of tax deduction to ensure that the tax burdens of all industries do not increase. In addition, government-managed funds set up without authorisation will be abolished, the collection of contributions to certain government-managed funds will be suspended, and some of these funds will be consolidated. More enterprises will be exempted from contributing to water conservancy construction funds. Exemptions from 18 administrative charges which currently apply only to small and micro businesses will be extended to include all enterprises and individuals.

[8] For more details about the survey, please see: Outbound Investment of Chinese Enterprises: Hong Kong the First Port of Call for Professional Services

[9] Source: National Bureau of Statistics